Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SunCoke Energy, Inc. | d249501d8k.htm |

| EX-99.1 - PRESS RELEASE DATED NOVEMBER 2, 2011 - SunCoke Energy, Inc. | d249501dex991.htm |

Q3 2011

Earnings Conference Call November 2, 2011

Exhibit 99.2 |

Safe Harbor

Statement This slide presentation should be reviewed in conjunction with

SunCoke’s Third Quarter 2011 earnings release conference call held on

November 2, 2011 at 10:00 a.m. ET and SEC Form 10-Q for the quarter ended September 30, 2011.

Statements in this presentation that are not historical facts are

forward-looking statements intended to be covered by the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These

forward-looking statements are based upon assumptions by SunCoke concerning

future conditions, any or all of which ultimately may prove to be

inaccurate, and upon the current knowledge, beliefs and expectations of SunCoke management. These forward-

looking statements are not guarantees of future performance.

Forward looking statements are inherently uncertain and involve significant risks

and uncertainties that could cause actual results to differ materially from

those described during this presentation. Such risks and uncertainties include economic, business,

competitive and/or regulatory factors affecting SunCoke’s business, as well as

uncertainties related to the outcomes of pending or future

litigation.

In

accordance

with

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995,

SunCoke

has included in its filings with the Securities and Exchange Commission, cautionary

language identifying important factors (though not necessarily all such

factors) that could cause future outcomes to differ materially from those set forth in the forward looking

statements. For more information concerning these factors, see SunCoke's Securities

and Exchange Commission filings. SunCoke expressly disclaims any obligation

to update or alter its forward looking statements, whether as a result of new

information, future events or otherwise. For more information concerning these

factors, see SunCoke's Securities and Exchange Commission

filings,

available

on

SunCoke's

website

at

www.suncoke.com

in

the

Investor

Relations

section.

This presentation includes certain non-GAAP financial measures intended to

supplement, not substitute for, comparable GAAP measures. Reconciliations of

non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end

of the presentation. Investors are urged to consider carefully the comparable GAAP

measures and the reconciliations to those measures provided in the Appendix,

or on our website at www.suncoke.com. Third Quarter 2011 Earnings Conference

Call 1

Exhibit 99.2 |

Overview

Third Quarter 2011 Earnings Conference Call

2

•

Q3

2011

Net

Income

attributable

to

SunCoke

shareholders

of

$18.4

million

and EPS of $0.26 per share

•

Q3 2011 Adjusted EBITDA of $44.8 million reflects improved sequential

performance over Q1 & Q2 2011

•

Decreased from $62.2 million in Q3 2010

•

Achieved record domestic coke production with return to target contract

volumes at Indiana Harbor

•

Completed purchase of GECC 19% stake in Indiana Harbor partnership

for $34 million

•

Accretive to 2012 Adjusted EBITDA by approximately $8 million

•

Commenced Middletown start-up in mid-October and expect to achieve 100%

throughput by July 2012 |

Overview

(continued) Third Quarter 2011 Earnings Conference Call

3

•

Coal

operations

improved

Q3

2011

Adjusted

EBITDA

by

$9.5

million on

stronger metallurgical coal pricing

•

Jewell

coal

production

flat

year

over

year

reflecting

challenges

to

Jewell

deep mining expansion

•

Corporate expense of $14.3 million reflects impact of standalone, relocation

and Middletown start-up costs in the quarter

•

Ended quarter with cash balance of $111 million with $150 million revolver

undrawn |

($ in

millions) Q3 '11

Q3 '10

Q2 '11

Q3 '11 vs.

Q3 '10

Q3 '11 vs.

Q2 '11

Revenue

$403.5

$331.6

$378.0

$71.9

$25.5

Operating Income

$30.1

$48.4

$21.4

($18.3)

$8.7

Net Income Attributable to

Shareholders

$18.4

$37.5

$22.4

($19.1)

($4.0)

Earnings Per Share

$0.26

$0.53

$0.32

($0.27)

($0.06)

Coke

Adjusted

EBITDA

(1)

$50.3

$66.2

$39.0

($15.9)

$11.3

Coal Adjusted EBITDA

$8.8

($0.7)

$9.1

$9.5

($0.3)

Corporate/Other

($14.3)

($3.3)

($10.5)

($11.0)

($3.8)

Adjusted

EBITDA

(2)

$44.8

$62.2

$37.6

($17.4)

$7.2

Coke Sales Volumes

968

984

927

(16)

41

Coal Sales Volumes

371

313

334

58

37

Q3 ‘11 Financial Results

(1)

Coke

Adjusted

EBITDA

includes

Adjusted

EBITDA

from

Jewell

Coke,

Other

Domestic

Coke

and

International

segments.

(2)

For

a

definition

of

Adjusted

EBITDA

and

reconciliation

of

Adjusted

EBITDA

to

net

income

and

operating

income,

please

see

the

appendix.

Third Quarter 2011 Earnings Conference Call

4

•

Achieved Q3 2011 EPS of

$0.26 and Adjusted

EBITDA of $44.8 million

•

Coke Adjusted EBITDA

85% of total operating

segment EBITDA

•

Comparisons to Q3 2010

impacted by

ArcelorMittal settlement

and higher corporate

costs

•

Sequential improvement

versus Q2 2011 driven by

better Domestic Coke

results |

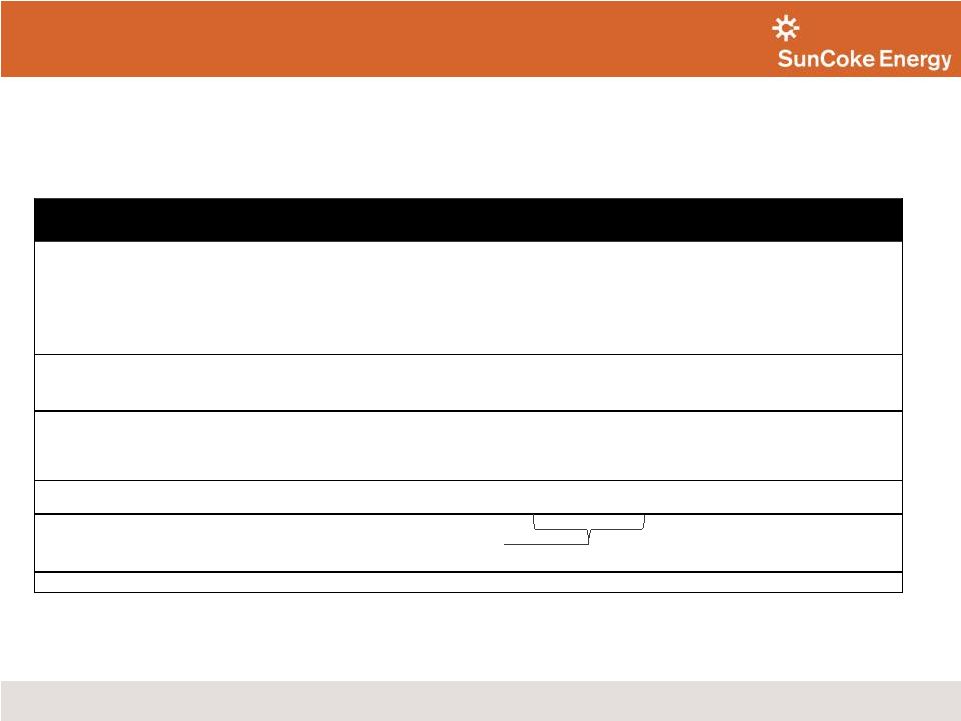

Q3 2010 to Q3

2011 Adjusted EBITDA

(1)

Bridge

Adjusted EBITDA reflects impact of ArcelorMittal settlement, higher corporate costs and

favorable non-recurring Q3 2010 domestic Coke items, offset by improved Coal Mining

results ($ in millions)

(1) For a definition of Adjusted EBITDA and reconciliation of Adjusted EBITDA

to net income and operating income, please see the appendix. (2) Jewell

Coke includes approximately $1.3 million in favorable coal transfer impact, Coal Mining includes offsetting $1.3 million unfavorable coal transfer impact.

5

Third Quarter 2011 Earnings Conference Call

$62.2

$44.8

$9.5

$1.1

($7.9)

($11.0)

($8.1)

($1.0)

$0

$10

$20

$30

$40

$50

$60

$70

Q3 2010A

Adjusted

EBITDA

ArcelorMittal

Settlement Impact

Corporate / Other

(incl. Middletown)

Other Domestic Coke

(ex-settlement)

Jewell Coke (2)

(ex-settlement)

Coal Mining (2)

International

Q3 2011A

Adjusted

EBITDA |

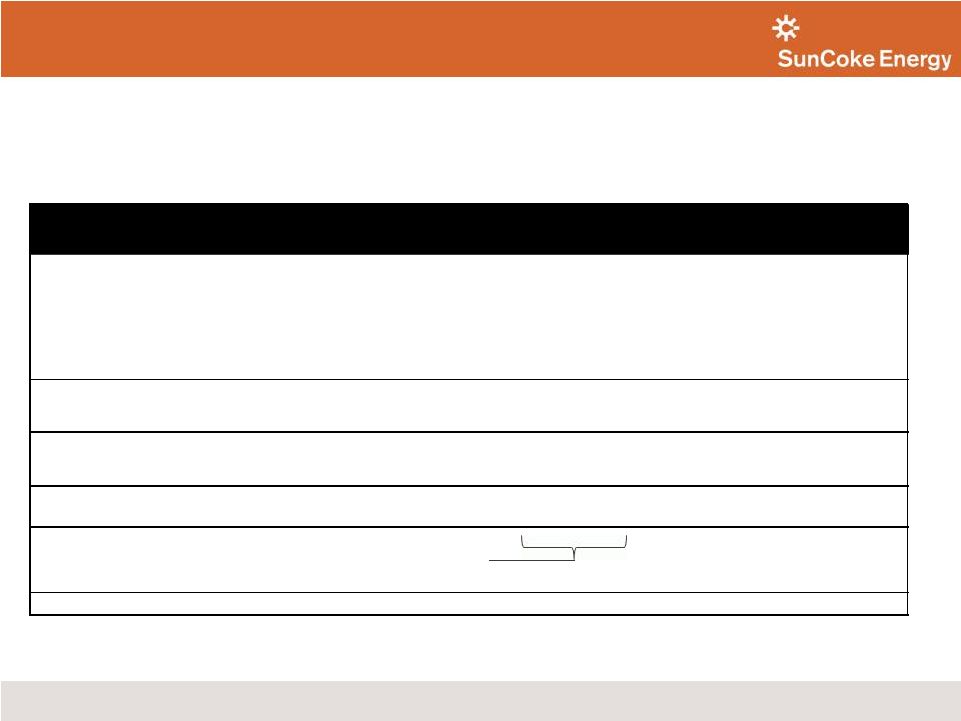

Q2 2011 to Q3

2011 Adjusted EBITDA

(1)

Bridge

Adjusted EBITDA reflects continued improvement at Indiana Harbor, improved yields at Granite

City and higher volumes at Jewell Coke, offset by Middletown start-up expenses and

higher Coal Mining costs ($ in millions)

(1) For a definition of Adjusted EBITDA and reconciliation of Adjusted EBITDA

to net income and operating income, please see the appendix. (2) Jewell

Coke includes approximately $1.9 million in unfavorable coal transfer impact, Coal Mining includes offsetting $1.9 million favorable coal transfer impact.

6

$44.8

Third Quarter 2011 Earnings Conference Call

$37.6

$5.6

$4.9

$1.4

($0.3)

($2.6)

($1.8)

$25

$30

$35

$40

$45

$50

$55

Q2 2011A

Adjusted

EBITDA

Indiana Harbor

Improvements

Granite City

Improvements

Jewell Coke (2)

Volume

Coal Mining (2)

Middletown Startup

Costs

Other

Q3 2011A

Adjusted

EBITDA |

$16

$11

$11

$14

$42

$8

$25

$34

$ 60/ton

$ 22/ton

$ 39/ton

$50/ton

$ 0

$ 20

$ 40

$ 60

$ 80

$ 100

$ 120

$ 140

($5)

$5

$15

$25

$35

$45

$55

$65

$75

Q3 '10

Q1 '11

Q2 '11

Q3 '11

Jewell Coke Segment

Domestic Coke Financial Summary

(Jewell Coke & Other Domestic Coke)

Domestic Coke Production

Domestic Coke Pro Forma Adjusted EBITDA

(1)

, Pro Forma for

ArcelorMittal Settlement and Coal Transfer Price

(Tons in thousands)

($ in millions, except per ton amounts)

Other

Domestic

Coke:

773

Other

Domestic

Coke:

745

Other

Domestic

Coke:

786

953

922

965

Pro Forma Adjusted EBITDA / ton

(1) For a definition of Pro Forma Adjusted EBITDA and Pro Forma Adjusted

EBITDA/Ton and a reconciliation of Pro Forma Adjusted EBITDA to operating

income, please see the appendix.

Third Quarter 2011 Earnings Conference Call

7

Other

Domestic

Coke:

687

861

$48

$36

$19

$58

•

Record domestic coke production on return to target

volume levels at Indiana Harbor

•

With continued improvement over Q1 2011

& Q2 2011

profitability 180

174

177

179

297

256

301

314

296

266

276

293

180

165

168

179

Q3 '10

Q1 '11

Q2 '11

Q3 '11

Jewell

Indiana Harbor

Haverhill

Granite City |

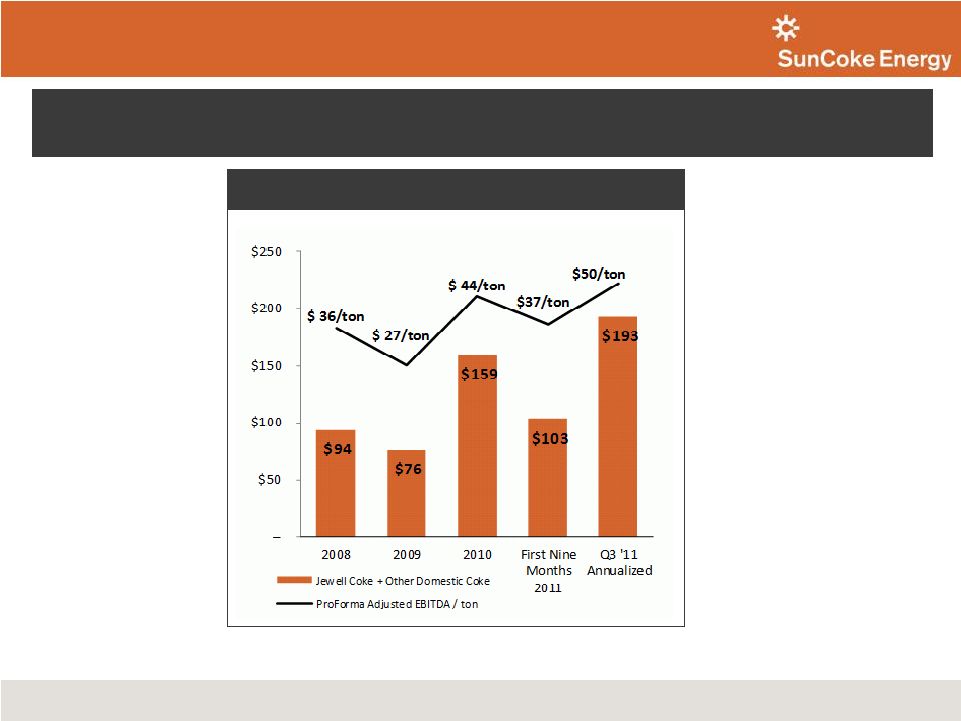

Domestic Coke

Profitability (Jewell Coke & Other Domestic Coke)

Third Quarter 2011 Earnings Conference Call

8

Domestic Coke Pro Forma Adjusted EBITDA

(1)

, Pro Forma for

ArcelorMittal Settlement and Coal Transfer Price

($ in millions, except per ton amounts)

(1) For a definition of Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA

per Ton and a reconciliation of Pro Forma Adjusted EBITDA to operating

income, please see the appendix.

Q3

2011

Adjusted

EBITDA

per

ton

representative

of

full

potential

of

current domestic coke assets (excluding Middletown) |

Coal Mining

Financial Summary Coal Sales, Production and Purchases

Cost/Ton

(Tons in thousands)

Coal Cash Cost

(1)

($ per ton)

(1)

Mining and preparation costs, excluding depreciation, depletion and amortization,

divided by coal production volume. Excludes $1.9M reduction in fair value of HKCC

contingent consideration liability.

(2)

Cost of mining and preparation costs, purchased raw coal costs, and depreciation,

depletion and amortization divided by coal sales volume. Depreciation, depletion and

amortization per ton were $8.96 and $6.26 for the third quarter of 2011 and 2010,

respectively and $9.50 and $7.05 for the first and second quarter of 2011, respectively.

Third Quarter 2011 Earnings Conference Call

9

•

Sales and production increased

Y-o-Y due to Harold Keene (HKCC)

acquisition

•

Flat Y-o-Y Jewell production

reflective of geology, staffing and

regulatory compliance challenges

•

Higher mining cash costs driven by

production challenges, employee

retention costs and higher royalties

•

Q-o-Q further impacted by

lower proportion of HKCC

production

$106

$114

$126

$132

$111

$124

$131

$134

Q3 '10

Q1 '11

Q2 '11

Q3 '11

Coal Production Cost (2)

314

386

334

371

270

335

340

340

51

51

24

22

Q3 '10

Q1 '11

Q2 '11

Q3 '11

Jewell Coal sales

Jewell Coal production

Jewell Coal purchases

66

323

308

256

269

337

272

84

68

HKCC production

49

26

48

HKCC third-party sales |

Jewell Coal

Mining Cost Summary Coal Cash Production Cost

Third Quarter 2011 Earnings Conference Call

10

(1)

Mining and preparation costs, excluding depreciation, depletion and amortization,

divided by coal production volume. (2)

The

reject

rate

is

calculated

as

1-

(clean

tons

/

raw

tons);

represents

the

amount

of

mined

material

that

is

not

usable

coal.

(3)

Average employees for the period includes mining, preparation, loading, support and

administrative/management employees (4)

Payroll and benefits excludes any accrued expenses for black lung liabilities

(5)

Raw tons and clean tons per employee annualized

Cash Production Cost Per Ton

(1)

, Reject Rate

(2) |

Coal Mining

Financial Summary Coal Mining Pro Forma Adjusted EBITDA

(1)

and Avg. Sales

Price/Ton

(2)

Pro Forma for Coal Transfer Price Impact

($ in millions, except per ton amounts)

Pro Forma Adjusted EBITDA

Pro Forma Adjusted EBITDA / ton

Third Quarter 2011 Earnings Conference Call

11

•

Q3 2011 Pro Forma Adjusted

EBITDA improved by $11 million

Y-o-Y on stronger coal prices

•

Q3 2011 Pro Forma Adjusted

EBITDA declined Q-o-Q due to sales

and production mix

•

Offset by $1.9 million favorable

fair value adjustment

•

2012 coal pricing expected to be

set

in

late

November

–

market

is

softer than Q2 2011 but still above

current contracts

Pro Forma Sales Price (2)

Coal Cash Cost per Ton

($2)

$12

$11

$9

$100

$152

$162

$155

($5)/ton

$32/ton

$34/ton

$25/ton

$106

$114

$126

$132

-$50

$0

$50

$100

$150

$200

Q3 '10

Q1 '11

Q2 '11

Q3 '11

(1)

For a definition of Pro Forma Adjusted EBITDA and a reconciliation of ProForma

Adjusted EBITDA to operating income, please

see the appendix

(2)

Average Sales Price is the weighted average sales price for all coal sales volumes, includes

sales to affiliates and sales to Jewell Coke established via a transfer pricing agreement. The

transfer price per ton to Jewell Coke was $103.68, $133.57, $156.12 and $163.53 for Q3

‘10, Q1 ‘11, Q2 ‘11 and Q3 ‘11,respectively. Pro Forma Sales

Price is the Average Sales Price adjusted to set the internal transfer price on

Jewell Coke coal purchase volumes equal to the Jewell Coke coal component

contract price. The per ton coal cost component included in the Jewell Coke

contract was approximately $100, $165, $165 and $165 for Q3 ‘10, Q1 ‘11, Q2

‘11 and Q3 ‘11, respectively. |

$3.5

$14.3

$4.3

$1.7

$2.5

$2.3

–

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

Q3 2010A

Standalone

Costs

Relocation

Costs

Middletown

Start-up Costs

Business

Development/

Legal Costs

Q3 2011A

Corporate Costs

Third Quarter 2011 Earnings Conference Call

12

Q3 2011 Corporate costs reflect combination of Standalone, Relocation and

Middletown start-up costs

($ in millions) |

Summary Cash

Flow ($ in millions, except where indicated)

Net Income

$22

$51

$131

Loss on firm purchase commitment

-

19

-

Depreciation, depletion, and amortization

15

42

36

Deferred income tax expense

9

15

11

Changes in working capital pertaining to operating activities

(4)

(65)

86

Other

1

(3)

(10)

Net cash provided by operations

$42

$59

$254

Capital Expenditures

Ongoing

($12)

($30)

($30)

Expansion

(44)

(154)

(106)

Acquisition of business, net of cash received

-

(38)

-

Net cash used in investing activities

($56)

($222)

($136)

Proceeds from issuance of long-term debt/costs/repayments

$679

$679

$0

Purchase of noncontrolling interest in Indiana Harbor facility

(34)

(34)

-

Distributions to noncontrolling interests in cokemaking operations

-

(1)

(19)

Increase (decrease) in advances/payable to/from affiliate

(551)

(408)

(83)

Repayment of notes payable assumed in acquisition

-

(2)

-

Net cash used in financing activities

$94

$234

($103)

Net increase (decrease) in cash

$80

$71

$16

Cash balance at beginning of period

$30

$40

$3

Cash balance at end of period

$111

$111

$18

Free Cash Flow

(1)

($14)

($165)

$118

Liquidity and leverage ratios as of September 30, 2011

Undrawn revolver

$150

Total liquidity

$261

Total Debt

$695

Total Debt / Adj. EBITDA LTM

(2)

4.8x

Net Debt

$584

Net Debt / Adj. EBITDA LTM

(2)

4.1x

For the

Three

Months

Ended

September

30, 2011

For the Nine

Months

Ended

September

30, 2011

For the Nine

Months

Ended

September

30, 2010

Third Quarter 2011 Earnings Conference Call

13

•

SunCoke retained $110 million

in cash after $700 million debt

issuance at time of IPO (net of

$575 million payment to Sunoco

and debt issuance costs)

•

Quarter end balance of

$111 million plus undrawn

$150 million revolver provides

adequate liquidity to finance

ongoing and expansion projects

•

Anticipate 2012 Capital

Expenditures to be lower with

Middletown completion in 2011

(1) Free Cash Flow represents cash from (i) operations; (ii) less investing; (iii)

less payments to minority interest. For a definition of

Free Cash Flow and a reconciliation of Free Cash Flow, please see the appendix.

(2) Last Twelve Months (LTM) Adjusted EBITDA for 2011 was approximately $144

million. For a definition of Adjusted EBITDA and reconciliation of Adjusted

EBITDA to net income and operating income, please see the appendix. Liquidity Update

|

Q4 2011

Outlook Third Quarter 2011 Earnings Conference Call

14

•

Adjusted EBITDA to increase with increase in SunCoke ownership

Indiana Harbor

Ownership Increase

•Preferred dividend of $9M recognized in Q4; paid in Q2 2012

International

•Nine Month Effective Tax Rate: 16%

•Expect

Q4

Effective

Tax

Rate:

7%

-

10%

•Expect

Year

End

Effective

Tax

Rate:

14%

-

16%

Effective

Tax Rate

•Increase in coal inventory at Middletown

•Expect

to

reduce

coal

inventory,

excluding

Middletown,

over

next

two

quarters

•Do not anticipate being a cash tax payer in Q4 ‘11

Working Capital

•Expect 2011 Capital Expenditures to be approximately $235 million

•Capital Expenditures YTD is $184 million

Capital Expenditures |

Coke Business

Update Indiana Harbor

•

Contract

renewal

negotiations

in

progress

•

Expect

to

spend

approximately

$50

million

over

next

3

years

to

refurbish

facility in anticipation of contract renewal

Middletown

•

Expect to reach full production levels by July 2012

Haverhill & Granite City

•

Discussions with EPA regarding NOVs on-going

•

Anticipate spending $80 to $100 million at these facilities from

2013 to 2016 to enhance environmental performance

•

Previous projection was approximately $65 million

•

Discussions with EPA regarding NOV at Indiana Harbor have been

postponed until early 2012

Third Quarter 2011 Earnings Conference Call

15 |

Coke Business

Update (continued) Third Quarter 2011 Earnings Conference Call

16

US Coke Plant Development

•

Near-term focus remains on obtaining permits for up to 1.1 million ton

per year facility; anticipate permits in latter half of 2012

•

Kentucky site remains preferred location (but not only location) for

multi-customer facility

•

Will defer seeking customer commitments until further progress on

permits achieved in light of current economic outlook

India Entry

•

Due diligence on Global Coke minority investment progressing well

•

Currently negotiating definitive agreements on estimated $30 million

investment |

Coal Mining

Business Update Third Quarter 2011 Earnings Conference Call

17

•

First coal shipments expected in late Q4 2011

•

Anticipate production of approximately 350K tons per year from 2012 to

2014 (estimated 75% Mid-Vol, 25% Thermal) from 1.2 million ton

reserve

•

Based on results to date, anticipate 2011 production of approximately

1.05 million tons

•

Given production challenges, focus on improving productivity of existing

mines in 2012 and defer opening new mines until 2013

•

Expect production of approximately 1.15 million tons in 2012; increasing

to 1.45 million tons in 2013

Jewell Coal Expansion

Surface Mining (Revelation) Partnership |

Coal Mining

Business Update (continued) Third Quarter 2011 Earnings Conference Call

18

•

Currently

evaluating

impact

of

Patient

Protection

and

Affordable

Care

Act, discount rate and other assumptions on expected Black Lung costs

•

No conclusions to date

•

But changes may increase liability by approximately $4-$6 million

•

Evaluation to be completed in Q4 2011

•

Expect total mining production of 1.8 million tons in 2012 (Jewell 1.15

million tons, Surface Mining 0.35 million tons, and HKCC 0.3 million

tons)

•

Underground mining cash costs to remain at about $130/ton until

productivity improvements take hold in 2012/2013

•

Economics

of

surface

mining

(Revelation)

partnership

expected

to

be

similar to existing underground Mid-Vol production

Production and Mining Costs

Black Lung Liability |

Questions

Third Quarter 2011 Earnings Conference Call

19 |

Summary

Third Quarter 2011 Earnings Conference Call

20

•

Continued sequential operational and financial improvements in the

quarter versus Q1 & Q2 2011

•

Coke earnings growth on track with Indiana Harbor

improvements/partnership purchase and start-up of Middletown facility

•

Significant Coal Mining earnings growth year over year despite production

challenges

and

delay

of

expansion,

with

additional

upside

likely

for

2012/2013

•

Solid liquidity position even after Indiana Harbor partnership purchase and

working capital build |

Appendix

Third Quarter 2011 Earnings Conference Call

21 |

Definitions

•

Adjusted EBITDA

adjusted for sales discounts and the deduction of income attributable to

non-controlling interests in our Indiana Harbor cokemaking

operations. EBITDA reflects sales discounts included as a reduction in

sales and other operating revenue. The sales discounts represent the sharing

with our customers of a portion of nonconventional fuels tax credits, which

reduce our income tax expense. However, we believe that our Adjusted EBITDA would

be inappropriately penalized if these

discounts

were

treated

as

a

reduction

of

EBITDA

since

they

represent

sharing

of

a

tax

benefit

which

is

not

included

in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these

sales discounts. Our Adjusted EBITDA also reflects the deduction of income

attributable to noncontrolling interest in our Indiana Harbor cokemaking

operations. EBITDA and Adjusted EBITDA do not represent and should not be

considered alternatives to net income or operating income under GAAP and may

not be comparable to other similarly titled measures of other businesses.

Management believes Adjusted EBITDA is an important measure of the operating

performance of the Company’s assets and is indicative of the

Company’s ability to generate cash from operations. •

Pro Forma Adjusted EBITDA

to equal the coal component contract price in Jewell Coke’s coke sales price

for coal sales volumes sold to Jewell Coke under the transfer pricing

agreement. Management believes Pro Forma Adjusted EBITDA provides transparency into the

underlying profitability of these respective segments for the periods

presented. •

Pro Forma Adjusted EBITDA/Ton

•

Free Cash Flow

controlling interests. Management believes Free Cash Flow information

enhances an investor’s understanding of a business’

ability to generate cash. Free Cash Flow does not represent and should not

be considered an alternative to net income or cash flows from operating

activities as determined under United States generally accepted accounting principles

(GAAP) and may not be comparable to other similarly titled measures of other

businesses. Third Quarter 2011 Earnings Conference Call

22

represents earnings before interest, taxes, depreciation, depletion and

amortization (“EBITDA”) represents Adjusted EBITDA adjusted for

the ArcelorMittal settlement impact and coal represents Pro Forma Adjusted

EBITDA divided by tons sold. equals cash from operations less cash used in

investing activities less cash distributions to non- transfer price

impacts. The Jewell Coke and Coal Mining results have been adjusted to set the internal transfer price |

Jewell Coke

Other

Domestic

Coke

International

Coke

Coal Mining

Corporate

and Other

Total

Net Income

$22

Add: Depreciation, depletion and amortization

15

Subtract: Interest Income

(1)

Add: Interest cost - affiliates

0

Subtract: Capitalized interest

(5)

Add: Interest expense

9

Add: Income tax expense

5

EBITDA

$14

$34

$2

$9

($14)

$45

Add: Sales discounts provided to customers due to sharing of nonconventional fuels tax

credits 3

$3

Add (Subtract): net (income) loss attributable to noncontrolling interests

(3)

(3)

Adjusted EBITDA

$14

$34

$2

$9

($14)

$45

Add (Subtract): coal transfer price impact

(0)

0

-

Pro Forma

Adjusted EBITDA without coal tranfer price impact $14

$34

$2

$9

($14)

$45

Sales Volumes (thousands of tons)

191

777

373

371

Pro Forma Adjusted EBITDA per Ton

$73

$44

$5

$25

Operating Income (Loss)

$13

$24

$2

$5

($15)

$30

Depreciation Expense

1

10

0

3

0

15

EBITDA

$14

$34

$2

$9

($14)

$45

EBITDA Reconciliation, $MM

For The Three Months Ended September 30, 2011

Third Quarter 2011 Earnings Conference Call

23

Domestic Coke Weighted

Average = $50 |

EBITDA

Reconciliation, $MM For The Three Months Ended June 30, 2011

Third Quarter 2011 Earnings Conference Call

24

Domestic Coke Weighted

Average = $39

Jewell Coke

Other

Domestic

Coke

International

Coke

Coal Mining

Corporate

and Other

Total

Net Income

$24

Add: depreciation, depletion and amortization

15

Subtract: interest income (primarily from affiliates)

(6)

Add:

interest

cost

-

affiliate

2

Subtract: capitalized interest

(0)

Add (Subtract): income tax expense (benefit)

2

EBITDA

$13

$24

$1

$9

($11)

$36

3

3

(2)

(2)

Adjusted EBITDA

$13

$25

$1

$9

($11)

$38

Add (Subtract): coal transfer price impact

(2)

2

-

Pro Forma Adjusted EBITDA without coal transfer impact

$11

$25

$1

$11

($11)

$38

Sales Volumes (thousands of tons)

170

757

412

334

Pro Forma Adjusted EBITDA per Ton

$62

$33

$34

Operating Income (Loss)

$12

$14

$1

$6

($11)

$21

Depreciation Expense

1

10

0

3

0

15

EBITDA

$13

$24

$1

$9

($11)

$36

Add (Subtract): net (income) loss attributable to noncontrolling interests Add: Sales discounts provided to customers due to

sharing of nonconventional fuels tax credits |

EBITDA

Reconciliation, $MM For The Three Months Ended March 31, 2011

Third Quarter 2011 Earnings Conference Call

25

Domestic Coke Weighted

Average = $22

Jewell Coke

Other

Domestic

Coke

International

Coke

Coal Mining

Corporate

and Other

Total

Net Income

$6

Add: depreciation, depletion and amortization

13

Subtract: interest income (primarily from affiliates)

(6)

2

Subtract: capitalized interest

(0)

Add (Subtract): income tax expense (benefit)

3

EBITDA

$19

($1)

$1

$4

($6)

$17

Add: sales discounts provided to customers due to sharing of nonconventional fuels tax

credits 3

3

6

6

Adjusted EBITDA

$19

$8

$1

$4

($6)

$27

Add (Subtract): coal transfer price impact

(8)

8

-

Pro Forma Adjusted EBITDA without coal transfer price impact

$11

$8

$1

$12

($6)

$27

Sales Volumes (thousands of tons)

175

697

362

386

Pro Forma Adjusted EBITDA per Ton

$63

$12

$32

Operating Income (Loss)

$18

($9)

$1

$2

($7)

$4

Depreciation Expense

1

9

0

3

1

13

EBITDA

$19

($1)

$1

$4

($6)

$17

For the Three Months Ended March 31, 2011 (Unaudited)

Add (Subtract): net (income) loss attributable to noncontrolling interests

Add:

interest

cost

-

affiliate |

EBITDA

Reconciliation, $MM For The Three Months Ended September 30, 2010

Third Quarter 2011 Earnings Conference Call

26

Domestic Coke Weighted

Average = $58

Jewell Coke

Other

Domestic

Coke

International

Coke

Coal Mining

Corporate

and Other

Total

Net Income

$41

Add: Depreciation, depletion and amortization

14

Subtract: Interest Income

(6)

1

Subtract: Capitalized interest

(0)

Add: Interest expense

-

Add: Income tax expense

12

EBITDA

$28

$38

$1

($1)

($3)

$62

Add: Sales discounts provided to customers due to sharing of nonconventional fuels tax

credits 3

$3

(3)

(3)

Adjusted EBITDA

$28

$37

$1

($1)

($3)

$62

Add (Subtract): pro forma impact of ArcelorMittal settlement

($13)

$5

($8)

Add (Subtract): coal transfer price impact

1

(1)

-

Pro Forma Adjusted EBITDA without ArcelorMittal settlement and coal tranfer price impacts

$16

$42

$1

($2)

($3)

$54

Sales Volumes (thousands of tons)

196

788

431

313

Pro Forma Adjusted EBITDA per Ton

$83

$54

$1

($5)

Operating Income (Loss)

$27

$27

$1

($3)

($3)

$48

Depreciation Expense

1

11

0

2

0

14

EBITDA

$28

$38

$1

($1)

($3)

$62

Add (Subtract): net (income) loss attributable to noncontrolling interests

Add:

interest

cost

-

affiliate |

EBITDA

Reconciliation, $MM For The Three Months Ended December 31, 2010

Third Quarter 2011 Earnings Conference Call

27

Domestic Coke Weighted

Average = $44

Jewell Coke

Other

Domestic

Coke

International

Coke

Coal Mining

Corporate and

Other

Total

Net Income

$15

Add: Depreciation, depletion and amortization

12

Subtract: Interest Income

(6)

Add:

Interest

cost

-

affiliates

1

Subtract: Capitalized interest

(0)

Add: Interest expense

0

Add: Income tax expense

6

EBITDA

$20

$7

$14

($8)

($4)

$28

Add: Sales discounts provided to customers due to sharing of nonconventional fuels tax

credits 3

3

3

3

Adjusted EBITDA

$20

$13

$14

($8)

($4)

$35

Add (Subtract): pro forma impact of ArcelorMittal settlement

(12)

5

Add: Legal and Settlement charges related to ArcelorMittal Settlement and Indiana Harbor

Arbitration 4

13

Add (Subtract): coal transfer price impact

(1)

1

Pro Forma Adjusted EBITDA without ArcelorMittal settlement and coal tranfer price impacts

$11

$31

$14

($7)

($4)

$44

Sales Volumes (thousands of tons)

179

750

Pro Forma Adjusted EBITDA per Ton

$59

$41

Operating Income (Loss)

$19

($2)

$14

($10)

($5)

$16

Depreciation Expense

1

9

0

2

0

12

EBITDA

$20

$7

$14

($8)

($4)

$28

Add (Subtract): net (income) loss attributable to noncontrolling interests |

Jewell

Coke

Other

Domestic

Coke

International

Coke

Coal

Mining

Corporate

and Other

Total

Net Income

$146

Add: Depreciation, depletion and amortization

48

Subtract: Interest Income (Primarily from Affiliates)

(24)

Add: Interest cost – Affiliate

5

Subtract: Capitalized interest

(1)

Add (Subtract): Income tax expense

47

EBITDA

$151

$74

$15

($4)

($14)

$222

Add: Sales discounts provided to customers due to sharing of nonconventional fuels tax

credits –

12

–

–

–

12

Add (Subtract): Net (Income) loss attributable to noncontrolling interests

–

(7)

–

–

–

(7)

Adjusted EBITDA

$151

$79

$15

($4)

($14)

$227

Add (Subtract): Pro Forma impact of ArcelorMittal settlement

(78)

18

–

–

–

(60)

Add: Legal and Settlement charges related to ArcelorMittal Settlement and Indiana Harbor

Arbitration 4

13

–

–

–

16

Add (Subtract): Pro Forma coal transfer price impact

(28)

–

–

28

–

–

Pro Forma Adjusted EBITDA without ArcelorMittal settlement and coal transfer price impacts

$49

$109

$15

$24

($14)

$184

Sales Volumes (thousands of tons)

721

2,917

–

1,277

–

Pro Forma Adjusted EBITDA per Ton

$69

$37

$19

Operating Income (Loss)

$147

$39

$15

($11)

($15)

$174

Add: Depreciation Expense

4

35

0

8

1

48

EBITDA

$151

$74

$15

($4)

($14)

$222

EBITDA Reconciliation, $MM

For The Year Ended 2010

Third Quarter 2011 Earnings Conference Call

28

Domestic Coke Weighted

Average = $44 |

EBITDA

Reconciliation, $MM For The Year Ended 2009

Third Quarter 2011 Earnings Conference Call

29

Domestic Coke Weighted

Average = $27

Jewell

Coke

Other

Domestic

Coke

International

Coke

Coal

Mining

Corporate

and Other

Total

Net Income

$211

Add: Depreciation, depletion and amortization

$32

Subtract: Interest Income (Primarily from Affiliates)

($2)

Add:

Interest

cost

–

Affiliate

$6

Subtract: Capitalized interest

($1)

Add (Subtract): Income tax expense

$21

EBITDA

$182

$36

$23

$11

($9)

$244

Add: Sales discounts provided to customers due to sharing of nonconventional fuels tax

credits –

8

–

–

–

$8

–

(22)

–

–

–

($22)

Adjusted EBITDA

$18

$23

$23

$11

($9)

$230

Add (Subtract): Pro Forma impact of ArcelorMittal settlement

(84)

13

–

–

–

($71)

Add (Subtract): Pro Forma coal transfer price Impact

(58)

–

–

58

–

–

Pro Forma Adjusted EBITDA without ArcelorMittal settlement and coal transfer price impacts

$41

$36

$23

$69

($9)

$159

Sales Volumes (thousands of tons)

694

2,119

1,214

Pro Forma Adjusted EBITDA per Ton

$59

$17

$56

Operating Income (Loss)

$178

$15

$23

$5

($9)

$212

Add: Depreciation Expense

5

22

0

6

0

$32

EBITDA

$182

$36

$23

$11

($9)

$244

Add (Subtract): net (income) loss attributable to noncontrolling interests |

EBITDA

Reconciliation, $MM For The Year Ended 2008

Third Quarter 2011 Earnings Conference Call

30

Domestic Coke Weighted

Average = $36

Jewell

Coke

Other

Domestic

Coke

International

Coke

Coal

Mining

Corporate

and Other

Total

Net Income

$133

Add: Depreciation, depletion and amortization

25

Subtract: Interest Income (Primarily from Affiliates)

(28)

Add:

Interest

cost

–

Affiliate

11

Subtract: Capitalized interest

(4)

Add (Subtract): Income tax expense

38

EBITDA

$119

$50

$5

$14

($13)

$175

Add: Sales discounts provided to customers due to sharing of nonconventional fuels tax

credits –

1

–

–

–

1

–

(19)

–

–

–

(19)

Adjusted EBITDA

$119

$32

$5

$14

($13)

$157

Add (Subtract): Pro Forma impact of ArcelorMittal settlement

(56)

16

–

–

–

(40)

Add (Subtract): Pro Forma coal transfer price Impact

(17)

–

–

17

–

–

Pro Forma Adjusted EBITDA without ArcelorMittal settlement and coal transfer price impacts

$46

$48

$5

$31

($13)

$117

Sales Volumes (thousands of tons)

727

1,901

1,233

Pro Forma Adjusted EBITDA per Ton

$63

$25

$25

Operating Income (Loss)

$114

$35

$5

$10

($13)

$151

Add: Depreciation Expense

5

15

0

4

0

25

EBITDA

$119

$50

$5

$14

($13)

$175

Add (Subtract): net (income) loss attributable to noncontrolling interests |

Free Cash Flow

Reconciliation, $MM Third Quarter 2011 Earnings Conference Call

31

For the Three

Months Ended

September 30, 2011

For the Six

Months Ended

June 30, 2011

For the Nine

Months Ended

September 30, 2011

For the Nine

Months Ended

September 30, 2010

Net Cash Provided by Operating Activities

42

$

16

$

59

$

254

$

Cash Flows from

Investing Activities: Capital Expenditures

On-going Capital

(12)

(18)

(30)

(30)

Expansion Capital

Coal Mining

(3)

(6)

(9)

-

Middletown

(41)

(104)

(145)

(106)

Total

(56)

$

(128)

$

(184)

$

(136)

$

Acquisition of business,

net of cash received -

(38)

(38)

-

Proceeds from the sales of assets

-

-

-

0

Net Cash Used in Investing Activities

(56)

$

(166)

$

(222)

$

(136)

$

Proceeds from issuance of

long-term debt/costs/repayments 679

-

679

-

Purchase of noncontrolling interest in Indiana Harbor facility

(34)

-

(34)

-

Cash distributions to noncontrolling interests in cokemaking operations

-

(1)

(1)

(19)

Increase (decrease) in advances/payable to/from affiliate

(551)

143

(408)

(83)

Repayment of notes payable assumed in acquisition

-

(2)

(2)

-

Net cash used in financing activities

94

$

140

$

234

$

(103)

$

Free Cash Flow

(14)

$

(149)

$

(163)

$

118

$

Free Cash Flow

excluding Expansion Capital 30

$

(39)

$

(9)

$

224

$

|

Media releases and SEC filings are available

on our website at www.suncoke.com

Contact Investor Relations for more information: 630-824-1907

Third Quarter 2011 Earnings Conference Call

32 |