Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CDI CORP | d263133d8k.htm |

| EX-99.1 - NEWS RELEASE ISSUED BY CDI CORP. ON DECEMBER 8, 2011 - CDI CORP | d263133dex991.htm |

CDI

Corporation Transformation:

Strategic Plan to Accelerate Profitable Growth

and Increase Shareholder Value

December 8, 2011

Copyright ©

2011 CDI Corp. All rights reserved.

Exhibit 99.2 |

Caution

Concerning Forward-Looking Statements

2

Copyright ©

2011 CDI Corp. All rights reserved.

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. All statements that address expectations or projections

about the future, including, but not limited to, statements about our strategies for growth and

future financial results (such as revenues, cost savings and operating profit margins), are

forward-looking statements. Some of the forward-looking statements can be identified by

words like “anticipates,” “believes,” “expects,” “may,” “will,” “could,” “should,” “intends,” “plans,”

“estimates” and similar expressions. These statements are not guarantees of future

performance and involve a number of risks, uncertainties and assumptions that are difficult to

predict. Because these forward-looking statements are based on estimates and assumptions

that are subject to significant business, economic and competitive uncertainties, many of which

are beyond our control or are subject to change, actual outcomes and results may differ

materially from what is expressed or forecasted in these forward-looking statements. Important

factors that could cause actual results to differ materially from the forward-looking statements

include, but are not limited to: weakness in general economic conditions and levels of capital

spending by customers in the industries we serve; weakness in the financial and capital

markets, which may result in the postponement or cancellation of our customers’ capital

projects or the inability of our customers to pay our fees; the inability to successfully

implement our new strategic plan; the termination or non-renewal of a major customer contract or

project; our ability to maintain or expand our existing bank credit facility on satisfactory terms;

credit risks associated with our customers; competitive market pressures; the availability and

cost of qualified personnel; our level of success in attracting, training and retaining

qualified management personnel and other staff employees; changes in tax laws and other

government regulations; the possibility of incurring liability for our activities, including

the activities of the our temporary employees; our performance on customer contracts; negative

outcome of pending and future claims and litigation; and government policies, legislation or judicial

decisions adverse to our businesses. More detailed information about these and other

risks and uncertainties may be found in our filings with the SEC, particularly in the "Risk

Factors" section of our Form 10-K and the "Management's Discussion and Analysis of

Financial Condition and Results of Operations" section of our Form 10-K's and Form

10-Q's. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. We assume no obligation to update such statements,

whether as a result of new information, future events or otherwise, except as required by law. |

Agenda

3

Transformational

Strategy Overview

Paulett

Eberhart

–

President

&

CEO

Strategy Execution

Phil

Clark

–

Executive

Vice

President,

Business Development & Operations

Global Engineering &

Technology Solutions

Robert

Giorgio

–

Executive

Vice

President,

Global Engineering & Technology Solutions

Financial Review

Bob

Larney

–

Executive

Vice

President

&

CFO

Transformational

Strategy Summary

Paulett

Eberhart

–

President

&

CEO

Questions and

Answers

CDI Executive Team

Copyright ©

2011 CDI Corp. All rights reserved.

Topic

Presenter |

Transformational

Strategy Overview

Paulett

Eberhart,

President

&

CEO

Copyright ©

2011 CDI Corp. All rights reserved. |

CDI

Today 5

Copyright ©

2011 CDI Corp. All rights reserved.

•

US-centric staffing company with four stand-alone

business segments operating with separate

management, operations, sales, and support

functions

•

Go-to-market approaches are executed differently

in each business unit

•

Growth efforts are not sufficiently focused

•

Growth investments have been minimal in recent

years

•

Engineering & Technology business units serve

20+ industries

•

Staffing drives 70% of revenue |

2011

Transition 6

Focus on

accountability

and deliver on

commitments

Copyright ©

2011 CDI Corp. All rights reserved.

Plan for the future

Rigorous

assessment

of corporate

strengths and

weaknesses

Personal

interaction

with clients,

employees,

and investors

New

executive

leadership

team |

2011

Transition 7

•

Be more disciplined in choosing areas of focus and investment

•

Have greater accountability

•

Reorganize reporting units to break down “silos”

•

Lower cost structure

What CDI needs to do:

New strategy and plan for ONE CDI

We must execute

Copyright ©

2011 CDI Corp. All rights reserved.

Conclusions |

CDI

Tomorrow 8

Copyright ©

2011 CDI Corp. All rights reserved.

CDI is an integrated market-leading Engineering and

Technology Services organization providing differentiated,

client-focused solutions in select global industries.

|

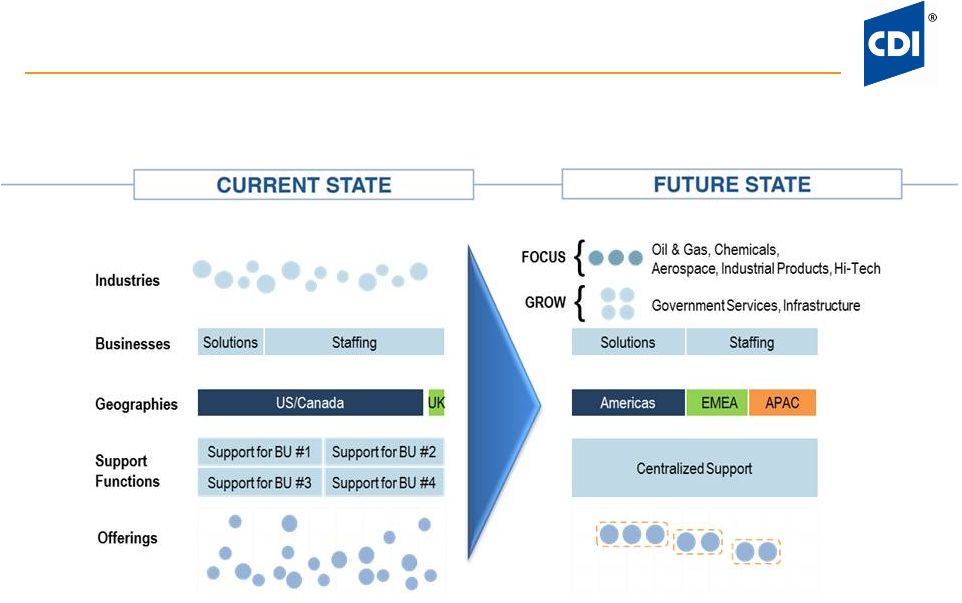

ONE

CDI becomes a reality 9

Geographies

Copyright ©

2011 CDI Corp. All rights reserved.

MRI

Industry Verticals

•

Government Services

•

Infrastructure

•

Americas

•

EMEA

•

APAC

•

Global Engineering

and Technology

Solutions (GETS)

•

Professional

Services Staffing

(PSS)

Service Lines

•

Oil & Gas

•

Chemicals

•

Aerospace

•

Industrial Products

•

Hi-Tech |

Accelerated Revenue Growth and Profitability to

Drive Increased Shareholder Value

10

•

Staffing and Solutions both expected to grow at higher

rates with new organizational model

•

Favorable changes to revenue mix anticipated

•

Reduced cost structure will boost profit margins

•

Investments will be made in leadership talent and

technology

Copyright ©

2011 CDI Corp. All rights reserved.

2014 Revenue Target Range: $1.3 to $1.4 Billion

2014 Operating Profit Margin Target Range: 3.5% to 4.5%

|

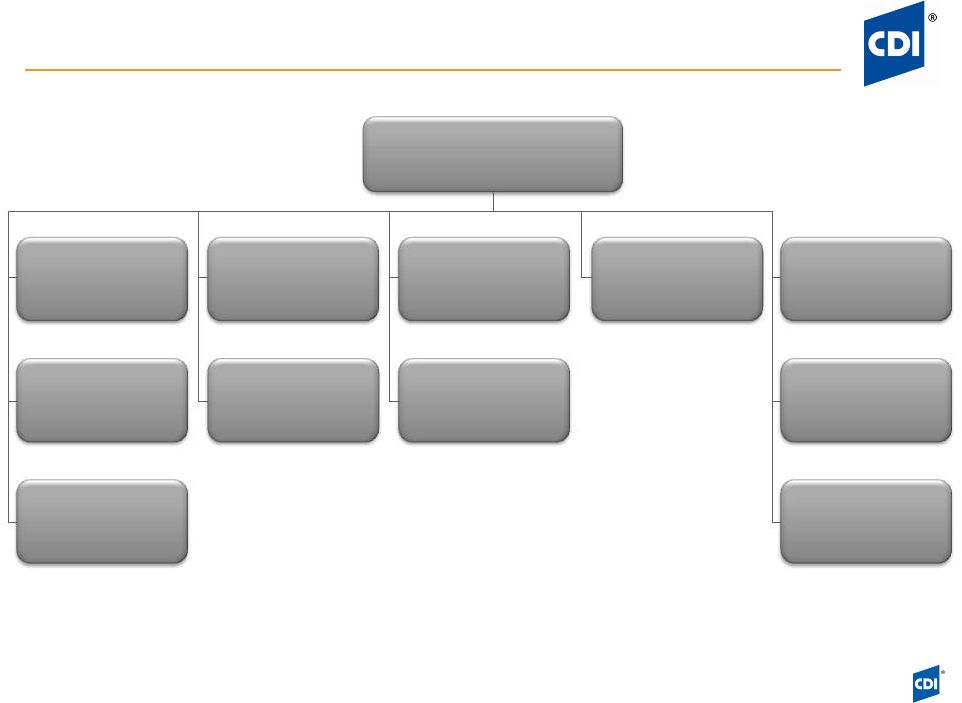

Peggy Besand

Organizational

Development &

Communications

Organization Chart –

Executive Leadership Team

11

CDI Executive Leadership Team

Paulett Eberhart

President and CEO

Robert Giorgio

Global Engineering &

Technology Solutions

Bob Larney

Finance

CFO

Phil Clark

Global Business

Development &

Operations

Eric Moorehead

Americas

President

Brian Short

Legal &

Human Resources

Greg Thullner

Professional

Services

Staffing

Rob Romaine

MRI

Phil Clark

APAC

President

TBA

EMEA

President

Dirk Dent

Enterprise

Client

Executive |

Transformational

Strategy Overview

Paulett

Eberhart,

President

&

CEO

Copyright ©

2011 CDI Corp. All rights reserved. |

Strategy Execution

Phil

Clark,

Executive

Vice

President,

Business Development & Operations

Copyright ©

2011 CDI Corp. All rights reserved. |

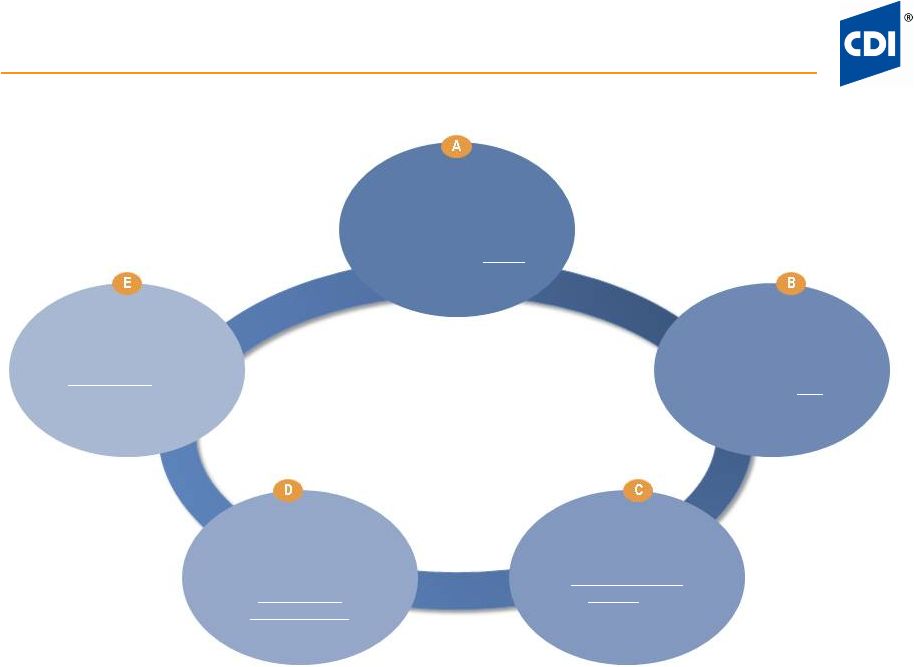

Five

guiding principles that drove CDI to its strategic objectives

CDI will

optimize

Professional

Services, of

which Staffing

is a critical

part

CDI will not

exit the

Staffing

business

CDI should

view Solutions

as “the end

game”

in its

focused

industries

CDI should

selectively

build its

presence in

Business

Advisory

Services

CDI must

develop a

portfolio that

has a mix of

longer term

and shorter

term offerings

14

Copyright ©

2011 CDI Corp. All rights reserved.

Become a recognized global market

leader in our chosen markets |

New

CDI 15

Copyright ©

2011 CDI Corp. All rights reserved. |

CDI

Multi-Dimensional Growth Strategy Matrix CDI’s Growth Strategy

16

Focuses on developing new offerings and capabilities allowing CDI to expand its

relevance to the targeted industries in both new and existing geographies

Copyright ©

2011 CDI Corp. All rights reserved.

The bulk of the strategy focuses on “one dimensional”

opportunities to accelerate profitable growth |

Differentiated Formula

Deliver high value

engineering and

technology

solutions

that

incorporates

and

leverages

professional staffing,

proprietary software, technology,

methods and processes

Specialize in

attracting, training &

retaining top quality

engineering talent

Acquire proprietary

software,

technology, methods

& processes (IP)

to

sustain innovation

Provide cost

effective, high

quality engineering

services via a

global delivery

model

that

incorporates local,

onshore and

offshore resources

Establish a world

class

collaboration

network for

knowledge

management

Leverage

established

credentials

with

Fortune 100 clients

17

CDI will develop a differentiated formula that comprises the following elements:

talent, intellectual property, efficient delivery model, knowledge management

and credentials

Copyright ©

2011 CDI Corp. All rights reserved. |

Strategic Client Engagement Model

18

Delivery Executive

Responsible for delivery of GETS and

PSS services

Industry Sales Executive

Sell across all offerings for Engineering,

IT, Staffing

Industry Executive

SME responsible for industry thought

leadership, consulting, demand creation

Client

Executive

Client Executive

Responsibility for client,

including financial performance,

growth, delivery excellence

Strategic

Client

Copyright ©

2011 CDI Corp. All rights reserved. |

19

Professional Services Staffing

$25-26 Billion

•

All staffing combined, optimized and developed into a global strategic

offering

•

Provide a global staffing network to support clients, while focusing on

select engineering and technology functional competencies

•

Expand to select emerging countries

Strategy

New client engagement model to grow client business through

cross-selling, penetrating new clients, and driving higher value

solutions and professional staffing

Copyright ©

2011 CDI Corp. All rights reserved.

CDI Addressable Market: 2014 |

20

Professional Services Staffing Strategy

$11-12 Billion

Copyright ©

2011 CDI Corp. All rights reserved.

•

Develop deep industry domain

knowledge

•

Recruit specific in-demand skill sets

for target industries

•

Leverage industry data to optimize

clients’

talent management

•

Focus on large, global managed

staffing contracts for Fortune 500

companies

•

Develop low-cost service model to

gain competitive advantage

Domain

Business Advisory

Function Outsource

Managed Services

Staff Augmentation

Contract Staffing

Managed Staffing Program |

21

Global Engineering & Technology Solutions (GETS)

$11-13 Billion

•

Provide engineering and IT solutions within a single organization

•

Focus on service excellence and quality

•

Leverage all global delivery resources to deliver high quality services at

a competitive price point

•

Enhance CDI’s ability to grow globally in select markets

Strategy

Copyright ©

2011 CDI Corp. All rights reserved.

CDI Addressable Market: 2014 |

22

Evolution to Growth

$11-12 Billion

•

Focused new vision and strategy for the entire company

•

Prioritized high potential industry sectors within leveraged service

offerings

and

select

geographic

markets

to

meet

the

global

needs

of

our

clients

•

New vision and strategy will improve revenue growth and profitability

Key Elements

Copyright ©

2011 CDI Corp. All rights reserved. |

Global Engineering &

Technology Solutions

Robert

Giorgio,

Executive

Vice

President,

Global Engineering & Technology Solutions

Copyright ©

2011 CDI Corp. All rights reserved. |

Global

Engineering & Technology Solutions (GETS) •

Scope and Key Strengths

•

Formation Process

•

Focus and Execution

•

Delivering Profitable Growth

24

Copyright ©

2011 CDI Corp. All rights reserved. |

GETS

Scope and Key Strengths •

GETS

will

be

the

global

solutions

services

delivery

organization

for

the

geographic regions

•

GETS will provide unrivaled solution delivery through:

–

Centers of Excellence (COE) with skill sets required for larger projects in

centralized locations

–

Regional centers to service local needs and use of COE

resources for

required skill sets

–

Client-centered offices to deliver site specific services and identify larger

project opportunities

–

Offshore and near-shore engineering centers to leverage low cost design

resources

25

Copyright ©

2011 CDI Corp. All rights reserved.

Scope

Focus on high potential growth markets |

•

Blue chip customer base

•

Multi-year client agreements in place

•

Track record of quality service delivery

•

Talented engineering and project management teams

•

Depth and breadth of skill sets equipped with industry

leading tool sets

•

Ability to scale quickly to meet client needs

GETS Scope and Key Strengths

26

Copyright ©

2011 CDI Corp. All rights reserved.

Key Strengths

Competitive advantage |

GETS

Formation Process •

Identified high potential growth markets (verticals)

•

Evaluated current capabilities vs. customer needs

•

Needed to capitalize on growth in engineering solutions

27

Copyright ©

2011 CDI Corp. All rights reserved.

Growth market assessment

Evaluated CDI’s organizational structure and processes

•

Critical mass in some key areas lacking

•

Must leverage and centralize our skill sets better

•

Better access to low cost/off shore engineering sources needed

•

Higher level strategic customer relationships necessary

•

Process/structure

improvements

required

to

accelerate

ability

to

bring

skilled solutions to clients

•

Lower cost delivery structure needed |

Up

to 35% of total global engineering spend projected to be outsourced by

2015

28

Copyright ©

2011 CDI Corp. All rights reserved.

75%

Focus

on

engineering

solutions

in

large,

fast

growing

industries

where

CDI

already has significant engineering capabilities

Engineering Global Market Forecast

2010

2012

2015

75%

25%

71%

29%

65%

35%

In House

Outsourced

GETS: Focus and Execution |

29

Copyright ©

2011 CDI Corp. All rights reserved.

Industry focus on large fast growing industries where CDI already has

significant engineering capabilities

•

Addressable market 2014: $6-$7 billion

•

Estimated revenue CAGR 2010-2014: 10%-12%

Oil & Gas and Chemicals

•

Addressable market 2014: $5-$6 billion

•

Estimated revenue CAGR 2011-2014: 4%-6%

Aerospace and Industrial Products

GETS: Focus and Execution |

30

Copyright ©

2011 CDI Corp. All rights reserved.

Oil & Gas and Chemicals Asset Lifecycle Services and Solutions

Go-to-Market Roadmap

GETS: Focus and Execution

Today

2014

Exploration

Onshore

production

Offshore production

Unconventional –

Upstream production

Wastewater

pre & post treatment

Pipeline

Tanks &

Terminals

Gas Processing

Oil Sands –

Upgrading

Refining

Petrochemicals |

•

Pre-feasibility

screening studies

•

Business case &

concept

development

•

Technology

assessment

•

Feasibility studies &

conceptual design

•

Initial cost estimating

& contract planning

•

Tech. selection &

financial analysis

•

Preliminary

engineering

(FEED/FEL)

•

Detailed cost

estimating

•

Execution planning

•

Detailed engineering

•

Regulatory

compliance

•

HSE services

•

Upgrade projects &

process optimization

•

Technology

integration

•

Ops and

maintenance support

31

Copyright ©

2011 CDI Corp. All rights reserved.

Oil & Gas and Chemicals: Lifecycle Optimization Framework

GETS: Focus and Execution

CDI Services

Identify

Evaluate

Define

Operate

Execute

CDI’s CORE BUSINESS

Project Management and Consulting

Asset Lifecycle |

32

Copyright ©

2011 CDI Corp. All rights reserved.

Aerospace and Industrial Products Asset Lifecycle Services and Solutions

Go-to-Market

Roadmap

GETS: Focus and Execution

Tier 1 and Tier 2 Manufacturers

OEMs

MROs

Depots

Operators/Airlines

Today

2014 |

•

Airframe design

•

Tooling

assessment and

design

•

Engineering

design analysis

•

Analytical

validation

•

FAA certification

•

Embedded

systems test &

validation

•

Supplier

evaluation &

management

•

Procurement

optimization

•

Embedded

systems test &

validation

•

Quality

management

•

Source

inspection

•

FAI

•

Embedded

systems test &

validation

•

Sustaining

engineering

•

Logistics

•

Life cycle

management

•

Technical

documentation

•

Value

engineering

•

Maintenance

cost analysis

•

Product support

analysis

33

Copyright ©

2011 CDI Corp. All rights reserved.

Aerospace and Industrial Products: Lifecycle Optimization

Framework

CDI Services

CDI’s CORE BUSINESS

Project Management and Consulting

Asset Lifecycle

GETS: Focus and Execution

Design

Analyze

Build

Deliver

Support

Optmize |

GETS

Summary •

Improved service excellence model that includes providing

services and solutions

in select global markets

•

Increased efficiencies and lower operating costs to become

more competitive

•

Increasing solutions market share by combining high value-

added services to better meet client needs

•

A focus on higher growth markets that match our capabilities

and strengths

34

Copyright ©

2011 CDI Corp. All rights reserved.

Delivering Profitable Growth |

Financial

Review

Bob Larney,

Executive Vice President &

CFO Copyright ©

2011 CDI Corp. All rights reserved. |

Restructuring Charge and Cost Savings

•

$8-$9 million pre-tax charge to be taken in 4th quarter

2011 for employee severance and related costs; cash

outlay in 2012

•

200 employee headcount reduction

•

Net savings of approximately $18.5 million in 2012

•

Portion of savings to be spent on investments to

accelerate growth, employee benefits and technology

upgrades

•

At least half of the net savings to benefit operating

profits and earnings per share

36

Copyright ©

2011 CDI Corp. All rights reserved. |

37

Segment Reporting

Americas

•

Global Engineering & Technology Solutions

•

Professional Services Staffing

EMEA

•

Global Engineering & Technology Solutions

•

Professional Services Staffing

APAC

•

Global Engineering & Technology Solutions

•

Professional Services Staffing

Management Recruiters International, Inc.

Copyright ©

2011 CDI Corp. All rights reserved. |

38

*Normalized

Revenue & Margin Targets

$1.0 billion

1.0%*

$1.3-1.4 billion

3.5-4.5%

12 months ended

9/30/11

Target 2014

(Organic)

Copyright ©

2011 CDI Corp. All rights reserved.

Revenue

Operating Profit Margin |

Strategy to Bottom Line Results

•

Measureable objectives

•

Organizational alignment

•

Competitive cost structure

•

Internal metrics

•

Cash flow generation

39

Copyright ©

2011 CDI Corp. All rights reserved.

•

Accelerate growth in revenue, operating margins and

earnings

•

Improve EBITDA and RONA

•

Deploy cash to increase shareholder value

Focus on Improving Shareholder Value |

Transformational

Strategy Summary

Paulett

Eberhart,

President

&

CEO

Copyright ©

2011 CDI Corp. All rights reserved. |

Transformational Strategy

•

Establish new geographic organization and rigorous client

engagement model

•

Create solutions that establish CDI as a market leader in our

chosen markets

•

Consolidate and optimize delivery of staffing and solution

offerings

•

Use acquisitions, alliances and partnerships judiciously to

increase skills, expand geographic footprint and accelerate

growth

•

Create a culture of accountability

•

Maintain a rigorous focus on execution and client

satisfaction

41

Copyright ©

2011 CDI Corp. All rights reserved.

Key Elements |

CDI

Corporation Transformation:

Strategic Plan to Accelerate Profitable Growth

and Increase Shareholder Value

December 8, 2011

Copyright ©

2011 CDI Corp. All rights reserved. |