Attached files

As filed with the Securities and Exchange Commission on November 10, 2011

Registration No. ________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ONE WORLD HOLDINGS, INC.

(Name of registrant in its charter)

|

Nevada

|

3942

|

87-0429198

|

|

(State or jurisdiction

of incorporation or organization)

|

(Primary Standard

Industrial Classification Code Number)

|

(IRS Employer

Identification No.)

|

418 Bridge Crest Boulevard

Houston, Texas 77082

Phone: 1 (866) 440-1470

(Address and telephone number of principal executive offices and principal place

of business or intended principal place of business)

Corinda Joanne Melton

Chief Executive Officer

418 Bridge Crest Boulevard

Houston, Texas 77082

Phone: 1 (866) 440-1470

(Name, address and telephone number of agent for service)

Copies to:

|

Robert D. Axelrod

|

|

Axelrod, Smith & Kirshbaum, P.C.

|

|

5300 Memorial Drive, Suite 700

|

|

Houston, Texas 77007

|

|

Phone: (713) 861-1996

|

|

Fax: (713) 552-0202

|

Approximate date of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o |

Accelerated filer [ ]

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

x |

Calculation of Registration Fee

|

Title of Each Class of Securities to be Registered

|

Amount to be

Registered

|

Proposed Maximum Offering Price Per Share(1)

|

Proposed Maximum Aggregate Offering Price(1)

|

Amount of Registration Fee

|

|

Common Stock

|

8,236,665

|

$0.04

|

$329,466.60

|

$37.76

|

|

Total

|

8,236,665

|

$0.04

|

$329,466.60

|

$37.76

|

(1) The offering price is the stated, fixed price of $0.04 per share until the securities are quoted on the OTC Bulletin Board for the purpose of calculating the registration fee pursuant to Rule 457. This amount is only for purposes of determining the registration fee, the actual amount received by a selling stockholder will be based upon fluctuating market prices, if the securities become quoted on the OTC Bulletin Board.

The registrant hereby amends its registration statement, on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this Prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated November 10, 2011.

PROSPECTUS

ONE WORLD HOLDINGS, INC.

RESALE OF

8,236,665 SHARES OF COMMON STOCK

The selling stockholders listed on page 38 may offer and sell up to 8,236,665 shares of our common stock under this Prospectus for their own account.

The selling stockholders may offer and sell the shares in a variety of transactions as described under the heading “Plan of Distribution” beginning on page 40, including transactions on any stock exchange, market or facility on which our common stock may be traded, in privately negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to such market prices or at negotiated prices. We have no basis for estimating either the number of shares of our common stock that will ultimately be sold by the selling stockholders or the prices at which such shares will be sold. We currently lack a public market for our common stock. Upon the filing of this Prospectus, we anticipate that a market maker will apply to have our stock quoted on the OTC Bulletin Board, of which there can be no assurance.

A current Prospectus must be in effect at the time of the sale of the shares of common stock described above. The selling stockholders will be responsible for any commissions or discounts due to brokers or dealers. We will pay all of the other offering expenses.

Each selling stockholder or dealer selling the common stock is required to deliver a current Prospectus upon the sale.

THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD A COMPLETE LOSS. WE URGE YOU TO READ THE "RISK FACTORS" SECTION BEGINNING ON PAGE 6, ALONG WITH THE REST OF THIS PROSPECTUS BEFORE YOU MAKE YOUR INVESTMENT DECISION.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is _______, 2011.

TABLE OF CONTENTS

|

Page

|

|

|

Prospectus Summary

|

5

|

|

Summary of the Offering

|

5

|

|

Risk Factors

|

6

|

|

Use of Proceeds

|

13

|

|

Dilution

|

13

|

|

Determination of Offering Price

|

13

|

|

Legal Proceedings

|

13

|

|

Description of Business

|

13

|

|

Directors, Executive Officers, Promoters and Control Persons

|

22

|

|

Executive and Director Compensation

|

25

|

|

Security Ownership of Certain Beneficial Owners and Management

|

26

|

|

Experts

|

27

|

|

Indemnification of Directors and Officers

|

27

|

|

Forward Looking Statements

|

28

|

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

28

|

|

Transactions with Related Persons, Promoters and Certain Control Persons

|

37

|

|

Descriptions of Capital Stock

|

38

|

|

Selling Stockholders

|

38

|

|

Plan of Distribution

|

40

|

|

Market for Common Equity and Related Stockholder Matters

|

41

|

|

Dividend Policy

|

42

|

|

Additional Information

|

42

|

|

Legal Matters

|

43

|

|

Dealer Prospectus Delivery Obligation

|

43

|

|

Index to Financial Statements

|

44

|

PROSPECTUS SUMMARY

The following summary highlights material information found in more detail elsewhere in the Prospectus. It does not contain all of the information you should consider. As such, before you decide to buy our common stock, in addition to the following summary, we urge you to carefully read the entire Prospectus, especially the risks of investing in our common stock as discussed under “Risk Factors.” In this Prospectus, the terms “we,” “us,” “our,” “Company,” and “One World” refer to One World Holdings, Inc., a Nevada corporation. “Common Stock” refers to the common stock, par value $0.0025 per share, of One World Holdings, Inc.

On July 21, 2011, we entered into and closed a Share Exchange Agreement (the “Exchange Agreement”) with The One World Doll Project Inc ("OWDP"), a Texas corporation, and the persons owning 100% of the outstanding capital stock of OWDP (the “OWDP Stockholders”). At closing, the OWDP Stockholders transferred all of their shares of common stock to us in exchange for newly issued shares of our common stock, which shares represented 90.55% of our voting securities. As a result of this transaction, OWDP became our wholly-owned subsidiary, we abandoned all of our previous business plans involving environmental remediation and recycling, and the business of OWDP became our sole business.

Our principal executive offices are located at 418 Bridge Crest Boulevard, Houston, Texas 77082. We are a development stage company engaged in the development and production of different lines of multi-cultural dolls. We have a limited operating history and are subject to all of the risks inherent to the development of a new business in the highly competitive environment in which we will operate.

As of the date hereof, we have limited assets and no revenues. Furthermore, we believe that operating as a reporting company, which is our plan following the effectiveness of our Registration Statement, of which this Prospectus is a part, will significantly increase our accounting, legal, managerial and filing expenses. We plan to seek out additional debt and/or equity financing; however, we do not currently have any specific plans to raise such additional financing at this time. The sale of additional equity securities, if undertaken and if accomplished, may result in dilution to our shareholders. We cannot assure you, however, that future financing will be available in amounts or on terms acceptable to us, or at all.

This summary is qualified in its entirety by the detailed information appearing elsewhere in this Prospectus. The securities offered hereby are speculative and involve a high degree of risk. See "Risk Factors," below.

SUMMARY OF THE OFFERING:

|

Common Stock Offered:

|

8,236,665 shares by selling stockholders

|

|

Common Stock Outstanding Before The Offering:

|

57,431,040 shares

|

|

Common Stock Outstanding After The Offering:

|

57,431,040 shares

|

|

Use Of Proceeds:

|

We will not receive any proceeds from the shares offered by the selling stockholders in this offering.

|

|

Offering Price:

|

The offering price of the shares has been arbitrarily determined by us based on estimates of the price that purchasers of speculative securities, such as the shares offered herein, will be willing to pay considering the nature and capital structure of our Company, the experience of our officers and Directors and the market conditions for the sale of equity securities in similar companies. The offering price of the shares bears no relationship to the assets, earnings or book value of us, or any other objective standard of value. We anticipate that no shares will be sold by the selling stockholders prior to us becoming a publicly-traded company, at which time the selling stockholders will sell shares based on the market price of such shares. We are not selling any shares of our common stock, and are only registering the re-sale of shares of common stock previously sold by us.

|

|

No Market:

|

No assurance is provided that a market will be created for our securities in the future, or at all. If in the future a market does exist for our securities, it is likely to be highly illiquid and sporadic.

We anticipate a market maker that is a licensed broker dealer will apply to the Financial Industry Regulatory Authority (“FINRA”) Over-The-Counter Bulletin Board to allow the trading of our common stock upon the filing of the Registration Statement with the SEC. If our common stock becomes traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling stockholders. The offering price would thus be determined by market factors and the independent decisions of the selling stockholders.

|

|

Need for Additional Financing:

|

We had (i) a working capital deficit of $116,560 and a total accumulated deficit of $1,177,623 as of June 30, 2011, (ii) no revenues for the six months ended June 30, 2011 or for the period from inception, October 1, 2010, to June 30, 2011, and (iii) a net loss of $1,042,741 for the six months ended June 30, 2011 and a net loss of $1,177,623 for the period from inception, October 1, 2010, to June 30, 2011. Furthermore, we believe that operating as a reporting company, which is our plan following the effectiveness of the Registration Statement, of which this Prospectus is a part, will cost us from $30,000 to $50,000 more per year in accounting, legal, managerial and filing expenses than we have historically spent. We believe that our capital requirements for the next 12 months will be approximately $1.5 million, including $300,000 for capital expenditures, manufacturing and inventory costs and $1.2 million for marketing, public relations, and general and administrative costs. We anticipate meeting our capital requirements by raising funds through a combination of private placements of our common stock and/or issuance of notes payable to private investors. Should we be unable to obtain the capital necessary to fund our expected future working capital needs, we would scale back on marketing, operational and administrative requirements, resulting in slower growth. This could have a material adverse effect on the value of our securities. Even assuming we raise the additional capital we require to continue our business operations, we anticipate incurring net losses for the foreseeable future. Our need for additional funding is described in greater detail below under “Liquidity and Capital Resources”.

|

|

Address:

|

418 Bridge Crest Boulevard

Houston, Texas 77082

|

|

Telephone Number:

|

1 (866) 440-1470

|

5

RISK FACTORS

The securities offered herein are highly speculative and should only be purchased by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this Prospectus before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risks Related to the Company, the Industry and the Offering

We have a limited operating history, and may not be successful in developing profitable business operations.

The Company has a limited operating history. Our business operations must be considered in light of the risks, expenses and difficulties frequently encountered in establishing a business in the doll and toy industry. As of the date of this Prospectus, we have generated no revenues and have limited assets. There is nothing at this time on which to base an assumption that our business operations will prove to be successful in the long-term. Our future operating results will depend on many factors, including:

|

·

|

our ability to raise adequate capital;

|

|

·

|

our ability to develop and design a marketable line of dolls;

|

|

·

|

our ability to cost effectively manufacture dolls;

|

|

·

|

our ability to market and sell our line of dolls;

|

|

·

|

the demand for dolls generally;

|

|

·

|

the level of our competition; and

|

|

·

|

our ability to attract and maintain key management and employees.

|

To achieve profitable operations in the future, we must, alone or with others, successfully manage the factors stated above. Despite our best efforts, we may not be successful in designing, manufacturing, and/or marketing our product.

We expect our future financial results to fluctuate significantly, and a failure to increase our revenues or achieve profitability may have a substantial negative effect on the Company.

Because of our limited operating history, we do not have meaningful historical information to predict demand for our products and trends that may emerge in our target markets. Moreover, because most of our expenses are relatively fixed in the short term, we may be unable to adjust spending quickly enough to offset any shortfall in revenue in any particular period. As a result, it is likely that in some future quarters or years, our operating results will fall well below the expectations of investors. Furthermore, we expect our future quarterly and annual operating results to fluctuate significantly as we attempt to expand our service offerings in our target markets. Our revenues, gross margins and operating results are difficult to forecast and may vary significantly from period to period due to a number of factors, many of which are not in our control. These factors include:

|

·

|

market acceptance of our products, sales and marketing efforts and pricing changes by our competitors;

|

|

·

|

number of dolls sold by us through key relationships with clients and distributors;

|

|

·

|

amount and timing of expenditures needed to produce our proposed results;

|

|

·

|

number of new contracts we obtain to distribute and manufacture dolls, and our relative performance under each such contract;

|

|

·

|

our ability to expand our operations and the amount and timing of related expenditures;

|

|

·

|

our ability to successfully expand our national marketing, advertising and sales activities;

|

|

·

|

our ability to successfully recruit, hire and retain key employees; and

|

|

·

|

general economic conditions affecting our industry.

|

We have limited capital and will need to raise additional capital in the future.

We do not currently have sufficient capital to fund both our continuing operations and our planned growth. We will require additional capital to continue to grow our business. We may be unable to obtain additional capital when required. Our current and future product lines, as well as our administrative requirements (such as salaries, insurance expenses and general overhead expenses, as well as legal compliance costs and accounting expenses) will require a substantial amount of additional capital and cash flow.

6

We may pursue sources of additional capital through various financing transactions or arrangements, including joint venturing of projects, debt financing, equity financing or other means. We may not be successful in identifying suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. If we do not succeed in raising additional capital, our resources may not be sufficient to fund our planned operations.

Any additional capital raised through the sale of equity may dilute the ownership percentage of our stockholders. Raising any such capital could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of other derivative securities, and issuances of incentive awards under equity employee incentive plans, which may have a further dilutive effect.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, which may adversely impact our financial condition.

There is substantial doubt about our ability to continue as a going concern.

To date, we have not yet achieved profitable operations and expect to incur losses in the development of our business. Accordingly, our independent registered public accounting firm has indicated in its report on our consolidated financial statements, as of December 31, 2010, that there exists substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our ability to generate future profitable operations and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come due. Management's plan to address our ability to continue as a going concern includes obtaining debt or equity funding from private placement or institutional sources or obtaining loans from financial institutions, where possible. Although management believes that it will be able to obtain the necessary funding to allow us to remain a going concern through the methods discussed above, there can be no assurances that such methods will prove successful.

We operate in a competitive market for doll products and face competitors with greater resources, which may make it more difficult for us to achieve any significant market penetration.

The markets that we serve and intend to serve are consistent yet rapidly evolving, and competition in each is intense and expected to increase significantly in the future. Most of the companies that we compete against have built large and established businesses and have much greater financial and human resources. Some of these competitors include Hasbro, Inc. and Mattel, Inc. While we believe that we are positioned well within our targeted markets, our relative position in the overall industry will be very small. There can be no assurance that we will be able to similarly build such successful businesses or offer products that are competitive with our competitors’ product offerings. Because most of our competitors have substantially greater resources than we do, they may, among other things, be able to undertake more aggressive marketing and pricing strategies, obtain more favorable pricing from vendors and make more attractive offers to strategic partners than we can. Therefore, we may be unable to successfully compete against numerous companies in our target markets.

The success of our business is dependent upon our ability to successfully identify or satisfy consumer preferences.

7

Our business and operating results will depend largely upon the appeal of doll product lines. Consumer preferences, particularly among the end users of our products, predominantly children, are continuously changing. The entrance of new dolls and trends into the market can cause significant and sudden shifts on demand. These trends are often unpredictable. Our ability to establish significant product sales of our lines of dolls will depend on our ability to satisfy play preferences, enhance existing products, develop and introduce new products, and achieve market acceptance of these products. Competition is intensifying due to recent trends towards shorter life cycles for individual toy products, the phenomenon of children outgrowing toys at younger ages, and an increasing use of more sophisticated technology in toys. If we do not successfully meet the challenges outlined above in a timely and cost-effective manner, demand for our products may never occur or could decrease, and our revenues, profitability and results of operations may be adversely affected.

Inaccurately anticipating changes and trends in popular culture, media and movies, fashion, or technology can negatively affect our sales.

Trends in media, movies, and children’s characters change swiftly and contribute to the transience and uncertainty of play preferences. We will attempt to respond to such trends and developments by modifying, refreshing, extending, and expanding our product offerings whenever possible. If we do not accurately anticipate trends in popular culture, movies, media, fashion, or technology, our products may not be accepted by children, parents, or families, and our revenues, profitability, and results of operations may be adversely affected.

Our business will be highly seasonal and our operating results will depend, in large part, on sales during the relatively brief traditional holiday season. Any events that disrupt our business during this peak demand time could significantly, adversely and disproportionately affect our business.

Retail sales of toy products are highly seasonal, with a majority of retail sales occurring during the period from September through December. As a result, our operating results depend, in large part, on sales during the relatively brief traditional holiday season. Our business will be subject to risks associated with the underproduction of popular dolls and the overproduction of dolls that do not match consumer demand. These risks are magnified during the holiday season. We believe that the increase in “last minute” shopping during the holiday season and the popularity of gift cards (which often shift purchases to after the holiday season) may negatively impact customer re-orders during the holiday season. These factors may decrease sales or increase the risks that we may not be able to meet demand for certain products at peak demand times or that our inventory levels may be adversely impacted by the need to pre-build products before orders are placed.

In addition, as a result of the seasonal nature of our business, we may be significantly and adversely affected, in a manner disproportionate to the impact on a company with sales spread more evenly throughout the year, by unforeseen events, such as terrorist attacks, economic shocks, or other catastrophic events, that harm the retail environment or consumer buying patterns during its key selling season, or by events, such as strikes, disruptions in transportation or port delays, that interfere with the manufacture or shipment of goods during the critical months leading up to the holiday purchasing season.

We will depend on third-party manufacturers, and if our relationship with any of them is harmed or if they independently encounter difficulties in their manufacturing processes, we could experience product defects, production delays, cost overruns or the inability to fulfill orders on a timely basis, any of which could adversely affect our business, financial condition and results of operations.

We have engaged a third-party manufacturer to manufacture our initial inventory of dolls. In the future, we may depend on multiple third-party manufacturers. Our manufacturers will develop, provide and use the tools, dies and molds that we own to manufacture our products. We have limited control, however, over the manufacturing processes themselves. As a result, any difficulties encountered by the third-party manufacturers that result in product defects, production delays, cost overruns or the inability to fulfill orders on a timely basis could adversely affect our business, financial condition and results of operations.

8

We do not have a long-term contract with our existing manufacturer or any other third-party manufacturers. Although we believe we could secure other third-party manufacturers to produce our products, our operations would be adversely affected if we lost our relationship with this manufacturer or any future manufacturers or suppliers. Any problems with manufacturers’ or suppliers’ operations, including problems with sea or air transportation, could adversely affect our business, even if the disruption in operations lasted for a relatively short period of time. Our tools, dies and molds will be located at the facilities of our third-party manufacturers.

Although we do not purchase the raw materials used to manufacture our products, we are potentially subject to variations in the prices we pay our third-party manufacturers for products, depending on what they pay for their raw materials.

Our manufacturing operations will be outside of the United States, subjecting us to risks common to international operations.

We will use third-party manufacturers located principally in China which are subject to the risks normally associated with international operations, including: currency conversion risks and currency fluctuations; limitations, including taxes, on the repatriation of earnings; political instability, civil unrest and economic instability; greater difficulty enforcing intellectual property rights and weaker laws protecting such rights; complications in complying with laws in varying jurisdictions and changes in governmental policies; greater difficulty and expenses associated with recovering from natural disasters; transportation delays and interruptions; the potential imposition of tariffs; and the pricing of intercompany transactions may be challenged by taxing authorities in both China and the United States, with potential increases in income taxes.

Our reliance on external sources of manufacturing can be shifted, over a period of time, to alternative sources of supply, should such changes be necessary. However, if we were prevented from obtaining products or components for a material portion of our product line due to medical, political, labor or other factors beyond our control, our operations would be disrupted while alternative sources of products were secured. Also, the imposition of trade sanctions by the United States against a class of products imported by us from, or the loss of “normal trade relations” status by China, could significantly increase our cost of products imported from that nation. Because of the importance of our international sourcing of manufacturing to our business, our financial condition and results of operations could be significantly and adversely affected if any of the risks described above were to occur.

If we are unable to adequately protect our proprietary intellectual property and information, our business, financial condition and results of operations could be adversely affected.

We anticipate that the value of our business will depend on our ability to protect our intellectual property and information, including our trademarks, trade names, copyrights, patents and trade secrets, in the United States and around the world, as well as our customer, employee, and consumer data. If we fail to protect our proprietary intellectual property and information upon development, including any successful challenge to our ownership of any intellectual property or material infringements of our intellectual property, this failure could have a significant adverse effect on our business, financial condition, and results of operations.

Issues with products may lead to product liability claims, recalls, withdrawals, replacements of products, or regulatory actions by governmental authorities that could divert resources, affect business operations, decrease sales, increase costs, and put us at a competitive disadvantage, any of which could have a significant adverse effect on our financial condition; we do not currently maintain product liability insurance.

9

In the future we may experience issues with products that may lead to product liability claims, recalls, withdrawals, replacements of products, or regulatory actions by governmental authorities. Any of these activities could result in increased governmental scrutiny, harm to our reputation, reduced demand by consumers for our products, decreased willingness by retailer customers to purchase or provide marketing support for those products, adverse impacts on our ability to enter into licensing agreements for products on competitive terms, absence or increased cost of insurance, or additional safety and testing requirements. Such results could divert development and management resources, adversely affect our business operations, decrease sales, increase legal fees and other costs, and put us at a competitive disadvantage compared to other companies not affected by similar issues with products, any of which could have a significant adverse effect on our financial condition.

Further, we do not currently maintain product liability insurance, which insurance would help mitigate the risks associated with product liability claims against the Company and its products. We anticipate obtaining product liability insurance in the future, at such time that adequate funds are available.

If we lose our key personnel or are unable to attract and retain additional key personnel, we may be unable to implement our business strategy or pursue new opportunities.

Our future success depends in large part upon attracting and retaining key sales, marketing and senior management personnel. The loss of the services of any of our key employees, particularly if lost to competitors, may significantly delay or prevent the achievement of our business objectives and may adversely affect our strategic direction. In particular, the services of Stacey McBride-Irby, our Chief Product Development Officer, or Corinda Joanne Melton, our Chief Executive Officer, would be difficult to replace. Although we do currently have employment agreements with Ms. McBride-Irby and Ms. Melton, there are no assurances that these employees will not terminate their employment with us at any time. In addition, we do not maintain key person life insurance for any of our personnel, but plan on obtaining key person life insurance on certain executive officers if funds permit.

Our future success will also depend on our ability to identify, recruit, train and retain additional qualified and skilled personnel. We may be unable to attract and retain personnel with the qualifications necessary for the further development of our business. If we fail to attract and retain personnel, particularly management and industry personnel, we may not be able to execute on our business plan.

Our affiliates control a significant percentage of our current outstanding common stock and their interests may conflict with those of our stockholders.

As of the date of this Prospectus, our executive officers and Directors collectively and beneficially own approximately 23.04% of our outstanding common stock. This concentration of voting control gives affiliates substantial influence over any matters which require a stockholder vote, including without limitation the election of Directors and approval of merger and/or acquisition transactions, even if their interests may conflict with those of other stockholders. It could have the effect of delaying or preventing a change in control or otherwise discouraging a potential acquirer from attempting to obtain control of the Company. This could have a material adverse effect on the market price of our common stock or prevent our stockholders from realizing a premium over the then prevailing market prices for their shares of common stock.

In the future, we may incur significant increased costs as a result of operating as a public company, and our management may be required to devote substantial time to new compliance initiatives.

If we are successful in bringing the Company public, as a result of operating as a public company, we may incur significant legal, accounting and other expenses. The Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), as well as new rules subsequently implemented by the SEC, have imposed various new requirements on public companies, including requiring changes in corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these new compliance initiatives. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly. For example, we expect these new rules and regulations to make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to incur substantial costs to maintain the same or similar coverage.

10

In addition, the Sarbanes-Oxley Act requires, among other things, that we maintain effective internal controls for financial reporting and disclosure controls and procedures. In particular, we will be required to perform system and process evaluation and testing on the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. Our testing may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. Our compliance with Section 404 will require that we incur substantial accounting expense and expend significant management efforts. We currently do not have an internal audit group, and we will need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. Moreover, if we are not able to comply with the requirements of Section 404 in a timely manner, or if we or our independent registered public accounting firm identifies deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses, the market price of our stock could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

Risks Related to Our Common Stock

There is presently no market for our common stock, and the price of our common stock may be volatile if a market develops.

Our common stock is not currently quoted on any exchange or any quotation system in the over-the-counter securities market. We anticipate that a market maker will file a Form 211 with FINRA to permit quotation of our stock on the over-the-counter market, but there can be no assurances when, if ever, this will occur. In any event, the application on Form 211 will not be approved until after our Registration Statement on Form S-1 is declared effective by the SEC. No assurance can be made that a market maker will file an application on Form 211 with FINRA to make a market in our common stock, that an application, if filed, will be approved by FINRA, or that a ticker symbol will be assigned by FINRA for our common stock or that the Registration Statement will be declared effective in a timely or prompt manner, if at all.

In the event a market for our stock develops, our shares will likely be very thinly traded, and there could be volatility in the volume and market price of our common stock. This volatility may be caused by a variety of factors, including the lack of readily available quotations, the absence of consistent administrative supervision of “bid” and “ask” quotations and generally lower trading volume. In addition, factors such as quarterly variations in our operating results, changes in financial estimates by securities analysts or our failure to meet our or their projected financial and operating results, litigation involving us, factors relating to the doll and toy industry, actions by governmental agencies, national economic and stock market considerations as well as other events and circumstances beyond our control could have a significant impact on the future market price of our common stock and the relative volatility of such market price.

The shares of common stock offered herein have been arbitrarily valued.

The offering price of the shares of common stock offered in this Prospectus were established arbitrarily by us, without any arms-length negotiations or appraisals, and do not necessarily bear any relationship to our assets, book value, net worth, expected earnings or to any other recognized objective criteria of value. The offering price may not be indicative of the actual value of the shares. The offering price of the shares has been arbitrarily determined by us based on estimates of the price that purchasers of speculative securities, such as the shares offered herein, will be willing to pay considering the nature and capital structure of our company, the experience of our officers and Directors and the market conditions for the sale of equity securities in similar companies. We anticipate that no shares will be sold by the selling stockholders prior to us becoming a publicly-traded company, at which time the selling stockholders will sell shares based on the market price of such shares.

11

The issuance of preferred stock could adversely affect the rights of the holders of common stock.

The Board of Directors has the authority to issue up to 10,000,000 shares of preferred stock in one or more series, to fix the number of shares constituting any such series, and to fix the rights and preferences of the shares constituting any series, without any further vote or action by the stockholders. The issuance of preferred stock by the Board of Directors could adversely affect the rights of the holders of common stock. For example, such issuance could result in a class of securities outstanding that would have preferences with respect to voting rights and dividends and in liquidation over the common stock, and could (upon conversion or otherwise) enjoy all of the rights appurtenant to common stock. The Board's authority to issue preferred stock could discourage potential takeover attempts and could delay or prevent a change in control of the Company through merger, tender offer, proxy contest or otherwise by making such attempts more difficult to achieve or more costly. There are no issued and outstanding shares of preferred stock; there are no agreements or understandings for the issuance of preferred stock, and the Board of Directors has no present intention to issue preferred stock.

We may be subject to penny stock regulations and restrictions, and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define a “penny stock” as an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. Although there is currently no market for our common stock, our common stock may be deemed a “penny stock” and be subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule.” This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000, excluding the value of the primary residence of such individuals, or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market (if a market for our stock ever develops), thus possibly making it more difficult for us to raise additional capital.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule required by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market of penny stocks.

There can be no assurance that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict persons from participating in a distribution of a penny stock, under certain circumstances, if the SEC finds that such a restriction would be in the public interest.

If a market develops, offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If a market for our common stock ever develops, our stockholders could sell substantial amounts of common stock in the public market, including shares sold upon the filing of this Registration Statement (or other registration statements that we could potentially file in the future) that registers such shares and/or upon the expiration of any statutory holding period under Rule 144 of the Securities Act, if available, or upon trading limitation periods. Such volume could create a circumstance commonly referred to as an “overhang” and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make it more difficult for us to secure additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

12

Our Directors and officers have rights to indemnification.

Our Articles of Incorporation provide, as permitted by governing Nevada law, that we will indemnify our Directors, officers and employees whether or not then in service as such, against all reasonable expenses actually and necessarily incurred by him or her in connection with the defense of any litigation to which the individual may have been made a party because he or she is or was a Director, officer or employee. The inclusion of these provisions in the Articles may have the effect of reducing the likelihood of derivative litigation against Directors and officers, and may discourage or deter stockholders or management from bringing a lawsuit against Directors and officers for breach of their duty of care, even though such an action, if successful, might otherwise have benefited us and our stockholders.

We do not anticipate paying any cash dividends.

We do not anticipate paying cash dividends on our common stock for the foreseeable future. The payment of dividends, if any, would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings, if any, to implement our business strategy; accordingly, we do not anticipate the declaration of any dividends in the foreseeable future.

USE OF PROCEEDS

We will not receive any proceeds from the resale of already issued and outstanding shares of common stock by the selling stockholders which are offered in this Prospectus.

DILUTION

The common stock to be sold by the selling stockholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing stockholders.

DETERMINATION OF OFFERING PRICE

All shares of common stock being offered hereby will be sold by existing stockholders without our involvement. Consequently, the actual price of the stock will be determined by prevailing market prices at the time of sale (if a market for our common stock develops) or in private transactions negotiated by the selling stockholders. The offering price will thus be determined by market factors and/or the independent decisions of the selling stockholders.

LEGAL PROCEEDINGS

We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results of operations. We may become involved in material legal proceedings in the future.

DESCRIPTION OF BUSINESS

Corporate History and Background

The Company was incorporated in December 1985 under the laws of the State of Nevada under the name “Cape Code Investment Company” and subsequently changed its name to “Cape Code Ventures, Inc.” In 1993, the Company changed its name to “Environmental Safeguards, Inc.” and its primary business became the development, production and sale of environmental remediation and recycling technologies and services to waste management companies, oil and gas companies, and other industrial customers through an operating subsidiary. In January 1997, the Company registered its common stock pursuant to Section 12(g) of the Exchange Act, and the Company became a fully reporting company with the SEC. Following a patent infringement lawsuit and related litigation initiated in July 2002, the Company’s operating subsidiary filed for bankruptcy in August 2004 and ceased operations. After the Company failed to remain current in its reports with the SEC, in November 2007 the SEC revoked the Company’s registration under Section 12 of the Exchange Act, and the Company ceased to be a reporting company with the SEC.

13

On July 21, 2011, the Company entered into and closed a Share Exchange Agreement (the “Exchange Agreement”) with The One World Doll Project Inc ("OWDP"), a Texas corporation, and the OWDP Stockholders. At closing, the OWDP Stockholders transferred all of their shares of common stock to the Company in exchange for an aggregate of 130,013,584 newly issued shares of the common stock of the Company. Upon closing of this transaction, the Company had 143,577,591 shares of common stock issued and outstanding. The 130,013,584 shares issued to the OWDP Stockholders at closing represented 90.55% of the Company’s voting securities.

As a result of the transactions effected by the Exchange Agreement, at closing (i) OWDP became a wholly-owned subsidiary of the Company, (ii) the Company abandoned all of its previous business plans involving environmental remediation and recycling, and (iii) the business of OWDP became the Company’s sole business. OWDP is a development stage company, incorporated under the laws of the State of Texas in January 2011. It is engaged in the development and production of different lines of multi-cultural dolls. Descriptions of the Company’s business hereinafter refer to the business of OWDP.

On July 26, 2011, the Company effected a reverse stock split of the Company's common stock at a split ratio of 1-for-2.5. Every two and one half pre-split shares of common stock, $.001 par value per share, issued and outstanding immediately prior to the stock split were automatically exchanged for one post-split share of common stock, $.0025 par value per share, with any fractional shares resulting from the exchange being rounded up to the nearest whole share. Accordingly, the number of shares of the Company's common stock issued and outstanding has been reduced from 143,577,591 shares to approximately 57,431,036 shares. Contemporaneous with the reverse stock split, the Company reduced the number of authorized shares of common stock from 250,000,000 shares, par value $.001, to 100,000,000 shares, par value $.0025. All shares amount within this Prospectus reflect post-reverse split numbers.

Business Concept

The concept behind the creation of The One World Doll Project is one that is based on a meeting between Trent T. Daniel, founder and Consultant of OWDP, and Ms. Stacey McBride-Irby, a creator of the So In Style™ line of Barbie® products offered by one of the nation’s leading toy and game company, Mattel. As a creator of this line of dolls, Stacey McBride-Irby achieved recognition due to the appeal of the So In Style™ dolls. Mr. Daniel and Ms. McBride-Irby determined that there was a major opening in the market for multi-cultural dolls that were 100% authentic to the varying hair, skin, body and facial features possessed by members of various ethnic communities. Shortly thereafter, The One World Doll Project Inc began its entry into the $20 billion a year market of dolls and stuffed toys. As described above under “Corporate History and Background,” The One World Doll Project Inc is now the operating subsidiary of One World Holdings, Inc.

The One World Doll Project

|

The initial concept for the One World Doll Project began with the plan to release a line of mainstream African-American dolls and a line of African-American celebrity dolls aimed at high-end collectors and young pre-teen girls. At current, the doll market is dominated by two major players, Mattel, which reported 2010 net revenues of $5.9 billion and earnings of $685 million, and Hasbro, which reported net revenues of $4.0 billion and earnings of $398 million. While Hasbro is a close competitor to Mattel, it should be noted that a majority of Hasbro’s income is generated from non-doll toys such as board games and action figures. The next closest competitor to Mattel and Hasbro is JAKKS Pacific, which reported 2010 net revenues of $747 million and earnings of $47 million.

Due to the size and market domination by Mattel and Hasbro, our strategy for competing is to initially focus on the African-American and multi-cultural markets which are extremely underrepresented by Mattel and Hasbro. To avoid the “in store” and limited shelf space competition of retail chains, we will focus our core sales model on internet and direct sales. By maintaining a web-based sales model, we can effectively capture our first year market of African-American doll buyers through specific advertising and promotions on traditional black media such as BET, TV1, Ebony, Essence and Jet magazines. After we have successfully captured the African-American market, we will have the track record and ability to expand our market to reach more mainstream and multi-cultural markets.

|

14

Market Opportunity

We have identified four primary customer segments in the doll market:

|

|

1.

|

Mainstream racially mixed children (including Anglo). This customer base consists of the 24.3 million children age 6-11 in the United States according to childstats.org.

|

|

|

2.

|

Black Sorority members. This customer base consists of over 750,000 African-American sorority members from the four African-American Pan Hellenic Sororities.

|

|

|

3.

|

Collectors of African-American celebrity dolls. These customers are high net-worth collectors and African-American celebrity enthusiasts.

|

|

|

4.

|

Celebrities wishing to have a doll designed by Stacey McBride-Irby. These customers will pay us to produce replica dolls of themselves.

|

Competition

According to a Dun and Bradstreet’s Zapdata Database and an industry report on Standard Industrial Classification (“SIC”) Code 3942 (Doll and Stuffed Toy manufacturing), there are 506 companies in the United States that fall within the North American Industry Classification System (“NAICS”) designation of Doll and Stuffed Toy manufacturing. Of these 506 companies only 11 reported 2010 sales of more than $5 million and only five of those reported sales of $20 million or more.

Of the five companies that reported sales of $20 million or more, Mattel and Hasbro are the dominant players, reporting sales of approximately $5.9 billion and $4.0 billion, respectively, for 2010. These figures give a good snapshot of the fierce competition presented to any competitor in this space by Mattel and Hasbro. However, due to the overwhelming demand for multi-cultural dolls, especially African-American dolls, we believe The One World Doll Project is in a perfect position to establish a foothold in the American doll market.

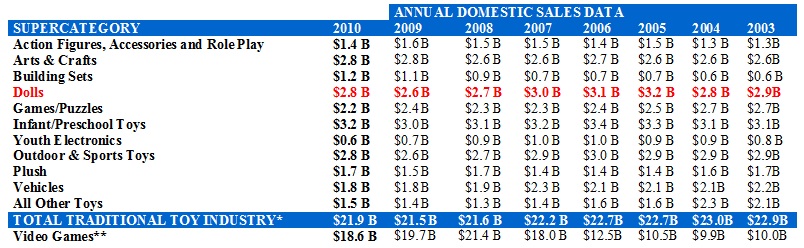

Historical Industry Wide Doll Sales

In 2010, consumers in the United States spent approximately $2.8 billion on dolls. The amount of annual sales of dolls in the United States has remained fairly consistent in recent years. The table below tracks annual domestic sales of the different segments within the toy industry for the last eight years:

15

*Source: The NPD Group / Consumer Panel Tracking ** Source: The NPD Group / Retail Tracking Service

Product Description

Our initial line of dolls will be labeled the “Prettie Girls!”, and will include six different multi-cultural doll designs—Sophia (two versions), Dahlia, Valencia, Kimani and Lena. Each of these six initial designs will have varying skin colors and features, along with their own outfit and accessories. In the future, we will design additional Prettie Girls! dolls that resemble other racial groups. Each of Sophia, Dahlia, Valencia, Kimani and Lena will have her own personal identity and background, as follows:

Sophia Having graduated with honors from the Dream Academy For Excellence, being a tennis star, Class President and in the Glee Club, with the voice of an angel, Sophia was the ultimate role model to the Prettie Girls!, always encouraging them to be their best, go for their dreams and participate in school activities. Now, Sophia is leading by example and going for her own dreams, as she plans to attend the Dream Academy for Higher Learning to pursue studies in Political Science. Will she be the first female President of the United States?

Dahlia You can always count on Dahlia for a good, belly aching laugh! With an energy that is electric, Dahlia is a natural born comedian, and loves being the center of attention. With her brilliant mind and quick wit, she is loved by all, especially by her cute puppy, Chance, that she rescued. Through her humorous and caring spirit, she is good at encouraging her friends to volunteer their time, skills & allowance money to give back to their communities. Although she is gentle and caring in nature, she is a beast when it comes to saving the planet! Are you recycling?

Kimani Kimani is beautiful on the inside and out. The best friend anyone could ever have. You can trust Kimani with your ultimate secret. When it comes to needing the perfect outfit, to the right jewelry or for any fashion tip, Kimani is the go to girl. Nothing can shake Kimani from experiencing joy. She is a spit fire, energetic free spirit & marches to the beat of her own drum. Artistic and creative in nature, Kimani loves the arts and dreams of red carpet moments. Watch for her name in lights!

Valencia Bold & daring, loving life is Valencia’s claim to fame! As a part of her passion for life, Valencia is all about working out and eating right! The athletic one is always focused on being her best self. Whenever you are around Valencia, be ready to move! She's a party all by herself! To be around her is so much fun because she is always moving and grooving to the hottest song, as a way to stay fit. She loves watching cooking shows to test her healthy “meals skills” on her friends. With her fun way of cooking healthy foods along with her exciting exercise tips, you can almost smell her own show coming to a network near you!

16

Lena Lena is fun, fresh, confident, exciting and has made being smart cool! Her friends call her “The Wiz Kid” because whatever she puts her mind to, she will come out on top! A straight A student, spelling bee champ, and top fundraiser on the cheerleading squad, Lena always finds time to help her friends with their homework & class projects. Setting goals is key, next move: Class President. An up and coming entrepreneur, you better believe the next big invention will be Lena’s!

Target Market

According to the United States 2010 Census Bureau reports and childstats.org, there are 24.3 million children in the U.S. between the ages of 6-11. Our goal is to capture at least 0.73% (177,000) of this market within our first year and to obtain at least 2.36% (572,404) of this market by the end of year three. While we will be competing for the total doll market, the multi-cultural market presents a substantial “out of the gate” opportunity.

With a primary focus on African-American broadcast and print outlets, we believe we can quickly capture a significant portion of the African-American target market. In order to accomplish this, we will maintain two first year marketing and public relations focal points. The first will be African-American mass media, and the second will be through web and social media.

With the mass media, we will flood the African-American marketplace with our brand through heavy TV, radio and print advertisements on African-American media outlets. We plan for these outlets to also include appearances and live promotions on shows such as Warren Ballentine, The Steve Harvey Show, Mo’Nique and more. We believe these shows can be booked based on our existing celebrity relationships. Print outlets will include Ebony, Essence and Jet magazine.

Business Strategy

Our strategy is to be the leading provider of multi-cultural doll products to the specialty, affinity, and mass merchandise retail marketplace through a focus on direct and online sales models. Key elements of our strategy include:

|

1.

|

Developing a strong online presence for The One World Doll Project. By focusing our core sales on internet and catalog sales, we believe we will be able to capture our market while eliminating the “eye level competition” we would face in the retail stores.

|

|

2.

|

Driving business by utilizing the celebrity of our lead doll designer to promote the products globally. We will be conducting a major global PR campaign around Stacey McBride-Irby, as the creator of the So In Style line of Barbie dolls.

|

|

3.

|

Using the power of celebrity partners and PR to develop relationships with major store chains. In year two, we intend to conduct celebrity VIP meet and greets, etc., to introduce and promote The One World Doll Project to major store chains.

|

Marketing Overview

The One World Doll Project is expected to be introduced to consumers in the first quarter of 2012 largely through a very comprehensive, strategic, and highly targeted public relations effort. We will use a national media relations campaign to launch the Company and our products, emphasizing the players involved and the cultural impact of our products. Our campaign will include the major print, online and broadcast news media. Other grassroots and social media tactics will be coordinated to create a sizable groundswell of interest and significant word-of-mouth buzz.

The following is an outline of initial public relations opportunities proposed to launch The One World Doll Project that will run concurrent with and be supported by marketing efforts, promotions, advertising and retail support, to be determined by market research conducted in the next phase of the project.

17

Marketing Objectives

|

·

|

Establish The One World Doll Project as one of the most significant positive cultural impacts in the doll category.

|

|

·

|

Position Stacey McBride-Irby as the driving force and key catalyst behind the movement to change the way mainstream dolls are designed, marketed and integrated into the fabric of the ever-changing face of America and abroad.

|

|

·

|

Foster and develop strategic partnerships with high-profile black women’s groups and organizations, such as sororities, etc.

|

|

·

|

Achieve major news media coverage in the launch period and beyond to not only generate consumer interest and attention, but also to drive sales.

|

|

·

|

Create and encourage a dialogue in the community about The One World Doll Project and solicit new ideas and product/promotion suggestions.

|

Marketing Strategies

The One World Doll Project seeks to revolutionize the multi-cultural doll market. Under the creative/design leadership of Stacey McBride-Irby, we seek to corner a significant percentage of the United States domestic doll market among mothers, families, and their daughters. This effort is greatly dependent upon the quality, feel, early brand development, and adoption of the dolls by young girls and their families.

Our success depends heavily upon our design and marketing team’s ability to strike the right chord with the 4-12-year old girl market. No group talks and shares more than little girls. We will create a great product that girls talk about and share. We want them to imagine themselves and their world through their dolls’ eyes. The One World Doll Project seeks to understand, market to, and intuitively commercialize the 4-12 -year old girl market through gaming, “eventizing,” focus groups, strategic earned media, paid media, boutique organizational partnerships, ancillary media brand opportunities, and an inherent finger on the pulse of the multi-cultural girl and her sensibilities.

The daunting proposition of capitalizing on the opportunity among multi-cultural doll buyers has been undertaken many times in the past by large toy manufacturers and by small, niche companies. The rationale for creating similar lines is manifold and immediate. We believe we are perfectly positioned to succeed for several significant reasons.

|

·

|

One, there is no substitute for desirable dolls and toys that resonate with children. Children will pester their parents, teachers, Sunday school teachers, grandparents, older siblings, and anyone else who will listen to achieve their consumption desires. The cornerstone of our Company is the product and the wherewithal to wrap that product in an aggressive marketing and message program. This campaign’s effectiveness will ultimately be measured by the effect it has on creating measurable and scalable demand from girls. At the end of the day, this innovative proposition is predicated upon products that stand out in the clutter of a crowded toy market.

|

|

·

|

Two, Ms. McBride-Irby brings to the Company product design and development experience within the doll industry. Given the creative and production freedom and platform of The One World Doll Project, Ms. McBride-Irby will be allowed to use her creativity to tap into the body of influence around her likely consumers.

|

18

|

·

|

Three, there is a huge, disaggregated market of toy consumers looking to buy multi-cultural dolls and to communicate racial/cultural self esteem to their children. Historically, multi-cultural dolls have simply been colorized – white dolls made Black, brown, or yellow. Our dolls will be more authentic and genuine approximations of women from multi-cultural backgrounds. Assisted by viral and social media, we seek to leverage this market through intensive efforts of marketing directly in platforms and among organizations like churches, fraternities, sororities, civic groups with cultural orientations, and professional groups concerned with advancing specific cultural self-awareness. Aggregating and expertly messaging individuals and organizations with these sensibilities is a key component of a larger path to success.

|

|

·

|

Four, there is a rising tide of sensibility among non-minority girls to widen the circle of inclusion, reflecting their friends, family, and world. We seek to be the most effective and efficient mover in this space through our diverse offerings. Princess Tiana™, from Disney Animation’s “The Princess and the Frog,” established in Christmas 2009 the viability of Disney’s ethnic products. The Princess Tiana™ product line sold very well with data pointing to heavy consumption from non-Black families.

|

The One World Doll Project story and its emphasis on positive narratives and self-esteem are hallmarks of our marketing strategy. Where other dolls appeal only to fashion, coolness, and trends, The One World Doll Project will marry those elements with multi-cultural awareness. We believe this will be a very valuable approach that will differentiate us and resonate with our target market.

Early Pillars of Marketing Campaign

Celebrity and Icons

Celebrity and thought leadership will drive positive reception and scale in media. We expect to indentify and pitch iconic leaders and celebrity influencers for promotional and endorsement support. We are specifically targeting child-age and mommy-age leaders and celebrities.

Partnerships and Organizations

Organizations such as The National Urban League, NAACP, National Medical Association, National Dental Association, National Association of Black School Educators, Jack and Jill, Twigs, and 100 Black Men are samples of boutique organizational relationships we will seek with large supportive and leverage-able networks. Organizations and partnerships serve as additional catalysts and brand extenders for media and mainstream acceptance to capture, maximize, and retain market share.

Media Partnerships, Earned Media, Social Media

We have had discussions with a large group of female ethnic bloggers and social media mavens regarding providing support for the initial rollout of The One World Doll Project. We believe a consumer product relationship with a large scale of bloggers will provide a huge down payment on earned and “planted” media. In this regard, our team can “cash in” reputational capital that competitors would be incapable of accessing.

Gamification

In order to stay competitive in the emerging realm of computer and online games, we plan to develop games that will incorporate the Prettie Girls characters into alternative counter-reality worlds, allowing girls to become their favorite doll and create online environments where they can live out their fantasies.

Eventizing

The One World Doll Project and Prettie Girls! model calls and regional competitions (as described in more detail below) will allow the Prettie Girls! brand to be introduced into certain U.S. markets with an “American Idol” style talent search. With partner organizations, we plan to leverage the desire of parents, girls, and their communities to exhibit the highest standards of excellence, beauty, talent, skill, poise, and self-esteem. We plan to work directly with known brands to create events that drive consumer traffic to our media platforms, social media, and consequently capture consumer data from prospective consumers. “Eventizing” allows us to plant our flag in local markets and to create additional product supply touch points for retailers, partners, and other associated entities.

19

Digital and Social Media

Through highly messaged social media and The One World Doll Project digital platforms we plan to design and manage an online environment with customized content that engages the young and computer proficient user on a daily basis. This will be a hallmark of our larger plan for product launches and customer retention. Formidable barriers to entry and sustainability with paid media create a difficult environment for us. Instead of relying solely on declining paid media platforms, we endeavor to maximize social media and digital platforms that thrust girls and their responsible parents, guardians, or friends into endless virtual worlds.

Client Relationship Management

Every effort will be made to ensure that current and potential customers will become part of the One World Doll Project online and social community. This community will be populated by young ladies and their families with news, information, and personalized message boards that allow them to express their individuality, likes, aspirations, and desires for their life.

Focus Groups

We will strive to have up-to-date market research on our target market of girls, age 4-12 years old, by regularly organizing focus groups. The data and information gathered will influence media buys, doll design, eventizing, partnerships, and the overall operation of the Company.

The REAL Prettie Girls!(tm)

We will hold a talent search competition to form a real entertainment group of girls named the “Prettie Girls.” The Prettie Girls Talent Search is conceived to create a driver to connect cyber and other direct marketing with a “bricks & mortar” presence. The competition will be an online based national outreach to first inform and then engage consumers, investors, and the public at large nationally. We anticipate the competition will have three rounds—local, regional, and national. Girls will be eligible to enter the competition with an online purchase of a Prettie Girls! doll. The regional and national rounds will be actual events where contestants will perform in front of judges and a live audience of fans. Contestants will be judged in each round based on their demonstrated skills and intangibles. Fans will be able to view and vote for contestants online through our website. We plan to target multiple marketing partners in order to bring attention to the competition.

Production and Manufacturing

To begin our entry into the market place, we anticipate releasing our first six dolls in time for summer 2012. In the first quarter of 2012, we will begin mass marketing and public relations of all six dolls.

In order to produce the highest quality products we have engaged a third party manufacturer in China to manufacture our initial inventory of dolls, taking advantage of its experience and more than 25 million square feet of production and warehousing space. Our manufacturer’s client base includes some of the world’s biggest toy and game developers including Mattel, Fisher-Price, MGA Entertainment, Lego, Hasbro, Playskool, MTV, Lionel, Disney and many more.

Our costs are consistent with customary industry practices that will include three main costing phases: pre-production, production and post-production. The pre-production phase is a setup process that involves development of all tools and equipment needed to produce the dolls and their accessories including clothes, shoes, jewelry as well as face painting masks. This setup phase bears the greatest amount of up-front costs but will give the Company everything needed to produce multiple dolls and accessories from the same set of tools. These tools will be developed from high yield metals and synthetics that will yield hundreds of thousands of units before needing replacement. These tools will remain the property of the Company but will be stored at the manufacturer’s facilities for future use. The second phase, production, will include the actual production, assembly and packaging of the dolls. This process will also include testing of the dolls for safety requirements set by the U.S. government. The third phase will include shipping and further safety and hazards testing.

20

Trademarks, Copyrights and Patents

We anticipate most of our products being sold under trademarks, trade names, and copyrights, and some products may incorporate patented devices or designs. Such intellectual property could become significant assets in that they will provide product recognition. We intend on seeking patent, trademark, or copyright protection covering our products. We will use our best efforts to ensure the rights to these properties are adequately protected, but there can be no assurance that our rights can be successfully asserted in the future or will not be invalidated, circumvented, or challenged.

Government Regulations

Any dolls we sell in the United States will be subject to the provisions of the Consumer Product Safety Act, the Federal Hazardous Substances Act, and the Consumer Product Safety Improvement Act of 2008, and may also be subject to the requirements of the Flammable Fabrics Act or the Food, Drug, and Cosmetics Act, and the regulations promulgated pursuant to such statutes. These statutes ban from the market consumer products that fail to comply with applicable product safety regulations. The Consumer Product Safety Commission (“CPSC”) may require the recall, repurchase, replacement, or repair of any such banned products or products that otherwise create a substantial risk of injury and may seek penalties for regulatory noncompliance under certain circumstances. Similar laws exist in some states and in many international markets.

We will attempt to maintain a high level of quality control to help ensure compliance with various federal, state, and applicable foreign product safety requirements, if any. We may in the future, however, experience, issues in products that result in recalls, withdrawals, or replacements of products. A product recall could have a material adverse effect on our results of operations and financial condition. A product recall could also negatively affect our reputation and the sales of our other products.

Environmental Issues

We are subject to legal and financial obligations under environmental, health and safety laws in the United States. We are not currently aware of any material environmental liabilities associated with any of our operations.

Employees