Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Linkwell CORP | v238930_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Linkwell CORP | v238930_ex32-1.htm |

| EX-31.4 - EXHIBIT 31.4 - Linkwell CORP | v238930_ex31-4.htm |

| EX-23.1 - EXHIBIT 23.1 - Linkwell CORP | v238930_ex23-1.htm |

| EX-31.3 - EXHIBIT 31.3 - Linkwell CORP | v238930_ex31-3.htm |

| EX-31.2 - EXHIBIT 31.2 - Linkwell CORP | v238930_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Amendment No. 2)

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2010

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number: 000-24977

Linkwell Corporation

(Exact name of registrant as specified in its charter)

|

Florida

|

65-1053546

|

|

|

(State of Incorporation)

|

(I.R.S. Employer

Identification Number)

|

|

|

1104 Jiatang Road

Jiading District

Shanghai, China

|

201807

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Securities registered under Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

None

|

Not Applicable

|

Securities registered pursuant to section 12(g) of the Act: common stock, par value $0.0005 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer o

|

Accelerated Filer o

|

Non-accelerated Filer o

(Do not check if a smaller

reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $6,835,660.65.

The number of shares outstanding of capital stock as of March 29, 2011 was 86,605,475.

DOCUMENTS INCORPORATED BY REFERENCE

N/A.

EXPLANATORY NOTE

Linkwell Corporation (the “Company”) is filing this Amendment No. 2 to its Annual Report on Form 10-K/A (this “Amendment”) to its Annual Report on Form 10-K for the year ended December 31, 2010 filed with the Securities and Exchange Commission (the “SEC”) on March 31, 2011 (the “Original Report”), as previously amended by Form 10-K/A filed with the SEC on October 26, 2011 (“Amendment No. 1”), to amend the following:

1) Item 15 of Part IV, to include revised certifications in accordance with the language set forth in Item 601(b)(31) of Regulation S-K in response to SEC comments.

For the purposes of this Amendment, the Original Report and Amendment No. 1 have been amended and restated in their entirety. No other changes have been made to the Original Report. This Amendment speaks as of the original filing date of the Original Report, does not reflect facts or events that may have occurred subsequent to the filing date of the Original Report, and does not modify or update in any way any other disclosures made in the Original Report, or subsequent to any periods for which disclosure was otherwise provided in the Original Report. Accordingly, this Amendment should be read in conjunction with our filings with the SEC subsequent to the filing date of the Original Report, including any amendments thereto.

TABLE OF CONTENTS

|

Part I

|

||||

|

Item 1.

|

Business.

|

2 | ||

|

Item 1A.

|

Risk Factors.

|

20 | ||

|

Item 1B.

|

Unresolved Staff Comments.

|

28 | ||

|

Item 2.

|

Properties.

|

28 | ||

|

Item 3.

|

Legal Proceedings.

|

28 | ||

|

Item 4.

|

(Removed and Reserved).

|

28 | ||

|

Part II

|

||||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

29 | ||

|

Item 6.

|

Selected Financial Data.

|

29 | ||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

29 | ||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

36 | ||

|

Item 8.

|

Financial Statements and Supplementary Data.

|

36 | ||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

36 | ||

|

Item9A.

|

Controls and Procedures.

|

36 | ||

|

Item 9B.

|

Other Information.

|

38 | ||

|

Part III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

38 | ||

|

Item 11.

|

Executive Compensation.

|

40 | ||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

41 | ||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

44 | ||

|

Item 14.

|

Principal Accounting Fees and Services.

|

45 | ||

|

Part IV

|

||||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

46 | ||

|

Signatures

|

49 |

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this annual report contain or may contain forward-looking statements that are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, our ability to increase our revenues, develop our brands, implement our strategic initiatives, economic, political and market conditions and fluctuations, government and industry regulation, U.S. and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control.

You should consider the areas of risk described in connection with any forward-looking statements that may be made in this annual report. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this annual report in its entirety, including the risks described in Part I, Item 1A, Risk Factors. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this annual report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

OTHER PERTINENT INFORMATION

As used herein, unless the context indicates otherwise, the terms:

“Linkwell”, the “Company”, “we” and “us” refers to Linkwell Corporation,

a Florida corporation;

“Linkwell Tech” refers to our 90% owned subsidiary Linkwell Tech Group, Inc.,

a Florida corporation;

“LiKang Disinfectant” refers to Shanghai LiKang Disinfectant High-Tech Company, Limited,

a wholly-owned subsidiary of Linkwell Tech;

“LiKang Biological” refers to Shanghai LiKang Biological High-Tech Co., Ltd.,

a wholly owned subsidiary of LiKang Disinfectant;

“LiKang International” refers to Shanghai LiKang International Trade Co., Ltd.,

formerly a wholly owned subsidiary of LiKang Disinfectant which was sold to Linkwell International Trading Co., Limited on May 31, 2008.

We also use the following terms when referring to certain related parties:

“Shanhai” refers to Shanghai Shanhai Group, a Chinese company which used to be the minority owner of LiKang Disinfectant;

“Meirui” refers to Shanghai LiKang Meirui Pharmaceuticals High-Tech Co., Ltd., a company of which Shanhai is a majority shareholder;

“ZhongYou” refers to Shanghai ZhongYou Pharmaceutical High-Tech Co., Ltd., a company owned by Shanghai Jiuqing Pharmaceuticals Company, Ltd., whose 65% owner is Shanghai Ajiao Shiye Co. Ltd. Our Chairman and Chief Executive Officer Xuelian Bian is a 60% shareholder of Shanghai Ajiao Shiye Co. Ltd.

The People's Republic of China is herein referred to as China or the PRC.

The information which appears on our web site at www.linkwell.us is not part of this report.

1

PART I

ITEM 1. BUSINESS.

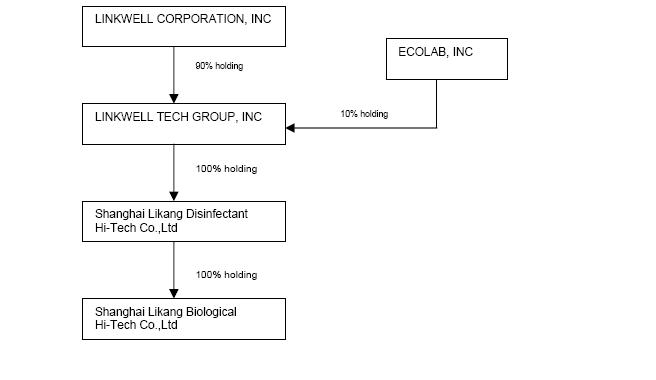

We operate under a holding company structure and currently have one direct operating subsidiary, Linkwell Tech Group Inc. (“Linkwell Tech”), a Florida corporation, of which we own 90%. On February 15, 2008, Linkwell Tech sold 10% of its issued and outstanding capital stock to Ecolab Inc., a Delaware corporation (“Ecolab”). Linkwell Tech owns 100% of Shanghai LiKang Disinfectant High-Tech Company, Limited (“LiKang Disinfectant”). LiKang Disinfectant's business is hospital disinfectant products which is our primary business. LiKang Disinfectant acquired 100% of LiKang Biological on March 5, 2009.

Linkwell Corporation, indirectly through LiKang Disinfectant, is engaged in the development, manufacture, sale and distribution of disinfectant health care products primarily to the medical industry in China. We have a national marketing and sales presence throughout all twenty-two provinces, as well as four autonomous regions, and four municipalities in China. We currently employ 33 full-time sales and marketing employees based in Shanghai. Shanghai ZhongYou Pharmaceutical High-Tech Co., Ltd, (“ZhongYou Pharmaceutical”) a company which is 65% owned by our Chairman and Chief Executive Officer Xuelian Bian, also sells our products using 62 independent sales representatives in China.

While we market our products to the medical industry in China, we are also making efforts to diversify and expand our products to reach the retail markets. We have made efforts to grow our customer base by expanding into the civil, industrial, livestock and agricultural disinfection markets of China. Currently we offer a variety of disinfectant products for the following applications:

· Skin and mucous membrane disinfectants;

· Hand disinfectants (external);

· Environment and surface disinfectants;

· Medical devices and equipment disinfectants;

· Machine disinfectants; and

· Animal disinfectants.

LiKang Disinfectant has 66 marketed products, 46 of which are certified by one or more government authority: the Chinese Ministry of Health, State Food and Drug Administration, or Ministry of Agriculture. China’s Ministry of Health approves products that require the highest level of licensing and have already granted 31 hygiene licenses to us. We also sell products which have been developed and manufactured by third parties. These parties manufacture disinfectant products that generated approximately 0.52% of our revenue for the fiscal year ended December 31, 2010. Products that we manufacture account for approximately 99.48% of our total net revenues for the fiscal year ended December 31, 2010.

Prior to May 31, 2008, we owned 100% of Shanghai LiKang International Trade Co. Ltd., through our subsidiary LiKang Disinfectant. The primary business of LiKang International was the import and export of a variety of products and services ranging from small medical equipment and chemical products to computers. On May 31, 2008, LiKang Disinfectant sold 100% of the capital stock of LiKang International to Linkwell International Trading Co., Ltd., a company registered in Hong Kong which is 100% owned by our Vice President and Director, Mr. Wei Guan.

2

On March 5, 2009, LiKang Disinfectant purchased 100% of LiKang Biological Company for approximately $291,792 (RMB 2,000,000) and 500,000 shares of our common stock.

As of 12/31/2010

Organizational Chart

Industry Background

In 2007, Frost & Sullivan stated, “The Chinese healthcare industry has been one of the fastest growing healthcare industries in the world. It is expected to become the fifth largest by 2010. Its growth is mainly driven by the government’s initiatives to simplify regulatory procedures, enhance trade relations, and attract foreign investment through friendly policies.”

According to the China Federation of Industrial Economics, China’s disinfectant industry is estimated to be well over $6.5 billion annually. The disinfectant industry in China may be characterized as an emerging industry, populated by approximately 1,000 small domestic manufacturers and distributors, and half a dozen large international companies with limited presence and products.

Major contributing factors responsible for the vigor of China’s disinfectant industry growth include the transition to a market economy, increasing health consciousness in the general population and increasing government health standards and education.

Increasing Domestic Demand

Since the shift to a market economy, the Chinese government has initiated several policies to improve public health and living standards and improve the Chinese healthcare industry. Consequently, these initiatives and traditional market forces have driven an increased demand for disinfectant products. According to Frost & Sullivan, China’s healthcare expenditures grew from 5.0% of GDP in 1999 to 6.7% in 2005, representing a growth rate of approximately 5%. During the same period, U.S. healthcare expenditures grew from 13.2% to 15.9%, representing a growth rate of approximately 3%.

3

After nearly 30 years of sustained economic growth in China, both the Chinese government and the public have become more concerned about the quality and cost of healthcare in China. A greater public awareness of the health benefits of our products, as well as growing public concern have led to a surge in interest for disinfectant products in China with consumers maintaining stockpiles of disinfectant products. Other factors that support the growth in demand for disinfectant products include:

· Rapidly increased infectious diseases spreading through the country, such as SARS, H1N1, AIDS, Super Bacteria and some other contagious diseases including cholera, turberculosis, etc.;

· Healthcare professionals and citizens wanting a healthcare system and hygienic standards as advanced as western countries;

· Ongoing government reforms in hospital sanitation, medical standards and disinfectant regulations;

· Government educational program increasing public awareness of public health and hygienic standards; and

· An increase in government investment in healthcare and medical services to achieve sustainable development of the disinfectant industry.

Recent Health Concerns in China

The most critical factors that triggered health concerns in China are the recent and recurring health crises that have led to several epidemics (see Table below) and potential pandemics. In response, the Chinese government has taken initiatives to improve public health and living standards, including the establishment of The Ministry of Public Health in China for the disinfectant industry in China.

|

Outbreak time

|

Location

|

Disease

|

Situation

|

|||

|

January 1988

|

Shanghai

|

Hepatitis A

|

310,000 reported cases of Hepatitis A, 47 deaths

|

|||

|

April - May 1998

|

Shenzhen

|

Sub-Tuberculosis bacillus disease

M. chelonae

|

Shenzhen Woman and Children Hospital reports an airborne infection. 168 patients infected, 46 severe cases

|

|||

|

November 2002

|

Throughout China

|

SARS

|

8,000 reported cases, 800 deaths

|

|||

|

June 24 - August 20, 2005

|

Sichuan Province

|

Streptococcus suis in swine and humans

|

204 reported cases of humans infected with the Swine streptococci in Sichuan, 38 deaths

|

|||

|

April 2005

|

Throughout China

|

Pulmonary tuberculosis, Hepatitis B

|

Pulmonary tuberculosis, Hepatitis B remain top two priorities on the infectious disease list in China

|

|||

|

June 2005

|

Tibet

|

Bubonic plague

|

Five infected cases reported, two deaths

|

|||

|

July-September 2005

|

Hunan, Fujian, Zhejiang provinces

|

Cholera

|

638 cases reported, two deaths

|

|||

|

August 2005

|

Guizhou, Ningxia, Liaoning, Jilin

|

Anthrax

|

140 cases reported, one death

|

|||

|

October 2005

|

Inner Mongolia, Hunan, Anhui, Liaoning, and Hubei provinces

|

Avian Flu

|

Three confirmed cases reported, two deaths

|

|||

|

October 2005

|

Zhejiang, Anhui provinces

|

Highly pathogenic bird flu

|

One confirmed case in each province reported

|

|||

|

March 24, 2006

|

Shanghai

|

Highly pathogenic bird flu

|

One confirmed case reported

|

|||

|

June 16,2006

|

Guangdong province

|

Highly pathogenic bird flu

|

One confirmed case reported

|

|||

|

August 14, 2006

|

XinJiang province

|

Highly pathogenic bird flu

|

One confirmed case reported

|

|||

|

January 9, 2007

|

Anhui province

|

Highly pathogenic bird flu

|

One confirmed case reported

|

|||

|

February 27, 2007

|

Fujian province

|

Highly pathogenic bird flu

|

One confirmed case reported

|

4

|

March 28, 2007

|

Anhui province

|

Highly pathogenic bird flu

|

One confirmed case reported

|

|||

|

May 24, 2007

|

People’s Liberation Army X department

|

Highly pathogenic bird flu

|

One confirmed case reported

|

|||

|

December 2, 2007

|

Jiangsu province

|

Highly pathogenic bird flu

|

One confirmed case reported

|

|||

|

December 6, 2007

|

Jiangsu province

|

Highly pathogenic bird flu

|

One confirmed case reported

|

|||

|

January-February , 2008

|

Xinjiang municipality

|

Measles Virus

|

11,000 cases reported, 21 deaths

|

|||

|

February 2008

|

Guangdong, Guangxi and Hunan provinces

|

Avian Flu

|

Three cases reported, three deaths

|

|||

|

April-May 2008

|

Nationwide

|

Hand, Foot and Mouth Disease

|

176,321 cases reported, 40 deaths

|

|||

|

January-September 2008

|

Nationwide

|

HIV

|

44,839 cases reported, 6,897 deaths

|

|||

|

October-November 2008

|

Hainan province

|

Cholera

|

42 cases reported

|

|||

|

October-November 2008

|

Hainan province

|

Diarrhea

|

351 cases reported

|

|||

|

January 2009

|

Nationwide

|

Avian Flu

|

Eight cases reported, five deaths

|

|||

|

April 2009

|

Worldwide

|

H1N1

|

12,220 deaths

|

|||

|

November 2009

|

Ukraine

|

Flu

|

1.4 million infected and 328 deaths

|

|||

|

January-December

2010

|

Nationwide

|

HIV

|

11,982 cases reported, 7,743 deaths

|

|||

|

October 2010

|

Ningxia Fujian

|

Super Bacteria

|

3 cases reported, 1 deaths

|

|||

|

January-December

2010

|

Nationwide

|

Cholera

|

157 cases reported

|

|||

|

January-December

2010

|

Nationwide

|

Hand, Foot and Mouth Disease

|

1,774,669, cases reported, 905 deaths

|

SARS - Severe Acute Respiratory Syndrome

In recent years, the Severe Acute Respiratory Syndrome (SARS) has threatened the community. SARS, which is a viral respiratory illness caused by a corona virus, called SARS-associated corona virus (SARS-CoV), was first reported in Asia in November 2002. Over the next few months, the illness spread to more than two dozen countries in North America, South America, Europe, and Asia before the SARS global outbreak of 2003 was contained. In April 2004, the Chinese Ministry of Health reported several new cases of possible SARS outbreaks in Beijing and the Anhui province, which is located in east-central China.

According to the Center for Disease Control of the central government of China, the common manner in which SARS appears to spread is by close person-to-person contact. The virus that causes SARS is thought to be transmitted most readily by respiratory droplets (“droplet spread”) when an infected person coughs or sneezes. Droplet spread occurs as germs from the cough or sneeze of an infected person are propelled a short distance (generally up to three feet) through the air and deposited on the mucous membranes of the mouth, nose, or eyes of nearby persons. The virus also can spread when a person touches a surface or object contaminated with infectious droplets and then touches his or her mouth, nose, or eye(s). Ultimately, there is much the global community does not know about SARS, and it is possible that the SARS virus might spread more broadly through the air (airborne spread) or by other ways that are not yet known.

5

Avian Influenza

In 2005, the threat of a global pandemic as a result of the avian flu began to capture the attention of the global community. The avian flu is a type of the A strain virus that infects birds. Typically, it is not common for humans to be infected with the virus via contact with birds, however, a few bird-to-human outbreaks have been reported and most have been in Asia. Humans were infected when they came into contact with sick birds or contaminated surfaces. In most cases, infected persons reported flu-like symptoms, but some had more serious complications, including pneumonia and acute respiratory distress. The avian flu has led to increased concerns for improved health conditions.

Leading up to February 5, 2009, there were 405 confirmed cases of highly pathogenic bird flu reported throughout the world that resulted in 254 deaths. Within China, there were 11 confirmed cases resulting in eight deaths during 2008.

H1N1

HINI is an influenza virus that had never been identified as a cause of infections in people before the current H1N1 pandemic. Genetic analyses of this virus have shown that it originated from animal influenza viruses and is unrelated to the human seasonal H1N1 viruses that have been in general circulation among people since 1977.

Antigenic analysis has shown that antibodies to the seasonal H1N1 virus do not protect against the pandemic H1N1 virus. However, other studies have shown that a significant percentage of people age 65 and older do have some immunity against the pandemic virus. This suggests that some people in older age groups may have some cross protection from exposure to viruses that have circulated in the more distant past.

Unlike typical seasonal flu patterns, the new virus caused high levels of summer infections in the northern hemisphere, and then even higher levels of activity during cooler months in this part of the world. After early outbreaks in North America in April 2009, the new influenza virus spread rapidly around the world. To date, many countries have confirmed infections from the new virus. In 2010, there were 7,123 H1N1 reported cases and 147 deaths in China.

The new virus has also led to patterns of death and illness not normally seen in influenza infections. Most of the deaths caused by the pandemic influenza have occurred among younger people, including those who were otherwise healthy. Pregnant women, younger children and people of any age with certain chronic lung or other medical conditions appear to be at higher risk of more complicated or severe illness. Many of the severe cases have been due to viral pneumonia, which is harder to treat than bacterial pneumonias usually associated with seasonal influenza. Many of these patients have required intensive care.

H1N1 flu viruses are spread mainly from person to person through coughing or sneezing. Sometimes people may become infected by touching an item with flu viruses on it and then touching their eyes, mouth, or nose. Providing sufficient facilities for hand washing and alcohol-based hand sanitizers in common workplace areas such as lobbies, corridors, and restrooms can reduce the chance of spread of the H1N1 virus. Studies have shown that the influenza virus can survive on environmental surfaces and can infect a person for up to 2-8 hours after being deposited on the surface. Disinfecting commonly touched hard surfaces in the workplace, such as work stations, counter tops, door knobs, and bathroom surfaces by wiping them down with disinfectant can reduce the chance of spread of the H1N1 virus.

China Health Standards

In July 2002, the Chinese Ministry of Public Health issued the 27th order of Ministry of Health of the People's Republic of China establishing national standards for the disinfection industry. The first criterion of the new order stipulated that disinfectant manufacturers in China must obtain a license to manufacture hygiene disinfectants. Secondly, prior to release, all disinfectant instruments must obtain the official hygiene permit document of both the local provincial hygiene administrative department and the Ministry of Public Health.

In June 2009, the Chinese Ministry of Public Health issued the Hygiene Standard of Manufacturers of Disinfection Products (2009) (“Hygiene Standard”) which updated the previously issued 2004 version. It specified plant layout, hygiene requirements for workplaces, requirements for production equipment, materials, warehouse and workers. The Hygiene Standard went into effect on January 1, 2010 and restricted market access of for certain small disinfectant companies due to the high Good Manufacturing Practice (“GMP”) standard, which should prove to be beneficial for the normalization of the disinfectant market.

6

The table below details the 30 licenses issued to LiKang Disinfectant by the Chinese Ministry of Public Health.

|

#

|

Products

|

Approved Date

|

||

|

1

|

An’erdian Skin Disinfectant

|

2010.6.11

|

||

|

2

|

An’erdian-type 2nd skin disinfectant

|

2010.6.11

|

||

|

3

|

An’erdian-type 3rd skin and mucous membrane disinfectant

|

2009.5.7

|

||

|

4

|

An’erdian pre-operation Skin Disinfectant

|

2010.6.11

|

||

|

5

|

An’erdian 0.1% PVP-I disinfectant

|

2010.6.11

|

||

|

6

|

Jifro disinfectant gel

|

2008.8.12

|

||

|

7

|

JifroTaixin disinfectant

|

2007.6.4

|

||

|

8

|

JifroSongning disinfectant

|

2008.8.12

|

||

|

9

|

Jifro surgical hand scrub

|

2009.12.22

|

||

|

10

|

Jifro washless surgical hand scrub

|

2010.6.11

|

||

|

11

|

PuTai Skin Disinfectant

|

2010.8.27

|

||

|

12

|

PuTai washless surgical hand scrub

|

2007.1.11

|

||

|

13

|

PuTai washless surgical hand foam disinfectant

|

2010.8.27

|

||

|

14

|

PuTai 4% Chlorhexidine gluconate surgical hand scrub

|

2010.8.27

|

||

|

15

|

Putai 2% Chlorhexidine gluconate disinfectant

|

2009.12.22

|

||

|

16

|

Dian’erkang compound iodine disinfectant

|

2007.11.14

|

||

|

17

|

Dian’erkang Iodophor disinfectant

|

2007.7.18

|

||

|

18

|

Dian’erkang PVP-I disinfectant

|

2009.5.7

|

||

|

19

|

Dian’erkang alcohol disinfectant

|

2007.12.12

|

||

|

20

|

Dian’erkang Aerosol Disinfectant

|

2007.11.14

|

||

|

21

|

Lineng glutaraldehyde disinfectant

|

2008.8.12

|

||

|

22

|

Aiershi disinfectant powder

|

2010.6.11

|

||

|

23

|

Aiershi disinfectant tablets

|

2010.6.11

|

||

|

24

|

Lvshaxing disinfectant tablets

|

2010.6.11

|

||

|

25

|

LiKang 84 disinfectant

|

2009.1.22

|

||

|

26

|

LiKang disinfectant detergent

|

2007.4.19

|

||

|

27

|

LiKang test paper of chlorine

|

2008.1.11

|

||

|

28

|

LiKang 1.8% Glutaraldehyde Monitors (Strip)

|

2009.11.3

|

||

|

29

|

LiKang steam pressure sterilization chemical indicator

|

2009.5.7

|

||

|

30

|

LiKang 121 steam pressure sterilization chemical indicator

|

2009.5.7

|

||

|

31

|

LiKang 132 steam pressure sterilization chemical indicator

|

2009.5.7

|

Product Lines

We market 66 products, which range from air disinfection machines to hot press bags, disinfection swabs, and disinfection indicators. Our products fall into five categories and six product types.

The Five Product Categories Include:

· Skin and Mucous Membrane Disinfectants – Eleven Products;

· Hand Disinfectants – Twelve Products;

· Environment and Surface Disinfectants – Eleven Products;

7

· Medical Devices and Equipment Disinfectants – Six Products;

· Air disinfection equipment – Seven Products; and

· Other products – Nineteen Products.

The Six Product Types Include:

· Liquids – gel;

· Tablets – powder;

· Aerosol;

· Chemical indicator;

· Disinfectant appliance; and

· Liquids – foam.

We believe our varied product line gives us a marketing advantage to build a national customer base for our products and services. Approximately 99.48% of our sales are derived from products we have internally developed and produced and 0.52% of our sales are produced by outside companies. The tables below offer a summary of our current product offerings:

Skin and Mucous Membrane Disinfectants

Skin and mucous membrane disinfectants target both external and internal applications. Prior to operations, incisions, or injections, the products are used to clean the skin surface. Mucous membrane disinfectants target internal germs located in the mouth, eye, perineum, and other internal sources. This product group accounted for approximately 48.51% of our sales in the 2010 fiscal year, and approximately 45.8% of our sales in the 2009 fiscal year. The table below lists our skin and/or mucous membrane disinfectants.

|

Product Names

|

Ingredients

|

Application

|

Industry Standard

|

|||

|

An’erdian Skin Disinfectant

|

iodine, alcohol

|

Skin disinfectant

|

Q/SUVE 20-2003

|

|||

|

An’erdian-type 3rd skin and mucous membrane disinfectant

|

iodine, chlorhexidine

|

Skin & mucous membrane disinfectant

|

Q/SUVE 22-2003

|

|||

|

Dian’erkang PVP-I disinfectant

|

Povidone-iodine

|

Skin & mucous membrane disinfectant

|

Q/SUVE 28-2004

|

|||

|

Dian’erkang alcohol disinfectant

|

alcohol

|

Skin disinfectant

|

Q/SUVE 08-2004

|

|||

|

PuTai Skin disinfectant

|

Chlorhexidine gluconate, alcohol

|

Skin disinfectant

|

Q/SUVE 37-2006

|

Hand Disinfectants

Hand disinfectants typically target the skin surface. Products are applied to the skin prior to medial procedures. This product group accounted for approximately 27.9% of our sales in the 2010 fiscal year and approximately 26.3% of our sales in the 2009 fiscal year. The table below lists our hand disinfectants.

|

Product Names

|

Ingredients

|

Application

|

Industry Standard

|

|||

|

Jifro antimicrobial hand washing

|

Chlorhexidine

|

Hand washing

|

Q/SUVE 04-2003

|

|||

|

Jifro disinfectant gel

|

DP300 (Triclosan)

|

Hand disinfectant

|

Q/SUVE 02-2003

|

|||

|

Jifro 4% Chlorhexidine gluconate surgical hand scrub

|

Chlorhexidine gluconate

|

Surgical hand disinfectant

|

Q/SUVE 09-2004

|

|||

|

PuTai washless surgical hand scrub

|

Chlorhexidine gluconate, alcohol

|

Hand disinfectant

|

Q/SUVE 39-2006

|

|||

|

PuTai washless surgical hand foam disinfectant

|

Chlorhexidine gluconate, alcohol

|

Hand disinfectant

|

Q/SUVE 38-2006

|

8

Environment and Surface Disinfectants

Environment and surface disinfectants target a variety of surfaces, such as floors, walls, tables, and medical devices. The products can also be applied to cloth materials including furniture and bedding. This product group accounted for approximately 9.76% of our sales in the 2010 fiscal year and approximately 12.5% of our sales in the 2009 fiscal year. The table below lists our environment and surface disinfectants.

|

Product Names

|

Ingredients

|

Application

|

Industry Standard

|

|||

|

Aiershi disinfectant tablets

|

Trichloroisocyanuric acid

|

Environment and surface disinfection

|

Q/SUVE 34-2004

|

|||

|

Lvshaxing disinfectant tablets

|

Dichloro dimethylhydantoin

|

Environment and surface disinfection

|

Q/SUVE 33-2003

|

|||

|

Dian’erkang aerosol disinfectant

|

Benzethonium Chloride

|

Environment and surface disinfection, preventing the spread of airborne viruses such as human influenza virus, SARS, and the Bird flu virus

|

Q/SUVE 07-2004

|

|||

|

Lvshaxing disinfectant granule

|

Dichloro dimethylhydantoin

|

Environment and surface disinfection

|

Q/SUVE 32-2003

|

|||

|

LiKang disinfectant detergent

|

Sodium hypochlorite

|

Surface disinfectant

|

Q/SUVE 37-2006

|

Medical Devices and Equipment Disinfectants

Medical devices and equipment disinfectants target medical equipment, including the sterilization of thermo sensitive instruments and endoscope equipment. This product group accounted for approximately 10.53% of our sales in the 2010 fiscal year and approximately 9.9% of our sales in the 2009 fiscal year. The table below lists our medical device and equipment disinfectants.

|

Product Names

|

Ingredients

|

Application

|

Industry Standard

|

|||

|

Dian’erkang 2% glutaraldehyde disinfectant

|

Glutaraldehyde

|

Disinfection and sterilization of device

|

Q/SUVE 10-2003

|

|||

|

Dian’erkang 2% glutaraldehyde disinfectant (sales to Olympus Corporation)

|

Glutaraldehyde

|

Disinfection and sterilization of endoscopes

|

Q/SUVE 10-2003

|

|||

|

Dian’erkang multi-enzyme rapid detergents

|

Multi-Enzyme

|

Rinsing and decontamination of device

|

Q/SUVE 14-2004

|

Disinfecting Apparatus Series

The disinfecting apparatus series is a line of disinfectants that target skin disinfection, air quality and disinfection results. This product group accounted for approximately 2.78% of our sales in the 2010 fiscal year and approximately 1.3% of our sales in the 2009 fiscal year. The table below lists our machine series disinfectants.

|

Product Names

|

Ingredients

|

Application

|

Industry Standard

|

|||

|

Lvshaxing LKQG-1000 air disinfection machine

|

Ozone, ultraviolet radiation, electrostatic

|

Air disinfection

|

Q/SUPE 09-2003

|

|||

|

An’erdian disinfection swab

|

An’erdian

|

Skin and disinfection

|

Q/NYMN07-2003

|

|||

|

LiKang test paper of chlorine

|

reagent

|

Indicates disinfectant concentration

|

Q/SUVE 40-2003

|

|||

|

LiKang 121 steam pressure sterilization chemical indicator (card and adhesive tape)

|

Indication oil

|

Indicates sterilization effect

|

Q/SUVE 16-2005

|

|||

|

LiKang 132 steam pressure sterilization chemical indicator (label)

|

Indication oil

|

Indicates sterilization effect

|

Q/SUVE 17-2005

|

|||

|

LiKang steam pressure sterilization chemical indicator

|

Indication oil

|

Indicates sterilization effect

|

Q/SUVE 18-2005

|

9

Retail products

In 2005, we began to expand our distribution to reach the retail markets. As a result, our products started being carried by hotels, schools, supermarkets, and drugstores. We have repackaged commercial disinfectant products for sale to the consumer market. Since October 1999, we redeveloped four separate products for distribution to the retail market. LiKang Disinfectant redeveloped the following products in the months and years listed:

|

· Jin Zhongda collutory (mouthwash)

|

October 1999

|

|

|

· Antibacterial lubricant

|

October 1999

|

|

|

· LiKang Disinfectant 84

|

August 2005

|

|

|

· Dian’erkang aerosol disinfectant

|

October 2005

|

Customers

We sell our products on a wholesale and retail basis to the medical community in China. We have approximately 6,000 or more active and recurring customers including hospitals, clinics, health centers, medical suppliers, and distribution companies throughout China. We maintain over 20 distribution contracts with wholesale dealers and agents. We generally offer our customers payment terms of four to six months to complete payment. For the fiscal year ended December 31, 2010, two affiliated entities that are our customers, ZhongYou Pharmaceutical and Shanghai Jiuqing Pharmaceuticals Co. Ltd., represented approximately 51.75% of our total net revenues.

Manufacturing

We operate two production facilities in Shanghai, one located in the Shanghai Jiading district and one located in the Shanghai Jinshan district. Products are manufactured primarily in liquid, tablet, and powder form. Approximately 99.48% of LiKang Disinfectant’s revenue for the 2010 fiscal year was derived from products manufactured in these two factories.

The Shanghai Jiading district factory is approximately 21,500 square feet, all of which is used for production. The main products produced at the Shanghai Jiading district factory are liquid and index disinfectant devices. The manufacturing facility has the capacity to produce approximately 9 million liters of liquid disinfectant annually. The manufacturing cycle for the liquids, from formulation to finished product, is one day.

The Shanghai Jinshan district factory is approximately 4,300 square feet and is used in the manufacture of the tablet and powder forms of disinfectants. The manufacturing capacity is 300 metric tons of tablet and 180 metric tons of powder disinfectant annually. The average manufacturing cycle for the tablets and powder, from formulation to finished product, is one day.

During the 2007 fiscal year, following GMP certification for both the factory and the equipment, we began utilizing the services of LiKang Biological, a related party, to manufacture some of our products including our An'erdian and Dian'erkang lines of disinfectants. On March 25, 2008, Linkwell Tech purchased 100% of the issued and outstanding stock of LiKang Biological.

10

We have found in our experience that products manufactured at GMP certified facilities utilizing GMP certified equipment can be sold at higher prices than similar products manufactured at non- GMP certified facilities. While GMP certified products cost more to produce, we are able to increase our selling prices proportionally. Our product packaging varies to meet different needs of the market. We package our liquid and gel disinfectants in popular sizes ranging from 40 ml to 5 liters. We package these tablets in 50 tablet, 100 tablet and 200 tablet bottles. Finally, we package our powder disinfectants in 250 gram and 500 gram containers.

We maintain an inventory of finished products equal to approximately 1 month of average sales. Currently, we are manufacturing at about 50% of full capacity based upon our current product demand, and we have the ability to increase to full capacity if demand continues to increase.

We have an in-house fulfillment and distribution operation, which is used to manage our supply chain, beginning with the placement of the order and continuing through order processing, packaging and shipping the products to each customer. We maintain inventory and fill customer orders from both the Jiading factory and the Jinshan factory.

Raw Materials

We purchase raw materials from six primary suppliers, and we have signed purchase contracts with these suppliers in an effort to ensure a steady supply of raw materials. We have maintained stable business relations with these suppliers for over 10 years, and we believe that our relationships with these primary suppliers will remain stable. In the event that these relationships falter, there are many other suppliers with the capability to supply our Company. We purchase raw materials on payment terms of 30 days to three months. Some of the suppliers import from foreign countries, as listed below, and we purchase directly from these suppliers.

The table below details the supply relationships for raw materials

|

Raw materials

|

Suppliers

|

Origin

|

||

|

Iodine

|

Shanghai Wenshui Chemical Co., Ltd

|

USA

|

||

|

Potassium iodide

|

Shanghai Wenshui Chemical Co., Ltd

|

Holland

|

||

|

Glutaraldehyde

|

Shanghai Jin an tang Hygienical Product Factory

|

Germany

|

||

|

Triclosan

|

Ciba Specialty Chemicals (China) LTD

|

Domestic

|

||

|

Alcohol

|

Shanghai Jangbo Chemical Co., L td

|

Domestic

|

||

|

Trichloroisocyanuric acid

|

Xuzhou Keweisi Disinfectant Co., Ltd

|

Domestic

|

Customer Service and Support

We believe that a high level of customer service and support is critical in retaining and expanding our customer base. Customer care representatives participate in ongoing training programs under the supervision of our training managers. These training sessions include a variety of topics such as product knowledge and customer service tips. Our customer care representatives respond to customers’ e-mails and calls that are related to order status, prices and shipping. If our customer care representatives are unable to respond to a customer’s inquiry at the time of the call, we strive to provide an answer within 24 hours. We believe our customer care representatives are a valuable source of feedback regarding customer satisfaction. Our customer returns and credits average approximately 1% of total sales.

New Product Development

We are committed to research and development. LiKang Disinfectant was created as a research and development organization by the Second Military Medical University (SMMU) of the Chinese Army in 1988. We develop our products internally and own all rights associated with these products.

11

In 2007, we commercialized four disinfectant products, including PuTai Skin Disinfectant, PuTai washless surgical hand scrub, PuTai washless surgical hand foam disinfectant and LiKang disinfectant detergent, which is an environmental and surface disinfectant. In 2008, eight products were in development, and licensing applications were filed for four of these eight products. In 2009, we commercialized two new disinfectant products, Jifro surgical hand scrub and Putai 2% Chlorhexidine gluconate disinfectant.

In 2010, we commercialized two new disinfectant products, An’erdian pre-operation Skin Disinfectant and An’erdian 0.1% PVP-I disinfectant, and we are also in the process of developing five additional products.

For the fiscal years ended December 31, 2010 and 2009, we spent approximately $311,268 and approximately $108,026, on research and development, respectively.

Marketing and Sales

We were formed in 1988 as a research and development organization by the Second Military Medical University (SMMU) of the Chinese Army. Our CEO, Mr. Xuelian Bian, was a member of the staff of SMMU. We believe that his relationships with alumni and business persons associated with SMMU provide us with certain marketing advantages. The university is a well recognized, prestigious institution in China and many of its graduates work at hospitals, medical suppliers and distribution companies throughout China in senior positions, which places them in the decision making process for purchasing the kind of products we sell. In addition, the students and faculty at the university provide a pool of talent from which we draw, both as potential employees or summer interns who go on to work at other companies, many of whom are customers or potential customers of our products. In marketing our products, we seek to leverage these relationships.

During the 2007 fiscal year, we expanded our distribution capability in the PRC. We have a national marketing and sales presence throughout all 22 provinces, as well as four autonomous regions, and four municipalities of China. We currently employ 33 full-time sales and marketing employees based in Shanghai. ZhongYou Pharmaceutical, an affiliate, also sells our products using 62 independent sales representatives in other provinces of China.

Approximately 48.25% of our sales are achieved by our proprietary sales force, while the remaining 51.75% are outsourced to independent dealers and agents. We compensate our proprietary salesman with a base salary plus commission. The sales representatives are located in each of China’s provinces. The external sales network currently covers hospitals in the following 22 provinces and municipalities including: Beijing, Guangdong, Tianjin, Fujian, Yunnan, Hainan, Jiangsu, Zhejiang, Anhui, Shandong, Henan, Hebei, Liaoning, Heilongjiang, Shaanxi, Gansu, Ningxia, Guizhou, Hunan, Sichuan, Xinjiang, Neimenggu. The independent sales representatives sell directly to the end-users.

Disinfectant Educational Center

On May 25, 2006, we entered into an agreement with China Pest Infestation Control and Sanitation Association, an association governed by the Chinese central government, to establish and operate a disinfectant educational center in Beijing, China. We are responsible for the establishment and development of the disinfectant educational center, as well as its management and funding. The China Pest Infestation Control and Sanitation Association is responsible for establishing a job training base in Beijing. We believe we were selected to participate in this program based upon our reputation and experience in the disinfectant industry.

We anticipate that the disinfectant educational center will offer a job training program to educate and train professionals to work in the disinfectant field. The disinfectant educational center will be a tuition based education program for which graduates will receive a license from the China Pest Infestation Control and Sanitation Association. After completion of the program, it is envisioned that a personnel exchange service center of the Chinese central government's Health Department will function much like a placement office and assist the center's graduates in securing positions with companies seeking to fill positions in the PRC. From time to time we may also recruit graduates from the disinfectant educational center to join our company.

12

In 2006, LiKang Disinfectant entered into an agreement with the China Pest Infestation Control Association, the Ministry of Health and the Beijing Olympic Game Committee to establish and operate a disinfectant educational center in Beijing, China. In accordance with the agreement, LiKang Disinfectant is responsible for the establishment of the disinfectant educational center, as well as its management and funding. As of December 31, 2007, we had provided the text books and technical standards for training. In 2008, prior to the Beijing Olympic Games starting, we held the first class for training the 2008 Beijing Olympic Staff. Out of the 51 participants in the training, 46 of them became qualified.

After the Wenchuan Earthquake occurred, LiKang Disinfectant entered into an agreement with the Ministry of Health, the National Patriot and Sanitation Committee, and the Dujiangyan National Disaster Headquarters to provide service to stricken areas. On June 6, 2008, Likang Disinfectant sent its own teams to Sichuan to provide sanitation technical training for over 270 staff as well as providing a qualification course and examinations to over 100 national disinfectors. On June 27, 2008, 76 national disinfectors had taken professional qualification exams and 67 national disinfectors were qualified. The passage rate was 88%.

In 2008, there were 325 participants that attended the Likang Disinfectant training course, of which 117 became qualified. In 2009, there were 2,320 participants that attended the Likang Disinfectant training course, of which 2,156 became qualified.

In 2010, there were 1,100 participants that attended the Likang Disinfectiant training course, of which 1,045 became qualified.

Intellectual Property

We have received eleven patents and have one pending patent application with National Property Right Administration of the PRC. The patent approval process can take up to 36 months. The following is a list of LiKang Disinfectant’s patents and pending patent applications:

|

Patent Category

|

Patent name

|

Patent No

|

Notes

|

|||

|

New invention

|

Low smell and stimulus contain chlorine disinfectant tablet, powder etc.

|

ZL 200410068135.8

|

Approved, expires August 2026

|

|||

|

New invention

|

A new skin & mucous membrane disinfectant including preparation methods

|

Application # 200410025305.4

|

Pending. Applied on 2004-11-12

|

|||

|

Appearance design

|

Bottle (with the wing stretch)

|

ZL 00 3 14391.0

|

Approved, expired on April 2010

|

|||

|

Appearance design

|

Packaging bottle

|

ZL 2003 3 0108274.5

|

Approved, expires November 2013

|

|||

|

Appearance design

|

Bottle

|

ZL 200530034239.2

|

Approved, expires December 2015

|

|||

|

Appearance design

|

Test paper box of chlorine

|

ZL 2004 3 0022740.2

|

Approved, expires May 2014

|

|||

|

Product Improvement

|

Improved heavy duty bottle

|

ZL 03 2 29616.9

|

Approved, expires March 2013

|

|||

|

Product Improvement

|

High strength water sterilizer with Model H ultraviolet lamp

|

ZL 03 2 10513.4

|

Approved, expires September 2013

|

|||

|

Product Improvement

|

Sewage application

|

ZL 2004 2 0037013.8

|

Approved, expires June 2014

|

|||

|

Product Improvement

|

Container with the vacuum pump

|

ZL 200420090682.1

|

Approved, expires June 2016

|

|||

|

Product Improvement

|

Multifunctional air disinfectant

|

ZL 200420037010.4

|

Approved, expires August 2015

|

|||

|

Product Improvement

|

Bracket for heavy duty bottle

|

ZL 200520039668.3

|

Approved, expires October 2016

|

13

We have nine product trademarks, of which four are registered trademarks with the China State Administration for industry and commerce trademark office. These trademarks cover our four major product lines, An’erdian, Jifro, Dian’erkang and Lvshaxing.

We are not a party to any confidentiality or similar agreement with any of our employees or any third parties regarding our intellectual property. It is possible that a third party could, without authorization, utilize our propriety technologies without our consent. We can give no assurance that our proprietary technologies will not otherwise become known or independently developed by competitors.

Competition

We operate in a fragmented, competitive national market for healthcare disinfectant products. According to a survey conducted in 2004 by the China Federation of Industrial Economics (CFIC), the disinfectant market in the PRC was approximately $6.25 billion (USD). While the disinfectant industry in China is an emerging industry, and the industry is populated with small regional players, we estimate that there are over 1,000 manufacturers and distributors of disinfectant products in China and a certain number of our major competitors distribute products similar to ours, including those which also prevent the spread of airborne viruses such as avian flu and SARS.

We also compete with foreign companies, including 3M, who are marketing a limited line of disinfectant products in China, as well as smaller, domestic manufacturers. Most domestic competitors offer a limited line of products and there are few domestic companies with a nationwide presence. We believe that our national marketing and sales presence throughout all twenty-two provinces, as well as four autonomous regions, and four municipalities of China gives us a competitive advantage over many other disinfectant companies in China.

In addition, prior to the adoption of industry standards in July 2002 by the central government of China, disinfectant products were generally marketed and sold based on pricing factors. We believe the recent standards implemented by the government and a growing middle income class will shift the customer demand from price to quality.

As a result of this heightened license and permit system, all disinfectant manufacturers must comply with "qualified disinfection product manufacturing enterprise requirements” established by the Ministry of Public Health. The requirements include standards for both hardware and software. Hardware includes facilities and machinery and software includes the technology to monitor the facilities. The requirements also encompass the knowledge and capability of both the production staff and quality control procedures.

Furthermore, we estimate that the government standards adopted in July 2002 have increased the barriers to enter into the disinfectant industry. We believe that the new standards may lead to fewer competitors as companies falter in their efforts to adhere to the new standards. The implementation of these improved production standards and licenses have effectively decreased the competitiveness of small and mid-size manufacturers. Compliance with the new standards is especially difficult for companies with limited product offerings and inferior technical content.

14

Competitive Advantages

We believe that the following are the principal competitive strengths that differentiate our Company from the majority of our competition:

· Strong sales and distribution network in China – This enables us to compete effectively with domestic competitors, as well as larger foreign-owned competitors.

· Product selection and availability – A number of our competitors are smaller, regional companies with a limited number of product offerings. We offer our customers a wide variety of disinfectant products and the ability to ship products to our customers on a timely basis throughout the PRC.

· Research and development – Our efforts to respond to market demand for new products have resulted in the issuance to us of 31 hygiene licenses by the Ministry of Public Health of the central government of China. Based upon our knowledge of our competitors, we do not believe any of our competitors have received as many licenses since the enactment of the licensing standards in July 2002.

· Strong product pipeline – We have a history of introducing three or four new products to the market each year. We have filed applications for four new products and have eight additional products in development.

· Manufacturing capacity – We are operating at 91% capacity to produce GMP certified products and we have the ability to increase capacity significantly at moderate costs.

· Customer services – Our sales personnel are thoroughly educated about our products, which enable them to better understand the needs of our customers. Our customer service representatives strive to answer questions immediately and, at a minimum, no later than 24 hours after a customer’s inquiry.

· Reliability and speed of delivery. We believe our products have developed a reputation of good quality and effectiveness and our manufacturing capabilities enable us to produce and ship products to our customers promptly.

· Customer service – Our customer service representatives participate in ongoing product training programs and we strive to respond to all customer inquiries within 24 hours.

· Price – We have developed relationships with a number of raw material suppliers which enables us to keep our costs low and thereby offer prices to our customers which are very competitive.

Our primary competitors in the sale of chemical disinfectants are 3M and Ace Disinfection Factory Co., Ltd. The primary competitors for instrument disinfectants are Chengdu Kangaking Instrument Co., Ltd. and Hangzhou Yangchi Medicine Article Co., Ltd. The primary competitors for chemical indicators are 3M and Shandong Xinhua Medical Instrument Co., Ltd. Domestic competition comes from regional companies which tend to offer products in small geographic areas and do not distribute their product lines throughout China.

Our primary competitors include:

|

Competitor

|

Products

|

|

|

3M Company

|

Hand disinfectant, skin and mucous disinfectant

|

|

|

Ace

|

Skin and mucous disinfectant

|

|

|

Chengdu Kangaking

|

Medical equipment and devices

|

|

|

Hangzhou Yangchi

|

Sterilized Q-tip

|

|

|

Shandong Xinhua

|

Chemical indicators

|

Our primary foreign competitor is 3M , which has had a presence in China for more than 20 years. 3M entered the hand disinfection market at the end of 2004 and primarily offers products in the areas of index and control devices and disinfectant machines. At present, 3M has five products for use in operating rooms and its products are found in provincial capital cities of China such as Shanghai, Beijing, Guangzhou, Hangzhou, Nanjing, Chengdu and Xi’an. 3M’s product line in China is relatively narrow, with few overlapping products between 3M and our Company.

15

Another foreign competitor is Johnson & Johnson, which established its operations in China in 1994. In China, Johnson & Johnson offers a variety of skin, hand, and medical equipment disinfectants. Prior to the recent initiatives taken by the government, disinfectant products were marketed based on pricing, and despite the brand awareness of Johnson & Johnson, its products did not have widespread reception among the community. Furthermore, Johnson & Johnson does not offer a wide variety of disinfectant products in China.

Government Regulations

Our business and operations are located in the PRC. We are subject to local food, drug, environmental laws related to certification of manufacturing and distributing of disinfectants. We are also licensed by the Shanghai City Government to manufacture and distribute disinfectants. We are in substantial compliance with all provisions of those licenses and have no reason to believe that they will not be renewed as required by the applicable rules of Shanghai. In addition, our operations must conform to general governmental regulations and rules for private companies conducting business in China.

Pursuant to the July 2002 Ministry of Public Health 27th Order of Ministry of Health of the People's Republic of China, all disinfectant manufacturers in China must obtain a license to manufacture hygiene disinfectants. Prior to such release, all disinfectant instruments must obtain the official hygiene permit document from the Ministry of Public Health and the approval of the provincial hygiene administrative department. The implementation of these improved production standards and licenses has effectively decreased the competitiveness of small to mid size manufacturers with single product and inferior technical content. Presently, we meet all standards initiated by this ordinance and we have been granted 28 hygiene licenses by the Ministry of Public Health.

We are also subject to various other rules and regulations, including the People’s Republic of China Infectious Disease Prevention and Cure Law, Disinfection Management Regulation, Disinfection Technique Regulation, Disinfection Product Manufacturer Sanitation Regulation, and Endoscope Rinse and Disinfection Technique Manipulation Regulation. We believe we are in material compliance with all of the applicable regulations.

Sanitary Standard for Producing Disinfectant products Enterprises 2009

To strengthen the supervision and standardize the behavior of disinfectant products, the People's Republic of China Ministry of Health have revised the old disinfectant manufacturing criteria and enacted the “ Sanitary Standard for Producing Disinfectant products Enterprises 2009 ” based on "Infectious Diseases Prevention Law" and "sterilization management approach" effective January 1, 2010.

According to the new guideline, the compounding, mixing, and subpackaging of Skin and mucous membrane disinfectants and antibacterial preparation (except for hand-washing products) should be processed in a workshop with a 300,000 level of air purification.

PRC Legal System

Since 1979, many laws and regulations addressing economic matters in general have been promulgated in the PRC. Despite the development of its legal system, the PRC does not have a comprehensive system of laws. In addition, the enforcement of existing laws may be uncertain and sporadic, and implementation and interpretation thereof inconsistent. The PRC judiciary is relatively inexperienced in enforcing the laws that exist, leading to a higher than usual degree of uncertainty as to the outcome of any litigation. Even where adequate laws exist in the PRC, it may be difficult to obtain swift and equitable enforcement of such laws, or to obtain enforcement of a judgment by a court of another jurisdiction. The PRC's legal system is based on written statutes and, therefore, legal precedents are often without any binding effect. The interpretation of PRC laws may be subject to policy changes reflecting domestic political changes. As the PRC legal system develops, the promulgation of new laws, changes to existing laws and the preemption of local regulations by national laws may adversely affect foreign investors. The trend of legislation over the past 20 years has, however, significantly enhanced the protection of foreign investors in the PRC. However, there can be no assurance that changes in such legislation or interpretation thereof will not have an adverse effect on our business operations or prospects.

16

Economic Reform Issues

Since 1979, the Chinese government has reformed its economic systems. Many reforms are unprecedented or experimental; therefore, they are expected to be refined and improved. Other political, economic and social factors, such as political changes, changes in the rates of economic growth, unemployment or inflation, or disparities in per capita of wealth between regions within China, could lead to further readjustment of the reform measures. We cannot predict if this refining and readjustment process may negatively affect our operations in future periods.

Over the last several years, China's economy has demonstrated a high growth rate. Recently, there have been indications that rates of inflation have increased. In response, the Chinese government has taken measures to curb the economy from expanding too rapidly. These measures have included devaluations of the Chinese currency as the result of inflation. This relative Renminbi (“RMB”) devaluation places some restrictions on the availability of domestic credit, the purchase capability of customers, and re-centralization of the approval process for some foreign product purchases. These measures alone may not succeed in slowing down the economy's excessive expansion or control inflation. The Chinese government may adopt additional measures to further combat inflation, including the establishment of freezes or restraints on certain projects or markets.

To date, China’s economic reforms have not adversely impacted our operations and are not expected to adversely impact operations in the foreseeable future; however, there is still no assurance that such reforms will not adversely affect us in the changes of China's political, economic, and social conditions and the changes in policies of the Chinese government. To be more specific, such as changes may include laws and regulations, measures which may be introduced to control inflation, changes in the rate or method of taxation, imposition of additional restrictions on currency conversion and remittance abroad, and reduction in tariff protection and other import restrictions.

As of December 31, 2010, we employed approximately 170 full time employees, including our executive officers. The numbers are listed as follows:

|

Department

|

Number of Employees

|

|

|

Administrative center

|

21

|

|

|

Accounting

|

11

|

|

|

Production

|

70

|

|

|

Logistics

|

18

|

|

|

Sales and Marketing Staff in Shanghai

|

33

|

|

|

Training

|

5

|

|

|

Research and Development

|

12

|

|

|

Total

|

170

|

17

U.S. Advisors

On May 1, 2008, we entered into a two year agreement with China Health Capital Group, Inc. (“CHC”) to provide us with financial and investment services. In connection with this agreement, on June 24, 2008, we issued 2,000,000 shares of common stock valued at $0.21 per share to CHC and recorded $420,000 as deferred compensation. We amortized $210,000 as stock-based compensation for the year ended December 31, 2009.

On June 27, 2008, Monarch Capital Fund, Ltd. exercised a warrant to purchase 100,000 shares of our common stock with a price of $0.20 per share. We received proceeds from this warrant exercise of $20,000 on June 24, 2008.

On July 1, 2009, we entered into a two year agreement with First Trust Group, Inc. In connection with this agreement, we issued 1,800,000 shares of our common stock valued at $0.09 per share to First Trust Group, Inc. and recorded $162,000 as deferred compensation. We amortized $121,500 as stock-based compensation for the year ended December 31, 2009.

History of Our Company

Linkwell Corporation (formerly Kirshner Entertainment & Technologies, Inc.) was incorporated in the State of Colorado on December 11, 1996. On May 31, 2000, we acquired 100% of HBOA.com, Inc. On December 28, 2000, we formed a new subsidiary, Aerisys Incorporated (“Aerisys”), a Florida corporation, to handle commercial private business. In June 2003, we formed our entertainment division and changed our name to reflect this new division. Effective as of March 31, 2004, we discontinued our entertainment division and our technology division, except for the Aerisys operations that continue on a limited basis.

On May 2, 2005, we entered into and consummated a share exchange with all of the shareholders of Linkwell Tech Group, Inc. (“Linkwell Tech”). Pursuant to the share exchange, we acquired 100% of the issued and outstanding shares of Linkwell Tech's common stock, in exchange for 36,273,470 shares of our common stock, which at closing represented approximately 87.5% of the issued and outstanding shares of our common stock. As a result of the transaction, Linkwell Tech became our wholly-owned subsidiary. Linkwell Tech was founded on June 22, 2004, as a Florida corporation. On June 30, 2004, Linkwell Tech acquired 90% of Shanghai LiKang Disinfectant High-Tech Company, Ltd. (“LiKang Disinfectant”), a PRC company, through a stock exchange. This transaction resulted in the formation of a U.S. holding company by the shareholders of LiKang Disinfectant as it did not result in a change in the underlying ownership interest of LiKang Disinfectant. LiKang Disinfectant is a science and technology enterprise founded in 1988. LiKang Disinfectant is involved in the development, production, marketing and sale, and distribution of disinfectant health care products.

LiKang Disinfectant has developed a line of disinfectant product offerings which are utilized by the hospital and medical industry in China. LiKang Disinfectant has developed a line of disinfectant product offerings. LiKang Disinfectant regards hospital disinfectant products as the primary segment of its business and has developed and manufactured several series of products in the field of skin mucous disinfection, hand disinfection, surrounding articles disinfection, medical instruments disinfection and air disinfection.

18

On June 30, 2005, our Board of Directors approved an amendment of our Articles of Incorporation to change the name of our Company to Linkwell Corporation. The effective date of the name change was after close of business on August 16, 2005.

On April 6, 2007, our subsidiary, Linkwell Tech, entered into two material stock purchase agreements as follows:

i) Linkwell Tech entered into an agreement (the “Biological Stock Purchase Agreement”) to acquire a 100% equity interest in Shanghai LiKang Biological High-Tech Company, Ltd. (“LiKang Biological”), a Chinese company, in a related party transaction with Mr. Xuelian Bian, the Company’s Chief Executive Officer, Mr. Wei Guan, the Company’s Vice-President and Director, and Shanghai Likang Pharmaceuticals Technology Co., Ltd. (“LiKang Pharmaceutical”), a PRC company. Before the Company entered into the Biological Stock Purchase Agreement, Mr. Bian and Mr. Guan owned 90% and 10% of LiKang Pharmaceutical, respectively. Mr. Bian and LiKang Pharmaceutical owned 60% and 40% of LiKang Biological, respectively. Pursuant to the terms of the Biological Stock Purchase Agreement, Mr. Bian and LiKang Pharmaceutical were to receive 1,000,000 shares of Linkwell Corporation’s restricted common stock.

Due to restrictions under PRC law that prohibited the consideration contemplated by the Biological Stock Purchase Agreement, the agreement did not close. As a result, on March 25, 2008, the parties agreed to enter into an amendment to the Biological Stock Purchase Agreement (“Biological Amendment”) in an effort to complete the stock purchase transaction. Pursuant to the terms of the Biological Amendment, the only material change to the Biological Stock Purchase Agreement related to the consideration paid by Linkwell Tech to Xuelian Bian and LiKang Pharmaceutical, which was changed from 1,000,000 shares of the Company’s common stock to 500,000 shares of common stock and $200,000. As of December 31, 2008, the Biological Stock Purchase Agreement was pending and required further approval from the PRC Ministry of Commerce. Due to the time consuming and complicated nature of the approval procedure, the parties agreed to enter into a second amendment to the Biological Stock Purchase Agreement (“Second Amendment”) in order to complete the purchase transactions timely and properly. Pursuant to the terms of the Second Amendment, the purchaser was changed from Linkwell Tech to LiKang Disinfectant, and, in addition, the consideration changed to RMB 2,000,000, approximately $292,500, and 500,000 shares of common stock. These changes were pertinent because an approval from the Ministry of Commerce in the People’s Republic of China would not be necessary if LiKang Disinfectant acquired 100% of the equity interest in LiKang Biological, as both companies are registered in the PRC. This transaction closed on March 5, 2009. During the quarter ended September 30, 2009, LiKang Disinfectant increased its investment into Likang Biological by injecting RMB 2.5 million cash and RMB 5.5 million in intangible assets (patents) into Likang Biological. Likang Biological is mainly engaged in producing the disinfectant concentrate.