Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SVB FINANCIAL GROUP | d262280d8k.htm |

J.P. Morgan SMID

Cap Conference December 1, 2011

Greg Becker, President & CEO

Exhibit 99.1 |

| The presentations

made at today’s meeting contain projections or other forward- looking statements

regarding management’s expectations about the future events or the future financial

performance of the Company, as well as future economic, market and tax conditions.

Forward-looking statements are

statements that are not historical facts.

We wish to caution you that such

statements are just predictions and actual events or results may

differ materially,

due to changes in economic, business and regulatory factors and trends.

We refer you to the documents the Company files from time to time with the

Securities and Exchange Commission, specifically the Company’s latest Annual

Report on Form 10-K for the year ended December 31, 2010, which was filed on

February 25, 2011, and our latest Quarterly Report on Form 10-Q.

These

documents contain and identify important risk factors that could

cause the

Company’s actual results to differ materially from those contained in our

projections or other forward-looking statements.

All subsequent written or oral

forward-looking

statements

attributable

to

the

Company

or

persons

acting

on

its

behalf are expressly qualified in their entirety by these cautionary statements. All

forward-looking statements included in this presentation are made only as of

today’s date and the Company undertakes no obligation to update such forward-

looking statements.

Safe Harbor Disclosure

2 |

SVB’s

Unique Model Strong Performance

Growth Initiatives

Outlook

Overview

3 |

A Unique

Financial Services Company Differentiated business model

•

Focus on “innovation”

markets

•

Balance sheet lender

•

Strong deposit franchise

•

Diversified revenue streams

Leader

•

Leading market share

•

More than 600 venture firm clients

•

The bank for innovation companies

Established

(1)

•

26 U.S. and seven international offices

•

12,000+ clients and 1,500+ employees

•

$19.2 billion in total assets

•

$34.8 billion in total client funds

(2)

4

(1) As of 9/30/11.

(2) Total client funds includes deposits and off-balance sheet client investment

funds. |

An Expansive

Financial Services Platform SVB PRIVATE BANK

(Private Banking)

•

Customized loan solutions

for select clients

•

Residential mortgages

•

Deposit services

•

Global ATM access

•

Elite cards

S

ILICON

V

ALLEY

B

ANK

(Commercial Banking)

•

Lending

•

Global Treasury

Management

•

Global Finance

•

Foreign Exchange

•

Investment Solutions

•

Elite cards

SVB GLOBAL

(Global Markets)

•

Global Commercial

Banking

•

Help clients access foreign

markets and opportunities

•

UK, China, Israel and

India

SVB ANALYTICS

(Analytics/Benchmarking)

•

Private company

409A valuations

•

Corporate equity mgmt.

•

Stock option expense

solutions

•

Corporate performance

benchmarking SVB CAPITAL

(VC Funds Management)

•

$1.0B+ fund family

•

Investments in 450+ funds domestically and internationally

5 |

Strong Q3 2011

Performance Outstanding

loan growth

Continued high

credit quality

Stable net interest

margin

Solid warrant and

VC fund gains

Robust net

interest income

growth

Strong client

transaction

volumes

Continued deposit

growth

Positive conditions

in client markets

Total client

liquidity at all-

time high *

6

•Total client liquidity includes

deposits and off-balance sheet client investment funds. |

27% Annual Growth

in Net Interest Income in 2011 Millions

NIM

7

All-time high |

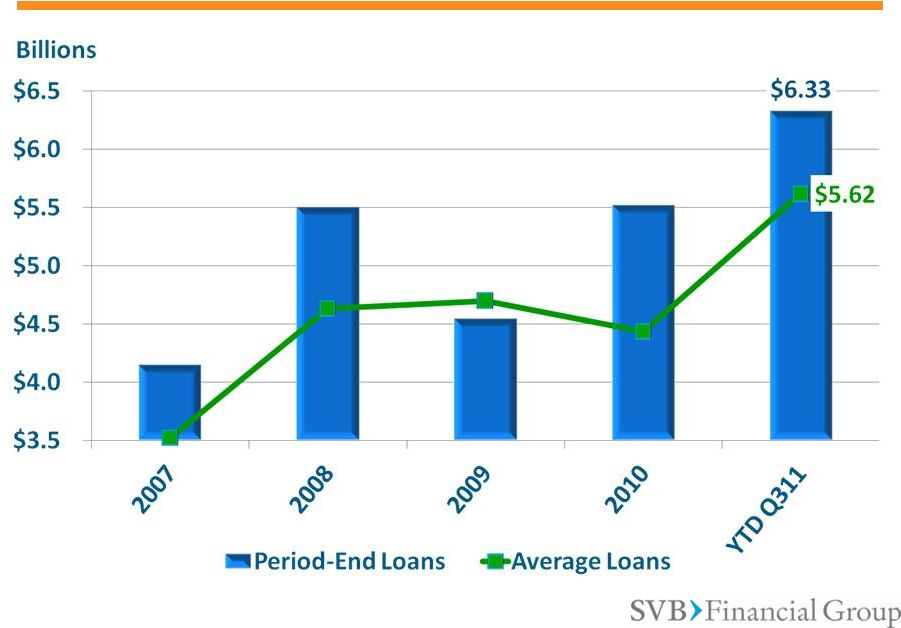

Growth in Average

Loans of 23% Since Q308 8

Growth Drivers

•

Resilience of innovation

sector and our clients

•

Growing pervasiveness

of technology

•

Growth initiatives:

o

U.S. domestic

o

Segmentation

o

Private Bank

o

Global

•

M&A market activity

among our clients

Billions

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

Period-end Loans

Average Loans |

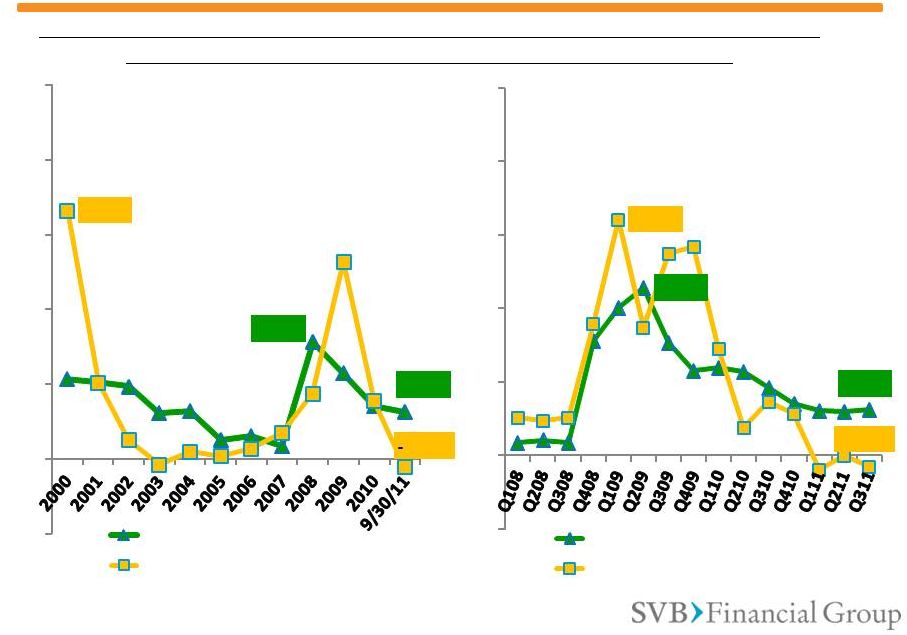

Solid Credit

Quality Through Cycles 9

Loss experience through multiple cycles suggests diversity and resilience of

“innovation”

industries results in little “concentration risk.”

-1%

0%

1%

2%

3%

4%

5%

NPLs as % of Total Gross Loans

NCOs as % of Total Gross Loans

3.32%

0.63%

0.11%

-0.15%

-1%

0%

1%

2%

3%

4%

5%

NPLs as % of Total Gross Loans

NCOs as % of Total Gross Loans

2.28%

3.21%

0.63%

1.57% |

Powerful Deposit

Franchise 10

Billions

$34.8

Organic Factors

•

Highly liquid clients

•

Clients performing well

•

New client acquisition

Other Factors

•

Safety of the balance

sheet (unlimited FDIC

insurance)

•

Low rate environment

$18.7

$16.1

$40

$35

$30

$25

$20

$15

$10

$5

$0

Period-End

Deposits

Period-End Client Investment Funds |

Diversified

Growth Across the Business 11

GLOBAL MARKETS & REACH

GLOBAL PLATFORM

New Global Core

Banking System

IT Backbone

Upgrade

Enhanced Global

Payment System

Enhanced On-

line/Mobile Systems

PRODUCT LINES

Expanded Banking

Network

New Debit & Credit

Cards

New Products &

Services

Enhanced Credit

Solutions

CLIENT NEEDS

Client Experience

Corporate Finance

Segment

Growth Segment

Private Bank

UK and Europe

India

China

Israel |

Expecting Solid

Performance in 2012 12

Business Driver

Preliminary 2012 Outlook

vs. 2011

(1)

Average loans

Mid-teens % growth

Gross loan charge-offs

40-70 bps of average total gross

loans

Net interest income

~10% growth

“Core”

(2)

fee income

Mid single digit % growth

Expenses

Mid to high single digit %

growth

(1)

Change estimates relative to expected 2011 full-year results; outlook is preliminary as of

October 20, 2011, and may change.

(2)

“Core” is defined as fees for deposit services, letters of credit, business credit

card, client investment, and foreign exchange, in aggregate. |

|

Appendix

1)

Financial Results

15

•

Highlights

16

•

Loans & Credit Quality

18

•

Client Liquidity

21

•

Balance Sheet

22

•

Sensitivity Charts

23

•

Capital Ratios

25

2)

Growth Initiatives

27

3)

Venture Capital Markets

31

4)

Non-GAAP Reconciliations

34 |

Financial

Results 15

Appendix |

Financial

Highlights: Q310 – Q311

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Diluted Earnings Per Share

$0.89

(3)

$0.41

$0.76

$1.50

(1)(2)

$0.86

Net Income Available to

Common Stockholders

$37.8M

(3)

$17.5M

$33.0M

$65.8M

(1)(2)

$37.6M

Average Loans

(Change)

$4.5B

(+9.4%)

$5.0B

(+11.3%)

$5.3B

(+6.1%)

$5.5B

(+4.2%)

$6.0B

(+8.6%)

Average Deposits

(Change)

$11.9B

(+0.1%)

$13.3B

(+11.6%)

$14.7B

(+10.3%)

$15.3B

(+4.1%)

$15.8B

(+3.5%)

Net Interest Margin

3.14%

2.74%

2.96%

3.13%

3.13%

Net Interest Income

$106.3M

$104.5M

$120.3M

$130.5M

$135.5M

Non-Interest Income

$86.2M

(3)

$71.9M

$90.0M

$123.7M

(1)

$95.6M

Net (Recoveries) Charge-

Offs/Total Average Gross

Loans

0.73%

0.57%

(0.19%)

(6)

0.00%

(5)

(0.15%)

(4)

Non-Interest Expense

$104.2M

$115.9M

$117.4M

$121.0M

(2)

$127.5M

(4)

Represents net recoveries of $2.3M.

(5)

Represents net charge-offs of $30K.

(6)

Represents net recoveries of $2.5M.

(1)

Includes gains of $0.51/share or $22.5M (net of tax) from sales of AFS securities.

(2)

Includes gains of $0.04/share or $1.9M (net of tax) from the early extinguishment of

debt and the termination of corresponding interest rate swaps.

(3)

Includes gains of $0.34/share or $14.2M (net of tax) from sales of AFS securities.

16

Appendix –

Financial Results (Highlights) |

Financial

Highlights: 2007 -2010 2007

2008

2009

2010

Diluted Earnings Per Share

$3.28

$2.16

$0.66

$2.24

Net Income Available to

Common Stockholders

$120.3M

$73.6M

$22.7M

$95.0M

Average Loans

(Change)

$3.5B

(+22.2%)

$4.6B

(+31.5%)

$4.7B

(+1.4%)

$4.4B

(-5.6%)

Average Deposits

(Change)

$4.0B

(+1.0%)

$4.9B

(+23.6%)

$8.8B

(+79.6%)

$12.0B

(+36.8%)

Average AFS Securities

$1.4B

$1.3B

$2.3B

$5.3B

Net Interest Margin

7.19%

5.72%

3.73%

3.08%

Net Interest Income

$375.8M

$368.6M

$382.2M

$418.1M

Non-Interest Income

$221.0M

$152.4M

$97.7M

$247.5M

Net Charge-Offs/Total Average

Gross Loans

0.35%

0.87%

2.64%

0.77%

Non-Interest Expense

$346.5M

$312.9M

$343.9M

$422.8M

17

Appendix –

Financial Results (Highlights) |

A

Well-Performing Loan Portfolio While strategically important, early-

stage has become a smaller portion

of our portfolio as a result of

growth in lending to larger

companies.

Our loan portfolio is focused but

well diversified

within technology

lending.

Total:

$6.3

billion

as

of

9/30/11

18

Appendix –

Financial Results (Loans)

Early-Stage

loans =

~9% of total

portfolio

(vs. ~30% in

2001) |

Loans Are at an

All-Time High 19

Appendix –

Financial Results (Loans) |

Credit Quality

Has Remained Strong 20

Appendix –

Financial Results (Credit Quality) |

Solid Franchise

With Consistent Growth 21

Billions

21

Appendix –

Financial Results (Assets)

•

Total client funds includes deposits and off-balance sheet client investment funds.

|

We Are Highly

Liquid (1)

As of 9/30/11.

(2)

Net of non-controlling interests, non-marketable securities were $346.4 million.

Non-GAAP number. Please see non-GAAP reconciliations at end of presentation and

in our most recent financial releases for more information. Non-Marketable

Securities

(VC Investments)

(2)

22

Appendix –

Financial Results (Balance Sheet) |

Rate Increases

Will Benefit Us Significantly We

expect

each

25

bps

increase

in

the

Fed

Funds

rate

to

contribute

approximately

$6

–

$9

million

to

Net

Interest

Income*

* Tax-effected; estimates are based on static balance sheet and assumptions as of

9/30/11 Changes in

Fed Funds

Rate (basis

points)

Changes in

Net Interest

Income (tax

effected)

Incremental

EPS Effect

Incremental

ROE Effect

Net Interest

Margin Effect

+75

+19.1M

$0.44

+0.9%

+0.18%

+100

+$26.8M

$0.62

+1.3%

+0.25%

+200

+$67.3M

$1.56

+3.2%

+0.63%

+300

+$108.3M

$2.51

+5.0%

+1.01%

23

Appendix –Financial Results (Rate Sensitivity) |

Higher Loan

Balances Will Benefit Us * Estimates

are

based

on

static

balance

sheet

and

assumptions

as

of

9/30/11

We expect each $250 million increase in loan volume to

contribute approximately $0.23 to EPS*

Growth in

Overall Loan

Balances

($$)

Changes in

Net Interest

Income (tax

effected)

Incremental

EPS Effect

Incremental

ROE Effect

Net Interest

Margin

Effect

+250 million

+$9.7M

$0.23

+0.5%

+0.09%

+500 million

+$19.4M

$0.45

+0.9%

+0.18%

+750 million

+$29.1M

$0.68

+1.64%

+0.27%

+1 billion

+$38.8M

$0.90

+1.9%

+0.36%

24

Appendix –Financial Results (Rate Sensitivity) |

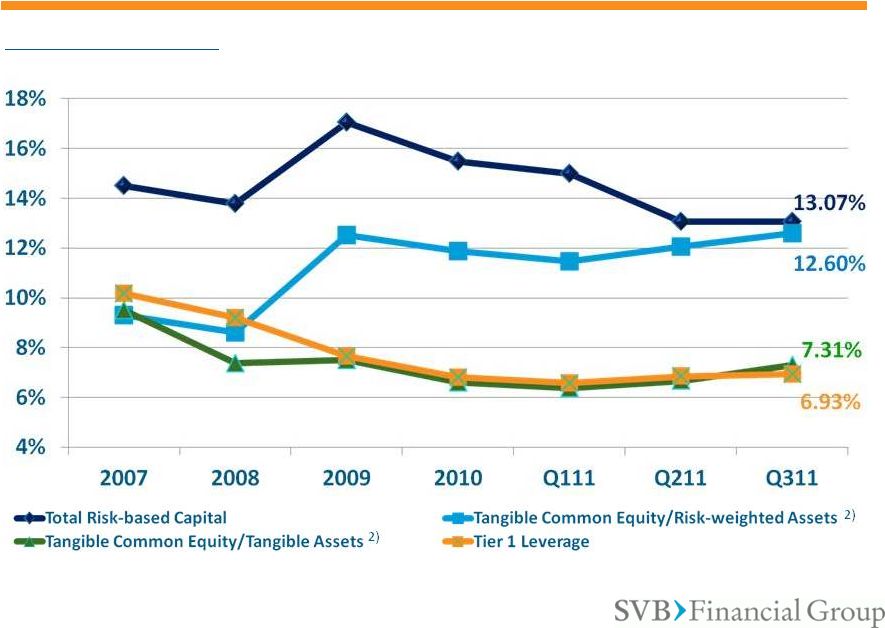

We Are Well

Capitalized 25

Appendix –Financial Results (Capital Ratios)

•

TCE/TA and TCE/RWA are non-GAAP numbers; please refer to Non-GAAP reconciliations at end

of presentation and in our most recent financial releases for more information.

Holding Company Capital Ratios |

We Are Well

Capitalized 2)

26

Appendix –Financial Results (Capital Ratios)

1)

All ratios, except TCE/TA and TCE/RWA are as reported in our most recent Bank Call

Reports. Bank TCE/TA and TCE/RWA ratios are as reported in our most recent financial releases.

2)

TCE/TA and TCE/RWA are non-GAAP numbers; please refer to non-GAAP reconciliations at end

of presentation and in our most recent financial releases for more information. Bank

Capital Ratios 1)

2) |

Growth

Initiatives 27

Appendix

–

Growth

Initiatives |

We’re

Supporting Clients At All Stages 28

Appendix

–

Growth

Initiatives

~50%

Market Share

10% –

12%

Market Share

< 10%

Market Share |

Prior to

2011

2011 -

2012

Long Term

Financial

Impact

-

Rep office

-

Loan

production

office

Branch and

full product

set

Subsidiary bank +

Europe; expansion

and growth

0-2 years

-

Rep Office

-

Funds

JV Bank and

related

activities

Subsidiary

Branch; expansion

and growth

3-5 years

-

Rep Office

-

Loan

production

office

Expansion and

growth

0-2 years

-

NBFC

-

Fund

Develop NBFC

Branch or

subsidiary

3-5 years

We Are Extending Our Platform Globally

29

29

Appendix

–

Growth

Initiatives |

Private

Bank •

Expanded private banking services

•

Tailored lending for influencers in the SVB

ecosystem

•

An advanced, easy-to-use, online platform

•

Support for clients’

success in all arenas:

business, family, life

30

Appendix –

Growth Initiatives |

Venture Capital

Markets 31

Appendix –

Venture Capital Markets |

Stabilizing VC

Markets 32

Appendix –

Venture Capital Markets

Source:

ThomsonReuters,

National

Venture

Capital

Association,

PricewaterhouseCoopers

-

MoneyTree |

Source:

ThomsonReuters,

National

Venture

Capital

Association,

PricewaterhouseCoopers

-

MoneyTree

33

Appendix –

Venture Capital Markets

Stabilizing VC Markets

Deal

Volume |

Non-GAAP

Reconciliations 34

Appendix –

Non-GAAP Reconciliations |

Non-GAAP

TCE/TA and TCE/RWA Reconciliation 35

Appendix –

Non-GAAP Reconciliations

September 30,

June 30,

March 31,

December 31,

December 31,

December 31,

December 31,

2011

2011

2011

2010

2009

2008

2007

GAAP SVBFG stockholders' equity

1,536,098

$

1,436,893

$

1,313,574

$

1,274,350

$

1,128,343

$

991,356

$

676,369

$

Less: intangible assets

650

709

749

847

665

1,087

1,632

Less: goodwill

-

-

-

-

-

4,092

4,092

Less: preferred stock

-

-

-

-

-

221,185

-

Tangible common equity (TCE)

1,535,448

$

1,436,184

$

1,312,825

$

1,273,503

$

1,127,678

$

764,992

$

670,645

$

GAAP total assets

19,195,363

$

19,366,735

$

18,618,266

$

17,527,761

$

12,841,399

$

10,018,280

$

6,692,171

$

Less: intangible assets

650

709

749

847

665

1,087

1,632

Less: goodwill

-

-

-

-

-

4,092

4,092

Tangible assets (TA)

19,194,713

$

19,366,026

$

18,617,517

$

17,526,914

$

12,840,734

$

10,013,101

$

6,686,447

$

Risk-weighted assets (RWA)

10,808,233

$

10,470,533

$

10,004,948

$

9,406,677

$

7,494,498

$

8,220,447

$

6,524,021

$

Tangible common equity to tangible

assets

8.00

%

7.42

%

7.05

%

7.27

%

8.78

%

7.64

%

10.03

%

Tangible common equity to risk-

weighted assets

14.21

13.72

13.12

13.54

15.05

9.31

10.28

Non-GAAP tangible common equity and

tangible assets (dollars in thousands,

except ratios)

SVB Financial

For additional non-GAAP disclosures, please refer to our latest Forms 10-Q and 10-K,

as well as our quarterly earnings releases. |

Non-GAAP

TCE/TA and TCE/RWA Reconciliation 36

Appendix –

Non-GAAP Reconciliations

September 30,

June 30,

March 31,

December 31,

December 31,

December 31,

December 31,

2011

2011

2011

2010

2009

2008

2007

GAAP stockholders' equity

1,317,325

$

1,216,268

$

1,107,544

$

1,074,561

$

914,068

$

695,438

$

586,949

$

Less: intangible assets

-

-

-

-

-

-

-

Tangible common equity (TCE)

1,317,325

$

1,216,268

$

1,107,544

$

1,074,561

$

914,068

$

695,438

$

586,949

$

GAAP total assets

18,016,695

$

18,227,021

$

17,397,095

$

16,268,589

$

12,186,203

$

9,419,440

$

6,164,111

$

Less: intangible assets

-

-

-

-

-

-

-

Tangible assets (TA)

18,016,695

$

18,227,021

$

17,397,095

$

16,268,589

$

12,186,203

$

9,419,440

$

6,164,111

$

Risk-weighted assets (RWA)

10,453,446

$

10,075,105

$

9,655,938

$

9,047,907

$

7,293,332

$

8,109,332

$

6,310,721

$

Tangible common equity to tangible

assets

7.31

%

6.67

%

6.37

%

6.61

%

7.50

%

7.38

%

9.52

%

Tangible common equity to risk-

weighted assets

12.60

12.07

11.47

11.88

12.53

8.58

9.30

Non-GAAP tangible common

equity and tangible assets (dollars in

thousands, except ratios)

Bank

For additional non-GAAP disclosures, please refer to our latest Forms 10-Q and 10-K,

as well as our quarterly earnings releases. |

Non-GAAP

Non-Marketable Securities Reconciliation 37

Appendix –

Non-GAAP Reconciliations

September 30,

2011

GAAP non-marketable securities

951,963

$

Less: noncontrolling interests in non-marketable securities

605,558

Non-GAAP non-marketable securities, net of noncontrolling interests

346,405

$

Non-GAAP non-marketable securities, net of noncontrolling interests

(dollars in thousands)

For additional non-GAAP disclosures, please refer to our latest Forms 10-Q and 10-K,

as well as our quarterly earnings releases. |

|