Attached files

Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on November 14, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Midstates Petroleum Company, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 1311 | 45-3691816 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

4400 Post Oak Parkway, Suite 1900

Houston, Texas 77027

(713) 595-9400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John Foley

Corporate Counsel

4400 Post Oak Parkway, Suite 1900

Houston, Texas 77027

(713) 595-9400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| David P. Oelman Matthew R. Pacey Vinson & Elkins L.L.P. 1001 Fannin, Suite 2500 Houston, Texas 77002-6760 (713) 758-2222 |

Joshua Davidson Kelly B. Rose Baker Botts L.L.P. One Shell Plaza Houston, Texas 77002-4995 (713) 229-1234 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to Be Registered |

Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Registration Fee | ||

| Common Stock, par value $0.01 per share |

$ 400,000,000 | $ 45,840 | ||

|

| ||||

|

| ||||

| (1) | Includes shares of common stock issuable upon exercise of the underwriters’ option to purchase additional shares of common stock. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated November 14, 2011

PROSPECTUS

Shares

Midstates Petroleum Company, Inc.

COMMON STOCK

Midstates Petroleum Company, Inc. is offering shares of its common stock and the selling stockholders named in this prospectus are offering shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholders.

This is our initial public offering, and no public market currently exists for our shares. We anticipate that the initial public offering price of our common stock will be between $ and $ per share.

We intend to apply to list our common stock on the New York Stock Exchange under the symbol “MPO.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 16.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PRICE $ PER SHARE

| Price to Public | Underwriting Discounts and Commissions |

Proceeds to Company |

Proceeds to Selling Stockholder | |||||

| Per Share |

||||||||

| Total |

Midstates Petroleum Company, Inc. and the selling stockholders have granted the underwriters the right to purchase up to an additional shares of common stock.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2012.

Joint Book-Running Managers

| Goldman, Sachs & Co. | ||||||

| Morgan Stanley | ||||||

| Wells Fargo Securities | ||||||

Prospectus dated , 2012

Table of Contents

Index to Financial Statements

Table of Contents

Index to Financial Statements

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the selling stockholders have authorized anyone to provide you with information different from that contained in this prospectus and any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the selling stockholders are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Through and including , 2012 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications or other published independent sources. Some data is also based on our good faith estimates. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

i

Table of Contents

Index to Financial Statements

This summary provides a brief overview of information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. Because it is abbreviated, this summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully before making an investment decision, including the information presented under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical consolidated financial statements and the related notes to those financial statements included elsewhere in this prospectus. Unless otherwise indicated, the information presented in this prospectus assumes that the underwriters’ option to purchase additional shares of common stock is not exercised. We have provided definitions for certain oil and natural gas terms used in this prospectus in the “Glossary of Oil and Natural Gas Terms” beginning on page A-1 of this prospectus.

In this prospectus, unless the context otherwise requires, the terms “we,” “us,” “our,” and the “Company” refer to Midstates Petroleum Holdings LLC and its subsidiaries before the completion of our corporate reorganization and Midstates Petroleum Company, Inc. and its subsidiaries as of the completion of our corporate reorganization and thereafter. See “Corporate Reorganization” beginning on page 106.

MIDSTATES PETROLEUM COMPANY, INC.

Overview

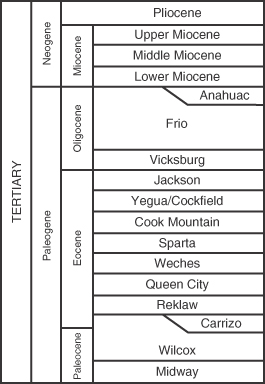

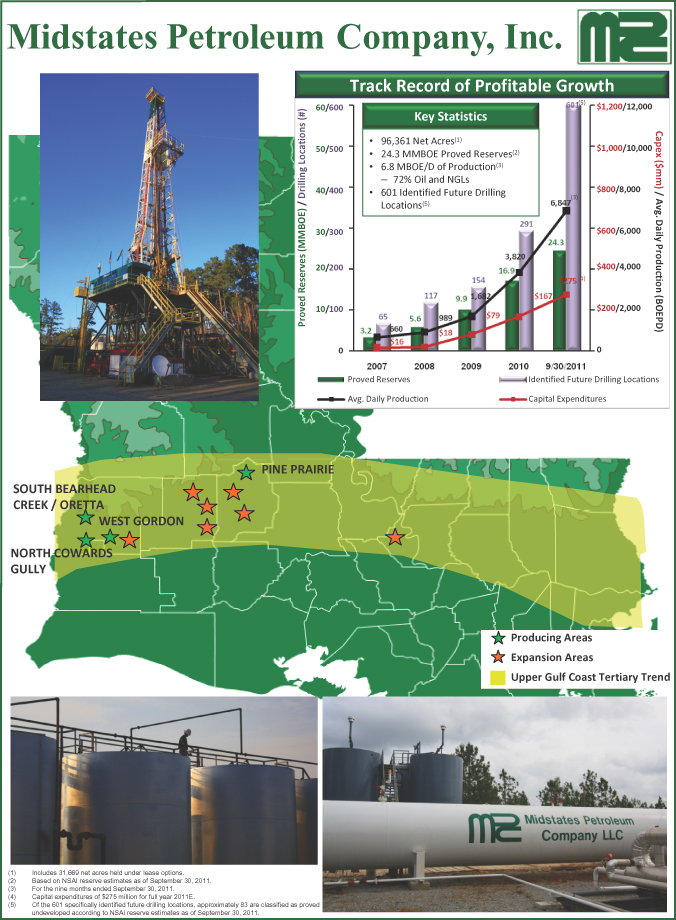

We are an independent exploration and production company focused on the application of modern drilling and completion techniques to oil-prone resources in previously discovered yet underdeveloped hydrocarbon trends. We were founded in 1993 to focus on oilfields in the Upper Gulf Coast Tertiary trend onshore in central Louisiana. The Upper Gulf Coast Tertiary trend extends from south Texas to Mississippi across our current operating areas in central Louisiana and is characterized by well-defined geology, including tight sands featuring multiple productive zones typically located within large geologic traps. Many of the oilfields in this trend were discovered by major oil companies in the 1940’s and 1950’s, but were not fully developed due to then-prevailing oil prices, the adoption of a state-level severance tax in Louisiana, restrictive production allowables and other regulatory limitations. We have applied modern formation evaluation and drilling and completion techniques to the trend, and, as a result, we have identified a large inventory of development drilling opportunities that we believe will provide strong economic returns. Our early entry and relatively long history in the trend have positioned us as a first-mover. We have accumulated approximately 64,700 net acres in the trend and have options to acquire an aggregate of approximately 31,700 additional targeted net acres.

Our development operations are currently focused in the Wilcox interval of the trend, drilling vertical wells and commingling production from multi-stage hydraulically fractured completions across stacked oil-producing intervals. Our strategy has been validated by the 42 gross wells we have drilled in the trend, approximately 90% of which produced commercially, since the third quarter of 2008. Over the past three years, we have increased our average daily production at a compound annual growth rate of 99%, from 1,024 Boe/d in the month ended September 30, 2008 to 8,033 Boe/d in the month ended September 30, 2011. We believe that, based on the results of our drilling program and our understanding of the geology underlying our acreage, we have a total of 601 specifically identified gross vertical drilling locations in the trend. In addition, we believe this trend may further benefit from the application of horizontal drilling and completion techniques. We intend to test this concept by drilling our first horizontal well by the end of 2011.

1

Table of Contents

Index to Financial Statements

Netherland, Sewell & Associates, Inc. (“NSAI”), our independent reserve engineers, estimated our net proved reserves to be 24.3 MMBoe as of September 30, 2011, 74% of which were comprised of oil and natural gas liquids (“NGLs”). As of September 30, 2011, our properties included approximately 86 gross active producing wells, 94% of which we operate, and in which we held an average working interest of approximately 99% across our 64,700 net acre leasehold. The following table presents summary data regarding our reserves and production for each of our four primary operating areas as well as other acreage we hold that we have identified as having significant hydrocarbon structures, as measured by either production tests or well log analysis, which we refer to as our expansion areas. The information in the table is as of September 30, 2011, unless otherwise indicated:

| Average Daily Production (1) |

Estimated Net Proved Reserves |

Acreage | Identified Vertical Drilling Locations (3) |

Budget | ||||||||||||||||||||||||||||||||

| 2011 Wells (4) |

2012 Wells |

2012 D&C (5) |

||||||||||||||||||||||||||||||||||

| (Boe/d) | (% Oil) (2) | (MMBoe) | (Gross) | (Net) | (Gross) | (Gross) | (Gross) | (In millions) | ||||||||||||||||||||||||||||

| Pine Prairie |

3,728 | 68 | % | 10.0 | 2,957 | 2,940 | 149 | 20 | 13 | $ | 50 | |||||||||||||||||||||||||

| South Bearhead Creek/Oretta |

2,908 | 70 | % | 6.0 | 3,646 | 3,560 | 38 | 8 | 10 | 56 | ||||||||||||||||||||||||||

| West Gordon |

516 | 70 | % | 5.0 | 12,896 | 12,686 | 75 | 9 | 13 | 72 | ||||||||||||||||||||||||||

| North Cowards Gully |

167 | 79 | % | 2.8 | 7,042 | 7,042 | 75 | 1 | 3 | 10 | ||||||||||||||||||||||||||

| Expansion Areas (6): |

||||||||||||||||||||||||||||||||||||

| Acreage under lease |

57 | 100 | % | 0.5 | 39,188 | 38,464 | 264 | 4 | 21 | 105 | ||||||||||||||||||||||||||

| Acreage under option |

— | — | — | 32,067 | 31,669 | — | — | — | — | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

7,376 | 70 | % | 24.3 | 97,796 | 96,361 | 601 | 42 | 60 | $ | 293 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| (1) | Average daily production for the three months ended September 30, 2011. |

| (2) | Includes volumes attributable to oil and NGLs. |

| (3) | Our drilling locations are specifically identified based on our interpretation of 2D and 3D seismic data, study of previously drilled wells and analogous well performance. We have selected our drilling locations to optimize the initial testing and subsequent delineation of all potential reservoirs in a given field or geologic structure. Drilling locations in our Pine Prairie area are primarily based on 10-acre spacing, while other drilling locations are primarily based on 40-acre spacing or greater. Of our 601 specifically identified gross vertical drilling locations, approximately 83 are classified as proved undeveloped according to NSAI’s September 30, 2011 reserve report. |

| (4) | Includes wells spud or expected to be spud between January 1, 2011 and December 31, 2011. |

| (5) | Represents drilling and completion expenditures. |

| (6) | For a description of our expansion areas, see “Business — Our Areas of Operation — Expansion Areas Within the Trend.” |

Our total 2011 capital expenditure budget is $275 million. Through September 30, 2011, approximately $179 million of our 2011 budget has been spent, and we have drilled or spud 27 wells out of 42 wells in our 2011 drilling plan. Our total 2012 capital expenditure budget is $353 million, approximately 30% of which will be spent developing acreage currently under lease in our expansion areas. Our 2012 budget consists of:

| • | $293 million for drilling and completion capital; |

| • | $52 million for acquisition of acreage and seismic data; and |

| • | $8 million in unallocated funds which are available for facilities. |

While we have budgeted $353 million for these purposes, the ultimate amount of capital we will expend may fluctuate materially based on market conditions and the success of our drilling results as the year progresses. Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” beginning on page 52.

2

Table of Contents

Index to Financial Statements

Our Business Strategy

Our goal is to increase stockholder value by growing reserves, production and cash flows at an attractive return on invested capital. We seek to achieve this goal through the following strategies:

| • | Accelerate development of our multi-year drilling inventory. We intend to drill and develop our current acreage position to maximize the value of our resource potential. Our assets are characterized by easily identifiable, thick geologic sections of tight sands featuring multiple productive zones typically located within large geologic traps. Our primary operating areas have well-established production histories and relatively low terminal production decline rates. We have identified an inventory of 601 gross vertical drilling locations targeting large, well-defined geologic structures that we believe will increase our reserves, production and cash flow. Since the third quarter of 2008, we have drilled 42 gross wells in the trend, approximately 90% of which produced commercially, making us the most active driller in the trend during that period. Our 2011 drilling plan contemplates using three drilling rigs to drill approximately 42 gross wells, 27 of which we had drilled or spud as of September 30, 2011. We expect to operate up to six drilling rigs by the end of 2012, which would enable us to drill as many as 60 gross operated wells during that year, 21 of which we anticipate drilling in our expansion areas. |

| • | Utilize our technical and operating expertise to enhance returns. Our management team is focused on the application of modern reservoir evaluation and drilling and completion techniques to reduce risk and enhance returns. We utilize relatively inexpensive 2D seismic data and existing sub-surface well control data to identify large, undeveloped or under-developed geologic traps that we believe have significant development potential as targets for our leasing activity. Once we have identified a potential target, we attempt to efficiently verify the economic viability of the target reservoir utilizing existing wellbores and techniques such as sidetracking and slim-hole drilling. Once the development potential of the target reservoir has been established, we seek to economically develop the opportunity by incorporating 3D seismic data and reservoir evaluation methods such as conventional and rotary sidewall coring, pressure sampling and other reservoir description techniques. We have accumulated 3D seismic data covering 90% of the acreage in our primary operating areas and 60% of our total acreage. We believe our primary operating areas represent the successful execution of this exploration to development approach. We are applying this same approach to our expansion areas, where we have recently leased approximately 38,000 net acres and have also entered into lease option agreements covering approximately 31,700 additional net targeted acres. We believe future development across our entire acreage position may be further optimized through specialized completion techniques, infill drilling, horizontal drilling and other enhanced recovery methods. |

| • | Strategically increase our acreage position. While we believe our existing inventory of specifically identified drilling locations provides significant growth opportunities, we continue to use the in-depth knowledge that we have gained as a first mover in the region to increase our leasehold position in the oil-prone portion of the Upper Gulf Coast Tertiary trend. We believe that this portion of the trend extends from east Texas through central Louisiana and into southern Mississippi and offers us significant opportunities to acquire additional acreage. We have screened more than 300 geologic structures in the oil-prone portion of the trend. Our current acreage position, including acreage under option, has captured 18 of these structures. We have specifically identified approximately 40 additional geologic structures throughout the trend that we believe have characteristics similar to our existing operating areas. In addition to increasing our acreage position through leasing, we may selectively pursue potential acquisitions of strategic assets or operating companies in the trend. Over time, we also |

3

Table of Contents

Index to Financial Statements

| expect to selectively target additional onshore basins in North America that would allow us to extend our competencies to large undeveloped acreage positions in hydrocarbon trends similar to our existing core area. |

| • | Apply rigorous investment analysis to capital allocation decisions. We employ rigorous investment analysis to determine the allocation of capital across our many drilling opportunities. We are focused on maximizing the internal rate of return on our investment capital and screen drilling opportunities by measuring risk and financial return, among other factors. We continually evaluate and rank our inventory of potential investments by these measures, incorporating past drilling results and new information we have gathered. This approach has allowed us to maintain attractive operational and efficiency metrics, measured by finding and development costs, even as our capital expenditures and drilling activities have significantly increased over the last three years. |

Our Competitive Strengths

We have a number of competitive strengths that we believe will help us to successfully execute our business strategies:

| • | Extensive technical knowledge, history and first-mover advantage in the Upper Gulf Coast Tertiary trend. We have had operations in the Upper Gulf Coast Tertiary trend since 1993. We believe our extensive operating experience in the trend provides us with an expansive technical understanding of the geology underlying our acreage and of the application of completion technologies and infrastructure design and optimization to our properties. We believe our relatively long history in this area and experience interpreting well control data, core data and 2D and 3D seismic data provides us with an information advantage over our competitors in the trend and has allowed us to identify and acquire quality acreage at a relatively low cost. In addition, we have developed amicable and mutually beneficial relationships with acreage owners in our operating areas, which we believe provides us with a competitive advantage with respect to our leasing and development activity. We also benefit from long-term relationships with local service companies and infrastructure providers that we believe contribute to our efficient low-cost operations. |

| • | Louisiana Light Sweet oil-weighted reserves, production and drilling locations with attractive economics. Our reserves, production and drilling locations are primarily oil with associated liquids rich natural gas. For the three months ended September 30, 2011, our production was comprised of approximately 56% oil and 13% NGLs. We benefit from selling our oil production to the Louisiana Light Sweet (“LLS”) market, which has historically commanded a premium to West Texas Intermediate (“NYMEX WTI”) oil prices due to its proximity to U.S. Gulf Coast refiners and the higher quality of the oil production sold in the LLS market. This premium has averaged approximately $6.53 per Bbl in the three years ended September 30, 2011 and has significantly increased in recent months. For the three months ended September 30, 2011, the average realized price before the effect of commodity derivative contracts for our oil production was $107.56 per Bbl, compared to an average NYMEX WTI price of $89.54 per Bbl for the same period, representing a premium of $18.02 per barrel. Our ability to capture a premium for our oil production in the LLS market provides us with a significant competitive advantage over companies with assets in other well known plays, such as the Bakken and Eagle Ford, where oil price realizations are typically at a discount to NYMEX WTI. In addition, our assets are located in an area with developed legacy infrastructure that reduces our development and transportation costs relative to other onshore basins in North America. |

| • | Multi-year drilling inventory with significant upside potential. We have an inventory of approximately 601 specifically identified gross vertical drilling locations. This inventory |

4

Table of Contents

Index to Financial Statements

| includes drilling locations in our expansion areas that have been meaningfully risked given the early stage of development. We believe our expansion areas possess substantially similar characteristics as our primary operating areas, and expect that the execution of our remaining 2011 and 2012 drilling plans will allow us to reduce our risk profile on this acreage and could add materially to our drilling opportunities. We also believe the potential drilling inventory on our existing acreage may increase significantly by targeting additional productive zones and through infill drilling. Based on the results of our development activities in our primary operating areas, we believe that infill drilling within thick geologic sections of tight sands increases the ultimate resource recovery. We have successfully downspaced to 10-acre spacing in portions of our Pine Prairie area. We are currently testing downspacing in our South Bearhead Creek/Oretta and North Cowards Gully areas and intend to apply this concept in our other primary operating areas and our expansion areas. In addition, we may be able to enhance the total recovery in the trend through specialized completion techniques, horizontal drilling and secondary recovery techniques. |

| • | Operating control over 95% of our portfolio. In order to maintain better control over our assets, we have established a leasehold position comprised primarily of properties that we expect to operate. Controlling operations allows us to dictate the pace of development and better manage the cost, type and timing of exploration and development activities. We expect to operate 95% of our 601 specifically identified gross drilling locations. For the three months ended September 30, 2011, approximately 99% of our production was attributable to properties that we operate. |

| • | Experienced management team with extensive operating expertise. Our management team has extensive operating expertise in the oil and gas industry and significant public company executive experience at Apache Corporation, Burlington Resources, ConocoPhillips, Noble Corporation, and SM Energy. Our management team has an average of 30 years of industry experience, including prior experience in the Upper Gulf Coast Tertiary trend and similar trends. We believe our management team is one of our principal competitive strengths relative to our industry peers due to our team’s proven track record of efficiently operating exploration and development programs. |

| • | Conservative financial position. We believe that our capital structure and hedge positions following this offering will allow us to continue our development program and acquire additional acreage even in challenging commodity price environments and periods of capital markets dislocation. Giving effect to the completion of this offering, our liquidity as of September 30, 2011 would have been $ million, consisting of $ million available under our revolving credit facility and $ million in cash and cash equivalents. After the completion of this offering, we believe we will have the liquidity and financial flexibility to more than fund our 2012 drilling program and production growth. In addition, we have an active hedging program in place, with swaps, collars and puts covering approximately 79% and 58% of our remaining budgeted 2011 and 2012 oil production. |

| • | Alignment among management, founders and public stockholders. Upon the completion of this offering, our management team will have a significant direct ownership interest in us. In addition, our management team will also own an indirect economic interest in us through their ownership of incentive units in MPCI Holdings LLC (“MPCI”). MPCI is controlled by funds affiliated with First Reserve Management, L.P. (“First Reserve”). The incentive units entitle our management to a portion of the proceeds to be received by First Reserve upon sales of our common stock by MPCI. Our management may significantly increase the value allocated to their incentive units by increasing the return on investment for First Reserve. We believe our management team’s direct ownership interest and incentive units provide significant incentives to grow the value of our business for the benefit of all stockholders. |

5

Table of Contents

Index to Financial Statements

Risk Factors

Investing in our common stock involves risks that include the speculative nature of oil and natural gas exploration, competition, volatile oil and natural gas prices and other material factors. For a discussion of these risks and other considerations that could negatively affect us, including risks related to this offering and our common stock, see “Risk Factors” beginning on page 16 and “Cautionary Note Regarding Forward-Looking Statements” beginning on page 36.

Conflicts of Interest

Affiliates of Goldman, Sachs & Co., Morgan Stanley & Co. LLC and Wells Fargo Securities, LLC are lenders, and in one case, an agent for the lenders, under our reserve-based revolving credit facility. Because a portion of the proceeds of this offering will be used to repay indebtedness under our revolving credit facility, a “conflict of interest” under Rule 5121 of the Financial Industry Regulatory Authority, or FINRA, is therefore deemed to exist. Accordingly, this offering is being made in compliance with FINRA Rule 5121. Pursuant to FINRA Rule 5121, a “qualified independent underwriter” meeting certain standards must participate in the preparation of the registration statement of which this prospectus forms a part and must exercise the usual standards of due diligence with respect thereto. has assumed the responsibilities of acting as the qualified independent underwriter in this offering. Please read “Underwriting — Conflicts of Interest” beginning on page 121.

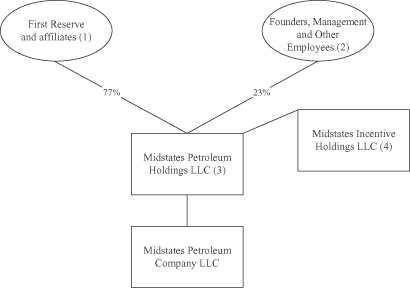

Corporate Sponsorship and Structure

We were recently incorporated pursuant to the laws of the State of Delaware as Midstates Petroleum Company, Inc. to become a holding company for Midstates Petroleum Company LLC, a wholly-owned subsidiary of Midstates Petroleum Holdings LLC. Midstates Petroleum Holdings LLC was formed as a Delaware limited liability company on August 13, 2008, by certain members of our senior management and First Reserve. Including First Reserve’s initial investment in August 2008, First Reserve has acquired an approximate 77% aggregate equity interest in us. With over $23 billion of raised capital dedicated exclusively to the energy and natural resources industries, First Reserve is the largest energy focused private investment firm, making both private equity and infrastructure investments throughout the energy value chain. For 28 years, it has invested solely in the global energy industry, utilizing its broad base of specialized energy industry knowledge as a competitive advantage. The firm is currently investing its most recent private equity fund, which closed in 2009 at approximately US $9 billion and its most recent infrastructure fund, which closed in 2011 at approximately US $1.2 billion.

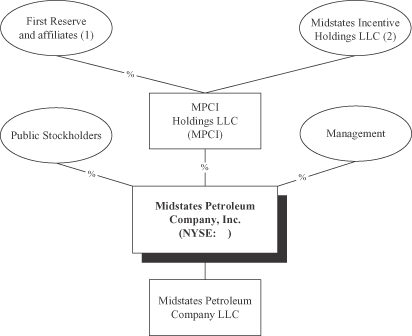

Pursuant to the terms of a corporate reorganization that will be completed simultaneously with the closing of this offering, Midstates Petroleum Company, Inc., will directly own all of the outstanding membership interests in Midstates Petroleum Company LLC. Following the completion of this offering, First Reserve will initially own an approximate % indirect economic interest in us through MPCI, which will initially own approximately % of our outstanding shares of common stock (or % if the underwriters’ option to purchase additional shares is exercised in full).

6

Table of Contents

Index to Financial Statements

The tables below present an overview of our organizational structure before and after the completion of this offering.

Current Organizational Structure

| (1) | Represents membership interests indirectly held by First Reserve through FR Midstates Holdings LLC. |

| (2) | Includes membership interests held directly by certain members of management and Midstates Petroleum Holdings, Inc., a subchapter S corporation, through which our founders, management and certain of our employees hold their equity interest in us. |

| (3) | Midstates Petroleum Holdings LLC is a holding company and its sole material asset is its 100% equity interest in Midstates Petroleum Company LLC, through which we conduct our operations. |

| (4) | Certain members of management and certain of our employees own incentive units through Midstates Incentive Holdings LLC that entitle them to receive a portion of any proceeds to be received by FR Midstates Holdings LLC from any sale of its equity interest in Midstates Petroleum Holdings LLC. |

7

Table of Contents

Index to Financial Statements

Organizational Structure After Giving Effect to this Offering

| (1) | Represents membership interests indirectly held by First Reserve through FR Midstates Holdings LLC. |

| (2) | Certain members of management and certain of our employees will own incentive units through Midstates Incentive Holdings LLC that entitle them to receive a portion of the proceeds to be received by First Reserve upon sales of shares of common stock in Midstates Petroleum Company, Inc. by MPCI. |

For more information on our reorganization and the ownership of our common stock by our principal and selling stockholders, see “Corporate Reorganization” beginning on page 106 and “Principal and Selling Stockholders” beginning on page 107.

Corporate Information

Our principal executive offices are located at 4400 Post Oak Parkway, Suite 1900, Houston, Texas 77027, and our telephone number at that address is (713) 595-9400. Our website is located at www.midstatespetroleum.com and will be activated in connection with the closing of this offering. We expect to make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission, or the SEC, available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

8

Table of Contents

Index to Financial Statements

| Common stock offered by Midstates Petroleum Company, Inc. |

shares ( shares if the underwriters’ option to purchase additional shares is exercised in full). |

| Common stock offered by the selling stockholders |

shares ( shares if the underwriters’ option to purchase additional shares is exercised in full). |

| Total common stock offered |

shares ( shares if the underwriters’ option to purchase additional shares is exercised in full). |

| Common stock to be outstanding after the offering |

shares ( shares if the underwriters’ option to purchase additional shares is exercised in full). |

| Common stock owned by the selling stockholders after the offering |

shares ( shares if the underwriters’ option to purchase additional shares is exercised in full). |

| Option to purchase additional shares |

We and the selling stockholders have granted the underwriters a 30-day option to purchase up to an aggregate of additional shares of our common stock. |

| Use of proceeds |

We expect to receive approximately $ million of net proceeds from the sale of the common stock offered by us, based upon the assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| We intend to use $ million of the net proceeds from this offering to repay all outstanding indebtedness under our revolving credit facility. The remaining proceeds of approximately $ million will be used to fund a portion of our exploration and development program. We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders. |

| Affiliates of certain of the underwriters are lenders under our revolving credit facility and, accordingly, will receive a portion of the proceeds from this offering. See “Use of Proceeds” and “Underwriting—Conflicts of Interest.” |

| Dividend policy |

We do not anticipate paying any cash dividends on our common stock. In addition, our revolving credit facility prevents us from paying cash dividends. See “Dividend Policy.” |

9

Table of Contents

Index to Financial Statements

| Risk factors |

You should carefully read and consider the information beginning on page 16 of this prospectus set forth under the heading “Risk Factors” and all other information set forth in this prospectus before deciding to invest in our common stock. |

| Listing and trading symbol |

We intend to apply to list our common stock on the New York Stock Exchange under the symbol “MPO.” |

10

Table of Contents

Index to Financial Statements

Summary Historical Consolidated Financial Data

You should read the following summary financial data in conjunction with “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical consolidated financial statements and unaudited financial information and related notes thereto included elsewhere in this prospectus. The financial information included in this prospectus may not be indicative of our future results of operations, financial position and cash flows.

Set forth below is (i) our summary historical consolidated financial data as of and for the nine months ended September 30, 2011, which has been derived from our audited consolidated financial statements included elsewhere in this prospectus; (ii) our summary historical consolidated financial data for the nine months ended September 30, 2010, which has been derived from our unaudited consolidated financial statements included elsewhere in this prospectus; (iii) our summary historical consolidated financial data as of and for the years ended December 31, 2010 and 2009 and for the period from August 30, 2008 through December 31, 2008, which has been derived from our audited consolidated financial statements included elsewhere in this prospectus; and (iv) the summary historical consolidated financial data for the period from January 1 to August 29, 2008 of Midstates Petroleum Corporation, our accounting predecessor, which has been derived from the audited financial statements of Midstates Petroleum Corporation included elsewhere in this prospectus.

| Successor | Predecessor | |||||||||||||||||||||||||

| Nine Months Ended September 30, |

Year Ended December 31, |

Period from August 30 to December 31, 2008 |

Period from January 1 to August 29, 2008 |

|||||||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | |||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||

| Statement of operations data Revenues: |

||||||||||||||||||||||||||

| Oil, gas and natural gas liquids revenues |

$ | 147,579 | $ | 58,296 | $ | 89,111 | $ | 30,133 | $ | 8,689 | $ | 27,458 | ||||||||||||||

| Gains (losses) on commodity derivative contracts-net |

22,442 | (6,453 | ) | (26,268 | ) | (5,987 | ) | 14,062 | (7,678 | ) | ||||||||||||||||

| Other revenue |

260 | 185 | 209 | 108 | 43 | 113 | ||||||||||||||||||||

| Total revenues |

170,281 | 52,028 | 63,052 | 24,254 | 22,794 | 19,893 | ||||||||||||||||||||

| Expenses: |

||||||||||||||||||||||||||

| Lease operating |

9,451 | 5,225 | 8,733 | 5,312 | 1,542 | 2,769 | ||||||||||||||||||||

| Workover |

1,301 | 3,856 | 4,683 | 5,226 | 2,376 | 2,206 | ||||||||||||||||||||

| Severance tax |

8,437 | 4,193 | 6,431 | 2,849 | 805 | 2,354 | ||||||||||||||||||||

| Asset retirement accretion |

205 | 108 | 175 | 120 | 37 | 79 | ||||||||||||||||||||

| General and administrative |

15,519 | 11,820 | 16,847 | 5,886 | 1,402 | 1,816 | ||||||||||||||||||||

| Depreciation, depletion and amortization |

61,640 | 26,924 | 41,827 | 12,322 | 2,995 | 3,117 | ||||||||||||||||||||

| Impairment in carrying value of oil and natural gas properties |

— | — | — | 4,297 | 26,776 | — | ||||||||||||||||||||

| Total expenses |

96,553 | 52,126 | 78,696 | 36,012 | 35,933 | 12,341 | ||||||||||||||||||||

| Income (loss) from operations |

73,728 | (98 | ) | (15,644 | ) | (11,758 | ) | (13,139 | ) | 7,552 | ||||||||||||||||

| Other income (expense): |

||||||||||||||||||||||||||

| Interest income |

15 | 6 | 9 | 6 | 7 | 12 | ||||||||||||||||||||

| Interest expense-net of amounts capitalized |

(735 | ) | — | — | — | — | (854 | ) | ||||||||||||||||||

| Net income (loss) |

$ | 73,008 | $ | (92 | ) | $ | (15,635 | ) | $ | (11,752 | ) | $ | (13,132 | ) | $ | 6,710 | ||||||||||

11

Table of Contents

Index to Financial Statements

| As of September 30, 2011 |

As of December 31, | |||||||||||||||

| 2010 | 2009 | 2008 | ||||||||||||||

| (in thousands) | ||||||||||||||||

| Balance sheet data: |

||||||||||||||||

| Cash and cash equivalents |

$ | 10,220 | $ | 11,917 | $ | 4,353 | $ | 3,214 | ||||||||

| Net property and equipment |

518,708 | 397,126 | 271,726 | 209,939 | ||||||||||||

| Total assets |

565,751 | 427,004 | 284,034 | 222,074 | ||||||||||||

| Long-term debt |

198,600 | 89,600 | 29,800 | 21,800 | ||||||||||||

| Total members’/stockholders’ equity |

277,922 | 255,879 | 235,334 | 192,006 | ||||||||||||

| Successor | Predecessor | |||||||||||||||||||||||||

| Nine Months Ended September 30, |

Year Ended December 31, |

Period from August 30 to December 31, 2008 |

Period from January 1 to August 29, 2008 |

|||||||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | |||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||

| Other financial data: |

||||||||||||||||||||||||||

| Net cash provided by operating activities |

$ | 103,311 | $ | 35,795 | $ | 50,768 | $ | 10,595 | $ | 3,670 | $ | 10,046 | ||||||||||||||

| Net cash used in investing activities |

(162,739 | ) | (94,274 | ) | (139,618 | ) | (75,215 | ) | (5,451 | ) | (9,480 | ) | ||||||||||||||

| Net cash provided by financing activities |

57,731 | 65,076 | 96,414 | 65,759 | 4,995 | 1,792 | ||||||||||||||||||||

| Adjusted EBITDA (1) |

102,758 | 34,736 | 53,274 | 12,539 | 3,032 | 15,413 | ||||||||||||||||||||

| (1) | Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net loss and net cash provided by operating activities, see “— Non-GAAP Financial Measures and Reconciliations” below. |

Non-GAAP Financial Measures and Reconciliations

Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies.

We define Adjusted EBITDA as earnings before interest income and expense, income taxes, depreciation, depletion and amortization, property impairments, asset retirement obligation accretion, unrealized derivative gains and losses and non-cash stock-based compensation expense. Adjusted EBITDA is not a measure of net income or cash flows as determined by United States generally accepted accounting principles, or GAAP.

We believe that Adjusted EBITDA is useful because it allows us to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure. We exclude items such as property impairments, asset retirement obligation accretion, unrealized derivative gains and losses and non-cash stock-based compensation expense from net income in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net income or cash flows from operating activities as determined in accordance with GAAP or as an indicator of our operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDA. Our computations of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. We believe that Adjusted EBITDA is a widely followed measure of operating performance and may also be used by investors to measure our ability to meet debt service requirements.

12

Table of Contents

Index to Financial Statements

The following table presents a reconciliation of the non-GAAP financial measure of Adjusted EBITDA to the GAAP financial measures of net income (loss) and net cash provided by operating activities, respectively.

| Successor | Predecessor | |||||||||||||||||||||||||

| Nine Months Ended September 30, |

Year Ended December 31, |

Period from August 30 to December 31, 2008 |

Period from January 1 to August 29, 2008 |

|||||||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | |||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||

| Adjusted EBITDA reconciliation to net income (loss): |

||||||||||||||||||||||||||

| Net income (loss) |

$ | 73,008 | $ | (92 | ) | $ | (15,635 | ) | $ | (11,752 | ) | $ | (13,132 | ) | $ | 6,710 | ||||||||||

| Depreciation, depletion and amortization |

61,640 | 26,924 | 41,827 | 12,363 | 2,995 | 3,117 | ||||||||||||||||||||

| Impairment in carrying value of oil and gas properties |

— | — | — | 4,297 | 26,776 | — | ||||||||||||||||||||

| Change in unrealized (gain) loss on commodity derivative contracts |

(34,587 | ) | 6,737 | 25,398 | 7,283 | (13,637 | ) | 4,665 | ||||||||||||||||||

| Interest income |

(15 | ) | (6 | ) | (9 | ) | (6 | ) | (7 | ) | (12 | ) | ||||||||||||||

| Interest expense-net of amounts capitalized |

735 | — | — | — | — | 854 | ||||||||||||||||||||

| Asset retirement obligation accretion |

205 | 108 | 175 | 120 | 37 | 79 | ||||||||||||||||||||

| Stock-based compensation |

1,772 | 1,065 | 1,518 | 234 | — | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Adjusted EBITDA |

$ | 102,758 | $ | 34,736 | $ | 53,274 | $ | 12,539 | $ | 3,032 | $ | 15,413 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Successor | Predecessor | |||||||||||||||||||||||||

| Nine Months Ended September 30, |

Year Ended December 31, |

Period from August 30 to December 31, 2008 |

Period from January 1 to August 29, 2008 |

|||||||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | |||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||

| Adjusted EBITDA reconciliation to net cash provided by operating activities: |

||||||||||||||||||||||||||

| Net cash provided by operating activities |

$ | 103,311 | $ | 35,795 | $ | 50,768 | $ | 10,595 | $ | 3,670 | $ | 10,046 | ||||||||||||||

| Changes in working capital |

(1,273 | ) | (1,053 | ) | 2,515 | 1,950 | (631 | ) | 4,525 | |||||||||||||||||

| Interest income |

(15 | ) | (6 | ) | (9 | ) | (6 | ) | (7 | ) | (12 | ) | ||||||||||||||

| Interest expense-net of amounts capitalized |

735 | — | — | — | — | 854 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Adjusted EBITDA |

$ | 102,758 | $ | 34,736 | $ | 53,274 | $ | 12,539 | $ | 3,032 | $ | 15,413 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

13

Table of Contents

Index to Financial Statements

Summary Historical Operating and Reserve Data

The following table presents summary data with respect to our estimated net proved oil and natural gas reserves as of the dates indicated. For additional information regarding our reserves, see “Business” beginning on page 63. The reserve estimates at September 30, 2011 and at December 31, 2010 and 2009 presented in the table below are based on reports prepared by NSAI. NSAI’s reports were prepared consistent with the rules and regulations of the SEC regarding oil and natural gas reserve reporting in effect during such periods. The reserve estimates at December 31, 2008 presented in the table below are based on estimates prepared by our internal engineers, in accordance with the rules and regulations of the SEC regarding oil and natural gas reserve reporting in effect during such period.

| At September 30, | At December 31, | |||||||||||||||

| 2011 | 2010 | 2009 | 2008 | |||||||||||||

| Reserve Data: |

||||||||||||||||

| Estimated proved reserves: |

||||||||||||||||

| Oil (MMBbls) |

14.2 | 11.9 | 7.6 | 4.8 | ||||||||||||

| Natural gas (Bcf) |

38.0 | 27.9 | 13.3 | 5.1 | ||||||||||||

| Natural gas liquids (MMBbls) |

3.8 | 0.3 | 0.1 | 0.0 | ||||||||||||

| Total estimated proved reserves (MMBoe) |

24.3 | 16.9 | 9.9 | 5.6 | ||||||||||||

| Proved developed reserves: |

||||||||||||||||

| Oil (MMBbls) |

6.3 | 5.4 | 2.8 | 2.3 | ||||||||||||

| Natural gas (Bcf) |

18.9 | 14.2 | 4.4 | 1.9 | ||||||||||||

| Natural gas liquids (MMBbls) |

1.9 | 0.1 | 0.0 | — | ||||||||||||

| Total proved developed (MMBoe) |

11.3 | 7.9 | 3.5 | 2.6 | ||||||||||||

| Percent proved developed |

47 | % | 47 | % | 36 | % | 46 | % | ||||||||

| Proved undeveloped reserves: |

||||||||||||||||

| Oil (MMBbls) |

7.9 | 6.5 | 4.8 | 2.5 | ||||||||||||

| Natural gas (Bcf) |

19.1 | 13.7 | 8.9 | 3.2 | ||||||||||||

| Natural gas liquids (MMBbls) |

1.9 | 0.2 | 0.1 | — | ||||||||||||

| Total proved undeveloped (MMBoe) |

13.0 | 9.0 | 6.4 | 3.0 | ||||||||||||

The following table sets forth the benchmark prices used to determine our estimated proved reserves from proved oil and natural gas reserves for the periods indicated.

| At September 30, 2011 |

At December 31, | |||||||||||||||

| 2010 | 2009 | 2008 | ||||||||||||||

| Oil and Natural Gas Prices (1): |

||||||||||||||||

| Oil (per Bbl) |

$ | 91.00 | $ | 75.96 | $ | 57.65 | $ | 44.61 | ||||||||

| Natural gas (per MMBtu) |

$ | 4.160 | $ | 4.376 | $ | 3.866 | $ | 5.710 | ||||||||

| (1) | Benchmark prices for oil and natural gas at September 30, 2011 and at December 31, 2010 and 2009 reflect the unweighted arithmetic average first-day-of-the-month prices for the prior 12 months, using Plains WTI posted prices for oil and NYMEX Henry Hub prices for natural gas. At December 31, 2008, benchmark prices for oil and natural gas reflect NYMEX WTI prices for oil and NYMEX Henry Hub prices for natural gas at such date. |

14

Table of Contents

Index to Financial Statements

The following table sets forth summary data with respect to our production results, average sales prices and production costs on a historical basis for the periods presented:

| Successor | Predecessor | |||||||||||||||||||||||||

| Nine Months Ended September 30, |

Year Ended December 31, |

Period from August 30 to December 31, 2008 |

Period from January 1 to August 29, 2008 |

|||||||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | |||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||

| Operating data: |

||||||||||||||||||||||||||

| Net production volumes: |

||||||||||||||||||||||||||

| Oil (MBbls) |

1,136 | 652 | 945 | 497 | 104 | 218 | ||||||||||||||||||||

| Natural gas (Mcf) |

3,154 | 1,446 | 2,253 | 690 | 110 | 131 | ||||||||||||||||||||

| Natural gas liquids (MBbls) |

207 | 4 | 74 | 2 | — | — | ||||||||||||||||||||

| Total oil equivalents (MBoe) |

1,869 | 897 | 1,394 | 614 | 122 | 240 | ||||||||||||||||||||

| Average daily production (Boe/d) |

6,847 | 3,285 | 3,820 | 1,682 | 984 | 996 | ||||||||||||||||||||

| Average sales prices: |

||||||||||||||||||||||||||

| Oil, without realized derivatives (per Bbl) |

$ | 108.08 | $ | 77.57 | $ | 80.29 | $ | 55.07 | $ | 75.68 | $ | 118.95 | ||||||||||||||

| Oil, with realized derivatives (per Bbl) |

97.39 | 78.01 | 79.37 | 57.69 | 79.78 | 105.15 | ||||||||||||||||||||

| Natural gas (per Mcf) |

4.70 | 5.23 | 4.66 | 3.89 | 7.72 | 11.48 | ||||||||||||||||||||

| Natural gas liquids (per Bbl) |

48.02 | 40.42 | 36.92 | 47.66 | — | — | ||||||||||||||||||||

| Cost and expenses (per Boe of production): |

||||||||||||||||||||||||||

| Lease operating |

$ | 5.06 | $ | 5.83 | $ | 6.26 | $ | 8.66 | $ | 12.64 | $ | 11.54 | ||||||||||||||

| Workover |

0.70 | 4.30 | 3.36 | 8.51 | 19.48 | 9.19 | ||||||||||||||||||||

| Severance tax |

4.51 | 4.68 | 4.61 | 4.64 | 6.60 | 9.81 | ||||||||||||||||||||

| Asset retirement accretion |

0.11 | 0.12 | 0.13 | 0.20 | 0.30 | 0.33 | ||||||||||||||||||||

| General and administrative |

8.08 | 12.71 | 11.73 | 9.59 | 11.50 | 7.57 | ||||||||||||||||||||

| Depreciation, depletion and amortization |

32.98 | 30.03 | 30.00 | 20.08 | 24.56 | 12.99 | ||||||||||||||||||||

15

Table of Contents

Index to Financial Statements

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below together with the other information set forth in this prospectus before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to the Oil and Natural Gas Industry and Our Business

A substantial or extended decline in oil and, to a lesser extent, natural gas, prices may adversely affect our business, financial condition or results of operations and our ability to meet our capital expenditure obligations and financial commitments.

The price we receive for our oil and, to a lesser extent, natural gas, heavily influences our revenue, profitability, access to capital and future rate of growth. Oil and natural gas are commodities and, therefore, their prices are subject to wide fluctuations in response to relatively minor changes in supply and demand. Historically, the markets for oil and natural gas have been volatile. These markets will likely continue to be volatile in the future. The prices we receive for our production and the levels of our production depend on numerous factors beyond our control. These factors include the following:

| • | worldwide and regional economic conditions impacting the global supply and demand for oil and natural gas; |

| • | the actions of the Organization of Petroleum Exporting Countries; |

| • | the price and quantity of imports of foreign oil and natural gas; |

| • | political conditions in or affecting other oil and natural gas-producing countries; |

| • | the level of global oil and natural gas exploration and production; |

| • | the level of global oil and natural gas inventories; |

| • | localized supply and demand fundamentals and transportation availability; |

| • | weather conditions and natural disasters; |

| • | domestic, local and foreign governmental regulations and taxes; |

| • | speculation as to the future price of oil and natural gas and the speculative trading of oil and natural gas futures contracts; |

| • | price and availability of competitors’ supplies of oil and natural gas; |

| • | technological advances affecting energy consumption; and |

| • | the price and availability of alternative fuels. |

Substantially all of our production is sold to purchasers under short-term (less than 12-month) contracts at market based prices. Lower oil and natural gas prices will reduce our cash flows, borrowing ability and the present value of our reserves. If oil and natural gas prices deteriorate, we anticipate that the borrowing base under our revolving credit facility, which is revised periodically, may be reduced. Lower oil and natural gas prices may also reduce the amount of oil and natural gas that we can produce economically. Substantial decreases in oil and natural gas prices could render uneconomic a significant portion of our identified drilling locations. This may result in our having to make significant downward adjustments to our estimated proved reserves. As a result, a substantial or extended decline in oil or natural gas prices may materially and adversely affect our future business, financial condition, results of operations, liquidity or ability to finance planned capital expenditures.

16

Table of Contents

Index to Financial Statements

A reduction in the premium to NYMEX WTI oil prices we receive by selling to the LLS market could significantly reduce the relative price advantage we receive for our production.

Because our producing properties are geographically concentrated in central Louisiana, we are vulnerable to fluctuations in pricing in that area. Our oil production is generally sold in the LLS market, which has recently commanded a premium to NYMEX WTI prices due to its proximity to U.S. Gulf Coast refiners and international markets that are typically correlated with Brent oil prices as well as take-away constraints at the Cushing, Oklahoma hub where NYMEX WTI contracts are settled. A reduction in this premium could significantly reduce the relative price advantage we receive for our production. In addition, as a result of this geographic concentration, we may be disproportionately exposed to the impact of regional supply and demand factors, transportation capacity constraints and curtailment or interruption of production from the wells in these areas.

Drilling for and producing oil and natural gas are high risk activities with many uncertainties that could adversely affect our business, financial condition or results of operations.

Our future financial condition and results of operations will depend on the success of our development, drilling and production activities. Our oil and natural gas drilling and production activities are subject to numerous risks beyond our control, including the risk that drilling will not result in commercially viable oil or natural gas production. Our decisions to purchase, explore or develop drilling locations or properties will depend in part on the evaluation of data obtained through 2D and 3D seismic data, geophysical and geological analyses, production data and engineering studies, the results of which are often inconclusive or subject to varying interpretations. While we have operated in the Upper Gulf Coast Tertiary trend since 1993, the production and operating data that is available with respect to this trend based on modern drilling and completion techniques is relatively limited compared to trends where multiple operators have been active for a significant period of time. As a result, we face more uncertainty in evaluating data than operators in more developed trends. For a discussion of the uncertainty involved in these processes, see “— Our estimated proved reserves are based on many assumptions that may turn out to be inaccurate. Any significant inaccuracies in these assumptions will materially affect the quantities and present value of our reserves.” Our costs of drilling, completing and operating wells is often uncertain before drilling commences. In addition, the application of new techniques in this trend, such as high-graded stimulation designs and horizontal completions, some of which we have not previously employed, may make it more difficult to accurately estimate these costs. Overruns in budgeted expenditures are common risks that can make a particular project uneconomical. Further, many factors may curtail, delay or cancel our scheduled drilling projects, including the following:

| • | shortages of, or delays in, obtaining equipment and qualified personnel; |

| • | facility or equipment malfunctions; |

| • | unexpected operational events; |

| • | pressure or irregularities in geological formations; |

| • | adverse weather conditions; |

| • | reductions in oil and natural gas prices; |

| • | delays imposed by or resulting from compliance with regulatory requirements; |

| • | proximity to and capacity of transportation facilities; |

| • | title problems; and |

| • | limitations in the market for oil and natural gas. |

17

Table of Contents

Index to Financial Statements

The standardized measure of discounted future net cash flows from our proved reserves will not be the same as the current market value of our estimated oil and natural gas reserves.

You should not assume that the standardized measure of discounted future net cash flows from our proved reserves is the current market value of our estimated oil and natural gas reserves. In accordance with SEC requirements in effect at September 30, 2011, December 31, 2010 and 2009, we based the discounted future net cash flows from our proved reserves on the 12-month unweighted arithmetic average of the first-day-of-the-month price for the preceding twelve months without giving effect to derivative transactions. As of December 31, 2008, we based the estimated discounted future net cash flows from our proved reserves on prices and costs in effect on the date of the estimate in accordance with SEC requirements then in effect. Actual future net cash flows from our oil and natural gas properties will be affected by factors such as:

| • | actual prices we receive for oil and natural gas; |

| • | actual cost of development and production expenditures; |

| • | the amount and timing of actual production; and |

| • | changes in governmental regulations or taxation. |

The timing of both our production and our incurrence of expenses in connection with the development and production of oil and natural gas properties will affect the timing and amount of actual future net revenues from proved reserves, and thus their actual present value. In addition, the 10% discount factor we use when calculating standardized measure may not be the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the oil and natural gas industry in general. Actual future prices and costs may differ materially from those used in the present value estimates included in this prospectus which could have a material effect on the value of our reserves.

If oil and natural gas prices decrease, we may be required to take write-downs of the carrying values of our oil and natural gas properties.

We use the full cost method of accounting for our oil and gas properties. Accordingly, we capitalize and amortize all productive and nonproductive costs directly associated with property acquisition, exploration and development activities. Under the full cost method, the capitalized cost of oil and gas properties, less accumulated amortization and related deferred income taxes may not exceed the “cost center ceiling” which is equal to the sum of the present value of estimated future net revenues from proved reserves, less estimated future expenditures to be incurred in developing and producing the proved reserves computed using a discount factor of 10%, plus the costs of properties not subject to amortization, plus the lower of the cost or estimated fair value of unproved properties included in the costs being amortized, less related income tax effects. If the net capitalized costs exceed the cost center ceiling, we recognize the excess as an impairment of oil and gas properties. This impairment does not impact cash flows from operating activities but does reduce our earnings and shareholders’ equity. The risk that we will be required to recognize impairments of our oil and natural gas properties increases during periods of low commodity prices. In addition, impairments would occur if we were to experience sufficient downward adjustments to our estimated proved reserves or the present value of estimated future net revenues. An impairment recognized in one period may not be reversed in a subsequent period even if higher oil and gas prices increase the cost center ceiling applicable to the subsequent period. We recorded a non-cash ceiling test impairment of approximately $26.8 million for the period ended December 31, 2008 and approximately $4.3 million for the year ended December 31, 2009. We could incur additional impairments of oil and natural gas properties in the future, particularly as a result of a decline in commodity prices.

18

Table of Contents

Index to Financial Statements

We have incurred losses from operations during certain periods since the beginning of 2008 and may continue to do so in the future.

We incurred net losses of $15.6 million and $11.8 million for the years ended December 31, 2010 and 2009, respectively, and $13.1 million for the period from August 30, 2008 to December 31, 2008. Our development of and participation in an increasingly larger number of drilling locations has required and will continue to require substantial capital expenditures. The uncertainty and risks described in this prospectus may impede our ability to economically acquire and develop oil and natural gas reserves. As a result, we may not be able to achieve or sustain profitability or positive cash flows provided by operating activities in the future.

Our estimated proved reserves are based on many assumptions that may turn out to be inaccurate. Any significant inaccuracies in these assumptions will materially affect the quantities and present value of our reserves.

The process of estimating oil and natural gas reserves is complex. It requires interpretations of available technical data and many assumptions, including assumptions relating to current and future economic conditions and commodity prices. Any significant inaccuracies in these assumptions could materially affect the estimated quantities and present value of reserves shown in this prospectus. See “Business — Our Operations” for information about our estimated oil and natural gas reserves.

In order to prepare our estimates, we must estimate production rates and the timing of development expenditures. We must also analyze available geological, geophysical, production and engineering data. The extent, quality and reliability of this data can vary. The process also requires economic assumptions about matters such as oil and natural gas prices, drilling and operating expenses, capital expenditures, taxes and availability of funds. Although the reserve information contained herein as of September 30, 2011, December 31, 2010 and December 31, 2009 was prepared by our independent reserve engineers, estimates of oil and natural gas reserves are inherently imprecise. In addition, reserve estimates for properties that do not have a lengthy production history, including the areas in which we operate, are less reliable than estimates for fields with lengthy production histories. Although we and our independent reserve engineers have analyzed historical production data from wells drilled in the Upper Gulf Coast Tertiary trend, there can be no assurance that this data will accurately predict future production, development expenditures or operating expenses from wells drilled and completed using modern techniques. In addition, this data is based on vertically drilled wells, which may not accurately reflect production, development expenditures or operating expenses that may result from the application of horizontal drilling techniques.

Actual future production, oil and natural gas prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable oil and natural gas reserves may vary from our estimates. Any significant variance could materially affect the estimated quantities and present value of reserves shown in this prospectus. In addition, we may adjust estimates of proved reserves to reflect production history, results of exploration and development, prevailing oil and natural gas prices and other factors, many of which are beyond our control.

Approximately 53% of our total estimated proved reserves at September 30, 2011 were proved undeveloped reserves.

Recovery of proved undeveloped reserves requires significant capital expenditures and successful drilling operations. The reserve data included in the reserve engineer reports assumes that substantial capital expenditures are required to develop such reserves. Although cost and reserve estimates attributable to our oil and natural gas reserves have been prepared in accordance with industry standards, we cannot be sure that the estimated costs are accurate, that development will occur as scheduled or that the results of such development will be as estimated.

19

Table of Contents

Index to Financial Statements

Unless we replace our oil and natural gas reserves, our reserves and production will decline, which would adversely affect our business, financial condition and results of operations.

Unless we conduct successful development and exploration activities or acquire properties containing proved reserves, our proved reserves will decline as those reserves are produced. Producing oil and natural gas reservoirs generally are characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Our future oil and natural gas reserves and production, and therefore our cash flows and income, are highly dependent on our success in efficiently developing our current reserves and economically finding or acquiring additional recoverable reserves. We may not be able to develop, find or acquire additional reserves to replace our current and future production at acceptable costs. If we are unable to replace our current and future production, the value of our reserves will decrease, and our business, financial condition and results of operations will be adversely affected.

Drilling locations that we have identified may not yield oil or natural gas in commercially viable quantities.

We describe some of our drilling locations and our plans to explore those drilling locations in this prospectus. Our drilling locations are in various stages of evaluation, ranging from a location which is ready to drill to a location that will require substantial additional interpretation. There is no way to predict in advance of drilling and testing whether any particular location will yield oil or natural gas in sufficient quantities to recover drilling or completion costs or to be economically viable. The use of technologies and the study of producing fields in the same area will not enable us to know conclusively prior to drilling whether oil or natural gas will be present or, if present, whether oil or natural gas will be present in sufficient quantities to be economically viable. Even if sufficient amounts of oil or natural gas exist, we may damage the potentially productive hydrocarbon bearing formation or experience mechanical difficulties while drilling or completing the well, resulting in a reduction in production from or abandonment of the well. If we drill additional wells that we identify as dry holes in our current and future drilling locations, our drilling success rate may decline and materially harm our business. We cannot assure you that the analogies we draw from available data from other wells, more fully explored locations or producing fields will be applicable to our identified drilling locations. In sum, the cost of drilling, completing and operating any well is often uncertain, and new wells may not be productive.

Our identified drilling locations are scheduled out over many years, making them susceptible to uncertainties that could materially alter the occurrence or timing of their drilling, which in certain instances could prevent production prior to the expiration date of leases for such locations. In addition, we may not be able to raise the amount of capital that would be necessary to drill a substantial portion of our identified potential drilling locations.

Our management team has specifically identified and scheduled certain drilling locations as an estimation of our future multi-year drilling activities on our existing acreage. These drilling locations represent a significant part of our growth strategy. Our ability to drill and develop these drilling locations depends on a number of uncertainties, including oil and natural gas prices, the availability and cost of capital, drilling and production costs, the availability of drilling services and equipment, drilling results, lease expirations, gathering system, marketing and pipeline transportation constraints, regulatory approvals and other factors. Because of these uncertain factors, we do not know if the numerous drilling locations we have identified will ever be drilled or if we will be able to produce oil or natural gas from these or any other drilling locations. In addition, unless production is established within the spacing units covering the undeveloped acres on which some of the potential locations are obtained, the leases for such acreage will expire. As such, our actual drilling activities may materially differ from those presently identified.

20

Table of Contents

Index to Financial Statements

The unavailability or high cost of additional drilling rigs, equipment, supplies, personnel and oilfield services could adversely affect our ability to execute our exploration and development plans within our budget and on a timely basis.

We utilize third-party services to maximize the efficiency of our organization. The cost of oilfield services may increase or decrease depending on the demand for services by other oil and gas companies. While we currently have excellent relationships with oilfield service companies, there is no assurance that we will be able to contract for such services on a timely basis or that the cost of such services will remain at a satisfactory or affordable level. Shortages or the high cost of frac crews, drilling rigs, equipment, supplies, personnel or oilfield services could delay or adversely affect our development and exploration operations or cause us to incur significant expenditures that are not provided for in our capital budget, which could have a material adverse effect on our business, financial condition or results of operations.

Our business depends on transportation by truck for our oil and condensate production, and our natural gas production depends on transportation facilities that are owned by third parties.

We transport all of our oil and condensate production by truck, which is more expensive and less efficient than transportation via pipeline. Our natural gas production depends in part on the availability, proximity and capacity of pipeline systems and processing facilities owned by third parties. Although we have some contractual control over the transportation of our product, material changes in these business relationships could materially affect our operations. Federal and state regulation of oil and natural gas production and transportation, tax and energy policies, changes in supply and demand, pipeline pressures, damage to or destruction of pipelines and general economic conditions could adversely affect our ability to produce, gather and transport oil and natural gas.