Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - DELTA AIR LINES, INC. | delta_8k-12141.htm |

Exhibit 99.1

2

This presentation contains various projections and other forward-looking statements which

represent Delta’s estimates or expectations regarding future events. All forward-looking

statements involve a number of assumptions, risks and uncertainties, many of which are

beyond Delta’s control, that could cause the actual results to differ materially from the

projected results. Factors which could cause such differences include, without limitation,

business, economic, competitive, industry, regulatory, market and financial uncertainties

and contingencies, as well as the “Risk Factors” discussed in Delta’s Form 10-K for the year

ended December 31, 2010. Caution should be taken not to place undue reliance on Delta’s

forward-looking statements, which represent Delta’s views only as of the date of this

presentation, and which Delta has no current intention to update.

represent Delta’s estimates or expectations regarding future events. All forward-looking

statements involve a number of assumptions, risks and uncertainties, many of which are

beyond Delta’s control, that could cause the actual results to differ materially from the

projected results. Factors which could cause such differences include, without limitation,

business, economic, competitive, industry, regulatory, market and financial uncertainties

and contingencies, as well as the “Risk Factors” discussed in Delta’s Form 10-K for the year

ended December 31, 2010. Caution should be taken not to place undue reliance on Delta’s

forward-looking statements, which represent Delta’s views only as of the date of this

presentation, and which Delta has no current intention to update.

In this presentation, we will discuss certain non-GAAP financial measures. You can find the

reconciliations of those measures to comparable GAAP measures on our website at

delta.com.

reconciliations of those measures to comparable GAAP measures on our website at

delta.com.

Safe Harbor

State of the Airline

Richard Anderson

Chief Executive Officer

Looking Ahead

Ed Bastian

President

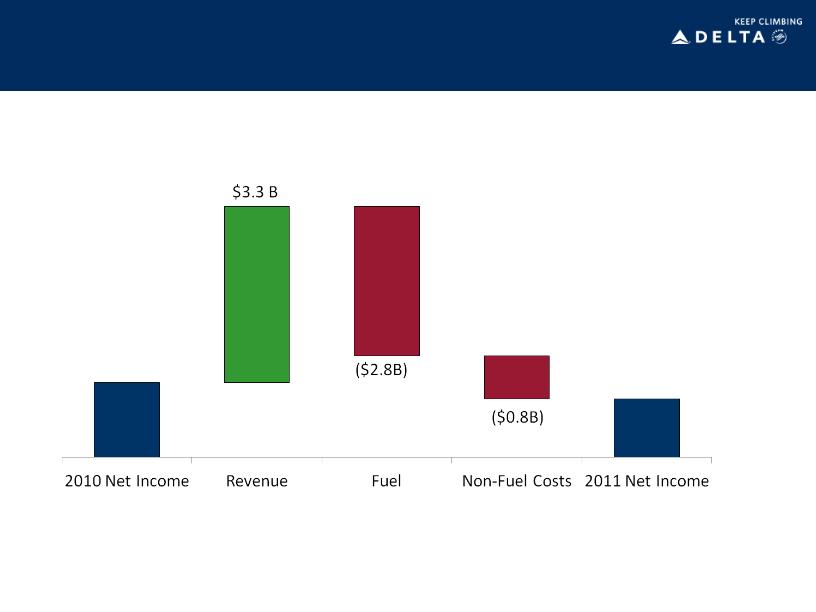

2011: Solid Results In Challenging Times

Challenging Times

Solid Results

• 30% increase in fuel prices, resulting

in $3 billion higher fuel expense

in $3 billion higher fuel expense

• Economic weakness in the world’s

two largest economies

two largest economies

• On-going impact of the earthquake

and tsunami in Japan

and tsunami in Japan

• War and unrest in the Middle East

• $1.1 billion net profit

• Fully recovered fuel price run-

up

up

• $1.5 billion of free cash flow

• Adjusted net debt of $12.9

billion, a $4.1 billion reduction in

two years

billion, a $4.1 billion reduction in

two years

• 8.8% return on invested capital

5

Note: All results are estimates and exclude special items.

Delta Has Built A Resilient Business Model

$1.4 B

$1.1B

Capacity discipline, strength in corporate revenues and hedging strategy have

mitigated high fuel costs

mitigated high fuel costs

6

Note: All results exclude special items . Including special items, Delta’s net income was $0.6 billion in 2010 and is estimated to be $0.8 billion for 2011.

Strong End To The Year

December quarter 2011

Operating margin

6 - 8%

Fuel price

$2.96

Profit sharing expense

$75 million

Non-operating expense

$275 - $300 million

Capital expenditures

$375 million

Total unrestricted liquidity

$5.3 billion

December quarter 2011 vs.

December quarter 2010

December quarter 2010

Passenger unit revenue

Up 11 - 12%

Consolidated unit cost

Up 8%

Consolidated ex-fuel unit cost

Up 2%

System capacity

Down 4-5%

Domestic

Down 3-4%

International

Down 4-5%

7

Margins will expand despite $600 million higher fuel expense

The Landscape Ahead For 2012

The 2012 Landscape

• Slow, but positive, global GDP growth

• Anticipate recession in Europe

• Fuel prices remain at historically high levels

• Industry restructuring and capacity discipline

allows for recovery of higher fuel costs

allows for recovery of higher fuel costs

Solid earnings growth

and continued free

cash flow generation

and continued free

cash flow generation

8

Industry Factors

Delta Factors

• Sustained caution on capacity, with a system

reduction of 2 - 3%

reduction of 2 - 3%

• Summer to winter variation of 20%

• Revenue momentum from corporate share

gains and new merchandising revenues

gains and new merchandising revenues

• Expect corporate travel up 6 - 8%

• Non-fuel costs remain under pressure

• Cost advantage critical to maintain

Delta’s Path Forward

Grow Unit Revenues

Improve Productivity

Invest in the Business

Delever the Balance

Sheet

Sheet

Grow passenger and ancillary unit revenues through

corporate revenue gains, fuel cost recovery, and

technology-enabled merchandising initiatives

corporate revenue gains, fuel cost recovery, and

technology-enabled merchandising initiatives

Focus on total cost productivity, including fuel, and

implement structural initiatives needed to return non-fuel

unit costs to 2010 levels

implement structural initiatives needed to return non-fuel

unit costs to 2010 levels

Continue investments in the network and toward

consistent, high-quality products and service that earn a

revenue premium

consistent, high-quality products and service that earn a

revenue premium

Maintain capital discipline, manage liquidity and direct

free cash flow toward debt reduction

free cash flow toward debt reduction

9

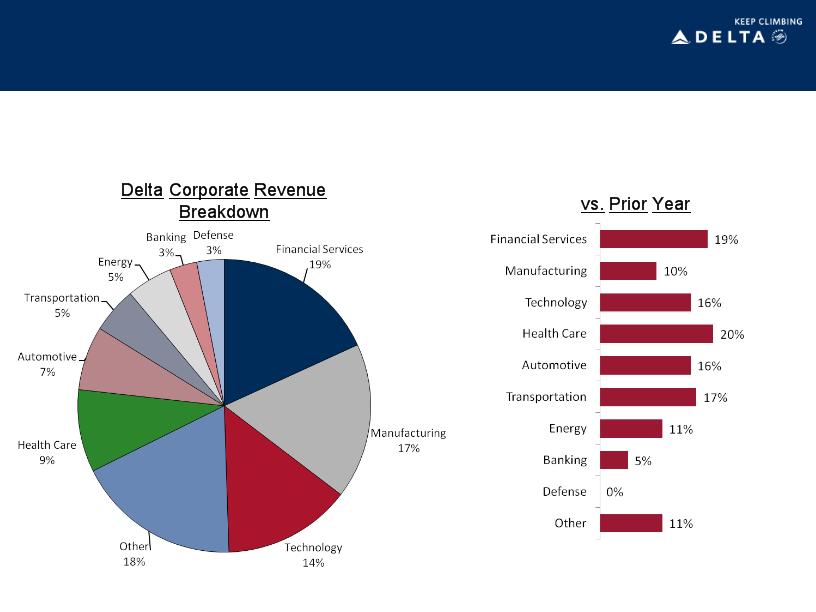

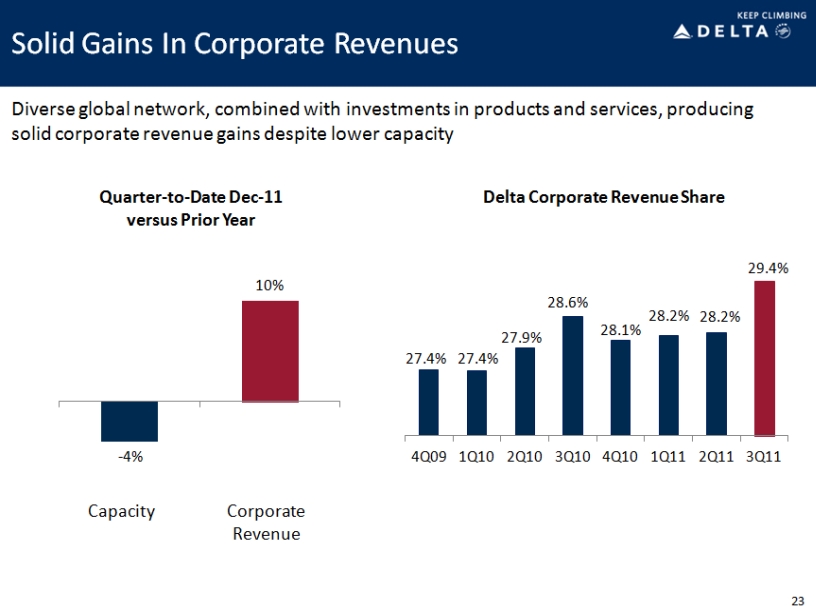

Largest Corporate Sectors Leading Growth

Rates

Rates

Last Four Weeks Booked Revenue

Corporate booked revenues up 14% despite 4-5% reduction in capacity

10

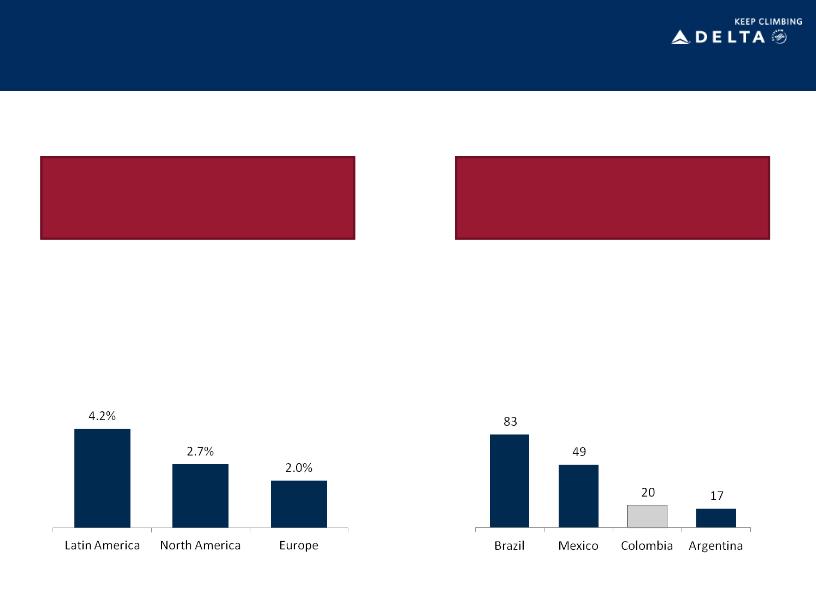

Strengthening Position In Latin America

Focused on building partnerships to leverage high growth potential in this region

11

Latin America Has High

Growth Potential

Growth Potential

Delta’s Expanded Latin

America Presence

America Presence

• Delta now accounts for nearly 20% of

US carriers’ capacity to Latin America

US carriers’ capacity to Latin America

• Partnerships with Aeromexico, GOL and

Aerolineas Argentinas give Delta access

to Latin America’s largest aviation

markets

Aerolineas Argentinas give Delta access

to Latin America’s largest aviation

markets

• Latin America expected to produce GDP

growth rates nearly double those of

Europe and US over next two decades

growth rates nearly double those of

Europe and US over next two decades

• Brazil, Mexico and Argentina are among

Latin America’s top growth areas

Latin America’s top growth areas

Annual GDP Growth (2011- (2030)

Source: Boeing 2011 Global Market Outlook

Aviation Market Size

(millions of passengers per year)

Source: IATA and Infraero

Maintaining A Competitive Cost Structure

12

YTD-September 2011 Non-Fuel Unit Costs (cents)

Note: excludes special items, ancillary businesses, and profit sharing.

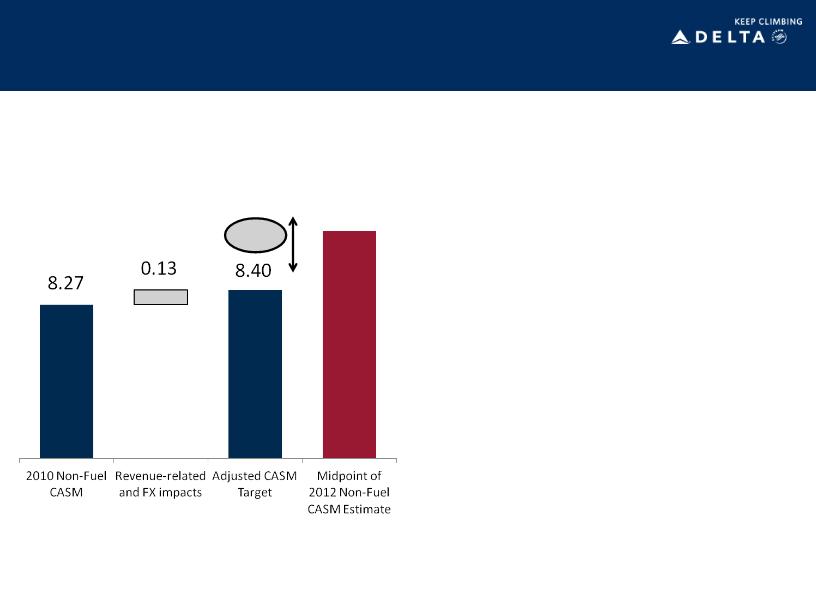

Non-Fuel Costs Present Opportunity

8.80

0.40

• Goal is to return non-fuel unit costs to

adjusted 2010 levels

adjusted 2010 levels

• 2012 revenues expected to be ~15%

higher than 2010

higher than 2010

• 2012 non-fuel unit costs are estimated to be

up 2-4% - ~4% or 0.40 cents higher than

this targeted level

up 2-4% - ~4% or 0.40 cents higher than

this targeted level

• Major drivers of the 0.40 cent differential:

Structural changes needed to bring costs down to targeted levels

13

|

• Wages and benefits -

wage harmonization, industry standard rates, and pension |

0.23 cents

|

|

• LaGuardia/ATL concourse F

|

0.05 cents

|

|

• Capacity reduction - fixed

cost impact |

0.15 cents

|

Note: excludes special items, ancillary businesses, and profit sharing.

Structural Changes Necessary To Lower Costs

• 737-900ER deliveries will

reduce overall fleet

maintenance costs;

maintenance reductions in

advance of those deliveries

to begin in late 2012

reduce overall fleet

maintenance costs;

maintenance reductions in

advance of those deliveries

to begin in late 2012

• Simplification of fleet post-

integration

integration

• Leverage AeroMexico joint

venture to optimize

maintenance opportunities

venture to optimize

maintenance opportunities

• With labor representation

resolved, workrules can be

harmonized and improve

productivity levels for

frontline employees

resolved, workrules can be

harmonized and improve

productivity levels for

frontline employees

• Continued improvements to

merit staff productivity

merit staff productivity

• Technology investments to

enhance efficiencies in crew

systems

enhance efficiencies in crew

systems

• Changing composition of

Delta’s fleet by eliminating

more smaller-gauge

aircraft, especially 50-seat

regional jets

Delta’s fleet by eliminating

more smaller-gauge

aircraft, especially 50-seat

regional jets

• Upgauging allows for

more efficient capacity

generation on smaller fleet

count

more efficient capacity

generation on smaller fleet

count

14

Investments In The Business Are Paying Off

Multi-Year Investments in

Products, Services and Facilities

Products, Services and Facilities

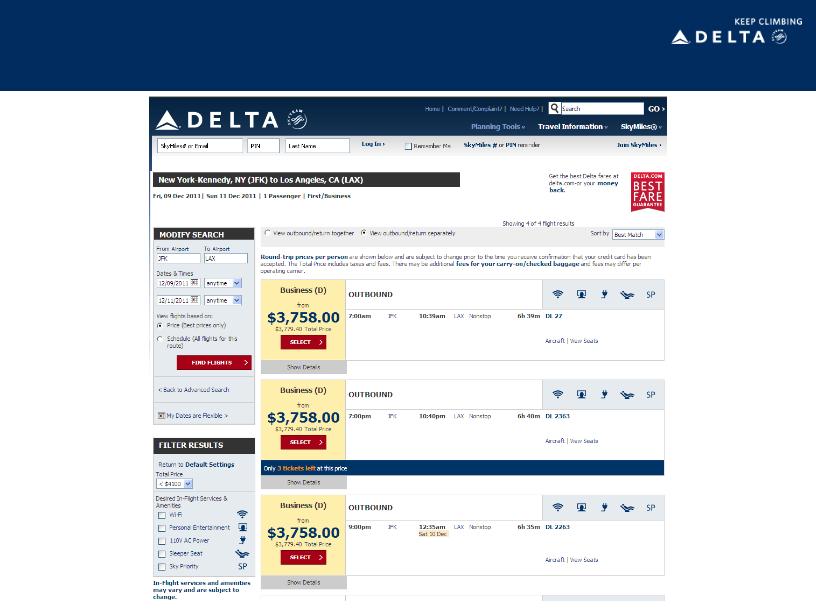

• Flat bed seats - more than 50% of

widebody international seats complete by

end of 2012

widebody international seats complete by

end of 2012

• Facilities - state of the art international

terminals slated for Atlanta (2012) and

JFK (2013)

terminals slated for Atlanta (2012) and

JFK (2013)

• Wi-Fi - entire mainline fleet complete,

installation on 2-class complete by early

2012

installation on 2-class complete by early

2012

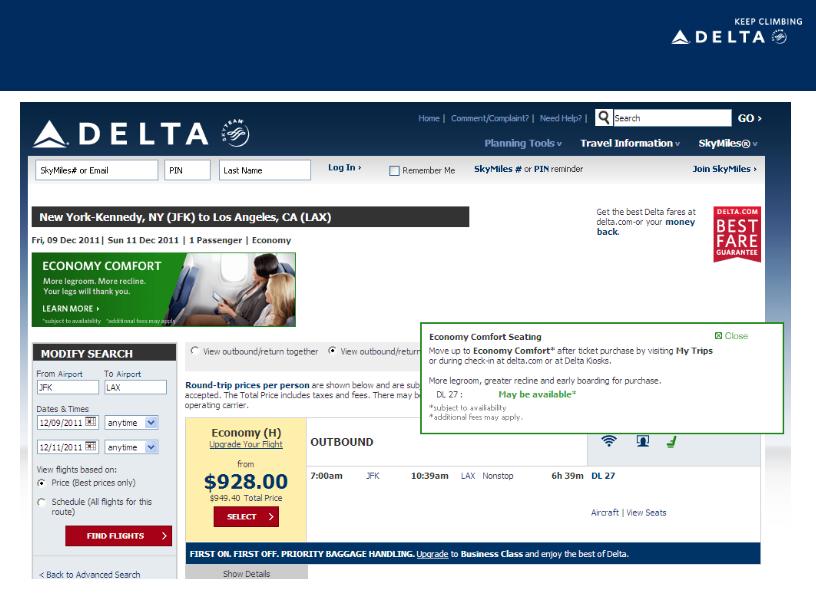

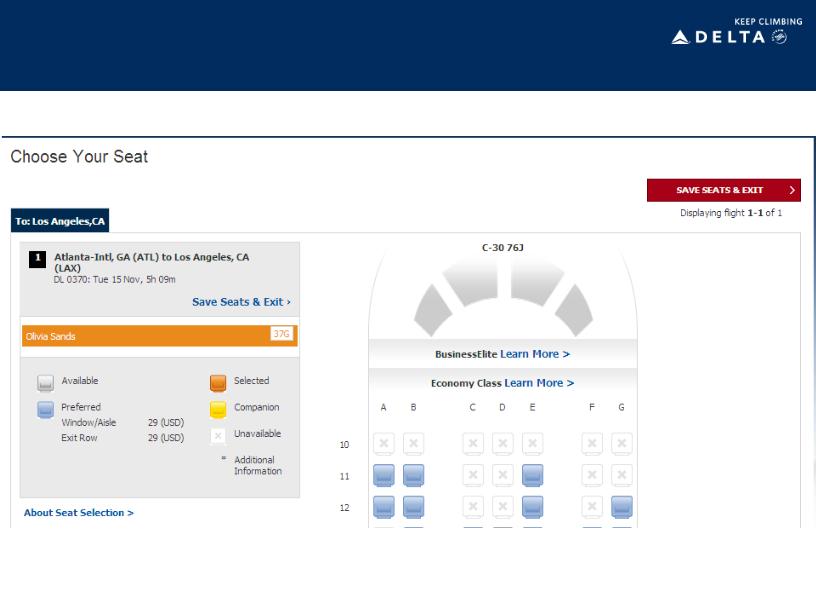

• Economy Comfort - international fleet

complete, domestic fleet (incl. 2-class

RJs) for summer 2012

complete, domestic fleet (incl. 2-class

RJs) for summer 2012

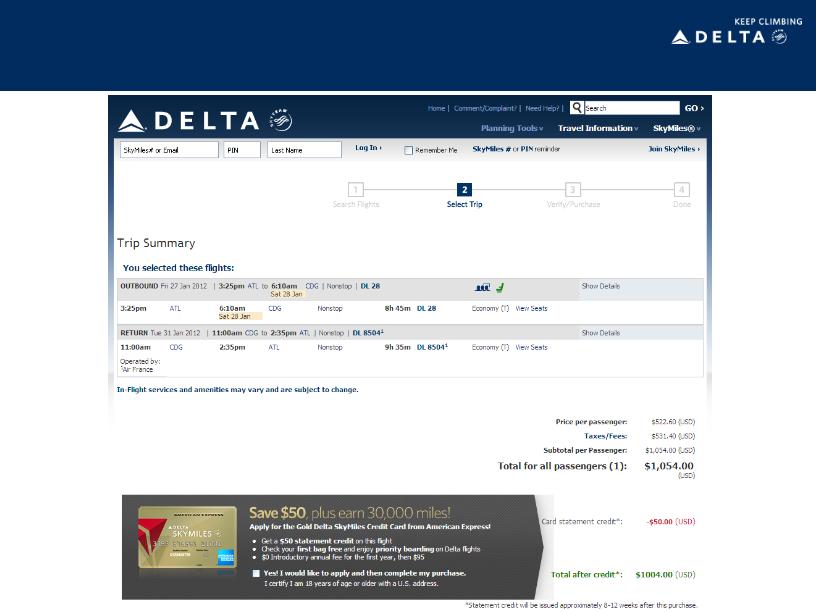

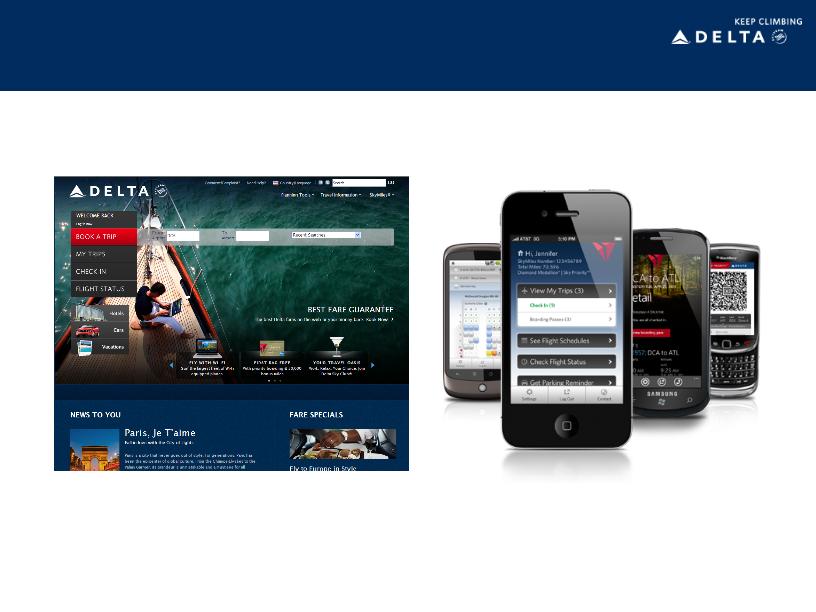

• Technology - enhancements to delta.com

and mobile applications

and mobile applications

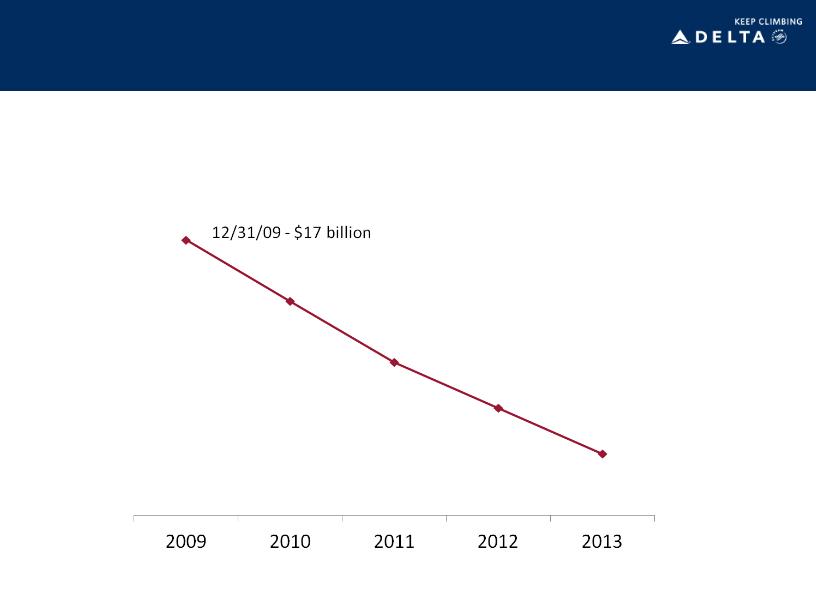

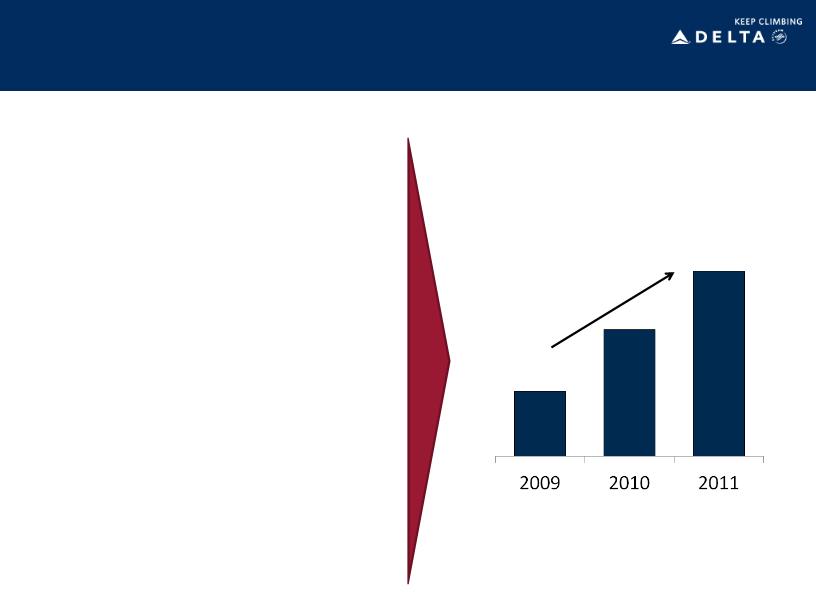

Solid Progress On Debt Reduction

12/31/11 - $12.9 billion

2013 - $10 billion

Adjusted Net Debt

Strong free cash flow generation has produced $4.1 billion net debt reduction in two

years

years

16

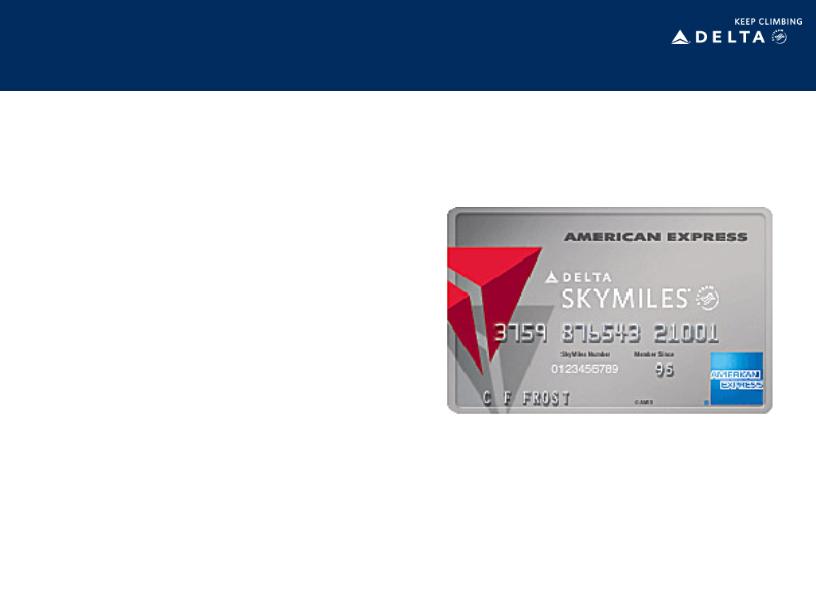

Continued Strong Relationship with American

Express

Express

• New four-year agreement with American

Express for annual SkyMiles pre-purchases of

$675 million

Express for annual SkyMiles pre-purchases of

$675 million

• Reduces seasonal volatility of cash flows

• From cash perspective, net effect is to

push out amortization of existing $1

billion agreement by two years

push out amortization of existing $1

billion agreement by two years

• SkyMiles American Express partnership is a

win-win for both companies

win-win for both companies

• Premium services for cardholders -

including priority boarding, free bags and

SkyClub access

including priority boarding, free bags and

SkyClub access

17

New agreement improves cash flows, extends benefits for cardholders

Delta: Keep Climbing

18

Focus on top-line

growth

growth

Taking a disciplined

approach

approach

Reducing risk

across the business

across the business

Growing and diversifying revenues through a broad

global network, corporate revenue gains, fuel cost

recovery and improved products and services

global network, corporate revenue gains, fuel cost

recovery and improved products and services

Disciplined management of capacity, costs and

capital to improve profitability, generate free

cash flow and invest in the business

capital to improve profitability, generate free

cash flow and invest in the business

Creating a solid franchise that generates strong margins and cash flow, provides for

net debt reduction and investment for the future

net debt reduction and investment for the future

Reducing labor, financial and operational risk

key to creating a stable business model in a

volatile industry

key to creating a stable business model in a

volatile industry

A Premium Revenue Carrier

Glen Hauenstein

EVP Network Planning and Revenue Management

A Premium Revenue Carrier

Product and facility enhancements targeted to

making Delta the airline of choice to, from and

through the U.S.

making Delta the airline of choice to, from and

through the U.S.

Elevate Delta’s Brand in the

Eyes of Our Customers

Eyes of Our Customers

Concentrate Capacity in

High Potential Markets

High Potential Markets

Expand Product Offerings

Leverage Alliances

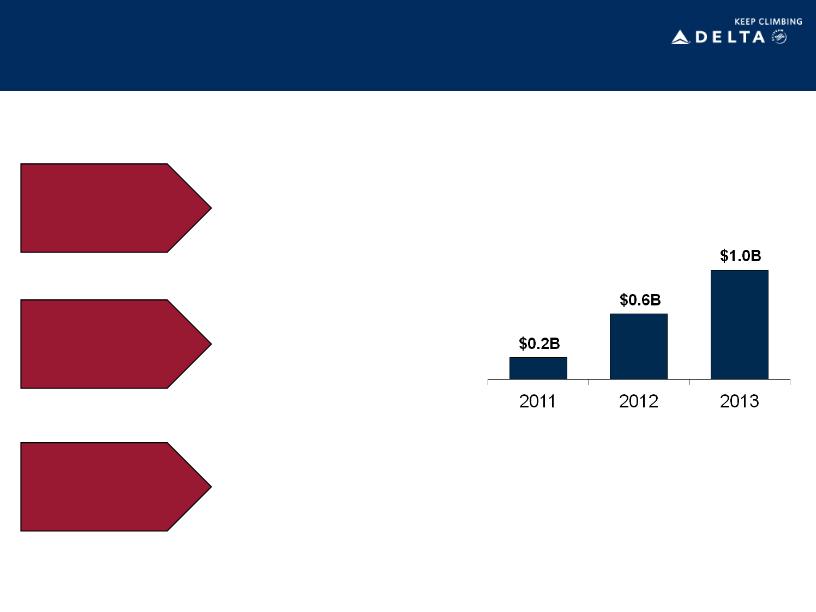

Grow annual merchandising revenues to $1 billion by

2013 through new products and enhanced eCommerce

2013 through new products and enhanced eCommerce

platforms

Schedule flexibility allows Delta to shift capacity to

high potential markets and adjust quickly to changing

demand dynamics

high potential markets and adjust quickly to changing

demand dynamics

Utilize global partnerships to expand network

breadth, leverage foreign point of sale, and improve

network value to the customer

breadth, leverage foreign point of sale, and improve

network value to the customer

20

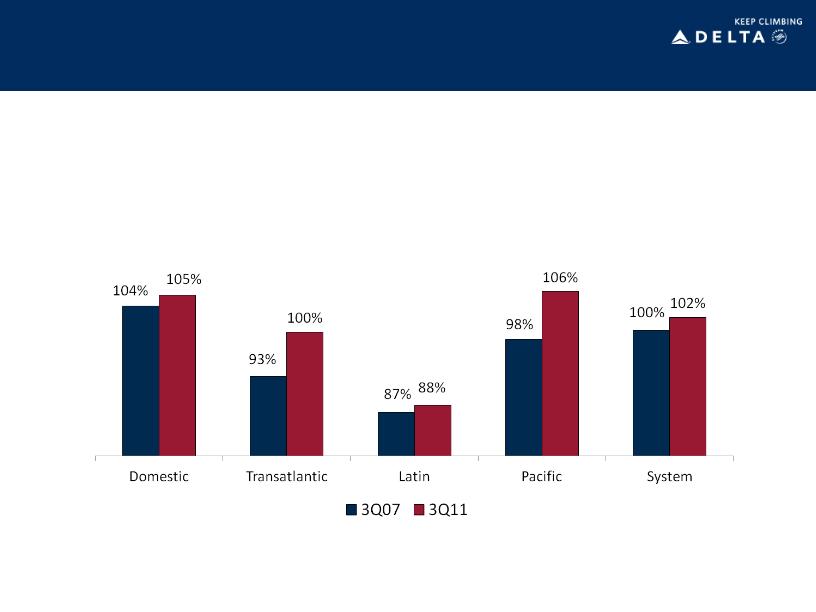

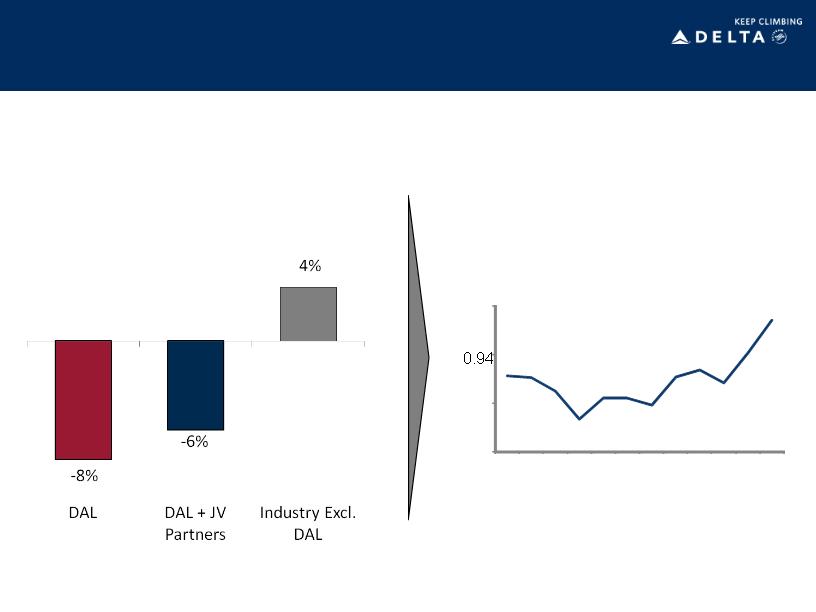

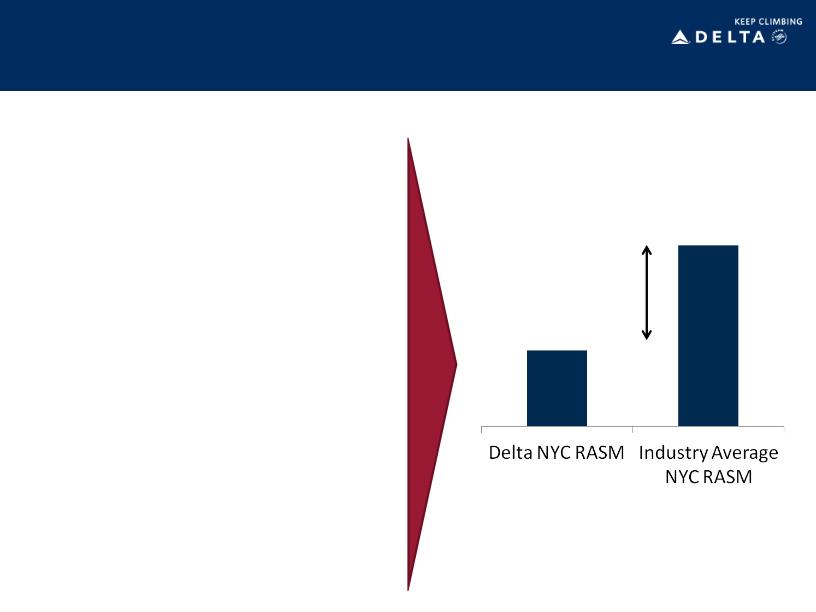

Delta Achieving Revenue Premium to the

Industry

Industry

Delta System Unit Revenue as

Percentage of ATA Average

Percentage of ATA Average

Merger synergies, capacity discipline, focus on higher value customer and

enhanced revenue management platforms allowing Delta to improve revenue

performance versus its peers in all entities

enhanced revenue management platforms allowing Delta to improve revenue

performance versus its peers in all entities

21

Investments Targeted at Higher Value

Passenger

Passenger

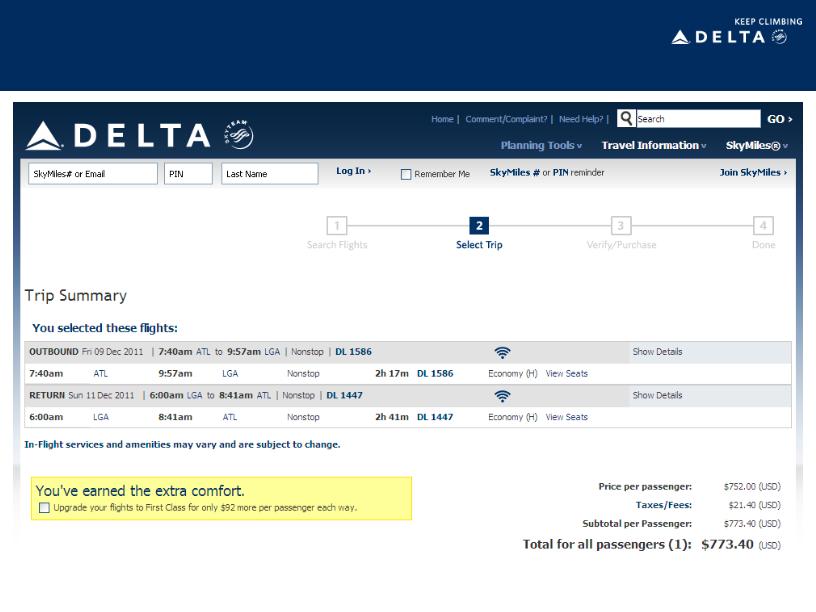

• Enhanced delta.com

platform

platform

• Personalized sales

programs

programs

• First Class Upsell

Delta named Best Overall Airline by Business Travel News

• New Atlanta international

terminal opening in 2012

terminal opening in 2012

• JFK Terminal 4 opening in

2013

2013

• Renewed Sky Clubs

• Ability to seamlessly

rebook a flight, check

itinerary and track baggage

rebook a flight, check

itinerary and track baggage

• Flat-bed seats installed on

entire international fleet by

Summer 2014

entire international fleet by

Summer 2014

• International and Domestic

Economy Comfort

Economy Comfort

• Most first class seats of any

domestic carrier

domestic carrier

• More than 800 Wi-Fi

equipped planes

equipped planes

Continuous effort to make Delta the airline of choice for corporate and business travelers

22

The Global Landscape

North America

Latin America

Europe

Asia

• Slow, but positive, GDP growth

• Continued industry capacity discipline

• Volatility increased as competitors go

through integration and restructuring

through integration and restructuring

• Delta capacity down 1-2%, driven by 60

small-gauge aircraft retirements

small-gauge aircraft retirements

• Anticipate recessionary climate

• Unit revenues pressured from economic

uncertainty combined with unfavorable

industry supply

uncertainty combined with unfavorable

industry supply

• Delta Transatlantic JV capacity down 7-8%

this year

this year

• 4 - 6% GDP growth

• Strongest margins in the system

• Growing Delta’s Latin America presence

through enhanced commercial partnerships

and equity investments

through enhanced commercial partnerships

and equity investments

• Solid GDP growth

• Japan demand returning to pre-event levels

by mid-2012

by mid-2012

• Building alliances with leading Chinese

airlines to capitalize on China growth

airlines to capitalize on China growth

• Annualization of 2011 additions to increase

overflight capacity by 10%

overflight capacity by 10%

24

Capacity Shifting to Higher Potential Markets

Aligning capacity with demand and reallocating assets to strategic core flying

|

Region

|

|

2012 Capacity

Change

|

|

Action Plan

|

|

Domestic

|

|

Down 1 - 2%

|

|

• Focus on right-sizing capacity

• Successfully implement LGA growth to reshape market

and achieve top position in New York • Provide competitive first class, mainline product in core

business and strategic markets |

|

Transatlantic

|

|

Down 7 - 8%

|

|

• Market optimization in coordination with JV partners

• Cancellation of underperforming routes

|

|

Latin

|

|

Flat to up 2%

|

|

• Growth to strong performing Brazil and Central America

• Rationalization of leisure capacity

|

|

Pacific

|

|

Up 1 - 2%

|

|

• Annualization of 2011 route additions

• Return to pre-earthquake Japan capacity

|

|

System

|

|

Down 2 - 3%

|

|

|

25

Rationalization of Transatlantic Capacity

Driving Unit Revenue Improvements

Driving Unit Revenue Improvements

U.S.-Europe Capacity Change,

December Quarter 2011 vs Prior Year

0.90

0.92

0.96

Q408

Q409

Q410

Q311

Delta Atlantic RASM Index

Rolling 4 Quarters

Capacity discipline has translated into improved performance versus peers

26

Alliances Expand Profit Potential

|

|

Delta

|

Delta with Partners

|

|

Destinations

|

343

|

1,164

|

|

Countries Served

|

63

|

187

|

|

Daily Flights

|

5,550

|

18,004

|

Ability to expand network breadth without significant fleet investment

Schedule data for March 2012

27

Revenue Growth from Expanded Product

Offerings

Offerings

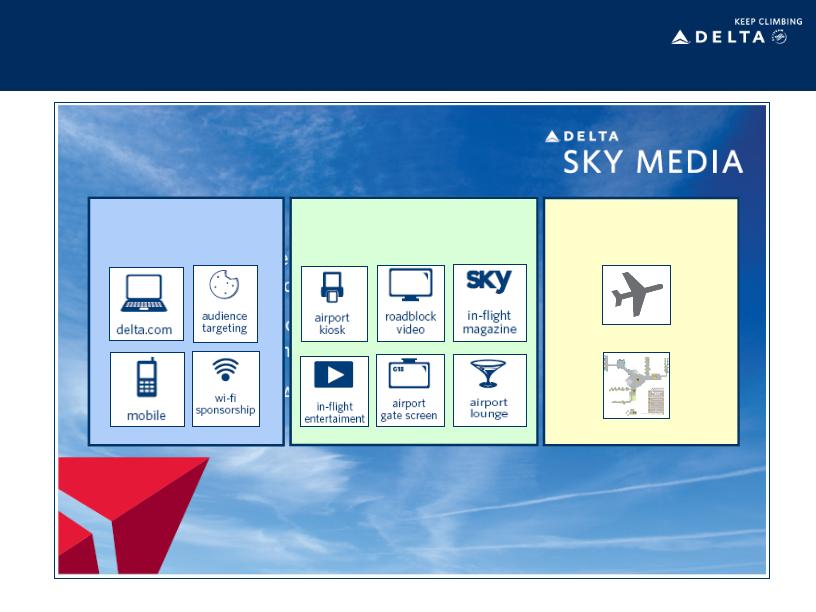

Target of $1 billion in annual merchandising revenue by 2013

Seat Related

Products

Products

• Economy Comfort

• First Class Upsell

• Sky Priority seating

• Same day Confirmed

Travel Products

and Services

and Services

Technology and

Product

Investments

Product

Investments

• Hotel, car rentals and trip

insurance

insurance

• Wi-Fi

• SkyClub passes

• Optional packages and services

• Other ancillary products

• New delta.com platform in

2012

2012

• Booking class realignment

• Improvements to pricing and

forecasting systems

forecasting systems

Merchandising Revenue

28

Revenue Innovation Through Technology

Tim Mapes

Senior Vice President - Marketing

A Brief History

31

“Impose”

• Bag Fees

• Meals for Sale

• “Service” Fees

“Involve”

• Amex Co-Brand

Card Acquisition

Card Acquisition

• Coach Up-sell to

First Class

First Class

• Sky Club Day Pass

“Improve”

• Economy

Comfort

Comfort

• Paid Preferred

Seats

Seats

• Segmented

offerings

offerings

PHASE 3

PHASE 4

PHASE 2

PHASE 1

“Inspire”

• Customization

of travel

experience

of travel

experience

• Bundled

offerings

offerings

PUSH

PULL

Strategic Building Blocks

Enterprise-wide clarity on varying levels of customer

value

value

Customer Segmentation

Product Differentiation

Leveraged Technology

Differentiated products, services based on customer

value

value

Simple, intuitive, reliable technology - across

platforms

platforms

Billions of annual customer touch points, impressions

Global Scale

32

Early Success

33

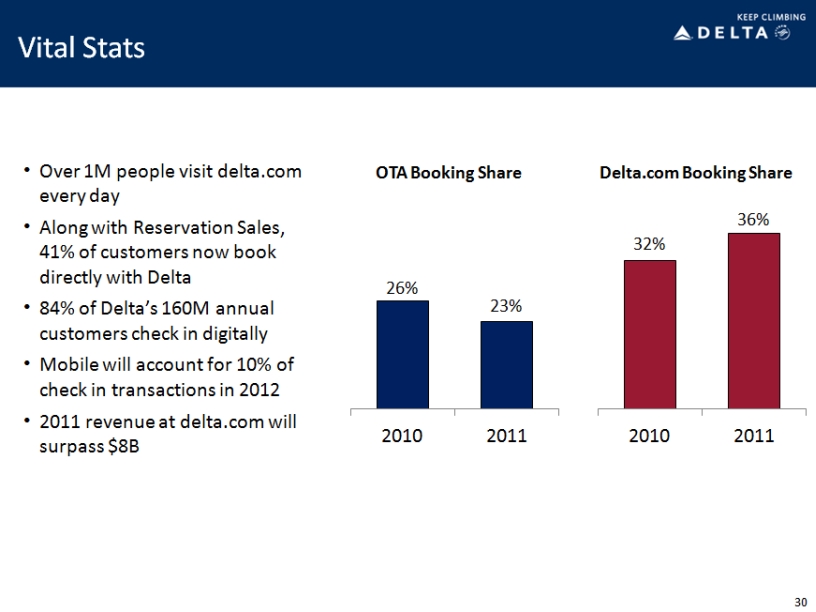

Improving Direct-Booking Revenue

34

Seizing Opportunities for Up-Sell

35

Launching New Products

36

Targeting Distinct Market Segments

37

Monetizing Delta’s “Media” Audience

terminals

airplanes

WEB ENABLED ASSETS

TRADITIONAL AIRLINE

OUT OF HOME ASSETS

OUT OF HOME ASSETS

AIRLINE UNIQUE ASSETS

www.delta.com/skymedia

38

Delta.com As Global “Store Front”

39

Financial & Customer Benefits

A quality “base” product

with a range of offerings

from which to choose to

enhance your

experience on Delta.

with a range of offerings

from which to choose to

enhance your

experience on Delta.

$1 Billion of incremental revenue by 2013

Differentiated bundles

of new products and

services customers

want - and will pay

for.

of new products and

services customers

want - and will pay

for.

Re-defined use of the

term “network” in an

airline to describe

Delta’s ability to deliver

5 billion customer

impressions/yr.

term “network” in an

airline to describe

Delta’s ability to deliver

5 billion customer

impressions/yr.

40

Winning in New York

Gail Grimmett

Senior Vice President - New York

Delta’s Plan To Win In New York

By simply getting a “fair share” of New

York revenue, Delta’s revenue would

increase by more than $200 million.

York revenue, Delta’s revenue would

increase by more than $200 million.

The path to achieving this includes:

• Building a leading network position

by capitalizing on the LGA

expansion and more efficient use of

the JFK hub

by capitalizing on the LGA

expansion and more efficient use of

the JFK hub

• Improving NYC corporate share,

including leveraging breadth of JV

partners

including leveraging breadth of JV

partners

• Delivering a high-quality product

and brand to all customers

and brand to all customers

$200+

million

million

42

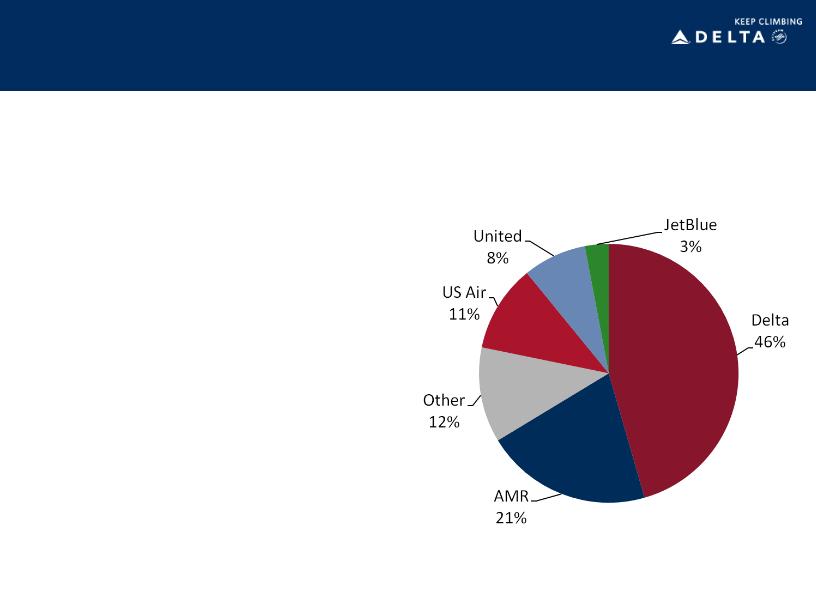

Building New York’s Leading Network Position

LGA Slot Position (Summer 2012)

• With over 250 flights per day, Delta will

be the premier carrier from LaGuardia

be the premier carrier from LaGuardia

• Nearly 50% of daily departures from

New York’s preferred business

airport

New York’s preferred business

airport

• Improved schedule

• New slots will allow 100 new flights

and 29 new destinations

and 29 new destinations

• Adding service to key business

destinations

destinations

• Improved facilities and amenities

• Terminals C & D connect to create a

26-gate complex

26-gate complex

• Maintain Marine Air Terminal for

high-value Shuttle customers

high-value Shuttle customers

43

Winning New York Corporate Customers

+3.5 pts

New York Corporate Share

• In just three years, Delta has increased its

corporate share in NY by 3.5 points

corporate share in NY by 3.5 points

• Future growth will be driven by:

• Broader network offering, with more than 500

daily flights from New York to key

destinations

daily flights from New York to key

destinations

• Expanded facilities with enhanced amenities

at LGA and JFK

at LGA and JFK

• Premium products for premium customers

such as VIP Select, SkyPriority and Business

Elite and Economy Comfort for transcon

flights

such as VIP Select, SkyPriority and Business

Elite and Economy Comfort for transcon

flights

• Leveraging the breadth of all joint venture

relationships

relationships

44

Winning In New York

Leading Network Position

Winning Corporate

Customers

Customers

Significant Investments

Underway

Underway

• With the best-positioned slot portfolio and an

international gateway to all regions, Delta has

built an unmatched network position in New

York

international gateway to all regions, Delta has

built an unmatched network position in New

York

• Delta’s improved travel offering - network,

products and alliances - is gaining traction

with New York corporate customers

products and alliances - is gaining traction

with New York corporate customers

• Significant investments are targeted at

producing a consistently high-quality product

and brand

producing a consistently high-quality product

and brand

46

Benefits of Operational Investment

Steve Gorman

Chief Operating Officer

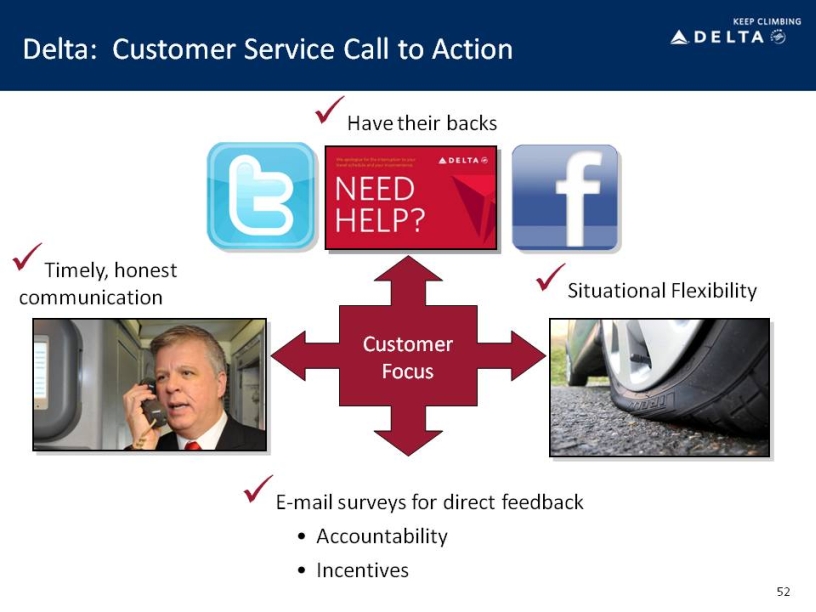

Delta: Performance Continues to Climb

Top tier completion factor,

on-time and baggage

performance

on-time and baggage

performance

Customer service focus

Positive feedback from

our customers

our customers

Making Delta an airline of preference

ü

ü

ü

48

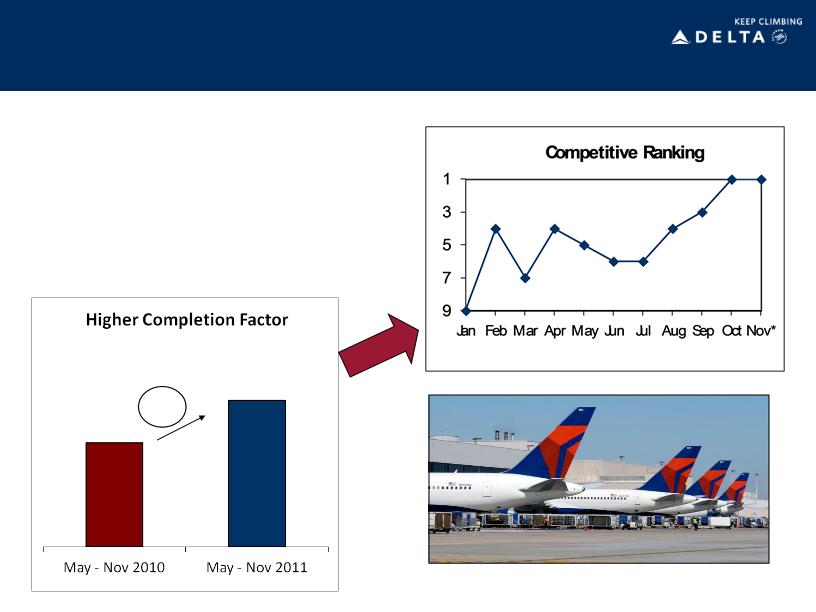

Delta: Completing Our Customers’ Flights

ü

Tech Ops action plans

• Added stations

• Technicians

• Parts

• Planning

49

*Preliminary

1 pt

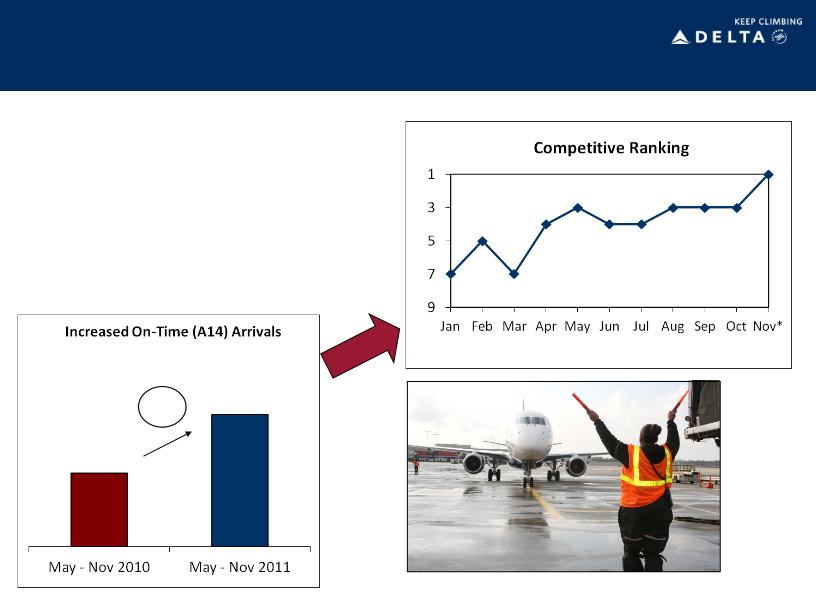

Delta: Arriving On Time

ü

Cross-functional action

team

team

• Awareness and promotion

• D-3 door closure

• Gate-checked bags

50

*Preliminary

9%

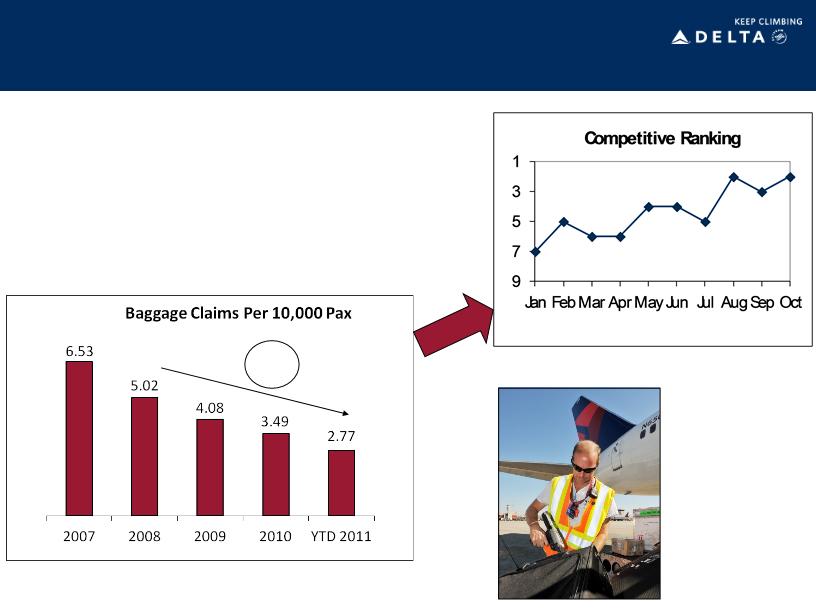

Delta: Bags Arrive with Customers

ü

Five-year positive trend

• Infrastructure

• Technology

• Process

58

%

%

51

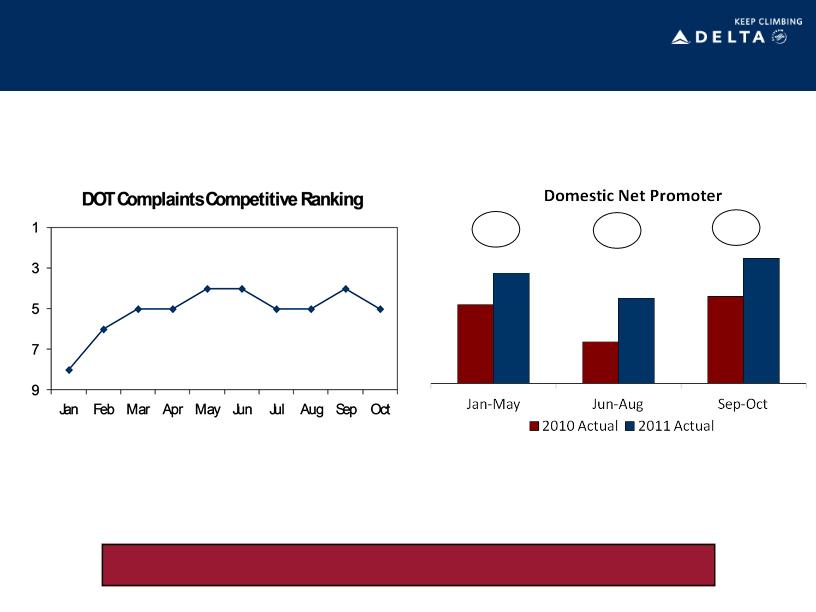

Delta: Our Customers Have Noticed

Making Delta an airline customers prefer

53

+30%

+64%

+34%

Solid Financial Foundation

Hank Halter

Chief Financial Officer

Solid Financial Foundation

Focus on Operating

Costs

Costs

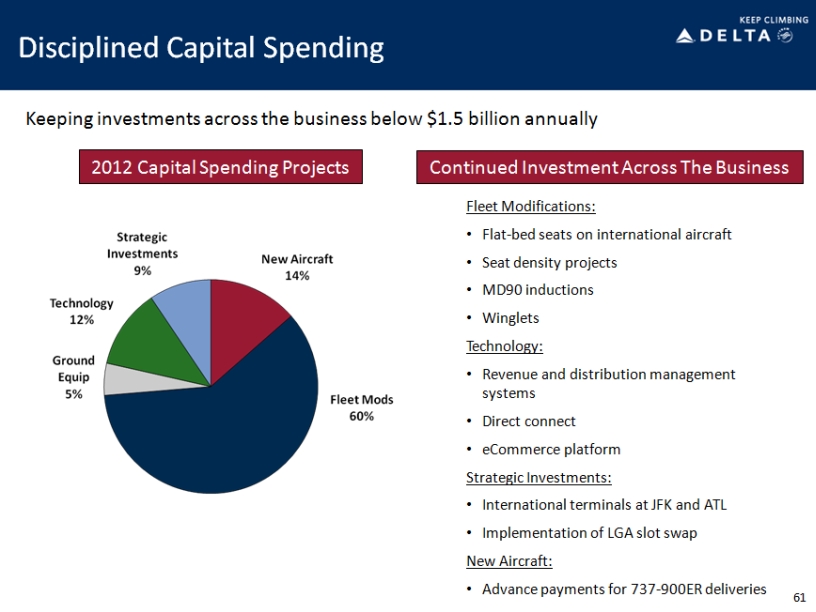

Disciplined Capital

Spending

Spending

• Measured capital spending, with focus on projects

with high rate of return

with high rate of return

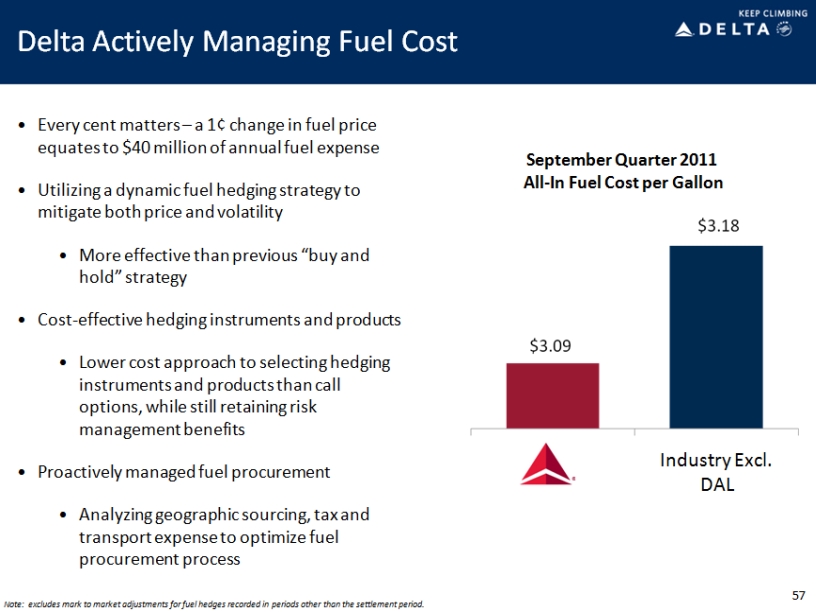

• Reducing fuel price volatility through hedging and

supply management

supply management

• Addressing non-fuel unit cost pressures to maintain

advantage to industry peers

advantage to industry peers

• Strong free cash flow generation provides for

delevering the balance sheet and derisking

the business

delevering the balance sheet and derisking

the business

Improved Balance

Sheet

55

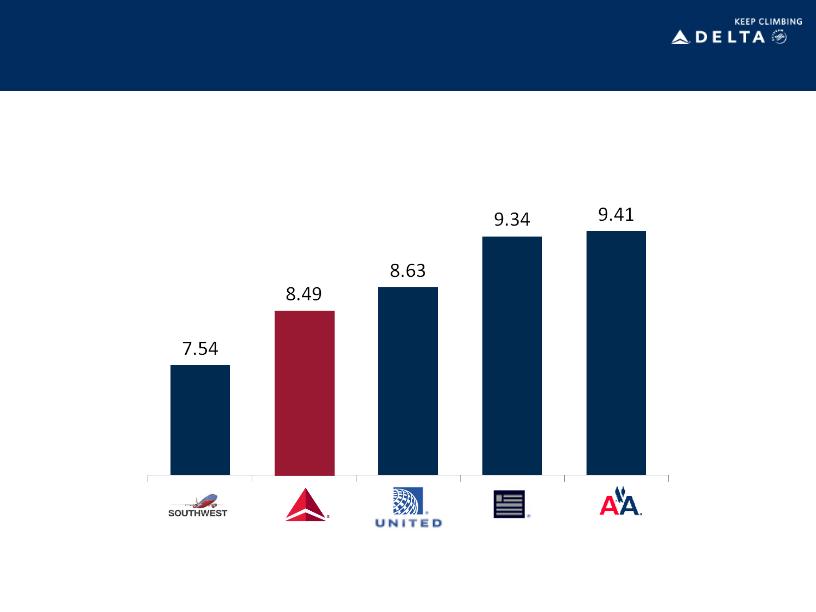

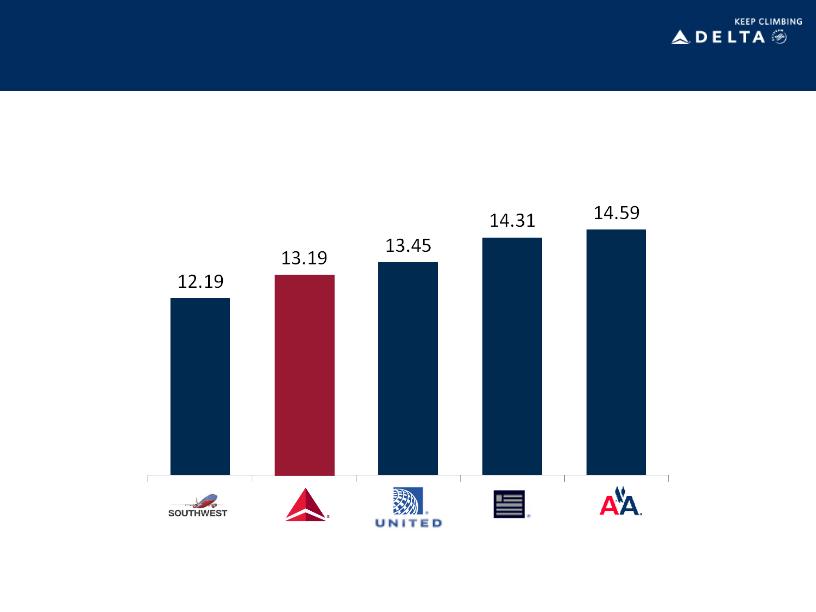

Maintaining A Total Cost Advantage

56

September 2011 Quarter Unit Costs (cents)

Note: excludes special items, ancillary businesses, and profit sharing.

Despite recent cost pressures, Delta maintains the lowest unit costs of the network carriers

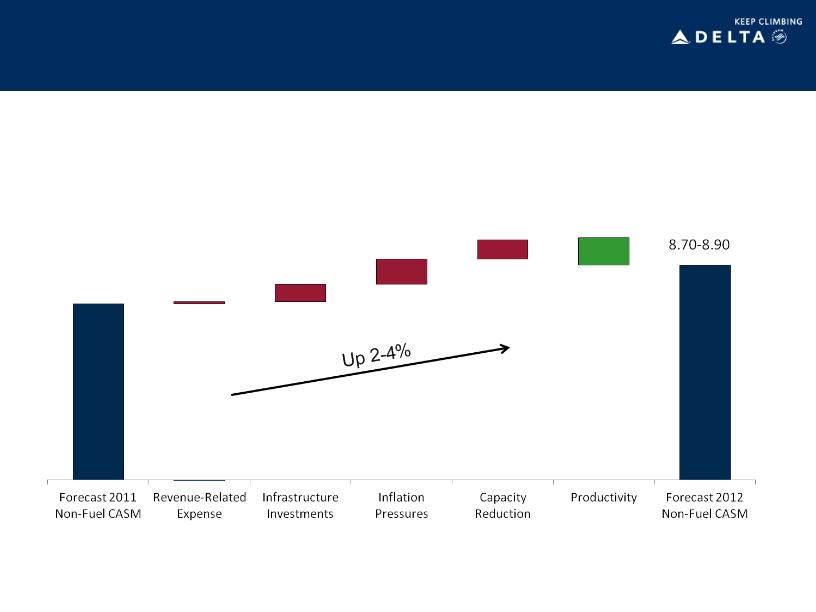

Pressure on 2012 Non-Fuel Unit Costs

8.53-8.55

Costs pressured by inflation, capacity reductions, and customer and operational

investments

investments

Non-Fuel Unit Cost

58

Note: excludes special items, ancillary businesses, and profit sharing.

2012 Initiatives Will Partially Offset Cost

Pressures

Pressures

• Increase employee productivity

• Benefits from voluntary headcount reduction

• Improve facility utilization and rates

• Streamline merit organization

Productivity

Maintenance

and Fleet

Distribution

and Technology

• Drive channel share to lower-cost delta.com with

new platform

new platform

• Improved alignment of commissions

• Renegotiate rates with GDS providers and OTAs

• Ground 140 older, less efficient aircraft over two

years

years

• Leverage AeroMexico JV to optimize maintenance

opportunities

opportunities

• Greater workscope efficiencies

59

Delta Actively Managing Liquidity

• A $5 billion target level

for total liquidity

provides sufficient

cushion to handle the

inherent volatilities in

the industry

for total liquidity

provides sufficient

cushion to handle the

inherent volatilities in

the industry

• Industry leading $1.8

billion of available

revolvers saves over

$100 million annually

billion of available

revolvers saves over

$100 million annually

60

Significant Free

Cash Flow

Generation

Cash Flow

Generation

• Continued focus on

generating returns from

the business

generating returns from

the business

• Free cash flow

generation, combined

with consistent access

to the capital markets,

reduces need to

maintain high liquidity

balances

generation, combined

with consistent access

to the capital markets,

reduces need to

maintain high liquidity

balances

$5 Billion Targeted

Liquidity

Liquidity

Minimize Liquidity

Carrying Costs

Carrying Costs

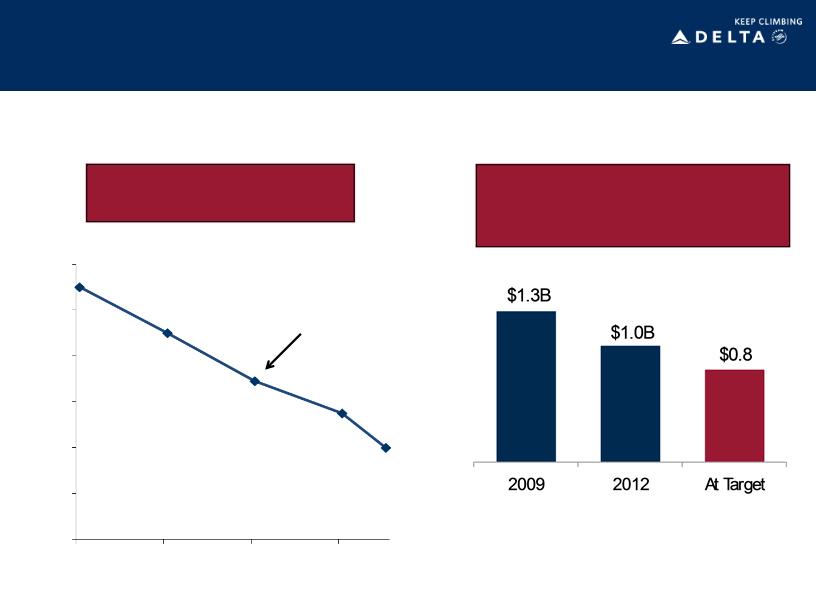

Derisking the Business through Debt Reduction

Solid Progress On Debt

Reduction…

Reduction…

$17B

12/31/11

$12.9B

$10B

62

On track to achieve $10 billion adjusted net debt target in the next 18 months

…Producing Interest Expense

Savings and Enhanced

Flexibility

Savings and Enhanced

Flexibility

2009

Mid-2013

Delta: Keep Climbing

63

Focus on top-line

growth

growth

Taking a disciplined

approach

approach

Reducing risk

across the business

across the business

Growing and diversifying revenues through a broad

global network, corporate revenue gains, fuel cost

recovery and improved products and services

global network, corporate revenue gains, fuel cost

recovery and improved products and services

Disciplined management of capacity, costs and

capital to improve profitability, generate free

cash flow and invest in the business

capital to improve profitability, generate free

cash flow and invest in the business

Creating a solid franchise that generates strong margins and cash flow, provides for

net debt reduction and investment for the future

net debt reduction and investment for the future

Reducing labor, financial and operational risk

key to creating a stable business model in a

volatile industry

key to creating a stable business model in a

volatile industry

|

Non-GAAP Financial Measures

|

||||||||||

|

We sometimes use information that is derived from our Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Certain of this information is considered “non-GAAP financial measures” under the U.S. Securities and Exchange Commission rules. The non-GAAP financial measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results.

|

||||||||||

|

Delta is unable to reconcile certain forward-looking projections to GAAP for future periods, including projected consolidated non-fuel cost per available seat mile (CASM), as the nature or amount of special items cannot be estimated at this time.

|

||||||||||

|

Delta excludes special items because management believes the exclusion of these items is helpful to investors to evaluate the company’s recurring operational performance.

|

||||||||||

|

Delta adjusts for mark-to-market (MTM) adjustments for fuel hedges recorded in periods other than the settlement period in order to evalutate the company's financial results in the period shown.

|

||||||||||

|

Delta uses adjusted total debt, including aircraft rent, in addition to long-term adjusted debt and capital leases, to present estimated financial obligations. Delta reduces adjusted total debt by cash, cash equivalents and short-term investments, resulting in adjusted net debt, to present the amount of additional assets needed to satisfy the debt.

|

||||||||||

|

Delta presents consolidated CASM excluding fuel expense and related taxes because management believes the volatility in fuel prices impacts the comparability of year-over-year financial performance.

|

||||||||||

|

Consolidated CASM excludes ancillary businesses not associated with the generation of a seat mile. These businesses include aircraft maintenance and staffing services Delta provides to third parties and Delta’s vacation wholesale operations.

|

||||||||||

|

Delta excludes profit sharing expense from consolidated CASM because management believes the exclusion of this item provides a more meaningful comparison of the company’s results to the airline industry and prior year results.

|

||||||||||

|

Delta presents free cash flow because management believes this metric is helpful to investors to evaluate the company’s ability to generate cash.

|

||||||||||

|

Net Income

|

||||||||

|

Full Year 2011

|

Full Year

|

|||||||

|

(in billions)

|

Projection

|

2010

|

||||||

|

Net income

|

$ | 0.8 | $ | 0.6 | ||||

|

Items excluded:

|

||||||||

|

Restructuring and other items

|

0.2 | 0.4 | ||||||

|

Loss on extinguishment of debt

|

0.1 | 0.4 | ||||||

|

MTM adjustments for fuel hedges recorded in periods other than the settlement period

|

- | - | ||||||

|

Net income excluding special items

|

$ | 1.1 | $ | 1.4 | ||||

|

Adjusted Net Debt

|

||||||||||||||||

|

December 31, 2011

|

||||||||||||||||

|

(in billions)

|

Projection

|

December 31, 2009

|

||||||||||||||

|

Debt and capital lease obligations

|

$ | 13.6 | $ | 17.2 | ||||||||||||

|

Plus: unamortized discount, net from purchase accounting and fresh start reporting

|

0.8 | 1.1 | ||||||||||||||

|

Adjusted debt and capital lease obligations

|

$ | 14.4 | $ | 18.3 | ||||||||||||

|

Plus: 7x last twelve months' aircraft rent

|

2.1 | 3.4 | ||||||||||||||

|

Adjusted total debt

|

16.5 | 21.7 | ||||||||||||||

|

Less: cash, cash equivalents and short-term investments

|

(3.6 | ) | (4.7 | ) | ||||||||||||

|

Adjusted net debt

|

$ | 12.9 | $ | 17.0 | ||||||||||||

|

Unit Cost

|

|

Full Year 2011

Projection

|

Full Year

2010

|

Nine Months Ended

September 30, 2011

|

Three Months Ended

September 30, 2011

|

% Change

Three Months Ended

December 31,

2011 vs. 2010

Projection |

||||||||||||||||

|

Unit Cost

|

14.08 to 14.10 | ¢ | 12.69 | ¢ | 14.18 | ¢ | 14.16 | ¢ | 5 | % | ||||||||||

|

Items excluded:

|

||||||||||||||||||||

|

Ancillary businesses

|

(0.35 | ) | (0.28 | ) | (0.34 | ) | (0.38 | ) | 0 | % | ||||||||||

|

Profit sharing

|

(0.11 | ) | (0.13 | ) | (0.10 | ) | (0.26 | ) | 0 | % | ||||||||||

|

Restructuring and other items

|

(0.09 | ) | (0.19 | ) | (0.09 | ) | - | 1 | % | |||||||||||

|

MTM adjustments for fuel hedges recorded in periods other than the settlement period

|

- | - | (0.11 | ) | (0.33 | ) | 2 | % | ||||||||||||

|

Unit Cost excluding special items

|

13.53 to 13.55

|

12.09 | 13.54 | 13.19 | 8 | % | ||||||||||||||

|

Aircraft fuel and related taxes

|

(5.00 | ) | (3.82 | ) | (5.05 | ) | (5.09 | ) | -6 | % | ||||||||||

|

Non-Fuel Unit Cost excluding special items

|

8.53 to 8.55 | ¢ | 8.27 | ¢ | 8.49 | ¢ | 8.10 | ¢ | 2 | % | ||||||||||

|

Free Cash Flow

|

||||||||

|

(in billions)

|

Full Year 2011 Projection

|

|||||||

|

Net cash provided by operating activities (GAAP)

|

$ | 2.6 | ||||||

|

Net cash used in investing activities (GAAP)

|

$ | (1.3 | ) | |||||

|

Adjustments:

|

||||||||

|

Redemption of short-term investments

|

(0.6 | ) | ||||||

|

Purchase of short-term investments

|

0.8 | |||||||

|

Cash used in investing

|

(1.1 | ) | ||||||

|

Total free cash flow

|

$ | 1.5 | ||||||

|

Average Price Per Fuel Gallon, Adjusted

|

||||||||

|

Three Months Ended

|

||||||||

|

Three Months Ended

|

December 31, 2011

|

|||||||

|

September 30, 2011

|

Projection

|

|||||||

|

Average price per fuel gallon including fuel expense incurred under contract carrier arrangements

|

$ | 3.29 | $ | 2.75 | ||||

|

MTM adjustments for fuel hedges recorded in periods other than the settlement period

|

(0.20 | ) | 0.21 | |||||

|

Average price per fuel gallon adjusted for MTM adjustments for fuel hedges recorded in periods other than the settlement period

|

$ | 3.09 | $ | 2.96 | ||||

|

Operating Margin

|

|||||

|

Full Year 2011

|

|||||

|

Projection

|

|||||

|

Operating Margin

|

7 to 9%

|

||||

|

Items excluded:

|

|||||

|

Restructuring and other items

|

1%

|

||||

|

MTM adjustments for fuel hedges recorded in periods other than the settlement period

|

-2%

|

||||

|

Operating Margin excluding special items

|

6 to 8%

|

||||

|

Non-Operating Expense

|

||||

|

(in millions)

|

Three Months Ended

December 31, 2011

Projection

|

|||

|

Non-operating expense

|

$315 - $340

|

|||

|

Item excluded:

|

||||

|

Loss on extinguishment of debt

|

40

|

|||

|

Non-operating expense excluding special items

|

$275 - $300

|

|||