Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Bohai Pharmaceuticals Group, Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - Bohai Pharmaceuticals Group, Inc. | v239328_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Bohai Pharmaceuticals Group, Inc. | v239328_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Bohai Pharmaceuticals Group, Inc. | v239328_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Bohai Pharmaceuticals Group, Inc. | v239328_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended September 30, 2011

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File Number: 000-53401

Bohai Pharmaceuticals Group, Inc.

(Exact name of registrant as specified in its charter)

|

`Nevada

|

98-0697405

|

|

(State or other jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

|

c/o Yantai Bohai Pharmaceuticals Group Co. Ltd.

|

|

|

No. 9 Daxin Road, Zhifu District

|

|

|

Yantai, Shandong Province, China

|

264000

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number (including area code): +86(535)-685-7928

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o

As of November 14, 2011, there were 17,861,085 shares of company common stock issued and outstanding.

Bohai Pharmaceuticals Group, Inc.

Quarterly Report on Form 10-Q

TABLE OF CONTENTS

|

PART I – FINANCIAL INFORMATION

|

||

|

Cautionary Note Regarding Forward-Looking Statements

|

|

|

|

Item 1.

|

Financial Statements (unaudited)

|

|

|

Condensed Consolidated Balance Sheets as of September 30, 2011 and June 30, 2011

|

1

|

|

|

Condensed Consolidated Statements of Income and Comprehensive Income for the Three Months ended September 30, 2011 and 2010

|

2

|

|

|

Condensed Consolidated Statements of Changes in Shareholders’ Equity for the Three Months Ended September 30, 2011

|

3

|

|

|

Condensed Consolidated Statements of Cash Flows for the Three Months ended September 30, 2011 and 2010

|

4

|

|

|

Notes to Condensed Consolidated Financial Statements

|

5

|

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

26

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

39

|

|

Item 4(T).

|

Controls and Procedures

|

39

|

|

PART II – OTHER INFORMATION

|

||

|

Item 1.

|

Legal Proceedings

|

41

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

41

|

|

Item 3.

|

Defaults Upon Senior Securities

|

41

|

|

Item 4.

|

Removed and Reserved

|

41

|

|

Item 5.

|

Other Information

|

41

|

|

Item 6.

|

Exhibits

|

41

|

|

SIGNATURES

|

42

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this Quarterly Report on Form 10-Q contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. We cannot give any guarantee that the plans, intentions or expectations described in the forward looking statements will be achieved. All forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including those factors described in the “Risk Factors” section of our Annual Report for the fiscal year ended June 30, 2011. Readers should carefully review such risk factors as well as factors described in other documents that we file from time to time with the Securities and Exchange Commission.

In some cases, you can identify forward-looking statements by terminology such as “guidance,” “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “proposed,” “intended,” or “continue” or the negative of these terms or other comparable terminology. You should read statements that contain these words carefully, because they discuss our expectations about our future operating results or our future financial condition or state other “forward-looking” information. There may be events in the future that we are not able to accurately predict or control. You should be aware that the occurrence of any of the events described in our risk factors and other disclosures could substantially harm our business, results of operations and financial condition, and that upon the occurrence of any of these events, the trading price of our securities could decline. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, growth rates, and levels of activity, performance or achievements. Factors that may cause actual results, our performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include, without limitation:

|

|

·

|

our ability to generate or obtain through financing sufficient working capital to (i) fund the acquisition of Yantai Tianzheng, which acquisition was consummated in August 2011 (currently $24 million is due within 12 months, and a total of $29 million is due); (ii) satisfy our obligations under our convertible notes due January 5, 2012 (currently $10.45 million due) or (iii) otherwise to support our business plans;

|

|

|

·

|

our ability to integrate the business of Yantai Tianzheng and any future acquisitions into our business;

|

|

|

·

|

our ability to expand our product offerings and maintain the quality of our products;

|

|

|

·

|

the availability of Chinese government granted rights to exclusively manufacture or co-manufacture our products;

|

|

|

·

|

the availability of Chinese national healthcare reimbursement of our products;

|

|

|

·

|

our ability to manage our expanding operations and continue to fill customers’ orders on time;

|

|

|

·

|

our ability to maintain adequate control of our expenses allowing us to realize anticipated revenue growth;

|

|

|

·

|

our ability to maintain or protect our intellectual property;

|

|

|

·

|

our ability to maintain our proprietary technology;

|

|

|

·

|

the impact of government regulation in China and elsewhere, including the support provided by the Chinese government to the Traditional Chinese Medicine and healthcare sectors in China;

|

|

|

·

|

our ability to implement product development, marketing, sales and acquisition strategies and adapt and modify them as needed;

|

|

|

·

|

our ability to integrate any future acquisitions;

|

|

|

·

|

our implementation of required financial, accounting and disclosure controls and procedures and related corporate governance policies; and

|

|

|

·

|

our ability to anticipate and adapt to changing conditions in the Traditional Chinese Medicine and healthcare industries resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics.

|

We cannot give any guarantee that our plans, intentions or expectations will be achieved. All forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including those factors listed above and described in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended June 30, 2011. Except as required by applicable law and including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF SEPTEMBER 30 AND JUNE 30, 2011

|

September 30,

|

June 30,

|

|||||||

|

2011

|

2011

|

|||||||

|

(unaudited)

|

||||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 16,230,301 | $ | 13,344,426 | ||||

|

Restricted cash

|

391,962 | 11,043 | ||||||

|

Accounts receivable

|

24,473,987 | 15,891,642 | ||||||

|

Inventories

|

3,128,213 | 1,511,021 | ||||||

|

Prepaid expenses and other current assets

|

1,375,518 | 1,060,138 | ||||||

|

Total current assets

|

45,599,981 | 31,818,270 | ||||||

|

Property, plant and equipment, net

|

11,757,622 | 5,214,962 | ||||||

|

Prepayment for property, plant and equipment

|

256,560 | - | ||||||

|

Intangible assets – pharmaceutical formulas

|

35,280,170 | 25,019,377 | ||||||

|

Long term prepayments - land use right, net

|

19,021,828 | 17,577,271 | ||||||

|

Customer relationships, net

|

13,837,904 | - | ||||||

|

Goodwill

|

4,944,646 | - | ||||||

|

Debt issue costs

|

247,679 | 485,039 | ||||||

|

TOTAL ASSETS

|

$ | 130,946,390 | $ | 80,114,919 | ||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Convertible notes, net of discount of $7,198,510 and $9,317,897 as of September 30 and June 30, 2011, respectively

|

$ | 3,251,490 | $ | 1,132,103 | ||||

|

Accounts payable

|

3,105,502 | 1,291,907 | ||||||

|

Advances from customers

|

172,004 | - | ||||||

|

Accrued expenses

|

5,461,790 | 4,324,313 | ||||||

|

Income taxes payable

|

1,911,097 | 721,771 | ||||||

|

Short-term borrowings

|

1,563,673 | 920,554 | ||||||

|

Acquisition price payable – current portion

|

24,000,000 | - | ||||||

|

Derivative liabilities - investor and agent warrants

|

605,382 | 937,867 | ||||||

|

Total current liabilities

|

40,070,938 | 9,328,515 | ||||||

|

Acquisition price payable – non-current portion

|

5,000,000 | - | ||||||

|

Deferred tax liability

|

8,449,282 | 2,878,397 | ||||||

|

TOTAL LIABILITIES

|

53,520,220 | 12,206,912 | ||||||

|

COMMITMENTS, CONTINGENCIES, AND OTHER MATTERS

|

||||||||

|

SHAREHOLDERS' EQUITY

|

||||||||

|

Common stock , $0.001 par value, 150,000,000 shares authorized, 17,861,085 shares issued and outstanding as of September 30 and June 30, 2011, respectively

|

17,861 | 17,861 | ||||||

|

Additional paid-in capital

|

24,593,353 | 18,345,574 | ||||||

|

Accumulated other comprehensive income

|

4,173,955 | 3,559,355 | ||||||

|

Statutory reserves

|

2,201,817 | 2,201,817 | ||||||

|

Retained earnings

|

46,439,184 | 43,783,400 | ||||||

|

Total shareholders’ equity

|

77,426,170 | 67,908,007 | ||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

|

$ | 130,946,390 | $ | 80,114,919 | ||||

See accompanying notes to the unaudited condensed consolidated financial statements

1

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME AND COMPREHENSIVE INCOME

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011 AND 2010

(UNAUDITED)

|

For the Three Months Ended September 30,

|

||||||||

|

2011

|

2010

|

|||||||

|

Revenues

|

$ | 29,927,856 | $ | 16,783,200 | ||||

|

Cost of revenues

|

6,943,720 | 3,200,818 | ||||||

|

Gross profit

|

22,984,136 | 13,582,382 | ||||||

|

Selling, general and administrative expenses

|

16,234,489 | 8,614,758 | ||||||

|

Income from operations

|

6,749,647 | 4,967,624 | ||||||

|

Other income (expense):

|

||||||||

|

Interest income

|

21,242 | - | ||||||

|

Interest expense

|

(2,622,511 | ) | (754,004 | ) | ||||

|

Other (expense) income, net

|

(6,720 | ) | 11,093 | |||||

|

Change in fair value of derivative liabilities

|

332,485 | (30,554 | ) | |||||

|

Total other expenses

|

(2,275,504 | ) | (773,465 | ) | ||||

|

Income before provision for income taxes

|

4,474,143 | 4,194,159 | ||||||

|

Provision for income taxes

|

(1,818,359 | ) | (1,181,684 | ) | ||||

|

Net income

|

$ | 2,655,784 | $ | 3,012,475 | ||||

|

Comprehensive income:

|

||||||||

|

Net income

|

2,655,784 | 3,012,475 | ||||||

|

Other comprehensive income

|

||||||||

|

Unrealized foreign currency translation gain

|

614,600 | 888,370 | ||||||

|

Comprehensive income

|

$ | 3,270,384 | $ | 3,900,845 | ||||

|

Earnings per common share

|

||||||||

|

Basic

|

$ | 0.15 | $ | 0.18 | ||||

|

Diluted

|

$ | 0.15 | $ | 0.15 | ||||

|

Weighted average common shares outstanding

|

||||||||

|

Basic

|

17,861,085 | 16,506,626 | ||||||

|

Diluted

|

23,086,085 | 22,250,104 | ||||||

See accompanying notes to the unaudited condensed consolidated financial statements

2

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF

CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

(UNAUDITED)

|

Common stock

|

Accumulated

other

|

Total

|

||||||||||||||||||||||||||

|

Par value

|

Additional

|

comprehensive

|

Statutory

|

Shareholders’

|

||||||||||||||||||||||||

|

Shares

|

$0.001 |

paid-in capital

|

income

|

reserves

|

Retained Earnings

|

Equity

|

||||||||||||||||||||||

|

Balances at June 30, 2011

|

17,861,085

|

$

|

17,861

|

$

|

18,345,574

|

$

|

3,559,355

|

$

|

2,201,817

|

$

|

43,783,400

|

$

|

67,908,007

|

|||||||||||||||

|

Capital contribution from shareholder

|

-

|

-

|

6,225,778

|

-

|

-

|

-

|

6,225,778

|

|||||||||||||||||||||

|

Restricted stock awards

|

-

|

-

|

22,000

|

-

|

-

|

-

|

22,000

|

|||||||||||||||||||||

|

Foreign currency translation adjustment

|

-

|

-

|

-

|

614,600

|

-

|

-

|

614,600

|

|||||||||||||||||||||

|

Net Income

|

-

|

-

|

-

|

-

|

-

|

2,655,784

|

2,655,784

|

|||||||||||||||||||||

|

Balances at September 30, 2011

|

17,861,085

|

$

|

17,861

|

$

|

24,593,353

|

$

|

4,173,955

|

$

|

2,201,817

|

$

|

46,439,184

|

$

|

77,426,170

|

|||||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements

3

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011 AND 2010

(UNAUDITED)

|

For the Three Months Ended

|

||||||||

|

September 30,

|

||||||||

|

2011

|

2010

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income

|

$ | 2,655,784 | $ | 3,012,475 | ||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation and amortization

|

751,660 | 85,701 | ||||||

|

Gain on disposal of property, plant and equipment

|

(2,755 | ) | 1,879 | |||||

|

Gain from foreign currency in Tianzheng’s acquisition payable

|

(308,847 | ) | - | |||||

|

Accretion of beneficial conversion feature

|

- | 147,423 | ||||||

|

Amortization of deferred fees on convertible notes

|

237,360 | 259,965 | ||||||

|

Interest expense on convertible notes

|

2,119,387 | 29,717 | ||||||

|

Change in fair value of warrants

|

(332,485 | ) | 30,554 | |||||

|

Stock based compensation

|

22,000 | 29,000 | ||||||

|

Deferred income taxes

|

221,722 | - | ||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

(1,516,059 | ) | (1,431,498 | ) | ||||

|

Other receivables and prepayments

|

(93,605 | ) | (589,373 | ) | ||||

|

Inventories

|

(274,098 | ) | (924,319 | ) | ||||

|

Accrued liabilities

|

(139,022 | ) | 402,743 | |||||

|

Accounts payable

|

(610,549 | ) | 1,000,823 | |||||

|

Other payable

|

131,669 | - | ||||||

|

Income taxes payable

|

442,781 | 385,112 | ||||||

|

Net cash provided by operating activities

|

3,304,943 | 2,440,202 | ||||||

|

Cash flows used in investing activities:

|

||||||||

|

Purchases of property, plant and equipment

|

(429,716 | ) | (3,953 | ) | ||||

|

Proceeds from disposal of property, plant and equipment

|

101,353 | 4,425 | ||||||

|

Prepaid land use rights

|

- | (4,743,139 | ) | |||||

|

Prepaid deposit for property, plant and equipment

|

(255,840 | ) | - | |||||

|

Cash acquired from acquisition of Yantai Tianzheng subsidiary

|

1,358,078 | - | ||||||

|

Cash paid for acquisition of Yantai Tianzheng subsidiary

|

(6,000,000 | ) | - | |||||

|

Net cash used in investing activities

|

(5,226,125 | ) | (4,742,667 | ) | ||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from short term borrowings

|

- | 877,540 | ||||||

|

Repayment of short term borrowings

|

(1,473,523 | ) | (877,540 | ) | ||||

|

Advance from shareholder

|

7,831 | - | ||||||

|

Note repayment from shareholder

|

- | 52,357 | ||||||

|

Capital contribution from shareholder

|

6,237,136 | - | ||||||

|

Release of restricted cash

|

10,000 | 387,492 | ||||||

|

Net cash flows provided by financing activities

|

4,781,444 | 439,849 | ||||||

|

Effect of foreign currency translation on cash and cash equivalents

|

25,612 | 253,779 | ||||||

|

Net (decrease) increase in cash and cash equivalent

|

2,885,875 | (1,608,837 | ) | |||||

|

Cash and cash equivalent at beginning of period

|

13,344,426 | 17,149,082 | ||||||

|

Cash and cash equivalent at end of period

|

$ | 16,230,301 | $ | 15,540,245 | ||||

|

Cash paid during the period for:

|

||||||||

|

Interest

|

$ | 265,762 | $ | 298,316 | ||||

|

Income taxes

|

$ | 1,213,899 | $ | 796,572 | ||||

|

Supplemental cash flow information

|

||||||||

|

Non-cash investing and financing activities:

|

||||||||

|

Common stock issued upon conversion of convertible notes and accrued interest

|

$ | - | $ | 136,117 | ||||

|

Non-cash portion of acquisition price payable for Yantai Tianzheng subsidiary

|

$ | 29,000,000 | $ | - | ||||

See accompanying notes to the unaudited condensed consolidated financial statements

4

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

1.

|

ORGANIZATION AND PRINCIPAL ACTIVITIES

|

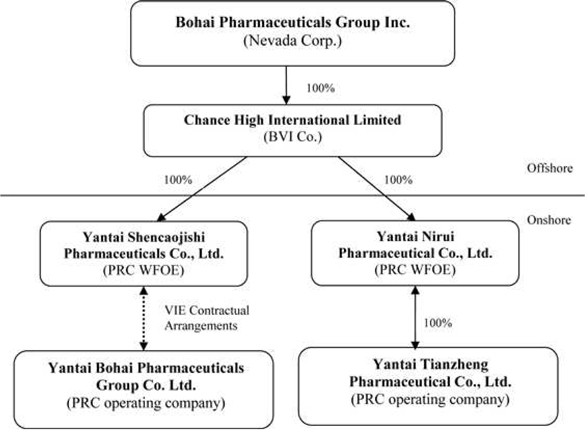

Bohai Pharmaceuticals Group, Inc. (“BPGI”) was incorporated under the laws of the State of Nevada on January 9, 2008 under the name of Link Resources, Inc. Prior to January 5, 2010, BPGI was a public “shell” company in the exploration stage since its formation and did not realize any revenues from its planned operations. BPGI became a public company on January 5, 2010 pursuant to a Share Exchange Agreement completed between BPGI (then known as Link Resources, Inc.) and the shareholders of Chance High (as defined below) (the “Share Exchange Agreement” and the transactions contemplated hereby, the “Share Exchange”) on January 5, 2010.

The Company is currently engaged in the production, manufacturing and distribution of herbal pharmaceuticals based on traditional Chinese medicine (“TCM”) in the People’s Republic of China (“China” or the “PRC”) through two operating subsidiaries:

(i) Yantai Bohai Pharmaceuticals Group Co., Ltd., a PRC company and the Company’s original operating subsidiary (“Bohai”) which is controlled by the Company through a variable interest entity arrangement (“VIE”) described below; and

(ii) Yantai Tianzheng Pharmaceuticals Company, Ltd., a PRC company (“Yantai Tianzheng”) which the Company acquired in August 2011 (with an effective control date of July 1, 2011) through a newly formed PRC wholly-foreign owned enterprise subsidiary, Yantai Nirui Pharmaceuticals, Ltd. (“WFOE II”).

The Company is headquartered and maintains its principal operations in the city of Yantai, Shandong Province, China, and conducts business operations exclusively in the PRC.

BPGI owns 100% of Chance High International Limited, a British Virgin Islands company (“Chance High”). Chance High owns 100% of the issued and outstanding shares of capital stock of a Chinese wholly-foreign owned enterprise known as Yantai Shencaojishi Pharmaceuticals Co., Ltd. (the “WFOE”). On December 7, 2009 (prior to the date of the Share Exchange), the WFOE entered into a series of variable interest entity contractual agreements (the “VIE Agreements”) with Bohai and its three shareholders, including Mr. Hongwei Qu, the Company’s current Chairman and Chief Executive Officer (“Mr. Qu”). Mr. Qu currently owns 96.7% of the outstanding equity interests of Bohai and two other shareholders who collectively own the remaining 3.3% of Bohai.

The VIE Agreements include (i) a Consulting Services Agreement, (ii) an Operating Agreement, and (iii) a Proxy Agreement, through which the WFOE has the right to advise, consult, manage and operate Bohai for an annual fee equal to all of Bohai’s yearly net profits after tax. Pursuant to these agreements, the WFOE indirectly owns but has 100% managerial and economic control of the business activities of Bohai including the right to appoint all executives and senior management and members of the board of directors of Bohai. Additionally, Bohai’s shareholders pledged their rights, titles and equity interest in Bohai as security for the WFOE to collect consulting and services fees provided to Bohai pursuant to an equity pledge agreement. In order to further reinforce the WFOE’s rights to control and operate Bohai, Bohai’s shareholders granted the WFOE an exclusive right and option to acquire all of their equity interests in Bohai through an option agreement. The VIE Agreements have perpetual terms unless otherwise determined by PRC law, and can (particularly in the case of the Consulting Services Agreement (which is the principal VIE Agreement) be terminated by the parties under certain circumstances, including material breach, the termination of Bohai’s business or a liquidation of Bohai. The WFOE (which is controlled indirectly by BPGI through Chance High) can also terminate the Consulting Services Agreement at will.

5

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

1.

|

ORGANIZATION AND PRINCIPAL ACTIVITIES (continued)

|

BPGI, its wholly owned subsidiary Chance High, WFOE, WFOE II, Bohai and Yantai Tianzheng are referred to herein collectively and as a consolidated basis as the “Company” or “we”, “us” or “our” or similar terminology.

|

2.

|

LIQUIDITY AND FINANCIAL CONDITION

|

The Company’s net income and cash flows from operations amounted to $2,655,784 and $3,304,943, respectively for the three months ended September 30, 2011. The Company had working capital of approximately $5,529,043 at September 30, 2011, after giving effect a $10,450,000 convertible note obligation that matures on January 5, 2012 (Note 12) but excluding a $605,382 derivative liability for the fair value of warrants that are not expected to result in a cash settlement. The Company has historically financed its operations principally from cash flows generated from operating activities and external financing raised in private placement transactions completed concurrently with and subsequent to the consummation of the Share Exchange.

As described further in Note 4, the Company completed its acquisition of Yantai Tianzheng on August 8, 2011 (the “Execution Date”), with an effective control date of July 1, 2011, for aggregate purchase consideration of US$35,000,000, payable in four installments in the equivalent of Chinese Renminbi, the functional currency of the PRC (“RMB”). $6,000,000 of the aggregate purchase price was paid on or before tenth calendar day after the Execution Date of the acquisition; $12,000,000 is due to be paid on or before the sixth month anniversary of the Execution Date; $12,000,000 is due to be paid on or before the 12 month anniversary of the Execution Date; and the remaining $5,000,000 is due to be paid on or before the 18 month anniversary of the Execution Date. As described in Note 4, the Company has the ability to convert the remaining payments that are due into two year installment obligations bearing interest at 6% per annum with full principal payments due before the end of two-year installment terms. The election of this option would reduce the $24,000,000 cash payment to the sellers by September 2012 to approximately $600,000. Like Bohai, Yantai Tianzheng is a TCM manufacturer based in Yantai, Shandong Province, China, and conducts business operations exclusively in the PRC.

The Company has expanded its existing product lines through the acquisition of Yantai Tianzheng and is expecting to gain the benefits of the economies of scale that management believes could be realized by combining and streamlining the cost structures of the historical Bohai and the acquired Yantai Tianzheng business.

In August 2011, Mr. Qu made a permanent equity capital contribution of $6,225,778 (RMB 40,000,000) into Bohai to support the Company’s future capital needs.

Management believes, based on the Company’s historical ability to fund operations using internally generated cash flow and the progress made towards expanding the business through the Yantai Tianzheng acquisition, that the Company’s currently available cash and funds it expects to generate from operations will enable it to operate the business and satisfy short term obligations through at least October 1, 2012.

6

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

2.

|

LIQUIDITY AND FINANCIAL CONDITION (continued)

|

However, the Company has ongoing obligations with respect to the Yantai Tianzheng acquisition, whether or not the intended benefits of the acquisition are realized, and must also repay the remaining $10,450,000 balance due on the Company’s convertible notes on the contractual maturity date of January 5, 2012 (see Note 12). Accordingly, the Company will require significant additional capital in order to fund these obligations and execute its longer term business plan. If the Company is unable to raise additional capital, or encounters unforeseen circumstances that place constraints on its capital resources, management will be required to take various measures to conserve liquidity, which could include, without limitation, curtailing the Company’s business development activities, suspending the pursuit of one or more elements of its business plan, and controlling overhead expenses. There is a material risk, and management cannot provide any assurances, that the Company will raise additional capital if needed. The Company has not received any commitments for new financing, and cannot provide any assurance that new financing will be available to the Company on acceptable terms, if at all.

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

Principles of Consolidation

The unaudited condensed consolidated financial information furnished herein has been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and reflects all adjustments, consisting only of normal recurring adjustments, which in the opinion of management, are necessary for a fair statement of the financial position and results of operations for the periods presented.

The preparation of the condensed consolidated financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and the accompany notes. Actual results could differ from those estimates and such differences may be material to the condensed consolidated financial statements. This Quarterly Report on Form 10-Q should be read in conjunction with our Annual Report on Form10-K for the Company’s fiscal year ended June 30, 2011. The results of operations for the three months ended September 30, 2011 are not necessarily indicative of the results of the full year 2012 ending June 30, 2012.

The accompanying consolidated financial statements include the accounts of BPGI, its wholly-owned subsidiary Chance High, WFOE, WFOE II, Yantai Tianzheng and our VIE Bohai. All significant intercompany accounts and transactions have been eliminated in consolidation.

The Company, in determining whether it is required to consolidate investee businesses, considers both the voting and variable interest models of consolidation as required under applicable GAAP. We adopted FAS Accounting Standards Codification (“ASC”) 810-10-15-14 and also ASC 810-10-05-8, which requires that a VIE be consolidated if that company is entitled to receive a majority of the VIE’s residual returns and has direct ability to make decisions on all operating activities of the VIE. We control Bohai through the VIE Agreements described in Note 1, under the following series of agreements entered into on December 7, 2009.

Under the Operating Agreement entered into between WFOE and Bohai, the WFOE has the direct ability to make decisions on all the operating activities and exercise all voting rights of Bohai. Under the Consulting Services Agreement entered into between WFOE and Bohai, Bohai agreed to pay all of its net income to WFOE quarterly as a consulting fee. Accordingly, WFOE has the right to receive the expected residual returns of Bohai. As such, the Company is the primary beneficiary of and maintains controlling managerial and financial interest in, Bohai in accordance with ASC 810-10-15-14. Accordingly, Bohai’s financial position and results of operations are consolidated with those of the Company for all periods presented.

7

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

We initially measured the assets, liabilities, and non-controlling interests of Bohai at their carrying amounts as of the date of the Share Exchange. We have subsequently accounted for the assets, liabilities, and non-controlling interest of Bohai as if it was consolidated based on voting interests. The usual accounting rules for which the VIE operates are applied as they would to a consolidated subsidiary as follows:

|

·

|

Carrying amounts of the VIE are consolidated into the financial statements of the Company as the primary beneficiary, or Primary Beneficiary (“PB”); and

|

|

·

|

Inter-company transactions and balances, such as revenues and costs, receivables and payables between or among the PB and the VIE(s) are eliminated in their entirety.

|

The carrying amount and classification of Bohai’s assets and liabilities included in the unaudited condensed consolidated balance sheets are as follows:

|

September 30,

|

June 30,

|

|||||||

|

2011

|

2011

|

|||||||

|

Total current assets*

|

$ | 43,251,996 | $ | 32,711,620 | ||||

|

Total assets*

|

91,413,859 | 80,523,230 | ||||||

|

Total current liabilities**

|

18,622,972 | 18,674,129 | ||||||

|

Total liabilities**

|

21,679,204 | 21,552,525 | ||||||

* Includes intercompany accounts in the amounts of $8,438,243 and $1,896,933 in current assets as of September 30 and June 30, 2011, respectively, that were eliminated in consolidation.

** Includes intercompany accounts in the amounts of $11,684,691 and $11,660,222 in current liabilities as of September 30 and June 30, 2011, respectively, that were eliminated in consolidation.

Basis of Presentation

The condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial statements and with the instructions to Form 10-Q and Article 8 of Regulation S-X of the United States Securities and Exchange Commission (“SEC”). Accordingly, they do not contain all information and footnotes required by GAAP for annual financial statements. The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. In the opinion of the Company’s management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary (consisting only of normal recurring accruals) to present the financial position of the Company as of September 30, 2011 and the results of operations and cash flows for the periods presented. The results of operations for the three months ended September 30, 2011 are not necessarily indicative of the operating results for the full fiscal year or any future period. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes thereto included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2011. The Company’s accounting policies are described in the Notes to Consolidated Financial Statements in its Annual Report on Form

8

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

10-K for the year ended June 30, 2011, filed on September 28, 2011, and updated, as necessary, in this Quarterly Report on Form 10-Q.

Business Combinations

The Company uses the acquisition method of accounting for business combinations which requires that the assets acquired and liabilities assumed be recorded at the date of the acquisition at their respective fair values. Assets acquired and liabilities assumed in a business combination that arise from contingencies are recognized at fair value if fair value can reasonably be estimated. If the acquisition date fair value of an asset acquired or liability assumed that arises from a contingency cannot be determined, the asset or liability is recognized if probable and reasonably estimable; if these criteria are not met, no asset or liability is recognized. Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Any excess of the purchase price (consideration transferred) over the estimated fair values of net assets acquired is recorded as goodwill. Transaction costs and costs to restructure the acquired company are expensed as incurred. The operating results of acquired business are reflected in the acquirer’s consolidated financial statements and results of operations after the date of the acquisition.

Reclassifications

Certain amounts in the September 30, 2010 unaudited condensed consolidated financial statements have been reclassified to conform to the September 30, 2011 presentation.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made; however, actual results could differ materially from those results.

Significant estimates and assumptions include allocating purchase consideration issued in business combinations, valuing equity securities and derivative financial instruments issued in financing transactions and in share-based payment arrangements, accounts receivable reserves, inventory reserves, and the carrying amounts of intangible assets. Certain estimates, including accounts receivable and inventory reserves and the carrying amounts of intangible assets (including present value of future cash flow estimates for our pharmaceutical formulas) could be affected by external conditions including those unique to our industry and general economic conditions. It is reasonably possible that these external factors could have an effect on our estimates that could cause actual results to differ from our estimates.

9

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

We re-evaluate all of our accounting estimates at least quarterly based on these conditions and record adjustments, when necessary.

Intangible Asset – Pharmaceutical Formulas

The Company has purchased pharmaceutical formulas that were approved by the State Food and Drug Administration of China (“SFDA”). These formulas can be renewed every 5 years without limitation for a minimum fee and are subject to certain protections under PRC drug regulations for an indefinite period of time. These regulations mitigate competition and the ability of other suppliers to replicate our products or produce comparable substitutes. These intangible assets are measured initially at cost not subject to amortization and are tested for impairment annually or in interim reporting periods if events or changes in circumstances indicate that the carrying amounts of these intangible asset might not be recoverable.

There were no impairment charges to record during the three months ended September 30, 2011 and 2010.

Fair Value Measurements and Fair Value of Financial Instruments

We adopted the guidance of ASC 820 for fair value measurements, which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1 - Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2 - Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3 - Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

The carrying amounts reported in the condensed consolidated balance sheets for cash, accounts receivable, other receivables, short-term borrowings, accounts payable and accrued expenses, customer advances, and amounts due from related parties approximate their fair market value based on the short-term maturity of these instruments.

ASC 825-10 “Financial Instruments,” allows entities to voluntarily choose to measure certain financial assets and liabilities at fair value (fair value option). The fair value option may be elected on an instrument-by-instrument basis and is irrevocable, unless a new election date occurs. If the fair value option is elected for an instrument, unrealized gains and losses for that instrument should be reported in earnings at each subsequent reporting date. We use Level 3 inputs to value our derivative liabilities.

The following table reflects gains and losses for the three months ended September 30, 2011 and 2010 for all financial assets and liabilities categorized as Level 3.

10

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

|

Liabilities:

|

||||

|

Balance of derivative liabilities as of June 30, 2011

|

$ | 937,867 | ||

|

Change in the fair value of derivative liabilities

|

(332,485 | ) | ||

|

Balance of derivative liabilities as of September 30, 2011

|

$ | 605,382 | ||

Estimating the fair value of derivative financial instruments require the development of significant and subjective estimates that may, and are likely to, change over the duration of the instrument with related changes in internal and external market factors. The assumptions used to value our derivatives, which had a direct effect on the fair values described above are more fully described in Note 12. In addition, valuation techniques are sensitive to changes in the trading market price of our Common Stock and its estimated volatility interest rate changes and other variables or market conditions not within our control that can significantly affect our estimates of fair value and changes in fair value. Because derivative financial instruments are initially and subsequently carried at fair value, our net income may include significant charges or credits as these estimates and assumptions change.

Foreign Currency Translation

Our reporting currency is the U.S. dollar. The functional currency of the Company’s operating business based in the PRC is the RMB. For our subsidiaries and affiliates whose functional currencies are the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the exchange rate in effect as of the end of the period, and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the functional currency financial statements into U.S. dollars are included in comprehensive income.

Exchange gains or losses arising from foreign currency transactions are included in the determination of net income for the respective periods. All of our revenue transactions are transacted in the functional currency. We have not entered into any material transactions that are either originated, or to be settled, in currencies other than the RMB. Accordingly, transaction gains or losses have not had, and are not expected to have a material effect on our results of operations.

Period end exchange rates used to translate assets and liabilities and average exchange rates used to translate results of operations in each of the reporting periods are as follows:

|

|

Three months ended

September, 2011

|

Year ended

June 30, 2011

|

Three months ended

September, 2010

|

|||||||||

|

Period end US$: RMB exchange rate

|

6.3952 | 6.4635 | 6.6981 | |||||||||

|

Average periodic US$: RMB exchange rate

|

6.4132 | 6.6278 | 6.7803 | |||||||||

The RMB is not freely convertible into any other currencies. In addition, all foreign exchange transactions in the PRC must be conducted through authorized institutions. Accordingly, management cannot provide any assurance that the RMB underlying the consolidated financial statement amounts could have been, or could be, converted into US dollars at the exchange rates used to translate the functional currency into the reporting currency.

11

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

Revenue Recognition

Revenue represents the invoiced value of goods sold recognized upon the delivery of goods to distributors. Pursuant to the guidance of ASC Topic 605 and ASC Topic 36, revenue is recognized when all of the following criteria are met:

|

·

|

Persuasive evidence of an arrangement exists;

|

|

·

|

Delivery has occurred or services have been rendered;

|

|

·

|

The seller’s price to the buyer is fixed or determinable; and

|

|

·

|

Collectability is reasonably assured.

|

We account for sales returns by establishing an accrual in an amount equal to our estimate of sales recorded for which the related products are expected to be returned. We determine the estimate of the sales return accrual primarily based on our historical experience regarding sales returns, but also by considering other factors that could impact sales returns. These factors include levels of inventory in the distribution channel, estimated shelf life, product discontinuances, and price changes of competitive products, introductions of generic products and introductions of competitive new products. For the three months ended September 30, 2011 and 2010, our sales return rate is low and deemed immaterial and accordingly, no provision for sales returns was recorded.

Research and Development Costs

Research and development costs are charged to expense as incurred and included in operating expenses. We have only one full-time employee who is engaged in research and development, so we are mainly dependent on a third-party, Yantai Tianzheng Medicine Research and Development Co., Ltd., to perform the limited amount of research and development that we undertake. Research and development costs were primarily incurred from Yantai Tianzheng Medicine Research and Development Co., Ltd., and were $0 and $184,357 for the three months ended September 30, 2011 and 2010, respectively.

Shipping costs

Shipping costs are included in selling, general and administrative expense. Shipping costs amounted to $296,175 and $156,862 for the three months ended September 30, 2011 and 2010, respectively.

Advertising and Promotion

Advertising and promotion costs are charged to expense as incurred. Advertising and promotion expenses included in selling, general and administrative expenses amounted to $3,590,338 and $2,827,712 for the three months ended September 30, 2011 and 2010, respectively.

12

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

Recent Accounting Pronouncements

In December 2010, the FASB issued ASU No. 2010-28, Intangibles - Goodwill and Other (ASC Topic 350). Under Topic 350 on goodwill and other intangible assets, testing for goodwill impairment is a two-step test. When a goodwill impairment test is performed (either on an annual or interim basis), an entity must assess whether the carrying amount of a reporting unit exceeds its fair value (Step 1). I f it does, an entity must perform an additional test to determine whether goodwill has been impaired and to calculate the amount of that impairment (Step 2). The amendments in this update modify Step 1 of the goodwill impairment test for reporting units with zero or negative carrying amounts. For those reporting units, an entity is required to perform Step 2 of the goodwill impairment test if it is more likely than not that a goodwill impairment exists. In determining whether it is more likely than not that goodwill impairment exists, an entity should consider whether there are any adverse qualitative factors indicating that impairment may exist. The qualitative factors require that goodwill of a reporting unit be tested for impairment between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. The amendments in this update are effective for fiscal years, and interim periods within those years, beginning after December 15, 2010. Early adoption is not permitted. The Company has recently completed goodwill assessment for the year ended June 30, 2011 and determined that there was no impairment of goodwill. We have only recently completed the Yantai Tianzheng acquisition and believe that the carrying amount of Yantai Tianzheng does not exceed its fair value.

In December 2010, the FASB issued Accounting Standards Update (ASU) No. 2010-29, Business Combinations (ASC Topic 805). The amendments in this update specify that if a public entity presents comparative financial statements, the entity should disclose revenue and earnings of the combined entity as though the business combination(s) that occurred during the current year had occurred as of the beginning of the comparable prior annual reporting period only. The amendments also improve the usefulness of the pro forma revenue and earnings disclosures by requiring a description of the nature and amount of material, nonrecurring pro forma adjustments that are directly attributable to the business combination(s). The amendments in this update are effective for fiscal years, and interim periods within those years, beginning after December 15, 2010. The Company adopted this standard on our condensed consolidated financial statement disclosures for the Yantai Tianzheng acquisition.

In May 2011, the FASB issued ASU No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS. The amendments change the wording used to describe the requirements in U.S. GAAP for measuring fair value and for disclosing information about the fair value measurements. The amendments include the following:

|

|

·

|

Those that clarify the intent of the Company’s Board of Directors regarding the application of existing fair value measurement and disclosure requirements.

|

|

|

·

|

Those that change a particular principle or requirement for measuring fair value or for disclosing information about fair value measurements.

|

The amendments in this Update are to be applied prospectively. For public entities, the amendments are effective during interim and annual periods beginning after December 15, 2011. Early application by public entities is not permitted.

The Company is currently evaluating the impact of this standard and do not expect its adoption have a material impact on the Company’s condensed consolidated financial statements.

In June 2011, the FASB issued ASU No. 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income. Under the amendments, an entity has the option to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. The presentation option under current GAAP to present the components of other comprehensive income as part of the statement of changes in shareholders’ equity has been eliminated.

13

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

3.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

The amendments in this Update should be applied retrospectively. For public entities, the amendments are effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. Early adoption is permitted because compliance with amendments is already permitted. The Company already complies with this presentation.

|

4.

|

ACQUISITION

|

On August 8, 2011, the Company, through WFOE II, a newly formed limited liability company formed under the laws of the PRC and wholly owned by Chance High (the Company’s wholly-owned subsidiary), signed a share transfer agreement with the shareholders of Yantai Tianzheng to acquire 100% of Yantai Tianzheng’s equity interests for total purchase consideration of US$35,000,000 (paid in its RMB equivalent), payable in four installments: US$6,000,000 was paid on or before the tenth calendar day after the Execution Date of the acquisition; $12,000,000 is due to be paid on or before the sixth month anniversary of the Execution Date; $12,000,000 is due to be paid on or before the 12 month anniversary of the Execution Date; and the remaining $5,000,000 is due to be paid on or before the 18 month anniversary of the Execution Date.

In the event that the Company fails to pay any of the installments when due, such outstanding installment will be automatically converted into a two-year term loan, with interest accruing on any unpaid portion of such loan from its due date until such installment is paid in full at the rate of six percent (6%) per annum.

The acquisition expands the Company’s product lines and should allow the Company to leverage the sales and distribution channels of Bohai and Yantai Tianzheng by introducing new products. Yantai Tianzheng's current sales network spans over 14 major provinces as well as over 14 Tier 2 and Tier 3 cities, with products sold in over 1,100 hospitals across China. In addition, Yantai Tianzheng brings excess manufacturing capacity which meets GMP standards and will allow Bohai to further expand its production. Bohai is currently consolidating and integrating the two companies' operations, which creates the potential for significant improvement in the operating efficiency of the combined companies.

The Company accounted for its acquisitions of Yantai Tianzheng using the acquisition method of accounting. Accordingly, the results of operations for the three ended September 30, 2011, include the revenues and expenses of the acquired businesses since the effective control date of acquisition on July 1, 2011, which is the date the Company assumed control of Yantai Tianzheng pursuant to the terms of the share transfer agreement between WFOE II and the shareholders of Yantai Tianzheng.

The fair value of the purchase consideration issued to the sellers of Yantai Tianzheng was allocated to fair value of the net tangible assets acquired, with the resulting excess allocated to separately identifiable intangibles including customer relationships that have a finite life, pharmaceutical formulas that have an indefinite life and the remainder recorded as goodwill.

14

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

4.

|

ACQUISITION (continued)

|

The preliminary purchase price allocation is as follows:

|

Purchase Consideration:

|

||||

|

Cash paid to sellers immediately following the closing

|

$ | 6,000,000 | ||

|

Acquisition installment obligation payable to sellers

|

29,000,000 | |||

|

Less cash acquired

|

(1,358,078 | ) | ||

|

Net purchase consideration

|

33,641,922 | |||

|

Tangible assets acquired:

|

||||

|

Restricted cash

|

386,787 | |||

|

Accounts receivable

|

6,893,730 | |||

|

Other receivable and advance to suppliers

|

208,240 | |||

|

Inventories

|

1,312,170 | |||

|

Property, plant and equipment

|

6,151,206 | |||

|

Long term prepayments - land use rights

|

1,394,291 | |||

|

Accounts payable

|

(2,386,576 | ) | ||

|

Other payable and accrued expenses

|

(1,081,425 | ) | ||

|

Income taxes payable

|

(729,796 | ) | ||

|

Advance from customers

|

(170,186 | ) | ||

|

Short-term borrowings

|

(2,088,652 | ) | ||

|

Deferred tax liabilities

|

(5,261,605 | ) | ||

|

Net tangible assets acquired

|

4,628,185 | |||

|

Purchase consideration in excess of fair value of net tangible assets

|

29,013,737 | |||

|

Allocated to:

|

||||

|

Customer relation

|

14,151,156 | |||

|

Pharmaceutical product formulas

|

9,887,986 | |||

|

Goodwill upon acquisition

|

4,974,595 | |||

| $ | 0 | |||

The purchase price allocation is preliminary and was based, in part, on management’s knowledge of Yantai Tianzheng’s business and the results of a third party appraisal commissioned by management. The purchase price allocation is subject to possible changes as additional facts and information about Yantai Tianzheng’s business come to the Company’s attention.

The unaudited pro-forma financial results for the three months ended September 30, 2011 and September 30, 2010, combines the historical results of the Company with those of Yantai Tianzheng as if the acquisition had been completed as of the beginning of the reporting periods presented.

15

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

4.

|

ACQUISITION (continued)

|

|

Three months ended

|

||||

|

September 30, 2010

|

||||

|

Net Sales

|

$ | 25,074,276 | ||

|

Net income

|

$ | 4,210,495 | ||

|

Earnings per share- basic

|

$ | 0.26 | ||

|

Earnings per share- diluted

|

$ | 0.20 | ||

The unaudited pro-forma results of operations are presented for information purposes only. The unaudited pro-forma results of operations are not intended to present actual results that would have been attained had the acquisition been completed as of the dates presented or to project potential operating results as of any future date or for any future periods.

|

5.

|

INVENTORIES

|

Inventories consist of the following:

|

September 30,

|

June 30,

|

|||||

|

2011

|

2011

|

|||||

|

Raw materials

|

$ | 1,572,477 | $ | 739,363 | ||

|

Work in progress

|

375,763 | 423,202 | ||||

|

Finished goods

|

1,179,973 | 348,456 | ||||

|

Total inventories

|

$ | 3,128,213 | $ | 1,511,021 | ||

|

6.

|

PREPAID EXPENSES AND OTHER CURRENT ASSETS

|

Prepaid expenses and other currents assets consist of the following:

|

September 30,

|

June 30,

|

|||||||

|

2011

|

2011

|

|||||||

|

Prepaid advertising and promotion

|

$ | 658,330 | $ | 935,275 | ||||

|

Other receivables

|

594,626 | 106,626 | ||||||

|

Other miscellaneous deposits and prepayments

|

122,562 | 18,237 | ||||||

|

Prepaid expenses and other current assets

|

$ | 1,375,518 | $ | 1,060,138 | ||||

16

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

7.

|

PROPERTY, PLANT AND EQUIPMENT, NET

|

Property, plant and equipment consist of the following:

|

September 30,

|

June 30,

|

|||||||

|

2011

|

2011

|

|||||||

|

Buildings

|

$ | 9,299,778 | $ | 5,122,557 | ||||

|

Plant equipment

|

2,283,327 | 1,348,819 | ||||||

|

Office equipment

|

102,410 | 107,520 | ||||||

|

Motor vehicles

|

281,997 | 258,720 | ||||||

|

Total

|

11,967,512

|

6,837,616 | ||||||

|

Less: accumulated depreciation

|

(1,738,298 | ) | (1,622,654 | ) | ||||

|

Construction in progress

|

1,528,408 | - | ||||||

|

Property, plant and equipment, net

|

$ | 11,757,622 | $ | 5,214,962 | ||||

Depreciation expense for property, plant and equipment for the three months ended September 30, 2011 and 2010 amounted to $136,657 and $85,701, respectively.

Substantially all of Bohai’s assets are pledged on a collective basis to secure the Company’s convertible notes obligations. As of September 30, 2011, there was no pledge of specific assets to secure bank loans. As of June 30, 2011, the Company has specifically pledged certain plant equipment and machinery having a carrying amount of $391,317 to secure a bank loan on behalf of Bohai.

On June 8, 2010, Yantai Huanghai Construction Co. signed an agreement with Yantai Tianzheng to perform certain portions of a factory construction located at the premises of Yantai Tianzheng. The total contract price is approximately $3.03 million (RMB 19 million) and the construction is estimated to be completed by the end of 2011. The remaining commitment of the contract was approximately $1.33 million (RMB 8.5 million) as of September 30, 2011.

|

8.

|

LONG TERM PREPAYMENTS - LAND USE RIGHTS, NET

|

| September 30, | June 30, | |||||||

|

2011

|

2011

|

|||||||

|

Land use rights, at cost

|

$

|

19,984,577

|

$

|

17,999,002

|

||||

|

Less: Accumulated amortization

|

(962,749

|

)

|

(421,731

|

)

|

||||

|

Intangible assets – land use rights, net

|

$

|

19,021,828

|

$

|

17,577,271

|

||||

Amortization expense amounted $148,966 and $18,009 for the three months ended September 30, 2011 and 2010, respectively. Amortization of land use rights for fiscal years ending subsequent to September 30, 2011 is as follows:

17

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

8.

|

LONG TERM PREPAYMENTS - LAND USE RIGHTS, NET (Continued)

|

|

Amortization

|

||||

|

Remainder of FY2012

|

$ | 2,730,763 | ||

|

2013

|

3,641,017 | |||

|

2014

|

3,641,017 | |||

|

2015

|

3,641,017 | |||

|

2016

|

3,641,017 | |||

|

Thereafter

|

1,726,997 | |||

|

Total

|

$ | 19,021,828 | ||

|

9.

|

INTANGIBLE ASSETS – CUSTOMBER RELATIONSHIPS, NET

|

Intangible assets –customer relationships, net represents customer relationships related to the Yantai Tianzheng workforce acquired during the Yantai Tianzheng acquisition as described in Note 4.

Customer relationships are amortized on a straight line basis over 5 and 8 years of useful life while human capital is amortized over 3 years useful life.

Intangible assets – customer relationship, net at September 30, 2011 is as follow:

|

September 30, 2011

|

||||

|

Customer relationships, at cost

|

$ | 14,302,289 | ||

|

Accumulated amortization

|

(464,385 | ) | ||

|

Intangible assets – customer relationships, net

|

$ | 13,837,904 | ||

|

10.

|

ACCRUED EXPENSES

|

Accrued expense consists of the following:

|

September 30,

|

June 30,

|

|||||||

|

2011

|

2011

|

|||||||

|

Accrued payroll and welfare

|

$ | 429,646 | $ | 261,144 | ||||

|

Accrued expense

|

30,000 | 197,496 | ||||||

|

Other taxes payable

|

1,660,758 | 1,056,691 | ||||||

|

Other payables

|

3,075,094 | 2,797,002 | ||||||

|

Amount due to equity holder

|

19,833 | 11,980 | ||||||

|

Other payable for construction

|

246,459 | - | ||||||

|

Total

|

$ | 5,461,790 | $ | 4,324,313 | ||||

18

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

11.

|

SHORT-TERM BORROWINGS

|

The Company has short-term loan facilities from financial institutions in the PRC. Short-term borrowings as of September 30, 2011 and June 30, 2011 consist of the following:

|

Loan from

|

Annual

|

September 30,

|

June 30,

|

||||||||||||

|

financial institution

|

Loan period

|

interest rate

|

2011

|

2011

|

|||||||||||

|

China Citic Bank

|

February 23, 2011 to February 23, 2012

|

7.57 | % | $ | 1,563,673 | $ | - | ||||||||

|

Yantai Laishan Rural Credit Union

|

September 21, 2010 to September 20, 2011

|

9.03 | % | - | 618,860 | ||||||||||

|

Yantai Laishan Rural Credit Union

|

September 21, 2010 to September 20, 2011

|

6.90 | % | - | 301,694 | ||||||||||

|

Total short-term borrowings

|

$ | 1,563,673 | $ | 920,554 | |||||||||||

The loan from China Citic Bank is from Yantai Tianzheng and is guaranteed by Yantai Tianzheng’s CEO, Chi Jiangbo and his wife Jiang Chunying. Interest expense for short-term borrowings for the three months ended September 30, 2011 amounted to $56,764 and $89,899, respectively.

|

12.

|

CONVERTIBLE PROMISSORY NOTES AND WARRANTS

|

Convertible notes, net of unamortized original issuance discounts are as follows:

| September 30, | June 30, | |||||||

|

2011

|

2011

|

|||||||

|

Convertible notes payable, at full principal value

|

$

|

10,450,000

|

$

|

10,450,000

|

||||

|

Less: unamortized beneficial conversion feature and warrants discount on convertible notes

|

(7,198,510

|

)

|

(9,317,897

|

)

|

||||

|

Convertible notes, net

|

$

|

3,251,490

|

$

|

1,132,103

|

||||

Convertible Notes

On January 5, 2010, pursuant to a Securities Purchase Agreement (the “Securities Purchase Agreement”) with 128 accredited investors (the “Investors”), we sold 6,000,000 units for aggregate gross proceeds of $12,000,000, each unit consisting of an 8% senior convertible promissory note in the principal amount of $2 and one Common Stock purchase warrant (collectively, the “Investor Warrants”). By agreement with the Investors, each investor received: (i) A single Note representing the aggregate number of Notes purchased by them as part of the units (each, a “Note” and collectively, the “Notes”) and (ii) a single Investor Warrant representing the aggregate number of Investor Warrants purchased by them as part of the units.

19

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

12.

|

CONVERTIBLE PROMISSORY NOTES AND WARRANTS (continued)

|

The Notes bear interest at 8% per annum, payable quarterly in arrears on the last day of each fiscal quarter of the Company. Principal is due on January 5, 2012. Each Note, plus all accrued but unpaid interest thereon, is convertible, in whole but not in part, at any time at the option of the holder, into shares of Common Stock at a conversion price of $2.00 per share, subject to adjustment as set forth in the Note.

Warrants

The Investor Warrants expire on January 5, 2013 and may be exercised by the holder at any time to purchase one share of Common Stock at an exercise price of $2.40 per share (subject to adjustment as set forth in the Investor Warrants). The exercise price of the Investor Warrants is subject to adjustment in the same manner as the conversion price of the Notes described above, except that the exercise price will not be adjusted to less than $1.20, as adjusted for any stock dividend, stock split, stock combination, reclassification or similar transaction. The Investor Warrants may only be exercised for cash and do not permit the holder to perform a cashless exercise.

In connection with the sale of the units, we paid our placement agents a cash fee of $1,200,000. In addition, the placement agents received warrants (the “Placement Agent Warrants” and, together with the Investor Warrants, the “Warrants”) to purchase 600,000 shares of Common Stock, which Placement Agent Warrants are substantially identical to the Investor Warrants.

At September 30, 2011, the fair values of the Investor Warrants and Placement Agent Warrants amounted $550,348 and $55,034, respectively, using a binomial model, based on the closing market price on that date of $0.80, a term equal to the remaining life of the Warrants which is 1.27 years, an expected dividend yield of 0%, a risk-free interest rate of 0.02% based on constant maturity rates published by the U.S. Federal Reserve applicable to the remaining life of the Warrants and estimated volatility of 55%, based on a review of the historical volatility of companies considered by management to be comparable to the Company. The effect of the down-round anti-dilution protection was not considered to be material and no adjustment was made for it in the estimated fair value of the Investor Warrants and the Placement Agent Warrants.

The aggregate change in the value of the Investor and Placement Agent Warrants for the three months ended September 30, 2011 and 2010 of $332,485 and $30,554, respectively, has been recorded as a gain and a loss, respectively, on the condensed consolidated statements of income.

The Convertible Notes were initially recorded at a discounted carrying amount of zero as a result of having allocated a portion of the proceeds to (i) the fair value of the warrants, which were recorded as liabilities stated at fair value, and (ii) a beneficial conversion feature that was not bifurcated as a free standing derivative at the time of issuance or at subsequent reporting based on a periodic classification assessments. Accretion of the note discount amounted to $2,119,387 and $29,717 for the three month periods ended September 30, 2011 and 2010, respectively. Accretion of the discount was recorded as a component of interest expense in the accompanying statements of income and comprehensive income. Contractual interest expense amounted to $2,328,387 and $256,717_for the three months ended September 30, 2011 and 2010, respectively. There is an aggregate of 5,225,000 shares of common stock issuable under all remaining convertible notes as of September 30, 2011.

20

BOHAI PHARMACEUTICALS GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

|

12.

|

CONVERTIBLE PROMISSORY NOTES AND WARRANTS (continued)

|

Escrowed Shares

As of January 5, 2010 and at September 30, 2011, our principal shareholder, Mr. Qu, is obligated to deliver 1,000,000 shares of Common Stock to the Investors if certain Events of Default occur (as defined in the Notes).

|

13.

|

COMMITMENTS, CONTINGENCIES AND OTHER MATTERS

|

|

(a)

|

Contract Research and Development Arrangement

|