Attached files

| file | filename |

|---|---|

| S-1 - FORM S-1 - TVAX Biomedical, Inc. | d250494ds1.htm |

| EX-4.3 - EX-4.3 - TVAX Biomedical, Inc. | d250494dex43.htm |

| EX-4.2 - EX-4.2 - TVAX Biomedical, Inc. | d250494dex42.htm |

| EX-3.2 - EX-3.2 - TVAX Biomedical, Inc. | d250494dex32.htm |

| EX-4.5 - EX-4.5 - TVAX Biomedical, Inc. | d250494dex45.htm |

| EX-4.6 - EX-4.6 - TVAX Biomedical, Inc. | d250494dex46.htm |

| EX-3.1 - EX-3.1 - TVAX Biomedical, Inc. | d250494dex31.htm |

| EX-4.4 - EX-4.4 - TVAX Biomedical, Inc. | d250494dex44.htm |

| EX-99.3 - EX-99.3 - TVAX Biomedical, Inc. | d250494dex993.htm |

| EX-99.2 - EX-99.2 - TVAX Biomedical, Inc. | d250494dex992.htm |

| EX-99.4 - EX-99.4 - TVAX Biomedical, Inc. | d250494dex994.htm |

| EX-10.8 - EX-10.8 - TVAX Biomedical, Inc. | d250494dex108.htm |

| EX-10.7 - EX-10.7 - TVAX Biomedical, Inc. | d250494dex107.htm |

| EX-23.1 - EX-23.1 - TVAX Biomedical, Inc. | d250494dex231.htm |

| EX-21.1 - EX-21.1 - TVAX Biomedical, Inc. | d250494dex211.htm |

| EX-99.1 - EX-99.1 - TVAX Biomedical, Inc. | d250494dex991.htm |

| EX-10.1 - EX-10.1 - TVAX Biomedical, Inc. | d250494dex101.htm |

Exhibit 10.9

COMMENCEMENT DATE MEMORANDUM

THIS MEMORANDUM, made as of March 3, 2010 by and between RREEF AMERICA REIT II CORP. YYY, a Maryland corporation (“Landlord”) and TVAX BIOMEDICAL, LLC, a Missouri limited liability company (“Tenant”).

Recitals:

| A. | Landlord and Tenant are parties to that certain Lease, dated for reference February 24, 2010 (the “Lease”) for certain premises (the “Premises”) consisting of approximately 5,616 square feet at the building commonly known as Westbrook Business Park — Building Two. |

| B. | Tenant is in possession of the Premises and the Term of the Lease has commenced. |

| C. | Landlord and Tenant desire to enter into this Memorandum confirming the Commencement Date, the Termination Date and other matters under the Lease. |

NOW, THEREFORE, Landlord and Tenant agree as follows:

1. The actual Commencement Date is March 1, 2010.

2. The actual Termination Date is 07/31/2015.

3. The schedule of the Annual Rent and the Monthly Installment of Rent set forth on the Reference Pages is deleted in its entirety, and the following is substituted therefor:

| Period | Rentable

Square Footage |

Annual Rent Per Square Foot |

Annual Rent | Monthly

Installment Of Rent |

||||||||||||

| From | Through | |||||||||||||||

| 03/01/10 | 02/28/11 | 5,616 | $ | 8.00 | $ | 44,928.00 | $ | 3,744.00 | * | |||||||

| 03/01/11 | 02/29/12 | 5,616 | $ | 8.45 | $ | 47,455.20 | $ | 3,954.60 | ||||||||

| 03/01/12 | 02/28/13 | 5,616 | $ | 8.70 | $ | 48,859.20 | $ | 4,071.60 | ||||||||

| 03/01/13 | 02/28/14 | 5,616 | $ | 8.96 | $ | 50,319.36 | $ | 4,193.28 | ||||||||

| 03/01/14 | 07/31/15 | 5,616 | $ | 9.23 | $ | 51,835.68 | $ | 4,319.64 | ||||||||

| * | Monthly installment of Rent is subject to abatement pursuant to Section 3.3 of the Lease. |

4. Capitalized terms not defined herein shall have the same meaning as set forth in the Lease.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date and year first above written.

| LANDLORD: | TENANT: | |||||||

| RREEF AMERICA REIT II CORP. YYY, a Maryland corporation |

TVAX BIOMEDICAL, LLC, a Missouri limited liability company | |||||||

| By: RREEF America L.L.C., a Delaware limited liability company, Its Investment Advisor | ||||||||

| By: | /s/ Mark Sabatino | By: | /s/ Gary Wood | |||||

| Name: | Mark Sabatino | Name: | Gary Wood | |||||

| Title: | Vice President, Asset Manager – North Central Region | Title: | CEO | |||||

LEASE

RREEF AMERICA REIT II CORP. YYY,

a Maryland corporation,

Landlord,

and

TVAX BIOMEDICAL, LLC,

a Missouri limited liability company,

Tenant

TABLE OF CONTENTS

| page | ||||||

| 1. |

USE AND RESTRICTIONS ON USE | 1 | ||||

| 2. |

TERM | 2 | ||||

| 3. |

RENT | 3 | ||||

| 4. |

RENT ADJUSTMENTS | 4 | ||||

| 5. |

SECURITY DEPOSIT | 7 | ||||

| 6. |

ALTERATIONS | 7 | ||||

| 7. |

REPAIR | 9 | ||||

| 8. |

LIENS | 11 | ||||

| 9. |

ASSIGNMENT AND SUBLETTING | 11 | ||||

| 10. |

INDEMNIFICATION | 14 | ||||

| 11. |

INSURANCE | 14 | ||||

| 12. |

WAIVER OF SUBROGATION | 15 | ||||

| 13. |

SERVICES AND UTILITIES | 15 | ||||

| 14. |

HOLDING OVER | 16 | ||||

| 15. |

SUBORDINATION | 16 | ||||

| 16. |

RULES AND REGULATIONS | 16 | ||||

| 17. |

REENTRY BY LANDLORD | 16 | ||||

| 18. |

DEFAULT | 17 | ||||

| 19. |

REMEDIES | 18 | ||||

| 20. |

TENANT’S BANKRUPTCY OR INSOLVENCY | 22 | ||||

| 21. |

QUIET ENJOYMENT | 23 | ||||

| 22. |

CASUALTY | 24 | ||||

| 23. |

EMINENT DOMAIN | 25 | ||||

| 24. |

SALE BY LANDLORD | 25 | ||||

| 25. |

ESTOPPEL CERTIFICATES | 26 | ||||

| 26. |

SURRENDER OF PREMISES | 26 | ||||

| 27. |

NOTICES | 27 | ||||

| 28. |

TAXES PAYABLE BY TENANT | 27 | ||||

| 29. |

RELOCATION OF TENANT [Intentionally Omitted.] | 28 | ||||

i

| page | ||||||

| 30. |

DEFINED TERMS AND HEADINGS | 28 | ||||

| 31. |

TENANT’S AUTHORITY | 28 | ||||

| 32. |

FINANCIAL STATEMENTS AND CREDIT REPORTS | 29 | ||||

| 33. |

COMMISSIONS | 29 | ||||

| 34. |

TIME AND APPLICABLE LAW | 29 | ||||

| 35. |

SUCCESSORS AND ASSIGNS | 29 | ||||

| 36. |

ENTIRE AGREEMENT | 29 | ||||

| 37. |

EXAMINATION NOT OPTION | 29 | ||||

| 38. |

RECORDATION | 29 | ||||

| 39. |

ACCELERATION OPTION | 30 | ||||

| 40. |

OPTION TO RENEW | 31 | ||||

| 41. |

MEDICAL WASTE POLICY | 32 | ||||

| 42. |

LIMITATION OF LANDLORD’S LIABILITY | 34 | ||||

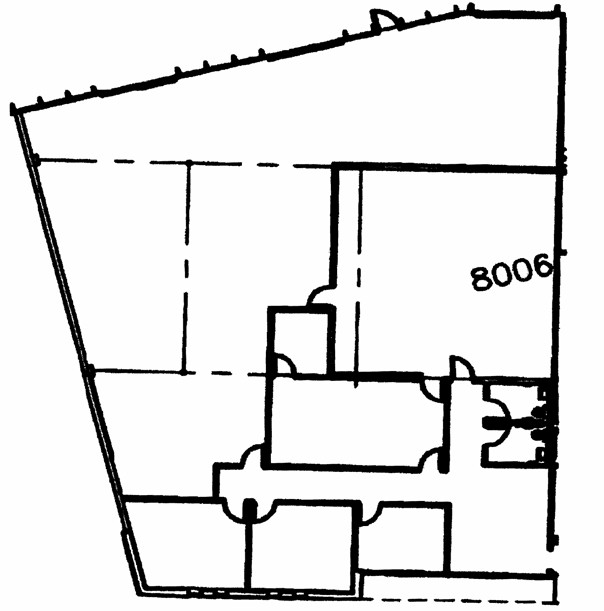

EXHIBIT A – FLOOR PLAN DEPICTING THE PREMISES

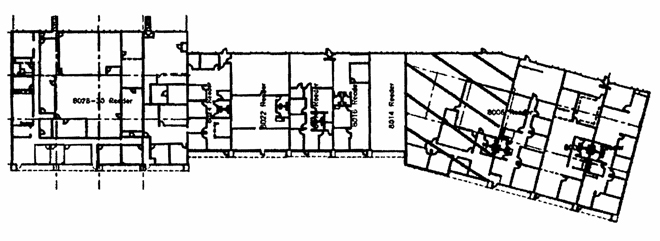

EXHIBIT A-1 – SITE PLAN

EXHIBIT B – INITIAL ALTERATIONS

EXHIBIT C – COMMENCEMENT DATE MEMORANDUM

EXHIBIT D – RULES AND REGULATIONS

EXHIBIT E – EARLY POSSESSION AGREEMENT

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

ii

MULTI-TENANT INDUSTRIAL GROSS (BASE YEAR) LEASE

REFERENCE PAGES

| BUILDING: | Westbrook Business Park – Building Two 8000 – 8030 Reeder Lenexa, Kansas 66214 | |

| LANDLORD: | RREEF AMERICA REIT II CORP. YYY, a Maryland corporation | |

| LANDLORD’S ADDRESS: | RREEF America REIT II Corp. YYY 875 N. Michigan Avenue, Suite 4100 Chicago, Illinois 60611 Attn: Chip George

with a copy to:

RREEF Alternative Investments 150 S. Wacker Drive, 28th Floor Chicago, Illinois 60606 Attn: Asset Manager | |

| WIRE INSTRUCTIONS AND/OR ADDRESS FOR RENT PAYMENT: | RREEF America REIT II Corp. YYY Westbrook Business Park 75 Remittance Drive, Suite 6761 Chicago, Illinois 60675-6761 | |

| LEASE REFERENCE DATE: | February 24, 2010 | |

| TENANT: | TVAX BIOMEDICAL, LLC, a Missouri limited liability company | |

| TENANT’S NOTICE ADDRESS: | ||

| (a) As of beginning of Term: |

8006 Reeder Lenexa, Kansas 66214 | |

| (b) Prior to beginning of Term (if different): |

8060 Reeder Lenexa, Kansas 66214 | |

| PREMISES ADDRESS: | 8006 Reeder Lenexa, Kansas 66214 | |

| PREMISES RENTABLE AREA: | Approximately 5,616 sq. ft. (for outline of Premises see Exhibit A) | |

| USE: | Office use to plan and conduct clinical trials and related production facility for immunotherapy. | |

| /s/ | ||||

| Initials | ||||

iii

| COMMENCEMENT DATE: | March 1, 2010 | |

| TERM OF LEASE: | Approximately five (5) years and five (5) months beginning on the Commencement Date and ending on the Termination Date. | |

| TERMINATION DATE: | July 31, 2015 | |

| ANNUAL RENT and MONTHLY INSTALLMENT OF RENT (Article 3): | ||

| Period | Rentable

Square Footage |

Annual Rent Per Square Foot |

Annual Rent | Monthly

Installment of Rent |

||||||||||||

| From | Through | |||||||||||||||

| Month 1 | Month 12 | 5,616 | $ | 8.00 | $ | 44,928.00 | $ | 3,744.00 | * | |||||||

| Month 13 | Month 24 | 5,616 | $ | 8.45 | $ | 47,455.20 | $ | 3,954.60 | ||||||||

| Month 25 | Month 36 | 5,616 | $ | 8.70 | $ | 48,859.20 | $ | 4,071.60 | ||||||||

| Month 37 | Month 48 | 5,616 | $ | 8.96 | $ | 50,319.36 | $ | 4,193.28 | ||||||||

| Month 49 | Month 65 | 5,616 | $ | 9.23 | $ | 51,835.68 | $ | 4,319.64 | ||||||||

| * | Monthly Installment of Rent for the first five (5) full calendar months of the initial Term is subject to abatement pursuant to Section 3.3 of the Lease. |

| BASE YEAR (TAXES AND INSURANCE COSTS): |

2010 | |

| INITIAL ESTIMATED MONTHLY INSTALLMENT OF EXPENSES: |

$791.00 | |

| TENANT’S PROPORTIONATE SHARE: |

15.64% | |

| SECURITY DEPOSIT: |

$5,111.00 | |

| ASSIGNMENT/SUBLETTING FEE: |

$1,500.00 | |

| REAL ESTATE BROKER: |

NAI Capital Realty, representing Landlord and First Scout Realty Advisors, representing Tenant | |

| TENANT’S SIC CODE: |

8099 | |

| AMORTIZATION RATE: |

11% | |

The Reference Pages information is incorporated into and made a part of the Lease. In the event of any conflict between any Reference Pages information and the Lease, the Lease shall control. The Lease includes Exhibits A through E, all of which are made a part of this Lease.

iv

IN WITNESS WHEREOF, Landlord and Tenant have executed this Lease as of the Lease Reference Date set forth above.

| LANDLORD: | TENANT: | |||||||

| RREEF AMERICA REIT II CORP. YYY, a Maryland corporation |

TVAX BIOMEDICAL, LLC, a Missouri limited liability company | |||||||

| By: | RREEF America L.L.C., a Delaware limited liability company, its Investment Advisor |

|||||||

| By: | /s/ Mark P. Sabatino | By: | /s/ Gary Wood | |||||

| Name: | Mark P. Sabatino | Name: | Gary W. Wood | |||||

| Title: | Vice President | Title: | CEO | |||||

| Dated: | 3/17/10 | Dated: | 3/2/2010 | |||||

v

LEASE

By this Lease Landlord leases to Tenant and Tenant leases from Landlord the Premises in the Building as set forth and described on the Reference Pages. The Premises are depicted on the floor plan attached hereto as Exhibit A, and the Building is depicted on the site plan attached hereto as Exhibit A-1. The Reference Pages, including all terms defined thereon, are incorporated as part of this Lease.

1. USE AND RESTRICTIONS ON USE.

1.1 The Premises are to be used solely for the purposes set forth on the Reference Pages. Tenant shall not do or permit anything to be done in or about the Premises which will in any way obstruct or interfere with the rights of other tenants or occupants of the Building or injure, annoy, or disturb them, or allow the Premises to be used for any improper, immoral, unlawful, or objectionable purpose, or commit any waste. Tenant shall not do, permit or suffer in, on, or about the Premises the sale of any alcoholic liquor without the written consent of Landlord first obtained. Tenant shall comply with all federal, state and city laws, codes, ordinances, rules and regulations (collectively, “Regulations”) applicable to the use of the Premises and its occupancy and shall promptly comply with all governmental orders and directions for the correction, prevention and abatement of any violations in the Building or appurtenant land, caused or permitted by, or resulting from the specific use by, Tenant, or in or upon, or in connection with, the Premises, all at Tenant’s sole expense. Tenant shall not do or permit anything to be done on or about the Premises or bring or keep anything into the Premises which will in any way increase the rate of, invalidate or prevent the procuring of any insurance protecting against loss or damage to the Building or any of its contents by fire or other casualty or against liability for damage to property or injury to persons in or about the Building or any part thereof.

1.2 Tenant shall not, and shall not direct, suffer or permit any of its agents, contractors, employees, licensees or invitees (collectively, the “Tenant Entities”) to at any time handle, use, manufacture, store or dispose of in or about the Premises or the Building any (collectively, “Hazardous Materials”) flammables, explosives, radioactive materials, hazardous wastes or materials, toxic wastes or materials, or other similar substances, petroleum products or derivatives or any substance subject to regulation by or under any federal, state and local laws and ordinances relating to the protection of the environment or the keeping, use or disposition of environmentally hazardous materials, substances, or wastes, presently in effect or hereafter adopted, all amendments to any of them, and all rules and regulations issued pursuant to any of such laws or ordinances (collectively, “Environmental Laws”), nor shall Tenant suffer or permit any Hazardous Materials to be used in any manner not fully in compliance with all Environmental Laws, in the Premises or the Building and appurtenant land or allow the environment to become contaminated with any Hazardous Materials. Notwithstanding the foregoing, Tenant may handle, store, use or dispose of products containing small quantities of Hazardous Materials (such as aerosol cans containing insecticides, toner for copiers, paints, paint remover and the like) to the extent customary and necessary for the use of the Premises for general office purposes; provided that Tenant shall always handle, store, use, and dispose of any such Hazardous Materials in a safe and lawful manner and never allow such Hazardous Materials

1

to contaminate the Premises, Building and appurtenant land or the environment. Tenant shall protect, defend, indemnify and hold each and all of the Landlord Entities (as defined in Article 30) harmless from and against any and all loss, claims, liability or costs (including court costs and attorney’s fees) incurred by reason of any actual or asserted failure of Tenant to fully comply with all applicable Environmental Laws, or the presence, handling, use or disposition in or from the Premises of any Hazardous Materials by Tenant or any Tenant Entity (even though permissible under all applicable Environmental Laws or the provisions of this Lease), or by reason of any actual or asserted failure of Tenant to keep, observe, or perform any provision of this Section 1.2.

1.3 Tenant and the Tenant Entities will be entitled to the non-exclusive use of the common areas of the Building as they exist from time to time during the Term, including the parking facilities, subject to Landlord’s rules and regulations regarding such use. However, in no event will Tenant or the Tenant Entities park more vehicles in the parking facilities than Tenant’s Proportionate Share of the total parking spaces available for common use. The foregoing shall not be deemed to provide Tenant with an exclusive right to any parking spaces or any guaranty of the availability of any particular parking spaces or any specific number of parking spaces.

2. TERM.

2.1 The Term of this Lease shall begin on the date (“Commencement Date”) as shown on the Reference Pages as the Commencement Date, and shall terminate on the date (“Termination Date”) as shown on the Reference Pages as the Termination Date, unless sooner terminated by the provisions of this Lease. Tenant shall, at Landlord’s request, execute and deliver a memorandum agreement provided by Landlord in the form of Exhibit C attached hereto, setting forth the actual Commencement Date, Termination Date and, if necessary, a revised rent schedule. Should Tenant fail to do so within thirty (30) days after Landlord’s request, the information set forth in such memorandum provided by Landlord shall be conclusively presumed to be agreed and correct.

2.2 Tenant agrees that in the event of the inability of Landlord to deliver possession of the Premises on the Commencement Date set forth on the Reference Pages for any reason, Landlord shall not be liable for any damage resulting from such inability, but except to the extent such delay is the result of the acts or omissions of Tenant or any Tenant Entity, Tenant shall not be liable for any rent until the time when Landlord delivers possession of the Premises to Tenant. No such failure to give possession on the Commencement Date set forth on the Reference Pages shall affect the other obligations of Tenant under this Lease, except that the actual Commencement Date shall be postponed until the date that Landlord delivers possession of the Premises to Tenant unless such delay is caused by the acts or omissions of Tenant or any Tenant Entities. If any delay is the result of the acts or omissions of Tenant or any Tenant Entities, the Commencement Date and the payment of rent under this Lease shall be accelerated by the number of days of such delay, but in no event shall the Commencement Date be earlier than the date set forth in the Reference Pages.

2

2.3 Subject to the terms of this Section 2.3 and provided that this Lease and the Early Possession Agreement (as defined below) have been fully executed by all parties and Tenant has delivered all prepaid rental, the Security Deposit, and insurance certificates required hereunder, Landlord grants Tenant the right to enter the Premises, at Tenant’s sole risk, solely for the purpose of installing telecommunications and data cabling, equipment, furnishings and other personalty. Such possession prior to the Commencement Date shall be subject to all of the terms and conditions of this Lease, except that Tenant shall not be required to pay Monthly Installment of Rent or Tenant’s Proportionate Share of Expenses and Taxes with respect to the period of time prior to the Commencement Date during which Tenant occupies the Premises solely for such purposes. However, Tenant shall be liable for any utilities or special services provided to Tenant during such period. Notwithstanding the foregoing, if Tenant takes possession of the Premises before the Commencement Date for any purpose other than as expressly provided in this Section, such possession shall be subject to the terms and conditions of this Lease and Tenant shall pay Monthly Installment of Rent, Tenant’s Proportionate Share of Expenses and Taxes, and any other charges payable hereunder to Landlord for each day of possession before the Commencement Date. Said early possession shall not advance the Termination Date. Landlord may withdraw such permission to enter the Premises prior to the Commencement Date at any time that Landlord reasonably determines that such entry by Tenant is causing a dangerous situation for Landlord, Tenant or their respective contractors or employees, or if Landlord reasonably determines that such entry by Tenant is hampering or otherwise preventing Landlord from proceeding with the completion of the Initial Alterations described in Exhibit B at the earliest possible date. As a condition to any early entry by Tenant pursuant to this Section 2.3, Tenant shall execute and deliver to Landlord an early possession agreement (the “Early Possession Agreement”) in the form attached hereto as Exhibit E, provided by Landlord, setting forth the actual date for early possession and the date for the commencement of payment of Monthly Installment of Rent.

3. RENT.

3.1 Tenant agrees to pay to Landlord the Annual Rent in effect from time to time by paying the Monthly Installment of Rent then in effect on or before the first day of each full calendar month during the Term (subject to the Abated Monthly Installment of Rent pursuant to Section 3.3 below). The Monthly Installment of Rent in effect at any time shall be one-twelfth (1/12) of the Annual Rent in effect at such time. Rent for any period during the Term which is less than a full month shall be a prorated portion of the Monthly Installment of Rent based upon the number of days in such month. Said rent shall be paid to Landlord, without deduction or offset and without notice or demand, at the Rent Payment Address, as set forth on the Reference Pages, or to such other person or at such other place as Landlord may from time to time designate in writing. Unless specified in this Lease to the contrary, all amounts and sums payable by Tenant to Landlord pursuant to this Lease shall be deemed additional rent.

3.2 Tenant recognizes that late payment of any rent or other sum due under this Lease will result in administrative expense to Landlord, the extent of which additional expense is extremely difficult and economically impractical to ascertain. Tenant therefore agrees that if rent or any other sum is not paid when due and payable pursuant to this Lease, a late charge shall be imposed in an amount equal to the greater of: (a) Fifty Dollars ($50.00), or (b) five percent (5%) of the unpaid rent or other payment; provided, however, that Tenant shall be entitled to a grace period of five (5) days for the first late payment in a calendar year. The amount of the late charge

3

to be paid by Tenant shall be reassessed and added to Tenant’s obligation for each successive month until paid. The provisions of this Section 3.2 in no way relieve Tenant of the obligation to pay rent or other payments on or before the date on which they are due, nor do the terms of this Section 3.2 in any way affect Landlord’s remedies pursuant to Article 19 of this Lease in the event said rent or other payment is unpaid after date due.

3.3 Notwithstanding anything in this Lease to the contrary, so long as Tenant is not in default under this Lease, Tenant shall be entitled to an abatement of Monthly Installment of Rent with respect to the Premises, as originally described in this Lease, in the amount of $3,744.00 per month for the first five (5) full calendar months of the initial Term. The maximum total amount of Monthly Installment of Rent abated with respect to the Premises in accordance with the foregoing shall equal $18,720.00 (the “Abated Monthly Installment of Rent”). If Tenant defaults under this Lease at any time during the Term and fails to cure such default within any applicable cure period under this Lease, then all Abated Monthly Installment of Rent shall immediately become due and payable. Only Monthly Installment of Rent shall be abated pursuant to this Section, as more particularly described herein, and Tenant’s Proportionate Share of Expenses, Taxes and Insurance Costs and all other rent and other costs and charges specified in this Lease shall remain as due and payable pursuant to the provisions of this Lease.

4. RENT ADJUSTMENTS.

4.1 For the purpose of this Article 4, the following terms are defined as follows:

4.1.1 Lease Year: Each fiscal year (as determined by Landlord from time to time) falling partly or wholly within the Term.

4.1.2 Expenses: All actual and reasonable costs of operation, maintenance, repair, replacement and management of the Building (including the amount of any credits which Landlord may grant to particular tenants of the Building in lieu of providing any standard services or paying any standard costs described in this Section 4.1.2 for similar tenants), as determined in accordance with generally accepted accounting principles, including the following costs by way of illustration, but not limitation: water and sewer charges; utility costs, including, but not limited to, the cost of heat, light, power, steam, gas; waste disposal; the cost of janitorial services; the cost of security and alarm services (including any central station signaling system); costs of cleaning, repairing, replacing and maintaining the common areas, including parking and landscaping, window cleaning costs; labor costs; costs and expenses of managing the Building including management and/or administrative fees (provided that such management fees for the Building (expressed as a percentage of gross receipts for the Building and the project in which the Building is located) shall not exceed four and one-half percent (4.5%) of such gross receipts); air conditioning maintenance costs; elevator maintenance fees and supplies; material costs; equipment costs including the cost of maintenance, repair and service agreements and rental and leasing costs; purchase costs of equipment; current rental and leasing costs of items which would be capital items if purchased; tool costs; licenses, permits and inspection fees; wages and salaries; employee benefits and payroll taxes; accounting and legal fees; any sales, use or service taxes incurred in connection therewith. In addition, Landlord shall be entitled to recover, as additional rent (which, along with any other capital expenditures constituting Expenses,

4

Landlord may either include in Expenses or cause to be billed to Tenant along with Expenses and Taxes but as a separate item), Tenant’s Proportionate Share of: (i) an allocable portion of the cost of capital improvement items which are reasonably calculated to reduce operating expenses; (ii) the cost of fire sprinklers and suppression systems and other life safety systems; and (iii) other capital expenses which are required under any Regulations or ordinances which were not applicable to the Building (as then interpreted and enforced) as of the date of this Lease; but the costs described in this sentence shall be amortized over the reasonable life of such expenditures in accordance with such reasonable life and amortization schedules as shall be determined by Landlord in accordance with generally accepted accounting principles, with interest on the unamortized amount at one percent (1%) in excess of the Wall Street Journal prime lending rate announced from time to time. Expenses shall not include Taxes, Insurance Costs, depreciation or amortization of the Building or equipment in the Building except as provided herein, loan principal payments, costs of alterations of tenants’ premises, leasing commissions, interest expenses on long-term borrowings, advertising costs, or, except as specifically provided in this Section 4.1.2, any capital improvement costs.

Notwithstanding the foregoing, for purposes of computing Tenant’s Proportionate Share of Expenses, the Controllable Expenses (hereinafter defined) shall not increase by more than five percent (5%) per calendar year on a compounding and cumulative basis over the course of the Term. In other words, Controllable Expenses for the second Lease Year of the Term shall not exceed one hundred five percent (105%) of the Controllable Expenses for the first Lease Year of the Term. Controllable Expenses for the third Lease Year of the Term shall not exceed one hundred five percent (105%) of the limit on Controllable Expenses for the second Lease Year of the Term, etc. By way of illustration, if Controllable Expenses were $10.00 per rentable square foot for the first Lease Year of the Term, then Controllable Expenses for the second Lease Year shall not exceed $10.50 per rentable square foot, and Controllable Expenses for the third Lease Year of the term shall not exceed $11.03 per rentable square foot (whether or not actual Controllable Expenses were less than, equaled or exceeded the limit on Controllable Expenses the prior year). “Controllable Expenses” shall mean all Expenses exclusive of the cost of insurance, utilities, taxes, capital improvements and the cost of snow removal, refuse removal, and lawn maintenance.

4.1.3 Taxes: Real estate taxes and any other taxes, charges and assessments which are levied with respect to the Building or the land appurtenant to the Building, or with respect to any improvements, fixtures and equipment or other property of Landlord, real or personal, located in the Building and used in connection with the operation of the Building and said land, any payments to any ground lessor in reimbursement of tax payments made by such lessor; and all fees, expenses and costs incurred by Landlord in investigating, protesting, contesting or in any way seeking to reduce or avoid increase in any assessments, levies or the tax rate pertaining to any Taxes to be paid by Landlord in any Lease Year. Taxes shall not include any corporate franchise, or estate, inheritance or net income tax, or tax imposed upon any transfer by Landlord of its interest in this Lease or the Building or any taxes to be paid by Tenant pursuant to Article 28.

4.1.4 Insurance Costs: Any and all insurance charges of or relating to all insurance policies and endorsements deemed by Landlord to be reasonably necessary or desirable and relating in any manner to the protection, preservation, or operation of the Building or any part thereof.

5

4.2 Tenant shall pay as additional rent for each Lease Year Tenant’s Proportionate Share of Expenses incurred for such Lease Year. If in any Lease Year, (i) Insurance Costs paid or incurred shall exceed Insurance Costs paid or incurred in the Base Year and/or (ii) Taxes paid or incurred by Landlord in any Lease Year shall exceed the amount of such Taxes which became due and payable in the Base Year, Tenant shall pay as additional rent for such Lease Year Tenant’s Proportionate Share of such excesses.

4.3 The annual determination of Expenses, Insurance Costs and Taxes shall be made by Landlord and shall be binding upon Landlord and Tenant, subject to the provisions of this Section 4.3. Landlord may deliver such annual determination to Tenant via regular U.S. mail. During the Term, Tenant may review, at Tenant’s sole cost and expense, the books and records supporting such determination in an office of Landlord, or Landlord’s agent, during normal business hours, upon giving Landlord five (5) days advance written notice within one hundred twenty (120) days after receipt of such determination, but in no event more often than once in any one (1) year period, subject to execution of a confidentiality agreement acceptable to Landlord, and provided that if Tenant utilizes an independent accountant to perform such review it shall be one of national standing which is reasonably acceptable to Landlord, is not compensated on a contingency basis and is also subject to such confidentiality agreement. If Tenant fails to object to Landlord’s determination of Expenses, Insurance Costs and Taxes within ninety (90) days after receipt, or if any such objection fails to state with specificity the reason for the objection, Tenant shall be deemed to have approved such determination and shall have no further right to object to or contest such determination. In the event that during all or any portion of any Lease Year or Base Year, the Building is not fully rented and occupied Landlord shall make an appropriate adjustment in occupancy-related Expenses for such year for the purpose of avoiding distortion of the amount of such Expenses to be attributed to Tenant by reason of variation in total occupancy of the Building, by employing consistent and sound accounting and management principles to determine Expenses that would have been paid or incurred by Landlord had the Building been at least ninety-five percent (95%) rented and occupied, and the amount so determined shall be deemed to have been Expenses for such Lease Year.

4.4 Prior to the actual determination thereof for a Lease Year, Landlord may from time to time estimate Tenant’s liability for Expenses, Insurance Costs and/or Taxes under Section 4.2, Article 6 and Article 28 for the Lease Year or portion thereof. Landlord will give Tenant written notification of the amount of such estimate and Tenant agrees that it will pay, by increase of its Monthly Installments of Rent due in such Lease Year, additional rent in the amount of such estimate. Any such increased rate of Monthly Installments of Rent pursuant to this Section 4.4 shall remain in effect until further written notification to Tenant pursuant hereto.

6

4.5 When the above mentioned actual determination of Tenant’s liability for Expenses, Insurance Costs and/or Taxes is made for any Lease Year and when Tenant is so notified in writing, then:

4.5.1 If the total additional rent Tenant actually paid pursuant to Section 4.3 on account of Expenses, Insurance Costs and/or Taxes for the Lease Year is less than Tenant’s liability for Expenses, Insurance Costs and/or Taxes, then Tenant shall pay such deficiency to Landlord as additional rent in one lump sum within thirty (30) days of receipt of Landlord’s bill therefor; and

4.5.2 If the total additional rent Tenant actually paid pursuant to Section 4.3 on account of Expenses, Insurance Costs and/or Taxes for the Lease Year is more than Tenant’s liability for Expenses, Insurance Costs and/or Taxes, then Landlord shall credit the difference against the then next due payments to be made by Tenant under this Article 4, or, if the Lease has terminated, refund the difference in cash. Tenant shall not be entitled to a credit by reason of actual Insurance Costs and/or Taxes in any Lease Year being less than Insurance Costs and/or Taxes in the Base Year.

4.6 If the Commencement Date is other than January I or if the Termination Date is other than December 31, Tenant’s liability for Expenses, Insurance Costs and Taxes for the Lease Year in which said Date occurs shall be prorated based upon a three hundred sixty-five (365) day year.

5. SECURITY DEPOSIT. Tenant Shall Deposit The Security Deposit With Landlord Upon The Execution Of This Lease. Said sum shall be held by Landlord as security for the faithful performance by Tenant of all the terms, covenants and conditions of this Lease to be kept and performed by Tenant and not as an advance rental deposit or as a measure of Landlord’s damage in case of Tenant’s default. If Tenant defaults with respect to any provision of this Lease, Landlord may use any part of the Security Deposit for the payment of any rent or any other sum in default, or for the payment of any amount which Landlord may spend or become obligated to spend by reason of Tenant’s default, or to compensate Landlord for any other loss or damage which Landlord may suffer by reason of Tenant’s default. If any portion is so used, Tenant shall within five (5) days after written demand therefor, deposit with Landlord an amount sufficient to restore the Security Deposit to its original amount and Tenant’s failure to do so shall be a material breach of this Lease. Except to such extent, if any, as shall be required by law, Landlord shall not be required to keep the Security Deposit separate from its general funds, and Tenant shall not be entitled to interest on such deposit. If Tenant shall fully and faithfully perform every provision of this Lease to be performed by it, the Security Deposit or any balance thereof shall be returned to Tenant at such time after termination of this Lease when Landlord shall have determined that all of Tenant’s obligations under this Lease have been fulfilled.

6. ALTERATIONS.

6.1 Tenant shall not make or suffer to be made any alterations, additions, or improvements, including, but not limited to, the attachment of any fixtures or equipment in, on, or to the Premises or any part thereof or the making of any improvements as required by Article 7, without the prior written consent of Landlord, which consent shall not be unreasonably withheld with respect to proposed alterations, additions, or improvements which: (a) comply with all applicable Regulations; (b) are, in Landlord’s opinion, compatible with the Building or the project of which the Building is a part and its mechanical, plumbing, electrical,

7

heating/ventilation/air conditioning systems, and will not cause the Building or such project or such systems to be required to be modified to comply with any Regulations (including, without limitation, the Americans With Disabilities Act); and (c) will not interfere with the use and occupancy of any other portion of the Building or such project by any other tenant or its invitees. When applying for such consent, Tenant shall, if requested by Landlord, furnish complete plans and specifications for such alterations, additions and improvements. Landlord’s consent shall not be unreasonably withheld with respect to alterations which (i) are not structural in nature, (ii) are not visible from the exterior of the Building, (iii) do not affect or require modification of the Building’s electrical, mechanical, plumbing, HVAC or other systems, and (iv) in aggregate do not cost more than $5.00 per rentable square foot of that portion of the Premises affected by the alterations in question.

6.2 In the event Landlord consents to the making of any such alteration, addition or improvement by Tenant, the same shall be made by using either Landlord’s contractor or a contractor reasonably approved by Landlord, in either event at Tenant’s sole cost and expense. If Tenant shall employ any contractor other than Landlord’s contractor and such other contractor or any subcontractor of such other contractor shall employ any non-union labor or supplier, Tenant shall be responsible for and hold Landlord harmless from any and all delays, damages and extra costs suffered by Landlord as a result of any dispute with any labor unions concerning the wage, hours, terms or conditions of the employment of any such labor. In any event Landlord may charge Tenant a construction management fee not to exceed five percent (5%) of the cost of such work to cover its overhead as it relates to such proposed work, plus third-party costs actually incurred by Landlord in connection with the proposed work and the design thereof, with all such amounts being due ten (10) business days after Landlord’s demand.

6.3 All alterations, additions or improvements proposed by Tenant shall be constructed in accordance with all Regulations, using Building standard materials where applicable, and Tenant shall, prior to construction, provide the additional insurance required under Article 11 in such case, and also all such assurances to Landlord as Landlord shall reasonably require to assure payment of the costs thereof, including but not limited to, notices of non-responsibility, waivers of lien, surety company performance bonds and funded construction escrows and to protect Landlord and the Building and appurtenant land against any loss from any mechanic’s, materialmen’s or other liens. Tenant shall pay in addition to any sums due pursuant to Article 4, any increase in real estate taxes attributable to any such alteration, addition or improvement for so long, during the Term, as such increase is ascertainable; at Landlord’s election said sums shall be paid in the same way as sums due under Article 4. Landlord may, as a condition to its consent to any particular alterations or improvements, require Tenant to deposit with Landlord the amount reasonably estimated by Landlord as sufficient to cover the cost of removing such alterations or improvements and restoring the Premises, to the extent required under Section 26.2.

6.4 Notwithstanding anything to the contrary contained herein, so long as Tenant’s written request for consent for a proposed alteration or improvements contains the following statement in large, bold and capped font “PURSUANT TO ARTICLE 6 OF THE LEASE, IF LANDLORD CONSENTS TO THE SUBJECT ALTERATION, LANDLORD SHALL NOTIFY TENANT IN WRITING WHETHER OR NOT LANDLORD WILL REQUIRE SUCH

8

ALTERATION TO BE REMOVED AT THE EXPIRATION OR EARLIER TERMINATION OF THE LEASE.”, at the time Landlord gives its consent for any alterations or improvements, if it so does, Tenant shall also be notified whether or not Landlord will require that such alterations or improvements be removed upon the expiration or earlier termination of this Lease. Notwithstanding anything to the contrary contained in this Lease, at the expiration or earlier termination of this Lease and otherwise in accordance with Article 26 hereof, Tenant shall be required to remove all alterations or improvements made to the Premises except for any such alterations or improvements which Landlord expressly indicates or is deemed to have indicated shall not be required to be removed from the Premises by Tenant. If Tenant’s written notice strictly complies with the foregoing and if Landlord fails to so notify Tenant whether Tenant shall be required to remove the subject alterations or improvements at the expiration or earlier termination of this Lease, it shall be assumed that Landlord shall require the removal of the subject alterations or improvements.

7. REPAIR.

7.1 Landlord shall have no obligation to alter, remodel, improve, repair, decorate or paint the Premises, except as specified in Exhibit B if attached to this Lease and except that Landlord shall repair and maintain the structural portions of the roof, foundation and walls of the Building. By taking possession of the Premises, Tenant accepts them as being in good order, condition and repair and in the condition in which Landlord is obligated to deliver them. It is hereby understood and agreed that no representations respecting the condition of the Premises or the Building have been made by Landlord to Tenant, except as specifically set forth in this Lease. Landlord shall not be liable for any failure to make any repairs or to perform any maintenance unless such failure shall persist for an unreasonable time after written notice of the need of such repairs or maintenance is given to Landlord by Tenant.

7.2 Tenant shall at its own cost and expense keep and maintain all parts of the Premises and such portion of the Building and improvements as are within the exclusive control of Tenant in good condition, promptly making all necessary repairs and replacements, whether ordinary or extraordinary, with materials and workmanship of the same character, kind and quality as the original (including, but not limited to, repair and replacement of all fixtures installed by Tenant, water heaters serving the Premises, windows, glass and plate glass, doors, exterior stairs, skylights, any special office entries, interior walls and finish work, floors and floor coverings, heating and air conditioning systems serving the Premises, electrical systems and fixtures, sprinkler systems, dock boards, truck doors, dock bumpers, plumbing work and fixtures, and performance of regular removal of trash and debris). Tenant as part of its obligations hereunder shall keep the Premises in a clean and sanitary condition. Tenant will, as far as possible keep all such parts of the Premises from deterioration due to ordinary wear and from falling temporarily out of repair, and upon termination of this Lease in any way Tenant will yield up the Premises to Landlord in good condition and repair, loss by fire or other casualty excepted (but not excepting any damage to glass). Tenant shall, at its own cost and expense, repair any damage to the Premises or the Building resulting from and/or caused in whole or in part by the negligence or misconduct of Tenant, its agents, employees, contractors, invitees, or any other person entering upon the Premises as a result of Tenant’s business activities or caused by Tenant’s default hereunder.

9

7.3 Except as provided in Article 22, there shall be no abatement of rent and no liability of Landlord by reason of any injury to or interference with Tenant’s business arising from the making of any repairs, alterations or improvements in or to any portion of the Building or the Premises or to fixtures, appurtenances and equipment in the Building. Notwithstanding the foregoing, except in emergency situations as determined by Landlord, Landlord shall exercise reasonable efforts to perform any such repairs, alterations or improvements in a manner that is reasonably designed to minimize interference with the operation of Tenant’s business in the Premises. Except to the extent, if any, prohibited by law, Tenant waives the right to make repairs at Landlord’s expense under any law, statute or ordinance now or hereafter in effect.

7.4 Tenant shall, at its own cost and expense, enter into a regularly scheduled preventive maintenance/service contract with a maintenance contractor approved by Landlord for servicing all heating and air conditioning systems and equipment serving the Premises (and a copy thereof shall be furnished to Landlord). The service contract must include all services suggested by the equipment manufacturer in the operation/maintenance manual and must become effective within thirty (30) days of the date Tenant takes possession of the Premises. Should Tenant fail to do so, Landlord may, upon notice to Tenant, enter into such a maintenance/ service contract on behalf of Tenant or perform the work and in either case, charge Tenant the cost thereof along with a reasonable amount for Landlord’s overhead. Notwithstanding anything to the contrary set forth in the Lease, so long as Tenant strictly complies with the requirements of this Section 7.4, and except to the extent caused by Tenant or any Tenant Entities acts and/or omissions or as a result of casualty, during the initial Term, to the extent Landlord is made aware and Landlord determines in its reasonable discretion that expenditures for repair or replacement of any heating, ventilating and air conditioning unit solely servicing the Premises and existing in the Premises as of the date of this Lease (collectively, the “HVAC Unit”) must be made, Landlord shall cause such work to be completed and Tenant’s obligation with respect to the costs and expenses associated with any such repair or replacement of the HVAC Unit shall not exceed Two Thousand Five Hundred Dollars ($2,500.00) during each full lease year of the initial Term (the “HVAC Cap”). Prior to performing any such repair or maintenance to the HVAC Units, Tenant shall notify Landlord in writing (Tenant’s “HVAC Repair Notice”) of the necessity of such repairs or maintenance and Tenant’s estimated cost thereof. Landlord, at its sole option, may investigate the type and necessity of any such contemplated repair or maintenance item, and procure a cost estimate of repairs or maintenance necessary to enable the HVAC Units to operate in a good, safe and satisfactory condition. Landlord may elect to perform any such repair or maintenance of the HVAC Units by providing written notice of such election within five (5) days of receiving notice from Tenant’s HVAC Repair Notice. In the event Landlord elects to perform or have its contractors perform any such repair or maintenance of the HVAC Units, Tenant shall reimburse Landlord its costs and expenses incurred in performing such repair and maintenance of the HVAC Units up to an amount equal to the HVAC Cap. The HVAC Cap shall not apply to the cost of Tenant’s maintenance/service contract or to any repair and maintenance obligations which are covered by Tenant’s preventative maintenance/service contract or would have been covered if Tenant had procured and maintained a preventative maintenance/service contract as required by this Section 7.4 or to any repair required as a result of the acts or omissions of Tenant or any Tenant Entities. The foregoing shall in no event modify or otherwise alter Tenant’s responsibility to pay Tenant’s Proportionate Share of Expenses, Taxes and Insurance Costs, including, without limitation, its share of the costs and expenses associated with repair and

10

maintenance of any heating, ventilation and air conditioning systems which serve the Building in general (as opposed to the HVAC Unit) and which are included in Expenses. The HVAC Unit shall exclude any supplemental heating, ventilating and air conditioning unit installed by or for the benefit of Tenant.

7.5 Landlord shall coordinate any repairs and other maintenance of any railroad tracks serving the Building and, if Tenant uses such rail tracks, Tenant shall reimburse Landlord or the railroad company from time to time upon demand, as additional rent, for its share of the costs of such repair and maintenance and for any other sums specified in any agreement to which Landlord or Tenant is a party respecting such tracks, such costs to be borne proportionately by all tenants in the Building using such rail tracks, based upon the actual number of rail cars shipped and received by such tenant during each calendar year during the Term.

8. LIENS. Tenant shall keep the Premises, the Building and appurtenant land and Tenant’s leasehold interest in the Premises free from any liens arising out of any services, work or materials performed, furnished, or contracted for by Tenant, or obligations incurred by Tenant. In the event that Tenant fails, within ten (10) days following the imposition of any such lien, to either cause the same to be released of record or provide Landlord with insurance against the same issued by a major title insurance company or such other protection against the same as Landlord shall accept (such failure to constitute an Event of Default), Landlord shall have the right to cause the same to be released by such means as it shall deem proper, including payment of the claim giving rise to such lien. All such sums paid by Landlord and all expenses incurred by it in connection therewith shall be payable to it by Tenant within ten (10) business days of Landlord’s demand.

9. ASSIGNMENT AND SUBLETTING.

9.1 Tenant shall not have the right to assign or pledge this Lease or to sublet the whole or any part of the Premises whether voluntarily or by operation of law, or permit the use or occupancy of the Premises by anyone other than Tenant, and shall not make, suffer or permit such assignment, subleasing or occupancy without the prior written consent of Landlord, such consent not to be unreasonably withheld or delayed, and said restrictions shall be binding upon any and all assignees of the Lease and subtenants of the Premises. In the event Tenant desires to sublet, or permit such occupancy of, the Premises, or any portion thereof, or assign this Lease, Tenant shall give written notice thereof to Landlord at least sixty (60) days but no more than one hundred twenty (120) days prior to the proposed commencement date of such subletting or assignment, which notice shall set forth the name of the proposed subtenant or assignee, the relevant terms of any sublease or assignment and copies of financial reports and other relevant financial information of the proposed subtenant or assignee.

9.2 Notwithstanding any assignment or subletting, permitted or otherwise, Tenant shall at all times remain directly, primarily and fully responsible and liable for the payment of the rent specified in this Lease and for compliance with all of its other obligations under the terms, provisions and covenants of this Lease. Upon the occurrence of an Event of Default, if the Premises or any part of them are then assigned or sublet, Landlord, in addition to any other remedies provided in this Lease or provided by law, may, at its option, collect directly from such

11

assignee or subtenant all rents due and becoming due to Tenant under such assignment or sublease and apply such rent against any sums due to Landlord from Tenant under this Lease, and no such collection shall be construed to constitute a novation or release of Tenant from the further performance of Tenant’s obligations under this Lease.

9.3 In addition to Landlord’s right to approve of any subtenant or assignee, Landlord shall have the option, in its sole discretion, in the event of any proposed subletting or assignment, to terminate this Lease, or in the case of a proposed subletting of less than the entire Premises, to recapture the portion of the Premises to be sublet, as of the date the subletting or assignment is to be effective. The option shall be exercised, if at all, by Landlord giving Tenant written notice given by Landlord to Tenant within thirty (30) days following Landlord’s receipt of Tenant’s written notice as required above. However, if Tenant notifies Landlord, within five (5) days after receipt of Landlord’s termination notice, that Tenant is rescinding its proposed assignment or sublease, the termination notice shall be void and the Lease shall continue in full force and effect. If this Lease shall be terminated with respect to the entire Premises pursuant to this Section, the Term of this Lease shall end on the date stated in Tenant’s notice as the effective date of the sublease or assignment as if that date had been originally fixed in this Lease for the expiration of the Term. If Landlord recaptures under this Section only a portion of the Premises, the rent to be paid from time to time during the unexpired Term shall abate proportionately based on the proportion by which the approximate square footage of the remaining portion of the Premises shall be less than that of the Premises as of the date immediately prior to such recapture. Tenant shall, at Tenant’s own cost and expense, discharge in full any outstanding commission obligation which may be due and owing as a result of any proposed assignment or subletting, whether or not the Premises are recaptured pursuant to this Section 9.3 and rented by Landlord to the proposed tenant or any other tenant.

9.4 In the event that Tenant sells, sublets, assigns or transfers this Lease, Tenant shall pay to Landlord as additional rent an amount equal to one hundred percent (100%) of any Increased Rent (as defined below), less the Costs Component (as defined below), when and as such Increased Rent is received by Tenant. As used in this Section, “Increased Rent” shall mean the excess of (i) all rent and other consideration which Tenant is entitled to receive by reason of any sale, sublease, assignment or other transfer of this Lease, over (ii) the rent otherwise payable by Tenant under this Lease at such time. For purposes of the foregoing, any consideration received by Tenant in form other than cash shall be valued at its fair market value as determined by Landlord in good faith. The “Costs Component” is that amount which, if paid monthly, would fully amortize on a straight-line basis, over the entire period for which Tenant is to receive Increased Rent, the reasonable costs incurred by Tenant for leasing commissions and tenant improvements in connection with such sublease, assignment or other transfer.

9.5 Notwithstanding any other provision hereof, it shall be considered reasonable for Landlord to withhold its consent to any assignment of this Lease or sublease of any portion of the Premises if at the time of either Tenant’s notice of the proposed assignment or sublease or the proposed commencement date thereof, there shall exist any uncured default of Tenant or matter which will become a default of Tenant with passage of time unless cured, or if the proposed assignee or sublessee is an entity: (a) with which Landlord is already in negotiation; (b) is already an occupant of the Building unless Landlord is unable to provide the amount of space

12

required by such occupant; (c) is a governmental agency; (d) is incompatible with the character of occupancy of the Building; (e) with which the payment for the sublease or assignment is determined in whole or in part based upon its net income or profits; or (f) would subject the Premises to a use which would: (i) involve increased personnel or wear upon the Building; (ii) violate any exclusive right granted to another tenant of the Building; (iii) require any addition to or modification of the Premises or the Building in order to comply with building code or other governmental requirements; or, (iv) involve a violation of Section 1.2. Tenant expressly agrees that for the purposes of any statutory or other requirement of reasonableness on the part of Landlord, Landlord’s refusal to consent to any assignment or sublease for any of the reasons described in this Section 9.5, shall be conclusively deemed to be reasonable.

9.6 Upon any request to assign or sublet, Tenant will pay to Landlord the Assignment/Subletting Fee plus, on demand, a sum equal to all of Landlord’s costs, including reasonable attorney’s fees, incurred in investigating and considering any proposed or purported assignment or pledge of this Lease or sublease of any of the Premises (the “Review Reimbursement”), regardless of whether Landlord shall consent to, refuse consent, or determine that Landlord’s consent is not required for, such assignment, pledge or sublease. Except as otherwise expressly provided herein, the Review Reimbursement shall not exceed $1,000.00 (the “Cap”). If: (a) Tenant fails to execute Landlord’s standard form of consent without any changes to this Lease, without material changes to the consent and without material negotiation of the consent, and (b) Landlord shall notify Tenant that the Review Reimbursement shall exceed the Cap as a result of such changes and/or negotiation, and (c) Tenant elects to proceed with such changes and/or negotiation, then the Cap shall not apply and Tenant shall pay to Landlord the Assignment/Subletting Fee plus the Review Reimbursement in full. The foregoing shall in no event be deemed to be a right of Tenant to rescind its written notice to Landlord requesting consent to a transfer of this Lease or a sublease of all or a portion of the Premises as provided in Section 9.1. In the event that Tenant fails to notify Landlord of its election as provided in subsection (c) above within three (3) business days following Landlord’s notice to Tenant of the excess described in subsection (b) above, then Tenant shall be deemed to have elected to proceed with any such changes and/or negotiation and the Cap shall not apply. Any purported sale, assignment, mortgage, transfer of this Lease or subletting which does not comply with the provisions of this Article 9 shall be void.

9.7 If Tenant is a corporation, limited liability company, partnership or trust, any transfer or transfers of or change or changes within any twelve (12) month period in the number of the outstanding voting shares of the corporation or limited liability company, the general partnership interests in the partnership or the identity of the persons or entities controlling the activities of such partnership or trust resulting in the persons or entities owning or controlling a majority of such shares, partnership interests or activities of such partnership or trust at the beginning of such period no longer having such ownership or control shall be regarded as equivalent to an assignment of this Lease to the persons or entities acquiring such ownership or control and shall be subject to all the provisions of this Article 9 to the same extent and for all intents and purposes as though such an assignment.

13

10. INDEMNIFICATION. None of the Landlord Entities shall be liable and Tenant hereby waives all claims against them for any damage to any property or any injury to any person in or about the Premises or the Building by or from any cause whatsoever (including without limiting the foregoing, rain or water leakage of any character from the roof, windows, walls, basement, pipes, plumbing works or appliances, the Building not being in good condition or repair, gas, fire, oil, electricity or theft), except to the extent caused by or arising from the gross negligence or willful misconduct of Landlord or its agents, employees or contractors. Tenant shall protect, indemnify and hold the Landlord Entities harmless from and against any and all loss, claims, liability or costs (including court costs and attorney’s fees) incurred by reason of (a) any damage to any property (including but not limited to property of any Landlord Entity) or any injury (including but not limited to death) to any person occurring in, on or about the Premises or the Building to the extent that such injury or damage shall be caused by or arise from any actual or alleged act, neglect, fault, or omission by or of Tenant or any Tenant Entity to meet any standards imposed by any duty with respect to the injury or damage; (b) the conduct or management of any work or thing whatsoever done by the Tenant in or about the Premises or from transactions of the Tenant concerning the Premises; (c) Tenant’s actual or asserted failure to comply with any and all Regulations applicable to the condition or use of the Premises or its occupancy; or (d) any breach or default on the part of Tenant in the performance of any covenant or agreement on the part of the Tenant to be performed pursuant to this Lease. The provisions of this Article shall survive the termination of this Lease with respect to any claims or liability accruing prior to such termination.

11. INSURANCE.

11.1 Tenant shall keep in force throughout the Term: (a) a Commercial General Liability insurance policy or policies to protect the Landlord Entities against any liability to the public or to any invitee of Tenant or a Landlord Entity incidental to the use of or resulting from any accident occurring in or upon the Premises with a limit of not less than $1,000,000 per occurrence and not less than $2,000,000 in the annual aggregate, or such larger amount as Landlord may prudently require from time to time, covering bodily injury and property damage liability and $1,000,000 products/completed operations aggregate; provided that except to the extent required by Landlord’s lender, Landlord shall only require any such increase in the amount of existing insurance required pursuant to this Section in the event that (i) Landlord reasonably determines that the amount of insurance carried by Tenant hereunder is materially less than the amount or type of insurance coverage typically carried by tenant’s of the Building and owners or tenants of comparable buildings located in the geographical area in which the Premises are located which are operated for similar purposes as the Premises, or (ii) if Tenant’s use of the Premises should change with or without Landlord’s consent; (b) Business Auto Liability covering owned, non-owned and hired vehicles with a limit of not less than $1,000,000 per accident; (c) Worker’s Compensation Insurance with limits as required by statute and Employers Liability with limits of $500,000 each accident, $500,000 disease policy limit, $500,000 disease—each employee; (d) All Risk or Special Form coverage protecting Tenant against loss of or damage to Tenant’s alterations, additions, improvements, carpeting, floor coverings, panelings, decorations, fixtures, inventory and other business personal property situated in or about the Premises to the full replacement value of the property so insured; and, (e) Business Interruption Insurance with limit of liability representing loss of at least approximately six (6) months of income.

14

11.2 The aforesaid policies shall (a) be provided at Tenant’s expense; (b) name the Landlord Entities as additional insureds (General Liability) and loss payee (Property—Special Form); (c) be issued by an insurance company with a minimum Best’s rating of “A-:VII” during the Term; and (d) provide that said insurance shall not be canceled unless thirty (30) days prior written notice (ten days for non-payment of premium) shall have been given to Landlord; a certificate of Liability insurance on ACORD Form 25 and a certificate of Property insurance on ACORD Form 28 shall be delivered to Landlord by Tenant upon the Commencement Date and at least thirty (30) days prior to each renewal of said insurance.

11.3 Whenever Tenant shall undertake any alterations, additions or improvements in, to or about the Premises (“Work”) the aforesaid insurance protection must extend to and include injuries to persons and damage to property arising in connection with such Work, without limitation including liability under any applicable structural work act, and such other insurance as Landlord shall require; and the policies of or certificates evidencing such insurance must be delivered to Landlord prior to the commencement of any such Work.

12. WAIVER OF SUBROGATION. Tenant and Landlord hereby mutually waive their respective rights of recovery against each other for any loss insured (or required to be insured pursuant to this Lease) by fire, extended coverage, All Risks or other insurance now or hereafter existing for the benefit of the respective party but only to the extent of the net insurance proceeds payable under such policies. Each party shall obtain any special endorsements required by their insurer to evidence compliance with the aforementioned waiver.

13. SERVICES AND UTILITIES. Tenant shall pay for all water, gas, heat, light, power, telephone, sewer, sprinkler system charges and other utilities and services used on or from the Premises, together with any taxes, penalties, and surcharges or the like pertaining thereto and any maintenance charges for utilities. Tenant shall furnish all electric light bulbs, tubes and ballasts, battery packs for emergency lighting and fire extinguishers. If any such services are not separately metered to Tenant, Tenant shall pay such proportion of all charges jointly metered with other premises as determined by Landlord, in its sole discretion, to be reasonable. Any such charges paid by Landlord and assessed against Tenant shall be immediately payable to Landlord on demand and shall be additional rent hereunder. Tenant will not, without the written consent of Landlord, contract with a utility provider to service the Premises with any utility, including, but not limited to, telecommunications, electricity, water, sewer or gas, which is not previously providing such service to other tenants in the Building. Landlord shall in no event be liable for any interruption or failure of utility services on or to the Premises. However, notwithstanding the foregoing, if the Premises, or a material portion of the Premises, are made untenantable for a period in excess of five (5) consecutive business days solely as a result of an interruption, diminishment or termination of services due to Landlord’s gross negligence or willful misconduct and such interruption, diminishment or termination of services is otherwise reasonably within the control of Landlord to correct (a “Service Failure”), then Tenant, as its sole remedy, shall be entitled to receive an abatement of the Monthly Installment of Rent and Tenant’s Proportionate Share of Expenses and Taxes payable hereunder during the period beginning on the sixth (6th) consecutive business day of the Service Failure and ending on the day the interrupted service has been restored. If the entire Premises have not been rendered untenantable by the Service Failure, the amount of abatement shall be equitably prorated.

15

14. HOLDING OVER. Tenant shall pay Landlord for each day Tenant retains possession of the Premises or part of them after termination of this Lease by lapse of time or otherwise at the rate (“Holdover Rate”) which shall be One Hundred Fifty Percent (150%) of the amount of the Annual Rent for the last period prior to the date of such termination plus Tenant’s Proportionate Share of Expenses, Taxes and Insurance Costs under Article 4, prorated on a daily basis, and also pay all damages sustained by Landlord by reason of such retention. If Landlord gives notice to Tenant of Landlord’s election to such effect, such holding over shall constitute renewal of this Lease for a period from month to month at the Holdover Rate, but if the Landlord does not so elect, no such renewal shall result notwithstanding acceptance by Landlord of any sums due hereunder after such termination; and instead, a tenancy at sufferance at the Holdover Rate shall be deemed to have been created. In any event, no provision of this Article 14 shall be deemed to waive Landlord’s right of reentry or any other right under this Lease or at law.

15. SUBORDINATION. Without the necessity of any additional document being executed by Tenant for the purpose of effecting a subordination, this Lease shall be subject and subordinate at all times to ground or underlying leases and to the lien of any mortgages or deeds of trust now or hereafter placed on, against or affecting the Building, Landlord’s interest or estate in the Building, or any ground or underlying lease; provided, however, that if the lessor, mortgagee, trustee, or holder of any such mortgage or deed of trust elects to have Tenant’s interest in this Lease be superior to any such instrument, then, by notice to Tenant, this Lease shall be deemed superior, whether this Lease was executed before or after said instrument. Notwithstanding the foregoing, Tenant covenants and agrees to execute and deliver within ten (10) business days of Landlord’s request such further instruments evidencing such subordination or superiority of this Lease as may be required by Landlord.

16. RULES AND REGULATIONS. Tenant shall faithfully observe and comply with all the rules and regulations as set forth in Exhibit D to this Lease and all reasonable and non-discriminatory modifications of and additions to them from time to time put into effect by Landlord. Landlord shall not be responsible to Tenant for the non-performance by any other tenant or occupant of the Building of any such rules and regulations.

17. REENTRY BY LANDLORD.

17.1 Landlord reserves and shall at all times have the right to re-enter the Premises to inspect the same, to show said Premises to prospective purchasers, mortgagees or tenants, and to alter, improve or repair the Premises and any portion of the Building, without abatement of rent, and may for that purpose erect, use and maintain scaffolding, pipes, conduits and other necessary structures and open any wall, ceiling or floor in and through the Building and Premises where reasonably required by the character of the work to be performed, provided entrance to the Premises shall not be blocked thereby, and further provided that the business of Tenant shall not be interfered with unreasonably. Landlord shall have the right at any time to change the arrangement and/or locations of entrances, or passageways, doors and doorways, and corridors, windows, elevators, stairs, toilets or other public parts of the Building and to change the name, number or designation by which the Building is commonly known. In the event that Landlord damages any portion of

16

any wall or wall covering, ceiling, or floor or floor covering within the Premises, Landlord shall repair or replace the damaged portion to match the original as nearly as commercially reasonable but shall not be required to repair or replace more than the portion actually damaged. Tenant hereby waives any claim for damages for any injury or inconvenience to or interference with Tenant’s business, any loss of occupancy or quiet enjoyment of the Premises, and any other loss occasioned by any action of Landlord authorized by this Article 17. Notwithstanding the foregoing, except as provided in Article 12 to the contrary, Tenant shall not be required to waive any claims against Landlord (other than for loss or damage to Tenant’s business) where such loss or damage is due to the gross negligence or willful misconduct of Landlord or any Landlord Entities; provided, however, that any such claim of Tenant shall be limited to the foreseeable, direct and actual damages incurred by Tenant.

17.2 For each of the aforesaid purposes, Landlord shall at all times have and retain a key with which to unlock all of the doors in the Premises, excluding Tenant’s vaults and safes or special security areas (designated in advance), and Landlord shall have the right to use any and all means which Landlord may deem proper to open said doors in an emergency to obtain entry to any portion of the Premises. As to any portion to which access cannot be had by means of a key or keys in Landlord’s possession, Landlord is authorized to gain access by such means as Landlord shall elect and the cost of repairing any damage occurring in doing so shall be borne by Tenant and paid to Landlord within five (5) days of Landlord’s demand.

18. DEFAULT.

18.1 Except as otherwise provided in Article 20, the following events shall be deemed to be Events of Default under this Lease:

18.1.1 Tenant shall fail to pay when due any sum of money becoming due to be paid to Landlord under this Lease, whether such sum be any installment of the rent reserved by this Lease, any other amount treated as additional rent under this Lease, or any other payment or reimbursement to Landlord required by this Lease, whether or not treated as additional rent under this Lease, and such failure shall continue for a period of five (5) days after written notice that such payment was not made when due, but if any such notice shall be given two (2) times during the twelve (12) month period commencing with the date of the first (1st) such notice, the third (3rd) failure to pay within five (5) days after due any additional sum of money becoming due to be paid to Landlord under this Lease during such twelve (12) month period shall be an Event of Default, without notice.

18.1.2 Tenant shall fail to comply with any term, provision or covenant of this Lease which is not provided for in another Section of this Article and shall not cure such failure within twenty (20) days (forthwith, if the failure involves a hazardous condition) after written notice of such failure to Tenant provided, however, that such failure shall not be an event of default if such failure could not reasonably be cured during such twenty (20) day period, Tenant has commenced the cure within such twenty (20) day period and thereafter is diligently pursuing such cure to completion, but the total aggregate cure period shall not exceed ninety (90) days.

17

18.1.3 Tenant shall fail to vacate the Premises immediately upon termination of this Lease, by lapse of time or otherwise, or upon termination of Tenant’s right to possession only.

18.1.4 Tenant shall become insolvent, admit in writing its inability to pay its debts generally as they become due, file a petition in bankruptcy or a petition to take advantage of any insolvency statute, make an assignment for the benefit of creditors, make a transfer in fraud of creditors, apply for or consent to the appointment of a receiver of itself or of the whole or any substantial part of its property, or file a petition or answer seeking reorganization or arrangement under the federal bankruptcy laws, as now in effect or hereafter amended, or any other applicable law or statute of the United States or any state thereof.

18.1.5 A court of competent jurisdiction shall enter an order, judgment or decree adjudicating Tenant bankrupt, or appointing a receiver of Tenant, or of the whole or any substantial part of its property, without the consent of Tenant, or approving a petition filed against Tenant seeking reorganization or arrangement of Tenant under the bankruptcy laws of the United States, as now in effect or hereafter amended, or any state thereof, and such order, judgment or decree shall not be vacated or set aside or stayed within sixty (60) days from the date of entry thereof.

19. REMEDIES.

19.1 Except as otherwise provided in Article 20, upon the occurrence of any of the Events of Default described or referred to in Article 18, Landlord shall have the option to pursue any one or more of the following remedies without any notice or demand whatsoever, concurrently or consecutively and not alternatively:

19.1.1 Landlord may, at its election, terminate this Lease or terminate Tenant’s right to possession only, without terminating the Lease.

19.1.2 Upon any termination of this Lease, whether by lapse of time or otherwise, or upon any termination of Tenant’s right to possession without termination of this Lease, Tenant shall surrender possession and vacate the Premises immediately, and deliver possession thereof to Landlord, and Tenant hereby grants to Landlord full and free license to enter into and upon the Premises in such event and to repossess Landlord of the Premises as of Landlord’s former estate and to expel or remove Tenant and any others who may be occupying or be within the Premises and to remove Tenant’s signs and other evidence of tenancy and all other property of Tenant therefrom without being deemed in any manner guilty of trespass, eviction or forcible entry or detainer, and without incurring any liability for any damage resulting therefrom, Tenant waiving any right to claim damages for such re-entry and expulsion, and without relinquishing Landlord’s right to rent or any other right given to Landlord under this Lease or by operation of law.

19.1.3 Upon any termination of this Lease, whether by lapse of time or otherwise, Landlord shall be entitled to recover as damages, all rent, including any amounts treated as additional rent under this Lease, and other sums due and payable by Tenant on the date of termination, plus as liquidated damages and not as a penalty, an amount equal to the sum of: (a)

18

an amount equal to the then present value of the rent reserved in this Lease for the residue of the stated Term of this Lease including any amounts treated as additional rent under this Lease and all other sums provided in this Lease to be paid by Tenant, minus the fair rental value of the Premises for such residue; (b) the value of the time and expense necessary to obtain a replacement tenant or tenants, and the estimated expenses described in Section 19.1.4 relating to recovery of the Premises, preparation for reletting and for reletting itself; and (c) the cost of performing any other covenants which would have otherwise been performed by Tenant.

19.1.4 Upon any termination of Tenant’s right to possession only without termination of this Lease:

19.1.4.1 Neither such termination of Tenant’s right to possession nor Landlord’s taking and holding possession thereof as provided in Section 19.1.2 shall terminate the Lease or release Tenant, in whole or in part, from any obligation, including Tenant’s obligation to pay the rent, including any amounts treated as additional rent, under this Lease for the full Term, and if Landlord so elects Tenant shall continue to pay to Landlord the entire amount of the rent as and when it becomes due, including any amounts treated as additional rent under this Lease, for the remainder of the Term plus any other sums provided in this Lease to be paid by Tenant for the remainder of the Term.