Attached files

| file | filename |

|---|---|

| EX-23.1 - DIVERSIFIED RESOURCES S-1/A, AUDITORS CONSENT - Diversified Resources Inc. | diversifiedexh23_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1/A

(Amendment No. 3 )

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

DIVERSIFIED RESOURCES INC.

(Name of small business issuer in its charter)

|

Nevada

|

1041

|

98-0687026

|

||

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification No.)

|

37 Mayfair Road SW, Calgary, Alberta, T2V 1Y8, Canada

(403) 862-5331

(Address and telephone number of principal executive offices)

37 Mayfair Road SW, Calgary, Alberta, T2V 1Y8, Canada

(Address of principal place of business or intended place of business)

Nevada Agency and Trust Company

50 West Liberty Street, Suite 880, Reno, Nevada 89501

(775) 322-0626

(Name, address and telephone number of agent for service)

With copies to:

Karen A. Batcher, Esq

Synergen Law Group, APC

819 Anchorage Place, Suite 28

Chula Vista, CA 91914

Tel: (619) 475-7882

Fax: (866) 352-4342

Approximate date of commencement of proposed sale to public:

As soon as practical after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities At registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, and accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated Filer | o | Non-accelerated filer | o | Smaller Reporting Company | x |

CALCULATION OF REGISTRATION FEE

|

TITLE OF EACH

CLASS OF

SECURITIES

TO BE REGISTERED

|

AMOUNT

TO BE

REGISTERED

|

PROPOSED

MAXIMUM

OFFERING

PRICE PER

SHARE (1)

|

PROPOSED

MAXIMUM

AGGREGATE

OFFERING

PRICE (1)

|

AMOUNT

OF REGISTRATION

FEE (1)

|

|

Class A common stock

|

2,200,000 shares

|

$0.02

|

$44,000

|

$5.10

|

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE RERGISTRATION SHALL BECOME EFFECTIVE ON SUCH A DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

SUBJECT TO COMPLETION, Dated October 25 , 2011

PROSPECTUS

DIVERSIFIED RESOURCES INC.

2,200,000 SHARES

CLASS A COMMON STOCK

The selling shareholders named in this prospectus are offering the 2,200,000 shares of our Class A common stock offered through this prospectus. The 2,200,000 shares offered by the selling shareholders represent 41.9% of the total outstanding shares as of the date of this prospectus. We will not receive any proceeds from this offering. We have set an offering price for these securities of $0.02 per share of our Class A common stock offered through this prospectus.

|

Offering Price

|

Underwriting

Discounts and

Commissions

|

Proceeds to

Selling Shareholders

|

|

|

Per Share

|

$0.02

|

None

|

$0.02

|

|

Total

|

$44,000

|

None

|

$44,000

|

Our Class A common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at 0.02 per share until such time as the shares of our Class A common stock are traded on the Over-The-Counter Bulletin Board electronic quotation service. Although we intend to apply for trading of our Class A common stock on the Over-The-Counter Bulletin Board electronic quotation service, public trading of our Class A common stock may never materialize. If our Class A common stock becomes traded on the Over-The-Counter Bulletin Board electronic quotation service, then the sale price to the public will vary according to prevailing market prices or privately

negotiated prices by the selling shareholders.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section of this Prospectus entitled “Risk Factors” on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: October 25 , 2011

Table of Contents

| Page | |

| 26 | |

Summary

As used in this prospectus, unless the context otherwise requires, “we”, “us”, “our”, “ Diversified Resources” or “Diversified” refers to Diversified Resources Inc. All dollar amounts in this prospectus are in U.S. dollars unless otherwise stated. The following summary is not complete and does not contain all of the information that may be important to you. You should read the entire prospectus before making an investment decision to purchase our common shares.

Diversified Resources Inc.

We are in the business of mineral exploration. On June 15, 2009 we entered in a Mineral Lease Agreement whereby we leased from Timberwolf Minerals, LTD a total of two (2) unpatented lode mining claims in the State of Nevada which we refer to as the Dunfee Property. These mineral claims are located in Section 14 & 23, Township 7 South, Range 41 1/2 East, Mt. Diablo Baseline & Meridian, Esmeralda County, Nevada, USA, owned by Timberwolf Minerals LTD. In January of 2011, we staked an additional twenty (20) unpatented lode mining claims under the mineral lease agreement to expand the Dunfee Property.

According to the lease Diversified has agreed to pay Timberwolf Minerals, LTD minimum royalty payments which shall be paid in advance. Diversified paid the sum of $5,275 upon execution of this lease. Diversified also paid $5,000 on the first anniversary of the lease, and paid $5,000 on the second anniversary of the lease and agreed to pay $10,000 on or before the third anniversary of the lease, $25,000 on or before the fourth anniversary of the lease and each annual payment after that shall be $75,000 plus an annual increase or decrease equivalent to the rate of inflation designated by the Consumer’s Price Index for that year with execution year as base year. Diversified will pay Timberwolf Minerals,

LTD a royalty of 3.5% of the Net Returns from all ores, minerals, concentrates, or other products mined and removed from the property and sold or processed by Diversified, quarterly. The term of this lease is for twenty (20) years, renewable for an additional twenty (20) years so long as conditions of the lease are met.

Our plan of operations is to conduct mineral exploration activities on the Dunfee Property in order to assess whether these claims possess commercially exploitable mineral deposits. (Commercially exploitable mineral deposits are deposits which are suitably adequate or prepared for productive use of a natural accumulation of minerals or ores). Our exploration program is designed to explore for commercially viable deposits of gold, silver, copper or any other valuable minerals. (Commercially viable deposits are deposits which are suitably adequate or prepared for productive use of an economically workable natural accumulation of minerals or ores). We have not, nor has any predecessor, identified

any commercially exploitable reserves of these minerals on our mineral claims. (A reserve is an estimate within specified accuracy limits of the valuable metal or mineral content of known deposits that may be produced under current economic conditions and with present technology). We are an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on our mineral claims.

After acquiring a lease on the Dunfee Property, we retained the services of Robert Thomas, a Professional Geologist. Mr. Thomas prepared geologic reports for us on the mineral exploration potential of the claims. Mr. Thomas has no direct or indirect interest and does not expect to receive an interest in any of the Dunfee Property claims. Included in the reports are recommended exploration programs which consists of mapping, sampling, staking additional claims and drilling. The recommendations of Mr. Thomas are further explained in the “Description of Business” section.

At this time we are uncertain of the extent of mineral exploration we will conduct before concluding that there are, or are not, commercially viable minerals on our claims. Further phases beyond the current exploration program will be dependent upon numerous factors such as Mr. Thomas’ recommendations based upon ongoing exploration program results and our available funds.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we have entered into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our property, or if such resources are discovered, that we will enter into commercial production of our mineral property.

As of July 31, 2011, we had $17,932 cash on hand and no liabilities. Accordingly our working capital position as of April 30, 2011 was $17,932. Since our inception through July 31, 2011, we have incurred a net loss of $42,068. We attribute our net loss to having no revenues to offset our expenses and the professional fees related to the creation and operation of our business.

John Kinross-Kennedy, C.P.A., our independent auditor, has expressed substantial doubt about our ability to continue as a going concern given our lack of operating history and the fact to date have had no revenues.

Our fiscal year ended is October 31.

We were incorporated on March 19, 2009 under the laws of the State of Nevada. Our principal offices are located at 37 Mayfair Road SW, Calgary, Alberta, Canada. Our telephone number is (403) 862-5331.

The Offering

|

Securities Being Offered

|

Up to 2,200,000 shares of our Class A common stock.

|

|

Offering Price

|

The offering price of the Class A common stock is $0.02 per share. We intend to apply to the Over-the-Counter Bulletin Board electronic quotation service to allow the trading of our Class A common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. If our Class A common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transaction negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders.

|

|

Minimum Number of Shares

|

None.

|

|

To Be Sold in This Offering

|

|

|

Securities Issued and to be Issued

|

5,250,000 shares of our Class A common stock are issued and outstanding as of the date of this prospectus. All of the Class A common stock to be sold under this prospectus will be sold by existing shareholders and thus there will be no increase in our issued and outstanding shares as a result of this offering. The issuance to the selling shareholders was exempt due to the provisions of Regulation S.

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of the Class A common stock by the selling shareholders.

|

Summary Financial Information

|

July 31, 2011

|

October 31, 2010

|

|||||||

|

Balance Sheet Data

|

(unaudited)

|

(audited)

|

||||||

|

Cash

|

$ | 17,932 | $ | 44,180 | ||||

|

Total Current Assets

|

$ | 17,932 | $ | 44,180 | ||||

|

Liabilities

|

$ | - | $ | - | ||||

|

Total Stockholder’s Equity

|

$ | 17,932 | $ | 44,180 | ||||

|

Statement of Loss and Deficit

|

From Inception

|

From Inception

|

||||||

|

|

(March 19, 2009) to

|

(March 19, 2009) to

|

||||||

|

|

July 31, 2011

|

October 31, 2010

|

||||||

|

|

(unaudited)

|

|

||||||

|

Revenue

|

$ | - | $ | - | ||||

|

Net Loss for the Period

|

$ | 42,068 | $ | 15,820 | ||||

Risk Factors

An investment in our Class A common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our Class A common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our Class A common stock, when and if we trade at a later date, could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related To Our Financial Condition and Business Model

If we do not obtain additional financing, our business will fail

Our current operating funds will only cover the first three phases of our exploration program. In order for us to carry out Phase Four or any further exploration or testing we will need to obtain additional financing. We currently do not have any operations and we have no income. We will require additional financing of approximately $150,000 to carry out Phase Four of our exploration program. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Although we have no

arrangements in place for any future equity financing, in the case that we did conduct a financing from the sale of our common stock, this financing would have a dilutive impact on our stockholders and could negatively affect the stock price. Obtaining additional financing would be subject to a number of factors, including the market prices for gold and other minerals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

You will experience dilution of your ownership interest upon the future issuance of additional shares of Class A common stock

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We are currently authorized to issue an aggregate of 75,000,000 shares of common stock, par value $0.001 per share.

We may also issue additional shares of our common stock or other securities that are convertible into exercisable for common stock in connection with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes, or other business purposes.

We have yet to attain profitable operations and because we will need additional financing to fund our exploration activities, our accountants believe there is substantial doubt about the company’s ability to continue as a going concern

We have incurred a net loss of $42,068 for the period from March 19, 2009 (Inception) to July 31, 2011 and have no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral project. These factors raise substantial doubt that we will be able to continue as a going concern.

Our financial statements included with this prospectus have been prepared assuming that we will continue as a going concern. Our auditors have made reference to the substantial doubt as to our ability to continue as a going concern in their audit report on our audited financial statements for the year ended October 31, 2010. If we are not able to achieve revenues, then we may not be able to continue as a going concern and our financial condition and business prospects will be adversely affected.

Since this is an exploration project, we face a high risk of business failure due to our inability to predict the success of our business

We are in the initial stages of exploration of our mineral project, and thus have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on March 19, 2009 and to date have been involved primarily in organizational activities and the acquisition and preliminary exploration of the Dunfee Property. We have not earned any revenues as of the date of this prospectus.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of gold or other minerals. The expenditures to be made by us on our exploration program may not result in the discovery of commercial quantities of ore. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. Problems such as unusual or unexpected formations and other

conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Even if we discover commercial reserves of precious metals on our mineral claims, we may not be able to successfully obtain commercial production

Our mineral claims do not contain any known reserves of precious metals. However, if our exploration programs are successful in discovering commercially exploitable reserves of precious metals, we will require additional funds in order to place the mineral claims into commercial production. At this time, there is a risk that we will not be able to obtain such financing as and when needed. It is premature to estimate the amount required to place the mineral claims into commercial production, as we do not have sufficient information.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

Because access to our mineral claims may be restricted by bad weather, we may be delayed in our exploration

Once exploration begins, access to the claim may be restricted through some of the year due to weather in the area. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. These limitations can result in significant delays in exploration efforts. Such delays can have a significant negative effect on our exploration efforts.

Because our executive officers have only agreed to provide their services on a part-time basis, they may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail

Because we are in the early stages of our business, our executive officers will not be spending a significant amount of time on our business. Mr. Smith, our president, expects to expend approximately 10 hours per week on Diversified business. Competing demands on Mr. Smith’s time may lead to a divergence between his interests and the interests of other shareholders. Mr. Smith works as a self-employed business man and none of this work will directly compete with Diversified. Mr. Cormie, our secretary, expects to expend approximately 2 hours per week on Diversified business. Competing demands on Mr. Cormies’s time may lead to a divergence between his interests and the interests of other

shareholders. Mr. Cormie is a lawyer and none of this work will directly compete with Diversified.

Because our directors own 58.09% of our outstanding Class A common stock, investors may find that corporate decisions influenced by the directors are inconsistent with the best interests of other stockholders

Our directors own approximately 58% of the outstanding shares of our Class A common stock. Accordingly, they will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of its assets, the interests of our directors may still differ from the interests of the other stockholders. Our President, Mr. Smith, owns 3,000,000 common shares for which he paid $0.005. Our Secretary, Mr. Cormie owns 25,000 common shares for which he

paid $0.02. Mr. O’Hara, a director, owns 25,000 common shares for which he paid $0.02.

Because our directors are Canadian residents, difficulty may arise in attempting to effect service or process on them in Canada

Because our directors are Canadian residents, difficulty may arise in attempting to effect service or process on them in Canada or in enforcing a judgment against Diversified’s assets located outside of the United States.

Because we lease the Dunfee Property, we face the risk of not being able to meet the requirements of the lease and may be forced to default on the agreement

Under the terms of the lease on the Dunfee Property, Diversified has agreed to pay minimum annual royalties on or before June 15 of every year. If Diversified is unable to meet these obligations, we may be forced to default on the agreement and the lease may be terminated by the owner resulting in the loss of the property for Diversified.

Risks Related To Legal Uncertainty and Regulations

As we undertake exploration of the Dunfee Property we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the State of Nevada as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We currently have budgeted $1,000 for regulatory compliance.

Risks Related To This Offering

If a market for our Class A common stock does not develop, shareholders may be unable to sell their shares

There is currently no market for our Class A common stock and a market may never develop. Our stock is currently not traded on any market or exchange, and therefore our shares can only be purchased through private transactions. We plan to apply for listing of our Class A common stock on the Over-the-Counter Bulletin Board electronic quotation service upon the effectiveness of the registration statement of which this prospectus forms a part. However, our shares may never be traded on the Over-the-Counter Bulletin Board electronic quotation service or, if traded, a public market may never materialize. If our Class A common stock is not

traded on the Over-the-Counter Bulletin Board electronic quotation service or if a public market for our Class A common stock does not develop, investors may not be able to re-sell the shares of our Class A common stock that they have purchased and may lose all of their investment.

If a market for our Class A common stock develops, our stock price may be volatile

If a market for our Class A common stock develops, we anticipate that the market price of our Class A common stock will be subject to wide fluctuations in response to several factors, including: the results of our geological exploration program; our ability or inability to arrange for financing; commodity prices for gold, silver or other minerals; and conditions and trends in the mining industry.

In addition, if our Class A common stock is traded on the Over-the-Counter Bulletin Board electronic quotation service, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations may adversely affect the market price of our Class A common stock.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline

The selling shareholders are offering 2,200,000 shares of our Class A common stock through this prospectus. Our Class A common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the Class A common stock is trading will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent approximately 41.9% of the Class A common shares outstanding as of the date of this prospectus.

Because our stock is a penny stock, shareholders will be more limited in their ability to sell their stock

The shares offered by this prospectus constitute a penny stock under the Securities and Exchange Act. The shares will remain classified as a penny stock for the foreseeable future. Penny stocks generally are equity securities with a price of less than $5.00. Broker/dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. The penny stock rules require a broker/dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the Securities and Exchange Commission that provides information about penny

stocks and the nature and level of risks in the penny stock market. The broker/dealer must provide the customer with bid and offer quotations for the penny stock, the compensation of the broker/dealer, and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules: the broker/dealer must make a special written determination that a penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of price fluctuations in the price of the stock and may

reduce the level of trading activity in any secondary market for a stock that becomes subject to the penny stock rules, and accordingly, investors in this offering may find it difficult to sell their securities, if at all.

Forward-Looking Statements

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section in this prospectus.

Use of Proceeds

We will not receive any proceeds from the sale of the Class A common stock offered through this prospectus by the selling shareholders.

Determination of Offering Price

The $0.02 per share offering price of our Class A common stock was determined arbitrarily by us. There is no relationship whatsoever between this price and our assets, earnings, book value or any other objective criteria of value. We intend to apply to the Over-the-Counter Bulletin Board electronic quotation service for the trading of our Class A common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934 (the “Exchange

Act”). If our Class A common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders named in this prospectus. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders named in this prospectus.

Dilution

The Class A common stock to be sold by the selling shareholders is Class A common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

Dilution represents the difference between the offering price of the shares of Class A common stock and the net tangible book value per share of Class A common stock immediately after completion of the offering. The shares of Class A common stock offered hereunder are issued and outstanding and will be sold by the selling security holders at a price of $.02 per share until the Company’s Class A common stock is quoted on the OTC Bulletin Board. Thereafter the selling security holders will sell at prevailing market prices. The net tangible book value per share of the Company’s Class A common stock prior to the offering hereunder is $0.008 per share, and after the offering hereunder will be $0.008 per

share, determined by dividing the net tangible book value (tangible assets minus liabilities) by the number of shares of Class A common stock outstanding before and after the offering hereunder.

As noted above, the public contribution to the Company under the proposed public offering through this Prospectus is $0 (zero), which is substantially less than the cash contribution of $16,000 from the sales of our common stock to our Officers, Directors, Promoters and any affiliates during the past five years.

Selling Shareholders

The selling shareholders named in this prospectus are offering all of the 2,200,000 shares of Class A common stock offered through this prospectus. The selling shareholders acquired the 2,200,000 shares of Class A common stock offered through this prospectus from us at a price of $0.02 per share in an offering that was exempt from registration under Regulation S of the Securities Act of 1933, as amended (the “Securities Act”) and completed on September 30, 2010. We will file with the Securities and Exchange Commission prospectus supplements to specify the names of any successors to the selling shareholders specified in this registration statement who are able to use the prospectus included in

this registration statement to resell the shares registered by this registration statement.

The following table provides, as of the date of this prospectus, information regarding the beneficial ownership of our Class A common stock held by each of the selling shareholders, including:

|

1.

|

The number of shares owned by each prior to this offering;

|

|

2.

|

The total number of shares that are to be offered by each;

|

|

3.

|

The total number of shares that will be owned by each upon completion of the offering;

|

|

4.

|

The percentage owned by each upon completion of the offering; and

|

|

5.

|

The identity of the beneficial holder of any entity that owns the shares.

|

|

Name Of Selling Stockholder

|

Shares

Owned Prior

to this

Offering

|

Total Number of

Shares to Be

Offered for Selling

Shareholder

Account

|

Total Shares

to be Owned

Upon

Completion of this Offering

|

Percent

Owned Upon

Completion of this Offering

|

||||

|

Jerrald Anderberg

|

50,000

|

50,000

|

Nil

|

Nil

|

||||

|

Angela Auty

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Kevin Auty “In Trust For Justin Auty”

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Kevin Auty

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Sean Baylis

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Nancy Bird

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Arlene Connell

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

John Connell

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Kevin Auty “In Trust For David Domoslai”

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Beverly Exner

|

50,000

|

50,000

|

Nil

|

Nil

|

||||

|

Gary Exner

|

50,000

|

50,000

|

Nil

|

Nil

|

||||

|

Roger Giovenetto

|

100,000

|

100,000

|

Nil

|

Nil

|

||||

|

Thomas Hewitt

|

500,000

|

500,000

|

Nil

|

Nil

|

||||

|

Barbara Horn

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Daniel Horner

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Bryon Howard

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Murray Luft

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Norman MacKenzie

|

250,000

|

250,000

|

Nil

|

Nil

|

||||

|

Jason McDonald

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

John McKee

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Beverly Munro

|

350,000

|

350,000

|

Nil

|

Nil

|

||||

|

Marilyn Mora (a)

|

150,000

|

150,000

|

Nil

|

Nil

|

||||

|

Lynn Morin

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Pro Golf Design

|

100,000

|

100,000

|

Nil

|

Nil

|

|

Andrew Rogers

|

100,000

|

100,000

|

Nil

|

Nil

|

||||

|

Chris Scase

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Darryl Scase

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Shannon Weaver

|

50,000

|

50,000

|

Nil

|

Nil

|

||||

|

Dick Zeeuwen

|

25,000

|

25,000

|

Nil

|

Nil

|

||||

|

Total

|

2,200,000

|

2,200,000

|

Nil

|

Nil

|

||||

|

(a) Pro Golf Design is a private company 75% owned by Harold Pasechnik and 25% owned by Vivian Pasechnik

|

||||||||

The named party beneficially owns and has sole voting and investment power over all shares or rights to these shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of Class A common stock not being offered in this prospectus or purchases additional shares of Class A common stock, and assumes that all shares offered are sold.

None of the selling shareholders:

|

|

(1)

|

has had a material relationship with us other than as a shareholder at any time within the past three years; or

|

|

|

(2)

|

has ever been one of our officers or directors.

|

Prior to each sale of shares to the Selling Shareholders, each Selling Shareholder represented in writing to the Company that the Shares would be purchased solely for the account of the shareholder and not for distribution. The selling Shareholders further represented that, at the time of purchase, they did not have any agreements or understandings, directly or indirectly, with any person to distribute the securities. All Selling Shareholders have represented to the Company that they intend to sell their shares in the ordinary course of business.

Plan of Distribution

The selling shareholders may sell some or all of their Class A common stock in one or more transactions, including block transactions:

|

1.

|

On such public markets as the Class A common stock may from time to time be trading;

|

|

2.

|

In privately negotiated transactions;

|

|

3.

|

Through the writing of options on the Class A common stock;

|

|

4.

|

In short sales; or

|

|

5.

|

In any combination of these methods of distribution.

|

The sales price to the public is fixed at $0.02 per share until such time as the shares of our Class A common stock are traded on the Over-the-Counter Bulletin Board electronic quotation service. Although we intend to apply for trading of our Class A common stock on the Over-the-Counter Bulletin Board electronic quotation service, public trading of our Class A common stock may never materialize. If our Class A common stock becomes traded on the Over-the-Counter Bulletin Board electronic quotation service, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public

may be:

|

1.

|

The market price of our Class A common stock prevailing at the time of sale;

|

|

2.

|

A price related to such prevailing market price of our Class A common stock; or

|

|

3.

|

Such other price as the selling shareholders determine from time to time.

|

We can provide no assurance that all or any of the Class A common stock offered will be sold by the selling shareholders named in this prospectus.

We are bearing all costs relating to the registration of the Class A common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the Class A common stock.

The selling shareholders named in this prospectus must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the Class A common stock. The selling shareholders and any broker-dealers who execute sales for the selling shareholders may be deemed to be an "underwriter" within the meaning of the Securities Act in connection with such sales. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the Class A common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

|

1.

|

Not engage in any stabilization activities in connection with our Class A common stock;

|

|

2.

|

Furnish each broker or dealer through which Class A common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and

|

|

3.

|

Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act.

|

Upon purchasing their shares, each of the selling shareholders named in this prospectus executed a subscription agreement wherein they acknowledged that they were purchasing the shares for their own account without a view to distribute. However, due to the fact that we are considered a "shell" company, the selling shareholders may be considered "underwriters" by the SEC.

Description of Securities

General

Our authorized capital stock consists of 75,000,000 shares of common stock, with a par value of $0.001 per share. As of October 25 , 2011, there were 5,250,000 shares of our common stock issued and outstanding held by thirty two (32) stockholders of record. Our Articles of Incorporation authorize us to issue several classes of stock with varying rights as shown in the following table.

|

CLASS

|

VOTING RIGHTS

|

RIGHTS TO DIVIDENDS

|

LIQUIDATION RIGHTS

|

|||

|

Class A Common, Class B Common, and

Class D Common

|

Yes

|

Yes, equally with Classes B, D, E, F and MP, but subject to preference provided to Class G and Class H Preferred Shareholders

|

Yes, equally with Classes B, D, E, F and MP, but subject to preference provided to Class G and Class H Preferred Shareholders

|

|||

|

Class C Common

|

Yes

|

No

|

No

|

|||

|

Class E Common

and Class F Common

|

No

|

Yes

|

Yes

|

|||

|

Class MP Common

|

Yes

|

Yes, once "activated"

|

Yes, once "activated"

|

|||

|

Class G Preferred

And Class H Preferred

|

No

|

Yes, with preference over all classes of common stock

|

Yes, with preference over all classes of common stock

|

Class A common stock

Our Class A common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law, the holders of our Class A common stock will possess voting power, along with those shareholders of Class . Generally, all matters to be voted on by stockholders must be approved by a majority or, in the case of election of directors, by a plurality, of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy. Two persons present and being, or represented by proxy, shareholders of the Corporation are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our

outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

The liquidation rights of the holders of Class A common shares, excluding Class C common (non-participating) shares and including only those Class "MP" common shares that have been deemed "activated", shall be entitled, on a per share basis equally with all other classes of common shares with liquidation rights, to receive the remaining assets and property of the Corporation on dissolution, liquidation or winding-up.

Holders of our Class A common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Dividend Policy

Our Class A common stock shareholders are entitled, on a per share basis equally with all other classes of common stock except Class C and Class MP common stock that has not been deemed "activated," to receive dividends, subject to the preference provided to Classes G and H preferred shareholders. We have never declared or paid any dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any dividends in the foreseeable future.

Pre-emptive Rights

Holders of any class of our common stock are not entitled to pre-emptive or subscription or conversion rights, and there are no redemption or sinking fund provisions applicable to the Common Stock. All outstanding shares of Class A common stock are, and the shares of Class A common stock offered hereby will be when issued, fully paid and non-assessable.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our Class A common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our Class A common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our Class A common stock or any rights convertible or exchangeable into shares of our Class A common stock.

Nevada Anti-Takeover laws

Nevada revised statutes sections 78.378 to 78.3793 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire

control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute does not apply to our company.

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the Class A common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

John Kinross-Kennedy, C.P.A., our accountant, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in his audit report. John Kinross-Kennedy, C.P.A. has presented his report with respect to our audited financial statements. The financial statements have been included in this prospectus and registration statement in reliance on the report by John Kinross-Kennedy, C.P.A., given his authority as an expert in auditing and accounting. The report of John Kinross-Kennedy, C.P.A. on the financial statements herein includes an explanatory paragraph that states that we have not generated revenues and have an accumulated deficit since inception

which raises substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Karen A. Batcher, Esq of Synergen Law Group, APC our independent legal counsel, has provided an opinion on the validity of our Class A common stock.

Description of Business

Glossary of Technical Terms

The following defined technical terms are used in our registration statement on Form S-1:

Ag: the chemical symbol for silver.

Au: the chemical symbol for gold.

Assay: qualitative or quantitative determination of the components of a material as an ore.

Cerargyrite: also known as horn silver, a mineral comprised of silver chloride.

Commercially exploitable deposits: suitably adequate or prepared for productive use of a natural accumulation of minerals or ores.

Deposit: an informal term for an accumulation of ore or other valuable earth material of any origin.

Drilling: the creation or enlargement of a hole in a solid material with a drill.

Geologic mapping: Representation of the geologic surface or subsurface features by means of signs and symbols and with an indicated means of orientation. Includes nature and distribution of rock units and the occurrence of structural features, mineral deposits and fossil localities.

Lode: a fissure in consolidated rock filled with mineral. Lode claim is that portion of a lode or vein and of the adjoining surface which has been acquired by a compliance with the law.

Mining claim: that portion of the public mineral lands which a miner, for mining purposes, takes and holds in accordance with mining laws.

Ore: The naturally occurring material from which a mineral or minerals of economic value can be extracted profitably or to satisfy social or political objectives.

Patent: a certificate of grant by a government of an exclusive right with respect to claims.

Porphyry: an igneous rock of any composition that contains conspicuous phenocrysts in a fine-grained groundmass.

Reserve: the quantity of material that is calculated to lie within given boundaries.

Reverse Circulation (RC): The circulation of bit-coolant and cuttings-removal liquids, drilling fluid, mud, air, or gas down the borehole outside the drill rods and upward inside the drill rods.

Sampling: collecting small rock chips from outcrop areas to obtain a representative sample for assay.

Unpatented claim: a mining claim to which a deed from the U.S. Government has not been received. A claim is subject to annual assessment work, to maintain ownership.

Vein: a mineral deposit in tabular or shell-like form, filling a fracture in a host rock.

In General

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We currently hold a lease on twenty two (22) unpatented lode mineral claims that we refer to as the Dunfee Property. Further exploration of these mineral claims is required before a final determination as to their viability can be made. Although exploratory work on the claims conducted prior to our obtaining a lease on the property has indicated some potential showings of mineralization, we are uncertain as to the potential existence of a commercially viable mineral deposit existing in these claims. The results of previous exploratory work of prior companies are in the

“History” section below.

Our plan of operations is to carry out exploration work on these claims in order to ascertain whether they possess commercially exploitable quantities of gold, silver, copper or any other valuable minerals. We will not be able to determine whether or not our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work concludes economic viability.

Mineral Lease Agreement between Diversified Resources Inc. and Timberwolf Minerals, LTD

We entered into a lease agreement with Timberwolf Minerals, LTD. effective June 15, 2009, granting Diversified Resources Inc. the exclusive possession of the Property for mining purposes during the term of this agreement. The property consists of two (2) unpatented lode mineral claims located in Section 14 & 23, Township 7 South, Range 41 1/2 East, Mt. Diablo Baseline & Meridian, Esmeralda County, Nevada, USA, owned by Timberwolf Minerals Ltd. The property is hereon referred to as the Dunfee Property. We selected this property based upon a recommendation from Robert Thomas, Professional Geologist, and in Mr. Thomas’s technical report, dated May 2009; he recommended that we further explore this property.

In January 2011 we staked an additional twenty (20) unpatented lode mining claims under the mineral lease agreement to expand the Dunfee Property.

According to the lease, as amended on May 1, 2011, Diversified has agreed to pay Timberwolf Minerals, LTD minimum royalty payments which shall be paid in advance. Diversified paid the sum of $5,275 upon execution of this lease. Diversified also paid $5,000 on the first and second anniversary of the lease, and has agreed to pay $10,000 on third anniversary of the lease, $25,000 on or before the fourth anniversary of the lease and each annual payment after that shall be $75,000 plus an annual increase or decrease equivalent to the rate of inflation designated by the Consumer’s Price Index for that year with execution year as base year. Diversified will pay Timberwolf Minerals, LTD a royalty of 3.5% of

the Net Returns from all ores, minerals, concentrates, or other products mined and removed from the property and sold or processed by Diversified, quarterly. The term of this lease is for twenty (20) years, renewable for an additional twenty (20) years so long as conditions of the lease are met.

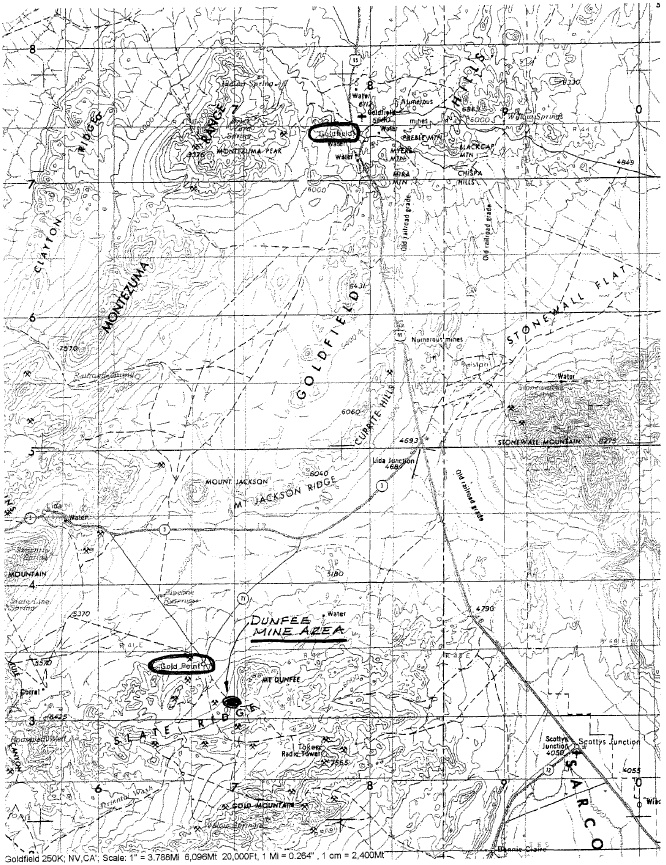

Description and Location of the Dunfee Property

The property consists of twenty two (22) unpatented lode mineral claims located in Section 14 & 23, Township 7 South, Range 41 1/2 East, Mt. Diablo Baseline & Meridian, Esmeralda County, Nevada, USA, owned by Timberwolf Minerals Ltd.

The Dunfee Property is located in south-central Esmeralda County, Nevada, 30 miles southwest of Goldfield, Nevada, and approximately 3 miles southeast of Gold Point, Nevada. The property lies on the southwest flank of Mount Dunfee, at an elevation of approximately 6,000 feet in coutry studded with sagebrush and an occasional Joshua Tree. Due the low elevation, winter snows rarely exceed 2-4”, and the property is accessible year-round. Access is by paved road south from Goldfield on St. Highway 95 for 15 miles, then west on St. Highway 266 for approximately 7 miles. Turn left on paved road and proceed another 7 miles to Gold Point. At the far end of town, turn left and follow dirt roads approximately 3 miles SE

to property.

The climate is western desert; hot, dry summers and cold, dry winters. It rarely gets below 20 degrees Fahrenheit. Local drainages in the mountain ranges around the property run year-round. The valleys would have water in local wells that would need to be drilled. As for power, rural electric lines are a few miles away, and generators could be used on site. Gold Point is approximately 3 miles from the property is the closest source of fuel and the closest workforce.

Dunfee Property Claim List

| Claim name | NMC# |

|

SH 2

|

1038773

|

|

SH 3

|

1038774

|

|

SH 4

|

1038775

|

|

SH 5

|

1038776

|

|

SH 6

|

1038777

|

|

SH 7

|

1038778

|

|

SH 8

|

1038779

|

|

SH 9

|

1038780

|

|

SH 10

|

1038781

|

|

SH 11

|

1038782

|

|

SH 12

|

980936

|

|

SH 13

|

1038783

|

|

SH 14

|

1038784

|

|

SH 15

|

1038785

|

|

SH 16

|

1038786

|

|

SH 17

|

1038787

|

|

SH 18

|

1038788

|

|

SH 19

|

980937

|

|

SH 20

|

1038789

|

|

SH 21

|

1038790

|

|

SH 22

|

1038791

|

|

SH 23

|

1038792

|

Figure 1

History

The Gold Point District, originally called the Hornsilver District, was discovered in the mid-1860’s. Early production was near surface, high-grade cerargyrite (hornsilver), which quickly played out. Ore was treated at local mills in the Gold Point area. Some gold, generally free native gold, was also treated. The deeper mines in Gold Point are encountered high grade gold at depth. Total historical production from the Gold Point region amounted to approximately $1 million. A series of shafts on the Dunfee vein indicate a small tonnage of gold ore was produced, but no specific numbers for the Dunfee vein are available.

The Dunfee Property is without known reserves and the proposed program is strictly exploratory in nature.

Geological Exploration Program in General

We have obtained an independent Geologic Report on the Dunfee Property and have acquired a lease on the property. Robert Thomas prepared the Geologic Report and reviewed all available exploration data completed on the mineral claims.

Mr. Robert D. Thomas is a graduate of the Wesleyan University, where he obtained a M.A. Degree in Geology in 1974. He has been engaged in his profession as a Professional Geologist since 1974.

Geologic Report for the Dunfee Property, Dated May 2009

A primary purpose of the geologic report was to review information from previous exploration of the property and to recommend exploration procedures to establish the feasibility of a mining project on the property. The report summarizes results of the history of the exploration of the property, the regional and local geology and the structure and mineralization of the property. The report also includes a recommended exploration program.

Conclusions of the Geologic Report for the Dunfee Property

Based on the property and research of the property Mr. Thomas came to the following conclusion:

The best potential on the Dunfee vein system lies at depth below the level that has been previously tested by shallow drilling. The presence of a series of parallel veins in the Dunfee area suggest the further possibility of a series of parallel zones of gold mineralization, and the upside potential for a broad zone where the rock between the veins also contains sufficient gold mineralization that the entire underlying intrusive might represent a Tintina Gold Belt-type gold system. The Dunfee Mine area is one of the few locations throughout western Esmeralda County where this bulk mineable potential does not appear to have been eroded.

Mr. Thomas recommended a four phase exploration program. Phase one and two consists of geologic mapping and sampling, completed in increasing detail as drill target areas are defined. Phase three consists of a possible (IP) geophysical survey to further define drill targets. Phase four consists of drilling 5,000 feet of Reverse Circulation drill holes, as well as assays and will require bonding, permitting and other associated expenses. The implementation of each phase is dependent on the previous phase.

Competition

We are a junior mineral resource exploration company engaged in the business of mineral exploration. We compete with other junior mineral resource exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral resource exploration companies. The presence of competing junior mineral resource exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

We also compete for mineral properties of merit with other junior exploration companies. Competition could reduce the availability of properties of merit or increase the cost of acquiring the mineral properties.

Employees

We have no employees as of the date of this prospectus other than our president and secretary. We currently do not conduct business as we are only in the development stage of our company. We plan to conduct our business largely through the outsourcing of experts in each particular area of our business.

Research and Development Expenditures

We have not incurred any material research or development expenditures since our incorporation.

Subsidiaries

We do not currently have any subsidiaries.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Office Property

We maintain our executive office at 37 Mayfair Road SW, Calgary, Alberta, T2V 1Y8, Canada. This office space is being provided to the company free of charge by our president, Mr. Smith. This arrangement provides us with the office space necessary at this point. Upon significant growth of the company it may become necessary to lease or acquire additional or alternative space to accommodate our development activities and growth.

Legal Proceedings

We are not currently a party to any legal proceedings.

Our agent for service of process in Nevada is Nevada Agency and Trust Company, 50 West Liberty Street, Suite 880, Reno, Nevada 89501.

Market for Common Equity and Related Stockholder Matters

No Public Market for Class A Common Stock

There is presently no public market for our Class A common stock. We anticipate making an application for trading of our Class A common stock on the Over-the-Counter Bulletin Board electronic quotation service upon the effectiveness of the registration statement of which this prospectus forms a part. However, we can provide no assurance that our shares will be traded on the Over-the-Counter Bulletin Board electronic quotation service or, if traded, that a public market will materialize.

The Securities Exchange Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that: (a) contains a description of the nature and level of risk in the market for

penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities' laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement.

Diversified Resources Inc. is subject to the penny stock rules, and disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock and stockholders may have difficulty selling those securities.

Holders of Our Class A Common Stock

As of the date of this Registration Statement, we had thirty three (33) shareholders of record.

Rule 144 Shares

The resale of our Class A common stock must be by way of registration or through reliance upon an exemption from registration. Our issued shares of Class A common stock are not currently available for resale to the public in accordance with the volume and trading limitations of Rule 144 of the Act because we are a shell company. Our shareholders cannot rely on Rule 144 for the resale of our Class A common stock until the following have occurred:

1. we have ceased to be a shell company;

2. we are subject to the reporting requirements of the Exchange Act;

3. we have filed all Exchange Act reports required for the past 12 months; and

4. a minimum of one year has elapsed since we filed current Form 10 information on Form 8-K changing our status from a shell company to a non- shell company.

When Rule 144 is available, our affiliate stockholder shall be entitled to sell within any three month period a number of shares that does not exceed the greater of:

1. 1% of the number of shares of the company's Class A common stock then outstanding; or

2. the average weekly trading volume of the company's Class A common stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale.

Sales under Rule 144 are also subject to manner of sale provisions and notice requirements and to the availability of current public information about the company.

Stock Option Grants

To date, we have not granted any stock options.

Registration Rights

We have not granted registration rights to the selling shareholders or to any other persons.

We are paying the expenses of the offering because we seek to: (i) become a reporting company with the Commission under the Securities Exchange Act of 1934; and (ii) enable our Class A common stock to be traded on the over-the-counter bulletin board. We plan to file a Form 8-A registration statement with the Commission to cause us to become a reporting company with the Commission under the 1934 Act. We must be a reporting company under the 1934 Act in order that our Class A common stock is eligible for trading on the over-the-counter bulletin board. We believe that the registration of the resale of shares on behalf of existing shareholders may facilitate the development of a public market

in our Class A common stock if our Class A common stock is approved for trading on a recognized market for the trading of securities in the United States.

We consider that the development of a public market for our Class A common stock will make an investment in our Class A common stock more attractive to future investors. In the near future, in order for us to continue with our development stage activities, we will need to raise additional capital. We believe that obtaining reporting company status under the 1934 Act and trading on the OTCBB should increase our ability to raise these additional funds from investors.

Financial Statements

Index to Financial Statements:

Unaudited consolidated financial statements for the nine months ended July 31, 2011, including:

Audited financial statements for the year ended October 31, 2010, including:

|

DIVERSIFIED RESOURCES, INC.

|

||||||||

|

(An Exploration Stage Company)

|

||||||||

|

Balance Sheet

|

||||||||

|

as at July 31, 2011 (unaudited) and October 31, 2010

|

||||||||

|

July 31,

|

October 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

(unaudited)

|

||||||||

| ASSETS | ||||||||

|

CURRENT ASSETS

|

||||||||

|

Cash and Cash Equivalents

|

$ | 17,932 | $ | 44,180 | ||||

|

|

||||||||

|

TOTAL ASSETS

|

$ | 17,932 | $ | 44,180 | ||||

|

LIABILITIES & STOCKHOLDERS' EQUITY

|

||||||||

|

LIABILITIES

|

$ | - | $ | - | ||||

|

STOCKHOLDERS' EQUITY

|

||||||||

|

Common Stock, par value $0.001; authorized 75,000,000 shares;

|

||||||||

|

issued and outstanding: 5,250,000 shares as of July 30, 2011

|

||||||||

|

issued and outstanding: 5,250,000 shares as of October 31, 2010

|

5,250 | 5,250 | ||||||

|

Additional paid-in capital

|

54,750 | 54,750 | ||||||

|

Deficit accumulated in the development stage

|

(42,068 | ) | (15,820 | ) | ||||

|

Total Stockholders' Equity

|

17,932 | 44,180 | ||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

$ | 17,932 | $ | 44,180 | ||||

|

DIVERSIFIED RESOURCES, INC.

|

||||||||||||||||||||

|

(An Exploration Stage Company)

|

||||||||||||||||||||

|

Statement of Operations

|

||||||||||||||||||||

|

(Unaudited)

|

||||||||||||||||||||

|

For the period

|

||||||||||||||||||||

|

from Inception,

|

||||||||||||||||||||

|

March 19, 2009

|

||||||||||||||||||||

|

For the three months ended

|

For the nine minths ended

|

through

|

||||||||||||||||||

|

July 31,

|

July 31,

|

July 31,

|

||||||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

2011

|

||||||||||||||||

|

REVENUES

|

$ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

COSTS AND EXPENSES

|

||||||||||||||||||||

|

Professional Fees

|

7,005 | - | 10,855 | - | 15,470 | |||||||||||||||

|

Mineral Lease

|

5,000 | 5,358 | 11,700 | 4,973 | 21,700 | |||||||||||||||

|

General and Administrative

|

2,112 | 469 | 3,693 | 494 | 4,899 | |||||||||||||||

|

TOTAL EXPENSES

|

14,116 | 5,827 | 26,248 | 5,467 | 42,068 | |||||||||||||||

|

NET INCOME (LOSS)

|

$ | (14,116 | ) | $ | (5,827 | ) | $ | (26,248 | ) | $ | (5,467 | ) | $ | (42,068 | ) | |||||

|

Net Income (Loss) per share, basic and diluted

|

$ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||||||

|

Weighted Average number of common

|

||||||||||||||||||||

|

shares, outstanding, basic and diluted

|

5,250,000 | 3,000,000 | 5,250,000 | 3,000,000 | ||||||||||||||||

|

DIVERSIFIED RESOURCES, INC.

|

||||||||||||||||||||

|

(An Exploration Stage Company)

|

||||||||||||||||||||

|

Statement of Changes in Stockholders' Equity

|

||||||||||||||||||||

|

For the period from Inception, March 19, 2009, to July 31, 2011

|

||||||||||||||||||||

|

(Unaudited)

|

||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||

|

Additional

|

Deficit During

|

|||||||||||||||||||

|

Common Stock

|

Paid-in

|

Development

|

||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Stage

|

Total

|

||||||||||||||||

|

Balances at Inception, March 19, 2010

|

- | $ | - | $ | - | $ | - | $ | - | |||||||||||

|

Stock issued for cash @ $0.005 per share

|

||||||||||||||||||||

|

May 12, 2009

|

3,000,000 | 3,000 | 12,000 | 15,000 | ||||||||||||||||

|

Net loss, period ended October 31,2009

|

(9,956 | ) | (9,956 | ) | ||||||||||||||||

|

Balances at October 31, 2009

|

3,000,000 | $ | 3,000 | $ | 12,000 | $ | (9,956 | ) | $ | 5,044 | ||||||||||

|

Stock issued for cash @ $0.02 per share

|

||||||||||||||||||||

|

September 30, 2010

|

2,250,000 | 2,250 | 42,750 | 45,000 | ||||||||||||||||

|

Net loss, year ended October 31, 2010

|

(5,864 | ) | (5,864 | ) | ||||||||||||||||

|

Balances at October 31, 2010

|

5,250,000 | 5,250 | 54,750 | (15,820 | ) | 44,180 | ||||||||||||||

|

Net loss, July 30, 2011

|

(26,248 | ) | (26,248 | ) | ||||||||||||||||

|

Balances at July 31, 2011

|

5,250,000 | $ | 5,250 | $ | 54,750 | $ | (42,068 | ) | $ | 17,932 | ||||||||||

|

DIVERSIFIED RESOURCES, INC.

|

||||||||||||

|

(An Exploration Stage Company)

|

||||||||||||

|

Statements of Cash Flows

|

||||||||||||

|

(Unaudited)

|

||||||||||||

|

For the period

|

||||||||||||

|

from Inception,

|

||||||||||||

|

March 19, 2009

|

||||||||||||

|

For the nine months ended

|

through

|

|||||||||||

|

July 31

|

July 31,

|

|||||||||||

|

2011

|

2010

|

2011

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||||

|

Net Income (Loss)

|

$ | (26,248 | ) | $ | (5,467 | ) | $ | (42,068 | ) | |||

|

Adjustments to reconcile net loss to net cash

|

||||||||||||

|

used by operating activities:

|

- | - | - | |||||||||

|

Change in operating assets and liabilities:

|

- | - | - | |||||||||

|

Net Cash provided by (used by)

|

||||||||||||

|

Operating Activities

|

(26,248 | ) | (5,467 | ) | (42,068 | ) | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||||||

|

Net Cash provided by Investing Activities

|

- | - | - | |||||||||