Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OMEGA PROTEIN CORP | d264872d8k.htm |

Investor Presentation

December 6, 2011

Exhibit 99.1 |

The

information presented herein may contain projections, predictions, estimates and other forward-

looking statements within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements will use words like “may,”

“may not,”

“believes,”

“do

not

believe,”

“expects,”

“do

not

expect,”

“anticipate,”

“does

not

anticipate,”

and

other

similar

expressions.

Although

the

Company

believes

that

its

expectations

are

based

on

reasonable

assumptions, we can give no assurance that these expectations will be realized.

Important factors that could cause actual results to differ materially from

those included in these forward looking statements include: (1) our ability

to meet our raw material requirements through our annual menhaden harvest,

which is subject to fluctuations due to natural conditions over which we have no

control, such as varying fish population, fish oil yields, adverse weather

conditions, oil spill impacts and disease; (2) the impact of laws and

regulations that may be enacted that may restrict our operations or the sale of products; (3) the

impact

of

worldwide

supply

and

demand

relationships

on

prices

for

our

products;

(4)

our

expectations

regarding demand and pricing for our products proving to be incorrect; (5)

fluctuations in the Company’s quarterly operating results due to the

seasonality of our business and our deferral of inventory sales based

on

worldwide

prices

for

competing

products;

(6)

the

effect

of

the

Deepwater

Horizon

oil

spill

on

our

business, operations and fish catch; and (7)

the business, operations, potential or prospects for our new

Cyvex Nutrition and InCon Processing subsidiaries, the dietary supplement market or

the human health and wellness segment generally.

Forward Looking Statements

2 |

Presentation Overview

3

Investment Highlights

Favorable Supply Demand Outlook

Operational Overview

Growth Initiatives

Business Divisions Review

Financial Highlights |

Investment Highlights

Pure play on high quality protein ingredients and omega-3 fatty acids

Benefitting from increasing demand for nutritional ingredients and

limited supply of fish meal and fish oil

Vertically integrated operations with significant barriers to entry

Strong 2010 financial performance

$168M revenue

$18M net income

Strong balance sheet

4 |

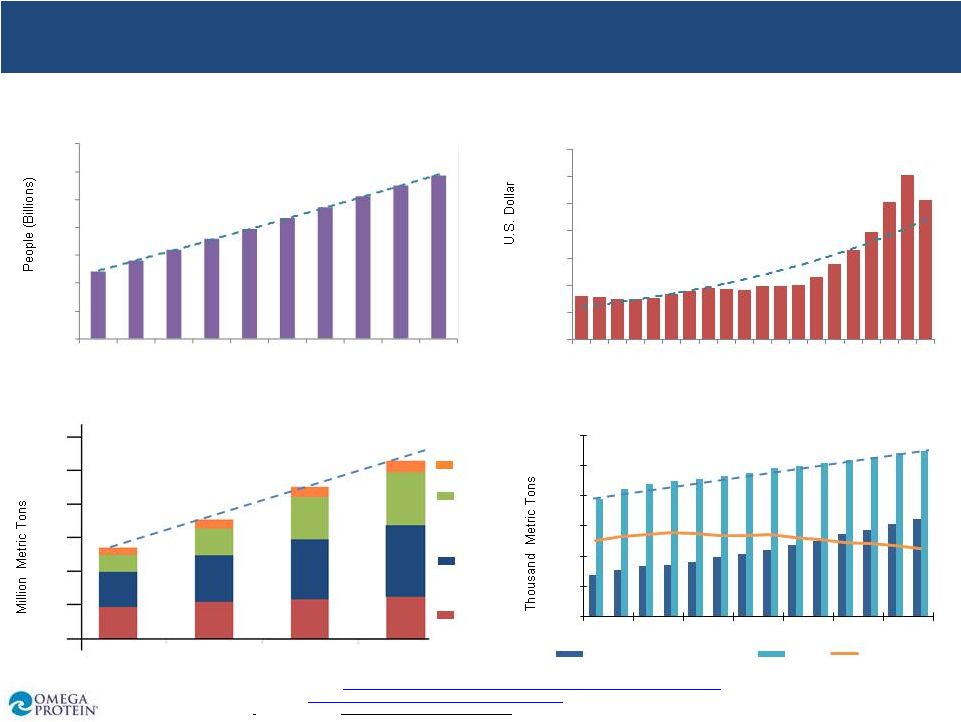

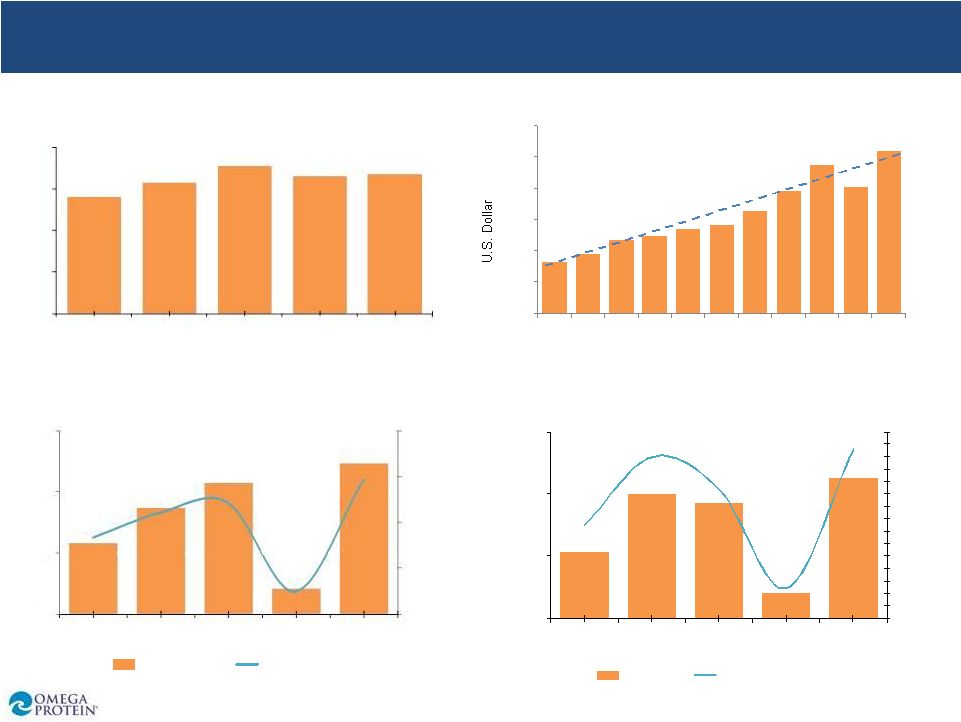

5

Global Demand for Meat

World Population

Standards of Living

Developing Countries* GDP per Capita (PPP)

* As defined by the World Bank-

2010-2011

300

250

200

150

100

50

0

+37%

+27%

+17%

1980

1990

2000

2010

Beef

Pork

Poultry

Other

Global Demand for Seafood

Growing Demand for Oil and Protein Around the World

5.60

5.80

6.00

6.20

6.40

6.60

6.80

7.00

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

0

2,000

4,000

6,000

8,000

10,000

12,000

1994

1996

1998

2000

2002

2004

2006

Global Aquaculture Consumption

Total

Wild Catch

Source: World Population-

World Bank, 2011.

http://search.worldbank.org/data?qterm=population&language=EN&format=html;

Standards

of

Living-

World

Bank,

2011

http://data.worldbank.org/indicator/NY.GDP.PCAP.CD

;

Global

Demand

for

Meat-

Hartog,

L.

“Global

Perspective

on

Integrated Pork Production”.

Presented at the London Swine Conference, England.2006 |

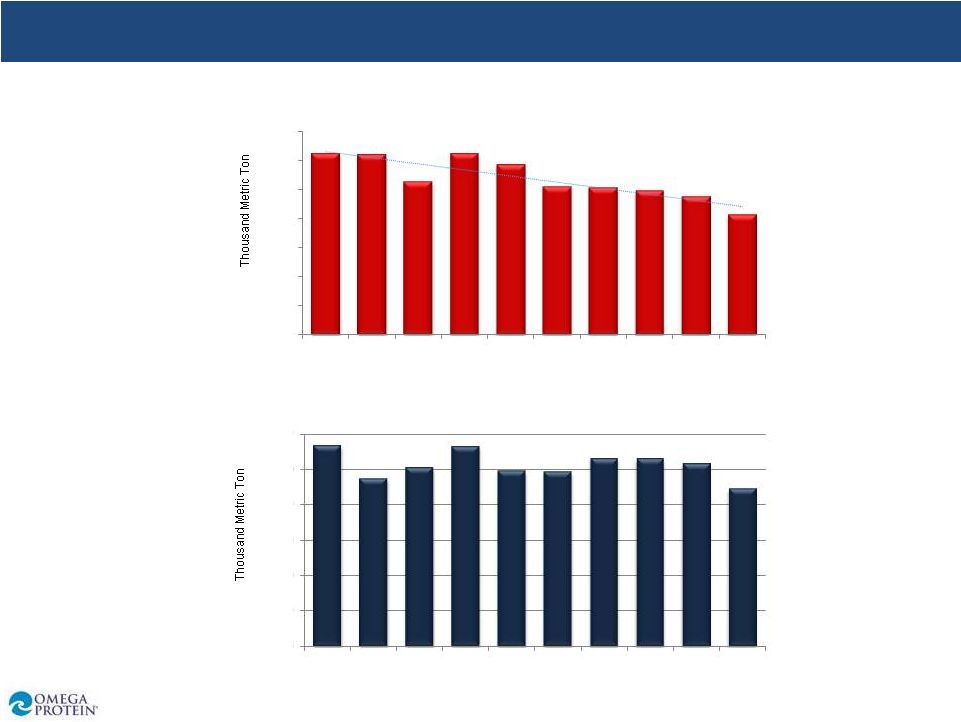

6

World Supply/Demand Imbalance

Global Fish Meal Production

Global Fish Oil Production

Source: IFFO, 2010

6,240

6,201

5,292

6,226

5,868

5,092

5,052

4,972

4,775

4,134

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

1,132

946

1,006

1,129

988

983

1,061

1,056

1,031

889

0

200

400

600

800

1,000

1,200

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010 |

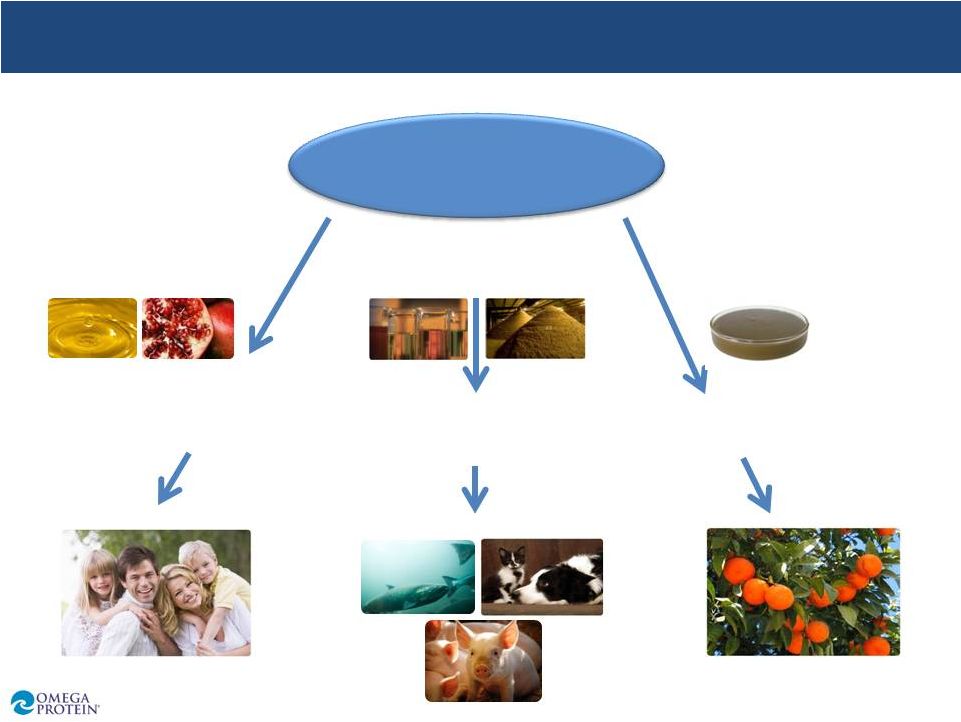

Our

Business Fuels Healthy Living 7

Omega Protein

Corporation

Human Nutrition

Ingredients

Animal Nutrition

Ingredients

Plant Nutrition

Ingredients

Nutraceuticals

Functional Foods

Aquaculture Feed

Pet Food

Livestock Feed

Organic

Fruits and Vegetables |

Vertically Integrated: From Catch to Market

8

A sustainable

fishery

49 vessels and

34 spotter

planes

4 meal and oil

processing

plants

Fish oil refinery

and

concentrating

capability

Sales and

distribution network

into top

manufacturers |

9

Focus on research and development

enhance production

improve health benefits of end

products

develop novel new products

Leverage customer relationships

Allocate funds based on return on capital

Additional product lines

Increase presence in human nutrition

Access opportunities in new markets

Add new customers in existing markets

Organic Growth

Acquisitions

Growth Initiatives

Leverage existing protein and fatty acid platform to

expand line of nutritional ingredients |

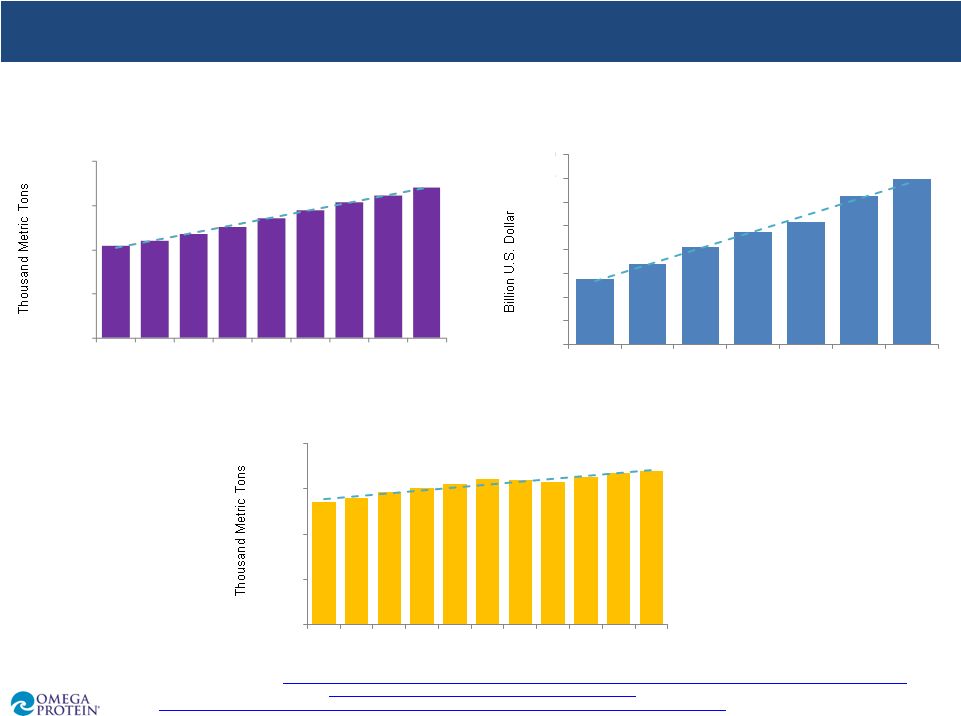

10

Animal Nutrition: Market is Growing

Global Swine Production by Volume

Global Aquaculture Production by Volume

Global Pet food Market by Retail Sales

0

20,000

40,000

60,000

80,000

2000

2001

2002

2003

2004

2005

2006

2007

2008

$44

$46

$48

$50

$52

$54

$56

$58

$60

2004

2005

2006

2007

2008

2009

2010

0

30,000

60,000

90,000

120,000

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Source: Aquaculture-

FAO, 2011.

http://www.fao.org/figis/servlet/SQServlet?file=/usr/local/tomcat/FI/5.5.23/figis/webapps/figis/temp/hqp_5836.xml&outtype=html

Swine-

USDA. Foreign Agriculture Services.

http://www.fas.usda.gov/dlp2/circular/1997/97-03/porkprod.htm

Petfood-

http://www.graintec.com/fileadmin/templates/PDF/25thPres/OUTLOOK_PET_FOOD_Euromonitor_Lee_Linthicum.pdf

|

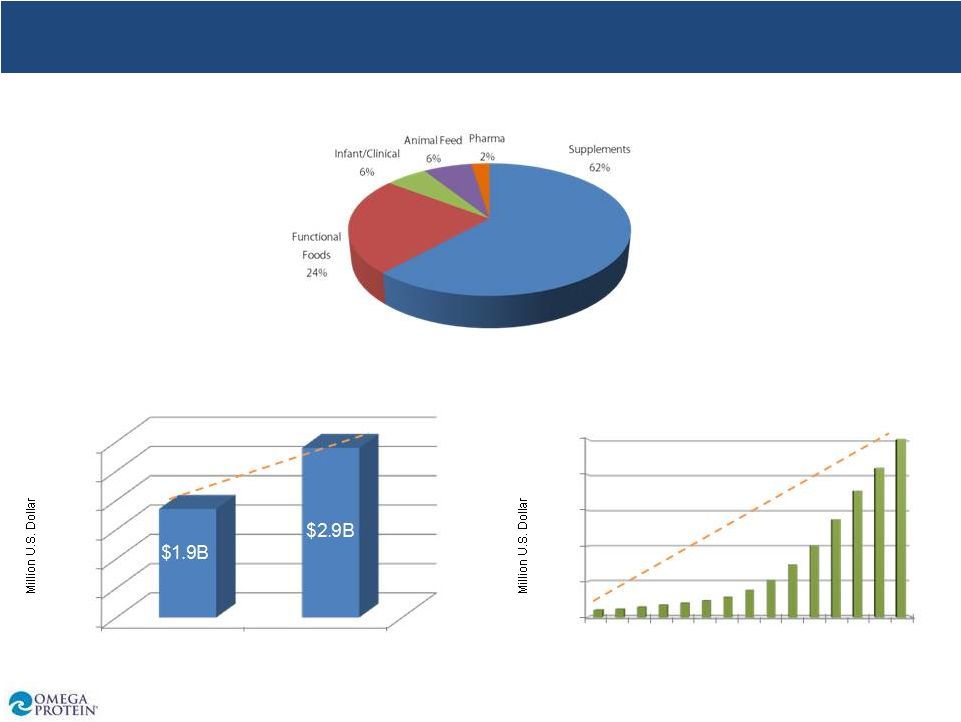

Nutraceutical Ingredients

•

Diverse product set of

nutritional ingredients

•

Supply to the dietary

supplement

and functional

food

markets

•

Sales today represent a

fraction of the market

Source: “Global Nutrition Industry.”

Nutrition Business Journal. March, 2010.

1995

1996 1997 1998 1999

2000 2001 2002 2003 2004 2005 2006

2007 2008

2009 2010 2011 2012 2013 2014

Global Nutrition Industry

$50,000

$0

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

$450,000

*2009-2014 are projections

11

Human Nutrition: Greatest Growth Potential |

12

Source:

“Global

Omega-3

Industry

Report.”

Frost

&

Sullivan.

September

2009.;

“Top

5

Supplements”.

Consumer

Lab.com.

Survey,

2011

End Use Applications of EPA and DHA Oils (Metric Tons)

Global Omega-3 Dietary Supplement Sales

U.S. Omega-3 Dietary Supplement Sales

Human Nutrition: Booming Supplement Market

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2007

2009

$-

$200

$400

$600

$800

$1,000

1995

1997

1999

2001

2003

2005

2007

2009 |

Founded in 1984

Located in Irvine, California

Selling focus: health and well-being

Strong customer relationships in the

dietary supplements industry

Focused on high-value, higher margin

products

13

Human Nutrition: Acquisitive Growth

Background

Transaction Rationale

Increase offering to the in human nutrition

industry

Provides access to the top dietary supplement

manufacturers

Adds established distribution network for

omega-3 fatty acids (fish oil)

Adds line of non-marine products

Supports shifting customer demand

B2B ingredient supplier |

Privately held company founded in 1993

Located near Chicago

Strong technology base in molecular

distillation and purification of nutritional

compounds

Existing producer of high purity omega-3’s

Customer base includes numerous Fortune

500 companies

14

Human Nutrition: Acquisitive Growth

Transaction Rationale

Vertical Integration: Fills gap in OME’s fish oil

value chain

Proven Assets: Unique opportunity to acquire

molecular distillation capacity accompanied with

processing and product development expertise

Strengthens

Distribution

Channel:

Broadens

product offerings, expands current customer

relationships and improves access to prospective

customers

Timing: Acquisition provides immediate access;

avoids Greenfield construction delay

Background |

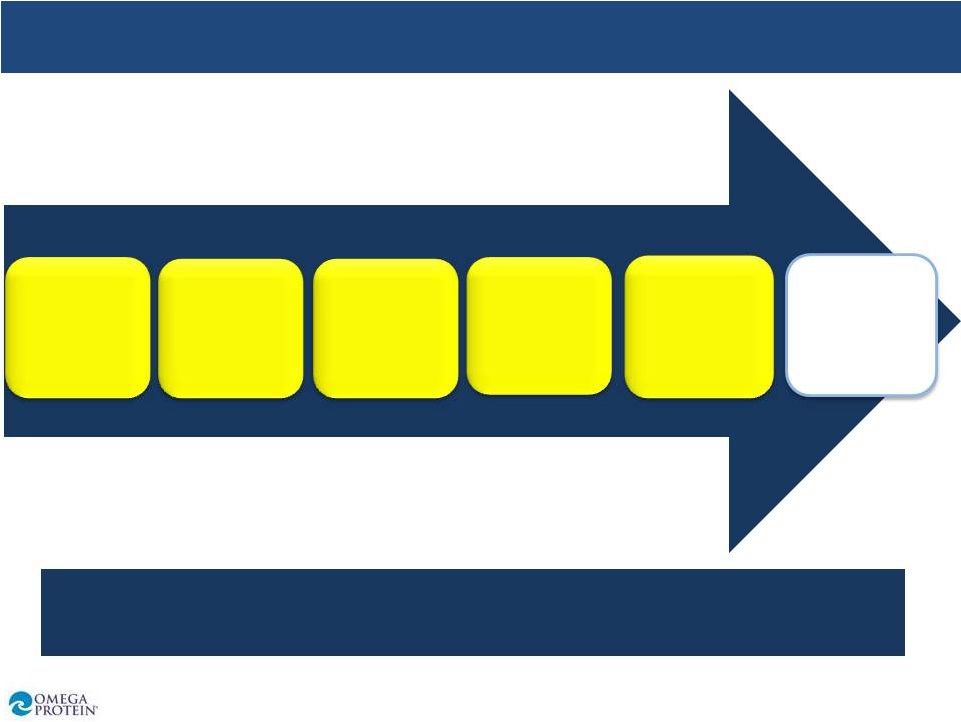

15

Value Chain-Fish Oil for Human Nutrition

Refine

Process

Harvest

Market &

Sell

(Cyvex)

Retail

Concen-

trate

(InCon)

Vertical integration allows Omega Protein to capture

additional value and further differentiate our fish oil

|

Plant Nutrition: Niche Opportunity

16

Source: Omega Protein

OmegaGrow®

Organic fertilizer produces healthier, faster

growing plants

OmegaGrow®

Plus

Provides the same benefits as OmegaGrow ®

but with 25% oil to enhance plant health and

fortification

Seacide®

Currently in process of bio-pesticide registration

Nutritive Products |

17

Comprehensive In-House Research and Development Effort

Omega Protein Technology and Innovation Center

Supports Process Innovation

Enhances Menhaden Utilization

Provides for Novel Product Development

Benefits from Partnerships and Contracts with Universities

R&D Initiatives Support Growth

-

Analytical Laboratory

-

Pilot Plant from Oil Refinery

-

AOCS/GOED certified for the analysis of marine oils

-

Beverage and Emulsions Laboratory

-

Commercial Kitchen and Bakery Laboratory |

Global Distribution Network

18

Source: Omega Protein

Canada = 8.0%

U.S. = 49.5%

Latin America = 6.8%

Europe = 11.7%

Asia = 24.0%

Optimize International Sales

Maximize Pricing

Enhance Margins

2010 exports= over 50% of sales |

Blue Chip Customers

19 |

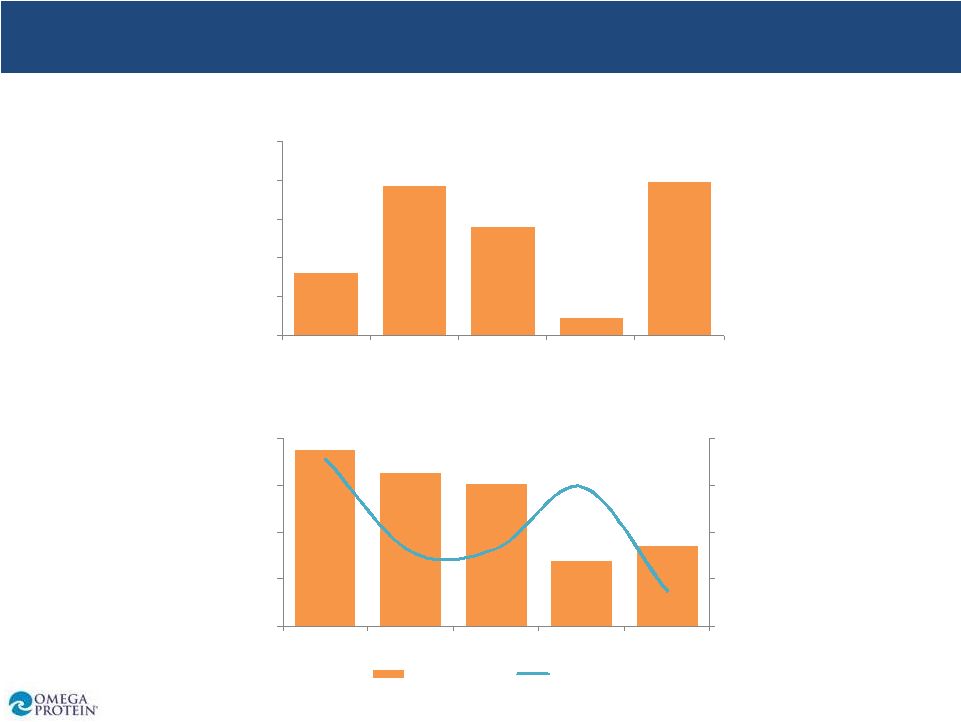

Income Statement Financial Highlights

Gross Margin 2006-2010 (Million U.S.

Dollars) Revenue 2006-2010 (Million U.S.

Dollars) 20

EBITDA 2006-2010 (Million U.S. Dollars)* $21

$40

$37

$8

$45

15%

26%

21%

5%

27%

0%

10%

20%

30%

$0

$20

$40

$60

2006

2007

2008

2009

2010

EBITDA

EBITDA Margin

Source: Omega Protein

$325

$374

$465

$489

$539

$563

$654

$784

$947

$806

$1,036

$0

$200

$400

$600

$800

$1,000

$1,200

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

OME Revenue per Ton (U.S. Dollars)

*See Appendix 1 for a reconciliation for EBITDA to net income

2006

2007

2008

2009

2010

$140

$157

$177

$165

$168

$200

$150

$100

$50

$0

$23

$35

$43

$8

$49

17%

22%

24%

5%

29%

0%

10%

20%

30%

40%

$0

$20

$40

$60

2006

2007

2008

2009

2010

Gross Profit

Gross Margin |

Balance Sheet Highlights

Cash Balance (Million U.S. Dollars)

21

Debt Balance (Million U.S. Dollars)

$8

$19

$14

$2

$20

$0

$5

$10

$15

$20

$25

2006

2007

2008

2009

2010

$75

$65

$61

$28

$35

3.6X

1.6X

1.7X

3.0X

0.8X

0.00

1.00

2.00

3.00

4.00

$0

$20

$40

$60

$80

2006

2007

2008

2009

2010

Debt

Debt/EBITDA

Source: Omega Protein |

Investment Summary

1.

Compelling fundamentals support increased demand for

high quality oil and protein

2.

Vertically integrated operations from catch to distribution

3.

Opportunities for organic growth through new product

development

4.

Focus on acquisitions to expand product offerings and

enter new markets

5.

Strong balance sheet with focus on creating

shareholder value

22 |

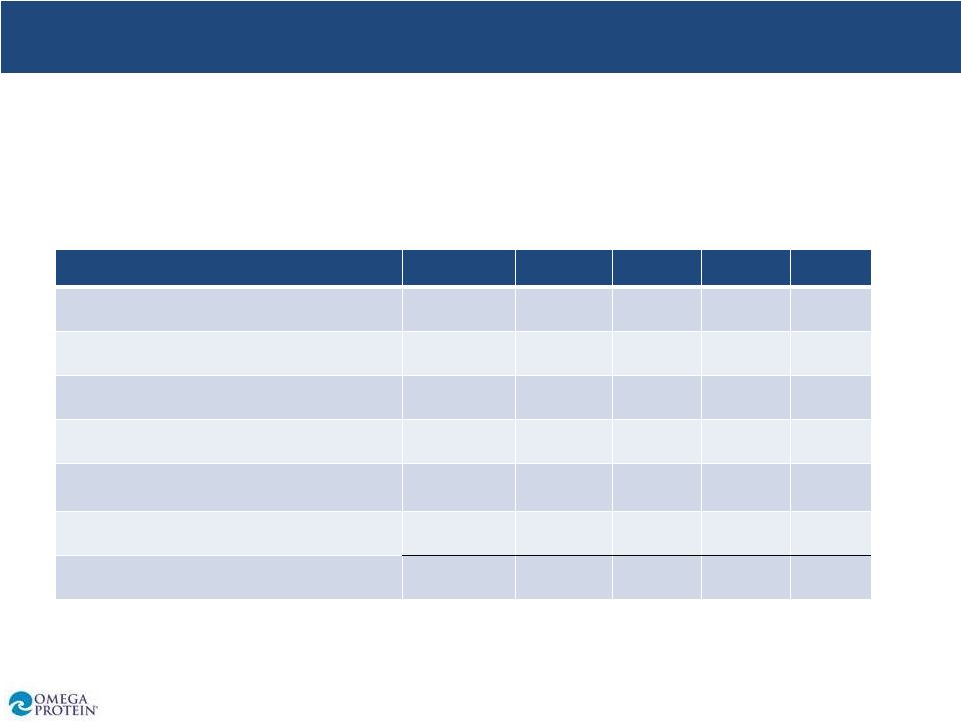

Appendix I

23

2006

2007

2008

2009

2010

Net Income (loss)

5

12

13

(6)

18

Reconciling items:

Interest expense

2

5

4

4

2

Income tax provision (benefit)

1

7

7

(3)

10

Depreciation and amortization

13

13

13

13

15

Debt refinancing costs

-

3

-

-

-

Adjusted EBITDA

21

40

37

8

45

The following table provides a reconciliation of Adjusted EBITDA*, a non-GAAP

(Generally Accepted Accounting Principles) financial measure, to net income,

the most directly comparable financial measure calculated and presented in

accordance with GAAP, for fiscal years ended December 31, 2006, 2007, 2008,

2009 and 2010: |

Appendix I

24

*Adjusted EBITDA represents net income before interest expense, income tax,

depreciation and amortization and debt financing costs. The Company has

reported Adjusted EBITDA because it believes Adjusted EBITDA is a measure

commonly reported and widely used by investors as an indicator of a company's

operating performance. The Company believes Adjusted EBITDA assists such

investors in comparing a company's performance on a consistent basis.

Adjusted EBITDA is not a calculation based on GAAP and should not be considered an

alternative to net income in measuring our performance or used as an

exclusive measure of cash flow because it does not consider the impact of

working capital growth, capital expenditures, debt principal reductions and other

sources and uses of cash which are disclosed in our consolidated statements

of cash flows. Investors should carefully consider the specific items included

in

our

computation

of

Adjusted

EBITDA.

While

Adjusted

EBITDA

has

been

disclosed

herein

to

permit

a

more

complete

comparative analysis of our operating performance relative to other companies,

investors should be cautioned that Adjusted EBITDA as reported by us may not

be comparable in all instances to Adjusted EBITDA as reported by other

companies. Adjusted EBITDA amounts may not be fully available for management's

discretionary use, due to certain requirements to conserve funds for capital

expenditures, debt service and other commitments, and therefore

management

relies

primarily

on

our

GAAP

results.

Adjusted

EBITDA

is

not

intended

to

represent

net

income

as

defined

by GAAP and such information should not be considered as an alternative to net

income, cash flow from operations or any other measure of performance

prescribed by GAAP in the United States. |