Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DUNKIN' BRANDS GROUP, INC. | d269143d8k.htm |

Dunkin’

Dunkin’

Brands Group, Inc.

Brands Group, Inc.

Investor Presentation

Investor Presentation

December 2011

December 2011

Exhibit 99.1 |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. Forward-looking statements

2

Certain information contained in this presentation, particularly information regarding future economic

performance, finances, and expectations and objectives of management constitutes

forward-looking statements. Forward-looking statements can be identified by the

fact that they do not relate strictly to historical or current facts and are generally contain

words such as “believes,” “expects,” “may,” “will,”

“should,” “seeks,” “approximately,” “intends,”

“plans,” “estimates” or “anticipates” or similar expressions. Our

forward-looking statements are subject to risks and uncertainties, which may cause actual results to

differ materially from those projected or implied by the forward-looking statement.

Forward-looking statements are based on current expectations and assumptions and currently

available data and are neither predictions nor guarantees of future events or performance. You

should not place undue reliance on forward-looking statements, which speak only as of the

date hereof. We do not undertake to update or revise any forward-looking statements

after they are made, whether as a result of new information, future events, or otherwise,

except as required by applicable law. Regulation G

This presentation contains certain non-GAAP measures which are provided to assist in

an understanding of the Dunkin’ Brands Group, Inc. business and its performance. These

measures should always be considered in conjunction with the appropriate GAAP measure.

Reconciliations of non-GAAP amounts to the relevant GAAP amount are provided as an

attachment to these slides. |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. Strong platform for continued growth

Our key business strengths

Strong and established brands with leading market positions

Two strong and highly recognized global brands that generated LTM

franchisee-reported sales of $8.1 bn

(1)

Strong comp store sales trajectory

Significant opportunities to grow brands globally

Over 16,500 global locations with significant opportunity for domestic and

international growth Invested during downturn to position ourselves for

growth Franchised business model provides platform for growth

Nearly 100% franchised business model generates high margins with low capex

requirements, driving cash flow generation

Store-level

economics

generates

franchisee

demand

for

additional

restaurants

Strong performance since IPO underscores long-term growth opportunity

Highly

experienced,

aligned

and

motivated

management

team

with

franchise

“operating”

philosophy

3

1. Last twelve months (“LTM”) ending September 24, 2011

|

Two

leading global brands each with over 60 years of heritage

Source:

NPD Group/CREST for year ending February 2011; Omnibus Awareness Study, July

2010; 4

Over 95% aided brand awareness in U.S.

#1 in QSR customer loyalty for 5 straight years

1 bn+ cups of coffee sold in the U.S. annually

#1 position in Hot Regular/Flavored/Decaf Coffee,

Iced Coffee, Donuts, Bagels and tied in Muffins

Over 50% share of New England coffee servings and

morning meal traffic

36 U.S. states and in 31 other countries

1,000+ ice cream flavors

95% aided brand awareness in U.S

#1 hard serve ice cream position in U.S.

#1 market share positions in Fast Food Ice Cream

category in Japan and South Korea in 2010

45 U.S. states and in 46 other countries

Brand Keys

America Runs on Dunkin’

®

More Flavors, More Fun™

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. U.S.

$6.2 bn

(76%)

Intl

$1.9bn

(24%)

$6.3bn

(78%)

$1.7bn

(22%)

9,900

(60%)

6,625

(40%)

U.S.

9,387

(57%)

Intl

7,138

(43%)

Substantial global platform across both brands

5

1. Last twelve months (“LTM”) ending September 24, 2011

2. Data as of September 24, 2011

LTM Franchisee-Reported Sales

1

Global Points of Distribution

2 |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 6

Our growth strategy |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 7

Focused growth strategies across each segment

7% of LTM revenue

73% of LTM revenue

20% of LTM revenue

Note: LTM figures as of 9/24/2011

Continue DD U.S.

contiguous store

expansion

Increase comparable

store sales growth of BR

U.S.

Drive accelerated

international growth

across both brands

Increase comparable

store sales and

profitability in DD U.S. |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 8

Strong DD U.S. comp growth momentum

Resilient comp performance throughout economic cycles

Note: Fiscal year-end changed from August to December starting in 2006

45 consecutive

quarters of

comparable store

sales growth

6.5%

5.7%

4.3%

7.0%

6.1%

4.3%

1.3%

(0.8%)

(1.3%)

(0.6%)

1.9%

2.7%

4.7%

2.8%

3.8%

6.0%

(2.0%)

0.0%

2.0%

4.0%

6.0%

8.0%

2001

2002

2003

2004

2005

2006

2007

2008

2009

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

Dunkin’

Donuts U.S. comparable store sales growth |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 9

Dunkin’

Donuts U.S. strategy

Drive comparable store sales and profitability

•

Successful product innovation record with strong pipeline

•

Differentiated brand platform with high-impact marketing

•

Operations-focused culture driving improved in-store

experience

Accelerate profitable and contiguous POD growth

•

Among one of the industry-leading expansion track records

•

Significant opportunity across U.S. |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 10

Powerful track record of product innovation

1995

Coffee excellence

•

Hazelnut and

French Vanilla

1996

Breakfast sandwiches

Bagels

1998

Fruit Coolatta

®

2000

Dunkaccino

®

Hot chocolate

2001

Vanilla Chai

2003

Hot espresso

platform

2004

Iced lattes

2005

Turbo Ice

®

Tropicana

®

Coolatta

®

9 iced coffee and hot

coffee flavors

2008

DD Smart

®

Flatbreads

2010

Bagel twists

Coolatta

®

mixology

PM snacks

2009

Wake-Up Wrap

®

2011

Big n’

Toasty

Shaped donuts

Dunkin’

K-Cups

Frozen Iced Tea

Captain America

Coolatta |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 11

High impact marketing with broad reach

Produce news “buzz”

from Limited Time

Offerings

TV, Radio, Print, Public Relations, Point

of Purchase, Local Marketing

Growing loyalty

program

Strong grocery

coffee business

Strong heritage in traditional media

Growing interactive, internet

and social media |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 12

Intense focus on restaurant level

operational support

People &

systems

Great guest

experience

Profitable

topline sales

Strong guest satisfaction scores

Clearly defined store

standards

Strong remodel program

Strong support to

franchisees and

restaurant managers with

training and marketing

Effective systems for

back-office management |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 13

Our U.S. development opportunity |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. Region

Population

(mm)

Stores

(1)

Penetration

Core

36.0

3,754

1:9,600

Eastern Established

53.8

2,180

1:24,700

Eastern Emerging

88.7

845

1:105,000

West

130.0

116

1:1,120,700

14

Significant opportunity for profitable growth

1. As of 9/24/2011 |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 15

Proven ability to increase penetration

in Established markets

Note: Penetration figures based on store counts as of 9/24/11

1. Represents net development of the region, not select DMAs, for the nine month

period ending 9/24/11 359,000

Total penetration of select

established markets

5,800

5,500

6,600

13,800

15,000

20,000

25,000

30,000

33,000

50,000

79,000

84,000

117,000

114,000

123,000

140,000

0

50,000

100,000

150,000

200,000

350,000

34,200

19,100

0

25,000

50,000

2000

Q3 2011

Core

Established

Emerging

29%

Q3 2011 YTD net

new open (% of total)

(1)

28%

38%

West

5% |

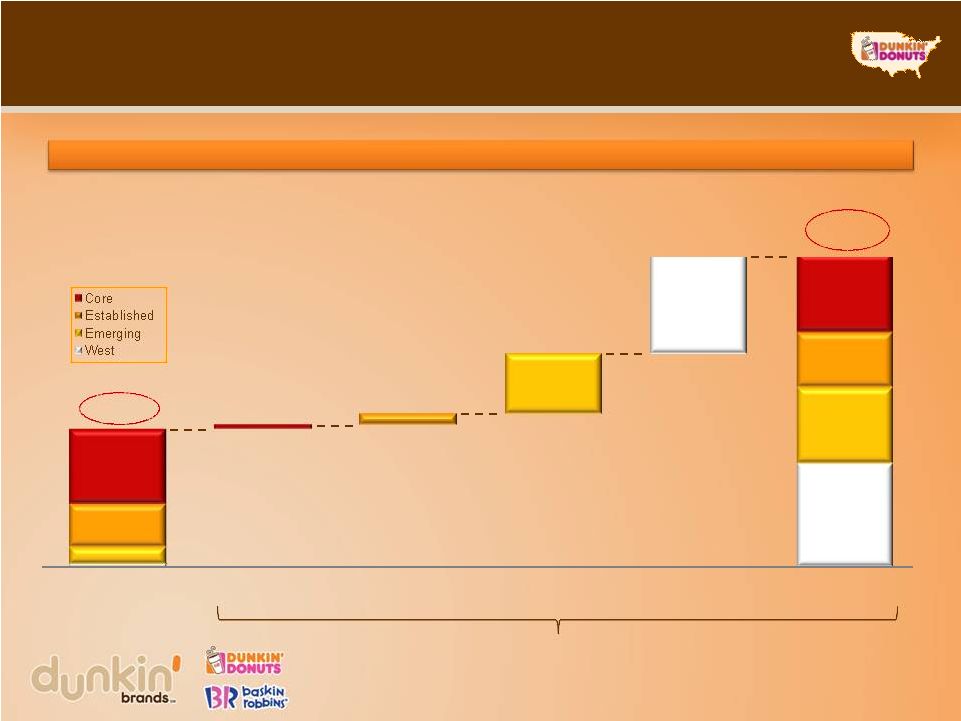

16

Significant long-term expansion opportunity

for Dunkin’

Donuts U.S.

~15,000

6,895

1:9,200

1:20,000

1:23,000

1:25,000

1:20,000

DD pro forma long-term penetration

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 116

~5,116

845

~3,845

2,180

~2,730

3,754

~3,954

~200

~550

~3,000

Q3 2011

Core

Established

Emerging

West

Long

term

~

5,000

Dunkin’

Donuts U.S. bridge to long-term goal (existing stores + new net

development) |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 17

Our international growth opportunity |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. Note:

Unit count as of 9/24/11

Store count:

5,255

429

577

88

789

6,000

18

Asia

Middle East

Europe

Americas

Australia / NZ

100

200

300

400

500

600

700

800

900

-

Baskin-Robbins

Dunkin' Donuts

2,349

233

101

311

11

2,906

556

328

266

77

Both brands have strong international

presence with significant growth potential |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. Drive continued international growth

for both brands

19

History of successful international growth, particularly

in Asia

Dunkin’

Brands is among the largest U.S. QSR

companies overseas by unit count

Emphasis on improving penetration in existing

markets, given strong concept acceptance

Both brands have been able to grow in new markets

•

Baskin-Robbins has close-to-universal product

appeal

•

Dunkin’

Donuts’

platform allows for localization

and flexibility

•

13% international SWS CAGR

•

9% international POD CAGR

Drive growth and increase penetration in established

markets (Japan, Korea and Middle East)

Leverage brands’

strengths to grow in newer, high-

potential markets

•

Accelerate China growth for both brands

•

Launch Dunkin’

Donuts in India

•

Build-out other emerging markets

450 –

500 planned 2011 net

openings

Focused international growth priorities

A history of successful international growth

2007 –

2010 international growth: |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 20

Continue to re-energize Baskin-Robbins U.S.

Leveraging 65-year heritage and 95% aided brand awareness

Implementing focused strategic plan aimed at improving comp sales

•

Sharpening brand differentiation

•

Improving operations and marketing

•

Optimizing supply chain to increase franchisee profitability

•

Introducing standardized retail technology

•

Accelerating store transfer program

Current results are encouraging

•

Improving comp sales trend (+1.7% in Q3)

•

Increased franchisee engagement

•

Reached an all-time high in overall guest satisfaction

|

21

Financial highlights

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 22

Long-term earnings target

Strong, consistent revenue growth

•

U.S. consolidated comps in the

2–4% range

•

Total net unit development of

approximately 3–5% with

opportunity to accelerate

Highly leverageable cost structure

•

Drives margin expansion of

150–200 bps per year

Strong free cash flow

•

Facilitates earnings growth through

deleveraging or shareholder payout

6–8% revenue growth

10–12% operating income

(excl. intangibles

amortization) growth

15%+ EPS (excl. intangibles

amortization) growth

* These targets are forward-looking, are subject to significant business, economic, regulatory and

competitive uncertainties and contingencies, many of which are beyond the control of the Company

and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may

be material. For discussion of some of the important factors that could cause these variations,

please consult the “Risk Factors” section of the preliminary prospectus. Nothing in this

presentation should be regarded as a representation by any person that these targets will be achieved

and the Company undertakes no duty to update its targets. Drivers

Long-term targets* |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. Three months

ended 9/24/11

Increase /

(decrease) to prior

year period

Nine months

ended 9/24/11

Increase /

(decrease) to prior

year period

Select operating metrics

Systemwide sales growth

8.9%

230 bps

7.1%

100 bps

Consolidated U.S. comp

5.6%

380 bps

3.9%

320 bps

Dunkin' Donuts U.S. comp

6.0%

330 bps

4.3%

290 bps

Baskin-Robbins U.S. comp

1.7%

750 bps

(0.7%)

540 bps

Consolidated global PODs

1

16,525

3.0%

16,525

3.0%

Dunkin' Donuts global PODs

9,900

2.3%

9,900

2.3%

Baskin-Robbins global PODs

6,625

3.9%

6,625

3.9%

Select income statement items ($mm)

Revenues

$163.5

9.3%

$459.7

7.6%

Adjusted operating income

2

75.9

21.3%

197.7

11.5%

Adjusted operating margin

46.4%

450 bps

43.0%

150 bps

Adjusted net income

2

31.3

32.5%

65.6

7.0%

Select balance sheet items ($mm)

Cash and cash equivalents

3

$181.8

Net debt

4

/ LTM adjusted EBITDA

5

4.6x

23

Third quarter and year-to-date results

1

Expected global net development of over 600 PODs in FY2011

2

Adjusted operating income and adjusted net income are non-GAAP measures

reflecting operating income and net income, determined in accordance with GAAP, further adjusted for amortization of

intangible assets,

impairment

charges,

and

Sponsor

management

agreement

termination

fee,

and

in

the

case

of

adjusted

net

income,

loss on debt extinguishment and refinancing charges, net of the

tax impact of such adjustments.

3

Amount includes $69.7mm cash held for advertising funds or reserved for gift

card/certificate programs 4

Net debt excludes cash held or reserved for gift card/gift certificate

programs 5

Adjusted

EBITDA

reflects

LTM

09/24/2011

credit

agreement

EBITDA

of

$300.7mm

Financial highlights |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 24

Executing on growth initiatives since IPO

Product innovation in beverages, premium breakfast sandwiches and deli sandwiches

driving higher average Dunkin’

Donuts U.S. ticket sales

Strengthening core comps and introduction of K-Cups helping further improve

franchisee profitability

•

No evidence of K-Cup cannibalization of in-store ready-brewed

coffee Global promotions and “What Are You Drinkin’?”

campaign reinforce position as

#1retailer of hot and iced coffee in U.S.

Average age of Dunkin’

Donuts U.S. restaurant image now less than 5 years

•

On track to complete record 500+ remodels in 2011

Strong interest from franchisee candidates for newly released markets

New Baskin-Robbins International store design and localized product

offerings support further expansion in existing and new markets

Q3 Baskin-Robbins U.S. comparable store sales of 1.7% highlight ongoing

operational improvements and successful promotional activities

10,000

Global Dunkin’

Donuts store opened in China

th |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. Brands have unique mix of heritage and

consumer buzz Track record of driving strong comps

Both domestic and international white space growth

opportunities

Experienced management team focused on disciplined

growth

Committed to strong long-term

earnings growth and cash flow

generation with an asset-light

business model

Summary

25 |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 26

Attachment –

Non-GAAP Reconciliation

Three months ended

Nine months ended

September

24, 2011

September

25, 2010

Increase

(Decrease)

September

24, 2011

September

25, 2010

Increase

(Decrease)

Operating income

$54,112

$54,574

(0.8)%

$160,742

$149,145

7.8%

Adjustments:

14,671

-

n/m

14,671

-

n/m

7,001

7,762

(9.8)%

21,106

25,315

(16.6)%

163

265

(38.5)%

1,220

2,955

(58.7)%

Adjusted operating income

$75,947

$62,601

21.3%

$197,739

$177,415

11.5%

Adjusted operating income is reconciled to operating income for the periods presented

as follows: Impairment charges

Amortization of intangible assets

Sponsor termination fee |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 27

Attachment –

Non-GAAP Reconciliation

Three months ended

Nine months ended

September

24, 2011

September

25, 2010

Basis

Point

Increase

(Decrease)

September

24, 2011

September

25, 2010

Basis

Point

Increase

(Decrease)

Operating income margin

33.1%

36.5%

(340)

35.0%

34.9%

10

Adjustments:

8.9%

0.0%

890

3.2%

0.0%

320

4.3%

5.2%

(90)

4.6%

5.9%

(130)

0.1%

0.2%

(10)

0.2%

0.7%

(50)

Adjusted operating income margin

46.4%

41.9%

450

43.0%

41.5%

150

Adjusted operating income margin is reconciled to operating income margin for the

periods presented as follows:

Impairment charges

Amortization of intangible assets

Sponsor termination fee |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 28

Attachment –

Non-GAAP Reconciliation

Three months ended

Nine months ended

September

24, 2011

September

25, 2010

Increase

(Decrease)

September

24, 2011

September

25, 2010

Increase

(Decrease)

Net income

$7,412

$18,842

(60.7)%

$22,851

$42,117

(45.7)%

Adjustments:

14,671

-

n/m

14,671

-

n/m

7,001

7,762

(9.8)%

21,106

25,315

(16.6)%

163

265

(38.5)%

1,220

2,955

(58.7)%

18,050

-

n/m

34,222

3,693

826.7%

(15,954)

(3,211)

396.9%

(28,488)

(12,785)

122.8%

Adjusted net income

$31,343

$23,658

32.5%

$65,582

$61,295

7.0%

Adjusted net income is reconciled to net income for the periods presented as

follows: 1

Tax impact of adjustments calculated at 40% effective tax rate for each period

presented. Impairment charges

Amortization of intangible assets

Sponsor termination fee

Loss on debt extinguishment and

refinancing transactions

Tax impact of adjustments

1 |

Confidential information: Copying, dissemination or distribution of this

information is strictly prohibited. 29 |