Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLIED HEALTHCARE PRODUCTS INC | v239954_8k.htm |

1 ALLIED HEALTHCARE ANNUAL SHAREHOLDER MEETING November 10, 2011

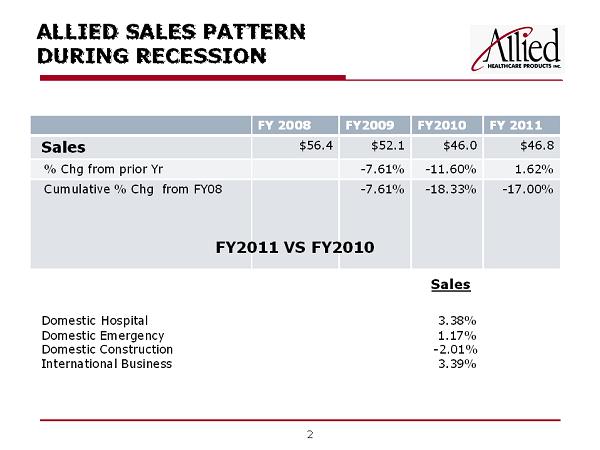

ALLIED SALES PATTERN DURING RECESSION FY 2008 FY2009 FY2010 FY 2011 Sales $56.4 $52.1 $46.0 $46.8 % Chg from prior Yr - 7.61% - 11.60% 1.62% Cumulative % Chg from FY08 - 7.61% - 18.33% - 17.00% 2 FY2011 VS FY2010 Sales Domestic Hospital 3.38% Domestic Emergency 1.17% Domestic Construction - 2.01% International Business 3.39%

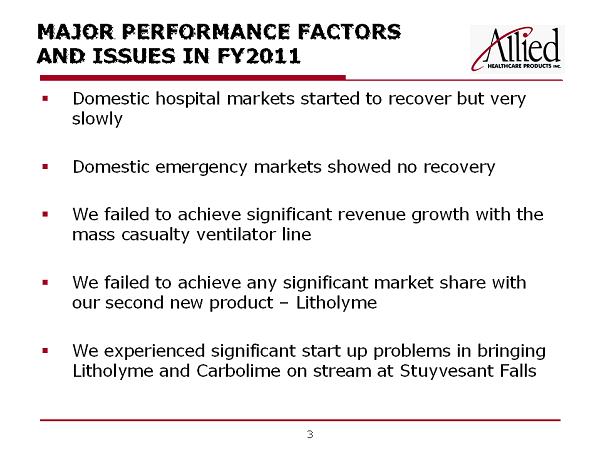

MAJOR PERFORMANCE FACTORS AND ISSUES IN FY2011 ▪ Domestic hospital markets started to recover but very slowly ▪ Domestic emergency markets showed no recovery ▪ We failed to achieve significant revenue growth with the mass casualty ventilator line ▪ We failed to achieve any significant market share with our second new product – Litholyme ▪ We experienced significant start up problems in bringing Litholyme and Carbolime on stream at Stuyvesant Falls 3

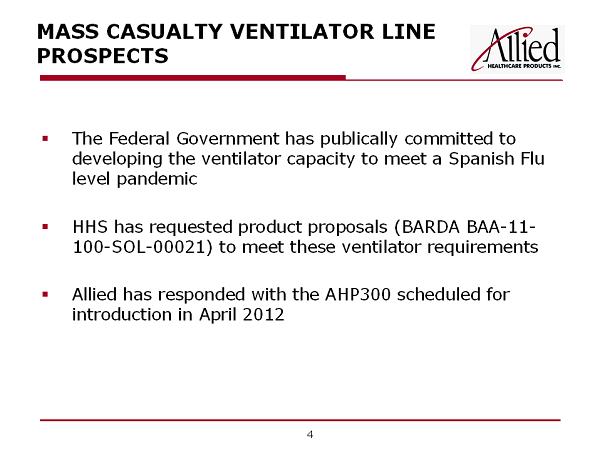

MASS CASUALTY VENTILATOR LINE PROSPECTS ▪ The Federal Government has publically committed to developing the ventilator capacity to meet a Spanish Flu level pandemic ▪ HHS has requested product proposals (BARDA BAA - 11 - 100 - SOL - 00021) to meet these ventilator requirements ▪ Allied has responded with the AHP300 scheduled for introduction in April 2012 4

AHP 300 5

LITHOLYME Product Advantages over Conventional CO ₂ Absorbents ▪ Does not produce Carbon Monoxide or other chemical by - products when it is desiccated ▪ Produces a permanent color change when spent Litholyme is priced at parity with Conventional CO ₂ Absorbents Why no take off? 6

LITHOLYME 7 ▪ Machine Specific Cartridges ▪ Standard Packaging

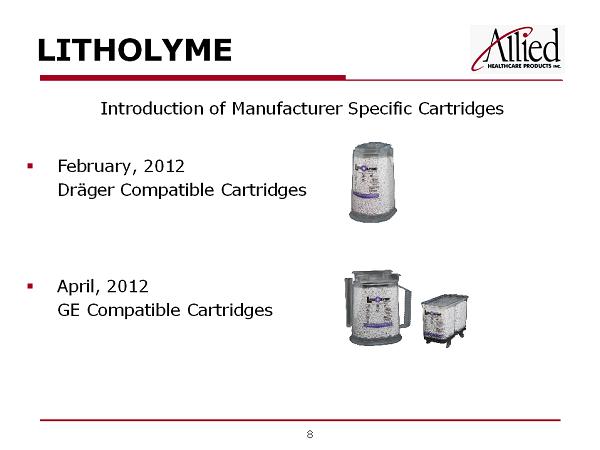

LITHOLYME Introduction of Manufacturer Specific Cartridges ▪ February, 2012 Dräger Compatible Cartridges ▪ April, 2012 GE Compatible Cartridges 8

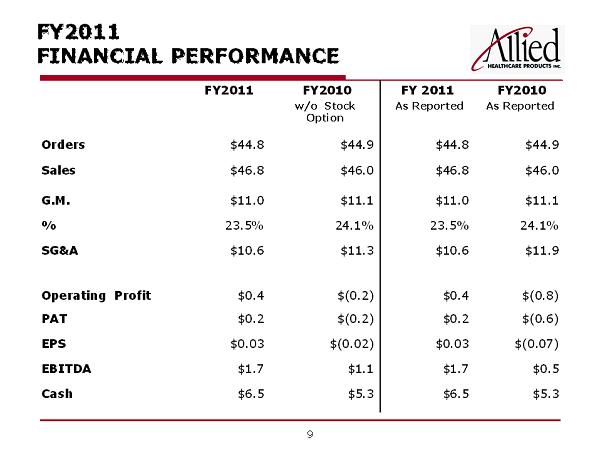

9 FY2011 FINANCIAL PERFORMANCE FY2011 FY2010 w/o Stock Option FY 2011 As Reported FY2010 As Reported Orders $44.8 $44.9 $44.8 $44.9 Sales $46.8 $46.0 $46.8 $46.0 G.M. $11.0 $11.1 $11.0 $11.1 % 23.5% 24.1% 23.5% 24.1% SG&A $10.6 $11.3 $10.6 $11.9 Operating Profit $0.4 $(0.2) $0.4 $(0.8) PAT $0.2 $(0.2) $0.2 $(0.6) EPS $0.03 $(0.02) $0.03 $(0.07) EBITDA $1.7 $1.1 $1.7 $0.5 Cash $6.5 $5.3 $6.5 $5.3

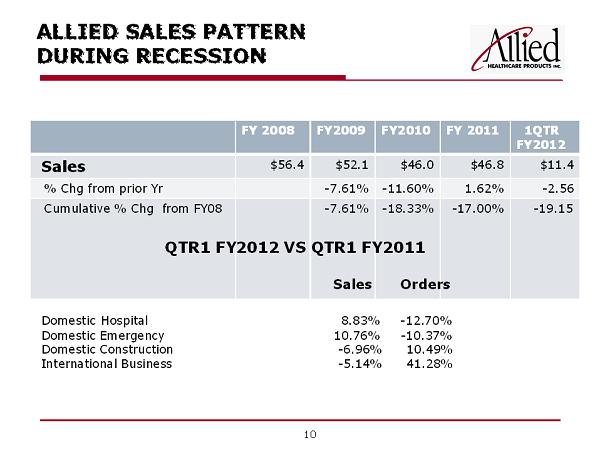

ALLIED SALES PATTERN DURING RECESSION FY 2008 FY2009 FY2010 FY 2011 1QTR FY2012 Sales $56.4 $52.1 $46.0 $46.8 $11.4 % Chg from prior Yr - 7.61% - 11.60% 1.62% - 2.56 Cumulative % Chg from FY08 - 7.61% - 18.33% - 17.00% - 19.15 10 QTR1 FY2012 VS QTR1 FY2011 Sales Orders Domestic Hospital 8.83% - 12.70% Domestic Emergency 10.76% - 10.37% Domestic Construction - 6.96% 10.49% International Business - 5.14% 41.28%

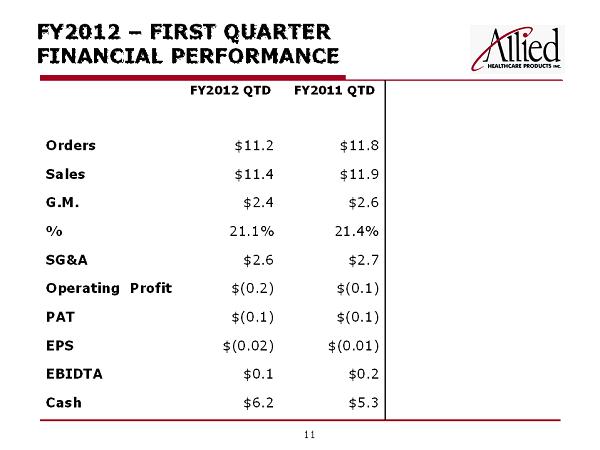

FY2012 – FIRST QUARTER FINANCIAL PERFORMANCE 11 FY2012 QTD FY2011 QTD Orders $11.2 $11.8 Sales $11.4 $11.9 G.M. $2.4 $2.6 % 21.1% 21.4% SG&A $2.6 $2.7 Operating Profit $(0.2) $(0.1) PAT $(0.1) $(0.1) EPS $(0.02) $(0.01) EBIDTA $0.1 $0.2 Cash $6.2 $5.3

▪ Non - GAAP Measures » The Company has presented its SG&A expense, operating profit, profit after tax, earnings per share and EBITDA for FY 2011 and 2010 with a side - by - side comparison to such amounts adjusted to exclude the effects of stock option expenses in FY 2010. The company believes that these non - GAAP measures are important because they eliminate non - recurring, non - cash charges to allow comparison of year - over - year performance. These non - GAAP financial measures are not intended to be a substitute for the comparable GAAP measures and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. » The stock option expense of the Company in FY 2010 was $.6 million. 12