Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOMEAWAY INC | d263801d8k.htm |

J.P. Morgan

SMid Cap Conference

November 30, 2011

Exhibit 99.1 |

Confidential

© Copyright 2011 HomeAway, Inc.

Safe Harbor Statement

This presentation contains “forward-looking”

statements that are based on our management’s beliefs and assumptions and on

information currently available to management. Forward-looking statements include

information concerning our possible or assumed future results of operations, business

strategies, financing plans, competitive position, industry environment, potential growth

opportunities, potential market opportunities, the effects of competition and the effects of

the release of our IPO lock-up share trading restrictions.

Forward-looking statements include all statements that are not historical facts and can be

identified by terms such as “anticipates,” “believes,”

“could,”

“seeks,”

“estimates,”

“intends,”

“may,”

“plans,”

“potential,”

“predicts,”

“projects,”

“should,”

“will,”

“would”

or

similar expressions and the negatives of those terms. Forward-looking statements represent

our management’s beliefs and assumptions only as of the date of this presentation,

November 30, 2011. Forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different

from

any future results, performance or achievements expressed or implied by the

forward-looking statements. A detailed discussion of such risks and uncertainties

are contained in our prospectus, which was filed with the SEC on June 29, 2011, as well as with our

most

recent Form 10-q filed with the SEC on November 4, 2011. Except as required by

law, we assume no obligation to update these forward-looking statements publicly,

or to update the reasons actual results could differ materially from those anticipated in the

forward-looking statements, even if new information becomes available in

the future.

2 |

Travelers

To make finding, selecting and renting a

vacation home as easy as booking a hotel

Our Mission

To make every vacation rental in the world available to every traveler in the world

through our online marketplace

Vacation Rental Owners/Managers

To be their most effective marketing partner

and #1 source of bookings

3

Confidential ©

Copyright 2011 HomeAway, Inc. |

Confidential

© Copyright 2011 HomeAway, Inc.

Headquartered in Austin, TX

145+ countries, 11 languages

905

employees

¹

625,000+

listings

²

The World’s Largest Vacation Rental Marketplace

4

Owners/managers pay ~$300

to list properties

Free for travelers

~90%+ annual subscription revenues

Key Facts

Simple Business Model

120

82

54

18

168

2006

2007

2008

2009

2010

32

(1)

24

34

51

2006

2007

2008

2009

2010

($MM)

($MM)

Revenues

Free Cash Flow

1

As of 9/30/2011

2

Paid vacation rental listings as of 9/30/2011

3

Includes Headquarter CapEx of $4.9MM

3 |

Clear market

leader with powerful global footprint Strong network effects and significant

competitive advantages Industry disruption provides numerous growth opportunities

Large, highly fragmented vacation rental industry presents huge opportunity

Rapidly growing, highly predictable and profitable subscription-based business

model Compelling

value

proposition

for

vacation

rental

owners/managers

and

travelers

Why Invest in HomeAway?

5

Confidential ©

Copyright 2011 HomeAway, Inc. |

Confidential

© Copyright 2011 HomeAway, Inc.

6.1 Million

0.2 Million

US and Europe

Number of Properties

Not

Rented

13.5MM

Rented

6.1MM

HomeAway

Listings

(625K+)

¹

Vacation

Rentals

19.6MM Vacation Homes

US and Europe

Highly Fragmented Supplier Base Ideal

for Market Maker

6.1MM Properties

16 Average Weeks Rented per Year

x

~$85

Billion

²

Hotels

Transforming an $85Bn, Highly Fragmented Industry

6

$882 Average Rental Rate

x

1

Global paid vacation rental listings as of 9/30/2011

2

According to November 2010 Radius Global Market Research survey titled “Market Sizing

Study” |

~15.0%

2.5%

Vacation Rentals

Hotels

Take Rate

HomeAway Addressable Market

$85 Billion Industry

x

$8.5 Billion

10% Take Rate

Supply

Demand

Services

Key Players in Value Chain

Platform Player With Significant Addressable Market

7

Confidential ©

Copyright 2011 HomeAway, Inc. |

Confidential

© Copyright 2011 HomeAway, Inc.

Annual Listing Fee

Estimated Annual

Rental Income

Outstanding Value Creation

~$335

¹

~40x:

Estimated ROI for

Owners/Managers

Strong

Growth

in

Listings

²

Outstanding Value Proposition for Owners/Managers

8

~$13,000

(000’s)

1

As of 9/30/2011

2

Paid vacation rental listings as of 12/31 each year |

Wider

Selection Lower Total Cost

Additional Space

Increased Privacy

Multiple Bedrooms

Multiple Bathrooms

Personal Kitchen

Common Living Areas

Private Swimming Pools

Compelling Value Proposition for Travelers

9

Example:

Family Trip

to Disney

4 bedroom house in Orlando

3,000 sq.ft. plus private pool

$214/night

or

$1,500/week

Vacation Rental

Hyatt Regency, Orlando

400 sq.ft., 2 beds, 1 bath

$300/night or $2,100/week

Hotel

“A greatly increased use of apartments and vacation homes in place of standard hotels

is the most pronounced trend in travel…”

Arthur Frommer, December 13, 2010

Confidential ©

Copyright 2011 HomeAway, Inc. |

Global Vision

and Platform 10

U.S.

Germany

France

U.K.

Italy

Brazil

Market Leader

Brand Portfolio

19

countries

with

dedicated

HomeAway websites

145

countries

with

vacation

rentals

listed on HomeAway websites

7 countries

with

HomeAway offices

Travel is a Global Experience for Consumers

International HomeAway Websites

Confidential ©

Copyright 2011 HomeAway, Inc.

United Kingdom

Canada

Spain

Argentina

Brazil

Sweden

Austria

Finland

France

Australia

Portugal

India

Italy

Norway

Columbia

Denmark

Germany

Mexico

The Netherlands |

884

1,048

1,139

1,269

1,559

1,411

Q2’10

Q3’10

Q4’10

Q1’11

Q2’11

Q3'11

Proprietary, Trusted Platform

11

270

¹

customer

service

personnel

Proprietary mix of cutting-edge technology

and business processes

Property Reviews

(000’s)

Commitment to Trust & Security

1

As of 9/30/2011

Confidential ©

Copyright 2011 HomeAway, Inc. |

Confidential

© Copyright 2011 HomeAway, Inc.

Network Effect is the Greatest Competitive Advantage

Owners/Managers

Easy to get started

Income from your vacation home

Dedicated help and support

Travelers

More space

More privacy

Better value than hotels

Global Presence

Trust and Security

Product and

Technology Innovation

Marketing

12 |

Confidential

© Copyright 2011 HomeAway, Inc.

Multiple Growth Drivers

13

Increase

Number of Listings

x

Base Price

Market-Based /

Tiered Pricing

Cross-selling /

add-ons

Best User Experience

Property Manager Channel

Awareness Marketing

New Geographies

Online Payments

Online Bookings

Traveler Products

Reflected in…

Increase

Revenue Per Listing

Average Revenue

per Listing

Other

Revenue

Through… |

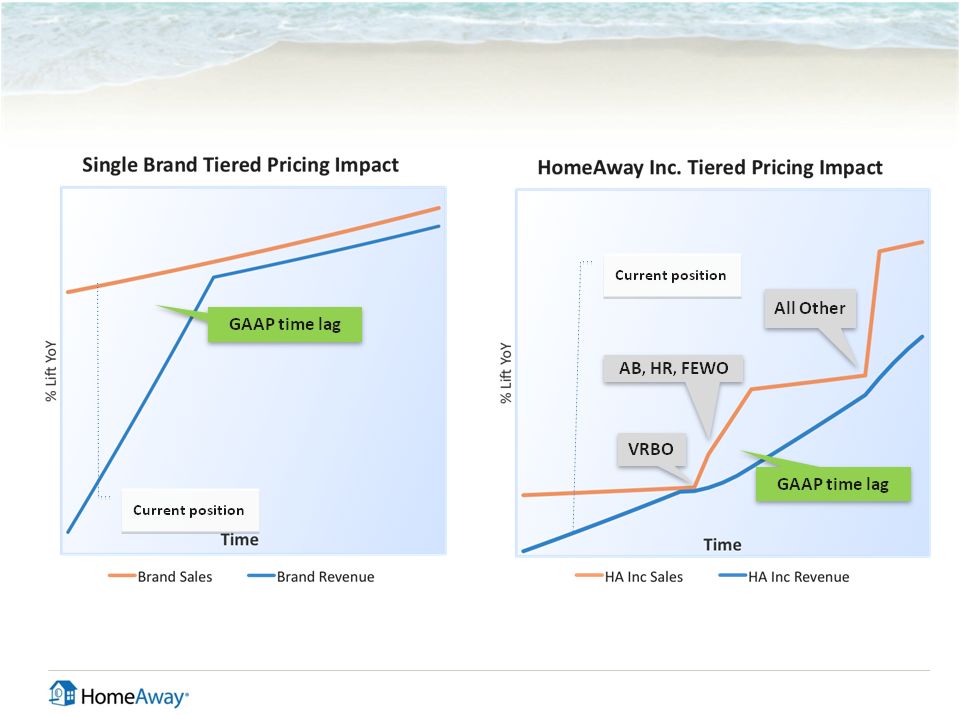

Tiered Pricing

Illustration 14

Confidential ©

Copyright 2011 HomeAway, Inc. |

Payments and

Ancillary Products Illustration 15

Confidential ©

Copyright 2011 HomeAway, Inc. |

Delivering

Against Long-Term Strategy Phase I = ’05-’10

Consolidation

Phase II = ’07-’11

Professionalization

Phase III = Now

Optimization

Phase IV = Future

Going Mainstream

World-Class

Capabilities

Operations

•

General management

•

SEO

•

Marketing

•

Sales

•

M&A

•

Customer service

Product

•

Agile development

•

Global teams

•

Secure IT

Single Network

•

Non-cyclical

•

Disciplined approach

to adding cost

Secure and Stable

Profit Model

•

Price-to-value

•

Regional/global

distribution packages

•

Payments and online

booking

•

Traveler products such

as insurance

•

OTA distribution

Future

Monetization

e-Commerce

World-Class

User Experience

16

The catalyst for the

travel industry’s #1

consumer trend

•

Marketing Leadership:

viral/social, broad

reach, and

nontraditional

•

Supply Leadership:

migrating offline renters

online

Confidential ©

Copyright 2011 HomeAway, Inc. |

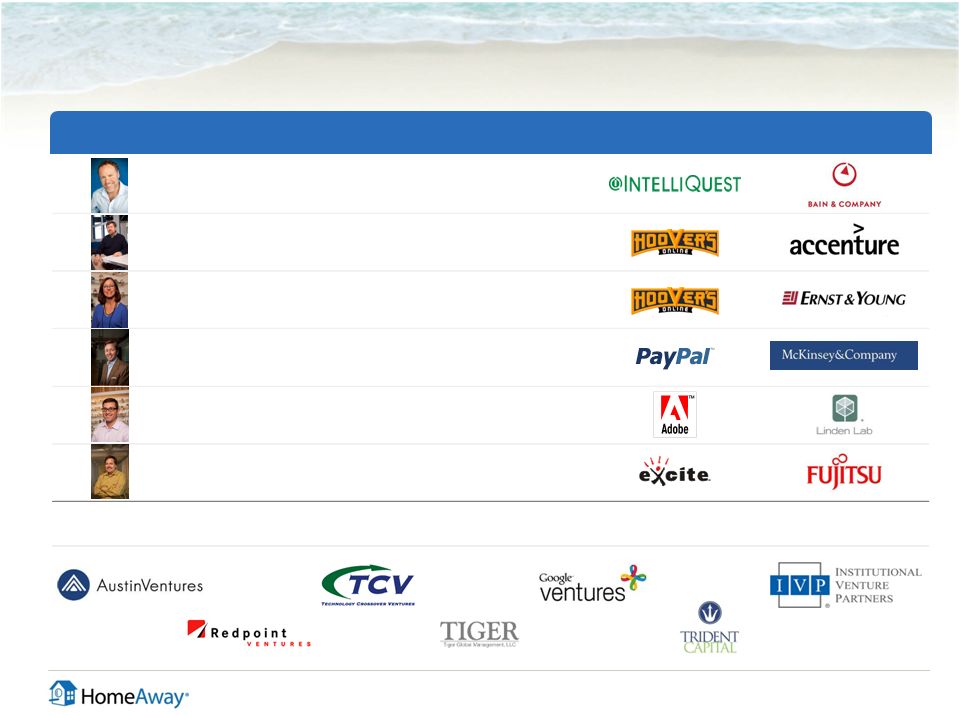

Blue-Chip

Investors World-Class Management Team and Investors

17

Highly Experienced Management Team

Previous Experience

Brian Sharples

Co-founder, President &

Chief Executive Officer

Carl Shepherd

Co-founder,

Chief Strategy Officer

Lynn Atchison

Chief Financial Officer

Brent Bellm

Chief Operating Officer

Tom Hale

Chief Product Officer

Ross Buhrdorf

Chief Technology Officer

Confidential ©

Copyright 2011 HomeAway, Inc. |

Confidential

© Copyright 2011 HomeAway, Inc.

Predictable, Profitable, Cash-Rich Business Model

18

Predictable

Free Cash Flow

Profitable

Subscription-Based Revenue Model

High Renewal Rates (75%+)

Leveraged Cost Structure

High Degree of Control over Margins

Annual Up-front Cash (~90%)

Low Capital Expenditures |

Confidential

© Copyright 2011 HomeAway, Inc.

0

10

20

30

40

50

60

3Q’08

4Q’08

1Q’09

2Q’09

3Q’09

4Q’09

1Q’10

2Q’10

3Q’10

4Q’10

1Q’11

2Q'11

3Q'11

Revenue

($MM)

Strong and Consistent Revenue Growth

19 |

Confidential

© Copyright 2011 HomeAway, Inc.

Rest of World

2%

76%

73%

74%

2008

2009

2010

Strong Renewal

Globally

Diversified

¹

13%

Subscription-Driven

¹

Europe

United States

Other

Listings

87%

36%

62%

Recurring and Diversified Revenue Streams

20

1

As of 9/30/2011 |

Confidential

© Copyright 2011 HomeAway, Inc.

30.6

43.2

34.1

50.0

24.8

2008

2009

2010

9 MOS.

2010

9 MOS.

2011

High EBITDA margins

Operating leverage from scale

Efficient operating expenses

Highly Efficient Operating Model with Strong Cash Flows

21

% Margin

32%

30%

25%

28%

29%

Adjusted EBITDA

($MM)

Free Cash Flow

($MM)

Seasonality

Best financial indicator

Low capital expenditures

33.9

48.6

38.5

51.5

32.3

2008

2009

2010

9 MOS.

2010

9 MOS.

2011

CapEx:

$4.5

$12.6

$10.4

$6.1

$8.9

1

2009 CapEx includes Leasehold Improvement Additions (Headquarter CapEx) of $4.9MM 1 |

Confidential

© Copyright 2011 HomeAway, Inc.

Average Revenue per Listing Trend

22

Influenced by…

$290

$298

$314

$311

$328

$339

$335

$250

$275

$300

$325

$350

1Q'10

2Q'10

3Q'10

4Q'10

1Q'11

2Q'11

3Q'11

Pricing changes

Entry into new markets

Short season products

Revenue recognition policy |

Confidential

© Copyright 2011 HomeAway, Inc.

Clear market leader with powerful global footprint

Strong network effects and significant competitive advantages

Industry disruption provides numerous growth opportunities

Large, highly fragmented vacation rental industry presents huge opportunity

Rapidly growing, highly predictable and profitable subscription-based business

model Compelling

value

proposition

for

vacation

rental

owners/managers

and

travelers

Why Invest in HomeAway?

23 |

Confidential

© Copyright 2011 HomeAway, Inc.

Appendix

24 |

Confidential

© Copyright 2011 HomeAway, Inc.

IPO Lock-up Expiration Impact to Shares Outstanding

25

1

Excludes vested options of approximately 5.5 million

Common Stock Outstanding

Float

Lock Up Release

12/26/11

Black Out

Release Feb.

2012

Publicly-held shares

9.2

Board and C-Team

52.9

1

Current employees & consultants

0.9

1

Former Employees

1.0

Other

16.5

9.2

17.5

53.8

% of Outstanding

11.4%

21.8%

66.8%

Breakdown of Other

Tiger, Trident & Google

8.6

~ 3 unrelated

Former Owners of Websites Purchased

5.2

~ 16 unrelated

Other

2.7

~ 25 unrelated |