Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WHIRLPOOL CORP /DE/ | d249888d8k.htm |

WHIRLPOOL

CORPORATION

1

November 2011

Exhibit 99.1 |

COMPANY

OVERVIEW 2

World’s #1 major appliance company

$18+ billion in revenue

Products sold in more than 130 countries

Every Home…Everywhere |

#1

Major

Appliance

Company

Strongest

Brand

Portfolio

Best

Distribution

Leading

Scale

3

STRONG FOUNDATION

+

GROWTH

= Long-Term Value Creation

Geographic expansion

Product innovation

Adjacent Businesses

Product line/

Channel share

growth |

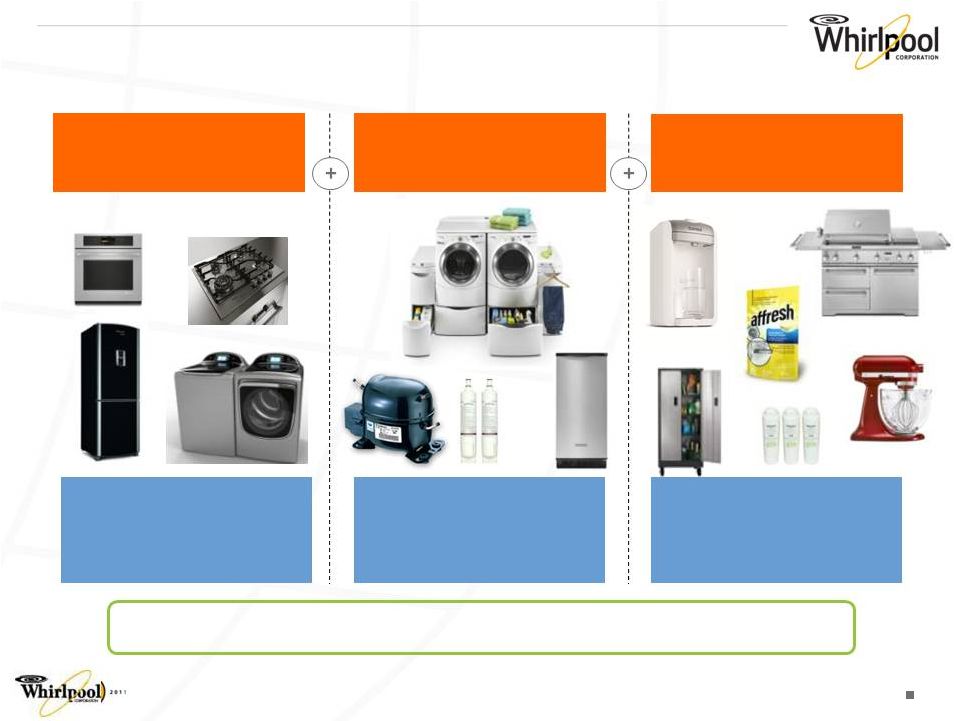

SIGNIFICANT

OPPORTUNITY TO GROW CORE PRODUCT LEADERSHIP AND EXPAND ADJACENCIES

4

EXTEND THE CORE

EXPAND BEYOND THE

CORE

Products or services that are

dependent on and related to

our core business

Stand-alone businesses that

leverage our core

competencies and core

business infrastructure

LEADING GLOBAL BRANDED CONSUMER PRODUCTS COMPANY

GROW THE CORE

T-12 major appliances |

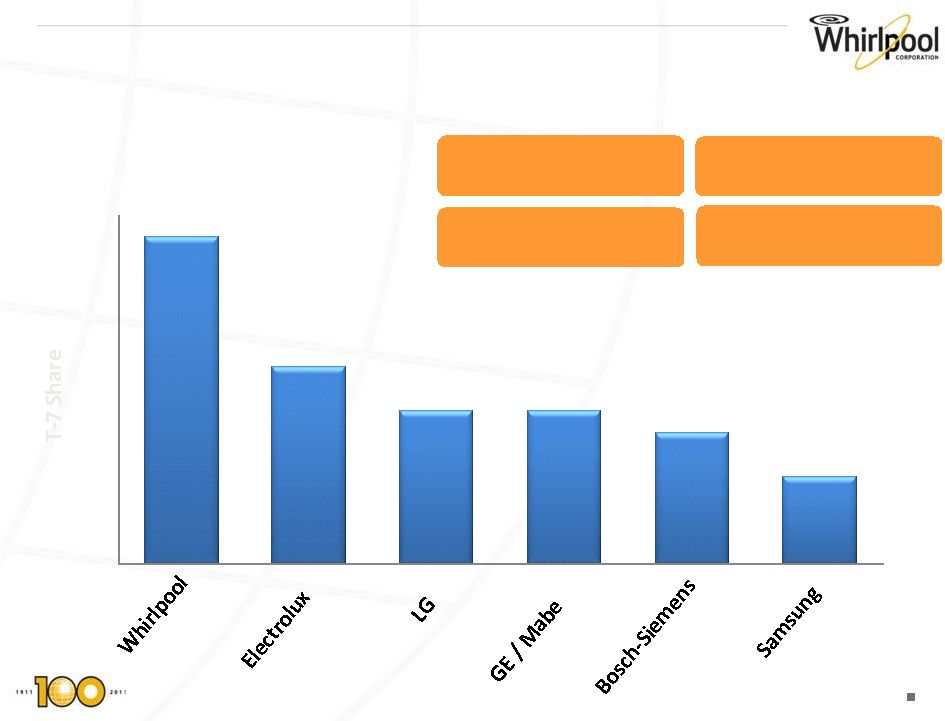

GLOBAL SHARE

WITH BROAD DISTRIBUTION #1 North America

#1 Latin America

#2 India

#3 Europe

5

0%

2%

4%

6%

8%

10%

12%

14%

16% |

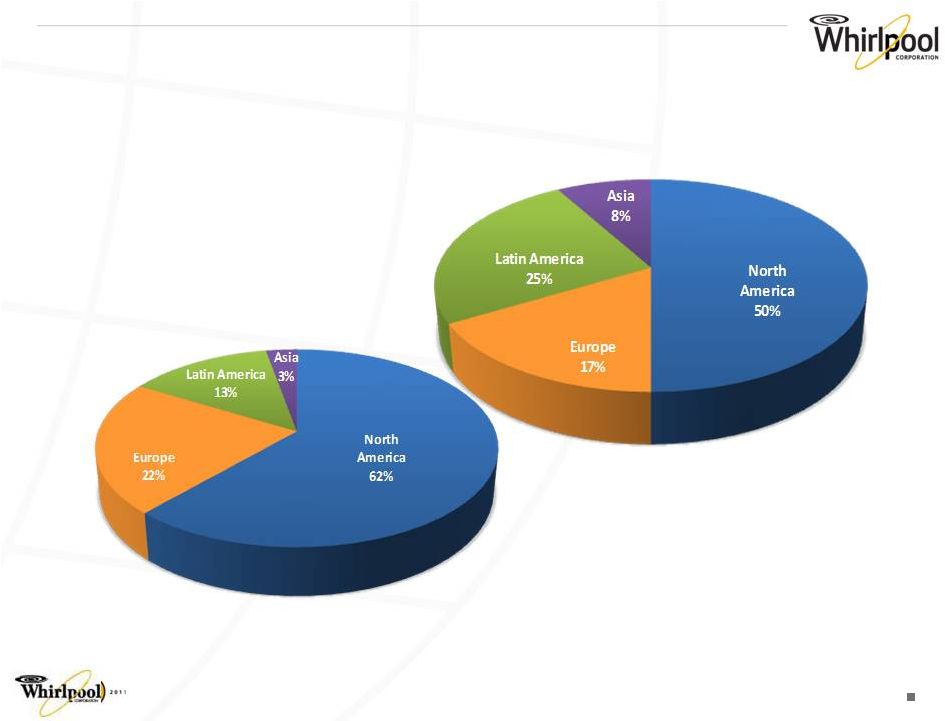

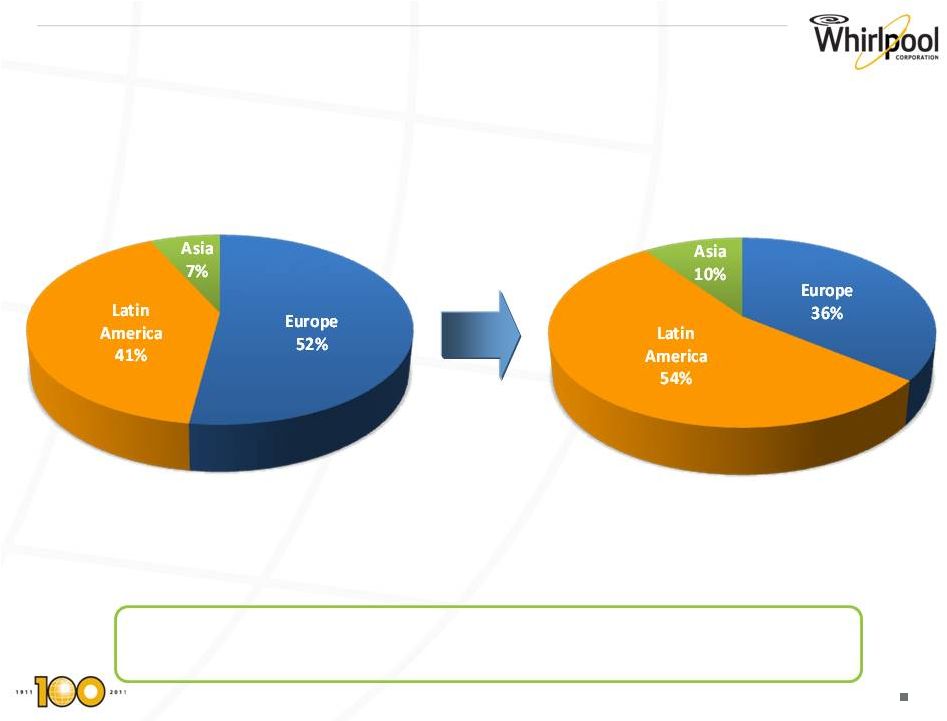

GLOBAL

LEADER MORE DIVERSIFIED THAN EVER BEFORE

2014 (est.)

2005

6 |

SIGNIFICANT

GROWTH OPPORTUNITIES Current Average Penetration %

Global Appliance Market ~$120 Billion

7

77%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

United

States

Western

Europe

Middle East

Central &

Eastern

Europe

Mexico

Latin

America

China

India |

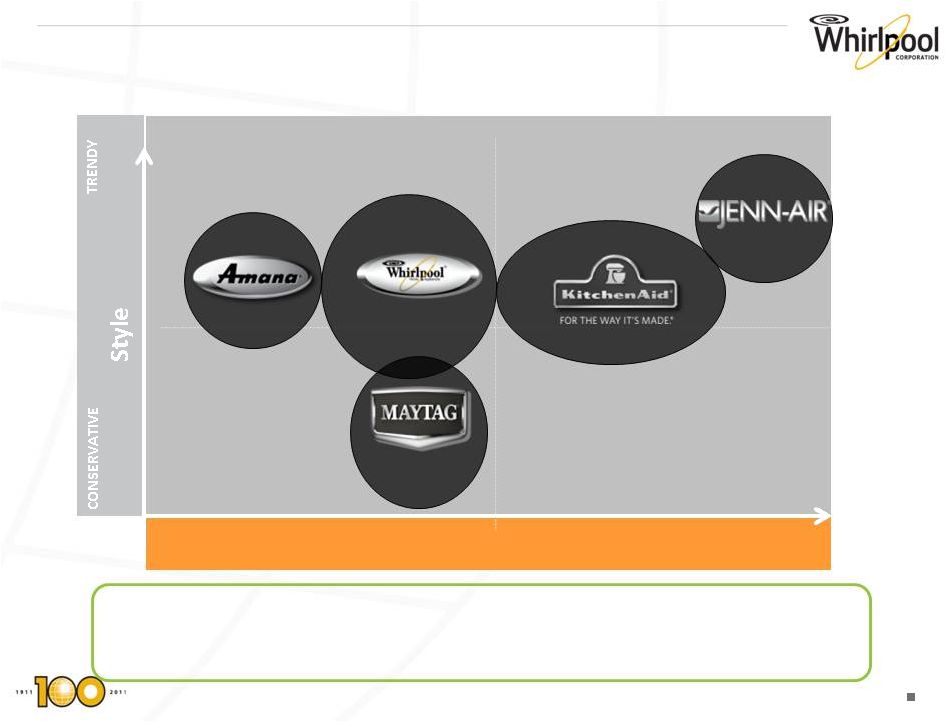

UNMATCHED U.S.

CONSUMER REACH HIGHER

LOWER

Willingness to pay

Consumer Target Segment % of Total

5%

30%

21%

9%

22%

Whirlpool Corporation’s Brand Portfolio Can Reach More Than

85% of Consumers, Most Consumer-Preferred Brands

8 |

STRONG

INTERNATIONAL ASSETS Leading brand portfolio

Leading emerging market position

#1 in Latin America appliance

#1 in Global Compressors

#2 in India

Platform for growth in China

Superior economies of scale

Leveraging global capabilities in local regions

Strong local management base

We have developed local capabilities to win

9 |

STRONG AND

GROWING PRESENCE IN EMERGING MARKETS

2006

2011 YTD

Nearly 2/3 of International Revenue is

Derived From Emerging Markets

10 |

Whirlpool

Confidential Q3 2011 REVIEW

Slowing global economy …

weakening global demand

U.S. consumer confidence declined to 2009 levels

European financial crisis has deepened

Slowdown in emerging markets

Elevated raw material prices …

reached record levels during quarter

Implementing cost and capacity reduction initiatives

11 |

Whirlpool

Confidential BUSINESS PRIORITIES

Expand operating margins

Accelerate innovative new product launches

Reduce structural costs and production capacity

Implement previously announced cost-based price increases

Fair trade actions

12

Positioning the company for margin

expansion

in a volatile demand environment |

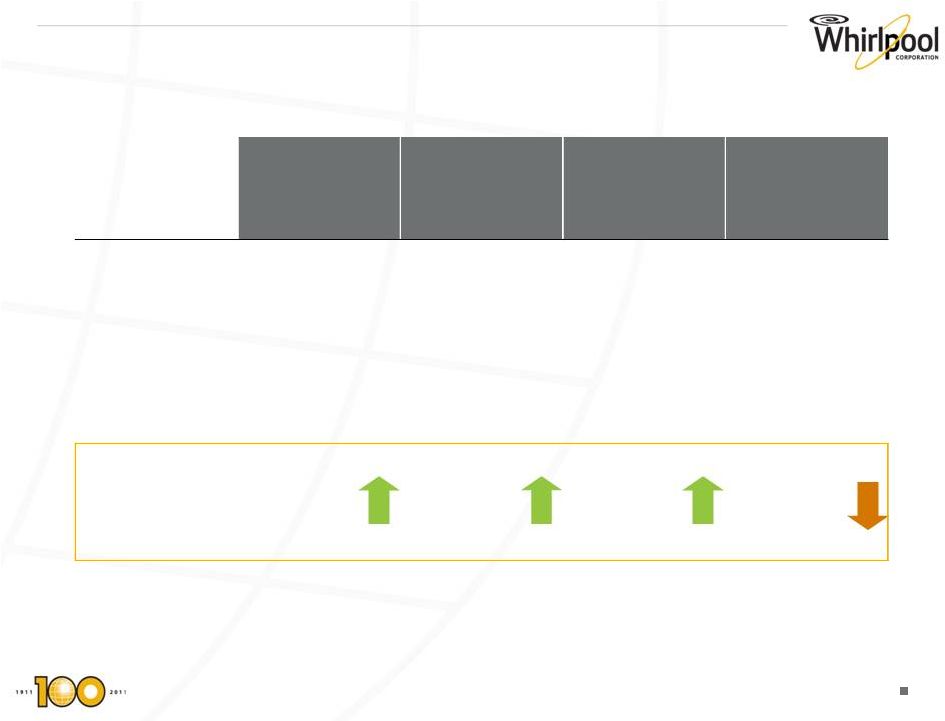

Sales

Diluted EPS

(GAAP)

Adjusted

Diluted EPS*

Free Cash

Flow YTD**

2011

$4.6B

$2.27

$2.35

$(0.7)B

2010

$4.5B

$1.02

$2.22

$(0.0)B

Change

$0.1B

$1.25

$0.13

$(0.7)B

Q3 2011 RESULTS OVERVIEW

13

*

Adjusted EPS is a non-GAAP measure. See appendix slide 22 & 23

**

Free Cash Flow is a non-GAAP measure. See appendix slide 25

|

Comprehensive

global review of our operations, products and manufacturing locations

Targets high-cost locations with product segments that have low profitability

Concentrates production in best-cost locations

Positions company to achieve long-term operating margin target

STRUCTURAL COST REDUCTION ACTIONS

14

14 |

STRUCTURAL

COST REDUCTION ACTIONS 15

Implementation has begun

15

Reduce Fixed Costs 2012 -

2013

Workforce Reduction

>5,000

Manufacturing Capacity Reduction

~6 million units

Restructuring Charges Q4 2011 –

2013

~$500 million

~$400 million |

~$87M

~$237M

~$109M

~$18M

~$43M

~$6M

$-

$50

$100

$150

$200

$250

$300

Q411

2012

2013

Non-Cash Charge

Cash Charge

~$105M

~$280M

~$115M

COST & CAPACITY REDUCTION INITIATIVES

16

~$500M restructuring expense |

$-

$50

$100

$150

$200

$250

$300

$350

$400

2012

2013

Annualized

EFFICIENCIES OF COST & CAPACITY REDUCTION

INITIATIVES

17

•

>5,000 headcount reduction

•

~6 million unit capacity reduction

•

~$400M annualized cost reduction |

LONG-TERM

VALUE CREATION TARGETS 18

Macroeconomic assumptions are critical

elements

in setting our long-range financial goals

Shareholder Value

Creation Targets

+5 –

7% Revenue Growth

8% Operating Margin

+10 –

15% EPS Growth

4 –

5% FCF % to Sales |

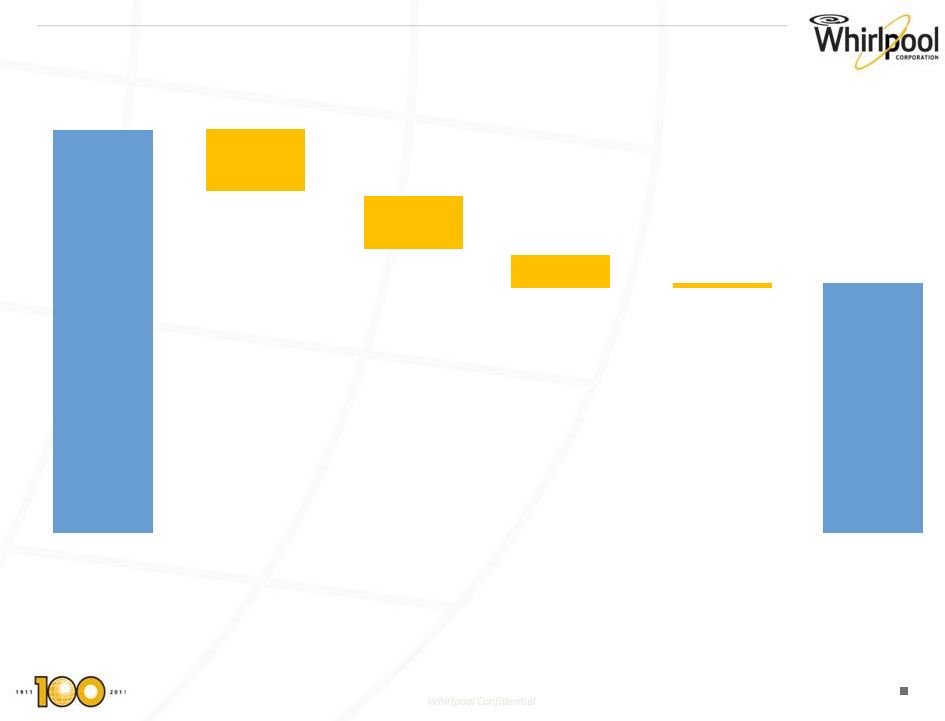

Fixed cost

and capacity reduction initiatives announced today Ongoing productivity

initiatives Improved price mix driven by innovation and cost-based price increases

Adjacent business growth

Pace of industry demand recovery

OPERATING MARGIN DRIVERS

19 |

2011 EARNINGS

GUIDANCE 20

$7.25 -

$8.25

$4.75 -

$5.25

~$ –

Incremental

Restructuring

Offset by

Non-Operating

Items*

Global Industry

Demand

Productivity

Cost Take-out

(Conversion Cost

Impacted by

Lower Demand)

Country and

Product Mix

Previous

Guidance

Latest

Guidance

~$(0.55)

~$(0.90)

~$(0.80)

*

Supplier Recovery, Curtailment Gain and Foreign Currency

(Provided 10/28/11) |

APPENDIX

21 |

The

reconciliation provided below reconciles the non-GAAP financial measures adjusted operating profit,

adjusted earnings before tax and adjusted diluted earnings per share, with the most directly

comparable GAAP financial measures, reported operating profit, earnings before income

taxes and other items, diluted earnings per share available to Whirlpool common

stockholders, for the three-months ended September 30, 2011. Adjusted

operating margin is calculated by dividing adjusted operating profit by net sales. ADJUSTED OPERATING PROFIT, ADJUSTED EARNINGS

BEFORE TAX, ADJUSTED DILUTED EARNINGS PER SHARE:

22

Reported GAAP Measure

136

$

58

$

2.27

$

Embraco

Antitrust

Matters

(a)

-

6

0.08

Adjusted Non-GAAP measure

136

$

64

$

2.35

$

Three-Months Ended

September 30, 2011

Operating Profit

Earnings Before

Tax

Diluted Earnings

Per Share |

The

reconciliation provided below reconciles the non-GAAP financial measures adjusted operating profit,

adjusted earnings before tax and adjusted diluted earnings per share, with the most directly

comparable GAAP financial measures, reported operating profit, earnings before income

taxes and other items, diluted earnings per share available to Whirlpool common

stockholders, for the three-months ended September 30, 2010. Adjusted

operating margin is calculated by dividing adjusted operating profit by net sales. ADJUSTED OPERATING PROFIT, ADJUSTED EARNINGS

BEFORE TAX, ADJUSTED DILUTED EARNINGS PER SHARE:

23

Reported GAAP Measure

234

$

76

$

1.02

$

Embraco

Antitrust

Matters

(b)

-

93

1.20

Adjusted Non-GAAP measure

234

$

169

$

2.22

$

Three-Months Ended

September 30, 2010

Operating Profit

Earnings Before

Tax

Diluted Earnings

Per Share |

2011 OUTLOOK

- ADJUSTED DILUTED EARNINGS PER SHARE:

24

Current GAAP Guidance

4.75

$

-

5.25

$

Brazilian Collection Dispute

3.70

-

3.70

Embraco Antitrust Matters

1.13

-

1.13

Supplier Quality Issue Recovery

(0.06)

-

(0.06)

Adjusted Non-GAAP Measure

9.52

$

-

10.02

$

2011 Outlook

Adjusted Diluted EPS |

As defined by

the company, free cash flow is cash provided by operating activities after capital expenditures

and proceeds from the sale of assets/businesses. The reconciliation provided below

reconciles actual nine-month 2011 and 2010 and projected 2011 full-year free

cash flow with actual and projected cash (used in) / provided by operating activities,

the most directly comparable GAAP financial measure. FREE CASH FLOW (Actual and 2011

Outlook): 25

* Includes 2011 Brazilian collection dispute payment.

(millions of dollars)

2011*

2010

Cash provided by / (used in) operating activities

(342)

$

377

$

Capital expenditures

(417)

(387)

Proceeds from sale of assets

20

9

Free Cash Flow

(739)

$

(1)

$

$ (150) -

20 -

Nine Months Ended

September 30,

$ 430 -

(600) -

2011 Outlook

400

(625)

25

( 200) |

| FOOTNOTES:

26

2011

a)

During the September 2011 quarter, we recognized an increased accrual of $6 million related to

the ongoing Embraco antitrust matters. The diluted earnings per share impact is

calculated based on an associated income tax impact of $0 due to the

non-deductibility of the expense for income tax purposes.

During

the

September

2010

quarter,

we

recorded

an

accrual

of

$93

million

related

to

antitrust

plea

agreements

entered

into

by

a

compressor

subsidiary

with

the

U.S.

government

and

with

the

Canadian

government.

The

diluted

earnings

per

share

impact

is

calculated

based

on

an

associated

income

tax

impact of $0 due to the non-deductibility of the expense for income tax purposes.

b)

2010 |

WHIRLPOOL

ADDITIONAL INFORMATION: 27

This document contains forward-looking statements about Whirlpool Corporation and its

consolidated subsidiaries (“Whirlpool”) that speak only as of this date.

Whirlpool disclaims any obligation to update these statements. Forward-looking

statements in this document may include, but are not limited to, statements regarding

expected earnings per share, cash flow, productivity and material and oil-related prices. Many risks,

contingencies and uncertainties could cause actual results to differ materially from

Whirlpool’s forward-looking statements. Among these factors are: (1) intense

competition in the home appliance industry reflecting the impact of both new and

established global competitors, including Asian and European manufacturers; (2)

Whirlpool’s ability to continue its relationship with significant trade customers and the

ability of these trade customers to maintain or increase market share; (3) changes in

economic conditions which affect demand for our products, including the strength of the

building industry and the level of interest rates; (4) litigation and legal compliance

risk and costs, especially costs which may be materially different from the amount we expect to incur

or have accrued for; (5) the effects and costs of governmental investigations or related

actions by third parties; (6) the ability of Whirlpool to achieve its business plans,

price increases, productivity improvements, cost control, leveraging of its global

operating platform, and acceleration of the rate of innovation; (7) fluctuations in the cost

of key materials (including steel, oil, plastic, resins, copper and aluminum) and components

and the ability of Whirlpool to offset cost increases; (8) product liability and

product recall costs; (9) the ability of Whirlpool to manage foreign currency

fluctuations; (10) global, political and/or economic uncertainty and disruptions,

especially in Whirlpool’s significant geographic regions, including uncertainty and

disruptions arising from natural disasters or terrorist attacks; (11) inventory and

other asset risk; (12) the ability of suppliers of critical parts, components and

manufacturing equipment to deliver sufficient quantities to Whirlpool in a timely and cost-

effective manner; (13) health care cost trends, regulatory changes and variations between

results and estimates that could increase future funding obligations for pension and

post retirement benefit plans; (14) Whirlpool’s ability to obtain and protect

intellectual property rights; (15) information technology system failures and data

security breaches; (16) the impact of labor relations; (17) our ability to attract, develop

and retain executives and other qualified employees; and (18) changes in the legal and

regulatory environment including environmental and health and safety regulations.

Additional information concerning these and other factors can be found in Whirlpool

Corporation's filings with the Securities and Exchange Commission, including the most recent annual

report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form

8-K. |

28

|