Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EQUITY LIFESTYLE PROPERTIES INC | d256170d8k.htm |

Exhibit 99.1

Equity LifeStyle Properties ELS Investor Presentation November 15, 2011

Equity LifeStyle Properties 2 Forward-Looking Statements This presentation includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used, words such as “anticipate,” “expect,” “believe,” “project,” “intend,” “may be” and “will be” and similar words or phrases, or the negative thereof, unless the context requires otherwise, are intended to identify forward-looking statements and may include, without limitation, information regarding the Company’s expectations, goals or intentions regarding the future, statements regarding the anticipated closings of the remainder of the pending Acquisition and the expected effect of the Acquisition on the Company. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, including, but not limited to: the Company’s ability to control costs, real estate market conditions, the actual rate of decline in customers, the actual use of sites by customers and its success in acquiring new customers at its Properties (including those that it may acquire); the Company’s ability to maintain historical rental rates and occupancy with respect to Properties currently owned or that the Company may acquire; the Company’s assumptions about rental and home sales markets; the Company’s assumptions and guidance concerning 2011 and 2012 estimated net income and funds from operations; in the age-qualified Properties, home sales results could be impacted by the ability of potential homebuyers to sell their existing residences as well as by financial, credit and capital markets volatility; results from home sales and occupancy will continue to be impacted by local economic conditions, lack of affordable manufactured home financing and competition from alternative housing options, including site-built single-family housing; impact of government intervention to stabilize site-built single family housing and not manufactured housing; the completion of the remainder of the Acquisition and future acquisitions, if any, and timing and effective integration with respect thereto and the Company’s estimates regarding the future performance of the Acquisition Properties; unanticipated costs or unforeseen liabilities associated with the Acquisition; ability to obtain financing or refinance existing debt on favorable terms or at all; the effect of interest rates; the dilutive effects of issuing additional securities; the effect of accounting for the entry of contracts with customers representing a right-to-use the Properties under the Codification Topic “Revenue Recognition;” and other risks indicated from time to time in the Company’s filings with the Securities and Exchange Commission. These forward-looking statements are based on management’s present expectations and beliefs about future events. As with any projection or forecast, these statements are inherently susceptible to uncertainty and changes in circumstances. The Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise.

ELS Equity LifeStyle Properties ELS Overview One of the nation’s largest real estate networks with over 380 properties( 1) owned or under contract containing over 140,000 sites in 32 states and British Columbia ELS has a unique business model ELS owns the land Leases individual developed sites to customers Customers own the units they place on the sites ELS site composition of properties owned or under contract 76,600 manufactured or resort home sites 65,600 RV sites for resort cottages (park models) and recreational vehicles •Includes 46,200 sites primarily rented on an annual basis ELS’s rent position is prime Over 1,000,000 customer contacts (1) As of November 8, 2011, ELS owns 375 properties containing approximately 138,915 sites, including approximately 72,100 manufactured home sites. As described on page 11, ELS expects to acquire an additional seven properties containing approximately 2,200 manufactured home sites on or before November 30, 2011.3

ELS Equity LifeStyle Properties ELS Key Value Drivers Well Located Real Estate >80 properties with lake, river or ocean frontage (1) >100 properties within 10 miles of coastal United States (1) Property locations are strongly correlated with population migration Long Term Predictable Cash Flows Favorable Customer Demographics Active adults and RV owners / Outdoor enthusiasts Product Flexibility Own, rent, flexible use or right to use 4 (1)Includes properties currently owned as well as the seven properties that are expected to be acquired on or before November 30, 2011. See page 11 for a discussion of our 2011 Acquisition. ELS

Equity LifeStyle Properties Real Estate Primary investment is land/appreciating component of real estate Lower maintenance costs/customer turnover costs High quality real estate Major metros/high growth areas High barriers to entry Retirement and vacation destinations Asset scarcity 5 ELS

Equity LifeStyle Properties ELS LifeStyle and Activities 6 Recreation Golf, softball, fishing, tennis, swimming, shuffleboard Arts Concerts, shows, art fairs, crafts Education Seminars, One Day University Volunteerism Consider Others, fund raising ELS

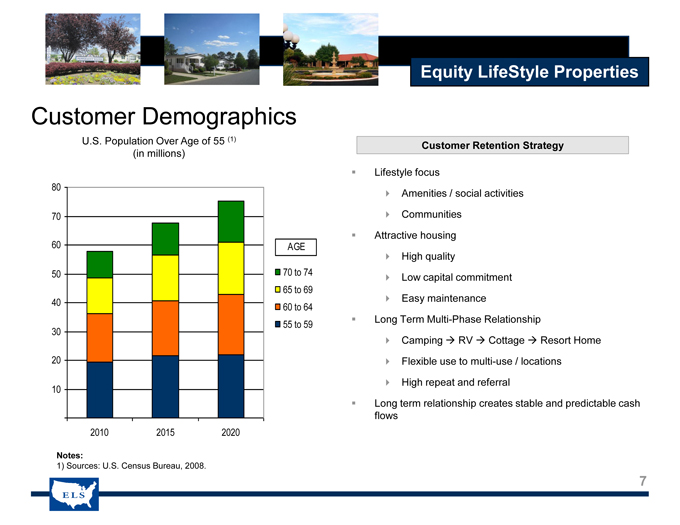

Equity LifeStyle Properties Customer Demographics Lifestyle focus Amenities / social activities Communities Attractive housing High quality Low capital commitment Easy maintenance Long Term Multi-Phase Relationship Camping RV Cottage Resort Home Flexible use to multi-use / locations High repeat and referral Long term relationship creates stable and predictable cash flows 7 U.S. Population Over Age of 55 (in millions)102030405060708020102015202070 to 7465 to 6960 to 6455 to 59AGEU.S. Population Over Age of 55 (1) (in millions) Customer Retention StrategyNotes: 1) Sources: U.S. Census Bureau, 2008. ELS

Equity LifeStyle Properties Management Focus8 Rental unit activity increase Decline in new home sales Increased capital investment 2011 Acquisition Properties increases exposure to affordable housing Opportunity for occupancy increases in Michigan Financial flexibility ELS

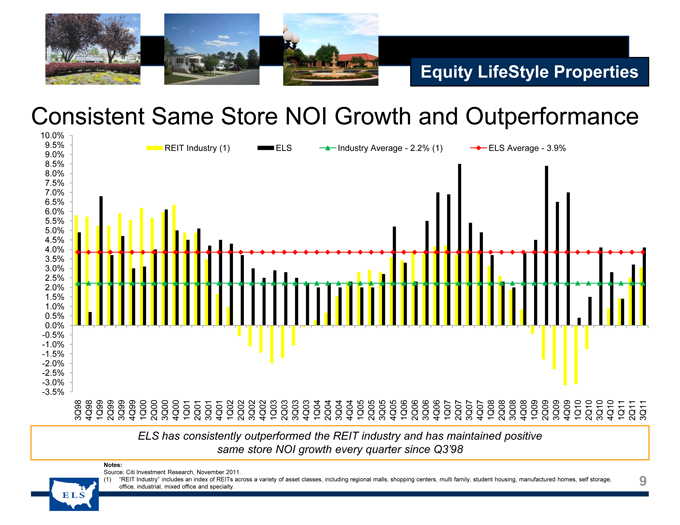

Equity LifeStyle Properties 9 Consistent Same Store NOI Growth and Out performance Notes: Source: Citi Investment Research, November 2011. (1) “REIT Industry” includes an index of REITs across a variety of asset classes, including regional malls, shopping centers, multi family, student housing, manufactured homes, self storage, office, industrial, mixed office and specialty. ELS has consistently outperformed the REIT industry and has maintained positive same store NOI growth every quarter since Q3’98-3.5%-3.0% -2.5%-2.0% -1.5%-1.0%-0.5%0.0%0.5% 1.0% 1.5% 2.0% 2.5% 3.0%3.5%4.0%4.5%5.0% 5.5%6.0% 6.5%7.0%7.5%8.0%8.5% 9.0% 9.5% 10.0% 3Q98 4Q98 1Q99 2Q99 3Q99 4Q99 1Q00 2Q00 3Q00 4Q00 1Q01 2Q01 3Q01 4Q01 1Q02 2Q02 3Q02 4Q02 1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04 1Q05 2Q05 3Q05 4Q05 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 REIT Industry (1) ELS Industry Average -2.2% (1) ELS Average -3.9% ELS

Equity LifeStyle Properties 10 2011 Acquisition Overview ELS

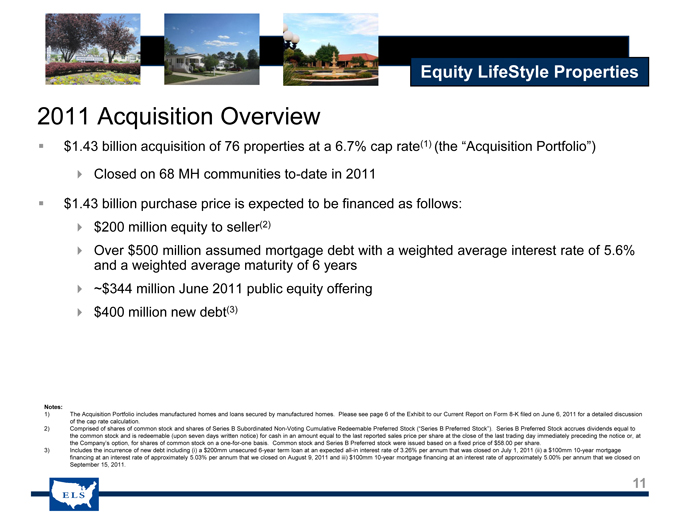

Equity LifeStyle Properties 2011 Acquisition Overview $1.43 billion acquisition of 76 properties at a 6.7% cap rate(1) (the “Acquisition Portfolio”) Closed on 68 MH communities to-date in 2011 $1.43 billion purchase price is expected to be financed as follows: $200 million equity to seller( 2) Over $500 million assumed mortgage debt with a weighted average interest rate of 5.6% and a weighted average maturity of 6 years ~$344 million June 2011 public equity offering $400 million new debt(3) 11 Notes: 1) The Acquisition Portfolio includes manufactured homes and loans secured by manufactured homes. Please see page 6 of the Exhibit to our Current Report on Form 8-K filed on June 6, 2011 for a detailed discussion of the cap rate calculation. 2) Comprised of shares of common stock and shares of Series B Subordinated Non-Voting Cumulative Redeemable Preferred Stock (“Series B Preferred Stock”). Series B Preferred Stock accrues dividends equal to the common stock and is redeemable (upon seven days written notice) for cash in an amount equal to the last reported sales price per share at the close of the last trading day immediately preceding the notice or, at the Company’s option, for shares of common stock on a one-for-one basis. Common stock and Series B Preferred stock were issued based on a fixed price of $58.00 per share. 3) Includes the incurrence of new debt including (i) a $200 mm unsecured 6-year term loan at an expected all-in interest rate of 3.26% per annum that was closed on July 1, 2011 (ii) a $100 mm 10-year mortgage financing at an interest rate of approximately 5.03% per annum that we closed on August 9, 2011 and iii) $100 mm 10-year mortgage financing at an interest rate of approximately 5.00% per annum that we closed on September 15, 2011. ELS

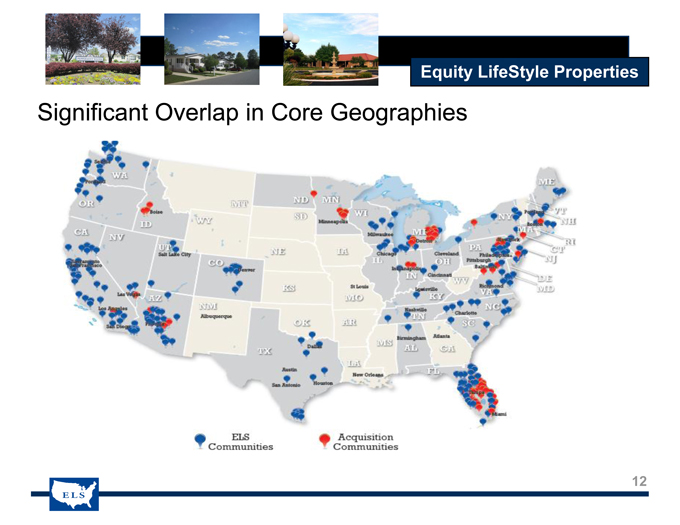

Equity LifeStyle Properties 12 Significant Overlap in Core Geographies ELS Communities Acquisition Communities ELS

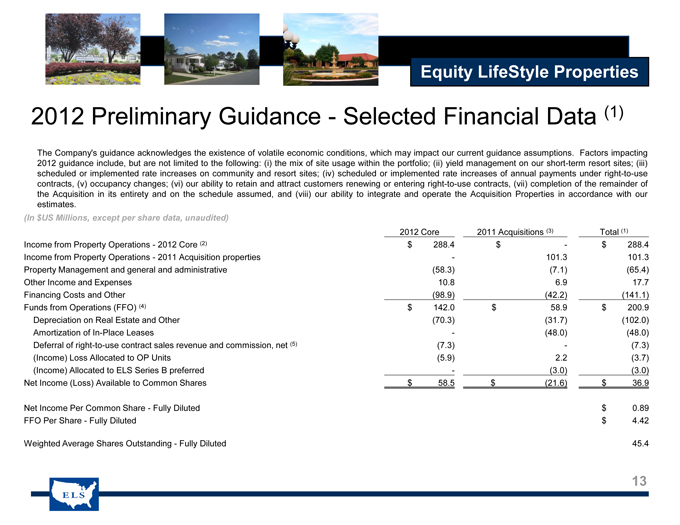

Equity LifeStyle Properties 2012 Preliminary Guidance -Selected Financial Data (1) 13 The Company’s guidance acknowledges the existence of volatile economic conditions, which may impact our current guidance assumptions. Factors impacting 2012 guidance include, but are not limited to the following: (i) the mix of site usage with in the portfolio; (ii) yield management on our short-term resort sites; (iii) scheduled or implemented rate increases on community and resort sites; (iv) scheduled or implemented rate increases of annual payments under right-to-use contracts,(v) occupancy changes;(vi) our ability to retain and attract customers renewing or entering right-to use contracts, (vii) completion of the remainder of the Acquisition in its entirety and on the schedule assumed, and (viii) our ability to integrate and operate the Acquisition Properties in accordance with our estimates.

| (In $US Millions, except per share data, unaudited) |

||||||||||||

| 2012 Core |

|

2011 |

|

|

Total |

|

||||||

| Income from Property Operations -2012 Core (2) |

$ |

288.4 |

|

$ |

— |

|

$ |

288.4 |

| |||

| Income from Property Operations -2011 Acquisition properties |

|

— |

|

|

101.3 |

|

|

101.3 |

| |||

| Property Management and general and administrative |

|

(58.3 |

) |

|

(7.1 |

) |

|

(65.4 |

) | |||

| Other Income and Expenses |

|

10.8 |

|

|

6.9 |

|

|

17.7 |

| |||

| Financing Costs and Other |

|

(98.9 |

) |

|

(42.2 |

) |

|

(141.1 |

) | |||

| Funds from Operations (FFO) (4) |

$ |

142.0 |

|

$ |

58.9 |

|

$ |

200.9 |

| |||

| Depreciation on Real Estate and Other |

|

(70.3 |

) |

|

(31.7 |

) |

|

(102.0 |

) | |||

| Amortization of In-Place Leases |

|

— |

|

|

(48.0 |

) |

|

(48.0 |

) | |||

| Deferral of right-to-use contract sales revenue and commission, net (5) |

|

(7.3 |

) |

|

— |

|

|

(7.3 |

) | |||

| (Income) Loss Allocated to OP Units |

|

(5.9 |

) |

|

2.2 |

|

|

(3.7 |

) | |||

| (Income) Allocated to ELS Series B preferred |

|

— |

|

|

(3.0 |

) |

|

(3.0 |

) | |||

| Net Income (Loss) Available to Common Shares |

$ |

58.5 |

|

$ |

(21.6 |

) |

$ |

36.9 |

| |||

| Net Income Per Common Share -Fully Diluted |

$ |

0.89 |

|

|||||||||

| FFO Per Share -Fully Diluted |

$ |

4.42 |

|

|||||||||

| Weighted Average Shares Outstanding -Fully Diluted |

|

45.4 |

|

|||||||||

ELS

Equity LifeStyle Properties 2012 Preliminary Guidance -Footnotes 14 1) Each line item represents the mid-point of a orange of possible outcomes and reflects management’s best estimate of the most likely outcome. Actual FFO, FFO pershare,

Net Income and Net Income pershare could vary materially from amounts presented above if any of our assumptions are incorrect. 2) Amount represents estimated 2012 Core income from property operations in 2011 of $282. 4 million multiplied by an estimated growth rate of 2.2%. 3) 2011 Acquisitions guidance makes certain assumptions about the timing of the Acquisition. There can be no assurances that our estimates will reflect actual timing. 4) See page 15 for definition of FFO. 5) Due to the uncertain timing and extent of right to use upfront payments and the resulting deferrals, actual income could differ materially from expected net income.

Equity LifeStyle Properties 15 Non GAAP Financial Measures Funds from Operations (“FFO”) is a non-GAAP financial measure. The Company believes that FFO, as defined by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”), is generally an appropriate measure of performance for an equity REIT. While FFO is a relevant and widely used measure of operating performance for equity REITs, it does not represent cash flow from operations or net income as defined by GAAP, and it should not be considered as an alternative to these indicators in evaluating liquidity or operating performance. The Company defines FFO as net income, computed in accordance with GAAP, excluding gains or actual or estimated losses from sales of properties, plus real estate related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO on the same basis. The Company receives up-front non-refundable payments from the entry of right-to-use contracts. In accordance with GAAP, the up front non-refundable payments and related commissions are deferred and amortized over the estimated customer life. Although the NAREIT definition of FFO does not address the treatment of nonrefundable right-to-use payments, the Company believes that it is appropriate to adjust for the impact of the deferral activity in its calculation of FFO. The Company believes that FFO is helpful to investors as one of several measures of the performance of an equity REIT. The Company further believes that by excluding the effect of depreciation, amortization and gains or actual or estimated losses from sales of real estate, all of which are based on historical costs and which may be of limited relevance in evaluating current performance, FFO can facilitate comparisons of operating performance between periods and among other equity REITs. The Company believes that the adjustment to FFO for the net revenue deferral of up front non-refundable payments and expense deferral of right-to-use contract commissions also facilitates the comparison to other equity REITs. Investors should review FFO, along with GAAP net income and cash flow from operating activities, investing activities and financing activities, when evaluating equity REIT’s operating performance. The Company computes FFO in accordance with its interpretation of standards established by NAREIT, which may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than the Company does. FFO does not represent cash generated from operating activities in accordance with GAAP, nor does it represent cash available to pay distributions and should not be considered as an alternative to net income, determined in accordance with GAAP, as an indication of the Company’s financial performance, or to cash flow from operating activities, determined in accordance with GAAP, as a measure of the Company’s liquidity, nor is it indicative of funds available to fund its cash needs, including its ability to make cash distributions.