Attached files

| file | filename |

|---|---|

| EX-3.3 - EX-3.3 - CYOPTICS INC | a2206034zex-3_3.htm |

| EX-3.2 - EX-3.2 - CYOPTICS INC | a2206034zex-3_2.htm |

| EX-10.4 - EX-10.4 - CYOPTICS INC | a2206034zex-10_4.htm |

| EX-23.1 - EX-23.1 - CYOPTICS INC | a2205179zex-23_1.htm |

| EX-21.1 - EX-21.1 - CYOPTICS INC | a2206034zex-21_1.htm |

| EX-10.1 - EX-10.1 - CYOPTICS INC | a2206034zex-10_1.htm |

| EX-10.23 - EX-10.23 - CYOPTICS INC | a2206034zex-10_23.htm |

| EX-10.20 - EX-10.20 - CYOPTICS INC | a2206034zex-10_20.htm |

As filed with the Securities and Exchange Commission on November 4, 2011

Registration No. 333-176262

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

CyOptics, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

3674 (Primary Standard Industrial Classification Code Number) |

95-4745030 (I.R.S. Employer Identification Number) |

9999 Hamilton Blvd.

Breinigsville, PA 18031

Tel: (484) 391-2061

Fax: (484) 397-2014

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Ettore J. Coringrato, Jr.

President and Chief Executive Officer

9999 Hamilton Blvd.

Breinigsville, PA 18031

Tel: (484) 391-2061

Fax: (484) 397-2014

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Caine Moss Richard A. Kline Goodwin Procter LLP 135 Commonwealth Drive Menlo Park, CA 94025 Tel: (650) 752-3100 Fax: (650) 853-1038 |

Jeffrey D. Saper Robert D. Sanchez Daniel S. Peale Wilson Sonsini Goodrich & Rosati Professional Corporation 1700 K Street, NW, Fifth Floor Washington, D.C. 20006 Tel: (202) 973-8800 Fax: (202) 973-8899 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Prospectus

SUBJECT TO COMPLETION, DATED NOVEMBER 4, 2011

Shares

Common Stock

This is the initial public offering of common stock of CyOptics, Inc. We are offering shares of common stock. The estimated initial public offering price is between $ and $ per share.

We intend to apply to have our common stock listed on The NASDAQ Global Select Market under the symbol "CYOP."

Investing in our common stock involves risks. See "Risk factors" beginning on page 12 of this prospectus.

| |

Per share | Total | |||||

|---|---|---|---|---|---|---|---|

Initial public offering price |

|||||||

Underwriting discounts and commissions |

|||||||

Proceeds to CyOptics (before expenses) |

|||||||

We have granted the underwriters a 30-day option to purchase up to additional shares of common stock from us on the same terms and conditions set forth above to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2011.

J.P. Morgan |

Barclays Capital |

Needham & Company, LLC |

Raymond James |

Roth Capital Partners |

Prospectus dated , 2011

You should rely only on the information contained in this prospectus and in any free writing prospectus prepared by or on behalf of us. We have not, and the underwriters have not, authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Through and including, , 2012 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside the United States: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes thereto and the information set forth under the sections "Risk factors" and "Management's discussion and analysis of financial condition and results of operations," in each case appearing elsewhere in this prospectus.

Company overview

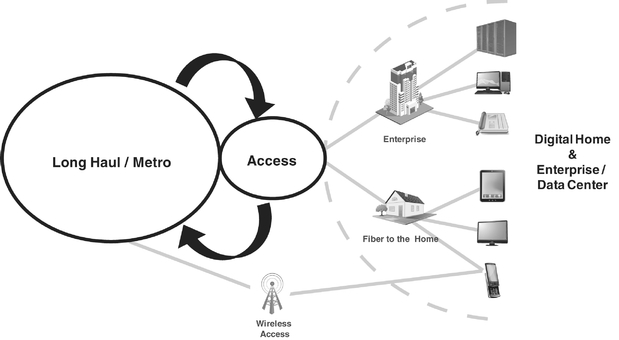

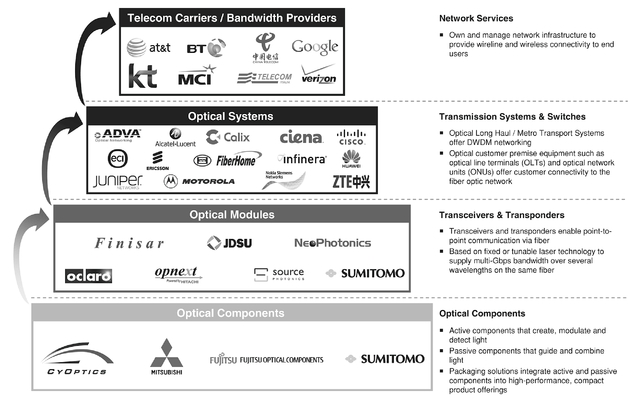

We are a leading platform-based provider of core optical technologies enabling bandwidth for high-speed networks. Our solutions provide the fundamental building blocks—the creation, modulation, routing and detection of light—for optical networking, which is a high-performance, cost-effective alternative to traditional networking technologies. We produce active components that create and detect light, passive components that guide and combine light, and packaging solutions that integrate active and passive components into compact, high-performance, power- and cost-efficient products. Through our vertically integrated technology and manufacturing platforms, we design, fabricate and package a broad portfolio of optical components—lasers, detectors, transmitters, receivers and modulators—for module manufacturers and systems providers, including network equipment manufacturers, who sell to communication service providers and enterprises in the Access, Enterprise/Data Center and Long Haul/Metro segments of the communications network, and for other emerging end market applications, such as defense and avionics, high performance computing, medical and security.

Network traffic continues to increase rapidly in volume, volatility and complexity, driven by unprecedented demand for bandwidth-intensive, rich content such as streaming and real-time video, the growth of online social networking and cloud-based computing services, and the proliferation of mobile devices. Optical networking is becoming the de facto transport technology with its attractive bandwidth capacity, reach, reliability, low power consumption and network intelligence capabilities. Within the optical networking value chain, innovation at the optical component level is driving increased functionality, performance and cost savings, and gradually capturing an increasing percentage of optical networking spending.

We believe we are one of the few companies in our industry with vertically integrated technology and manufacturing platforms that span from Indium Phosphide and Silica-on-Silicon fabrication to proprietary, highly automated assembly and test facilities. Our in-house capabilities allow us to offer a dependable supply of quality optical components and modules. Our photonic integrated circuit and components on board solutions incorporate greater functionality and intelligence at the component level, which enables us to serve next-generation, higher speed networks. We continue to leverage and expand upon more than 25 years of research, development and investments, including by the former optoelectronics divisions of Lucent Technologies and Bell Labs, which we obtained through our acquisition of a division of TriQuint Semiconductor, Inc. in 2005, and our broad portfolio of proprietary technologies, which form the foundation of our technical expertise and extensive know-how.

1

We sell our products to a global, diversified customer base that includes module manufacturers and network equipment manufacturers, who in turn sell to communication service providers and enterprises, and to defense and avionics contractors. Our largest customers by revenue during 2010 include Cambridge Industries Group, Ltd., Ciena Corporation, Finisar Corporation, Huawei Technologies Co., Ltd., Source Photonics, Inc. and Superxon Technology, Ltd, and our largest customer by revenue during 2010 in the defense and avionics markets is Lockheed Martin Corporation. We believe that greater than 70% of our revenue was sole-sourced in 2010, which we believe demonstrates the differentiation of our products and gives us significant insight into our customers' product and technology roadmaps.

We believe we have an attractive financial profile, with strong top-line performance. Furthermore, our strong, collaborative design relationships with our customers, which provide us with an understanding of forward-looking customer demand profiles and percent share awards, in combination with our backlog levels provides us with a degree of revenue visibility for the following quarter and also helps us manage our short-term cost structure. We have grown our revenue at a 31.3% compound annual growth rate, or CAGR, from 2005 to 2010 and 55.4% period over period from the six months ended June 30, 2010 to the six months ended June 30, 2011. We have also experienced significant margin expansion, as our income (loss) from operations margin increased from 9.2% in the six months ended June 30, 2010 to 12.9% in the six months ended June 30, 2011. In addition, our non-GAAP adjusted income (loss) from operations margin increased from 11.6% in the six months ended June 30, 2010 to 13.9% in the six months ended June 30, 2011. Adjusted income (loss) from operations margin is not calculated in accordance with generally accepted accounting principles in the United States, or GAAP, and should not be considered as an alternative to income (loss) from operations margin calculated and presented in accordance with GAAP. A reconciliation of this non-GAAP measure to income (loss) from operations margin calculated and presented in accordance with GAAP is included in this prospectus in "Management's discussion and analysis of financial condition and results of operations—Key business metrics—Use of non-GAAP financial measures." We incurred aggregate net losses of $96.1 million from 2005 to 2010.

Industry

Network traffic continues to increase rapidly in volume, volatility and complexity. To address this trend, communication service providers and enterprises are expanding and upgrading their existing network infrastructures.

Optical networking is becoming the de facto transport technology due to its attractive bandwidth capacity, reach, reliability, low power consumption and network intelligence capabilities. Optical components and modules provide the fundamental building blocks—the creation, modulation, routing and detection of light—for the optical network ecosystem, from Long Haul/Metro, Access to the Digital Home, through fiber-to-the-home, to Enterprise/Data Center. Ovum, a third-party industry analyst, estimates the market for optical components and modules was $5.6 billion in 2010 and is forecasted to grow to $10.5 billion in 2015, representing a 13.4% CAGR. However, we believe there are specific market segments and

2

geographies we address that are expected to meaningfully exceed that growth rate. These include:

- •

- Access network segment. Access networks increasingly use

high-speed optical fiber in new deployments and as a replacement for copper lines in legacy networks. Passive optical networks (PON) are currently the fastest-growing broadband Access

technology. Gigabit passive optical networks (GPON) are expected to continue to gain market share over prior passive optical network technologies. According to Ovum, gigabit passive optical

network transceiver sales are projected to grow from $288.5 million in 2010 to $576.7 million in 2015, representing a 14.9% CAGR. However, with China's aggressive fiber-to-the-home

rollout, Dell'Oro, a third-party industry analyst, expects gigabit passive optical network revenue in China to grow by as much as 40% year-over-year in 2011.

- •

- Enterprise/Data Center network segments. Fueled primarily by

server virtualization and cloud computing, server-to-switch connection rates are moving rapidly from 1 gigabit Ethernet to 10 gigabit Ethernet. The adoption of

10 gigabit Ethernet is accelerating the migration of copper to optical fiber and the need for 40 gigabit Ethernet and 100 gigabit Ethernet on data center core uplinks. Traditional

architectures are no longer adequate for 40 gigabit Ethernet and 100 gigabit Ethernet, which require multi-channel architectures to meet the requirements of next-generation

switches. According to Ovum, 100 gigabit Ethernet transceiver sales will increase from $51.6 million in 2010 to $712.6 million in 2015, representing a 69.1% CAGR.

- •

- Long Haul/Metro network segments. Communication service

providers are accelerating deployments of next-generation 40 gigabits per second, or Gbps, and 100Gbps networks. A key emerging technology for next-generation 40Gbps and

100Gbps networks is coherent detection. According to Ovum, revenue from 100Gbps coherent modules will increase from $35.3 million in 2010 to $786.5 million in 2015, representing an 86.0%

CAGR, while revenue from 40Gbps and 100Gbps Long Haul/Metro receivers is forecasted to grow from $66.0 million in 2010 to $494.8 million in 2015, representing a 49.6%

CAGR.

- •

- Other emerging end market applications. Optical components and modules are increasingly being used in emerging end market applications, such as defense and avionics, high performance computing, medical and security, which require high-speed, high-bandwidth data transmission, higher levels of integration and/or high performance laser/receiver solutions.

Demand for increased bandwidth capacity and lower costs is driving higher levels of integration at the module and system level to achieve increased faceplate density, lower power dissipation and greater system functionality. This trend is creating an opportunity for optical component manufacturers to deliver next-generation optical modules and optical components on board solutions, with the technical capabilities mentioned above, directly to network equipment manufacturers. Our existing products and manufacturing solutions provide these key technical capabilities, which we believe enable us to meet the requirements necessary to address current optical networking trends. We believe that innovation at the optical component level is driving increased functionality, higher performance and cost savings in optical networking solutions. Innovative optical component solutions, many of which are based on photonic integrated circuits, such as multi-channel coherent components and tunable lasers, are expected to comprise an increasing percentage of total optical system capital expenditures.

3

For example, according to Cisco Systems, while optical components represent approximately 19% of capital expenditures for 10Gbps systems, they represent approximately 68% for 100Gbps systems.

We believe optical module manufacturers and network equipment manufacturers face many challenges, such as meeting demand for high-performance, high-speed optical solutions, increasing system complexity, decreasing time to market, and reducing capital investment and operating expenses for service providers. We believe these challenges present opportunities that our solutions can address.

Our solutions

We design, fabricate and package a broad portfolio of optical components, including lasers, detectors, transmitters, receivers and modulators. The key benefits of our solutions include:

- •

- High levels of photonic integration. Our in-house

Indium Phosphide and Silica-on-Silicon technology platforms and diverse toolbox of device elements enable the efficient design and scalable, high volume fabrication of a broad

variety of highly integrated photonic integrated circuits that allow us to produce small, reliable and power-efficient solutions.

- •

- High bit rate products. Our high bit rate, bidirectional

optical subassembly products are used in next-generation Access networks (10Gbps or higher), while our photonic integrated circuit-based components and

next-generation modules are used for communication switches in high capacity Enterprise/Data Center (40Gbps or higher) and coherent Long Haul/Metro (40Gbps or higher) networks.

- •

- Cost-efficient solutions. Our highly automated

chip fabrication operations and packaging operations enable us to manufacture our products at high yields and low labor cost, while the re-usability, re-configurability and

scalability of our assembly and test equipment reduces our on-going capital needs. We believe these operational efficiencies enable us to deliver products that are at a lower or competitive cost

relative to our competitors while maintaining a differentiated product portfolio.

- •

- Tailored solutions. We leverage our in-house

hybrid and monolithic photonic integration techniques, highly automated assembly and test manufacturing, cooled and uncooled Indium Phosphide laser fabrication capabilities, and our array of device

and packaging technologies, to tailor our products to each communications network segment.

- •

- Consistent quality and reliability. Our automated manufacturing and control systems that we have built into our device fabrication, packaging and testing processes enable us to deliver products with stable performance, high quality and a high level of reliability.

Competitive strengths

We believe our key competitive strengths include the following:

- •

- Strong institutional knowledge base and track record of technology innovation. We develop industry-leading optical components, including photonic integrated circuit-based components and next-generation modules, by leveraging and expanding upon more than 25 years of investments including those made by the former optoelectronics divisions of

4

Lucent Technologies and Bell Labs, which we obtained through our acquisition of a division of TriQuint Semiconductor, Inc. in 2005, and our broad portfolio of proprietary technologies, which form the foundation of our extensive technical expertise and know-how.

- •

- Greater intelligence at the component level. As the industry

migrates to higher speed networks, increased system-level consolidation and integration is expected to increase optical components' share of capital expenditures and enhance opportunities for

differentiation. Our photonic integrated circuit and components on board solutions, which provide significant performance and cost advantages over traditional, non-integrated components, are well

positioned to capture a larger share of the optical value chain bill of materials at higher network speeds.

- •

- Vertical integration. We believe we are one of the few

companies in our industry with vertically integrated technology and manufacturing platforms that span from Indium Phosphide and Silica-on-Silicon fabrication to proprietary,

highly automated assembly and test facilities. Our comprehensive in-house capabilities allow us to offer our customers a dependable supply of quality optical components and modules, giving

us significant time-to-market, time-to-volume and cost advantages and the ability to respond more quickly to changing market and customer requirements.

- •

- Industry-leading market position. We are a leader in several

of our served market segments and are positioned to be a leader in next-generation components on board and photonic integrated circuit solutions. For example, we believe that our

fiber-to-the-home, bidirectional optical subassembly products were deployed in 49.5% of all gigabit passive optical network and Ethernet passive optical network optical line terminals and 47.3%

of all gigabit passive optical network optical network units sold worldwide in 2010.

- •

- Diversity across network segments, products and

customers. Our revenues are diversified across network segments, allowing us to capitalize on growth in investment cycles in the communications network, and across

products, with more than 2,500 products across various product types. We also have a large, global and diversified customer base.

- •

- Experienced management team with strong execution track-record. Most of our executive officers have more than 15 years of relevant industry experience, with the substantial majority having more than 25 years of relevant experience. Members of our management team and board of directors also played integral roles in leading Lucent Technologies' optoelectronic components business in 2000. We have acquired and successfully integrated five businesses since 2003, and have grown sales from $27.8 million in 2005 to $108.3 million in 2010, representing a 31.3% CAGR.

5

Our strategy

Our goal is to become the leading provider of high-performance optical technologies that enable the rapid growth in high-speed optical networking communications. Key elements of our strategy are as follows:

- •

- Extend leadership in fiber-to-the-home. We intend to maintain

our strong position in our core fiber-to-the-home markets and extend our market share in gigabit passive optical networks by winning new customers and introducing next generation products. We plan to

take advantage of market disruption and product cycle transitions by providing an alternative to traditional transceiver vendors through our bidirectional optical subassembly product offerings and by

developing new products to address emerging fiber-to-the-home applications and technologies.

- •

- Capture an increasing share of the Enterprise/Data Center and Long-Haul/Metro market

segments. We intend to leverage our technology leadership, Indium Phosphide and Silica-on-Silicon integration and

high-performance packaging to establish leadership in 40Gbps and 100Gbps Ethernet multi-channel photonic integrated circuits, receivers and miniaturized tunable lasers for coherent

applications and tunable 10Gbps transmit optical subassembly products for both module manufacturers and network equipment manufacturers. Our goal is to become the market leader in these segments

through a combination of high performance, on-time delivery and low manufacturing cost.

- •

- Continue to grow our defense and avionics business and other emerging end market

applications. We intend to continue to leverage our differentiated technologies and U.S.-based design and manufacturing to address the growing demand

for optical components and modules in defense and avionics and other emerging end market applications.

- •

- Continue our gross margin expansion. We intend to continue

our gross margin improvement through increased scale, manufacturing efficiencies and continued introduction of higher performance products with greater component-level intelligence and integrated

functionality to module manufactures and network equipment manufacturers.

- •

- Selectively pursue complementary acquisitions. We intend to continue to selectively pursue acquisitions that accelerate our revenue growth, complement our strengths, help us execute our strategies and grow our addressable markets.

6

Risk factors

Our business is subject to numerous risks and uncertainties, such as those highlighted in "Risk factors" immediately following this prospectus summary, including:

- •

- We are subject to the cyclical nature of the markets in which we compete and any future downturn may reduce demand for our

products and revenue;

- •

- If spending for optical communications networks does not continue to grow as expected, our business may suffer;

- •

- Given the high fixed cost associated with our vertically integrated business, a reduction in demand for our products may

adversely impact our gross profits and our results of operations;

- •

- We are dependent on our key customers for a significant portion of our revenue and the loss of, or a significant reduction

in orders from, any of our key customers may reduce our revenue and adversely impact our results of operations;

- •

- We face intense competition and continuous pricing pressure in our industry, which could negatively impact our results of

operations and market share; and

- •

- We must continually achieve new design wins and enhance existing products or our business may be harmed.

Corporate information

We were incorporated in the State of Delaware in 1999. Our principal executive offices are located at 9999 Hamilton Boulevard, Breinigsville, Pennsylvania 18031, and our telephone number is (484) 391-2061. Our website address is www.cyoptics.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider information contained on our website as part of this prospectus or in deciding whether to purchase shares of our common stock.

Our name is a trademark of CyOptics, Inc. for which we are seeking registration in the United States and selected international jurisdictions. This prospectus contains additional trade names and trademarks of ours and of other companies.

This summary highlights selected information appearing elsewhere in this prospectus and does not contain all the information you should consider before investing in our common stock. You should carefully read this prospectus in its entirety before investing in our common stock, including "Risk factors," and our consolidated financial statements and related notes included elsewhere in this prospectus.

7

Common stock offered by us: Shares

Common stock to be outstanding after this offering: Shares

Use of proceeds

We intend to use the net proceeds from this offering for working capital and general corporate purposes, including capital expenditures. We also may use a portion of the net proceeds to selectively pursue acquisitions that complement our strengths and help us execute our strategies or to repay some or all of the outstanding amounts under our credit facilities. However, we have no understandings or agreements with respect to any such acquisition or investment or debt repayment. See "Use of proceeds."

Proposed NASDAQ Global Select Market symbol: "CYOP"

The number of shares of our common stock to be outstanding following this offering is based on 14,359,377 shares of our common stock outstanding as of June 30, 2011 on a pro forma basis and excludes:

- •

- 1,665,343 shares of common stock issuable upon the exercise of options outstanding as of June 30, 2011, with

a weighted average exercise price of $2.92 per share;

- •

- 26,038 shares of common issuable upon the exercise of outstanding warrants, with a weighted average exercise price of

$10.03 per share; and

- •

- shares of our common stock reserved for future issuance under our stock-based compensation plans, including sh ares of common stock reserved for issuance under our 2011 Stock Option and Incentive Plan, which will become effective in connection with this offering, and any future increase in shares reserved for issuance under such plan.

Unless otherwise noted, the information in this prospectus reflects and assumes the following:

- •

- the conversion of all outstanding shares of our convertible preferred stock into an aggregate of 13,064,838 shares of

common stock upon the closing of this offering;

- •

- a 1-for-52 reverse stock split effected on January 13, 2011;

- •

- the filing of our amended and restated certificate of incorporation immediately prior to the effectiveness of this

offering; and

- •

- no exercise by the underwriters of their over-allotment option.

8

Summary consolidated financial data

The tables below summarize our consolidated financial data. The following summary financial data should be read together with our consolidated financial statements and related notes and "Management's discussion and analysis of financial condition and results of operations" included elsewhere in this prospectus. The data for each of the three years ended December 31, 2010, 2009 and 2008 have been derived from our audited consolidated financial statements appearing elsewhere in this prospectus. The data for the six months ended June 30, 2011 and 2010 have been derived from our unaudited condensed consolidated financial statements appearing elsewhere in this prospectus. The historical results presented below are not necessarily indicative of financial results to be achieved in future periods.

| |

Year ended December 31, | Six months ended June 30, | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except for share and per share amounts) |

||||||||||||||||||||

| 2010 |

2009 |

2008 |

2011 |

2010 |

||||||||||||||||

| |

|

|

|

(unaudited) |

||||||||||||||||

Consolidated Statement of Operations Data: |

||||||||||||||||||||

Total revenues |

$ | 108,336 | $ | 65,730 | $ | 72,564 | $ | 76,611 | $ | 49,290 | ||||||||||

Cost of revenues |

79,375 | 60,646 | 63,157 | 55,894 | 36,272 | |||||||||||||||

Gross profit |

28,961 | 5,084 | 9,407 | 20,717 | 13,018 | |||||||||||||||

Gross margin |

26.7% | 7.7% | 13.0% | 27.0% | 26.4% | |||||||||||||||

Operating expenses: |

||||||||||||||||||||

Research and development |

12,010 | 19,540 | 19,031 | 7,324 | 5,754 | |||||||||||||||

Sales and marketing |

2,671 | 3,181 | 3,888 | 1,736 | 1,253 | |||||||||||||||

General and administrative |

3,270 | 7,972 | 5,904 | 1,811 | 1,469 | |||||||||||||||

Severance and liquidation expenses |

— | 6,465 | — | — | — | |||||||||||||||

Asset impairment |

— | 3,221 | 9,841 | — | — | |||||||||||||||

Total operating expenses |

17,951 | 40,379 | 38,664 | 10,871 | 8,476 | |||||||||||||||

Income (loss) from operations |

11,010 | (35,295 | ) | (29,257 | ) | 9,846 | 4,542 | |||||||||||||

Interest expense, net |

(1,328 | ) | (1,617 | ) | (2,148 | ) | (554 | ) | (684 | ) | ||||||||||

Other (expense) income, net |

(292 | ) | 1,574 | (642 | ) | (192 | ) | 49 | ||||||||||||

Income (loss) before income taxes |

9,390 | (35,338 | ) | (32,047 | ) | 9,100 | 3,907 | |||||||||||||

Provision for income taxes |

501 | 128 | 177 | 2,226 | 202 | |||||||||||||||

Net income (loss) |

$ | 8,889 | $ | (35,466 | ) | $ | (32,224 | ) | $ | 6,874 | $ | 3,705 | ||||||||

Net income (loss) attributable to common stockholders |

$ | 1,115 | $ | (35,466 | ) | $ | (32,224 | ) | $ | 48,092 | $ | 464 | ||||||||

Net income (loss) per common share(1): |

||||||||||||||||||||

Basic |

$ | 0.73 | $ | (23.74 | ) | $ | (22.68 | ) | $ | 36.90 | $ | 0.30 | ||||||||

Diluted |

$ | 0.73 | $ | (23.74 | ) | $ | (22.68 | ) | $ | 0.45 | $ | 0.30 | ||||||||

Weighted average number of shares outstanding: |

||||||||||||||||||||

Basic |

1,519,124 | 1,494,124 | 1,420,786 | 1,303,131 | 1,521,391 | |||||||||||||||

Diluted |

1,523,183 | 1,494,124 | 1,420,786 | 15,110,781 | 1,521,391 | |||||||||||||||

Pro forma net income per common share (unaudited)(2): |

||||||||||||||||||||

Basic |

||||||||||||||||||||

Diluted |

||||||||||||||||||||

Weighted average number of shares used in pro forma computation (unaudited)(2) : |

||||||||||||||||||||

Basic |

||||||||||||||||||||

Diluted |

||||||||||||||||||||

Pro forma as adjusted net income per common share (unaudited)(3): |

||||||||||||||||||||

Basic |

||||||||||||||||||||

Diluted |

||||||||||||||||||||

Weighted average number of shares used in pro forma as adjusted computation (unaudited)(3): |

||||||||||||||||||||

Basic |

||||||||||||||||||||

Diluted |

||||||||||||||||||||

(1) We applied the two-class method to compute net income (loss) per common share which requires that earnings for the period be allocated between common and participating securities based upon their respective contractual rights to receive distributed and undistributed earnings. See Note 2 of the notes to each of our consolidated financial statements and our unaudited condensed consolidated financial statements included elsewhere in this prospectus.

9

(2) The pro forma basic and diluted net income per share have been calculated assuming (i) the conversion of all outstanding shares of convertible preferred stock into an aggregate of 13,064,838 shares of our common stock as of the beginning of the applicable period and (ii) the reclassification of outstanding preferred stock warrants from long-term liabilities to additional paid-in capital as of the beginning of the applicable period. The numerator of the pro forma net income per share calculation is derived by adding $ for the year ended December 31, 2010 related to the preferred stock warrant liability and by excluding the impact of $ for the six months ended June 30, 2011 related to the redemption of preferred stock below carrying value to arrive at net income attributable to common shares of approximately $ and $ for the year ended December 31, 2010 and the six months ended June 30, 2011, respectively.

(3) The pro forma as adjusted basic and diluted net income per share have been calculated assuming (i) the conversion of all outstanding shares of convertible preferred stock into an aggregate of 13,064,838 shares of our common stock as of the beginning of the applicable period and (ii) the reclassification of outstanding preferred stock warrants from long-term liabilities to additional paid-in capital as of the beginning of the applicable period, (iii) the sale by us of the shares of common stock in our initial public offering as of the beginning of the applicable period, and (iv) the filing of our amended and restated certificate of incorporation which will occur immediately prior to the closing of the offering. The numerator of the pro forma net income per share calculation is derived by adding for the year ended December 31, 2010 related to the preferred stock warrant liability, and subtracting for the six months ended June 30, 2011 related to the redemption of preferred stock below carrying value to net income as reported to arrive at net income attributable to common shares of approximately $ and $ for the year ended December 31, 2010 and the six months ended June 30, 2011, respectively.

The following table presents our summary consolidated balance sheet data as of June 30, 2011:

- •

- on an actual basis;

- •

- on a pro forma basis to give effect to (i) the conversion of all outstanding shares of preferred stock into shares

of our common stock and all outstanding warrants to purchase preferred stock into warrants to purchase common stock; and (ii) the reclassification of our outstanding preferred stock warrants

from long-term liabilities to additional paid-in capital; and

- •

- on a pro forma as adjusted basis to give effect to the conversion and reclassification described in the prior bullet and (i) the sale by us of the shares of common stock offered by this prospectus at an initial public offering price of $ per share, the midpoint of the price range on the cover of this prospectus, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us; and (ii) the filing of our amended and restated certificate of incorporation, which will occur immediately prior to the closing of this offering.

| |

June 30, 2011 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) |

Actual |

Pro forma |

Pro forma as adjusted |

|||||||

Consolidated Balance Sheet Data: |

||||||||||

Working capital(1) |

$ | 58,761 | $ | 58,761 | $ | |||||

Total assets |

107,372 | 107,372 | ||||||||

Long-term obligations, including current portion |

12,065 | 11,826 | ||||||||

Convertible preferred stock |

95,404 | — | ||||||||

Total stockholders' equity (deficit) |

(30,104 | ) | 65,539 | |||||||

(1) Working capital is defined as total current assets less total current liabilities.

10

Key business metrics

| |

Years ended December 31, | Six months ended June 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except percentages) |

2010 |

2009 |

2008 |

2011 |

2010 |

|||||||||||

GAAP metrics: |

||||||||||||||||

Total revenues |

$ | 108,336 | $ | 65,730 | $ | 72,564 | $ | 76,611 | $ | 49,290 | ||||||

Gross profit |

$ | 28,961 | $ | 5,084 | $ | 9,407 | $ | 20,717 | $ | 13,018 | ||||||

Gross margin |

26.7% | 7.7% | 13.0% | 27.0% | 26.4% | |||||||||||

Income (loss) from operations |

$ | 11,010 | $ | (35,295 | ) | $ | (29,257 | ) | $ | 9,846 | $ | 4,542 | ||||

Income (loss) from operations margin |

10.2% | (53.7)% | (40.3)% | 12.9% | 9.2% | |||||||||||

Net income (loss) |

$ | 8,889 | $ | (35,466 | ) | $ | (32,224 | ) | $ | 6,874 | $ | 3,705 | ||||

Net cash provided by (used in) operating activities |

$ | 8,233 | $ | (14,766 | ) | $ | (23,176 | ) | $ | 4,523 | $ | 4,040 | ||||

Non-GAAP metrics: |

||||||||||||||||

Adjusted gross profit* |

$ | 30,483 | $ | 9,198 | $ | 10,381 | $ | 21,126 | $ | 13,528 | ||||||

Adjusted gross margin* |

28.1% | 14.0% | 14.3% | 27.6% | 27.4% | |||||||||||

Adjusted income (loss) from operations* |

$ | 13,175 | $ | (19,664 | ) | $ | (16,861 | ) | $ | 10,623 | $ | 5,726 | ||||

Adjusted income (loss) from operations margin* |

12.2% | (29.9)% | (23.2)% | 13.9% | 11.6% | |||||||||||

Adjusted net income (loss)* |

$ | 11,216 | $ | (19,835 | ) | $ | (19,828 | ) | $ | 7,517 | $ | 4,860 | ||||

EBITDA* |

15,694 | (25,167 | ) | (22,928 | ) | 11,618 | 7,380 | |||||||||

EBITDA margin* |

14.5% | (38.3)% | (31.6)% | 15.2% | 15.0% | |||||||||||

Adjusted EBITDA* |

$ | 15,953 | $ | (12,056 | ) | $ | (12,523 | ) | $ | 11,701 | $ | 7,390 | ||||

Adjusted EBITDA margin* |

14.7% | (18.3)% | (17.3)% | 15.3% | 15.0% | |||||||||||

Free cash flow* |

$ | 5,306 | $ | (18,217 | ) | $ | (25,015 | ) | $ | 117 | $ | 3,295 | ||||

* These performance measures are not calculated in accordance with GAAP. A reconciliation of these non-GAAP measures to the most directly comparable measure calculated and presented in accordance with GAAP is included in this prospectus in "Management's discussion and analysis of financial condition and results of operations—Key business metrics—Use of non-GAAP financial measures." These non-GAAP measures should not be considered as an alternative to any measure of financial performance calculated and presented in accordance with GAAP. In addition, our non-GAAP measures may not be comparable to similarly titled measures of other companies because other companies may not calculate such similarly titled measures in the same manner as we do. We prepare our non-GAAP measures to eliminate the impact of items that we do not consider indicative of our core operating performance. We encourage you to evaluate these adjustments, the reasons we consider them appropriate and the material limitations of these non-GAAP measures as described in "Management's discussion and analysis of financial condition and results of operations—Key business metrics—Use of non-GAAP financial measures."

11

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before deciding whether to purchase shares of our common stock. If any of the following risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our common stock could decline and you could lose part or all of your investment.

Risks related to our business and industry

We are subject to the cyclical nature of the markets in which we compete and any future downturn may reduce demand for our products and revenue.

In the past, the markets in which we compete have experienced significant downturns, often connected with, or in anticipation of, the maturation of product cycles—for both manufacturers' and their customers' products—and with declining general economic conditions. These downturns have been characterized by diminished product demand, production overcapacity, high inventory levels and accelerated erosion of average selling prices. These markets are impacted by the aggregate capital expenditures of service providers and enterprises as they build out and upgrade their network infrastructure. These markets are highly cyclical and characterized by constant and rapid technological change, pricing pressures, evolving standards and wide fluctuations in product supply and demand.

We may experience substantial period-to-period fluctuations in future results of operations. Any future downturn in the markets in which we compete, or changes in demand for our products from our customers, could result in a significant reduction in our revenue. It may also increase the volatility of the price of our common stock.

In addition, the communications networks industry from time to time has experienced and may again experience a pronounced downturn. To respond to a downturn, many service providers and enterprises may slow their capital expenditures, cancel or delay new developments, reduce their workforces and inventories and take a cautious approach to acquiring new equipment and technologies from network equipment manufacturers, any of which could cause our results of operations to fluctuate from period to period and harm our business.

If spending for optical communications networks does not continue to grow as expected, our business may suffer.

Our future success depends on continued capital investment in global communications network infrastructure and on continued demand for high-bandwidth, high-speed communications networks and the ability of network equipment manufacturers to meet this demand. Spending on communications networks is limited by several factors, including limited investment resources, uncertainty regarding the long-term evolution and sustainability of service provider business models and a changing regulatory environment. We cannot be certain that demand for bandwidth-intensive content will continue to grow at the same pace in the future or that communications service providers will continue to increase spending to meet such demand. If expectations for growth of communications networks and bandwidth consumption are not realized and investment in communications networks does not grow as anticipated, our business, results of operations and gross margins could be harmed.

12

Given the high fixed costs associated with our vertically integrated business, a reduction in demand for our products may adversely impact our gross profits and our results of operations.

We have a high fixed cost base due to our vertically integrated business model, including the fact that 536 of our employees as of June 30, 2011 were employed in manufacturing engineering and operations and business operations. We may not be able to adjust these fixed costs quickly to adapt to rapidly changing market conditions. Our gross profit and gross margin is greatly affected by our sales volume and volatility on a quarterly basis and the corresponding absorption of fixed manufacturing overhead expenses. In addition, because we are a vertically integrated manufacturer, insufficient demand for our products may subject us to the risk of high inventory carrying costs and increased inventory obsolescence. Given our vertical integration, the rate at which we turn inventory has historically been low when compared to our cost of sales. We do not expect this to change significantly in the future and believe that we will have to maintain a relatively high level of inventory compared to our cost of sales. As a result, we continue to expect to have a significant amount of working capital invested in inventory. We may be required to write down inventory costs in the future and our high inventory costs may have an adverse effect on our gross profits and our results of operations.

We are dependent on our key customers for a significant portion of our revenue and the loss of, or a significant reduction in orders from, any of our key customers may reduce our revenue and adversely impact our results of operations.

Historically, we have generated most of our revenue from a limited number of customers. In 2010, our top ten customers represented 61.9% of our total revenue, with only Finisar Corporation (15.3% of revenues) representing more than 10.0% of our revenues. Furthermore, sales of certain of our current products are dependent upon and concentrated among a limited number of customers and the successful introduction of future component and module products could similarly be dependent upon a limited number of customers. As a result, the loss of, or a significant reduction in orders from any our key customers would materially and adversely affect our revenue and results of operations. Adverse events affecting our key customers could also negatively affect our revenue and results of operations. In addition, network equipment manufacturers may continue to consolidate, and we may not be able to offset any potential decline in revenue arising from the consolidation of our existing customers with revenue from new customers or additional revenue from the combined company.

We face intense competition which could negatively impact our results of operations and market share.

The communications networking industry is highly competitive. Our competitors range from large, international companies offering a wide range of products beyond the optical networking component or module markets to smaller companies specializing in niche markets within the optical networking component and module markets. Some of our competitors, particularly larger, more diversified companies, have substantially greater technical, financial and marketing resources, name recognition, manufacturing capacity, and/or better-established relationships with customers than we have. Some of our competitors have more resources to develop or acquire, and more experience in developing or acquiring, new products and technologies and in creating market awareness for and selling these products and technologies. Some of our competitors may be able to develop new products more quickly than we can and may be able to develop products that are more reliable or which provide more functionality than our products. All of these advantages may cause us to lose sales or market share or reduce the prices of our products.

13

We also face competition from some of our customers who evaluate our capabilities against the merits of manufacturing products internally. Such customers may be able to internally manufacture competitive products at a lower cost than we would charge these customers. As a result, customers may purchase fewer of our products or we may be forced to lower our selling prices, both of which would negatively impact our financial results.

We must continually achieve new design wins and enhance existing products or our business may be harmed.

The markets for our products are characterized by frequent new product introductions, changes in customer and market requirements and evolving industry standards, all with an underlying pressure to reduce cost and meet stringent reliability and qualification requirements. Our future performance will depend on our successful and timely development, introduction and market acceptance of new and enhanced products that address these challenges. The anticipated or actual introduction of new and enhanced products by us and by our competitors may lead our customers to defer or cancel orders for our existing products and rapid obsolescence and value diminution of existing inventory.

The development of new, technologically-advanced products is a complex and uncertain process requiring frequent innovation, highly-skilled engineering and development personnel and significant capital expenditures, as well as the accurate anticipation of technological and market trends. Product development delays may result from numerous factors, including:

- •

- changing product specifications and customer requirements;

- •

- unanticipated engineering and manufacturing complexities and problems discovered during development and manufacturing;

- •

- difficulties in reallocating engineering resources and overcoming resource limitations; and

- •

- changing market or competitive product requirements.

We have in the past experienced slowdowns in demand for existing products and delays in new product development, and such delays may occur again in the future. We cannot assure you that we will be able to identify, develop, manufacture, market or support new or enhanced products successfully, if at all, or on a timely basis. To the extent customers defer or cancel orders for our products for any reason or we fail to achieve new design wins, our competitive and financial position would be adversely affected and our ability to grow our revenue would be impaired.

Further, we cannot assure you that our new products will gain market acceptance or that we will be able to respond effectively to product introductions by competitors, technological changes or emerging industry standards. We also may not be able to develop and evolve the underlying core technologies necessary to create new products and enhancements, license these technologies from third parties, or remain competitive in our markets.

We are under continuous pressure to reduce the prices of our products.

The communications networking industry has historically been characterized by declining product prices for components over time as a result of new product and technology introductions, increased competition, aggressive pricing from our competitors and pricing pressure from customers. We have reduced the prices of some of our products in the past, and we expect to continue to experience pricing pressure for our products in the future. When

14

seeking to maintain or increase their market share, our competitors may also reduce the prices of their products. In addition, our customers may have the ability to internally develop and manufacture competing products at a lower cost than we would otherwise charge, which would add additional downward pressure on our selling prices. If we are unable to offset future reductions in our average selling prices by increasing our sales volume, by reducing our costs and expenses or by introducing new products at higher price points, our profitability could suffer.

Our manufacturing processes are extremely complex and specialized and disruptions could have a material adverse effect on our business, financial condition and results of operations.

The fabrication of our products involves extremely complex and precise processes. We may experience delays, disruptions or quality control problems in our manufacturing operations. For instance, minor impurities, contamination of the clean room environment, errors in any step of the fabrication process, defects in equipment or materials, human error, or a number of other factors can cause a substantial percentage of our products to be rejected or malfunction. We could also experience a disruption in our fabrication facility for our products due to equipment maintenance, repairs and/or upgrades.

Additionally, manufacturing yields depend on a number of factors, including the stability and manufacturability of the product design, manufacturing improvements gained over cumulative production volumes, the quality and consistency of component parts and the nature and extent of customization requirements by customers. Capacity constraints, raw materials shortages, logistical issues, labor shortages, the introduction of new product lines and changes in customer requirements, manufacturing facilities or processes, or those of some third party contract manufacturers and suppliers of raw materials and components have historically caused, and may in the future cause, reduced manufacturing yields. Moreover, an increase in the rejection and rework rate of products during the quality control process before, during or after manufacture would result in our experiencing lower yields. As a result of all of these potential difficulties, we could incur additional costs to fulfill customer orders and/or product shipments to our customers could be delayed, each of which would negatively affect our revenue, costs, competitive position and reputation.

We rely on a limited number of suppliers for certain raw materials, and if they stopped, decreased or delayed shipments to us, it could have an adverse effect on our business.

We depend on a limited number of suppliers for certain raw materials we have qualified to use in the manufacture of certain of our products. Some of these suppliers could disrupt our business if they stop, decrease or delay shipments or if the materials they ship have quality or consistency issues. Some of these materials are available only from a limited number of suppliers or have been qualified only from a single supplier. For example, we currently rely on two suppliers, Finisar Corporation and Alps Electric (USA), Inc., for certain piece parts used in our products that comprised approximately 23% and 21% of our total revenue for the year ended December 31, 2010, respectively. Collectively, such piece parts were used in products that comprised approximately 23% of our revenues for the year ended December 31, 2010 as there was significant overlap between the products that incorporated such piece parts. Although we rely on these two suppliers as the single source of our supply for such piece parts, these piece parts are available from a limited number of other sources. We may also face material shortages if we experience increased demand for materials beyond what our qualified suppliers can deliver on a timely basis or at all. Although we strive to mitigate shortages, any

15

inability on our part to timely obtain sufficient quantities of critical piece parts at reasonable costs could adversely affect our ability to meet demand for our products, which could cause our revenue, results of operations, or both to suffer.

We typically have not entered into long-term agreements with our suppliers and, therefore, our suppliers could stop supplying materials at any time or fail to supply adequate quantities of piece parts on a timely basis. It is difficult, costly, time consuming and, on short notice, sometimes impossible for us to identify and qualify new suppliers. The reliance on a sole supplier, single qualified vendor or limited number of suppliers could result in delivery and quality problems and reduced control over product pricing, reliability and performance. We have in the past had to change suppliers, which has, in some instances, resulted in delays in product development and manufacturing and loss of revenue.

If we fail to retain our key personnel or if we fail to attract additional qualified personnel, we may not be able to achieve our anticipated level of growth and our business could suffer.

Our future success depends, in part, on our ability to attract and retain key personnel, including our senior management team and others, and on the continued contributions of members of our senior management team and key technical personnel, each of whom would be difficult to replace. The loss of any of the members of our senior management team or key personnel or the inability to continue to attract and retain qualified personnel could have a material adverse effect on our business. Competition for highly skilled technical personnel is extremely intense, and we continue to face challenges identifying, hiring and retaining qualified personnel in certain areas of our business. If we fail to retain our senior management and other key personnel or if we fail to attract additional qualified personnel, our business could suffer.

Our success will depend on our ability to anticipate and quickly respond to rapidly changing technologies and customer requirements.

The communications networking industry is characterized by substantial investment in new technologies and the development of diverse and changing technologies. For example, new technologies are required to satisfy the emerging standards for 40Gbps and 100Gbps data transmission in communications networks. Furthermore, fast introduction of new products can be critical to success. It is difficult to displace an existing supplier for a particular type of product once a network equipment manufacturer has chosen a supplier, even if a later-to-market product provides superior performance or cost efficiency. If we are unable to make our new or enhanced products commercially available on a timely basis, we may lose existing and potential customers for extended time periods, which would cause our financial results to suffer.

The communications networking industry has long product development cycles requiring us to incur product development costs without assurances of an acceptable investment return.

The communications networking industry is highly capital-intensive. Large volumes of equipment and support structures are installed with considerable expenditures of funds and other resources, and long investment return period expectations. At the component supplier level, this creates considerable, typically multi-year, gaps between the commencement of new product development and volume purchases. Accordingly, we often incur significant research and development costs for products that, at the earliest, will be purchased by our customers

16

long after much of the cost is incurred and, in some cases, may never be purchased due to changes in industry or customer requirements in the interim.

Due to changing industry and customer requirements, we are constantly developing new products and developing and using new technologies in our products. These development activities can and are expected to necessitate a significant investment of capital. Our new products often require a long time to develop because of their complexity and rigorous testing and qualification requirements. Additionally, developing a manufacturing approach with an acceptable cost structure and yield for new products can be expensive and time-consuming. Due to the costs and length of research and development and manufacturing process cycles, we may not recognize revenue from new products until long after such expenditures are incurred, if at all, and our gross margin may decrease if our costs are higher than expected.

If our customers do not qualify our products for use, then our results of operations may suffer.

Prior to placing volume purchase orders with us, most of our customers require us to obtain their approval of our new and existing products, and our customers often audit our manufacturing facilities and perform other vendor evaluations during this process. The approval process, generally known as qualification, involves product sampling and reliability testing and collaboration with our product management and engineering teams in the design and manufacturing stages. For example, we have developed new technologies and products that are key components in our customers' systems for 40Gbps and 100Gbps data transmission. While we are shipping certain products for 40Gbps and 100Gbps system designs today, many of our products for these systems are currently being qualified for use by our customers. If we are unable to qualify these and other of our products with customers, then our future revenues would be lower than expected, and we may not be able to recover the costs of our investments in new and existing products, each of which would have an adverse effect on our results of operations.

In addition, due to rapid technological changes in our markets, a customer may cancel or modify a design project before we have qualified our product or begun volume manufacturing of a qualified product. It is unlikely that we would be able to recover the expenses for cancelled or unutilized custom design projects. It is difficult to predict with any certainty whether our customers will delay or terminate product qualification or the frequency with which customers will cancel or modify their projects, but any such delay, cancellation or modification would have a negative effect on our results of operations.

Rapidly changing standards and regulations could make our products obsolete, which would cause our revenue and results of operations to suffer.

We design our products to conform to regulations established by governments and to standards set by industry standards bodies worldwide, such as the American National Standards Institute, the European Telecommunications Standards Institute, the International Telecommunications Union and the Institute of Electrical and Electronics Engineers, Inc. Various industry organizations are currently considering whether and to what extent to create standards for elements used in 100Gbps systems. Because certain of our products are designed to conform to current specific industry standards, if competing or new standards emerge that are preferred by our customers, we would have to make significant expenditures to develop new products. If our customers adopt new or competing industry standards with which our products are not compatible, or the industry groups adopt standards or governments issue

17

regulations with which our products are not compatible, our existing products would become less desirable to our customers and our revenue and results of operations would suffer.

Customer demand is difficult to forecast and, as a result, we may be unable to optimally match production with customer demand.

We make planning and spending decisions, including determining the levels of business that we will seek and accept, production schedules, component procurement commitments, personnel needs and other resource requirements, based on our estimates of customer demand. The majority of our products are purchased pursuant to individual purchase orders. While our customers generally provide us with their demand forecasts, they are typically not contractually committed to buy any quantity of products beyond firm purchase orders. The short-term nature of our customer commitments and the possibility of unexpected changes in demand for their products limit our ability to accurately predict future customer demand. On occasion, customers have required rapid increases in production, which has strained our resources. We may not have sufficient capacity at any given time to meet the volume demands of our customers, or one or more of our suppliers may not have sufficient capacity at any given time to meet our volume demands. Conversely, a downturn in the markets in which our customers compete can cause, and in the past has caused, our customers to significantly reduce the amount of products ordered from us or to cancel existing orders, leading to lower utilization of our facilities. Because many of our costs and operating expenses are relatively fixed, reduction in customer demand would have an adverse effect on our gross margin, income (loss) from operations and cash flow. During an industry downturn, there is also a higher risk that our trade receivables would be uncollectible.

It could be discovered that our products contain defects that may cause us to incur significant costs, divert our management's attention, result in a loss of customers and result in product liability claims.

Our products are complex and undergo quality testing and formal qualification by our customers and us. However, defects may occur from time to time. Our customers' testing procedures involve evaluating our products under likely and foreseeable failure scenarios and over varying amounts of time. For various reasons, such as the occurrence of performance problems that are unforeseeable in testing or that are detected only when products age or are operated under peak stress conditions, our products may fail to perform as expected long after customer acceptance. Failures could result from faulty components or design, problems in manufacturing or other unforeseen reasons. For the majority of our products, we provide a product warranty of one year or less from date of shipment. For select customers, we provide extended warranties beyond our normal product warranty period for specified failures on a case-by-case basis. As a result, we could incur significant costs to repair or replace defective products under warranty, particularly when such failures occur in installed systems. We have experienced failures in the past and will continue to face this risk going forward, as our products are widely deployed throughout the world in multiple demanding environments and applications. In addition, we may in certain circumstances honor warranty claims after the warranty has expired or for problems not covered by warranty in order to maintain customer relationships. Any significant product failure could result in lost future sales of the affected product and other products, as well as customer relations problems, litigation and damage to our reputation.

18

In addition, our products are typically embedded in, or deployed in conjunction with, our customers' products, which incorporate a variety of components, modules and subsystems and may be expected to interoperate with modules and subsystems produced by third parties. As a result, not all defects are immediately detectable and when problems occur, it may be difficult to identify the source of the problem. These problems may cause us to incur significant damages or warranty and repair costs, divert the attention of our engineering personnel from our product development efforts and cause significant customer relations problems or loss of customers, all of which would harm our business. The occurrence of any defects in our products could also give rise to liability for damages caused by such defects. Although we carry product liability insurance to mitigate this risk, insurance may not adequately cover costs that may arise from defects in our products or otherwise, nor will it protect us from reputational harm that may result from such defects.

If we fail to adequately manage our long-term growth and expansion requirements, our business will suffer.

In recent years, we have experienced significant growth through, among other things, internal expansion programs, new product developments and acquisitions of other companies. We expect to continue to grow, which could require us to expand our manufacturing operations, including hiring new personnel, purchasing additional equipment, leasing or purchasing additional facilities, expanding our management infrastructure and working with our suppliers to manage any such expansion. If we fail to secure these expansion requirements or manage our future growth effectively, our business could suffer.

Natural disasters, terrorist attacks or other catastrophic events could harm our operations.

Our worldwide operations could be subject to natural disasters and other business disruptions, which could harm our future revenue and financial condition and increase our costs and expenses. Further, a terrorist attack, including one aimed at energy or communications infrastructure suppliers, could hinder or delay the development and sale of our products. Although we maintain casualty and business interruption insurance, if an earthquake, typhoon, hurricane, terrorist attack or other natural or manmade catastrophe were to destroy any part of our facilities, destroy or disrupt vital infrastructure systems or interrupt our operations for any extended period of time, our business would be materially adversely affected.

Our manufacturing facilities are leased from third parties.

We conduct all of our manufacturing operations at facilities located in Pennsylvania, New Jersey and Mexico. The leases for our facilities located in Pennsylvania expire in July 2014 and October 2017, if not renewed at our option; the lease for our facility located in New Jersey expires in July 2014, if not renewed at our option; and the lease for our facility located in Mexico expires in December 2011, if not renewed at our option. We are substantially dependent on our facilities in Pennsylvania and New Jersey and a loss of use of one or more of our manufacturing facilities may result in an interruption or delay in our ability to manufacture our products. If we are unable to renew our leases with the owners of the facilities on commercially reasonable terms, or if we migrate to new facilities, we may experience delays in delivering our products until leases for other facilities can be arranged and the migration to a new facility is completed.

Our operations also rely heavily on the availability of electrical power and cooling capacity, which are also supplied by third-party providers. If our facilities experience a major power

19

outage or if the cost of electrical power increases significantly, our operations and profitability could be harmed. If our facilities experience a major power outage, we would have to rely on back-up generators, which may not function properly, and their supply may be inadequate. Such a power outage could result in the disruption of our business. Additionally, if our current facilities fail to have sufficient cooling capacity or availability of electrical power, we would need to find alternative facilities.

If we fail to protect, or incur significant costs in defending, our intellectual property and other proprietary rights, our business and results of operations could be materially harmed.

Our success depends to a significant degree on our ability to protect our intellectual property and other proprietary rights. We rely on a combination of patent, trademark, trade secret and unfair competition laws, as well as license agreements and other contractual provisions, to establish and protect our intellectual property and other proprietary rights. We have applied for patent registrations in the United States, most of which have been issued. In addition, we are applying to register the trademark "CyOptics" in the United States. We cannot guarantee that our pending applications will be approved by the applicable governmental authorities. Moreover, our existing and future patents and trademarks may not be sufficiently broad to protect our proprietary rights or may be held invalid or unenforceable in court. Failure to obtain patents or trademark registrations or a successful challenge to our registrations in the United States would limit our ability to protect the intellectual property rights that these applications and registrations are intended to cover.

We also attempt to protect our intellectual property, including our trade secrets and know-how, through the use of trade secret and other intellectual property laws, and contractual provisions. We enter into confidentiality and invention assignment agreements with our employees and independent consultants. We also use non-disclosure agreements with other third parties who may have access to our proprietary technologies and information. Such measures, however, provide only limited protection, and there can be no assurance that our confidentiality and non-disclosure agreements will not be breached, especially after our employees or those of our third-party contract manufacturers end their employment or engagement, and that our trade secrets will not otherwise become known by competitors or that we will have adequate remedies in the event of unauthorized use or disclosure of proprietary information. Unauthorized third parties may try to copy or reverse engineer our products or portions of our products, otherwise obtain and use our intellectual property, or may independently develop similar or equivalent trade secrets or know-how. If we fail to protect our intellectual property and other proprietary rights, or if such intellectual property and proprietary rights are infringed or misappropriated, our business, results of operations or financial condition could be materially harmed.

Policing unauthorized use of our technology is difficult, and we cannot be certain that the steps we have taken will prevent the misappropriation, unauthorized use or other infringement of our intellectual property rights. Further, if we are unable to effectively protect our intellectual property rights from misappropriation or other infringement in foreign countries where we have not applied for patent protections, and where patent, trademark, trade secret and other intellectual property laws are ineffective or unavailable, or do not protect our proprietary rights as fully as U.S. law, our business could be materially harmed.

If we are compelled to take legal actions to protect and enforce our intellectual property rights and determine their validity and scope, these actions would result in litigation costs and could require significant time and attention from our technical and management personnel. In addition, an adverse outcome of such proceedings could reduce our competitive advantage or otherwise harm our financial condition and our business.

20

We have entered into an agreement with one of our customers that requires us to place manufacturing or technical information, including patents, trade secrets, know-how, source code and other intellectual property, into an escrow. Such agreement provides that the customer will have a right to access the escrowed materials if we experience insolvency, commit a material breach and/or are unable or unwilling to deliver the ordered products in the allotted timeframe. Depending on the licenses granted upon release of the escrow, we may not be able to control the customer's use of the released materials and may not be able to receive the same revenue that we would receive when selling the products in the ordinary course of business.