Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Energy Future Holdings Corp /TX/ | d253195d8k.htm |

EFH

Corp. 2011 EEI Financial Conference

Discussion Deck

November

6

th

-

9

th

Exhibit 99.1 |

1

Safe Harbor Statement

This presentation contains forward-looking statements, which are subject

to various risks and uncertainties. A discussion of the risks and

uncertainties that could cause actual results to differ materially from

management's current projections, forecasts, estimates and expectations

is contained in EFH Corp.'s filings with the Securities and Exchange

Commission (SEC).

Regulation G

This presentation includes certain non-GAAP financial measures. A

reconciliation

of

these

measures

to

the

most

directly

comparable

GAAP

measures is included in the appendix to this presentation.

|

2

Table of Contents

I.

Energy Future Holdings (EFH)

Overview…………………… II.

Luminant

Overview…………………………...……………....

III.

TXU Energy

Overview.…………………………………….….

IV.

Oncor

Overview.………………………………………..…..…

V.

EFH Supplemental

Information………………………..…...

VI.

Appendix –

Reg

G…………………………………..………....

3

-

4

5

-

22

23

-

27

28

-

31

32

-

35

36

-

40 |

3

Largest competitive electric

generator in Texas

Largest lignite/coal and

nuclear generation fleet in

Texas

Low-cost lignite reserves

Largest T&D utility in

Texas

Leader in smart-grid

development

Constructive regulatory

regime

Largest retail

electricity provider in

Texas

Strong customer value

proposition

The largest power generator, retail electricity provider and transmission &

distribution utility in Texas.

Energy Future Holdings Overview |

2011 Key

Highlights 4

Operational

achievements

Solid safety performance

Coal fueled plant generation

OG/S5 Q3 capacity factor (~95%)

Gas plant summer operations

New

ERCOT summer and winter demand

records

TXU Energy bad debt reduction

Top decile nuclear cost & reliability

ERCOT nodal execution

Land reclamation program

CREZ construction program

AMS deployment and plan

Financial

achievements

Liability Management Program

–

Extended ~$15B of TCEH TLB

–

Issued

~$1.8B

of

TCEH

1

Lien

notes

Defended creditor allegations

Effective cost / capex management

Effective asset management

IRS tax settlement progression

Strategic

initiatives

EPA regulations

Support ERCOT/PUCT engagement and

advocacy on resource adequacy

TXUE marketing partnerships

(Southwest/SolarCity)

Nuclear licensing progression

All 14 CCNs for CREZ approved

Monetized non-core assets

st |

5 |

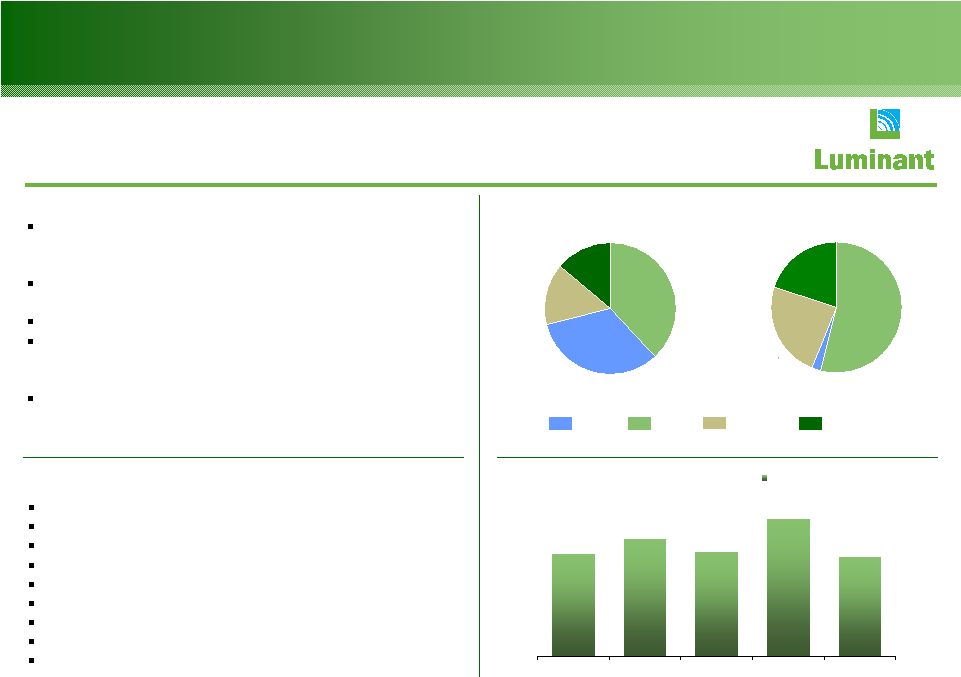

6

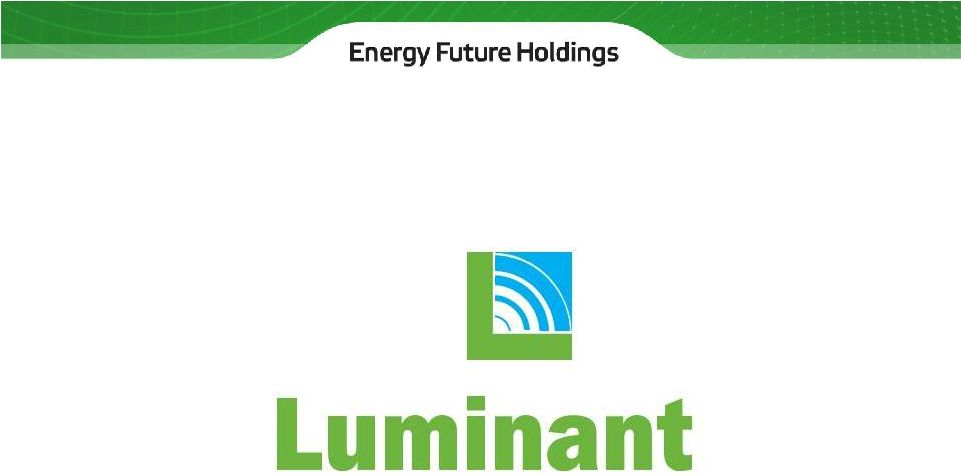

Luminant Generation Facilities

Generation capacity in ERCOT

At 12/31/10; MW

Nuclear

2,300 MW

Coal

8,017

Natural gas¹

5,110

Total

15,427 MW

1

Includes four mothballed units (1,655 MW) not currently available for dispatch and eight units (1,268

MW) currently operated for unaffiliated parties.

HOUSTON

SAN ANTONIO

AUSTIN

WACO

MIDLAND

LUFKIN

ODESSA

DALLAS

TYLER

FORT

WORTH

Power Plants

Natural gas

Coal

Coal, new build

Nuclear |

40

55

42

47

41

2007

2008

2009

2010

2011E

Luminant Recordables

(# of Incidents)

1

Includes four mothballed units (1,655 MW) not currently available for dispatch and

eight units (1,268 MW) currently operated for unaffiliated parties. 2

Nine months ended September 30, 2011 (excludes purchased power).

24%

54%

20%

Business Profile

Generation

Largest coal & nuclear generation fleet in ERCOT with

around-the-clock assets that dispatch at low heat rate

levels

Top decile nuclear plant production and cost

performance

Top quartile coal fleet production and cost performance

Liquidity-light natural gas hedging program designed to

provide cash flow security (~47% hedged for Jan 1, 2011

–

Dec 31, 2015)

Comanche Peak expansion through Mitsubishi

partnership may provide a long term nuclear growth

option

14%

33%

38%

15%

Coal

Gas

Nuclear

Generating

Capacity¹

as

of

12/31/10

Total

Net

Generation²

Sept.

2011

15,427 MW

60,775 GWh

New Build-Coal

Safety

Wholesale power prices

Natural gas hedge program

Coal/ Nuclear plant reliability

Mining operations

Fuel/ O&M costs

Peaking gas assets

Operational excellence/continuous improvement

Competitive market

Value Drivers

Safety Performance

07-11E

Luminant is the largest power generator in Texas.

Luminant

Business Summary

7

2% |

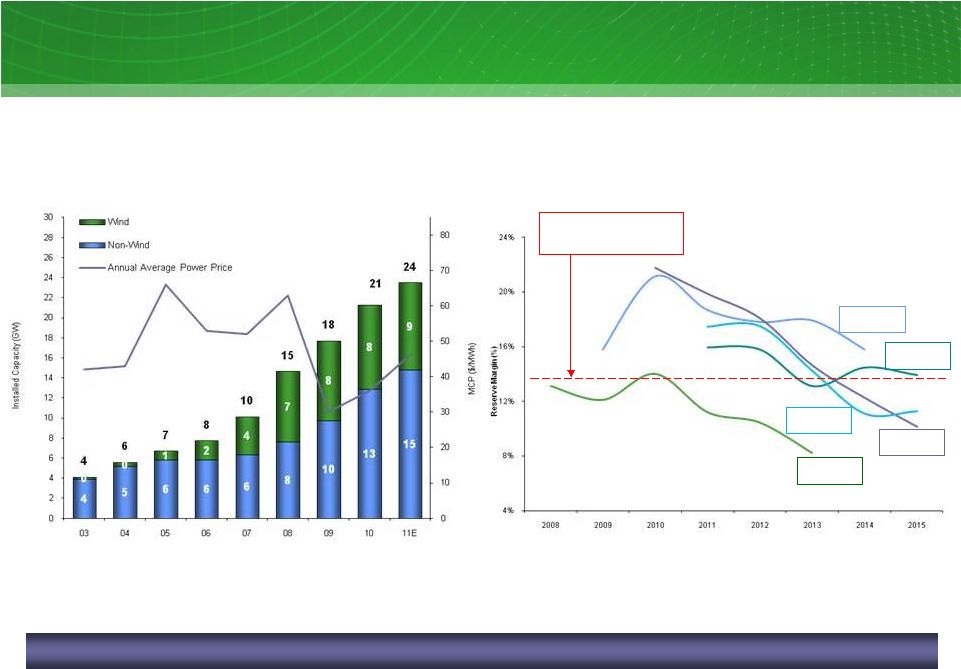

ERCOT

Fundamental Supply and Demand Dynamics ERCOT Supply Additions

03-11; GW

ERCOT Reserve Margin Projections Over Time

08-15; Percent

Dec 07

Target Min Reserve

Margin of 13.75%

Dec 08

Dec 09

Dec 10

ERCOT projects target reserve margin will be below 13.75% beginning in 2014

8

May 11

Source: ERCOT’s Capacity, Demand and Reserves Reports

|

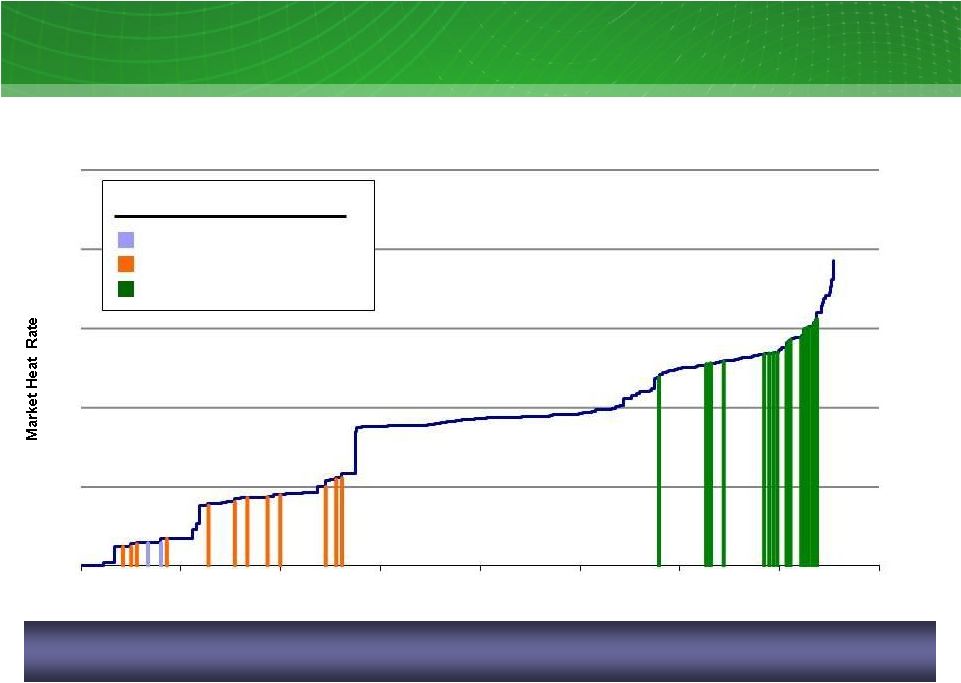

Summer

2011

ERCOT

supply

stack

-

indicative

ERCOT Supply Stack

Sources: ERCOT and Energy Velocity

®, Ventyx Luminant

plants

are

typically

on

the

“book-ends”

of

the

supply

stack.

ERCOT’s

marginal price is set by natural gas in most hours of the year.

9

Luminant nuclear plant

Luminant lignite/coal plants

Luminant gas plants

Legend

0

4

8

12

16

20

0

10

20

30

40

50

60

70

80

Cumulative MWs |

Nuclear

Reliability vs. Cost Benchmarks 75

80

85

90

95

10.00

15.00

20.00

25.00

30.00

35.00

40.00

O&M costs ($/MWh)

08-10 Capability Factor / O&M

$/MWh

Benchmarking peer set defined as 18 month fuel cycle U.S. nuclear plants. 2011 for

CPNPP is an estimate of full year performance. Source: EUCG May 2011 release

for Cost and WANO for Capability Factors. Braidwood

Byron

STP

CPNPP

Decile

Quartile

Median

Decile

Quartile

Median

Vogtle

08-10

09-11

10 |

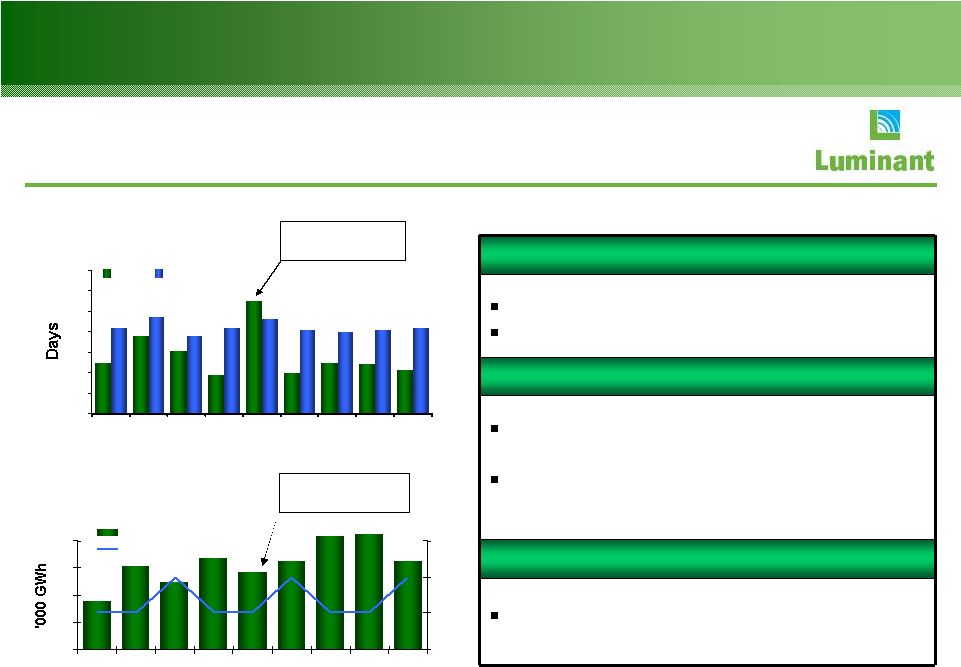

11

0

10

20

30

40

50

60

70

2003

2004

2005

2006

2007

2008

2009

2010

2011

EFH

Industry

Impact of Refueling Outages

Avg. nuclear

fleet

refueling

outage

duration¹

-

18

month

cycle units

03-11; days

Nuclear fleet output

03-11; thousand GWh

Nuclear Refueling Cycle

18 months

Duration: ~19-26 days

2011 Refueling Outage Impact

2011 outages: Unit 1 -

20 days

Unit 2 -

23 days

Shortest Fall outage to date & 2nd

shortest Spring outage in the industry

2012 Refueling Outage Impact

2012 outage planned for 22 days (Unit 2)

1

2005

and

2008

were

dual

refueling

outage

years;

this

graph

shows

the

average

outage

duration

for

each

of

those

years.

2

Industry based on early release data from Electric Utility Cost Group (EUCG)

2

World record steam

generator outage

World record steam

generator outage

16

17

18

19

20

2003

2004

2005

2006

2007

2008

2009

2010

2011E

0

1

2

3

EFH

# of Refueling Outages |

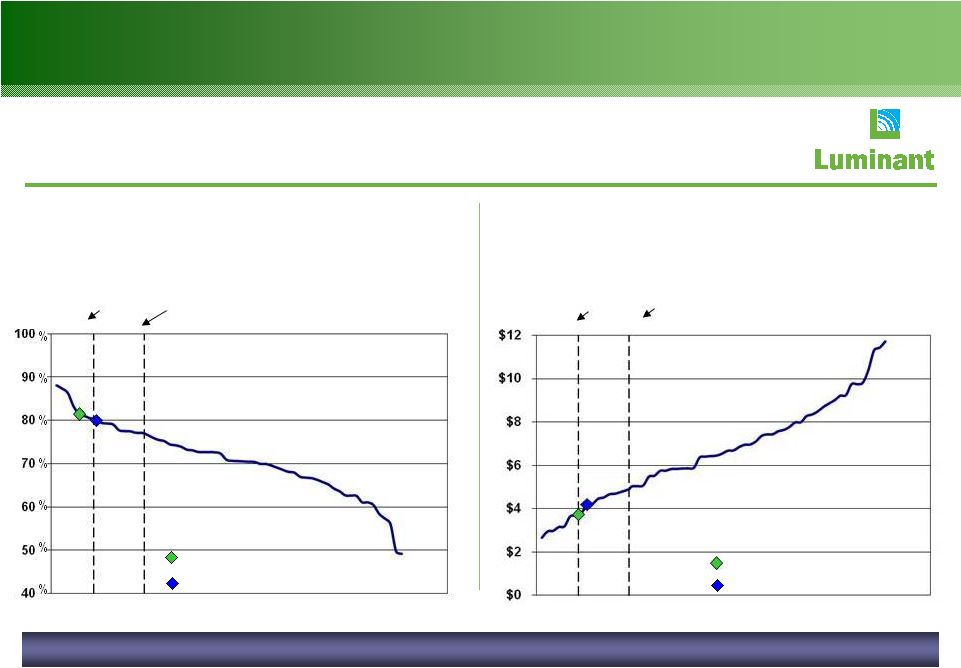

1

Benchmarking net capacity factors based on GADS. Luminant is legacy

lignite/coal fleet only and based on net capacity of 5,837 MW. Luminant

08–10 fleet avg. = 81.5 % Luminant 10 fleet = 79.9%

Source: GKS

Luminant

vs. US coal fleet net capacity factors

Percent

Luminant vs. US coal fleet O&M

$/MWh

Luminant has industry leading performance relative to other coal-fueled

generators. High-Performance Coal Operator

12

1

Top decile

80.4%

Top quartile

76.9%

Top decile

$3.68

Top quartile

$4.90

Luminant 08–10 fleet avg. = $3.72

Luminant 10 fleet = $4.15 |

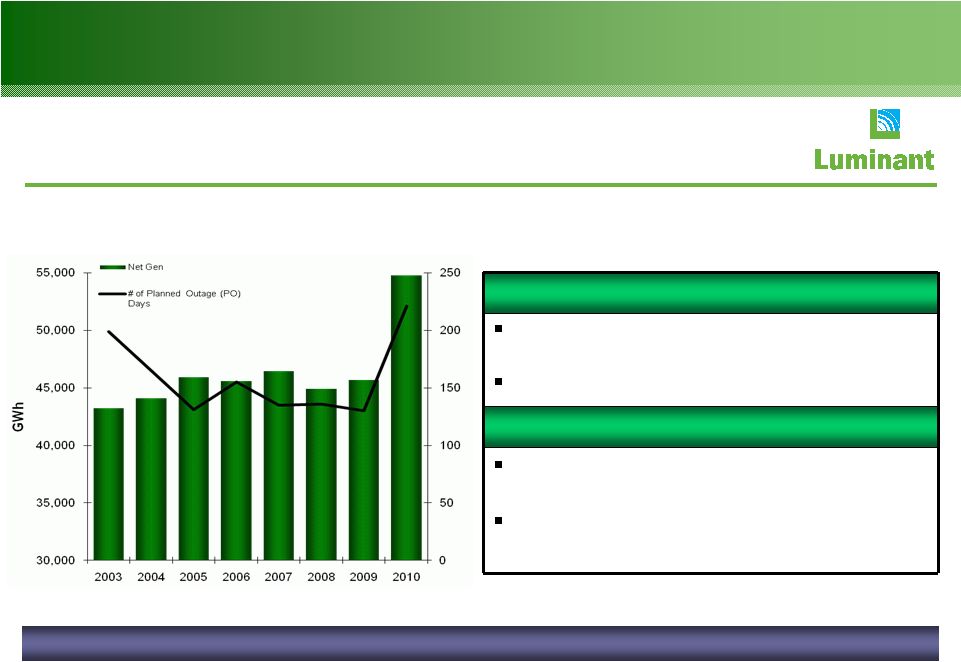

13

Coal Fleet Output

Coal fleet output

1,2

03-10; GWh

Coal Fleet Planned Outage Cycle

3 or 4 year overhaul cycle depending on

unit

Duration is scope dependent

2010 Planned Outage Impact

2010 reflects 221 planned outage days

(41 at new units)

2010 average major outage duration was

48 days

Increased generation from new units and improved reliability from legacy fleet.

1

2009 includes 1,443 GWh of new build generation (Sandow 5 and Oak Grove 1 units). 2

2010 includes 11,384 GWh of new build generation and 41 planned outage days (Sandow 5,

Oak Grove 1 & 2 units). |

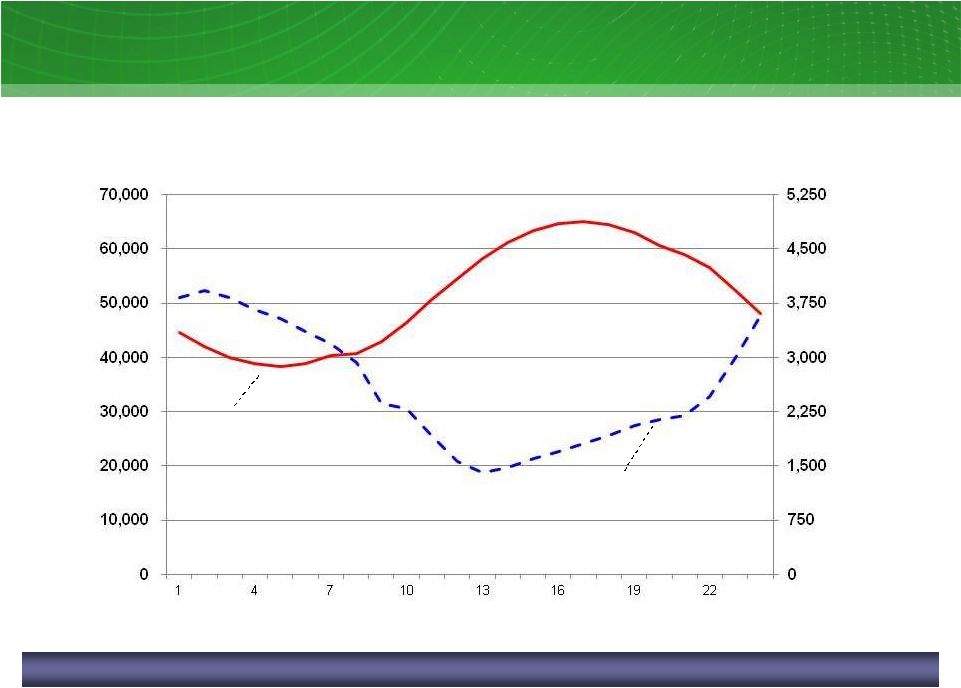

14

ERCOT Average Daily Profile of Load and Wind

Source: ERCOT

ERCOT average daily profile of load and wind output

August 11; mixed measures

Average

Load

Average

Wind Output

Hour

Load

(aMW)

Wind Output

(MW)

Wind operating characteristics necessitate additional resources for

reliability. |

15

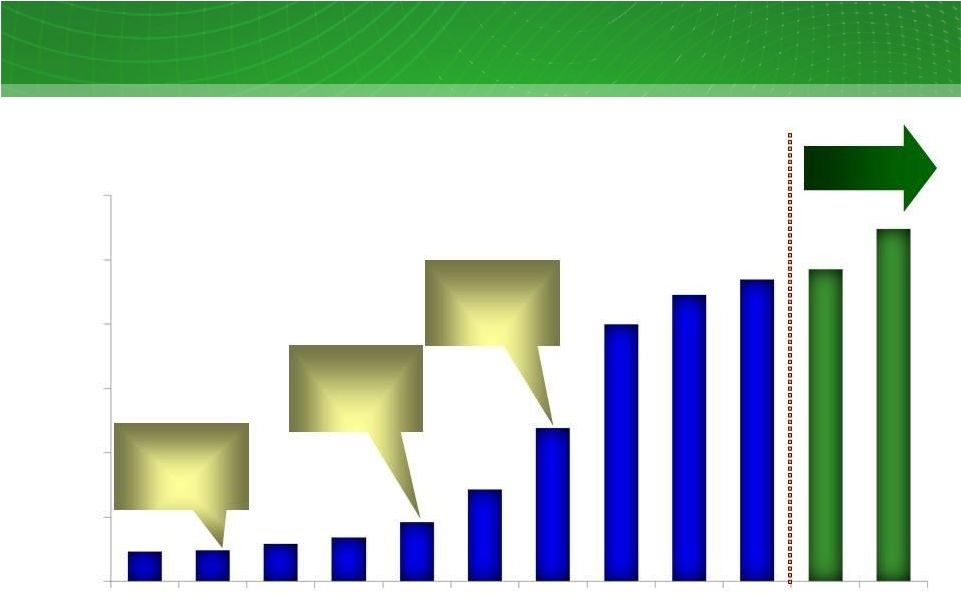

Texas Wind Additions

ERCOT SGIA

2

Cumulative wind capacity additions in Texas

Pre-01 -

10;11E -

12E; MW

1

Renewable

Portfolio

Standard

2

Signed

Generation

Interconnect

Agreement

Source:

ERCOT

–

January

2011

System

Planning

Report

to

the

Reliability

and

Operations

Subcommittee

RPS

1

Target

of 2,880 MW

by 2009

RPS

1

Target

of 5,880 MW

by 2015

CREZs

Designated

0

2,000

4,000

6,000

8,000

10,000

12,000

Pre 01

02

03

04

05

06

07

08

09

10

11E

12E |

16

Summer 2011 Heat Wave Impacts –

August was the story

Averages

°F

#

of

Days

>

100

°F

Cooling Degree Days

(CDDs)

On-Peak Heat Rate

# of hours with prices

> $2,000/MWh

Entering Summer ‘11 we generally had a long position bias given

market point-of-view and desire to maintain peaking reserves for unit

outages

Load

was

hedged

against

95

percentile

weather

with

call

options

Actual

summer

outcome

–

exceptional

coal

unit

performance

provided

incremental

long

position,

>

99 percentile

weather

created

load

short

at high prices partially offset by hedges (call options)

Select August Data

Asset

Management

was

able

to

realize

a

net

benefit

when

compared

to

last

year

due

to

strong unit performance and sound asset management strategies

th

th |

TCEH

Heat Rate Position 12-15

1,2

; TWh

46

9

2

29

66

78

80

~75

~75

~80

~80

2012

2013

2014

2015

% Hedged

~60%

~12%

~2%

~0%

Open Position

TXUE & LUME

Net Position²

1

As of the end of Q3 2011 and includes the impact of Cross-State Air Pollution

Rule 2

Excludes speculative trading positions

TCEH Heat Rate Position

In general, heat rate position is un-hedged past 36 months. Before entering

a year, the heat rate position is hedged to ~70-80% through retail and

wholesale channels. Within the year, various months and products are

either hedged or left as open positions depending on

point-of-view 17

2 |

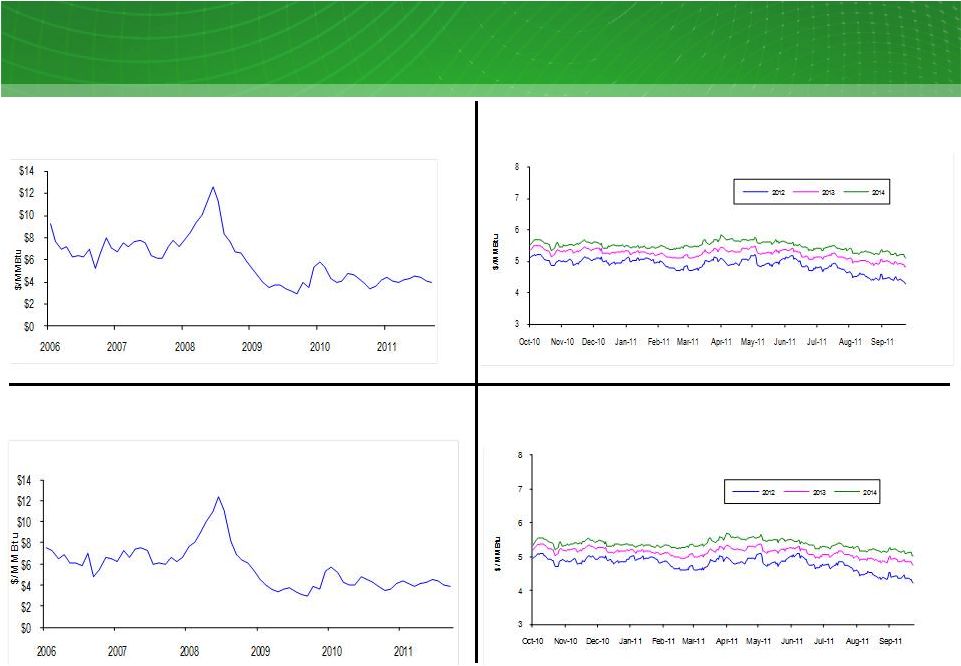

HSC

Natural Gas Futures $/MMBtu

ERCOT NHub ATC (7x24) Heat Rate

MMBtu/MWh

*limited broker

quotes

18

Forward Natural Gas Prices and Heat Rates

Forward position has benefited from recent rise in heat rates, while forward gas has

continued to hold at ~$5/mmbtu |

Historical 2014 Forward Natural Gas Prices

Historical 2014 Forward Houston Ship Channel (HSC) Gas Prices

Q1’07-

Q3’11; $/MMBtu

19 |

20

20

Houston

Ship

Channel

settled

natural

gas

prices¹

Jan 06-Sep 11; $/MMBtu

Market Price Snapshot

NYMEX

forward

natural

gas

prices

2012-2014; $/MMBtu

NYMEX

settled

natural

gas

prices

Jan 06-Sep 11; $/MMBtu

1

Settled prices are monthly averages

2

Forward prices reflect market observable quotes during the 12 months ended Sep 30, 2011 for the

following delivery periods: 2012, 2013 and 2014

2

1

Houston Ship Channel forward natural gas prices

2012-2014; $/MMBtu

2 |

21

21

Market Price Snapshot

ERCOT North HUB 7x24 settled heat rate

Jan 06-Sep11; MMBtu/MWh

ERCOT

North HUB 7x24 forward heat rate

2012-2014; MMBtu/MWh

ERCOT

North HUB 5x16 forward heat rate

2012-2014; MMBtu/MWh

ERCOT

North HUB 5x16 settled heat rate

Jan 06-Sep 11; MMBtu/MWh

1

Market heat rate calculated by dividing 7x24 and 5x16 power prices, as appropriate,

by Houston Ship Channel natural gas prices 2

Settled prices are monthly averages

3

Forward prices reflect market observable quotes during the 12 months ended Sep 30,

2011 for the following delivery periods: 2012, 2013 and 2014 5

10

15

20

25

30

35

2006

2007

2008

2009

2010

2011

6

7

8

9

10

11

12

Oct-10

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Apr-11

May

-11

Jun-11

Jul-11

Aug-11

Sep-11

2012

2013

2014

5

10

15

20

25

30

35

40

45

50

55

2006

2007

2008

2009

2010

2011

6

7

8

9

10

11

12

Oct-10

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

2012

2013

2014

1,2

1,2

1,3

1,3 |

Currently Installed¹

Environmental Control Equipment At

Luminant Coal Units

Coal Unit

Capacity

(MW)

FGD

(Scrubber)²

Activated

Carbon

Injection³

ESP

4

SNCR

5

SCR

5

Bag-

house

4

Fuel Source

Oak Grove 1

800

Lignite

Oak Grove 2

800

Lignite

Sandow 4

557

Lignite

Sandow 5

580

Lignite

Martin Lake 1

750

Lignite/PRB

6

Martin Lake 2

750

Lignite/PRB

Martin Lake 3

750

Lignite/PRB

Monticello 1

565

Lignite/PRB

Monticello 2

565

Lignite/PRB

Monticello 3

750

Lignite/PRB

Big Brown 1

575

Lignite/PRB

Big Brown 2

575

Lignite/PRB

Currently installed

1

There is no assurance that the currently installed control equipment will satisfy

the requirements under any change to applicable law or any future Environmental Protection Agency or

Texas Commission on Environmental Quality regulations.

2

FGD refers to flue gas desulfurization systems that reduce SO2 emissions with

co-benefits of other emissions reductions. 3

Activated carbon injection systems reduce mercury emissions.

4

ESP refers to electro-static precipitation systems. ESP and bag-house

systems reduce particulate emissions with co-benefits of other emissions reductions.

5

SNCR refers to selective non-catalytic reduction systems. SCR refers to

selective catalytic reduction systems. Both systems reduce NOx emissions.

6

PRB refers to Powder River Basin coal transported to plants via

railcar. 22 |

23 |

TXU Energy

Business Summary Strong customer value proposition

•

High brand recognition in Texas competitive areas

•

Competitive retail prices

•

Innovative products and services

•

Committed to low-income customer assistance

•

Improved customer care delivery capabilities

Balance Sheet

•

Combined TCEH risk management and liquidity efficient

capital structure

Expected margins (5–10% net)

Source: Latest available company filings, TXU Energy estimates.

Sources: NERC, ERCOT

Residential

Customers

/

Meters

(in

millions)

TXU Energy is the leading electricity retailer in the ERCOT market

Residential

Customers

(in

thousands)

TXU Energy has maintained market position since 2006

Projected Annual Demand Growth

CAGR (2010A-2019E)

Value Drivers

TXU Energy is the largest electricity retailer in Texas.

24

43% |

TXU Energy

Marketing Campaign GM Billboards

GM Television & Radio

Online & Email

Direct Mail

Print

Mass Media in Market -

Southwest Airlines Exclusive Partnership

25 |

TXU Energy

Marketing Campaign Direct Mail

Sunday Insert

Val Pac

Newspaper

Mass Media in Market -

No Variable

Online

26 |

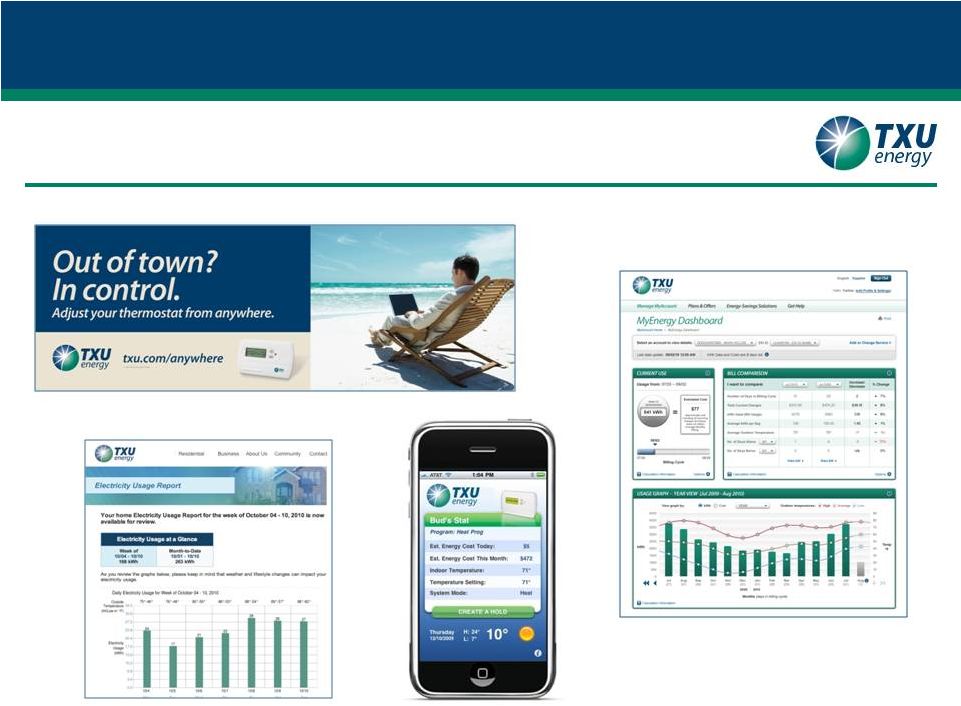

TXU

Energy Marketing Campaign Innovations

TXU Energy MyEnergy Dashboard

TXU Energy Electricity Usage Report

TXU Energy iPhone App

27

Brighten

iThermostat

SM |

28 |

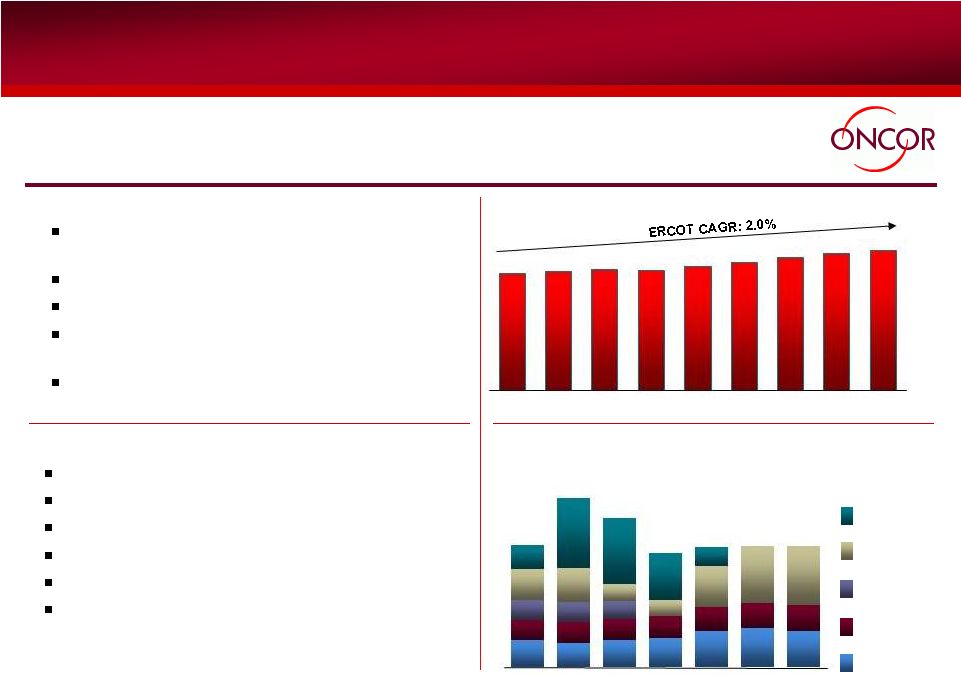

1

Oncor currently estimates that the total cost of the CREZ / Voltage Support

projects will be approximately $2.0 billion. Supportive regulatory

environment 10.25% authorized ROE

Improved capital expenditure recovery

Low operating costs per customer

Low rates compared to peers

Strong reliability and safety performance

Oncor Overview

Value Drivers

Business Profile

Oncor, which is approximately 80% owned by EFH Corp., is the largest transmission

& distribution utility in Texas.

6

th

largest US transmission & distribution

company

Low costs and high reliability

No commodity position

Accelerated recovery of investments in

advanced meters and transmission

$2.0

billion¹

CREZ

investment

Sources: ERCOT, CDR Report, May 2011

Projected peak demand growth

08-18E; GW

Actual and Estimated Capital Expenditures

’10 -

’16E; $ millions

New Service

Advanced

Metering

CREZ

/

Voltage

Support

IT /

Maintenance /

General Plant

Transmission

Grid

Expansion

29

62

64

64

66

68

71

73

74

63

2008A

2009A

2010A

2011E

2012E

2013E

2014E

2015E

2016E

226

200

230

240

305

325

305

171

180

170

185

200

205

215

164

160

150

257

290

140

135

475

490

202

580

555

390

1,020

1,410

1,250

950

1,000

1,005

1,010

340

155

10

11E

12E

13E

14E

15E

16E

1 |

30

New Oncor

Infrastructure

1

Oncor

currently estimates that the cost of these projects will be approximately $2.0

billion. Oncor’s

investment in CREZ will receive accelerated recovery,

consistent with other transmission investment, mitigating regulatory delay.

…to

…to

to

support

support

the

the

continued

continued

buildout

buildout

of

of

wind

wind

capacity

capacity

in

in

Texas

Texas

Oncor

expects to invest ~$2.0 billion¹

on new

CREZ-related transmission lines… |

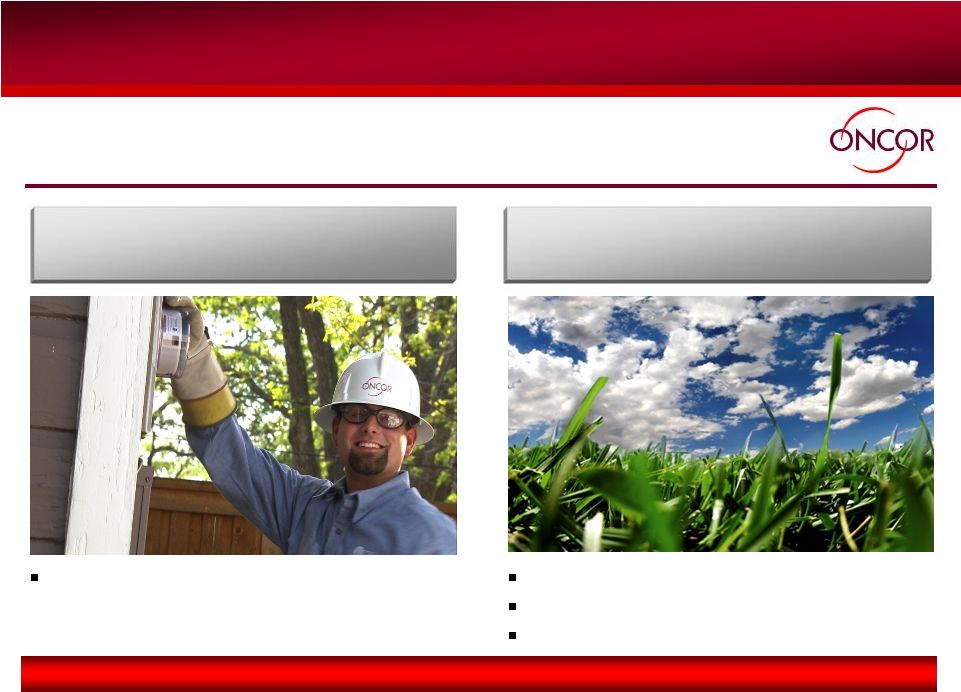

31

Oncor Demand-Side Management

Oncor is leading the largest advanced metering initiatives deployment in the US with

a commitment to have 3.2 million meters installed by the end of 2012 (over 2.1

million meters have been installed through September 2011)

Oncor recovers its investment through a

PUC -approved

surcharge

Customer monitoring of consumption

“Smart”

appliances

Dynamic pricing

Oncor’s

energy

efficiency

filing

has

been

approved

and

is

reflected

in

rates.

1

Public Utility Commission of Texas.

Oncor to deploy ~$690 million of capital

for advanced metering

initiatives… …that will enable key DSM initiatives

1 |

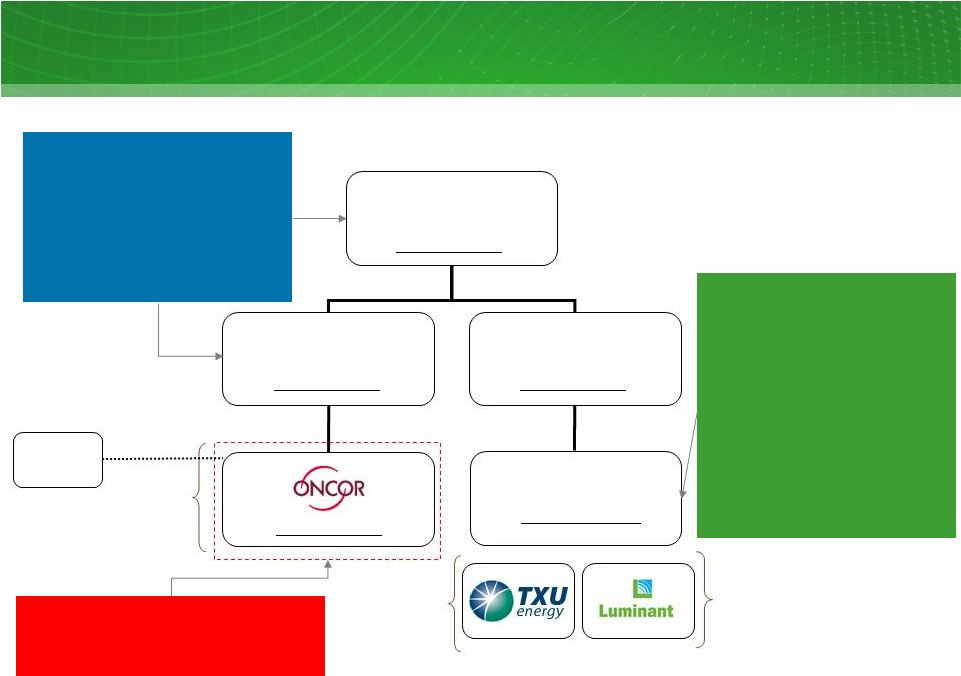

Energy

Future Holdings Corp. Energy Future Holdings Corp.

32 |

Approx. 80% Ownership

$41.7B total gross

debt

$39.7B total net

debt

Ring-fenced entity

Approx. 20%

Ownership

As of 9/30/11

$15.4B 1 Lien TLB due 2017

$3.8B 1

Lien TLB due 2014

$1.02B Deposit LC due 2017

$0.04B Deposit LC due 2014

$1.75B 1

Lien Notes @ 11.5% due

2020

$1.6B 2

Lien Notes @ 15% due

2021

$4.6B Unsecured LBO Notes @

10.25/10.5% due 2015/2016

$1.5B Unsecured PCRBs/Other

$3.5B 1st Lien Notes @ 9.75/10%

due 2019/2020

$0.4B 2

Lien Notes @ 11% due

2021

$0.6B Unsecured LBO Notes @

10.875/11.25% due 2017

$1.4B Unsecured Legacy Notes @

5.55

–

6.55%

$0.1B Unsecured Other

$0.5B Revolver @ L+27.5 due 2013

$4.8B @ avg. 6.5%

$0.6B @ avg. 5.2%

1

Gross debt includes amount currently due and unamortized debt and fair value

discounts and premiums. 2

Total net debt equals total gross debt less total cash & equivalents and

restricted cash of ~$2.0 billion. 3

Excludes $211 million from A/R Securitization.

EFH Capital Structure Overview

33

TCEH

~ $29.7B gross

debt³ Energy

Future Competitive Holdings

~ $0.1B gross debt

~ $5.9B gross debt

Energy Future

Intermediate Holding

~ $2.7B gross debt

Texas

Transmission

Investment

LLC

EFH

~ $3.3B gross debt

2

1

nd

st

st

st

nd |

Key

Drivers 2012 Est. Impact vs

2011 (millions)

Assumptions

Nuclear outage

$75 –

$85

2 refueling outages in 2011 vs. 1 in 2012

Safe and reliable operational performance

Lower outage related expenses

Higher coal

generation and

operational

improvements

$20 -

$30

1 incremental TWh from new lignite units

~$20/MWh average incremental margin¹ Lower operating

and maintenance costs Impact of CSAPR

$250 -

$270

Impact

of

CSAPR²

on

legacy

coal/lignite

units

~9 TWh lower generation from idling MO1&2

Shifting to 100% PRB on BB & MO3

Commodity

$25 -

$125

Lower

weighted

average

NG

hedge

price³

of

~$0.20 /mmbtu for ~500 mm mmbtu

Higher

heat

rate

of

~0.30

–

0.35

on

~68

-

70

TWh

4

Impact of normal weather and load related costs

on 2012 asset management margins relative to

2011

Retail

$25 -

$125

Potential decline driven by lower count, price

environment and normal weather in 2012

2011E TCEH

Adjusted EBITDA

$2,739

YTD

9/30/11

2012 TCEH Adjusted EBITDA (non-GAAP) Key Drivers

$?

Q4

1

Based on ERCOT North Hub 7X24 HSC power prices for 2012 of ~$38/MWh as of

7/29/2011 2

CSAPR as issued in July 2011

3

Weighted average prices are based on NYMEX Henry Hub prices of forward natural gas

sales positions in the long-term hedging program (excluding the impact of offsetting purchases for

rebalancing and pricing point basis transactions)

4

Excludes volume committed under a long term purchase contract

5

See Appendix for Regulation G reconciliation.

Illustrative for discussion purposes

34

5 |

TCEH

Open EBITDA (non-GAAP) Estimate 1

Open EBITDA is intended to provide a view of our projected earnings for the fiscal

year ended December 31, 2012, assuming that (1) our expected coal and nuclear generation for 2012

is sold at market observed forward power prices as of 9/30/11 less our expected

costs to produce the power, including expected fuel expense, O&M and SG&A expenses, assuming

CSAPR as issued July 2011. (2) our retail revenues are derived from market observed

retail rates, and (3) we do not engage in any natural gas and power hedging activities. This is not

intended to serve as an indication of what we expect our earnings to be for the

fiscal year ended December 31, 2012, or how we intend to operate the business. EFH Corp. does not

provide projected EBITDA for future periods and, as a result, there is no

comparable GAAP financial measure to which we can reconcile Open EBITDA.

2

Estimated wholesale power prices for 2012 is based on average ERCOT North Hub

prices as of 9/30/11. 3

Includes fuel (excluding nuclear fuel amortization), O&M and SG&A

expenses 4

5

Calculation assumes a 35% overall tax rate

Assumptions

Units

2012E

Wholesale

Total coal and nuclear generation

TWh

70 -

72

Estimated

power

price²

$/MWh

$36 -

$38

Average

coal

and

nuclear

cost³

$/MWh

$30 -

$32

Retail

Revenues

4

$

$4.2 -

$5.0

Profitability

percentage

(after

tax)

5

%

5 -

10%

TCEH

Open

EBITDA

(non-GAAP)¹

Estimate

12E: $ millions

$700 - $1,300

2012E

35

Based

on

a

10.5¢

/

kWh

average

residential

pricing

and

~$2.0

billion

of

small

and

large

business

revenue

based

on

trailing

12

months

(Q4

2010

and

Q1-Q3

2011).

For

residential

new

offer

pricing

please

go

to

www.powertochoose.org. |

Appendix –

Regulation G Reconciliations

36 |

37

Table 1: EFH Corp. Net Debt Reconciliation

As of September 30, 2011

$ millions

Description

9/30/11

Short-term borrowings²

0

Long-term debt due currently

462

Long-term debt, less amounts due currently

35,298

Total debt

35,760

Less:

Cash and cash equivalents

(838)

Restricted cash

(1,031)

Net debt

33,891

1

GAAP basis which reflects deconsolidation of Oncor. Oncor’s total debt

is ~$5.9 billion, added to EFH Corp.’s debt equals ~$41.7 billion.

2

Excludes $211 million at TXU Receivables Company related to the accounts receivable

securitization program. 1 |

38

Table 2: TCEH Total Debt Reconciliation

As of September 30, 2011

$ millions

1

Excludes $211 million at TXU Receivables Company related to the accounts receivable

securitization program. Description

9/30/11

Short-term borrowings¹

0

Long-term debt due currently

444

Long-term debt, less amounts due currently

29,251

Total debt

29,695 |

39

Table 3: Oncor Net Debt Reconciliation

As of September 30, 2011

$ millions

Description

9/30/11

Short-term borrowings

553

Long-term debt due currently

493

Long-term debt, less amounts due currently

4,882

Total debt

5,928

Less:

Cash and cash equivalents

(2)

Restricted cash

(84)

Net debt

5,842 |

Table 4:

TCEH Adjusted EBITDA Reconciliation Three and Nine Months Ended September 30,

2010 and 2011 $ millions

Factor

Q3 10

Q3 11

YTD 10

YTD 11

Net loss

(3,690)

(709)

(3,646)

(1,660)

Income tax expense (benefit)

214

(375)

260

(874)

Interest expense and related charges

852

1,372

2,516

3,020

Depreciation and amortization

345

371

1,027

1,097

EBITDA

(2,279)

659

157

1,583

Adjustments to EBITDA (pre-tax):

Interest income

(23)

(20)

(65)

(66)

Amortization of nuclear fuel

38

35

102

104

Purchase accounting adjustments

33

32

124

147

Impairment of assets and inventory write down

-

427

1

427

Impairment of goodwill

4,100

-

4,100

-

Unrealized net (gain) loss resulting from hedging transactions

(767)

(138)

(1,615)

247

EBITDA amount attributable to consolidated unrestricted subsidiaries

-

(2)

-

(5)

Amortization of ”day one”

net loss on Sandow 5 power purchase agreement

(9)

-

(19)

-

Corp. depreciation, interest and income tax expense included in SG&A

4

4

9

11

Noncash compensation expense

-

5

11

8

Severance expense

-

50

3

52

Transition and business optimization costs

4

1

18

2

33

Transaction and merger expenses

5

9

9

29

28

Restructuring and other

6

2

(3)

1

70

Expenses incurred to upgrade or expand a generation station

7

-

-

100

100

TCEH Adjusted EBITDA per Incurrence Covenant

1,109

1,076

2,940

2,739

Expenses related to unplanned generation station outages

31

71

122

162

Pro forma adjustment for Oak Grove 2 reaching 70% capacity in Q2

2011

8

-

7

-

32

Other adjustments allowed to determine Adjusted EBITDA per Maintenance Covenant

9

10

-

19

8

TCEH Adjusted EBITDA per Maintenance Covenant

1,150

1,154

3,081

2,941

1

Includes amortization of the intangible net asset value of retail and wholesale

power sales agreements, environmental credits, coal purchase contracts, nuclear fuel contracts and power

purchase agreements and the stepped up value of nuclear fuel. Also includes

certain credits and gains on asset sales not recognized in net income due to purchase accounting.

2

Impairment of assets includes impairment of emissions allowances

and certain assets relating to mining operations due to EPA rule and impairment of

land. 3

Includes

expenses

recorded

under

stock-based

compensation

accounting

standards

and

excludes

capitalized

amounts.

4

Includes certain incentive compensation expenses, systems development professional

fees related to major generation operations and retail billing / customer care computer applications

and costs relating to certain growth initiatives.

5

Includes costs related to the 2007 merger and the Sponsor Group management

fee. 6

Includes net third-party fees paid in connection with the amendment and

extension of the TCEH Senior Secured Facilities, gains on termination of a long-term power sales contract and

settlement of amounts due from a hedging/trading counterparty, and reversal of

certain liabilities accrued in purchase accounting. 7

Reflects noncapital outage costs.

8

Represents the annualization of the actual six months ended September 30, 2011

EBITDA results for Oak Grove 2, which achieved the requisite 70% average capacity factor in the second

quarter 2011.

9

Primarily pre-operating expenses related to Oak Grove and Sandow 5 generation

facilities. 40

3

2

1 |

41

EFH Corp. Investor Relations Contacts

Rima Hyder

Director, Investor Relations

214-812-5090

rima.hyder@energyfutureholdings.com

Charles Norvell

Senior Analyst, Investor Relations

214-812-8062

charles.norvell@energyfutureholdings.com

|