Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIFTH THIRD BANCORP | d256644d8k.htm |

Fifth Third Bank | All Rights Reserved

Exhibit 99.1

Bank of America Merrill Lynch

Banking & Financials Conference

Daniel T. Poston

Executive Vice President & Chief Financial Officer

November 16, 2011

Please refer to earnings release dated October 20, 2011 and

10-Q dated November 9, 2011 for further information

|

2

Fifth Third Bank | All Rights Reserved

Well-positioned for success and leadership in new banking landscape

Key themes |

3

Fifth Third Bank | All Rights Reserved

A foundation of continued robust results

Capital

–

exceeds required and targeted levels

—

Tier

1

common*

capital

up

~500bps

or

$4.6bn

from

4Q08

—

Capital base transformed through series of capital actions

–

~9.8% pro forma

1

Tier 1 common ratio* on a fully-phased in

Basel III-adjusted basis

—

Capital levels supplemented by strong reserve levels

–

Loan loss reserves 3.08% of loans and 158% of NPLs

Credit

–

ongoing steady improvement

—

Broad-based improvements in problem loans

–

72% reduction in 90+ day delinquent loans since 3Q09

–

NCO ratio of 1.32%, lowest level since 1Q08

–

235% PPNR / NCOs*

—

Balance sheet risk lowered through asset sales, resolutions

–

$1.4bn (48%) decline in NPLs since 4Q09

Profitability

–

strong relative and absolute results

—

PPNR* remained stable throughout cycle

—

6 consecutive profitable quarters

—

Return on assets 1.3%

—

Return

on

average

tangible

common

equity

*

15%

* Non-GAAP measure; see Reg. G reconciliation on pages 25-27.

1

Current estimate (non-GAAP), subject to final rule-making and clarification

by U.S. banking regulators; currently assumes unrealized securities gains

are included in common equity for purposes of this calculation

2

Nonperforming

loans

and

leases

as

a

percent

of

portfolio

loans,

leases

and

other

assets,

including other real estate owned (does not include nonaccrual loans

held-for-sale) 3

Excluding $510mm net charge-offs attributable to credit actions

|

4

Fifth Third Bank | All Rights Reserved

Environment characterized by low growth

expectations and low interest rates

Potential lower growth and prolonged low-

rate environment

Lower securities reinvestment yields on

portfolio cash flows

Strong deposit flows

Competitive dynamics

Elevated mortgage refinance activity

Firms facing significant litigation related to:

—

Mortgage securitizations

—

GSE repurchases

—

Private label mortgage repurchases

Concerns about European banks and

sovereign debt

Higher capital standards and limitations on

distributions

Continued strong loan production

—

Rates on loan originations have remained

relatively stable

Careful management of liability costs

—

Disciplined pricing on deposits

—

Continued evaluation of term liabilities

including CDs and TruPS

Strong mortgage banking results

Mortgage risks manageable

—

Quarterly mortgage repurchase costs

~$20-25mm and claims inventory declining

—

Total mortgage securitizations outstanding

$28mm

(2003 HELOC) and performing well

No direct European sovereign exposure

—

Total exposure to European peripheral*

borrowers less than $0.2 billion

—

Gross exposure to European banks less than

$0.3 billion

Strong profitability and capital in excess of fully

phased-in Basel III standards today

* Greece, Ireland, Italy, Portugal, Spain

Fifth Third is well-positioned to deal with current environmental

challenges Characteristics of current environment

Fifth Third’s response / position |

5

Fifth Third Bank | All Rights Reserved

Diverse revenue stream

•

Business

mix

provides

higher

than

average

diversity

among

spread

and

fee

revenues

—

Current NII lower than normalized levels due to impact of low rate environment (e.g.

low cost deposits including DDAs providing little NII benefit)

•

Added clarity regarding effect of reform on deposit and interchange fees

—

Service charge impact from Reg E in run-rates

—

Initial $30 million per quarter impact of Durbin amendment expected to be mitigated

over time (~2/3 by mid-2012); will implement carefully and

deliberately Revenue results remain solid, profitability strong despite

sluggish economy |

6

Fifth Third Bank | All Rights Reserved

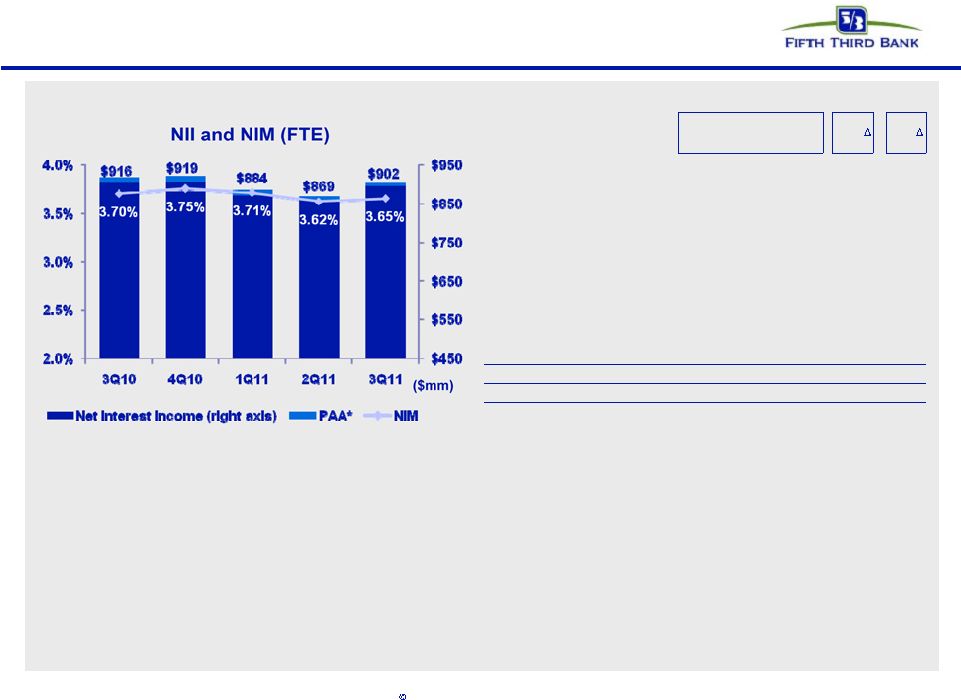

Net interest income

•

Sequential net interest income trends reflect:

–

Growth in C&I, residential mortgage, auto, and bankcard loan balances

–

Higher securities balances

–

Partially offset by lower yields on loans and securities

•

NII up $33mm from 2Q11, down $14mm from 3Q10; NIM +3 bps from 2Q11, -5 bps from

3Q10 •

Yield on interest-earning assets declined 9 bps sequentially and 29 bps

year-over-year –

Effect offset by lower liability costs, down 14 bps from 2Q11 and down 27 bps from

3Q10 –

Expect less asset yield compression and less liability rate improvement over next

year * Represents purchase accounting adjustments included in net interest

income. Selected Yield Analysis

3Q10

2Q11

3Q11

Seq.

(bps)

YoY

(bps)

Commercial and industrial loans

4.81%

4.35%

4.29%

(6)

(52)

Commercial mortgage loans

3.97%

4.00%

3.94%

(6)

(3)

Commercial construction loans

3.06%

3.01%

3.02%

1

(4)

Residential mortgage loans

4.81%

4.54%

4.47%

(7)

(34)

Home equity

3.99%

3.91%

3.89%

(2)

(10)

Automobile loans

5.71%

4.81%

4.52%

(29)

(119)

Credit card

10.70%

9.91%

9.49%

(42)

(121)

Total loans and leases

4.85%

4.54%

4.48%

(6)

(37)

Taxable securities

4.06%

3.97%

3.88%

(9)

(18)

Tax exempt securities

4.05%

6.41%

5.84%

(57)

179

Other short-term investments

0.36%

0.25%

0.25%

-

(11)

Total interest-earning assets

4.57%

4.37%

4.28%

(9)

(29)

Total interest-bearing liabilities

1.13%

1.00%

0.86%

(14)

(27)

Net interest rate spread (FTE)

3.44%

3.37%

3.42%

5

(2) |

7

Fifth Third Bank | All Rights Reserved

Core funded balance sheet and pricing discipline

•

Strong, deposit-rich core funding mix supports

relatively low cost of funds

–

Low reliance on wholesale funding

•

Run-off of high cost CDs (particularly from 2H08)

will benefit NII in 4Q11

–

Incremental $15mm in 4Q11 versus 3Q11

•

Pricing discipline on commercial loans

–

Spreads have narrowed from post-crisis levels

but remain attractive

–

Loan origination rates have stabilized the past

several months

SOURCE: SNL Financial and company reports. Data as of 3Q11

End of period transaction deposits defined as DDA, NOW and Savings/MMDA accounts;

Cost of Funds defined as interest incurred on interest-bearing liabilities as a percentage of average noninterest-bearing deposits

and interest-bearing liabilities |

8

Fifth Third Bank | All Rights Reserved

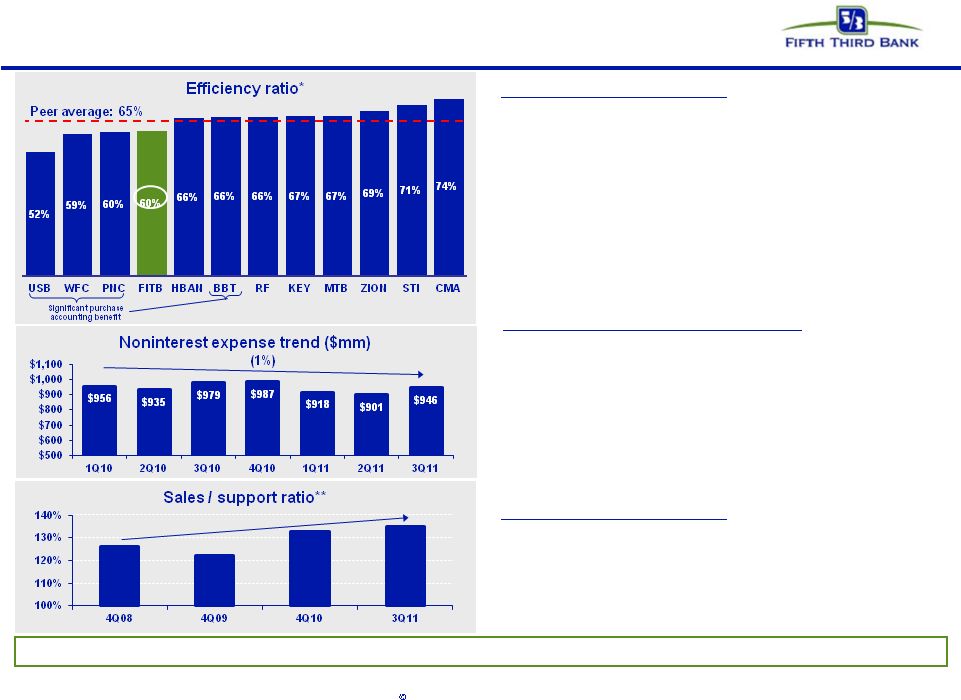

Expense discipline

Efficient business model:

•

Efficiency ratio better than most peers through

weak economic environment

–

Reflects below-capacity balance sheet and

lower revenue than we expect and can

support longer term

–

Current impact of credit costs on revenue

and expenses

•

Expenses being managed carefully in response

to revenue environment

–

No net growth over past few years

–

Continuous process of expense evaluation

at Fifth Third

Investment for the future:

•

Sales to support ratio has increased through

careful management of back office and front

office staff

Managing expenses for current revenue environment and long-term franchise

value * Source: Company reports. Data as of 3Q11. Efficiency ratio calculated

as reported noninterest expense / (net interest income (fully taxable equivalent)+ noninterest income)

** Sales / support ratio calculated as Sales Headcount (full-time equivalent) /

Support Headcount (full-time equivalent) Disciplined expense

management |

9

Fifth Third Bank | All Rights Reserved

Strong pre-provision net revenue*

Source: SNL Financial and company reports. Data as of 3Q11.

* Non-GAAP measure. See Reg. G reconciliation on pages 25-27.

** There

are

limitations

on

the

usefulness

of

credit-adjusted

PPNR,

including

the

significant

degree

to

which

changes

in

credit

and

fair

value

are

integral,

recurring

components

of

the

Bancorp’s

core

operations

as

a

financial institution. This measure has been included herein to facilitate a greater

understanding of the Bancorp’s financial condition. •

PPNR* of $617mm flat from 2Q11 reflecting strong mortgage banking results

•

PPNR* down 19% from 3Q10 driven by lower mortgage banking revenue, the 3Q10 net

benefit from the settlement of BOLI-related litigation, and improved

credit costs •

Adjusted PPNR* of $633mm, including positive adjustments totaling $16mm, up 9%

sequentially and flat year-over-year

Robust pre-provision profitability = strong capacity to absorb losses and

generate capital |

10

Fifth Third Bank | All Rights Reserved

Expect ROAA upside longer-term

Third quarter ROA of 1.34% included

—

Provision expense / average loans

of 44 bps

—

$70mm of credit-related costs in

revenue and expense

Elevated credit costs should decline as

conditions normalize

—

Credit-related costs historically of

~$25mm (pre-credit crisis)

—

1997-2006 Average Provision /

Loans of ~50 bps (45 bps average

net charge-off ratio)

—

3Q11 results and historical average

credit results would produce an

ROAA of approximately 1.4%

Long-term target of 1.3 –

1.5% return on assets

Earning asset growth

Mid-50% efficiency ratio long-term

NIM of 3.5-4.0%

Provision of 40-60 bps

Fees / Revenue ~40%

Mitigation of financial reform

Upper end of ROA target range assumes balance sheet growth and normalized rate

environment 3Q11

Actual

3Q11

Illustrative*

PPNR ex-credit costs**^

$687

$687

Credit costs

(70)

(25)

PPNR**

617

662

Provision***

(87)

(99)

Pre-tax income

530

563

Taxes***

(149)

(169)

Net Income

381

394

ROAA

1.34%

1.38%

Illustrative ROA calculation using

historical NCO and credit-related costs* |

11

Fifth Third Bank | All Rights Reserved

Strong relative credit trends

FITB credit metrics are in line with or better than peers

|

12

Fifth Third Bank | All Rights Reserved

Strong credit coverage levels

Source: SNL Financial and company reports. Data as of 3Q11. HFI NPAs and NPLs

exclude loans held-for-sale and also exclude covered assets for BBT, USB, and ZION

* Non-GAAP measure. See Reg. G reconciliation on pages 25-27.

Reserves and capital levels significant in relation to problem assets

|

13

Fifth Third Bank | All Rights Reserved

Strong capital position, Basel I and Basel III

Source: SNL Financial, company filings, and third-party estimates. Regulatory

financial data as of 3Q11. * Peers include BAC, BBT, C, CMA, COF, HBAN, JPM,

KEY, MTB, PNC, RF, STI, USB, WFC, ZION

** Non-GAAP measure. See Reg. G reconciliation on pages 25-27.

Fifth Third’s capital position already well in excess of established standards,

likely standards, and most peers |

14

Fifth Third Bank | All Rights Reserved

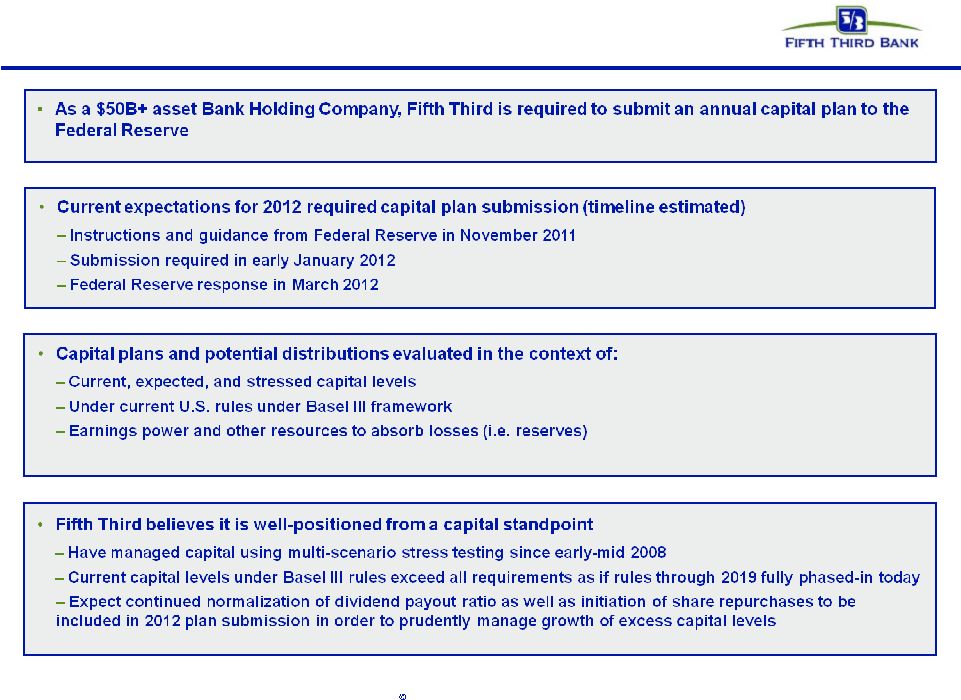

Capital management philosophy

* Subject to Board of Directors and regulatory approval

** Comprehensive Capital Adequacy Review by Federal Reserve; proposed future

capital actions confidentially submitted Strong internal capital generation;

current long-term Tier 1 common equity target of ~8% Organic growth

opportunities •

Support growth of core banking franchise

•

Continued loan growth despite sluggish

economy

Return to more normal dividend policy

*

•

Strong levels of profitability would support

significantly higher dividend than current level

•

Incorporated higher dividends in 1Q11 CCAR**

submission

Strategic opportunities

*

•

Prudently expand franchise via disciplined

acquisitions or de novos, increasing density in

core markets

•

Expect future acquisition activity although less

likely in near-term

•

Attain top 3 market position in 65% of markets

or more longer term

Repurchases / Redemptions

*

•

Common shares:

—

Manage excess capital in light of regulatory

environment, other deployment alternatives,

maintenance of buffers over targeted / required

capital levels, and stock price

—

Not included in 1Q11 CCAR** submission

•

Trust preferred shares (TruPS):

—

Potential redemption of certain TruPS included in

1Q11 CCAR

**

submission

—

Have called $517mm due to regulatory capital

treatment event or on normal call dates

—

Will evaluate remaining TruPS in context of

regulatory developments and desired capital

structure given continued changes in regulations |

15

Fifth Third Bank | All Rights Reserved

2012 Annual capital plan |

16

Fifth Third Bank | All Rights Reserved

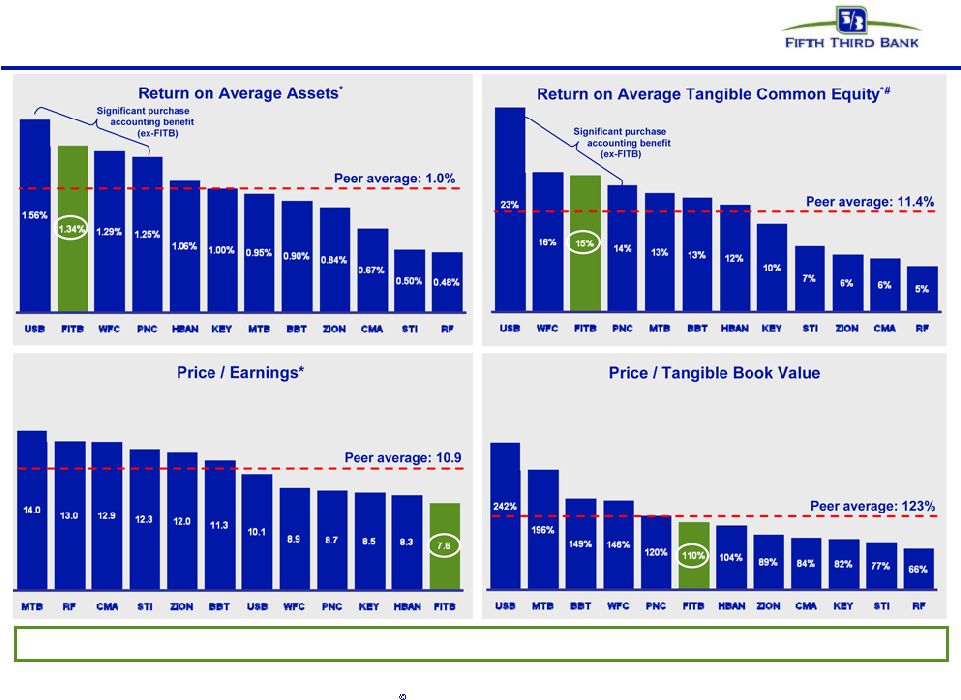

Strong returns drive capital generation

# Non-GAAP measure. See Reg. G reconciliation on pages 25-27.

* 3Q11 annualized

Price as of 11/11/11

Well above average profitability and capital generation, well below average

valuation |

17

Fifth Third Bank | All Rights Reserved

Well-positioned for the future

•

Holding company cash currently sufficient for more than 2 years of obligations;

minimal holding company or Bank debt maturities until 2013

•

Fifth Third has completely exited all crisis-era government support

programs Superior capital and liquidity position

•

NCOs of 1.3%; 2.4x reserves / annualized NCOs

•

$1.2B problem assets addressed through loan sales and transfer to HFS in 3Q10

•

Substantial reduction in exposure to CRE since 1Q09; relatively low CRE exposure

versus peers Proactive approach to risk management

•

Traditional commercial banking franchise built on customer-oriented localized

operating model •

Strong market share in key markets with focus on further improving density

•

Fee income ~40% of total revenues

Diversified traditional banking platform

•

PPNR^ has remained strong throughout the credit cycle

•

PPNR^ substantially exceeds annual net charge-offs (235% PPNR / NCOs^ in

3Q11) •

1.3% ROAA; 15% return on average tangible common equity^

Industry leader in earnings power

^ Non-GAAP measure. See Reg. G reconciliation on pages 25-27.

–

Fifth Third is one of the few large banks that have no TLGP-guaranteed debt to

refinance in 2012 |

18

Fifth Third Bank | All Rights Reserved

Cautionary statement

This

report

contains

statements

that

we

believe

are

“forward-looking

statements”

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the

Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated

thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future

performance

or

business.

They

usually

can

be

identified

by

the

use

of

forward-looking

language

such

as

“will

likely

result,”

“may,”

“are

expected

to,”

“is

anticipated,”

“estimate,”

“forecast,”

“projected,”

“intends

to,”

or

may

include

other

similar

words

or

phrases

such

as

“believes,”

“plans,”

“trend,”

“objective,”

“continue,”

“remain,”

or

similar

expressions,

or

future

or

conditional

verbs

such

as

“will,”

“would,”

“should,”

“could,”

“might,”

“can,”

or similar verbs. You should not place undue reliance on these statements, as they

are subject to risks and uncertainties,

including

but

not

limited

to

the

risk

factors

set

forth

in

our

most

recent

Annual

Report

on

Form

10-K.

When

considering

these

forward-looking statements, you should keep in mind these risks and

uncertainties, as well as any cautionary statements we may make. Moreover,

you should treat these statements as speaking only as of the date they are made and based only on information then actually

known to us.

There are a number of important factors that could cause future results to differ

materially from historical performance and these forward- looking

statements. Factors that might cause such a difference include, but are not limited to: (1) general economic conditions and

weakening in the economy, specifically the real estate market, either nationally or

in the states in which Fifth Third, one or more acquired entities and/or the

combined company do business, are less favorable than expected; (2) deteriorating credit quality; (3) political

developments, wars or other hostilities may disrupt or increase volatility in

securities markets or other economic conditions; (4) changes in the interest

rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan

loss provisions; (6) Fifth Third’s ability to maintain required capital levels

and adequate sources of funding and liquidity; (7) maintaining capital

requirements may limit Fifth Third’s operations and potential growth; (8) changes and trends in capital markets; (9) problems

encountered

by

larger

or

similar

financial

institutions

may

adversely

affect

the

banking

industry

and/or

Fifth

Third;

(10)

competitive

pressures

among

depository

institutions

increase

significantly;

(11)

effects

of

critical

accounting

policies

and

judgments;

(12)

changes

in

accounting policies or procedures as may be required by the Financial Accounting

Standards Board (FASB) or other regulatory agencies; (13)

legislative

or

regulatory

changes

or

actions,

or

significant

litigation,

adversely

affect

Fifth

Third,

one

or

more

acquired

entities

and/or

the

combined

company

or

the

businesses

in

which

Fifth

Third,

one

or

more

acquired

entities

and/or

the

combined

company

are

engaged,

including the Dodd-Frank Wall Street Reform and Consumer Protection Act; (14)

ability to maintain favorable ratings from rating agencies; (15)

fluctuation

of

Fifth

Third’s

stock

price;

(16)

ability

to

attract

and

retain

key

personnel;

(17)

ability

to

receive

dividends

from

its

subsidiaries;

(18)

potentially

dilutive

effect

of

future

acquisitions

on

current

shareholders’

ownership

of

Fifth

Third;

(19)

effects

of

accounting or financial results of one or more acquired entities; (20) difficulties

in separating Vantiv, LLC, formerly Fifth Third Processing Solutions

from

Fifth

Third;

(21)

loss

of

income

from

any

sale

or

potential

sale

of

businesses

that

could

have

an

adverse

effect

on

Fifth

Third’s earnings and future growth; (22) ability to secure confidential

information through the use of computer systems and telecommunications

networks;

and

(23)

the

impact

of

reputational

risk

created

by

these

developments

on

such

matters

as

business

generation and retention, funding and liquidity.

You

should

refer

to

our

periodic

and

current

reports

filed

with

the

Securities

and

Exchange

Commission,

or

“SEC,”

for

further

information

on other factors, which could cause actual results to be significantly different

from those expressed or implied by these forward-looking statements.

|

19

Fifth Third Bank | All Rights Reserved

Customer-centric traditional banking model:

well-positioned for changed financial landscape

Fifth Third’s business model is driven by traditional banking activities, consistent with

direction of financial reform

—

Dodd-Frank / Basel III do not require substantial changes to Fifth Third’s business

model or asset mix with attendant execution risk

—

Low level of financial system “interconnectedness”

–

International activity primarily related to trade finance and lending to U.S.

subsidiaries of foreign companies

–

(e.g.) Fifth Third loss in Lehman bankruptcy expected to be less

than $2mm

—

Little to no impact from Volcker rule (de minimis market maker in derivatives,

proprietary trading)

–

Daily VaR ~$1mm or less

–

Small private equity portfolio ~$100mm

—

No originations of CDOs, securitizations on behalf of others

—

Didn’t originate or sell subprime mortgages or Option ARMs

—

No mortgage securitizations outstanding (except ~$28mm HELOC from 2003)

Business profile positions Fifth Third well –

today and in the future

No significant

business at Fifth Third impaired during crisis |

20

Fifth Third Bank | All Rights Reserved

Liquidity levels elevated in 3Q11

As of 3Q11, readily available borrowing capacity at FHLB:

$6.3B; contingent borrowing capacity at the Fed: $21.2B

—

Executed

$2.5B in three-month FHLB borrowings in July

as a precaution to supplement liquidity through the

discussion and resolution of the U.S. debt ceiling limit

Holding Company cash at 9/30/11: $2.1B

Cash currently sufficient to satisfy all fixed obligations

for more than 2 years (debt maturities, common and

preferred dividends, interest and other expenses)

without accessing capital markets; relying on dividends

from subsidiaries; proceeds from asset sales

Expected cash obligations over the next 12 months

—

$25mm debt maturities

—

~$300mm common dividends

—

~$35mm Series G preferred dividends

—

~$459mm interest and other expenses

Bank unsecured debt maturities ($mm –

excl. Brokered CDs)

Heavily core funded

Strong liquidity profile |

21

Fifth Third Bank | All Rights Reserved

Mortgage repurchase overview

33% drop in 3Q11 outstanding claims balance driven by

high number of resolutions in quarter

Virtually all sold loans and the majority of new claims

relate to agencies

—

98% of outstanding balance of loans sold

—

Three-quarters

of current quarter outstanding claims

Majority of outstanding balances of the serviced for

others portfolio relates to origination activity in 2009

and later

Private claims and exposure relate to whole loan sales

(no outstanding first mortgage securitizations)

—

Preponderance of private sales prior to 2006

Repurchase Reserves* ($ in millions)

Outstanding Counterparty Claims ($ in millions)

Outstanding Balance of Sold Loans ($ in millions)

3Q10

4Q10

1Q11

2Q11

3Q11

Beginning balance

85

103

101

87

80

Net reserve additions

47

21

10

15

20

Repurchase losses

(29)

(23)

(23)

(22)

(31)

Ending balance

103

101

87

80

69

2005 and prior

GSE

GNMA

Private

Total

$7,838

$301

$578

$8,717

2006

1,791

64

277

2,132

2007

2,911

95

239

3,244

2008

2,975

729

0.3

3,704

2009 and later

29,971

8,718

1

38,690

Total

$45,485

$9,907

$1,096

$56,488

*

Includes reps and warranty reserve ($52mm) and reserve for loans sold with recourse

($17mm) |

22

Fifth Third Bank | All Rights Reserved

Troubled debt restructurings overview

Successive improvement in vintage performance during

2008 and 2009 as volume of modification increased

Fifth Third’s mortgage portfolio TDRs have redefaulted

at a lower rate than GSE composites

Of $1.8B in consumer TDRs, $1.6B were on accrual

status and $215mm were nonaccruals

—

$1.1B of TDRs are current and have been on the

books 6 or more months; within that, nearly

$940mm of TDRs are current and have been on

the books for more than a year

As current TDRs season, their default propensity

declines significantly

—

We see much lower defaults on current loans after

a vintage approaches 12 months since

modification

* Fifth Third data includes changes made to align with OCC/OTS methodology (i.e.

excludes government loans, closed loans and OREO from calculations) |

23

Fifth Third Bank | All Rights Reserved

Commercial

3Q10

4Q10

1Q11

2Q11

3Q11

Beginning NPL Amount

1,980

1,261

1,214

1,211

1,253

Transfers to nonperforming

522

269

329

340

217

Transfers to performing

(21)

(2)

(2)

(10)

Transfers to performing (restructured)

(10)

-

-

-

Transfers to held for sale

(342)

-

(16)

(15)

Loans sold from portfolio

(5)

(9)

(12)

(7)

Loan paydowns/payoffs

(153)

(111)

(108)

(91)

Transfer to other real estate owned

(92)

(48)

(37)

(39)

Charge-offs

(627)

(170)

(164)

(141)

Draws/other extensions of credit

9

24

7

5

5

Ending Commercial NPL

1,261

1,214

1,211

1,253

1,155

Consumer

3Q10

4Q10

1Q11

2Q11

3Q11

Beginning NPL Amount

549

NPL rollforward

Significant improvement in NPL inflows over past year

Prior period NPL inflows restated to reflect additional detail and with transfers

to nonaccrual status presented to reflect gross inflows and charge-offs.

NPL HFI Rollforward

(11)

(1)

(58)

(17)

(77)

(20)

(136)

418

323

466

434

386

Transfers to nonperforming

256

365

232

214

201

Transfers to performing

(45)

(36)

(35)

(34)

(33)

Transfers to performing (restructured)

(29)

(25)

(50)

(41)

(39)

Transfers to held for sale

(205)

-

-

-

-

Loans sold from portfolio

-

-

(1)

(21)

-

Loan paydowns/payoffs

(37)

(17)

(18)

(27)

(27)

Transfer to other real estate owned

(50)

(20)

(18)

(15)

(16)

Charge-offs

(118)

(130)

(144)

(126)

(91)

Draws/other extensions of credit

2

4

2

2

2

Ending Consumer NPL

323

466

434

386

383

Total NPL

1,584

1,680

1,645

1,639

1,538

Total new nonaccrual loans -

HFI

778

634

561

554 |

24

Fifth Third Bank | All Rights Reserved

Non-performing loans

* 3Q10 inflows into NPLs HFS were $217mm, reflecting performing loans moved to

held-for-sale in 3Q10 that were deemed impaired as a result of the decision to sell these loans.

Prior period NPL inflows restated to reflect additional detail and with transfers to

nonaccrual status presented to reflect gross inflows and charge-offs. See

slide 13 for more information. |

25

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

$ in millions

(unaudited)

For the Three Months Ended

September

June

March

December

September

June

March

December

2011

2011

2011

2010

2010

2010

2010

2009

Pre-tax Pre-provision Net Revenue:

Income before income taxes (a)

$ 530

$

506

$ 377

$

417

$ 303

$

242

$

(22) $

(214) Provision expense (b)

87

113

168

166

457

325

590

776

Pre-tax, pre-provision net revenue (PPNR) (a) + (b)

617

619

545

583

760

567

568

562

Annualized PPNR (c)

2,448

2,483

2,210

2,313

3,015

2,274

2,304

2,230

Adjustments remove (benefit) / detriment

Securities (gains) / losses

(26)

(6)

(8)

(21)

(4)

(8)

(14)

(2)

Gain on BOLI settlement

-

-

-

-

(127)

-

-

-

Valuation of 2009 Visa total return swap

17

4

9

5

-

-

9

-

Vantiv, LLC warrants & puts

(3)

(29)

2

(3)

5

(10)

2

(20)

Termination of certain borrowings & hedging

transactions

28

-

-

-

-

-

-

-

Other litigation reserve expense

-

-

-

-

-

3

4

22

Extinguishment (gains) / losses

-

(6)

(3)

17

-

-

-

-

Adjusted PPNR (k)

633

582

545

581

634

552

569

562

Annualized Adjusted PPNR (d)

2,511

2,334

2,210

2,305

2,515

2,214

2,308

2,230

Credit-related items in noninterest income

Gain / (loss) on sale of loans

3

8

17

21

(1)

25

8

8

Commercial loans HFS FV adjustment

(6)

(9)

(16)

(35)

(9)

(9)

(17)

(30)

Gain / (loss) on sale of OREO properties

(21)

(26)

(2)

(19)

(29)

(16)

(21)

(22)

Mortgage repurchase costs

(2)

(0)

(2)

(1)

(4)

-

(2)

-

Total credit-related revenue impact (i)

25

28

3

34

44

1

31

45

Credit-related items in noninterest expense

Mortgage repurchase expense

19

14

8

20

45

39

17

11

Provision for unfunded commitments

(10)

(14)

(16)

(4)

(23)

9

11

44

Derivative valuation adjustments

4

1

(0)

(1)

8

8

(2)

21

OREO expense

7

6

13

11

9

6

9

6

Other problem asset related expenses

25

30

28

27

28

29

37

29

Total credit-related operating expenses (j)

45

36

32

53

67

91

73

111

Credit-adjusted PPNR (k) + (i) + (j)

703

646

580

668

745

643

673

717

PPNR excluding credit costs (a) + (b) + (i) + (j)

687

683

580

670

871

658

672

717

Financial & Asset Quality Metrics:

Risk-weighted assets (e)

$ 102,562

$ 100,320

$ 99,392

$ 100,561

$ 98,904

$ 97,888

$ 99,220

$ 100,862

Net charge-offs

262

304

367

356

956

434

582

708

Annualized net charge-offs (f)

1,039

1,219

1,488

1,412

3,793

1,741

2,360

2,809

Total assets (g)

114,905

110,805

110,485

111,007

112,322

112,025

112,651

113,380

Average assets (h)

113,295

111,200

110,844

111,858

111,854

112,613

113,433

111,505

Ratios:

PPNR / RWA (c) / (e)

2.4%

2.5%

2.2%

2.3%

3.0%

2.3%

2.3%

2.2%

PPNR / NCO (c) / (f)

235%

204%

149%

164%

79%

131%

98%

79%

PPNR / Total assets (c) / (g)

2.1%

2.2%

2.0%

2.1%

2.7%

2.0%

2.0%

2.0%

PPNR / Average assets (c) / (h)

2.2%

2.2%

2.0%

2.1%

2.7%

2.0%

2.0%

2.0%

Adjusted PPNR / RWA (d) / (e)

2.4%

2.3%

2.2%

2.3%

2.5%

2.3%

2.3%

2.2%

Adjusted PPNR / NCO (d) / (f)

242%

191%

149%

163%

66%

127%

98%

79%

Adjusted PPNR / Total assets (d) / (g)

2.2%

2.1%

2.0%

2.1%

2.2%

2.0%

2.0%

2.0%

Adjusted PPNR / Average assets (d) / (h)

2.2%

2.1%

2.0%

2.1%

2.2%

2.0%

2.0%

2.0% |

26

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

$ and shares in millions

(unaudited)

For the Three Months Ended

September

June

March

December

September

2011

2011

2011

2010

2010

Net income available to common shareholders (U.S. GAAP)

$

373

$

328

$

88

$

270

$

175 Add:

Intangible amortization, net of tax

3

4

5

7

7

Tangible net income available to common shareholders

376

332

93

277

182

Tangible net income available to common shareholders (annualized) (a)

1,492

1,332

377

1,099

722

Average Bancorp shareholders' equity (U.S. GAAP)

12,841

12,365

13,052

14,007

13,852

Less:

Average preferred stock

398

398

1,557

3,648

3,637

Average goodwill

2,417

2,417

2,417

2,417

2,417

Average intangible assets

47

52

59

67

78

Average tangible common equity (b)

9,979

9,498

9,019

7,875

7,720

Total Bancorp shareholders' equity (U.S. GAAP)

13,029

12,572

12,163

14,051

13,884

Less:

Preferred stock

(398)

(398)

(398)

(3,654)

(3,642)

Goodwill

(2,417)

(2,417)

(2,417)

(2,417)

(2,417)

Intangible assets

(45)

(49)

(55)

(62)

(72)

Tangible common equity, including unrealized gains / losses (c)

10,169

9,708

9,293

7,918

7,753

Less: Accumulated other comprehensive income / loss

(542)

(396)

(263)

(314)

(432)

Tangible common equity, excluding unrealized gains / losses (d)

9,627

9,312

9,030

7,604

7,321

Total assets (U.S. GAAP)

114,905

110,805

110,485

111,007

112,322

Less:

Goodwill

(2,417)

(2,417)

(2,417)

(2,417)

(2,417)

Intangible assets

(45)

(49)

(55)

(62)

(72)

Tangible assets, including unrealized gains / losses (e)

112,443

108,339

108,013

108,528

109,833

Less: Accumulated other comprehensive income / loss, before tax

(834)

(609)

(405)

(483)

(665)

Tangible assets, excluding unrealized gains / losses (f)

111,609

107,730

107,608

108,045

109,168

Common shares outstanding (g)

920

920

919

796

796

Total nonperforming assets, excluding held-for-sale (h)

1,944

Total ninety days past due loans and leases (i)

274

Allowance for loan and lease losses (j)

2,439

Ratios:

Return on average tangible common equity (a) / (b)

14.9%

14.0%

4.2%

13.9%

9.4%

Tangible common equity (excluding unrealized gains/losses) (d)

/ (f)

8.63%

8.64%

8.39%

7.04%

6.70%

Tangible common equity (including unrealized gains/losses) (c)

/ (e)

9.04%

8.96%

8.60%

7.30%

7.06%

Tangible book value per share (c) / (g)

11.05

10.55

10.11

9.94

9.74

"Texas Ratio" (HFI NPAs + Over 90s) / (Reserves + TCE) ((h) + (i)) / ((c) +

(j)) 18% |

27

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

$ in millions

(unaudited)

For the Three Months Ended

September

June

March

December

September

2011

2011

2011

2010

2010

Total Bancorp shareholders' equity (U.S. GAAP)

$ 13,029

$ 12,572

$ 12,163

$ 14,051

$ 13,884

Goodwill and certain other intangibles

(2,514)

(2,536)

(2,546)

(2,546)

(2,525)

Unrealized gains

(542)

(396)

(263)

(314)

(432)

Qualifying trust preferred securities

2,273

2,312

2,763

2,763

2,763

Other

20

20

12

11

8

Tier I capital

12,266

11,972

12,129

13,965

13,698

Less:

Preferred stock

(398)

(398)

(398)

(3,654)

(3,642)

Qualifying trust preferred securities

(2,273)

(2,312)

(2,763)

(2,763)

(2,763)

Qualifying noncontrolling interest in consolidated subsidiaries

(30)

(30)

(30)

(30)

(30)

Tier I common equity (a)

9,565

9,232

8,938

7,518

7,263

Unrealized gains

542

Disallowed deferred tax assets

-

Disallowed MSRs

64

Other

10

Less:

10% of individual deferred tax assets, MSRs, investment in financial entities

-

15% of aggregate deferred tax assets, MSRs, investment in financial entities

-

Tier 1 common equity, Basel III proforma (b)

10,181

Risk-weighted assets, determined in accordance with

prescribed regulatory requirements (c)

$ 102,950

$ 100,320

$ 99,392

$ 100,561

$ 98,904

Add:

Regulatory deductions not deducted from Tier 1 common equity,

risk-weighted at 250%

1,377

Risk-weighted assets, Basel III proforma (d)

104,327

Allowance for loan and lease losses (e)

$ 2,439

Ratios:

Tier I common equity (a) / (c)

9.29%

9.20%

8.99%

7.48%

7.34%

Tier I common equity, Basel III proforma (b) / (d)

9.76%

Tier I common + reserves / RWA ((a) + (e)) / (c)

11.66%

Tier I common + reserves / RWA, Basel III proforma ((b) + (e))

/ (d)

12.10% |