Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8K/A - PAID INC | leaseterms.htm |

| EX-10.2 - LEASE TERMINATION - 155 FLANDERS ROAD - PAID INC | a102-leaseterminationagree.htm |

FORTY WASHINGTON LLC

40 Washington Street

Westborough, Massachusetts 01581

Lease to

PAID, INC.

THE SUBMISSION OF THIS LEASE FOR EXAMINATION, REVIEW, NEGOTIATION AND/OR SIGNATURE SHALL NOT CONSTITUTE AN OFFER OR AN OPTION TO LEASE OR A RESERVATION OF THE PREMISES AND IS SUBJECT TO WITHDRAWAL OR MODIFICATION AT ANY TIME BY EITHER PARTY. THIS LEASE SHALL BECOME EFFECTIVE AND BINDING ONLY IF AND WHEN IT SHALL BE EXECUTED AND DELIVERED BY BOTH LANDLORD AND TENANT.

Table Of Contents By Articles And Sections

ARTICLE | SECTION | PAGE |

1. | Reference Data and Definitions. | |

1.01 Reference Data | 1 | |

1.02 General Provisions | 4 | |

1.03 Terms Defined | 5 | |

2. | Premises. | |

2.01 Premises | 11 | |

2.02 Appurtenances | 12 | |

2.03 Reservations By Landlord | 12 | |

3. | Term. | |

3.01 Term Commencement | 12 | |

3.02 Termination | 12 | |

4. | Rent. | |

4.01 Basic Rent | 12 | |

4.02 Computation of Basic Rent | 13 | |

4.02 Payment with Tenant’s Stock | 13 | |

5. | Use of Premises. | |

5.01 Use Restricted | 15 | |

5.02 Rules and Regulations | 15 | |

6. | Taxes; Operating Expenses; Estimated Cost of Electrical Services. | |

6.01 Expenses and Taxes | 16 | |

6.02 Annual Statement of Additional Rent Due | 16 | |

6.03 Monthly Payments of Additional Rent | 16 | |

6.04 Accounting Periods | 16 | |

6.05 Abatement of Taxes | 16 | |

6.06 Electric, Gas and Water Service | 17 | |

6.07 Late Payment of Rent and Late Charges | 17 | |

7. | Improvements, Repairs, Additions, Replacements. | |

7.01 Preparation of the Premises | 18 | |

7.02 Alterations and Improvements | 18 | |

7.03 Maintenance by Tenant | 19 | |

7.04 Redelivery | 19 | |

ARTICLE | SECTION | PAGE |

8. | Landlord's Obligations. | |

8.01 Maintenance by Landlord | 20 | |

8.02 Limitations on Landlord's Liability | 20 | |

9. | Tenant's Particular Covenants. | |

9.01 Pay Rent | 20 | |

9.02 Occupancy of the Premises | 20 | |

9.03 Safety | 20 | |

9.04 Equipment | 21 | |

9.05 Electrical Equipment | 21 | |

9.06 Pay Taxes | 21 | |

10. | Requirements of Public Authority. | |

10.01 Legal Requirements | 22 | |

10.02 Contests | 22 | |

11. | Covenant Against Liens. | |

11.01 Mechanics’ Liens | 23 | |

11.02 Right to Discharge | 23 | |

12. | Access to Premises. | |

12.01 Access | 23 | |

13. | Assignment and Subletting: Company Arrangements. | |

13.01 Subletting and Assignments | 23 | |

14. | Indemnity. | |

14.01 Tenant's Indemnity | 25 | |

14.02 Landlord's Liability | 25 | |

15. | Insurance. | |

15.01 Liability Insurance | 26 | |

15.02 Casualty Insurance | 26 | |

15.03 Certificates | 26 | |

16. | Waiver of Subrogation. | |

16.01 Waiver of Subrogation | 26 | |

16.02 Waiver of Rights | 27 | |

ARTICLE | SECTION | PAGE |

17. | Damage or Destruction. | |

17.01 Damage by Fire, Casualty Eminent Domain | 27 | |

17.02 Restoration | 28 | |

18. | Eminent Domain. | |

18.01 Total Taking | 28 | |

18.02 Partial Taking | 28 | |

18.03 Awards and Proceeds | 29 | |

19. | Quiet Enjoyment. | |

19.01 Landlord's Covenant | 29 | |

19.02 Superiority of Lease: Option to Subordinate | 29 | |

19.03 Notice to Mortgagee | 29 | |

19.04 Other Provisions Regarding Mortgagees | 30 | |

20. | Defaults; Events of Default. | |

20.01 Defaults | 30 | |

20.02 Tenant's Best Efforts | 31 | |

21. | Insolvency. | |

21.01 Insolvency | 31 | |

22. | Landlord's Remedies; Damages on Default. | |

22.01 Landlord's Remedies | 31 | |

22.02 Surrender | 31 | |

22.03 Right to Relet | 32 | |

22.04 Survival of Covenants | 32 | |

22.05 Right to Equitable Relief | 33 | |

22.06 Right to Self Help; Interest on Overdue Rent. | 33 | |

22.07 Payment of Landlord’s Cost of Enforcement | 33 | |

22.08 Further Remedies | 34 | |

ARTICLE | SECTION | PAGE |

23. | Waivers. | |

23.01 No Waivers | 34 | |

24. | Security Deposit. | |

24.01 Security Deposit | 34 | |

25. | General Provisions. | |

25.01 Force Majeure | 35 | |

25.02 Notices and Communications | 36 | |

25.03 Certificates, Estoppel Letter | 36 | |

25.04 Governing Law | 36 | |

25.05 Partial Invalidity | 36 | |

25.06 Notice of Lease | 36 | |

25.06 Notice of Lease | 36 | |

25.08 Bind and Inure; Limitation of Landlord’s Liability | 36 | |

25.09 Parties | 37 | |

26. | Miscellaneous. | |

26.01 Holdover Clause | 37 | |

26.02 Relocation | 37 | |

26.03 Brokerage | 38 | |

26.04 Landlord's Expenses Regarding Consents | 38 | |

26.05 Financial Statements | 38 | |

26.06 Signage | 38 | |

26.07 Furniture | 38 | |

26.08 Option to Extend Term | 38 | |

26.09 Right of First Offer | 39 | |

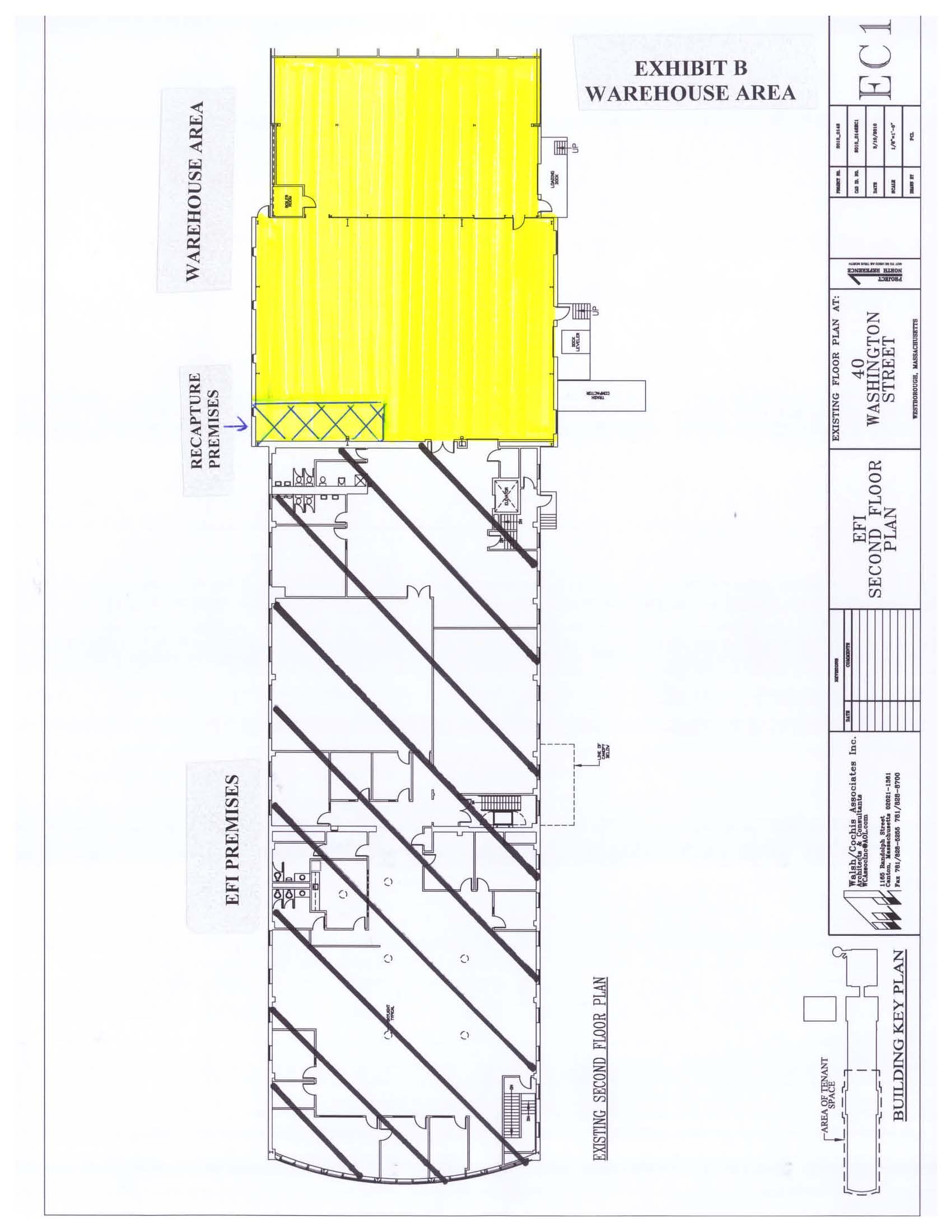

26.10 Warehouse Area Recapture | 40 | |

27. | Entire Agreement. | |

27.01 Entire Agreement | 41 | |

FORTY WASHINGTON LLC

40 Washington Street

Westborough, Massachusetts

LEASE EXHIBITS

Exhibit A: | Legal Description | 42 | |

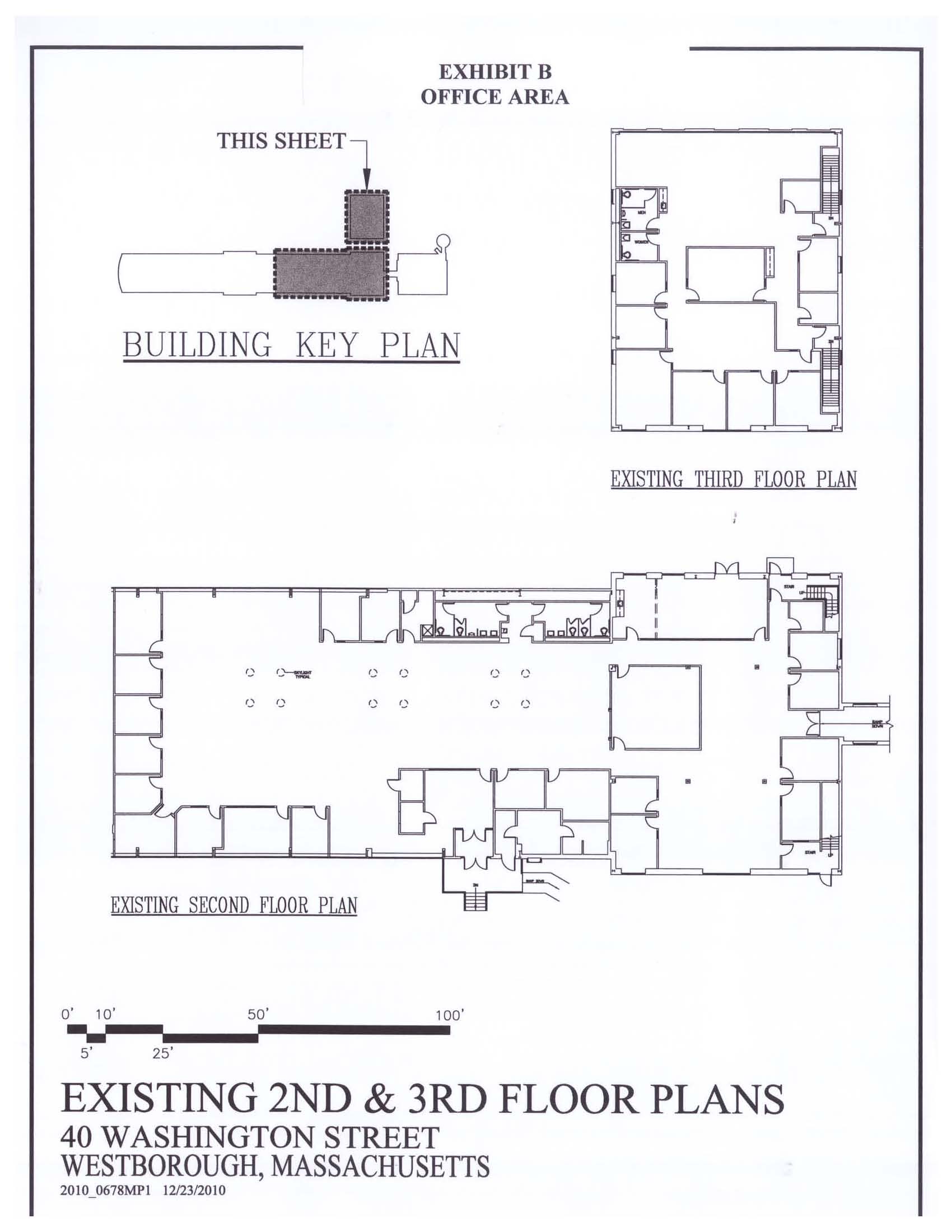

Exhibit B: | Plan Showing Tenant's Space | 43 | |

Exhibit C: | Memorandum of Work and Installations To Be Initially Performed and Furnished in the Premises | 46 | |

Exhibit D: | Services to be Provided by Landlord as Operating Expenses | 47 | |

Exhibit E: | Rules and Regulations | 48 | |

Exhibit F: | Tenant Estoppel Certificate | 50 | |

Exhibit G: | Agreement of Subordination Nondisturbance and Attornment | 53 | |

Exhibit H: | Certificate of Vote | 56 | |

Exhibit I: | Parking | 57 | |

Exhibit J: | Guaranty – Intentionally Omitted | ||

Exhibit K: | Trash Removal | 58 | |

Exhibit L: | Notice of Lease | 59 | |

FORTY WASHINGTON LLC

40 Washington Street

Westborough, Massachusetts

LEASE

STANDARD FORM

THIS LEASE by and between FORTY WASHINGTON LLC, a Massachusetts limited liability company, ("Landlord") having a principal place of business at 116 Flanders Road, Suite 2000, Westborough, Massachusetts 01581, and PAID, INC., a duly organized and existing Delaware corporation ("Tenant") having a principal place of business at 4 Brussels Street, Worcester, Massachusetts 01610 (Tenant Address).

W I T N E S S E T H :

ARTICLE 1

Reference Data and Definitions

1.01 Reference Data

LANDLORD: | Forty Washington LLC |

LANDLORD'S REPRESENTATIVE: | Mr. Marc R. Verreault Senior Vice President, Finance Forty Washington LLC |

LANDLORD'S ADDRESS: (FOR PAYMENT OF RENT) | Forty Washington LLC 116 Flanders Road, Suite 2000 Westborough, Massachusetts 01581 |

LANDLORD'S ADDRESS: (FOR NOTICE): | Mr. Christopher F. Egan and Mr. Marc R. Verreault Forty Washington LLC 116 Flanders Road, Suite 2000 Westborough, MA 01581 |

With a copy to: | Joseph Jenkins, Esquire 116 Flanders Road, Suite 1100 Westborough, MA 01581 Telephone: 508-898-3900 Facsimile: 508-898-9777 |

LANDLORD’S PHONE NUMBER: | 508-898-3800 |

LANDLORD’S FACSIMILE NUMBER | 508-898-3005 |

TENANT: | Paid, Inc. |

TENANT’S ADDRESS (FOR NOTICE PRIOR TO OCCUPANCY) | Mr. Christopher Culross Chief Financial Officer Paid, Inc. 4 Brussels Street Worcester, MA 01610 Telephone: 508-791-6710 Facsimile: 508-797-5398 Email: cculross@paid.com |

With a copy to: | Peter J. Dawson, Esq. Mirick O’Connell 100 Front Street Worcester, MA 01608 Telephone: 508-929-1626 Facsimile: 508-983-6241 Email: pdawson@mirickoconnell.com |

TENANT’S ADDRESS (FOR NOTICE AFTER OCCUPANCY) | Mr. Christopher Culross Chief Financial Officer Paid, Inc. 40 Washington Street, Suite 3000 Westborough, MA 01581 Telephone: Facsimile: Email: cculross@paid.com |

With a copy to: | Peter J. Dawson, Jr. Mirick O’Connell 100 Front Street Worcester, MA 01608 Telephone: 508-929-1626 Facsimile: 508-983-6241 Email: pdawson@mirickoconnell.com |

TENANT'S REPRESENTATIVE: | Mr. Christopher Culross Chief Financial Officer |

TENANT'S PHONE NUMBER: | 617-861-6050 x207 |

TENANT’S FACSIMILE NUMBER: | 508-635-6843 |

PREMISES: | The portion of the Building shown on Exhibit B attached hereto. |

RENTABLE AREA OF PREMISES: | Office Area:Approximately 18,329 Square Feet. Warehouse Area:Approximately 7,732 Square Feet. Total Premises: Approximately 26,061 Square Feet. |

RENTABLE AREA OF THE BUILDING: | Approximately 59,124 Square Feet. |

TERM COMMENCEMENT DATE: | The Term Commencement Date for the Office Area shall be the earlier of (a) the date Tenant shall occupy all or any part of the Office Area for the conduct of business or (b) the date on which Landlord’s Work shall be deemed substantially complete under Exhibit C. The Term Commencement Date for the Warehouse Area shall be the earlier of (a) the date Tenant shall occupy all or any part of the Warehouse Area for the conduct of business or (b) the date on which Landlord’s Work shall be deemed substantially complete under Exhibit C. The Term Commencement Date shall not occur unless the lease to the existing occupant has been terminated. Landlord will give Tenant notice of the date the Term Commencement date will occur. |

STATED EXPIRATION DATE: | The last day of the month in which the fifth (5th) anniversary of the Warehouse Term Commencement Date shall occur, provided that, if the Warehouse Term Commencement Date shall be the first day of a calendar month, then the Stated Expiration Date shall be the day before the fifth (5th) anniversary of the Warehouse Term Commencement Date. |

BASIC RENT: | From the Term Commencement Date for the Office Area to the day prior to the Warehouse Area Term Commencement Date: $116,939.02 per annum ($9,744.92 per month), to be paid in accordance with Section 4.03 hereof. From the Warehouse Area Term Commencement Date to the Stated Expiration Date: $166,269.18 per annum ($13,855.77 per month) |

TENANT'S SHARE: | From the Term Commencement Date of the Office Area to the day prior to the Warehouse Area Term Commencement Date: 32.63% From the Warehouse Area Term Commencement Date to the Stated Expiration Date: 46.40% |

GUARANTOR: | N/A |

PERMITTED USES: | Office, warehouse, distribution |

SECURITY DEPOSIT: | Is to be paid in accordance with the provisions of Section 4.03 hereof. |

1.02 General Provisions.

For all purposes of the Lease unless otherwise expressed and provided herein or therein or

unless the context otherwise requires:

(a) | The words herein, hereof, hereunder and other words of similar import refer to the Lease as a whole and not to any particular article, section or other subdivision of this Lease. |

(b) | A pronoun in one gender includes and applies to the other gender as well. |

(c) | Each definition stated in Section 1.01 or 1.03 of this Lease applies equally to the singular and the plural forms of the term or expression defined. |

(d) | Any reference to a document defined in Section 1.03 of this Lease is to such document as originally executed, or, if modified, amended or supplemented in accordance with the provisions of this Lease, to such document as so modified, amended or supplemented and in effect at the relevant time of reference thereto. |

(e) | All accounting terms not otherwise defined herein have the meanings assigned to them in accordance with generally accepted accounting principles. |

(f) | All references in Section 1.01 hereof are subject to the specified definitions thereof (if any) in Section 1.03 hereof. |

1.03 Terms Defined.

Each term or expression set forth above in Section 1.01 hereof or below in this Section 1.03 has the meaning stated immediately after it.

Additional Rent. All sums which Tenant shall be obligated to pay hereunder other than Basic Rent.

Affiliate. With respect to any specified Person, any other Person directly or indirectly controlling or controlled by or under direct or indirect common control with such specified Person. For the purposes of this definition, the term "control", when used with respect to any specified Person, means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, and the terms "controlling" and "controlled by" have meanings correlative to the foregoing.

Authorizations. All franchises, licenses, permits and other governmental consents issued by Governmental Authorities pursuant to Legal Requirements which are or may be required for the use and occupancy of the Premises or the conduct or continuation of a Permitted Use therein.

Building. The Building located at 40 Washington Street, Westborough, Massachusetts.

Business Day. A day which is not a Saturday, Sunday or other day on which banks in Boston, Massachusetts, are authorized or required by law or executive order to remain closed.

Calendar Year. The First Calendar Year, the Last Calendar Year and each full calendar year (January 1 through December 31) occurring during the Lease Term.

Common Areas. All areas devoted to the common use of occupants of the Building or the provision of Services to the Building, including but not limited to the atrium, all corridors, elevator foyers, air shafts, elevator shafts, and elevators, stairwells and stairs, mechanical rooms, janitor closets, vending areas, parking lot areas and other similar facilities for the provision of Services or the use of all occupant or multi-tenant floors or all occupants of the Building.

Control. As defined in the definition of Affiliate.

Corporation. A corporation, company, association, limited partnership, liability company, business trust or similar organization wherever formed.

Default. Any event or condition specified in Article 20 hereof so long as any applicable requirement for the giving of notice or lapse of time or both have not been fulfilled.

Event of Default. Any event or condition specified in (a) Article 20 hereof (if all applicable periods for cure after the giving of notice or lapse of time or both have expired) or (b) in Article 21 hereof.

First Calendar Year. The partial Calendar Year period commencing on the Term Commencement Date and ending on the next succeeding December 31.

Force Majeure. Acts of God, strikes, lockouts, labor troubles, inability to procure materials, failure of power, restrictive Legal Requirements, riots and insurrection, acts of public enemy, wars, earthquakes, hurricanes and other natural disasters, fires, explosions, other causes beyond a party's reasonable control, or any act, failure to act or Default of the other party to this Lease; provided, however, lack of money shall not be deemed such a cause.

Governmental Authority. United States of America, the Commonwealth of Massachusetts, the

Town of Westborough, County of Worcester, and any political subdivision thereof and any agency, department, commission, board, bureau or instrumentality of any of them.

Insolvency. The occurrence with respect to any Person of one or more of the following events: the death, dissolution, termination of existence (other than by merger or consolidation), insolvency, appointment of a receiver for all or substantially all of the property of such Person, the making of a fraudulent conveyance or the execution of an assignment or trust mortgage for the benefit of creditors by such Person, or the filing of a petition in bankruptcy or the commencement of any proceedings by or against such Person under a bankruptcy, insolvency or other law relating to the relief or the adjustment of indebtedness, rehabilitation or reorganization of debtors; provided that if such petition or commencement is involuntarily made against such a Person and is dismissed within sixty (60) days of the date of such filing or commencement, such event shall not constitute an Insolvency hereunder.

Insurance Requirements. All terms of any policy of insurance maintained by Landlord or Tenant and applicable to (or affecting any condition, operation, use or occupancy of) the Building or the Premises or any part or parts of either and all requirements of the issuer of any such policy and all orders, rules, regulations and other requirements of the National Board of Fire Underwriters (or any other body exercising similar functions).

Land. The land located at 40 Washington Street, Westborough, Massachusetts, County of Worcester, Commonwealth of Massachusetts, described in Exhibit A.

Landlord's Work. The work to be done by Landlord with respect to the Premises described in Section 7.01 and Exhibit C.

Last Calendar Year. The partial Calendar Year commencing on January 1 of the Calendar Year in which the Lease Termination Date occurs and ending on the Lease Termination Date.

Lease Term. The period commencing on the Term Commencement Date and ending on the Lease Termination Date.

Lease Termination Date. The earliest to occur of (1) the Stated Expiration Date, (2) the termination of this Lease by Landlord as the result of an Event of Default, or (3) the termination of this Lease pursuant to Article 17 (Damage or Destruction) or Article 18 (Eminent Domain) hereof.

Lease Year. A period commencing on the Term Commencement Date (or an anniversary thereof) and ending on the day before the next succeeding anniversary thereof. For example, the first Lease Year is a period commencing on the Term Commencement Date and ending on the day before the first anniversary thereof. The last Lease Year shall end on the Lease Termination Date.

Legal Requirements. All laws, statutes, codes, ordinances (and all rules and regulations thereunder), all executive orders and other administrative orders, judgments, decrees, injunctions and other judicial orders of or by any Governmental Authority which may at any time be applicable to the Building or the Premises or to any condition or use thereof and the provisions of all Authorizations.

Occupancy Arrangement. With respect to the Premises or any portion thereof, and whether (a) written or unwritten or (b) for all or any portion of the Lease Term, an assignment, a sublease, a tenancy at will, a tenancy at sufferance, or any other arrangement (including but not limited to a license or concession) pursuant to which a Person occupies, or shall have the right to occupy, the

Premises for any purpose.

Operating Expenses. All expenses, costs, and disbursements of every kind and nature which Landlord shall pay or become obligated to pay in connection with the ownership, operation and maintenance of the Building (including all facilities in operation on the Term Commencement Date and such additional facilities which are necessary or beneficial for the operation of the Building), including, but not limited to (a) wages, salaries, fees and costs to Landlord of all Persons engaged in connection therewith, including taxes, insurance, and benefits relating thereto; (b) the cost of (i) all supplies and materials, electricity and lighting, (ii) water, heat, air conditioning, and ventilating, (iii) all maintenance, janitorial, and service agreements, (iv) all insurance, including the cost of casualty and liability insurance, (v) repairs, replacements and maintenance, including, without limitation, Landlord's costs and expenses of performing its obligations under Section 8.01 (including, without limitation, costs and expenses which may be capital in nature), (vi) capital items which are primarily for the purpose of reducing Operating Expenses or which may be required by a Governmental Authority, amortized over the reasonable life of the capital items with the reasonable life and amortization schedule being determined by Landlord in accordance with generally accepted accounting principles (provided that in the event the reasonably estimated annual savings arising from the installation of any such capital improvement intended to reduce Operating Expenses shall exceed such annual amortization, Operating Expenses shall include, in lieu of such amortization, such estimated annual savings until the cost of such improvement shall have been completely amortized), (vii) pursuing an application for an abatement of taxes pursuant to Section 6.05 hereof to the extent not deducted from the abatement, if any, received, (viii) independent auditors, (ix) Landlord's central accounting functions, and (x) providing office space for the manager of the Building; (c) management fees; and (d) the cost to Landlord of operating, repairing and maintaining exterior common areas and facilities which may not be located entirely on the Land but which may be used for parking or for landscaping, security and maintenance for common roadways and open areas. Operating Expenses shall not include specific costs paid by specific tenants, including utility costs paid by tenants. Operating Expenses shall be determined using the accrual basis of accounting. If at any time during the Term, less than ninety five percent (95%) of the Rentable Area of the Building is occupied, Operating Expenses shall be adjusted by the Landlord to reasonably approximate the Operating Expenses which would be incurred if the project had been at least ninety five percent (95%) occupied.

The following items shall be excluded from “Operating Expenses”:

1. material repairs or other work occasioned by (i) earthquake, fire, windstorm, or other casualty of the type which Landlord has insured or is required to insure pursuant to the terms of this Lease, or for which Landlord is entitled to reimbursement, whether or not collected, from third parties, or (ii) the exercise of the right of eminent domain;

2. marketing costs, leasing commissions, finders’ fees, attorney’s fees, costs, and disbursements and other expenses incurred in connection with negotiations or disputes with other tenants, other occupants, prospective tenants or other occupants, or the sale or refinancing of the Building, or legal fees incurred in connection with the preparation of this Lease:

3. expenses for permits, license, design, space planning, and inspection costs incurred in tenant build-out, renovating or otherwise improving or decorating, painting or redecorating other tenants space or other occupant of space;

4. Landlord’s costs of electricity and other services sold or provided to tenants in the Building and for which Landlord is entitled to be reimbursed, whether or not collected, by such tenants as a separate additional charge or rental over and above the basic rent or escalation payment payable under the lease with such tenant;

5. except as provided herein, costs incurred by Landlord for alterations which are considered capital improvements and replacements under generally accepted accounting principles consistently applied, and all other costs of a capital nature, including, but not limited to, capital improvements, capital equipment and capital, tools all determined in conformity with generally accepted accounting principles consistently applied, except as provided in the Lease;

6. depreciation and amortization, except as provided in the Lease;

7. expenses in connection with non-Building standard services or benefits of a type which are not available to Tenant but which are provided to other tenants or occupant of the Building, or for which Tenant is charged directly but which are provided to another tenant or occupant of the Building without direct charge;

8. costs incurred due to violation by Landlord or any tenant, other than Tenant, or other occupant of the terms and conditions of any lease or other rental arrangement covering space in the Building;

9. advertizing and promotional expenditures, and costs of signs in or on the Building indentifying the owner of the Building or any other tenant of the Building unless such sign is common to Tenant as well;

10. any costs, fines, or penalties incurred due to violations by Landlord of any governmental rule or authority;

11. costs for or relating to sculpture, paintings, or other art;

12. rentals (other than temporary) and other related expenses incurred in the leasing of air conditioning systems, elevators, or other equipment ordinarily considered to be of a capital nature, except equipment which is used in providing janitorial services and which is not affixed to the Building;

13. any violation of, or to otherwise comply with, any laws, statutes, and only laws and legal requirements before the Lease Commencement Date, ordinances, codes or other governmental rules, regulations or requirements not in force or which may hereafter be in force, or with the requirements of any board of fire underwriters or other similar body now or hereafter constituted, and only laws and requirements before the Lease Commencement Date;

14. charitable or political contributions;

15. costs associated with the operation of the business of the partnership or entity which constitutes Landlord, or the operation of any parent, subsidiary or affiliate of Landlord, as the same are distinguished from the costs of operation of the Building, including without limitation partnership accounting and legal matters, costs of defending any lawsuits with any mortgagee, costs of selling, syndicating, financing,

mortgaging or hypothecating any of Landlord’s interest in the Building, and costs of any disputes between Landlord and its employees or disputes of Landlord with third-party building management;

16. costs and expenses due to termination or underfunding of any plan under ERISA or any other law or regulation governing employee pension plans or other benefits; and

17. costs incurred in connection with investigating, assessing, removing, encapsulating or otherwise remediating or abating asbestos or other hazardous or toxic materials or other forms of contamination in or on the building or on or under the real property or any part thereof (including without limitation groundwater contamination), unless caused by Tenant.

Partial Taking. Any Taking which is not a Total Taking.

Permitted Exceptions. Any liens or encumbrances on the Premises in the nature of (a) liens for T\axes assessed but not yet due and payable, (b) easements, reservations, restrictions and rights of way encumbering or affecting the Land on the date of this Lease, provided that such easements, reservations, restrictions and rights of way do not materially adversely affect Tenant’s rights under this Lease or its access to or use of the Premises for the Permitted Uses, (c) the rights of Landlord, Tenant and any other Person to whom Landlord has granted such rights to exercise in common with respect to the Land and the Common Areas the rights granted to Tenant hereunder, (d) mortgages of record, and (e) Title Conditions.

Person. An individual, a Corporation, a company, a voluntary association, a partnership, a trust, an unincorporated organization or a government or any agency, instrumentality or political subdivision thereof.

Premises. The space in the Building shown on Exhibit B hereto.

Proceeds. With respect to any Taking or occurrence described in Article 17 hereof, with respect to which any Person is obligated to pay any amount to or for the account of Landlord, the aggregate of (i) all sums payable or receivable under or in respect of any insurance policy, and (ii) all sums or awards payable in respect to a Taking.

Rent. Basic Rent and all Additional Rent.

Rentable Area of the Premises. The number of square feet stated in Section 1.01, whether the same should be more or less as a result of minor variations resulting from actual construction and completion of the Premises so long as such work is done in accordance with the terms and provisions hereof. The calculation was made according to the following formula:

(i) | On single tenant floors, the usable area measured from the outside surfaces of the outer walls of the Building, plus Tenant's Share of interior Common Areas. |

(ii) | On multi‑tenant floors, the usable area measured from the outside surface of the outer walls of the Building to the midpoint of all demising walls of the space being measured plus the area of each corridor adjacent to and required as the result of the layout of the space being measured, measured from the midpoint of the adjacent demising walls, plus Tenant's Share of interior Common Areas. |

Rules and Regulations. Reasonable rules and regulations promulgated by Landlord and uniformly

applicable to Persons occupying the Building regulating the details of the operation and use of the Building. The initial Rules and Regulations are attached hereto as Exhibit E.

Stated Expiration Date. The Stated Expiration Date as stated in Section 1.01.

Taking. The taking or condemnation of title to all or any part of the Land or the possession or use of the Building or the Premises by a Person for any public use or purpose or any proceeding or negotiations which might result in such a taking or any sale or lease in lieu of or in anticipation of such a taking.

Taxes. All taxes, special or general assessments, water rents, rates and charges, sewer rents and other impositions and charges imposed by Governmental Authorities of every kind and nature whatsoever, extraordinary as well as ordinary, and each and every installment thereof which shall or may during the term of this Lease be charged, levied, laid, assessed, imposed, become due and payable or become liens upon or for or with respect to the Land or any part thereof or the Building or the Premises, appurtenances or equipment owned by Landlord thereon or therein or any part thereof or on this Lease under or by virtue of all present or future Legal Requirements or a tax based on a percentage, fraction or capitalized value of the Rent (whether in lieu of or in addition to the taxes hereinbefore described). Taxes shall not include inheritance, estate, excise, succession, transfer, gift, franchise, net income, gross receipt, or profit taxes except to the extent such are in lieu of or in substitution for Taxes as now imposed on the Building, the Land, the Premises or this Lease. If for any year Taxes have been reduced or abated, or are subsequently reduced or abated, because of vacancies in the Building, Taxes for such year shall be adjusted by Landlord to reasonably approximate the amount Taxes would have been had such vacancies not existed.

Tenant. As defined in the preamble hereof.

Tenant's Share. Tenant's Share is specified in Section 1.01 and is equal to the Rentable Area of the Premises divided by 95% of the Rentable Area of the Building.

Term Commencement Date. The Term Commencement Date stated in Section 1.01.

Title Conditions. All covenants, agreements, restrictions, easements and declarations of record on the date hereof so far as the same may be from time to time in force and applicable.

Total Taking. (i) a Taking of: (a) the fee interest in all or substantially all of the Building or (b) such title to, easement in, over, under or such rights to occupy and use any part or parts of the Building to the exclusion of Landlord as shall have the effect, in the good faith judgment of the Landlord, of rendering the portion of the Building remaining after such Taking (even if restoration were made) unsuitable for the continued use and occupancy thereof for the Permitted Uses or (ii) a Taking of all or substantially all of the Premises or such title to or easement in, on or over the Premises to the exclusion of Tenant which in the good faith judgment of the Landlord prohibits access to the Premises or the exercise by Tenant of any rights under this Lease.

ARTICLE 2

Premises

2.01 | Premises. |

Landlord hereby leases and lets to Tenant, and Tenant hereby takes and hires from Landlord, upon and subject to the terms, conditions, covenants and provisions hereof, the Premises subject to

the Permitted Exceptions. Landlord reserves the right to install within or without the Premises pipes, ducts, vents, flues, conduits, wires and appurtenant fixtures which service other parts of the Building; provided that such work shall be done in such a manner that it does not unreasonably interfere with Tenant's use of the Premises. Subject to the rights of the existing tenant, and subject to the Landlord’s obligations pursuant to Section 7.01 and Exhibit C, the Landlord shall provide Tenant with access to the Premises prior to the Term Commencement Date to allow Tenant an opportunity to ready the Premises for Tenant’s occupancy provided, however, Tenant shall not commence business operations at the Premises until the Term Commencement Date.

2.02 Appurtenances.

Tenant, in common with others entitled thereto from time to time, may use the Common Areas for the purposes for which they were designed.

Landlord reserves the right, from time to time, to grant easements affecting the Land, to change or alter the boundaries of the Land and to alter, and grant to others the right to use, the entrances, parking areas and driveways on the Land, all for purposes of developing and using properties adjacent to the Land, so long as the same do not unreasonably interfere with Tenant’s use of the Common Areas or reduce the number of parking spaces available for Tenant.

2.03 Reservations By Landlord.

Landlord reserves the right, exercisable at any time and from time to time without the same constituting an actual or constructive eviction and without incurring any liability therefor or otherwise affecting Tenant’s obligations under this Lease, to make changes, alterations, additions, improvements, repairs or replacements to the Building and the Common Areas as long as such work does not unreasonably interfere with Tenant’s business, including, without limitation, elimination of Common Areas and changing the size, arrangement and location of, and eliminating, entrances, lobbies, driveways, parking areas, doors, corridors, elevators, stairs and restrooms.

ARTICLE 3

Term

3.01 Term Commencement.

The Lease Term shall commence on the Term Commencement Date.

3.02 Termination.

The Lease Term shall end on the Lease Termination Date.

ARTICLE 4

Rent

4.01 Basic Rent.

Tenant shall pay Landlord for the Premises, without offset or deduction and without previous demand therefor, the Basic Rent as annual rent for each Lease Year. Basic Rent shall be paid in accordance with Section 4.03 below. Basic Rent for partial months at the beginning or end of the Lease Term shall be pro‑rated.

4.02 Computation of Basic Rent.

The Basic Rent for each Lease Year shall be as stated in Article 1.01 hereof.

Basic Rent shall be exclusive of (and in addition to) amounts due hereunder for Taxes and Operating Expenses.

4.03 Payment with Tenant’s Stock

Tenant represents and warrants that:

(a) Tenant is a duly organized and existing Delaware corporation in good standing in Delaware and Massachusetts;

(b) Tenant’s authorized capital consists of 350,000,000 shares of common stock (“Common Stock”) of which 302,368,821 shares are issued and outstanding as of October 28, 2011;

(c) Except for the restrictions on the Common Stock imposed by Rule 144 of the Securities and Exchange Commission, the Common Stock to be issued hereunder will be subject to no restrictions on transfer;

(d) Tenant’s Board of Directors has approved the issuance of Common Stock hereunder;

(e) No consent or approval from any other Person is required for the valid and lawful issuance of Common Stock hereunder;

(f) The Common Stock is traded over the counter; and

(g) When issued, the Common Stock to be issued hereunder will be validly issued, deemed fully paid and non-assessable.

On the Term Commencement Date and on the first day of each of the next two (2) calendar months thereafter, Tenant shall pay to Landlord $9,744.92 as a monthly installment of Basic Rent and for the next four (4) calendar months thereafter Tenant shall pay Landlord $13,855.77 as a monthly installment of Basic Rent (“Initial Cash Basic Rent Payments”). Such amount shall be pro-rated for any partial month. Notwithstanding the foregoing, if the Term Commencement Date is the first day of a calendar month, then Tenant shall makes a total of six (6) such payments of Basic Rent.

Tenant shall make three (3) payments in Common Stock no later than ten (10) days after the execution and delivery hereof in payment of the Rent specified:

(1) Tenant shall deliver to Landlord one or more certificates of Common Stock having an aggregate value of $823,124.50, as payment in full (subject to the following provisions) for the aggregate Basic Rent for the initial Lease Term;

(2) Tenant shall deliver to Landlord one or more certificates of Common Stock having an aggregate value of Four Hundred Seventy Two Thousand Dollars and No Cents ($472,000.00), for estimated Taxes and Operating Expenses for the initial Lease Term based on 2010 tax rates and prior operating history, to be credited against Taxes and Operating Expenses for the initial Lease Term, subject to the following provisions and the provisions of Article 6 with respect to any shortfall based on actual amounts owed, which shall be paid in cash: and

(3) Tenant shall deliver to Landlord one or more certificates of Common Stock having a value of $83,134.62, as the Security Deposit.

The Common Stock shall be valued as of the trading day immediately prior to issuance, at a price equal to the “Last Price” as reflected on the OTCBB as of such trading day.

Landlord acknowledges and agrees that Common Stock may not be sold or otherwise transferred for six (6) months after the date of issuance (the “Restricted Period”), after which time Landlord may sell the Common Stock on the open market. Tenant hereby guarantees that, within three (3) months after Landlord shall provide the broker paperwork required hereby, Landlord shall receive an amount in cash equal to the total amounts set forth in subsections (1), (2) and (3) above for the Common Stock sold after the end of the Restricted Period, if Landlord provides all required broker paperwork to sell the Common Stock to the market maker or approved broker within sixty (60) days after the end of the Restricted Period and notifies Tenant of its intent and willingness to sell all such shares of Common Stock at such time.

Tenant agrees that at the time Tenant desires to sell Common Stock (a) there will be adequate public information concerning Tenant to permit the sale of Common Stock under Rule 144 and (b) Tenant will promptly take all action, including, without limitation, causing its counsel to issue an appropriate opinion letter, to remove the legend from the Restricted Common Stock and to permit Landlord to sell the same.

In the event of a shortfall from the guaranteed amounts, in each case Tenant shall pay such shortfall amount in additional Restricted Common Stock promptly on demand therefor. Sales of such additional shares of Common Stock shall be guaranteed in the same manner as the original issuance of Common Stock, except that such guaranty shall be paid in cash on demand.

In the event Landlord sells the Common Stock and receives a net amount equal to or greater than the aggregate of the dollar amounts set forth in (1), (2) and (3) above:

(a) Landlord shall pay to Tenant the sum of $55,423.08, thereby reducing the Security Deposit to a cash Security Deposit in the amount of $27,711.54 (plus any amount added to the Security Deposit pursuant to Exhibit C);

(b) Provided Tenant has timely made the cash payments of Basic Rent required above, Landlord shall pay to Tenant the sum of $74,912.92 to refund cash payments of Basic Rent in such amount; and

(c) If after the payment of the sums specified in (a) and (b) above, the net remaining proceeds from the sale of the Common Stock (including the $27,711.54 cash Security Deposit) exceed $1,322,836.04, such excess shall be credited against Tenant’s future obligations to pay Taxes and Operating Expenses.

Tenant may prepay any amount due in cash at any time.

If Landlord chooses to retain ownership of the shares of Common Stock as an investment or otherwise, or if Landlord does not timely provide all required broker paperwork to sell the Common Stock to the market maker or approved broker or fails to notify Tenant of its intent and willingness to sell all the shares of Common Stock by such time, the sales value of such shares of Common Stock shall no longer be guaranteed, and such portion of shares shall be considered payment pro rata. By way of example only, if Landlord determines to hold all of the shares of

Common Stock without providing all required broker paperwork to sell the common stock to the market maker or approved broker in accordance with the guaranty requirements and timelines under this Section 4.03, the Basic Rent, Security Deposit, Taxes, and Operating Expenses to the extent specified above shall be deemed paid in full. Alternatively, if Landlord determines to hold, for example, 25% of all Common Stock paid to it as Basic Rent, Taxes, and Operating Expenses, and if the total Basic Rent, Taxes and Operating Expenses equal $1,000,000, then $250,000 shall be deemed paid for Basic Rent, Taxes and Operating Expenses, and Tenant guarantees that Landlord will receive for the Common Stock sold for the applicable sales periods an amount equal to $750,000, or 75% of the Basic Rent, Taxes and Operating Expenses provided above. Any shortfall shall be paid by Tenant, and any excess amount to Landlord shall be applied to Taxes and Operating Expenses payable by Tenant, if any.

ARTICLE 5

Use of Premises

5.01 Use Restricted.

The Premises may be used for the Permitted Uses and for no other purpose. No improvements may be made in or to the Premises except as otherwise provided in this Lease.

5.02 Rules and Regulations.

Tenant shall comply with the Rules and Regulations established from time to time by Landlord. Landlord shall not be liable to Tenant for (a) the failure of other tenants to comply with such Rules and Regulations, (b) the failure of other tenants to comply with any term or provision of their respective leases or (c) any nuisance or wrongful, negligent, improper, offensive or unlawful act or omission of any such other tenant. The Landlord shall endeavor to enforce the Rules and Regulations uniformly among the tenants of the Building.

ARTICLE 6

Taxes; Operating Expenses;

Electrical and Gas Services; Late Payment

6.01 Operating Expenses and Taxes.

With respect to each Calendar Year, Tenant shall pay Tenant's Share of Operating Expenses and Taxes. Amounts due under this Section 6.01 shall be due on the date which is thirty (30) days after receipt by Tenant of the statement described in Section 6.02 hereof. Tenant shall receive credits against the amount otherwise due as provided in Section 4.03.

6.02 Annual Statement of Additional Rent Due.

Landlord shall render to Tenant a statement, showing (i) for the Calendar Year so indicated (a) Taxes and (b) Operating Expenses and (ii) for the then current Calendar Year, an estimate for (a) Operating Expenses, (b) Taxes and (c) Tenant's obligation under Section 6.01.

6.03 Monthly Payments of Additional Rent.

Tenant shall pay to Landlord in advance for each calendar month of the Lease Term falling between receipt by Tenant of the statement described in Section 6.02 and receipt by Tenant of the next such statement, as Additional Rent, an amount equal to 1/12th of Tenant's estimated obligation under Section 6.01 shown thereon. The amount due under this Section 6.03 shall be paid with Tenant's monthly payments of Basic Rent and shall be credited by Landlord to Tenant's obligations under Section 6.01. If the total amount paid hereunder exceeds the amount due under such Section, such excess shall be credited by Landlord against the monthly installments of Additional Rent next falling due or shall be refunded to Tenant upon the expiration or termination of this Lease (unless such expiration or termination is the result of an Event of Default).

6.04 Accounting Periods.

Landlord shall have the right from time to time to change the periods of accounting hereunder to any other annual period than a Calendar Year, and upon any such change, all items referred to in this Article 6 shall be appropriately apportioned. In all statements rendered under Section 6.02, amounts for periods partially within and partially without the accounting periods shall be appropriately apportioned, and any items which are not determinable at the time of a statement shall be included therein on the basis of Landlord's estimate and with respect thereof Landlord shall render to Tenant promptly after determination a supplemental statement and an appropriate adjustment shall be made according thereto.

6.05 Abatement of Taxes.

Landlord may at any time and from time to time make application to the appropriate Governmental Authority for an abatement of Taxes. If (i) such an application is successful for reasons other than the existence of vacancies in the Building and (ii) Tenant has made any payment in respect of Taxes pursuant to this Article 6 for the period with respect to which the abatement was granted, Landlord shall (a) deduct from the amount of the abatement all expenses incurred by it in connection with the application, (b) recompute Tenant's obligation with respect to Taxes under Section 6.01 and refund any overpayment to Tenant and (c) retain the balance, if any.

6.06 Electric and Gas Service.

Tenant shall arrange to obtain electricity and gas for the Premises at Tenant’s expense from such source or sources as Landlord shall designate as the source or sources therefor for the Building from time to time. Landlord shall have no obligation with respect to the provision of electricity and gas for the Premises.

If at any time Landlord provides electricity which it or an Affiliate has generated, whether by solar panels or otherwise (“Landlord-generated Electricity”), Landlord may (a) charge Tenant therefor if Tenant pays for electricity by metering , by the payment of the Estimated cost of Electrical Service or otherwise and (b) to the extent electricity may be included in Operating Expenses, Landlord may include a charge for such Landlord-generated Electricity in Operating Expenses, in each case at the same rate which the electric utility provider charges for the same amount of electricity. If Landlord or an Affiliate generates Landlord-generated Electricity at another property which results in Landlord obtaining a credit against the electric utility provider’s charges for electricity at the Building, the cost of electricity at the Building shall be determined as if such credit had not been obtained.

6.07 Late Payment of Rent and Late Charges.

Tenant’s failure to pay Rent, Additional Rent, or any other Lease costs when due under this Lease may cause Landlord to incur unanticipated costs. The exact amount of such costs are impractical or extremely difficult to ascertain. Such costs may include, but are not limited to, processing and accounting charges and late charges that may be imposed on Landlord by any ground lease, mortgage, or deed of trust encumbering the Land or Building.

Therefore, if Landlord does not receive the Rent, Additional Rent, or any other Lease costs in full within five (5) days of its due date, Tenant shall pay Landlord a late charge, which shall constitute liquidated damages, equal to ten percent (10%) of each unpaid portion (“Late Charge”), which shall be paid to Landlord together with such Rent, Additional Rent, or other Lease costs then in arrears.

The parties agree that such Late Charge represents a fair and reasonable estimate of the cost Landlord will incur by reason of such late payment.

For each Tenant payment check to Landlord that is returned by a bank for any reason, Tenant shall pay both a Late Charge (if applicable) and a returned check charge (“Returned Check Charge”) in an amount equal to that charged by Landlord’s bank at the time.

All Late Charges and any Returned Check Charge shall then become Additional Rent and shall be due and payable immediately along with such other Rent, Additional Rent, or other Lease costs then in arrears.

Money paid by Tenant to Landlord shall be applied to Tenant’s account in the following order: (i) to any unpaid Additional Rent, including, without limitation, Late Charges, Returned Check Charges, legal fees and/or court costs legally chargeable to Tenant, Operating Expenses and Taxes; and then (ii) to unpaid Basic Rent.

Nothing herein contained shall be construed so as to compel Landlord to accept any payment of Rent, Additional Rent, or other Lease costs in arrears or Late Charge or Returned Check Charge should Landlord elect to apply its rights and remedies available under this Lease or at law or in equity in the case of an Event of Default hereunder by Tenant. Landlord’s acceptance of Rent,

Additional Rent, or other Lease costs in arrears or Late Charge or Returned Check Charge pursuant to this clause shall not constitute a waiver of Landlord’s rights and remedies available under this Lease at law or in equity.

In the event that Tenant makes three or more late payments of Rent during the Term, Landlord may deem such action, without further notice, to constitute an Event of Default sufficient to terminate (i) the Lease (ii) any provision for exercise by Tenant of any option rights under the Lease or (iii) both.

ARTICLE 7

Improvements, Repairs, Additions, Replacements

7.01 Preparation of the Premises.

Tenant shall accept the Premises in its "as is" condition as of the Term Commencement Date, and Landlord shall have no obligation to perform any work or construction to prepare the Premises for Tenant, except as defined in “Exhibit C”.

7.02 Alterations and Improvements.

Tenant shall not make alterations or additions to the Premises without Landlord's prior written approval and then only in accordance with plans and specifications therefor first approved by Landlord. Without limitation, Landlord may withhold approval of any alterations or additions which would (a) delay completion of the Premises or the Building, (b) require unusual expense to readapt the Premises to normal use upon termination of this Lease or (c) increase the cost of construction or insurance or increased Taxes. All alterations and additions shall be part of the Premises unless and until Landlord shall specify the same for removal in a notice delivered to Tenant on or before the Lease Termination Date. All of Tenant's alterations and additions and installation of furnishings shall be coordinated with any work being performed by Landlord and in such manner as to maintain harmonious labor relations and not to damage the Building or the Premises or interfere with Building operation and, except for installation of furnishings, shall be performed by contractors or workmen first approved by Landlord. Except for work done by or through Landlord, Tenant before its work is started shall: secure all licenses and permits necessary therefor; deliver to Landlord a statement of the names of all its contractors and subcontractors and the estimated cost of all labor and material to be furnished by them, provided to Landlord such payment, performance and lien bonds or other security as Landlord shall reasonably require; and cause each contractor to carry workers’ compensation insurance in statutory amounts covering all the contractor's and subcontractor's employees and commercial general liability insurance with such limits as Landlord may reasonably require, but in no event less than $1,000,000.00 and property damage insurance with limits of not less than $1,000,000.00 and have deductibles of no more than $5,000.00 (all such insurance to be written by companies approved by Landlord and insuring Tenant and Landlord and its managing agent and its mortgagees, as well as the contractors), and to deliver to Landlord certificates of all such insurance. Tenant agrees to pay promptly when due the entire cost of any work done in the Premises by Tenant, its agents, employees or independent contractors, and not to cause or permit any liens therewith to attach to the Premises and immediately to discharge any such liens which may so attach. All construction work done by Tenant, its agents, employees or independent contractors shall be done in a good and workmanlike manner and in compliance with all Legal Requirements and Insurance Requirements.

7.03 Maintenance By Tenant.

Except for Landlord's obligations under Section 8.01, Tenant shall, at all times during the Lease Term, and at its own cost and expense, (a) keep and maintain the Premises in good repair and condition (damage by fire or casualty only excepted) and (b) use all reasonable precautions to prevent waste, damage or injury thereto.

7.04 Redelivery.

On the Lease Termination Date, without limiting its other obligations under this Lease (including under Section 7.02), Tenant shall surrender all keys to the Premises, remove all of its trade fixtures, equipment and personal property in the Premises and all of Tenant’s signs and quit and surrender the Premises free and clear of all tenants, occupants, liens, and encumbrances whatsoever. Tenant shall, subject to the provisions of Articles 17 and 18 hereof, surrender the Premises to Landlord broom clean and in good condition and repair (damage by fire or casualty only excepted) with all damage occasioned by Tenant's removal of Tenant's trade fixtures, equipment or equipment repaired at Tenant's cost to Landlord's satisfaction. Any property not so removed shall be deemed abandoned and may be removed and disposed of by Landlord in such manner as it shall determine. Tenant shall pay Landlord the entire cost and expense incurred by it in effecting such removal and disposition and in making any incidental repairs and replacements.

ARTICLE 8

Landlord's Obligations

8.01 Maintenance By Landlord.

Subject to Sections 17 and 18, Landlord shall maintain in good working order and repair and replace as necessary the Common Areas, exterior walls (exclusive of glass and doors and exclusive of the interior surface of the exterior walls, all of which Tenant shall maintain and repair), roof, foundation, structural supports of the Building and the heating, plumbing, electrical, air-conditioning and mechanical systems, provided that Landlord shall not be required to repair or maintain any specialized systems installed by or for Tenant unless Landlord otherwise elects.

8.02 Limitations on Landlord's Liability.

Landlord shall not be liable in damages, and shall not be in default hereunder, for any failure or delay in complying with any of its obligations hereunder when such failure or delay is occasioned by Force Majeure or by the act or Default of Tenant. No such failure or delay shall be held or pleaded as eviction or disturbance in any manner whatsoever of Tenant's possession or give Tenant any right to terminate this Lease or give rise to any claim for set‑off or any abatement or Rent or of any of Tenant's obligations under this Lease.

ARTICLE 9

Tenant's Particular Covenants

9.01 Pay Rent.

Tenant shall pay when due all Rent and Additional Rent, including, without limitation, all charges for utility services rendered to the Premises.

9.02 Occupancy of the Premises.

Tenant shall occupy the Premises from the Term Commencement Date for the Permitted Uses only. Tenant shall not (i) injure or deface the Premises or the Building, (ii) install any exterior sign, (iii) permit in the Premises any flammable fluids or chemicals not reasonably related to the Permitted Uses or (iv) permit any nuisance or any use thereof which is improper, offensive, contrary to any Legal Requirement or Insurance Requirement or liable to render necessary any alteration or addition to the Building.

Tenant shall not permit any noise, vibration or odor to emit from the Premises which in Landlord’s sole discretion is offensive or inappropriate for a first class warehouse / storage facility for office Building. In the event any direct, indirect or consequential loss is incurred by Landlord as a result of said offensive or inappropriate noise, odor or vibration, Tenant shall indemnify Landlord for such loss.

9.03 Safety.

Tenant shall keep the Premises equipped with all safety appliances required by Legal Requirements or Insurance Requirements because of any use made by Tenant. Tenant shall procure all Authorizations so required because of such use and, if requested by Landlord, shall do any work so required because of such use, it being understood that the foregoing provision shall not be construed to broaden in any way the Permitted Uses.

9.04 Equipment.

Tenant shall not place a load upon the floor of the Premises exceeding the live load for which the floor has been designed for fifty (50) pounds per square foot and shall not move any safe or other heavy equipment in, about or out of the Premises except in such a manner and at such a time as Landlord shall in each instance authorize. Tenant shall isolate and maintain all of Tenant's machines and mechanical equipment which cause or may cause air-borne or structure-borne vibration or noise, whether or not it may be transmitted to any other premises so as to eliminate such vibration or noise.

9.05 Electrical Equipment.

Tenant shall not, without prior written notice to Landlord in each instance connect to the Building electric distribution system anything other than normal office and warehouse equipment. Tenant's use of electrical energy in the Premises shall not at any time exceed the capacity of any of the electrical conductors or equipment in or otherwise serving the Premises. Tenant shall not, without prior written notice to Landlord in each instance, connect to the Building electric distribution system any fixtures, appliances or equipment which operate on a voltage in excess of 120 volts nominal or make any alteration or addition to the electric system of the Premises.

9.06 Pay Taxes.

Tenant shall pay promptly when due all taxes upon personal property (including, without limitation, fixtures and equipment) in the Premises to whomsoever assessed.

ARTICLE 10

Requirements of Public Authority

10.01 Legal Requirements.

Tenant shall, at its own cost and expense, promptly observe and comply with all Legal Requirements. Tenant shall pay all costs, expenses, liabilities, losses, damages, fines, penalties, claims and demands, that may in any manner arise out of or be imposed because of the failure of Tenant to comply with the covenants of this Article 10. Landlord shall not be responsible or liable for any loss or interruption of Tenant’s business, or any costs of compliance, caused by the enforcement of any Legal Requirements which are related to Tenant’s use of the Premises or the Common Areas.

Tenant shall not dump, flush, or in any way introduce any Hazardous Substances or any other toxic substances into the septic, sewage or other waste disposal system or generate, store or dispose of Hazardous Substances in or on the Premises or the Land, or dispose of Hazardous Substances from the Premises or the Land to any other location without the prior written consent of Landlord and then only in compliance with the Resource Conservation and Recovery Act of 1976, as amended,

42 U.S.C.§6901 et seq., the Massachusetts Hazardous Waste Management Act, M.G.L. c.21C., as amended, the Massachusetts Oil and Hazardous Material Release Prevention and Response Act, M.G.L. c.21E, as amended, and all other applicable codes, regulations, ordinances and laws. Tenant shall notify Landlord of any incident which would require the filing of a notice under M.G.L. c.21E and shall comply with the orders and regulations of all governmental authorities with respect to zoning, building, fire, health and other codes, regulations, ordinances or laws applicable to the Premises or the Land. “Hazardous Substances” as used in this Section shall mean “hazardous substances” as defined in the Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended, 42 U.S.C. §9601 and regulations adopted pursuant to such Act.

Landlord may, if it so elects after written notice to Tenant, make any of the repairs, alterations, additions or replacements which otherwise would be Tenant’s responsibility under this Section which affect the Building structure or the Building systems, and Tenant shall reimburse Landlord for the reasonable cost thereof within twenty (20) days of Landlord’s invoice therefor.

Tenant will provide Landlord, from time to time upon Landlord’s request, with all records and information regarding any Hazardous Substance maintained on the Premises by Tenant.

Landlord shall have the right to make such inspections as Landlord shall reasonably elect from time to time to determine if Tenant is complying with this Section or with Tenant’s obligations elsewhere under this Lease. Such inspections shall be at Tenant’s expense if Tenant is found to be in non-compliance with this Article or as to Tenant’s obligations pursuant to this Lease.

10.02 Contests.

Tenant shall have the right to contest by appropriate legal proceedings diligently conducted in good faith, in the name of Tenant or Landlord (if legally required), or both (if legally required), without cost, expense, liability or damage to Landlord, the validity or application of any Legal Requirement, and, if compliance with any of the terms of any such Legal Requirement may legally be delayed pending the prosecution of any such proceeding, Tenant may delay such compliance therewith until the final determination of such proceeding.

ARTICLE 11

Covenant Against Liens

11.01 Mechanics’ Liens.

Landlord's right, title and interest in the Premises shall not be subject to or liable for liens of mechanics or materialmen for work done on behalf of Tenant in connection with improvements to the Premises. Notwithstanding such restriction, if because of any act or omission of Tenant, any mechanics’ lien or other lien, charge or order for payment of money shall be filed against any portion of the Premises, Tenant shall, at its own cost and expense, cause the same to be discharged of record within fifteen (15) days after the filing thereof.

11.02 Right to Discharge.

Without otherwise limiting any other remedy of Landlord for default hereunder, if Tenant shall fail to cause such liens to be discharged of record within the aforesaid fifteen (15) day period, then Landlord shall have the right to cause the same to be discharged. All amounts paid by Landlord to cause such liens to be discharged shall constitute Additional Rent.

ARTICLE 12

Access to Premises

12.01 Access.

Landlord and Landlord's agents and designees shall have the right, but not the obligation, to enter upon the Premises at all reasonable times during ordinary business hours to examine same and to exhibit the Premises to prospective purchasers, mortgagees, tenants or other persons or agents as Landlord shall designate from time to time. Landlord shall endeavor to provide Tenant reasonable notice prior to such entry except in the case of an emergency. Tenant shall have access to the Premises twenty four (24) hours per day, seven (7) days per week including holidays.

ARTICLE 13

Assignment and Subletting: Occupancy Arrangements

13.01 Subletting and Assignment.

Tenant shall not enter into any Occupancy Arrangement, either voluntarily or by operation of law without the prior consent of Landlord, which consent will not be unreasonably withheld. Without limiting the generality of the foregoing, in no event shall Tenant enter into negotiations to sublet all or any part of the Premises or to assign this Lease, offer to so sublet or assign or so sublet or assign to any tenant or occupant of the Building or to any party with whom Landlord is then negotiating with respect to space in the Building.

If Tenant intends to enter into an Occupancy Arrangement, Tenant shall so notify Landlord in writing, stating the name of (and providing a financial statement with respect to) the Person whom Tenant intends to enter into such Arrangement, the exact terms of the Occupancy Arrangement and a precise description of the portion of the Premises intended to be subject thereto. Within thirty (30) days of receipt of such writing, Landlord shall either (i) consent to such Occupancy Arrangement, (ii) terminate this Lease with respect to so much of the Premises as is intended to be

subject thereto, or (iii) deny consent to such Occupancy Arrangement. The Landlord shall not be deemed to be unreasonable in denying its consent to any proposed assignment or subletting by the Tenant based on any of the following factors, without limitation:

(a) | The business of the proposed tenant is not consistent with the image and character which the Landlord desires to promote for the Building; |

(b) | The proposed assignment or subletting could adversely affect the ability of the Landlord and its affiliates to lease space in the Building or elsewhere in the Park (if applicable), including leasing space to any proposed assignee or subtenant; and |

(c) | The credit worthiness of the proposed tenant is unsatisfactory to the Landlord, as the Landlord may determine in its reasonable discretion. |

If the Landlord consents to such Occupancy Arrangement, Tenant shall (i) enter into such Arrangement on the exact terms described to Landlord within fourteen (14) days of Landlord's consent or comply again with the terms of this Section and (ii) remain liable for the payment and performance of the terms and covenants of this Lease. If Tenant enters into such an Occupancy Arrangement, Tenant shall pay to Landlord when received the excess, if any, of amounts received in respect of such Occupancy Arrangement over the Rent. For the purpose of the preceding sentence, amounts received by Tenant in respect of such Occupancy Arrangement shall be deemed to include (a) any costs assumed or paid by the subtenant thereunder (such as brokerage commissions, tenant improvements and other expenses) which normally are paid by landlords or sub-landlords in comparable transactions and (b) any sums paid for the sale, rental or use of any of Tenant’s personal property (in case of a sale only, reduced by Tenant’s depreciated basis thereof for federal income tax purposes).

If Landlord terminates this Lease pursuant to this Section, all Rent due shall be adjusted as of the day the Premises (or portion thereof) are redelivered to Landlord. Any portion of the Premises so redelivered shall be in the condition specified in Section 7.04 hereof.

If Tenant’s stock is not publically held, the provisions of this Section 13.01 shall apply to a transfer (by one or more transfers) of a majority of the stock or other ownership interests of Tenant as if Tenant had entered into an Occupancy Arrangement. Such provisions shall not apply to transactions with an entity into or with which Tenant is merged or consolidated or to which substantially all of Tenant’s assets are transferred or to any entity which controls or is controlled by Tenant or is under common control with Tenant, provided that in any of such events (i) the successor to Tenant has a tangible net worth computed in accordance with generally accounting principles at least equal to the tangible net worth of Tenant immediately prior to such merger, consolidation or transfer, (ii) proof satisfactory to Landlord of such tangible net worth shall have been delivered to Landlord at least ten (10) days prior to the effective date of any such transaction, and (iii) the assignee agrees directly with Landlord, by written instrument in form satisfactory to Landlord, to be bound by all the obligations of Tenant hereunder including, without limitation, the covenant against further assignment or subletting.

Notwithstanding the foregoing, Tenant shall have the right to assign or sublet to an acquirer of its stock or all or substantially all of its assets with at least the same tangible net worth or greater without limitation. Transfer among its existing shareholders and issuances of additional securities also shall be excluded from transfer provisions.

ARTICLE 14

Indemnity

14.01 Tenant’s Indemnity.

To the fullest extent permitted by law, Tenant shall indemnify and save harmless Landlord from and against any and all liability, damage, penalties or judgments and from and against any claims, actions, proceedings and expenses and costs in connection therewith, including reasonable counsel fees, arising from injury to person or property sustained by anyone in and about the Building or the Premises or the Land by reason of an act or omission of Tenant, or Tenant's officers, agents, servants, employees, contractors, sublessees or invitees. Tenant shall, at its own cost and expense, defend any and all suits or actions (just or unjust) in which Landlord may be impleaded with others upon any such above mentioned matter, claim or claims, except as may result from the acts as set forth in Section 14.02. All merchandise, furniture, fixtures and property of every kind, nature and description of Tenant or Tenant's employees, agents, contractors, invitees, visitors, or guests which may be in or upon the Premises or the Building during the Lease Term shall be at the sole risk and hazard of Tenant, and if the whole or any part thereof shall be damaged, destroyed, stolen or removed by reason of any cause or reason whatsoever, other than the negligence or willful misconduct of Landlord, no part of said damage or loss shall be charged to or borne by Landlord.

14.02 Landlord's Liability.

Except for wrongful acts or negligence of Landlord or the wrongful acts or negligence of its officers, agents, servants, employees or contractors, Landlord shall not be responsible or liable for any damage or injury to any property, fixtures, buildings or improvements, or to any person or persons, at any time in the Premises, including any damage or injury to Tenant or to any of Tenant's officers, agents, servants, employees, contractors, invitees, customers or sublessees.

ARTICLE 15

Insurance

15.01 Liability Insurance.

Tenant, at its expense, shall maintain in force during the Lease Term commercial general liability insurance in a good and solvent insurance company or companies licensed to do business in the Commonwealth of Massachusetts selected by Tenant and reasonably satisfactory to Landlord in an amount reasonably required by Landlord from time to time but in any event not less than Five Million Dollars ($5,000,000.00) with respect to injury or death to any one person and Five Million Dollars ($5,000,000.00) with respect to injury or death to more than one person in any one accident or other occurrence and Five Million Dollars ($5,000,000.00) with respect to damage to property. Such policy or policies shall include Landlord and Landlord's managing agent and mortgagees as additional insureds and have deductibles of no more than $5,000.00.

Tenant shall also maintain in force during the Lease Term worker’s compensation insurance with statutory limits covering all of Tenant’s employees working at the Premises.

15.02 Casualty Insurance.

Unless Landlord shall elect to insure the same, Tenant shall cause its improvements to the Premises to be insured for the benefit of Landlord and Tenant, as their respective interests may appear, against loss or damage under all risk coverage satisfactory to Landlord in an amount equal to the replacement value thereof.

15.03 Certificates.

Tenant shall deliver certificates of the insurance required under Sections 15.01 and 15.02 to Landlord as of the date hereof and thereafter not less than thirty (30) days prior to the expiration of any such policy. Such insurance shall not be cancelable without thirty (30) days' written notice to Landlord.

ARTICLE 16

Waiver of Subrogation

16.01 Waiver of Subrogation.

All property insurance policies carried by either party covering the Premises, including but not limited to contents shall expressly waive any right on the part of the insurer to make any claim against the other party. The parties hereto agree that their policies will include such waiver clause or endorsement.

16.02 Waiver of Rights.

Each of Landlord and Tenant, on behalf of itself and its insurers, hereby waives all claims, causes of action and rights of recovery against the other and the other's respective partners, agents, officers and employees, for any damage to or destruction of property or business which shall occur on or about the Building and shall result from any of the perils insured under any and all policies of insurance maintained by the waiving party, regardless of cause, including the negligence and intentional wrongdoing of either party and their respective agents, officers and employees but only to the extent of recovery, if any, under such policy or policies of insurance; provided however, that this waiver shall be ineffective in the event any such insurer would be relieved from the obligation to make payment pursuant to a policy of insurance by reason of this waiver.

ARTICLE 17

Damage or Destruction

17.01 Damage by Fire, Casualty, Eminent Domain.

In case of damage to the Premises by fire or casualty or action of public authority in consequence thereof, Landlord shall restore the Premises to the same condition it was in prior to the damage, excluding, however, any alterations or improvements made by parties other than Landlord, provided, however, that in no event shall Landlord be required to expend in the repair of the Premises and any other portions of the Building sustaining such damage more than the proceeds of such insurance made available to it by its mortgagee. The work shall be commenced within thirty (30) days after receipt of the insurance proceeds and completed with due diligence except for delays due to governmental regulation, unusual scarcity of or inability to obtain labor or materials, or causes beyond Landlord’s reasonable control, and Landlord shall be entitled to receive and retain the proceeds of all insurance against the damage. If insurance is not carried against the damage, or if the available insurance proceeds, in Landlord’s sole judgment, would be insufficient to cover the cost of repair to the Premises, Landlord shall either restore the Premises to the same condition it was in prior to the damage or taking, excluding, however, any alterations or improvements made by parties other than Landlord, or terminate this Lease by giving Tenant, within sixty (60) days after the damage, at least fifteen (15) days prior notice specifying the termination date.

In the event that the Building is damaged or destroyed to the extent that Landlord shall determine that the same cannot, with reasonable diligence, be fully repaired or restored by Landlord within a period of six (6) months after the date of receipt of insurance proceeds, Landlord and Tenant each shall have the option to terminate this Lease. Landlord shall have the sole right to determine whether the Building can be fully repaired or restored within such six (6) month period, and such determination shall be conclusive upon Tenant. Landlord shall notify Tenant in writing within sixty (60) days after the date of such damage or destruction of its determination whether or not the Building can be fully repaired or restored within such six (6) month period (“Determination Notice”). In the event Landlord determines that restoration cannot be effected within such six (6) month period, Landlord or Tenant each shall have the option to terminate this Lease by giving notice to the other party of such termination within seven (7) days after the date of the Determination Notice, which notice shall specify a termination date not less than forty-five (45) days nor more than sixty (60) days following the date of the notice (“Termination Notice”). Failure to send the Termination Notice in a timely manner shall be conclusively presumed to be a waiver of such option to terminate. If Landlord determines that the Building can be fully repaired or restored within such six (6) month period, or if it is determined that such repair or restoration cannot be made within such period but

neither Landlord or Tenant elects to terminate, this Lease shall remain in full force and effect.

During the final year of the Lease Term, in the event that said restoration is not complete within one hundred twenty (120) days of said damage and Tenant is not found to have caused such damage by a governmental authority or neutral third party approved by both Landlord and Tenant, Tenant shall have the option to terminate the Lease upon thirty (30) days notice to Landlord, if Tenant is not in default hereunder and Tenant tenders payment to Landlord of all remaining unamortized transaction costs as determined by Landlord.

In case the Premises are rendered untenantable by fire or other casualty or action of public authority in consequence thereof, and this Lease is not terminated as herein provided, a just proportion of the Rent and real estate taxes, according to the nature of the injury, shall be abated until the repair is completed.

17.02 Restoration.

Landlord may, but shall not be required to, repair or restore any alterations or improvements made by Tenant, and, if Landlord elects to do so, Tenant shall make available to Landlord all insurance proceeds relating thereto. Landlord shall not be required to rebuild, repair, or replace any part of Tenant's furniture, furnishings or fixtures or equipment. Landlord shall not be liable for any inconvenience or annoyance to Tenant or injury to the business of Tenant resulting in any way from such damage or the repair thereof.

ARTICLE 18

Eminent Domain

18.01 Total Taking.

If the Premises or the Building should be the subject of a Total Taking, then this Lease shall terminate as of the date when physical possession of the Building or the Premises is taken by the condemning authority.

18.02 Partial Taking.