Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K AMENDMENT #1 - TPC Group Inc. | d256413d8ka.htm |

A

leader in service-based processing, infrastructure and logistics for the

C 4

hydrocarbons industry.

C4 Hydrocarbons

Exhibit 99.1 |

Forward-Looking Statements & Non-GAAP Financial Measures

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

securities

laws.

These

statements

include

assumptions,

expectations,

predictions,

intentions

or

beliefs

about

future

events,

particularly statements that may relate to future operating results, existing and

expected competition, market factors that may impact financial performance,

and plans related to strategic alternatives or future expansion activities

and capital expenditures. Although TPC Group believes that such statements are

based on reasonable assumptions, no assurance can be given that such statements

will prove to have been

correct.

A

number

of

factors

could

cause

actual

results

to

vary

materially

from

those

expressed

or

implied in any forward-looking statements, including risks and uncertainties

such as volatility in the petrochemicals industry, limitations on the

Company’s access to capital, the effects of competition, leverage and

debt service, general economic conditions, litigation and governmental investigations, and

extensive

environmental,

health

and

safety

laws

and

regulations.

More

information

about

the

risks

and

uncertainties relating to TPC Group and the forward-looking statements are

found in the Company’s SEC filings, including the Transition Report on

Form 10-K, which are available free of charge on the SEC’s website

at http://www.sec.gov . TPC Group

expressly disclaims any obligation to update any forward- looking

statements contained herein to reflect events or circumstances that may arise after the date of this

presentation.

This presentation may also include non-GAAP financial information. A

reconciliation of non-GAAP financial measures to the most directly

comparable GAAP financial measures, as well as additional detail regarding

the utility of such non-GAAP financial information, is included in the Appendix.

2 |

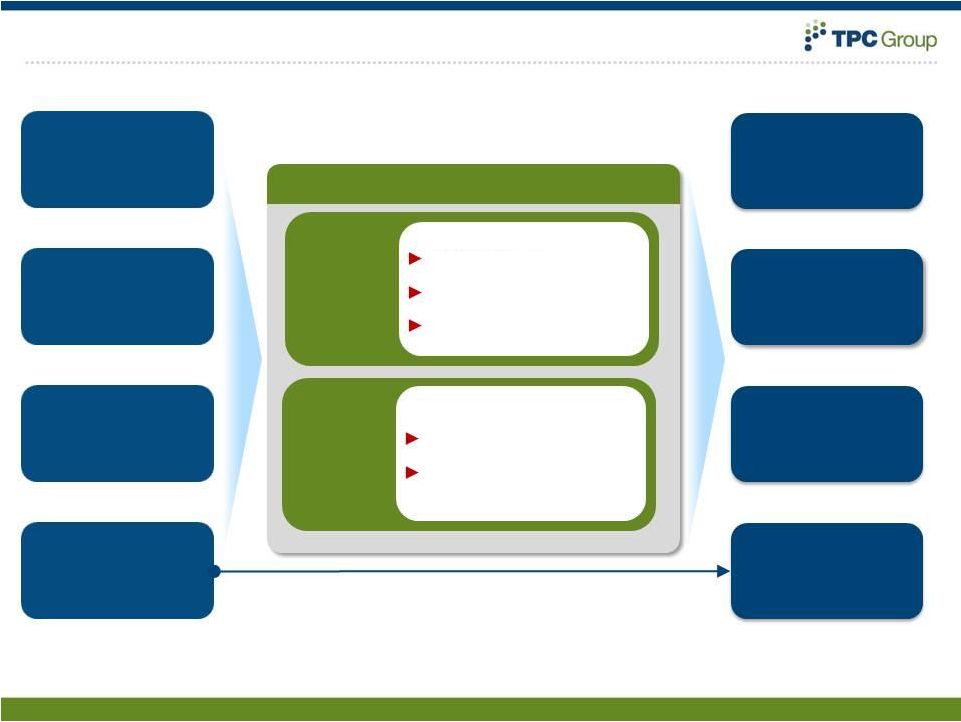

Cash

Flow Service Fees

Operational Efficiency

Volume Growth

3

Market Leader in

C4 Hydrocarbons

Growing end-user

markets

Unique logistics

and infrastructure

Disciplined,

experienced

management

Value Proposition

Stable, consistent

cash flows

Stable, consistent

cash flows

High Return on

Invested Capital

High Return on

Invested Capital

Value Creation for

Shareholders

Value Creation for

Shareholders

Growth in fees

and margins

Value Drivers

Capital

Investment

On Purpose Butadiene

On Purpose Isobutylene

Direct Alignment with Shareholders |

Fuels & Blending

Company Overview

4

C4 Processing

Butadiene Sales Volumes

North America

Gross Profit ($MM)

$250

Volumes (MMlbs)

2,538

Gross Profit (¢/lb)

9.8

Performance Products

PIB Capacity

North America

Companies: Ineos

Lubrizol, Oronite, Infinium

Merchant

Captive

Highly Reactive

Conventional

Companies: Exxon, Ineos,

Lanxess, Lyondell, Sabina, Shell

TPC Group

Products

Segment Vol.

Uses

BD

47%

Rubber, Nylons

B-1

10%

Plastics, Fuels

Raffinates

37%

Fuels

MTBE

6%

Fuels

Gross Profit ($MM)

$82

Volumes (MMlbs)

628

Gross Profit (¢/lb)

13.0

Products

Segment Vol.

Uses

PIB

32%

Lube & Fuel Additives

DIB

15%

Surfactants,plastics,resins

HPIB

18%

Rubber,additives,coatings

Prop Deriv

35%

Surfactants

TPC

30%

A

21%

B

15%

C

15%

E

7%

TPC

28%

A

25%

B

20%

C

18%

D

9%

F

4%

(LTM September 2011)

Revenue:

$2,670 MM

Gross Profit/lb:

11.2 ¢/lb

Gross Profit:

$ 332 MM

Debt:

$348 MM

EBITDA:

$ 160 MM

Cash:

$ 82 MM

CFO-Cap Ex:

$ 53 MM

Shares Outstanding:

ROIC:

13.7%

Market Capitalization:

Volume:

3,167 MMlbs

15.6

MM

$314 MM |

What

we do—C4 Processing and Logistics Infrastructure BD

BD

BD

BD

BD

BD

BD

BD

BD

BD

B1

B1

B2

B2

iBL

iBL

Bn

Bn

Ethylene

Steam Cracker

Mixed C4 Coproduct

Logistics and Infrastructure

Pipeline -

Barge -

Railcar

Separation

Purification

BD

BD

BD

BD

BD

BD

BD

BD

BD

BD

B1

B1

B2

B2

iBL

iBL

Bn

Bn

Purified C4 Components

Ot

Ot

5

A leading service-based processor and infrastructure and logistics provider of

value-added products derived from C

4

hydrocarbons

Elastomers

Plastics

Fuels

Nylons |

What

we

do

-

Performance

Products

Isobutylene

High Purity Isobutylene (HPIB)

Diisobutylene (DIB)

Polyisobutylene

–

(PIB,HR-PIB)

Propylene

Nonene

Tetramer

iBL

6

Stable, contractual business model focused on growth in profitable

downstream derivatives

Surfactants

Sealants

Surfactants

Fuel & Lube

Additives

Plasticizers

Antioxidants

Plasticizers

Performance Products

Performance Products

iBL

iBL

iBL

iBL

iBL

iBL

iBL |

Service Based Fee Business Model

7

Butadiene (BD)

47%

Butylenes:

•

Butene-1 (B-1)

•

Raffinates

10%

High Purity

Isobutylene

18%

Nonene

Tetramer

35%

Customers-Contractual, fixed service fees*

Suppliers-Processing fee with energy pass-through

Buy at %ULR, Sell at ULR + NG + Fee

Buy at %ULR, Sell at Butane + NG + Fee

Fixed Fee

37%

Buy at %ULR, Sell at higher %ULR

PIB

DIB

32%

15%

Buy at Butane, Sell at Butane + NG + Fee

100%

100%

80%

100%

75%

60%

60%

*BD price does not affect margins

Product

% Segment

Contractual Fee Structure

% Contract |

Strong, Sustainable Cash Flow

8

1

excludes Dehydro assets

Strategic

Location

(US “Petrochemical

Corridor”)

Considerable

Barriers to Entry

Long Standing, Integrated

Relationships

Unique,

Scalable

Infrastructure

($120/share)¹

Replacement Value

Sole Independent

Merchant Processor |

TPC is

transforming to unlock opportunities 9

Future

Strategically-driven

Market Leader

Service-based infrastructure

and logistics business

model

Driving a performance-based

culture

Operational excellence focus

Expanded profit streams

Diverse business models

Natural gas liquids

economics

Strong performance culture

-

ownership mentality

-

results driven

Fully utilized asset base

Strategically-driven

Market Leader

Services, infrastructure &

processing business model

Driving a performance-based

culture

Operational excellence focus

Tactically-driven

“Me-too”

player

Toll-processing business

Present

Past

model |

Our

strategy is based on compelling fundamentals 10

Excellent Long-

Term Market

Fundamentals

Idled Assets and

Scalable

Infrastructure

Able to

Be Deployed

Key Products in

Structural Short

Supply

Cost-Advantaged

Raw Materials

(NGLs) in

Plentiful Supply |

Key

Products in Structurally Short Supply Source:

CMAI

Source:

CMAI

Low-cost Ethane from NGLs resulting from Shale Drilling

Causing shift from heavier (e.g. Naptha) to lighter (e.g. Ethane)

Ethylene Cracker Feedstocks

NA Ethylene Industry

now Globally

Competitive

Ethylene Production

now generates less Co-

Products, particularly

Butadiene

1,124

1,118

1,131

822

W. Europe

SE Asia

NE Asia

U.S. Ethane

World Ethylene Cash Cost

($/Metric Ton)

17.7%

8.7%

7.2%

2.5%

Naphtha

Butane

Propane

Ethane

Butadiene to Ethylene Ratio |

Strategy Going Forward

12

Meet the Growing Demand for

On-Purpose Butadiene and

Isobutylene

Our strategies could result in a 2x-3x increase in EBITDA in five years

•

Restart dehydrogenation assets and rebuild

proprietary OXO-D™

assets for on-purpose butadiene

production

•

Restart dehydrogenation assets

for on-purpose isobutylene production

Excellent

Long-Term

Market

Fundamentals

Idled Assets

and Scalable

Infrastructure

Able to

Be Deployed

Key Products in

Structural Short

Supply

Cost-

Advantaged

Raw Materials

(NGLs) in

Plentiful

Supply |

Profit growth a result of service-based model

13

96.3

58.6

89.5

159.6

2008

2009

2010

LTM Sept-

11

Adjusted EBITDA ($MM)

0.7%

4.4%

8.4%

13.7%

2008

2009

2010

LTM Sept-

11

ROIC |

14

Value Proposition

Direct Alignment with Shareholders

Market Leader in

C4 Hydrocarbons

Unique logistics

and infrastructure

Growing end-user

markets

Disciplined,

experienced

management

Service Fees

Operational Efficiency

Volume Growth

On Purpose Butadiene

On Purpose Isobutylene

Stable, consistent

cash flows

Growth in fees

and margins

Value Drivers

Cash Flow

Capital

Investment

High Return on

Invested Capital

Value Creation for

Shareholders |

Appendix

15 |

SEC

Disclosure Information 16

Reconciliation of Adjusted EBITDA to Net Income

9/30/2011

6/30/2011

3/31/2011

12/31/2010

9/30/2010

Net income (loss)

9.4

$

34.3

$

11.4

$

(0.7)

$

12.8

$

Income tax expense

6.4

17.7

5.7

(1.6)

6.9

Interest expense, net

8.6

8.6

8.4

11.1

3.2

Depreciation and amortization

10.0

10.4

10.0

9.9

9.8

Adjusted EBITDA

34.4

$

71.0

$

35.5

$

18.7

$

32.7

$

Quarter Ended

(Unaudited, in millions)

(*) Adjusted EBITDA is presented and discussed herein because management believes it enhances

understanding by investors and lenders of the Company’s financial performance.

Adjusted EBITDA is not a measure computed in accordance with GAAP. Accordingly it does not represent cash flow from operations, nor

is it intended to be presented herein as a substitute for operating income or net income as indicators

of the Company’s operating performance. Adjusted EBITDA is the primary performance

measurement used by senior management and our Board of Directors to evaluate operating results of, and to allocate capital

resources between, our business segments. We calculate Adjusted EBITDA as earnings before

interest, taxes, depreciation and amortization (EBITDA), which is then adjusted to remove or

add back certain items. The items removed or added back have historically consisted of items we consider to be non-recurring in

nature and which we believe distort comparability between periods. There were no such items

identified in the Reconciliations of Adjusted EBITDA to Net Income for the periods presented

above. Our calculation of Adjusted EBITDA may be different from calculations used by other companies; therefore, it may not be

comparable to other companies.

|

Glossary

C4 hydrocarbons –

a mixture of four carbon hydrocarbon molecules

BD –

1,3 Butadiene, C

4

H

6

B-1 –

Butene-1, C

4

H

8

B-2 –

Butene-2, C

4

H

8

Isobutylene –

Isobutene, C

4

H

8

Butane –

Normal Butane or Isobutane, C

4

H

10

Hydrocarbon –

compounds containing carbon and hydrogen bonded together

Olefins –

carbon molecules containing a double bond, unsaturated hydrocarbons.

Paraffins -

carbon molecules containing only single bonds, saturated hydrocarbons.

Butylenes –

generic name for the olefins Butene-1 or Butene-2 or Isobutene

Raffinate –

mixture of butylenes and butanes

ULR –

US Gulf Coast Unleaded Gasoline Price

NG –

Natural Gas

HR PIB –

Highly Reactive PIB

17 |