Attached files

| file | filename |

|---|---|

| EX-32.1 - SECTION 906 CEO CERTIFICATION - GEOSPACE TECHNOLOGIES CORP | d249151dex321.htm |

| EX-23.1 - CONSENT OF UHY LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - GEOSPACE TECHNOLOGIES CORP | d249151dex231.htm |

| EX-32.2 - SECTION 906 CFO CERTIFICATION - GEOSPACE TECHNOLOGIES CORP | d249151dex322.htm |

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - GEOSPACE TECHNOLOGIES CORP | d249151dex211.htm |

| EX-31.1 - SECTION 302 CEO CERTIFICATION - GEOSPACE TECHNOLOGIES CORP | d249151dex311.htm |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - GEOSPACE TECHNOLOGIES CORP | d249151dex312.htm |

| EXCEL - IDEA: XBRL DOCUMENT - GEOSPACE TECHNOLOGIES CORP | Financial_Report.xls |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the Fiscal Year Ended September 30, 2011

OR

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission file number 001-13601

OYO GEOSPACE CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 76-0447780 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) |

7007 Pinemont Drive

Houston, Texas 77040-6601

(Address of Principal Executive Offices)

(713) 986-4444

(Registrant’s telephone number, including area code)

Securities Registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock | The NASDAQ Global Market |

Securities Registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

There were 6,352,758 shares of the Registrant’s Common Stock outstanding as of the close of business on December 5, 2011. As of March 31, 2011, the aggregate market value of the Registrant’s Common Stock held by non-affiliates was approximately $454 million (based upon the closing price of $98.58 on March 31, 2011, as reported by The NASDAQ Global Market).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the Registrant’s 2012 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

Table of Contents

PART I

Item 1. Business

Overview

OYO Geospace Corporation is a Delaware corporation incorporated on September 13, 1997. Unless otherwise specified, the discussion in this Annual Report on Form 10-K refers to OYO Geospace Corporation and its subsidiaries. We design and manufacture instruments and equipment used in the acquisition and processing of seismic data as well as in the characterization and monitoring of producing oil and gas reservoirs. Demand for our products has been, and will likely continue to be, vulnerable to downturns in the economy and the oil and gas industry in general. While natural gas prices have stabilized and crude oil prices have strengthened during most of fiscal years 2010 and 2011, there was substantial volatility in oil and natural gas prices during fiscal years 2008 and 2009. Please refer to the risks discussed under the heading “Risk Factors” for more information.

We have engaged in the seismic instrument and equipment business since 1980 and market our products primarily to the oil and gas industry. We also design, manufacture and distribute thermal imaging equipment and thermal media products targeted at the screen print, point of sale, signage and textile market sectors. We have been manufacturing thermal imaging products since 1995. We report and evaluate financial information for each of these two segments: Seismic and Thermal Solutions.

Seismic Products

The seismic segment of our business accounts for the majority of our sales. Geoscientists use seismic data primarily in connection with the exploration, development and production of oil and gas reserves to map potential and known hydrocarbon bearing formations and the geologic structures that surround them.

Seismic Exploration Products

A seismic energy source and a seismic data recording system are combined to acquire seismic data. We provide many of the components of seismic data recording systems, including data acquisition systems, geophones, hydrophones, multi-component sensors, seismic leader wire, geophone strings, connectors, seismic telemetry cables and other seismic related products. On land, our customers use our data acquisition systems, geophones, leader wire, cables and connectors to receive and measure seismic reflections resulting from an energy source to data recording units, which store information for processing and analysis. In the marine environment, large ocean-going vessels tow long seismic cables known as “streamers” containing hydrophones which are used to detect pressure changes. Hydrophones transmit electrical impulses back to the vessel’s data recording unit where the seismic data is stored for subsequent processing and analysis. Our marine seismic products help steer streamers while being towed and help recover streamers if they become disconnected from the vessel.

Our seismic sensor, cable and connector products are compatible with most major competitive seismic data acquisition systems currently in use, and sales result primarily from seismic contractors purchasing our products as components of new seismic data acquisition systems or to repair and replace components of seismic data acquisition systems already in use.

During fiscal year 2008, we announced the development of a land-based wireless (or nodal) data acquisition system. Each nodal station operates independently and therefore can be deployed in virtually unlimited channel configurations. Rather than utilizing interconnecting cables as required by most traditional land data acquisition systems, each nodal station operates as an independent data collection system. As a result, our nodal system requires less maintenance, which we believe allows our customers to operate more effectively and efficiently because of its reduced environmental impact, lower weight and ease of operation. Our nodal system is designed into configurations ranging from one to four channels per station. Since its introduction, we have sold approximately 91,000 channels of our land-based nodal acquisition system and currently have approximately 32,000 available for rent. We may increase our rental fleet further pending additional demand by our customers.

1

Table of Contents

In October 2009, we introduced a marine-based nodal data acquisition system. Similar to our land nodal system, the marine nodal system can be deployed in virtually unlimited channel configurations and does not require interconnecting cables between each station. Our deepwater versions of this nodal system can be deployed in depths of up to 3,000 meters.

Our wholly-owned subsidiary in the Russian Federation manufactures international standard geophones, sensors, seismic leader wire, seismic telemetry cables and related seismic products for customers in the Russian Federation and other international seismic marketplaces. Operating in foreign locations involves certain risks as discussed under the heading “Risk Factors – Our Foreign Subsidiaries and Foreign Marketing Efforts Face Additional Risks and Difficulties” in this Annual Report on Form 10-K.

Seismic Reservoir Products

We have developed permanently installed high-definition reservoir characterization products for ocean-bottom applications in producing oil and gas fields. We also produce a retrievable version of this ocean-bottom system for use on fields where permanently installed systems are not appropriate or economical. Seismic surveys repeated over selected time intervals show dynamic changes within the reservoir and can be used to monitor the effects of production. Utilizing these tools, producers can enhance the recovery of oil and gas deposits over the life of a reservoir.

In addition, we produce seismic borehole acquisition systems which employ a fiber optic augmented wireline capable of very high data transmission rates. These systems are used for several reservoir characterization applications, including an application pioneered by us allowing operators and service companies to monitor and measure the results of fracturing operations.

Emerging Technology Products

Our products continue to develop and expand beyond seismic applications through the utilization of our existing engineering experience and manufacturing capabilities. We design and manufacture power and communication transmission cable products for offshore applications and market these products to the offshore oil and gas and offshore construction industries. These products include a variety of specialized cables, primarily used in deepwater applications, such as remotely operated vehicle (“ROV”) tethers, umbilicals and electrical control cables. These products also include specially designed and manufactured cables, including armored cables, engineered to withstand harsh offshore operating environments.

In addition, we design and manufacture industrial sensors for the vibration monitoring, security and earthquake detection markets. We also design and manufacture other specialty cable and connector products, such as those used in connection with global positioning products and water meter applications.

Thermal Solutions Products

Our thermal solutions product technologies were originally developed for seismic data processing applications. In 1995, we modified this technology for application in other markets. Our thermal printers include both thermal imagesetters for graphics applications and thermal plotters for seismic applications. In addition, our thermal solutions products include direct-to-screen systems, thermal printheads, dry thermal film, thermal transfer ribbons and other thermal media. Our thermal imaging solutions produce images ranging in size from 12 to 54 inches wide and in resolution from 400 to 1,200 dots per inch. We market our thermal imaging solutions to a variety of industries, including the screen printing, point-of-sale, signage, flexographic and textile markets. We also continue to sell these products to our seismic customers.

The quality of thermal imaging is determined primarily by the interrelationship between a thermal printhead and the thermal media, be it film, ribbon, or any other media. We manufacture thermal printheads and thermal film, which we believe will enable us to more effectively match the characteristics of our thermal printers to thermal film, thereby improving print quality, and make us more competitive in markets for these products.

2

Table of Contents

We also distribute private label high-quality dry thermal media for use in our thermal printers and direct-to-screen systems. In addition, we are continuously engaged in efforts to develop new lines of dry thermal film and ribbon in order to improve the image quality of our media for use with our printheads. In order to achieve more than marginal growth in our thermal solutions product business in future periods, we believe that it is important to continue our concentration of efforts on both our printhead and media improvements.

Products and Product Development

Seismic Products

Our seismic product lines currently consist of land and marine nodal seismic data acquisition systems, high-definition reservoir characterization products and services, geophones and hydrophones, including multi-component geophones and hydrophones, seismic leader wire, geophone string and acquisition system connectors, seismic telemetry cables, marine seismic cable retrieval and steering devices and specialized data acquisition systems targeted at conventional and niche markets. Our seismic products are compatible with most major seismic data acquisition systems currently in use. We believe that our seismic products are among the most technologically advanced instruments and equipment available for seismic data acquisition.

In fiscal year 2008, we introduced “wireless” land and marine nodal seismic data acquisition systems which allow our customers to deploy an unlimited quantity of autonomous nodal stations without the requirement to deploy and maintain lengthy power/communication cables. Our nodal systems are designed into configurations ranging from one to four channels per station. Since its introduction, we have sold approximately 85,000 channels of our land-based nodal acquisition system through September 30, 2011. At September 30, 2011, we had approximately 20,000 channels in our rental fleet which were available for rent to our customers. We expect to increase our rental fleet further pending additional demand by our customers.

Our high-definition reservoir characterization products include the HDSeis™ product line and a suite of borehole and reservoir characterization products and services. Our HDSeis™ System is a high-definition seismic data acquisition system with flexible architecture that allows it to be configured as a borehole seismic system or as a subsurface system for both land and marine reservoir-monitoring projects. The scalable architecture of the HDSeis™ System enables custom designed system configuration for applications ranging from low-channel engineering and environmental-scale surveys requiring a minimum number of recording channels to high-channel surveys required to efficiently conduct permanent reservoir imaging and monitoring. Modular architecture allows virtually unlimited channel expansion. In addition, multi-system synchronization features make the HDSeis™ System well suited for multi-well or multi-site acquisition, simultaneous surface and downhole acquisition and continuous reservoir monitoring projects.

Reservoir characterization requires special purpose or custom designed systems in which portability becomes less critical and functional reliability assumes greater importance. This reliability factor helps assure successful operations in inaccessible locations over a considerable period of time. Additionally, reservoirs located in deepwater or harsh environments require special instrumentation and new techniques to maximize recovery. Reservoir characterization also requires high-bandwidth, high-resolution seismic data for engineering project planning and reservoir management. We believe our HDSeis™ System and tools, designed for cost-effective deployment and lifetime performance, will make borehole and seabed seismic acquisition a cost-effective and reliable process for the challenges of reservoir characterization and monitoring.

Our multi-component seismic product developments include an omni-directional geophone for use in reservoir monitoring, a compact marine three-component or four-component gimbaled sensor and special-purpose connectors, connector arrays and cases.

Our products used in marine seismic data acquisition include our patented marine seismic streamer retrieval devices (“SRDs”). Occasionally, streamer cables are severed and become disconnected from the vessel as a result of obstacles, inclement weather, vessel traffic or human error. Our SRDs, which are attached to the streamer cables, contain air bags which are designed to inflate automatically at a given depth, bringing the severed

3

Table of Contents

streamer cables to the surface. These SRDs save the seismic contractors significant time and money compared to the alternative of losing the streamer cable. We also produce seismic streamer steering devices, or “birds,” which are finlike devices that attach to the streamer cable. These birds help maintain the streamer cable at a certain desired depth as it is being towed through the water.

In order to take advantage of our existing cable manufacturing facilities and capabilities in Houston, we are designing and selling cable products to the offshore oil and gas and offshore construction industries. The production of offshore marine cables requires specialized design capabilities and manufacturing equipment. We also utilize these design capabilities and manufacturing equipment to produce deepwater reservoir characterization products. We are aggressively working to diversify our seismic product lines as well as utilizing our manufacturing capabilities to develop and produce products for use in other industries.

Thermal Solutions Products

Our thermal solutions products include thermal imagesetters for graphics applications and thermal plotters for seismic applications. In addition, our thermal solution products include thermal printheads and thermal media products. We market these products to a variety of industries, including the screen print, point of sale, signage and textile markets. We also sell these products to our seismic customers.

We design, manufacture and sell thermal printers with data images ranging in size from 12 to 54 inches wide and resolution ranging from 400 to 1,200 dpi. We also manufacture our own line of thermal film products as well as distribute another brand of thermal film to the users of our thermal printers. In our thermal solutions segments, we derive revenue primarily from the sale of thermal solutions products to our commercial graphics customers.

Competition

Seismic Products

We believe that we are one of the world’s largest manufacturers and distributors of seismic related products. The principal competitors in our seismic business segment for data acquisition systems, geophones, hydrophones, geophone string connectors, leader wire and telemetry cables are SERCEL (a division of CGGVeritas), ION Geophysical (“ION”), INOVA (a joint venture formed in 2009 between ION and Bureau of Geophysical Prospecting, a subsidiary of China National Petroleum Company) and Steward Cable (a division of Amphenol Corporation). Furthermore, entities in China affiliated with SERCEL as well as other Chinese manufacturers produce low-cost geophones meeting current industry standards.

We believe that the principal keys for success in the seismic instruments and equipment market are technological superiority, product durability, reliability, and customer support. We also believe that price and product delivery are always important considerations for our customers. In general, most customers prefer to standardize data acquisition systems, geophones and hydrophones, particularly if they are used by seismic companies which have multiple crews which are able to support each other. This standardization makes it difficult for competitive manufacturers to gain market share from other manufacturers with existing customer relationships.

As mentioned above, a key factor for seismic instruments and equipment manufacturers is durability under harsh field conditions. Instruments and equipment must meet not only rigorous technical specifications regarding signal integrity and sensitivity, but must also be extremely rugged and durable to withstand the rigors of field use, often in harsh environments.

We believe our primary competitors for our “wireless” nodal seismic data acquisition systems are SERCEL, Fairfield Industries and INOVA.

With respect to our marine seismic products, we are not aware of any competing companies that manufacture a product functionally similar to our patented seismic streamer retrieval device. We believe our primary competitors in the manufacture of our streamer depth positioning device, or “birds,” are ION and SERCEL.

4

Table of Contents

We believe our primary competitors for our deepwater cabled reservoir characterization and monitoring systems are SERCEL, ION and Petroleum Geo-Services ASA.

We believe our primary competitors for high-definition borehole seismic data acquisition systems are Avalon and SERCEL.

We believe our primary competitors for rental of seismic equipment are Mitcham Industries, Inc. and Seismic Equipment Solutions.

Thermal Solutions Products

We believe that the primary competitors to our thermal imaging business segments include emulsion producers like KIWO USA, Inc. as a distributor of direct-to-screen technologies, Colour Scanned Technology as a manufacturer of direct-to-screen technologies, iSys Group as a manufacturer of thermal technologies for oil and gas exploration applications, as well as manufacturers of alternative technologies such as inkjet devices distributed and used for film output. A key competitive factor in this market is producing equipment that is technologically advanced, yet cost effective.

Suppliers

We produce our own brand of dry thermal film internally. We also purchase a substantial quantity of dry thermal film manufactured by Agfa-Gevaert N.V. (AGFA”). For a discussion of the risks related to our reliance on AGFA, see “Risk Factors – We Rely on a Key Supplier for a Significant Portion of Our Dry Thermal Film.”

We do not currently experience any significant difficulties in obtaining raw materials from our suppliers for the production of our seismic or thermal imaging products.

Product Manufacturing and Assembly

Our manufacturing and product assembly operations consist of machining or molding the necessary component parts, configuring these parts along with components received from various vendors and assembling a final product. We manufacture seismic equipment to the specifications of our customers. For example, we can armor cables for applications such as deepwater uses. We assemble geophone strings and seismic telemetry cables based on a number of customer choices such as length, gauge, tolerance and color of molded parts. With regard to dry thermal film, we mix and react various chemicals to formulate a reactive layer that is then coated onto a clear polyester film. The film is then coated with a protective topcoat that produces the final product. Upon completion of our manufacturing and assembly operations, we test our final products to the functional and, in the case of seismic equipment, environmental extremes of product specifications and inspect the products for quality assurance. We normally manufacture and ship our products based on customer orders and, therefore, typically do not maintain significant inventories of finished goods held for sale.

5

Table of Contents

Markets and Customers

Our principal seismic customers are seismic contractors and major independent and government-owned oil and gas companies that either operate their own seismic crews or specify seismic instrument and equipment preferences to contractors. For our deepwater reservoir characterization products, our customers are generally large international oil and gas companies that operate long-term offshore oil and gas producing properties. Our thermal imaging customers primarily consist of direct users of our equipment as well as specialized resellers that focus on the newsprint, silkscreen and corrugated box printing industries. Two customers comprised 20.2% and 11.1% of our revenues during fiscal year 2011. One customer comprised 13.2% and 12.0% of our revenues during the fiscal years 2010 and 2009, respectively. The following table describes our sales by customer type (in thousands):

| YEAR ENDED SEPTEMBER 30, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Seismic exploration customers |

$ | 131,645 | $ | 89,777 | $ | 59,084 | ||||||

| Seismic reservoir customers |

15,968 | 14,600 | 12,020 | |||||||||

| Industrial customers |

11,040 | 10,397 | 7,939 | |||||||||

| Thermal solutions customers |

13,519 | 12,955 | 13,028 | |||||||||

| Other |

798 | 804 | 789 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 172,970 | $ | 128,533 | $ | 92,860 | |||||||

|

|

|

|

|

|

|

|||||||

During the last three years, there has been substantial uncertainty in the capital markets and access to credit remains uncertain. Due to these conditions, certain of our customers may curtail their seismic contracting activities which would result in a decrease in demand for our products. Furthermore, certain of our customers could experience an inability to pay suppliers, including us, in the event they are unable to access the capital markets to fund their business operations. These risks are more fully described under the heading “Risk Factors” in this Annual Report on Form 10-K.

Intellectual Property

We seek to protect our intellectual property by means of patents, trademarks, trade secrets and other measures. Although we do not consider any single patent essential to our success, we consider our patents regarding our marine seismic cable retrieval devices to be of particular value to us. These patents are scheduled to expire in 2013 and 2022.

Research and Development

We expect to incur significant future research and development expenditures aimed at the development of additional seismic data acquisition products and thermal imaging technologies. We have incurred company-sponsored research and development expenses of $11.5 million, $9.9 million and $8.1 million during the fiscal years ended September 30, 2011, 2010 and 2009, respectively.

Employees

As of September 30, 2011, we employed approximately 1,008 people predominantly on a full-time basis, of which 602 were employed in the United States and 361 in the Russian Federation. Our employees in the Russian Federation belong to a national union for machine manufacturers. Our remaining employees are not unionized. We have never experienced a work stoppage and consider our relationship with our employees to be satisfactory.

Financial Information by Segment and Geographic Area

For a discussion of financial information by segment and geographic area, see Note 17 to the consolidated financial statements contained in this Annual Report on Form 10-K.

6

Table of Contents

This Annual Report on Form 10-K, along with our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), are available free of charge through our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). Our website address is http://www.oyogeospace.com.

Item 1A. Risk Factors

Risk Factors

Commodity Price Levels May Affect Demand for Our Products

Demand for many of our products and the profitability of our operations depend primarily on the level of worldwide oil and gas exploration activity. Prevailing oil and gas prices and market expectations regarding potential changes in such prices significantly affect the level of worldwide oil and gas exploration activity. During periods of improved energy commodity prices, the capital spending budgets of oil and natural gas operators tend to expand, which results in increased demand for our products. Conversely, in periods when these energy commodity prices deteriorate, capital spending budgets of oil and natural gas operators tend to contract and the demand for our products generally weakens. Historically, the markets for oil and gas have been volatile and are subject to wide fluctuation in response to changes in the supply of and demand for oil and gas, market uncertainty and a variety of additional factors that are beyond our control. These factors include the level of consumer demand, regional and international economic conditions, weather conditions, domestic and foreign governmental regulations, price and availability of alternative fuels, political conditions and hostilities in the Middle East and other significant oil-producing regions, increases and decreases in foreign supply of oil and gas, and the ability of OPEC to set and maintain production levels and prices of foreign imports and overall economic conditions.

Continued effects of the economic recession could lead to a decline in demand for crude oil and natural gas. Further slowdowns in economic activity would likely reduce worldwide demand for energy and result in an extended period of lower crude oil and natural gas prices. Any unexpected material changes in oil and gas prices or other market trends that adversely impact seismic exploration activity would likely affect the demand for our products and could materially and adversely affect our results of operations and liquidity.

Our New Products May Not Achieve Market Acceptance

Our outlook and assumptions are based on various macro-economic factors and internal assessments, and actual market conditions could vary materially from those assumed. In recent years, we have incurred significant expenditures to fund our research and development efforts, and we intend to continue those expenditures in the future. However, research and development is by its nature speculative, and we cannot assure you that these expenditures will result in the development of new products or services or that any new products and services we have developed recently or may develop in the future will be commercially marketable or profitable to us. In particular, we have incurred substantial expenditures to develop our wireless nodal seismic data acquisition systems, as well as other seismic products for reservoir characterization applications. In addition, we try to use some of our capabilities, particularly our cable manufacturing capabilities, to supply products to new markets. Further, we have incurred substantial expense and expended significant effort to develop our thermal solutions products. We cannot assure you that we will realize our expectations regarding acceptance of and revenues generated by our new products and services in existing or new markets.

We May Experience Fluctuations in Quarterly Results of Operations

Historically, the rate of new orders for our products has varied substantially from quarter to quarter. Moreover, we typically operate, and expect to continue to operate, on the basis of orders in-hand for our products before we commence substantial manufacturing “runs.” The short-term nature of our order backlog generally does not allow us to predict with any accuracy demand for our products more than approximately three months in advance. Thus, our ability to replenish orders and the completion of orders, particularly large orders for deepwater reservoir characterization projects, can significantly impact our operating results and cash flow for any quarter, and results of operations for any one quarter may not be indicative of results of operations for future quarters. These periodic fluctuations in our operating results could adversely affect our stock price.

7

Table of Contents

Our Credit Risk Could Increase if Our Customers Face Difficult Economic Circumstances

We believe that our allowances for bad debts are adequate in light of known circumstances. However, we cannot assure you that additional amounts attributable to uncollectible receivables and bad debt write-offs will not have a material adverse effect on our future results of operations. Many of our seismic customers are not well capitalized and as a result cannot always pay our invoices when due. We have in the past incurred write-offs in our accounts receivable due to customer credit problems. We have found it necessary from time to time to extend trade credit, including on promissory notes, to long-term customers and others where some risks of non-payment exist. With the recent global financial crisis and tight commercial credit availability, some of our customers relying on credit markets as the source of funds for their capital spending may experience significant liquidity difficulties, which increase those credit risks. An increase in the level of bad debts and any deterioration in our credit risk could adversely affect the price of our stock. In addition, we rent equipment to our customers that can be utilized in various countries around the world. If our rental customers experienced financial difficulties, it could be difficult or impossible to retrieve our rental equipment from foreign countries.

Our industry is characterized by rapid technological development and product obsolescence

Our instruments and equipment in both of our business segments are constantly undergoing rapid technological improvement. Our future success depends on our ability to continue to:

| • | improve our existing product lines, |

| • | address the increasingly sophisticated needs of our customers, |

| • | maintain a reputation for technological leadership, |

| • | maintain market acceptance of our products, |

| • | anticipate changes in technology and industry standards, |

| • | respond to technological developments on a timely basis, and |

| • | develop new markets for our products and capabilities. |

Current competitors or new market entrants may develop new technologies, products or standards that could render our products obsolete. We cannot assure you that we will be successful in developing and marketing, on a timely and cost effective basis, product enhancements or new products that respond to technological developments, that are accepted in the marketplace or that comply with new industry standards. Additionally, in anticipation of customer product orders, from time to time we acquire substantial quantities of inventories, which if not sold or integrated into products within a reasonable period of time, could become obsolete. We would be required to impair the value of such inventories on our balance sheet.

We Operate in Highly Competitive Markets

The markets for most of our products are highly competitive. Many of our existing and potential competitors have substantially greater marketing, financial and technical resources than we do. Some competitors currently offer a broader range of instruments and equipment for sale than we do and may offer financing arrangements to customers on terms that we may not be able to match. In addition, new competitors may enter the market and competition could intensify. As to our thermal solutions products, we compete with other printing solutions, including inkjet and laser printing technologies, many of which are provided by large companies with significant resources.

We cannot assure you that sales of our products will continue at current volumes or prices if current competitors or new market entrants introduce new products with better features, performance, price or other characteristics than our products. Competitive pressures or other factors may also result in significant price competition that could have a material adverse effect on our results of operations.

8

Table of Contents

We Have a Limited Market for Our Seismic Products

In our seismic business segment, we market our traditional products to seismic service contractors and to large, independent and government-owned oil and gas companies. We estimate that, based on published industry sources, fewer than 50 seismic contracting companies are currently operating worldwide (excluding those operating in the Russian Federation and the former Soviet Union, India, the People’s Republic of China and certain Eastern European countries, where seismic data acquisition activity is difficult to verify). We estimate that fewer than 20 seismic contractors are engaged in marine seismic exploration. Due to these market factors, a relatively small number of customers, some of whom are experiencing financial difficulties, have accounted for most of our sales. From time to time these seismic contractors have sought to vertically integrate and acquire our competitors, which has influenced their supplier decisions before and after such transactions. The loss of a small number of these customers could materially and adversely impact sales of our seismic products.

We Cannot Be Certain of the Effectiveness of Patent Protection

We hold and from time to time apply for certain patents relating to some of our seismic data acquisition and other products. We also own several patents which relate to the development of dry thermal film. We cannot assure you that our patents will prove enforceable or free of challenge, that any patents will be issued for which we have applied or that competitors will not develop functionally similar technology outside the protection of any patents we have or may obtain.

Our Foreign Subsidiaries and Foreign Marketing Efforts Face Additional Risks and Difficulties

Based on customer billing data, net sales outside the United States accounted for approximately 46.6% of our net sales during fiscal year 2011; however, we believe the percentage of sales outside the United States is much higher as many of our products are first delivered to a domestic location and ultimately shipped to a foreign location. We again expect net sales outside of the United States to represent a substantial portion of our net sales for fiscal year 2012 and subsequent years.

Foreign sales are subject to special risks inherent in doing business outside of the United States, including the risk of war, terrorist activities, civil disturbances, embargo and government activities and foreign attitudes about conducting business activities with the United States, restrictions of the movement and exchange of funds, inhibitions of our ability to collect accounts receivable, international sanctions, expropriation and nationalization of our assets or those of our customers, currency fluctuations, devaluations and conversion restrictions, confiscatory taxation or other adverse tax policies and governmental actions that may result in the deprivation of our contractual rights, all of which may disrupt markets or our operations.

A portion of our manufacturing is conducted through our subsidiary OYO-GEO Impulse, which is based in the Russian Federation. Our business could be directly affected by political and economic conditions in the Russian Federation. Boycotts, protests, governmental sanctions and other actions in the region could adversely affect our ability to operate profitably. The risk of doing business in the Russian Federation and other economically or politically volatile areas could adversely affect our operations and earnings. Foreign sales are also generally subject to the risk of compliance with additional laws, including tariff regulations and import and export restrictions. Sales in certain foreign countries require prior U.S. government approval in the form of an export license. We cannot assure you that we will not experience difficulties in connection with future foreign sales. Also due to foreign laws and restrictions, should we experience substantial growth in certain foreign markets, for example in the Russian Federation, we may not be able to transfer cash balances to the United States to assist with debt servicing or other obligations.

Our subsidiaries in the Russian Federation and in Canada together reported operating losses of $1.3 million and $3.3 million, respectively, for fiscal years 2010 and 2009 primarily due to difficult seismic market conditions. These market conditions are influenced by macro-economic conditions such as the world-wide economic crisis, credit availability, crude oil and natural gas commodity price volatility and other factors impacting world-wide energy exploration activities. In addition, other factors contributed to these difficult conditions such as high tax regimes, the over-supply of natural gas as recently seen in North America, intense competitive pricing pressures,

9

Table of Contents

and reduced demand by our Houston-based operations for products manufactured by our Russian subsidiary. We cannot assure you that these conditions will improve in the near term or that these subsidiaries will not experience these difficult market conditions again in the future, and these subsidiaries may generate future operating losses, asset impairments charges, or closure if we are unable to stabilize their operations.

Unfavorable Currency Exchange Rate Fluctuations Could Adversely Affect Our Results of Operations

Substantially all of our sales from the United States are made in U.S. dollars, though from time to time we may make sales in foreign currencies. As a result, we may be subject to foreign currency fluctuations on our sales. The reporting currency for our financial statements is the U.S. dollar. However, the assets, liabilities, revenues and costs of our Russian, Canadian and United Kingdom subsidiaries are denominated in currencies other than U.S. dollars. To prepare our consolidated financial statements, we must translate those assets, liabilities, revenues and expenses into U.S. dollars at then-applicable exchange rates. Consequently, increases and decreases in the value of the U.S. dollar versus these other currencies will affect the amount of these items in our consolidated financial statements, even if their value has not changed in their original currency. These translations could result in significant changes to our results of operations from period to period. For the fiscal year ended September 30, 2011, approximately 9.1% of our consolidated revenues related to the operations of our foreign subsidiaries.

We Have a Relatively Small Public Float, and Our Stock Price May be Volatile

We have approximately 4.7 million shares outstanding held by non-affiliates. This small float results in a relatively illiquid market for our common stock. Our daily trading volume for the year ended September 30, 2011 averaged approximately 55,000 shares. Our small float and daily trading volumes have in the past caused, and may in the future result in, significant volatility in our stock price.

We Rely on a Key Supplier for a Significant Portion of Our Dry Thermal Film

While we currently manufacture dry thermal film, we also purchase a large quantity of dry thermal film from a European manufacturer through its distributor in the United Kingdom. Except for the film produced by us and sold to us by this manufacturer/distributor, we know of no other source for dry thermal film that performs well in our thermal imaging equipment. If we are unable to economically manufacture dry thermal film internally or the European manufacturer/distributor we rely on were to discontinue producing dry thermal film, were to become unwilling to contract with us on competitive terms or were unable to supply dry thermal film in sufficient quantities to meet our requirements, our ability to compete in the thermal imaging marketplace could be impaired, which could adversely affect our financial performance.

Our Success Depends Upon a Limited Number of Key Personnel

Our success depends on attracting and retaining highly skilled professionals. A number of our employees are highly skilled engineers and other professionals. In addition, our success depends to a significant extent upon the abilities and efforts of the members of our senior management. If we fail to continue to attract and retain such professionals, our ability to compete in the industry could be adversely affected.

A General Downturn in the Economy in Future Periods May Adversely Affect Our Business

The recent downturn in the economy, and any economic slowdown in future periods, could adversely affect our business in ways that we cannot predict. During times of economic slowdown, our customers may reduce their capital expenditures and defer or cancel pending projects. Such developments occur even among customers that are not experiencing financial difficulties. Any economic downturn may adversely affect the demand for oil and gas generally or cause volatility in oil and gas commodity prices and, therefore, adversely affect the demand for our services to the oil and gas industry and related service and equipment. It could also adversely affect the demand for consumer products, which could in turn adversely affect our thermal solutions business. To the extent these factors adversely affect other seismic companies in the industry, there could be an oversupply of products and services and downward pressure on pricing for seismic products and services, which could adversely affect us. Additionally, bankruptcies or financial difficulties among our customers could reduce our cash flows and adversely impact our liquidity and profitability.

10

Table of Contents

Global Capital and Credit Market Issues Could Negatively Affect Our Liquidity and Increase Our Costs of Borrowing

United States and global credit markets have recently experienced significant dislocations and liquidity disruptions which have caused the spreads on prospective debt refinancings to widen considerably. These circumstances materially impacted liquidity in the debt markets, making financing terms for borrowers less attractive, and in certain cases have resulted in the unavailability of certain types of debt financing. Events affecting the credit markets have also had an adverse effect on other financial markets in the United States, which may make it more difficult or costly in the future for us to borrow additional funds. Our business could also be negatively impacted if our suppliers or customers experience disruptions resulting from tighter capital and credit markets or a slowdown in the general economy. Any of these risks could increase our interest expense, or impair our ability to fund our operations or expand our business, which could have a material adverse effect on our financial results.

We Have a Minimal Disaster Recovery Program at the Pinemont Facility

Due to its proximity to the Texas Gulf Coast, our Pinemont facility is annually subject to the threat of hurricanes, and the aftermath that follows. Hurricanes may cause, among other types of damage, the loss of electrical power for extended periods of time. If we lost electrical power at the Pinemont facility, or if a fire or other natural disaster occurred, we would be unable to continue our manufacturing operations during the power outage because we do not own a generator or any other back-up power source large enough to provide for our manufacturing power consumption needs. We have a back-up generator to provide power for our information technology operations. Although we store our back-up data offsite, we do not maintain an alternative facility to run our information technology operations. Additionally, we do not have an alternative manufacturing or operating location in the United States. A significant disruption in our manufacturing and information technology operations could materially and adversely affect our business operations during an extended period of a power outage, fire or other natural disaster.

The Credit Agreement Imposes Restrictions on Our Business

We and several of our subsidiaries are parties to a credit agreement with a bank. The credit agreement contains covenants and requires maintenance of certain financial ratios and tests, which impose restrictions on our business and on the business of our guarantor-subsidiaries. We currently believe that the most restrictive covenant in the credit agreement is the consolidated cash flow coverage ratio. Our ability to comply with these restrictions may be affected by events beyond our control, including, but not limited to, prevailing economic, financial and industry conditions and continuing declines in our sales of products. The breach of any of these covenants or restrictions, as well as any failure to make a payment of interest or principal when due, could result in a default under the credit agreement. Such a default would permit our lender to declare amounts borrowed from it to be due and payable, together with accrued and unpaid interest, and the ability to borrow under the credit agreement could be terminated. If we are unable to repay debt to our lender, the lender could proceed against the collateral securing that debt. While we intend to seek alternative sources of cash in such a situation, there is no guarantee that any alternative cash source would be available, or would be available on terms favorable to us.

We Have Been Subject to Control by a Principal Stockholder

At September 30, 2011, OYO Corporation owned indirectly in the aggregate approximately 20.3% of our common stock. Accordingly, OYO Corporation, through its wholly owned subsidiary OYO Corporation U.S.A., is able to exercise substantial influence over our management, operations and affairs. In addition, we currently have, and may continue to have, a variety of contractual relationships with OYO Corporation and its affiliates. These relationships could further enable OYO Corporation to indirectly exert substantial influence on our operations.

11

Table of Contents

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

As of September 30, 2011, our operations included the following locations:

| Location |

Owned/Leased | Approximate Square Footage |

Use | |||||

| Houston, Texas |

Owned | 387,000 | See Note 1 below | |||||

| Houston, Texas |

Owned | 77,000 | See Note 2 below | |||||

| Ufa, Bashkortostan, Russia |

Owned | 120,000 | Manufacturing, sales and service | |||||

| Calgary, Alberta, Canada |

Owned | 45,000 | Manufacturing, sales and service | |||||

| Luton, Bedfordshire, England |

Owned | 8,000 | Sales and service | |||||

| Beijing, China |

Leased | 1,000 | Sales and service | |||||

We believe that our facilities are adequate for our current and immediately projected needs.

| (1) | This property is located at 7007 Pinemont Drive in Houston, Texas (the “Pinemont facility”). The Pinemont facility contains all manufacturing, engineering, selling, marketing and administrative activities for both the seismic and thermal solution segment of our company in the United States. The Pinemont facility also serves as our company headquarters. |

| (2) | This property, located at 7334 N. Gessner in Houston, Texas (the “Gessner facility”), previously contained a manufacturing operation and certain support functions. In February 2006, we entered into a seven-year lease with a tenant whereby the tenant agreed to lease portions of the building up to August 15, 2008, and to lease the entire building from August 16, 2008 through February 14, 2013. The lease agreement was amended in 2009 to allow the tenant the option to lease the entire building through July 31, 2020. |

Item 3. Legal Proceedings

From time to time we are a party to what we believe is routine litigation and proceedings that may be considered as part of the ordinary course of our business.

On July 8, 2009, we received a complaint filed in the United States District Court in Nevada alleging that the Geospace Seismic Recorder (“GSR”), our newly developed wireless data acquisition system, infringes a patent held by Ascend Geo, LLC (“Ascend”). We requested and were granted a change in venue to the United States District Court for the Southern District of Texas in Houston (the “Court”). In addition to monetary damages, Ascend requested a preliminary injunction against future sales by us of the GSR nodal system. We filed our response with the Court requesting that it deny Ascend’s request for a preliminary injunction and, on November 4, 2009, the Court denied Ascend’s request for a preliminary injunction. On January 4, 2011, the Court dismissed Ascend’s case with prejudice. On April 5, 2011, the U.S. Patent and Trademark Office cancelled all claims of Ascend’s patent.

12

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters

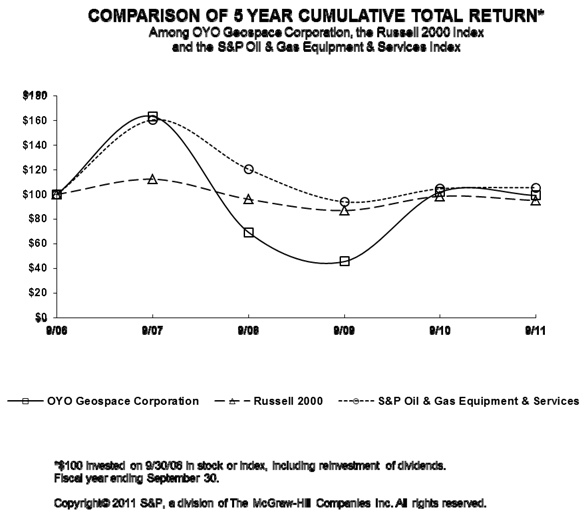

The following graphs compare the performance of the Company’s common stock with the performance of the Russell 2000 index and the Standard & Poor’s Oil & Gas Equipment and Services index as of each of the dates indicated.

The graph assumes $100 invested on September 30, 2006 (a) in the Company’s common stock, (b) in the stocks comprising the Russell 2000 index on that day and (c) in the stocks comprising the Standard & Poor’s Oil & Gas Equipment and Services index on that day. Reinvestment of all dividends on stocks comprising the two indices is assumed. The foregoing graphs are based on historical data and are not necessarily indicative of future performance. These graphs shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to the Regulations of 14A or 14C under the Exchange Act or to the liabilities of Section 18 of the Exchange Act.

Our common stock is quoted on The NASDAQ Global Market under the symbol “OYOG”. On December 5, 2011, there were approximately 17 holders of record of our common stock, and the closing price per share on such date was $87.22 as quoted by The NASDAQ Global Market.

13

Table of Contents

The following table shows the high and low per share sales prices for our common stock reported on The NASDAQ Global Market.

| Low | High | |||||||

| Year Ended September 30, 2011: |

||||||||

| Fourth Quarter |

$ | 55.08 | $ | 107.25 | ||||

| Third Quarter |

82.01 | 100.62 | ||||||

| Second Quarter |

84.33 | 109.99 | ||||||

| First Quarter |

58.00 | 100.30 | ||||||

| Year Ended September 30, 2010: |

||||||||

| Fourth Quarter |

$ | 45.17 | $ | 58.40 | ||||

| Third Quarter |

41.23 | 55.47 | ||||||

| Second Quarter |

33.85 | 50.47 | ||||||

| First Quarter |

23.02 | 43.70 | ||||||

Since our initial public offering in 1997, we have not paid dividends, and we do not intend to pay cash dividends on our common stock in the foreseeable future. We presently intend to retain our earnings for use in our business, with any future decision to pay cash dividends dependent upon our growth, profitability, financial condition and other factors our Board of Directors may deem relevant. Our existing credit agreement also has covenants that materially limit our ability to pay dividends. For a discussion of our credit agreement, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operation – Liquidity and Capital Resources” contained in this Annual Report on Form 10-K.

The following equity plan information is provided as of September 30, 2011:

Equity Compensation Plan Information

| Plan Category | Number of Securities to be (a) |

Weighted-average Exercise Price of Outstanding Options, Warrants and Rights (b) |

Number of Securities (c) |

|||||||||

| Equity Compensation Plans Approved by Security Holders (1) |

172,400 | $ | 27.69 | 137,896 | ||||||||

| Equity Compensation Plans Not Approved by Security Holders |

400 | $ | 39.22 | 19,000 | ||||||||

| (1) | The securities are to be issued pursuant to the Company’s 1999 Broad-Based Option Plan. A description of such plan is provided in Note 11 to the consolidated financial statements contained in this Annual Report on Form 10-K. |

14

Table of Contents

Item 6. Selected Consolidated Financial Data

The following table sets forth certain selected historical financial data on a consolidated basis. We have derived the selected consolidated financial information as of September 30, 2011 and 2010 and for fiscal years 2011, 2010 and 2009 from our audited consolidated financial statements appearing elsewhere in this Annual Report on Form 10-K. We have derived the selected consolidated financial information as of September 30, 2009, 2008 and 2007 and for fiscal years 2008 and 2007 from audited consolidated formation not included herein. The selected consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in item 7 and our consolidated financial statements appearing elsewhere in this Annual Report on Form 10-K. When reviewing the table below, please also note the recent transactions and new accounting pronouncements described in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies”, contained in this Annual Report on Form 10-K.

| Year Ended September 30, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (in thousands, except share and per share amounts) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Sales |

$ | 172,970 | $ | 128,533 | $ | 92,860 | $ | 134,495 | $ | 138,106 | ||||||||||

| Cost of sales |

98,857 | 81,177 | 66,287 | 87,441 | 87,587 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

74,113 | 47,356 | 26,573 | 47,054 | 50,519 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Selling, general and administrative |

18,051 | 16,618 | 14,572 | 16,913 | 16,492 | |||||||||||||||

| Research and development |

11,529 | 9,925 | 8,062 | 8,945 | 7,327 | |||||||||||||||

| Bad debt expense (recovery) |

128 | (479 | ) | 318 | 1,615 | 236 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

29,708 | 26,064 | 22,952 | 27,473 | 24,055 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gain (loss) on disposal of equipment |

— | (184 | ) | (12 | ) | 604 | 1,655 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations |

44,405 | 21,108 | 3,609 | 20,185 | 28,119 | |||||||||||||||

| Other income (expense), net |

214 | (206 | ) | (298 | ) | 233 | 118 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

44,619 | 20,902 | 3,311 | 20,418 | 28,237 | |||||||||||||||

| Income tax expense |

14,908 | 6,820 | 1,551 | 6,266 | 8,638 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 29,711 | $ | 14,082 | $ | 1,760 | $ | 14,152 | $ | 19,599 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per share: |

||||||||||||||||||||

| Basic |

$ | 4.78 | $ | 2.33 | $ | 0.30 | $ | 2.40 | $ | 3.38 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

$ | 4.73 | $ | 2.27 | $ | 0.29 | $ | 2.31 | $ | 3.23 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||

| Basic |

6,220,657 | 6,031,314 | 5,950,403 | 5,908,727 | 5,793,840 | |||||||||||||||

| Diluted |

6,286,324 | 6,193,018 | 6,079,378 | 6,116,039 | 6,063,446 | |||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Depreciation, amortization and stock-based compensation |

$ | 7,783 | $ | 5,629 | $ | 5,472 | $ | 4,598 | $ | 3,912 | ||||||||||

| Capital expenditures |

20,144 | 6,117 | 1,709 | 9,796 | 17,007 | |||||||||||||||

| As of September 30, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Working capital |

$ | 124,900 | $ | 91,577 | $ | 82,842 | $ | 82,475 | $ | 60,329 | ||||||||||

| Total assets |

196,801 | 163,496 | 141,482 | 159,380 | 128,162 | |||||||||||||||

| Short-term debt |

— | 440 | 728 | 709 | 322 | |||||||||||||||

| Long-term debt |

— | 7,260 | 8,820 | 19,526 | 5,147 | |||||||||||||||

| Stockholders’ equity |

177,013 | 136,586 | 118,658 | 117,363 | 102,370 | |||||||||||||||

We did not declare or pay any dividends during any of the periods noted in the above tables.

15

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following is management’s discussion and analysis of the major elements of our consolidated financial statements. You should read this discussion and analysis together with our consolidated financial statements, including the accompanying notes, and other detailed information appearing elsewhere in this Annual Report on Form 10-K, including under the heading “Risk Factors”. The discussion of our financial condition and results of operations includes various forward-looking statements about our markets, the demand for our products and services and our future plans and results. These statements are based on assumptions that we consider to be reasonable, but that could prove to be incorrect. For more information regarding our assumptions, you should refer to the section entitled “—Forward-Looking Statements and Assumptions” contained in this Item 7 in this Annual Report on Form 10-K.

Background

We design and manufacture instruments and equipment used in the acquisition and processing of seismic data as well as in the characterization and monitoring of producing oil and gas reservoirs. We have been in the seismic instrument and equipment business since 1980 and market our products primarily to the oil and gas industry. We also design, manufacture and distribute thermal imaging equipment and thermal media products targeted at the screen print, point of sale, signage and textile market sectors. We have been manufacturing thermal imaging products in our Thermal Solutions segment since 1995. For a more detailed discussion of our business segments and products, see the information under the heading “Business” in this Annual Report on Form 10-K.

Worldwide Economic Slowdown

Demand for many of our products depends primarily on the level of worldwide oil and gas exploration activity. That activity, in turn, depends primarily on prevailing oil and gas prices and availability of seismic data. Despite signs of economic recovery in 2010 and 2011, sovereign debt issues in Europe and slower economic growth in the U.S. and China have renewed the uncertainty of the global economy and may, in turn, cause energy commodity prices to decline.

We saw a strong recovery in the demand for some of our products in fiscal year 2011. However, we remain cautious regarding the future and we continue to monitor the impact that these economic conditions may have on our operations. We believe that our current cash balances, cash flow from operations and cash borrowings available under our credit facility will provide sufficient resources to meet our working capital liquidity needs for the next twelve months.

Consolidated Results of Operations

The economic slowdown adversely affected our product revenues in fiscal year 2009. In fiscal year 2009, we experienced declines in almost every major product category in each of our business segments. In fiscal year 2010 and again in fiscal year 2011 product revenues increased from the previous year in most product categories. We have not sold any large-scale seabed reservoir characterization systems since fiscal year 2007, although a smaller seabed system was sold in fiscal year 2010. These reservoir characterization products generally have higher profit margins than our traditional seismic exploration products.

As we have reported in the past, our sales and operating profits have varied significantly from quarter-to-quarter, and even year-to-year, and are expected to continue that trend in the future, especially when our quarterly financial results are impacted by the presence or absence of relatively large, but somewhat erratic, shipments of seismic seabed, borehole reservoir characterization systems and/or wireless data acquisition systems. At present, we do not have any large orders for seabed reservoir characterization products in our backlog, although we remain optimistic about on-going discussions with customers concerning these products. The quote-to-contract time for large permanent and retrievable seabed seismic data acquisition systems is generally quite long, and since these sales are not recognized in our financial statements until the products are shipped and/or accepted by our customer, the exact timing of any future sales can dramatically affect our quarterly results.

16

Table of Contents

In fiscal years 2010 and 2009, our subsidiaries located in the Russian Federation and in Canada experienced significant declines in sales and, together, generated operating losses of $1.3 million and $3.3 million, respectively. The difficult seismic market conditions in the Russian Federation resulted from a decline in oil exploration activities precipitated in part by the severe drop in crude oil commodity prices (relative to prices in prior years) and a higher federal tax imposed upon Russian producers of crude oil for export. In addition, our Houston-based manufacturing operation significantly reduced the purchase of products manufactured by our Russian subsidiary in an effort to stabilize and eventually reduce our consolidated inventory levels. The resulting low factory utilization, combined with intense competition for declining seismic product orders in the Russian market, contributed to the poor financial results of our Russian subsidiary during fiscal years 2010 and 2009. In regards to our subsidiary in Canada, high levels of natural gas storage and low natural gas demand in North America significantly reduced natural gas-oriented seismic exploration activities both in the United States and in Canada, resulting in low levels of product sales and the under-utilization of our seismic rental equipment. The lower level of sales recorded by our Canadian subsidiary in 2010 and 2009 was not adequate to offset fixed costs associated with rental equipment depreciation and facility utilization as well as general overhead costs. While both the Russian and Canadian subsidiaries experienced significant revenue increases during fiscal year 2011, the Russian subsidiary reported an operating loss of $0.4 million in fiscal year 2011 and continues to face intense pricing competition for product sales to its Russian and CIS customers. We are working closely with the Russian management team to address these issues in an effort to return this operation to profitability.

We report and evaluate financial information for two segments: Seismic and Thermal Solutions. Summary financial data by business segment follows (in thousands):

| Year Ended September 30, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Seismic |

||||||||||||

| Exploration product sales |

$ | 131,645 | $ | 89,777 | $ | 59,084 | ||||||

| Reservoir product sales and services |

15,968 | 14,600 | 12,020 | |||||||||

| Industrial product sales |

11,040 | 10,397 | 7,939 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total seismic sales |

158,653 | 114,774 | 79,043 | |||||||||

| Operating income |

53,477 | 28,955 | 10,591 | |||||||||

| Thermal Solutions |

||||||||||||

| Sales |

13,519 | 12,955 | 13,028 | |||||||||

| Operating income (loss) |

(37 | ) | 397 | 370 | ||||||||

| Corporate |

||||||||||||

| Sales |

798 | 804 | 789 | |||||||||

| Operating loss |

(9,035 | ) | (8,244 | ) | (7,352 | ) | ||||||

| Consolidated Totals |

||||||||||||

| Sales |

172,970 | 128,533 | 92,860 | |||||||||

| Operating income |

44,405 | 21,108 | 3,609 | |||||||||

Overview

Fiscal Year 2011 Compared to Fiscal Year 2010

Consolidated net sales for fiscal year 2011 increased $44.4 million, or 34.6%, from fiscal year 2010. The higher level of sales resulted from increased customer demand for our seismic products and particularly robust demand for sales and rentals of our land-based wireless (or nodal) data acquisition systems. The increased demand for our seismic products is being driven by strong oil and gas exploration activities throughout the world.

17

Table of Contents

Consolidated gross profits for fiscal year 2011 increased by $26.8 million, or 56.5%, from fiscal year 2010. The increase in gross profits resulted from (i) increased sales and rentals of seismic products, (ii) a more favorable product mix, and (iii) improved manufacturing productivity due to higher production output.

Consolidated operating expenses for fiscal year 2011 increased $3.6 million, or 14.0%, from fiscal year 2010. The increase in operating expenses resulted from (i) increased pretax earnings giving rise to $0.5 million of increased incentive compensation expenses, (ii) increased product development expenditures of $1.2 million relating to product enhancements and new product introductions, and (iii) a general increase in expenses associated with increased sales activities.

The U.S. statutory tax rate applicable to us for fiscal years 2011 and 2010 was 35.0%; however, our effective tax rate was 33.4% and 32.6% for fiscal years 2011 and 2010, respectively. The lower effective tax rate in fiscal year 2011 resulted from (i) the impact of the manufacturers’/producers’ deduction available in the United States and (ii) an increase in research and experimentation tax credits resulting from United States Congress’ renewal and extension of the tax credit program during fiscal year 2011 through December 2012. The lower effective tax rate in fiscal year 2010 resulted from (i) the impact of the manufacturers’/producers’ deduction available in the United States, (ii) a revaluation of our United States net deferred tax assets from 34.0% to 35.0%, (iii) the revaluation of a tax loss carryback for our Canadian subsidiary, and (iv) a reduction in our contingent tax expenses.

Fiscal Year 2010 Compared to Fiscal Year 2009

Consolidated net sales for fiscal year 2010 increased $35.7 million, or 38.4%, from fiscal year 2009. The higher level of sales stems from the increase in customer demand for our seismic products and particularly robust demand for our land-based wireless (or nodal) data acquisition systems. The increased demand for our seismic products in fiscal year 2010 was driven by higher crude oil commodity prices and increased natural gas exploration activities in North America.

Consolidated gross profits for fiscal year 2010 increased by $20.8 million, or 78.2%, from fiscal year 2009. The increase in gross profits was caused by an increase in sales of our products, improved factory utilization and a favorable product mix.

Consolidated operating expenses for fiscal year 2010 increased $3.1 million, or 13.6%, from fiscal year 2009. Increased operating expenses primarily resulted from a $2.3 million increase of incentive compensation resulting from higher consolidated pretax profits, and general expense increases due to higher sales volume. These operating expense increases were partially offset by lower bad debt expenses resulting from improved collection of our outstanding accounts receivable.

The U.S. statutory tax rate applicable to us for fiscal years 2010 and 2009 was 35.0% and 34.0%, respectively; however, our effective tax rate was 32.6% and 46.8% for fiscal years 2010 and 2009, respectively. The lower effective tax rate in fiscal year 2010 resulted from (i) the impact of the manufacturers’/producers’ deduction available in the United States, (ii) a revaluation of our United States net deferred tax assets from 34.0% to 35.0%, (iii) the revaluation of a tax loss carryback for our Canadian subsidiary, and (iv) a reduction in our contingent tax expenses. The United States Congress had not extended the provision for research and experimentation credits beyond calendar year 2009; therefore, the Company had not recorded any related tax benefit of such credits beyond its first quarter ended December 31, 2009. The higher effective tax rate for fiscal year 2009 resulted primarily from pretax losses in foreign taxing jurisdictions having lower statutory tax rates than the U.S. statutory rate.

18

Table of Contents

Segment Results of Operations

Seismic Products

Fiscal Year 2011 Compared to Fiscal Year 2010

Net Sales. Sales of our seismic products for fiscal year 2011 increased $43.9 million, or 38.2%, from fiscal year 2010. The increase in our seismic product sales is due to (i) robust demand for sales and rentals of our wireless data acquisition systems, (ii) increased demand for most of our other seismic products, including higher margin marine and reservoir products, and (iii) improving market conditions in Canada and the Russian Federation.

Operating Income. Operating income for fiscal year 2011 increased $24.5 million, or 84.7%, from fiscal year 2010. The higher operating income resulted primarily from increased product sales and equipment rentals, improved factory productivity, and a more favorable product mix. These improvements in our operating income were partially offset by (i) additional charges for inventory obsolescence due to the aging of certain of our inventories, (ii) increased incentive compensation expenses due to a higher level of pretax income, and (iii) operating losses at our subsidiary in the Russian Federation due to competitive pricing pressures in its local market.

Fiscal Year 2010 Compared to Fiscal Year 2009

Net Sales. Sales of our seismic products for fiscal year 2010 increased $35.7 million, or 45.2%, from fiscal year 2009. The increase in sales is due to a higher demand for most of our seismic products caused by increased oil and gas exploration activities worldwide. In addition, we experienced robust demand for our land-based wireless (or nodal) data acquisition system.

Operating Income. Operating income from sales of our seismic products for fiscal year 2010 increased $18.4 million, or 173.4%, from fiscal year 2009. The higher operating income is directly related to (i) improved product sales and product mix, (ii) higher factory utilization resulting from increased manufacturing activities, (iii) improved operating results from our subsidiary in the Russian Federation, and (iv) the leveraging of fixed operating expenses over a greater volume of revenues.

Thermal Solutions Products

Fiscal Year 2011 Compared to Fiscal Year 2010

Net Sales. Sales of our thermal solutions products for fiscal year 2011 increased $0.6 million, or 4.4%, from fiscal year 2010. Approximately $0.3 million of this increase resulted from growing sales to our Canadian customers. We consider the remaining increase to be somewhat normal due to recurring fluctuations in product sales volume and not associated with any long-term trend.

Operating Income. Our operating income from our thermal solutions products for fiscal year 2011 decreased $0.4 million, or 109.3%, from fiscal year 2010. The decline in profitability resulted from (i) lower margins on product sales due to higher material costs for our film products, (ii) additional charges for inventory obsolescence expense due to the aging of certain inventories, and (iii) increased incentive compensation expenses relative to the improvement in our consolidated financial results.

Fiscal Year 2010 Compared to Fiscal Year 2009

Net Sales. Sales of our thermal solutions products for fiscal year 2010 decreased $73,000, or 0.6%, from fiscal year 2009. We consider this small decrease to be somewhat normal due to recurring fluctuations in product sales volume and not associated with any long-term trend.

Operating Income. Our operating income from our thermal solutions products for fiscal year 2010 increased $27,000, or 7.3%, from fiscal year 2009. The increase in operating income is caused by increased production efficiencies.

Incentive Compensation Program

We adopted an incentive compensation program for fiscal year 2011 whereby most employees will be eligible to begin earning incentive compensation if the Company reaches a five percent pretax return on stockholders’ equity, determined as of September 30, 2010. To be eligible to participate in this incentive

19

Table of Contents