Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Expedia Group, Inc. | d259659d8k.htm |

Investor

Presentation (NASDAQ: TRIP)

Q4 2011

Exhibit 99.1 |

Safe Harbor

Statement 2

Forward-Looking Statements.

Non-GAAP Measures.

Industry / Market Data.

Additional Information about the TripAdvisor Spin-Off.

result of new information, future events or otherwise. Investors are cautioned not to

place undue reliance on forward-looking statements. prepared for other purposes. We

have not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness.

participants may be included in other relevant documents to be filed with the SEC.

supplement, not substitute for, GAAP comparable measures. Investors are urged to consider

carefully the comparable GAAP measures and reconciliations.

This presentation contains "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements are not

historical facts or guarantees of future performance and are based on management's assumptions and expectations as of November 21, 2011, which are

inherently subject to difficult to predict uncertainties, risks and changes in

circumstances. The use of words such as "intends,” “expects,” “may,” “believes,” “should,” “seeks,”

“intends,” “plans,” “potential,” “will,”

“projects,” “estimates,” “anticipates” or similar expressions generally identify forward-looking statements. However, these words are not

the exclusive means of identifying such statements, and any statements that refer to

expectations, beliefs, plans, predictions, projections, forecasts, objectives, assumptions,

models, illustrations, profiles or other characterizations of future events or circumstances

are forward-looking statements, including w/o limitation statements relating to future

revenues, expenses, margins, performance, profitability, cash flows, net income/(loss),

earnings per share, growth rates and other measures of results of operations (such as,

among others, EBITDA or adjusted EBITDA) and future growth prospects for TripAdvisor’s

business. Actual results and the timing and outcome of events may differ materially

from those expressed or implied in the forward-looking statements for a variety of

reasons, including, among others, those discussed in the “Risk Factors” section of the

registration statement on Form S-4 (File No. 333-175828-1), which included a proxy

statement for Expedia, Inc. (“Expedia”) and prospectus for Expedia and TripAdvisor (the

“Prospectus/Proxy Statement”). Except as required by law, we undertake

no obligation to update any forward-looking or other statements in this presentation, whether as a

Reconciliations to GAAP measures of non-GAAP measures included in this presentation are

included in Appendix. These measures are intended to

Industry and market data used in this presentation have been obtained from industry

publications and sources as well as from research reports As previously announced, Expedia intends to spin-off its TripAdvisor Media Group

businesses into a separate publicly-traded company, TripAdvisor, Inc. The

spin-off is subject to various conditions, including the requirement that the spin-off be approved by the affirmative vote of

holders of a majority of the outstanding shares of Expedia common stock, other than shares

owned or controlled by Expedia management. In connection with the proposed

spin-off, Expedia, Inc. and TripAdvisor, Inc. have filed a Prospectus/Proxy Statement with

the SEC. Stockholders of Expedia and investors are urged to read the Prospectus/Proxy

Statement because it contains important information about Expedia, TripAdvisor and the

proposed spin-off transaction and related matters. Investors and security holders can

obtain free copies of the Prospectus/Proxy Statement by contacting Investor Relations,

Expedia, 333 108th Avenue N.E., Bellevue, Washington 98004 (Telephone: (425) 679-

3555). Investors and security holders can also obtain free copies of the Prospectus/Proxy

Statement and other documents filed by Expedia and TripAdvisor with the SEC at the

SEC’s web site

at In addition to the Prospectus/Proxy Statement, Expedia

files, and TripAdvisor will file following the spin-off, annual, quarterly and current

reports, proxy statements and other information with the SEC, each of which should be

available at the SEC’s web site at www.sec.gov. You may also read and copy any reports,

statements and other information filed by Expedia or TripAdvisor at the SEC public reference

room at 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-

800-SEC-0330 for further information. Expedia and its directors, executive

officers and certain members of management and other employees may be deemed to be

participants in the solicitation of proxies of Expedia stockholders to approve the proposed

spin-off transaction, which transaction will be considered for approval by Expedia

stockholders at the 2011 Annual Meeting of Stockholders on December 6, 2011. Directors,

executive officers and certain members of management and other employees of Expedia may

have interests in the transaction as described in the Prospectus/Proxy Statement, including as a result of current holdings of options, restricted share units or

shares of Expedia stock and future holdings of options, restricted share units or shares of

TripAdvisor stock, which will be impacted in the transaction. The Prospectus/Proxy

Statement, first mailed to Expedia stockholders on or around November 3, 2011, contains

information regarding Expedia and the equity interests of its directors and officers

who may be deemed participants in the solicitation of proxies is contained in the

Prospectus/Proxy Statement. Additional information regarding the interests of such potential

www.sec.gov.

|

TRIPADVISOR

OVERVIEW STEPHEN KAUFER, CO-FOUNDER, PRESIDENT AND CEO

3

TripAdvisor and the TripAdvisor logo are trademarks or registered trademarks of TripAdvisor

LLC in the U.S. and/or other countries. All other trademarks are the property of their

respective owners. (c) 2011 TripAdvisor LLC. All rights reserved.

|

It all started

when… 4

Iberostar Tucan Hotel, Playa del Carmen |

Investment

Highlights Leading online travel media platform

•

44M monthly uniques

(1)

Huge and growing market opportunity

•

$39B+

(2)

spent on travel advertising each year

Definitive resource for travelers and critical partner for merchants

•

Over 50M reviews and opinions; over 500,000 hotels featured

Powerful network effects

•

Scale generates a richer experience for all, attracts new consumers and provides great

defensibility Compelling and differentiated business model

•

Rich user-generated content creates valuable monetization opportunities and efficient cost

structure 5

(1)

comScore, September 2011

(2)

IDC, Worldwide New Media Market Model, August 2011 |

TripAdvisor by

the Numbers 6

Scaled, growing, profitable –

leading online travel media platform

Market

opportunity

160,000+

Attractions

57,000,000+

Facebook connections

50,000,000+

Reviews and opinions

520,000+

Hotels

715,000+

Restaurants

8,000,000+

Candid photos

Destinations

93,000+

10,000,000+

Mobile downloads

The leading

travel media

platform

Financial

$485M

2010 Revenue

(2)

$261M

2010 Adjusted EBITDA

(2)

2006-2010 revenue CAGR

(3)

46%

$294,000,000,000+

2011E

Travel

e-commerce

spend

(1)

$39,000,000,000+

2011E

Travel

ad

spend

(1)

(1)

IDC, Worldwide New Media Market Model, August 2011

(2)

Reflects TripAdvisor Holdings, LLC Combined Results of Operations as disclosed in Annex E of

Amendment No. 4 to Expedia, Inc. Form S-4 filed November 1, 2011 with the SEC. Revenue includes intercompany revenues from

Expedia, Inc. Adjusted EBITDA is defined as Operating Income attributed to TripAdvisor

Holdings, LLC plus: (1) depreciation of property and equipment, including internal use software and website development; (2) amortization

of intangible assets; (3) stock-based compensation; and (4) non-recurring expenses

incurred to effect the spin-off during the six month ended June 30, 2011

(3)

Reflects compound annual growth of segment reported revenue as disclosed in Expedia, Inc. Form

10-K filings with the SEC |

Travel: Huge

Market, Underpenetrated Online 7

Online

travel

44%

All other

e-commerce

56%

2011 Global

eCommerce

market size:

$673B

11%

17%

3%

10%

Example OTA

Commission

(3)

Online

Offline

2011E Online travel spend

($B)

2010-2012E Online

travel spend CAGR

(1)

IDC, Worldwide New Media Market Model, August 2011

(2)

PhoCusWright U.S. Online Travel overview, Eleventh edition; PhoCusWright European Online Travel

Overview, Sixth Edition; PhoCusWright APAC Online Travel Overview, Fourth Edition (3)

Example OTA commission is Orbitz Worldwide’s, based on take rates derived from

Orbitz Worldwide’s 2010 Form 10-K. 44% Travel

~$300B

Offline:

62%

Online:

38%

Offline:

84%

Online:

16%

Total 2011E bookings:

$875B

(2)

Travel 2011E ad spend:

$39B+

(1)

(2011E)

Travel

nearly

half

of

global

e-commerce

(1)

Online hotel bookings growing faster, more

profitable

(2)

Online travel –

US / Europe maturing while

APAC

/

LATM

growing

fast

(2)

Travel ad spend is large and

underpenetrated online

$149

$120

$55

$11

US

EUR

APAC

LATM

6%

3%

15%

32%

US

EUR

APAC

LATM

76%

62%

24%

38%

Hotel / Other

Air |

Most Important

Information Influencing $800B+ of Travel Spend (1)

8

Word of mouth content is most important

in

influencing

purchasing

decisions

(2)

76%

49%

40%

37%

35%

13%

15%

16%

17%

19%

21%

25%

27%

29%

30%

Recommendations

from people I know

Customer

Reviews

Friend

recommendations

98% of participants found TripAdvisor’s hotel

reviews

to

accurately

represent

the

experience

(3)

(2)

Nielsen, Trends in Advertising Spend and Effectiveness, June 2011

User-generated

photos

(3)

PhoCusWright, custom report, July 2011

Consumer opinions

posted online

Emails I signed up for

Editorial content

Brand websites

Ads in newspapers

Ads on TV

Ads in radio

Ads in magazines

Ads served in search

engine results

Online video ads

Products shown

embedded in TV

Online banner ads

Ads on social networks

Ads on mobile devices

(1)

PhoCusWright U.S. Online Travel overview, Eleventh edition; PhoCusWright European Online Travel

Overview, Sixth Edition; PhoCusWright APAC Online Travel Overview, Fourth Edition

% of respondents who “trust completely” or “trust somewhat” a

source |

Significant

Network Effects and Economies of Scale 9

Scale drives content generation

Critical source of customers for

suppliers

Audience

High monetization enables efficient

customer acquisition

Reviewers want

access to broadest

audience

A source for a very

high % of client leads.

Scale generates

higher prices

Breadth of information

means majority of

users find the content

they need

Continues to invest

in ROI-positive

customer growth

Over 50M

users and

opinions |

Strong and

Differentiated Competitive Position 10

Search

providers

OTAs

Other travel

media

Other review

services

High traffic

Rich content

TripAdvisor

position

Depth of reviews

drive user

experience

TripAdvisor is a

mission critical

supplier

TripAdvisor has

significantly greater

reach/scale

Depth and breadth

of travel-focused

content

The leading online

travel media

platform |

TripAdvisor’s Business Model

Business listing

Lead generation

Display ad /

sponsorship

Candid photos

Search filtering

Room tips

Tips from friends

Review summary

Display ad /

Cost per click ad

Friend experiences

11

Detailed reviews

Consumer Value

Business Value |

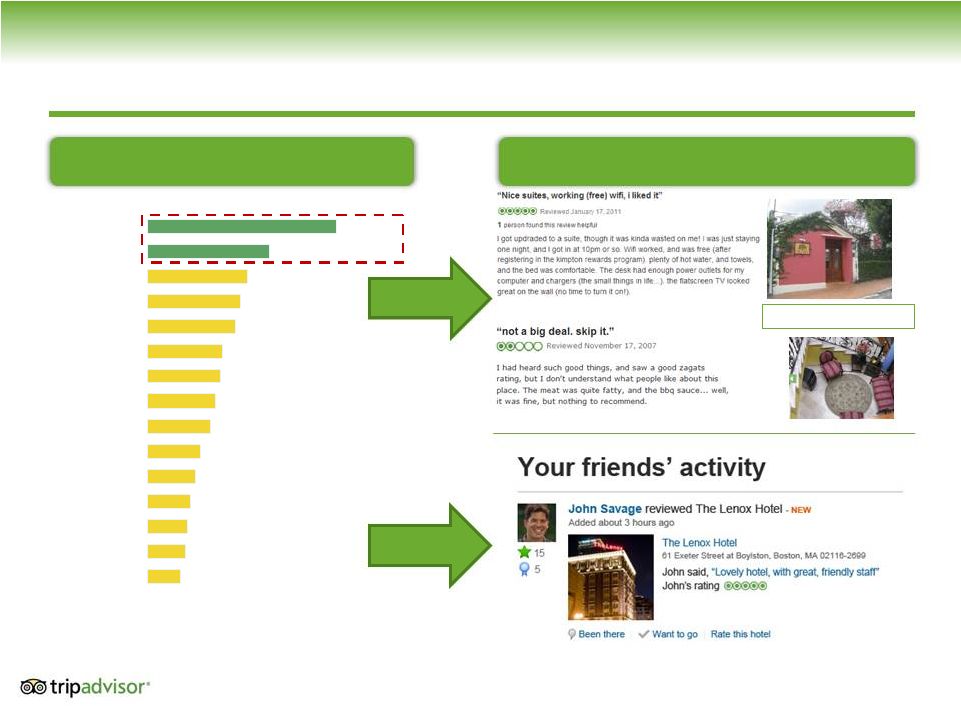

Wisdom of

Friends – Ability to Connect Improves Experience

12

Deep social

integration

heightens the

experience

Since launch, 57M

people have been

instantly

personalized

Facebook users

are more engaged

on the site

Facebook users

are 2x more likely

to contribute full

reviews

Higher conversion

and monetization |

31,419

27,941

15,347

14,224

12,188

11,109

10,576

10,378

9,232

8,411

8,355

44,461

TripAdvisor Sites

Booking.com

Expedia Sites

Yahoo! Travel

Orbitz Worldwide

Travelocity

Qunar.com

Ctrip.com

Hotels.com

Kayak.com

Groupe SNCF

Priceline

Leading Scale and Global Reach

13

Monthly

unique

visitors

(‘000s)

–

branded

websites

Travel Website Landscape

Global reach

30

countries

in

21

languages

Brand

Direct navigation

Organic search

Paid search

Partners / referrals

Highly efficient sources of traffic

Source: comScore, September 2011 |

Content

Syndication 14

A powerful

extension of

TripAdvisor

30,000 partner

sites use Trip-

Advisor content

Provides access

to

150M monthly

uniques

Syndication makes

TripAdvisor the

de-facto standard

for travel review

information |

TripAdvisor

Media Group 15

TripAdvisor branded sites

44M monthly uniques

(1)

TripAdvisor Media Group

61M monthly uniques

(1)

(1)

comScore Media Metrix, September 2011 |

Key Areas of

Investment and Growth 16

China

Vacation rentals

Mobile

•

World’s 2

nd

largest economy after

the US

•

1B hours spent online per day,

twice the amount of time in

the

U.S.

(3)

•

Expect more than 650M internet

users

by

2015

–

but

still

less

than

50% penetration

(3)

•

Widely varied travel pricing

•

An $85B vacation rental market in

2010 and growing

(2)

•

Highly fragmented and inefficient

market

•

Extending the leading TripAdvisor

online travel platform

•

Mobile travel spend expected to

be over $2B by 2014, growing

40+% year-over-year

(1)

•

Mobile monetization still early

•

Travel is 4th largest category in

the Apple App store

New Platforms

New Geographies

New Products

IDC, Worldwide New Media Market Model, Aug 2011

Radius Global Market Research, Market Sizing Study, Nov 2011 (as cited in HomeAway prospectus)

Boston Consulting Group, The Internet’s New Billion: Digital Consumers in Brazil, Russia,

India, China and Indonesia, Sept 2010 (1)

(2)

(3) |

TripAdvisor

Strategy: Mobile Adoption 17

Early success:

10M+

downloads

Global:

Available

in 20 languages

Depth:

Multiple reviews on

hundreds of

activities in each city

Frictionless:

GPS and direct

bookings maximize

functionality

Breadth:

Information on

thousands of

activities, hotels,

transport

Mobile channel is additive and complementary to the web experience

|

What TripAdvisor

is Doing in China 18

Purchased Kuxun:

#2 metasearch player in

China

Built Daodao from scratch:

launched in 2008 |

Vacation

Rentals 19

A new growth

opportunity

Over 200,000

vacation rental

listings

Uniquely leverages

platform to target

travellers searching

for hotels

Acquired FlipKey

and Holiday Lettings

Partnered with

Interhome, Stayz,

Toprural and AKENA |

We Have a

Winning Culture . . . 20

Speed wins

•

Rapid iteration and product development cycle

Recruit the best and brightest . . . globally

•

Top engineering talent and robust training programs

Say thank you

•

Recognized by Boston Globe’s “Top Places to Work”

(2010, 2011)

And give back

•

2% of operating profit

(1)

allocated to employee sponsored charities that help

…

(1)

Represents operating income before amortization of intangible assets

those

less

fortunate |

Led by an

Experienced Management Team 21

Experienced management with proven ability to execute

Steve Kaufer

Chief Executive Officer and Co-Founder

(11 years)

Barbara Messing

Chief Marketing Officer

(Joined in 2011, formerly at Hotwire)

Andy Gelfond

Vice President, Engineering

(7 years)

Julie Bradley

Chief Financial Officer

(Joined in 2011)

Marc Charron

Managing Director, APAC

(5 years)

Robin Ingle

Senior Vice President, Advertising Sales

(10 years)

Christine Petersen

President, TripAdvisor for Business

(7 years)

Adam Medros

Vice President, Global Product

(7 years)

Eric Rosenzweig

Senior Vice President,

Strategic Development and Sales

(6 years)

Bryan Saltzburg

General Manager, New Initiatives

(3 years)

Tyler Young

Vice President,

Finance and Administration

(7 years)

Seth Kalvert

Senior Vice President,

General Counsel and Secretary

(Joined in 2011, formerly at Expedia & IAC) |

FINANCIAL

OVERVIEW JULIE BRADLEY, CFO

22 |

TripAdvisor

Financial Highlights 23

Compelling business

model

•

Diversified revenue streams globally

•

Differentiated content provides natural search advantage

Highly profitable and

cash flow generative

Rapid growth

Highly scalable;

capital efficient

•

Low fixed costs

•

Low cost to acquire customers

•

Free user generated content

•

Strong margins

•

High cash flow conversion

•

Low capital expenditures

•

Among the fastest growing Internet businesses

•

Long-term revenue growth driven by expanding traffic and

user-generated content –

the network effect |

Track Record of

Growth and Profitability 24

Revenue

(

¹

)

($M)

Adjusted EBITDA

(1)

($M)

y/y

growth

47% 18%

38%

NA

34%

Adj. EBITDA

Margin

49%

56%

54%

54%

54%

(1)

Reflects TripAdvisor Holdings, LLC Combined Results of Operations as disclosed in Annex E of

Amendment No. 4 to Expedia, Inc. Form S-4 filed November 1, 2011 with the SEC. Revenue includes intercompany revenues

from

Expedia,

Inc.

Adjusted

EBITDA

is

defined

as

Operating

Income

attributed

to

TripAdvisor

Holdings,

LLC

plus:

(1)

depreciation

of

property

and

equipment,

including

internal

use

software

and

website

development;

(2)

amortization of intangible assets; (3) stock-based compensation; and (4) non-recurring

expenses incurred to effect the spin-off during the six month ended June 30, 2011

$298

$352

$486

$239

$318

2008

2009

2010

Through

Q2'10

Through

Q2'11

$147

$197

$261

$141

$175

2008

2009

2010

Through

Q2'10

Through

Q2'11 |

Robust

Historical Growth and Pattern of Seasonality 25

TripAdvisor Media Group Segment Revenue by Quarter ($M)1

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

q/q growth

rate

10%

8%

(27%)

39%

5%

8%

(18%)

43%

10%

11%

(23%)

38%

14%

7%

y/y growth:

+14%

+14%

+29%

+33%

+39%

+43%

+34%

+30%

+35%

+30%

+19%

1

Reflects segment revenue as reflected in Expedia 10-K and 10-Q filings. Includes

Expedia intersegment revenue and does not adjust for separation. $0

$25

$50

$75

$100

$125

$150

$175

$200

$225

2008

2009

2010

2011 |

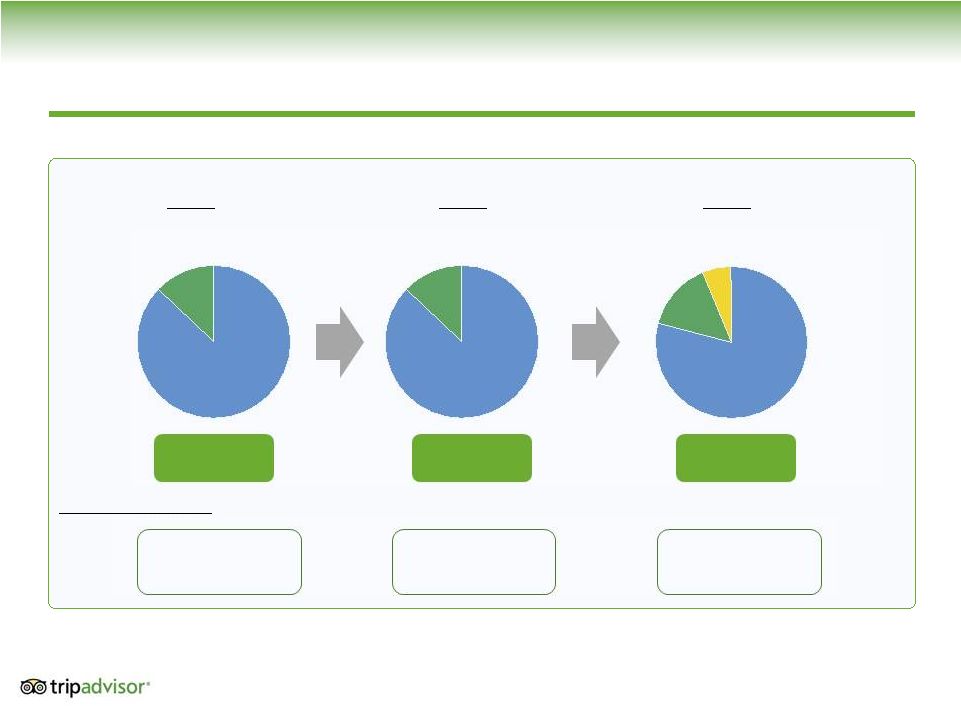

Increasing

Revenue Diversification 26

Display

13%

CPC

87%

Display

14%

CPC

86%

Subscription /

Other

6%

Display

15%

CPC

79%

2008

2009

2010

Note: Reflects segment data as disclosed in Expedia 10-K and 10-Q filings. Includes

Expedia intersegment revenue and does not adjust for separation. Revenue by

geography $298M

$352M

$485M

US

82%

UK

8%

Rest of world

10%

US

62%

UK

14%

Rest of world

24%

US

70%

UK

12%

Rest of world

18% |

Illustrative

Post-Spin Operating Model 27

•

Changes to the Expedia customer relationship

•

Standalone public company costs

•

User experience enhancement initiatives (e.g., site redesign / de-monetization)

•

Growth investments (e.g., China, mobile, vacation rentals)

•

Sales and marketing spend (e.g., branding and traffic acquisition)

COGS

2%

S&M

31%

-

35%

T&C

8%-9%

G&A

10% -

12%

Adjusted

EBITDA

42%

-

47%

Illustrative post-spin business profile (annual basis)

Key impacts and initiatives

Notes: Adjusted EBITDA is defined as Operating Income attributed to TripAdvisor Holdings, LLC

plus: (1) depreciation of property and equipment, including internal use software and website development; (2) amortization of

intangible assets; (3) stock-based compensation; and (4) non-recurring expenses

incurred to effect the spin-off during the six month ended June 30, 2011

|

Strong Balance

Sheet 1

28

TripAdvisor Holdings LLC ($M, except per share amounts)

Historical (as of

6/30/2011)

Pro forma

adjustments

Pro forma (as

of 6/30/2011)

Cash and cash equivalents

$112

$32

$144

Short-term investments

21

-

21

Receivable from Expedia, net

75

(75)

-

Other current assets

91

-

91

Total current assets

298

(43)

256

Other non-current assets

39

3

42

Intangible assets, net

48

-

48

Goodwill

466

-

466

Total assets

$851

($40)

$811

Current liabilities

$161

$20

$181

Long-term debt

-

380

380

Deferred income taxes, net

30

-

30

Other long-term liabilities

12

-

12

Total liabilities

587

Invested capital

648

(648)

-

Common shares, $0.001 par value, 1,600,000 authorized; 123,783 issued and

outstanding on a pro-forma basis

-

124

124

Class B common stock, $0.001 par value, 400,000 authorized; 12,800 issued and

outstanding on a pro-forma basis

-

13

13

Additional paid-in capital

-

208

208

Accumulated other comprehensive loss

(1)

-

(1)

Total liabilities and equity

$851

($40)

$811

Key highlights

Significant cash

flow generation

Low working

capital usage

Strong coverage of

debt obligations

1

As set forth in the prospectus |

Operational

Drivers 29

•

Number of reviews

•

Natural search rankings

•

Engagement / time spent on site

•

Seasonality

Engagement

Reach

Scalability

•

Advertising (CPC, CPM)

•

Syndication / licensing

•

Members

•

Traffic

•

Listings

Monetization

•

Sales and marketing

•

Traffic acquisition

•

Engineering

•

International expansion

Product

Investments

•

Vacation rentals

•

Mobile

•

China |

Spin

Transaction 30

•

Spin rationale

•

Value creation opportunity for both TripAdvisor and Expedia

•

Benefits of an enhanced equity currency and greater transparency

•

Businesses historically managed as independent entities

•

Create businesses that have a single business focus

•

Enhance the effectiveness of employee compensation structures

•

Key dates

•

Shareholder meeting on December 6th

•

Spin expected to be effective by end of year |

CONCLUDING

REMARKS STEPHEN KAUFER, CO-FOUNDER, PRESIDENT AND CEO

31 |

Investment

Highlights Leading online travel media platform

•

45M

monthly

uniques

(1)

Huge and growing market opportunity

•

$33B

(2)

spent

on

travel

advertising

each

year

Definitive resource for travelers and critical partner for merchants

•

Over 50M reviews and opinions; over 500,000 hotels featured

Powerful network effects

•

Scale generates a richer experience for all, attracts new consumers and provides great

defensibility Compelling and differentiated business model

•

Rich user-generated content creates valuable monetization opportunities and efficient cost

structure 32

(1)

comScore, September 2011

(2)

IDC, Worldwide New Media Market Model, August 2011 |

APPENDIX

33 |

Adjusted EBITDA

reconciliation 34

($ in thousands)

Six months ended

Year ended December 31,

June 30,

2008

2009

2010

2010

2011

Adjusted EBITDA

$146,626

$197,219

$260,963

$140,675

$174,494

Depreciation

of

property

and

equipment

(1)

5,022

9,330

12,871

5,678

8,616

OIBA

$141,604

$187,889

$248,092

$134,997

$165,878

Amortization of intangible assets

(11,161)

(13,806)

(14,609)

(6,242)

(3,249)

Stock-based compensation

(5,560)

(5,905)

(7,183)

(3,721)

(4,442)

Spin-off costs

(1,054)

GAAP Operating income

$124,883

$168,178

$226,300

$125,034

$157,133

Related-party interest income (expense), net

(4,035)

(978)

(241)

(148)

315

Other, net

(1,738)

(660)

(1,644)

(2,674)

1,422

Provision for income taxes

(46,788)

(64,325)

(85,461)

(44,723)

(57,389)

Net (income) loss attributable to noncontrolling

interest

49

212

(178)

(54)

(139)

Net income attributable to TripAdvisor Holdings, LLC

$72,371

$102,427

$138,776

$77,435

$101,342

(1)

Includes internal use software and website development

Source: Expedia S-4 amendment number 4 as filed with the SEC on November 1, 2011

|