Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CME GROUP INC. | d253773d8k.htm |

| EX-99.1 - PRESS RELEASE - CME GROUP INC. | d253773dex991.htm |

Exhibit 99.2

The McGraw-Hill Companies

CME GROUP

Strategic Joint Venture Between McGraw-Hill and CME Group

Investor Presentation

November 4, 2011

Donald S. Rubin

Senior Vice President, Investor Relations The McGraw-Hill Companies

John Peschier

Managing Director, Investor Relations CME Group

| 1 |

Forward-Looking Statements

Statements in this presentation that are not historical facts are forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or implied in any forward-looking statements. These statements include, but are not limited to, the benefits of the transaction involving The McGraw-Hill Companies and CME Group, including future financial and operating results, the joint venture’s plans, objectives, expectations and intentions and other statements that are not historical facts. Such statements are based on current beliefs, expectations, forecasts, and assumptions of The McGraw-Hill Companies and CME Group’s management which are subject to risks and uncertainties which could cause actual outcomes and results to differ materially from these statements. Other risks and uncertainties relating to the proposed transaction include, but are not limited to the satisfaction of conditions to closing, including receipt of antitrust, regulatory and other approvals; the proposed transaction may not be consummated on the proposed terms and schedule; uncertainty of the expected financial performance of the joint venture following completion of the proposed transaction; The McGraw-Hill Companies and CME Group may not be able to achieve the expected cost savings, synergies and other strategic benefits as a result of the proposed transaction or may take longer to achieve the cost savings, synergies and benefits than expected; general industry and market conditions; general domestic and internal economic conditions; the strength of the equity and debts markets; and governmental laws and regulations affecting domestic and foreign operations. The McGraw-Hill Companies and CME Group undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

For more information regarding other related risks, see Item 1A of McGraw-Hill’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010 and Item 1A of CME Group’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010 and any updates provided in their most recent Quarterly Reports on Form 10-Q. Copies of said 10-Ks and 10-Qs are available online at http://www.sec.gov or on request from the applicable company. You should not place undue reliance on forward-looking statements, which speak only as of the date of this presentation. Except for any obligation to disclose material information under the Federal securities laws, The McGraw-Hill Companies and CME Group undertake no obligation to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date of this presentation.

| 2 |

Harold McGraw III

Chairman, President and CEO The McGraw-Hill Companies

Craig Donohue

CEO CME Group

| 3 |

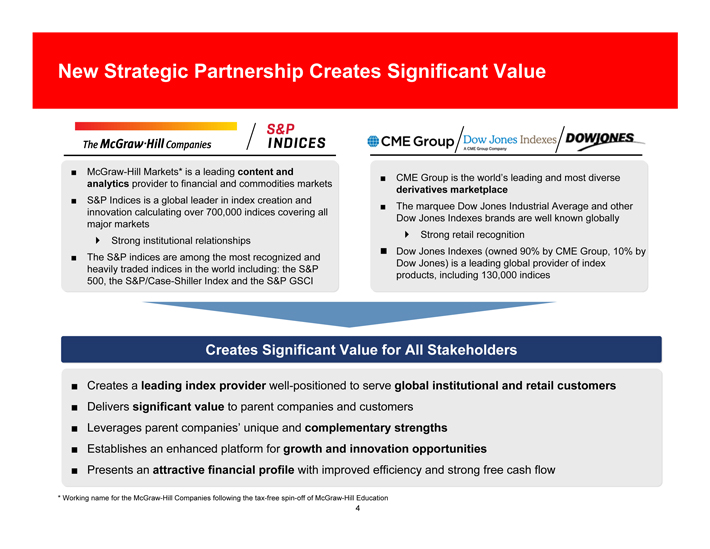

New Strategic Partnership Creates Significant Value

The McGraw-Hill Companies

S&P INDICES

CME Group

Dow Jones Indexes

A CME Group Company

DOWJONES

McGraw—Hill Markets* is a leading content and

CME Group is the world’s leading and most diverse analytics provider to financial and commodities markets derivatives marketplace

S&P Indices is a global leader in index creation and

The marquee Dow Jones Industrial Average and other innovation calculating over 700,000 indices covering all Dow Jones Indexes brands are well known globally major markets

Strong retail recognition

Strong institutional relationships

Dow Jones Indexes (owned 90% by CME Group, 10% by

The S&P indices are among the most recognized and

Dow Jones) is a leading global provider of index heavily traded indices in the world including: the S&P products, including 130,000 indices 500, the S&P/Case—Shillerr Index and the S&P GSCI

Creates Significant Value for All Stakeholders

Creates a leading index provider well-positioned to serve global institutional and retail customers

Delivers significant value to parent companies and customers

Leverages parent companies’ unique and complementary strengths

Establishes an enhanced platform for growth and innovation opportunities

Presents an attractive financial profile with improved efficiency and strong free cash flow

* Working name for the McGraw-Hill Companies following the tax-free spin-off of McGraw-Hill Education 4

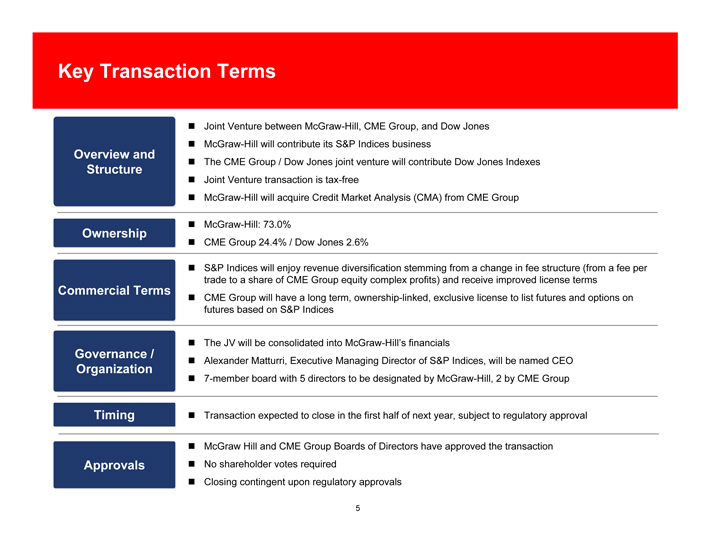

Key Transaction Terms

Overview and Structure

Joint Venture between McGraw-Hill, CME Group, and Dow Jones

McGraw-Hill will contribute its S&P Indices business

The CME Group / Dow Jones joint venture will contribute Dow Jones Indexes

Joint Venture transaction is tax-free

McGraw-Hill will acquire Credit Market Analysis (CMA) from CME Group

Ownership

McGraw-Hill: 73.0%

CME Group 24.4% / Dow Jones 2.6%

Commercial Terms

S&P Indices will enjoy revenue diversification stemming from a change in fee structure (from a fee per trade to a share of CME Group equity complex profits) and receive improved license terms

CME Group will have a long term, ownership-linked, exclusive license to list futures and options on futures based on S&P Indices

Governance / Organization

The JV will be consolidated into McGraw-Hill’s financials

Alexander Matturri, Executive Managing Director of S&P Indices, will be named CEO

7-member board with 5 directors to be designated by McGraw-Hill, 2 by CME Group

Timing

Transaction expected to close in the first half of next year, subject to regulatory approval

Approvals

McGraw Hill and CME Group Boards of Directors have approved the transaction

No shareholder votes required

Closing contingent upon regulatory approvals 5

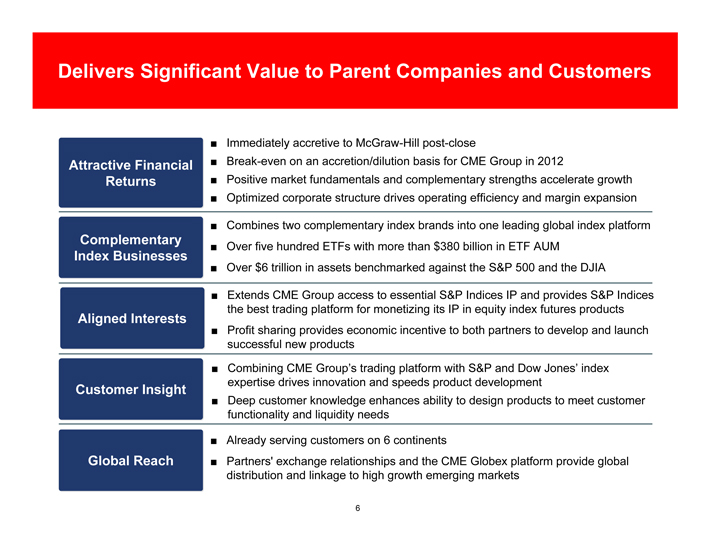

Delivers Significant Value to Parent Companies and Customers

Immediately accretive to McGraw-Hill post-close

Attractive Financial Break-even on an accretion/dilution basis for CME Group in 2012

Returns Positive market fundamentals and complementary strengths accelerate growth

Optimized corporate structure drives operating efficiency and margin expansion

Combines two complementary index brands into one leading global index platform

Complementary

Over five hundred ETFs with more than $380 billion in ETF AUM

Index Businesses Over $6 trillion in assets benchmarked against the S&P 500 and the DJIA

Extends CME Group access to essential S&P Indices IP and provides S&P Indices the best trading platform for monetizing its IP in equity index futures products Aligned Interests Profit sharing provides economic incentive to both partners to develop and launch successful new products

Combining CME Group’s trading platform with S&P and Dow Jones’ index expertise drives innovation and speeds product development Customer Insight Deep customer knowledge enhances ability to design products to meet customer functionality and liquidity needs

Already serving customers on 6 continents

Global Reach Partners’ exchange relationships and the CME Globex platform provide global distribution and linkage to high growth emerging markets

| 6 |

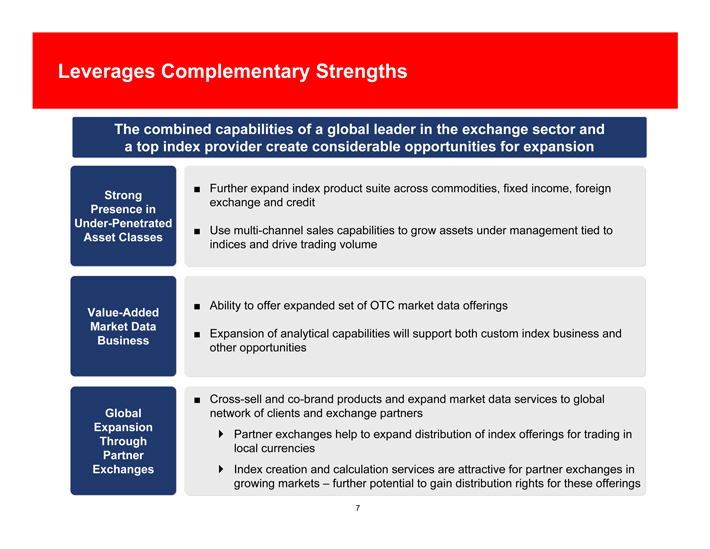

Leverages Complementary Strengths

The combined capabilities of a global leader in the exchange sector and a top index provider create considerable opportunities for expansion

Further expand index product suite across commodities, fixed income, foreign

Strong exchange and credit

Presence in Under-Penetrated

Use multi-channel sales capabilities to grow assets under management tied to

Asset Classes indices and drive trading volume

Ability to offer expanded set of OTC market data offerings

Value-Added Market Data

Expansion of analytical capabilities will support both custom index business and

Business other opportunities

Cross-sell and co-brand products and expand market data services to global network of clients and exchange partners

Expansion

` Partner exchanges help to expand distribution of index offerings for trading in

Through local currencies

Partner

Exchanges ` Index creation and calculation services are attractive for partner exchanges in growing markets – further potential to gain in distribution rights for these offerings

7

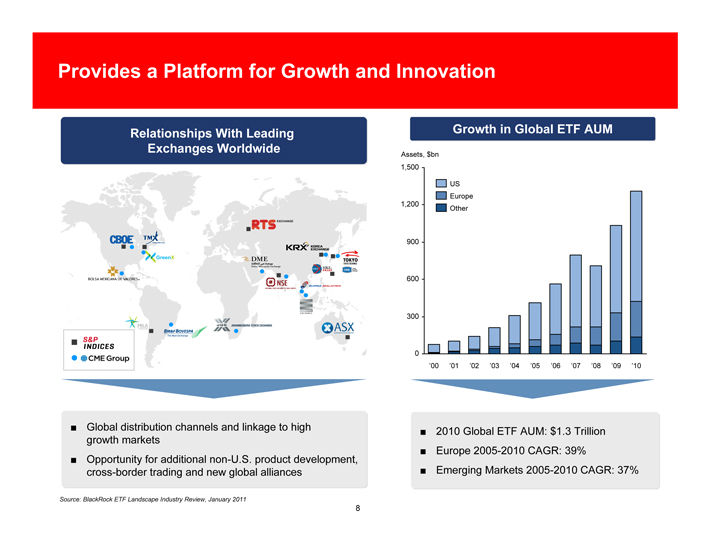

Provides a Platform for Growth and Innovation

Relationships With Leading Exchanges Worldwide

Growth in Global ETF AUM

CBOE

TMX

Green X

BOLSA MEXICANA DE VALORES

MILA

S&P

INDICES

CME GROUP

BM&F BOVERSPA

The New Exchange

RTS Exchange

KRX KOREA EXCHANGE

DME

Dubai Mercantile Exchange

HKE

TOKYO STOCK EXCHANGE

Osaka Securities Exchange

Mercad integrad

Latino American

NSE National stock Exchange of india limited

Bursa Malaysia

Singapore Exchange

ASX

Australian Securities Exchange

Assets, $bn 1,500

US Europe 1,200 Other

900 600 300

0

‘00 ‘01 ‘02 ‘03 ‘04 ‘05 ‘06 ‘07 ‘08 ‘09 ‘10

Global distribution channels and linkage to high 2010 Global ETF AUM: $1.3 Trillion . growth markets

Europe 2005—2010 2010 CAGR: 39%

Opportunity for additional non-U.S. product development, cross-border trading and new global alliances Emerging Markets 2005-2010 CAGR: 37%

Source: BlackRock ETF Landscape Industry Review, January 2011

| 8 |

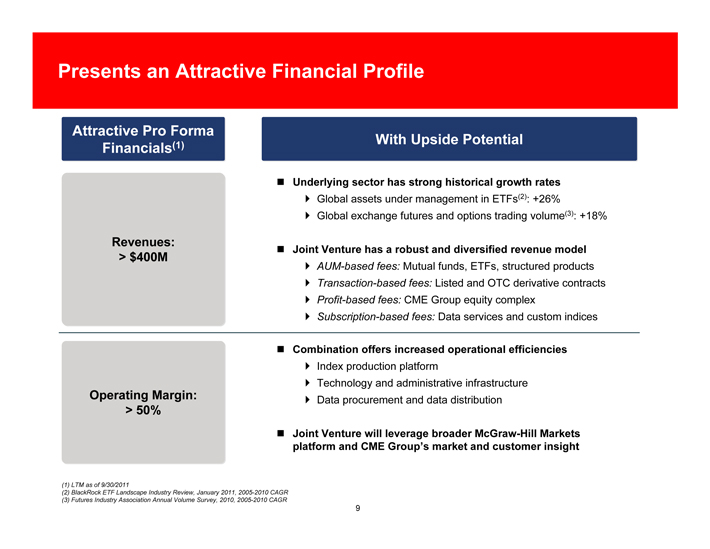

Presents an Attractive Financial Profile

Attractive Pro Forma

(1) With Upside Potential Financials

Underlying sector has strong historical growth rates

`Global assets under management in ETFs(2): +26%

`Global exchange futures and options trading volume(3): +18%

Revenues:

Joint Venture has a robust and diversified revenue model

> $400M

AUM-based fees: Mutual funds, ETFs, structured products

Transaction-based fees: Listed and OTC derivative contracts

Profit-based fees: CME Group equity complex

Subscription-based fees: Data services and custom indices

Combination offers increased operational efficiencies

Index production platform

`Technology and administrative infrastructure Operating Margin: Data procurement and data distribution

> 50%

Joint Venture will leverage broader McGraw-Hill Markets platform and CME Group’s market and customer insight

(1) LTM as of 9/30/2011

(2) BlackRock ETF Landscape Industry Review, January 2011, 2005-2010 CAGR (3) Futures Industry Association Annual Volume Survey, 2010, 2005-2010 CAGR

9

Roadmap to Completion / Next Steps

Regulatory filings will be made as soon as possible

Index businesses will operate separately until transaction closes

Relationships with other exchanges will remain in place

Transaction expected to close in the first half of next year, pending regulatory approval

10

Summary: Creates Significant Value for All Stakeholders

A leading index provider

Serving global institutional and retail customers

Unique and complementary strengths

Enhanced platform for growth and innovation

Attractive financial profile

11

The McGraw-Hill Companies

CME Group

Strategic Joint Venture Between McGraw-Hill and CME Group

Investor Presentation

November 4, 2011

The McGraw-Hill Companies

CME Group

Strategic Joint Venture Between McGraw-Hill and CME Group

Investor Presentation Replay Information

Internet replay available approximately two hours after the end of the call and will remain available for one year

- Go to: www.mcgraw-hill.com/investor_relations or www.cmegroup.com/investor-relations

Telephone replay available through December 5, 2011

- Domestic: 1-800-348-3514

- International: +1-402-220-9676 (long distance charges will apply) No password required