Attached files

| file | filename |

|---|---|

| 8-K - UIL HOLDINGS CORPORATION 8-K 11-3-2011 - UIL HOLDINGS CORP | form8-k.htm |

| EX-99 - EXHIBIT 99 - UIL HOLDINGS CORP | ex99.htm |

3Q ‘11 Earnings Conference Call

November 4, 2011

Exhibit 99.1

2

3Q ’11 Earnings

James P. Torgerson

President and Chief Executive Officer

Richard J. Nicholas

Executive Vice President and Chief Financial Officer

Safe Harbor Provision

Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the

Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs,

expectations or forecasts for the future. Such forward-looking statements are based on UIL Holdings’ expectations and involve risks and

uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and

uncertainties include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for

electricity, gas and other products and services, unanticipated weather conditions, changes in accounting principles, policies or

guidelines, and other economic, competitive, governmental, and technological factors affecting the operations, markets, products and

services of UIL Holdings’ subsidiaries, The United Illuminating Company, The Southern Connecticut Gas Company, Connecticut

Natural Gas Corporation and The Berkshire Gas Company. Such risks and uncertainties with respect to UIL Holdings’ recent

acquisition of The Southern Connecticut Gas Company, Connecticut Natural Gas Corporation and The Berkshire Gas Company

include, but are not limited to, the possibility that the expected benefits will not be realized, or will not be realized within the expected

time period. The foregoing and other factors are discussed and should be reviewed in UIL Holdings’ most recent Annual Report on Form

10-K and other subsequent periodic filings with the Securities and Exchange Commission. Forward-looking statements included herein

speak only as of the date hereof and UIL Holdings undertakes no obligation to revise or update such statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances.

Note to Investors

3

3Q ’11 Earnings

3Q & YTD 2011 Highlights

YTD ’11 consolidated earnings of $78.4M was $34M higher than YTD ’10,

primarily due to net income from the gas companies

primarily due to net income from the gas companies

3Q ’11 consolidated earnings of $12.2M were $4.8M lower than 3Q ’10, primarily

due to mark to market and tax rate adjustments

due to mark to market and tax rate adjustments

Ø These non-operational charges were partially offset by an increase in income from

GenConn

GenConn

First full quarter in which both GenConn plants were in operation

Gas integration progressing on schedule - substantially exited Transition Services

Agreement with Iberdrola USA as of the end of September

Agreement with Iberdrola USA as of the end of September

Tropical Storm Irene caused damage to UI’s electric distribution system, causing

approximately 50% of UI’s customers to lose power

approximately 50% of UI’s customers to lose power

Ø UIL team and mutual assistance crews from around the country repaired the system and

power was restored to 99.8% of UI’s customers within one week

power was restored to 99.8% of UI’s customers within one week

Ø As of 9/30/11, the cost estimate was approximately $20M, of which approximately $4M

has been capitalized

has been capitalized

› Expects to seek recovery in future rate proceedings

4

3Q ’11 Earnings

Gas Conversions

Momentum of interest in conversions increasing as heating season begins

Ø Direct mail marketing deployed in October to increase customers’ awareness of conversion

benefits

benefits

Ø Financing options are being expanded to assist customers with up-front conversion costs

Approximately 6,800 customer(1) additions in 2010

Ø Targeting 30,000-35,000 additional gas heating customers over the next 3 years

› ’11 - approximately 25% increase over ‘10 levels

› ’12 - approximately 50% increase over ’10 levels

Ø YTD 9/30/11, there were 4,129 conversions, compared to 3,654 conversions for YTD 9/30/10

Through September, residential conversions are 13% ahead of 2010 levels

New residential customers are anticipated to generate approximately $280-$315 of

distribution net operating income per customer

distribution net operating income per customer

(1) Residential and commercial

5

3Q ’11 Earnings

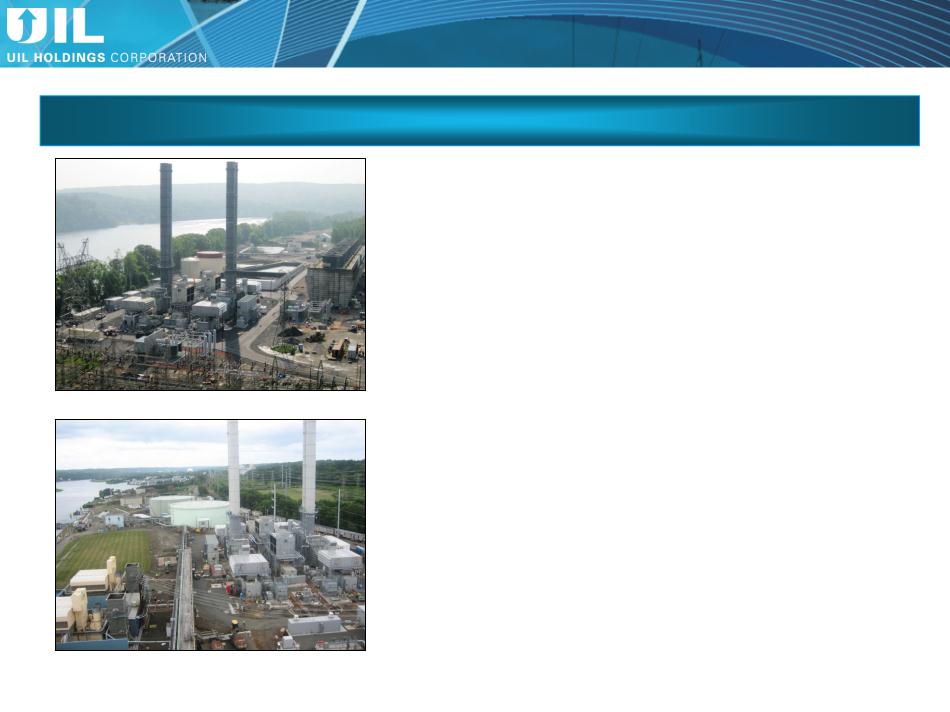

GenConn Energy

50/50 Joint Venture between UI and NRG

Middletown

Devon

Both GenConn Middletown & Devon are

now operating in the ISO-New England

(ISO-NE) markets

now operating in the ISO-New England

(ISO-NE) markets

Ø UIL reported pre-tax income of $3.5M and

$8.2M in the 3Q and first nine months of

’11, respectively

$8.2M in the 3Q and first nine months of

’11, respectively

6

3Q ’11 Earnings

Ø Final decision by CT PURA approving CNG & SCG

settlement of rate case appeals was issued on 8/3/11

(DN 08-12-06RE02 & DN 08-12-07RE02)

settlement of rate case appeals was issued on 8/3/11

(DN 08-12-06RE02 & DN 08-12-07RE02)

› Resolves all pending issues related to the rate case

appeals

appeals

› Removes the 10 basis point ROE penalty for

monitoring

monitoring

› Authorized ROEs going forward: CNG - 9.41%,

SCG - 9.36%

SCG - 9.36%

› Terminates the SCG potential overearnings

investigation

investigation

› Companies are allowed to recover carrying

charges on the interim rate decrease amounts over-

credited to customers during the stay of the rate

case decisions (since 2009)

charges on the interim rate decrease amounts over-

credited to customers during the stay of the rate

case decisions (since 2009)

› Approximately $3.7M to be recovered and

collected over the next two non-winter periods,

collected over the next two non-winter periods,

$2.2M booked to earnings in 3Q ’11

Regulatory Update

|

|

|

|

|

|

SCG Potential Overearnings

Generic ROE Proceeding

UI Electric Decoupling

SCG/CNG Rate Case Appeals

PURA schedule has not been updated

Ø Final decision issued on 8/31/11 (DN 08-07-04RE03)

› Approved decoupling credit of $1.4M for ‘10 rate year

› Allows decoupling mechanism to continue until next

general rate case proceeding

general rate case proceeding

GenConn ’12 Revenue Requirement

Ø Annual revenue requirement filed with CT PURA on

7/29/11 (DN 11-07-12)

7/29/11 (DN 11-07-12)

› Requesting approximately $78M for the period

commencing 1/1/12 - 12/31/12

commencing 1/1/12 - 12/31/12

› Draft decision expected 12/7/11

› Final decision expected 12/21/11

7

3Q ’11 Earnings

Regulatory Update - continued

Transmission ROE

Utility Company Storm Response Docket

Ø Several New England governmental entities have filed a

complaint with FERC regarding the base return on equity

for transmission investments

complaint with FERC regarding the base return on equity

for transmission investments

› Claim that the current approved base ROE on

transmission investments of 11.14% is not just and

reasonable and are seeking a reduction of the base

transmission investments of 11.14% is not just and

reasonable and are seeking a reduction of the base

ROE to 9.20%

Ø Investigation of the service response and communications of

utilities in CT following Tropical Storm Irene (DN 11-09-09)

utilities in CT following Tropical Storm Irene (DN 11-09-09)

Electric Distribution Rate Case

Ø Evaluating timing of distribution rate case to reflect

significant investments in distribution infrastructure

significant investments in distribution infrastructure

8

3Q ’11 Earnings

Governmental Update

|

|

|

|

|

|

Implementation of Public Act 11-80

Ø Department of Energy & Environmental Protection (DEEP) was created

Ø Former DPUC has become the Public Utilities Regulatory Authority (PURA)

› Change from 5 DPUC commissioners to three PURA directors

§ Kevin DelGobbo (former DPUC chair), John Betkoski and Anna Ficeto

Ø Allows each electric distribution company to develop and own up to 10 MW renewable

source generation

source generation

Post-Storm Irene Investigations

Ø Participated in two legislative hearings

Ø Governor Malloy established a State Team Organized for the Review of Management of

Irene (S.T.O.R.M. Irene) assessment team

Irene (S.T.O.R.M. Irene) assessment team

Low Income Home Energy Assistance Program (LIHEAP)

Ø Anticipate significant reductions in funds available for home energy assistance

programs

programs

Next Legislative Session February-May ‘12

9

3Q ’11 Earnings

Economic Update

Economic recovery has been extremely slow over the past 2 years

Ø September - moving primarily sideways with a slight downside bias

CT labor markets are now slightly lagging the national average

Seasonally adjusted unemployment rate as of September 2011

Ø CT - 8.9%

Ø MA - 7.3%

Ø National - 9.1%

Unemployment rates in largest cities in our territory (as of August 2011)

Ø Bridgeport - 8.3%

Ø New Haven - 9.4%

Ø Hartford - 9.0%

Source: U.S. Bureau of Labor Statistics

10

3Q ’11 Earnings

3Q & YTD 2011 Financial Results by Business

Net Income ($M)

Net Income ($M)

3Q ’11 vs. 3Q ’10

YTD ‘11 vs. YTD

’10

’10

11

3Q ’11 Earnings

3Q & YTD 2011 Financial Results - Details

Electric distribution, CTA, GenConn & Other

Ø 1% increase in net income YTD, 3Q was lower primarily due to mark to market & effective tax rate

adjustments, offset by GenConn earnings

adjustments, offset by GenConn earnings

› The mark to market & effective tax rate adjustments reduced net income by $2.3M & $3.4M for the

3Q & nine months of ’11, respectively

› GenConn contributed to UIL pre-tax income of $3.5M & $8.2M for the 3Q & first nine months of

’11, respectively

’11, respectively

Ø Average D & CTA ROE as of 9/30/11: 9.63%

Electric transmission

Ø 19% increase in net income for the quarter & YTD

› Increase attributable to an increase in the allowance for funds used during construction due to

increased CWIP

increased CWIP

Gas Distribution

Ø YTD income of $29.7M , 3Q loss of $6.2M due to seasonality of earnings

Ø YTD - colder than normal winter season in New England in ’11

Ø Recovered approximately $2.2M pre-tax of carrying charges in the 3Q ’11 on interim rate

decrease amounts over-credited to customers during stay of rate case decisions

decrease amounts over-credited to customers during stay of rate case decisions

› Recovery of carrying charges will continue until the outstanding surcharge balance is exhausted

Ø Preliminary average ROE as of 9/30/11: SCG 8.30-8.40%, CNG 8.90-9.00%

Corporate

Ø YTD after-tax costs of $9.4M, a decrease of $0.1M compared to ’10

Ø After-tax costs of $2.3M in the 3Q, a decrease of $2M compared to 3Q ’10

Ø The decrease for the quarter & YTD was primarily attributable to the absence in ’11 of after-tax

acquisition related costs that occurred in the 3Q ’10, partially offset by the interest expense related to

the October ‘10 issuance of $450M of public debt

acquisition related costs that occurred in the 3Q ’10, partially offset by the interest expense related to

the October ‘10 issuance of $450M of public debt

Ø Interest expense on the $450M of public debt was $3.2M & $9.5M for the 3Q and first nine

months of ’11, respectively

months of ’11, respectively

12

3Q ’11 Earnings

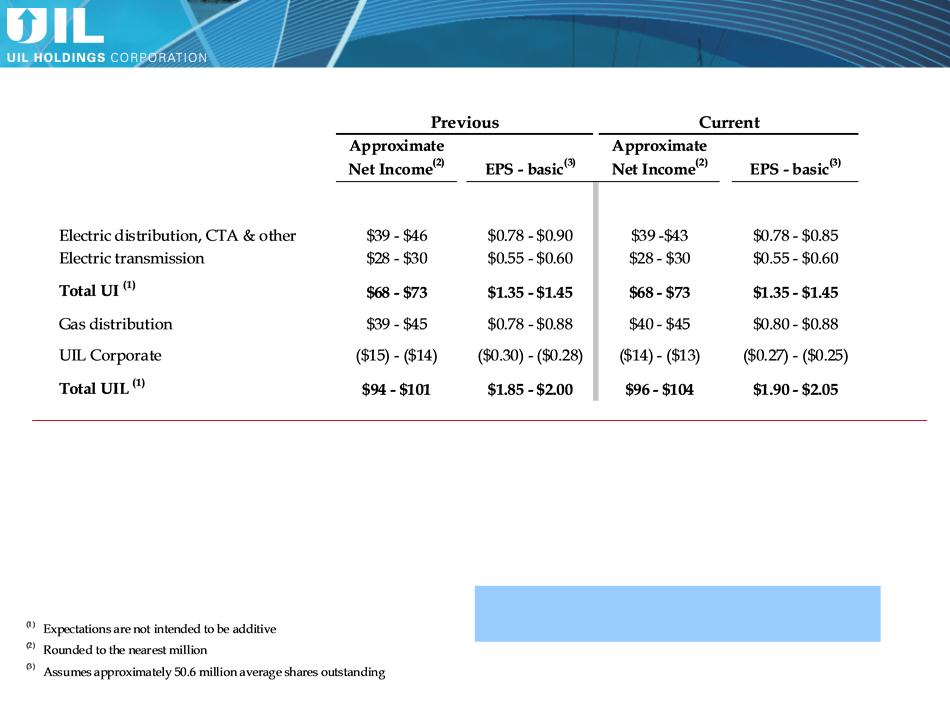

Increased ‘11 Earnings Expectations

Current Assumptions

Ø Electric distribution, CTA & Other and Gas distribution ranges were narrowed reflecting year-to-date performance

Ø GenConn expected to earn $0.12-$0.14 per share

Ø UIL Corporate was reduced to reflect tax savings resulting from the deductibility of certain gas company acquisition costs

‘12 earnings expectations will be discussed on the

4Q ‘11 earnings call

4Q ‘11 earnings call

Q&A