Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - FIRSTCITY FINANCIAL CORP | a11-29412_18k.htm |

EXHIBIT 99.1

NEWS RELEASE

|

Contact: |

Suzy W. Taylor |

|

|

866-652-1810 |

FirstCity Financial Corporation Reports Third Quarter 2011 Results

Waco, Texas November 8, 2011……….

Highlights:

· FirstCity reported third quarter 2011 earnings of $2.7 million or $0.26 per diluted share.

· FirstCity and its partners acquired $87.7 million of portfolio assets with a face value of $144.9 million during the quarter. Subsequent to the quarter, FirstCity and its partners acquired $72.4 million of portfolio assets with a face value of $159.0 million.

· FirstCity and its partners, year to date, have acquired $252.9 million of portfolio assets with a face value of $484.5 million.

· FirstCity invested $10.4 million in non-portfolio debt and equity investments during the quarter, bringing year-to-date totals to $28.4 million.

Components of FirstCity’s quarterly results are summarized below:

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||

|

|

|

September 30, |

|

September 30, |

| ||||||||

|

(Dollars in thousands, except per share data) |

|

2011 |

|

2010 |

|

2011 |

|

2010 |

| ||||

|

|

|

(Unaudited) |

| ||||||||||

|

Continuing Operations: |

|

|

|

|

|

|

|

|

| ||||

|

Portfolio Asset Acquisition and Resolution |

|

$ |

3,136 |

|

$ |

(3,346 |

) |

$ |

10,725 |

|

$ |

2,795 |

|

|

Special Situations Platform |

|

1,376 |

|

8,346 |

|

3,469 |

|

9,681 |

| ||||

|

Corporate and other |

|

(1,782 |

) |

(2,108 |

) |

(5,311 |

) |

(6,061 |

) | ||||

|

Earnings from continuing operations |

|

2,730 |

|

2,892 |

|

8,883 |

|

6,415 |

| ||||

|

Income from discontinued operations - Special Situations Platform (1) |

|

— |

|

(333 |

) |

— |

|

4,310 |

| ||||

|

Net earnings attributable to FirstCity |

|

$ |

2,730 |

|

$ |

2,559 |

|

$ |

8,883 |

|

$ |

10,725 |

|

|

Diluted earnings per common share |

|

$ |

0.26 |

|

$ |

0.25 |

|

$ |

0.86 |

|

$ |

1.06 |

|

(1) Represents the results of operations of the Company’s consolidated coal mine that dissolved in December 2010.

James T. Sartain, CEO of FirstCity, commented, “I am very pleased with our strong operating results this quarter, the level of collections from our portfolio assets, and our investment activity. Investment opportunities remain strong and continue to grow. We believe that our recent acquisitions, combined with our strong pipeline and prospects for future investments, will bolster the future earnings power of our servicing platform.”

(more)

Portfolio Asset Acquisition and Resolution Business Segment

For the third quarter of 2011 (“Q3 2011”), our Portfolio Asset Acquisition and Resolution business segment reported $3.1 million in earnings — comprised primarily of $17.3 million in revenues, $1.4 million of equity in earnings of unconsolidated subsidiaries, $13.0 million of operating costs and expenses, and $2.6 million of income tax expense and net income attributable to noncontrolling interests. Earnings for Q3 2011 were positively impacted by continued revenue streams from our core investment activities and servicing platform (due to increased collections). Additional information related to our Portfolio Asset Acquisition and Resolution business segment, including the major components of revenue, costs and expenses, is included in the supplemental schedules of this release.

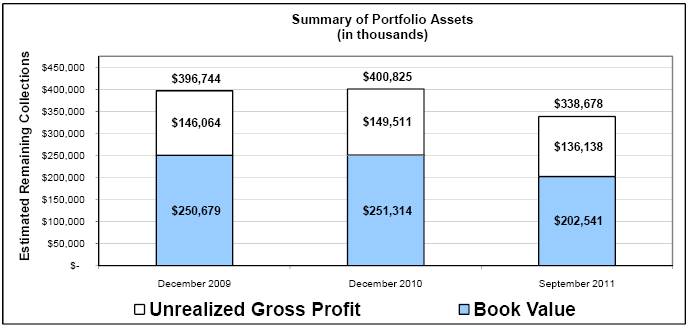

The Company’s unrealized gross profit associated with its core portfolio assets totaled $136.1 million at September 30, 2011. Unrealized gross profit is a non-GAAP measure. Refer to the Schedule of Estimated Unrealized Gross Profit from Portfolio Assets on page 9 of this release for a reconciliation of this measure with the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP.

Special Situations Platform Business Segment

Our Special Situations Platform business segment provided $1.4 million in earnings for Q3 2011 — comprised primarily of $2.9 million in revenues, $1.4 million in equity in earnings of unconsolidated subsidiaries, and $2.4 million of operating costs and expenses. Additional information related to our Special Situations Platform business segment, including the major components of revenue, costs and expenses, is included in the supplemental schedules of this release.

Conference Call

A conference call will be held on Tuesday, November 8, 2011 at 9:00 a.m. Central Time to discuss Q3 2011 results. A question and answer session will follow the prepared remarks. Details to access the call and webcast are as follows:

|

|

Event: |

FirstCity Financial Corporation Third Quarter 2011 Conference Call | ||

|

|

Date: |

Tuesday, November 8, 2011 | ||

|

|

Time: |

9:00 a.m. Central Time | ||

|

|

Host: |

James T. Sartain, FirstCity’s President and Chief Executive Officer | ||

|

|

|

| ||

|

|

Web Access: |

FirstCity’s web page - |

www.fcfc.com/invest.htm or, | |

|

|

|

CCBN’s Investor websites - |

www.streetevents.com and, | |

|

|

|

|

www.earnings.com | |

|

|

|

| ||

|

|

Dial In Access: |

Domestic |

800-561-2693 | |

|

|

|

International |

617-614-3523 | |

|

|

|

|

| |

|

|

|

Pass code |

95272833 | |

Replay available on FirstCity’s web page (www.fcfc.com/invest.htm)

FirstCity Financial Corporation is a diversified financial services company with operations dedicated primarily to distressed asset acquisitions and special situations investments. FirstCity has offices in the U.S. and affiliate organizations in Europe and Latin America. FirstCity common stock is listed on the NASDAQ Global Select Market (NASDAQ: FCFC).

Cautionary Statement Regarding Forward-Looking Statements

FirstCity may from time to time make written or oral forward-looking statements, including statements contained in this press release, FirstCity’s filings with the Securities and Exchange Commission (“SEC”), in its reports to stockholders and in other FirstCity communications. These statements relate to FirstCity’s or management’s intentions, hopes, beliefs, expectations, representations, projections, plans or predictions of the future and may be deemed to be forward-looking statements under the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements in this press release are based upon management’s beliefs, assumptions and expectations of the Company’s future operations and economic performance, taking into account currently available information. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us. Actual events or results may differ from those expressed or implied in any such forward-looking statements as a result of various factors and risks, including the precautionary statements included in this document and those contained from time to time in the Company’s filings with the SEC including but not limited to its annual reports on Form 10-K, its quarterly reports on Form 10-Q, and its current reports on Form 8-K, filed with the SEC and available through the Company’s website, which contain a more detailed discussion of the Company’s business, including risks and uncertainties that may affect future results. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof. Information in this press release may be superseded by more recent information or statements, which may be disclosed in later press releases, subsequent filings with the SEC or otherwise. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or to reflect any change in events, conditions or circumstances on which any such forward-looking statements are based, in whole or in part.

FirstCity Financial Corporation

Summary of Operations and Selected Balance Sheet Data

(Dollars in thousands, except per share data)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||

|

|

|

September 30, |

|

September 30, |

| ||||||||

|

|

|

2011 |

|

2010 |

|

2011 |

|

2010 |

| ||||

|

Revenues: |

|

|

|

|

|

|

|

|

| ||||

|

Finance and Servicing: |

|

|

|

|

|

|

|

|

| ||||

|

Servicing fees |

|

$ |

2,829 |

|

$ |

2,252 |

|

$ |

7,734 |

|

$ |

5,998 |

|

|

Income from Portfolio Assets |

|

11,964 |

|

8,195 |

|

33,902 |

|

34,280 |

| ||||

|

Gain on sale of SBA loans held for sale, net |

|

306 |

|

197 |

|

1,836 |

|

360 |

| ||||

|

Gain on sale of investment security |

|

— |

|

— |

|

— |

|

3,250 |

| ||||

|

Interest income from SBA loans |

|

350 |

|

314 |

|

1,024 |

|

895 |

| ||||

|

Interest income from loans receivable |

|

872 |

|

1,097 |

|

2,683 |

|

3,185 |

| ||||

|

Other income |

|

1,774 |

|

1,856 |

|

5,756 |

|

4,552 |

| ||||

|

|

|

18,095 |

|

13,911 |

|

52,935 |

|

52,520 |

| ||||

|

Manufacturing and Railroad Operations: |

|

|

|

|

|

|

|

|

| ||||

|

Operating revenues - manufacturing |

|

— |

|

— |

|

— |

|

10,466 |

| ||||

|

Operating revenues - railroad |

|

2,157 |

|

998 |

|

5,017 |

|

3,459 |

| ||||

|

|

|

2,157 |

|

998 |

|

5,017 |

|

13,925 |

| ||||

|

Total revenues |

|

20,252 |

|

14,909 |

|

57,952 |

|

66,445 |

| ||||

|

Costs and expenses: |

|

|

|

|

|

|

|

|

| ||||

|

Finance and Servicing: |

|

|

|

|

|

|

|

|

| ||||

|

Interest and fees on notes payable to banks and other |

|

3,195 |

|

4,211 |

|

10,156 |

|

10,587 |

| ||||

|

Interest and fees on note payable to affiliate |

|

374 |

|

393 |

|

1,140 |

|

1,185 |

| ||||

|

Salaries and benefits |

|

5,360 |

|

4,995 |

|

16,034 |

|

16,067 |

| ||||

|

Provision for loan and impairment losses |

|

1,553 |

|

4,090 |

|

2,370 |

|

8,417 |

| ||||

|

Asset-level expenses |

|

1,572 |

|

2,257 |

|

4,716 |

|

5,981 |

| ||||

|

Other |

|

4,114 |

|

2,158 |

|

8,981 |

|

8,660 |

| ||||

|

|

|

16,168 |

|

18,104 |

|

43,397 |

|

50,897 |

| ||||

|

Manufacturing and Railroad Operations: |

|

|

|

|

|

|

|

|

| ||||

|

Cost of revenues and operating costs - manufacturing |

|

— |

|

— |

|

— |

|

10,788 |

| ||||

|

Cost of revenues and operating costs - railroad |

|

1,211 |

|

635 |

|

2,978 |

|

1,868 |

| ||||

|

|

|

1,211 |

|

635 |

|

2,978 |

|

12,656 |

| ||||

|

Total costs and expenses |

|

17,379 |

|

18,739 |

|

46,375 |

|

63,553 |

| ||||

|

Earnings (loss) before other revenue and income taxes |

|

2,873 |

|

(3,830 |

) |

11,577 |

|

2,892 |

| ||||

|

Equity in earnings of unconsolidated subsidiaries |

|

2,777 |

|

9,962 |

|

7,931 |

|

14,007 |

| ||||

|

Gain on business combination |

|

155 |

|

— |

|

433 |

|

891 |

| ||||

|

Earnings from continuing operations before income taxes |

|

5,805 |

|

6,132 |

|

19,941 |

|

17,790 |

| ||||

|

Income tax expense |

|

421 |

|

473 |

|

2,047 |

|

1,192 |

| ||||

|

Earnings from continuing operations, net of tax |

|

5,384 |

|

5,659 |

|

17,894 |

|

16,598 |

| ||||

|

Income (loss) from discontinued operations |

|

— |

|

(333 |

) |

— |

|

4,310 |

| ||||

|

Net earnings |

|

5,384 |

|

5,326 |

|

17,894 |

|

20,908 |

| ||||

|

Less: net income attributable to noncontrolling interests |

|

2,654 |

|

2,767 |

|

9,011 |

|

10,183 |

| ||||

|

Net earnings attributable to FirstCity |

|

$ |

2,730 |

|

$ |

2,559 |

|

$ |

8,883 |

|

$ |

10,725 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Basic earnings per share of common stock: |

|

|

|

|

|

|

|

|

| ||||

|

Earnings from continuing operations |

|

$ |

0.26 |

|

$ |

0.28 |

|

$ |

0.86 |

|

$ |

0.64 |

|

|

Discontinued operations |

|

$ |

— |

|

$ |

(0.03 |

) |

$ |

— |

|

$ |

0.43 |

|

|

Net earnings per common share |

|

$ |

0.26 |

|

$ |

0.25 |

|

$ |

0.86 |

|

$ |

1.07 |

|

|

Weighted average common shares outstanding (in thousands) |

|

10,290 |

|

10,160 |

|

10,279 |

|

10,054 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Diluted earnings per share of common stock: |

|

|

|

|

|

|

|

|

| ||||

|

Earnings from continuing operations |

|

$ |

0.26 |

|

$ |

0.28 |

|

$ |

0.86 |

|

$ |

0.63 |

|

|

Discontinued operations |

|

$ |

— |

|

$ |

(0.03 |

) |

$ |

— |

|

$ |

0.43 |

|

|

Net earnings per common share |

|

$ |

0.26 |

|

$ |

0.25 |

|

$ |

0.86 |

|

$ |

1.06 |

|

|

Weighted average common shares outstanding (in thousands) |

|

10,326 |

|

10,280 |

|

10,297 |

|

10,162 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

September 30, |

|

December 31, |

|

|

|

|

| ||||

|

|

|

2011 |

|

2010 |

|

|

|

|

| ||||

|

|

|

(Unaudited) |

|

|

|

|

|

|

| ||||

|

Selected Balance Sheet Data: |

|

|

|

|

|

|

|

|

| ||||

|

Cash and cash equivalents |

|

$ |

47,142 |

|

$ |

46,597 |

|

|

|

|

| ||

|

Earning assets: |

|

|

|

|

|

|

|

|

| ||||

|

Portfolio Asset Acquisition and Resolution assets: |

|

|

|

|

|

|

|

|

| ||||

|

United States |

|

209,441 |

|

241,589 |

|

|

|

|

| ||||

|

Latin America |

|

38,409 |

|

39,476 |

|

|

|

|

| ||||

|

Europe |

|

49,698 |

|

68,642 |

|

|

|

|

| ||||

|

Special Situations Platform assets - U.S. |

|

52,318 |

|

50,765 |

|

|

|

|

| ||||

|

Service fees receivable and other assets |

|

13,829 |

|

13,335 |

|

|

|

|

| ||||

|

Total assets |

|

$ |

410,837 |

|

$ |

460,404 |

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Notes payable to banks and other |

|

$ |

237,358 |

|

$ |

293,034 |

|

|

|

|

| ||

|

Notes payable to affiliates |

|

7,860 |

|

11,805 |

|

|

|

|

| ||||

|

Other liabilities |

|

31,191 |

|

30,825 |

|

|

|

|

| ||||

|

Total liabilities |

|

276,409 |

|

335,664 |

|

|

|

|

| ||||

|

Total equity |

|

134,428 |

|

124,740 |

|

|

|

|

| ||||

|

Total liabilities and equity |

|

$ |

410,837 |

|

$ |

460,404 |

|

|

|

|

| ||

FirstCity Financial Corporation

Supplemental Information

(Dollars in thousands)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||

|

|

|

September 30, |

|

September 30, |

| ||||||||

|

|

|

2011 |

|

2010 |

|

2011 |

|

2010 |

| ||||

|

Summary Operating Statement Data for Business Segments |

|

|

|

|

|

|

|

|

| ||||

|

Portfolio Asset Acquisition and Resolution segment: |

|

|

|

|

|

|

|

|

| ||||

|

Revenues |

|

$ |

17,287 |

|

$ |

12,823 |

|

$ |

50,388 |

|

$ |

49,358 |

|

|

Equity in earnings of unconsolidated subsidiaries |

|

1,401 |

|

(1,446 |

) |

4,781 |

|

(253 |

) | ||||

|

Gain on business combinations |

|

— |

|

— |

|

278 |

|

891 |

| ||||

|

Costs and expenses |

|

(11,840 |

) |

(11,268 |

) |

(34,372 |

) |

(34,517 |

) | ||||

|

Operating contribution before provision for loan and impairment losses and noncontrolling interest expense |

|

6,848 |

|

109 |

|

21,075 |

|

15,479 |

| ||||

|

Provision for loan and impairment losses, net |

|

(1,553 |

) |

(2,236 |

) |

(2,370 |

) |

(5,394 |

) | ||||

|

Net income attributable to noncontrolling interests |

|

(2,159 |

) |

(1,219 |

) |

(7,980 |

) |

(7,290 |

) | ||||

|

Operating contribution (loss), net of direct taxes |

|

$ |

3,136 |

|

$ |

(3,346 |

) |

$ |

10,725 |

|

$ |

2,795 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Special Situations Platform segment: |

|

|

|

|

|

|

|

|

| ||||

|

Revenues |

|

$ |

2,905 |

|

$ |

2,081 |

|

$ |

7,424 |

|

$ |

16,993 |

|

|

Equity in earnings of unconsolidated subsidiaries |

|

1,376 |

|

11,408 |

|

3,150 |

|

14,260 |

| ||||

|

Gain on business combination |

|

155 |

|

— |

|

155 |

|

— |

| ||||

|

Costs and expenses |

|

(2,565 |

) |

(1,741 |

) |

(6,229 |

) |

(15,656 |

) | ||||

|

Operating contribution before provision for loan and impairment losses and noncontrolling interest expense |

|

1,871 |

|

11,748 |

|

4,500 |

|

15,597 |

| ||||

|

Provision for loan and impairment losses |

|

— |

|

(1,854 |

) |

— |

|

(3,023 |

) | ||||

|

Net income attributable to noncontrolling interests |

|

(495 |

) |

(1,548 |

) |

(1,031 |

) |

(2,893 |

) | ||||

|

Operating contribution, net of direct taxes |

|

$ |

1,376 |

|

$ |

8,346 |

|

$ |

3,469 |

|

$ |

9,681 |

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||

|

|

|

September 30, |

|

September 30, |

| ||||||||

|

|

|

2011 |

|

2010 |

|

2011 |

|

2010 |

| ||||

|

Portfolio Asset Acquisition and Resolution segment: |

|

|

|

|

|

|

|

|

| ||||

|

Revenues and equity in earnings of investments by region: |

|

|

|

|

|

|

|

|

| ||||

|

United States |

|

$ |

11,538 |

|

$ |

7,543 |

|

$ |

31,826 |

|

$ |

31,752 |

|

|

Latin America |

|

2,820 |

|

2,466 |

|

8,535 |

|

7,159 |

| ||||

|

Europe |

|

4,330 |

|

1,368 |

|

14,808 |

|

10,194 |

| ||||

|

Total |

|

$ |

18,688 |

|

$ |

11,377 |

|

$ |

55,169 |

|

$ |

49,105 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Revenues and equity in earnings of investments by source: |

|

|

|

|

|

|

|

|

| ||||

|

Equity in earnings (losses) of unconsolidated subsidiaries |

|

$ |

1,401 |

|

$ |

(1,446 |

) |

$ |

4,781 |

|

$ |

(253 |

) |

|

Income from Portfolio Assets |

|

11,964 |

|

8,195 |

|

33,902 |

|

34,280 |

| ||||

|

Servicing fees |

|

2,829 |

|

2,252 |

|

7,734 |

|

5,998 |

| ||||

|

Gain on sale of investment security |

|

— |

|

— |

|

— |

|

3,250 |

| ||||

|

Gain on sale of SBA loans held for sale, net |

|

306 |

|

197 |

|

1,836 |

|

360 |

| ||||

|

Interest income from SBA loans |

|

350 |

|

314 |

|

1,024 |

|

895 |

| ||||

|

Interest income from loans receivable |

|

379 |

|

435 |

|

1,170 |

|

1,371 |

| ||||

|

Other |

|

1,459 |

|

1,430 |

|

4,722 |

|

3,204 |

| ||||

|

Total |

|

$ |

18,688 |

|

$ |

11,377 |

|

$ |

55,169 |

|

$ |

49,105 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Special Situations Platform segment: |

|

|

|

|

|

|

|

|

| ||||

|

Revenues and equity in earnings of investments by source: |

|

|

|

|

|

|

|

|

| ||||

|

Equity in earnings of unconsolidated subsidiaries |

|

$ |

1,376 |

|

$ |

11,408 |

|

$ |

3,150 |

|

$ |

14,260 |

|

|

Interest income from loans receivable |

|

493 |

|

662 |

|

1,513 |

|

1,814 |

| ||||

|

Operating revenue - railroad |

|

2,157 |

|

998 |

|

5,017 |

|

3,459 |

| ||||

|

Operating revenue - manufacturing |

|

— |

|

— |

|

— |

|

10,466 |

| ||||

|

Other |

|

255 |

|

421 |

|

894 |

|

1,254 |

| ||||

|

Total |

|

$ |

4,281 |

|

$ |

13,489 |

|

$ |

10,574 |

|

$ |

31,253 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Number of personnel at period end: |

|

|

|

|

|

|

|

|

| ||||

|

U.S. - Portfolio Asset Acquisition and Resolution segment |

|

89 |

|

88 |

|

|

|

|

| ||||

|

U.S. - Special Situations Platform segment |

|

38 |

|

32 |

|

|

|

|

| ||||

|

Latin America |

|

118 |

|

114 |

|

|

|

|

| ||||

|

Corporate |

|

30 |

|

30 |

|

|

|

|

| ||||

|

Total personnel |

|

275 |

|

264 |

|

|

|

|

| ||||

FirstCity Financial Corporation

Supplemental Information

(Dollars in thousands)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||

|

|

|

September 30, |

|

September 30, |

| ||||||||

|

|

|

2011 |

|

2010 |

|

2011 |

|

2010 |

| ||||

|

Analysis of Equity Investments |

|

|

|

|

|

|

|

|

| ||||

|

FirstCity’s average investment: |

|

|

|

|

|

|

|

|

| ||||

|

U.S. - Portfolio Asset Acquisition and Resolution segment |

|

$ |

54,789 |

|

$ |

32,495 |

|

$ |

44,183 |

|

$ |

21,366 |

|

|

U.S. - Special Situations Platform segment |

|

12,944 |

|

8,536 |

|

13,325 |

|

5,023 |

| ||||

|

Latin America |

|

14,148 |

|

16,671 |

|

14,427 |

|

17,064 |

| ||||

|

Europe |

|

— |

|

5,099 |

|

(25 |

) |

6,539 |

| ||||

|

Europe - servicing subsidiaries |

|

35,581 |

|

30,184 |

|

35,295 |

|

26,942 |

| ||||

|

Latin America - servicing subsidiaries |

|

3,216 |

|

1,750 |

|

3,107 |

|

2,048 |

| ||||

|

Total |

|

$ |

120,678 |

|

$ |

94,735 |

|

$ |

110,312 |

|

$ |

78,982 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

FirstCity’s share of equity earnings (losses): |

|

|

|

|

|

|

|

|

| ||||

|

U.S. - Portfolio Asset Acquisition and Resolution segment |

|

$ |

700 |

|

$ |

(98 |

) |

$ |

1,520 |

|

$ |

(61 |

) |

|

U.S. - Special Situations Platform segment |

|

1,376 |

|

11,408 |

|

3,150 |

|

14,260 |

| ||||

|

Latin America |

|

(880 |

) |

(550 |

) |

(1,152 |

) |

(505 |

) | ||||

|

Europe |

|

— |

|

(1,158 |

) |

29 |

|

(2,123 |

) | ||||

|

Europe - servicing subsidiaries |

|

1,452 |

|

473 |

|

3,825 |

|

3,274 |

| ||||

|

Latin America - servicing subsidiaries |

|

129 |

|

(113 |

) |

559 |

|

(838 |

) | ||||

|

Total |

|

$ |

2,777 |

|

$ |

9,962 |

|

$ |

7,931 |

|

$ |

14,007 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Selected Other Data: |

|

|

|

|

|

|

|

|

| ||||

|

Average investment in consolidated portfolio assets |

|

|

|

|

|

|

|

|

| ||||

|

and loans receivable: |

|

|

|

|

|

|

|

|

| ||||

|

U.S. - Portfolio Asset Acquisition and Resolution segment |

|

$ |

157,282 |

|

$ |

215,556 |

|

$ |

176,873 |

|

$ |

215,376 |

|

|

U.S. - Special Situations Platform segment |

|

23,216 |

|

28,598 |

|

23,172 |

|

28,288 |

| ||||

|

Latin America |

|

17,199 |

|

17,745 |

|

17,541 |

|

18,208 |

| ||||

|

Europe |

|

7,768 |

|

12,882 |

|

11,709 |

|

15,938 |

| ||||

|

Total |

|

$ |

205,465 |

|

$ |

274,781 |

|

$ |

229,295 |

|

$ |

277,810 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Income from consolidated portfolio assets and loans receivable: |

|

|

|

|

|

|

|

|

| ||||

|

U.S. - Portfolio Asset Acquisition and Resolution segment |

|

$ |

8,367 |

|

$ |

6,008 |

|

$ |

23,827 |

|

$ |

25,500 |

|

|

U.S. - Special Situations Platform segment |

|

493 |

|

662 |

|

1,513 |

|

1,814 |

| ||||

|

Latin America |

|

1,997 |

|

1,449 |

|

4,285 |

|

3,085 |

| ||||

|

Europe |

|

2,635 |

|

1,684 |

|

9,820 |

|

8,321 |

| ||||

|

Total |

|

$ |

13,492 |

|

$ |

9,803 |

|

$ |

39,445 |

|

$ |

38,720 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Servicing fee revenues: |

|

|

|

|

|

|

|

|

| ||||

|

Portfolio assets - U.S. partnerships: |

|

|

|

|

|

|

|

|

| ||||

|

Servicing fee revenue |

|

$ |

1,240 |

|

$ |

691 |

|

$ |

3,092 |

|

$ |

986 |

|

|

Average servicing fee |

|

3.1 |

% |

3.2 |

% |

3.2 |

% |

3.4 |

% | ||||

|

Portfolio assets - Latin American partnerships: |

|

|

|

|

|

|

|

|

| ||||

|

Servicing fee revenue |

|

$ |

1,335 |

|

$ |

1,439 |

|

$ |

4,109 |

|

$ |

4,684 |

|

|

Average servicing fee % |

|

22.0 |

% |

32.3 |

% |

24.3 |

% |

26.5 |

% | ||||

|

Total service fees - Portfolio Assets: |

|

|

|

|

|

|

|

|

| ||||

|

Servicing fee revenue |

|

$ |

2,575 |

|

$ |

2,130 |

|

$ |

7,201 |

|

$ |

5,670 |

|

|

Average servicing fee % |

|

5.6 |

% |

8.3 |

% |

6.3 |

% |

12.1 |

% | ||||

|

Service fees - SBA loans |

|

$ |

254 |

|

$ |

122 |

|

$ |

533 |

|

$ |

328 |

|

|

Total Service Fees |

|

$ |

2,829 |

|

$ |

2,252 |

|

$ |

7,734 |

|

$ |

5,998 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Collections: |

|

|

|

|

|

|

|

|

| ||||

|

U.S. unconsolidated partnerships |

|

$ |

39,657 |

|

$ |

21,347 |

|

$ |

97,413 |

|

$ |

29,221 |

|

|

Latin American unconsolidated partnerships |

|

7,400 |

|

6,080 |

|

20,740 |

|

22,182 |

| ||||

|

European unconsolidated partnerships |

|

— |

|

2,180 |

|

— |

|

12,109 |

| ||||

|

Total unconsolidated partnership collections |

|

47,057 |

|

29,607 |

|

118,153 |

|

63,512 |

| ||||

|

U.S. consolidated partnerships |

|

28,721 |

|

18,958 |

|

77,246 |

|

78,026 |

| ||||

|

Latin American consolidated partnerships |

|

1,906 |

|

1,416 |

|

3,852 |

|

2,608 |

| ||||

|

European consolidated partnerships |

|

3,676 |

|

2,706 |

|

27,727 |

|

13,412 |

| ||||

|

Total consolidated partnership collections |

|

34,303 |

|

23,080 |

|

108,825 |

|

94,046 |

| ||||

|

Total collections |

|

$ |

81,360 |

|

$ |

52,687 |

|

$ |

226,978 |

|

$ |

157,558 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Servicing portfolio (face value) at period end: |

|

|

|

|

|

|

|

|

| ||||

|

United States |

|

$ |

1,230,555 |

|

$ |

1,123,882 |

|

|

|

|

| ||

|

Latin America |

|

1,448,967 |

|

1,544,181 |

|

|

|

|

| ||||

|

Europe |

|

1,212,280 |

|

1,075,782 |

|

|

|

|

| ||||

|

Total |

|

$ |

3,891,802 |

|

$ |

3,743,845 |

|

|

|

|

| ||

FirstCity Financial Corporation

Supplemental Information

(Dollars in thousands)

(Unaudited)

Portfolio Purchases and Other Investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FirstCity |

|

|

| ||||||||

|

|

|

Portfolio Purchases |

|

FirstCity |

|

FirstCity |

|

Investment |

|

|

| ||||||||||||||

|

|

|

United |

|

|

|

Latin |

|

|

|

Investment |

|

Investment |

|

in Special |

|

|

| ||||||||

|

|

|

States |

|

Europe |

|

America |

|

Total |

|

in Portfolios |

|

in Other |

|

Situations |

|

Total |

| ||||||||

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

3rd Quarter |

|

$ |

87,112 |

|

$ |

594 |

|

$ |

— |

|

$ |

87,706 |

|

$ |

18,728 |

|

$ |

7,814 |

|

$ |

2,601 |

|

$ |

29,143 |

|

|

2nd Quarter |

|

81,653 |

|

— |

|

— |

|

81,653 |

|

22,159 |

|

7,396 |

|

— |

|

29,555 |

| ||||||||

|

1st Quarter |

|

11,091 |

|

— |

|

— |

|

11,091 |

|

4,810 |

|

9,931 |

|

700 |

|

15,441 |

| ||||||||

|

Total Year 2011 |

|

$ |

179,856 |

|

$ |

594 |

|

$ |

— |

|

$ |

180,450 |

|

$ |

45,697 |

|

$ |

25,141 |

|

$ |

3,301 |

|

$ |

74,139 |

|

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

4th Quarter |

|

$ |

51,059 |

|

$ |

— |

|

$ |

— |

|

$ |

51,059 |

|

$ |

14,473 |

|

$ |

14,314 |

|

$ |

175 |

|

$ |

28,962 |

|

|

3rd Quarter |

|

15,025 |

|

— |

|

— |

|

15,025 |

|

10,513 |

|

4,956 |

|

148 |

|

15,617 |

| ||||||||

|

2nd Quarter |

|

141,566 |

|

— |

|

— |

|

141,566 |

|

28,122 |

|

14,482 |

|

8,107 |

|

50,711 |

| ||||||||

|

1st Quarter |

|

18,114 |

|

— |

|

— |

|

18,114 |

|

14,605 |

|

9,005 |

|

4,790 |

|

28,400 |

| ||||||||

|

Total Year 2010 |

|

$ |

225,764 |

|

$ |

— |

|

$ |

— |

|

$ |

225,764 |

|

$ |

67,713 |

|

$ |

42,757 |

|

$ |

13,220 |

|

$ |

123,690 |

|

|

Total Year 2009 |

|

$ |

200,590 |

|

$ |

— |

|

$ |

— |

|

$ |

200,590 |

|

$ |

147,654 |

|

$ |

33,873 |

|

$ |

12,415 |

|

$ |

193,942 |

|

|

Total Year 2008 |

|

$ |

64,394 |

|

$ |

1,823 |

|

$ |

23,097 |

|

$ |

89,314 |

|

$ |

72,307 |

|

$ |

33,007 |

|

$ |

19,906 |

|

$ |

125,220 |

|

Portfolio Asset Acquisition and Resolution segment:

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||

|

|

|

September 30, |

|

September 30, |

| ||||||||

|

|

|

2011 |

|

2010 |

|

2011 |

|

2010 |

| ||||

|

Aggregate purchase price of portfolios acquired: |

|

|

|

|

|

|

|

|

| ||||

|

Acquisition partnerships |

|

|

|

|

|

|

|

|

| ||||

|

United States |

|

$ |

87,112 |

|

$ |

15,025 |

|

$ |

179,856 |

|

$ |

174,705 |

|

|

Latin America |

|

— |

|

— |

|

— |

|

— |

| ||||

|

Europe |

|

594 |

|

— |

|

594 |

|

— |

| ||||

|

Total |

|

$ |

87,706 |

|

$ |

15,025 |

|

$ |

180,450 |

|

$ |

174,705 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

Purchase |

|

FirstCity’s |

|

|

|

|

| ||||

|

|

|

Price |

|

Investment |

|

|

|

|

| ||||

|

Historical acquisitions of Portfolios - annual: |

|

|

|

|

|

|

|

|

| ||||

|

First nine months of 2011 |

|

$ |

180,450 |

|

$ |

45,697 |

|

|

|

|

| ||

|

2010 |

|

225,764 |

|

67,713 |

|

|

|

|

| ||||

|

2009 |

|

200,590 |

|

147,654 |

|

|

|

|

| ||||

|

2008 |

|

89,314 |

|

72,307 |

|

|

|

|

| ||||

|

2007 |

|

214,333 |

|

126,714 |

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

September 30, |

|

December 31, |

|

|

|

|

| ||||

|

|

|

2011 |

|

2010 |

|

|

|

|

| ||||

|

Portfolio acquisition and resolution assets by region: |

|

|

|

|

|

|

|

|

| ||||

|

United States |

|

$ |

209,441 |

|

$ |

241,589 |

|

|

|

|

| ||

|

Latin America |

|

38,409 |

|

39,476 |

|

|

|

|

| ||||

|

Europe |

|

49,698 |

|

68,642 |

|

|

|

|

| ||||

|

Total |

|

$ |

297,548 |

|

$ |

349,707 |

|

|

|

|

| ||

Special Situations Platform segment:

|

|

|

Total |

|

FirstCity Denver’s Investment |

| ||||||||

|

|

|

Investment |

|

Debt |

|

Equity |

|

Total |

| ||||

|

Historical investments - annual: |

|

|

|

|

|

|

|

|

| ||||

|

First nine months of 2011 |

|

$ |

3,301 |

|

$ |

1,200 |

|

$ |

2,101 |

|

$ |

3,301 |

|

|

2010 |

|

13,739 |

|

8,825 |

|

4,395 |

|

13,220 |

| ||||

|

2009 |

|

20,058 |

|

12,023 |

|

392 |

|

12,415 |

| ||||

|

2008 |

|

28,750 |

|

16,650 |

|

3,256 |

|

19,906 |

| ||||

|

2007 |

|

22,314 |

|

5,630 |

|

5,900 |

|

11,530 |

| ||||

FirstCity Financial Corporation

Supplemental Information

(Dollars in thousands, except exchange rate data)

(Unaudited)

Summary of Consolidated Portfolio Assets (at Carrying Value) by Region and Type

|

|

|

September 30, 2011 |

| ||||||||||||||||||||||

|

|

|

Income-Accruing Loans |

|

Non-Accrual Loans |

|

|

|

|

| ||||||||||||||||

|

|

|

Purchased |

|

|

|

Purchased Credit- |

|

|

|

|

|

|

|

|

| ||||||||||

|

|

|

Credit- |

|

|

|

Impaired Loans |

|

Other |

|

|

|

|

| ||||||||||||

|

|

|

Impaired |

|

|

|

|

|

Cost recovery |

|

|

|

Cost recovery |

|

|

|

|

| ||||||||

|

|

|

Loans |

|

Other |

|

Cash basis |

|

basis |

|

Cash basis |

|

basis |

|

Real Estate |

|

Total |

| ||||||||

|

United States |

|

$ |

30,134 |

|

$ |

4,796 |

|

$ |

27,893 |

|

$ |

36,390 |

|

$ |

1,349 |

|

$ |

— |

|

$ |

28,998 |

|

$ |

129,560 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

France |

|

— |

|

1,282 |

|

818 |

|

— |

|

— |

|

2,077 |

|

— |

|

4,177 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Germany |

|

— |

|

— |

|

2,415 |

|

818 |

|

— |

|

— |

|

217 |

|

3,450 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Mexico |

|

— |

|

— |

|

— |

|

9,219 |

|

— |

|

— |

|

— |

|

9,219 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Total |

|

$ |

30,134 |

|

$ |

6,078 |

|

$ |

31,126 |

|

$ |

46,427 |

|

$ |

1,349 |

|

$ |

2,077 |

|

$ |

29,215 |

|

$ |

146,406 |

|

|

|

|

December 31, 2010 |

| ||||||||||||||||||||||

|

|

|

Income-Accruing Loans |

|

Non-Accrual Loans |

|

|

|

|

| ||||||||||||||||

|

|

|

Purchased |

|

|

|

Purchased Credit- |

|

|

|

|

|

|

|

|

| ||||||||||

|

|

|

Credit- |

|

|

|

Impaired Loans |

|

Other |

|

|

|

|

| ||||||||||||

|

|

|

Impaired |

|

|

|

|

|

Cost recovery |

|

|

|

Cost recovery |

|

|

|

|

| ||||||||

|

|

|

Loans |

|

Other |

|

Cash basis |

|

basis |

|

Cash basis |

|

basis |

|

Real Estate |

|

Total |

| ||||||||

|

United States |

|

$ |

3,420 |

|

$ |

1,640 |

|

$ |

94,144 |

|

$ |

41,959 |

|

$ |

1,574 |

|

$ |

— |

|

$ |

33,709 |

|

$ |

176,446 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

France |

|

— |

|

1,125 |

|

2,499 |

|

— |

|

— |

|

2,037 |

|

— |

|

5,661 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Germany |

|

— |

|

— |

|

2,022 |

|

12,659 |

|

— |

|

— |

|

9,376 |

|

24,057 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Mexico |

|

— |

|

— |

|

— |

|

9,897 |

|

— |

|

— |

|

— |

|

9,897 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Total |

|

$ |

3,420 |

|

$ |

2,765 |

|

$ |

98,665 |

|

$ |

64,515 |

|

$ |

1,574 |

|

$ |

2,037 |

|

$ |

43,085 |

|

$ |

216,061 |

|

Illustration of the Effects of Foreign Currency Fluctuations on Net Earnings

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

2011 |

|

2010 |

|

2011 |

|

2010 |

|

|

|

|

|

|

|

|

| ||||

|

Net earnings attributable to FirstCity |

|

$ |

2,730 |

|

$ |

2,559 |

|

$ |

8,883 |

|

$ |

10,725 |

|

|

|

|

|

|

|

|

|

|

Foreign currency gains (losses), net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Euro |

|

$ |

(310 |

) |

503 |

|

689 |

|

(446 |

) |

|

|

|

|

|

|

|

| |||

|

Mexican Peso |

|

(513 |

) |

103 |

|

15 |

|

100 |

|

|

|

|

|

|

|

|

| ||||

|

Argentine Peso |

|

(11 |

) |

(4 |

) |

(21 |

) |

(16 |

) |

|

|

|

|

|

|

|

| ||||

|

Chilean Peso |

|

— |

|

59 |

|

57 |

|

(8 |

) |

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Exchange rate at valuation date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Euro |

|

0.74 |

|

0.73 |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Mexican Peso |

|

13.42 |

|

12.50 |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Argentine Peso |

|

4.22 |

|

3.97 |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Chilean Peso |

|

514.40 |

|

489.46 |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

FirstCity Financial Corporation

Schedule of Estimated Unrealized Gross Profit from Portfolio Assets (Unaudited)

September 30, 2011

|

|

|

Basis in Portfolio Assets (1), (4) |

| |||||

|

($ in 000’s) |

|

12/31/2009 |

|

12/31/2010 |

|

9/30/2011 |

| |

|

Domestic |

|

$ |

190,541 |

|

196,159 |

|

169,638 |

|

|

Europe |

|

32,665 |

|

31,826 |

|

12,149 |

| |

|

Latin America |

|

27,473 |

|

23,329 |

|

20,754 |

| |

|

Total |

|

$ |

250,679 |

|

251,314 |

|

202,541 |

|

|

|

|

Estimated Remaining Collections (2) |

| |||||

|

|

|

12/31/2009 |

|

12/31/2010 |

|

9/30/2011 |

| |

|

Domestic |

|

$ |

276,018 |

|

290,626 |

|

250,093 |

|

|

Europe |

|

50,328 |

|

43,634 |

|

26,929 |

| |

|

Latin America |

|

70,398 |

|

66,564 |

|

61,656 |

| |

|

Total |

|

$ |

396,744 |

|

400,825 |

|

338,678 |

|

|

|

|

Estimated Unrealized Gross Profit (3) |

| |||||

|

|

|

12/31/2009 |

|

12/31/2010 |

|

9/30/2011 |

| |

|

Domestic |

|

$ |

85,476 |

|

94,469 |

|

80,455 |

|

|

Europe |

|

17,663 |

|

11,807 |

|

14,781 |

| |

|

Latin America |

|

42,925 |

|

43,235 |

|

40,903 |

| |

|

Total |

|

$ |

146,064 |

|

149,511 |

|

136,138 |

|

|

|

|

Estimated Unrealized Gross Profit % |

| ||||

|

|

|

12/31/2009 |

|

12/31/2010 |

|

9/30/2011 |

|

|

Domestic |

|

30.97 |

% |

32.50 |

% |

32.17 |

% |

|

Europe |

|

35.10 |

% |

27.06 |

% |

54.89 |

% |

|

Latin America |

|

60.97 |

% |

64.95 |

% |

66.34 |

% |

|

Total |

|

36.82 |

% |

37.30 |

% |

40.20 |

% |

This schedule provides selected information related to the Company’s economic interests in consolidated and unconsolidated Portfolio Assets and is provided for informational purposes to provide an indication of the future potential unrealized gross profit attributable to those portfolios. In preparing this schedule, management was required to make certain estimates and assumptions surrounding the underlying assets in the Portfolios that impact the reported amounts. Such estimates and assumptions could change in the future, as more information becomes known, which could impact the reported amounts. As future events and their effects cannot be determined with precision, actual results could differ significantly from these estimates.

(1) Basis in Portfolio Assets represents FirstCity’s share of the unamortized purchase price of the Portfolios held by the various acquisition entities, some of which are consolidated by FirstCity and others held through equity and beneficial interests in unconsolidated partnerships.

(2) Estimated Remaining Collections represents FirstCity’s share of future projected net cash collections expected from the Portfolios Assets.

(3) Unrealized Gross Profit represents the excess difference between the Estimated Remaining Collections and the Basis in Portfolio Assets.

(4) FirstCity considers Basis in Portfolio Assets a useful measurement of the Company’s underlying holdings and interests in Portfolio Assets. As FirstCity’s share of Basis in Portfolio Assets is considered a non-GAAP measure, the following reconciliation is provided:

|

|

|

12/31/2009 |

|

12/31/2010 |

|

9/30/2011 |

| |

|

FirstCity’s consolidated Portfolio Assets (as reported in “Portfolio Assets” on the balance sheet of the respective Form 10-K or 10-Q) |

|

$ |

224,384 |

|

216,061 |

|

146,406 |

|

|

Noncontrolling interests in FirstCity’s consolidated Portfolio Assets (component of “Non-controlling interests” as reported on the balance sheet of the respective Form 10-K or 10-Q) |

|

(37,277 |

) |

(23,482 |

) |

(18,490 |

) | |

|

FirstCity’s equity and beneficial interests in Portfolio Assets held by unconsolidated partnerships (components of “Assets” as reported in the “Condensed Combined Balance Sheets” tabular disclosure under the “Equity Investments” footnote, and “Investment securities” as reported on the balance sheet of the respective Form 10-K or 10-Q) |

|

63,572 |

|

58,735 |

|

74,625 |

| |

|

FirstCity’s economic basis in consolidated and unconsolidated Portfolio Assets |

|

$ |

250,679 |

|

251,314 |

|

202,541 |

|