Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GARDNER DENVER INC | d253333d8k.htm |

Gardner Denver

Investor Presentation

November, 2011

Exhibit 99.1 |

| SF PowerPoint Template 03-27-08/2

2

Safe Harbor Disclosure

All of the statements made by Gardner Denver in this presentation or made orally in connection with

it, other than historical facts, are forward-looking statements. As a general matter,

forward-looking statements are those focused upon anticipated events or trends,

expectations, and beliefs relating to matters that are not historical in nature. The

Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for these

forward-looking statements. In order to comply with the terms of the safe harbor, the

Company notes that forward-looking statements are subject to known and unknown risks,

uncertainties, and other factors relating to the Company’s operations and business environment,

all of which are difficult to predict and many of which are beyond the control of the

Company. These known and unknown risks, uncertainties, and other factors could cause

actual results to differ materially from those matters expressed in, anticipated by or implied

by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: changing

economic conditions; pricing of the Company’s products and other competitive market

pressures; the costs and availability of raw materials; fluctuations in foreign currency rates

and energy prices; risks associated with the Company’s current and future litigation; and

the other risks detailed from time to time in the Company’s SEC filings, including but not

limited to, its annual report on Form 10-K for the fiscal year ending December 31, 2010,

and its quarterly reports on Form 10-Q.

These statements reflect the current views and assumptions of management with respect to future

events. The Company does not undertake, and hereby disclaims, any duty to update these

forward- looking statements, although its situation and circumstances may change in the

future. The inclusion of any statement in this presentation does not constitute admission

by the Company or any other person that the events or circumstances described in such statement

are material. |

Gardner

Denver

Overview |

4

Gardner Denver Overview

Early stages of transformation to a high

quality,

high margin Industrial Company with Energy exposure

Leading

brands

and

technologies

…

strong

distribution

New, operationally focused team driving “The Gardner Denver Way”

~$2.4B

(1)

global Company with diverse and attractive end markets

Growing, profitable aftermarket opportunity

Focused on superior cash and earnings growth

Strong track record on analyzing and integrating acquisitions

(1)

Company estimates (see note on p. 31) |

SF

PowerPoint Template 03-27-08/5 5

A

global

leader

in

compressed

air

and

gas,

vacuum

and

fluid

transfer

technologies

We serve a wide range of industries with efficient & reliable products

Energy

Medical

Mining

Transportation

Food &

Beverage |

6

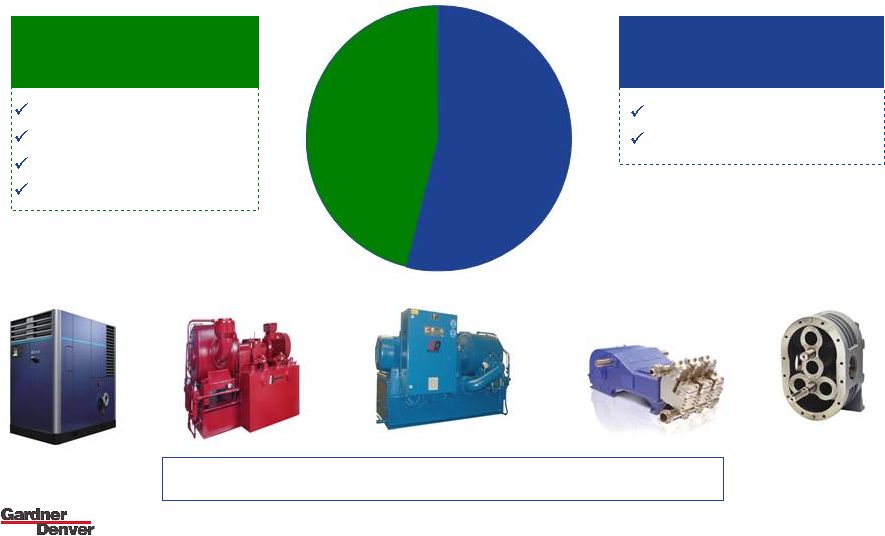

Two business segments aligned to effectively

serve our customers

Engineered Products

Group

Industrial Products

Group

2011 Sales by segment

~$1.2B

~$1.1B

(1)

Company estimates (see note on p. 31)

(1)

Petroleum pumps

Liquid ring pumps

Loading arms

OEM compressors

Compressors (>50psi)

Blowers (<50psi)

Great portfolio of brands and businesses |

SF

PowerPoint Template 03-27-08/7 7

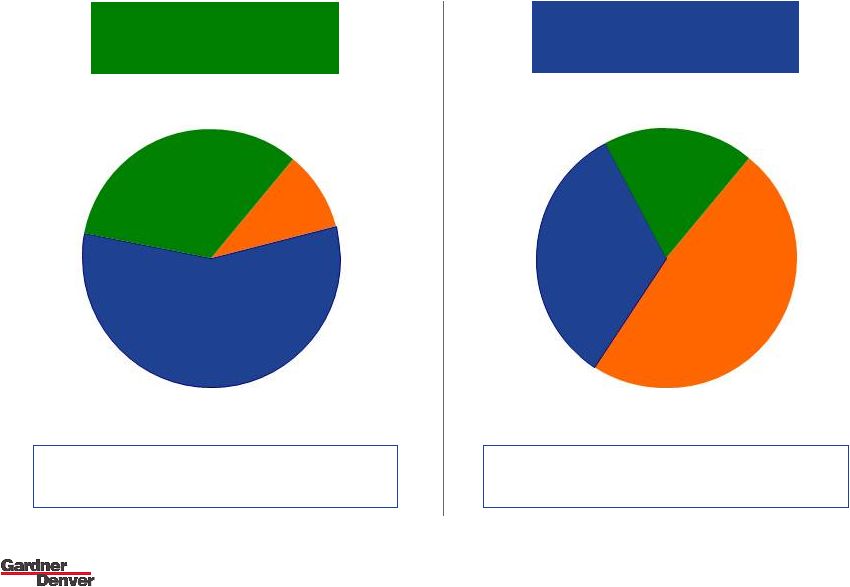

Well established sales channels

Distribution

10%

Direct

57%

OEM

33%

Engineered Products

Group

Industrial Products

Group

Distribution

48%

Direct

33%

OEM

19%

Products designed for customer

specific applications

Primarily standard configuration

products |

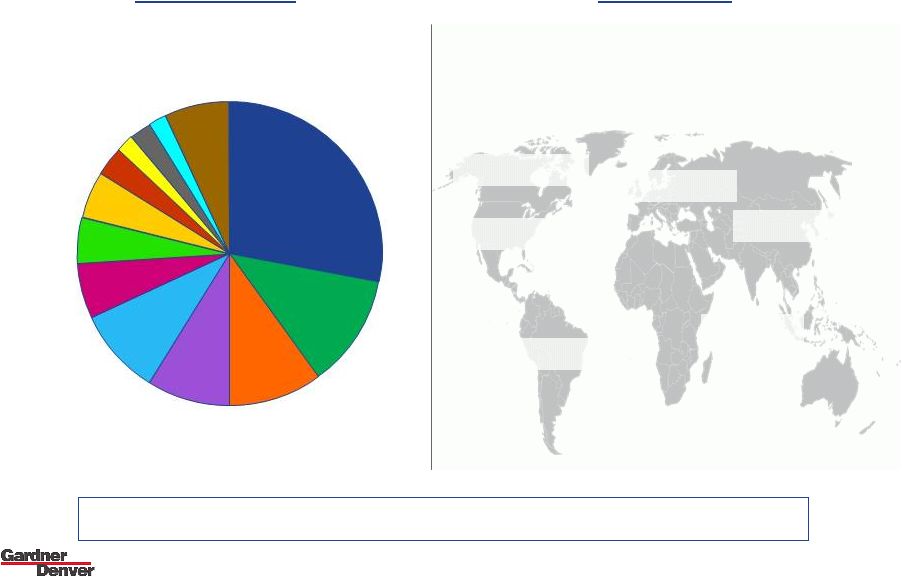

8

Highly diversified and global

End Markets

(1)

Geographic

Industrial

Manufacturing

(28%)

Upstream

Energy

(12%)

Downstream

Energy

(10%)

Medical/

Laboratory

(9%)

Transportation

(9%)

Food

&

Beverage

(6%)

Mining

&

Construction

(5%)

Chemical (5%)

Environment (3%)

Printing (2)%

Auto Svcs (2%)

Paper (2)%)

Other

(7%)

2010 Revenue by End User

Canada 4%

United States 35%

Latin America 3%

Europe 35%

Other 7%

Asia 16%

2010 Revenue by Geography

Visibility to a large cross section of global economy

(1)

Company estimates (see note on p. 31) |

SF

PowerPoint Template 03-27-08/9 9

Exposed to multiple phases of the

economic cycle

Early Cycle

(1-18 months)

Late Cycle

(36+ months)

Mid Cycle

(18-36 months)

Engineered packages

Infrastructure projects

Industrial air compressors

OEM

Aftermarket |

SF PowerPoint Template 03-27-08/10

10

Current end market dynamics

Comment

Status

Strong growth in Americas

Well servicing and drilling

pump demand very strong

China softening, APAC strong

Stable

U.S. Industrial Production

-

Capacity utilization

E.U. Industrial Production

Oil & Gas

-

Rig

count,

crude

/

nat

gas pricing

China/Asia Pacific

OEM applications

End market / Indicator

Stable …

cautionary tone

Generally,

favorable

end

markets

in

an

uncertain

environment |

SF PowerPoint Template 03-27-08/11

11

Prepared

for

economic

volatility

Cautiously optimistic on macro economy …

contingency plans in the works since April 2011

Strong track record on cost reductions since 2008

Headcount

(23)%

reduction

/

2,700

employees

Footprint

Closed

8

plants

One ERP

71%

+

450

bps

Operating

Margins |

Growth

Strategy |

13

•

Strengthen presence in attractive

end markets & emerging markets

4.

Selective acquisitions

•

Access to faster growing end

markets and generate synergies

Strategy

Focus

2.

Aftermarket growth

•

Higher margin, less cyclical

5.

Margin expansion

•

Cost reductions and operational excellence

3.

Innovative products

•

Expand share with differentiated

technologies

Simple, focused 5-point strategy

Execution

supported

by

the

principles

of

the

Gardner

Denver

Way

1.

Organic growth |

SF PowerPoint Template 03-27-08/14

14

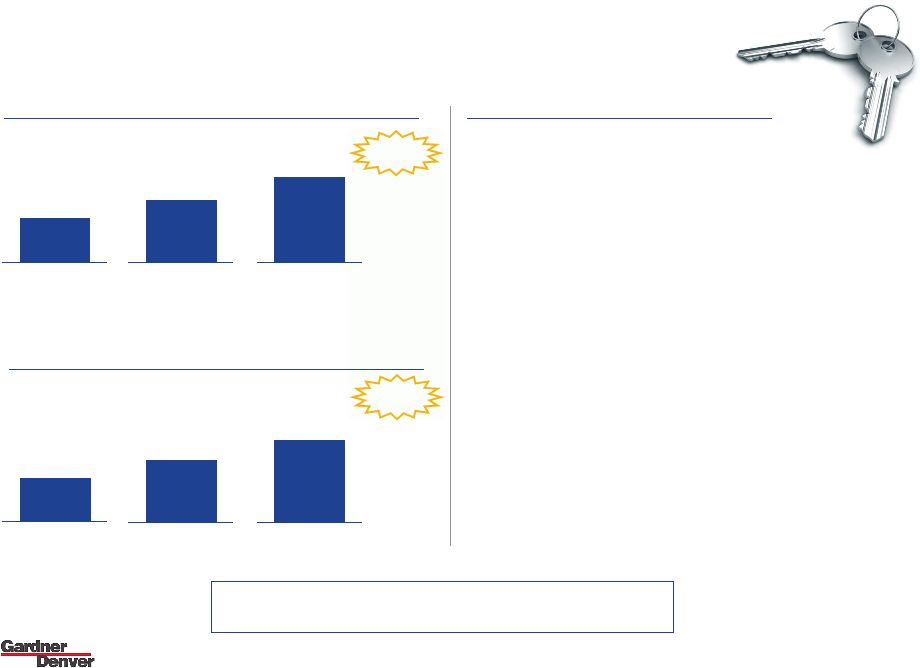

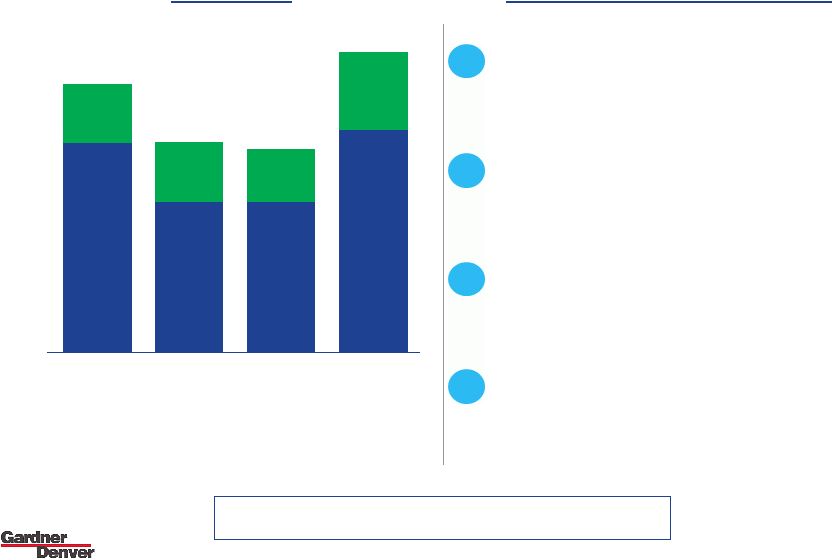

’11E

(1)

~$600

Organic growth

Keys to organic growth

•

Leading brands & technologies

Orders

~10%

•

Diverse end markets …

strong

distribution channels

‘10

$554

Backlog

’11E

(1)

~$2.5B

~20%

‘10

$2,060

‘09

$1,570

‘09

$395

•

Growing emerging markets presence

•

Higher growth end markets …

energy

•

Aftermarket

($’s in millions)

(1)

Company estimates (see note on p. 31)

Good momentum going into 2012 |

SF PowerPoint Template 03-27-08/15

15

Build out the aftermarket

Key growth drivers

•

Large installed base

Aftermarket as % of sales

•

Big opportunity in pressure pumping

repair and fluid ends

‘10

31%

‘09

29%

‘08

26%

•

Remote monitoring capabilities

•

Design in proprietary features

Goal

40-45%

•

Extended warranty and service

agreements

Higher

margin,

less

cyclical

growth |

SF PowerPoint Template 03-27-08/16

16

A more innovative Company

Voice of customer differentiates products from competition

Value proposition based on customer needs

2011 product launches across multiple divisions demonstrate progress

PZ-2400 Drilling Pump

Hoffman Revolution

Quantima Compressor

Goal: ~10% of annual revenues from new products |

17

24 acquisitions over 15 years

1996

2011

Engineered Products

Group

Industrial Products

Group

TCM

Twentieth Century Mfg

.

Water Jetting

•

Butterworth

•

CRS Power Flow

•

Jetting Systems

Strong

track

record

on

analyzing

&

integrating

acquisitions |

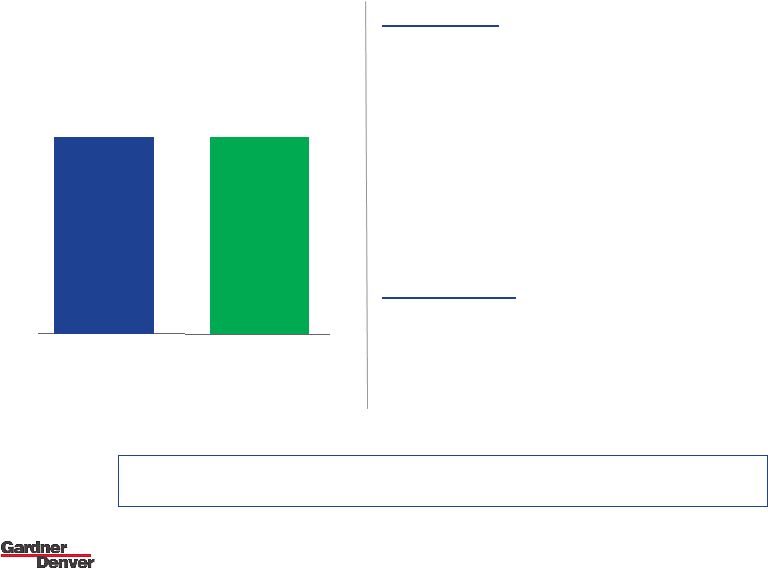

18

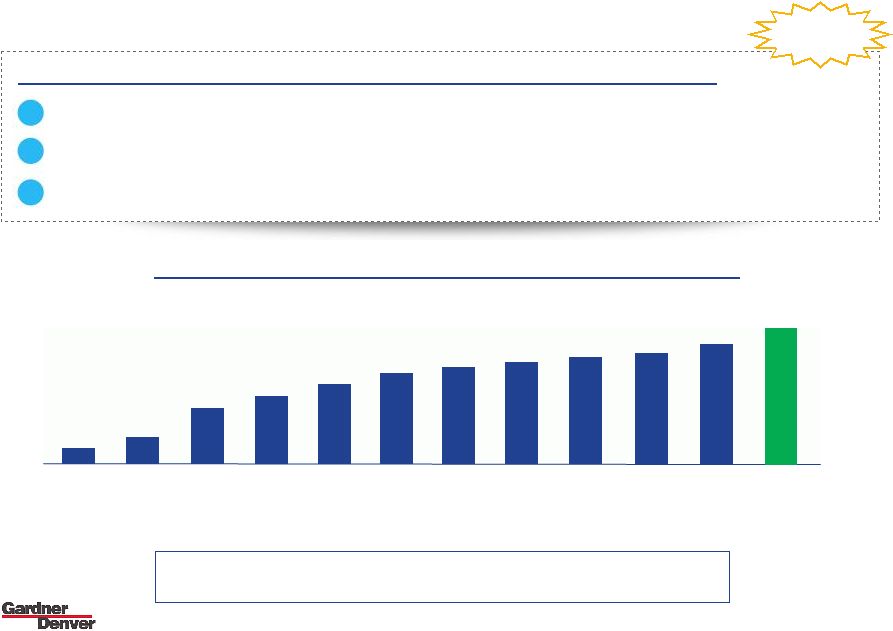

IPG Margin Expansion

1Q09

1Q10

2.0%

2Q09

3Q09

4Q09

10

Quarters

of

Sequential

Margin

Expansion

(2)

2Q10

2Q11

3Q10

4Q10

1Q11

3Q11

2.5%

6.8%

7.5%

8.3%

8.6%

9.4%

10.1%

11.3%

11.7%

13.1%

Goal

14%

+150 bps of margin expansion annually w/no volume growth:

Restructuring …

27% reduction in employment since Oct ’08, ~$70 million program

Productivity investments …

8 fewer facilities, Lean, Capex / machine tools, SAP

Low Cost Country Sourcing …

“just getting started”

1

2

3

“14 x 14”

(2)

Adjusted Operating Margin (see note on p. 31)

Committed

to

continued

margin

expansion |

19

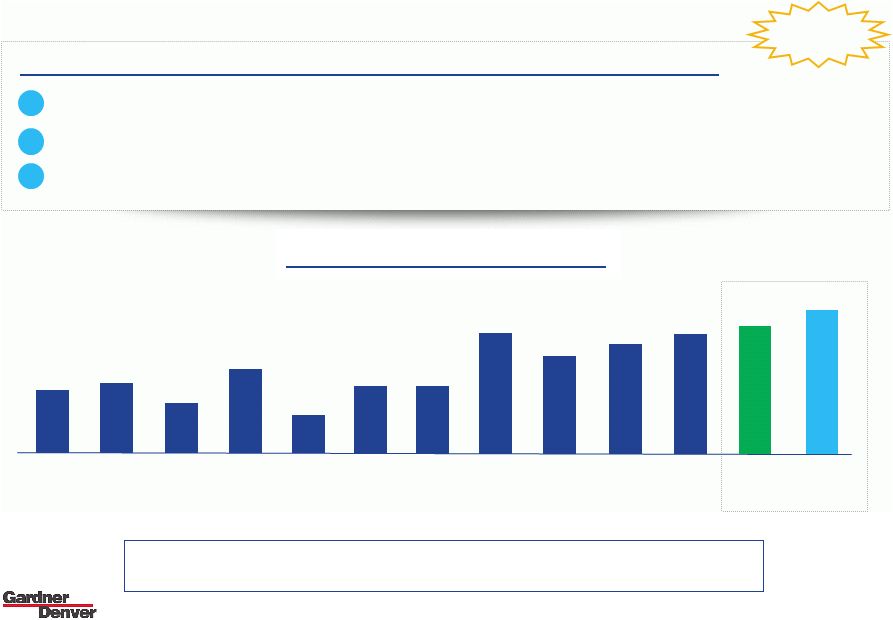

EPG Margin Expansion

1Q09

1Q10

19.5%

2Q09

3Q09

4Q09

EPG Margin Expansion

(2)

2Q10

2Q11

3Q10

4Q10

1Q11

3Q11

19.7%

17.8%

20.9%

16.0%

19.5%

19.7%

24.0%

22.9%

23.3%

23.6%

Last

Peak

24.5%

+50 bps of margin expansion annually w/ no volume growth:

Restructuring …

reduced employment by 15% since ’08 with 15% increase in revenue

Productivity investments …

Lean, Capex / capacity, enhanced project mgmt

Low Cost Country Sourcing …

some progress made, but more opportunities

1

2

3

+50 bps

“New”

Peak

~28.5%

(2)

Adjusted Operating Margin (see note on p. 31)

Expanding

already

attractive

operating

margins |

Financial Results |

SF PowerPoint Template 03-27-08/21

21

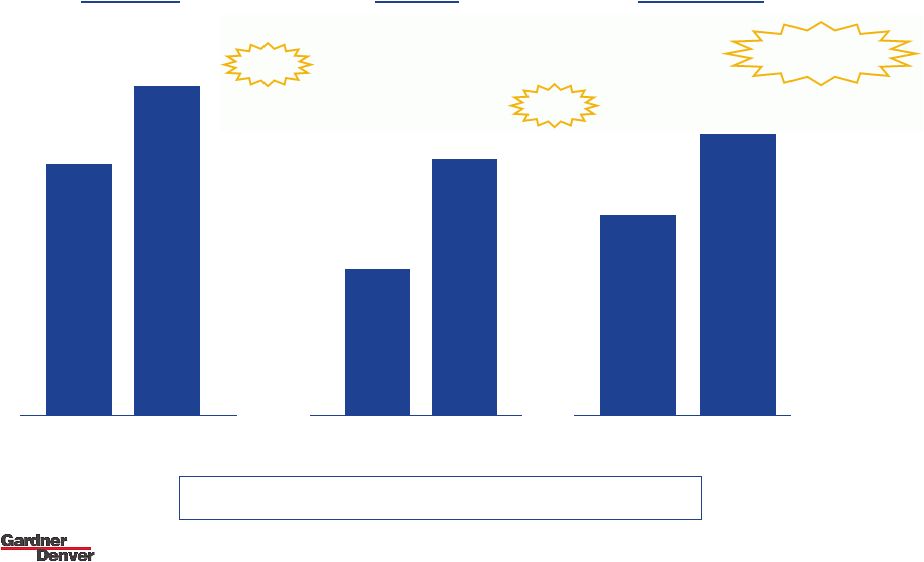

2000

$379

$1,215

2005

$1,895

2010

Revenue

$3.28

2010

2005

$1.37

$0.60

2000

DEPS

2000

$31

2005

$115

2010

$202

Cash Flow from

Operations

A decade of financial performance

17%

CAGR

Strong track record

19%

CAGR

21%

CAGR

($’s in millions) |

22

$1.9B

2010

~$2.4B

2011

Revenue

$5.44 -

$5.49

2011

2010

$3.39

Adjusted

DEPS

(2)

2010

$202

2011

~$300

2011 financial outlook

~25%

~60%

1.2

x

Net

Income

A record year on key financial metrics

(1)

Company estimates (see note on p. 31)

(1)

Cash Flow from

Operations

(2)

Adjusted DEPS (see note on p. 31)

(in line with guidance) |

SF PowerPoint Template 03-27-08/23

23

Strong cash generation

2008

$237

$169

2009

$169

2010

Cash Flow

Disciplined capital deployment

FCF

CFOA

2011E

$278

$211

$202

~$300

~$250

FCF

Conv.

143%

N/M

98%

~90%

(1)

($’s in millions)

(1)

Company estimates (see note on p. 31)

Capital

expenditures…

organic

growth

and productivity

1

2

3

4

Capital Deployment Strategy

Financial

objectives…

reduce

debt,

strong balance sheet

Selective

acquisitions…

inorganic

investment to create value

Return

to

shareholders...

dividend,

opportunistic buyback |

SF PowerPoint Template 03-27-08/24

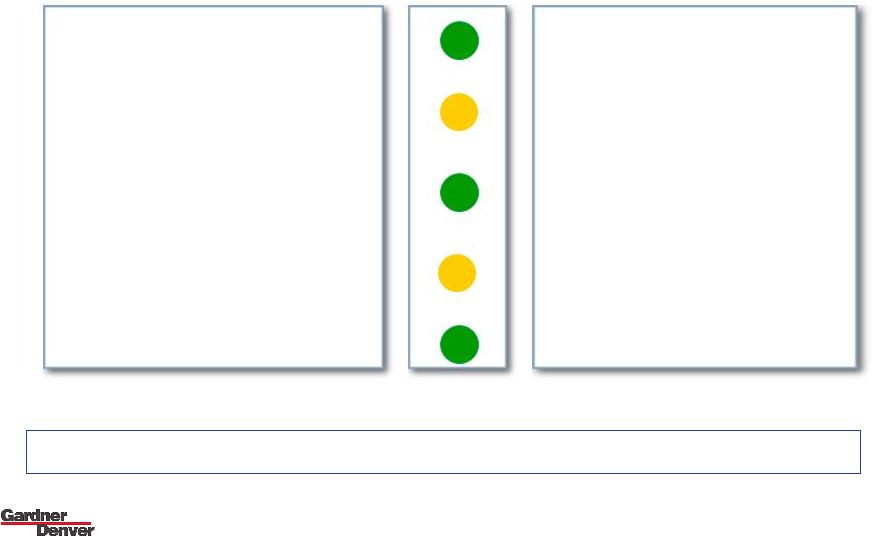

24

Internal long term operating goals

progress

•

Grow 2 x GDP

Operating goals

Good progress YTD …

more to do

3Q YTD Comment

•

Margin expansion

•

FCF Conversion

•

Increase ROIC

•

Lean cost structure

+

+

+

/

+

+

•

Revenue up 29%

•

DEPS up 74%

•

86%

•

ROIC ~19%

•

16.8% SG&A to sales

-

2011 |

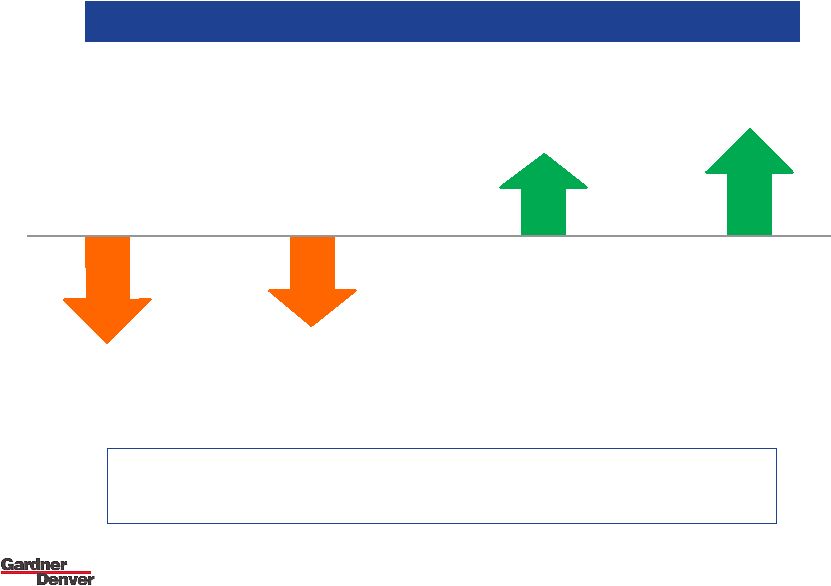

25

2012 earnings growth framework

Tailwinds:

+

Margin expansion “The Gardner Denver Way”

+

Orders momentum / EPG backlog

+

Strength in Energy end markets

+

Aftermarket momentum

+

Accretive M&A …

Robuschi

+

Reduced share count

Headwinds:

–

Macro uncertainty incl. China, Europe

–

Late cycle infrastructure projects

–

Tougher comparisons to record 2011

’11 Adj DEPS

(2)

~$5.44-5.49

’12 Adj DEPS

+

(2)

Adjusted DEPS (see note on p. 31)

Positioned

to

deliver

in

an

uncertain

environment |

The

Gardner

Denver

Way |

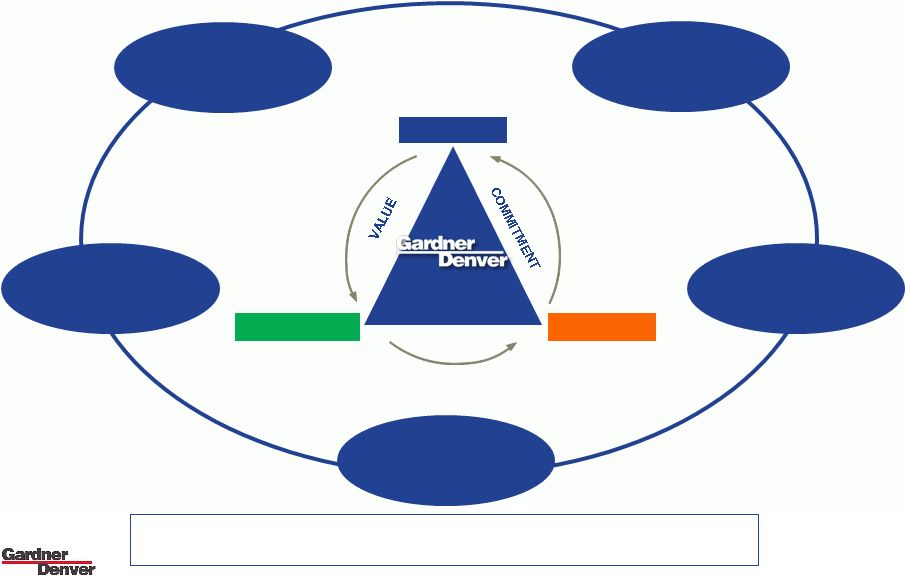

27

Aftermarket

growth

Innovative

products

Selective

acquisitions

Margin

expansion

Organic

growth

CUSTOMERS

Innovation

High Velocity

RESOURCES

Strategy supported by The Gardner

Denver Way

Execution

requires

superior

human

resources

SHAREHOLDERS

EMPLOYEES |

28

Building a high performance culture

New,

operationally

focused

management

team driving transformation

Operationally

focused team

Policy

deployment

Operating

rhythms

Clear

accountability

Continuous

improvement |

29

Gardner Denver Summary

Early stages of transformation to a high

quality,

high margin Industrial Company with Energy exposure

Leading

brands

and

technologies

…

strong

distribution

New, operationally focused team driving “The Gardner Denver Way”

~$2.4B

(1)

global Company with diverse and attractive end markets

Growing, profitable aftermarket opportunity

Focused on superior cash and earnings growth

Strong track record on analyzing & integrating acquisitions

(1)

Company estimates (see note on p. 31) |

Gardner Denver

Investor Presentation

November, 2011 |

| SF PowerPoint Template 03-27-08/31

31

Presentation notes

•

Note 1:

Company estimates

•

Note

2:

Adjusted

Operating

Income,

Adjusted

Operating

Margins,

Adjusted

Net

Income

and

Adjusted

DEPS are financial measures that are not in accordance with US GAAP. Adjusted

Operating Income, Adjusted Operating Margins and Adjusted DEPS exclude the

impact of expenses incurred for profit improvement initiatives,

non-recurring items and impairment charges. Adjusted net income is net

income excluding non-cash impairment charges, net of related changes in

deferred tax assets and liabilities.

Gardner Denver believes the non-GAAP financial measure of Adjusted Operating

Income, Adjusted Operating

Margins,

Adjusted

Net

Income

and

Adjusted

DEPS

provide

important

supplemental

information

to

both

management

and

investors

regarding

financial

and

business

trends

used

in

assessing its results of operations. Gardner Denver believes excluding the

specified items from the aforementioned financial measures provides a more

meaningful comparison to the corresponding prior year periods and internal

budgets and forecasts, assists investors in performing analysis that is

consistent with financial models developed by investors in performing and research

analysts, provides management with a more relevant measurement of operating

performance, and is more useful in assessing management

performance. |