Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ACCURIDE CORP | acw11-8kq3.htm |

| EX-99.1 - EX-99.1 - ACCURIDE CORP | acw11-99d1.htm |

Page | 1

Third Quarter 2011

Earnings Call

Earnings Call

Page | 2

Statements contained in this news release that are not purely historical are forward-

looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding Accuride’s expectations, hopes, beliefs and

intentions with respect to future results. Such statements are subject to the impact

on Accuride’s business and prospects generally of, among other factors, market

demand in the commercial vehicle industry, general economic, business and

financing conditions, labor relations, governmental action, competitor pricing activity,

expense volatility and other risks detailed from time to time in Accuride’s Securities

and Exchange Commission filings, including those described in Item 1A of

Accuride’s Annual Report on Form 10-K for the fiscal year ended December 31,

2010. Any forward-looking statement reflects only Accuride’s belief at the time the

statement is made. Although Accuride believes that the expectations reflected in

these forward-looking statements are reasonable, it cannot guarantee its future

results, levels of activity, performance or achievements. Except as required by law,

Accuride undertakes no obligation to update any forward-looking statements to

reflect events or developments after the date of this news release.

looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding Accuride’s expectations, hopes, beliefs and

intentions with respect to future results. Such statements are subject to the impact

on Accuride’s business and prospects generally of, among other factors, market

demand in the commercial vehicle industry, general economic, business and

financing conditions, labor relations, governmental action, competitor pricing activity,

expense volatility and other risks detailed from time to time in Accuride’s Securities

and Exchange Commission filings, including those described in Item 1A of

Accuride’s Annual Report on Form 10-K for the fiscal year ended December 31,

2010. Any forward-looking statement reflects only Accuride’s belief at the time the

statement is made. Although Accuride believes that the expectations reflected in

these forward-looking statements are reasonable, it cannot guarantee its future

results, levels of activity, performance or achievements. Except as required by law,

Accuride undertakes no obligation to update any forward-looking statements to

reflect events or developments after the date of this news release.

Forward Looking Statements

Page | 3

Third Quarter 2011 Earnings

Ø Opening Comments

• CEO Update

• Industry Highlights

• Plan Execution

Ø Financial Information

• Second Quarter Results

• 2011 Outlook

Ø Q&A

Ø Closing Comments

Rick Dauch

President & CEO

Greg Risch

Vice President &

Interim-CFO

Interim-CFO

Rick Dauch

Greg Risch

Rick Dauch

Page | 4

Page | 5

3rd Quarter Highlights

• Strong customer volumes: Class 8, Trailer, Improving 5-7

• Aluminum Wheel Capacity qualified and on-line at Erie, Camden, AdM

• Gunite:

• OE pricing negotiations are 95% complete

• Daily production consistently improving

• Imperial and Brillion businesses generating positive EBITDA

• LEAN Mfg. principles being implemented at Wheels plants

• Fabco sold (cash proceeds of $30.7 million)

• Aluminum capacity at Erie launched 60-days behind schedule

• Gunite operational challenges continue:

• Quality Issue

• Customer Demand > Current Operational Capability

Page | 6

Page | 7

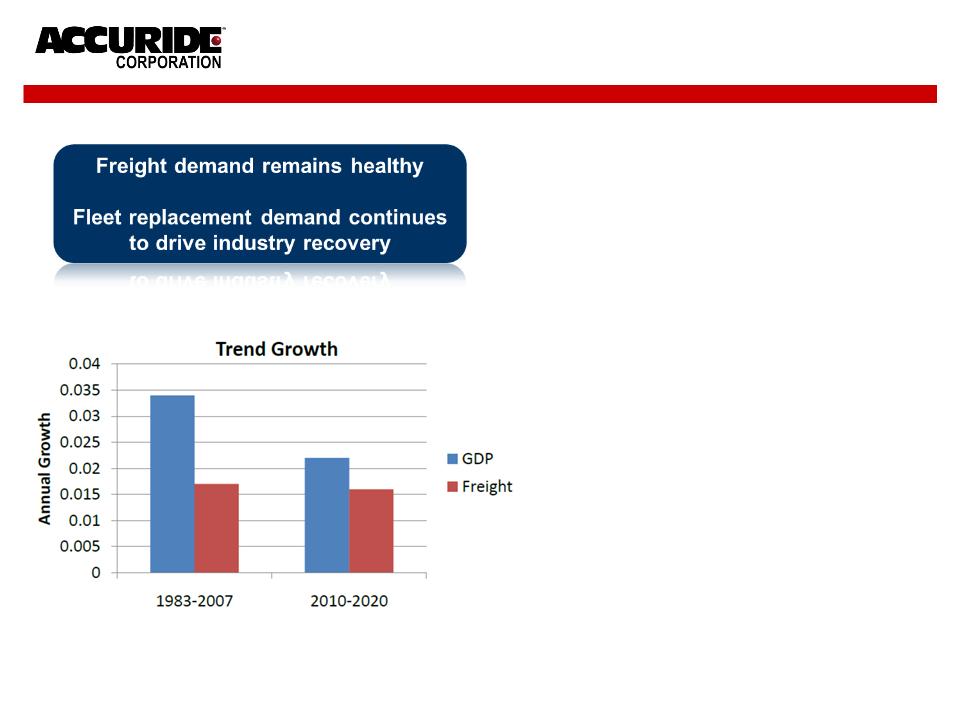

Economic Indicators

Source: FTR Associates

• GDP trend growth is forecasted to

average 2 - 2.5% over the next decade

average 2 - 2.5% over the next decade

• The economy is expected to be more

manufacturing driven which will insulate

freight volumes

manufacturing driven which will insulate

freight volumes

• Our recent discussions with

customers confirm the continued

recovery of the NA commercial truck

and trailer market

customers confirm the continued

recovery of the NA commercial truck

and trailer market

Page | 8

Trucking Indicators

• Cass Freight Index Improving

• September Expenditures rose 15% YOY

• September Shipments rose 7.5% YOY

• Pulse of Commerce Flat Lined

• Diesel fuel consumption declined .2% YOY in

September

September

Page | 9

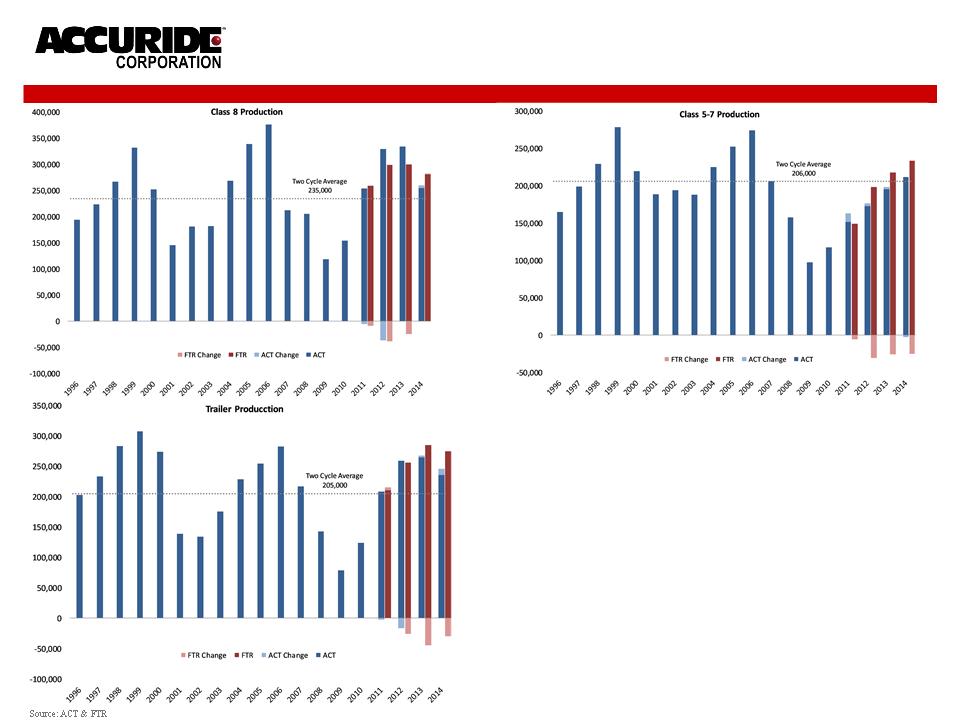

Build Levels

• Class 8 production forecasts

indicate continued upward

momentum

indicate continued upward

momentum

• Recovery in the medium-duty

segment of the market is 18

months behind Class 8

segment of the market is 18

months behind Class 8

• Trailer builds continue to increase

Page | 10

Page | 11

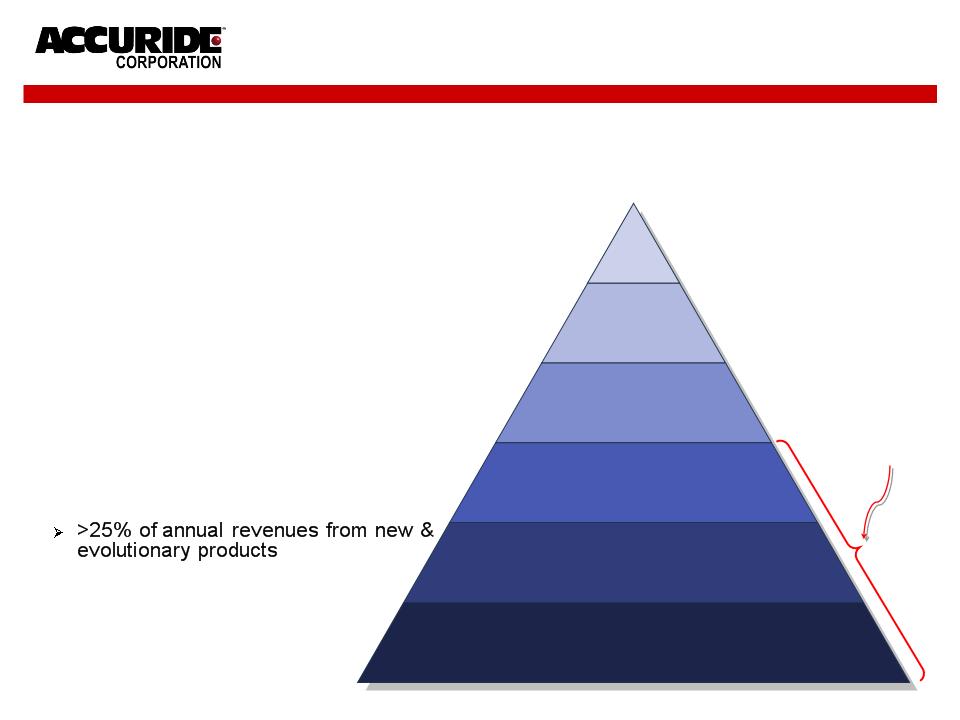

Strategic Objectives

Ø #1-2 globally in wheel-end systems

Ø ROIC > 20% through a cycle

Ø >80% of products from CORE products

Ø Balanced geographical revenues:

• 40% North America

• 30% Asia

• 20% Europe

• 10% South America

Ø >95% retention of personnel

Ø Maximize ACW share price

Share

Price

Grow Globally

Create a Competitive

Cost Structure &

LEAN Operating Culture

Divest Non-Core Assets

Fix Core Business & Operations

Customer Centric, Technology Leadership

Ethical People, Selfless Leaders, Team Oriented

Accuride Vision: Accuride will be the premier supplier of wheel-end system

solutions to the global commercial vehicle industry

solutions to the global commercial vehicle industry

Our

Focus

Focus

Page | 12

Top Five Priorities

1. Strengthen Organization

2. Fix Gunite Business

3. Strengthen Steel Wheel Business

4. Grow Aluminum Wheel Business

5. Pursue Strategic Opportunities

Page | 13

A New Senior Leadership Team

Rick Dauch

President & CEO

Greg Risch

VP, Interim CFO

Mary Blair

SVP, Supply Chain

Jim Maniatis

SVP, Human Resources

Chuck Byrnes

SVP, Sales & Marketing

Ken Sparks

SVP, Gunite & Brillion

Steve Martin

SVP, Chief Counsel

Scott Hazlett

SVP, Wheels

Dave Adams

SVP, CTO

Paul Clark

VP & General Manager, Imperial

*

*

* New position

New Hire

Same

Reassigned

Page | 14

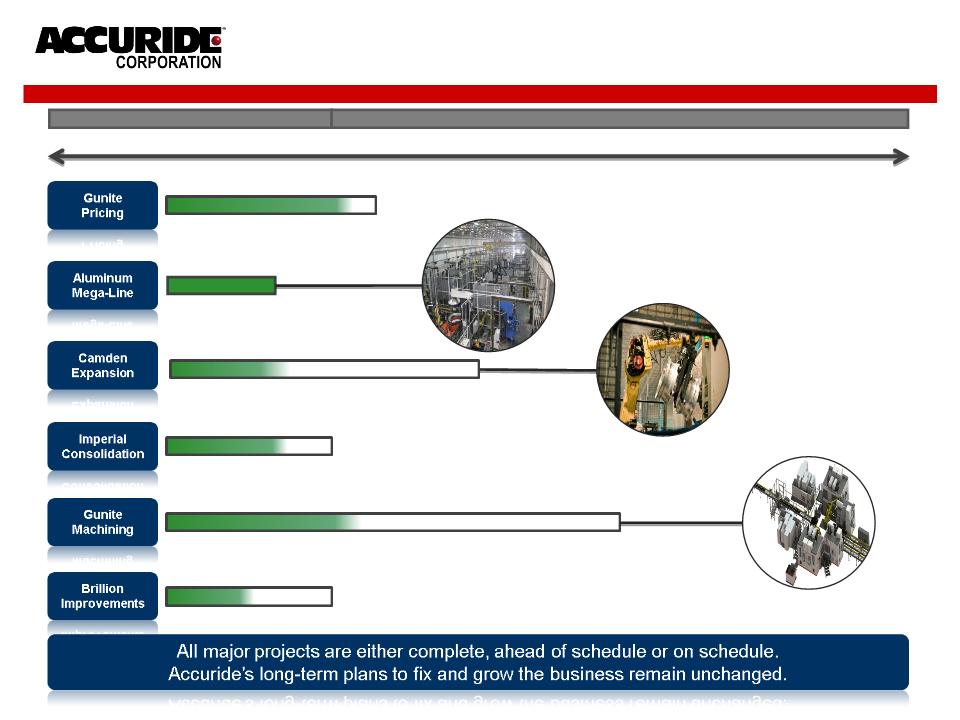

Project Timeline

Q3

Q4

Q1

Q2

Q3

Q4

2011

2012

Page | 15

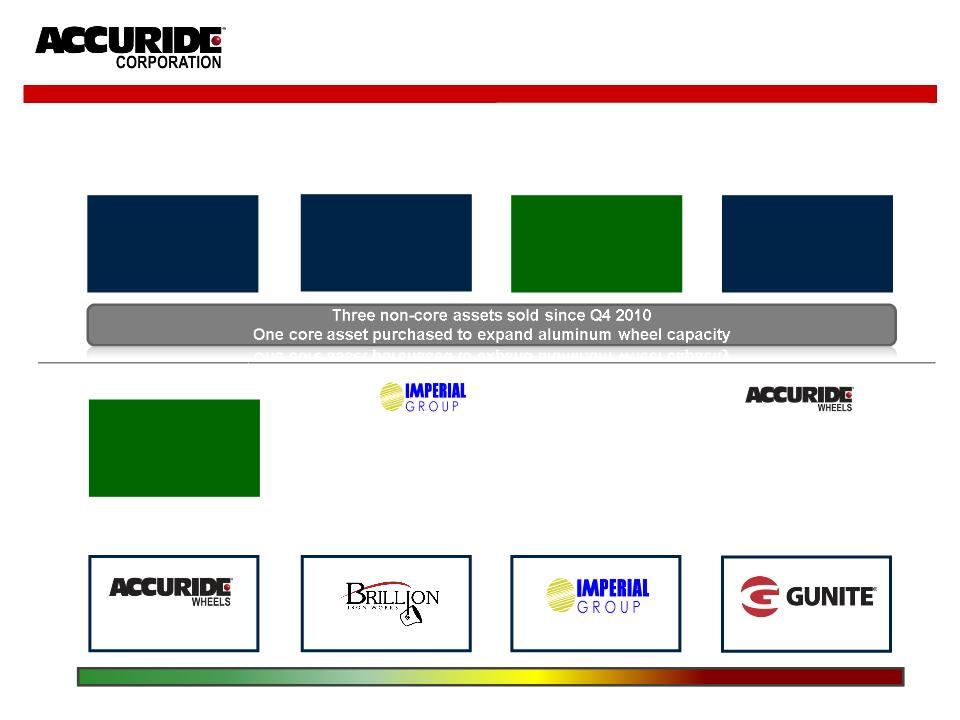

Ø We continue to execute on a series of strategic initiatives to focus on our core operations

Ø We are delaying International expansion activities until we fix our existing businesses

|

|

|

|

|

Acquired

Forgitron

Divested

Brillion Farm

Equipment

Equipment

Additional

Actions

Pursue Strategic Opportunities

Ø Portland, TN plant #1 consolidation 90% complete

Ø 9 presses relocated to Decatur, TX from TN and WA

Ø TX operations grow from $35m/yr to >$100M/yr in 2012

Ø Driving Imperial Group to >10% EBITDA in 2012

Ø Transferring heavy duty wheel capacity from

our London, ONT facility to our Monterrey,

MX facility by 1Q12

our London, ONT facility to our Monterrey,

MX facility by 1Q12

Ø Negotiating with CAW in London

Divested

Bostrom

Seating

Divested

Fabco

Grow

Fix

Fix

Fix

Page | 16

Page | 17

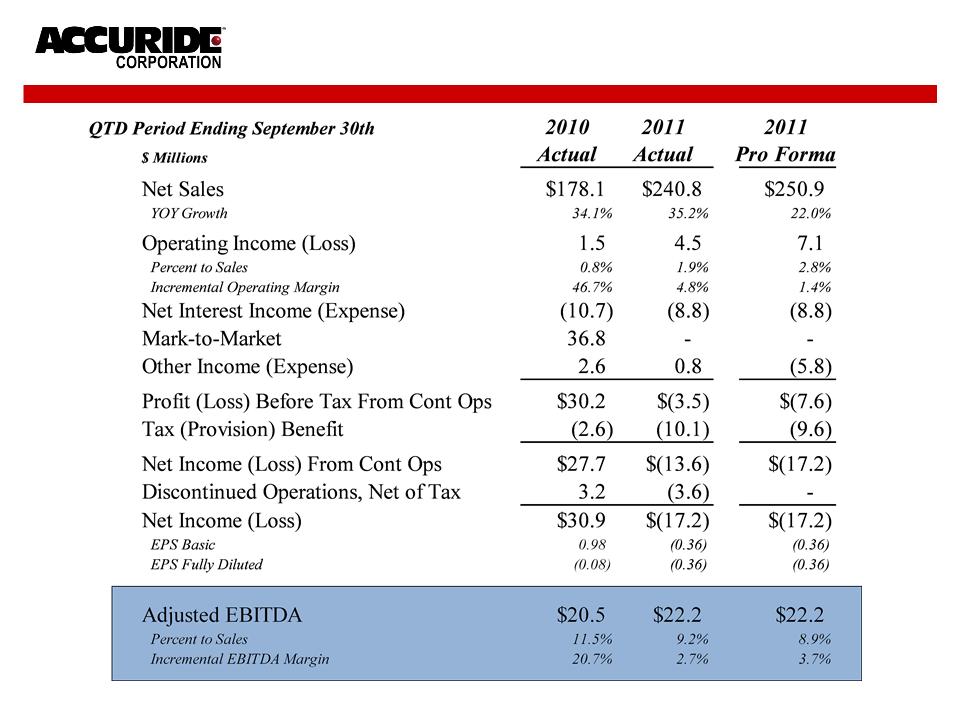

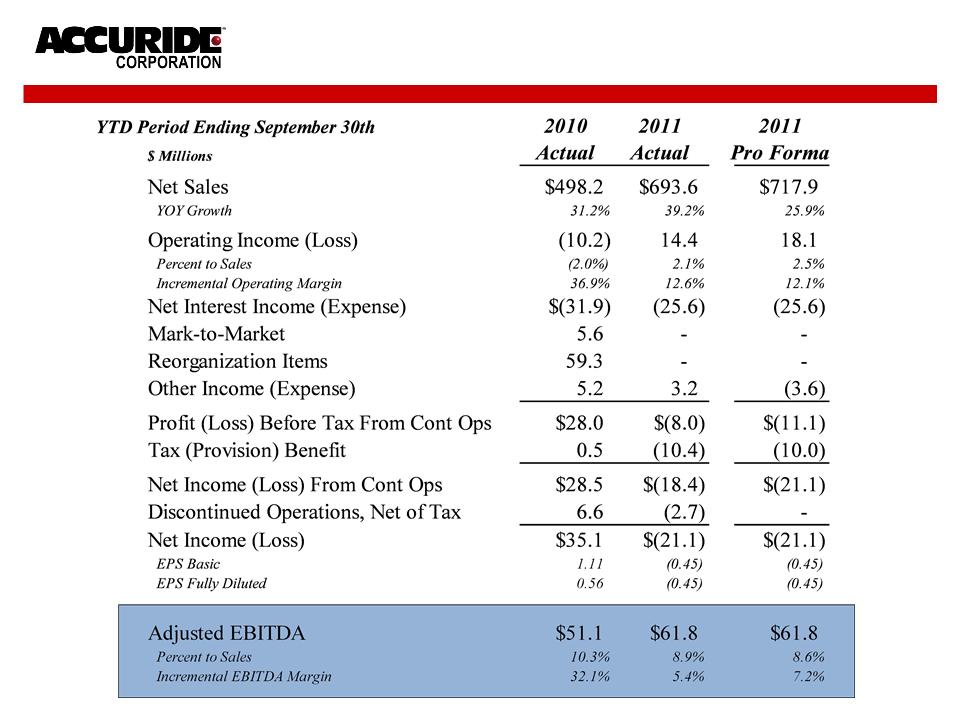

Summary Income Statement

Page | 18

Segment Revenue

Page | 19

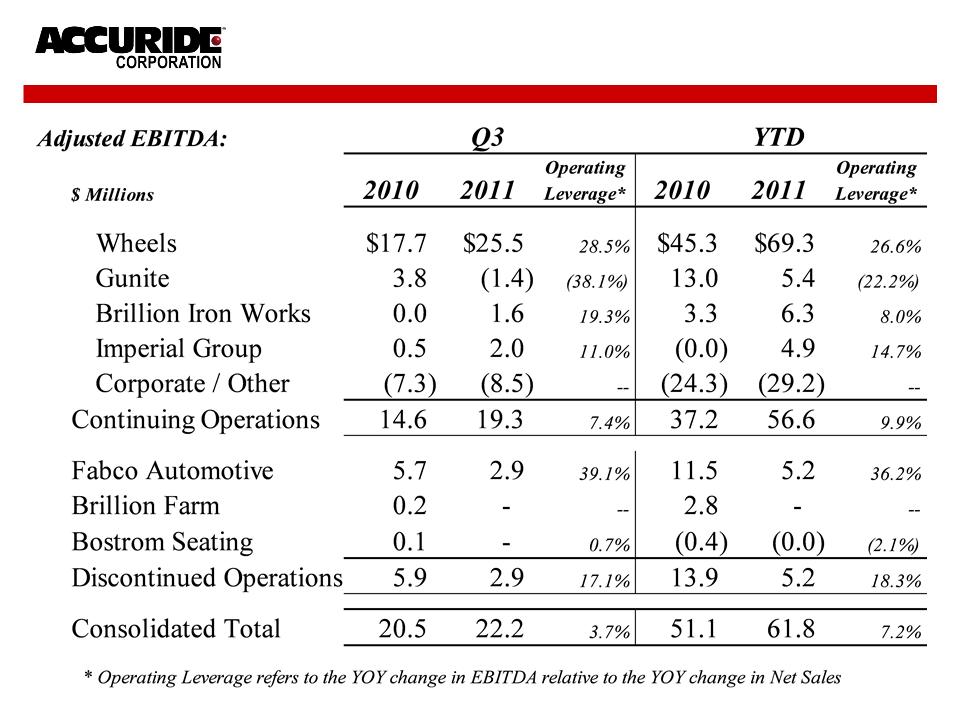

Segment EBITDA

Page | 20

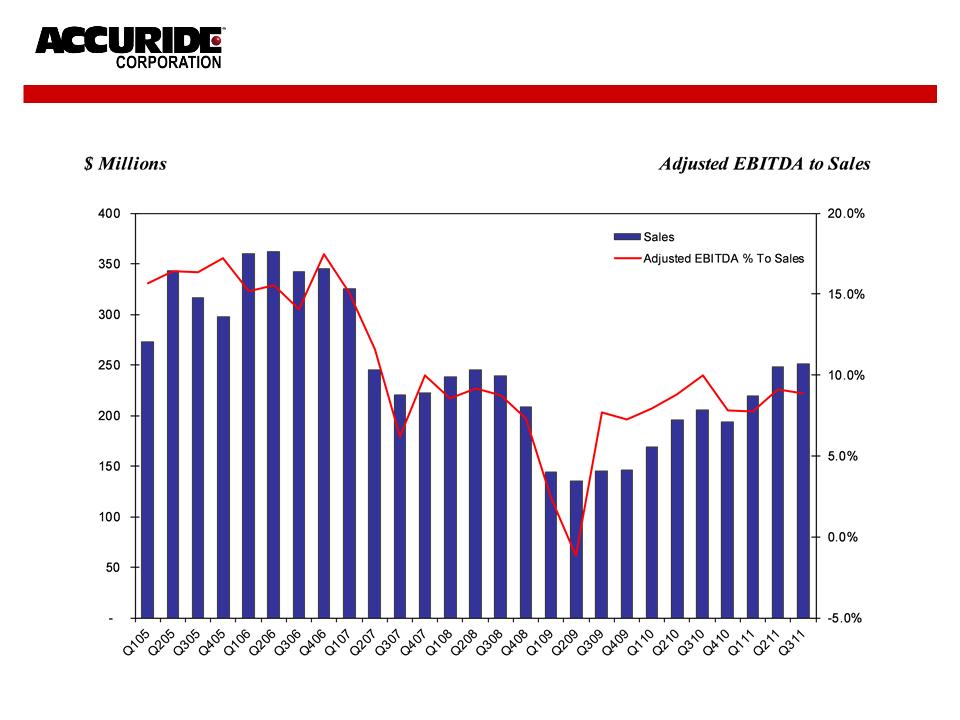

Sales & Adjusted EBITDA

Page | 21

Trade Working Capital

Page | 22

Customer Receivables - Net

Page | 23

Inventories - Net

Page | 24

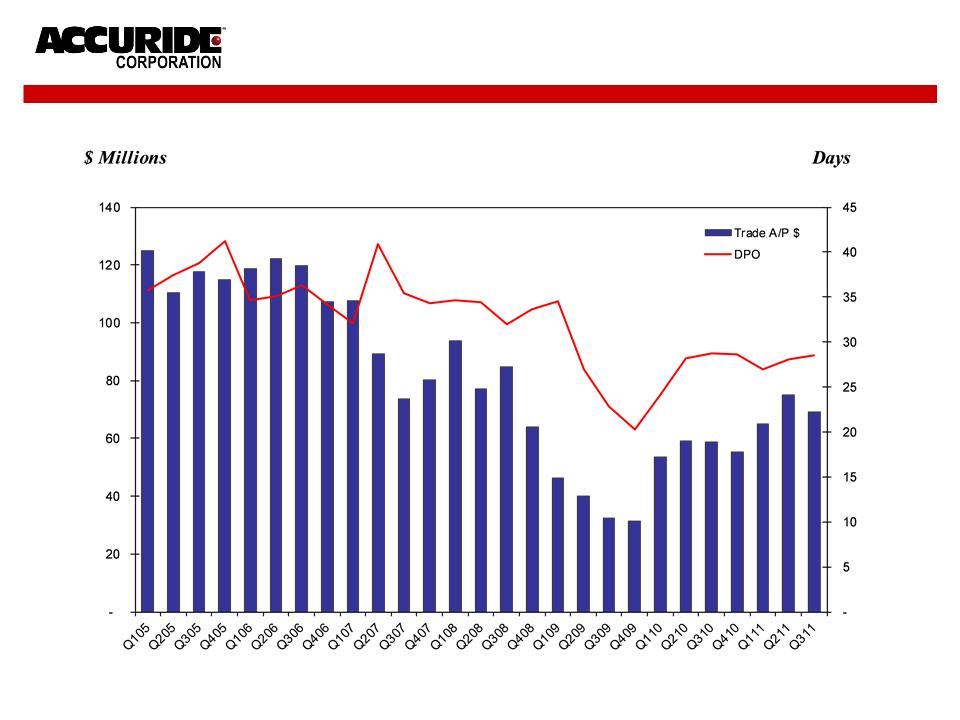

Accounts Payable

Page | 25

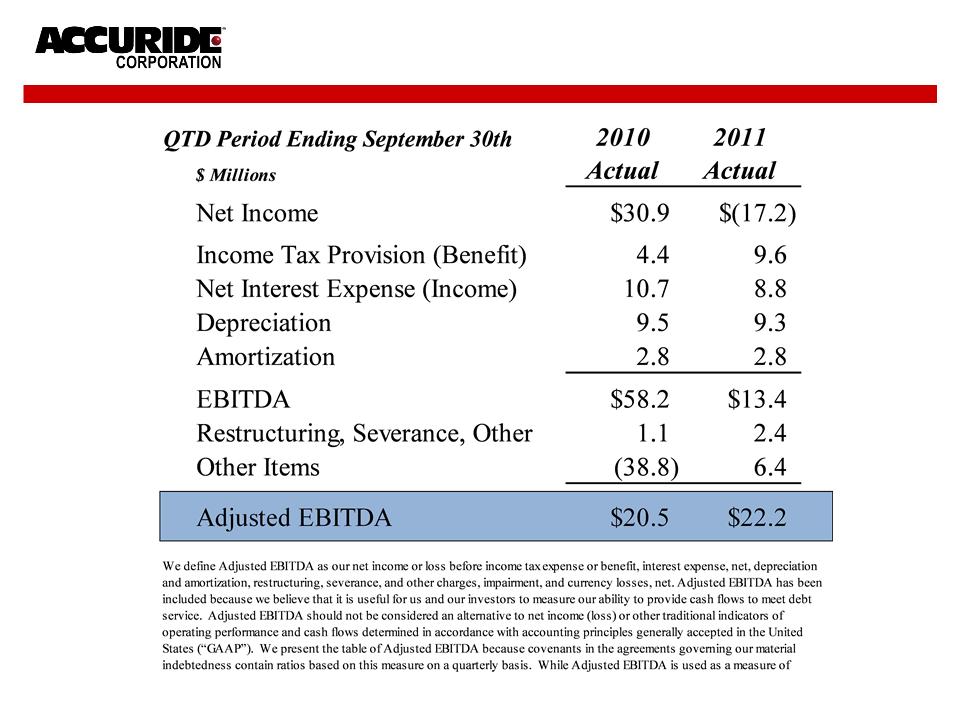

Net Income to EBITDA Reconciliation

Page | 26

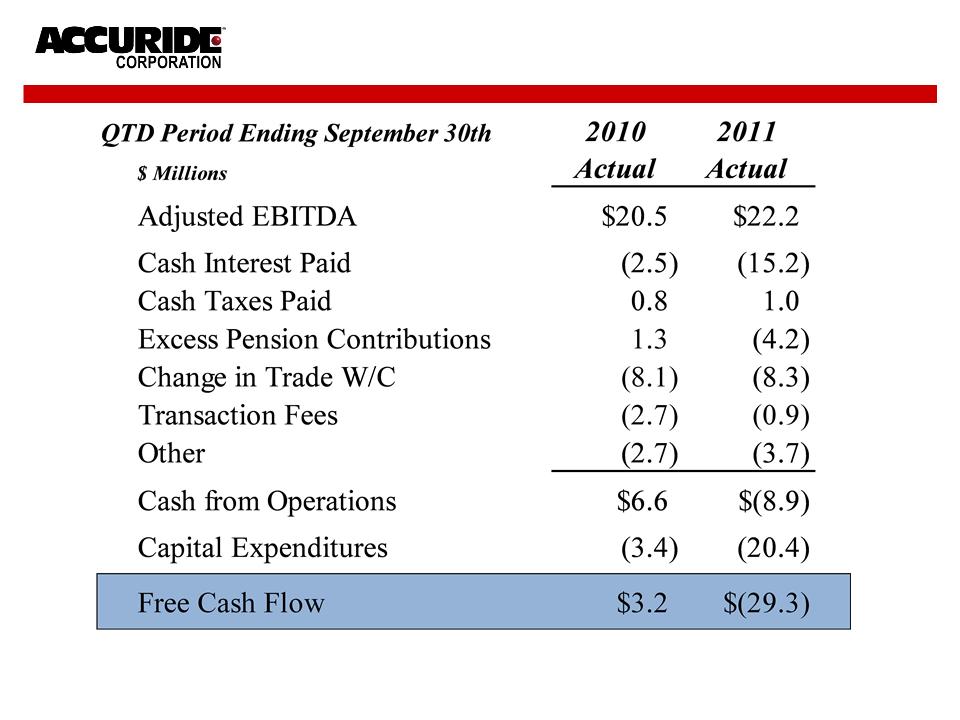

Free Cash Flow

Page | 27

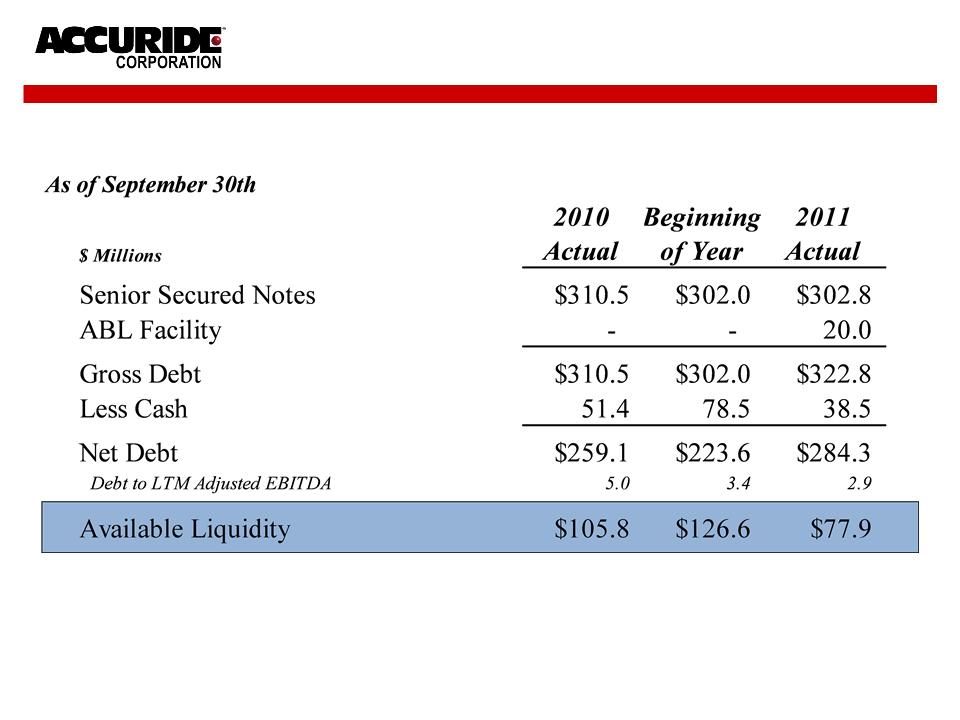

Net Debt & Liquidity

Page | 28

Summary Income Statement

Page | 29

Full Year Guidance

Net Sales (1) $950.0 to $975.0

Adjusted EBITDA $85.0 to $90.0

EPS - Diluted (2) $(0.40) to $(0.30)

Depreciation & Amortization $49.0

Capital Expenditures $63.0

Cash Interest Expense $31.0

Excess Pension Contributions $15.0

Trade Working Capital Use of Cash $25.0

Free Cash Flow ($55.0) to ($50.0)

(1) Includes $24.3 million of sales from Discontinued Operations

(2) Includes $(0.33) in Q3 and $(0.02) in Q4 related to the Fabco sale and other non-cash charges

Page | 30

• Focus on fixing our “core” assets:

• Accuride Wheels, Gunite

• Operational excellence - manufacturing & supply chain

• Make strategic investments:

• Organizational skill set improvements

• CAPEX - process capability, capacity footprint

• Research & Development - future products

• Opportunistic acquisitions

• 100% commitment to:

• Fix what is not working today

• Divest non-core assets

• Expand globally to support our customers’ needs

• Southern US and Mexico

• Asia

• South America

• Europe

Summary

Page | 31