Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ONCOR ELECTRIC DELIVERY CO LLC | d248673d8k.htm |

Oncor Electric

Delivery Third Quarter 2011

Investor Call

October 28, 2011

Exhibit 99.1 |

| 1

Oncor Electric Delivery

Forward Looking Statements

This presentation contains forward-looking statements, which are subject to

various risks and uncertainties.

Discussion of risks and uncertainties that could cause actual results to differ

materially from management’s current projections, forecasts, estimates and

expectations is contained in filings made by Oncor Electric Delivery Company

LLC (Oncor) with the Securities and Exchange Commission (SEC).

Specifically,

Oncor

makes

reference

to

the

section

entitled

“Risk

Factors”

in

its

annual

and

quarterly

reports.

In addition to the risks and uncertainties set forth in Oncor’s SEC filings, the

forward-looking statements in this presentation could be affected by,

among other things: prevailing governmental policies and regulatory

actions;

legal

and

administrative

proceedings

and

settlements;

weather

conditions

and

other

natural phenomena; acts of sabotage, wars or terrorist activities; economic

conditions, including the impact of a recessionary environment; unanticipated

population growth or decline, or changes in market demand and demographic

patterns; changes in business strategy, development plans or vendor relationships;

unanticipated changes in interest rates or rates of inflation; unanticipated changes

in operating expenses, liquidity needs and capital expenditures; inability of

various counterparties to meet their financial obligations to Oncor, including

failure of counterparties to perform under agreements; general industry trends; hazards

customary

to

the

industry

and

the

possibility

that

Oncor

may

not

have

adequate

insurance

to cover losses

resulting from such hazards; changes in technology used by and services offered by

Oncor; significant changes in Oncor’s relationship with its employees;

changes in assumptions used to estimate costs of providing employee benefits,

including pension and other post-retirement employee benefits, and future

funding requirements related thereto; significant changes in critical accounting

policies material to Oncor; commercial bank and financial market conditions,

access to capital, the cost of such capital, and the results of financing and

refinancing efforts, including availability of funds in the capital markets and the potential impact

of disruptions in US credit markets; circumstances which may contribute to future

impairment of goodwill, intangible or other long-lived assets; financial

restrictions under Oncor’s revolving credit facility and indentures

governing its debt instruments; Oncor’s ability to generate sufficient cash flow to make interest

payments on its debt instruments; actions by credit rating agencies; and Oncor’s

ability to effectively execute its operational strategy. Any

forward-looking statement speaks only as of the date on which it is made, and

Oncor undertakes no obligation to update any forward-looking statement to reflect

events or circumstances after the date on which it is made or to reflect the

occurrence of unanticipated events. Regulation G

This presentation includes certain non-GAAP financial measures. A reconciliation

of these measures to the most directly comparable GAAP measures is included in

this presentation, which is available on Oncor’s website,

www.oncor.com,

under

the

‘News’

tab

in

the

Investor

Information

section,

and

also

filed

with

the

SEC. |

| 2

Oncor Electric Delivery

3rd Quarter 2011 Investor Call Agenda

Financial Overview

David Davis

Chief Financial Officer

Operational Review

Bob Shapard

Chairman and CEO

Q&A |

3

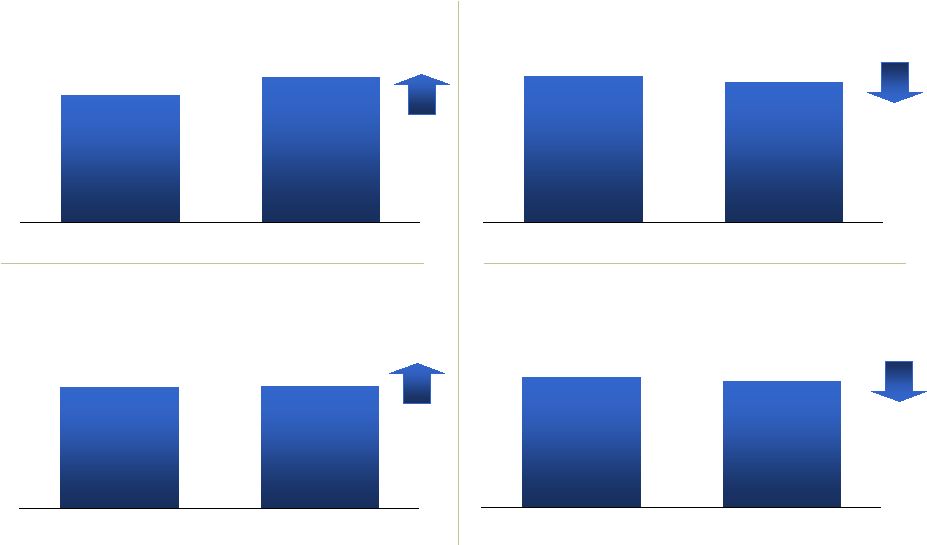

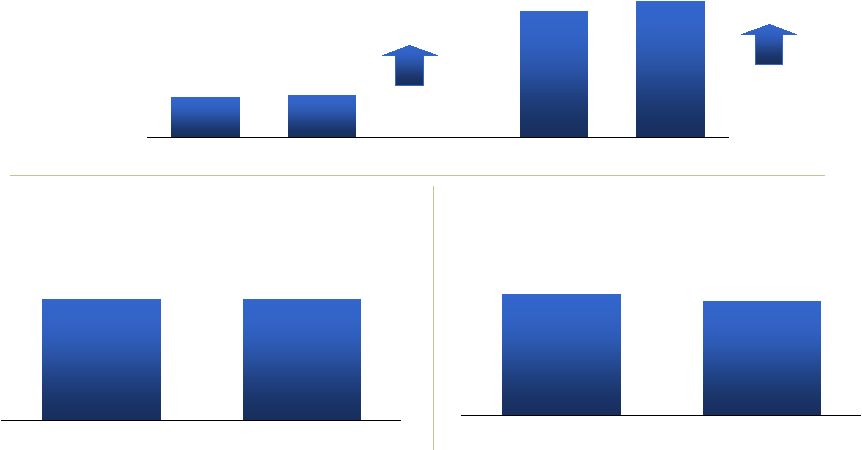

Oncor Electric Delivery

Weather Drove Q3 2011 Volumes and Impacted Weather-

Adjusted Response

Avg KWH/Residential Premise, Weather Adj

Q3 ‘10 vs. Q3 ‘11

Residential GWH, Actual

Q3

1

‘10 vs. Q3 ‘11

Residential Points of Delivery

Q3 ‘10 vs. Q3 ‘11; thousands of meters

Residential GWH, Weather Adj

Q3 ‘10 vs. Q3 ‘11

14,133

16,098

Q3 '10

Q3 '11

4,836

4,664

Q3 '10

Q3 '11

13,017

12,671

Q3 '10

Q3 '11

2,693

2,717

At 9/30/2010

At 9/30/2011

0.9%

13.9%

2.7%

3.6%

1

Unless otherwise indicated, reflects three months ended September 30.

|

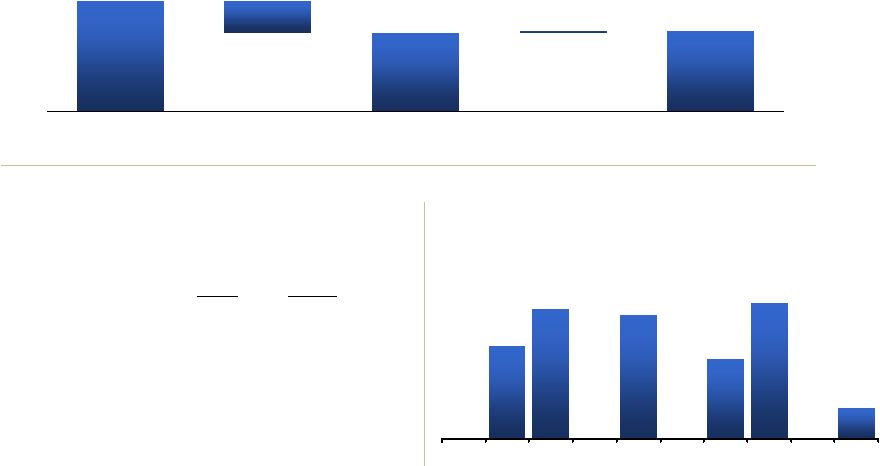

4

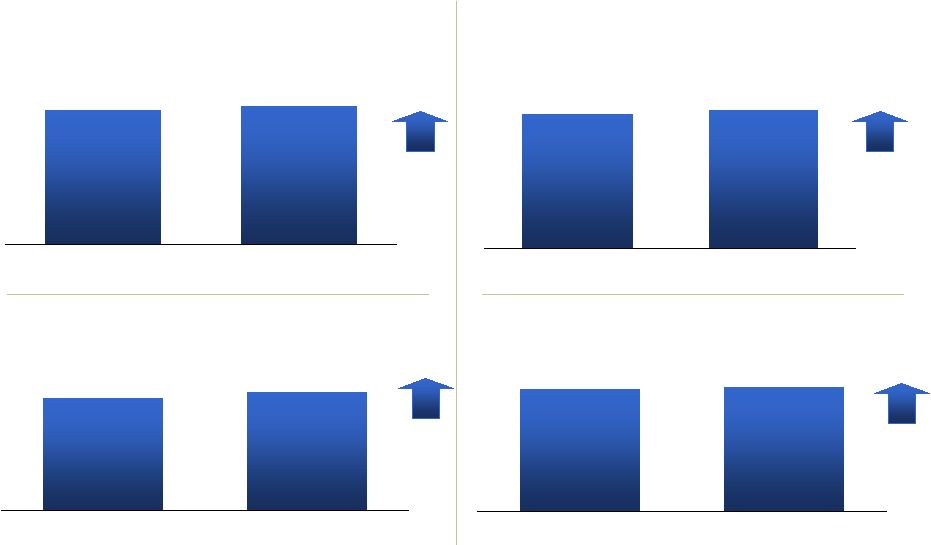

Oncor Electric Delivery

Large C&I Demand and Usage Trends Suggest Continued

Economic Recovery

Large C&I GWH, Actual

Q3 ‘10 vs. Q3 ‘11

Large C&I GWH, Weather Adj

Q3 ‘10 vs. Q3 ‘11

18,411

18,722

Q3 '10

Q3 '11

3.4%

2.9%

17,640

18,234

Q3 '10

Q3 '11

Large C&I Billed MW Demand (Avg)

Q3

1

‘10 vs. Q3 ‘11

18,795

19,822

Q3 '10

Q3 '11

17,053

16,575

Q3 '10

Q3 '11

Large C&I Actual MW Demand (Avg)

Q3 ‘10 vs. Q3 ‘11

5.5%

1.7%

1

Three months ended September 30. |

5

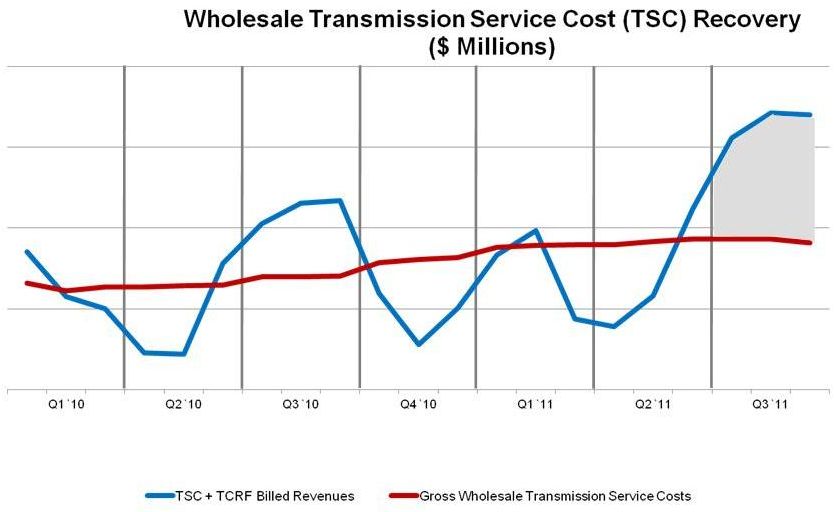

Oncor Electric Delivery

Starting Q3 ‘11, Distribution “Book”

Revenue Related to

Recovery of Wholesale Transmission Service Will Match

Expense

1

$143

$144

$147

$153

$158

$160

$160

$144

$130

$172

$133

$150

$147

$204

Includes affiliate transmission costs and excludes impacts of deferrals of accounting recognition to

reflect timing of recovery under PUCT regulations. Numbers indicate amounts TCRF – Transmission Cost Recovery Factor

1

per quarter |

6

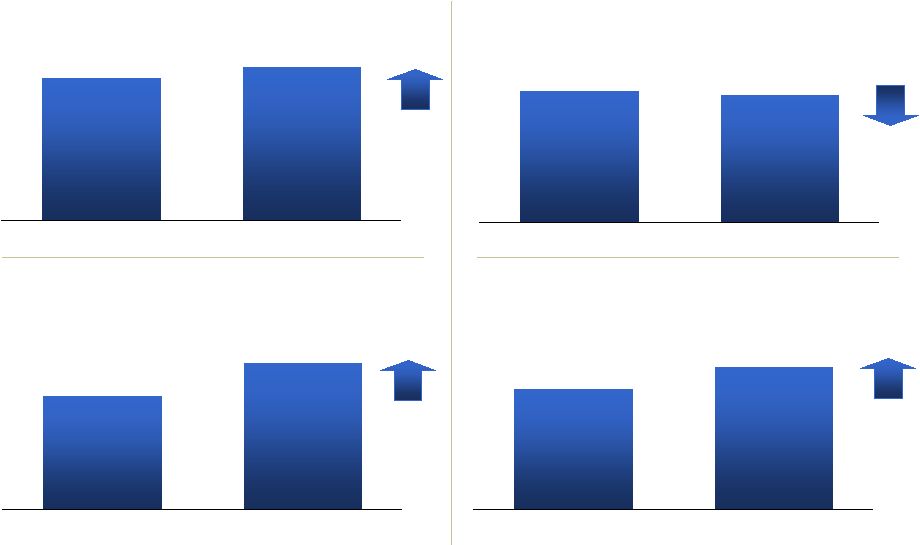

Oncor Electric Delivery

Summary of Financial Results

1

Adjusted Net Income

Q3 ‘10 vs. Q3 ‘11; $ millions

146

141

Q3 '10

Q3 '11

Adjusted Operating Revenues

Q3

2

‘10 vs. Q3 ‘11; $ millions

788

851

Q3 '10

Q3 '11

PP&E, net

Q3 ‘10 vs. Q3 ‘11; $ millions

9,529

10,247

At 9/30/2010

At 9/30/2011

Adjusted Operating Cash Flow

Q3 ‘10 vs. Q3 ‘11; $ millions

334

396

Q3 '10

Q3 '11

1

Excludes impacts from transition bond debt, and fair value accounting adjustments associated with the

October 2007 merger. 2

Unless otherwise indicated, reflects three months ended September 30.

8.0%

18.6%

3.4%

7.5% |

7

Oncor Electric Delivery

Credit Metrics

1

Continue to be Strong

EBITDA

Q3

2

‘10 vs. Q3 ’11 and TME

3

9/30/10 vs TME 9/30/11; $ millions

EBITDA/Cash Interest

TME 9/30/10 vs. TME 9/30/11; Ratio

4.7x

4.7x

TME 9/30/10

TME 9/30/11

Debt/EBITDA

TME 9/30/10 vs. TME 9/30/11; Ratio

3.7x

3.5x

TME 9/30/10

TME 9/30/11

1

Excludes impacts from transition bond debt, a one-time write-off of regulatory assets and fair

value accounting adjustments associated with the October 2007 merger. 2

Three months ended September 30.

3

Twelve months ended.

452

480

1,407

1,509

Q3 '10

Q3 '11

TME 9/30/10

TME 9/30/11

7.2%

6.2% |

8

Oncor Electric Delivery

Oncor’s Credit Facility Maturity Has Been Extended to

October 2016

Revolver Capacity

Borrowings and

Letters of Credit

Effective Remaining

Capacity

Cash

Total Available

Liquidity

$2.0

billion

Secured

Revolving

Credit

Facility

1

Balances at October 26, 2011; $ millions

$2,000

$564

$1,436

$20

$1,456

Rating

Outlook

Moody’s

Baa1

Stable

Standard & Poor’s

A-

Stable

Fitch Ratings

BBB+

Stable

Solid Credit Ratings

1

Oncor’s $2.0 billion Credit Facility matures in 2016.

2

Excludes transition bond debt.

$376

$524

$500

$324

$550

$126

11

12

13

14

15

16

17

18

19

20

Long-Term Debt

2

Maturity Profile

2011-2020; $ millions |

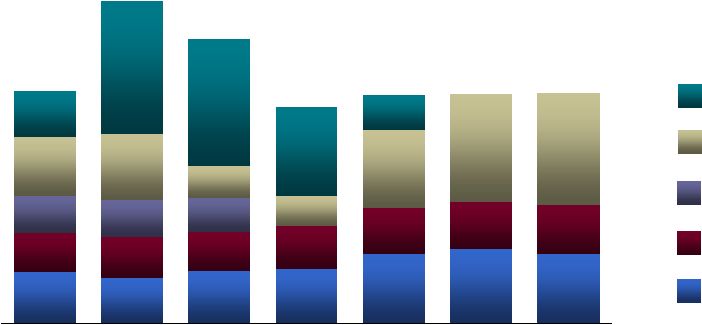

9

Oncor Electric Delivery

226

200

230

240

305

325

305

171

180

170

185

200

205

215

164

160

150

257

290

140

135

475

490

202

580

555

390

1,020

1,410

1,250

950

1,000

1,005

1,010

340

155

10

11E

12E

13E

14E

15E

16E

Actual and Estimated Capital Expenditures

10 -

16E; $ millions

New Service

Advanced Metering

CREZ

1

/ Voltage

Support

IT / Maintenance /

General Plant

Transmission Grid

Expansion

Capital Program

1

Oncor currently estimates that the total cost of the CREZ / Voltage Support

projects will be approximately $2.0 billion. |

| 10

Oncor Electric Delivery

3rd Quarter 2011 Investor Call Agenda

Financial Overview

David Davis

Chief Financial Officer

Operational Review

Bob Shapard

Chairman and CEO

Q&A |

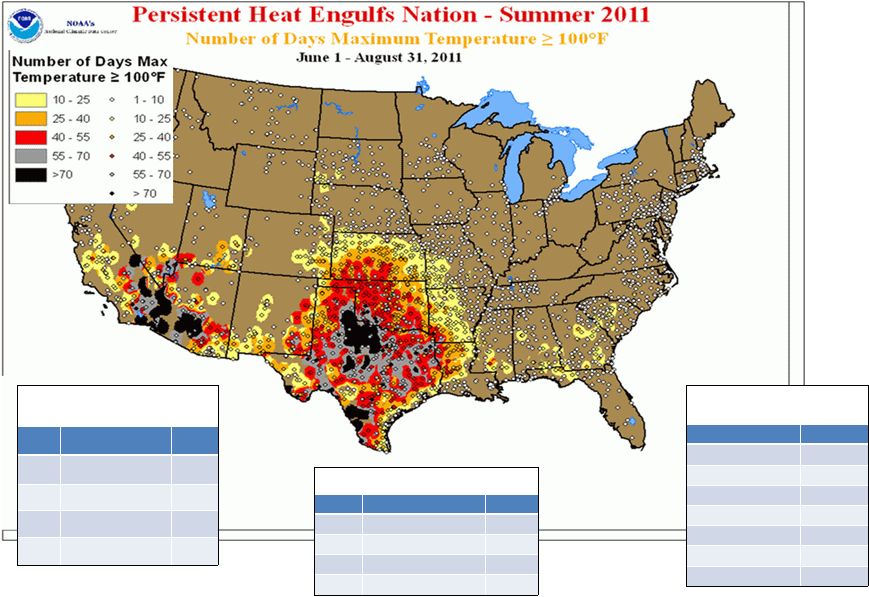

11

Oncor Electric Delivery

Summer Heat of 2011

DFW

Days Low >= 80

o

1

2011

55

2

1998

39

3

2008

27

4

2010

24

5

2006

23

DFW

Days>=105

o

Since 1998

2011

19

2000

10

1998

9

2006

6

1999

5

2008

5

2010

3

2003

2

DFW

Days >= 100

o

1

2011

70

2

1980

69

3

1998

56

4

1954

52

5

1956

48 |

12

Oncor Electric Delivery

CREZ Update

Competitive Renewable Energy Zones

2011 signals major shift in CREZ

project as it moves from CCN

proceedings to ROW acquisition

and actual construction

Will invest ~$2.0 billion on project

in total, including voltage support,

and $580M in 2011

$689M invested in CREZ through

September 30, 2011; $373M

invested YTD 2011

All 14 CCN’s have been approved |

13

Oncor Electric Delivery

AMS Initiative on Target for 2012 Completion

Advanced Metering Initiative

More than 2.1M meters installed

through September 30, 2011;

~609,000 meters installed in YTD

‘11

$477M invested in AMS through

September 30, 2011; $117M

invested YTD 2011

Customer education |

14

Oncor Electric Delivery

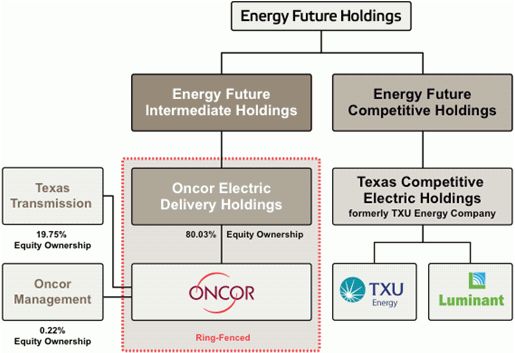

Oncor’s Ring-Fencing

Oncor Holdings and Oncor

are ring-fenced entities and

have no obligation to pay

any amounts due on EFH

and EFIH debt that is

secured by EFIH’s equity in

Oncor Holdings.

In the event of a valid

permitted asset transfer

(disposition of EFIH’s

equity interests in Oncor

Holdings), this debt would

become obligations of the

third party transferee. |

15

Oncor Electric Delivery

Appendix -

Regulation G Reconciliations and Supplemental

Data |

16

Oncor Electric Delivery

Measure

Definition

TSC

+TCRF Billed Revenues

(non-GAAP)

Charges billed to retail electric providers under Public Utility

Commission of

Texas (PUCT) approved tariffs for the recovery of wholesale transmission

service costs excluding accruals for unbilled deliveries and deferral of

over/under collected amounts calculated under PUCT reconciliation rules

Gross Wholesale Transmission

Service Costs (non-GAAP)

Charges billed to Oncor distribution business under the PUCT’s wholesale

transmission tariff matrix, including Oncor transmission affiliate charges and

excluding deferrals of costs calculated under PUCT reconciliation rules

Adjusted Operating Revenues

(non-GAAP)

Oncor operating revenues, less operating revenues of Oncor Electric Delivery

Transition Bond Company LLC (BondCo)

Adjusted Net Income (non-

GAAP)

Oncor net income, less effects of purchase accounting and net income of

BondCo

Debt (non-GAAP)

Oncor total debt, less transition bonds of BondCo

Adjusted Operating Cash Flow

(non-GAAP)

Oncor cash provided by operating activities, less BondCo cash provided by

operating activities

Total Debt (GAAP)

Oncor long-term debt (including current portion), plus bank loans and

commercial paper

EBITDA (non-GAAP)

Income from continuing operations before interest expense and related

charges and provisions in lieu of income tax, plus depreciation and

amortization and special items. EBITDA is a measure used by Oncor to

assess performance.

Debt/EBITDA (non-GAAP)

Total debt less transition bonds divided by EBITDA. Transition,

or

securitization, bonds are serviced by a regulatory transition charge on wires

rates and are therefore excluded from debt in credit reviews. Debt / EBITDA is

a measure used by Oncor to assess credit quality.

EBITDA/Cash Interest (non-

GAAP)

EBITDA divided by cash interest expense is a measure used by Oncor to

assess credit quality.

Financial Definitions |

17

Oncor Electric Delivery

Table 1: Oncor TSC + TCRF Billed Revenues and

Wholesale Transmission Service Costs Reconciliation

Three Months Ended Q1 ‘10 –

Q3 ‘11

$ millions

Q1 ‘10

Q2 ’10

Q3 ’10

Q4 ’10

Q1 ’11

Q2 ’11

Q3 ’11

Oncor operating revenues

703

702

831

678

706

756

897

Adjustments:

Operating

revenues

–

Bondco

(41)

(37)

(43)

(32)

(35)

(38)

(46)

Other

revenues

(547)

(504)

(616)

(526)

(552)

(526)

(695)

TCRF revenue deferral

-

-

-

-

-

-

39

Unbilled revenues

29

(31)

-

13

31

(45)

9

TSC + TCRF billed revenues

144

130

172

133

150

147

204

Oncor operation and maintenance expense

249

252

256

252

258

259

281

Less:

Non-wholesale transmission service expense

(151)

(154)

(154)

(156)

(155)

(153)

(168)

Wholesale transmission service expense

98

98

102

96

103

106

113

Plus: Affiliate wholesale transmission service costs

45

46

45

49

50

50

51

Net wholesale transmission cost deferral

-

-

-

8

5

4

(4)

Gross wholesale transmission service costs

143

144

147

153

158

160

160

1

Other revenues consist of distribution base rates other than TSC and TCRF, advanced

metering surcharges, third party transmission revenues and other miscellaneous

revenues 1 |

18

Oncor Electric Delivery

Table 2: Oncor Adjusted Operating Revenues Reconciliation

Three Months Ended September 30, ‘10 and ‘11

$ millions

Q3 ‘10

Q3 ‘11

Operating revenues –

Oncor

831

897

Less: Operating revenues –

BondCo

(43)

(46)

Adjusted operating revenues, excluding BondCo

788

851 |

19

Oncor Electric Delivery

Q3 ‘10

Q3 ‘11

Net income –

Oncor

149

144

Less: Effects of fair value accounting (after tax)

(3)

(3)

Adjusted net income, excluding BondCo

146

141

Table 3: Oncor Adjusted Net Income Reconciliation

Three Months Ended September 30, ‘10 and ‘11

$ millions |

20

Oncor Electric Delivery

Table 4: Oncor Operating Cash Flow Reconciliation

Three Months Ended September 30, ‘10 and ‘11

$ millions

Q3 ‘10

Q3 ‘11

Operating cash flow –

Oncor

368

436

Less: Operating cash flow –

BondCo

(34)

(40)

Operating cash flow, excluding BondCo

334

396 |

21

Oncor Electric Delivery

Table 5: Oncor EBITDA Reconciliation

Three Months Ended September 30, ‘10 and ‘11

$ millions

Q3 ‘10

Q3 ‘11

Net income –

Oncor

149

144

Plus: Depreciation & amortization –

Oncor

176

190

Provision in lieu of income taxes –

Oncor

79

99

Interest expense –

Oncor

87

89

Equals: EBITDA –

Oncor

491

522

Less: Net income –

BondCo

-

-

Depreciation & amortization –

BondCo

(33)

(38)

Provision in lieu of income taxes –

BondCo

-

-

Interest expense –

BondCo

(9)

(8)

Effects of fair value accounting (pre tax)

(8)

(7)

Regulatory asset amortization

11

11

Oncor EBITDA, excluding BondCo

452

480 |

22

Oncor Electric Delivery

Table 6: Oncor EBITDA Reconciliation

Twelve Months Ended September 30, ‘10 and ‘11

$ millions

TME ‘10

TME ‘11

Net Income –

Oncor

352

350

Plus: Depreciation & amortization –

Oncor

659

706

Provision in lieu of income taxes –

Oncor

207

238

Interest expense –

Oncor

347

353

Equals: EBITDA –

Oncor

1,565

1,647

Less: Net income –

BondCo

-

-

Depreciation & amortization –

BondCo

(115)

(116)

Provision in lieu of income taxes –

BondCo

-

-

Interest expense –

BondCo

(39)

(33)

Effects of fair value accounting (pre tax)

(35)

(30)

Regulatory asset amortization

41

41

Adjustment of goodwill liability

(10)

-

Oncor EBITDA, excluding BondCo

1,407

1,509 |

23

Oncor Electric Delivery

Table 7: Oncor Total Debt Reconciliation

At September 30, ‘10 and ‘11

$ millions

‘10

‘11

Short-term debt-

Oncor

428

553

Long-term debt due currently –

Oncor

111

493

Long-term debt, less due currently –

Oncor

5,395

4,882

Total debt –

Oncor, including BondCo

5,934

5,928

Less: Short-term debt –

BondCo

-

-

Long-term debt due currently –

BondCo

(111)

(117)

Long-term debt, less due currently –

BondCo

(591)

(472)

Fair value adjustment –

BondCo

4

2

Total Oncor debt, excluding BondCo

5,236

5,341 |

24

Oncor Electric Delivery

Table 8: Oncor Interest and Debt Coverages

Twelve Months Ended September 30, ‘10 and ‘11

$ millions

TME ‘10

TME ‘11

Ref

Source

Interest

expense

and

related

charges

–

Oncor

347

353

Amortization

of

debt

fair

value

discount

–

Oncor

(1)

-

Amortization

of

debt

discount

–

Oncor

(7)

(3)

AFUDC

–

Oncor

-

2

Cash

interest

expense

–

Oncor

339

352

Less:

Interest

expense

–

BondCo

(39)

(33)

Cash interest expense, excluding BondCo

300

319

A

EBITDA, excluding BondCo

1,407

1,509

B

Table 5

Total debt, excluding BondCo

5,236

5,341

C

Table 6

EBITDA/cash

interest

–

ratio

(B

/ A)

4.7x

4.7x

Debt/EBITDA

–

ratio

(C

/

B)

3.7x

3.5x |