Attached files

| file | filename |

|---|---|

| EX-10.26 - ORAL AMENDMENT TO STOCKHOLDER'S RIGHTS TRANSFER AGMTS - Joway Health Industries Group Inc | d235049dex1026.htm |

| EX-10.20 - CITIC TRUST AGREEMENT - Joway Health Industries Group Inc | d235049dex1020.htm |

| EX-10.27 - ORAL AMENDMENT TO STOCKHOLDER'S RIGHTS TRANSFER AGMTS - Joway Health Industries Group Inc | d235049dex1027.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 2

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 7, 2010

Joway Health Industries Group Inc.

(Exact name of registrant as specified in its charter)

| Texas | 333-108715 | 98-0221494 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

No. 2, Baowang Road, Baodi Economic Development Zone,

Tianjin, PRC 301800

(Address of Principal Executive Offices)

Registrant’s telephone number: +(86)-22-22533666

G2 Ventures, Inc.

16th Floor, Tianjin Global Zhiye Square, 309 Nanjing Road,

Nankai District, Tianjin, PRC 300100

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

EXPLANATORY NOTE

The purpose of this Second Amended Current Report on Form 8-K/A is to amend Item 2.01—Completion of Acquisition or Disposition of Assets and Item 9.01—Financial Statements and Exhibits of our Current Report on Form 8-K which was filed with the Securities and Exchange Commission (the “SEC”) on October 7, 2010 (the “Original 8-K”) and amended on June 10, 2011. These amendments are being made to address certain comments received from the Staff of the SEC with respect to the First Amended Current Report on Form 8-K/A which was filed with the SEC on June 10, 2011.

Except as stated herein, this Current Report on Form 8-K/A does not reflect events occurring after the filing of the Original 8-K on October 7, 2010 and no attempt has been made is this Current Report on Form 8-K/A to modify or update other disclosures as presented in the Original 8-K. Accordingly, this Form 8-K/A should be read in conjunction with the Original 8-K and our filings with the SEC subsequent to the filing of the Original 8-K.

In particular, the body of this Amended Current Report on Form 8-K/A does not reflect the conversion of the Company’s domicile from the State of Texas to the State of Nevada, the amendment of the Company’s Articles of Incorporation filed with Nevada Secretary of State on December 22, 2010, pursuant to which the name of the Company was changed from “G2 Ventures, Inc.” to “Joway Health Industries Group Inc.”

CONVENTIONS THAT APPLY TO THIS CURRENT REPORT ON FORM 8-K

Except where the context otherwise requires and for purposes of this Current Report on Form 8-K only:

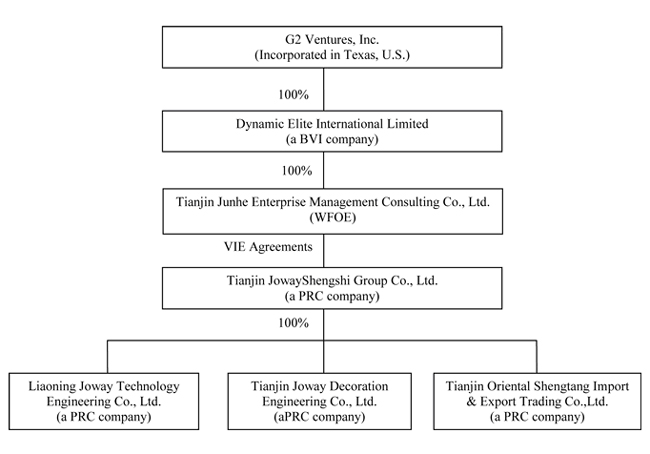

| • | “we,” “us,” “our company,” “our,” “the Company” and “G2 Ventures” refer to G2 Ventures, Inc., its consolidated subsidiaries, namely Dynamic Elite International Limited, a British Virgin Islands limited liability company (“Dynamic Elite”), Tianjin Junhe Enterprise Management Consulting Co., Ltd., a PRC incorporated company (“Junhe Consulting”), and its operating entities, namely Tianjin JowayShengshi Group Co., Ltd. (“Joway Group”), Liaoning Joway Technology Engineering Co., Ltd. (“Joway Technology”), Tianjin Joway Decoration Engineering Co., Ltd. (“Joway Decoration”) and Tianjin Oriental Shengtang Import & Export Trading Co., Ltd.(“Shengtang Trading”), four PRC companies. |

| • | references to the “Bulletin Board,” the “OTC Bulletin Board” or the “OTCBB” are to the Over-the-Counter Bulletin Board, a securities quotation service, which is accessible at the website www.otcbb.com. |

| • | references to PRC Operating Entities’ “registered capital” are to the equity of PRC Operating Entities, which under PRC law is measured not in terms of shares owned but in terms of the amount of capital that has been contributed to a company by a particular shareholder or all shareholders. The portion of a limited liability company’s total capital contributed by a particular shareholder represents that shareholder’s ownership of the company, and the total amount of capital contributed by all shareholders is the company’s total equity. Capital contributions are made to a company by deposits into a dedicated account in the company’s name, which the company may access in order to meet its financial needs. When a company’s accountant certifies to PRC authorities that a capital contribution has been made and the company has received the necessary government permission to increase its contributed capital, the capital contribution is registered with regulatory authorities and becomes a part of the company’s “registered capital.” |

| • | “China” or “PRC” refers to the People’s Republic of China, excluding Taiwan and the Special Administrative Regions of Hong Kong and Macau; |

| • | all references to “Renminbi” or “RMB” are to the legal currency of China; and |

| • | all references to “U.S. dollars,” “dollars,” or “$” are to the legal currency of the United States. |

Amounts may not always add to the totals due to rounding.

Unless otherwise noted, all translations from Renminbi to U.S. dollars using the exchange rate refers to the exchange rate quoted on http://www.xe.com on October 6, 2010, which was RMB 6.6928 to the $1.00. We make no representation that the RMB amounts referred to in this Current Report on Form 8-K could have been or could be converted into U.S. dollars at any particular rate or at all.

1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K or Form 8-K and other reports filed by us from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) as they relate to our industry, our operations and results of operations, and any businesses that we may acquire. Should one or more of the events described in these risk factors materialize, or should our underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the U.S. federal securities laws, we do not intend to update any of the forward-looking statements to conform them to actual results. The following discussion should be read in conjunction with our pro forma financial statements and the related notes that will be filed herein.

2

Item 2.01 Completion of Acquisition or Disposition of Assets

As described in Item 1.01 of Form 8-K filed on October 1, 2010, we acquired all the issued and outstanding shares of Dynamic Elite pursuant to the Share Exchange Agreement and Dynamic Elite became our wholly owned subsidiary. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein Dynamic Elite is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of Dynamic Elite have been brought forward at their book value and no goodwill has been recognized.

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, on October 1, 2010, we acquired Dynamic Elite in a Reverse Merger acquisition transaction. Item 2.01(f) of Form 8-K states that if the registrant were a shell company as we were immediately before the Reverse Merger transaction disclosed under Item 1.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities under the Exchange Act on Form 10.

Accordingly, we are providing below the information that would be included in a Form 10 registration statement. Please note that the information provided below relates to the combined enterprises after the acquisition of Dynamic Elite, except that information relating to periods prior to the date of the Reverse Merger only relate to Dynamic Elite and its subsidiaries unless otherwise specifically indicated.

CORPORATE STRUCTURE AND HISTORY

Corporate History

G2 Ventures, Inc.

3

We were originally formed as a Texas corporation on March 21, 2003 to acquire most of the assets and certain liabilities of and succeed to the business of G2 Companies, Inc., (formerly Hartland Investment, Inc.), as an independent recording company and artist management company. The acquisition of G2 Companies, Inc. was consummated on April 1, 2003. On May 13, 2008, through a registered offering, we sold 1,284,574 shares of our common stock raising an aggregate of $128,457, before costs of the Offering. Our common stock began trading on the Over-the-Counter Bulletin Board (“OTCBB”) under the symbol “GTVI” on September 11, 2009. Prior to the Share Exchange Transaction, we were a development stage music recording, production and artist management company that had limited operations, primarily due to our inability to raise sufficient capital.

PRC Operating Entities

Joway Group. On May 17, 2007, Jinghe Zhang, Si Lijun and Song Baogang founded Tianjin Joway Textile Co., Ltd. as a limited liability company under the laws of the PRC. On November 24, 2009, the company changed its name to Tianjin Joway Shengshi Group Co., Ltd. (“Joway Group”). The registered capital of the Joway Group is RMB 50,000,000 and its term of operation will expire on May 16, 2022. Mr. Jinghe Zhang is the Executive Director and General Manager of Joway Group. On July 1, 2010, Si Lijun transferred 4% of the equity interest in Joway Group to Jinghe Zhang. As a result, Mr. Zhang owns 99% of the equity interest in Joway Group. Baogang Song owns the remaining 1% of the equity interest of Joway Group. Joway Group owns 100% equity interest in each of Joway Technology, Joway Decoration, and Shengtang Trading.

Joway Technology. Joway Technology was incorporated under the laws of the PRC on March 28, 2007, with a registered capital of RMB 1,100,000. Its term of operation expires on March 27, 2017. It was formed to engage in intelligent engineering design and construction, development and sales of electronics, water filters, and other similar products. Prior to July 25, 2010, Joway Group held 90.91% of Joway Technology. On July 25, 2010 the Joway Group acquired the remaining 9.09% of Joway Technology from Chen Jingyun for RMB100,000.

Joway Decoration. Joway Decoration was incorporated by Joway Group under the PRC laws on April 22, 2009, with a registered capital of RMB 2,000,000. Its term of operation expires on April 21, 2019. It was formed to engage in the business of intelligent electric heating project design and construction, development and sales of electronics technology and water filters, and the manufacture and sales of wood products. Prior to July 9, 2010, the Joway Group owned 90% of Joway Decoration. On July 9, 2010, the Joway Group acquired the remaining 10% of Joway Decoration from Chen Jingyun for RMB200,000.

Shengtang Trading. Shengtang Trading was incorporated by Joway Group under the PRC laws on September 18, 2009, with a registered capital of RMB 2,000,000. Its term of operation expires on September 17, 2029. It was formed to engage in the business of the import and export of merchandise and technology; knitwear, biochemistry (excluding toxic chemicals and drugs), and wholesale and retail sale of hardware. Prior to July 28, 2010, the Joway Group owned 95% of Shengtang. On July 28, 2010, the Joway Group acquired the remaining 5% of Shengtan from Wang Aiying for RMB100,000.

Jingyun Chen is currently a General Manager of Joway Technology and Joway Decoration. Aiying Wang currently is an employee of Joway Group but does not hold any management position.

Reorganization of PRC Entities; Variable Interest Entity Arrangement

In 2010, the shareholders of the Joway Group determined to reorganize the Joway Group with the ultimate goal of consummating a reverse merger with a U.S. publicly traded company. To this end, on June 2, 2010, at the request of Mr. Zhang, Mr. Lionel Even Liu founded Dynamic Elite International Limited, a limited liability company under the laws of the British Virgin Islands and on June 18, 2010 Mr. Liu was issued 10,000 shares of Dynamic Elite representing 100% of the issued and outstanding shares. On June 18, 2010 Mr. Liu was appointed a Director of Dynamic Elite and on September 17, 2010 Mr. Zhang was appointed the Executive Director of Dynamic Elite.

On June 2, 2010, Mr. Liu and Mr. Zhang entered into an Entrust Agreement pursuant to which Mr. Liu:

| • | Appointed Mr. Zhang as Mr. Liu’s exclusive agent and attorney, with respect to all of his shareholder’s rights and shareholder’s voting rights in Dynamic Elite; |

Granted Mr. Zhang irrevocable authority to operate and manage Dynamic Elite, including the power to appoint directors, legal representatives, and executive and other senior officers;

| • | Agreed not to cause the Company to conduct any transaction that would materially affect the assets, obligations, rights or the operations of the Company, without the consent of Mr. Zhang; |

| • | Agreed not to (i) issue or create any new shares, equity, registered capital, ownership interest, or equity-linked securities, or any options or warrants that are directly convertible into, or exercisable or exchangeable for, shares, equity, registered capital, ownership interest, or equity-linked securities of the Company, or other similar equivalent arrangement; (ii) alter the shareholding structure of the Company; (iii) cancel or otherwise alter the shares held by Mr. Liu; (iv) amend the register of members or the memorandum and articles of association of the Company; (v) liquidate or wind up the Company, or; (vi) act or omit to act in such a way that would effect the interest of shares held by Mr. Liu, without the prior consent of Mr. Zhang; and |

| • | Waived all rights as a shareholder in Dynamic Elite in favor of Mr. Zhang. |

Pursuant to the Entrust Agreement, Mr. Liu transferred to Mr. Zhang all of Mr. Liu’s rights to manage and operate Dynamic Elite as well as all of Mr. Liu’s rights as a shareholder, including the right to vote his shares of Dynamic Elite. Pursuant to the Agreement, Mr. Zhang has the sole and exclusive right to appoint the directors of Dynamic Elite and to manage and operate the company and its business. In addition, Mr. Liu was prohibited from undertaking any transaction affecting the business, assets, operations or securities of the Company without the consent of Mr. Zhang. As a result, Mr. Liu did not retain any operational or organizational control over Dynamic Elite.

On June 18, 2010, Mr. Liu established Crystal Globe Limited, a limited liability company under the laws of the British Virgin Islands and on June 18, 2010 Mr. Liu was issued 10,000 shares of Crystal Globe representing 100% of the issued and outstanding shares. On July 20, 2010, Mr. Zhang was appointed the Executive Director of Crystal Globe and Mr. Liu was appointed a Director of Crystal Globe. On September 18, 2010, Mr. Liu, the sole shareholder of Dynamic Elite, transferred all of the shares of Dynamic Elite to Crystal Globe.

On July 20, 2010, Mr. Liu entered into a Call Option Agreement with Mr. Zhang and Mr. Song, the two shareholders of the Joway Group, pursuant to which Mr. Liu granted Mr. Zhang and Mr. Song the right to purchase up to 100% of the shares of Crystal Globe at an aggregate price equal of $20,000 over the next three years. In addition, the Option Agreement also provides that Mr. Liu shall not dispose any of the shares of Crystal Globe without consent of Mr. Zhang and Mr. Song.

On October 1, 2010, G2 Ventures, Inc., Dynamic Elite and Crystal Globe, the sole shareholder of Dynamic Elite entered into and consummated a Share Exchange Agreement pursuant to which Crystal Globe assigned, transferred, conveyed and delivered 10,000 shares of Dynamic Elite (representing 100% of the issued and outstanding shares) to G2 Ventures in consideration for the issuance to Crystal Globe of 15,215,426 restricted shares of common stock of G2 Ventures (the “Reverse Merger”). As of the date of the Reverse Merger and as of the date of the Current Report on Form 8-K filed with the SEC on October 7, 2010, Mr. Liu was the sole shareholder of Crystal Globe. Except as set forth in the Call Option Agreement and the Entrust Agreement or as otherwise set forth above, Mr. Zhang had no ownership, directly or indirectly, in Crystal Globe and Dynamic Elite before the Reverse Merger.

On September 15, 2010, Mr. Lionel Even Liu established a wholly-owned subsidiary of Dynamic Elite — Tianjin Junhe Management Consulting Co., Ltd. (“Junhe Consulting”), as a wholly foreign-owned enterprise (WOFE) under the laws of the PRC for the purposes of acquiring the Joway Group and engaging in the manufacture and distribution of tourmaline products in China.

Under Article 6 of the Law of the People’s Republic of China on Wholly Foreign-Owned Enterprises, adopted April 12, 1986 at the 4th Sess. of the 6th National People’s Congress and as amended on October 31, 2000

4

(“PRC WOFE Law”),) and Article 7 of the Detailed Rules for the Implementation, any person or entity that intends to establish an enterprise in the PRC with foreign capital is required to submit an application for examination and approval to the appropriate department under the State Council. Approval of the application is vested in the applicable local authority if the wholly foreign-owned enterprise meets the following conditions: (1) Where the total amount of investment is within the approval limits of the local authority prescribed by the State Council; or (2) Where the enterprise does not need any raw materials to be allocated by the state and will not affect the national comprehensive balance of energy resources, communication and transportation and export quota for foreign trade.

The total investment in Junhe Consulting is USD $20,000 which is within the approval limits of the Tianjin government, and Junhe Consulting does not need any raw materials to be allocated by the state and will not affect the national comprehensive balance of energy resources, communication and transportation and export quota for foreign trade.

On September 9, 2010, the local Tianjin government issued a certificate of approval approving the foreign ownership of Junhe Consulting by Dynamic Elite. Mr. Zhang Jinghe was appointed the Executive Director of Junhe Consulting.

Purpose of the VIE Agreements

Under PRC law the acquisition of the Joway Group by Junhe Consulting must be structured as a cash transaction with the purchase price based on the appraised value of the equity interest or assets to be sold.

Neither Junhe Consulting nor Dynamic Elite had sufficient cash to pay the appraised value of the equity interest or assets of the Joway Group. Alternatively, the shareholders of the Joway Group and Dynamic Elite decided to enter into a series of contractual agreements (the “VIE Agreements”) which would enable Dynamic Elite to gain control of the Joway Group and consolidate into its financial statements the results, assets and liabilities of Joway Group and its subsidiaries without triggering the regulatory requirements of PRC law.

Under PRC law no governmental approval is required as the VIE Agreements are considered commercial transactions among legal entities and individuals, namely Joway Group, Junhe Consulting, Jinghe Zhang and Baogang Song, and are properly executed and approved by the shareholders of Joway Group in accordance with the Articles of Association of Joway Group. Although the pledge by the Joway Group’s equity holders of all their equity in Joway Group to Junhe Consulting pursuant to the Equity Pledge Agreement (the “Equity Pledge”) must be registered with the appropriate governmental agency. The Equity Pledge was registered with local administration department for industry and commerce pursuant to the Section 1 of Article 226 of PRC Property Law passed by National People’s Congress on March 16, 2007.

On September 16, 2010, Dynamic Elite through its wholly-owned subsidiary Junhe Consulting entered into the VIE Agreements with Joway Group and its shareholders. On September 16, 2010, the date the VIE Agreements were executed, Zhang Jinghe owned 99% of the Joway Group and was the executive director of Junhe Consulting. As a result, the Joway Group and Junhe Consulting were under the common control of Zhang Jinghe who signed the following agreements on behalf of both parties:

| • | Consulting Services Agreement; |

| • | Operating Agreement; |

| • | Voting Rights Proxy Agreement; |

| • | Option Agreement; and |

| • | Equity Pledge Agreement |

Terms of the VIE Agreements

Consulting Agreement

Under the Consulting Agreement, Joway Group retained Junhe Consulting to (i) provide general advice and assistance relating to the management and operation of Joway Group’s business; (ii) provide general advice and

5

assistance with respect to employment and staffing issues, including recruiting and training of management personnel, administrative personnel and other staff, establishing an efficient payroll management system, and relocation assistance; (iii) provide business development advice and assistance; and (iv) such other advice and assistance as may be agreed upon by the parties. In return, Joway Group agreed to pay Junhe Consulting quarterly a consulting fee in an amount equal to all of Joway Group’s net income for that quarter within fifteen (15) days after receipt of Joway Group’s quarterly financial statements. Joway Group shall cause the owners of Joway Group to pledge their equity interests in Joway Group to Junhe Consulting to secure the payment of the foregoing consulting fee.

Joway Group is subject to a number of covenants typical for this type of transaction, including the obligation to provide monthly, quarterly and annual reports, and other information requested by Junhe Consulting. In addition, Joway Group is subject to a number of negative covenants, including the agreement that it will not (i) issue, purchase or redeem any equity or debt, or equity or debt securities, (ii) create, incur, assume or suffer to exist any liens upon any of its property or assets (except certain enumerated liens), (iii) wind up, liquidate or dissolve its affairs or enter into any transaction of merger or consolidation, or sale of all or substantially all of its assets; (iv) declare or pay any dividends, (v) incur, assume or suffer to exist any indebtedness, (other than certain enumerated exceptions); (vi) lend money or credit or make advances to any Person, or purchase or acquire any stock, obligations or securities of, or any other interest in, or make any capital contribution to, any other Person, except receivables in the ordinary course of business; (vii) enter into any transaction or series of related transactions, whether or not in the ordinary course of business, with any of its affiliates or related parties, other than on terms and conditions substantially as favorable to Joway Group as would be obtainable in a comparable arm’s-length transaction; (viii) make any expenditure for fixed or capital assets (including, without limitation, expenditures for maintenance and repairs which are capitalized in accordance with generally accepted accounting principles in the PRC and capitalized lease obligations) during any quarterly period which exceeds the aggregate the amount contained in the budget; (ix) amend or modify or change its Articles of Association or business license, or any agreement entered into by it, with respect to its capital stock, or enter into any new agreement with respect to its capital stock; or (x) engage (directly or indirectly) in any business other than those types of business prescribed within the business scope of its business license.

The Consulting Agreement may be terminated by Junhe Consulting for any reason at any time. In addition, the Consulting Agreement may be terminated by Junhe Consulting by written notice in the event of a material breach by Joway Group which, in the case of breach of a non-financial obligation, has not been remedied within fourteen (14) days following the receipt of such written notice. Either party may terminate the Consulting Agreement by written notice to the other party if (i) the other party becomes bankrupt or insolvent or is the subject of proceedings or arrangements for liquidation or dissolution or ceases to carry on business or becomes unable to pay its debts as they become due; (ii) if the operations of Junhe Consulting are terminated; or (iii) if circumstances arise which materially and adversely affect the performance or the objectives of the Consulting Agreement.

Operating Agreement

Under the Operating Agreement, Junhe Consulting agreed to guarantee Joway Group’s performance of contracts, agreements or transactions with third parties in consideration for the pledge by Joway Group to Junhe Consulting of all of Joway Group’s assets. In addition, Joway Group and its shareholders agreed that Joway Group would not, without the prior written consent of Junhe Consulting, enter into any transactions which may materially affect the assets, obligations, rights or the operations of Joway Group (excluding transactions entered into in the ordinary course of business and the lien obtained by relevant counter parties due to such agreements), including transactions involving (i) the borrowing of money or assumption of any debt; (ii) the sale or purchase from any third party any asset or right, including, but not limited to, any intellectual property rights; (iii) the provision of any guarantees to any third parties using its assets or intellectual property rights; or (iv) the assignment of any business agreements to any third party. Joway Group and its shareholders also agreed to appoint to the Joway Group’s board of directors, and Joway Group’s General Manager, Chief Financial Officer, and other senior officers those persons recommended or selected by Junhe Consulting.

Voting Rights Proxy Agreement

6

Under the Proxy Agreement, the Shareholders irrevocably granted to Junhe Consulting, for the maximum period of time permitted by law, all of their voting rights as shareholders of Joway Group. In addition, the Shareholders agreed not to transfer their equity interest in Joway Group to any third party (other than Junhe Consulting or a designee of Junhe Consulting). The Proxy Agreement may not be terminated without the unanimous consent of all Parties, except Junhe Consulting, which may terminate the Proxy Agreement with or without cause on thirty (30) days prior written notice.

Option Agreement

Under the Option Agreement, the Shareholders irrevocably granted to Junhe Consulting or its designee an exclusive option to purchase at any time, to the extent permitted under PRC Law, all or a portion of the Shareholders’ Equity Interest in Joway Group for a price equal to the capital paid in by the Shareholders on a pro rata basis in accordance with the percentage of the Shareholders’ Equity Interest acquired, subject to applicable PRC laws and regulations.

Equity Pledge Agreement

Under the Equity Pledge Agreement, the Shareholders pledged all of their right, title and interest in their equity interests in Joway Group to Junhe Consulting to guarantee Joway Group’s performance of its obligations under the Consulting Services Agreement. The pledge expires two (2) years after the satisfaction by Joway Group of all of its obligations under the Consulting Services Agreement. During the term of the Equity Pledge Agreement, Junhe Consulting is entitled to vote, control, sell, or dispose of the Pledged Collateral in the event the Company does not perform its obligations under the Consulting Services Agreement. In addition, Junhe Consulting is entitled to collect any and all dividends declared or paid in connection with the Pledged Collateral.

The description of the VIE Agreements contained in this Current Report on Form 8-K/A is qualified in its entirety by reference to the complete text of the VIE Agreements, copies of which are filed as Exhibits 10.2, 10.3, 10.4, 10.5, and 10.6 to the Company’s Current Report on Form 8-K filed with the SEC on October 7, 2010, each of which is incorporated herein by reference.

Through these contractual arrangements, we have the ability to substantially influence the daily operations and financial affairs of Joway Group and to receive, through our subsidiaries, all of its profits. As a result, we are considered the primary beneficiary of Joway Group and its operations, and Joway Group and its subsidiaries are deemed to be our variable interest entities. Accordingly, we are able to consolidate into our financial statements the results, assets and liabilities of Joway Group and its subsidiaries.

Call Option Agreement

As part of the reorganization of the Joway Group, Mr. Liu and the shareholders of the Joway Group entered into a Call Option Agreement, pursuant to which the shareholders of the Joway Group have the right to purchase up to 100% of the shares of Crystal Globe at an aggregate price equal of $20,000 over the next three years. In addition, the Option Agreement also provides that Mr. Liu shall not dispose any of the shares of Crystal Globe without consent of Mr. Zhang and Mr. Song. Upon the consummation of the Share Exchange Transaction, Crystal Globe became the principal shareholder of G2 Ventures, Inc. and Mr. Zhang and Mr. Song became indirect beneficial owners of the shares in G2 Ventures held by Crystal Globe pursuant to this Call Option Agreement.

Basis on Which Company Determined that Joway Group is a VIE

The Company concluded that Joway Group is a VIE because the contractual arrangements between the Company’s wholly owned subsidiary Junhe Consulting and Joway Group pursuant to the VIE Agreements: (i) obligates the Company and Junhe Consulting to absorb a majority of the risk of loss from the activities of Joway Group and its subsidiaries, and (ii) enables the Company, through Junhe Consulting, to receive a majority of the expected returns of Joway Group and its subsidiaries. The Company’s conclusion is based on the terms of the VIE Agreements as follows:

7

(1) Under the Consulting Services Agreement, Junhe Consulting will provide exclusive consulting services to Joway Group and its subsidiaries for a quarterly fee in the amount of Joway Group’s quarterly net income after tax. The Company has the right to receive all of these expected residual gains. The Company is also obligated to absorb the risk of loss from the activities of Joway Group and its subsidiaries and is not guaranteed a return by Joway Group, its subsidiaries or by any other party affiliated with Joway Group or its subsidiaries.

(2) Under the Equity Pledge Agreement, the shareholders of Joway Group have pledged all of their rights, title and equity interest in Joway Group to Junhe Consulting as security for the payment of the quarterly consulting fee pursuant to the Consulting Services Agreement.

(3) Under the Operating Agreement, Junhe Consulting has the exclusive right to make all decisions regarding Joway Group’s ongoing major operations, including establishing compensation levels and hiring and firing key personnel. In addition, Junhe Consulting has agreed to guarantee Joway Group’s performance under any contract, agreement or transaction with third parties relating to Joway Group’s operations. As a counter guarantee, Joway Group has pledged all of its assets including receivables to Junhe Consulting which have not been pledged to any third parties at the execution date of the agreement.

(4) Under the Voting Rights Proxy Agreement, the shareholders of Joway Group authorized any designee of Junhe Consulting to exercise all of their respective voting rights as owners of Joway Group.

(5) Under the Option Agreement, the shareholders of Joway Group granted Junhe Consulting the exclusive right and option to acquire all of their equity interests in Joway Group.

Accordingly, the Company accounts for the operations of Joway Group and its wholly owned subsidiaries as a VIE in accordance with ASC 810-10-15-14.

Share Exchange Transaction

On September 28, 2010, Mr. Kepler, the former sole executive officer, director and majority stockholder of G2 Ventures, sold all of his 3,300,000 shares of common stock in G2 Ventures (representing approximately 69% of the issued and outstanding capital stock of G2 Ventures) to Crystal Globe. In connection with the sale, Mr. Kepler resigned as our sole officer and director and appointed Jinghe Zhang as our new President, Chief Executive Officer and sole director and Yuan Huang as our new Chief Financial Officer, Secretary and Treasurer on that date.

On October 1, 2010, G2 Ventures, Dynamic Elite and Crystal Globe, the sole shareholder of Dynamic Elite entered into and consummated a Share Exchange Agreement pursuant to which G2 Ventures issued Crystal Globe 15,215,426 restricted shares of its common stock in exchange for all of the issued and outstanding capital stock of Dynamic Elite. As of result of the Share Exchange Transaction, Crystal Globe holds a total of 18,515,426 shares of our common stock or approximately 92.58% of our total and issued shares of common stock and is our single largest shareholder. On October 1, 2010, the date the Share Exchange Agreement was signed, Zhang Jinghe was the Chief Executive Officer of G2 Ventures and signed the Share Exchange Agreement on behalf of G2 Ventures.

As described above, because of our acquisition of Dynamic Elite, we now control, through Junhe Consulting, the PRC Operating Entities under the VIE Agreements and are now involved in the manufacture and sale of tourmaline-related healthcare products.

In connection with the Share Exchange Transaction, AllbrightLaw Offices, our PRC counsel, opined that the conduct of business through the VIE Agreements is not in violation of existing PRC laws, rules and regulations.

All of our business operations are conducted through our PRC Operating Entities. The chart below sets forth our corporate structure.

8

9

DESCRIPTION OF OUR BUSINESS

Overview

We are through our PRC Operating Entities, engaged in the manufacture and sales of tourmaline-related healthcare products. As of October 6, 2010, we have approximately 128 employees. Our principal executive offices are located at16th Floor, Tianjin Global Zhiye Square, 309 Nanjing Road, Nankai District, Tianjin, PRC 300100.

Introduction to Tourmaline

Tourmaline is the most important raw material we use in the manufacture of our healthcare products. It is a crystalsilicate mineral compounded with elements such as aluminum, iron, magnesium, sodium, lithium, or potassium. Tourmaline is classified as a semi-precious stone and the gem comes in a wide variety of colors. (Source: http://en.wikipedia.org/wiki/Tourmaline)

Tourmaline has the ability to become its own source of electric charge, as it is both pyroelectric, as well as piezoelectric. When it is put under greater amounts of pressure or when it is dramatically heated or cooled, tourmaline creates an electrical charge capable of emitting far infrared rays (“FIR”) and negative ions. (Source: http://www.globalhealingcenter.com/tourmaline.html)

FIRs are invisible waves of energy capable of penetrating deep into the human body. Negative ions are atoms that have a negative electric charge. FIRs and negative ions are perceived to have certain health benefits. (Source: http://www.globalhealingcenter.com/tourmaline.html).

Because it is a permanent source of FIRs and negative ions, tourmaline is perceived to have certain health benefits (Source: Niwa Institute for Immunology, Japan. Int J. Biometeorol 1993 Sep; 37(3) 133-8). In view of its perceived health benefits, tourmaline has been used to manufacture a wide range of healthcare products, including apparel, bedding, water purifiers, sauna rooms, and personal care products.

While tourmaline has perceived health benefits, the actual benefits of tourmaline to human health are unknown. The full efficacy of tourmaline to human health requires further significant clinical study. We are not aware of any formal clinical studies which have validated the health benefits of tourmaline.

We purchase liquid tourmaline from domestic companies which, in turn, import it from South Korea. Liquid tourmaline is readily available and its price has remained relatively stable. We have not experienced any shortage in tourmaline but as a precaution, we closely monitor its price and have several back-up suppliers.

Manufacturing Process

In order to take advantage of Tourmaline’s health benefits, we coat or infuse liquid or granular tourmaline into our products using the following methods:

The Spray Method

We use special high-pressure nozzles to spray liquid tourmaline onto the surface of the product. Through this process, the tourmaline particles attach onto the surface of the product. We then use a high-temperature ironing machine to embed the tourmaline particles into the fibers of the product. This method is used in the manufacture of large pieces of textile products, such as mattresses.

The Dip Method

We completely immerse fabrics into liquid tourmaline and then stir the fabrics in the liquid tourmaline to ensure the tourmaline particles attach to the surface of the fabrics. Finally, we embed the tourmaline particles into the fibers by applying heat with our special high-temperature ironing machine. This method is used in the manufacture of smaller products, such as underwear, scarves, and shirts.

10

The Filling Method

We fill the products with tourmaline particles. This method is used to make activated water machines and other water treatment products.

The three methods mentioned above are key to our manufacturing process. We protect our manufacturing methods via confidentiality agreements entered into between us and our employees. Pursuant to the confidentiality agreement, the employee is prohibited from unlawfully revealing and using our confidential technology during his term of employment and ten years after the termination of employment. We also plan to submit a patent application for the dip method in the PRC.

Our Products and Services

We primarily manufacture the following three series of tourmaline-related healthcare products:

| 1. | Healthcare Knit Goods Series |

For the fiscal years ended December 31, 2008 and 2009, our healthcare knit goods series of products accounted for approximately 3.5% and 55.4% of our annual sales revenue, respectively. This series of products is comprised of tourmaline treated mattresses, bed linen, underwear, and shirts. We use either the spray or dip method to embed tourmaline particles into the fabric of this series of products.

Set forth below is a list of healthcare knit goods products, the trademarks or marks under which they are marketed and the manufacturing method employed:

| No. |

Products |

Trademark/Mark |

Manufacturing Method | |||

| 1 | Golden Mattress |

|

Spray Method | |||

| 2 | Tourmaline Mattress |

|

Spray Method | |||

| 3 | Tourmaline Undergarment |

|

Dip Method | |||

| 4 | Tourmaline Bed Linens |

|

Spray Method | |||

| 5 | Tourmaline Male Shirts |

|

Dip Method |

| 2. | Daily Healthcare and Personal Care Series |

For the fiscal years ended December 31, 2008 and 2009, our daily healthcare and personal care series of products accounted for approximately 0% and 16% of our annual sales revenue, respectively. This series is comprised of tourmaline-treated wrist protectors, knee protectors, scarves, and shampoo and soap products. We use all three production methods to embed tourmaline particles into these products. We believe these tourmaline-treated daily healthcare products and personal care products produce FIRs and negative ions which have perceived health benefits.

Set forth below is a list of our products in the daily healthcare and personal care series, the trademarks or marks under which they are marketed and the manufacturing method employed:

| No. |

Products |

Trademark/Mark |

Manufacture Method | |||

| 1 | Tourmaline Wrist Protector |

|

Spray Method | |||

| 2 | Tourmaline Knee Protector |

|

Spray Method | |||

| 3 | Tourmaline Scarves |

|

Dip Method | |||

| 4 | Tourmaline Shampoo |

|

Filling Method | |||

| 5 | Tourmaline Soap |

|

Filling Method | |||

| 6 | Tourmaline Socks |

|

Dip Method |

11

| 3. | Wellness House and Activated Water Machine |

For the years ended December 31, 2008 and 2009, our wellness house and activated water machine series of products accounted for approximately 96.5% and 28.5% of our annual sales revenue, respectively. This series of products is comprised mainly of tourmaline wellness houses, tourmaline wellness house materials, tourmaline activated water machines and drinking mugs. Our tourmaline wellness house resembles a regular sauna room in which users experience heat sessions. However, the inner layer of our wellness house is coated with tourmaline, which emits FIRs and negative icons when heated. Tourmaline wellness houses are currently used to stimulate perspiration to improve health. It is believed that the user will feel more rejuvenated after using our tourmaline wellness house. We manufacture two types of wellness houses: one for family use, which is designed to be installed in the corner of a room and can seat one to eight people depending on its size; the other is customized and constructed on site for commercial bathrooms or spas according to their specifications.

Below is a list of different models of our Wellness House for family use:

| Model |

Trademark/Mark |

Material |

Dimension |

Capacity |

Manufacturing Method | |||||

| Classic Mini Wellness House |

|

Hemlock | 1.0mX1.0mX1.9m | 1-2 persons | Spray Method | |||||

| Classic Twin Wellness House I |

|

Hemlock | 1.2mX1.05MX1.9m | 2-3 persons | Spray Method | |||||

| Classic Twin Wellness House II |

|

Snow Pine | 1.2mX1.05mX1.9m | 2-3 persons | Spray Method | |||||

| Elegant Multi-Person Wellness House |

|

Hemlock | 1.5mX0.53mX1.37mX1.9m | 4-5 persons | Spray Method | |||||

| Classic Multi-Person Wellness House |

|

Hemlock | 1.75mX1.6mX1.9m | 6-7 persons | Spray Method |

We infuse tourmaline particles into the filters of our tourmaline water machines and water mugs. Tourmaline is perceived to have certain health benefits.

Below is a list of our water treatment products:

| No. |

Products |

Trademark/Mark |

Manufacturing Method | |||

| 1 | Tourmaline Water Machine |

|

Filling Method | |||

| 2 | Tourmaline Water Mug |

|

Filling Method |

Return policy

It is the Company’s normal commercial practice that we only allow for the return of goods that do not conform to the customer’s order due to some occasional error in packaging or shipment. The return should be requested within seven days of purchase. Customers may also request a free repair of defective products within 15 days of purchase. For products purchased more than 15 days ago, we charge a service fee of 110% of the cost of repaired or replaced parts.

12

Services: Wellness House Maintenance

Our wellness house products generally carry a one-year warranty. When the warranty expires, we provide our customers the option to engage us to service and maintain their wellness houses for a fee equal to 200% of the cost of the repaired or replaced parts.

Except for fiscal year 2007 when maintenance services contributed 62.8% of our then annual revenue, there has been very little demand for our wellness house maintenance services.

Manufacturing Facilities

Our manufacturing facilities are located in Baodi District, Tianjin, PRC, with an area of approximately 2,500 square meters. The major equipment we use in the manufacture our products include three ironing machines, three driers, three washing machines, three cutting machines, 43 sewing machines, six chainsaws, six impact drills and six air nailers. We have 33 employees engaged in manufacturing as of October 6, 2010. We have our own design team comprising four designers who are responsible for designing new styles for our products every quarter. They are also responsible for the product packaging design.

Customers and Suppliers

Customers

Below is a list of our top ten customers for the years 2007, 2008 and 2009, respectively.

| Top Ten Customers in 2007 |

||||||||||||||||

| No. |

Name |

Amount (RMB) |

Amount (US$) |

Products Sold |

Percentage of Sales |

|||||||||||

| 1 | Shenyang Xike Quartz Co., Ltd. |

26,047 | 3,836 | Wellness House maintenance | 62.8 | % | ||||||||||

| 2 | Fengrong Bo |

7,115 | 1,048 | Wellness House materials | 17.2 | % | ||||||||||

| 3 | Xinhua Insurance Company |

4,089 | 602 | Wellness House materials | 9.9 | % | ||||||||||

| 4 | Anshan City Tiedong District Aiming Law Firm |

3,438 | 506 | Wellness House materials | 8.3 | % | ||||||||||

| 5 | Beijing Luhang Machinery Factory |

763 | 112 | Wellness House materials | 1.8 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total | 41,453 | 6,104 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Top Ten Customers in 2008 |

||||||||||||||||

| No. |

Name |

Amount (RMB) |

Amount (US$) |

Products Sold |

Percentage of Sales |

|||||||||||

| 1 | Shenyang New City Riverside Health Center |

270,419 | 39,826 | Wellness House | 9.2 | % | ||||||||||

| 2 | Chenghong Wei |

168,600 | 24,831 | Wellness House | 5.7 | % | ||||||||||

| 3 | Xiaoyun Zhu |

165,000 | 24,300 | Wellness House | 5.6 | % | ||||||||||

| 4 | Yanmei Feng |

165,000 | 24,300 | Wellness House | 5.6 | % | ||||||||||

| 5 | Youfeng Lu |

162,620 | 23,950 | Wellness House | 5.5 | % | ||||||||||

| 6 | Shenyang Shifa Special Rubber Co., Ltd. |

157,000 | 23,122 | Wellness House | 5.3 | % | ||||||||||

| 7 | Weichun Zhou |

156,000 | 22,975 | Wellness House | 5.3 | % | ||||||||||

13

| 8 | Lijuan Gu | 140,000 | 20,619 | Wellness House | 4.8 | % | ||||||||||

| 9 | Xudong Wang | 137,500 | 20,250 | Wellness House | 4.7 | % | ||||||||||

| 10 | Runmei Zhang | 133,430 | 19,651 | Wellness House | 4.5 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total | 1,656,139 | 243,824 | 56.3 | % | ||||||||||||

|

|

|

|

|

|

|

14

| Top Ten Customers in 2009 |

||||||||||||||||

| No. |

Name |

Amount (RMB) |

Amount (US$) |

Products Sold |

Percentage of Sales |

|||||||||||

| 1 | Shandong Jingbo Holdings Development Co., Ltd. |

523,223 | 77,058 | Wellness House materials |

2.5 | % | ||||||||||

| 2 | Beijing No. 9 Urban Construction Engineering Company Limited |

397,087 | 58,481 | Wellness House materials |

1.9 | % | ||||||||||

| 3 | Baocong Yang Joining Franchise Store |

380,788 | 56,080 | Tourmaline mattress and underwear |

1.8 | % | ||||||||||

| 4 | Jinbao Liu Joining Franchise Store |

369,461 | 54,412 | Tourmaline mattress, pillowcases and soap |

1.7 | % | ||||||||||

| 5 | Xiuchun Jia Joining Franchise Store |

357,615 | 52,668 | Tourmaline mattress, mugs and scarves |

1.7 | % | ||||||||||

| 6 | Fengqi Wu |

349,628 | 51,492 | Tourmaline Wellness House |

1.6 | % | ||||||||||

| 7 | Zhuoguan Joining Franchise Store |

330,795 | 48,718 | Tourmaline mattress, pillowcases and soap |

1.6 | % | ||||||||||

| 8 | Zhengyi Qiao Joining Franchise Store |

290,334 | 42,759 | Tourmaline mattress, pillowcases and soap |

1.4 | % | ||||||||||

| 9 | Ning Fang Joining Franchise Store |

289,004 | 42,563 | Tourmaline mattress, pillowcases and soap |

1.4 | % | ||||||||||

| 10 | Liang Ping Joining Franchise Store |

288,362 | 42,469 | Tourmaline mattress, pillowcases and soap |

1.4 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total | 3,576,308 | 526,700 | 16.8 | % | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

Our main customers are franchise stores that are authorized to sell our products exclusively. Two customers made up more than 10% of our sales in 2007. However, none of our customers have accounted for more than 10% of our annual sales revenue for the fiscal years 2008 and 2009.

In the past three fiscal years, our products have been primarily sold to the northeastern part of China, which includes Liaoning province, Jilin province and Heilongjiang province. Set forth below is a geographical breakdown of our sales for the fiscal years 2008 and 2009 and six months ended June 30, 2010:

15

| Region |

Percentage of Sale |

|||

| Northeast China (Liaoning, Jilin, Heilongjiang) |

40 | % | ||

| North China(Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia) |

23 | % | ||

| East China (Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi) |

20 | % | ||

| Central China (Henan, Hubei, Hunan) |

6 | % | ||

| Southwest China (Chongqing, Sichuan, Guizhou, Yunnan, Tibet) |

6 | % | ||

| South China (Guangdong, Hainan, Guangxi) |

5 | % | ||

Suppliers

Below is a list of our top ten suppliers for the years 2008 and 2009, respectively.

| Top Ten Suppliers in 2008 |

||||||||||||||||

| No. |

Name |

Amount (RMB) |

Amount (US$) |

Product Purchased |

Percentage of Purchase |

|||||||||||

| 1 | Shenyang Joway Industrial Development Co., Ltd. |

784,990 | 115,609 | Water machine, bedding, underwear, waist protector and kneepad | 31.3 | % | ||||||||||

| 2 | Liaoning Jiadebao Home Building Materials Supermarket Co., Ltd. |

445,568 | 65,621 | Wellness House materials | 17.8 | % | ||||||||||

| 3 | Tianjin Daxing Import & Export Trading Co., Ltd. |

245,020 | 36,086 | Silk cloth and mugs | 9.8 | % | ||||||||||

| 4 | Guangdong Hongjie Underwear Industrial Co., Ltd. |

235,842 | 34,734 | Underwear | 9.4 | % | ||||||||||

| 5 | Daekjeng Medicare |

100,000 | 14,727 | Tourmaline | 4.0 | % | ||||||||||

| 6 | Shenyang Hongguangyuan Wood Co., Ltd. |

52,171 | 7,684 | Wellness House materials | 2.1 | % | ||||||||||

| 7 | Shenyang Yuzhi Foam Factory |

43,040 | 6,339 | Wellness House materials | 1.7 | % | ||||||||||

| 8 | Shenyang Heyi Polyurethane Co., Ltd. |

39,600 | 5,832 | Wellness House materials | 1.6 | % | ||||||||||

| 9 | Shenyang Hongyu Villa |

33,623 | 4,952 | Wellness House materials | 1.3 | % | ||||||||||

| 10 | Shenyang Xinxin Taiyang Electronic Technology Co., Ltd. |

30,248 | 4,455 | Wellness House materials | 1.2 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total | 2,010,101 | 296,039 | 80.2 | % | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Top Ten Suppliers in 2009 |

||||||||||||||||

| No. |

Name |

Amount (RMB) |

Amount (US$) |

Product Purchased |

Percentage of Purchase |

|||||||||||

| 1 | Tianjin Daxing Import & Export Trade Co., Ltd. |

2,278,539 | 335,573 | Cloth, cotton, fabrics and underwear | 18.2 | % | ||||||||||

| 2 | Shenyang Joway Industrial Development Co., Ltd. |

2,227,718 | 328,088 | Cloth, cotton, underpants and hats | 17.8 | % | ||||||||||

| 3 | Haining Futianrun Silk Co., Ltd. |

604,125 | 88,973 | Cloth and Cotton, | 4.8 | % | ||||||||||

| 4 | Hangzhou Chufan Textile Co., Ltd. |

603,752 | 88,918 | Cloth, cotton and mattress | 4.8 | % | ||||||||||

| 5 | Beijing Quanfu Wood Products Co., Ltd. |

598,560 | 88,153 | Wellness House materials | 4.8 | % | ||||||||||

16

| 6 | Shenyang Hongguangyuan Wood Co., Ltd. |

413,318 | 60,871 | Wellness House materials | 3.3 | % | ||||||||||

| 7 | Shenzhen Maskcare Biological Technology Co., Ltd. |

354,265 | 52,174 | Soap, shampoo and shower gel | 2.8 | % | ||||||||||

| 8 | Tianjin Tielingjiacai Wood Co., Ltd. |

347,849 | 51,230 | Wellness House | 2.8 | % | ||||||||||

| 9 | Beijing Chenjiehao Paint Debug Ltd. |

331,250 | 48,785 | Wellness House materials | 2.6 | % | ||||||||||

| 10 | Tianjin Sunflower Packaging and Printing Co., Ltd. |

238,035 | 35,057 | Packaging materials and product manuals | 1.9 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total | 7,997,411 | 1,177,822 | 63.8 | % | ||||||||||||

|

|

|

|

|

|

|

17

Supplier: Shenyang Joway Industrial Development Co., Ltd. (“Shenyang Joway”)

We had two major suppliers that accounted for 18.2% and 17.8% of our annual purchase of raw materials in 2009 and two major suppliers that accounted for 31.3% and 17.8% of our annual purchase of raw materials in 2008. We do not have long term contracts with any of our suppliers since the materials we use in our manufacture are readily available on the market and their prices are generally stable.

Shenyang Joway was formed in 2005 in Shenyang, China by Mr. Jinghe Zhang and three other individuals. Mr. Zhang holds more than 50% of the equity in Shenyang Joway. Shenyang Joway was in the business of marketing and distributing clothing and related products to other companies. In 2008 and 2009 Joway Group entered into a number of sales contracts with Shengyang Joway, pursuant to which the Joway Group purchased inventory and equipment from Shengyang Joway. In 2009 Mr. Zhang decided to shut down the operations of Shenyang Joway in order to focus his attention on the Joway Group’s business and on December 20, 2009, Joway Group entered into a final sales contract with Shengyang Joway pursuant to which the Joway Group purchased inventory in the amount of $137,395 from Shengyang Joway. In addition, from 2007 through 2009, Shenyang Joway advanced the Joway Group an aggregate of $694,458. The advances were noninterest bearing and had no specified repayment terms. As of June 30, 2010, the total unpaid principal balance due Shenyang Joway for advances was $138,093. Shenyang Joway also licensed the trademarks “Xi” and “Joway” to the Joway Group pursuant to a royalty-free license.

Shenyang Joway has ceased operations, although it still exists as a legal entity, and the Joway Group was able to find new suppliers with no material adverse impact to the Company.

Franchise Stores

Approximately 72% of our annual sales were made through the operation of franchise stores in 2009. For the six months ended June 30, 2010, approximately 86.78% of our sales were made through franchise stores.

As of the date of this Report, there are approximately 219 franchise stores across the PRC that are authorized to sell our products exclusively. Set forth below is a geographical breakdown of the franchise stores:

| Region |

Number of Franchise Stores | |||

| Northeastern China (Liaoning, Jilin, Heilongjiang) |

52 | |||

| Northern China (Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia) |

48 | |||

| Eastern China (Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi) |

31 | |||

| Southern China (Guangdong, Hainan, Guangxi) |

27 | |||

| Central China (Henan, Hubei, Hunan) |

30 | |||

| Southwestern China (Chongqing, Sichuan, Guizhou, Yunnan, Tibet) |

31 | |||

|

|

|

|||

| Total |

219 | |||

|

|

|

|||

We use multiple criteria to select our franchise stores, including reviewing each potential franchisee’s financial conditions, sales network, sales personnel, and faculties. Generally the potential franchise store submits an application to become our franchise store; we will review the overall conditions of the applicant and authorize the applicant to sell our products if the applicant meets the minimum working capital requirement of RMB 40,000 and has the requisite business facilities.

The Company enters into franchising agreements to develop retail outlets for the Company’s products. The agreements provide that franchisees will sell Company products exclusively. In exchange the Company provides them with geographic exclusivity, discounted product, training and support. The agreements also require franchisees to adhere to certain standards of product merchandising, promotion and presentment. The agreements also require franchisees to charge certain minimum sales prices, and prohibit them from selling competitor’s products. The agreements do not require any initial franchise fees from the franchisees, nor do they require the franchisees to pay continuing royalties. The agreements do not require the franchisees to purchase any minimum levels of product, but do require that they make at least one purchase during each year. The Company does not act to manage the franchisees’ levels of product. Franchisees hold periodic conferences, assisted by the Company’s marketing department, to promote product awareness and the introduction of new products. The franchising agreements are generally for terms of three years and are renewable at the mutual agreement of both parties. The franchising agreements are cancelable at the Company’s discretion if franchisees violate the terms of the agreements.

18

Compared with the large volume of sales from franchise stores, sales to individual consumers are relatively small. Sales to individual consumers accounted for approximately 28% of our annual sales in 2009. For the six months ended June 30, 2010, sales to individual consumers only accounted for 13.22%. The individual consumers typically make orders at product meetings or via telephone and we deliver the products upon receipt of the payment. We ship for free if the purchase per order exceeds RMB 80,000 (approximately $11, 764.71).

Marketing and Sales

The success of our business largely depends on our marketing and sales efforts.

Our primary marketing strategies are directed towards both our franchisees and end users, and the marketing efforts of our franchisees are directed towards end users. The Company assists franchisees on monthly product introduction seminars, which are open to both our franchisees and to the general public. We also host an annual conference, which is open to both our franchisees and to the general public. For example, in 2009, in connection with our annual conference we sponsored an episode of Our Chinese Heart, a well-known international original Chinese song concert series hosted by China Central Television, which was broadcasted internationally.

The franchise stores are responsible for the cost of organizing the monthly product introduction seminars and meetings and we are responsible for the travel expenses of our employees who attend these meetings and seminars to explain and promote our various product lines. There are on average 15 such seminars and meetings each month nationwide and we have budgeted travelling expenses of approximately RMB30,000 (approximately $4,400) each month. Generally, we choose the venue for the product seminars and meetings based on market prospects, sales volume and the extent of meeting preparation. As of October 6, 2010, we have held product seminars and meetings in approximately 105 cities in the PRC.

Generally, we are responsible for the cost of annual conferences. The cost of the annual conferences for 2008 and 2009 was approximately RMB1,000,000 (approximately $147,000) and RMB 7,096,147 (approximately $1,043,551.03), respectively.

Below is a breakdown of our marketing expenses in the fiscal years 2008 and 2009.

| 2008 | 2009 | |||||||||||||||

| Expenses |

RMB | US$ (approx.) | RMB | US$ (approx.) | ||||||||||||

| Promotion | 325,588.00 | 46,764.77 | 7,065,743.60 | 1,032,870.57 | ||||||||||||

| Printing | 0.00 | 0.00 | 268,808.51 | 39,294.43 | ||||||||||||

| Travelling | 9,788.60 | 1,405.95 | 353,189.20 | 51,629.21 | ||||||||||||

| Training | 31,416.48 | 4,512.40 | 137,145.80 | 20,047.98 | ||||||||||||

| Salaries | 8,820.00 | 1,266.83 | 272,740.00 | 39,869.14 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total | 375,613.08 | 53,949.96 | 8,097,627.11 | 1,183,711.32 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

In 2009, we spent RMB 7.1 million on the annual conference and had revenue of approximately RMB 6.0 million from ticket sales. The net expense was contained in selling expenses in consolidated operation statements.

For the fiscal year 2010, we have a marketing and sales budget of RMB 4,500,000 (approximately, $662,000), among which, approximately RMB2,600,000 (approximately $382, 352.94) will be spent on our annual conference, RMB 1,000,000 (approximately $147,058.82) on salaries of sales personnel, RMB 400,000 (approximately $58,823.53) on training, RMB 200,000 (approximately $29,411.76) on travelling and RMB 300,000 (approximately $ 44,117.65) on daily operation of the marketing and sales department.

19

Seasonality

Because our products are for daily use, our business is not subject to seasonal variations in demand.

Industry

We are operating in the large and rapidly growing healthcare industry in the PRC. The healthcare industry in the PRC is supported by a combination of socio-economic factors, such as the growth of the PRC’s economy, size of its overall population and the proportion of its population over the age of 60, living standards, health consciousness, lifestyle related disorders and active PRC government support.

China Healthcare Industry—Generally

According to the PRC Statistical Yearbook 2009 (the “Yearbook”), from 2005 to 2009, the average per capita annual disposable income of the PRC’s urban residents increased from approximately RMB 3,225 (approximately $474) to RMB5, 153 (approximately $1,356). According to the Yearbook, the PRC’s Gross Domestic Product (“GDP”) grew at a compound annual growth rate (“CAGR”) of 16.4% from 2005 to 2009, and its per capita GDP grew from RMB18, 494 (approximately $2,719) in 2005 to approximately RMB33, 535 (approximately $4,931) in 2009. During this period, national income and disposable income levels increased significantly.

With rising living standards and increasing disposable income, people in the PRC have naturally become more health conscious. These developments have resulted in both urban and rural residents spending more on healthcare. According to the PRC National Bureau of Statistics, consumer expenditure on healthcare in the PRC’s urban and rural areas increased from approximately RMB476 (approximately $70) and RMB118 (approximately $17) per person in 2003, respectively, to approximately RMB786 (approximately $115) and RMB246 (approximately $36) per person in 2007, respectively.

China’s Tourmaline Health Products Market

The main industrial application of tourmaline has been in the healthcare industry. In 1970s and 1980s, more developed nations such as Japan and the United States have used the tourmaline as an important industrial mineral. (Source: 2010-2012 China’s tourmaline market and investment prospects research report, Institute of China Uniway Economics, Aug, 2010).

By contrast, the Chinese had been using tourmaline as gemstones in jewelry until around 2001, with the steady improvement of living standards and higher health consciousness, the Chinese began to realize the health benefits of tourmaline.

More companies began producing tourmaline related health products. China’s tourmaline health products industry is still in its infancy and highly fragmented. (Source: 2010-2012 China’s tourmaline market and investment prospects research report, Institute of China Uniway Economics, Aug, 2010).

20

Users of tourmaline health product are typically middle-aged and elderly people. Currently, there are numerous kinds of tourmaline health products in the market such as tourmaline clothes, tourmaline mattresses, tourmaline water machines, etc. Demand for these products is still relatively low compared to the size of the Chinese population.

We believe that the main challenge for the tourmaline health product companies is market development rather than competition. With rising living standards, increasing disposable income, higher health consciousness and the greater awareness of health benefit produced by tourmaline health products, we believe that the tourmaline health products market will grow rapidly in the next few years.

Competition

Competitive Environment

China’s tourmaline health products market is highly segmented and is still in its infancy. Currently, Japanese and Korean companies are leaders in tourmaline technology, however, they have not yet developed a sizeable market share for their products in the PRC (Source: 2010-2012 China’s tourmaline market and investment prospects research report, Institute of China Uniway Economics, Aug, 2010). Therefore, we believe that there is a great opportunity for us to create demand and market share and further establish ourselves as leaders in the tourmaline healthcare-related products field.

Our Competitors

We believe our major competitors in the PRC are:

| • | Heilongjiang Xingfuren Technology Development Co., Ltd. operates in PRC. They mainly focus on producing far-infrared health products and tourmaline health products. |

| • | Harbin Jiuguang Daily Health Products Co., Ltd. operates in PRC. They mainly focus on the manufacture of tourmaline sauna rooms and tourmaline health products. |

| • | Ihanya Nano Technology Co., Ltd. operates in Changsha, Hunan province, PRC. They mainly focus on manufacturing tourmaline sauna rooms and tourmaline health products. |

| • | Harbin Handu Tourmaline Nano Technology Development Co., Ltd. operates in PRC. They mainly focus on manufacturing tourmaline sauna rooms and tourmaline health products. |

| • | Harbin Wanshou Nano Science and Technology Co., Ltd. operates in the PRC. They mainly focus on new Nano technology research and development, and the manufacture of tourmaline health products and tourmaline sauna rooms. |

Our Competitive Advantages

We believe that by leveraging the following strengths, we can effectively compete and enhance our market position:

| • | Brand Advantage: We are one of the first tourmaline health products manufacturers in the PRC. We believe we have established a well-known brand (“Joway”) in the PRC tourmaline health products market. |

| • | Technology Advantage: We possess several tourmaline healthcare products patents. We also have six technicians engaged in research and development activities to develop new tourmaline products. |

| • | Sales Channels Advantage: We have approximately 219 franchise stores covering most of the big cities in the PRC. We are still expanding our sales networks. We believe our extensive sales networks will assure our |

21

| products sales growing continuously. |

Business Strategy

We believe the market for tourmaline healthcare products in the PRC will grow rapidly. In order to benefit from the market opportunities, we plan to implement the following strategies:

| • | We will focus on expanding the sales network for our tourmaline health products in the PRC. Meanwhile we also plan to develop our sales network in India, Indonesia, Russia, Ukraine, Eastern Europe, Africa, South America and other foreign markets. |

| • | We will seek to optimize our product portfolio to include more products with higher profit margins and expand our product offerings. We believe that tourmaline daily healthcare products, water treatment products, tourmaline home accessories and tourmaline environmentally friendly paint have more profit potential. We will spend more money on Research and Development (“R&D”) of these products. |

| • | We intend to improve our operations, exploit our competitive strengths, and expand our operations by acquiring other existing businesses. |

Research and Development

As of October 6, 2010, we have six technicians engaged in research and development activities. Our research and development focus is on developing new tourmaline products such as, tourmaline wool blankets, tourmaline laundry balls, tourmaline washing powder and tourmaline foot spa basins.

During the fiscal years ended December 31, 2008 and 2009, we spent RMB 7,800 (approximately $1,120.33) and RMB 59,010.15(approximately $8,626.09), respectively, on R&D. Set forth below are a breakdown of our R&D expense for the fiscal years 2008 and 2009, respectively and a breakdown of R&D budget for the fiscal years 2010 and 2011, respectively:

| 2008 | 2009 | 2010 (Budget) | 2011 (Budget) | |||||||||||||||||||||||||||||

| Item |

RMB | US$ (approx.) | RMB | US$ (approx.) | RMB | US$ (approx.) | RMB | US$ (approx.) | ||||||||||||||||||||||||

| R & D Equipment |

1,300 | 186.72 | 11,865.05 | 1,734.43 | 30,000 | 4,389 | 100,000 | 14,631 | ||||||||||||||||||||||||

| R & D Sample |

0 | 0 | 12,110.10 | 1,770.25 | 15,000 | 2,195 | 80,000 | 11,705 | ||||||||||||||||||||||||

| Travel Expense |

0 | 0 | 4,235 | 619.07 | 8,000 | 1,170 | 50,000 | 7,316 | ||||||||||||||||||||||||

| Salary |

6,500 | 933.61 | 30,800 | 4,502.34 | 155,000 | 22,678 | 180,000 | 26,336 | ||||||||||||||||||||||||

| Inspection Fee |

0 | 0 | 0 | 0 | 18,000 | 2,634 | 60,000 | 8,779 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

7,800 | 1,120.33 | 59,010.15 | 8,626.09 | 226,000 | 33,066 | 470,000 | 68,767 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Intellectual Property

We regard our trademarks, trade secrets, patents and similar intellectual property as critical factors to our success. We rely on patent, trademark and trade secret law, as well as confidentiality and license agreements with certain of our employees, customers and others to protect our proprietary rights.

The trademarks we currently use include the “Xi” trademarks and the “Joway” trademark which are owned by Shenyang Joway Industrial Development Co., Ltd. (“Shenyang Joway”) and our President, Chief Executive Officer and director, Jinghe Zhang, respectively. We are licensed to use the “Xi” trademarks pursuant to a license agreement with Shenyang Joway dated December 1, 2009 for a term of nine years. We are also permitted to use the “Joway” trademark pursuant to a license agreement with Jinghe Zhang dated December 1, 2009 for a term of ten years. The agreements are renewable at the end of their respective terms. We do not have to pay any license fee to Shenyang Joway and Jinghe Zhang for the use of the trademarks.

22

We have also submitted applications for twelve trademarks which are under review by the Trademark Office of State Administration of Industry and Commerce of the PRC.

Set forth below is a detailed description of the trademarks we use and the trademarks under application.

| Mark |

Registration /Application No. |

Class |

Effective Date |

Expiration Date |

Owner/ | |||||

|

6104256 | Class 3: Cosmetics and Cleaning Preparations. Bleaching preparations and other substances for laundry use; cleaning, polishing, scouring and abrasive preparations; soaps; perfumery, essential oils, cosmetics, hair lotions; dentifrices. |

March 21, 2010 | March 20, 2020 | Shenyang Joway Industrial Development Co., Ltd. | |||||

|

6104253 | Class 11: Environmental control apparatus. Apparatus for lighting, heating, steam generating, cooking, refrigerating, drying, ventilating, water supply and sanitary purposes. |

February 14, 2010 | February 13, 2020 | Shenyang Joway Industrial Development Co., Ltd. | |||||

|

4794111 | Class 24: Fabrics. Textiles and textile goods, not included in other classes; bed and table covers. |

February 21, 2009 | February 20, 2019 | Jinghe Zhang | |||||

|

8467175 | Class 30: Staple foods. Coffee, tea, cocoa, sugar, rice, tapioca, sago, artificial coffee; flour and preparations made from cereals, bread, pastry and confectionery, ices; honey, treacle; yeast, baking-powder; salt, mustard; vinegar, sauces (condiments); spices; ice. | Registration Application Accepted on July 9, 2010 |

Tianjin Joway Group Co., Ltd. | ||||||

|

8236587 | Class 5: Pharmaceuticals. Pharmaceutical, veterinary and sanitary preparations; dietetic substances adapted for medical use, food for babies; plasters, materials for dressings; material for stopping teeth, dental wax; disinfectants; preparations for destroying vermin; fungicides, herbicides. |

Registration Application Accepted on April 23, 2010 |

|||||||

|

8236524 | Class 24: Fabrics. Textiles and textile goods, not included in other classes; bed and table covers. |

Registration Application Accepted on April 23, 2010 |

|||||||

23

| 8029074 | Class 11: Environmental control apparatus. Apparatus for lighting, heating, steam generating, cooking, refrigerating, drying, ventilating, water supply and sanitary purposes. |

|||||||||

| 8029052 | Class 5: Pharmaceuticals. Pharmaceutical, veterinary and sanitary preparations; dietetic substances adapted for medical use, food for babies; plasters, materials for dressings; material for stopping teeth, dental wax; disinfectants; preparations for destroying vermin; fungicides, herbicides. |

Registration Application Accepted on January 27, 2010 |

||||||||

| 8029009 | CLASS 2: Paints Paints, varnishes, lacquers; preservatives against rust and against deterioration of wood; colorants; mordants; raw natural resins; metals in foil and powder form for painters, decorators, printers and artists. |

|||||||||

|

8236733 | Class 30: Staple foods. Coffee, tea, cocoa, sugar, rice, tapioca, sago, artificial coffee; flour and preparations made from cereals, bread, pastry and confectionery, ices; honey, treacle; yeast, baking-powder; salt, mustard; vinegar, sauces (condiments); spices; ice. |

Registration Application Accepted on April 23, 2010 |

|||||||

| 8236706 | Class 25: Clothing. Clothing, footwear, headgear. |

|||||||||

| 8236538 | Class 24: Fabrics. Textiles and textile goods, not included in other classes; bed and table covers. |

|||||||||

| 8236684 | Class 11: Environmental control apparatus. Apparatus for lighting, heating, steam generating, cooking, refrigerating, drying, ventilating, water supply and sanitary purposes. |

|||||||||

| 8236608 | Class 5: Pharmaceuticals. Pharmaceutical, veterinary and sanitary preparations; dietetic substances adapted for medical use, food for babies; plasters, materials for dressings; material for stopping teeth, dental wax; disinfectants; preparations for |

|||||||||

24

| destroying vermin; fungicides, herbicides. | ||||||||||

| 8236641 | Class 3: Cosmetics and Cleaning Preparations. Bleaching preparations and other substances for laundry use; cleaning, polishing, scouring and abrasive preparations; soaps; perfumery, essential oils, cosmetics, hair lotions; dentifrices. |

|||||||||

25

Currently we do not own any patents we use. Pursuant to a license agreement with our President, Chief Executive Officer and director, Jinghe Zhang, we are permitted to use the following five patents for free from December 1, 2009 to the expiration date of each patent.

| No. |

Product |

Type |

Patent No. |

Application Date |

Effective Date |

Term | Owner & Inventor | |||||||

| 1 |

Water Purifier | Utility Model | ZL200720014571.6 | September 17, 2007 | October 29, 2008 | Ten years | Jinghe Zhang | |||||||

| 2 |

Tourmaline Undergarment | Utility Model | ZL200720015434.4 | October 22, 2007 | July 16, 2008 | Ten years | Jinghe Zhang | |||||||