Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PILGRIMS PRIDE CORP | d248675d8k.htm |

Pilgrim’s

Pride Corporation Financial Results for

Third Fiscal Quarter Ended

September 25, 2011

1

Exhibit 99.1 |

Cautionary Notes

and Forward-Looking Statements 2

Statements contained in this presentation that share our intentions, beliefs, expectations or

predictions for the future, denoted by the words “anticipate,”

“believe,” “estimate,” “should,” “expect,”

“project,” “plan,” “imply,” “intend,” “foresee” and similar expressions, are forward-looking statements that reflect our

current views about future events and are subject to risks, uncertainties and assumptions.

Such risks, uncertainties and assumptions include the following matters affecting the

chicken industry generally, including fluctuations in the commodity prices of feed ingredients and chicken; actions and decisions of our creditors;

while JBS USA Holdings, Inc. (“JBS USA”) has significant acquisition experience and

historically has been able to realize substantial benefits through synergies, JBS USA

may not be able to fully achieve all of the anticipated synergistic from the sale of 67% of the company’s common stock to JBS USA within the time frames

expected; our ability to obtain and maintain commercially reasonable terms with vendors and

service providers; our ability to maintain contracts that are critical to our

operations; our ability to retain management and other key individuals; certain of our reorganization and exit or disposal activities, including selling assets,

idling facilities, reducing production and reducing workforce, resulted in reduced capacities

and sales volumes and may have a disproportionate impact on our income relative to the

cost savings; risk that the amounts of cash from operations together with amounts available under our exit credit facility will not be

sufficient to fund our operations; management of our cash resources, particularly in light of

our substantial leverage; restrictions imposed by, and as a result of, our substantial

leverage; additional outbreaks of avian influenza or other diseases, either in our own flocks or elsewhere, affecting our ability to conduct our operations

and/or demand for our poultry products; contamination of our products, which has previously

and can in the future lead to product liability claims and product recalls; exposure to

risks related to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited

and potentially inadequate; changes in laws or regulations affecting our operations or the

application thereof; new immigration legislation or increased enforcement efforts in

connection with existing immigration legislation that cause our costs of business to increase, cause us to change the way in which we do

business or otherwise disrupt our operations; competitive factors and pricing pressures or the

loss of one or more of our largest customers; currency exchange rate fluctuations, trade

barriers, exchange controls, expropriation and other risks associated with foreign operations; disruptions in international markets and

distribution channels, including exports to Russia, the anti-dumping proceeding in Ukraine

and the anti-dumping and countervailing duty proceeding in China; and the impact of

uncertainties of litigation as well as other risks described herein and under “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the

Securities and Exchange Commission (the “SEC”).

Actual results could differ materially from those projected in these forward-looking

statements as a result of these factors, among others, many of which are beyond our

control. In making these statements, we are not undertaking, and specifically decline to undertake, any obligation to address or update each or any

factor in future filings or communications regarding our business or results, and we are not

undertaking to address how any of these factors may have caused changes to information

contained in previous filings or communications. Although we have attempted to list comprehensively these important cautionary risk

factors, we must caution investors and others that other factors may in the future prove to be

important and affecting our business or results of operations. We have included certain information regarding our results of operations and components

thereof that have been adjusted to exclude charges associated with the

company’s restructuring under Chapter 11 Bankruptcy protection and other additional

reorganization items. We have included this information as we believe that investors

may be interested in our results excluding these items as this is a way our management analyzes our results from continuing operations.

“EBITDA” is defined as net income (loss) from continuing operations plus interest,

income taxes, depreciation and amortization. “Adjusted EBITDA” is defined as

the sum of EBITDA plus restructuring charges, reorganization items and loss on early

extinguishment of debt less net income attributable to noncontrolling interests. Our

method of computation may or may not be comparable to other similarly titled measures used in filings with the SEC by other companies. See the

consolidated statements of income and consolidated statements of cash flows included in our

financial statements. EBITDA is presented because we believe it provides

meaningful additional information concerning a company’s operating results and its ability to service long-term debt and to fund its growth, and we

believe it is frequently used by securities analysts, investors and other interested parties,

in addition to and not in lieu of results under U.S. Generally Accepted Accounting

Principles (GAAP), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how

our management analyzes EBITDA from continuing operations. The Company also believes that

Adjusted EBITDA, in combination with the Company's financial results calculated in

accordance with GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and

facilitates a more direct comparison of its performance with its competitors. EBITDA and

Adjusted EBITDA are not measurements of financial performance under GAAP and should not

be considered as an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to net income as indicators

of our operating performance or any other measures of performance derived in accordance with

GAAP. |

Third Quarter

2011 Financial Review Net loss of $162.5 million, or $0.76 per share, vs. net profit of

$57.9 million, or $0.27 per share for the comparable quarter a year earlier

Even with the non-recurring events, Pilgrim’s generated a positive operating

cash flow of $10.7 million

Total net sales increased 10.0%, or $171.4 million

Quarter with strategic decisions that must be made to generate positive impact on future

quarters and with external non-recurring events that impacted our result:

Total impact of non-recurring events reached US$52.7 million

Recurring EBITDA (excluding non-recurring events) was a loss of $31.4 million vs. a

positive $170 million for the same period a year ago

Overall this

year

we

have

sold

approximately

5

billion

pounds

at

an

average

of

3.8

cents

less

than in the prior year. This equates to almost $200 million less in revenue year over

year. We’ve also incurred grain costs year to date that are $545 million

higher than 2010 3 |

Results

Highlights 4

* Adjusted for $52.7 million in non-recurring events in COGS and SG&A

Main Indicators ($MM)

3Q10

3Q11

Net Revenue

1,719.8

1,891.2

Gross (Loss) Profit

159.8

(62.4)

Net Income

57.9

(162.5)

EBITDA

170.0

(84.1)

Recurring EBITDA*

170.0

(31.4) |

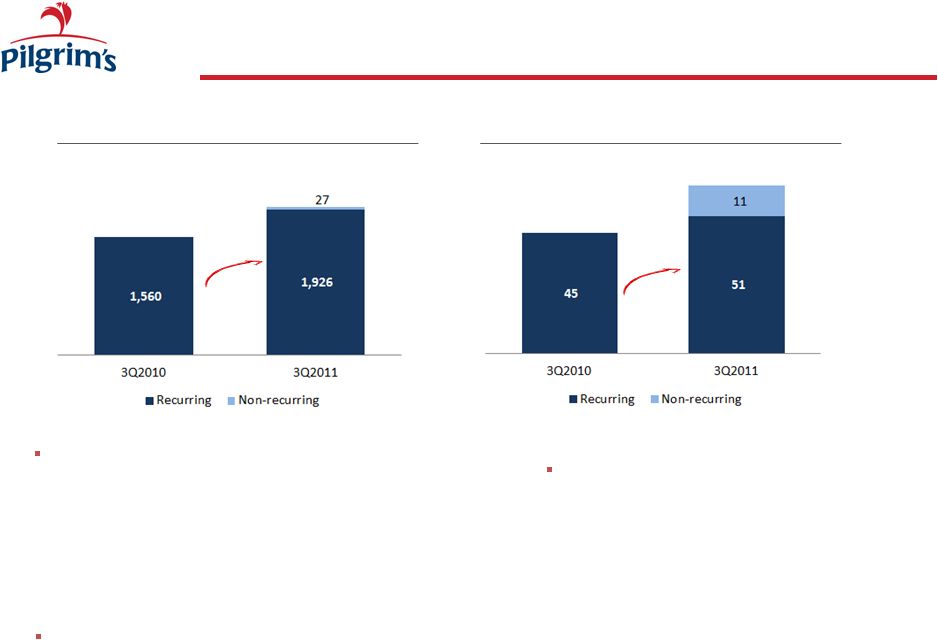

Sales

Breakdown Domestic Sales ($MM)

+3.8%

Exports ($MM)

Mexico Sales ($MM)

Domestic: higher volume on lower average price

Exports: higher volume and higher price

Mexico: higher volume on lower average price

+65.6%

+24.8%

5 |

Market

Prices Bird MW WOG (Without Giblets)

MW Breast Tender Out

MW Wings

MW Leg Quarters

6 |

Operating

Costs COGS ($MM)

+23.5%

SG&A ($MM)

7

Non recurring Events:

–

$11.5 MM in Egg/ pullets destruction

–

$6 MM LOCOM

–

$7.9 MM inventory recall costs

–

Uninsured

Losses

in

Marshville:

$1.9MM

Non recurring Events:

–

$8.8 MM in HFS Assets

–

$2.6 MM in Dallas shut-down costs

Other Impacts (below the line) : US$14 MM FX loss on Mexico

+13.5% |

Feed Costs

Corn ($ per Bushel)

Soymeal ($per ton)

8

65.3%

15.4%

7.65

6.17

382

326

Feed ingredients purchased were approximately $102 million higher during the quarter than

the year-ago period

For the year, feed ingredients purchased were $545 higher than 2010

4.21

Q3 2010

Q3 2011

305

352

Q3 2010

Q3 2011

6.96 |

Results of

Operations 9

Main Indicators ($MM)

3Q10

3Q11

Change

Net Income

57.9

(162.5)

(220.4)

Net Income per Share

Basic

0.27

(0.76)

(1.03)

Diluted

0.27

(0.76)

(1.03)

Recurring Net Income*

57.9

(109.8)

(170.2)

Recurring

Net

Income

per

Share

Basic

0.27

(0.52)

(0.79)

Diluted

0.27

(0.52)

(0.79)

* Adjusted for $11.5MM in Egg/Hen disposal, $7.9MM in expenses related to a product

recall, $6MM in LOCOM, $1.9MM in Marshville uninsured costs. Also includes

adjustments for $8.8MM in assets that were sold during the period , $2.6MM of Dallas shut-down costs

and $14MM in FX loss in Mexico due to impacts of devaluation of Peso on Mexico Balance Sheet

|

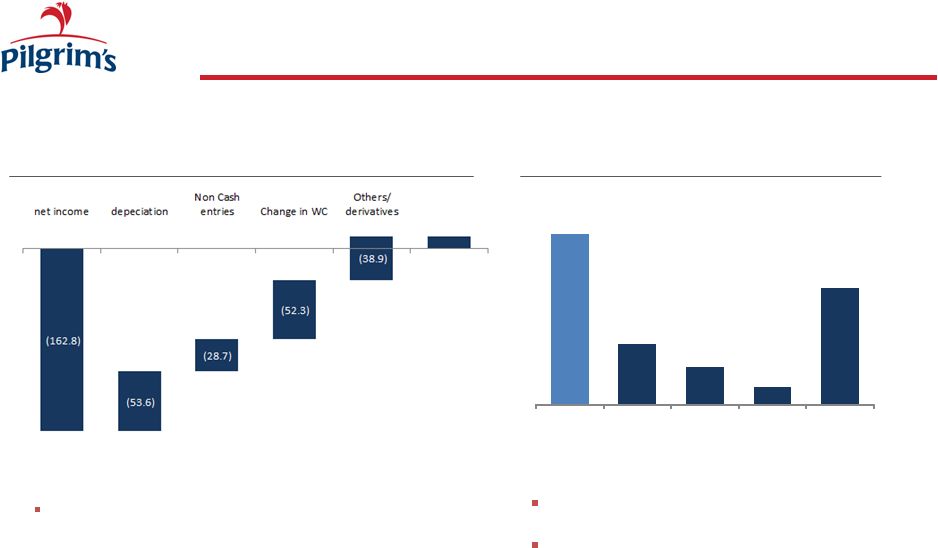

Operating Cash

Flow and CAPEX Operating Cash Flow ($MM)

10

Capex ($ MM)

Tight reign on capital spending

Capex for the year to be around $130

million

Positive Operating Cash Flow in the Quarter

–

Reduction of A/R

–

Optimizing Inventory

–

Non-cash, non-recurring impacts

10.7

179.3

64.0

39.2

18.7

121.9

2010 Total

Q1

Q2

Q3

2011 YTD |

Total Debt and

Availability 11

Sources of Liquidity

Amount Available

Q1

Q2

Q3

Cash and cash equivalents

63

34.6

46.9

Short-term investments in available-for-

sale securities

1.4

0.8

0.1

Borrowing arrangements:

Exit Credit Facility

334.7

279.8

243.9

ING Credit Facility

46.5

46.8

22.2*

JBS Subordinated Loan Agreement

-

50

50

* The total credit line is $46.8MM, with $22.2 currently committed

Total debt: US$1.5 billion

–

Net Interest: $27.9 MM

Liquidity of $362.8MM |

Highlights and

Strategy Going Forward Quarter with difficult decisions that must be made to generate

positive impact on future quarters

Grain volatility is here to stay

Chicken Industry is adjusting its offer to meet demand and cold inventories are already below

2010 levels

We remain committed to Become the best managed and most respected company in our

industry:

Relentless pursuit of operational excellence by achieving T25 performance and meeting 400 mm

annualized cost improvement.

Become irreplaceable valued partner to key customers.

Create an ownership culture of accountability and improvement.

Add value to exports

Risk Management

12 |

IR

Contact Investor Relations:

Rosemary Geelan

E-mail:

rosemary.geelan@pilgrims.com

Phone:

+1 (970) 506-8192

Address:

1770 Promontory Circle

Greeley, CO 80634 USA

Website:

www.pilgrims.com

13 |