Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NATIONAL PENN BANCSHARES INC | form8k.htm |

EXHIBIT 99.1

SLIDE PRESENTATION

National Penn Bancshares,

Inc.

Inc.

3nd Quarter 2011

Earnings Webcast

Earnings Webcast

1

Safe Harbor Regarding Forward Looking Statements

This presentation contains forward-looking information about National Penn Bancshares, Inc. that is intended to be covered by the safe harbor for forward-looking

statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. These

statements can be identified by the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,’’ “project,” ”could,” “plan,’’ “goal,” “potential,”

“pro forma,” “seek,” “intend,’’ or “anticipate’’ or the negative thereof or comparable terminology, and include discussions of strategy, financial projections, guidance

and estimates (including their underlying assumptions), statements regarding plans, objectives, expectations or consequences of announced transactions, and

statements about the future performance, operations, products and services of National Penn and its subsidiaries. National Penn cautions readers not to place undue

reliance on these statements.

statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. These

statements can be identified by the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,’’ “project,” ”could,” “plan,’’ “goal,” “potential,”

“pro forma,” “seek,” “intend,’’ or “anticipate’’ or the negative thereof or comparable terminology, and include discussions of strategy, financial projections, guidance

and estimates (including their underlying assumptions), statements regarding plans, objectives, expectations or consequences of announced transactions, and

statements about the future performance, operations, products and services of National Penn and its subsidiaries. National Penn cautions readers not to place undue

reliance on these statements.

National Penn’s business and operations are subject to a variety of risks, uncertainties and other factors. Consequently, actual results and experience may

materially differ from those contained in any forward-looking statements. Such risks, uncertainties and other factors that could cause actual results and experience to

differ from those projected include, but are not limited to, the following: increased capital requirements and other requirements or actions mandated by National

Penn’s regulators, National Penn’s ability to raise capital and maintain capital levels, variations in interest rates, deterioration in the credit quality of loans, the effect

of credit risk exposure, declines in the value of National Penn’s assets and the effect of any resulting impairment charges, recent and ongoing changes to the state

and federal regulatory schemes under which National Penn and other financial services companies operate (including the Dodd-Frank Act and regulations adopted

or to be adopted to implement that Act), competition from other financial institutions, interruptions or breaches of National Penn’s security systems, and the

development and maintenance of National Penn’s information technology. These risks and others are described in greater detail in National Penn’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2010, as well as in National Penn’s Quarterly Reports on Form 10-Q and other documents filed by National Penn

with the SEC after the date thereof. National Penn makes no commitment to revise or update any forward-looking statements in order to reflect events or

circumstances occurring or existing after the date any forward-looking statement is made.

materially differ from those contained in any forward-looking statements. Such risks, uncertainties and other factors that could cause actual results and experience to

differ from those projected include, but are not limited to, the following: increased capital requirements and other requirements or actions mandated by National

Penn’s regulators, National Penn’s ability to raise capital and maintain capital levels, variations in interest rates, deterioration in the credit quality of loans, the effect

of credit risk exposure, declines in the value of National Penn’s assets and the effect of any resulting impairment charges, recent and ongoing changes to the state

and federal regulatory schemes under which National Penn and other financial services companies operate (including the Dodd-Frank Act and regulations adopted

or to be adopted to implement that Act), competition from other financial institutions, interruptions or breaches of National Penn’s security systems, and the

development and maintenance of National Penn’s information technology. These risks and others are described in greater detail in National Penn’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2010, as well as in National Penn’s Quarterly Reports on Form 10-Q and other documents filed by National Penn

with the SEC after the date thereof. National Penn makes no commitment to revise or update any forward-looking statements in order to reflect events or

circumstances occurring or existing after the date any forward-looking statement is made.

This presentation contains supplemental financial information determined by methods other than in accordance with Accounting Principles Generally Accepted in the

United States of America (“GAAP”). National Penn’s management uses these non-GAAP measures in its analysis of National Penn’s performance. These measures

should not be considered a substitute for GAAP basis measures nor should they be viewed as a substitute for operating results determined in accordance with GAAP.

Management believes the presentation of the following non-GAAP financial measures, which exclude the impact of the specified items, provides useful supplemental

information that is essential to a proper understanding of the financial results of National Penn.

United States of America (“GAAP”). National Penn’s management uses these non-GAAP measures in its analysis of National Penn’s performance. These measures

should not be considered a substitute for GAAP basis measures nor should they be viewed as a substitute for operating results determined in accordance with GAAP.

Management believes the presentation of the following non-GAAP financial measures, which exclude the impact of the specified items, provides useful supplemental

information that is essential to a proper understanding of the financial results of National Penn.

l Tangible common equity excludes goodwill and intangible assets and preferred equity. Banking and financial institution regulators also exclude goodwill

and intangible assets from shareholders’ equity when assessing the capital adequacy of a financial institution. Tangible common equity provides a method

to assess the company’s tangible capital trends.

and intangible assets from shareholders’ equity when assessing the capital adequacy of a financial institution. Tangible common equity provides a method

to assess the company’s tangible capital trends.

l Tangible book value expresses tangible common equity on a per-share basis. Tangible book value provides a method to assess the level of tangible net

assets on a per-share basis.

assets on a per-share basis.

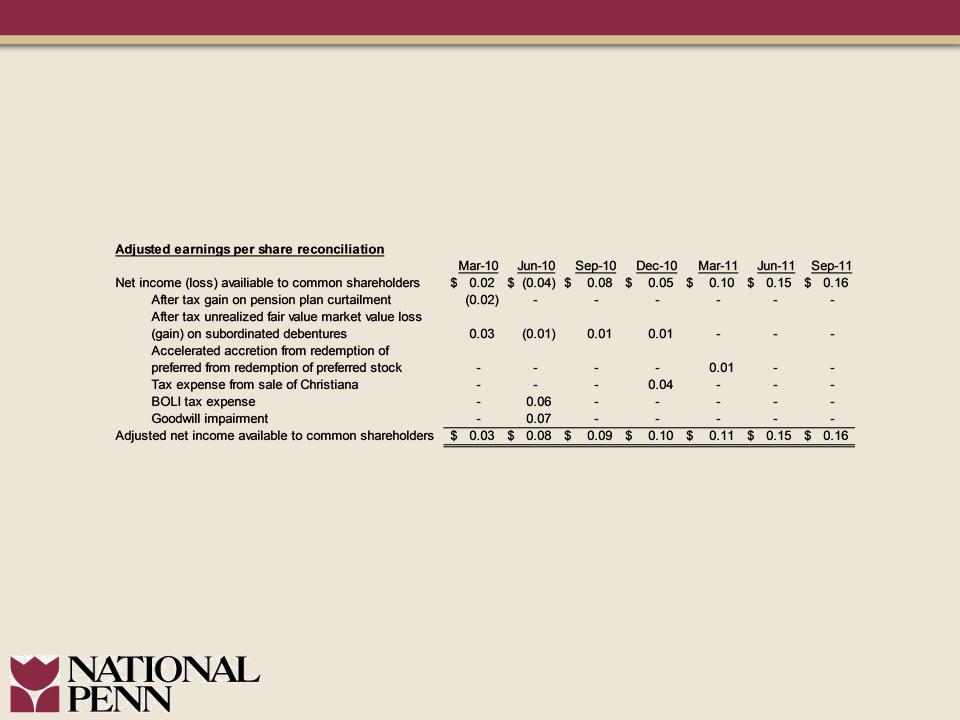

l Adjusted net income excludes the effects of certain gains and losses, adjusted for applicable taxes. Adjusted net income provides a method to assess

earnings performance by excluding items that management believes are not comparable among the periods presented.

earnings performance by excluding items that management believes are not comparable among the periods presented.

l Efficiency ratio expresses operating expenses as a percentage of fully-taxable equivalent net interest income plus non-interest income. Operating

expenses exclude items from non-interest expense that management believes are not comparable among the periods presented. Non-interest income is

adjusted to also exclude items that management believes are not comparable among the periods presented. Efficiency ratio is used as a method for

management to assess its operating expense level and to compare to financial institutions of varying sizes.

expenses exclude items from non-interest expense that management believes are not comparable among the periods presented. Non-interest income is

adjusted to also exclude items that management believes are not comparable among the periods presented. Efficiency ratio is used as a method for

management to assess its operating expense level and to compare to financial institutions of varying sizes.

Management believes the use of non-GAAP measures will help readers compare National Penn’s current results to those of prior periods as presented in the

accompanying Financial Highlights and financial data tables.

accompanying Financial Highlights and financial data tables.

Non-GAAP Financial Measures

2

3Q 2011 Highlights

• Continued strong earnings and returns

• Continued improvement in asset quality

• Continued strengthening of the balance sheet

• Positioning the company for future growth

3

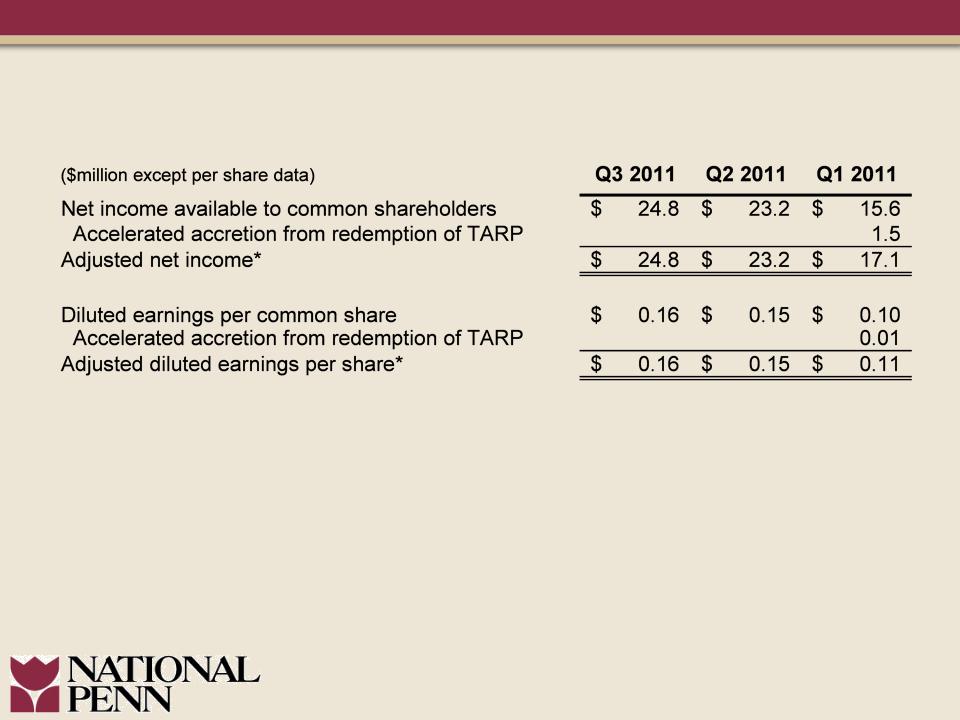

Quarterly Earnings

*A non-GAAP measure.

Improving Adjusted Earnings Per Share*

*Refer to Appendix for reconciliation of Non-GAAP measure

4

5

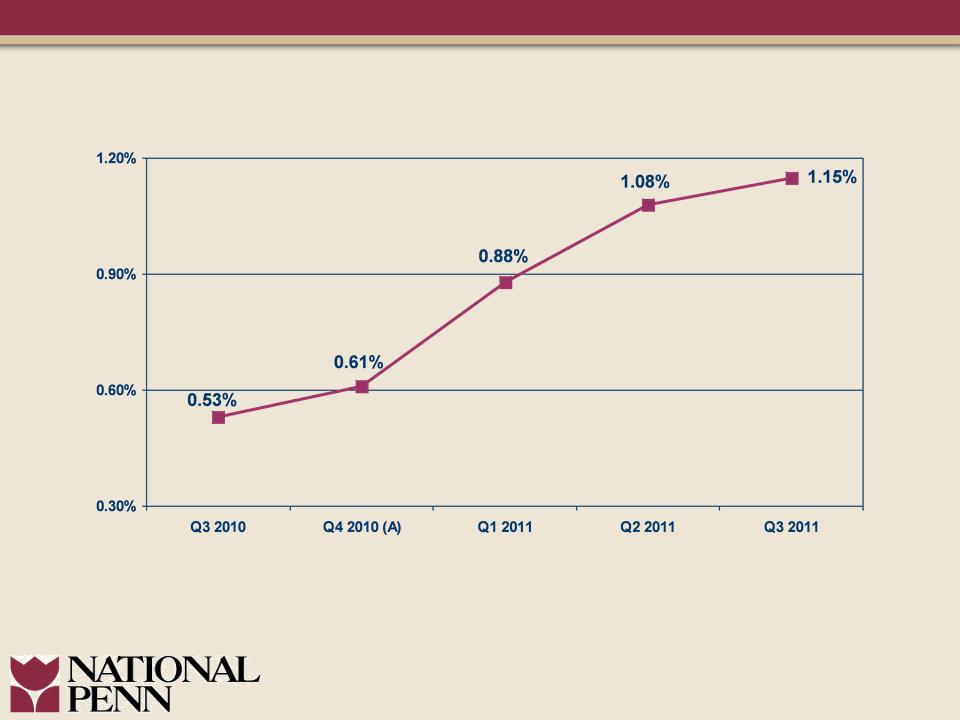

Positive Return on Asset Trend

(A) Excludes charges associated with the divestiture of Christiana

Bank & Trust Company on December 3, 2010

Bank & Trust Company on December 3, 2010

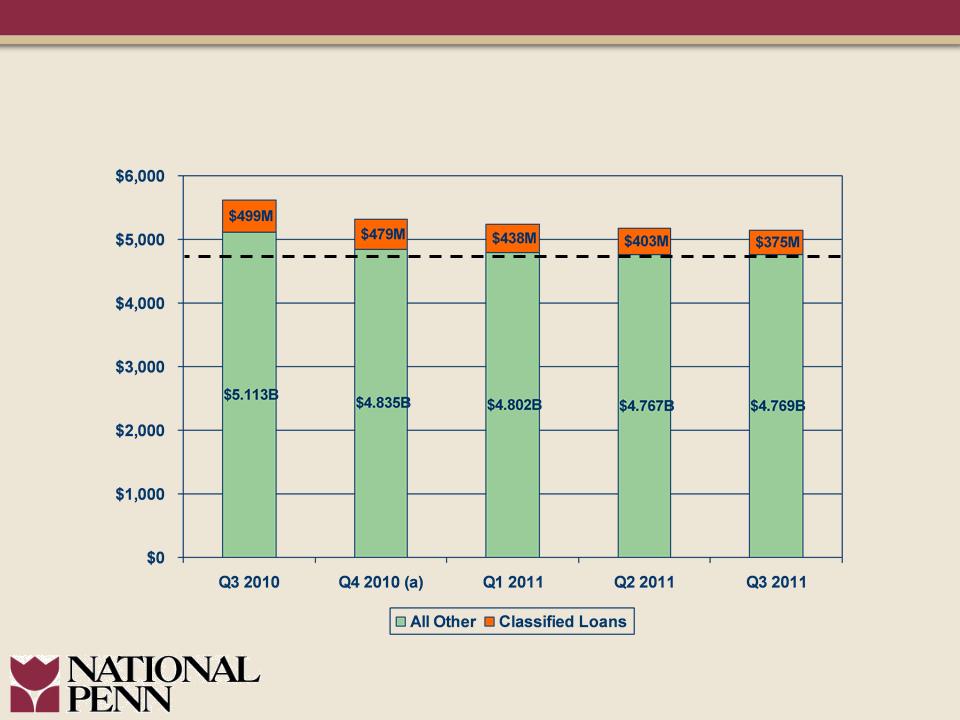

Loan Balances Stable

6

($million)

(a) Christiana Bank & Trust Company divested on December 3, 2010.

7

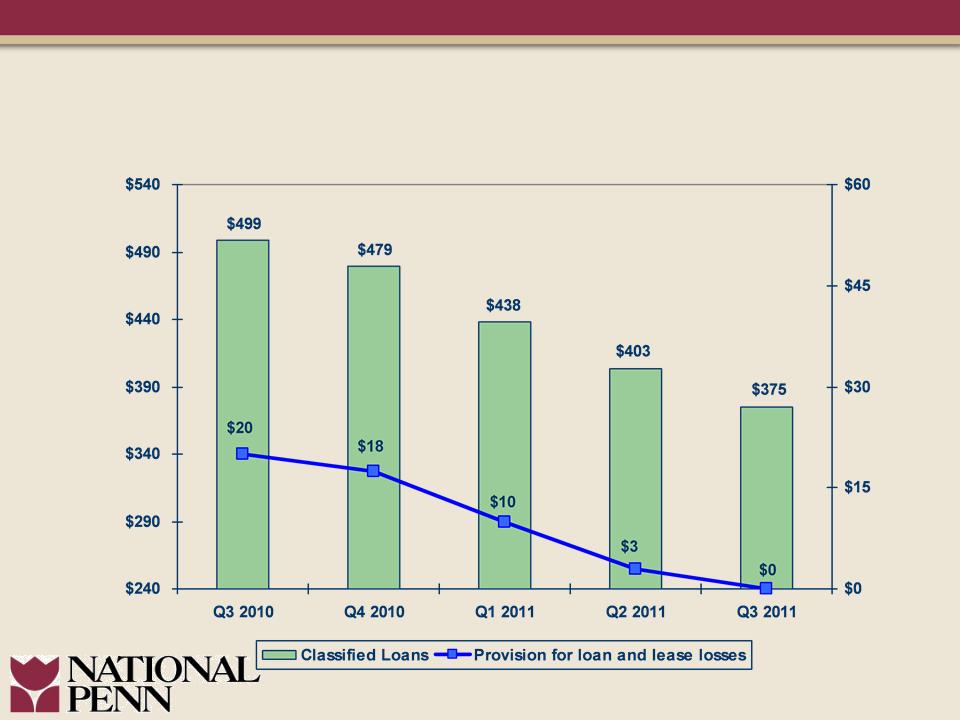

Sustained Asset Quality Improvement

Net Charge-Offs/Average Loans

Net Charge-Offs/Average Loans

Sustained Asset Quality Improvement

Classified Loans & Provision Trends

Classified Loans & Provision Trends

8

($million)

($million)

9

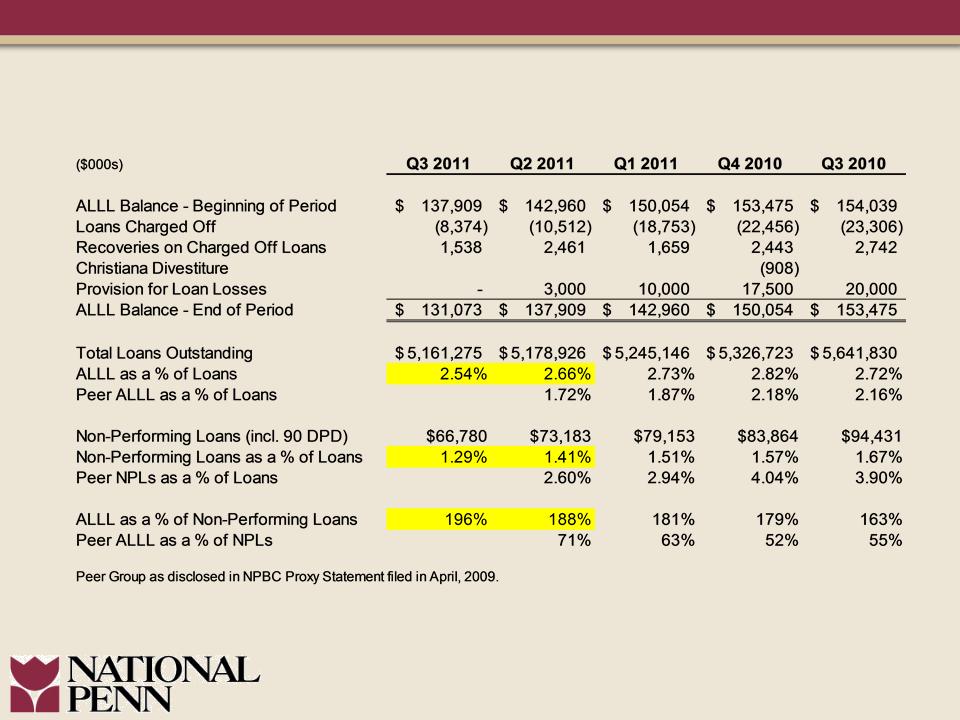

Asset Quality Overview / Peer Comparison

Capital Position Further Enhanced

10

($million)

11

Net Interest Margin

12

• Extension of a portion of “excess” liquidity -

-Approximately $100 million in 3rd quarter.

• Sale of floating rate securities and redeployment into MBS

with duration of 3-4 years and termination of repurchase

agreements.

with duration of 3-4 years and termination of repurchase

agreements.

• Continued focus on deposit pricing including on transaction

accounts.

accounts.

• Third quarter 2011 loan volumes positively impacting 4th

quarter average loans.

quarter average loans.

• Pooled TRUPS swap mature in 4th quarter.

Net Interest Margin Initiatives

13

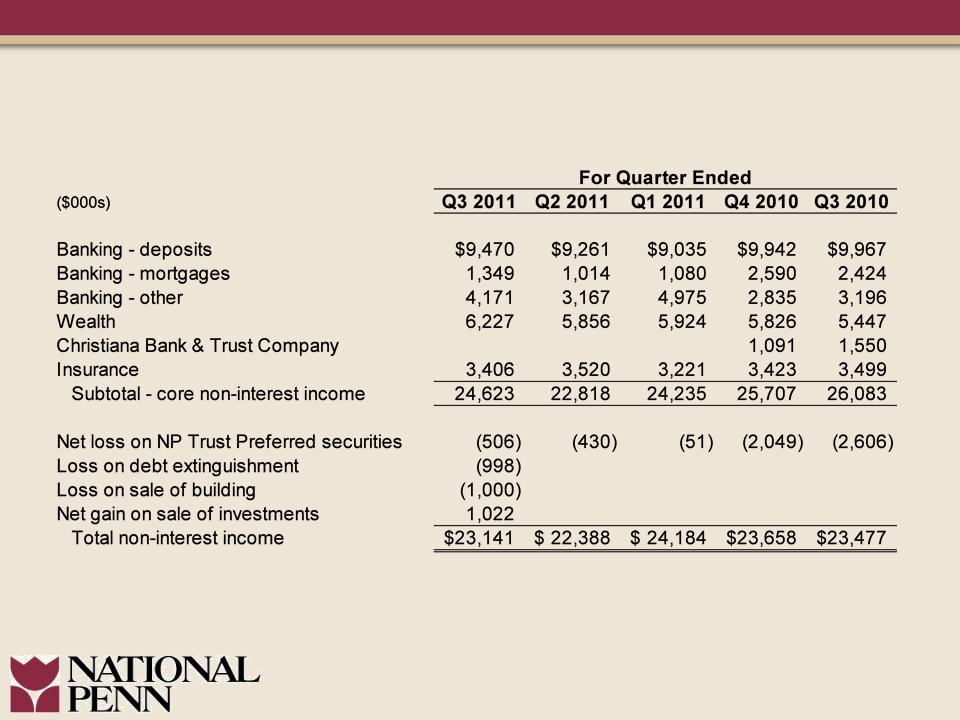

Non-Interest Income

14

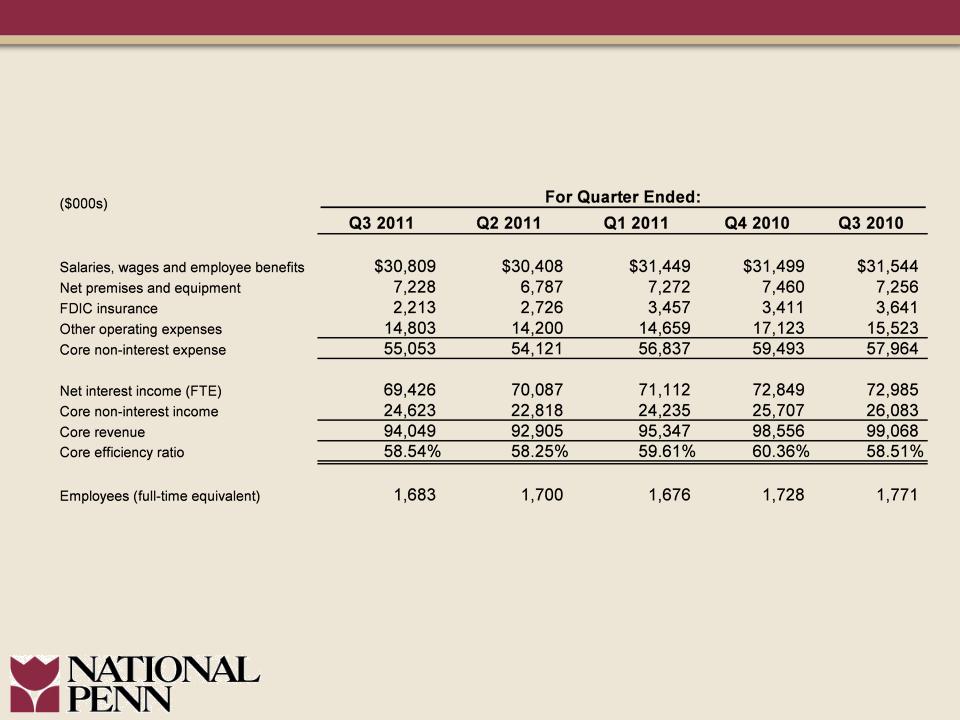

Expense Management Maintained

15

• Capital management strategies

• Continued focus on asset quality

• Manage net interest margin through low interest

rate environment

rate environment

• Win market share

• Re-risk appropriately

• Patient and disciplined approach

Executing on Our Strategic Plan

16

17

Appendix

Loan Risk Profile

September 30, 2011

Loan Risk Profile

September 30, 2011

Appendix

Reconciliation of Non-GAAP Measures

Reconciliation of Non-GAAP Measures

18