Attached files

| file | filename |

|---|---|

| EX-10.2 - Chimera Energy Corp | ex10-2.htm |

| EX-23.1 - Chimera Energy Corp | ex23-1.htm |

| EX-5.1 - Chimera Energy Corp | ex5-1.htm |

As filed with the Securities and Exchange Commission on December 5, 2011

Registration No. 333-177406

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

(AMENDMENT NO. 2)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CHIMERA ENERGY CORPORATION

(Name of Small Business Issuer in its Charter)

|

Nevada

|

5084

|

45-2941876

|

|

(State or Other Jurisdiction of Organization)

|

(Primary Standard Industrial Classification

Code)

|

(IRS Employer

Identification #)

|

|

BizFilings

|

|

|

2800 Post Oak Blvd., Suite 4100

|

311 South Division Street

|

|

Houston, TX 77056

|

Carson City, NV 89703

|

|

(832) 390-2334

|

(608) 827-5300

|

|

(Address and telephone of

registrant's executive office)

|

(Name, address and telephone number of agent for service)

|

Please send copies of all correspondence to:

|

David M. Loev

|

John S. Gillies

|

|

|

The Loev Law Firm, PC

|

The Loev Law Firm, PC

|

|

|

6300 West Loop South, Suite 280

|

&

|

6300 West Loop South, Suite 280

|

|

Bellaire, Texas 77401

|

Bellaire, Texas 77401

|

|

|

Phone: (713) 524-4110

|

Phone: (713) 524-4110

|

|

|

Fax: (713) 524-4122

|

Fax: (713) 456-7908

|

Approximate date of proposed sale to the public: After this registration statement becomes effective.

If the securities being registered herein will be sold by the security shareholders on a delayed or continuous basis pursuant to Rule 415 of the Securities Act of 1933 please check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller Reporting Company

|

x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

|

Amount

|

Proposed Maximum

|

Proposed Maximum

|

Amount of

|

||||||||||||

|

Securities to be

|

Amount to be

|

Offering Price

|

Aggregate

|

Registration

|

||||||||||||

|

Registered

|

Registered

|

Per Share (1) (2)

|

Offering Price

|

Fee (2)

|

||||||||||||

|

Common Stock by Company par value $0.001

|

5,000,000

|

$

|

0.015

|

$

|

75,000

|

$

|

8.71

|

|||||||||

(1) The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price.

(2) Estimated solely for purposes of calculating the registration fee in accordance with Rule 457( a ) of the Securities Act of 1933.

The Registrant Hereby Amends This Registration Statement On Such Date Or Dates As May Be Necessary To Delay Its Effective Date Until The Registrant Shall File A Further Amendment Which Specifically States That This Registration Statement Shall Thereafter Become Effective In Accordance With Section 8(A) Of The Securities Act Of 1933 Or Until The Registration Statement Shall Become Effective On Such Date As The Commission, Acting Pursuant To Said Section 8(A), May Determine.

The Information In This Prospectus Is Not Complete And May Be Changed. We May Not Sell These Securities Until The Registration Statement Filed With The Securities and Exchange Commission Is Effective. This Prospectus Is Not An Offer To Sell These Securities And It Is Not Soliciting An Offer To Buy These Securities In Any State Where The Offer Or Sale Is Not Permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 5, 2011

PROSPECTUS

CHIMERA ENERGY CORPORATION

5,000,000 SHARES OF COMMON STOCK

Initial Public Offering

Prior to this registration, there has been no public trading market for the common Stock of CHIMERA ENERGY CORPORATION ("CEC", the "Company", "us", "we", and "our") and it is not presently traded on any market or securities exchange. A total of 5,000,000 shares of common stock are being offered for sale by the Company to the public.

The offering of the 5,000,000 shares is being conducted on a self-underwritten, "best efforts" basis, which means that our director and officer, Charles Grob, will use his best efforts to sell the common stock and there is no commitment by any person to purchase any shares. This prospectus will permit our president to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares he may sell. In offering the securities on our behalf, he will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. The shares will be offered at a fixed price of $0.015 per share for the duration of the offering.

There is no minimum number of shares required to be sold to close the offering. This offering will continue until the earlier of: (i) 90 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 5,000,000 shares registered hereunder have been sold; provided that we may at our discretion extend the offering for an additional 90 days. Proceeds from the sale of the shares will be used to fund the initial stages of our business development. The Company will deliver stock certificates attributable to shares of common stock purchased directly to the purchasers within ninety (90) days of the close of the offering. The offering date is the date by which this registration statement becomes effective. This is a direct participation offering since we, and not an underwriter, are offering the stock.

|

PRICE TO

|

SELLING AGENT

|

PROCEEDS TO

|

|||||||

|

BY COMPANY

|

PUBLIC

|

COMMISSIONS

|

THE COMPANY

|

||||||

|

Per Share

|

$

|

0.015

|

Not applicable

|

$

|

0.015

|

||||

|

Minimum Purchase

|

None

|

Not applicable

|

Not applicable

|

||||||

|

Total (5,000,000 shares)

|

$

|

75,000

|

Not applicable

|

$

|

75,000

|

||||

The Company currently has a limited operating history. Any investment in the shares offered herein involves a high degree of risk. You should only purchase shares if you can afford a loss of your investment. Our independent registered public accountant has issued an audit opinion for the Company which includes a statement expressing substantial doubt as to our ability to continue as a going concern.

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to be eligible for trading on the Over-the-Counter Bulletin Board or OTCQB Market. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation

service or that any market for our stock will develop.

Neither the Securities and Exchange Commission nor any state regulatory authority has approved or disapproved of these securities, endorsed the merits of this offering, or determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

AN INVESTMENT IN OUR SECURITIES IS SPECULATIVE. INVESTORS SHOULD BE ABLE TO AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT. SEE THE SECTION ENTITLED "RISK FACTORS" BEGINNING ON PAGE 4 OF THIS PROSPECTUS.

THIS PROSPECTUS SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY THESE SECURITIES AND WE SHALL NOT SELL ANY OF THESE SECURITIES IN ANY STATE WHERE SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER SUCH STATE'S SECURITIES LAWS.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus.

The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

TABLE OF CONTENTS

|

PAGE NO.

|

|

|

SUMMARY INFORMATION

|

1

|

|

OUR OFFERING

|

1

|

|

BUSINESS SUMMARY

|

3

|

|

SUMMARY OF OUR FINANCIAL INFORMATION

|

4

|

|

RISK FACTORS

|

4

|

|

DIVIDEND POLICY

|

16

|

|

USE OF PROCEEDS

|

16

|

|

DETERMINATION OF OFFERING PRICE

|

18

|

|

DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES

|

18

|

|

THE OFFERING

|

19

|

|

PLAN OF DISTRIBUTION

|

19

|

|

DESCRIPTION OF SECURITIES

|

21

|

|

INTEREST OF NAMED EXPERTS AND COUNSEL

|

22

|

|

EXPERTS

|

22

|

|

LEGAL MATTERS

|

22

|

|

BUSINESS DESCRIPTION

|

22

|

|

DESCRIPTION OF PROPERTY

|

27

|

|

LEGAL PROCEEDINGS

|

27

|

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

27

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

28

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

33

|

|

CODE OF BUSINESS CONDUCT AND ETHICS

|

33

|

|

MANAGEMENT

|

33

|

|

CONFLICTS OF INTEREST

|

34

|

|

COMMITTEES OF THE BOARD OF DIRECTORS

|

35

|

|

EXECUTIVE COMPENSATION

|

36

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

|

37

|

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

|

38

|

|

INDEMNIFICATION OF OFFICERS AND DIRECTORS

|

39

|

|

REPORTS TO SECURITY HOLDERS

|

39

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

39

|

|

STOCK TRANSFER AGENT

|

40

|

|

FINANCIAL STATEMENTS

|

F-1

|

SUMMARY INFORMATION

This prospectus, and any supplement to this prospectus include "forward-looking statements". To the extent that the information presented in this prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. These forward-looking statements which include words such as "anticipates", "believes", "expects", "intends", "forecasts", "plans", "future", "strategy" or words of similar meaning, are subject to risks and uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results,

performance or achievements expressed or implied by the forward-looking statements. You should not unduly rely on these statements. Forward-looking statements involve assumptions and describe our plans, strategies, and expectations. You can generally identify a forward-looking statement by words such as may, will, should, expect, anticipate, estimate, believe, intend, contemplate or project. Factors, risks, and uncertainties that could cause actual results to differ materially from those in the forward-looking statements include those risks set forth under “Risk Factors.”

With respect to any forward-looking statement that includes a statement of its underlying assumptions or basis, we caution that, while we believe such assumptions or basis to be reasonable and have formed them in good faith, assumed facts or basis almost always vary from actual results, and the differences between assumed facts or basis and actual results can be material depending on the circumstances. When, in any forward-looking statement, we or our management express an expectation or belief as to future results, that expectation or belief is expressed in good faith and is believed to have a reasonable basis, but there can be no assurance that the stated expectation or belief will result or be achieved or

accomplished. All subsequent written and oral forward-looking statements attributable to us, or anyone acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Except as required by applicable law, including the securities laws of the United States and/or if the existing disclosure fundamentally or materially changes, we do not undertake any obligation to publicly release any revisions to any forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect unanticipated events that may occur.

This summary only highlights selected information contained in greater detail elsewhere in this prospectus. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire prospectus, including "Risk Factors" beginning on Page 4, and the financial statements, before making an investment decision

All dollar amounts refer to US dollars unless otherwise indicated.

We have 10,000,000 shares of common stock issued and outstanding. Through this offering we will register 5,000,000 shares of common stock for offering to the public. These shares represent additional common stock to be issued by us. We may endeavor to sell all 5,000,000 shares of common stock after this registration becomes effective. The price at which we offer these shares is fixed at $0.015 per share for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of the common stock.

|

5,000,000 shares of common stock, par value $0.001 offered by us in a direct offering.

|

|

|

Offering price per share

|

We are offering the 5,000,000 shares of our common stock at $0.015 per share.

|

|

Total offering proceeds

|

$75,000

|

|

Number of shares outstanding before the offering of common shares

|

10,000,000 common shares are currently issued and outstanding.

|

|

Number of shares outstanding after the offering of common shares

|

15,000,000 common shares will be issued and outstanding if we sell all of the shares that we are offering.

|

|

The minimum number of shares to be sold in this offering

|

None.

|

-1-

|

There is no public market for the common shares. The price per share is $0.015.

|

|

|

We may not be able to meet the requirement for a public listing or quotation of our common stock. Further, even if our common stock is quoted or granted listing, a market for the common shares may not develop.

|

|

|

The offering price for the shares will remain $0.015 per share for the duration of the offering.

|

|

|

Use of Proceeds

|

We will receive all proceeds from the sale of the common stock and intend to use the proceeds from this offering to begin implementing the business and marketing plan. The expenses of this offering, including the preparation of this prospectus and the filing of this registration statement, estimated at $11,000 are being paid for by us.

|

|

Termination of the Offering

|

This offering will terminate upon the earlier to occur of (i) 90 days after this registration statement becomes effective with the Securities and Exchange Commission, and (ii) the date on which all 5,000,000 shares registered hereunder have been sold; provided that we may, at our discretion, extend the offering for an additional 90 days. The Company will deliver stock certificates attributable to shares of common stock purchased directly to the purchasers within ninety (90) days of the close of the offering..

|

|

Terms of the Offering

|

Our sole officer and director will sell the common stock upon effectiveness of this registration statement on a “best efforts” basis.

|

|

Risk Factors

|

See “Risk Factors” on pages 4 through 15 and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock.

|

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. We are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted.

-2-

BUSINESS SUMMARY

We are a Houston based energy company, incorporated in the State of Nevada on August 5, 2011, with a fiscal year end of August 31. Our business and registered office is located at 2800 Post Oak Blvd., Suite 4100, Houston, Texas 77056. Our telephone number is 832-390-2334. Our Internet address ishttp://www.chimeraenergyusa.com. The information on, or that may be accessed through, our website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus. Our current business supplies equipment and components that are used in the exploration and production of oil and gas. In August 2011, we

capitalized our business operations with a $100,000 note that bears interest at an annual rate of 15% per annum and is due and payable on August 21, 2013, and commenced our operations with the purchase of $30,000 of inventory. On August 22, 2011, our founder, sole officer and director, Charles Grob, purchased 10,000,000 shares of our common stock for $10,000 at a price per share of $0.001.

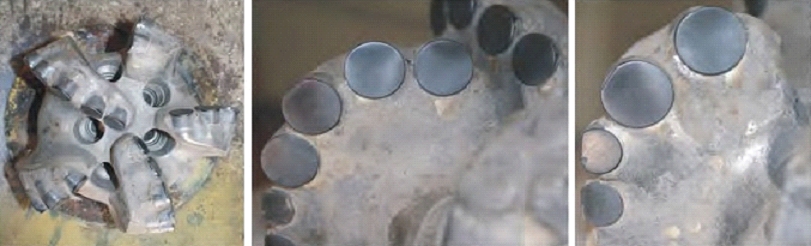

In addition to our present business line, we intend to develop additional product lines to become a diversified equipment company. We are endeavoring to raise growth capital to further develop our business plan. The proceeds from this offering will be used to provide working capital for our polycrystalline diamond compact (PDC) products and provide cash for additional development. We will not have the necessary capital to fully execute our business plan until we are able to secure additional debt and equity financing. There can be no assurance that such financing will be available on suitable terms, if at all. Even if we sell all of the shares offered in this offering, we will require additional capital to fund the

future growth and development of the business.

We need to raise $500,000 (including the $75,000 of capital which will be raised from this offering, assuming it is fully subscribed) to fully implement our business plan over the next 24 months. The funds raised in this offering, even assuming we sell all the shares being offered herein, will serve as intermediate financing to fund operations and growth until we can raise additional funds. We anticipate a cash burn rate for overhead of approximately $3,000 per month. If we sell 25% of the shares offered herein, we anticipate being able to continue our operations for approximately six months without raising additional funding. If we sell 50% of such offered shares, we estimate that we will be able to

continue our operations for approximately 12 months. If we sell 75% of such offered shares, we estimated that we will be able to continue our operations for approximately 18 months and in the event we sell 100% of the shares offered herein, we estimate that we will be able to continue our operations, without any additional funding for approximately 24 months.

Our management believes that at the current level of development, the Company can only justify a limited financing. We believe that with the money raised through this offering we will be able to advance our business sufficiently to attract more financing, which in turn will provide us with the lower cost of capital required to develop our business.

If we sell less than 25% of the number of shares offered through this offering and we are unable to secure additional financing, we will not be able to effectively conduct the business development activities necessary to move the Company forward. Under those circumstances, investors will likely lose their entire investment in the Company.

We intend to develop a wholesale oilfield equipment business that offers multiple lines of products to both oilfield equipment manufacturers and oil and gas companies. We expect our business plan to require at least three years of development before we have fully diversified product lines. Until that time, and as we are developing business segments, we will have concentrations in certain areas. For instance, as of the date of this offering, 100% of our operations reside in the distribution of PDC cutters. Provided that our business obtains additional financing, we intend to diversify our product mix.

-3-

Major oil and gas companies are spending significant amounts of money investing in oilfield equipment. While alternative energy businesses continue to become more competitive as investment in those sectors increases, we believe that the predominance of energy will continue to be supplied by oil and gas companies. We intend to build a diversified oilfield equipment business that is scalable enough to provide high-growth opportunities to our investors.

We intend to take an opportunistic approach to investments in future projects. We will endeavor to identify and fund the most economically viable projects that have the potential to provide the highest returns to our stakeholders for a given level of risk. We need to raise an additional $500,000 (including the proposed $75,000 capital raise which is being undertaken through the offering of the shares included herein) to implement our business plan over the next 24 months. The funds raised in this offering, even assuming we sell all the shares offered, will be insufficient to develop a diversified energy business.

The following table sets forth selected financial information, which should be read in conjunction with the information set forth in the "Management's Discussion and Analysis of Financial Position and Results of Operations" section and the accompanying financial statements and related notes included elsewhere in this prospectus.

|

Summary Statement of Operations

For The Period From Inception On

|

||||

|

(August 5, 2011) Through

August 31, 2011

|

||||

|

Revenues

|

$

|

17,000

|

||

|

Cost of goods sold

|

$

|

15,000

|

||

|

Expenses

|

$

|

1,080

|

||

|

Net Profit (Loss)

|

$

|

550

|

||

|

Net Profit (Loss) per share

|

$

|

0.00

|

||

|

Summary Balance Sheet

As of August 31, 2011

|

||||

|

Cash and cash equivalents

|

$

|

78,989

|

||

|

Total assets

|

$

|

110,989

|

||

|

Total liabilities

|

$

|

100,439

|

||

As indicated in the financial statements accompanying this prospectus, our revenue to date is $17,000 and we have incurred limited profits since inception. We have had early-stage operations and have been issued a "going concern" opinion by our auditor, based upon our reliance on the sale of our common stock as the sole source of funds for our future operations.

Please consider the following risk factors and other information in this prospectus relating to our business and prospects before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount. Please consider the following risk factors before deciding to invest in our common stock.

-4-

Risks related to Our Business

We Are An Early Stage Company, Our Business Is Evolving And Our Business Prospects Are Difficult To Evaluate.

We are an early stage company with very limited operating history. We have a limited operating history that you can rely on in connection with an investment decision. Our prospects must be carefully considered in light of our history, our high capital costs, our exposure to operating losses and the other risks, uncertainties and difficulties that are typically encountered by companies that are implementing new business models. Some of the principal risks and difficulties we expect to encounter include our ability to:

|

·

|

Raise substantial capital to finance our planned expansion, together with the losses we may incur in our early stage of development;

|

|

·

|

Develop new products at the cost and on the time-table we project. We may encounter unexpected technical and legal challenges that may delay our implementation time line and/or increase our costs;

|

|

·

|

Develop, implement and maintain systems to ensure compliance with a variety of governmental and quasi-governmental rules, regulations and policies;

|

|

·

|

Adapt and successfully execute our rapidly evolving and inherently unpredictable business plan and respond to competitive developments and changing market conditions;

|

|

·

|

Attract, retain and motivate qualified personnel; and

|

Because of our lack of operating history and our early stage of development, we have limited insight into trends and conditions that may exist or might emerge and affect our business. There is no assurance that our business strategy will be successful or that we can or will successfully address these risks.

We May Need To Raise Additional Capital To Continue Our Business Operations In Addition To The Funds We Hope To Raise Through This Offering.

We believe that we may need to raise additional capital in the future in addition to the $75,000 we hope to raise through this offering. We believe that the proceeds from this offering in addition to our existing cash on hand will satisfy our cash requirements for up to 24 months. If we are unable to raise additional monies, we only have enough capital to cover the costs of this offering and to begin implementing the business and marketing plan. The expenses of this offering include the preparation of this prospectus, the filing of this registration statement and transfer agent fees. As of August 31, 2011, we had $78,989 cash on hand. If we are unable to raise additional monies, we only have enough

capital to cover the costs of this offering and to begin implementing the business and marketing plan. Additionally, if we fail to significantly grow our operations in the future, additional financing may be required. If we are unable to obtain additional financing, our future growth, if any, could be impaired. If we fail to raise additional funding in the future, we may not have enough money to pay our legal and accounting expenses and we could be forced to curtail or abandon our business plan, causing any investment in us to become worthless. Additionally, even if we do raise additional funding, there can be no assurance that additional capital from outside sources will be available for our marketing and future growth, if any, or if such financing is available, that it will not involve issuing securities senior to our common stock or equity financings

which are dilutive to holders of our common stock. In addition, in the event we do not raise additional capital, we may be limited in our ability to grow our Company.

-5-

The Repayment Of Our $100,000 Notes Payable Is Secured By A Security Interest In Substantially All Of Our Assets.

On or around August 22, 2011, Kylemore Corp., loaned us $100,000 which was evidenced by a Promissory Note. The note is due on August 21, 2013 and accrues interest at the rate of 15% per annum. In the event an event of default occurs under the note the interest rate increases to 25% per annum (subject to applicable law). The note is secured by a security interest in substantially all of our assets and we do not currently have sufficient funds to repay the note. If we default on the repayment of the note, the holder thereof may enforce its security interest over the assets of the Company, which if enforced could leave us without any assets, and as a result, we could be forced to

curtail or abandon our current business plans and operations. If that were to happen, any investment in the Company could become worthless.

We Do Not Know The Exact Development And Operating Costs Of Our Potential Additional Product Lines.

We only have one product line and have not developed additional product lines and therefore, we do not know the exact costs involved with the organic development and operation of the products in which we intend to pursue. These products include, but are not limited to, equipment used for oil and gas exploration, production, transportation, and refining. In the case of higher than expected costs to acquire and/or develop these products, we may not be able to operate profitably in the market place. If we are unable to successfully build profitable product lines, we will have to cease our operations, which may result in the complete loss of your investment.

Our Lack Of An Operating History Gives No Assurance That Our Future Operations Will Result In Profitable Revenues, Which Could Result In The Suspension Or End Of Our Operations.

We were incorporated on August 5, 2011, and although we have realized operating revenues to date, we have very little operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon the completion of this offering and our ability to generate revenues in excess of our expenses.

Based upon current plans, we expect to incur operating losses in future periods because we will likely incur expenses that exceed our revenues. We cannot guarantee that we will be successful in generating a profit in the future. Failure to generate a profit may cause us to go out of business.

We Are A New Company With A Limited Operating History And We Face A High Risk Of Business Failure Which Would Result In The Loss Of Your Investment.

We are an early stage company formed recently to carry out the activities described in this prospectus and thus have only a limited operating history upon which an evaluation of its prospectus can be made. We were incorporated on August 5, 2011, and to date have been involved primarily in the development of our business plan and early-stage operations. Because we have a limited operating history there is little internal or industry-based historical financial data upon which to estimate our planned operating expenses.

We expect that our results of operations may also fluctuate significantly in the future as a result of a variety of market factors including, among others, the entry of new competitors; the availability of motivated and qualified personnel; the initiation, renewal or expiration of our customer base; pricing changes by the Company or its competitors, specific economic conditions in the energy markets and general economic conditions. Accordingly, our future sales and operating results are difficult to forecast.

Adverse Developments In The Global Economy Restricting The Credit Markets May Materially And Negatively Impact Our Business.

The recent downturn in the world's major economies and the constraints in the credit markets have heightened or could continue to heighten a number of material risks to our business, cash flows and financial condition, as well as our future prospects. Continued issues involving liquidity and capital adequacy affecting lenders could affect our ability to access credit facilities or obtain debt financing and could affect the ability of lenders to meet their funding requirements when we need to borrow. Further, in the uncertain event that a public market for our stock develops, the volatility in the equity markets may make it difficult in the future for us to access the equity markets for additional capital at

attractive prices, if at all. The current credit crisis in other countries, for example, and concerns over debt levels of certain other European Union member states, has increased volatility in global credit and equity markets. If we are unable to obtain credit or access capital markets, our business could be negatively impacted. For example, we may be unable to raise all or a portion the $500,000 that we estimate we will require to execute Phases I and II of our business plan (including the $75,000 we hope to raise in this offering).

-6-

Because We Are Small And Do Not Have Much Capital, We Must Limit Our Marketing Activities. As A Result, Our Sales May Not Be Enough To Operate Profitably. If We Do Not Make A Profit, We May Have To Suspend Or Cease Operations.

Due to the fact we are small and do not have much capital, we must limit our marketing activities to potential customers having the likelihood of purchasing our products. We intend to increase our sales efforts to increase revenues from the sale of our inventory of PDC cutters. Because we will be limiting the scope of our marketing activities to regional PDC drill bit manufacturers, we may not be able to generate enough sales to operate profitably. If we cannot operate profitably, we may have to suspend or cease operations.

We Have Been Focused On The Development Of Our PDC Cutter Distribution Business Segment, And As Such, Have Not Commenced Operations Or Generated Revenues From Other Product Lines. Investing In The Company Before It Has Diversified Product Lines Involves Substantial Risk To Any Investor.

An investment in our Company is characterized by a high degree of risk. Investors should take caution when considering our revenue, minimal earnings, and lengthy development cycle. Our current operations reside entirely in the wholesale distribution of PDC cutters, a primary component used in oil and gas drill bits. We intend to diversify our product lines to provide more stability to our operations. Although we believe that future capital investments in other product lines will ultimately generate additional revenues and earnings for the Company, there can be no assurance that we will be able to effectively acquire or develop these products or that they will be profitable.

There is no assurance that investments in other product lines will be beneficial to us in the future. In order for us to benefit from our investments, product lines in which we invest must generate revenues and earnings. The success of these investments depends on the ability of management to successfully develop, market, and sell new products; and generate revenues and earnings therefrom. The inability of new products in which we invest to generate net income may adversely affect our financial performance and stock price.

We Have Limited Assets That May Be Used To Develop Execute Our Business Plan. Our Lack Of Assets May Have An Adverse Impact On Our Ability To Grow Our Business And Generate Revenues And Earnings.

We have limited financial and operational assets as well as limited long-term assets such as property, facilities and equipment to fully develop our business plan. We will need to raise additional capital to provide for a facility, purchase equipment and inventory, and fund the labor required to appropriately develop new product lines. Our lack of financial and operational assets may impair our ability to generate future revenues and earnings which may result in a loss of your investment.

We May Incur Substantial Losses In The Future As We Expand Our Operations And Invest In The Development Of New Product Lines.

We will incur costs related to investing or developing new product lines. When developing new products organically, it is likely that we will incur costs for a prolonged period prior to generating revenues, if any. The foregoing costs and expenses will likely give rise to substantial near-term operating losses and may prevent the Company from achieving profitability for an extended period of time. We expect to rely on equity and debt financing to fund potential operating losses and other cash requirements until we are able to generate larger profits from operations. We may experience negative cash flow, which will hamper current operations and prevent the Company from expanding. We may be unable to attain, sustain

or increase profitability on a quarterly or annual basis in the future, which could require us to scale back or terminate our operations.

-7-

Introducing New Product Lines Is Time Consuming And Expensive And May Not Ultimately Result In An Operating Profit.

The cost associated with the introduction of new product lines can be very high and new product lines often generate substantial losses for an extended period of time before making a meaningful contribution to administrative overhead. There is no assurance that any potential products from which we may generate revenue will be successfully developed, or that our marketing activities will be successful or profitable. Even if we are ultimately successful, delays, additional expenses and other factors may significantly impair our potential profitability and there is no assurance that the Company will ever generate an operating profit.

We Will Be A Small Player In An Intensely Competitive Industry And May Be Unable To Compete.

The oilfield equipment distribution industry in the United States is large and intensely competitive. Although we operate in a niche market with very esoteric components, many of our competitors have substantially more financial and operational resources than us. As a result of this competition, our efforts to commercialize any products under development in the future may be preempted, rendered obsolete, or priced out of the market by our competitors. Competition in oil and gas exploration and production, conventional power generation, and alternative power generation is also robust and there are substantial barriers to entry. Some of the barriers to entry include capital requirements, operational staff, technical

expertise, and access to high quality assets.

Oil And Gas Equipment And Other Products That We May Develop And/Or Distribute May Be Subject To Certification And Approval From Regulatory Agencies.

Products that we may distribute may be subject to oversight and/or approval from certain regulatory agencies including the International Organization for Standardization (ISO), American Petroleum Institute (API), Environmental Protection Agency (EPA), and the Texas Railroad Commission. Should we fail to meet regulatory standards and attain such approvals our ability to operate may be impaired. Attainment of permits and certifications can be costly and may lead to substantially longer development timelines. Should we fail to attain regulatory certifications, our financial and operational performance could be adversely affected and you could lose your investment.

If The Company Is Dissolved, It Is Unlikely That There Will Be Sufficient Assets Remaining To Distribute To Our Shareholders.

In the event of the dissolution of the Company, the proceeds realized from the liquidation of our assets, if any, will be used primarily to pay the claims of our creditors, if any, before there can be any distribution to the shareholders. In that case, the ability of equity investors to recover all or any portion of their investment will depend on the amount of funds realized and the claims to be satisfied therefrom.

If We Are Forced To Incur Unanticipated Costs Or Expenses, We May Have To Suspend Or Cease Our Activities Entirely Which Could Result In A Total Loss Of Your Investment.

Because we are a small business, with limited assets, we are not in a position to bear unanticipated costs and expenses. If we have to make changes in our structure or are faced with circumstances that are beyond our ability to afford, we may have to suspend or cease our activities entirely which could result in a total loss of your investment.

-8-

Key Management Personnel May Leave The Company Which Could Adversely Affect The Ability Of The Company To Continue Its Development.

Because we are almost entirely dependent on the efforts of our sole officer and director, Charles Grob, his departure or the loss of other key personnel in the future, could have a material adverse effect on our business. We do not maintain key man life insurance on any of our officers or directors.

Because Our Current Sole Officer And Director Does Not Have Significant Experience In Operating An Energy Equipment Company, Our Business Has A Higher Risk Of Failure.

Although our Chief Executive Officer and Director has extensive academic business knowledge, he does not have experience in developing an energy equipment company. Therefore, without this experience, our management's business experience may not be enough to effectively develop and maintain our company. As a result, the implementation of our business plan may be delayed, or eventually, unsuccessful.

Our Sole Officer And Director May Face Conflicts Of Interest Associated With His Commitment To The Company And His Other Activities Outside Of The Company.

As of the date of this prospectus, we have no employees, other than Mr. Grob, our founder, Chief Executive Officer and sole director, who currently devotes 10 to 25 hours per week to our business as required from time to time without compensation. We have not entered into any formal agreement with Mr. Grob regarding the provision of his services to the Company. Mr. Grob is not obligated to commit his full time and attention to our business and accordingly, he may encounter a conflict of interest in allocating his time between our operations and those of other businesses. Although Mr. Grob is presently able to devote 10 to 25 hours per week to our business, this may change. Also, if we require Mr. Grob to devote more

than 10 to 25 hours per week to our business on a regular basis for an extended period, it is uncertain that he will be able to satisfy our requirements unless we have sufficient resources to compensate him for any lost income from his private business. Due to the above, Mr. Grob may face a conflict of interest between the Company and his other business interests.

Since Our Sole Officer And Director Currently Owns 100% Of The Outstanding Shares of Common Stock, And Controls The Company, Investors May Find That His Decisions Are Contrary To Their Interests And You Should Not Purchase Shares Unless You Are Willing To Entrust All Aspects Of Management To Our Sole Officer And Director, Or His Successors.

Our sole officer and director, Charles Grob, owns 10,000,000 shares of common stock representing 100% of our outstanding stock. Mr. Grob will continue to own 10,000,000 shares of our common stock after this offering is completed representing 66% of our outstanding shares, assuming all securities offered herein are sold. As a result, he will have control of us even if the full offering is subscribed and will be able to choose all of our directors. His interests may differ from the interests of other stockholders. Factors that could cause his interests to differ from the other stockholders include the impact of corporate transactions on the timing of business operations and his ability to continue to manage the

business given the amount of time he is able to devote to us.

All decisions regarding the management of our affairs will be made exclusively by him along with the outcome of all corporate transactions and other matters, including the election of Directors, mergers, consolidations, the sale of all or substantially all of our assets, and he will also have the power to prevent or cause a change in control. Purchasers of the offered shares may not participate in our management and, therefore, are dependent upon his management abilities. The only assurance that our shareholders, including purchasers of the offered shares, have that our sole officer and director will not abuse his discretion in executing our business affairs, is his fiduciary obligation and business integrity. Such

discretionary powers include, but are not limited to, decisions regarding all aspects of business operations, corporate transactions and financing. Mr. Grob also has the ability to accomplish or ratify actions at the shareholder level which would otherwise implicate his fiduciary duties if done as one of the members of our board of directors.

-9-

Accordingly, no person should purchase the offered shares unless willing to entrust all aspects of management to the sole officer and director, or his successors. Potential purchasers of the offered shares must carefully evaluate the personal experience and business performance of our management.

Because We Only Have One Supplier Of Our PDC Cutters, We Have A Concentration In Our Supply Chain. In The Event That We Are Not Able To Continue To Purchase Inventory From Our Supplier With Favorable Prices And Terms, It Could Adversely Affect Our Operations And Your Investment.

In the event that our sole supplier increases prices, presents unfavorable trade terms, experiences problems with quality control, becomes insolvent, or simply decides to no longer sell its products to us, our financial and operational results will be materially, adversely affected. As a result, this could cause you to lose a portion or all of your investment in our business.

Because We Only Have One Purchaser Of Our PDC Cutters, We Have A Concentration In Our Distribution Chain. In The Event That We Are Not Able To Continue To Make Sales To Our One Customer It Could Adversely Affect Our Operations And Your Investment.

In the event that our sole customer decides not to purchase our products, determines that they are not willing to pay the previous prices they have historically paid for our products or ceases to purchase our products for any reason, our financial and operational results will be materially, adversely affected. As a result, this could cause you to lose a portion or all of your investment in our business.

We May Be Unable To Collect Our Accounts Receivable.

For the period from August 5, 2011 (inception) through August 31, 2011, the Company recorded one sale in the amount of $17,000 of which $8,500 remains uncollected as of the date of this filing. In the event the Company is unable to collect the amount currently due or on amounts due in the future, it could have a material adverse effect on the Company’s operations and/or force the Company to curtail its planned business operations.

A Significant Or Prolonged Economic Downturn Could Have A Material Adverse Effect On Our Results Of Operations.

Our results of operations will be affected by the level of business activity of our customers and future customers, which in turn will be affected by the level of economic activity in the customer segments, industries and markets that they serve. A decline in the level of business activity of our customers could have a material adverse effect on our revenues and profit margin. Future economic conditions could cause customers to reduce or defer their expenditures for our products, which could cause a material adverse effect on our revenues and results of operations.

A Reduction In Spending Due To The Economic Downturn Could Result In A Decrease In Demand For Our Products.

If spending on capital expenditures in the oil and gas industry decreases, the demand for products like those provided by us would likely decline. This decrease could reduce our opportunity for growth, increase our marketing and sales costs, and reduce the prices we can charge for products, which could reduce our revenue and operating results, if any.

We Face Corporate Governance Risks And Negative Perceptions Of Investors Associated With The Fact That We Currently Have Only One Officer And Director.

Charles Grob is our sole officer and director. As such, he has significant control over our business direction. Additionally, as he is our only director, there are no other members of the Board of Directors available to second and/or approve related party transactions involving Mr. Grob, including the compensation Mr. Grob may be paid and the employment agreements we may enter into with Mr. Grob. Additionally, there is no segregation of duties between officers because Mr. Grob is our sole officer, and as such, he is solely responsible for the oversight of our accounting functions. Therefore, investors may perceive that because no other directors are approving related party

transactions involving Mr. Grob and no other officers are approving our financial statements that such transactions are not fair to the Company and/or that such financial statements may contain errors. The price of our common stock may be adversely affected and/or devalued compared to similarly sized companies with multiple officers and directors due to the investing public’s perception of limitations facing our company due to the fact that we only have one officer and director.

-10-

If We Are Unable To Adequately Protect Our Intellectual Property Rights Our Business Is Likely To Be Adversely Affected.

We plan to rely on a combination of patents, trademarks, non-disclosure agreements and other security measures to establish and protect our proprietary rights. The measures we have taken or may take in the future may not prevent misappropriation of our proprietary information or prevent others from independently developing similar products or services, designing around our proprietary or patented technology or duplicating our products or services.

Risks Related To Our Industry

Volatility Or Decline In Oil And Natural Gas Prices May Result In Reduced Demand For Our Products And Services Which May Adversely Affect Our Business, Financial Condition And Results Of Operation.

The markets for oil and natural gas have historically been extremely volatile. We anticipate that these markets will continue to be volatile in the future. Although oil and gas prices have increased significantly in recent years, there can be no guarantees that these prices will remain at current levels. Such volatility in oil and gas prices, or the perception by our customers of unpredictability in oil and natural gas prices, affects the spending patterns in our industry. The demand for our products and services is, in large part, driven by current and anticipated oil and gas prices and the related general levels of production spending and drilling activity. In particular, volatility or a decline in oil and gas

prices may cause a decline in exploration and drilling activities. This, in turn, could result in lower demand for our products and services and may cause lower prices for our products and services. As a result, volatility or a prolonged decline in oil or natural gas prices may adversely affect our business, financial condition and results of operations.

Competition From New And Existing Competitors Within Our Industry Could Have An Adverse Effect On Our Results Of Operations.

The oil and gas industry is highly competitive and fragmented. Our principal competitors include companies capable of competing effectively in our markets on a local basis as well as a number of large companies that possess substantially greater financial and other resources than we do. Furthermore, we face competition from companies working to develop oil and gas products which would compete with us. Additionally, our larger competitors may be able to devote greater resources to developing, promoting and selling their products and services. We may also face increased competition due to the entry of new competitors. As a result of this competition, we may experience lower sales if our prices are

undercut or advanced technology is brought to market, which would likely have an adverse effect on our results of operations and force us to curtail or abandon our current business plan.

Our Results Of Operations May Be Negatively Affected By Sustained Downturns Or Sluggishness In The Economy, Including Reductions In Demand Or Low Levels In The Market Prices Of Commodities, All Of Which Are Beyond Our Control.

Sustained downturns in the economy generally affect the markets in which we operate and negatively influence our operations. Declines in demand for oil and gas as a result of economic downturns may reduce our cash flows, especially if our customers reduce exploration and production activities and, therefore, use of our products.

Lower demand for oil and gas and lower prices for oil and gas result from multiple factors that affect the markets which consume our products and services:

• supply of and demand for energy commodities, including any decreases in the production of oil and gas which could negatively affect the demand for oil and gas in general, and as a result the need for our products;

-11-

• general economic conditions, including downturns in the United States, Canada or other economies which affect energy consumption particularly in which sales to industrial or large commercial customers which could negatively affect the demand for oil and gas in general, and as a result the need for our products; and

• federal, state and foreign energy and environmental regulations and legislation, which could make oil and gas exploration more costly, which could in turn drive down demand for oil and gas, and which could in turn reduce the demand for our products and cause our revenues to decrease.

The Long-Term Financial Condition Of Our Businesses Is Dependent On The Continued Availability Of Oil And Gas Reserves.

Our business is dependent upon the continued availability of oil production and reserves. Low prices for oil and gas, regulatory limitations, or the lack of available capital for these projects could adversely affect the development of additional reserves and production, and, therefore, demand for our products and services.

Risks Related to Our Financial Condition

There Is Substantial Uncertainty About Our Ability To Continue As A Going Concern.

In their audit report, our auditors have expressed an opinion that substantial doubt exists as to whether we can continue as an ongoing business. Although we have revenues, we have had limited profits and continue to require substantial capital to develop our business. Because our activities have been financed with a loan from a single investor, we have a concentration of sources of funding. Failure to receive future capital from this investor, or to replace that funding with new investment capital, may require us to suspend or cease our activities altogether which could result in the loss of your investment.

We Have Significant Weaknesses In Our System Of Internal Controls That Could Subject Us To Regulatory Scrutiny Or Impair Investor Confidence, Which Could Adversely Affect Our Business.

Section 404 of the Sarbanes-Oxley Act of 2002 requires companies to perform a comprehensive evaluation of their internal controls. At present, our system of internal controls does not satisfy all applicable regulatory requirements. Future efforts to bring our system of internal controls into compliance with Section 404 and related regulations will likely require the commitment of significant financial and managerial resources. If we fail in that effort, we could be subject to regulatory scrutiny or suffer a loss of investor confidence, which could adversely affect our business.

Risks Related to This Offering

Because There Is No Public Trading Market For Our Common Stock, You May Not Be Able To Resell Your Stock.

We intend to apply to have our common stock quoted on the OTC markets. This process takes some time and the application must be made on our behalf by a market maker. Our stock may be quoted or traded only to the extent that there is interest by broker-dealers in acting as a market maker. Despite our best efforts, we may not be able to convince any broker/dealers to act as market-makers and make quotations on the OTC Bulletin Board or OTCQB market.

If our common stock becomes quoted and a market for the stock develops, the actual price of our shares will be determined by prevailing market prices at the time of the sale.

-12-

We cannot assure you that there will be a market in the future for our common stock. The trading of securities on the OTC markets is often sporadic and investors may have difficulty buying and selling our shares or obtaining market quotations for them, which may have a negative effect on the market price of our common stock. You may not be able to sell your shares at their purchase price or at any price at all. Accordingly, you may have difficulty reselling any shares you purchase from the selling security holders.

Investing In Our Company Is Highly Speculative And Could Result In The Entire Loss Of Your Investment.

Purchasing the offered shares is highly speculative and involves significant risk. The offered shares should not be purchased by any person who cannot afford to lose their entire investment. Our business objectives are also speculative, and it is possible that we would be unable to accomplish them. Our shareholders may be unable to realize a substantial or any return on their purchase of the offered shares and may lose their entire investment. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business and/or investment advisor.

Investing In Our Company May Result In An Immediate Loss Because Buyers Will Pay More For Our Common Stock Than The Pro Rata Portion Of The Assets Are Worth.

We have only been recently formed and have only a limited operating history, therefore, the price of the offered shares is not based on any data. The offering price and other terms and conditions regarding our shares have been arbitrarily determined and do not bear any relationship to assets, earnings, book value or any other objective criteria of value. No investment banker, appraiser or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares. Our net tangible book value per share of common stock is $0.001 as of August 31, 2011, our most recent financial statement date.

The arbitrary offering price of $0.015 per common share as determined herein is substantially higher than the net tangible book value per share of our common stock. Our assets do not substantiate a share price of $0.015. This premium in share price applies to the terms of this offering. The offering price will not change for the duration of the offering even if we obtain a listing on any exchange or become quoted on the OTC Bulletin Board or OTCQB market.

We May Issue Additional Shares Of Common Stock Or Derivative Securities That Will Dilute The Percentage Ownership Interest Of Our Existing Shareholders And May Dilute The Book Value Per Share Of Our Common Stock And Adversely Affect The Terms On Which The Company May Obtain Additional Capital.

Our authorized capital consists of 100,000,000 shares of common stock. The Board of Directors has the authority, without action by or vote of our shareholders, to issue all or part of the authorized shares of common and preferred stock for any corporate purpose, including for the conversion or retirement of debt. We are likely to seek additional equity capital in the future as we develop our business and expand our operations. Any issuance of additional shares of common stock or derivative securities, such as convertible promissory notes, will dilute the percentage ownership interest of our shareholders and may dilute the book value per share of our common stock. Additionally, the exercise or conversion of

derivative securities could adversely affect the terms on which the Company can obtain additional capital. Holders of derivative securities are most likely to voluntarily exercise or convert their derivative securities when the exercise or conversion price is less than the market price for the underlying common stock. Holders of derivative securities will have the opportunity to profit from any rise in the market value of our common stock or any increase in our net worth without assuming the risks of ownership of the underlying shares of our common stock. It is possible that, due to additional share issuance, you could lose a substantial amount, or all, of your investment.

Our Board of Directors may attempt to use non-cash consideration to satisfy obligations, which would likely consist of restricted shares of our common stock. Our Board of Directors has authority, without action or vote of the shareholders, to issue all or part of the authorized but unissued shares of common stock. In addition, if a trading market develops for our common stock, we may attempt to raise capital by selling shares of our common stock, possibly at a discount to market. These actions will result in dilution of the ownership interests of existing shareholders, may further dilute common stock book value, and that dilution may be material. Such issuances may also serve to enhance existing management’s

ability to maintain control of the Company because the shares may be issued to parties or entities committed to supporting existing management.

-13-

As We Do Not Have An Escrow Or Trust Account With Subscriptions For Investors, If We File For Or Are Forced Into Bankruptcy Protection, Investors Will Lose The Entire Investment.

Invested funds for this offering will not be placed in an escrow or trust account and if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. As such, you will lose your investment and your funds will be used to pay creditors.

We Do Not Anticipate Paying Dividends In The Foreseeable Future, So There Will Be Less Ways In Which You Can Make A Gain On Any Investment In Us.

We have never paid dividends and do not intend to pay any dividends for the foreseeable future. To the extent that we may require additional funding currently not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because we do not intend to pay dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

In The Event That Our Shares Are Traded, They May Trade Under $5.00 Per Share And Thus Will Be A Penny Stock. Trading In Penny Stocks Has Many Restrictions And These Restrictions Could Severely Affect The Price And Liquidity Of Our Shares.

In the event that our shares are traded, and our stock trades below $5.00 per share, our stock would be known as a "penny stock", which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. Securities and Exchange Commission (the "SEC") has adopted regulations which generally define a "penny stock" to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our common stock could be considered to be a "penny stock". A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other

than established customers and accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser's written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the "penny stock" rules may restrict the ability of broker/dealers to sell our securities, and may negatively affect the ability of holders of shares of our common stock to resell them. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile and you may not be able

to buy or sell the stock when you want to.

Financial Industry Regulatory Authority ("FINRA") Sales Practice Requirements May Also Limit Your Ability To Buy And Sell Our Common Stock, Which Could Depress The Price Of Our Shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common

stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

-14-

You May Face Significant Restrictions On The Resale Of Your Shares Due To State "Blue Sky" Laws.

Each state has its own securities laws, often called "blue sky" laws, which (1) limit sales of securities to a state's residents unless the securities are registered in that state or qualify for an exemption from registration, and (2) govern the reporting requirements for broker-dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or it must be exempt from registration. The applicable broker-dealer must also be registered in that state.

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as market makers for our common stock. We have not yet applied to have our securities registered in any state and will not do so until we receive expressions of interest from investors resident in specific states after they have viewed this prospectus. We will initially focus our offering in the state of Texas and will rely on exemptions found in the Texas Securities Act. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our

securities. You should therefore consider the resale market for our common stock to be limited, as you may be unable to resell your shares without the significant expense of state registration or qualification.

We Will Incur Significant Increased Costs As A Result Of Operating As A Fully Reporting Company As Well As In Connection With Section 404 Of The Sarbanes Oxley Act.

We will incur legal, accounting and other expenses in connection with our future status as a fully reporting public company. The Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act") and rules subsequently implemented by the SEC have imposed various requirements on public companies, including requiring changes in corporate governance practices. As such, our management and other personnel will need to devote a substantial amount of time to these compliance initiatives. Moreover, these rules and regulations will increase our legal and financial compliance costs and make some activities more time-consuming and costly. The Sarbanes-Oxley Act requires, among other

things, that we maintain effective internal controls for financial reporting and disclosure of controls and procedures. In particular, we must perform system and process evaluation and testing of our internal controls over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting. Our testing may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. Our compliance with Section 404 and our future status as a publicly reporting company will require that we incur substantial accounting, legal and filing expenses and expend significant management efforts. We currently do not have an internal audit group, and we may need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. Moreover, if we are not

able to comply with the requirements of Section 404 in a timely manner, the market price of our stock, if any, could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

If Our Common Stock Is Not Approved For Quotation On The Over-The-Counter Bulletin Board or OTCQB Market, Our Common Stock May Not Be Publicly-Traded, Which Could Make It Difficult To Sell Shares Of Our Common Stock And/Or Cause The Value Of Our Common Stock To Decline In Value.

In order to have our common stock quoted on the Over-The-Counter Bulletin Board (“OTCBB”) or OTCQB market, which is our current plan, we will need to first have our Registration Statement, of which this prospectus is apart, declared effective by the SEC; then engage a market maker, who will file a Form 15c2-11 with FINRA; and clear FINRA comments to obtain a trading symbol. Assuming we clear SEC comments and assuming we clear FINRA comments, we anticipate receiving a trading symbol and having our shares of common stock quoted on the OTCBB in approximately one (1) to two (2) months after the effectiveness of our Registration Statement. In the event

we are unable to have our Registration Statement declared effective by the SEC or our Form 15c2-11 is not approved by FINRA for the OTCBB, we plan to file a 15c2-11 to quote our shares of common stock on the OTC Pink Sheets. If we are not cleared to have our securities quoted on the OTCBB, OTCQB and/or in the event we fail to obtain effectiveness of our Registration Statement, and are not cleared for trading on the OTC Pink Sheets, there will be no public market for our common stock and it could be difficult for our then shareholders to sell shares of common stock which they own. As a result, the value of our common stock will likely be less than it would otherwise due to the difficulty shareholders will have in selling their shares. If we are unable to obtain clearance to quote our securities on the OTCBB, OTCQB and/or the Pink Sheets, it will be difficult for us to raise capital and

we could be forced to curtail or abandon our business operations, and as a result, the value of our common stock could become worthless.

-15-

DIVIDEND POLICY

To date, we have not declared or paid any dividends on our outstanding shares. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock. Although we intend to retain our earnings to finance our operations and future growth, our Board of Directors will have discretion to declare and pay dividends in the future. Payment of dividends in the future will depend upon our earnings, capital requirements and other factors, which our Board of Directors may deem relevant.

USE OF PROCEEDS

Our offering is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.015. The following table sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by us.

|

IF 25% OF

|

IF 50% OF

|

IF 75% OF

|

IF 100% OF

|

|||||||||||||

|

SHARES (1,250,000 SHARES) ARE SOLD

|

SHARES (2,500,000 SHARES) ARE SOLD

|

SHARES (3,750,000 SHARES) ARE SOLD

|

SHARES (5,000,000 SHARES) ARE SOLD

|

|||||||||||||

|

GROSS PROCEEDS FROM THIS OFFERING

|

$

|

18,750

|

$

|

37,500

|

$

|

56,250

|

$

|

75,000

|

||||||||

|

OFFERING EXPENSES

|

||||||||||||||||

|

Accounting fees

|

4,000

|

4,000

|

4,000

|

4,000

|

||||||||||||

|

Legal fees

|

5,000

|

5,000

|

5,000

|

5,000

|

||||||||||||

|

Printing

|

500

|

500

|

500

|

500

|

||||||||||||

|

Transfer Agent

|

1,500

|

1,500

|

1,500

|

1,500

|

||||||||||||

|

TOTAL OPERATING EXPENSES EXPECTED

|

11,000

|

11,000

|

11,000

|

11,000

|

||||||||||||

|

BUSINESS DEVELOPMENT

|

750

|

19,500

|

38,250

|

57,000

|

||||||||||||

|

MARKETING

|

4,000

|

4,000

|

4,000

|

4,000

|

||||||||||||

|

ADMINISTRATION EXPENSES

|

3,000

|

3,000

|

3,000

|

3,000

|

||||||||||||

|

TOTAL EXPECTED

|

$

|

18,750

|

$

|

37,500

|

$

|

56,250

|

$

|

75,000

|

||||||||

The use of proceeds from this offering is anticipated to be utilized as follows:

Offering Expenses

The accounting, legal, printing (Edgarizing) and Transfer Agent fees are the estimated costs associated with conducting this offering.

Business Development

We intend to conduct an investigation to identify potential development opportunities that have the potential to add the most value to our shareholders. The level of effort in this investigation increases as the offering proceeds increase. For proceeds raised up to 50% of the total offering amount, we would focus on developing our PDC distribution segment. If we raise more than 50% of the total offering amount, we would begin preliminary investigations into other additional product lines.

-16-