Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSOCIATED BANC-CORP | d250220d8k.htm |

Associated Banc-Corp

Investor Presentation

Third Quarter 2011

Exhibit 99.1 |

Forward-Looking Statements

1

Statements made in this presentation which are not purely historical are forward-looking

statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes

any statements regarding management’s plans, objectives, or goals for future operations,

products or services, and forecasts of its revenues, earnings, or other measures of performance.

Forward-looking statements are based on current management expectations and, by their

nature, are subject to risks and uncertainties. These statements may be identified by the use

of words such as “believe”, “expect”, “anticipate”, “plan”,

“estimate”, “should”, “will”, “intend”, or similar

expressions. Outcomes related to such statements are subject to numerous risk factors and

uncertainties including those listed in the company’s most recent Form10-K and any

subsequent Form 10-Q.

Important

Note

Regarding

Forward-Looking

Statements: |

Leading Midwest Banking Franchise

•

$22 billion in assets

•

Approximately 270 banking offices

•

Top 50 U.S. bank holding company

•

Largest bank headquartered in Wisconsin

•

#1 mortgage originator

1

and #1 SBA lender in Wisconsin

2

•

Known for its strong relationships with the communities it

serves, with roots that trace back to the First National Bank of

Neenah, founded in 1861

•

Strong capital ratios

•

Tier 1 Common:

12.44%

•

Total Capital Ratio:

15.81%

2

*FDIC market share data 6/30/11

WI

St. Louis

Chicago

Neenah

Rockford

No. 1

Top 4

Top 8

La Crosse

Hudson

Manitowoc

Madison

Minneapolis

Green Bay

Wausau

Stevens Point

Peoria

Milwaukee

1

Based on 2010 number of funded mortgage loans per HMDA data

2

Based on 2011 FY number of funded SBA loans

$3.0B

53

#18 Illinois

#6 Minnesota

#3 Wisconsin

$1.3B

$9.8B

23

194

Deposits*

Offices*

Market Share*

Appleton

MN

IL |

Attractive Midwest Markets

3

1

Source:

Gross

State

Product:

2010

GDP

by

state

from

the

Bureau

of

Economic

Analysis;

2

Source:

U.S.

Bureau

of

Labor

Statistics,

Sept.

2011;

3

Source:

State

of

Wisconsin

Department

of

Workforce

Development;

4

Source:

FRB

Chicago;

5

Source:

Wisconsin

Department

of

Revenue

Economic

Outlook,

Fall

2011;

6

Source:

Fitch

Ratings

Wisconsin

•

Population: 5.6 million

•

GSP

1

: $248 billion

•

Unemployment

2

: 7.8%

Minnesota

•

Population: 5.3 million

•

GSP

1

: $270 billion

•

Unemployment

2

: 6.9%

Illinois

•

Population: 12.8 million

•

GSP

1

: $652 billion

•

Unemployment

2

: 10.0%

U.S (National)

•

Unemployment

2

: 9.1%

Employment

•

Wisconsin and Minnesota posted job gains in September and continue to

show above average employment levels

•

Gains in Wisconsin are wide-spread, with 67 of 72 counties showing an

improvement

in

unemployment

levels

Output

4

Outlook

5

•

Chicago Fed’s Midwest Manufacturing Index continues to strengthen

•

Midwest Manufacturing is up 7.2% year-over-year (vs. 4.3%

nationally) •

Midwest Machinery output is up 15.5% year-over year

•

Wisconsin expects to add 136,000 jobs by 2014

•

Wisconsin unemployment rate is expected to fall through 2014

•

Wisconsin building permits likely bottomed in mid-2011 and is expected to

grow strongly in 2012, 2013, and 2014

•

Minnesota is expected to have continuing job growth on a year-over-year

basis

and

better

than

5%

sales

growth

year-over-year

in

2012

6

3 |

ASBC

Vision Statement Associated Banc-Corp will be the most admired

Midwestern financial services company, distinguished by sound,

value-added financial solutions with personal service for our

customers, built upon a strong commitment to our colleagues and the communities we

serve, resulting in exceptional value for our shareholders.

4 |

Execution of Strategic Plan Well Under Way

5

Management Team

Has Driven Results

•

Aggressively reduced legacy problem credits

•

Realigned credit policies for profitable future originations

•

Improved core profitability by restructuring existing business portfolio

•

The OCC Memorandum of Understanding has been terminated

Well Positioned for

Growth in the

Midwest Market

Improved Credit

Quality Trends

Strong Capital and

Liquidity Position

•

Upper Midwest has outpaced the broader economy

•

Disruptions in major metro markets create opportunities for further market share

gains •

Proven ability to grow loans in challenging economic environment

•

Nonperforming assets at the lowest level since 2008

•

Do not expect bulk loan sales going forward

•

Loan loss reserves now cover nearly 100% of nonaccrual loans

•

Credit ratings outlook is stable from all major agencies (A3/BBB)

•

ASBC capital ratios compare favorably to peers and far exceed well-capitalized

regulatory benchmarks

•

Capital and liquidity exceed Basel III guidelines

TARP Repayment

•

Completed the repurchase of remaining TARP funds through senior note and

preferred stock offerings |

•

Oliver

Buechse,

Chief

Strategy

Officer

•

John

Utz,

Head

of

Specialized

Industries

•

Donna

Smith,

Head

of

Regional

Commercial

Banking

•

Christopher

Del

Moral-Niles,

Deputy

Chief

Financial

Officer

•

Breck

Hanson,

Head

of

Commercial

Real

Estate

•

Arthur

Heise,

Chief

Risk

Officer

•

Patrick

Derpinghaus,

General

Auditor

•

Scott

Stiverson,

Director

of

Credit

Risk

Management

•

Eldon

Passey,

Head

of

Treasury

Management

Services

•

Liza

Warner,

Chief

Compliance

Officer

•

Tim

Watson,

Treasurer

Management Team –

Driving Results

6

Improved Core Profitability

Addressed OCC M.O.U. &

Repaid TARP

Reduced Problem Credits

Key Recent Hires (2010 –

Present) |

Growing Commercial Relationships

•

Focus on commercial growth in key markets

–

Net production and line draws of $198 million for 3Q11

•

Portfolio of specialty niches with dedicated resources

–

Mortgage warehouse growth of $70 million in 3Q11

–

Oil & Gas segment growth of $30 million in 3Q11

•

Regional and owner-occupied CRE growth of $39 million in 3Q11

•

Investing in Treasury Management capabilities and talent

7

Commercial &

Business Lending

Commercial Real

Estate Lending

•

Clarified organizational responsibility with expanded expertise in key

markets •

Proactive monitoring of portfolio composition and trends

•

Portfolio grew by $108 million to $3.0 billion in 3Q11

•

Selective geographic expansion

–

Opened offices in Indianapolis and Cincinnati in 1Q11

–

Closed first CRE loans in IN and OH in 2Q11

–

Added commercial bankers to the Indianapolis office in 3Q11 to provide full

relationship banking

Note:

CB&L includes C&I, Leasing, and Owner-occupied CRE

CREL includes Investor CRE and Construction |

Growing Household Relationships

•

Focusing on core Wealth disciplines and business development activities

•

Leveraging Private Banking as center of client relationship

•

Build out of specialized segments

•

Deepening the bench strength with the addition of new talent

•

Product and service enhancements to drive results in affluent client base

8

Wealth

Retail Banking

•

Strengthening the basics

–

Strengthening our focus on our premier banking customers

–

Enhancing our branch footprint

–

Expanding the scope and reach of our market-leading mortgage franchise

•

Building distinctiveness in core business units: Consumer Banking, Residential

Lending, Business Banking, Retail Payments, Retail Brokerage

•

Focusing on changing environment in payment systems |

Differentiating Associated in Retail Banking

9

•

We are differentiating ourselves with our retail bank through investments in our

Premier Banking program and leveraging our relationship with the Green Bay

Packers & Aaron Rodgers Packers Banking

Further promoting strong affinity (balances,

cross-sell, retention all over-index)

Introduced partnership with Aaron Rodgers

Premier Banking

Top 7% of Retail Households

At least 1 specially-trained, designated

Premier Banker in each branch

Dedicated concierge number

Immediate funds availability on deposits

New debit and credit cards

Many other benefits, including identity

theft

protection |

Our

New In-Store Branch Look 10

•

We are differentiating ourselves through investments in our Footprint

project. Pictured below is our new in-store location in Oak

Creek, WI, our first in-store in the Milwaukee area |

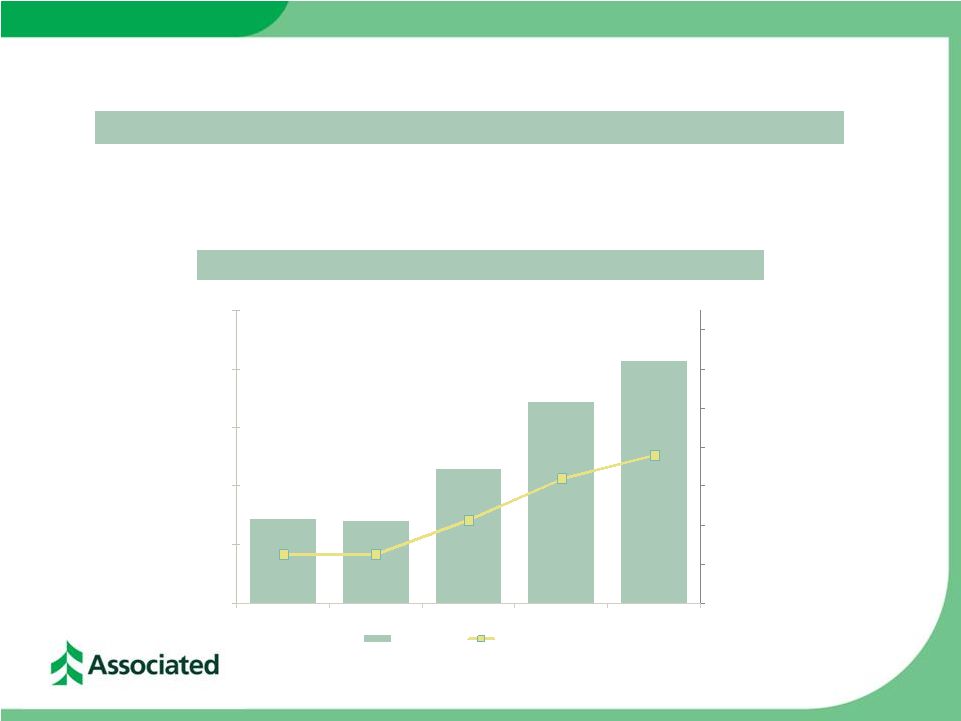

Third Quarter Highlights

11

Net Income and ROAA

Quarterly Results Reflect Positive Trends

•

Net income to common shareholders of $34 million or $0.20 per share

•

Pre-tax income improved 33%, or $15 million, and net income to common

shareholders improved 33%, or $8 million, from the prior quarter

$14

$14

$23

$34

$41

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

$0

$10

$20

$30

$40

$50

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

Net Income

ROAA |

Third Quarter Highlights

•

Total loans of $13.5 billion were up 3% from the end of the second quarter

–

Commercial and business lending (C&I, leasing, and owner-occupied CRE

loans) grew by a net $198 million on a linked-quarter basis

–

Commercial real estate lending (Investor CRE and construction loans) increased by

a net $108 million from the prior quarter

–

Retail loans and residential mortgages grew by a net $108 million during the third

quarter •

Continued improvement in key credit metrics

–

Nonaccrual loans declined 14% from the prior quarter and 45% on a

year-over-year basis to $403 million, the lowest level in seven

quarters –

Provision for loan losses of $4 million was down significantly from the prior

quarter –

Net charge-offs of $30 million were down 32% from $45 million for the second

quarter •

Capital ratios remain very strong with a Tier 1 common ratio of 12.44% and total

capital ratio of 15.81%

12

Quarterly Results Reflect Positive Trends |

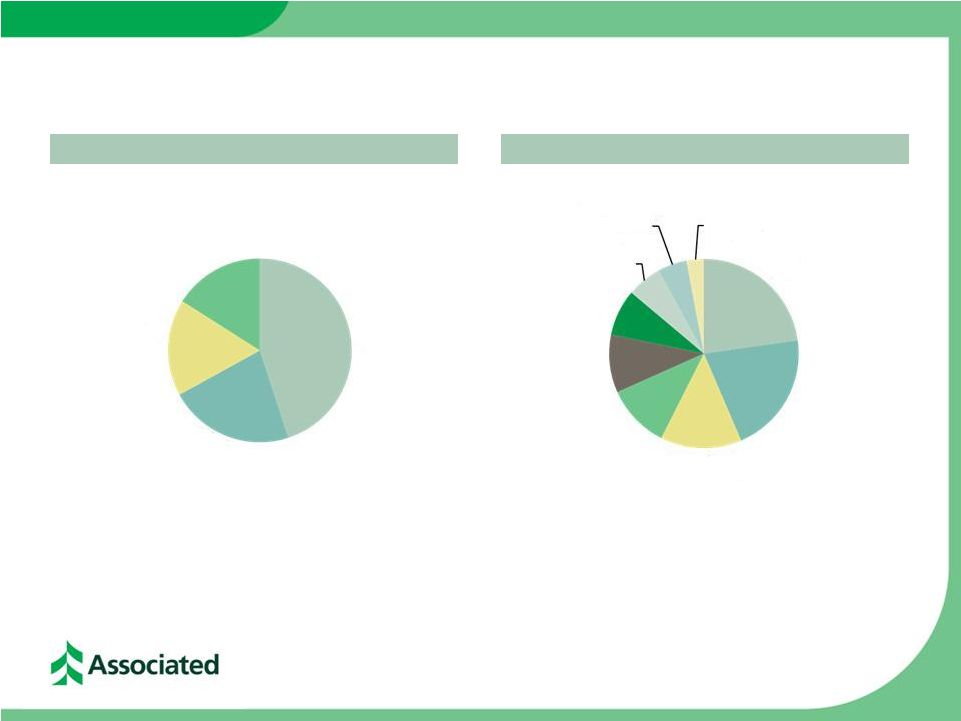

Positioned for Growth in Key Loan Categories

13

Total Loans of $13.5 billion at September 30, 2011

Loan Mix –

4Q 2008 vs 3Q 2011

Total Loans ($ in billions)

+3% QoQ

4Q 2008

3Q 2011

Peak Loans (4Q 2008) $16.3 billion

$12.4

$12.6

$12.7

$13.1

$13.5

$10.5

$12.0

$13.5

$15.0

$16.5

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

CRE Investor

14%

Construction

14%

Commercial &

Business

Lending

35%

Res Mtg

14%

Home Equity

18%

Consumer

5%

CRE Investor

19%

Construction

4%

Commercial &

Business

Lending

33%

Res Mtg

21%

Home Equity

19%

Consumer

4% |

Significant Improvements in Credit Quality Indicators

14

($ in millions)

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

Provision for loan losses

$ 64.0

$ 63.0

$ 31.0

$ 16.0

$ 4.0

Net charge offs

$ 109.9

$ 108.2

$ 53.4

$ 44.5

$ 30.2

ALLL/Total loans

4.22%

3.78%

3.59%

3.25%

2.96%

ALLL/Nonaccruals

71.72%

83.02%

93.07%

91.09%

99.09%

NPA/Assets

3.47%

2.84%

2.50%

2.33%

2.03%

Nonaccruals/Loans

5.88%

4.55%

3.86%

3.57%

2.99%

NCOs / Avg Loans

3.39%

3.41%

1.71%

1.37%

0.90% |

Maintaining a Strong Capital Profile

15

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

ASBC

Capital

Ratios

Stockholders’

equity

/

assets

14.21%

14.50%

14.88%

13.60%

13.01%

Tangible common equity / tangible assets

8.03%

8.12%

8.42%

8.49%

8.77%

Tangible equity / tangible assets

10.41%

10.59%

10.93%

9.71%

9.07%

Tier 1 common equity / risk-weighted assets

12.31%

12.26%

12.65%

12.61%

12.44%

Tier 1 leverage ratio

10.78%

11.19%

11.65%

10.46%

9.62%

Tier 1 risk-based capital ratio

17.68%

17.58%

18.08%

16.03%

14.35%

Total risk-based capital ratio

19.16%

19.05%

19.56%

17.50%

15.81% |

TARP

Repayment •

Completed the repurchase of remaining TARP funds primarily through senior note

and preferred stock offerings

•

OCC Memorandum of Understanding terminated

–

Bank-level capital and dividend constraints removed

16

TARP Repayment in a Shareholder-friendly Manner

Relative Shareholder Friendliness Scale

$430 mm

Senior Notes

$65 mm

8% Retail Preferred

~$30 mm

Cash-on-hand

$0 mm

No Common Stock |

Summary

17

–

Strong, stable Midwestern franchise; well positioned for growth

–

Execution of our strategic initiatives and continued loan growth

–

Strong balance sheet with ample liquidity

–

Solid long-term strategy to reduce and manage risk

–

Improved systems, processes, and procedures for credit improvement

–

Exited TARP in a shareholder-friendly manner

2011

–

Poised

for

Revenue

Growth

and

Earnings

Expansion

–

Continuing to invest in our brand, our footprint, and our people

–

Our customer centric investments will provide attractive returns

–

Strong headwinds impacting margins and fee income

–

Opportunities to capitalize on pending disruptions in our markets

(M&I, competitor fall-out, and retrenchment)

|

Appendix

•

Deposit Portfolio

•

Investment Securities Portfolio

•

Loan Portfolio

–

Residential Mortgages

–

Home Equity

–

Investor Commercial Real Estate

–

Construction Loans

–

Commercial & Business Lending Loans

•

Credit Details

–

See attached press release financial tables

18 |

Strong and Low Cost Funding Profile

19

($ in thousands)

Cost of Funds

Jun 30, 2011

Sep 30, 2011

$ Change

% Change

3Q 2011

Demand

3,218,722

$

3,711,570

$

492,848

15%

Savings

1,007,337

1,013,195

5,858

1%

0.11

%

Interest-bearing demand

1,931,519

2,071,627

140,108

7%

0.18

Money market

4,982,492

5,205,401

222,909

4%

0.30

Brokered CDs

316,670

203,827

(112,843)

-36%

1.29

Other time deposits

2,609,310

2,576,790

(32,520)

-1%

1.50

Total deposits

14,066,050

14,782,410

716,360

5%

0.56

Customer repo sweeps

930,101

871,619

(58,482)

-6%

Customer repo term

1,147,938

1,141,450

(6,488)

-1%

Total customer funding

2,078,039

2,013,069

(64,970)

-3%

Total Deposits and Customer Funding

16,144,089

16,795,479

651,390

4%

Network transaction deposits

824,003

875,630

51,627

6%

Brokered CDs

316,670

203,827

(112,843)

-36%

1.29

Total Networked and Brokered Deposits

1,140,673

1,079,457

(61,216)

-5%

Net Customer Deposits and Funding

15,003,416

$

15,716,022

$

712,606

5%

Jun 11 vs Sep 11

Period End Deposit and Customer Funding Composition |

Managing the Cost of Funds and Customer Funding Levels

20

Cost of Money Market Deposits

Cost of Interest-Bearing Liabilities

$6.8b

$6.0b

$5.1b

$5.0b

$5.1b

$16.4b

$15.5b

$14.9b

$15.3b

$15.2b

Net Customer Deposits and Funding

($ in billions)

0.54%

0.47%

0.37%

0.33%

0.30%

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

1.03%

0.98%

0.89%

0.91%

0.83%

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

$14.6

$14.2

$14.7

$15.0

$15.7

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011 |

Appendix

•

Deposit Portfolio

•

Investment Securities Portfolio

•

Loan Portfolio

–

Residential Mortgages

–

Home Equity

–

Investor Commercial Real Estate

–

Construction Loans

–

Commercial & Business Lending Loans

•

Credit Details

–

See attached press release financial tables

21 |

High

Quality Investment Securities Portfolio 22

Investment Portfolio –

September 30, 2011

Market Value Composition –

September 30, 2011

Portfolio Composition Ratings –

September 30, 2011

Type

Bk Value

(000’s)

Mkt Value

(000’s)

TEY

(%)

Duration

(Yrs)

Govt &

Agencies

$ 26,290

$ 26,318

0.68

0.53

MBS

1,455,622

1,559,143

4.58

1.26

CMOs

2,717,182

2,754,018

2.49

1.46

Municipals

782,806

827,385

5.74

4.89

ABS

213,955

213,234

0.41

0.23

Corporates

63,074

62,005

1.33

0.41

Other

9,813

11,713

---

---

TOTAL AFS

$5,268,742

$5,453,816

3.44

1.85

Credit Rating

(& in millions)

Mkt Value

% of Total

Govt & Agency

$ 4,294,998

78.8%

AAA

228,369

4.2%

AA

757,144

13.9%

A

89,933

1.6%

BAA1, BAA2 & BAA3

17,731

0.3%

BA1 & Lower

41,596

0.8%

Non-rated

24,045

0.4%

Total

$5,453,816

100.0%

MBS

29%

CMOs

50%

Municipals

15%

ABS

4%

All Other

1 %

Govt

&

Agencies

1% |

Appendix

•

Deposit Portfolio

•

Investment Securities Portfolio

•

Loan Portfolio

–

Residential Mortgages

–

Home Equity

–

Investor Commercial Real Estate

–

Construction Loans

–

Commercial & Business Lending Loans

•

Credit Details

–

See attached press release financial tables

23 |

Loan

Portfolio Trends 24

($ in thousands)

Cost of Funds

Jun 30, 2011

Sep 30, 2011

$ Change

% Change

3Q 2011

Commercial and industrial

3,202,301

$

3,360,502

$

158,201

5%

Lease financing

54,001

54,849

848

2%

Commercial real estate - owner occupied

1,030,060

1,068,616

38,556

4%

Commerical and business lending

4,286,362

4,483,967

197,605

5%

Commercial real estate - investor

2,393,626

2,481,411

87,785

4%

Real estate - construction

533,804

554,024

20,220

4%

Commercial real estate lending

2,927,430

3,035,435

108,005

4%

Total commercial

7,213,792

7,519,402

305,610

4%

4.28

%

Home equity

2,594,029

2,571,404

(22,625)

-1%

Installment

589,714

572,243

(17,471)

-3%

Total retail

3,183,743

3,143,647

(40,096)

-1%

4.78

Residential mortgage

2,692,054

2,840,458

148,404

6%

4.09

Total Loans

13,089,589

$

13,503,507

$

413,918

3%

4.36

Jun 11 vs Sep 11

Period End Loan Composition |

Residential Mortgage and Home Equity

25

Residential Mortgage portfolio of $2.8 billion

21% of Total Loans, at Sept. 30, 2011

Portfolio Mortgage Balance by State

Home Equity portfolio of $2.6 billion

19% of Total Loans, at Sept. 30, 2011

Home Equity Balance by State

Home Equity NCOs by State

Portfolio Mortgage NCOs by State

Wisconsin

58%

Illinois

26%

Minnesota

8%

Other

8%

Wisconsin

66%

Illinois

16%

Minnesota

18%

Wisconsin

71%

Illinois

16%

Minnesota

11%

Other

2%

Wisconsin

56%

Illinois

20%

Minnesota

24% |

Investor Commercial Real Estate and Construction

26

Investor CRE portfolio of $2.5 billion

18.4% of Total Loans, at Sept. 30, 2011

Investor CRE Loans by State

Construction portfolio of $554 million

4% of Total Loans, at Sept. 30, 2011

Construction Loans by State

Construction Loans by Collateral

Investor CRE Loans by Collateral

Wisconsin

53%

Illinois

19%

Minnesota

16%

Other

7%

Missouri

3%

Florida

2%

Office/Mixed Use

28%

Multi

-Family

26%

Retail

21%

Other

10%

Industrial

9%

Hotel/Motel

5%

Single

Family/Condo

1%

Land

0%

Wisconsin

35%

Illinois

31%

Minnesota

17%

Colorado

8%

Other

6%

Missouri

3%

Retail

29%

Land

27%

Single

Family/Condo

12%

Other

9%

Multi

-Family

9%

Office

6%

Industrial

4%

Mixed Use

4% |

Commercial & Business Lending Loans by State

Commercial & Business Lending Loans

27

Commercial

&

Business

Lending

portfolio

of

$4.4

billion,

or

33%

of

Total

Loans,

at

Sept.

30,

2011

Commercial & Business Lending Loans by Collateral

Wisconsin

45%

Illinois

22%

Minnesota

17%

Other

16%

Other

23%

Manufacturing

21%

Real Estate &

Rental/Leasing

14%

Finance

&

Insurance

11%

Wholesale Trade

10%

Retail Trade

8%

Health Care &

Social

Assistance

6%

Professional,

Scientific

, &

Technical

Services, 5%

Transportation &

Warehousing

3% |

Appendix

•

Deposit Portfolio

•

Investment Securities Portfolio

•

Loan Portfolio

–

Residential Mortgages

–

Home Equity

–

Investor Commercial Real Estate

–

Construction Loans

–

Commercial & Business Lending Loans

•

Credit Details

–

See attached press release financial tables

28 |

Continuing Decline in Potential Problem Loans

29

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

YoY

Change

Commercial and industrial

$

373,955

(45%)

Commercial real estate

553,126

492,778

465,376

382,056

392,737

(29%)

Real estate -

construction

175,817

91,618

70,824

63,186

37,155

(79%)

Lease financing

2,302

2,617

1,705

1,399

507

(78%)

Total commercial

1,105,200

941,297

886,854

676,048

637,750

(42%)

Home equity

6,495

3,057

4,737

4,515

4,975

(23%)

Installment

692

703

230

216

272

(61%)

Total retail

7,187

3,760

4,967

4,731

5,247

(27%)

Residential mortgage

19,416

18,672

19,710

18,575

16,550

(15%)

Total Potential Problem Loans

$ 1,131,803

$ 963,729

$ 911,531

$ 699,354

$ 659,547

(42%)

($ in millions)

$ 348,949

$ 229,407

$ 207,351

$ 354,284 |