Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - General Motors Co | d253679d8k.htm |

| EX-99.1 - NEWS RELEASE - General Motors Co | d253679dex991.htm |

General Motors Company

Q3 2011 Results

November 9, 2011

Exhibit 99.2

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

******* |

Forward Looking Statements

In this presentation and in related comments by our management, our use of

the words “expect,”

“anticipate,”

“possible,”

“potential,”

“target,”

“believe,”

“commit,”

“intend,”

“continue,”

“may,”

“would,”

“could,”

“should,”

“project,”

“projected,”

“positioned”

or similar expressions is intended to identify forward

looking statements that represent our current judgment about possible future

events. We believe these judgments are reasonable, but these statements

are not guarantees of any events or financial results, and our actual

results may differ materially due to a variety of important factors. Among

other items, such factors might include:

our ability to realize production efficiencies and

to achieve reductions in costs as a result of our restructuring initiatives and

labor modifications; our ability to maintain quality control over our

vehicles and

avoid

material

vehicle

recalls;

our

suppliers’

ability

to

deliver

parts,

systems and components at such times to allow us to meet production

schedules; our ability to maintain adequate liquidity and financing sources

and an appropriate level of debt, including as required to fund our planned

significant

investment

in

new

technology;

our

ability

to

realize

successful

vehicle applications of new technology; and our ability to continue to attract

new customers, particularly for our new products.

GM's most recent annual report on Form 10-K and quarterly reports on Form

10-Q provide information about these and other factors, which we may

revise or supplement in future reports to the SEC.

1 |

Third

Quarter 2011 Highlights 2

Q3 ‘11

F/(U) vs.

Q3 ‘10

Global Deliveries

2.2M

Net Revenue

$36.7B

EBIT -

Adj.

$2.2B

-

GMNA

$2.2B

-

GME

$(0.3)B

-

GMIO

$0.4B

-

GMSA

$0.0B

Auto Free Cash Flow

$0.3B |

Third

Quarter Highlights •

Reached labor agreement with UAW

–

Maintains GM’s low break-even level

–

Gives employees a direct stake in company’s performance

–

Protects GM’s balance sheet

•

Corporate credit rating upgrades

•

GM and SAIC agreement for the co-development of new

electric vehicle architecture

•

Agreement with LG to jointly design & engineer future

electric vehicles

•

Important product announcements –

Cadillac ELR,

Chevy Colorado midsize pickup, Chevy Spark minicar,

Spark EV (all electric), Chevy Trailblazer midsize SUV

3 |

Q3

2010

Q3

2011

GAAP

Net Revenue ($B)

34.1

36.7

Operating Income ($B)

1.7

1.8

Net Income to Common Stockholders ($B)

2.0

1.7

EPS –

Diluted ($/Share)

1.20

1.03

Non-

GAAP

EBIT-

Adj. ($B)

2.3

2.2

Automotive Free Cash Flow ($B)

1.4

0.3

Summary of Q3 2011 Results

4

Note: Starting Q4 2010, EBIT-Adj. includes GM Financial on an Earnings Before

Tax (EBT) basis |

Net

Income Impact of Special Items 5

Q3

2010

Q3

2011

Net Income to Common Stockholders ($B)

2.0

1.7

EPS –

Diluted ($/Share)

1.20

1.03

Special Items Included ($B):

None

-

-

Total Impact of Special Items:

Net Income to Common Stockholders ($B)

-

-

EPS –

Diluted ($/Share)

-

- |

Q3

Operating Income Walk to EBIT- Adj.

6

($B)

Q3

2010

Q3

2011

Operating Income

1.7

1.8

Equity Income

0.4

0.4

Non-Controlling Interests

(0.1)

0.0

Non-Operating Income

0.3

0.0

Earnings Before Interest & Taxes (EBIT)

2.3

2.2

Less Special Items

0.0

0.0

EBIT-

Adj.

2.3

2.2

Note: Starting Q4 2010 EBIT & EBIT-Adj. include GM Financial on an Earnings

Before Tax (EBT) basis Note: Results may not foot due to rounding

|

Q3

EBIT & EBIT- Adj.

2.1

(0.6)

0.5

0.2

n/a

0.0

2.3

0.0

2.3

2.2

(0.3)

0.4

0.0

0.2

(0.2)

2.2

0.0

2.2

GMNA

GME

GMIO

GMSA

GM

Financial*

Corp. /

Elims

EBIT-

Adj.

Plus

Special Items

EBIT

($B)

* GM Financial at an Earnings Before Tax basis (EBT)

GMNA

GME

GMIO

GMSA

GM

Financial*

Corp./

Elims

EBIT-

Adj.

Plus

Special Items

EBIT

Q3 2010

Q3 2011

Note: Results may not foot due to rounding

7 |

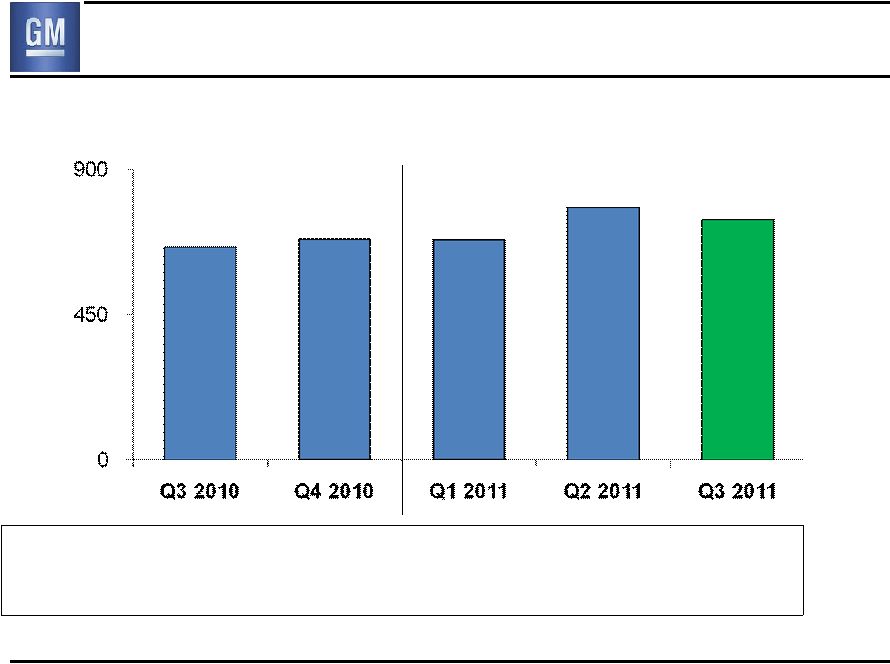

Global Deliveries

(000’s)

Global Share

11.4%

11.5%

11.4%

12.2%

12.0%

GM deliveries & market share include vehicles sold around the world under GM

and JV brands, and through GM-branded distribution network

8 |

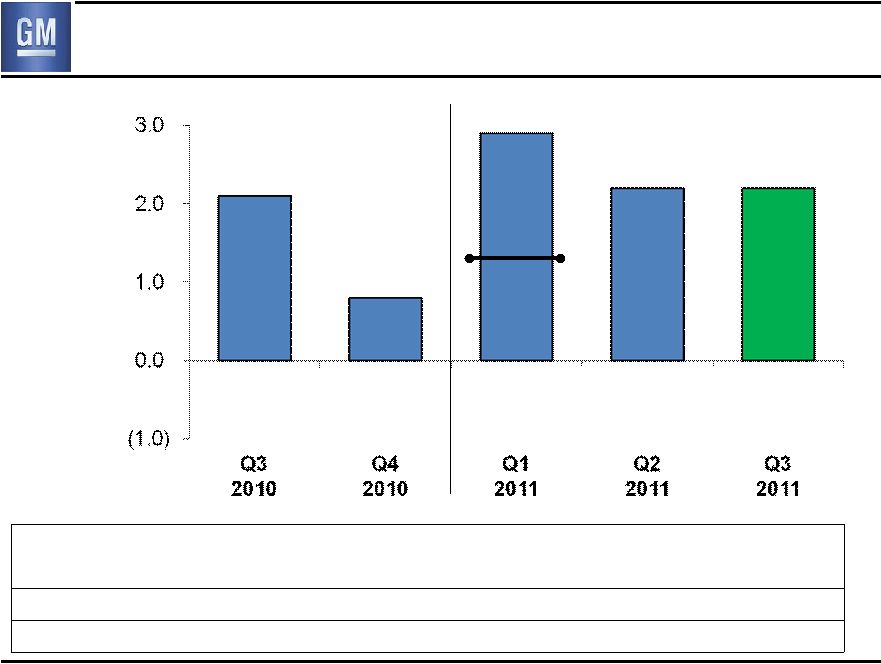

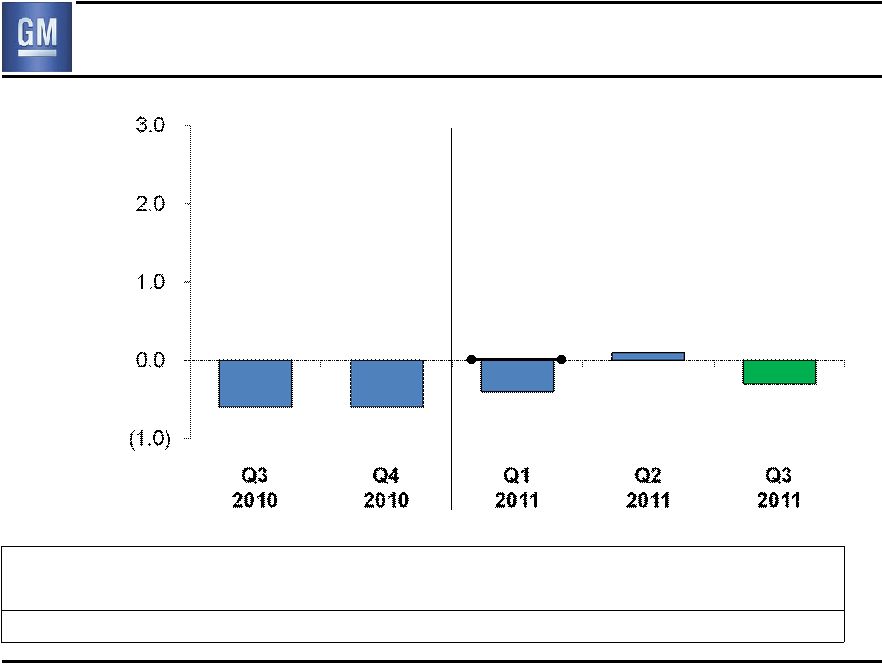

Earnings Before Interest & Taxes

($B)

Revenue ($B)

34.1

36.9

36.2

39.4

36.7

Oper Inc % Rev

5.1%

0.8%

2.6%

6.2%

4.9%

EBIT-

Adj % Rev.

6.7%

2.8%

5.6%

7.5%

6.0%

Production (000’s)

2,104

2,269

2,327

2,400

2,221

2.3

1.3

3.5

1.0

EBIT-Adj.

2.0

EBIT-Adj.

Note: Starting Q4 2010 EBIT & EBIT-Adj. include GM Financial on an Earnings

Before Tax (EBT) basis 9

3.0

2.2 |

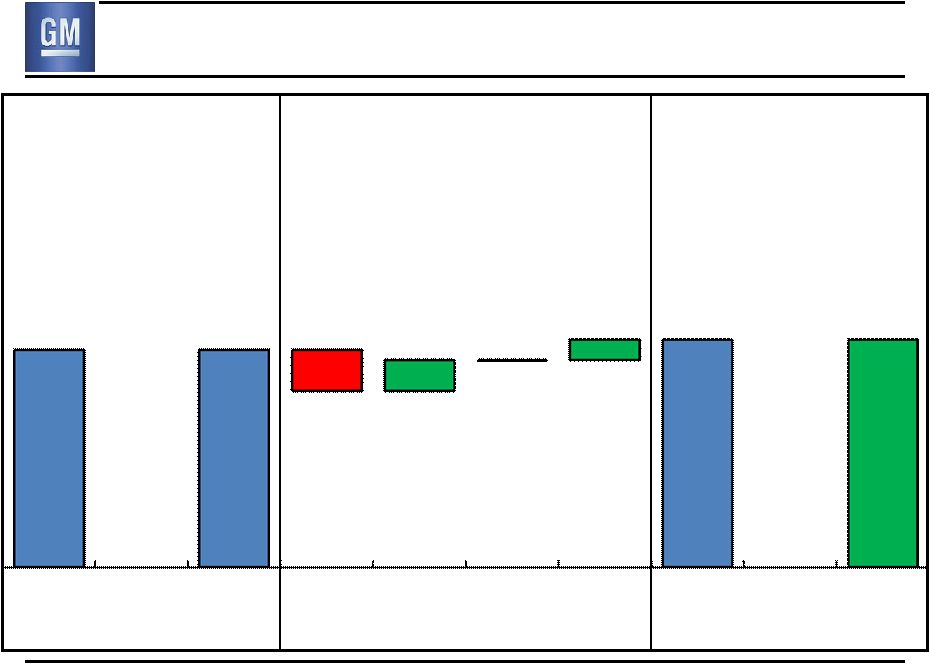

Consolidated EBIT –

Q3 2010 vs. Q3 2011

Q3 2010

EBIT ($B)

Q3 2011

EBIT ($B)

$0.1B Decrease

EBIT

EBIT-Adj.

Less Special

Items

EBIT-Adj.

EBIT

Plus Special

Items

0.0

0.4

(0.4)

(0.1)

Volume /

Mix

Price

Cost

Other

0.0

2.3

2.3

2.2

0.0

2.2

10 |

GMNA

Deliveries (000’s) GMNA Share

17.7%

18.5%

18.3%

19.1%

18.8%

U.S. Share

18.3%

19.1%

19.0%

20.0%

19.7%

660

685

684

11

784

745 |

2,500

3,000

3,500

4,000

4,500

5,000

5,500

6%

8%

10%

12%

14%

16%

18%

20%

22%

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Key GMNA Performance Indicators

Avg. U.S. Retail Incentive as % of ATP

GM %

12.6

10.7

9.6

9.6

9.4

10.4

12.5

13.1

9.7

8.7

8.9

8.7

9.7

10.1

9.8

8.9

GM vs. Ind.

(GM % / Ind. %)

1.12

1.01

0.95

1.02

0.97

1.00

1.25

1.22

0.95

0.99

1.08

0.99

0.98

1.03

1.03

1.03

Share

$/Unit

U.S. Retail Share

U.S. Total Share

Avg. GM U.S. Retail

Incentive

Note: Incentive & ATP Information Based on J.D. Power and Associates

Power Information Network data Oct

2011

12 |

GMNA

Earnings Before Interest & Taxes ($B)

Revenue ($B)

21.5

22.0

22.1

23.1

21.9

EBIT-

Adj % Rev

9.9%

3.4%

5.7%

9.7%

10.0%

Production

(000’s)

707

703

786

824

740

U.S. Dealer Inv (000’s) 478

511

574

605

558

2.1

0.8

2.9

1.3

EBIT-Adj.

13

2.2

2.2 |

GMNA

EBIT – Q3 2010 vs. Q3 2011

Q3 2010

EBIT ($B)

Q3 2011

EBIT ($B)

$0.1B Improvement

EBIT

EBIT-Adj.

Less Special

Items

EBIT-Adj.

EBIT

Plus Special

Items

(0.4)

0.3

0.0

0.2

Volume /

Mix

Price

Cost

Other

0.0

2.1

2.1

2.2

0.0

2.2

14 |

GME

Deliveries (000’s)

GME Share

8.9%

9.0%

8.5%

9.1%

8.8%

Germany Share

8.5%

9.0%

8.2%

8.9%

8.6%

U.K. Share

12.6%

12.4%

12.6%

13.3%

11.9%

Chevrolet

GME Excl.

Chevrolet

GME deliveries and market share include unit sales of Chevrolets

produced by GMIO and delivered to customers in GME.

Revenue and associated costs of these unit sales are reported by

GMIO

15 |

GME

Earnings Before Interest & Taxes ($B)

Revenue ($B)

5.7

6.9

6.9

7.5

6.2

EBIT-

Adj % Rev

(9.9)%

(9.2)%

0.1%

1.4%

(4.7)%

Production (000’s)

286

313

344

326

270

(0.6)

(0.6)

(0.4)

0.0

EBIT-Adj.

16

0.1

(0.3) |

GME

EBIT – Q3 2010 vs. Q3 2011

Q3 2010

EBIT ($B)

Q3 2011

EBIT ($B)

$0.3B Improvement

EBIT

EBIT-Adj.

Less Special

Items

EBIT-Adj.

EBIT

Plus Special

Items

Volume /

Mix

Price

Cost

Other

0.0

0.1

0.0

0.2

0.0

0.0

(0.6)

(0.6)

(0.3)

(0.3)

17 |

GMIO

Deliveries (000’s)

GMIO Share

8.7%

8.6%

9.1%

9.6%

9.4%

China Share

13.6%

11.6%

13.6%

13.4%

14.1%

India Share

3.0%

3.4%

3.1%

3.4%

3.7%

China

GMIO Excl.

China

18 |

GMIO

Earnings Before Interest & Taxes ($B)

Revenue ($B)

EBIT margin from

consolidated operations*

Total China JV NI/Rev**

5.1

4.5%

11.8%

6.1

2.0%

7.7%

5.4

3.0%

12.0%

6.6

3.4%

11.1%

6.3

(0.6)%

10.5%

Consolidated Prod. (000’s)

Joint Venture Prod. (000’s)

Total Production (000’s)

235

631

866

265

747

1,012

257

709

966

310

693

1,003

253

715

968

0.5

0.3

0.5

0.6

EBIT-Adj.

19

0.6

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

* Excludes equity income and non-controlling interest adjustment. See

supplementary schedule S8 for additional details. ** Revenue not consolidated

in GM results, pro-rata share of earnings reported as equity inc. ***

Joint Venture production includes China & other JV’s 0.4

***

Equity Income |

EBIT

EBIT-Adj.

Less Special

Items

EBIT-Adj.

EBIT

Plus Special

Items

Volume /

Mix

Price

Cost

Other

Q3 2010

EBIT ($B)

Q3 2011

EBIT ($B)

$0.1B Decrease

0.2

(0.2)

(0.1)

0.0

0.0

0.0

0.5

0.5

0.4

0.4

GMIO EBIT –

Q3 2010 vs. Q3 2011

20 |

GMSA

Deliveries (000’s)

GMSA Share

19.8%

19.6%

18.7%

19.3%

18.7%

Brazil Share

18.3%

18.4%

17.3%

17.6%

17.1%

Brazil

GMSA Other

21 |

GMSA

Earnings Before Interest & Taxes ($B)

Revenue ($B)

4.0

4.5

3.9

4.4

4.4

EBIT-

Adj % Rev

4.1%

4.4%

2.3%

1.3%

(1.0)%

Production (000’s)

245

241

231

247

243

0.2

0.2

0.1

0.1

22

0.0 |

GMSA

EBIT – Q3 2010 vs. Q3 2011

Q3 2010

EBIT ($B)

Q3 2011

EBIT ($B)

$0.2B Decrease

EBIT

0.0

(0.2)

(0.1)

0.1

EBIT

EBIT-Adj.

Less Special

Items

EBIT-Adj.

Plus Special

Items

Volume /

Mix

Price

Cost

Other

0.2

0.2

0.0

0.0

0.0

0.0

23 |

Automotive Free Cash Flow

($B)

Q3 2010

Q3 2011

Net Income to Common Stockholders

2.0

1.7

Add-back Non-Controlling Interests, Preferred Dividends &

undistributed earnings allocated to Series B

0.2

0.4

Deduct Non-Auto (GM Financial)

n/a

(0.1)

Automotive Net Income

2.2

2.0

Depreciation / Amortization

1.7

1.4

Working Capital

(0.5)

(0.3)

Pension / OPEB –

Cash in Excess of Expense

(0.3)

(0.3)

Other

(0.5)

(1.0)

Automotive Net Cash Provided/(Used)

Operating Activities

2.6

1.8

Capital Expenditures

(1.2)

(1.5)

Automotive Free Cash Flow

1.4

0.3

24 |

Key

Automotive Balance Sheet Items ($B)

Sep. 30

2010

Jun. 30

2011

Sep. 30

2011

Cash & marketable securities*

34.5

33.8

33.0

Available Credit Facilities

1.3

5.9

5.9

Available Liquidity*

35.8

39.7

38.8

Key Obligations:

Debt

8.6

4.7

4.2

Series A Preferred Stock

7.0

5.5

5.5

U.S. Pension Underfunded Status**

18.0

10.8

8.7

Unfunded OPEB

9.4

10.0

9.5

* Includes Canadian HC Trust restricted cash

** Excludes U.S. non-qualified plan PBO of ~$0.9 billion

*** Excludes ~$2B stock contribution completed 1/13/11 that is counted as a

plan asset starting in July 2011 25

***

Note: Results may not foot due to rounding |

GM

Financial Q3

2010

Q3

2011

Industry Avg. (Excl. GM)

Q3

2010

Q3

2011

GM Sales Penetrations

U.S. Subprime (<=620)

4.8%

6.6%

4.5%

5.1%

U.S. Lease

8.6%

11.4%

20.5%

20.6%

Canada Lease

2.1%

9.4%

13.8%

15.0%

GM / GM Financial Linkage

GM as % of GM Financial Originations

(GM New / GMF Loan & Lease)

15.7%

39.3%

GM Fin. as % of GM U.S. S/P & Lease

9.8%

16.9%

GM Financial Performance

GM Financial Credit Losses

(annualized net charge-offs as % avg. receivables)

5.4%

3.0%

EBT ($M)

91

178

26

GM Sales Penetrations based on JD Power PIN

* GM acquired GM Financial in Oct. 2010, prior to this GM Financial was an

independent entity and not consolidated into GM results. Q3 2010 does not

reflect purchase accounting and is not directly comparable to Q3 2011 |

Q4 2011 Outlook

27

•

Based on current industry outlook, expect Q4 EBIT-

Adj. to

be at levels similar to Q4 2010

Seasonal trends in GMNA

Continued weakness in Europe

•

GME will not reach target of breakeven EBIT-

Adj. before

restructuring charges due to declining economic conditions

•

Expect a special items gain in Q4 of ~$800M related to

Canadian Health Care Trust (HCT) |

Third Quarter

Summary 28

•

Calendar-year-to-date results encouraging

Revenue $112B

Global share +0.5 pts to 11.9%

EBIT-Adj. $7.2B

•

Good progress, but more to do to deliver long-term

sustainable results

Improve results in GME & GMSA

Reduce complexity

Focus on cost containment

Leverage expected global growth

Deliver improved margins |

New

GM 29 |

General Motors Company

Select Supplemental Financial Information

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

*****

***** |

EBIT

Walk to Net Income to Common Stockholders S1

($B)

Q3

2010

Q3

2011

GMNA

2.1

2.2

GME

(0.6)

(0.3)

GMIO

0.5

0.4

GMSA

0.2

0.0

Corp & Elims

0.0

(0.2)

GM Financial

n/a

0.2

Total EBIT

2.3

2.2

Interest Expense / (Income)

0.1

0.0

Income Tax Expense / (Benefit)

0.0

0.1

Net Income to Stockholders

2.2

2.1

Undistributed earnings allocated to Series B (Basic)

n/a

(0.2)

Dividends on Preferred Stock

(0.2)

(0.2)

Net Income to Common Stockholders

2.0

1.7

Note: Starting Q4 2010 EBIT includes GM Financial on an Earnings

Before Tax (EBT) basis

Note: Results may not foot due to rounding |

Reconciliation of Q3 2011 EBIT-

Adj.

($B)

Q3

2010

Q3

2011

Net Income to Common Stockholders

2.0

1.7

Add Back:

Undistributed earnings allocated to Series B (Basic)

n/a

0.2

Dividends on Preferred Stock

0.2

0.2

Interest Expense / (Income)

0.1

0.0

Income Tax Expense / (Benefit)

0.0

0.1

Earnings Before Interest & Taxes (EBIT)

2.3

2.2

Less Special Items:

None

-

-

Total Special Items

0.0

0.0

EBIT-

Adj.

2.3

2.2

Note: Results may not foot due to rounding

S2

Note: Starting Q4 2010, EBIT includes GM Financial on an Earnings Before Tax (EBT)

basis |

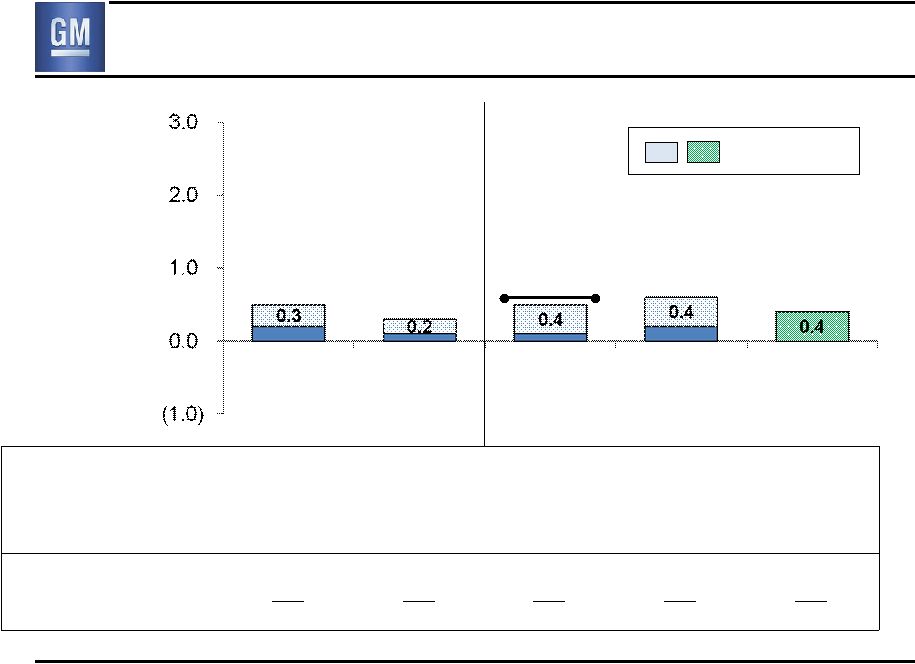

Restructuring (not included in special items)

($B)

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

GMNA –

Dealer Related

0.0

0.0

0.0

0.0

0.0

GMNA –

Non-Dealer

Related

0.1

0.2

0.0

0.0

(0.1)

Total GMNA

0.1

0.2

0.0

0.0

(0.1)

Total GME

(0.1)

(0.1)

0.0

(0.1)

(0.1)

Total GMIO

0.0

0.0

0.0

0.0

0.0

Total GMSA

0.0

0.0

0.0

0.0

0.0

Total

(0.1)

0.1

(0.1)

(0.1)

(0.2)

S3

Note: Results may not foot due to rounding |

Operating Income Walk to EBIT-

Adj.

($B)

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Operating Income

1.7

0.3

0.9

2.5

1.8

Equity Income

0.4

0.3

2.1

0.4

0.4

Non-Controlling Interests

(0.1)

(0.1)

0.0

0.0

0.0

Non-Operating Income

0.3

0.9

0.5

0.2

0.0

Earnings Before Interest & Taxes

(EBIT)

2.3

1.3

3.5

3.0

2.2

Less Special Items

0.0

0.3

1.5

0.0

0.0

EBIT-

Adj.

2.3

1.0

2.0

3.0

2.2

Note: Starting Q4 2010 EBIT & EBIT-Adj. include GM Financial on an

Earnings Before Tax (EBT) basis S4

Note: Results may not foot due to rounding |

Reconciliation of Automotive Free Cash Flow

($B)

Q3

2010

Q3

2011

Net cash provided by operating activities

2.6

2.0

Less net cash provided by operating activities-GM Financial

n/a

(0.2)

Automotive Net Cash Provided/(Used)

Operating Activities

2.6

1.8

Capital expenditures

(1.2)

(1.5)

Automotive Free Cash Flow

1.4

0.3

S5 |

GM

Financial – Key Metrics

($M)

Q3 2011

Memo:

Q3 2010**

Earnings Before Tax

178

91

Total Originations

1,547

959

GM new vehicles as % of total

39.3%

16.5%

Finance Receivables

9,438

8,676

Delinquencies (>30 days)*

6.4%

8.7%

Annualized net charge-offs as % of

avg. receivables

3.0%

5.4%

S6

* Excludes finance receivables in repossession

** GM acquired GM Financial in Oct. 2010, prior to this GM Financial was an

independent entity and not consolidated into GM results. Q3 2010 does not

reflect purchase accounting and is not directly comparable to Q3 2011 |

Info

Item: GMNA – C$ Net Monetary Liability

GMNA C$ NML Translational Impact

Q3

2010

Q4

2010

CY

2010

Q1

2011

Q2

2011

Q3

2011

Non-Cash EBIT Impact ($B)

$(0.2)

$(0.2)

$(0.4)

$(0.2)

$0.0

$0.3

Period End FX (CAD per USD)

Inc/(Dec) vs. Prior Period

1.0269

(0.0222)

0.9980

(0.0289)

0.9980

(0.0507)

0.9713

(0.0267)

0.9730

0.0017

1.0317

0.0587

•

GM Canada balance sheet includes C$ Net Monetary Liability (NML)

position, primarily pension, OPEB and accrued liabilities

•

USD value of NML will vary due to difference in period end to period end FX

•

Since GM Canada is USD functional, translation exchange realized

as non-

cash charge recorded to GMNA P&L

S7 |

Calculation

of

EBIT-

Adj.

as

a

Percent

of

Revenue

($B)

Q3

2010

%

Q4

2010

%

Q1

2011

%

Q2

2011

%

Q3

2011

%

Consolidated

Revenue

34.1

36.9

36.2

39.4

36.7

Operating Income

1.7

5.1%

0.3

0.8%

0.9

2.6%

2.5

6.2%

1.8

4.9%

EBIT-

Adj.

2.3

6.7%

1.0

2.8%

2.0

5.6%

3.0

7.5%

2.2

6.0%

GMIO

Revenue

5.1

6.1

5.4

6.6

6.3

Operating Income

0.1

2.5%

0.1

1.1%

0.1

1.8%

0.2

2.3%

0.0

0.2%

Non-Operating Income (Expense)

0.1

0.1

0.0

0.1

(0.1)

Plus Special Items *

0.0

0.0

0.1

0.0

0.0

EBIT from consolidated

operations

0.2

4.5%

0.1

2.0%

0.2

3.0%

0.2

3.4%

0.0

(0.6)%

Note: EBIT-

Adj. includes GM Financial on an Earnings Before Tax (EBT) basis; Results may not

foot due to rounding * Q1 2011 includes $67 million charge recorded as

a special item S8 |

EBIT

to EBIT– Adj.

($B)

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

EBIT

GMNA

2.1

0.8

2.9

2.2

2.2

GME

(0.6)

(0.6)

(0.4)

0.1

(0.3)

GMIO

0.5

0.3

0.5

0.6

0.4

GMSA

0.2

0.2

0.1

0.1

0.0

Corp & Elim.

0.0

0.4

0.3

(0.2)

(0.2)

GM Financial*

n/a

0.1

0.1

0.1

0.2

Total EBIT

2.3

1.3

3.5

3.0

2.2

Special Items

GMNA

0.0

(0.1)

(1.6)

0.0

0.0

GME

0.0

(0.1)

0.4

0.0

0.0

GMIO

0.0

0.0

0.1

0.0

0.0

GMSA

0.0

0.0

0.0

0.0

0.0

Corp & Elim.

0.0

(0.2)

(0.3)

0.0

0.0

GM Financial

0.0

0.0

0.0

0.0

0.0

Total Special Items

0.0

(0.3)

(1.5)

0.0

0.0

EBIT–

Adj.

GMNA

2.1

0.8

1.3

2.2

2.2

GME

(0.6)

(0.6)

0.0

0.1

(0.3)

GMIO

0.5

0.3

0.6

0.6

0.4

GMSA

0.2

0.2

0.1

0.1

0.0

Corp & Elim.

0.0

0.2

0.0

(0.2)

(0.2)

GM Financial*

n/a

0.1

0.1

0.1

0.2

Total EBIT–

Adj.

2.3

1.0

2.0

3.0

2.2

S9

Note: Results may not foot due to rounding

* GM Financial at an Earnings Before Tax basis (EBT)

|