Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF GRANT THORNTON LLP - Parabel Inc. | d257673dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on December 1, 2011

Registration No. 333-168742

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PetroAlgae Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2860 | 33-0301060 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1901 S. Harbor City Blvd., Suite 600

Melbourne, FL 32901

(321) 409-7500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Anthony John Phipps Tiarks

Chief Executive Officer

PetroAlgae Inc.

1901 S. Harbor City Blvd., Suite 600

Melbourne, FL 32901

(321) 409-7500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Andrew J. Beck, Esq. Daniel P. Raglan, Esq. Torys LLP 1114 Avenue of the Americas New York, NY 10036 (212) 880-6000 |

James P. Dietz Chief Financial Officer PetroAlgae Inc. 1901 S. Harbor City Blvd., Suite 600 Melbourne, FL 32901 (321) 409-7500 |

Robert E. Buckholz, Jr., Esq. Sullivan & Cromwell LLP 125 Broad Street New York, NY 10004 (212) 558-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where such offer or sale is not permitted.

Subject to Completion. Dated December 1, 2011.

Shares

Common Stock

This is an initial public offering of shares of the common stock of PetroAlgae Inc.

PetroAlgae is offering of the shares to be sold in this offering. The selling stockholders identified in this prospectus are offering an additional shares in this offering. PetroAlgae will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Our common stock is currently quoted on the OTCQB under the symbol “PALG.” On November 30, 2011, the last reported sale price of our common stock was $5.50. It is currently estimated that the initial public offering price per share will be between $ and $ .

Application has been made for listing on under the symbol “ ”.

Investing in our common stock involves a high degree of risk. See “Risk Factors” on page 15 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to PetroAlgae |

$ | $ | ||||||

| Proceeds, before expenses, to the Selling Stockholders |

$ | $ | ||||||

The underwriters have the option, exercisable until the date which is days following the closing of this offering, to purchase up to an additional shares at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2012.

| Goldman, Sachs & Co. | UBS Investment Bank | Citigroup |

| Baird | Cowen and Company |

Prospectus dated , 2012.

Table of Contents

| Page | ||||

| 1 | ||||

| 11 | ||||

| 13 | ||||

| 15 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 37 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

38 | |||

| 60 | ||||

| 79 | ||||

| 85 | ||||

| 93 | ||||

| 97 | ||||

| 99 | ||||

| 105 | ||||

| MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF OUR COMMON STOCK |

107 | |||

| 110 | ||||

| 116 | ||||

| 117 | ||||

| 118 | ||||

| F-1 | ||||

Neither we nor the selling stockholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we nor the selling stockholders take any responsibility for, and can provide any assurance as to the reliability of, any other information that others may give you. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where such offer or sale is not permitted. The information contained in this prospectus is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States, neither we, the selling stockholder nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider before deciding to invest in our common stock. Before investing in our common stock, you should carefully read this entire prospectus, including our audited consolidated financial statements and the related notes thereto and the information set forth under the sections “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case included in this prospectus. Unless otherwise stated, (1) we use the terms “PetroAlgae,” “company,” “we,” “us” and “our” in this prospectus to refer to PetroAlgae Inc. and its sole operating subsidiary, PA LLC, (2) we use the term “selling stockholders” in this prospectus to refer to , and (3) information presented in this prospectus assumes that the underwriters do not exercise their option to purchase additional shares.

Our Company

We provide renewable technology and solutions to address the global demand for new economical sources of feed, food and fuel.

Our objective is to be the leading global provider of technology and processes for the commercial production of micro-crop biomass. We have developed proprietary technology, which we believe will allow our customer licensees to grow aquatic micro-crops at accelerated rates for conversion into products for both agriculture and energy markets. We seek to license this renewable technology to meet the significant and growing demand in these markets in both emerging and developed economies. Furthermore, we expect that our solution will deliver strong and consistent economic returns to our customer licensees as a consequence of continuous, predictable, year-round operations without the need for government subsidies.

Our strategy is to license and provide management support for micro-crop production facilities in equatorial regions around the world. Our solution is scalable and flexible, which we believe will allow our customer licensees to expand in order to meet market demand. We intend to generate revenue from licensing fees and royalties primarily from customer licensees. Our licensing approach is designed to minimize our capital expenditures, because our customer licensees will be expected to invest in the development and construction of the production facilities.

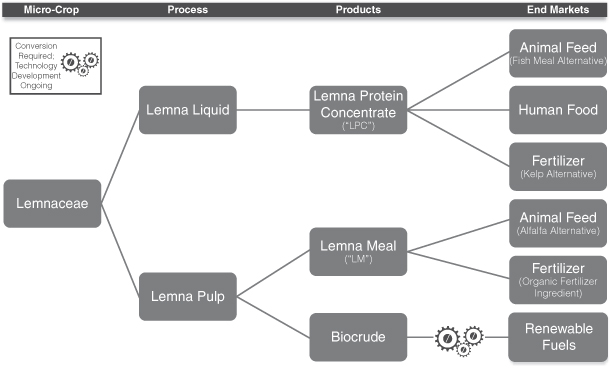

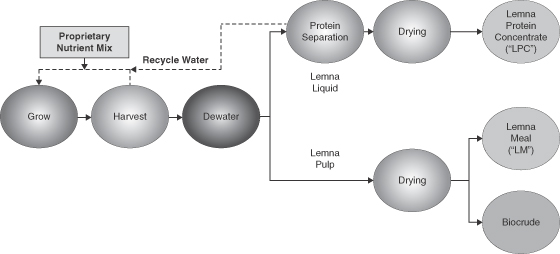

Our proprietary technology uses indigenous micro-crops that are not genetically modified and demonstrate an optimal growth profile for a particular geography and environment. These micro-crops will then be grown, harvested and processed in a manner that we believe will optimize the production of our micro-crop biomass, which our customer licensees can use to produce three products:

| Ÿ | Lemna Protein Concentrate, or LPC: LPC is a free-flowing powder containing a minimum 65% crude protein. We expect that our customer licensees will manufacture LPC for use in both animal and, potentially, human markets. Based on internal and third-party testing, we believe that LPC is similar in quality to fish meal and represents a potentially viable protein source for feed formulations in multiple industries, including aquaculture and swine. We believe that LPC can also be used as an alternative to kelp meal in fertilizer applications. |

| Ÿ | Lemna Meal, or LM: LM is a carbohydrate-rich free-flowing powder containing a minimum 15% crude protein. We expect that our customer licensees will manufacture LM for use in animal feed markets. Based on internal and third-party testing, we believe that LM is similar in quality to alfalfa meal and represents a potentially viable feed ingredient for formulations in multiple industries, including dairy and swine. We also believe that LM could be used in fertilizer and animal bedding applications. |

1

Table of Contents

| Ÿ | Biocrude: With a small change in process parameters (but not equipment), our processing system can produce Biocrude rather than LM. Biocrude is a renewable energy feedstock that, through the use of a variety of third-party conversion systems currently under development, could potentially be converted into renewable fuels. |

In 2011, we entered into a license agreement with a customer licensee in South America. See “Business—Our Customer Licensees—AIQ”. We are currently negotiating additional agreements with prospective customer licensees, including, among others, state-owned enterprises and multinational food companies. We expect that the successful execution of early projects will help validate our technology and ultimately enhance our ability to enter into commercial-scale agreements with other prospective customer licensees.

Our Markets

Our current product strategy is to enable customer licensees to sell our LPC product in the global animal feed market as a fish meal alternative and our LM product in the global animal feed market as an alternative to alfalfa meal. We believe that focusing in the near-term on the deployment of our technology for the production of animal feed helps to reduce the market risks associated with our solution, given the relatively high-value, high demand and low complexity of our animal feed products. We also believe that LPC is well positioned as an alternative to kelp meal, commonly used in fertilizers for turf grasses, such as those on golf courses, and that LM could potentially be used as an ingredient in organic fertilizers and in animal bedding applications.

Our research also indicates that LPC has the potential to be used in human food applications. We have commissioned and will continue to commission third-party testing regarding human food applications and are seeking regulatory approvals. If successful, we believe that the human use of our products would significantly increase the value of LPC.

We also expect to benefit from the development of third-party technology that will facilitate the commercial production of renewable fuel from Biocrude. We expect these efforts to provide our customer licensees with the option to pursue multiple fuel options with our Biocrude product, including use as a renewable energy feedstock that can be converted into fuel products or burned directly as a combustion fuel. The process of developing our fuel technology is ongoing through a number of joint development and collaboration efforts with petrochemical companies, which we believe will accelerate our fuel product platform commercialization.

2

Table of Contents

Our Industry

The food, feed and fuel markets are global and significant in size and the demand in these markets is expected to grow rapidly. We believe that our products will meet a portion of that growing demand. We also believe that our technology will deliver high production yields, particularly in equatorial regions, in which we expect the demand for our feed and food substitutes will be strong, and will enable our customer licensees to address the needs of the following markets.

Animal Feed

| Ÿ | Fish Meal: Fish meal, most of which is produced by the commercial fishing of wild schools of small fish, is a critical ingredient in the diets of nursery animals and aquaculture stocks. The fish meal supply is currently limited due to the effects of overfishing, while the demand for fish meal as a source of protein in animal diets continues to rise sharply. Global fish meal demand for aquafeed is expected to reach approximately 7 million metric tonnes in 2012 and to rise every year thereafter to approximately 16 million metric tonnes in 2020, a rate which is expected to significantly outpace supply. As a consequence, there is a large and growing need for an alternative protein source to address this supply and demand imbalance. |

Based on research conducted by the University of Idaho, we believe that LPC is strongly positioned as a fish meal alternative due to its nutritive qualities. We expect that our ability to locate production near sources of demand will provide our customer licensees with several commercial advantages, including the potential to reduce freight and duty import expenses, along with the ability to offer continuous production and just-in-time inventory management. Based on these factors, we expect the market price of LPC to be comparable to fish meal.

| Ÿ | Alfalfa Meal: Alfalfa meal is a premium forage ingredient, used to meet nutrition and growth requirements in numerous animal diets. The supply of alfalfa is limited due to the concentration of production in specific areas, such as the United States and Europe. Meanwhile, demand is continuing to rise, particularly in Asia. For dairy and swine alone, the global demand for alfalfa meal will be approximately 254 million metric tonnes in 2012, rising every year thereafter to approximately 262 million metric tonnes in 2020. |

Trials conducted by the University of Minnesota demonstrated that LM is a high quality alternative for alfalfa meal in diets for dairy cattle. Third-party testing is continuing with other animals that are customarily fed alfalfa, such as swine and horses. Based on LM’s nutritional similarity with alfalfa meal, we expect that its market price will be comparable.

Fertilizer

Kelp and other high nitrogen biomass can be used as organic fertilizers. However, the production of kelp is costly due to the limited areas in which it grows in the wild, as well as environmental regulations that limit the scale of its harvesting. We believe that LPC can be a lower-cost, potentially higher-value alternative to kelp. We also believe that LM could be used as a nitrogen source in organic fertilizers. We believe that LPC will be competitive in the specialty turf fertilizer market given its favorable chemical composition and the opportunity it presents to reduce potential environmental pollution as compared to other alternatives.

3

Table of Contents

Fortification of Basic Human Food Products

We are developing our technology to address the rising demand for human food, a market of particular relevance in the equatorial regions in which we believe our technology will be well-suited to grow. We believe that LPC can eventually serve the global market for fortification of basic food ingredients for malnourished populations, particularly in developing and emerging countries. Given the rapidly growing populations in regions such as South Asia, Africa and South America, we believe that there is a clear need for an alternative supply of high quality and economical protein to supplement and enhance basic foods, such as breads, tortillas, noodles and crackers.

Specialty Markets for Prepared Foods

In the long term, we believe we can develop a higher protein content product from lemna using alternative separation techniques. This would allow our customer licensees to access specialty markets for prepared foods for human consumption, such as baked goods, meats and frozen foods. Third-party research is continuing to validate our results and enhance our understanding of these properties. While this process change would increase the capital expenditure and operating costs associated with our technology, we anticipate that the increased value of the end product produced would in many cases justify the additional expenses.

Renewable Fuels

We expect that third-party technology will lead to the conversion of Biocrude into drop-in fuels. If the technology is successfully developed in this manner, we anticipate that our customer licensees will have the ability to create products that address the significant and continuing global demand for renewable fuel.

Our Solution and Customer Licensee Approach

We believe that our solution will result in the commercial scale production of renewable products specifically for the feed, food and fuel industries. Our technology platform primarily consists of four components: micro-crop selection and testing, growth and harvesting techniques, processing technology, and control systems. Our technology includes the selection of indigenous micro-crops that demonstrate an optimal profile for a particular geography and environment, which we believe will allow our customer licensees to grow, harvest and process these micro-crops efficiently and profitably. We have developed a scalable and flexible model based on micro-crop growth units of 150 hectare increments. This model is designed to be attractive to a wide range of entities, including agricultural customers with an interest in the sustainable production of feed products, larger operators of renewable fuel production facilities and financial investment groups.

The estimated capital expenditure for a 150 hectare facility as an entry point is $12 million (excluding the cost of land and improvements)—a model that we believe involves manageable costs, risks and build-out times, while also enabling our customer licensees to evaluate the commercial potential of the technology on a larger scale. Due to economies of scale, we believe that a 600 hectare unit would deliver an attractive internal rate of return on our customer licensees’ investment. Ultimately, we expect that our customer licensees will expand their facilities in 150 hectare increments at similar costs in order to complete facilities of up to 5,000 hectares. Depending on economies of scale, we expect that the capital expenditure for a 5,000 hectare facility will be approximately $375 million (excluding the cost of land and improvements). We believe that a license unit of this size will enable our customer licensees to deliver significant volumes of product to market, thereby maximizing internal rates of return on their investments.

4

Table of Contents

Our business model requires minimal capital expenditures from us and involves the licensing of our technology and processes to customer licensees for fees and royalties during the life of the license. Our customer licensees will be required to pay the upfront infrastructure costs as well as continued maintenance costs for their licensed facilities.

Since our inception in 2006, we have focused on continuously developing our technology with the objective of enabling our customer licensees to produce renewable feed, food and fuel products at commercial scale. We believe research and development is an ongoing effort and we continue to look for ways to improve our technology and processes so that our customer licensees will be able to scale up our technology efficiently and profitably. We have successfully built and operated a demonstration facility (approximately one hectare) and have extracted small field-scale product quantities for technical validation. We believe that this process of scaling up our technology from the laboratory scale to demonstration scale will allow us to reach commercial scale with our initial customer licensees.

Our Competitive Strengths

Our key competitive strengths are:

| Ÿ | Strong economic returns to our customer licensees without the need for government subsidies. We believe that our solution will present our customer licensees with the opportunity to invest profitably in renewable technology designed to meet the significant and growing demand for feed, food and fuel. The profitability of our technology and processes is not dependent on government subsidies; although any subsidies that we or our customer licensees receive will enhance the profitability of our technology and processes. |

| Ÿ | Highly scalable and flexible technology, with initial license units providing the basis for larger-scale operations in the future. To facilitate rapid deployment opportunities in the near future, we have developed a highly scalable and flexible model for potential customer licensees. Our solution involves the construction and operation of production facilities based on 150 hectare increments of micro-crop growth bioreactors. We expect each 150 hectare unit will be a profitable module that can be replicated as the components of a larger-scale project of up to 5,000 hectares. |

| Ÿ | Fully integrated, comprehensive solution that transforms simple, naturally occurring inputs, such as sunlight, water and indigenous micro-crops, into valuable outputs. We will provide our customer licensees with a comprehensive system that contains all components necessary for the creation of renewable products at commercial scale, from selection and testing of micro-crops to growth, harvesting and processing. In addition to a fully integrated technology platform, we expect to provide our customer licensees with extensive facility planning, design and construction/operation management services. |

| Ÿ | Product compatibility with the existing agriculture infrastructure. Our processes for producing LPC and LM are designed to be compatible with standard processing techniques that can be implemented using existing agricultural equipment and infrastructure. We expect both products to become direct substitutes for existing protein supplies in animal feed applications. Our technology can potentially provide a new source of supply where existing demand or expected growth in demand cannot be met solely by existing sources due to environmental and other constraints. |

| Ÿ | First mover advantage in providing renewable micro-crop technology to produce products that serve the global animal feed market. We believe that the deployment of our solution will place our customer licensees in a position to enter the global animal feed market as a first-mover in producing animal feed from renewable micro-crops. |

5

Table of Contents

| Ÿ | Experienced management team with a track record of innovative growth, value creation and commercial scaling of businesses. Our senior management team has broad expertise in guiding early-stage development companies to commercialization. Our management team has been involved in various technical and management roles within leading organizations across various industries. |

Our Business Strategy

Building on our competitive strengths, our objective is to become the leading global provider of technology and processes for the commercial production of micro-crop biomass for the agriculture and energy markets. Key elements of our strategy include:

| Ÿ | Rapid deployment and support of modular and highly scalable license units. Our customer licensees will be able to assemble our proprietary units from modular, cost-effective bioreactors and other ancillary equipment, which are currently operating at a smaller scale at our fully operational demonstration facility. These modular bioreactors are designed to enable rapid deployment at predictable cost and productivity levels. |

| Ÿ | Leveraging our capital-light licensing model. Our customer licensees will be required to pay the upfront infrastructure costs as well as continued maintenance costs for their licensed facilities. This business model allows us to make minimal capital expenditures while generating fees and royalties over the term of the license. |

| Ÿ | Expansion of our customer base on a global scale. We are continuing to expand our marketing efforts internationally. In 2011, we expanded our operations in China to further our focus in the region. We also recently expanded our sales and marketing efforts in both Africa and South America, which represent key locations where we expect to license our technology. In addition, we are establishing relationships and seeking opportunities with investment funds. |

| Ÿ | Further development of our technology and pursuit of additional applications for our products. We expect to further enhance our technology in order to provide our customer licensees with additional end market applications for our products along with the ability to capture higher economic returns. We expect these efforts to provide our customer licensees with access to markets for human food and renewable fuels. |

| Ÿ | Assisting our customer licensees in the identification of off-take partners. We will continue academic and commercial testing of our products to confirm their market viability. This third-party validation will assist us and our customer licensees in establishing off-take arrangements in which companies will purchase products produced by our customer licensees. |

| Ÿ | Creation of brand loyalty. We intend to become recognized as the leading global provider of technology for the commercial production of micro-crop biomass for agriculture and energy markets. We intend to become a recognized provider of green technology solutions. |

6

Table of Contents

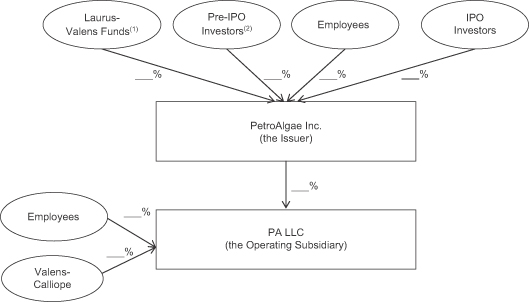

Our Structure

Background

PetroAlgae Inc. is a holding company whose sole asset is its controlling equity interest in its operating subsidiary, PA LLC. We operate and control the business and affairs, and consolidate the financial results, of PA LLC. As of , we held % of the equity interests in PA LLC, with the remainder held by Valens-Calliope (as defined under “—The Exchange Transactions”) and certain of our employees.

PA LLC was originally founded in September 2006 by XL TechGroup, Inc., or XL Tech, as a company focused on developing technologies for the renewable energy market. In August 2008, XL Tech exchanged certain of its assets, including the equity it held in PA LLC, for the outstanding debt of XL Tech that was held by the Laurus-Valens Funds (as defined under “Our Principal Stockholders”). Subsequent to that exchange, the Laurus-Valens Funds transferred the equity they received and certain related debt to PetroTech Holdings Corp., or PetroTech, a holding company controlled by the Laurus-Valens Funds. In December 2008, PetroTech acquired a shell company that was quoted on the OTC Bulletin Board, or the OTCBB, and assigned its interest in PA LLC to this shell company, which it then renamed PetroAlgae Inc.

Our Principal Stockholders

Our principal stockholders consist of private investment entities that are managed by Laurus Capital Management, LLC, or LCM, and Valens Capital Management, LLC, or VCM. We refer to these private investment entities as the Laurus-Valens Funds. At the completion of this offering, the Laurus-Valens Funds will own directly or indirectly approximately % of our common stock (or % if the underwriters exercise their option in full) and approximately % of the equity interests in PA LLC. The Laurus-Valens Funds have invested in micro-cap and small private and publicly traded companies since 2001. For more information about our principal stockholders, see “Principal and Selling Stockholders.”

7

Table of Contents

Governance Matters

Prior to the completion of this offering, we will enter into a stockholders agreement with our principal stockholders, or the stockholders agreement. The stockholders agreement will become effective upon completion of this offering. The stockholders agreement will contain a voting agreement that provides, among other things, that:

| • | our principal stockholders will agree to vote any shares of our common stock they and their affiliates own pro rata with our unaffiliated stockholders (other than in connection with any vote relating to (i) a consolidation or merger of the company or any of its affiliates into or with any other person (other than affiliates of our principal stockholders); or (ii) a sale, lease or transfer of all or substantially all of our assets or capital stock to another person (other than affiliates of our principal stockholders)); and |

| • | our principal stockholders will not vote in favor of the removal of any of our independent directors unless our unaffiliated stockholders approve such removal. |

For more information regarding our governance, see “Relationships and Related Party Transactions — Stockholders Agreement.”

The Exchange Transactions

Prior to the acquisition of the shell company, our employees were compensated in part with equity incentives consisting of units in PA LLC. Since that acquisition, our employees have received equity incentives in PetroAlgae Inc. In order to provide liquidity for their equity interests in PA LLC and to facilitate the exchange of all equity interests in PA LLC, we have committed to the following:

| Ÿ | We will enter into an exchange agreement with certain of our employees, Valens U.S. SPV I, LLC, or Valens U.S., and Calliope Capital Corporation, or CCC, which, together with Valens U.S., we refer to as Valens-Calliope. Each of these entities and employees will also be a selling stockholder in this offering. The exchange agreement will give those employees and Valens-Calliope the right to exchange a portion of their units in PA LLC for shares of PetroAlgae Inc. common stock that they will then sell in this offering, subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications. |

| Ÿ | We will set aside $ from this offering to redeem up to units of PA LLC held by certain of our employees who are not party to the exchange agreement. |

| Ÿ | No sooner than months after the completion of this offering, we will file a registration statement that will cover the exchange from time to time of the aggregate number of shares of PetroAlgae Inc. common stock that will be issuable in exchange for the remaining units in PA LLC held by Valens-Calliope and our employees. |

We have reserved million shares of common stock for issuance to cover all exchanges of PA LLC units for shares of our common stock by our employees. We have reserved a further million shares of common stock for issuance to cover all such exchanges by Valens-Calliope.

8

Table of Contents

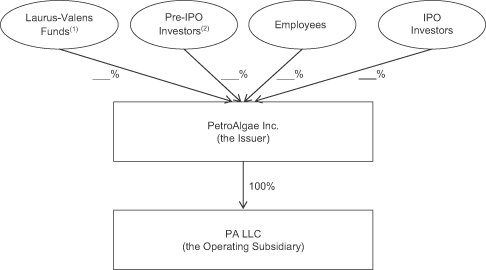

Our Organizational Structure

The following diagram depicts our organizational structure immediately following the consummation of this offering:

| (1) | The Laurus-Valens Funds hold their interests in PetroAlgae Inc. through PetroTech. |

| (2) | The Pre-IPO Investors consist of acquirors of our common stock pursuant to private placements, over-the-counter trading or the 2008 shell company transaction and which are not affiliated with the Laurus-Valens Funds. |

The following diagram depicts our organizational structure following the consummation of this offering and assuming that all of the equity interests of PA LLC are exchanged as described in “—The Exchange Transactions”:

| (1) | The Laurus-Valens Funds hold their interests in PetroAlgae Inc. through PetroTech. |

| (2) | The Pre-IPO Investors consist of acquirors of our common stock pursuant to private placements, over-the-counter trading or the 2008 shell company transaction and which are not affiliated with the Laurus-Valens Funds. |

9

Table of Contents

Risk Factors

Our business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” beginning on page 15 and elsewhere in this prospectus. These risks could materially and adversely impact our business, financial condition, operating results and cash flow, which could cause the trading price of our common stock to decline and could result in a partial or total loss of your investment. You should carefully consider such risks before deciding to invest in our common stock.

Our Corporate Information

PetroAlgae Inc. became a Delaware corporation on August 12, 2008 upon a change of domicile by its predecessor, a California corporation originally incorporated on April 15, 1988. Our principal executive office is located at 1901 S. Harbor City Blvd., Suite 600, Melbourne, FL 32901 and our telephone number is (321) 409-7500. Our website address is www.petroalgae.com. The information contained on, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus. We are currently a reporting company under Section 13 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. “PetroAlgae”, the “PetroAlgae logo” and other trademarks or service marks of PetroAlgae Inc. appearing in this prospectus are the property of PetroAlgae Inc. This prospectus contains additional trade names, trademarks and service marks of others, which are the property of their respective owners and the inclusion of such trade names, trademarks or service marks in this prospectus does not signify a relationship with, or endorsement or sponsorship of us by, these other companies.

Industry and Market Data

Market data and industry statistics and forecasts used throughout this prospectus are based on independent industry publications, reports by market research firms and other published independent sources. Some data and other information are also based on our good faith estimates, which are derived from our review of internal surveys and independent sources. Certain information contained in this prospectus is based on results of studies conducted by the University of Idaho, the University of Minnesota, Purdue University, Kansas State University and Craft Technologies. We commissioned each of the aforementioned studies. Furthermore, to our knowledge, each of the studies cited in this prospectus represent the most recent information with respect to the subject matter of such study.

10

Table of Contents

| Common stock offered by us |

shares. |

| Common stock offered by the selling stockholders |

shares. |

| Common stock to be outstanding immediately after this offering(1) |

shares. |

| Common stock to be outstanding immediately after this offering, as adjusted(2) |

shares. |

| Voting rights |

Each share of our common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. See “Description of Capital Stock—Common Stock.” |

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $ (based on the midpoint of the range listed on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us). |

| We will set aside $ of the net proceeds to redeem up to units of PA LLC held by certain of our employees who are not otherwise selling in this offering. We intend to use the remainder of the net proceeds from this offering for working capital and other general corporate purposes. |

| We will not receive any of the proceeds from the sale of shares by the selling stockholders. See “Use of Proceeds.” |

| Risk factors |

See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

| OTCQB symbol |

“PALG”. |

| Proposed symbol |

“ ”. |

| (1) | The number of shares of our common stock that will be outstanding immediately after this offering is based on shares of PetroAlgae common stock outstanding as of and excludes: |

| Ÿ | shares of our common stock issuable upon the exercise of options outstanding at a weighted average exercise price of $ per share; |

| Ÿ | shares of our common stock issuable upon the exercise of warrants outstanding at a weighted average exercise price of $ per share; |

11

Table of Contents

| Ÿ | shares of our common stock reserved for issuance under the 2009 Equity Compensation Plan; and |

| Ÿ | any exercise by the underwriters of their right to purchase up to an additional shares of our common stock from . |

| (2) | The number of shares of our common stock that will be outstanding immediately after this offering, as adjusted, is based on shares of PetroAlgae common stock outstanding as of and includes: |

| Ÿ | shares of our common stock offered by us in this offering; |

| Ÿ | shares of our common stock reserved for issuance to cover exchanges by our employees of their PA LLC units for common stock of PetroAlgae Inc.; and |

| Ÿ | shares of our common stock reserved for issuance to cover exchanges by Valens-Calliope of their PA LLC units for common stock of PetroAlgae Inc. |

and excludes:

| Ÿ | shares of our common stock issuable upon the exercise of options outstanding at at a weighted average exercise price of $ per share; |

| Ÿ | shares of our common stock issuable upon the exercise of warrants outstanding at at a weighted average exercise price of $ per share; |

| Ÿ | shares of our common stock reserved for issuance under the 2009 Equity Compensation Plan; and |

| Ÿ | any exercise by the underwriters of their right to purchase up to an additional shares of our common stock from . |

12

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following summary consolidated financial data for the years ended December 31, 2007, 2008, 2009 and 2010 are derived from our audited consolidated financial statements. The summary audited consolidated financial data for the period beginning September 22, 2006 and ending December 31, 2010 is derived from our audited consolidated financial statements for such period that are included elsewhere in this prospectus. The summary unaudited consolidated interim financial data for the nine months ended September 30, 2010 and 2011 and as of September 30, 2011 are derived from our unaudited consolidated interim financial statements for such periods and dates that are included elsewhere in this prospectus. The unaudited consolidated interim financial statements were prepared on a basis consistent with our audited consolidated financial statements and include, in the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary for the fair presentation of the financial information contained in those statements. The historical results presented below are not necessarily indicative of financial results to be achieved in future periods. Prospective investors should read these summary consolidated financial data together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| For the

Period From September 22, 2006 (Inception) Through December 31, |

(Unaudited) Nine Months Ended September 30, |

Pro Forma(1) | ||||||||||||||||||||||||||||||||||

| Years Ended December 31, | (Unaudited) Year Ended December 31, |

(Unaudited) Nine Months Ended September 30, |

||||||||||||||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2010 | 2010 | 2011 | 2010 | 2011 | ||||||||||||||||||||||||||||

| (in thousands, except for share and per share data) |

||||||||||||||||||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||||||||||||||||||

| Revenue |

$ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||

| Costs and expenses: |

||||||||||||||||||||||||||||||||||||

| Selling, general and administrative |

2,984 | 8,251 | 17,401 | 21,850 | 50,666 | 9,447 | 8,074 | 21,850 | 8,074 | |||||||||||||||||||||||||||

| Research and development |

4,863 | 9,866 | 15,085 | 17,424 | 48,469 | 11,184 | 8,463 | 17,424 | 8,463 | |||||||||||||||||||||||||||

| Interest expense—related party |

44 | 1,764 | 3,198 | 4,077 | 9,483 | 2,912 | 4,646 | 2,860 | 3,736 | |||||||||||||||||||||||||||

| Depreciation |

55 | 269 | 1,138 | 1,128 | 2,591 | 773 | 669 | 1,128 | 669 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total costs and expenses |

8,346 | 20,150 | 36,822 | 44,479 | 111,209 | 24,316 | 21,852 | 43,262 | 20,942 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net loss before non-controlling interest |

(8,346 | ) | (20,150 | ) | (36,822 | ) | (44,479 | ) | (111,209 | ) | (24,316 | ) | (21,852 | ) | (43,262 | ) | (20,942 | ) | ||||||||||||||||||

| Non-controlling interest |

— | 162 | 6,554 | 6,469 | 13,186 | 3,842 | 2,797 | 6,285 | 2,681 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net loss attributable to PetroAlgae Inc. |

$ | (8,346 | ) | $ | (19,988 | ) | $ | (30,268 | ) | $ | (38,010 | ) | $ | (98,023 | ) | $ | (20,474 | ) | $ | (19,055 | ) | $ | (36,977 | ) | $ | (18,261 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Basic and diluted common shares outstanding |

100,000,000 | 100,362,021 | 104,866,065 | 106,731,469 | 106,664,896 | 106,920,730 | 108,719,586 | 108,908,847 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Basic and diluted loss per share |

$ | (0.08 | ) | $ | (0.20 | ) | $ | (0.29 | ) | $ | (0.36 | ) | $ | (0.19 | ) | $ | (0.18 | ) | $ | (0.34 | ) | $ | (0.17 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

13

Table of Contents

| As of September 30, 2011 | ||||||||||||

| Actual | Pro Forma(1) |

Pro Forma As Adjusted(1)(2) |

||||||||||

| (Unaudited) | ||||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash |

$ | 6,715 | $ | 6,715 | $ | |||||||

| Property and equipment, net |

1,358 | 1,358 | ||||||||||

| Total assets |

8,324 | 8,324 | ||||||||||

| Current liabilities (excluding notes payable) |

12,232 | 9,310 | ||||||||||

| Notes payable—related party (current) |

72,053 | 62,053 | ||||||||||

| Total stockholders’ equity (deficit) |

(75,993 | ) | (63,071 | ) | ||||||||

| (1) | On a pro forma basis to give effect to the conversion (as of January 1, 2010 for statements of operations data and as of September 30, 2011 for balance sheet data) of all of our outstanding convertible debt of $10 million and accrued interest into common shares at a conversion price of $5.43 per share. |

| Ÿ | On the consolidated statements of operations: |

| Ÿ | $1.2 million and $0.9 million of interest expense was reversed for the year ended December 31, 2010 and the nine months ended September 30, 2011, respectively; and |

| Ÿ | net loss attributable to non-controlling interest of $0.2 million and $0.1 million was reversed for the year ended December 31, 2010 and the nine months ended September 30, 2011, respectively. |

| Ÿ | On the consolidated balance sheet: |

| Ÿ | the sum of accrued interest and notes payable – related party of $12.9 million was reclassified to reduce total stockholders’ deficit as of September 30, 2011. |

| (2) | On a pro forma as adjusted basis to give further effect to: |

| Ÿ | the sale by us of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the range listed on the cover page of this prospectus, and our receipt of the estimated net proceeds from that sale after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us; |

| Ÿ | the exchange of million shares of common stock reserved for issuance prior to the closing of this offering and that are issuable upon the exchange of units of PA LLC for common shares of PetroAlgae; and |

| Ÿ | our use of approximately $ million of the net proceeds of this offering to redeem certain of the equity units of PA LLC held by our employees. |

14

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, before deciding whether to invest in our common stock. Our business, prospects, financial condition or operating results could be materially adversely affected by any of these risks. The trading price of our common stock could decline as a result of any of these risks, and you could lose part or all of your investment in our common stock. When deciding whether to invest in our common stock, you should also refer to the other information in this prospectus, including our consolidated financial statements and related notes and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus. You should read the section entitled “Special Note Regarding Forward-Looking Statements” immediately following these risk factors for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus.

Risks Related to Our Business

We have a limited operating history.

We are a development stage company. As a result, we have no significant history of revenues, operating or net income, cash flows or the other financial performance metrics that will affect the future market price of our common stock. Any investment you make in our common stock will necessarily be speculative and based largely on your own views as to the future prospects for our business. If we are unable to generate sufficient revenues or profits, we may be unable to continue operating and you may lose your entire investment in our common stock.

In addition, because of this limited operating history, investors and research analysts could have more difficulty valuing our common stock, which could lead to significant variability in the value ascribed to our common stock by market participants. This, in turn, could lead to a high degree of volatility in the market price of our common stock, which could have adverse effects on our investors and on our ability to conduct financing activities, determine dividend policy and price any stock options we grant for compensation or other purposes.

We have a history of operating losses and our auditors have indicated that there is a substantial doubt about our ability to continue as a going concern.

To date, we have not been profitable and have incurred significant losses and cash flow deficits. For the fiscal years ended December 31, 2010, 2009, and 2008, we reported net losses before non-controlling interest of $44.5 million, $36.8 million, $20.2 million, respectively, and negative cash flow from operating activities of $22.8 million, $27.6 million, and $11.8 million, respectively. For the nine months ended September 30, 2011, we reported net losses of $19.1 million and negative cash flow from operating activities of $13.4 million. As of September 30, 2011, we had an aggregate accumulated deficit of $117.1 million. We anticipate that we will continue to report losses and negative cash flow for the next several years.

As a result of these net losses and cash flow deficits and other factors, our independent auditors issued an audit opinion with respect to our consolidated financial statements for the three years ended December 31, 2010 that indicated that there is a substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty. These adjustments would likely include substantial impairment of the carrying amount of our assets and potential contingent liabilities that may arise if we are unable to fulfill various operational commitments. In addition, the value of our securities, including common stock issued in this offering, would be greatly impaired. Our ability to continue as a going concern is

15

Table of Contents

dependent upon generating sufficient cash flow from operations and obtaining additional capital and financing, including funds to be raised in this offering. If our ability to generate cash flow from operations is delayed or reduced and we are unable to raise additional funding from other sources, we may be unable to continue in business even if this offering is successful. For further discussion about our ability to continue as a going concern and our plan for future liquidity, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Ability to Continue as a Going Concern.”

We expect to rely on a small number of early-adopter customer licensees for substantially all of our revenue during our next several years of operation.

We expect to be reliant on a small number of customer licensees for substantially all of our revenue. During the next several years, our business will depend on the successful operation of the license units to which our initial contracts will relate.

Our initial contract is, and we expect that our additional early contracts will be, subject to significant conditionality. These contracts may be terminated by customer licensees if these conditions are not met. See “—Our initial contracts will be conditioned on pilot-scale facilities built by our customer licensees meeting certain levels of productivity, and the failure to meet those levels may lead to the termination of these contracts, which will materially adversely affect our ability to generate revenue.” In addition, these contracts are generally subject to termination in the event that we fail to satisfy our obligations under such contracts. Although we believe that we have satisfied, and intend to continue to satisfy, these obligations, there can be no assurance that we will be able to continue to do so in the future.

Furthermore, there is no assurance that our customer licensees will be able to successfully commercialize and distribute LPC, LM or Biocrude created using our technology. If our customer licensees are unable to sell the products that they produce with our technology, they may seek to terminate our contracts or renegotiate the terms. If any of these contracts are terminated or renegotiated on less favorable terms, if contracts are terminated for failure to meet conditions or if any of our customer licensees fail to meet their payment obligations to us, our ability to generate revenues will be materially adversely affected, and this could have a material adverse effect on our business, financial condition and results of operations.

Our dependence on certain turnkey contracts subjects us to certain legal and financial terms that could adversely affect us.

We expect that some of the contracts with our initial early-adopter customer licensees will provide for the build-out of a turnkey license unit of 150 hectares after the successful completion of the testing phase of our technology. This means that we will direct the general contractor of such units and we will be required to deliver the unit at a fixed cost. We will receive payment for the build-out of the license unit on a progress basis as the license unit is constructed. The difference in the amounts and timing of our payments to contractors and suppliers relative to payments we receive from our customer licensees exposes us to liquidity risk and could leave us vulnerable in the event we encounter challenges in building the facility or bringing it online, delays in achieving commercial viability with our production process, disputes with our customer licensees or other unanticipated events that may occur prior to the time we receive payment from our customer licensees. Because our customer licensees’ payments will be capped, we will bear the responsibility for construction costs in excess of those anticipated, which could cause us to suffer significant losses on these license units.

16

Table of Contents

Our success depends on future royalties we expect will be paid to us by our customer licensees, and we face the risks inherent in a royalty-based business model.

We are a licensing business without a substantial amount of tangible assets, and our long-term success depends on future royalties paid to us by customer licensees. The amount of royalty payments we expect to receive will be primarily based upon the revenues generated by our customer licensees’ operations, so we will be dependent on the successful operations of our customer licensees for a significant portion of our revenues. Furthermore, we expect that the terms of some of our early-adopter customer license contracts will provide for royalty payments in lieu of license fees, which will cause us to recognize revenue from these contracts only once the license units have been built and are operational and the end products are being sold by the customer licensee. We face risks inherent in a royalty-based business model, many of which are outside of our control, including those arising from our reliance on the management and operating capabilities of our customer licensees and the cyclicality of supply and demand for end-products produced using our technology. Should our customer licensees fail to achieve sufficient profitability in their operations, our royalty payments would be diminished and our business, financial condition and results of operations could be materially adversely affected.

Our initial contracts are or will be subject to significant conditionality, including that the pilot-scale facilities built by our customer licensees achieve certain minimum levels of projected investment return, and the failure to meet these conditions may lead to the termination of these contracts.

Our initial contract is, and we expect that our additional early contract will be, subject to significant conditionality. For example, our initial contract may be terminated if our customer licensee deems the performance of its pilot-scale facility to be unsatisfactory. See “Business—Our Customer Licensees—AIQ.” In the contracts that we are currently negotiating, our prospective customer licensees will be permitted to terminate their agreements if projected investment returns, based upon the performance of their pilot-scale facilities and other factors, do not meet minimum investment return requirements. We generally will not receive any revenues under these contracts unless such returns are met during the test periods prescribed in each such contract. We cannot provide any assurances that any or all of our customer licensees’ pilot-scale facilities will meet the minimum investment returns required under these contracts. If a pilot-scale facility does not meet the minimum investment return requirements, the relevant contract may be terminated by the customer licensee, which in turn could have a material adverse effect on our business, financial condition and results of operations and our ability to generate revenue.

Our proposed licensing terms may not be accepted by prospective customer licensees and, even if accepted, there can be no assurance that customer licensees will meet their payment obligations under these licensing terms.

Prospective customer licensees may not accept our planned license agreement model. For example, prospective customer licensees may be unwilling to pay the proposed licensing fees prior to or during the construction of our micro-crop production system or prior to full commercial deployment of the system. We expect that our initial contracts will generally be royalty-based and will not involve any significant payment of license fees, and there can be no assurance that future contracts will involve significant license fees. Therefore, even if we are successful in attracting new customer licensees for our technology, we may not realize revenue from such customer licensees in the form or time frame we currently anticipate. Furthermore, there is no guarantee that customer licensees will make payments in the time frame to which they agree. If prospective customer licensees are unwilling or unable to pay as anticipated, the timing of our revenues and incoming cash flows could be reduced or delayed, which could have a material adverse effect on our business, financial condition and results of operations.

17

Table of Contents

We may be unable to acquire and retain customer licensees.

Our main source of revenue will be in the form of licensing fees and royalties from our customer licensees. Therefore, obtaining a significant number of customer licensees is critical for our growth and operation. Because our technology has not previously been deployed in the marketplace, it is uncertain whether it will be accepted by prospective customer licensees and there is a risk that we will be unable to acquire and retain licensees due to a number of factors, including our proposed licensing fee and royalty structure, capital expenditure requirements or questions surrounding commercial feasibility of our technology. For example, the projected investment returns of our micro-crop production system and the processes and methodologies used to operate the system may not yield a result that is commercially attractive to prospective customer licensees (compared to competitive products or otherwise). Our micro-crop production system requires our customer licensees to incur large fixed capital costs, which could render the system cost prohibitive for prospective customer licensees. A failure to secure customer licensees in a timely manner could have a material adverse effect on our business, financial condition and results of operations.

We have yet to construct our technology on a commercial scale, and may be unable to solve technical and engineering challenges that would prevent our technology from being economically attractive to prospective customer licensees.

Although we have successfully built a fully operational demonstration facility (approximately one hectare) and have extracted small field-scale quantities of LPC, LM and Biocrude for technical validation, we have not demonstrated that our technology is viable on a commercial scale, which we define to mean an operation consisting of at least 150 hectares. All of the tests conducted to date by us with respect to our technologies have been performed on limited quantities of micro-crops, and we cannot provide any assurances that the same or similar results could be obtained at competitive cost on a large-scale commercial basis. We have never utilized this technology under the conditions or in the volumes that will be required to be profitable and cannot predict all of the difficulties that may arise. While our bioreactors are modular in design, a single commercial-scale facility would be substantially larger than our demonstration facility, and the implementation of our technology on that scale will require further research, development, design and testing. Such an undertaking involves significant uncertainties, and consequently the construction of a commercial-scale facility may face delays, failures or unexpected costs. Furthermore, we may not be able to successfully design a scalable, cost-effective system for the growth and harvesting of micro-crops.

In addition, once a customer licensee begins to scale up and replicate such a system, unforeseen factors and issues may arise which make any such system uneconomical, thus causing additional delays or outright failure. The production of LPC and LM from micro-crops involves complex outdoor aquatic systems with inherent risks, including weather, disease, and contamination. As a result, the operations of our customer licensees may be adversely affected from time to time by climatic conditions, such as severe storms, flooding, dry spells and changes in air and water temperature or salinity, and may also be adversely affected by pollution and disease. Any of these or other factors could cause production at commercial-scale operations to be significantly below those we project based on results we have achieved at our demonstration facility. Because we expect to rely on license fees and royalties for our revenues, any operational difficulties experienced by our customer licensees would have an adverse effect on our revenues and profitability, and such effects could be material.

If we encounter significant engineering or other obstacles in implementing our technology at commercial scale, or if our customer licensees experience significant operational difficulties, our business, financial condition, and results of operations could be materially adversely affected.

18

Table of Contents

The market may not accept the end-products produced by our technology.

The biomass produced by our micro-crop production system produces several end-products: principally LPC, LM and Biocrude. The commercial viability of our technology largely depends on the ability of our customer licensees to sell these end-products into existing markets.

It has yet to be proven that potential buyers for the specific end-products produced by our technology, such as feed companies, would ultimately purchase the end-products produced by our customer licensees. For example, market acceptance of our LPC and LM will be a function, among others, of digestibility and palatability (the assessment of which will require additional laboratory and field study). Should these studies not proceed favorably, the market for our LPC and LM may not materialize or could be materially diminished. Failure to establish such a market or any significant reduction in a customer licensee’s profitability would decrease the amount of any royalties we would otherwise receive and may result in their failing to pay us expected licensing fees. Any of these events may have a material adverse effect on our business, financial condition and results of operations.

The revenue and returns we believe our customer licensees will realize from our technology will be highly dependent on the market price of the end-products produced using our technology.

The economic viability of our technology depends on the ability of our customer licensees to generate sufficient revenues from the sale of LPC, LM and other potential end-products of our technology. These revenues, and the internal rates of return our customer licensees can expect from their investment in our technology, are sensitive to the market prices of these products. Should our customer licensees be unable to obtain an adequate price for these products, their profits would be lower than expected and they might incur losses.

If our customer licensees cannot operate at a reasonable level of profit or incur losses, they might cease operations, which would result in our losing license fees and royalty payments. In such a circumstance, it is also likely that we would face significant difficulties attracting new customer licensees. Either or both outcomes would likely have a materially adverse effect on our business, financial condition and results of operations.

The end-products produced by our technology are subject to industry and regulatory testing.

The end-products produced by our technology generally require industry or regulatory testing in the countries in which they are produced or sold. For example, LPC requires regulatory approvals before it can be used in animal feed or for human consumption. To date, we have obtained approval for the use of LPC in animal feed only in Indonesia. Regulatory approvals in other jurisdictions will be essential to the commercial viability of our technology. In addition, we have not yet submitted LPC’s application for human consumption for regulatory approval in any jurisdiction. Such approvals could take several years or longer to obtain, if they can be obtained at all. See “Business—Regulatory.”

Should the end-products produced by our technology fail to meet industry or regulatory requirements, there would be an adverse effect on the ability of our customer licensees to market the products of their micro-crop operations, which would adversely affect their profitability. Since we expect to rely on licensing fees and royalties for the substantial majority of our revenues, such events would also materially adversely affect our business, financial condition and results of operations. See “Business—Regulatory.”

19

Table of Contents

The assumptions underlying the projected revenues and profitability of our license units that we develop in conjunction with our customer licensees are inherently uncertain and are subject to significant business, economic, financial, regulatory and competitive risks and uncertainties that could cause our customer licensees’ actual results to differ materially from those projected.

The projected revenues and returns on investment of our license units that we develop in conjunction with our customer licensees are based on assumptions relating to construction costs and other capital costs associated with building a unit, operating expenses and productivity, end-product price ranges and numerous other assumptions, all of which are inherently uncertain and are subject to significant business, economic, meteorological, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those projected. If our license units do not achieve the projected results, our customer licensees may not generate revenues or profits sufficient for them to continue operating license units or the revenues that we receive from such license units may be significantly less than we anticipate. Any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

If a competitor were to achieve a technological breakthrough, our financial condition, results of operations and business could be negatively impacted.

There currently exist a number of businesses that are pursuing the use of algae, bacteria and other micro-crops and other methods for creating biomass, food and feed products, and alternative fuels. Should a competitor achieve a research and development, technological or biological breakthrough with significantly lower production costs, or if the costs of similar competing products were to fall substantially, we may have difficulty attracting customer licensees. In addition, competition from other technologies considered “green technologies” could decrease the demand for the end-products produced by our technology. Furthermore, competitors may have access to larger resources (capital or otherwise) that provide them with an advantage in the marketplace, which could result in a negative impact on our business, financial condition and results of operations.

Any competing technology that produces biomass of similar quality and on a more efficient cost basis than ours could render our technology obsolete. In addition, because we do not have any issued patents, we may not be able to preclude development of even directly competing technologies using the same methods, materials and procedures as we use to achieve our results. Any of these competitive forces may inhibit or materially adversely affect our ability to attract and retain customer licensees, or to obtain royalties or other fees from our customer licensees. This could have a material adverse effect on our financial condition, results of operations and business.

If we fail to establish, maintain and enforce intellectual property rights with respect to our technology, our financial condition, results of operations and business could be negatively impacted.

Our ability to establish, maintain and enforce intellectual property rights with respect to the technology that we license to our customer licensees will be a significant factor in determining our future financial and operating performance. We seek to protect our intellectual property rights by relying on a combination of patent, trade secret and copyright laws. We also use confidentiality and other provisions in our agreements that restrict access to and disclosure of our confidential know-how and trade secrets.

We have filed patent applications with respect to many aspects of our technologies, including those relating to our bioreactors, growth management systems and downstream processing technologies. However, we cannot provide any assurance that any of these applications will ultimately

20

Table of Contents

result in issued patents or, if patents are issued, that they will provide sufficient protections for our technology against competitors. See “—Although we have filed patent applications for some of our core technologies, we do not currently hold any issued patents and we may face delays and difficulties in obtaining these patents, or we may not be able to obtain such patents at all.”

Outside of these patent applications, we seek to protect our technology as trade secrets and technical know-how. However, trade secrets and technical know-how are difficult to maintain and do not provide the same legal protections provided by patents. In particular, only patents will allow us to prohibit others from using independently developed technology that is similar. If competitors develop knowledge substantially equivalent or superior to our trade secrets and technical know-how, or gain access to our knowledge through other means such as observation of our technology that embody trade secrets at customer sites which we do not control, the value of our trade secrets and technical know-how would be diminished.

While we strive to maintain systems and procedures to protect the confidentiality and security of our trade secrets and technical know-how, these systems and procedures may fail to provide an adequate degree of protection. For example, although we generally enter into agreements with our employees, consultants, advisors, customer licensees and strategic partners restricting the disclosure and use of trade secrets, technical know-how and confidential information, we cannot provide any assurance that these agreements will be sufficient to prevent unauthorized use or disclosure. In addition, some of the technology deployed at our customer sites which we do not control, may be readily observable by third parties who are not under contractual obligations of non-disclosure, which may limit or compromise our ability to continue to protect such technology as a trade secret.

Although we seek to secure intellectual property rights with respect to our technology where such rights are available, certain aspects of our technology cannot be protected as intellectual property. For example, unlike certain other companies operating in the alternative energy or biofuel industry, our technology does not involve the creation or use of manufactured or genetically engineered organisms. The micro-crops that our processes ultimately convert to LPC, LM and Biocrude are naturally-occurring species indigenous to the environments in which our customer licensees operate. Since we do not have, and cannot obtain, intellectual property rights with respect to these species, and consequently other companies are free to develop competing technologies to grow these organisms, it is important that we secure and protect our intellectual property rights in the technology that we license to customer licensees, including our processes and system for growing micro-crops at an optimal rate. If we fail to secure and protect these rights, other companies will be able to freely copy or otherwise reproduce our technology, which may in turn cause us to lose customer licensees and prospective customer licensees to those competitors.

While we are not currently aware of any infringement or other violation of our intellectual property rights, monitoring and policing unauthorized use and disclosure of intellectual property is difficult. If we learned that a third party was in fact infringing or otherwise violating our intellectual property, we may need to enforce our intellectual property rights through litigation. Litigation relating to our intellectual property may not prove successful and might result in substantial costs and diversion of resources and management attention.

From our customer licensee’s standpoint, the strength of the intellectual property under which we grant licenses can be a critical determinant of the value of these licenses. If we are unable to secure, protect and enforce our intellectual property, it may become more difficult for us to attract new customer licensees. Any such development could have a material adverse effect on our business, financial condition and results of operations.

21

Table of Contents

Although we have filed patent applications for some of our core technologies, we do not currently hold any issued patents and we may face delays and difficulties in obtaining these patents, or we may not be able to obtain such patents at all.

Patents are a key element of our intellectual property strategy. We have currently filed patent applications for six families of technologies, both in the United States and in foreign jurisdictions. These pending patent applications relate to, among other aspects of our technology, the design of our bioreactors, the physical and chemical treatment processes for biomass, our growth algorithms, multi-spectral cameras and imaging algorithms, the use of our processes to make Biocrude, LPC and LM, and our enterprise management system. Our patent applications are in the early stages and we have not received substantive feedback from relevant patent offices regarding the viability of our patent applications. It may take two or more years for any patents to issue from our applications, we cannot provide any assurance that any patents will ultimately be issued or that any patents that do ultimately issue will issue in a form that will adequately protect our commercial advantage.

Our ability to obtain patent protection for our technologies is uncertain due to a number of factors, including that we may not have been the first to make the inventions covered by our pending patent applications or to file patent applications for these inventions. We have not conducted any formal analysis of the prior art in the areas in which we have filed our patent applications, and the existence of any such prior art would bring the novelty of our technologies into question and could cause the pending patent applications to be rejected.