Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mastercard Inc | d247321d8k.htm |

| EX-99.1 - PRESS RELEASE - Mastercard Inc | d247321dex991.htm |

Exhibit 99.2

Exhibit 99.2

MasterCard Incorporated

Third-Quarter 2011

Financial Results Conference Call

November 2, 2011

Business Update

Operational Overview

Economic Update

Business Highlights

| 2 |

|

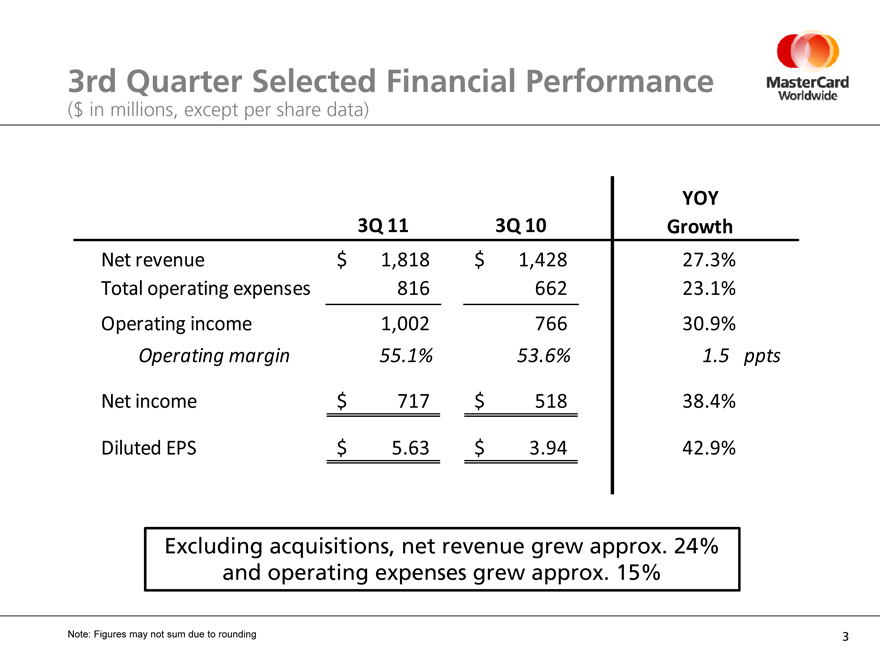

3rd Quarter Selected Financial Performance

($ in millions, except per share data)

YOY

3Q 11 3Q 10 Growth

Net revenue $ 1,818 $ 1,428 27.3%

Total operating expenses 816 662 23.1%

Operating income 1,002 766 30.9%

Operating margin 55.1% 53.6% 1.5 ppts

Net income $ 717 $ 518 38.4%

Diluted EPS $ 5.63 $ 3.94 42.9%

Excluding acquisitions, net revenue grew approx. 24% and operating expenses grew approx. 15%

Note: Figures may not sum due to rounding

| 3 |

|

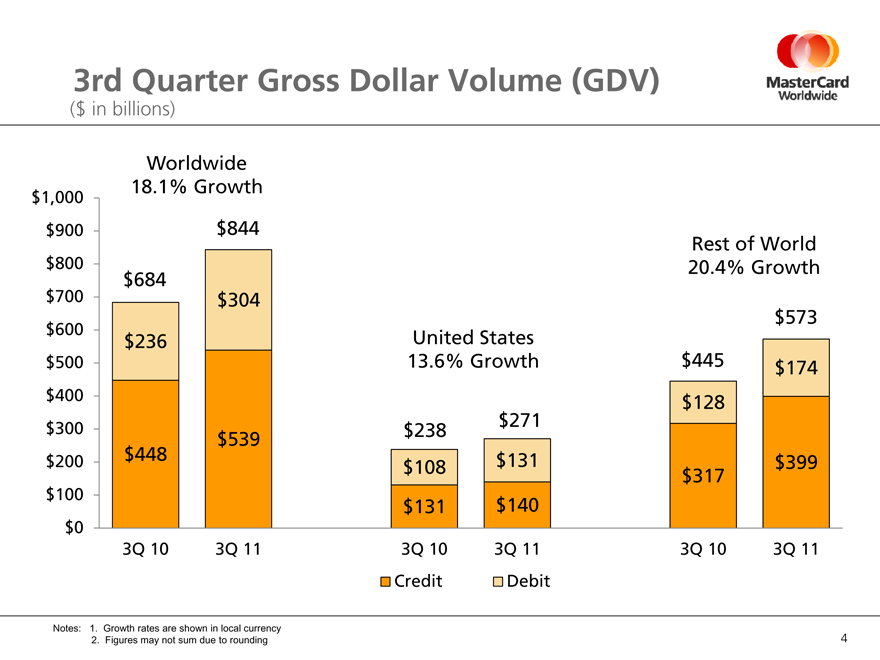

3rd Quarter Gross Dollar Volume (GDV)

($ in billions)

Notes: 1. Growth rates are shown in local currency

2. Figures may not sum due to rounding

$1,000 $900 $800 $700 $600 $500 $300 $200 $100 $0 $400

Worldwide

18.1% Growth

$684 $844 $236 $304 $448 $539

3Q 10 3Q 11

United States

13.6% Growth

$238 $271 $108 $131 $131 $140

3Q 10 3Q 11

Rest of World

20.4% Growth

$445 $573 $128 $174 $317 $399

3Q 10 3Q 11

Credit Debit

| 4 |

|

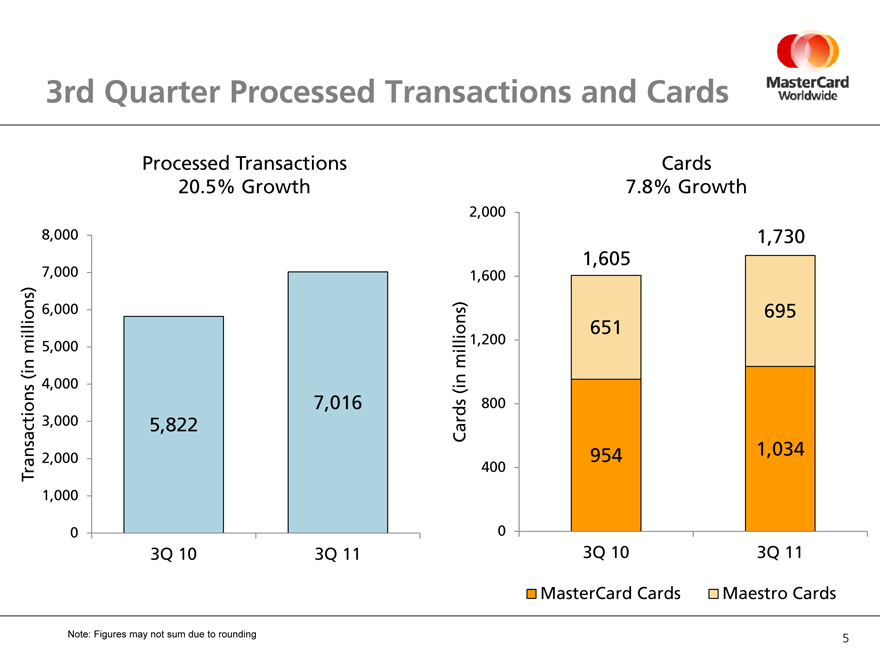

3rd Quarter Processed Transactions and Cards

Processed Transactions

20.5% Growth

Transactions (in millions)

8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0

5,822 7,016

3Q 10 3Q 11

Cards

7.8% Growth

Cards (in millions)

2,000 1,600 1,200 800 400 0

1,605 651 954

1,730 695 1,034

3Q 10 3Q 11

MasterCard Cards Maestro Cards

Note: Figures may not sum due to rounding

| 5 |

|

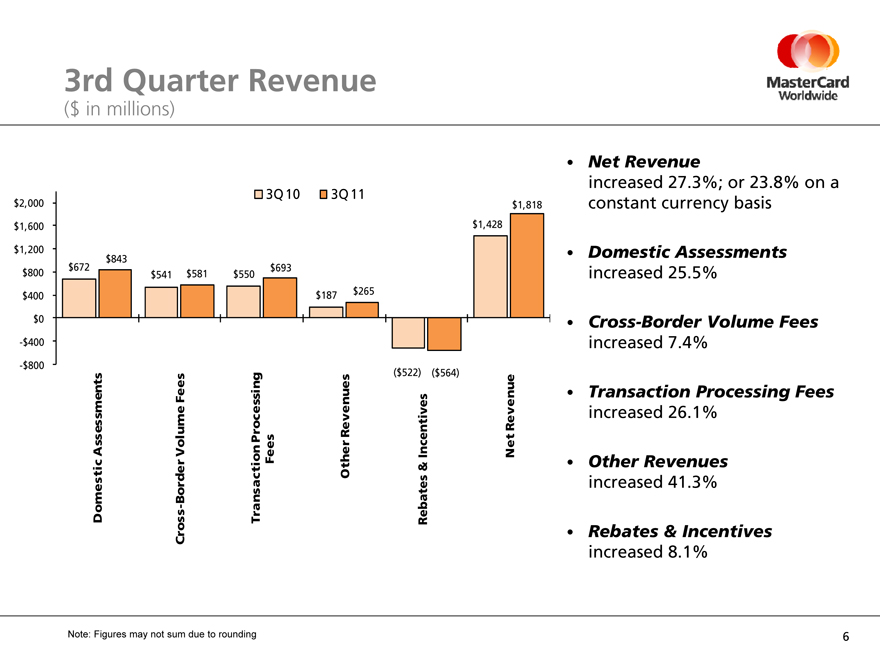

3rd Quarter Revenue

($ in millions)

$2,000 3Q 10 3Q 11

$1,818

$1,600 $1,428

$1,200 $672 $843 $693 $800 $541 $581 $550 $265 $400 $187

$0

-$400

-$800

($522) ($564)

Domestic Assessments

Cross-Border Volume Fees

Transaction Processing

Fees

Other Revenues

Net Revenue

Rebates & Incentives

Net Revenue increased 27.3%; or 23.8% on a constant currency basis

Domestic Assessments increased 25.5%

Cross-Border Volume Fees increased 7.4%

Transaction Processing Fees increased 26.1%

Other Revenues increased 41.3%

Rebates & Incentives increased 8.1%

Note: Figures may not sum due to rounding

| 6 |

|

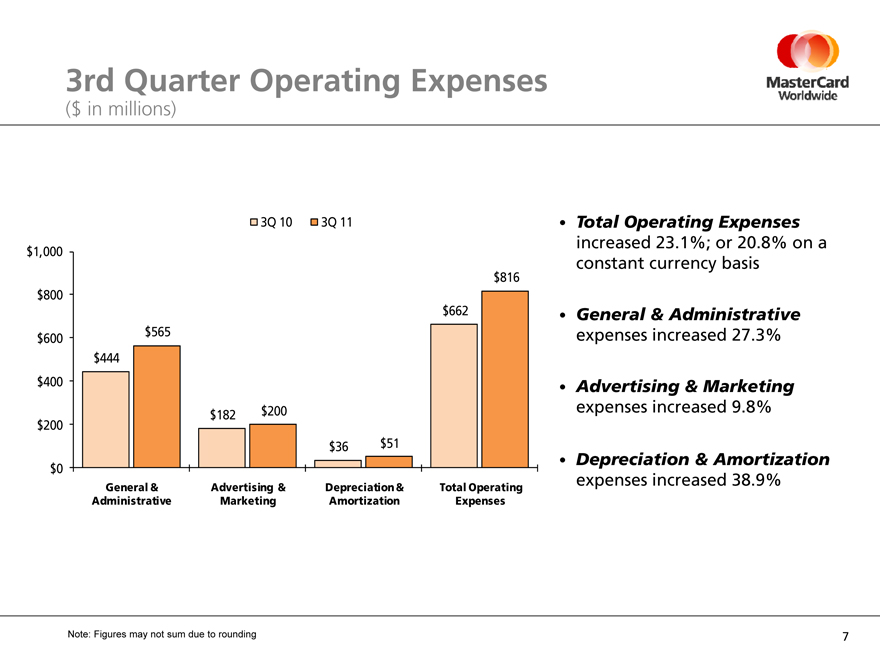

3rd Quarter Operating Expenses

($ in millions)

3Q 10 3Q 11 $1,000

$816 $800 $662 $565 $600 $444

$400

$182 $200 $200

$36 $51 $0

General & Advertising & Depreciation & Total Operating Administrative Marketing Amortization Expenses

Total Operating Expenses increased 23.1%; or 20.8% on a constant currency basis

General & Administrative expenses increased 27.3%

Advertising & Marketing expenses increased 9.8%

Depreciation & Amortization expenses increased 38.9%

Note: Figures may not sum due to rounding

| 7 |

|

3rd Quarter Cash Flow Statement and Balance Sheet Highlights

Cash flow from operations of $1.0 billion in 3Q11

Cash, cash equivalents and other liquid investments of $4.4 billion at September 30, 2011

Share Repurchase Activity

3Q11: 250,100 shares (cost of $77 million) As of October 27, remaining authorization: $879 million

| 8 |

|

Thoughts for the Future

Business update through October 28

Thoughts for 2011

Net Revenue Total Operating Expenses Tax Rate

Long-term financial objectives

9

MasterCard

Worldwide

The Heart of Commerce™

10