Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXELON GENERATION CO LLC | d249992d8k.htm |

Exhibit 99.1

Exelon and Constellation Energy: Merger and Company Update

Edison Electric Institute Financial Conference

November 7-8, 2011 |

Cautionary

Statements Regarding Forward-Looking Information

2

Except for the historical information contained herein, certain of the matters discussed in this

communication constitute “forward-looking statements” within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private

Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “anticipate,”

“estimate,” “expect,” “project,” “intend,” “plan,”

“believe,” “target,” “forecast,” and words and terms of similar substance used

in connection with any discussion of future plans, actions, or events identify forward-looking

statements. These forward- looking statements include, but are not limited to, statements

regarding benefits of the proposed merger of Exelon Corporation (Exelon) and Constellation

Energy Group, Inc. (Constellation), integration plans and expected synergies, the expected

timing of completion of the transaction, anticipated future financial and operating performance and results,

including estimates for growth. These statements are based on the current expectations of management

of Exelon and Constellation, as applicable. There are a number of risks and uncertainties that

could cause actual results to differ materially from the forward-looking statements

included in this communication regarding the proposed merger. For example, (1) the companies

may be unable to obtain shareholder approvals required for the merger; (2) the companies may be unable to

obtain regulatory approvals required for the merger, or required regulatory approvals may delay the

merger or result in the imposition of conditions that could have a material adverse effect on

the combined company or cause the companies to abandon the merger; (3) conditions to the

closing of the merger may not be satisfied; (4) an unsolicited offer of another company to

acquire assets or capital stock of Exelon or Constellation could interfere with the merger; (5) problems may

arise in successfully integrating the businesses of the companies, which may result in the combined

company not operating as effectively and efficiently as expected; (6) the combined company may

be unable to achieve cost-cutting synergies or it may take longer than expected to achieve

those synergies; (7) the merger may involve unexpected costs, unexpected liabilities or

unexpected delays, or the effects of purchase accounting may be different from the companies’ expectations;

(8) the credit ratings of the combined company or its subsidiaries may be different from what the

companies expect; (9) the businesses of the companies may suffer as a result of uncertainty

surrounding the merger; (10) the companies may not realize the values expected to be obtained

for properties expected or required to be divested; (11) the industry may be subject to future

regulatory or legislative actions that could adversely affect the companies; and (12) the companies may be

adversely affected by other economic, business, and/or competitive factors. Other unknown or

unpredictable factors could also have material adverse effects on future results, performance

or achievements of Exelon, Constellation or the combined company.

|

Cautionary

Statements Regarding Forward-Looking Information

(Continued) 3

Discussions of some of these other important factors and assumptions are contained in Exelon’s

and Constellation’s respective filings with the Securities and Exchange Commission (SEC),

and available at the SEC’s website at www.sec.gov, including: (1) Exelon’s 2010

Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary

Data: Note 18; (2) Exelon’s Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2011 in (a) Part II, Other Information, ITEM 1A. Risk Factors, (b)

Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of

Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 13; (3)

Constellation’s 2010 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

and (c) ITEM 8. Financial Statements and Supplementary Data: Note 12; and (4) Constellation’s Quarterly Report on

Form 10-Q for the quarterly period ended June 30, 2011 in (a) Part II, Other Information, ITEM 1A.

Risk Factors and ITEM 5. Other Information, (b) Part I, Financial Information, ITEM 2.

Management’s Discussion and Analysis of Financial Condition and Results of Operations and

(c) Part I, Financial Information, ITEM 1. Financial Statements: Notes to Consolidated Financial Statements,

Commitments and Contingencies. These risks, as well as other risks associated with the proposed

merger, are more fully discussed in the definitive joint proxy statement/prospectus included in

the Registration Statement on Form S-4 that Exelon filed with the SEC and that the SEC

declared effective on October 11, 2011 in connection with the proposed merger. In light of these risks,

uncertainties, assumptions and factors, the forward-looking events discussed in this communication

may not occur. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this communication. Neither Exelon nor

Constellation undertake any obligation to publicly release any revision to its forward-looking statements to reflect

events or circumstances after the date of this communication.

Additional Information and Where to Find it In

connection with the proposed merger between Exelon and Constellation, Exelon filed with the SEC a Registration Statement on

Form S-4 that included the definitive joint proxy statement/prospectus. The Registration Statement

was declared effective by the SEC on October 11, 2011. Exelon and Constellation mailed the

definitive joint proxy statement/prospectus to their respective security holders on or about

October 12, 2011. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE DEFINITIVE JOINT PROXY

STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY CONTAIN

IMPORTANT INFORMATION about Exelon, Constellation and the proposed merger. Investors and security holders may

obtain copies of all documents filed with the SEC free of charge at the SEC's website, www.sec.gov. In

addition, a copy of the definitive joint proxy statement/prospectus may be obtained free of

charge from Exelon Corporation, Investor Relations, 10 South Dearborn Street, P.O. Box 805398,

Chicago, Illinois 60680-5398, or from Constellation Energy Group, Inc., Investor Relations, 100

Constellation Way, Suite 600C, Baltimore, MD 21202.

|

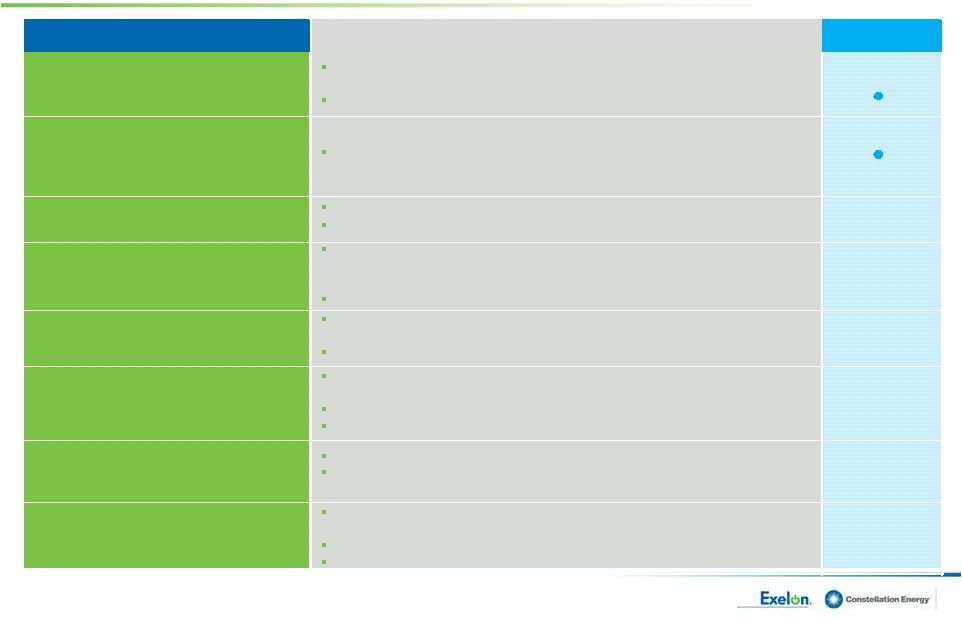

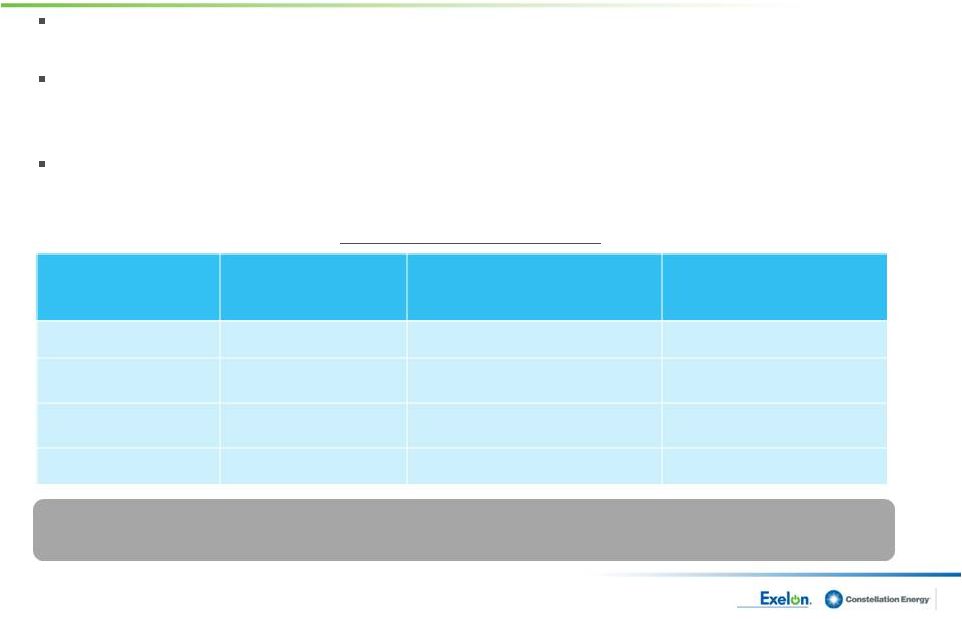

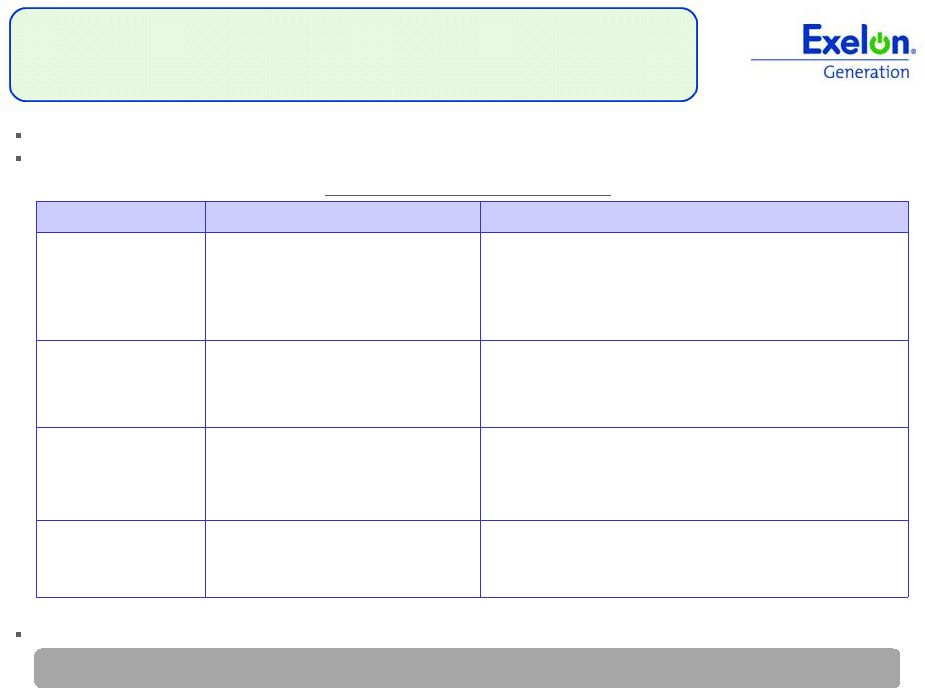

4

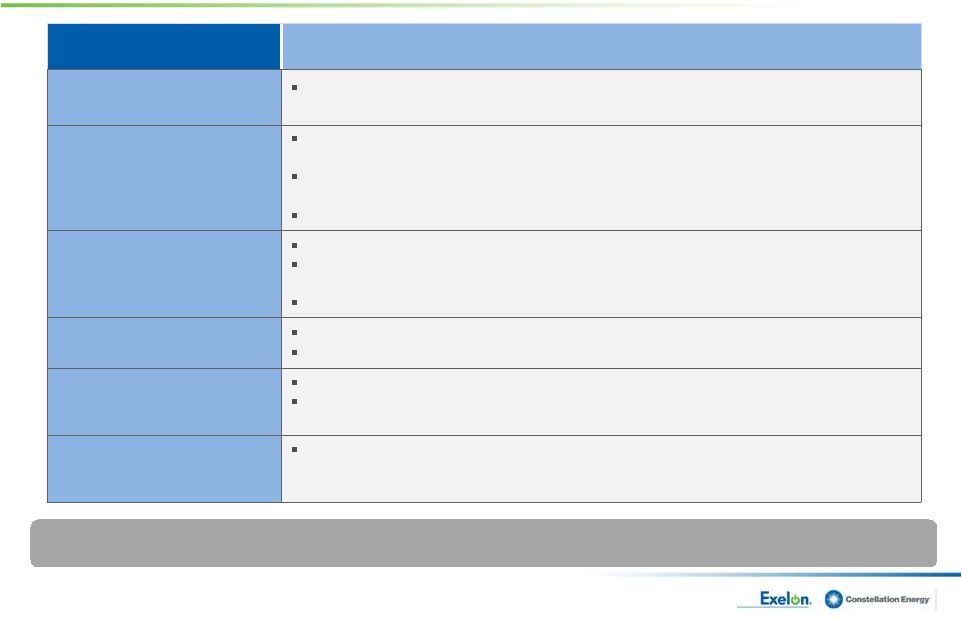

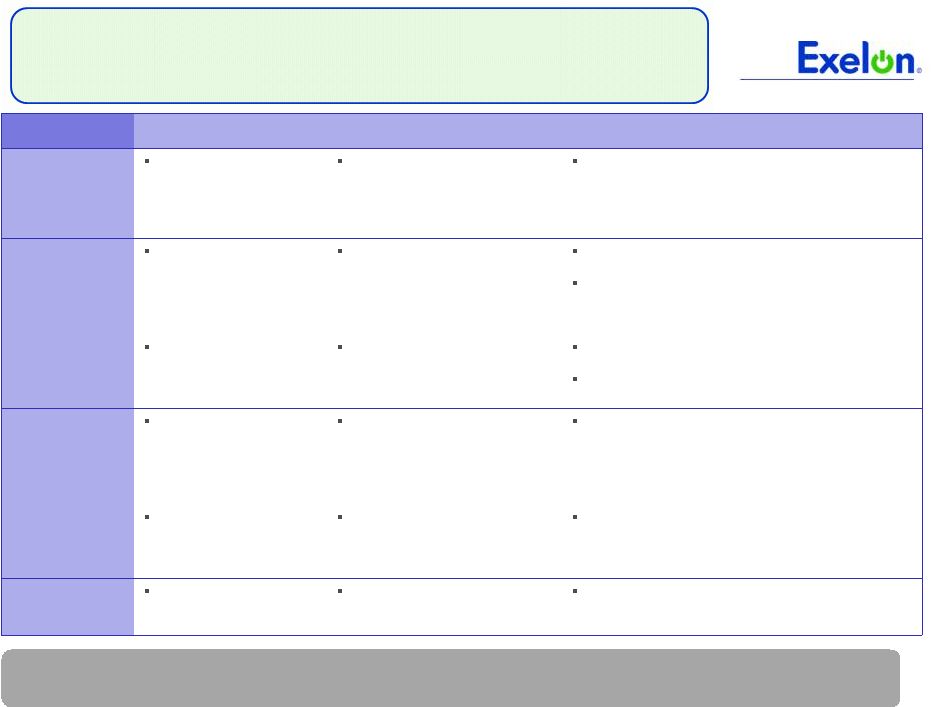

Compelling Merger Rationale

Creates the leading competitive energy

provider in the U.S.

Matches Exelon’s clean generation fleet

with Constellation’s customer-facing

leading retail and wholesale platform

Creates economies of scale through

expansion across the value chain

Strategic Benefits

Financial Benefits

Diversifies generation portfolio across

regions

Adds clean generation to the portfolio

Enhances margins in the competitive

portfolio

Competitive Portfolio

Earnings and cash flow accretive

Dividend uplift for Constellation

shareholders

Continued upside to power market

recovery

Strong balance sheet for combined

company

Utility Benefits

Maintains a regulated earnings profile

with three large urban utilities

Enables operational enhancements

from sharing of best practices across

utilities

Transaction creates incremental strategic and financial value

aligned with both companies’

existing goals |

5

Merger Appeals to Key Stakeholders and Governments

(1) Based on the 30-day average Exelon and Constellation closing stock

prices as of April 26, 2011. Stakeholder

Commitments & Benefits

Customers

$100 one

-time credit for BGE residential customers

Direct benefit from merger synergies at the utilities

Opportunities for operational improvements through sharing of

utilities’

best practices

$15 million for various programs with direct benefits to BGE

customers

Investors

Upfront premium of 18.5%

(1)

to CEG shareholders

Dividend accretion of 103% post-close for CEG shareholders

EPS accretion of >5% in 2013

Earnings upside to power market recovery

Strong credit profile maintained for combined company

State of Maryland and City

of Baltimore

Maintains a large employee presence and platform for growth

in Maryland

New LEED-certified headquarters for wholesale, retail and

renewable energy development business in Baltimore

BGE to maintain independent operations and remain

headquartered in Baltimore

25 MWs of renewable energy development in MD

$4 million to support EmPower Maryland Energy Efficiency Act

Charitable contributions maintained at current levels for at

least 10 years after the merger closes |

6

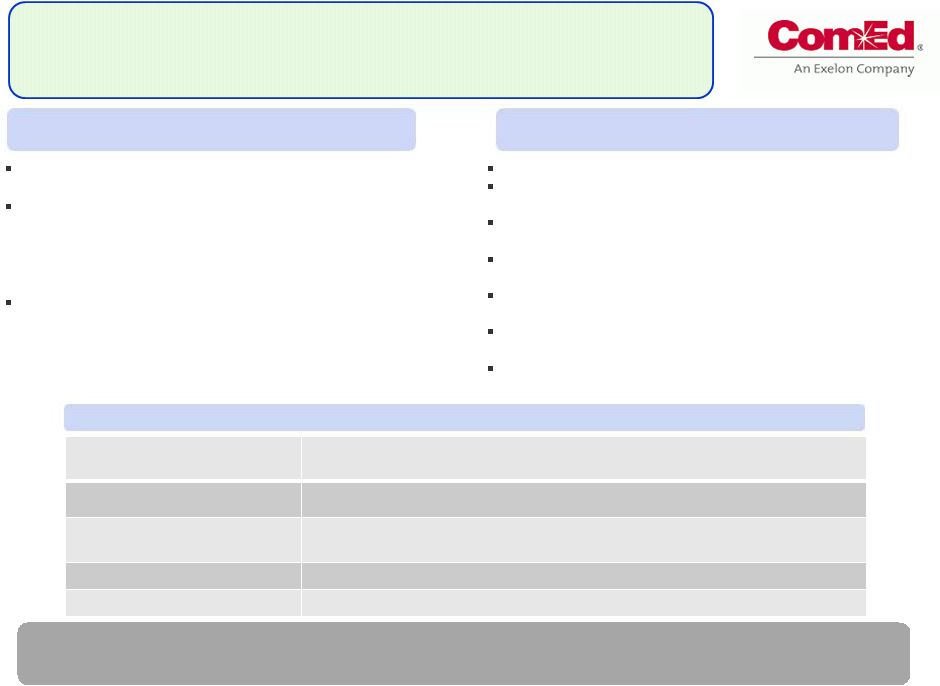

Enhanced Maryland Proposal

Our additional commitments address a number of key stakeholder concerns

Intervenor Concerns

Key Exelon/Constellation Additional Commitments

Additional Customer

Benefits

Added flexibility for Maryland PSC to determine use of $15 million offered for

programs directly benefiting BGE customers

Ring-Fencing

No corporate reorganization under certain defined circumstances relating to RF

HoldCo, BGE or Exelon Energy Delivery Company without prior Commission

approval Obtain a new non-consolidation opinion to ensure the

effectiveness of BGE ring- fencing

No requests for modification of BGE ring-fencing for 3 years

Financial

Regular reporting on credit ratings and metrics of BGE to Maryland PSC

Specific commitments regarding the level of BGE capital and O&M expenditures

in 2012 and 2013

Report comparative pre-

and post-merger shared services costs to PSC

Corporate Governance

BGE’s CEO will be a member of Exelon Management’s Executive

Committee Executive Committee will meet periodically in Baltimore

Service and Operation

Commitment to meet existing BGE supplier diversity requirements

Provide assessment of BGE CAIDI (outage duration) performance within 12 months

after the merger closes

Market Power

In

addition

to

2,648

MW

of

identified

plant

divestitures,

comply

with

settlement

terms

with PJM Market Monitor restricting buyers of divested plants and imposing other

behavioral commitments |

7

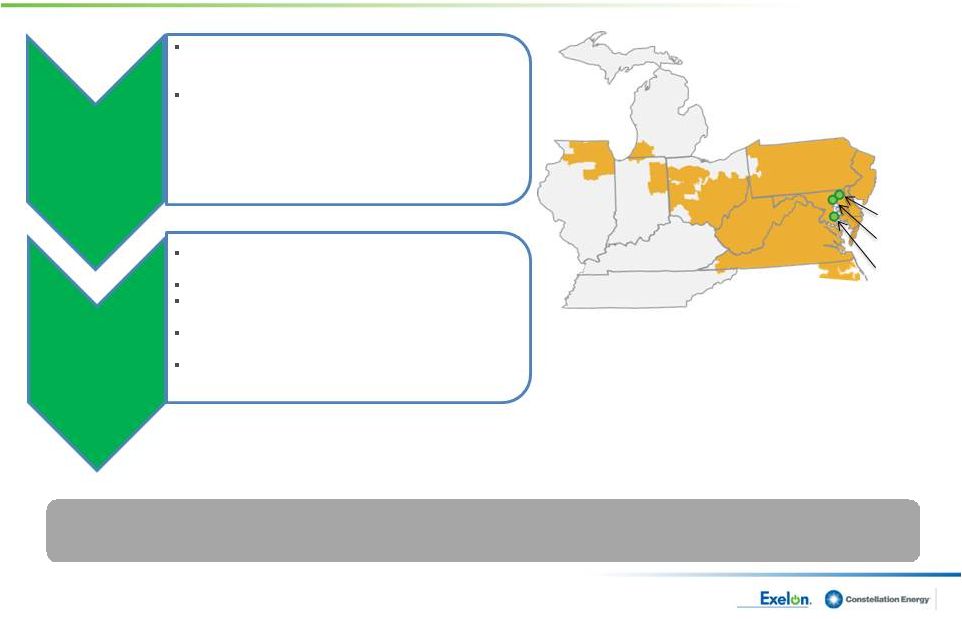

Strong Proposal to Address Market Power

The companies have offered a comprehensive, robust mitigation package

C.P. Crane

399 MW

Brandon Shores

1,273 MW

H.A. Wagner

976 MW

Note:

Assets

to

be

divested

–

Brandon

Shores

(Coal),

H.A.

Wagner

(Coal/Oil/Gas)

and

C.P.

Crane

(Oil/Coal).

Analyzed market power considerations and proposed

mitigation plan to address market concentration

concerns

Proposed comprehensive mitigation plan to address

market concentration in PJM in initial application,

including:

•

Physical sale of 3 baseload generation facilities

totaling 2,648 MW

•

Additional sale of 500 MW via contracts to

mitigate temporary market power issues

Filed with FERC and Maryland PSC on October 11,

2011

No change to assets identified in original proposal

Additional commitment not to sell plants to certain

identified PJM generators

Additional assurances on how we will bid units in PJM

energy and capacity markets

Future retirement of units will be conditioned on meeting

specified requirements

Proactive

divestiture

proposal

Settlement with

PJM

Independent

Market Monitor

(IMM) |

8

Note: Data as of 9/30/11. Exelon solar addition MW based on alternating

current (AC); Constellation solar additions (in MW) based on direct current

(DC). (1) Generation capacity net of physical market

mitigation assumed to be 2,648 MW consisting of Brandon Shores (1,273 MW), H.A. Wagner

(976 MW) and C.P. Crane (399 MW).

(2) Electric load includes all booked 2011E competitive retail

and wholesale sales, including index products. Exelon load does not include the

ComEd swap (~26 TWh). Gas load includes all booked and forecasted 2011E competitive

retail sales as of 9/30/11. Reserves (gas)

266 bcf

Owned Generating

Capacity

35 GWs

(1)

Electric

Transmission

7,350 miles

Electric & Gas Dist.

6.6 million

customers

Retail &

Wholesale Volumes

(2)

(Electric & Gas)

~167 TWh, 372 bcf

Notable Generation Acquired or

Under Development in 2011

Exelon Additions

720 MW Wolf Hollow CCGT (TX)

230 MW Antelope Valley Solar Ranch

One (CA)

230 MW Michigan Wind Projects (MI)

Constellation Additions

2,950 MW Boston Generating gas

fleet

30.4 MW Sacramento Municipal Utility

District Solar (CA)

16.1 MW Maryland Generating Clean

Horizons Solar (MD)

7.8 MW Vineland Municipal Electric

Utility Solar (NJ)

5.4 MW Toys “R”

Us Solar (NJ)

5.2 MW Johnson Matthey, West

Deptford Solar (NJ)

5.0 MW U.S. State Department Solar

(NJ)

Transaction creates the largest –

and growing –

competitive energy

company in the U.S.

Scale, Scope and Flexibility Across the

Value Chain

Upstream

Downstream |

Well Positioned

for Evolving Regulatory Requirements (1)

Total owned generation capacity as of 9/30/2011 for Exelon and Constellation, net

of physical market mitigation assumed to be 2,648 MW.

(2)

Coal capacity shown above includes Eddystone 2 (309 MW) to be retired on

6/1/2012. (3)

Oil capacity shown above includes Cromby 2 (201 MW) to be retired on

12/31/2011. (4)

Pending approval of owner group.

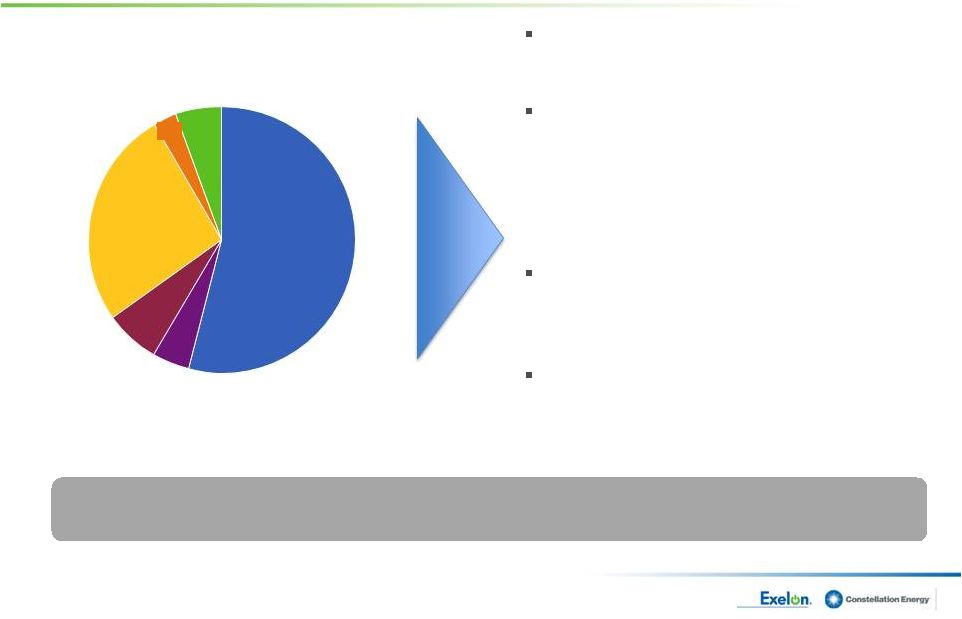

A clean and diverse portfolio that is well positioned for environmental

upside from EPA regulations

9

Total Generation Capacity

(1)

: 35,327 MW

5%

Wind/Solar/Other

3%

Gas

Hydro

Oil

(3)

Nuclear

54%

6%

Coal

(2)

5%

Cleanest large merchant generation

portfolio in the nation

Less than 5% of combined generation

capacity will require capital expenditures

to comply with Air Toxic rules

-

Approx. $200 million of CapEx, majority of

which is at Conemaugh

(4)

(Exelon and

Constellation ownership share ~31%)

Low-cost generation capacity provides

unparalleled leverage to rising commodity

prices

Incremental 500 MW

of coal and oil

capacity to be retired by middle of next

year

Combined Company Portfolio

27% |

10

Texas Generation Portfolio Is Well Suited to Serve Load

ERCOT Generation

Capacity –

MW

(1)

5,311

CEG Intermediate

1,839

EXC Intermediate

2,210

Exelon Peaking

1,262

(1)

Generation and capacity for Exelon and Constellation includes owned and contracted

units, less any PPAs or tolls sold, as of 09/30/2011.

Exelon

wind

assets

in

Texas

(open

or

hedged)

are

not

included

in

the

capacity

shown

above.

Constellation

capacity

includes 517 MWs under a contract that expires in December 2011.

The combined generation portfolio will enhance the hedging capability for

managing load positions in Texas

Premium

Location

–

A

sizeable

generation

Hedging

Flexibility

–

Leverage

strong

asset

Strong

Asset

Mix

–

Intermediate

and

peaking

base and utilize market-based hedging

instruments to effectively manage load-

following obligations

position close to large load pockets in Dallas

and Houston

generation assets are effectively call options at

various heat rates that benefit from price

volatility |

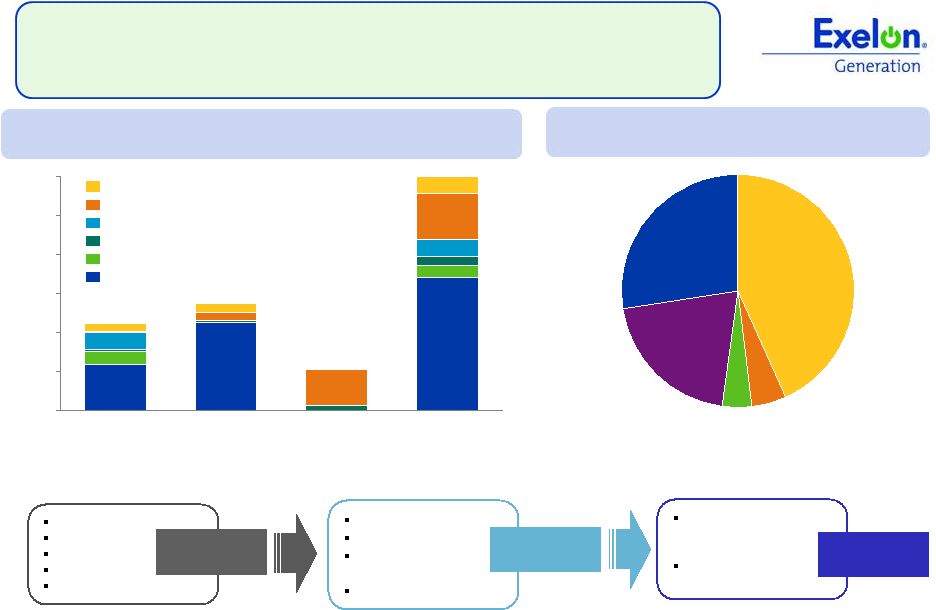

11

We will continue to use a well-defined hedging strategy to carefully

balance risk management and value creation

Increase the amount of generation

hedged over time, leaving some open

generation length

Exhibit flexibility in timing and type of

sales executed based on market

expectations

Select products and markets that

optimize the value of the generation

portfolio

Integrate hedging policy with financial

planning process to protect investment-

grade credit rating

Wholesale and Retail Businesses

Grow our generation to load strategy in multiple regions of the country by

identifying attractive investments and markets

Expand product offerings to customers in regions we serve

Growing the Portfolio

Growing the Portfolio

Hedging Program Characteristics

Hedging Program Characteristics |

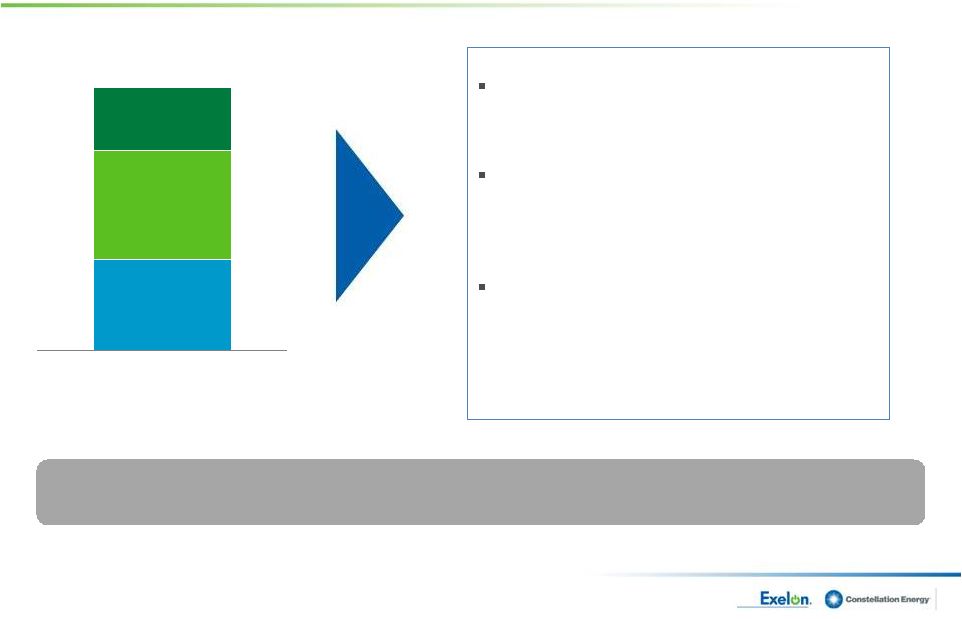

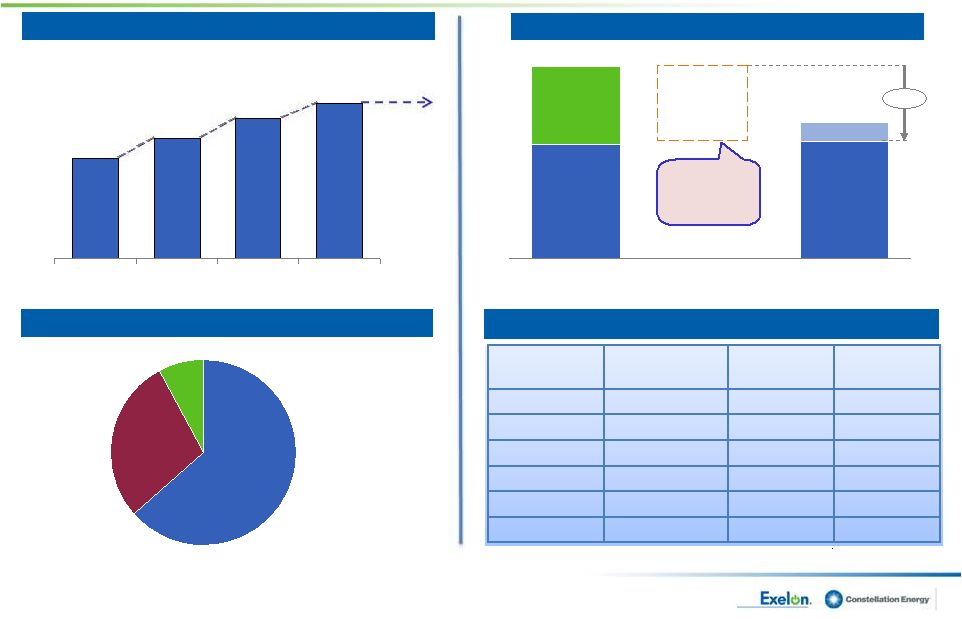

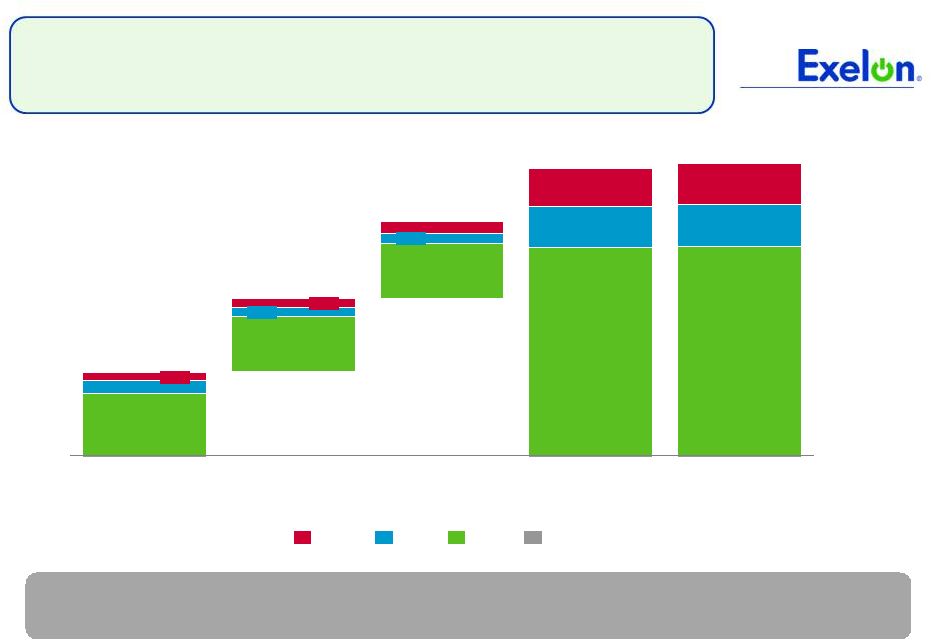

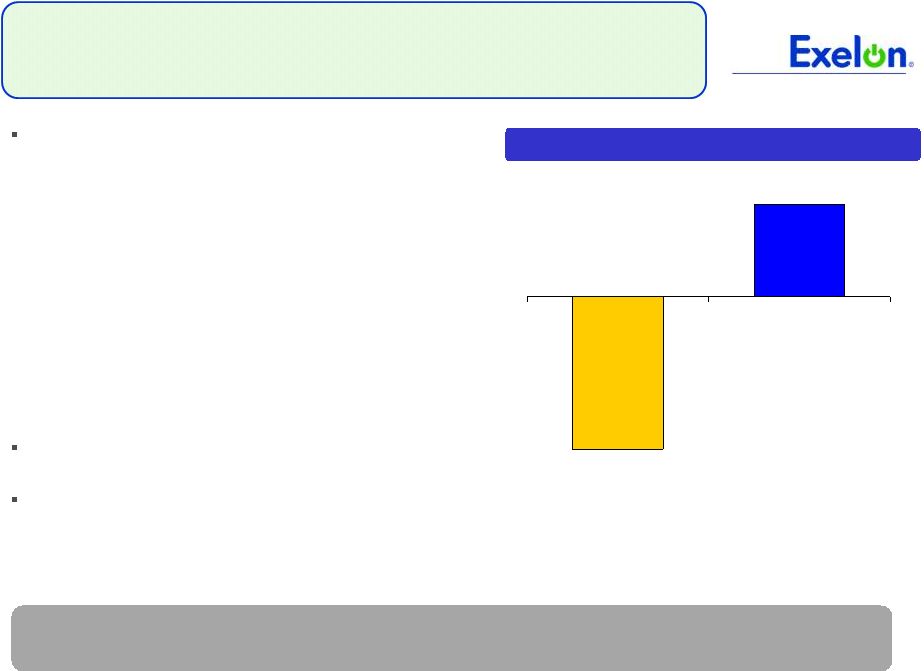

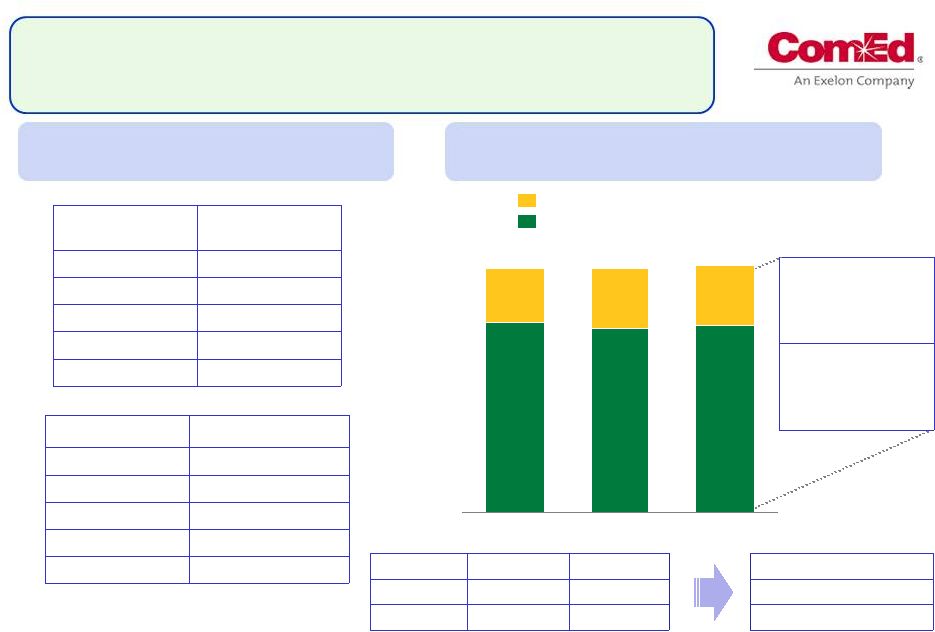

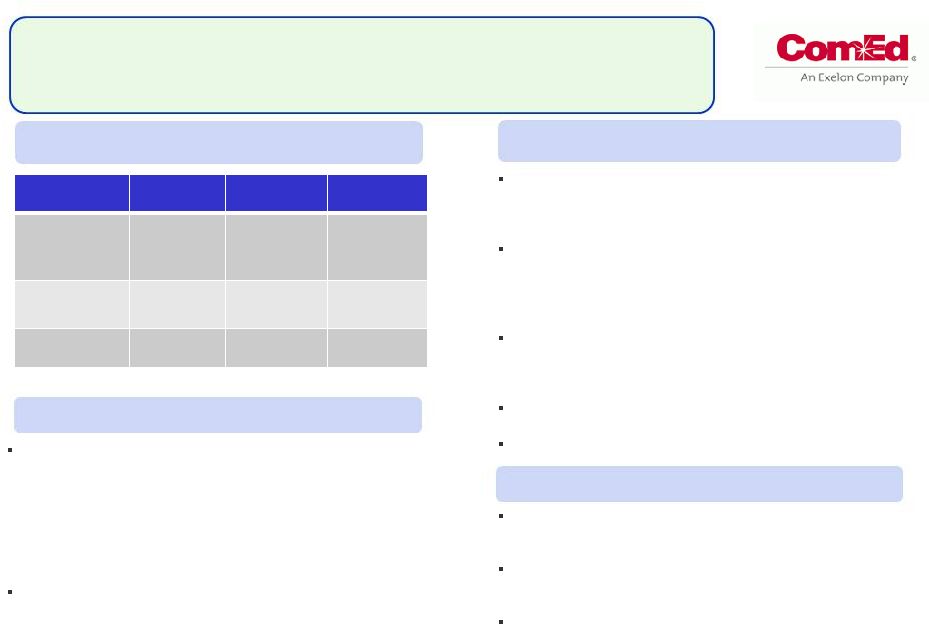

Transaction

Maintains Solid Financial Position Achievable Synergies

Annual

run rate

BGE

8%

ComEd & PECO

29%

Unregulated

Businesses

63%

Year 4

$310

Year 3

Year 2

Year 1

$200

Annual O&M Expense Savings

(1)

(in $MM)

12

Lower Liquidity Requirements

Existing liquidity

(ex-utilities)

Pro-forma liquidity

$10.3

Reduction in

existing liquidity

(in $B)

5-Year

Total

Synergies

Allocation

(2)

Maintaining

Strong

Investment

Grade

Ratings

(3)

Moody’s Credit

Ratings

S&P Credit

Ratings

Fitch Credit

Ratings

Exelon

Baa1

BBB-

BBB+

ComEd

Baa1

A-

BBB+

PECO

A1

A-

A

Generation

A3

BBB

BBB+

Constellation

Baa3

BBB-

BBB-

BGE

Baa2

BBB+

BBB+

$3-$4

-39%

$6.3

-

$7.3

Pro-Forma

$6.1

Exelon

$4.2

Constellation

Annual cost

savings of

$35M-$45M

(1)

Before total costs to achieve of ~$650M primarily attributable to employee-related costs and

transaction costs. (2)

Source: DeGregorio testimony filed with Maryland PSC on May 25, 2011.

(3)

Ratings as of November 1, 2011. Represents senior unsecured ratings of Exelon, Generation,

Constellation and BGE and senior secured ratings for ComEd and PECO. S&P and Fitch

affirmed all Exelon ratings upon announcement of merger. Moody’s affirmed the ratings of ComEd and PECO and

placed the ratings of Exelon and Generation on review for downgrade. S&P and Moody’s placed

Constellation on credit watch positive and affirmed BGE ratings. Fitch affirmed

Constellation and BGE ratings upon announcement. |

13

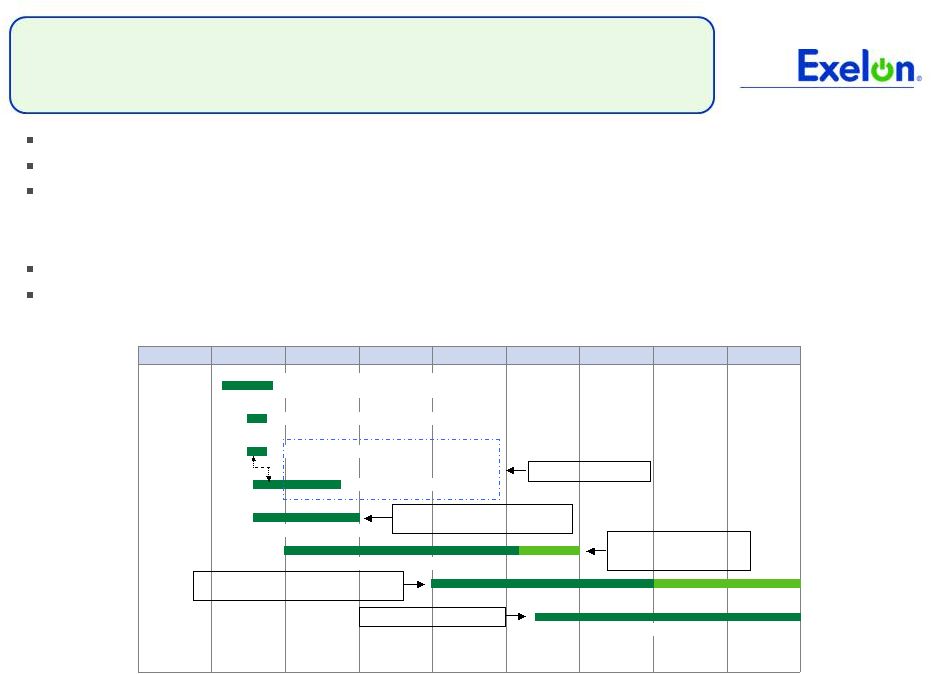

Phased Approach to Designing the Future

Our past experience with successful integration and our phased

approach to integrating Exelon and Constellation will enable the

realization of merger benefits

Success is defined by:

Closing the transaction in early 2012

Maintaining consistent and reliable operations

Capturing value and meeting synergy targets

Meeting commitments to stakeholders, regulators and governments

Acting as one to build an integrated enterprise that is positioned for

continued growth

August

–

December

Begins post-close

Completed in August

Begins in November |

Exelon

& Constellation Energy Appendix |

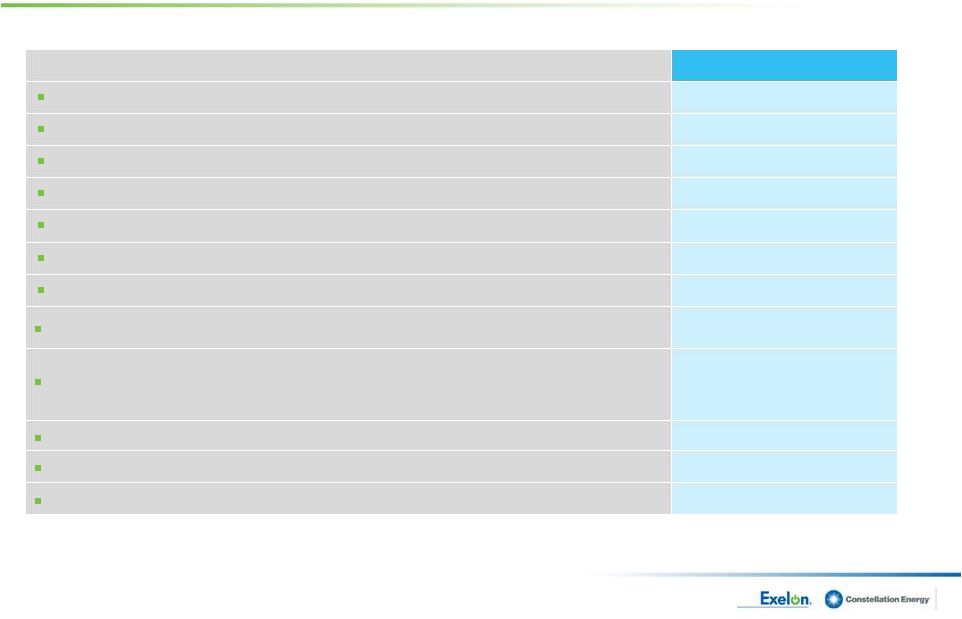

15

Merger Approvals Process on Schedule

(as of 11/1/11)

Note: The Department of Public Utilities in Massachusetts concluded on September

26, 2011 that it does not have jurisdiction over the merger.

Stakeholder

Status of Key Milestones

Approved

Texas PUC

(Case No. 39413)

Filed for approval with the Public Utility Commission of Texas on May 17,

2011

Approval received on August 3, 2011

Securities and Exchange Commission

(SEC)

(File No. 333-175162)

Joint proxy statement declared effective on October 11, 2011

Shareholder Approval

Proxies mailed to shareholders of record at October 7, 2011

Shareholder meetings set for November 17, 2011

New York PSC

(Case No. 11–E–0245)

Filed with the New York Public Service Commission on May 17, 2011

seeking a declaratory order confirming that a Commission review is not

required

Decision expected in Q4 2011

Department of Justice (DOJ)

antitrust laws and certified compliance with second request

Clearance expected by January 2012

Federal Energy Regulatory Commission

(FERC)

(Docket No. EC 11-83)

Filed

merger

approval

application

and

related

filings

on

May

20,

2011,

which

Settlement agreement filed with PJM Market Monitor on October 11, 2011

Order expected by November 16, 2011 (end of statutory period)

Nuclear Regulatory Commission

(Docket Nos. 50-317, 50-318, 50-220,

50-410, 50-244, 72-8, 72-67)

Filed for indirect transfer of Constellation Energy licenses on May 12, 2011

Order expected by January 2012

Maryland PSC

(Case No. 9271)

Filed for approval with the Maryland Public Service Commission on May 25,

2011

Evidentiary hearings begin October 31, 2011

Order expected by January 5, 2012

Submitted Hart-Scott-Rodino filing on

May 31, 2011 for review under U.S.

assesses market power-related issues |

16

Maryland PSC Review Schedule (Case No. 9271)

Significant Events

Date of Event

Filing of Application

May 25, 2011

Intervention Deadline

June 24, 2011

Prehearing Conference

June 28, 2011

Filing of Staff, Office of People Counsel and Intervenor Testimony

September 16, 2011*

Filing of Rebuttal Testimony

October 12, 2011*

Filing of Surrebuttal Testimony

October 26, 2011

Status Conference

October 28, 2011

Evidentiary Hearings

October 31, 2011 -

November 18, 2011

Public Comment Hearings

November 29, December 1 &

December 5, 2011

Filing of Initial Briefs

December 5, 2011

Filing of Reply Briefs

December 19, 2011

Decision Deadline

January 5, 2012

* Initial

intervenor

testimony

with

respect

to

market

power

was

due

on

September

23

for

all

parties

except

for

the

Independent

Market

Monitor

and

rebuttal

testimony

with

respect

to

market

power

was

due

on

October

17 .

rd

th |

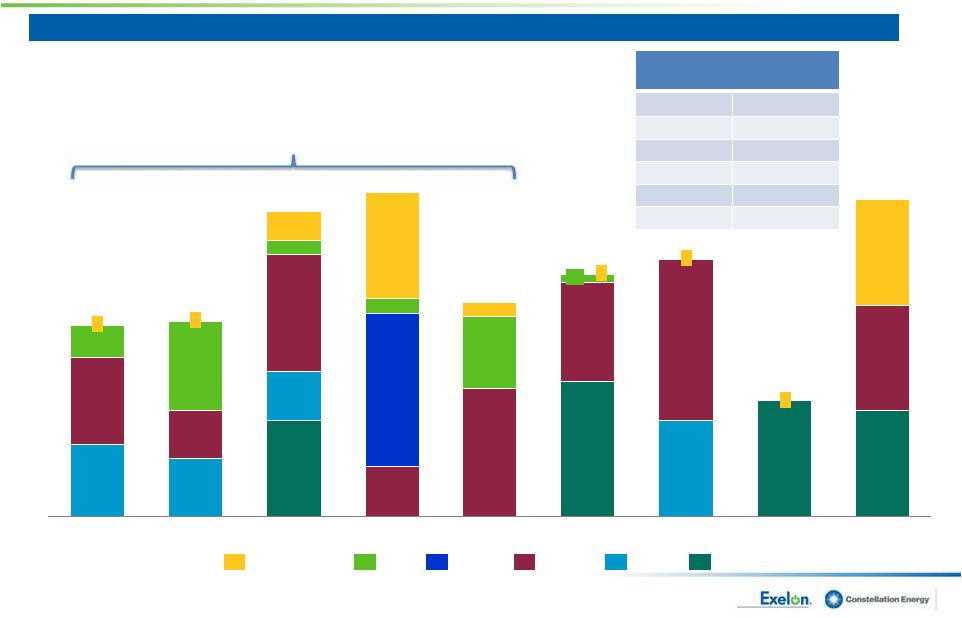

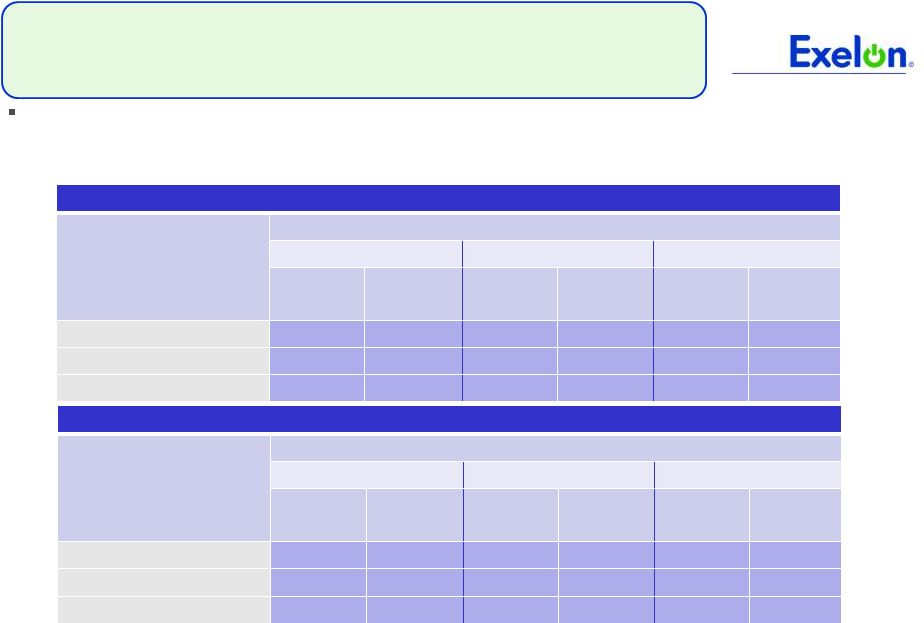

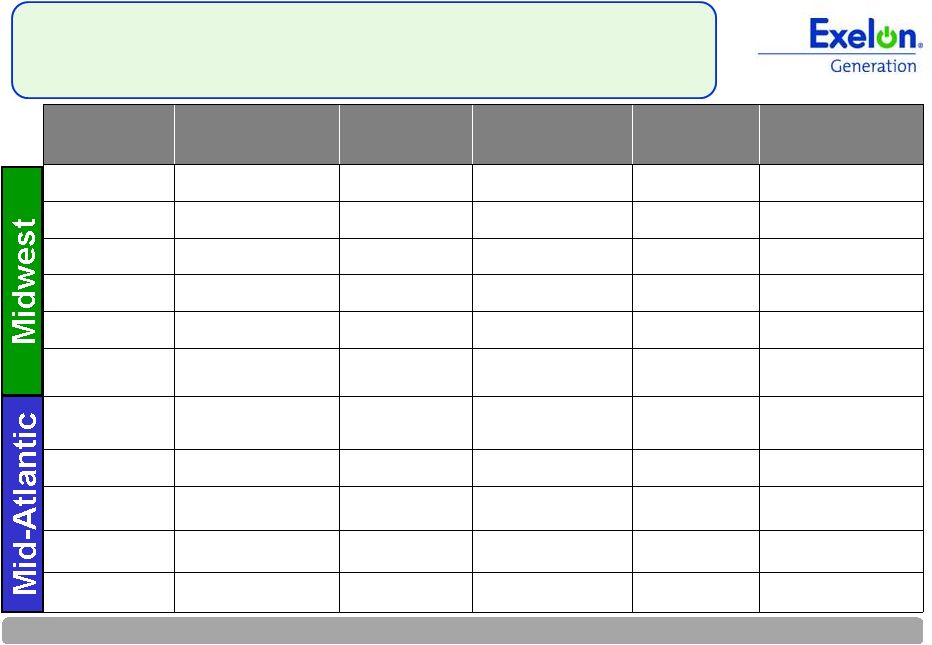

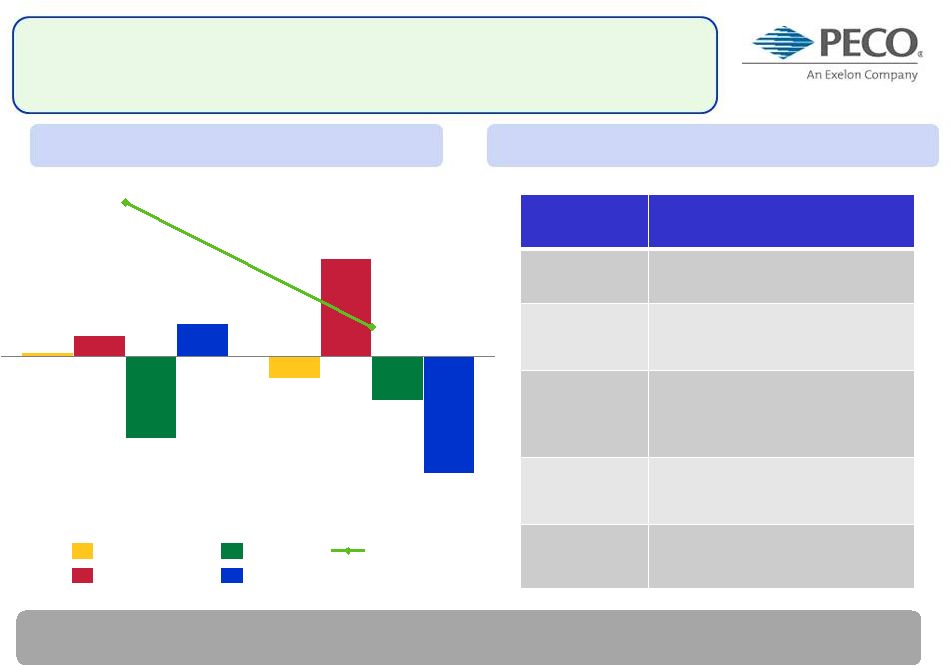

Portfolio

Matches Generation with Load in Key Competitive Markets

MISO (TWh)

PJM

(1)

(TWh)

South

(2)

(TWh)

ISO-NE & NY ISO

(3)

(TWh)

West

(4)

(TWh)

The combination establishes an industry-leading platform with regional

diversification of the generation fleet and customer-facing load business

Note: Data for Exelon and Constellation represents available expected generation

(owned and contracted) and booked electric sales for 2011 as of 9/30/11. Expected

generation is adjusted for assets that have long term PPAs sold by Exelon or

Constellation, including but not limited to wind and South assets. Exelon load doesn’t include

the ComEd swap (~26 TWh). Index load, which is a pass through load product with no

price or volumetric risk to the seller, is not included in the load estimate.

(1)

Constellation

generation

includes

output

from

Brandon

Shores,

C.P.

Crane

and

H.A.

Wagner

(total

generation

~8.5

TWh).

(2)

Represents load and generation in ERCOT, SERC and SPP.

(3)

Constellation load includes ~0.7 TWh of load served in Ontario.

(4)

Constellation generation includes ~0.4 TWh of generation in Alberta.

Load

75.1

42.0

33.1

Generation

175.6

29.8

145.8

Constellation

Exelon

5.7

Load

5.1

0.6

Generation

8.6

8.6

18.5

Load

30.3

Generation

26.2

7.7

1.9

Load

Generation

0.6

Load

29.2

Generation

32.1

32.1

29.2

17 |

Manageable

Debt Maturities Debt

Maturity

Profile

(2012-2020)

EXC

EXC

EXC

Exelon

1,652

1,686

1,589

ExGen

PECO

ComEd

Exelon

BGE

Constellation

~70%

of

2012

–

2016

debt

maturities

consist

of

regulated

utility

debt

(in $M)

18

Weighted Average Cost of

Debt

(2)

Exelon

5.2%

ComEd

5.4%

PECO

5.5%

ExGen

5.5%

Constellation

6.2%

BGE

6.3%

152

552

74

552

(1)

2020

550

550

2019

602

600

2018

1,342

500

840

2017

1,261

702

516

41

2016

1,117

665

379

2015

260

800

75

2014

500

250

617

70

2013

1,020

300

252

467

2012

1,001

375

450

2

2

2

173

3

2

(1)

Debt maturity schedule and weighted average cost of debt as of 9/30/11. Amounts do not include

fair value swaps at Constellation. BGE debt balances include annual transition bond payments

from 2012 – 2017. (2)

Weighted average cost of debt excludes any benefits for interest rate swaps. Utilities’ weighted

average cost of debt includes debt amortization costs. |

19

Exelon Dividend

Exelon’s Board of Directors approved a contingent stub dividend for Exelon

shareholders of $0.00571/share

per

day

for

Q1

2012

in

anticipation

of

the

merger

close

($0.525/share

for

the

quarter)

Stub dividend declaration ensures that Exelon shareholders continue to receive all

dividends at the current $2.10 per share annualized rate

Pre-

and post-close stub dividends must be declared separately to account for

Constellation shareholders becoming Exelon shareholders at merger

close Assuming

a

February

1,

2012

close

for

illustrative

purposes

only:

$0.525

Current Exelon shareholders will continue to receive a total dividend of

$0.525 per quarter

Record Date

Payment Date

Per Share

Amount

11/15/2011

12/09/2011

Regular Dividend

$0.525

1/31/2012

3/1/2012

Pre-close Stub Dividend

$0.440

2/15/2012

3/09/2012

Post-close Stub Dividend

$0.085

5/15/2012

6/09/2012

Regular Dividend

$0.525

(1)

(1)

(2)

(1)

Assuming a 2/1/2012 merger close; for Exelon shareholders, Q1 2012 dividend will be based on a per

diem rate of $0.00571 ($0.525 divided by 92 days).

(2)

Future dividend, following the stub dividend, is subject to approval by the Board of Directors. |

20

Constellation Dividend

Record Date

Payment Date

Per Share

Amount

12/12/2011

1/03/2012

Regular CEG Dividend

$0.24

1/31/2012

3/1/2012

Pre-close CEG Stub

Dividend

(1)

$0.132

2/15/2012

3/09/2012

Post-close EXC Stub

Dividend

(1)

$0.085

5/15/2012

6/09/2012

Regular

EXC

Dividend

(2)

$0.525

Constellation Energy’s Board of Directors approved a contingent stub dividend

for Constellation shareholders of $0.00264/share per day for Q1 2012 in

anticipation of merger close Stub dividend declaration ensures that

Constellation shareholders continue to receive their existing quarterly

dividend rate prior to the merger, and benefit from the Exelon annualized dividend rate

($2.10 per share) beginning on the day the merger closes

Pre-

and post-close stub dividends must be declared separately to account for

Constellation shareholders becoming Exelon shareholders at merger

close Constellation shareholders will receive the Exelon dividend rate

upon

merger close

(1)

Assuming a 2/1/2012 merger close, Q1 2012 dividend will be based on a per diem rate of $0.00264 ($0.24

divided by 91 days). Post-close Exelon Q1 2012 stub dividend will be based on a

per diem rate of $0.00571.

(2)

Assuming a 2/1/2012 merger close, Constellation shareholders will start receiving the full quarterly

Exelon dividend of $0.525 per share in Q2 2012. Future dividend, following the stub dividend,

is subject to approval by the Board of Directors.

Assuming

a

February

1,

2012

close

for

illustrative

purposes

only: |

21

Financial and Operating Data |

22

2011 Operating Earnings Guidance

(1)

Earnings guidance for OpCos may not add up to consolidated EPS guidance.

(2)

Refer to slides 29 and 30 for a reconciliation of adjusted (non-GAAP)

operating EPS to GAAP EPS. 2011 operating earnings guidance is

$4.15-$4.30/share (2)

;

2012 guidance for combined company to be provided after merger close

$0.55 -

$0.65

$4.05 -$4.25

$0.55 -

$0.65

$4.15 -

$4.30

$3.00 -

$3.10

$1.12

$0.50 -

$0.60

$0.55 -

$0.65

$2.95 -

$3.10

$0.79

$0.17

$0.16

$0.13

$0.79

$1.05

$0.15

$1.17

$0.90

$0.19

$0.11

HoldCo

ExGen

PECO

ComEd

Q1

Actual

Q2

Actual

Q3

Actual

2011 Prior

Guidance

(1)

2011 Revised

Guidance

(1) |

23

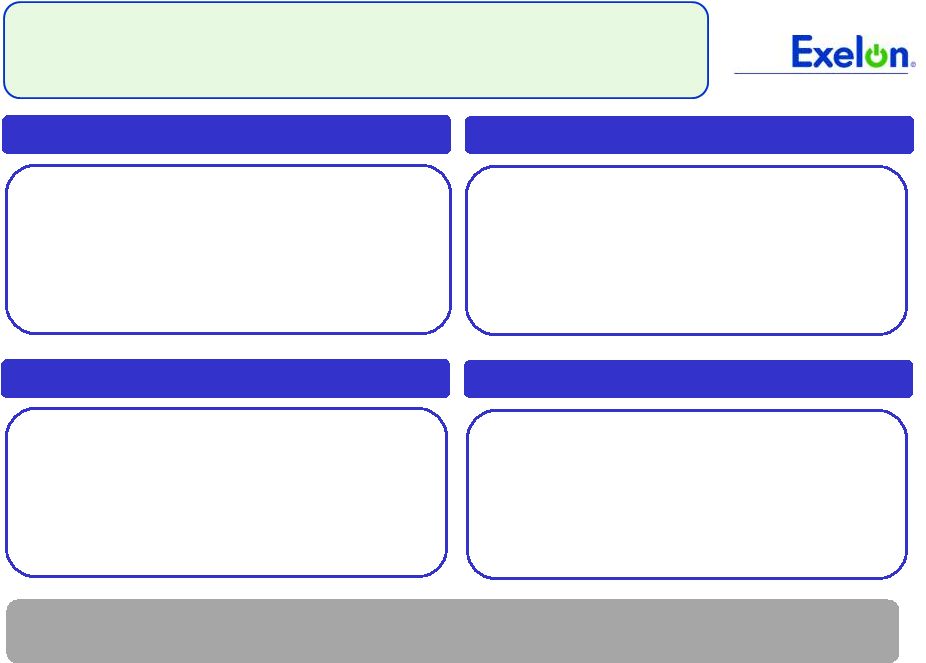

Exelon’s Commitment to Growth

Organic Growth

Competitive Markets

Renewables

Utility Infrastructure

Nuclear Fleet Expansion via Uprates:

Industry leading, proven and value driven program to add

1,175 –

1,300 MW to the nation’s largest nuclear fleet

RiteLine Transmission Project:

First major foray into development of backbone

transmission projects with $1.1 billion investment

Wolf Hollow Acquisition:

Diversify generation technology and expand footprint in

Texas via acquisition of 720 MW combined cycle plant

Merchant Transmission Projects:

Investments to improve transmission infrastructure in

western PJM and MISO to reduce congestion

Wind Development:

Exelon Wind to expand its portfolio to at least 965 MW of

capacity by year end 2012 with operations in eight states

Solar Investment:

Acquisition of Antelope Valley Solar Ranch One (230

MW), one of the largest solar PV projects in the world

PECO Smart Grid:

Investment of $650 million with rate recovery to build out

advanced meter infrastructure network

ComEd System Modernization:

$2.6B of incremental investment over 10 years and

formula rates for distribution

Exelon continues to diversify and grow on a standalone basis with

investments that are earnings and cash flow accretive |

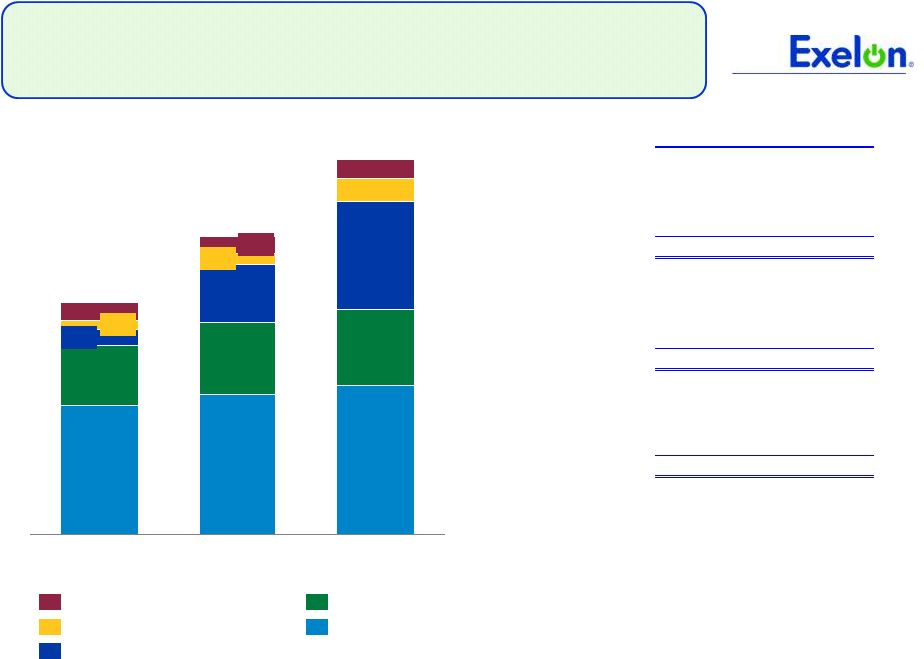

Exelon Capital Expenditures Expectations

325

2012E

5,375

2,125

1,100

1,550

275

2011E

4,275

2,000

1,050

825

150

250

2010

3,325

1,850

850

250

125

250

Base CapEx

Nuclear Fuel

Nuclear Uprates and Solar/Wind

Smart Grid

New Business at Utilities

(1)

Excludes potential capex associated with NRC Post-Fukushima

requirements which have not yet been finalized.

(2)

Nuclear fuel shown at ownership, including Salem.

(3)

Includes capex associated with SB 1652 in 2012.

(4)

Includes transmission growth projects.

$ millions

24

2010

2011E

2012E

Exelon Generation

Base CapEx

(1)

775

850

825

Nuclear Fuel

(2)

850

1,050

1,100

Nuclear Uprates

250

375

450

Solar / Wind

-

450

1,100

Total ExGen

1,875

2,725

3,475

ComEd

Base CapEx

(3)

650

750

975

Smart Grid/Meter

(3)

100

75

250

New Business

(4)

200

200

225

Total ComEd

950

1,025

1,450

PECO

Base CapEx

425

350

300

Smart Grid/Meter

25

75

75

New Business

50

50

50

Total PECO

500

475

425

Corporate

-

50

25

|

25

Investment strategy achieved positive 2011 YTD

returns in a very challenging market environment due

to effectiveness of asset allocations and hedging

strategy:

•

Diversified asset allocation

•

Liability hedge

Pension plans are 83% funded as of September 30,

2011

Anticipate no substantial changes to contribution plan

S&P 500

Exelon

Pension

Fund Assets

-8.7%

5.3%

Pension Funds Performance

Exelon’s pension investment strategy has effectively dampened the

volatility of plan assets and plan funded status

2011 YTD Returns at 9/30/2011

o

Decreased equity investments and

increased investment in fixed income

securities and alternative investments

o

The liability hedge has offset more than

50% of the pension liability increase

caused by lower interest rates |

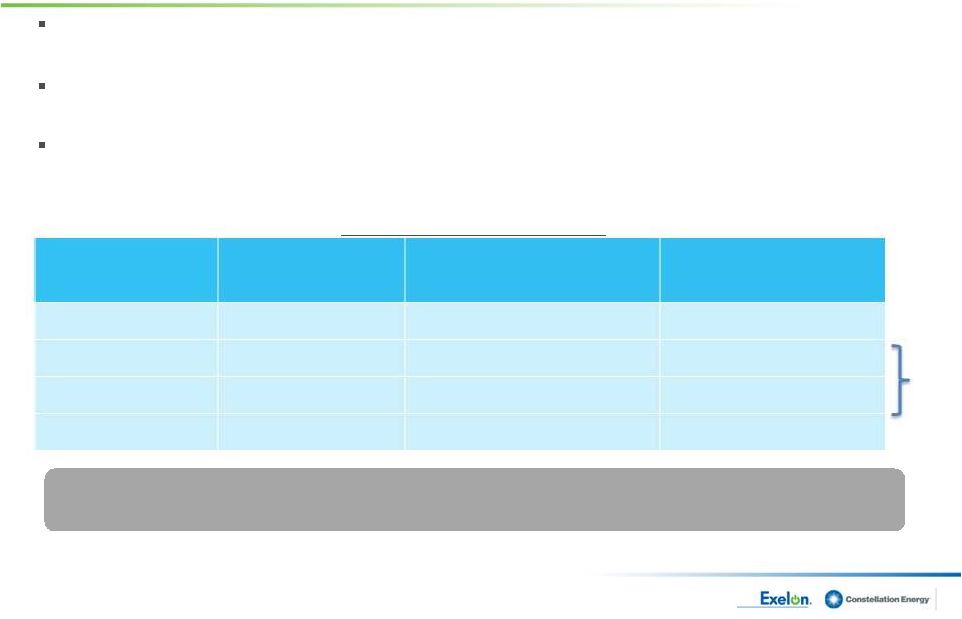

26

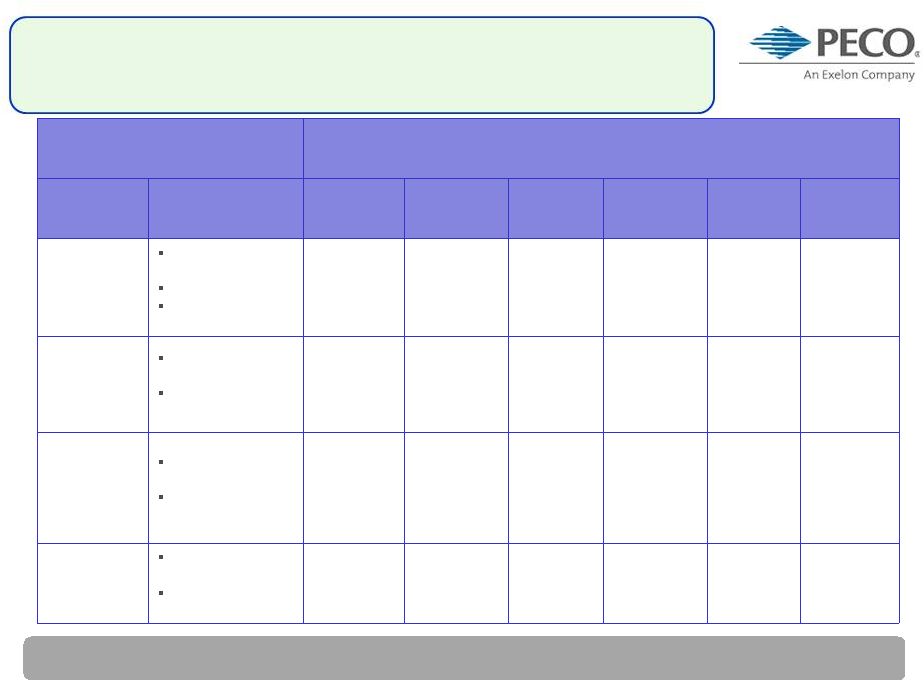

2012 Pension and OPEB Sensitivities

Tables

below

provide

sensitivities

for

Exelon’s

2012

pension

and

OPEB

expense

and

contributions

(1)

under

various discount rate and S&P 500 asset return scenarios

•

Pension and OPEB asset returns are driven by overall market performance (S&P

500 is used as a proxy) as well as discount rates

2012 Pension Sensitivity

(2)

Discount Rate on 12/31/11

S&P 500 Returns in Q4 2011

(3)

5%

0%

-5%

Pre-Tax

Expense

(in M)

Contribution

(in M)

Pre-Tax

Expense

(in M)

Contribution

(in M)

Pre-Tax

Expense

(in M)

Contribution

(in M)

4.85%

(4)

$290

$140

$300

$140

$305

$140

+50 bps (5.35%)

$260

$140

$265

$140

$270

$140

-50 bps (4.35%)

$330

$130

$335

$130

$340

$135

2012 OPEB Sensitivity

(2)

Discount Rate on 12/31/11

S&P 500 Returns in Q4 2011

(3)

5%

0%

-5%

Pre-Tax

Expense

(in M)

Contribution

(in M)

Pre-Tax

Expense

(in M)

Contribution

(in M)

Pre-Tax

Expense

(in M)

Contribution

(in M)

4.92%

(4)

$260

$340

$265

$345

$265

$350

+50 bps (5.42%)

$235

$310

$240

$315

$240

$320

-50 bps (4.42%)

$290

$375

$290

$380

$295

$385

(1)

Contributions shown in the table above are based on Exelon’s current contribution policy. (2) Pension and OPEB expenses assume

25% capitalization rate.

(3)

Final 2011 asset return for pension and OPEB will depend in part on overall equity market returns in

Q4 2011 as proxied by the S&P 500. As of 9/30/11, YTD S&P return was -8.7%.

(4)

Projected 12/31/11 discount rate as of 9/30/11.

Note: Tables above for illustrative purposes and not intended to represent a forecast of future

outcomes. |

27

Exelon Credit Metric Outlook

Credit metrics continue to be very strong at each operating company

Managing 5-year financial plan to ensure each operating company can maintain

strong investment grade credit ratings under a variety of economic scenarios

Expect to be at or above target ranges through 2013, while funding growth

projects and meeting future obligations including dividend, pension and

uprates FFO/Debt Forecast and Target Range

Through 2013, Exelon expects to maintain credit metrics at or above targets

10%

20%

30%

40%

50%

Exelon

PECO

ComEd

2011E

2010A

2009A

FFO / Debt

Target

Range

ComEd:

15-18%

PECO:

15-18%

Generation:

30-35%

(1)

(1)

FFO/Debt Target Range reflects Generation FFO/Debt in addition to the debt obligations of Exelon Corp.

Range represents FFO/Debt to maintain current ratings at current business risk.

ExGen/

Corp |

RITE

Line Transmission Project 420

miles

of

765kV

transmission

stretches

from

Northern

Illinois

to

Ohio

border

ComEd/Exelon

investment

~$1.1

billion

–

no

significant

investment

expected

in

2012

FERC accepted Formula Rate and granted incentives for the project, with a 11.43%

total ROE •

100% CWIP and 100% cost recovery if the project is abandoned through no fault of

developers •

9.93% base ROE with 150 basis points of incentives

Pursuing PJM RTEP Approval, expect confirmation in 2012 or 2013

Project ensures reliability, enables states to meet RPS standards, and reduces

congestion 28

Note: ETA = Electric Transmission America

RPS = Renewable Portfolio Standards

RTEP = Regional Transmission Expansion Planning

2010

2011

2012

2013

2014

2015

2016

2017

2018

In-Service

Construction

State Local Outreach & Project Siting

Pursue PJM RTEP Approval

PJM Compliance Filing

FERC Order No. 1000

FERC Incentive Filing and Order

Established Definitive Agreement

Between Exelon & ETA

Non-project Specific Event

RTEP Approval expected in 2012 or 2013,

dependent on PJM Planning criteria

Time length depends on:

1. Land negotiations

2. Receipt of State Certifications

Construction can range from 3-5 years depending

on the length of time needed to site the project

Lines can be in-serviced phases |

YTD

GAAP EPS Reconciliation NOTE: All amounts shown are per Exelon share

and represent contributions to Exelon's EPS. Amounts may not add due to rounding.

Nine Months Ended September 30, 2010

ExGen

ComEd

PECO

Other

Exelon

2010 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$2.10

$0.55

$0.51

$(0.06)

$3.10

2007 Illinois electric rate settlement

(0.01)

-

-

-

(0.01)

Mark-to-market impact of economic hedging activities

0.25

-

-

-

0.25

Unrealized gains related to nuclear decommissioning trust funds

0.04

-

-

-

0.04

Non-cash charge resulting from health care legislation

(0.04)

(0.02)

(0.02)

(0.02)

(0.10)

Non-cash remeasurement of income tax uncertainties

0.10

(0.16)

(0.03)

(0.01)

(0.10)

Retirement of fossil generating units

(0.05)

-

-

-

(0.05)

Emission allowances impairment

(0.05)

-

-

-

(0.05)

YTD 2010 GAAP Earnings (Loss) Per Share

$2.34

$0.37

$0.46

$(0.09)

$3.08

Nine Months Ended September 30, 2011

ExGen

ComEd

PECO

Other

Exelon

2011 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$2.47

$0.43

$0.47

$(0.03)

$3.34

Mark-to-market impact of economic hedging activities

(0.34)

-

-

-

(0.34)

Unrealized losses related to nuclear decommissioning trust funds

(0.07)

-

-

-

(0.07)

Retirement of fossil generating units

(0.04)

-

-

-

(0.04)

Asset retirement obligation

(0.03)

-

0.00

-

(0.02)

Constellation acquisition costs

(0.00)

(0.00)

(0.00)

(0.03)

(0.04)

AVSR 1 acquisition costs

(0.01)

-

-

-

(0.01)

Non-cash charge resulting from Illinois tax rate change legislation

(0.03)

(0.01)

-

(0.00)

(0.04)

Wolf Hollow acquisition

0.03

-

-

-

0.03

Recovery of costs pursuant to distribution rate case order

-

0.03

-

-

0.03

YTD 2011 GAAP Earnings (Loss) Per Share

$1.99

$0.44

$0.47

$(0.07)

$2.84

29 |

GAAP

to Operating Adjustments Exelon’s 2011 adjusted (non-GAAP) operating

earnings outlook excludes the earnings effects of the following:

•

Mark-to-market adjustments from economic hedging activities

•

Unrealized gains and losses from nuclear decommissioning trust fund investments to

the extent not offset by contractual accounting as described in the notes

to the consolidated financial statements

•

Significant impairments of assets, including goodwill

•

Changes in decommissioning obligation and asset retirement obligation

estimates •

Non-cash charge to remeasure deferred taxes at higher Illinois corporate tax

rates •

Financial impacts associated with the planned retirement of fossil generating

units •

One-time benefits reflecting ComEd’s 2011 distribution rate case order

for the recovery of previously

incurred

costs

related

to

the

2009

restructuring

plan

and

for

the

passage

of

Federal

health care legislation in 2010

•

Certain costs associated with Exelon’s acquisition of a wind portfolio (now

known as Exelon Wind) and AVSR 1, and Exelon’s proposed merger with

Constellation •

Non-cash

gain

on

purchase

in

connection

with

the

acquisition

of

Wolf

Hollow,

net

of

acquisition

costs

•

Non-cash charge remeasurement of income tax uncertainties

•

Non-cash charge resulting from passage of Federal health care

legislation •

Costs associated with the 2007 electric rate settlement agreement

•

Impairment of certain emission allowances

•

Other unusual items

•

Significant changes to GAAP

Operating

earnings

guidance

assumes

normal

weather

for

remainder

of

the

year

30 |

31

Exelon Consolidated Metric Calculations

and Ratios

Exelon 2010 YE Adjustments

FFO Calculation

2010 YE

Source - 2010 Form 10-K (.pdf version)

Net Cash Flows provided by Operating Activities

5,244

Pg 159 - Stmt. of Cash Flows

+/- Change in Working Capital

644

Pg 159 - Stmt. of Cash Flows

(1)

- PECO Transition Bond Principal Paydown

(392)

Pg 174 - Stmt. of Cash Flows

(2)

+ PPA Depreciation Adjustment

207

Pg 295 - Commitments and Contingencies

(3)

+/- Pension/OPEB Contribution Normalization

448

Pg 268-269 - Post-retirement Benefits

(4)

+ Operating Lease Depreciation Adjustment

35

Pg 299 - Commitments and Contingencies

(5)

+/- Decommissioning activity

(143)

Pg 159- Stmt. of Cash Flows

+/- Other Minor FFO Adjustments

(6)

(54)

= FFO (a)

5,989

Debt Calculation

Long-term Debt (incl. Current Maturities and A/R agreement)

12,828

Pg 161 - Balance Sheet

Short-term debt (incl. Notes Payable / Commercial Paper)

- Pg 161 - Balance Sheet

- PECO Transition Bond Principal Paydown

- N/A - no debt outstanding at year-end

+ PPA Imputed Debt

1,680

Pg 295 - Commitments and Contingencies

(7)

+ Pension/OPEB Imputed Debt

3,825

Pg 268 - Post-retirement benefits

(8)

+ Operating Lease Imputed Debt

428

Pg 299 - Commitments and Contingencies

(9)

+ Asset Retirement Obligation

- Pg 261-267 - Asset Retirement Obligations

(10)

+/- Other Minor Debt Equivalents

(11)

84

= Adjusted Debt (b)

18,845

Interest Calculation

Net Interest Expense

817

Pg 158 - Statement of Operations

- PECO Transition Bond Interest Expense

(22)

Pg 182 - Significant Accounting Policies

+ Interest on Present Value (PV) of Operating Leases

29

Pg 299 - Commitments and Contingencies

(12)

+ Interest on PV of Purchased Power Agreements (PPAs)

99

Pg 295 - Commitments and Contingencies

(13)

+/- Other Minor Interest Adjustments

(14)

37

= Adjusted Interest (c)

960

Equity Calculation

Total Equity

13,563

Pg 161 - Balance Sheet

+ Preferred Securities of Subsidaries

87

Pg 161 - Balance Sheet

+/- Other Minor Equity Equivalents

(15)

111

= Adjusted Equity (d)

13,761

(1)

Includes changes in A/R, Inventories, A/P and other accrued expenses, option premiums,

counterparty collateral and income taxes. Impact to FFO is opposite of

impact to cash flow (2)

Reflects retirement of variable interest entity + change in restricted cash

(3)

Reflects net capacity payment –

interest on PV of PPAs (using weighted average cost of debt)

(4)

Reflects employer contributions –

(service costs + interest costs + expected return on assets),

net of taxes at 35%

(5)

Reflects operating lease payments –

interest on PV of future operating lease payments (using

weighted average cost of debt)

(6)

Includes AFUDC / capitalized interest

(7)

Reflects PV of net capacity purchases (using weighted average cost of debt)

$ in millions

(8)

Reflects unfunded status, net of taxes at 35%

(9)

Reflects PV of minimum future operating lease payments (using weighted average cost

of debt)

(10)

Nuclear decommissioning trust fund balance > asset retirement obligation.

No debt imputed (11)

Includes accrued interest less securities qualifying for hybrid treatment (50% debt /

50% equity)

(12)

Reflects interest on PV of minimum future operating lease payments (using weighted

average cost of debt)

(13)

Reflects interest on PV of PPAs (using weighted average cost of debt)

(14)

Includes AFUDC / capitalized interest and interest on securities

qualifying for hybrid

treatment (50% debt / 50% equity)

(15)

Includes interest on securities qualifying for hybrid treatment (50% debt / 50%

equity) FFO / Debt Coverage =

FFO (a)

Adjusted Debt (b)

FFO Interest Coverage =

FFO (a) + Adjusted Interest (c)

Adjusted Interest (c)

Adjusted Capitalization (e) =

Adjusted Debt (b) + Adjusted Equity (d)

=

32,606

Rating Agency Debt Ratio =

Adjusted Debt (b)

Adjusted Capitalization (e)

32%

7.2x

58%

=

=

=

2010A Credit Metrics |

32

Environmental |

Exelon’s Clean Fleet Is a Product of

Long-Term Planning

1999

2007

2008

2009

Exelon 2020

Announced

plan to offset

or displace

more than 15

million metric

tons of

greenhouse

gas emissions

per year by

2020

2011

Exelon has made numerous investment decisions over time to prepare for the

country’s mandated transition to cleaner air, and will invest nearly $5 billion

in cost-efficient, clean energy products from 2010 to 2015

2010

Acquisition

Announced

acquisition of

wind portfolio

with 735 MW

operating and

230 MW under

advanced

development

33

Nuclear

Capacity

Factor

(1)

Nuclear

Operations

Set goal to run

nuclear units

at world-class

operating

levels

89.4%

94.5%

93.9%

93.6%

93.9%

93.4%

1997

48.8%

Coal PPA

Terminated

PPA with

State Line

coal facility

Uprates, Coal/Oil

Retirements &

Keystone

Announced $3.3

billion nuclear uprate

program designed to

add 1,175 -1,300

MW through 2017

Announced

retirements of

Eddystone 1&2 and

Cromby 1&2 coal /oil

units by 2012

Invested more than

$140 million to install

scrubbers at

Keystone coal plant

2003

93.4%

ComEd

Fossil Plants

& Uprates

ComEd

divested

5,645 MW of

fossil

generation

plants

Through

2008, added

~1,100 MW

from nuclear

uprates

AmerGen

Nuclear Units

Purchased

remaining

50% interest

in AmerGen’s

nuclear units

from British

Energy

Acquisition &

Energy Efficiency

Announced 230

MW acquisition of

AVSR 1 solar

project

Invested more

than $240 million

through mid-2011

on energy

efficiency

programs

(1) Capacity factors in 1997, 1998 and 1999 represents Unicom nuclear units’ performance, and

2011 data represents performance through 9/30/11 for Exelon’s nuclear units. |

34

EPA Rulemaking Timeline

Note: For definition of the EPA regulations referred to on this slide, please see

the EPA Terms of Environment (http://www.epa.gov/OCEPAterms/). CSAPR

EPA is committed to rulemaking timeline as mandated under Clean Air Act

Air Toxic Rules

316(b) Rules

Targets reductions in

So

2

and NoX to

downwind states

Compliance standards

can be met with a variety

of controls

Modest changes

proposed but no change

in compliance timing

Targets the cooling

water intake structures

Technology decisions

based on site-specific

factors, and cost-benefit

analysis

Implementation of

cooling towers not

mandated

Targets mercury and

other toxic air pollutants

Rules provide certainty

to industry

3-year implementation

period provides

adequate time to invest

in required technology

2010

2011

2012

2015

2016

Draft CSAPR

issued

Draft Air

Toxic rules

issued

Final

CSAPR

Issued

Final Air

Toxic Rules

Expected

Compliance

with CSAPR

Compliance

with Air

Toxics Rule

Phase in of

Compliance with

316(b) Rules

Draft 316(b)

rules issued |

Myths

& Facts about EPA Clean Air Rules Topic

Myth

Fact

Supporting Facts

Jobs

Jobs will be lost during the

economic recovery

Between 2010 and 2015, the new

jobs created through investments

spurred by the EPA clean air rules

will more than offset any job

reductions from plant retirements

A June 2011 Economic Policy Institute report concludes

that the Toxics Rule will have a modest positive net

impact on overall employment

Reliability

Plant retirements will lead

to rolling blackouts

Blanket delay of the rules is

the only option to prevent

local reliability issues

Reliability of the electric system

will not be compromised

If and when necessary, state and

federal regulators have tools to

mitigate any issues

PJM August 2011 report finds that resource adequacy

will not be at risk in spite of projected retirements

PJM May 2011 RPM forward capacity auction results

indicate that there will be ample electricity after

proposed EPA rules take effect in 2015

Clean Air Act provides an opportunity for a 1-year

extension to install pollution controls

U.S. Secretary of Energy has authority to order units to

operate on a limited basis in emergency situations

Timeline

The rules are a surprise

and utilities need more time

to plan

Utilities don’t have enough

time to install pollution

controls

Companies have known about

these rules for almost decade and

most, including Exelon, have

planned accordingly and invested

billions of dollars

Utilities have installed pollution

controls in less than 3 years

The Hazardous Air Pollutants (HAP) regulations have

been in the pipeline for more than 10 years and about

60% of coal-burning plants have already installed

controls

Most controls like Activated Carbon Injection (ACI) and

Dry Sorbent Injection (DSI), can be installed in 2 years

or less, and companies will have 3 years to complete

installation until the Air Toxic rules take effect in 2015

Control

Technology

Pollution control technology

is not proven

Pollution control technology is

already in use and widely

available

The industry has extensive experience installing and

operating a range of control technologies

Arguments used to recommend blanket delays to implementing

EPA regulations are not supported by facts

35 |

36 |

37

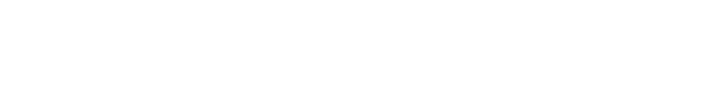

Antelope Valley Solar Ranch One

Transaction Summary

(1) Based on alternating current (AC).

AVSR 1 further diversifies Exelon’s clean generation portfolio with a unique

entry point into large-scale solar generation with attractive

economics Los

Angeles

Antelope Valley Solar Ranch One (AVSR 1)

•

230-MW

(1)

solar photovoltaic (PV) facility located in Los Angeles County

o

Technology: FS Series 3 cadmium telluride (CdTe) PV panels; single-

axis tracking system

•

First portion of plant on line in Oct. 2012; fully operational by end of 2013

•

AVSR 1 will be one of the largest solar PV projects in the world

Financing

•

All-in cost of up to $1.36 billion

•

Up to $646M of a non-recourse loan guaranteed by U.S. Department of

Energy’s Loan Programs Office

•

Exelon to invest up to $713M from closing to the end of 2013 –

funded with cash and short-term debt

•

Tax benefits from investment tax credit (ITC) and depreciation provide

additional source of cash beginning in 2012

•

Initial investment recovered by 2015

Power Purchase Agreement (PPA)

•

25-year PPA with Pacific Gas & Electric generates long-term regulated

cash flow stream

•

Contract for all output produced by project

Structure

•

AVSR 1 is a wholly owned indirect subsidiary of Exelon Generation |

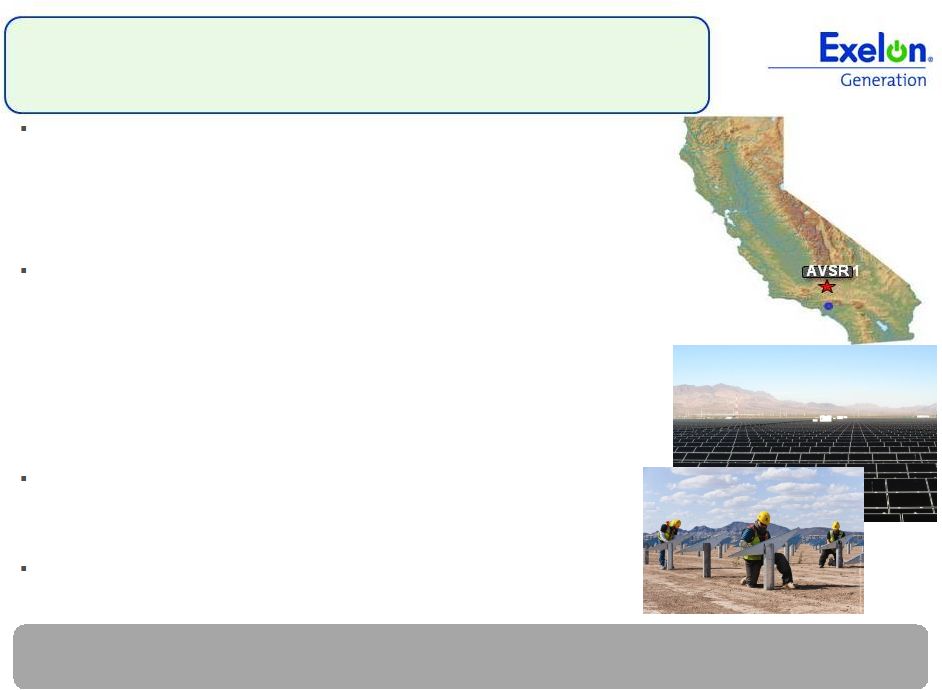

-400

-300

-200

-100

0

100

200

300

400

2015E

2014E

2013E

2012E

2011E

$0.03

$0.03

$0.02

2015E

2014E

2013E

Antelope Valley Solar Ranch One

Attractive Economics

Free cash flow accretive beginning in 2013

•

Cash

outflows

in

2011-2012

during

construction

mitigated

significantly

by

tax

benefits

and

operating cash inflows received as portions of project come online

EBITDA run-rate of ~$75M per year post full commercial operation date

Expect transaction to have minimal impact on credit metrics

EPS Accretion

Net Equity Cash Flows ($ millions)

Equity Payback

Cumulative Equity Cash Flows

Annual Equity Cash Flows

Expect to recover investment by 2015, largely driven by investment tax

credits and other tax benefits

38 |

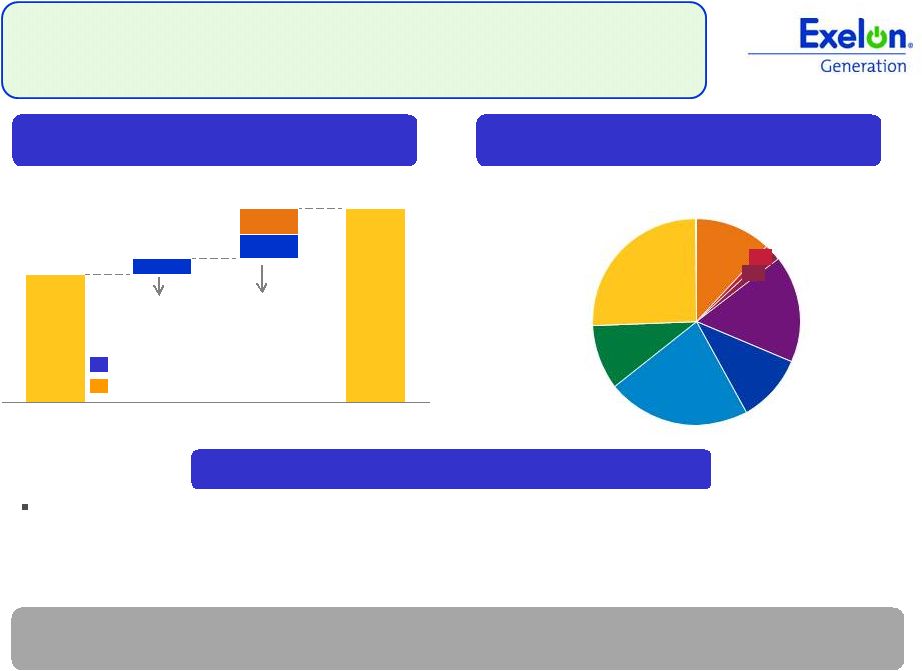

Exelon Wind Development Strategy

1,115

735

EOY 2012

Position

2012 Additions

140

150

2011 Additions

90

2010

MW Additions

MW by state –

735 MW at EOY 2010

Texas

Oregon

10%

Missouri

22%

Minnesota

11%

Michigan

17%

Kansas

Illinois

Idaho

12%

1%

2%

Longer term pipeline of 500 to 1,000 MW of wind projects may be developed or

acquired over the next five years

•

Several states under consideration, including ID, ND, CA, NM, KS, OK, PA, MN,

MI •

Growth strategy post 2013 assumes tax benefits are extended beyond 2012

MI development projects with signed PPAs

Exelon’s balance sheet strength and ability to monetize tax benefits are

key competitive advantages in the wind development business

Invest in new wind projects that are primarily

hedged via PPAs and meet internal hurdle rates

Focus on geographic diversity to minimize

production risk for the overall portfolio

Growth Plans

$250 million

CapEx

$550 million

CapEx

26%

Near

term

pipeline

(1)

(1) New wind development will depend on ability to sign PPAs and meet internal hurdle rates. 39

|

Wolf

Hollow Acquisition Diversifies generation portfolio

•

Expands geographic and fuel characteristics of fleet

•

Advances Exelon and Constellation merger strategy of

matching load with generation in key competitive markets

Creates value for shareholders

•

$305M purchase price compares favorably to cost of other

recent transactions

•

Free cash flow accretive beginning in 2012; earnings and credit

neutral

•

Eliminates current above market purchase power agreement

(PPA) with Wolf Hollow

•

Enhances opportunity to benefit from future market heat rate

expansion in ERCOT

The acquisition of Wolf Hollow strengthens Exelon’s position in a

valuable Texas market

720 MW Combined Cycle

Natural Gas Plant

Located in Granbury, Texas

(near Dallas)

40 |

41

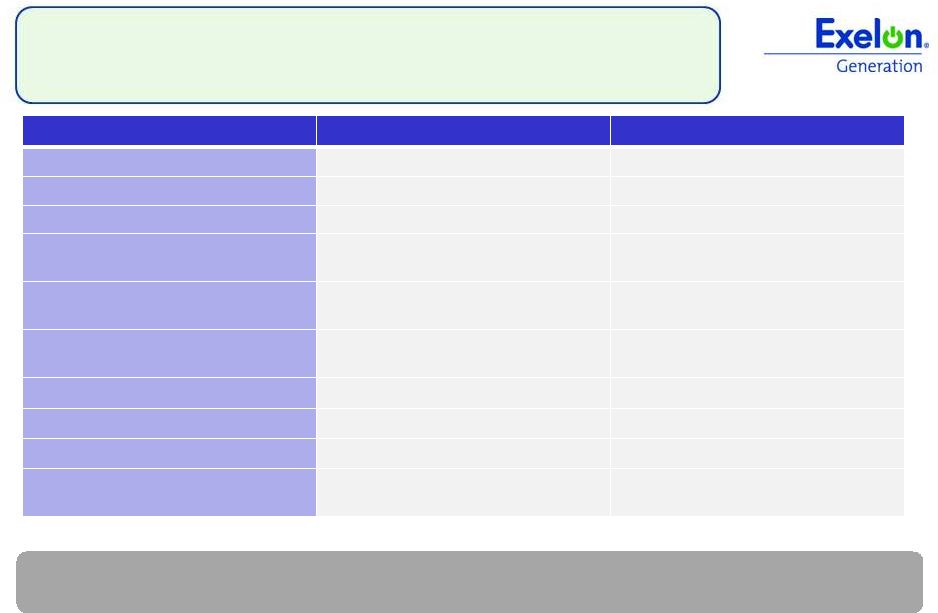

Growing Clean Generation with Uprates

Station

Base Case

MW

Max Potential

MW

MW Online

to Date

Year of Full

Operation

by Unit

MW Recovery & Component Upgrades:

Quad Cities

97

104

99

2011 / 2010

Dresden

3

3

2013 / 2012

Peach Bottom

25

32

2011 / 2012

Dresden

103

110

19

2012 / 2013

Limerick

4

4

2012 / 2013

Peach Bottom

2

2

2014 / 2015

MUR:

LaSalle

35

39

39

2011 / 2011

Limerick

33

41

30

2011 / 2011

Braidwood

34

42

2012 / 2012

Byron

34

42

2012 / 2012

Quad Cities

21

23

2014 / 2014

Dresden

28

31

2014 / 2015

TMI

12

15

2014

EPU:

Clinton

2

2

2

2010

Peach Bottom

134

148

2015 / 2016

LaSalle

303

336

2016 / 2015

Limerick

306

340

2016 / 2017

Total

1,176

1,314

189

(1)

In 2011 dollars. Overnight costs do not include financing costs or cost

escalation.

Est. IRR

Overnight

Cost

(1)

Approval

Process

Project

Duration

Megawatt

Recovery &

Component

Upgrades

12-14%

$790 M

Not required

3-4

Years

MUR

(Measurement

Uncertainty

Recapture)

13-16%

$330 M

Straight

forward

approval

process

2-3

Years

EPU

(Extended

Power Uprate)

10-14%

$2,155 M

Straight

forward

approval

process

3-6

Years

Executing uprate projects across our

geographically diverse nuclear fleet, and

expect to add 99 MW in 2011

Nuclear Uprate Program Summary |

Exelon’s Uprate Program Is a Pragmatic

Approach to Nuclear Growth

42

Key Considerations

Exelon Uprate Program

New Merchant Nuclear

(2)

Overnight cost

(1)

$2,500 –

$2,800 / KW

$4,500 –

$6,000 / KW

Time to market

2 –

6 years

At least 9 years

O&M cost

No additional O&M cost

$10 –

$15 / MWh

Ancillary costs –

NDT, maintenance

capital, etc

Minimal ancillary costs

$ 2 –

$3 / MWh

Asset diversification

Operational risk spread amongst

several assets

Operational risk concentrated to single

asset

Market diversification

Diversify revenue source amongst

several power markets/ regions

Market risk concentrated to one

location

Market timing risk

Lower risk due to phased execution

Risk of hitting low commodity cycle

Regulatory approval

1 –

2 years review period

3-year minimum review period

Financing Source

Leverage balance sheet strength

Loan guarantees needed

Development flexibility

Ability to respond to changing market /

financial conditions

Much less flexibility to cancel

(1)

In 2011 dollars. Overnight costs do not include financing costs or cost

escalation. (2)

Cost estimates are based on Exelon’s internal projections for new merchant

nuclear. Exelon’s

uprate

program

is

a

proven

approach

to

add

clean

generation

to

the

portfolio,

and it provides flexibility to respond to changing economic and market

conditions |

43

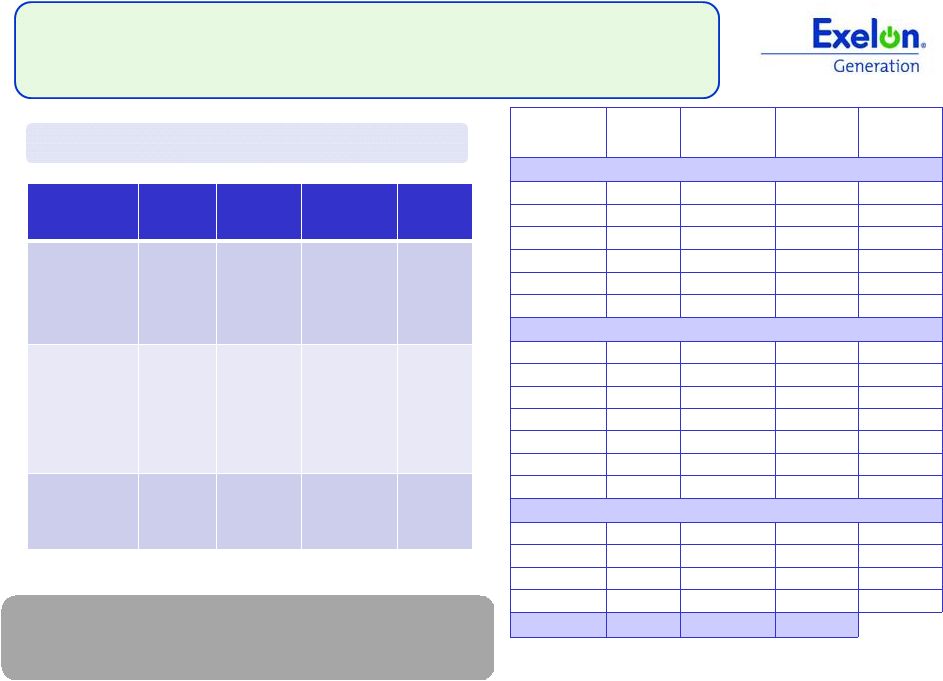

Nuclear Fuel and Outage Management

(1)

Exelon

data

includes

Salem.

The

2009

average

includes

23

days

of

TMI

outage

that

extended

into

2010

for

a

steam

generator

replacement.

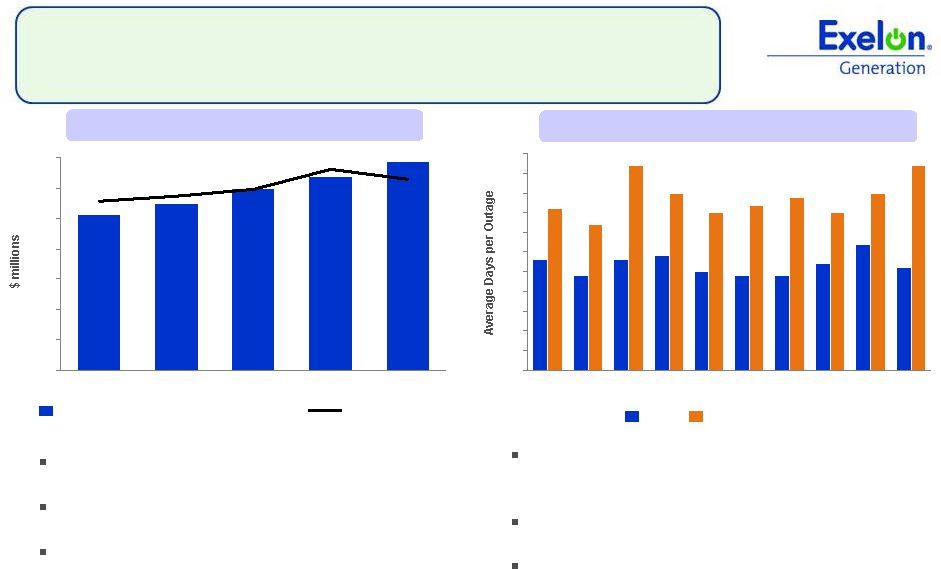

Effectively Managing Nuclear Fuel Spend

Note:

At

100%,

excluding

Salem.

Excludes

costs

reimbursed

under

the

settlement

agreement

with

the

DOE.

Industry Leading Refueling Outage Duration

(1)

All Exelon owned units are on a 24-month

refueling cycle except for Braidwood, Byron and

Salem, which are on 18-month cycles

12 planned refueling outages (six in Spring and

six in Fall) in 2011, including two at Salem

10 planned refueling outages (four in Spring and

six in Fall) in 2012, including one at Salem

0

200

400

600

800

1,000

1,200

1,400

1,200

1,100

2012E

1,025

2015E

2014E

2016E

2013E

1,375

1,275

Nuclear Fuel Capex

Nuclear Fuel Expense (Amortization + Spent Fuel)

0

5

10

15

20

25

30

35

40

45

50

55

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

Industry (w/o Exelon)

Exelon

Exelon Nuclear’s uranium demand is 100%

physically hedged through 2015

Nuclear fuel expenditures are capitalized in the

period of investment

Capitalized nuclear fuel is amortized to expense

over three refueling outage cycles |

Exelon’s actions are aligned with coordination that is taking place across the

U.S. nuclear industry Exelon

agrees

with

the

Commission’s

recognition

of

the

need

for

performance-based,

flexible

approaches

to

address

site-

-

specific circumstances

Other Staff Recommendations:

Implement

other

tier

1

recommendations

from

2013

–

2016

Post Fukushima: NRC Staff Review

Process and Anticipated Implications

Recommendation

Anticipated Impact on Exelon

Exelon Actions

Protect back up

equipment from external

events

and

provide equipment for

multi-unit events (B5b)

2011:

Obtain additional back up equipment to establish multi-unit

capability at dual unit sites and perform evaluations of back up

equipment storage locations at all sites to minimize vulnerability to

external events

2012:

Participate in stakeholder process on equipment and

“reasonable protection”

requirements

Spent Fuel Pool (SFP)

instruments

In or beyond 2012:

Design and install

SFP instrumentation

2011:

Conducting preliminary evaluation of available technology

2012:

Participate in stakeholder process to define requirements.

Potentially

begin

conceptual

design

and/or

installation,

in

line

with

the

schedule to be indentified by the NRC

Reliable hardened vents

for Mark I and II

containment

Beyond 2012:

Evaluate reliability of

existing Mark I hardened vents

(1)

Design and install new Mark II hardened

vents as required in final order

2011:

Evaluate whether procedures or staging can be updated to

improve ease of using hardened containment vents within current

plant configurations

2012:

Participate in developing stakeholder process on hardened

vent criteria and begin conceptual design

Improve station blackout

coping time

2014 and beyond:

Begin implementing

requirements of rule

2011:

Analyzing current extended station blackout capability and

developing actions to improve capability

2012-2013:

Participate in stakeholder process on coping time

requirements

Key

Tier

1

Staff

Recommendations

Exelon expects the costs to comply with NRC recommendations to be manageable

(1)

All Exelon units with Mark I containment have hardened vents.

44

In or beyond 2012:

Develop plans for

reasonably protecting back up equipment

and evaluate new regulatory requirements

to determine whether additional backup or

upgraded equipment is required |

45

Exelon Nuclear Fleet Overview

Plant Location

Type/

Containment

Water Body

License Extension

Status / License

Expiration

(1)

Ownership

Spent Fuel Storage/

Date to lose full core

discharge capacity

(2)

Braidwood, IL

(Unit 1 and 2)

PWR

Concrete/Steel Lined

Kankakee River

Expect to file application in

2013/ 2026, 2027

100%

Dry Cask (Fall 2011)

Byron, IL

(Unit1 and 2)

PWR

Concrete/Steel Lined

Rock River

Expect to file application in

2013/ 2024, 2026

100%

Dry Cask

Clinton, IL

(Unit 1)

BWR

Concrete/Steel Lined / Mark III

Clinton Lake

2026

100%

2018

Dresden, IL

(Unit 2 and 3)

BWR

Steel Vessel / Mark I

Kankakee River

Renewed / 2029, 2031

100%

Dry Cask

LaSalle, IL

(Unit 1 and 2)

BWR

Concrete/Steel Lined / Mark II

Illinois River

2022, 2023

100%

Dry Cask

Quad Cities, IL

(Unit 1 and 2)

BWR

Steel Vessel / Mark I

Mississippi River

Renewed / 2032

75% Exelon, 25%

Mid-American

Holdings

Dry Cask

Limerick, PA

(Units 1 and 2)

BWR

Concrete/Steel Lined / Mark II

Schuylkill River

Filed application in June

2011 (decision expected in

2013) / 2024, 2029

100%

Dry Cask

Oyster Creek, NJ

(Unit 1)

BWR

Steel Vessel / Mark I

Barnegat Bay

Renewed / 2029

(3)

100%

Dry Cask

Peach Bottom, PA

(Units 2 and 3)

BWR

Steel Vessel / Mark I

Susquehanna River

Renewed / 2033, 2034

50% Exelon, 50%

PSEG

Dry Cask

TMI, PA

(Unit 1)

PWR

Concrete/Steel Lined

Susquehanna River

Renewed / 2034

100%

2023

Salem, NJ

(Units 1 and 2)

PWR

Concrete/Steel Lined

Delaware River

Renewed / 2036, 2040

42.6% Exelon, 57.4%

PSEG

Dry Cask

(1)

Operating license renewal process takes approximately 4-5 years from

commencement until completion of NRC review. (2)

The date for loss of full core reserve identifies when the on-site storage pool

will no longer have sufficient space to receive a full complement of fuel from the reactor core. Dry cask

storage

will

be

in

operation

at

those

sites

prior

to

losing

full

core

discharge

capacity

in

their

on-site

storage

pools.

(3)

On December 8, 2010, Exelon announced that Generation will permanently cease

generation operations at Oyster Creek by December 31, 2019. The current NRC license for

Oyster Creek expires in 2029.

Exelon pursues license extensions well in advance of expiration to ensure adequate

time for review by the NRC |

46

Flexible Hedging Program and Diverse

Sales Mix Enhance Portfolio Value

(1) Reflects owned and contracted generation (in MW) as of 9/30/2011.

Excludes PPA with Tenaska Georgia Partners. (2) Data as of 9/30/2011.

Utility procurements includes Full Requirements, Block Energy and Power Sales Agreements.

2012-2014

Sales

as

a

Percentage

of

Expected

Generation

(2)

Current

Owned

&

Contracted

Generation

Capacity

by

Fuel

Type

(1)

43%

Standard Product Sales

27%

Utility Procurements

20%

Retail

4%

Options

5%

Open Generation

PJM East & West

MISO

SPP

Entergy

ERCOT

Multiple

Products

Wholesale

-

OTC, Mid Marketing

and Origination

Retail

-

Multiple

Channels

Multiple

Regions

0

5,000

10,000

15,000

20,000

25,000

30,000

Mid-Atlantic

Midwest

South & West

Total Portfolio

Coal

Gas

Oil

Nuclear

Hydro

Wind/Solar/Other

Standard Products

Full Requirements

Options –

Power, Gas

& Heat Rate

Bilateral Transactions

Exelon Energy |

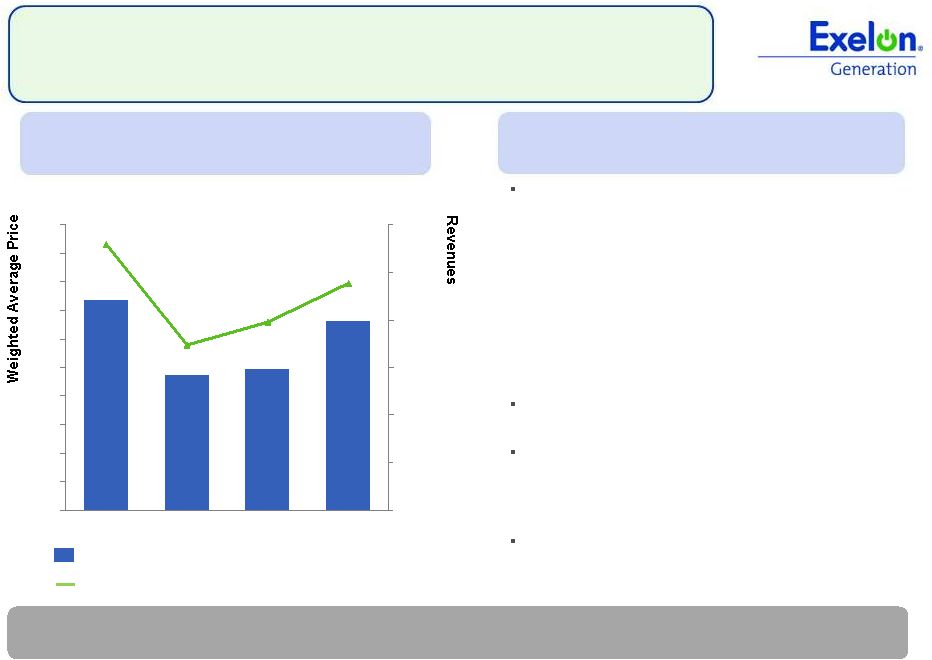

Reliability Pricing Model (RPM)

47

(1)

Weighted average $/MW-Day would apply if all owned generation cleared. Prices

are rounded. Revenues reflect capacity cleared in base and incremental auctions.

NOTE: For definitions of RPM related terms, refer to PJM Manual 18 for capacity

markets at http://pjm.com/documents/manuals.aspx PJM

RPM

Capacity

Prices

and

Revenues

0

20

40

60

80

100

120

140

160

180

200

0

200

400

600

800

1,000

1,200

$99

2012

$133

2013

2014

$95

2011

$148

Exelon fleet weighted average price ($/MW-day)

The Brattle Group assessment of the PJM RPM market

indicates that it has achieved resource adequacy and

reduced costs by fostering competition. The Brattle Group

proposed changes that appear to have some traction

include:

•

Modify the 2.5% holdback so it increases the amount of

generation and premium DR products that will clear in the

base residual auction

•

Update the methodology of calculating the E&AS offset used

in Net CONE for a CT to be consistent with actual margins

•

Increase the slope of the demand curve when supply falls

below reserve margin

AEP Ohio and Duke Ohio are expected to move their

capacity assets and load from their FRR plan into RPM

NJ and MD have both issued RFPs for new CCGTs to

be built in their states, which could possibly be bid into

the 15/16 BRA. Currently, these CCGT projects will be

subject to MOPR when bidding into the capacity auction

PJM reports for PY 14/15 indicate that elevated bidding

most likely reflected environmental compliance costs

and highlight the benefits of Exelon’s regionally

balanced portfolio

Exelon

benefits

from

a

balanced

capacity

position

across

PJM

and

has

significant

revenues

locked in via the PJM capacity market

Revenues ($ millions)

RPM Update

(1) |

48

Exelon Generation Hedging Disclosures

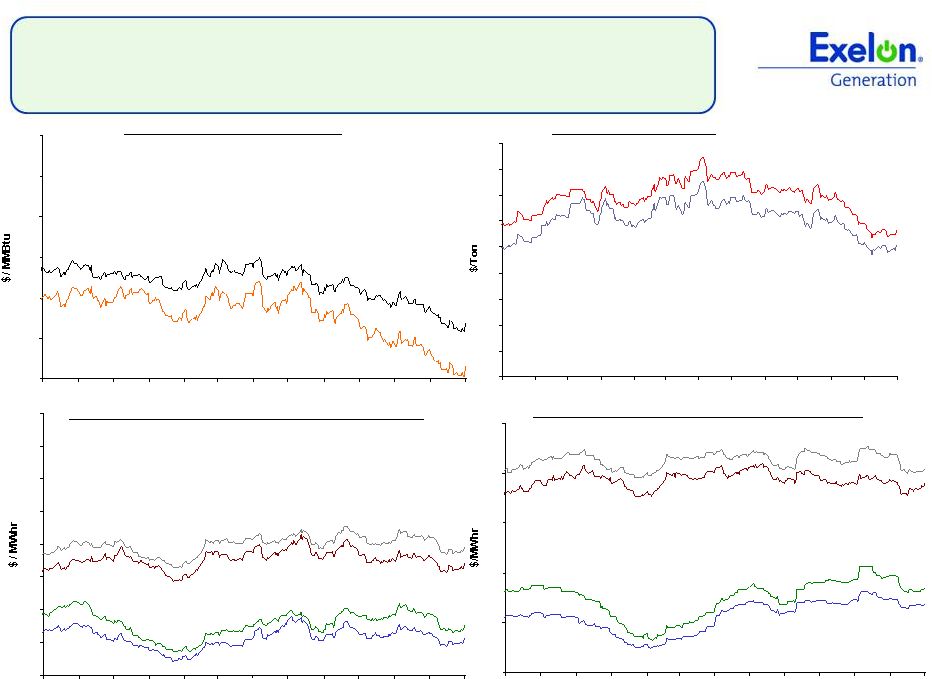

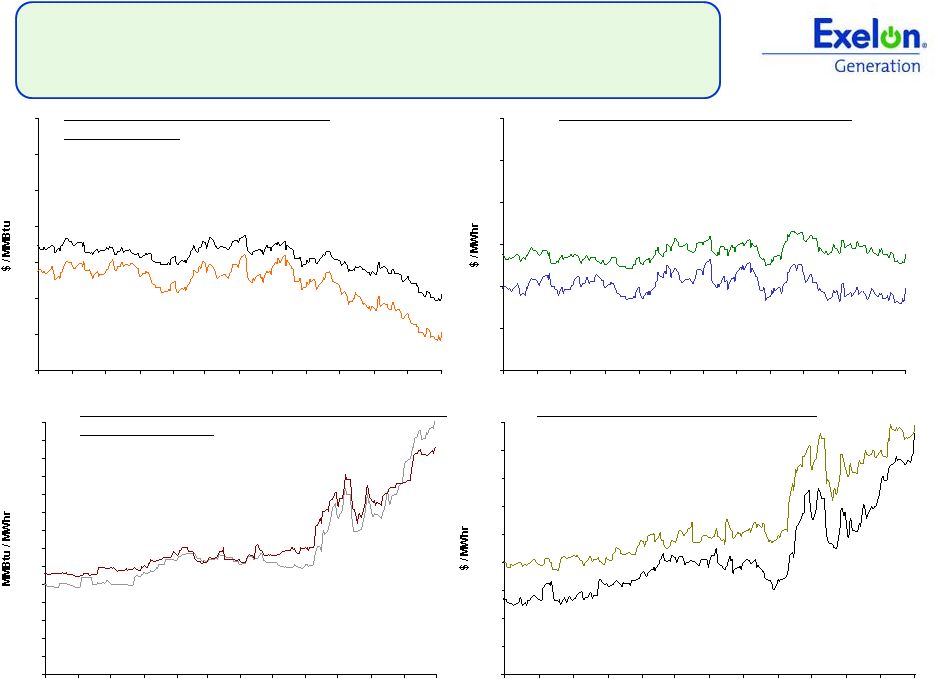

(as of September 30, 2011) |

Important Information

49

The following slides are intended to provide additional information regarding the hedging

program at Exelon Generation and to serve as an aid for the purposes of modeling Exelon

Generation’s gross margin (operating revenues less purchased power and fuel expense). The

information on the following slides is not intended to represent earnings guidance or a forecast

of future events. In fact, many of the factors that ultimately will determine Exelon

Generation’s actual gross margin are based upon highly variable market factors outside of

our control. The information on the following slides is as of September 30, 2011. We

update this information on a quarterly basis. Certain