Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FMC CORP | form8-k11032011.htm |

Exhibit 99.1

FMC Corporation W. Kim Foster Executive Vice President and CFO Milton Steele President, Agricultural Products Group NY and Boston

November 3-4, 2011

Disclaimer

Safe Harbor Statement These slides and the accompanying presentation contain “forward-looking statements” that represent management's best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements.

Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the Company's periodic reports filed under the Securities Exchange Act of 1934, as amended.

The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

Non-GAAP Financial Terms

These slides contain certain “non-GAAP financial terms” which are defined on our website at www.fmc.com. In addition, we have also provided on our website at www.fmc.com reconciliations of non-GAAP terms to the closest GAAP term.

FMC Corporation LTM ending September 30, 2011 ($ millions) FMC Corporation Revenue: $3,280

EBIT: $593 EBIT Margin: 18.1% Agricultural Products Revenue: $1,390 EBIT: $338 EBIT Margin: 24.3% Focus Markets, Crops, Regions Specialty Chemicals Revenue: $862

EBIT: $195 EBIT Margin: 22.6% BioPolymer - Food & Pharmaceuticals Lithium Industrial Chemicals

Revenue: $1,034 EBIT: $141 EBIT Margin: 13.6% Soda Ash Peroxygens

Strong Operating Position Across Global Economic Scenarios Leading market positions serving diverse end markets - low correlation to economic cycles Over 80% of sales in markets with low correlation to economic cycles Agriculture, Food, Pharmaceuticals, Energy Storage, Environmental Biasing growth toward Rapidly Developing Economies (RDEs) 43% of 2010 sales in RDEs Plan for 50% of sales by 2015

Focus on faster-growing agriculture, food, pharmaceutical, energy storage markets in Asia, Latin America, CEETR Diversified raw material structure and sourcing Raw material costs represented only 25% of COGS in 2010 No single raw material represented over 10% of total raw material costs in 2010 Price increases currently offsetting or exceeding cost increases Low energy requirements & exposure to petrochemicals

Energy costs represented only 9% of COGS in 2010 Limited exposure to oil price fluctuations: +/- $10 per barrel oil equates to +/- $4MM EBIT to FMC

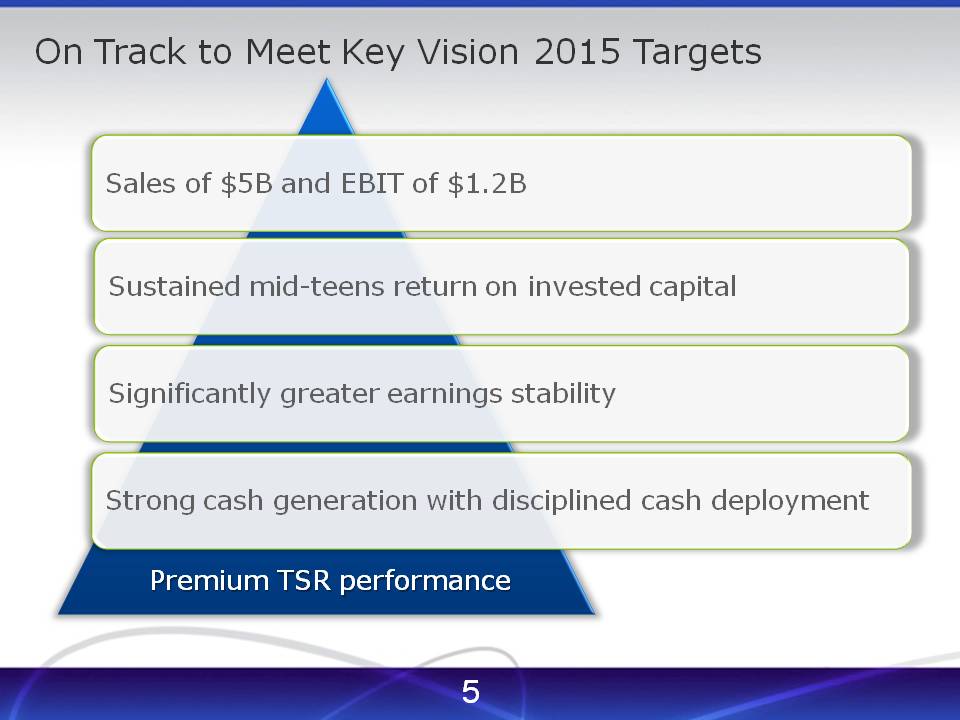

On Track to Meet Key Vision 2015 Targets Sales of $5B and EBIT of $1.2B Sustained mid-teens return on invested capital Significantly greater earnings stability Strong cash generation with disciplined cash deployment Premium TSR performance

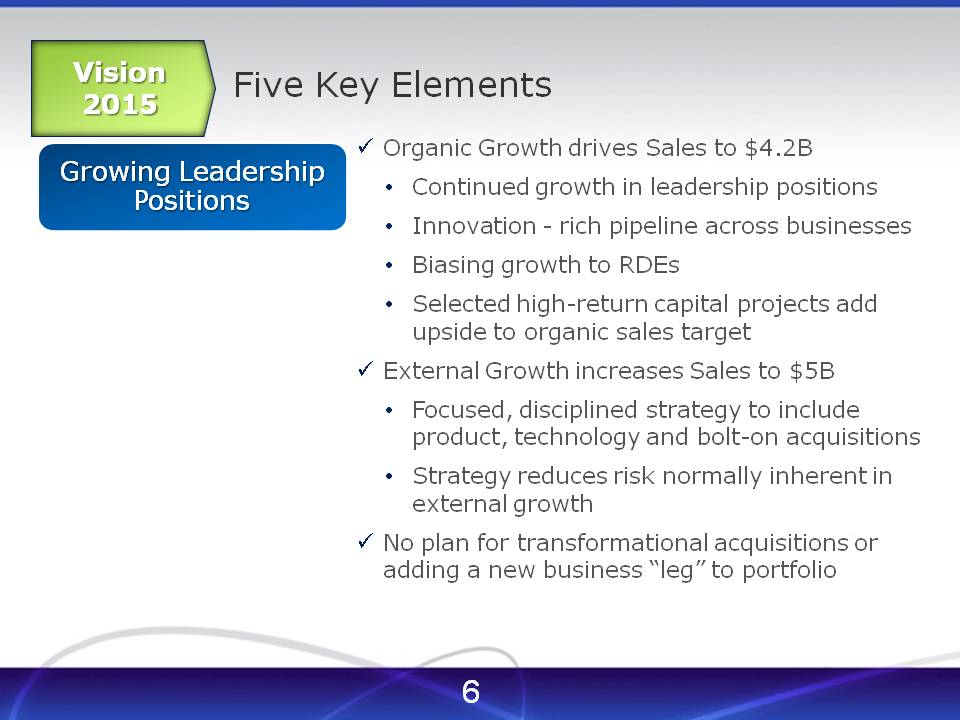

Five Key Elements Growing Leadership Positions Organic Growth drives Sales to $4.2B Continued growth in leadership positions Innovation - rich pipeline across businesses Biasing growth to RDEs Selected high-return capital projects add upside to organic sales target External Growth increases Sales to $5B Focused, disciplined strategy to include product, technology and bolt-on acquisitions Strategy reduces risk normally inherent in external growth No plan for transformational acquisitions or adding a new business “leg” to portfolio

Key Themes By Business Agricultural Products Maintaining premium margins while growing sales Increasing contribution from market and product innovations External growth focused on acquiring new product lines and accessing third-party active ingredients Specialty Chemicals

Food Ingredients - growing portfolio into other texturants and in RDEs, primarily through bolt-on acquisitions Pharmaceuticals - maintaining leading share and margin, selectively broadening portfolio Lithium - focusing on high growth Asian/Energy Storage markets Industrial Chemicals

Soda Ash - market leadership; operational excellence Peroxygens - global business shifting to specialty applications Environmental - commercializing product pipeline and investing to accelerate growth

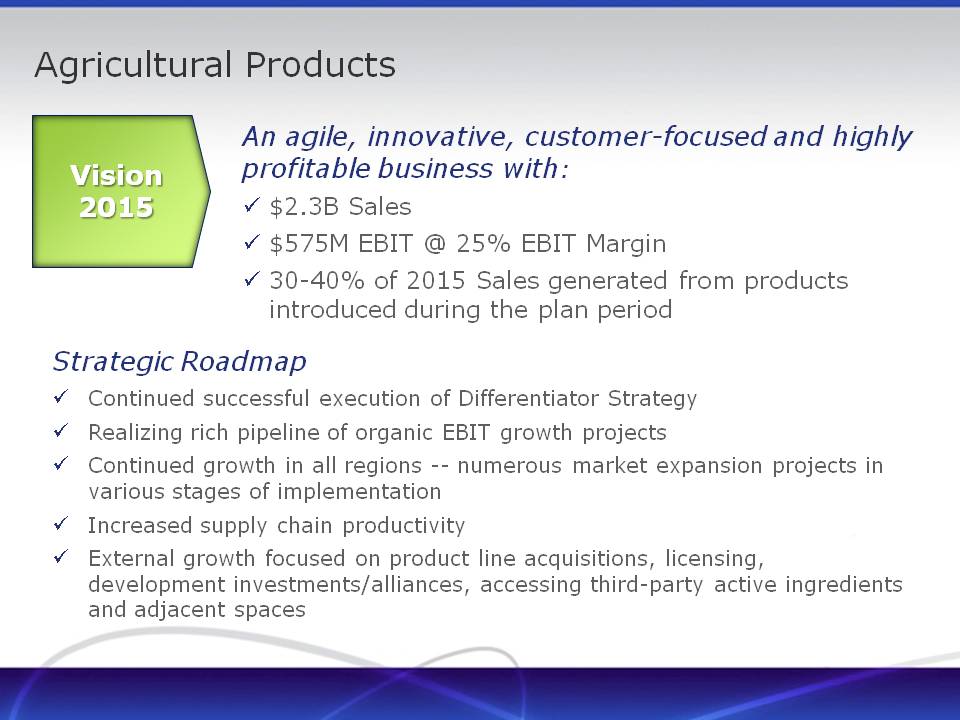

Agricultural Products An agile, innovative, customer-focused and highly profitable business with: $2.3B Sales $575M EBIT @ 25% EBIT Margin

30-40% of 2015 Sales generated from products introduced during the plan period Strategic Roadmap Continued successful execution of Differentiator Strategy Realizing rich pipeline of organic EBIT growth projects Continued growth in all regions -- numerous market expansion projects in various stages of implementation Increased supply chain productivity External growth focused on product line acquisitions, licensing, development investments/alliances, accessing third-party active ingredients and adjacent spaces

Organic Growth -- Rich Pipeline of EBIT Growth Opportunities Organic Growth Contribution to EBIT Innovation: Technologies to differentiate existing chemistries, e.g., increased control at lower use rates Access to third party chemistries Continue to extend and/or expand product life cycles Market Access: Alliances & investments strengthen market access in focus markets Operational Improvement: Maintain low-cost, virtual manufacturing structure Reinvent supply chain processes/systems to improve efficiencies and working capital performance Develop next-generation of low-cost sourcing

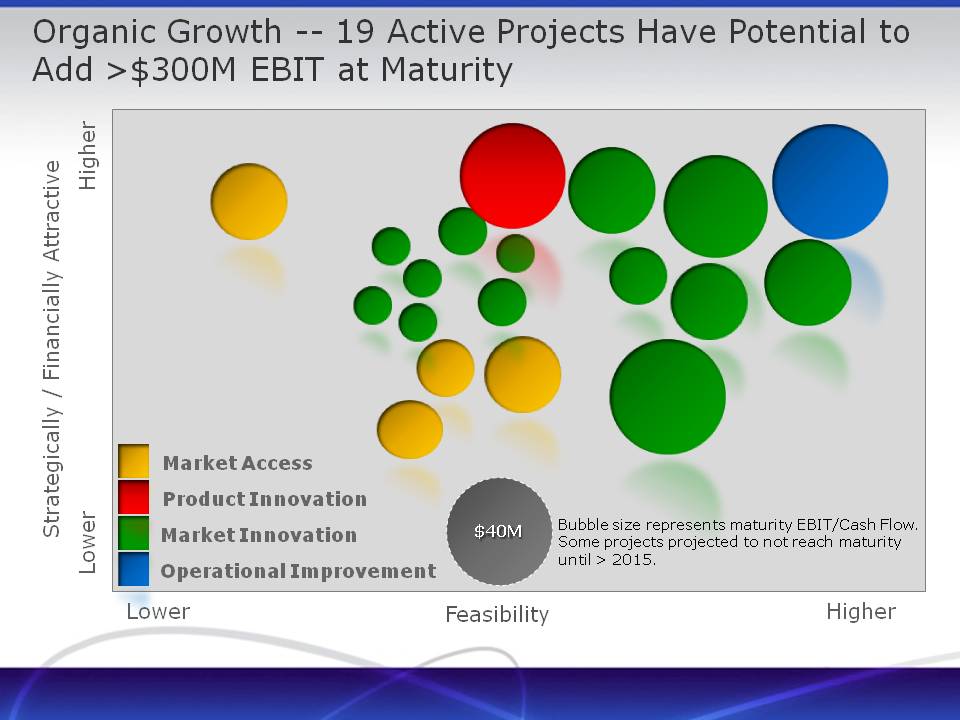

Organic Growth -- 19 Active Projects Have Potential to Add >$300M EBIT at Maturity

Strategically / Financially Attractive

Bubble size represents maturity EBIT/Cash Flow.

Some projects projected to not reach maturity until > 2015.

$40M

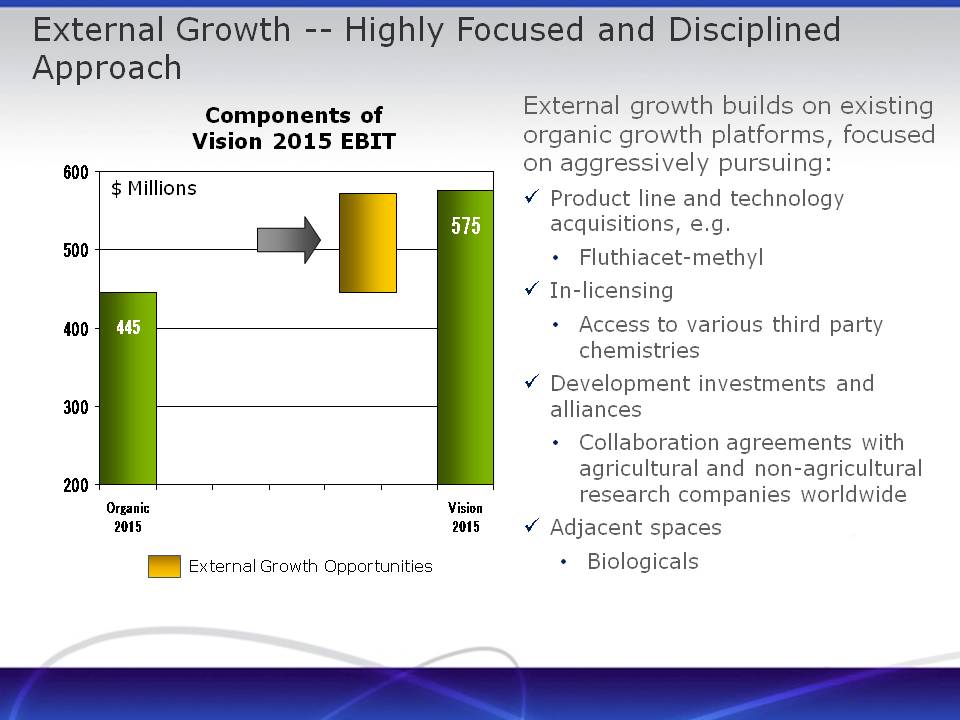

External Growth -- Highly Focused and Disciplined Approach Components of Vision 2015 EBIT External Growth Opportunities

External growth builds on existing organic growth platforms, focused on aggressively pursuing: Product line and technology acquisitions, e.g.

Fluthiacet-methyl In-licensing Access to various third party chemistries Development investments and alliances Collaboration agreements with agricultural and non-agricultural research companies worldwide Adjacent spaces Biologicals

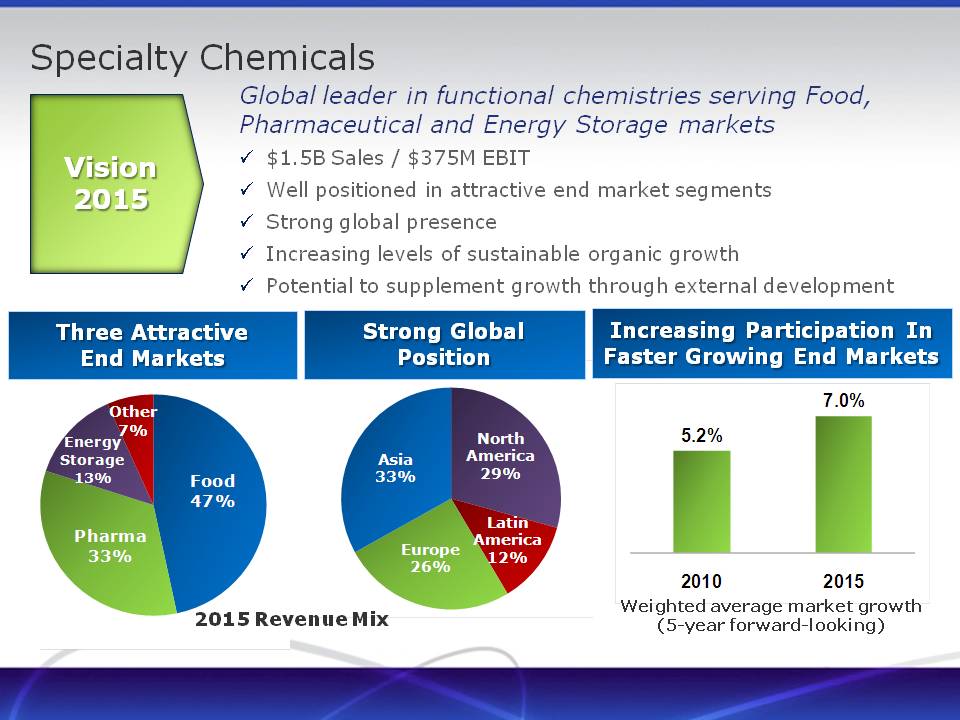

Specialty Chemicals Global leader in functional chemistries serving Food, Pharmaceutical and Energy Storage markets $1.5B Sales / $375M EBIT

Well positioned in attractive end market segments Strong global presence Increasing levels of sustainable organic growth Potential to supplement growth through external development Three Attractive End Markets Strong Global Position Increasing Participation In Faster Growing End Markets Weighted average market growth (5-year forward-looking) Energy Storage 13% Other 7% Food 47% Pharma 33% Asia 33% North America 29% Europe 26% Latin America 12% 5.2% 7.0%

Food Ingredients A $700M specialty ingredient supplier solving customer's global product development needs through innovative ingredient solutions Market Drivers Health & Nutrition Convenience Indulgence Rising Incomes (RDEs) Value FMC Starting Position Sales of ~$370M in 2010 Medium size, global innovator of texture ingredients Leadership positions in seaweed and cellulose specialties Low cost, premium supplier Premier performance among peers

Food Ingredients Market -- ~4% Stable Annual Growth $35B space fragmented by end-use applications and ingredient technology Percent of Category Natural Colors Synthetic Colors Flavor Enhancers Flavors Gelatin Soy concentrate Soy isolates Dairy whey fractions Dairy caseinates Pectin Gums Cellulosic Seaweed Native starch Modified starch Emulsifiers Vitamins Preservatives Antioxidants Enzymes Cultures Nutraceuticals Acidulants Current FMC market

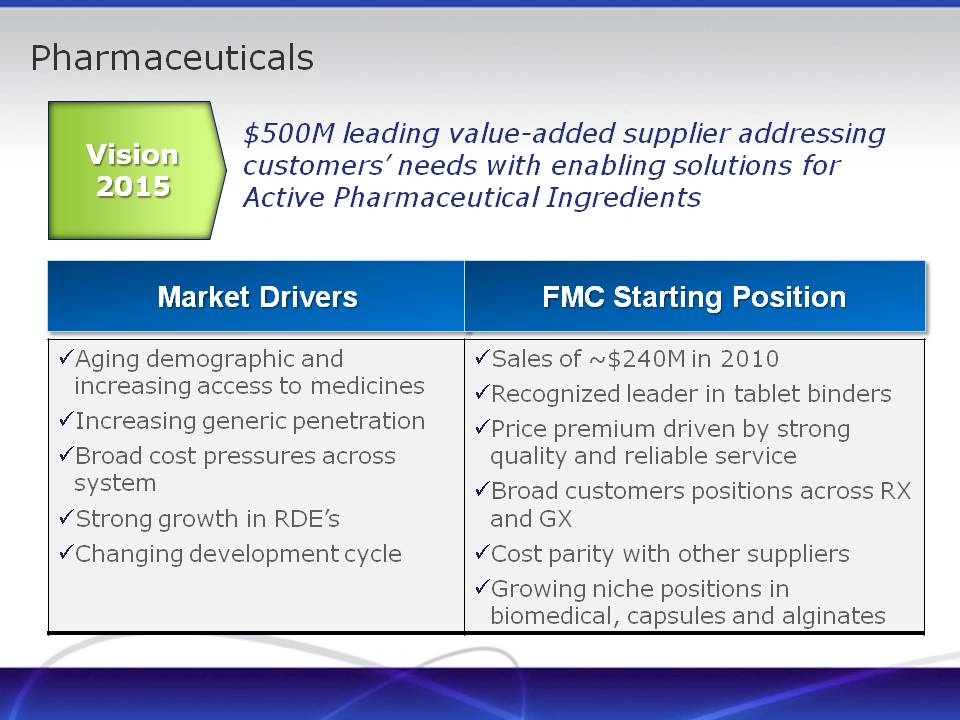

Pharmaceuticals $500M leading value-added supplier addressing customers' needs with enabling solutions for Active Pharmaceutical Ingredients Market Drivers Aging demographic and increasing access to medicines Increasing generic penetration Broad cost pressures across system Strong growth in RDE's Changing development cycle FMC Starting Position Sales of ~$240M in 2010 Recognized leader in tablet binders

Price premium driven by strong quality and reliable service Broad customers positions across RX and GX Cost parity with other suppliers

Growing niche positions in biomedical, capsules and alginates

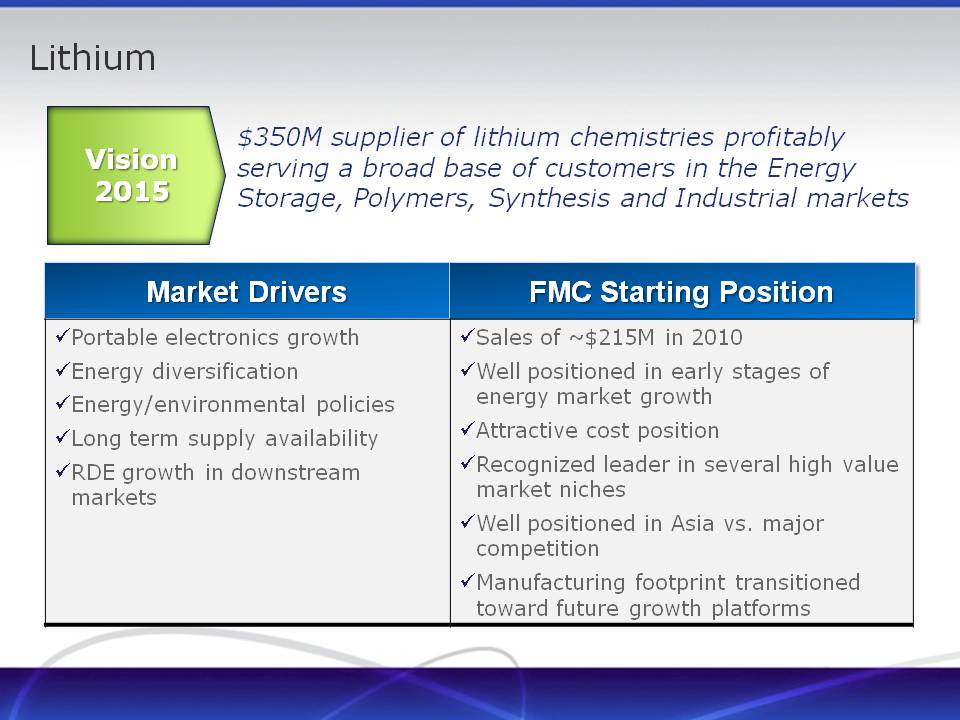

Lithium $350M supplier of lithium chemistries profitably serving a broad base of customers in the Energy Storage, Polymers, Synthesis and Industrial markets Market Drivers Portable electronics growth Energy diversification Energy/environmental policies Long term supply availability RDE growth in downstream markets FMC Starting Position Sales of ~$215M in 2010 Well positioned in early stages of energy market growth Attractive cost position Recognized leader in several high value market niches Well positioned in Asia vs. major competition Manufacturing footprint transitioned toward future growth platforms

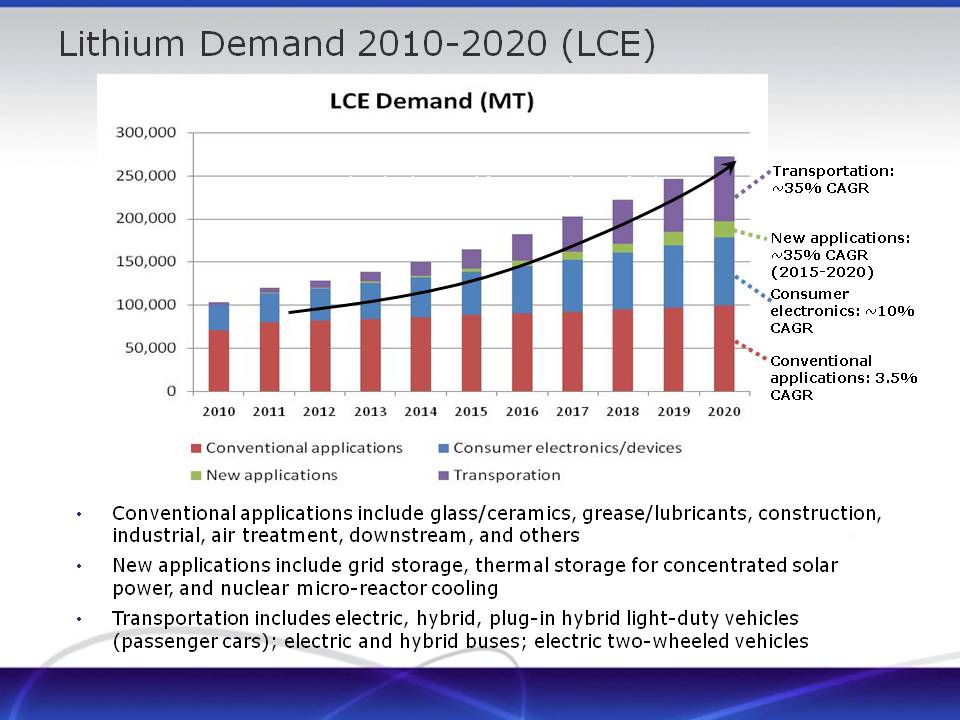

Lithium Demand 2010-2020 (LCE) Transportation: ~35% CAGR New applications: ~35% CAGR (2015-2020) Consumer electronics: ~10% CAGR

Conventional applications: 3.5% CAGR Conventional applications include glass/ceramics, grease/lubricants, construction, industrial, air treatment, downstream, and others New applications include grid storage, thermal storage for concentrated solar power, and nuclear micro-reactor cooling Transportation includes electric, hybrid, plug-in hybrid light-duty vehicles (passenger cars); electric and hybrid buses; electric two-wheeled vehicles

Non-GA

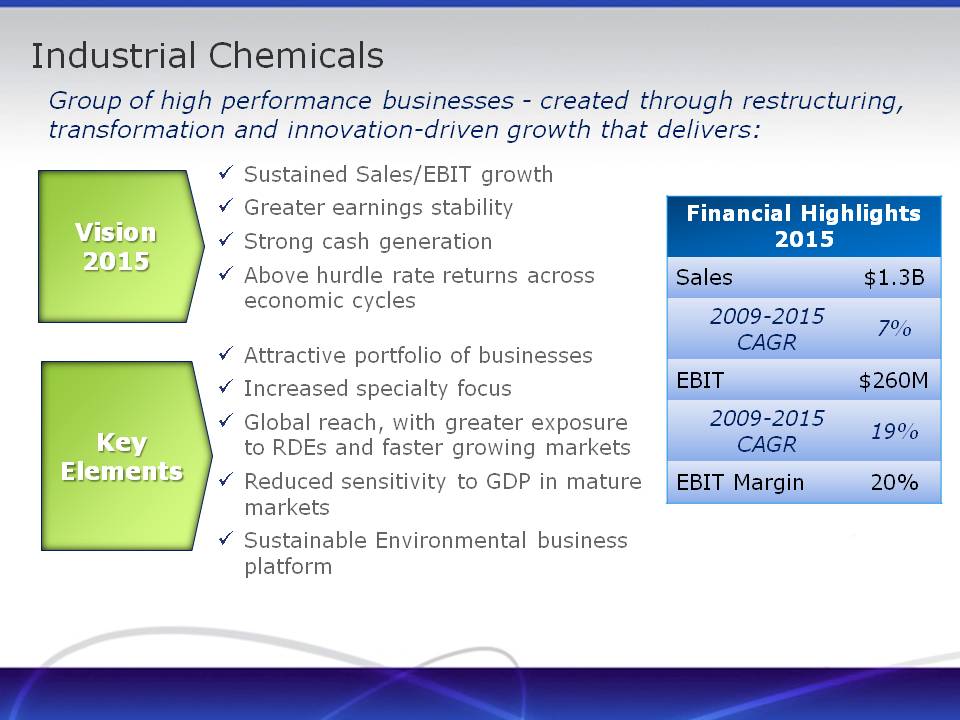

Industrial Chemicals Group of high performance businesses - created through restructuring, transformation and innovation-driven growth that delivers: Sustained Sales/EBIT growth Greater earnings stability Strong cash generation Above hurdle rate returns across economic cycles

Attractive portfolio of businesses Increased specialty focus Global reach, with greater exposure to RDEs and faster growing markets

Reduced sensitivity to GDP in mature markets Sustainable Environmental business platform Financial Highlights 2015 Sales $1.3B

2009-2015 CAGR 7% EBIT $260M 2009-2015 CAGR 19% EBIT Margin 20%

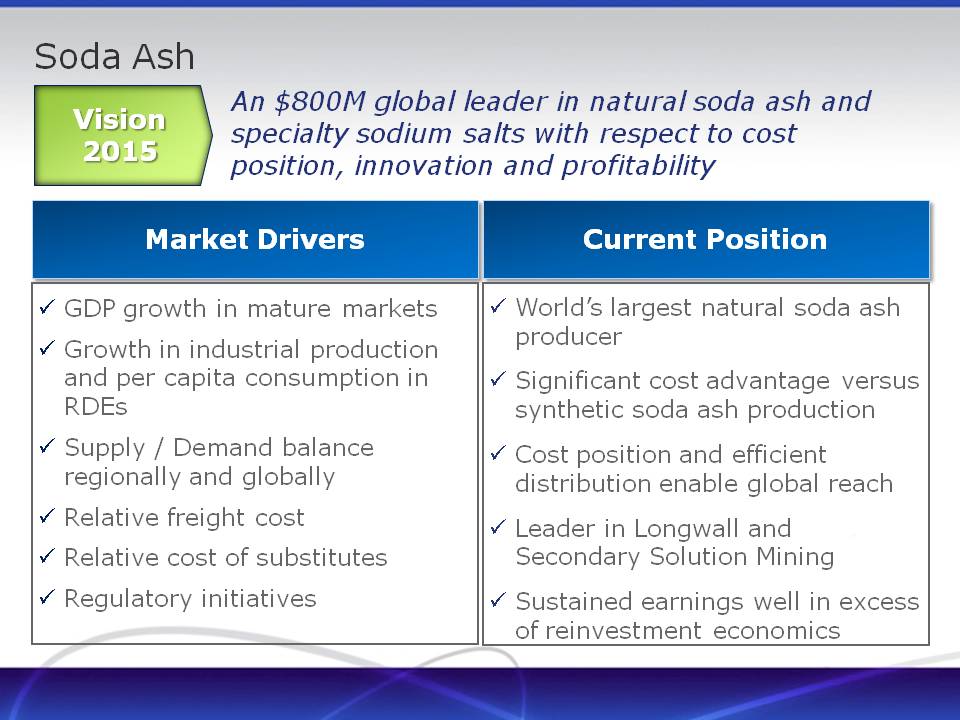

Soda Ash An $800M global leader in natural soda ash and specialty sodium salts with respect to cost position, innovation and profitability

Market Drivers GDP growth in mature markets Growth in industrial production and per capita consumption in RDEs

Supply / Demand balance regionally and globally Relative freight cost Relative cost of substitutes Regulatory initiatives Current Position

World's largest natural soda ash producer Significant cost advantage versus synthetic soda ash production Cost position and efficient distribution enable global reach Leader in Longwall and Secondary Solution Mining Sustained earnings well in excess of reinvestment economics

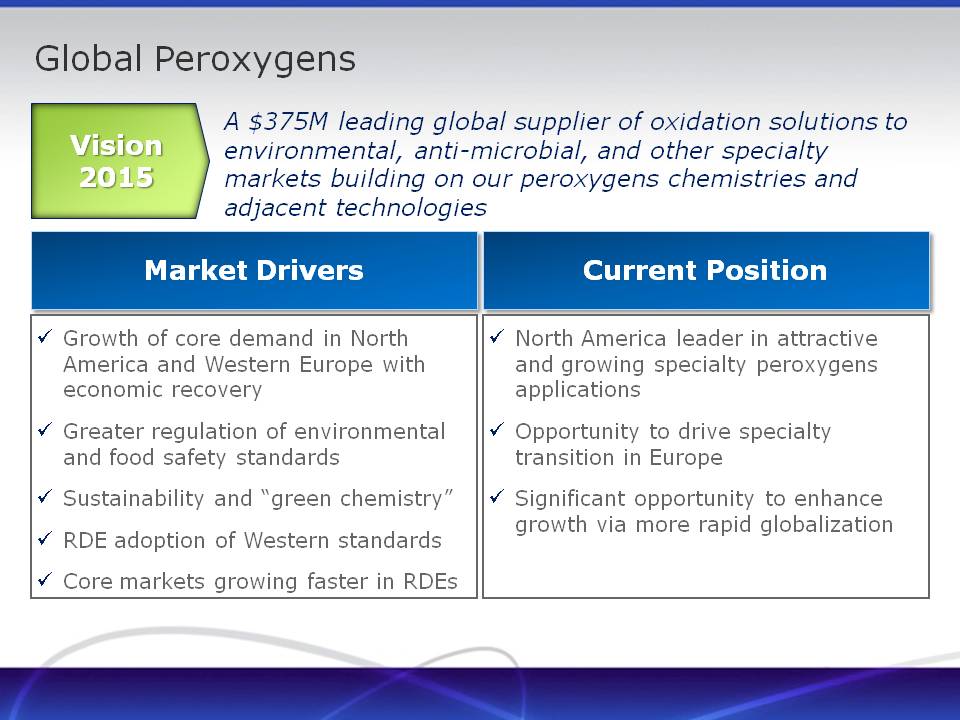

Global Peroxygens

A $375M leading global supplier of oxidation solutions to environmental, anti-microbial, and other specialty markets building on our peroxygens chemistries and adjacent technologies Market Drivers Growth of core demand in North America and Western Europe with economic recovery

Greater regulation of environmental and food safety standards Sustainability and “green chemistry” RDE adoption of Western standards

Core markets growing faster in RDEs Current Position North America leader in attractive and growing specialty peroxygens applications

Opportunity to drive specialty transition in Europe Significant opportunity to enhance growth via more rapid globalization

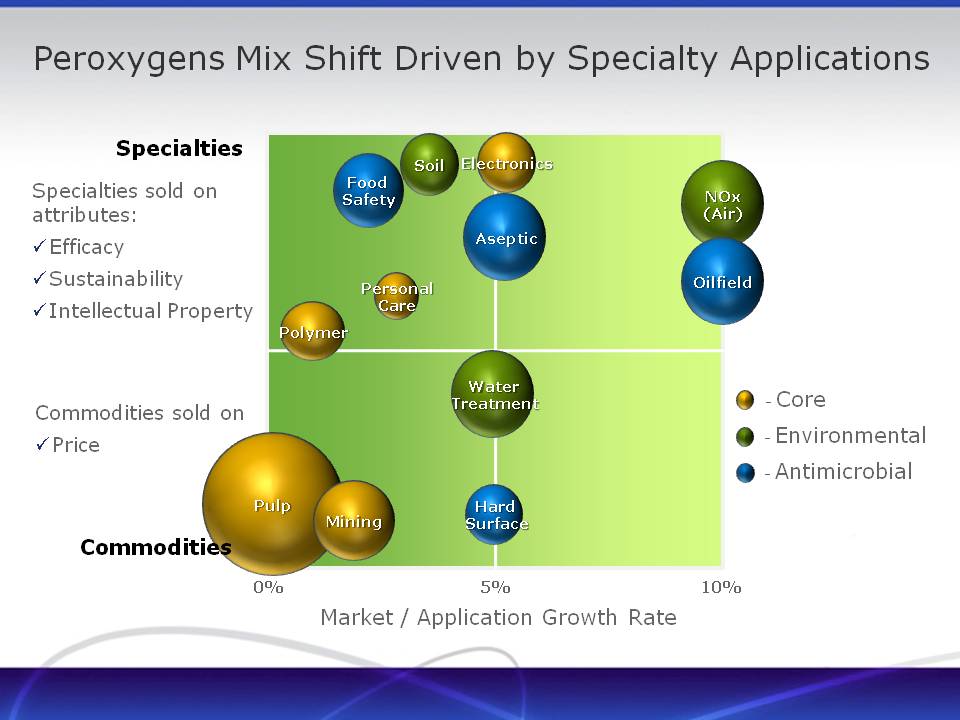

Peroxygens Mix Shift Driven by Specialty Applications Specialties Specialties sold on attributes: Efficacy Sustainability Intellectual Property Commodities Commodities sold on Price

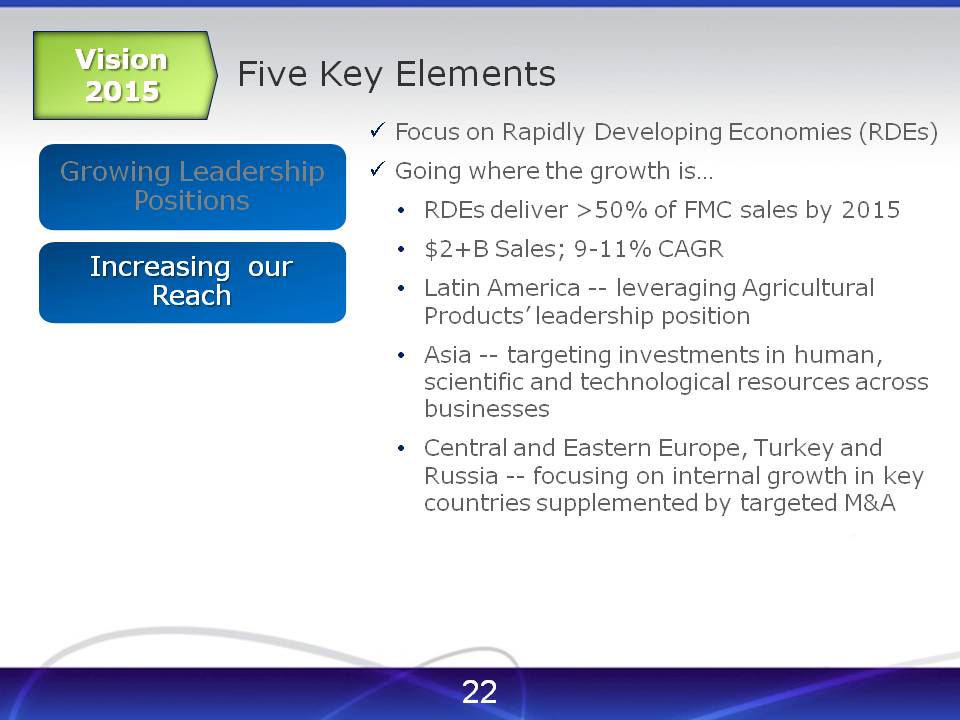

Five Key Elements Increasing our Reach Focus on Rapidly Developing Economies (RDEs) Going where the growth is… RDEs deliver >50% of FMC sales by 2015 $2+B Sales; 9-11% CAGR Latin America -- leveraging Agricultural Products' leadership position Asia -- targeting investments in human, scientific and technological resources across businesses Central and Eastern Europe, Turkey and Russia -- focusing on internal growth in key countries supplemented by targeted M&A

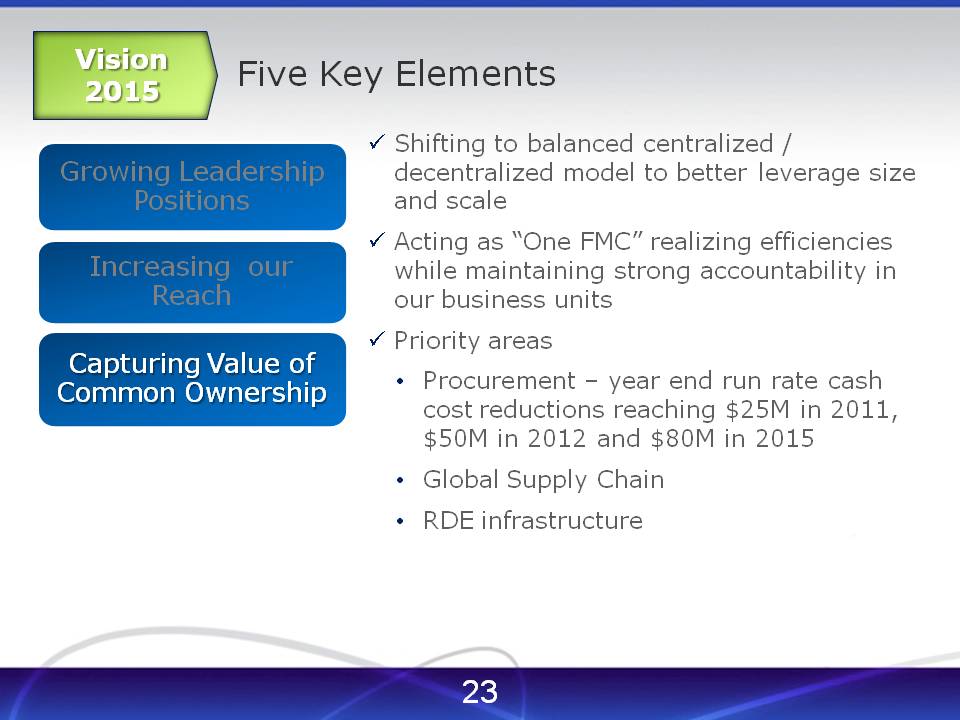

Five Key Elements Capturing Value of Common Ownership Shifting to balanced centralized / decentralized model to better leverage size and scale Acting as “One FMC” realizing efficiencies while maintaining strong accountability in our business units Priority areas Procurement - year end run rate cash cost reductions reaching $25M in 2011, $50M in 2012 and $80M in 2015 Global Supply Chain RDE infrastructure

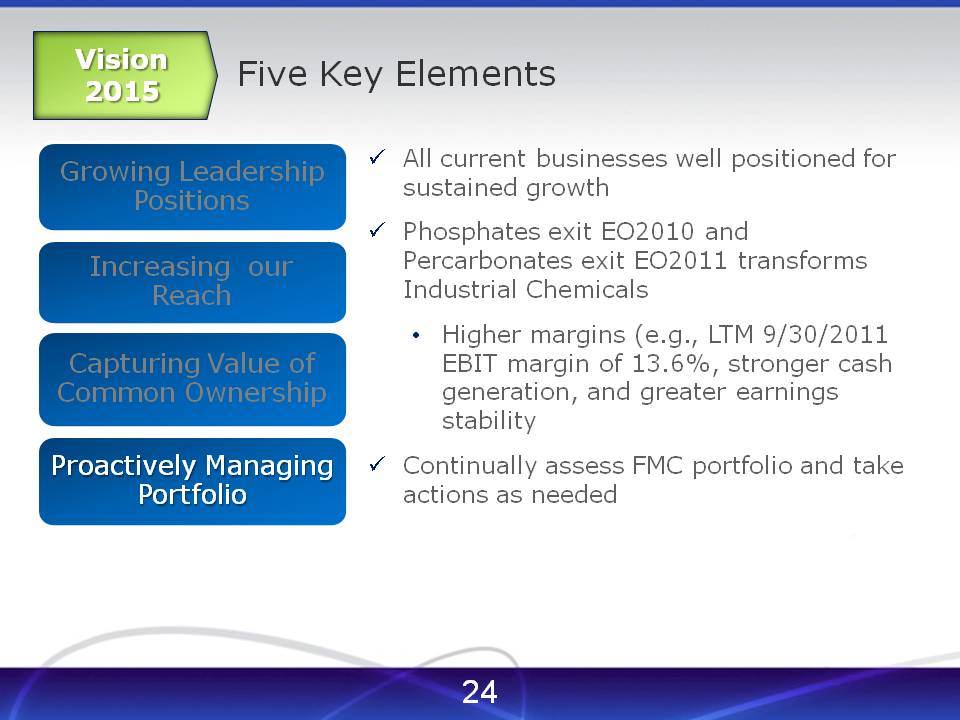

Five Key Elements Proactively Managing Portfolio All current businesses well positioned for sustained growth Phosphates exit EO2010 and Percarbonates exit EO2011 transforms Industrial Chemicals Higher margins (e.g., LTM 9/30/2011 EBIT margin of 13.6%, stronger cash generation, and greater earnings stability Continually assess FMC portfolio and take actions as needed

Five Key Elements Disciplined Cash Deployment Expect cumulative cash of ~$3B for deployment over 2010 - 2015 Delivering on organic growth goals generates ~$2B cash flow ~$1B additional debt capacity consistent with solid investment grade credit rating External growth strategy not expected to consume all cash available for deployment Expect to return meaningful amount of cash to shareholders over this period

Vision 2015 FMC The right Chemistry

Glossary of Financial Terms & Reconciliations of GAAP to Non-GAAP

Non-GAAP Financial Terms These slides contain certain “Non-GAAP” financial terms which are defined below. In addition, we have provided reconciliations of Non-GAAP terms to the closest GAAP term in the appendix of this presentation EBIT (Earnings Before Interest and Taxes) is the sum of Adjusted Income/(Loss) from Continuing Operations before Interest and Taxes EBIT Margin is the quotient of EBIT (defined above) divided by Revenue

EBIT Reconciliation: LTM 9/30/2011 Reconciliation of consolidated income from continuing operations before income taxes (a GAAP measure) to EBIT (a Non-GAAP measure) (Unaudited, in $ millions) Income (loss) from continuing operations before income taxes Net Income attributable to non-controlling interests Restructuring and other charges/income, net Non qualified pension settlement charge adjustments Interest expense, net Non-Operating pension and postretirement charges EBIT (Non- GAAP) $403.0 (15.7) 143.4 7.3 39.8 15.3 $593.1

Vision 2015 FMC The right Chemistry