Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PEABODY ENERGY CORP | btu8k20111130.htm |

Investor Presentation

Investor PresentationNovember 2011

Statement on Forward-Looking Information

Statement on Forward-Looking InformationSome of the following information contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, and is intended to come within the safe-harbor protection provided by those sections.

Our forward-looking statements are based on numerous assumptions that the company believes are reasonable, but they are open to a wide range of uncertainties and business risks that may cause actual results to differ materially from expectations as of October 25, 2011. These factors are difficult to accurately predict and may be beyond the company's control. The company does not undertake to update its forward-looking statements. Factors that could affect the company's results include, but are not limited to: demand for coal in the United States and the seaborne thermal and metallurgical coal markets; price volatility and demand, particularly in higher-margin products and in our trading and brokerage businesses; impact of weather and natural disasters on demand, production and transportation; reductions and/or deferrals of purchases by major customers and ability to renew sales contracts; credit and performance risks associated with customers, suppliers, co-shippers, trading, banks and other financial counterparties; geologic, equipment, permitting and operational risks related to mining; transportation availability, performance and costs; availability, timing of delivery and costs of key supplies, capital equipment or commodities such as diesel fuel, steel, explosives and tires; successful implementation of business strategies, including our Btu Conversion and generation development initiatives; negotiation of labor contracts, employee relations and workforce availability; changes in postretirement benefit and pension obligations and funding requirements; replacement and development of coal reserves; availability, access to and the related cost of capital and financial markets; effects of changes in interest rates and currency exchange rates (primarily the Australian dollar); ability to fund, complete, and integrate Macarthur and other acquisitions; economic strength and political stability of countries in which we have operations or serve customers; legislation, regulations and court decisions or other government actions, including new environmental and mine safety requirements, changes in income tax regulations or other regulatory taxes; litigation, including claims not yet asserted; and other risks detailed in the company's reports filed with the Securities and Exchange Commission (SEC). The use of “Peabody,” “the company,” and “our” relate to Peabody, its subsidiaries and majority-owned affiliates.

EBITDA or Adjusted EBITDA is defined as income from continuing operations before deducting net interest expense, income taxes, asset retirement obligation expense, and depreciation, depletion and amortization. EBITDA, which is not calculated identically by all companies, is not a substitute for operating income, net income or cash flow as determined in accordance with United States generally accepted accounting principles. Management uses EBITDA as a key measure of operating performance and also believes it is a useful indicator of the company's ability to meet debt service and capital expenditure requirements.

2

Peabody Energy: Expanding Global Reach to Serve Coal's Supercycle

Peabody Energy: Expanding Global Reach to Serve Coal's SupercycleUnmatched international growth pipeline with major Australian and Asia projects

Largest position in fastest growing U.S. regions

Significant upside with earnings growth and multiple expansion

3

Peabody Platform Delivers Superior Margins in All Markets

Peabody Platform Delivers Superior Margins in All MarketsPeabody Gross Margins

2009

2010

YTD 2011

Well positioned in U.S. with highly-contracted production; increasing global volumes to serve expanding Asia-Pacific economies

Leading positions in low-cost U.S. regions of ILB and PRB

Australia expansions at Wilpinjong and Metropolitan targets cost benefits

Targeting process improvements and upgrades across the platform to manage costs

YTD data as of September 30, 2011. Peer group includes ACI, ANR, CLD, CNX and PCX for all periods; MEE and ICO for 2009 and 2010 only.

4

Peabody's Earnings Now Balanced with Australia

Peabody's Earnings Now Balanced with AustraliaPeabody continues transformation to global coal company

Multiple global initiatives increase earnings leverage to stronger international markets

2003 U.S. > 99%

2007 U.S. 83% Australia 17%

YTD 2011 U.S. 51% Australia 49%

Percentages represent share of Mining EBITDA. YTD information as of Sept. 30, 2011.

5

Global Coal Markets

Global Coal Markets World in Early Stages of Supercycle for Coal

World in Early Stages of Supercycle for Coal Asia Represents 90% of 4.4 Billion Tonne Coal Demand Growth

Coal Demand Growth 2009 - 2035 (Tonnes in Millions):

+50

+315

+1,080

+100

+2,220

+710

Coal Demand Growth 2009 - 2035 (Tonnes in Millions)

U.S. growth presented in short tons.

Source: World Energy Outlook 2011, International Energy Agency; Annual Energy Outlook 2011, Energy Information Administration; Peabody analysis.

7

Thermal Coal Market: Global Coal-Fueled Generation Growing Dramatically

Thermal Coal Market: Global Coal-Fueled Generation Growing DramaticallyNew Coal-Fueled Generation 2011 - 2020 (GW)

China 450

India 125

Other Asia 57

Others 26

Europe 25

USA 8

~700 GW of new/ announced generation requires more than 2 billion tonnes of new annual thermal coal supply over the next decade

Nearly 300 million tonnes of new coal demand for generation expected this year alone

Asia represents 90% of expected growth in new coal generation

Australia/Indonesia Expected to Supply Majority of Seaborne Thermal Growth

Source: Platts Worldwide Power Plant Database and Peabody analysis.

8

Metallurgical Coal Market: Use Expected to Rise >500 Million Tonnes by 2020

Metallurgical Coal Market: Use Expected to Rise >500 Million Tonnes by 2020Approximately 50 Million Tonnes of New Supply Required Each Year

Global Met Coal Demand (Tonnes in Millions)

2010 920

2015 1,185

2020 1,440

Growth

2015 ~30%

2020 ~60%

CAGR

2015 ~5%

2020 ~5%

Australia Expected to Supply Majority of Seaborne Metallurgical Coal Growth

Source: Peabody Global Energy Analytics.

9

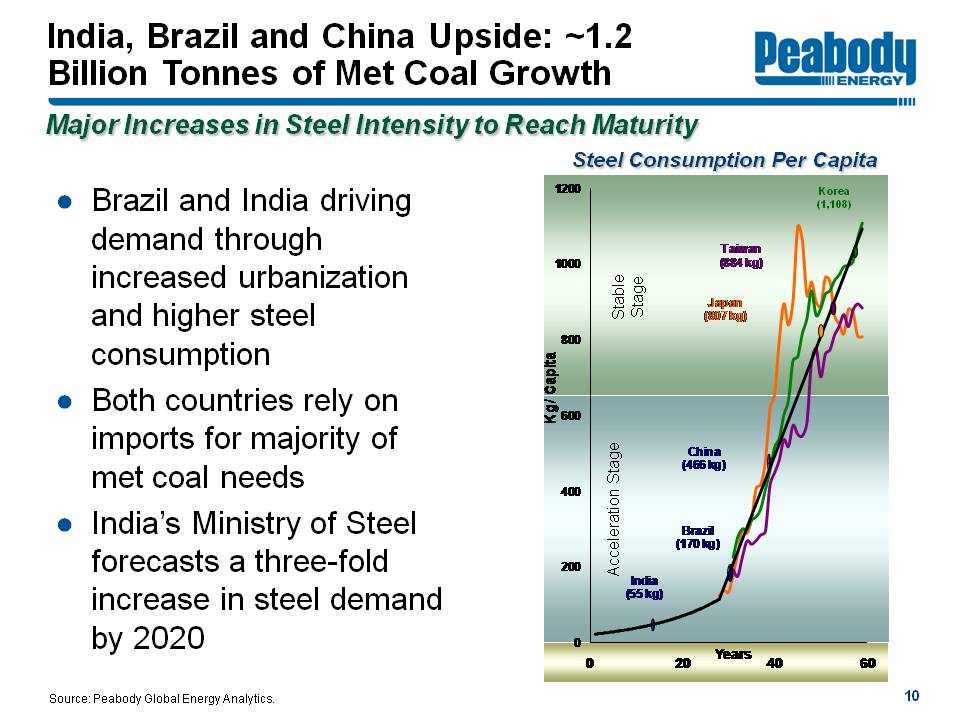

India, Brazil and China Upside: ~1.2 Billion Tonnes of Met Coal Growth

Major Increases in Steel Intensity to Reach Maturity

Brazil and India driving demand through increased urbanization and higher steel consumption

Both countries rely on imports for majority of met coal needs

India's Ministry of Steel forecasts a three-fold increase in steel demand by 2020

Steel Consumption Per Capita

Stable Stage

Japan 807kg

Taiwan 884kg

Korea 1,108

Acceleration Stage

India 55kg

Brazil170kg

China 466kg

Source: Peabody Global Energy Analytics.

10

U.S. Market: PRB and Illinois Basin Expected to Grow as Appalachia Declines

U.S. Market: PRB and Illinois Basin Expected to Grow as Appalachia DeclinesU.S. Demand Growth Moderate, Significant Shifts in Key Basins

CAPP challenged by permitting, geology, safety and significant increases in cost structure

PRB and ILB demand growing from new plants, increasing exports and fuel switching in Eastern markets

Ultra-low sulfur PRB demand expected to increase due to new EPA regulations

Expected U.S. Coal Demand Change 2010 - 2015

(Tons in Millions)

CAPP (45-55)

Other (10-15)

NAPP (5) - 5

ILB 45-55

PRB 60-70

Estimates based on Peabody analysis and industry reports. Includes exports.

11

Near-Term Global Coal Fundamentals Favor Peabody/Macarthur Portfolio

Near-Term Global Coal Fundamentals Favor Peabody/Macarthur Portfolio Largest YTD Inventory Drawdowns Since 1993

New Air Rules Likely to Lift Value of Ultra-Low Sulfur PRB Coal

Europe Raises Coal Use on Lower Nuclear Burn and High Gas Prices

India Thermal Coal Imports Up 40% YTD

Global Steel Production Up 8% YTD

Thermal Generation Up 14% YTD; Imports Running Above Prior Year Levels

Japan Utility Coal Use Recovering as Nuclear Use Shrinks to New Lows

Tight Australian Supply, Met & Thermal Prices Above 2010 Levels

Year-to-date information as of October 2011.

Source: Industry reports and Peabody analysis.

12

Peabody Targeting Multiple Growth Projects

Peabody Targeting Multiple Growth ProjectsEnergizing the world on BTU at a time

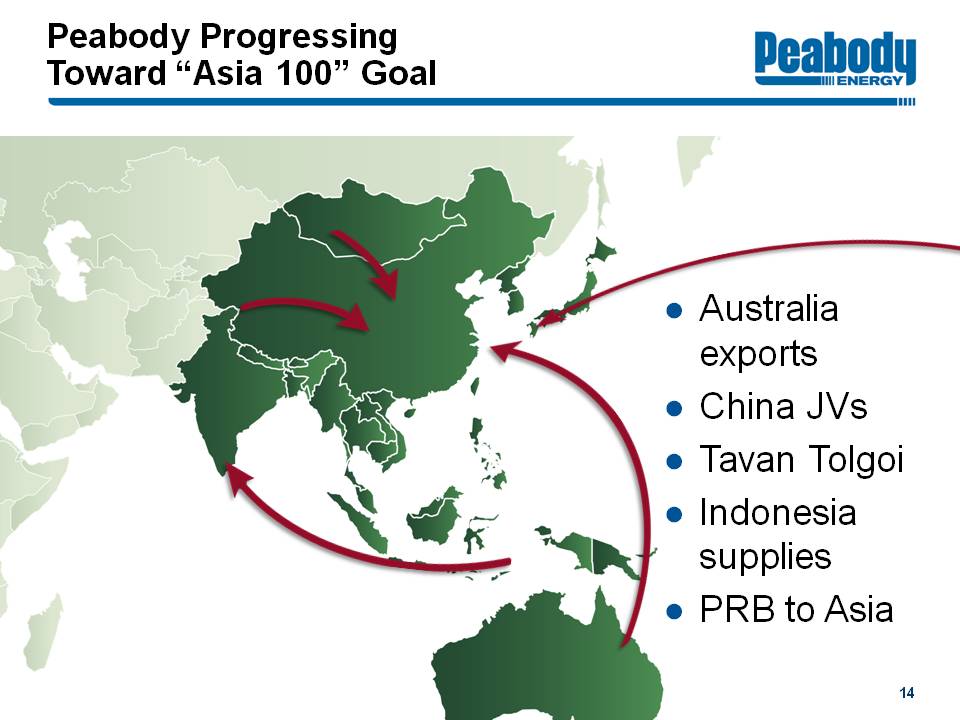

Peabody Progressing Toward “Asia 100” Goal

Peabody Progressing Toward “Asia 100” GoalAustralia exports

China JVs

Tavan Tolgoi

Indonesia supplies

PRB to Asia

14

Australia Platform Expanding Through Organic Growth and Macarthur Acquisition

Australia Platform Expanding Through Organic Growth and Macarthur Acquisition Expansions are in process at Burton, Wilpinjong, Metropolitan and other operations

Expected Australia Volumes

2010

Domestic Thermal 6

Seaborne Thermal 11

Met 10

Total 27

2011

Domestic Thermal 6.5

Seaborne Thermal 12-13

Met 8.5-9.5

Total 27-29

2014-2015

Domestic Thermal ~8

Seaborne Thermal 15-17

Met 12-15

Macarthur 10

Total 45-50

Macarthur volumes based on Macarthur plans at time of acquisition; ultimate production and timing subject to future investments and other factors.

15

Peabody Delivering on Organic Growth Projects

Peabody Delivering on Organic Growth Projects Planned Expansions (Tons in Millions)

Mine

Additional MTPY

First Coal

Burton 1 - 2 HCC Late 2012

North Goonyella 1 - 2 HQHCC 2014

Millennium 1 - 2 SH/PCI Late 2011

Wilpinjong 2 - 3 T Q4 2011

Wambo ~3 T 2012 - 2013

Metropolitan 1 HCC Late 2013

Met Coal Mine

Burton

North Goonyella

Eaglefield

Millennium

Metropolitan

Thermal Coal Mine

Wilkie Creek

Wilpinjong

Wambo Underground

Wambo Open Cut

Port

Abbot Point

Dalrymple Bay

Gladstone

Brisbane

PWCS

NCIG

Port Kembla

Queensland

New South Wales

Additional volumes expected to be offset by some mine depletions.

16

Overview of Acquisition of Macarthur Coal (ASX: MCC)

Overview of Acquisition of Macarthur Coal (ASX: MCC)Transaction Description Purchase of 100% of the shares of Macarthur Coal

Transaction Structure Takeover under Australian securities law

Equity Purchase Price A$16.25 per share = A$4.9 billion; US$5.1 billion

Peabody Share Up to 100% (ArcelorMittal intends to sell 40% interest)

Financing Cash and debt

Status 90% relevant interest achieved; Compulsory acquisition of remaining shares under way

Sales Macarthur: 4.2 Mt in FY 2011 from two active mines Macarthur guidance of 5.5 - 5.8 Mt in FY 2012 (ending June 30)

Growth Platform Expanding mines and new growth projects Reserves of 286 MT on 100% basis (184 MT attributable basis); Resources of 2.6 BT on 100% basis (1.9 BT attributable basis)

US$ conversion assumes currency exchange of 1.03 AUD:USD; Tons shown in short tons, unless otherwise noted; Reserves and resources based on Macarthur June 30, 2011 reporting using JORC basis; FY refers to fiscal year ended June 30.

17

Acquisition Delivers Value Via Increased Global Access, Earnings Expansion

Acquisition Delivers Value Via Increased Global Access, Earnings ExpansionMacarthur acquisition expands Peabody's presence with quality met product in high-growth region

Provides growth opportunities, large reserve base and significant potential synergies

Continues global buildout and earnings contribution from international assets

18

PCI in Growing Demand from Global Steel Producers

PCI in Growing Demand from Global Steel Producers Global PCI Market Growing at 5% CAGR

Pulverized Coal Injection (PCI) a replacement for coke made from met coal

Steelmakers expanding use of PCI to reduce costs

Majority of high quality,

low-vol PCI supply from Australia

Low-vol PCI typically priced at 70% to 80% of

HQ Hard Coking Coal

Steel making process using LV PCI Coal

Coking Coal

Coke Oven

Coke

Iron Ore

Flux

Blast furnace

Slag

Pig Iron

Hot Air

LV PCI Coal

Steel Production

Source: Macarthur Coal

19

Macarthur: Active Production Base With Major Growth Pipeline

Macarthur: Active Production Base With Major Growth PipelineQueensland

Port

Abbott Point

Dalrymple Bay

Gladstone

Wiggins Island

Peabody Met Coal Mine

Burton

North Goonyella

Eaglefield

Millennium

Macarthur Mine

Coppabella

Moorvale

Macarthur Development

Olive Downs

Codrilla

Vermont East

Middlemount

Peabody Met Coal Mine

Port

Macarthur Mine

Macarthur Development

Producing mines million short tons Coppabella Resources 100% 214 Attributable 157 Reserves 65 48 Production FY 2011 2.3 Moorvale 126 93 47 34 1.9

Announced Projects Middlemount 135 68 106 53 0 Codrilla 88 64 55 40 0

Development Projects Vermont East / Wilunga 541 466 TBD TBD 0 Olive Downs North 140 103 13 9 0 Olive Downs South 300 270 TBD TBD 0

Exploration / Concept Projects

Potential exploration projects provide additional resources of more than 1 billion tons (100% basis) or 720 million tons (attributable basis).

Macarthur data based on June 30, 2011 public filings; Resources and reserves shown on a JORC basis and converted to short tons.

20

Transaction Significantly Strengthens Peabody's Position in Australia

Transaction Significantly Strengthens Peabody's Position in AustraliaPeabody Australia pro forma 2010 production of 32 million tons with Macarthur

Pro forma production of 45 - 50 million tons by 2014-15 given combined growth platforms

Australian Production

Thermal

Met

Tons in Millions

Xstrata 57

BHP/BMA 53

Proforma BTU Australia2015 45-50

Rio Tinto 34

Anglo American 32

Proforma BTU Australia2010 32

BTU Australia 27

Wesfarmers 15

New Hope 6

Macarthur 5

Vale 4

Whitehaven 4

Gloucester 3

Note: Pro forma 2010 BTU production combines Peabody and calendarized Macarthur production; Pro forma 2015 production based on current Peabody growth targets and Macarthur's growth plans at time of acquisition; ultimate production and timing subject to future investments and other factors; Production shown in millions of short tons.

21

Macarthur Acquisition Fully Financed With Cash and Debt

Macarthur Acquisition Fully Financed With Cash and DebtFinancing in place:

$1.0 billion in cash

$1.0 billion new term loan

$3.1 billion new senior notes

Aligns with Peabody's financial strategy:

Maintains leverage in comfortable range

Ensures adequate liquidity to run business

Takes advantage of historically low interest rates

Avoids refinancing risk in any given year

Peabody's Debt-to-Capital Ratio (%)

Target Zone: 40 - 60

2006* 57

2007 52

2008 47

2009 42

2010 37

9/2011 32

Post-MCC 56

Debt-to-cap calculations above assume 100% ownership in Macarthur.

*2006 ratio reflects pro forma June 30, 2006 data used at the time of the Excel Coal acquisition.

22

Macarthur Acquisition: Next Steps

Macarthur Acquisition: Next StepsComplete acquisition and implement transition plan

Achieve synergies

Operational performance

Supply chain efficiencies

Marketing/blending potential

Improve mining plan and equipment efficiency at Coppabella Mine in coming months

Advance growth projects to build production pipeline

23

Asia Initiatives: Pursuing Development of One of China's Largest Mines

Asia Initiatives: Pursuing Development of One of China's Largest MinesAdvancing 50 million ton-per-year thermal project in Xinjiang Province

Xinjiang likely to be world's fastest growing coal region

100 million tonnes of production in 2010

May reach 1 billion tonnes per year by ~2025

Government supportive

Committed to accelerate coal reserve allocations

China's coal production base is shifting from older, underground operations in the East to large-scale open-cut operations in the Western provinces Xinjiang development would be one of China's largest mines.

Xinjiang

Tibet

Qinghai

Gansu

Inner Mongolia

Ningxia

Sichuan

Yunnan

Heilongjiang

Jilin

Liaoning

Beijing

Shanxi

Hebei

Tianjin

Shaanxi

Shandong

Henan

Jiangsu

Anhui

Hubei

Chongqing

Guizhou

Guangxi

Hunan

Hainan

Jiangxi

Shanghai

Zhejiang

Fujian

Guangdong

Hong Kong

Taiwan

24

Advancing Multiple Projects to Serve Growing Demand Within China

Advancing Multiple Projects to Serve Growing Demand Within ChinaYankuang Wucaiwan Mine

Pursuing development of

20 million ton-per-year surface mine in Xinjiang

Would include 2 GW supercritical power plant and SNG facility

Lu'an Shaxi Mine

Pursuing development of

15 million ton-per-year surface

mine in Xinjiang

GreenGen Plant

Only non-Chinese equity partner

in 650 MW IGCC plant

First phase starts up this year

CCS for enhanced oil recovery

The GreenGen coal-fueled IGCC plant near Tianjin is due to begin operations later this year

25

Peabody Leveraging Leading PRB and Illinois Basin Presence

Peabody Leveraging Leading PRB and Illinois Basin PresencePeabody's North Antelope Rochelle Mine produces more than 100 million tons per year of ultra-low sulfur coal with a sulfur content 40% below the benchmark PRB product - a valuable feature in a market with rising SO2 allowance prices

Illinois Basin to…

New York, South Carolina and Florida

Europe and India through Gulf of Mexico

Powder River Basin to…

Asia via West Coast

Europe through Gulf

Eastern U.S. backfill for CAPP

Texas and other lignite regions to comply with CSAPR regs

26

Advancing Multiple Projects in U.S.

Advancing Multiple Projects in U.S.Bear Run

Growing to ~8 MT in 2012

Gateway North

Expanding ~40% to 4.5 MT

by 2014

Powder River Basin

Adding ultra-class trucks; Modest volume growth

in 2011

Accessing NARM North reserves and loadout facilities for blending opportunities, margin enhancements and export supplies

West Coast Exports

Developing plans for PRB exports to Asia at scale

Peabody has as 24 million tonne per year throughput agreement for a deep-draft export facility being permitted in Cherry Point, Wash.

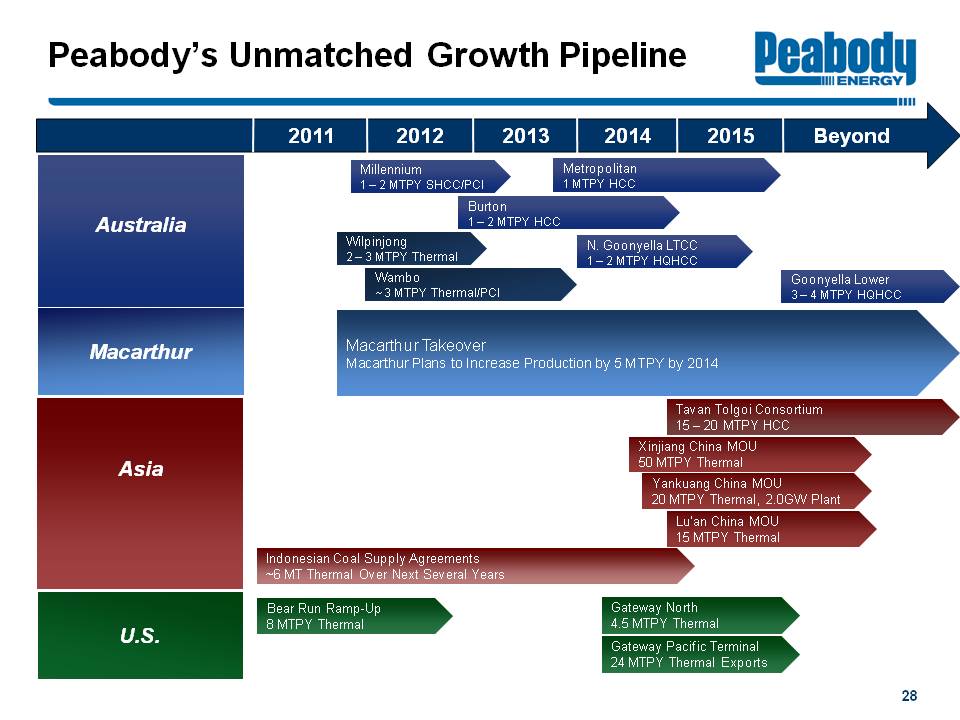

Peabody's Unmatched Growth Pipeline

Peabody's Unmatched Growth Pipeline2011 2012 2013 2014 2015 Beyond

Australia

Millennium 1-2 MTPY SHCC/PCI

Burton 1 - 2 MTPY HCC

Metropolitan 1 MTPY HCC

N. Goonyella LTCC 1 - 2 MTPY HQHCC

Wilpinjong 2 - 3 MTPY Thermal

Wambo ~3 MTPY Thermal/PCI

Goonyella Lower 3-4 MTPY HQHCC

Macarthur

Macarthur Takeover

Macarthur Plans to Increase Production by 5 MTPY by 2014

Asia

Tavan Tolgoi Consortium 15 - 20 MTPY HCC

Xinjiang China MOU 50 MTPY Thermal

Yankuang China MOU 20 MTPY Thermal, 2.0GW Plant

Lu'an China MOU 15 MTPY Thermal

Indonesian Coal Supply Agreements ~6 MT Thermal Over Next Several Years

U.S.

Bear Run Ramp-Up 8 MTPY Thermal

Gateway North 4.5 MTPY Thermal

Gateway Pacific Terminal 24 MTPY Thermal Exports

28

Peabody Positioned for Significant Growth and Value Creation

Peabody Positioned for Significant Growth and Value CreationIndustry Leading Reserves and Production Base

Major Cash Flow Generation and Strong Balance Sheet

Expanding in Fastest Growing Global Markets

Significant Organic Growth Capability

Addition of Macarthur Coal

Multiple Expansion to Return to More Traditional Levels

BTU Drivers To Deliver Premium Valuation

29

Investor Presentation

November 2011