Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ELECTRONICS FOR IMAGING INC | d251441d8k.htm |

Long-Term Financial Model

Long-Term Financial Model

Vincent Pilette

CFO

Exhibit 99.1 |

What

Do You Need to Know? What Do You Need to Know?

We Have Been Delivering on the Growth Opportunities…

We Have Been Delivering on the Growth Opportunities…

•

Great momentum going into Q4’11

•

Seven consecutive quarters of double-digit revenue growth

•

Four consecutive quarters of double-digit operating margin

•

Reiterating Q4 outlook of $155-160M revenue and $0.31-0.34 EPS

•

Solid revenue growth drivers

•

Plethora of new product introductions in 2

nd

half of 2011

•

Three tuck-in acquisitions closed in 2011

•

Record recurring revenue, ink and software maintenance

•

Multiple drivers of profit growth

•

Inkjet gross margin back to 40% driven by high quality products

•

APPS gross margin expansion as a result of higher sales volume

•

OPEX efficiencies driving towards business target of 40-44% of revenue

•

Active capital management

•

Working capital improvements, growing cash from operations

•

Increased funnel of acquisitions and stock buy-back strategy

2

This information speaks as of the date hereof and is not subject

to update. |

EFI

Total Addressable Market EFI Total Addressable Market

Addressable Market is Growing at High-Single Digit

Addressable Market is Growing at High-Single Digit

Segments

Estimated

Market

CAGR

(’11-14)

Digital Controllers

•

Medium/high-end Controllers

$1.8B

$0.5B

3-5%

Print Production Software

•

Creative Software

•

Offset workflow

•

Print MIS –

Production

•

Print MIS –

Packaging

•

Web-to-Print

•

Other

$5.0B

$0.3B

$0.3B

$0.3B

4-5%

4-5%

~8%

S/WF Digital Printers

•

SWF Printer Ink

•

WF Printer Ink

$1.3B

10-12%

Labeling Digital Printers

•

Digital Printer ink

•

Conversion-ready Analog

$0.7B

13-15%

(1) SOURCE: I.T. Strategies,

Info-Trends, EFI business intelligence

•

Today, EFI’s direct

addressable market

amounts to $3.5B growing

at ~8% CAGR

•

#1 market share in high-

end controllers

•

#1 market share in

business automation

software for commercial

printers

•

Plethora of new product

introductions in Inkjet

3

(2) The 2011E information speaks as of the date hereof and is not subject to

update. |

Historical Revenue Trend & FY 2011 Estimate

Historical Revenue Trend & FY 2011 Estimate

Revenue Mix is Changing and Recurring Revenue is Growing

Revenue Mix is Changing and Recurring Revenue is Growing

4

Two years of double-digit

revenue growth, on track to

pass record year (2007)

Driving revenue mix and

diversification of portfolio

Recurring revenue growing

at 11% CAGR (‘07 –

’11),

43% of non-Fiery revenue,

23% of total revenue

(1) 2011E based on Q4’11 midpoint of company’s outlook (Revenue of

$155-160M and non-GAAP EPS of $0.31-0.34). (2) The 2011E

information speaks as of the date hereof and is not subject to update.

~

~

~

3

2

1 |

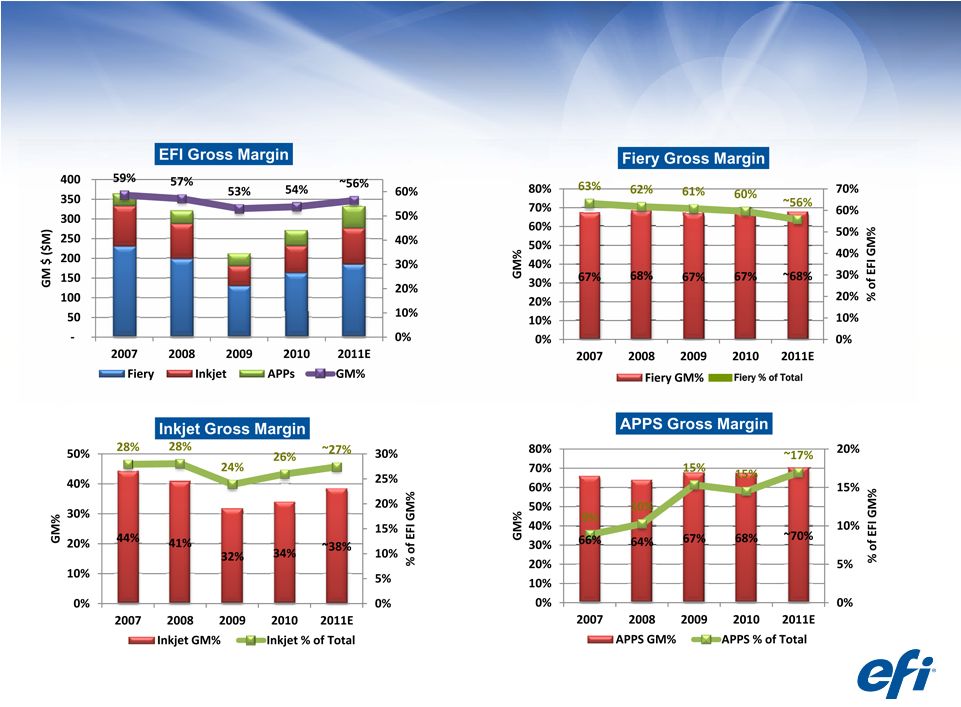

Non-GAAP Gross Margin % Trend

Non-GAAP Gross Margin % Trend

Expanding Gross Margin While Diversifying Gross Profit Sources

Expanding Gross Margin While Diversifying Gross Profit Sources

5

(1) 2011E based on Q4’11 midpoint of company’s outlook (Revenue of

$155-160M and non-GAAP EPS of $0.31-0.34). (2) Non-GAAP

numbers have been adjusted to exclude certain items. See GAAP to non-GAAP reconciliation and our use of non-GAAP information.

(3) The 2011E information speaks as of the date hereof and is not subject to

update. |

Cost

Structure Trend Cost Structure Trend

Lowering Spend as % of Revenue

Lowering Spend as % of Revenue

•

OPEX efficiencies driving towards lower % of revenue

•

OPEX balance between technology investment and direct sales capacity

•

Infrastructure savings leading to higher % of innovation and variable spend

6

(2) Non-GAAP numbers have been adjusted to exclude certain items. See

GAAP to non-GAAP reconciliation and our use of non-GAAP information.

(1) 2011E based on Q4’11 midpoint of company’s outlook (Revenue of

$155-160M and non-GAAP EPS of $0.31-0.34). (3) The 2011E

information speaks as of the date hereof and is not subject to update. |

Non-GAAP P&L

Non-GAAP P&L

Returning to Historical Operating Profit Margin Performance

Returning to Historical Operating Profit Margin Performance

2007

2007

2008

2008

2009

2009

2010

2010

2011E

2011E

Revenue

YoY %

$621M

+10%

$560M

-10%

$401M

-28%

$504M

+26%

$586M

+16%

GM %

58.5%

57.1%

53.0%

53.8%

~56%

OPEX

% of Rev

$285M

46%

$278M

50%

$230M

57%

$235M

47%

~$263M

~45%

OP

% of Rev

$78M

12.6%

$42M

7.5%

($18M)

(4.5%)

$36M

7.1%

~$66M

~11%

EPS

$1.19

$0.74

($0.22)

$0.59

$1.08

•

2011 return to double

digit operating profit

margin

•

Moving towards

sustainable profit drop

rate of ~25%+ on

annual basis

•

2011E OP and EPS

growth > 80% YoY

driven by gross margin

improvement and

increased spend

productivity

7

(1) 2011E based on Q4’11 midpoint of company’s outlook (Revenue of

$155-160M and non-GAAP EPS of $0.31-0.34). (3) The 2011E

information speaks as of the date hereof and is not subject to update. (2)

Non-GAAP numbers have been adjusted to exclude certain items. See GAAP to non-GAAP reconciliation and our use of non-GAAP information. |

Balance Sheet Optimization

Balance Sheet Optimization

Growing Cash from Operations

Growing Cash from Operations

Key

Balance

Sheet

Figures

Q3’07

Q3’08

Q3’09

Q3’10

Q3’11

Total

Cash

&

Investments*

$550M

$202M

$270M

$207M

$203M

YTD Cash Flow from

Operations

% of Revenue

$54M

12%

$25M

6%

($26M)

--

$19M

5%

$43M

10%

Working Capital (Days)

52.5

63.7

80.7

61.0

59.2

Accounts Receivable

(net)

$97M

$97M

$80M

$86M

$91M

DSO

56.5

61.4

72.5

61.0

57.2

Net Inventory

$37M

$48M

$44M

$45M

$47M

Inventory Turns

7.0

5.3

4.5

5.5

5.4

Total Assets

$1,199M

$865M

$731M

$685M

$720M

* Excludes $56.9 million long term restricted investments

8 |

Capital Allocation Strategy

Capital Allocation Strategy

•

Continued focus on cash generation

(~1 x OP on annual basis)

•

Use

of

cash:

the

Board

and

Management will continue to evaluate

options, including:

-

M&A-

strengthening our existing segments,

with accretive deals

-

Continue to

reduce the shares of common

stock outstanding

-

Accumulate cash

•

Currently

we

are

not

focused

on:

-

Transformative acquisition

-

Dividend

9

The 2011E information speaks as of the date hereof and is not subject to

update. |

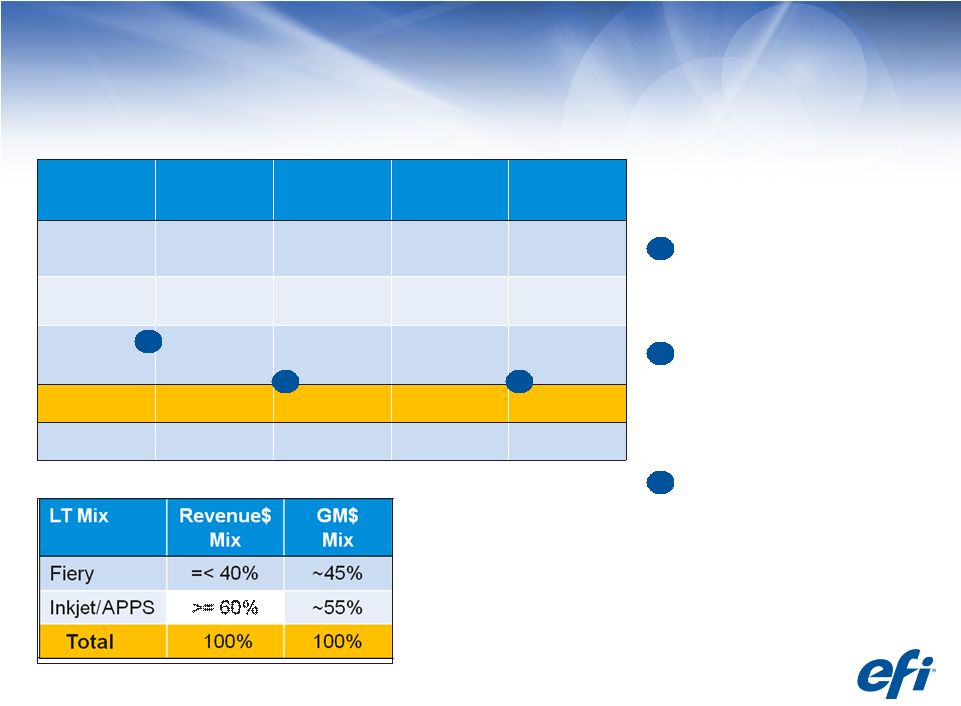

Non-GAAP Long-Term Financial Model

Non-GAAP Long-Term Financial Model

Targeting 12-15% Operating Profit Margin

Targeting 12-15% Operating Profit Margin

2011

LT Model

L-T Growth

Gross

Margin

OPEX

Op Margin

Fiery

GDP+

66% -

68%

Inkjet

10% -15%

~ 40%

APPS

10% -

20%

> 70%

Total

~ 10%

55%-

57%

40%-

44%

12%-

15%

53-55%

40-44%

10-14%

~10%

2010 LT model

10

Raising long term APPS

revenue growth target to

10-20% YoY

Raising EFI long-term GM

rate to 55-57% driven by

APPS GM expansion and

revenue mix

Raising EFI long-term

operating profit margin

range to 12-15% of revenue

1

1

2

2

3

3

The 2011E information speaks as of the date hereof and is not subject to

update. 6-10%

6-10%

GDP+

66-68%

~40%

67-69%

2010 LT model

2010 LT model

2010 LT model |

Appendix

Appendix |

About our Non-GAAP Net Income

About our Non-GAAP Net Income

and Adjustments

and Adjustments

This information speaks as of the date hereof and is not subject

to update.

12 |

Q3

2011 Results Summary Q3 2011 Results Summary

.

This information speaks of the date hereof and is not subject to

update.

$M

Q3 2011

Q2 2011

% Change

Q3 2010

% Change

NON-GAAP

Revenue

147.3

$

141.2

$

4%

129.0

$

14%

Operating Profit

16.5

14.1

17%

11.1

49%

Operating Profit %

11.2%

10.0%

1.2 pts

8.6%

2.6 pts

Net Income

11.6

11.3

3%

10.7

8%

EPS

0.25

$

0.23

$

9%

0.23

$

9%

GAAP

GAAP Net Income

6.1

3.6

69%

13.4

(54%)

GAAP EPS

0.13

$

0.07

$

86%

0.29

$

(55%)

Non-GAAP numbers have been adjusted to exclude certain items. See GAAP to

non-GAAP reconciliation and our use of non-GAAP information.

13 |

Reconciliation of GAAP to Non-GAAP

Reconciliation of GAAP to Non-GAAP

•

This information speaks of the date hereof and is not subject to update.

•

Non-GAAP numbers have been adjusted to exclude certain items. See our description of

our use of non-GAAP information. 14

GAAP to Non-GAAP Reconciliation ($M)

Q110

Q210

Q310

Q410

FY10

Q111

Q211

Q311

FY11 YTD

GAAP

Net Income (Loss)

(11.4)

(2.5)

13.4

8.0

7.5

6.2

3.6

6.1

16.0

EPS

(0.25)

$

(0.06)

$

0.29

$

0.17

$

0.16

$

0.13

$

0.07

$

$0.13

0.33

$

ADJUSTMENTS

COGS: Excess Solvent Inventories &

End of Life Purchases

-

2.3

-

-

2.3

-

-

-

$

-

COGS: Stock Based Compensation Expense

0.3

0.3

0.3

0.2

1.0

0.2

0.4

0.7

$

1.3

OPEX: Stock Based Compensation Expense

3.7

3.0

4.6

3.6

14.9

5.0

6.7

4.6

$

16.2

OPEX: Amortization of Identified Intangibles

2.9

2.9

3.4

3.2

12.4

3.4

3.0

2.3

$

8.7

OPEX: Acquisition-Related Transaction Costs

0.6

0.5

0.1

-

1.2

0.6

0.2

0.7

$

1.6

OPEX: Change in Fair Value of

Contingent Consideration

-

-

-

-

-

-

-

1.5

$

1.5

OPEX: Restructuring and Other

2.0

1.0

1.0

0.3

4.3

1.4

0.4

0.6

$

2.3

OI&E: Gain on Sale of Minority Investment

in a Privately-Held Company

-

-

-

-

-

-

-

(2.9)

$

(2.9)

Tax Effect of Non-GAAP Adjustments

1.7

(3.4)

(12.0)

(2.0)

(15.7)

(3.3)

(3.0)

(2.0)

$

(8.3)

NON-GAAP

Non-GAAP Net Income (Loss)

(0.1)

$

4.0

$

10.7

$

13.3

$

27.9

$

13.5

$

11.3

$

11.6

$

36.4

$

Non-GAAP EPS

-

$

0.09

$

0.23

$

0.28

$

0.59

$

0.28

$

0.23

$

$0.25

0.75

$ |

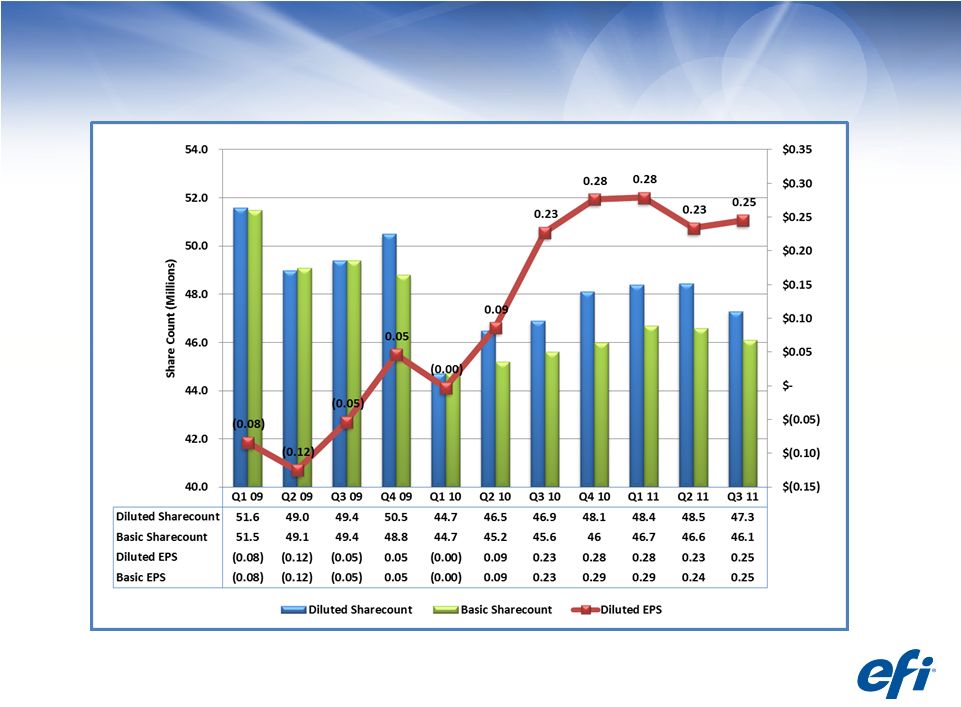

Share Count & Non-GAAP EPS

Share Count & Non-GAAP EPS

Non-GAAP numbers have been adjusted to exclude certain items. See GAAP to

non-GAAP reconciliation and our use of non-GAAP information.

15 |