Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - INTERNATIONAL SILVER INC | islv_ex311.htm |

| EX-32.2 - CERTIFICATION - INTERNATIONAL SILVER INC | islv_ex322.htm |

| EX-32.1 - CERTIFICATION - INTERNATIONAL SILVER INC | islv_ex321.htm |

| EX-23.1 - CONSENT OF SEALE AND BEERS, CPA'S - INTERNATIONAL SILVER INC | islv_ex231.htm |

| EX-31.2 - CERTIFICATION - INTERNATIONAL SILVER INC | islv_ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10 – K /A

Amendment No. 3

|

(MARK ONE)

|

|

|

x

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the Fiscal Year Ended December 31, 2010.

|

|

|

OR

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

FOR THE TRANSITION PERIOD FROM _______ TO _______.

|

International Silver, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Arizona

|

|

(State or other jurisdiction of incorporation or organization)

|

|

333-147712

|

86-0715596

|

|

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

5210 E. Williams Circle, Suite 700

|

|

Tucson, Arizona 85711

|

|

(Address of principal executive offices including zip code)

|

|

(520) 889-2040

|

|

(Registrant's telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Exchange Act: (None)

Securities registered pursuant to Section 12(g) of the Exchange Act: (None)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 13(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained in this form, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. To the best of registrants' knowledge, there are no disclosures of delinquent filers required in response to Item 405 of Regulation S-K. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of " large accelerated filer", "accelerated filer" and "small reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

Non-accelerated filer

|

o |

Smaller reporting company

|

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of December 31, 2010, the aggregate market value of the voting stock held by non-affiliates of the registrant ("aggregate market value") was approximately $3,691,350.

Issuer's revenues for its most recent fiscal year: $63,660. The number of shares of the registrant's $.0001 par value common stock outstanding as of March 31, 2011 was 28,581,753.

Table of Contents

|

Page No.

|

|||||

|

PART I

|

|||||

|

Item 1.

|

Business

|

3

|

|||

|

Item 1A.

|

Risk Factors

|

8

|

|||

|

Item 1B.

|

Unresolved Staff Comments

|

||||

|

Item 2.

|

Properties

|

15

|

|||

|

Item 3.

|

Legal Proceedings

|

24

|

|||

|

Item 4.

|

(Removed and Reserved)

|

||||

|

PART II

|

|||||

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

24

|

|||

|

Item 6.

|

Selected Consolidated Financial Data

|

27

|

|||

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operation

|

27

|

|||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

37

|

|||

|

Item 8.

|

Financial Statements and Supplementary Data

|

37

|

|||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

63

|

|||

|

Item 9A.

|

Controls and Procedures

|

63

|

|||

|

Item 9B.

|

Other Information

|

63

|

|||

|

PART III

|

|||||

|

Item 10.

|

Directors and Executive Officers of the Registrant

|

64

|

|||

|

Item 11.

|

Executive Compensation

|

70

|

|||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

72

|

|||

|

Item 13.

|

Certain Relationships and Related Transactions

|

73

|

|||

|

Item 14.

|

Principal Accountant Fees and Services

|

75

|

|||

|

Part IV

|

|||||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

76

|

|||

|

Signatures

|

77

|

||||

2

PART I

This annual report of Form 10-K/A is being filed as an amendment to our Form 10-K for the year ended December 31, 2010, which was filed with the Securities and Exchange Commission on April 25, 2011. This amendment reflects changes in Part 1, Item 1 – Business (General and Description), Item 2 – Properties, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Plan of Operations and Exploration Phase I and II, Item 8 – Financial Statements and Supplementary Data – Consolidated Statements of Income, Note A – Organization and Business – Key Properties and Note J – Related Party Transactions, Item 9A – Controls and Procedures. Currently dated and amended Exhibits 31.1, 31.2, 32.1 and 32.2, signed by the principal executive and financial officer, are included in this filing.

Item 1. Business

International Silver is referred to herein as “we”, “our” or “us”

Business

Glossary

Adits - An underground mine tunnel with only one end daylighting.

Alluvial (valleys) - Material created by the erosion of rocks by water, air and climate conditions.

Argentite - Silver sulfide

Arroyo - Spanish word that defines a dry creek bed.

Banded barite and jasper - Rock formed by the action of hot solutions containing dissolved silica, which forms layers composed of barium sulfate and silica.

Barite - Barium Sulfate.

Cerussite - Lead carbonate, an oxide ore mineral of lead.

Dolomite - Refers to magnesium bearing limestone.

Flotation tests - The use of flotation for the separation of minerals by the mixing of reagents, air and water during agitation to cause the minerals to separate by floating to the surface of the solution along with air bubbles.

Galena - Lead sulfide mineral.

Hemimorphite - Zinc silicate mineral.

Igneous bodies - Rock masses created by intrusion of molten rock.

3

Igneous rock out crops - Masses of igneous rocks, which are exposed.

Limonite - Porous iron oxides.

Limonitic Anglesite - Form of lead sulfate with oxidized iron found in many lead-zinc-silver ore zones.

Mine planning - Computerized mine planning; the use of computers to simulate a multi-dimensional mine to form a visual image of a planned mine.

Pyrite - Refers to iron sulfide.

Scout Sampling - Refers to the practice of taking samples of rocks in areas previously not sampled.

Shoring - The use of wood braces to support underground workings to prevent rock cave-ins.

Smithsonite - Refers to zinc carbonate, an oxide ore mineral of zinc.

Sphalerite - Refers to zinc sulfide, a common ore mineral of zinc.

Staking - Refers to the practice of placing stakes in the form of pipes or wooden posts to identify property being claimed under the rules of the Bureau of Land Management of the United States.

Veins - Natural conduits of mineral deposition of varying grades and thickness, typically linear in form.

Wulfenite - A mineral of tungsten.

General

We are an exploration stage company that searches for mineral deposits of precious metals . We have not yet engaged in either development or production stage activities. We plan to acquire, stake claims, or lease exploration properties, and conduct exploration activities in North America.

The primary assets of International Silver, Inc., are the 1) Calico Silver Project, an exploration project , located in the Calico Mining District of San Bernardino County, California and held by unpatented Federal lode mining claims owned by the company; 2) its Lease/ Option to acquire and explore the Prince Mine; 3) its Lease/ Option to explore and purchase the Pan American Mine and the Caselton Concentrator; 4) a block of 495 acres of unpatented Federal lode mining claims adjacent to the Prince Mine and 4 5 0 acres of unpatented Federal lode claims adjacent to the Caselton Mine and Mill, both claim blocks owned directly by us. A ll of the latter assets are located in the Pioche Mining District of Lincoln County, Nevada. The Prince Mine and Pan American Mine with the Caselton Concentrator are former producing silver lead zinc gold mines with mineral extraction facilities that are inactive and on a “care and maintenance” status.

Although we generated total revenues of $145,659 in 2009 from engineering/mining related consulting services, revenues generated decreased to $63,660 in 2010. Engineering related revenues, along with funding from third-party sources allow us to continue our focus on exploration and development activities.

We have relied upon funds raised from the sale of our common stock funds from private placements and limited engineering services to cover our operating costs and expenses. Management is pursuing additional funding for exploration at the Prince and Pan American Mines and for general corporate activities. Our independent accountant has issued an opinion that there is substantial doubt about our ability to continue as a going concern.

4

DESCRIPTION OF BUSINESS

Business Development

We were incorporated in the State of Arizona on September 6, 1992 as Western States Engineering and Construction, Inc. On June 16, 2006, we changed our name to International Silver, Inc. to reflect our present business plan of conducting exploration activities in North America, but continue providing limited engineering consulting services. Prior to June 16, 2006, we only conducted engineering mining related consulting services.

We have never filed or been involved in any bankruptcy, receivership or similar proceeding. We have never been involved or conducted any transaction involving a material reclassification, merger, consolidation, or purchase or sale of a significant amount of assets not in the ordinary course of business.

Business

We are an exploration stage company that engages in exploration activities. An exploration stage company searches for mineral deposits or reserves, and has not yet engaged in either development or production stage activities. We plan to acquire, stake claims, or lease exploration properties, and conduct exploration activities in North America.

Competition

We compete with other exploration companies, most of which have greater financial, operational, and technical resources than us. Additionally, many of our competitors have longer operating histories, more established and a greater number of exploration properties and have strategic partnerships and relationships that benefit their activities, which we do not currently have.

Hedging Transactions

We do not engage in hedging transactions and we have no hedged mineral resources.

Employees

We currently have six employees: (a) Mr. Harold R. Shipes, our Chief Executive Officer; (b) Mr. John A. McKinney, our Executive Vice President/Chief Financial Officer; (c) Mr. Matthew J. Lang, our Vice President of Administration/Corporate Secretary; and (d) Mr. Daniel Dominguez our Corporate Controller; (e) Mr. Alexander Makaron, our Engineer and (f) Ms. Danielle Lang, Staff Accountant.

Production Distribution Methods

Should we be successful in producing metallic concentrates, we will attempt to sell such concentrates directly to smelters or to metals trading companies for shipment to smelters around the world. Should we be successful in producing precious metals, we will attempt to sell them directly to precious metals trading companies that purchase the metals in connection with their ongoing trading activities of such metals.

Sources and Availability of Raw Materials

We do not use raw materials.

5

Dependence on One or a Few Major Customers

We do not expect to become dependent upon a few major customers, since we will attempt to sell concentrates directly to smelters and metals trading companies and to do not expect to become dependent upon any one or a few such companies.

Dependence on Third Party Contractors Not Yet Hired or Equipment Sellers Not Yet Contracted With

We will depend on outside contractors for the following:

|

·

|

Exploration equipment rentals from companies in Barstow, California, Cedar City, Utah, Ely and Las Vegas, Nevada;

|

|

|

·

|

Sample preparation and assay services in both areas from ALS Chemex, a world-wide, registered, assay laboratory located in Canada and American Analytical laboratories a certified and registered laboratory with offices in Sparks and Elko Nevada.;

|

|

|

·

|

Purchase of bulldozers, excavators, and grading equipment through equipment companies such as the Catepillar dealer and use equipment dealer.

|

|

|

·

|

Smelting, refining and purchasing of product through Glencore, Trafigura, Gerald Metals, and Penoles;

|

|

|

·

|

Transportation through SPor UP Railways in the United States, Ferro Carriles de Mexico, and local truck haulage companies in both major areas;

|

|

|

·

|

Diesel fuel and gasoline for the generation of electricity and fueling of equipment, which we will purchase from commercial suppliers in Barstow, California, Cedar City, Utah, Ely and Las Vegas, Nevada;

|

|

|

·

|

Tires to be purchased from Goodyear or Michelin;

|

|

|

·

|

Equipment, parts and service to be furnished by local suppliers;

|

|

|

·

|

Flotation reagents, that are used for separating valuable minerals from their gangue rock, which will be purchased from Dow Chemicals or other suppliers;

|

|

|

·

|

Consumables to be furnished by local suppliers;

|

|

|

·

|

Grinding media that is used for milling of mined products to enable flotation recovery of valuable minerals, to be purchased from Nucor Steel or other commercial foundries;

|

We have no verbal or written agreements or any arrangements, whatsoever, with any of the above companies or other third party contractors or equipment sellers to operate on our properties or to sell us the items or provide the services reflected above. The above information only reflects our projected operational plan to use these companies if we can purchase the items from them or secure their services at the time they are needed.

Patents, Trademarks, Licenses, Royalty Agreements, Franchise Agreements:

We do not have any patents, trademarks, licenses, royalty agreements, or franchise agreements, nor do we anticipate the need in our future operations for the foregoing.

Compliance with Government Regulations and Need for Government Approval and Environmental Permits

There are various levels of governmental controls and regulations that govern environmental impact of mineral exploration activities and mineral processing operations, including performance standards, air and water quality emission standards and other design or operational requirements, and health and safety standards. We will be subject to various levels of federal and state laws and regulations, which include the following:

6

Calico Silver Property

The following approvals will be required from the following government agencies relative to our Calico Silver property prior to advanced exploration such as drilling:

|

●

|

California Department of Wildlife Management.

|

|

●

|

Bureau of Land Management in the case of the Plan of Operation allowing advanced exploration activities on Federal land held by unpatented mining claims..

|

Nevada Properties

The following approvals will be required from the following government agencies depending on the level of activity relative to our Pioche properties:

|

●

|

Water Quality Division of the Nevada Department of Environmental Protection, required prior to commercial processing of ore and or de-watering of mines for exploration.

|

|

|

●

|

Air Quality Division of the Nevada Department of Environmental Protection required only prior to commercial ore processing operations or construction of related facilities.

|

|

|

●

|

Explosives Permit from the Federal Bureau of Alcohol, Tobacco and Firearms required only prior to mine operation or other blasting activity.

|

|

|

●

|

Bureau of Land Management in the case of the Plan of Operation , if advanced exploration or mining activities are to be conducted on federal managed land held by unpatented mining claims.

|

|

| ● |

Nevada Division of Water Resources approval for drilling exploration wells.

|

|

| ● | Federal Mine Safety and Health Administration must be provided notice of renewal of underground mining for inspection scheduling. | |

Costs and Effective of Compliance with Federal, State and Local Environmental Laws

Effect of Existing of Probable Governmental Regulations on our Business

Cost of Permits

We have budgeted $150,000 for initial permit related work, to be completed by our Consulting Geologist and other contract services.

Research and Development Expenditures/Last Two Years:

We have not engaged in any research and development or assumed any such expenses over the past two years, nor do we anticipate any such expenditure in the future. The processing technologies we will use for the recovery of metals are the standard technology used by the mining industry around the world.

Disclosure Regarding Forward-Looking Statements And Risk Factors

Forward-Looking Statements.

This Annual Report on Form 10-K includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact included in this Annual Report regarding our financial position, business strategy, plans and objectives of our management for future operations and capital expenditures, and other matters, other than historical facts, are forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements and the assumptions upon which the forward-looking statements are based are reasonable, we can give no assurance that such expectations will prove to have been correct.

7

Additional statements concerning important factors that could cause actual results to differ materially from our expectations are disclosed in the following "Risk Factors" section and elsewhere in this Annual Report. In addition, the words "believe", "may", "will", "when", "estimate", "continue", "anticipate", "intend", "expect" and similar expressions, as they relate to us, our business, or our management, are intended to identify forward-looking statements. All written and oral forward-looking statements attributable to us or persons acting on our behalf subsequent to the date of this Annual Report are expressly qualified in their entirety by the following Risk Factors.

Available Information.

Item 1A. Risk Factors.

An investment in our securities involves a high degree of risk, and you should only consider an investment in our securities if you can afford to sustain the loss of your entire investment. You should carefully consider the following risk factors and all other information contained herein as well as the information included in this Annual Report on Form 10-K, in evaluating our business and prospects. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, other than those we describe below, that are not presently known to us or that we currently believe are immaterial, may also impair our business operations. If any of the following risks occur, our business and financial results could be harmed. You should refer to the other information contained in this Annual Report, including our consolidated financial statements and the related notes.

Risks Related to our Business Activities.

Our financial condition raises substantial doubt about our ability to continue as a going concern.

As of December 31, 2010, we have an accumulated deficit of $1,327,174. We are an exploration stage enterprise and have generated nominal revenue during our exploration stage. Our auditor has issued a going concern opinion that there is substantial doubt whether we can continue as an ongoing business. If we fail to obtain approximately $4.5 million of financing, we will be unable to pursue our business plan and operations will have to be curtailed or terminated, in which case you will lose part or all of your investment in our common stock. Further, if we raise funds through the sale of our equity securities, our shareholders will suffer significant dilution.

Because our properties or claims may never have reserves or be profitable, your investment in our common shares may be negatively impacted.

None of the properties or claims on which we have the right to explore for silver and other precious metals is known to have any confirmed commercially mineable reserves of silver ore or ores of other metals that may be mined at a profit. We may be unable to develop our properties at a profit, either because:

|

·

|

the deposits are not of the quality or size that would enable us to make a profit from actual mining activities; or

|

|

·

|

because it may not be economically feasible to extract metals from the deposits.

|

In either case, you may lose part or all of you entire investment.

8

Fluctuations in the market price for silver may affect both the value of our assets and the market price of our stock.

Silver is a commodity and its price is very volatile. Our ability to raise funds and the price and terms on which we are able to raise funds may be affected by the both the volatility in the price of silver and the investment community’s perception of the future price of silver. Such changes could affect both the value of our assets and the price of our stock.

We are subject to risks applicable to mining operations.

Mining operations inherently imply certain risk of which investors should be aware, as follows:

|

●

|

World-wide economic cycles influence prices of base and precious metals. As economies recede, demand for these commodities may decline, which may negatively impact the supply and demand ratio, causing prices to respond accordingly. The cash flow generated by mining activities is dependent on price levels of the metals produced. Future world-wide economic cycles may cause prices to vary outside assumed parameters in cash flow models which include certain price assumptions.

|

|

|

●

|

Ore grades vary within ore bodies. Lower grades than predicted might negatively impact cash flow since less metal may be produced from specific ore blocks.

|

|

|

●

|

Our economic performance is dependent upon production of the predicted and planned tonnage and grade from the mine. Ground conditions in underground mines can cause fluctuation of tonnage production from that planned. Lower tonnage from that planned would imply less metal production, and would negatively impact cash flow.

|

|

|

●

|

Economic performance of the mining operation is dependent on sales of the mine production. While both base and precious metals are commodities that are sold world-wide, they still must be sold. Failure to maintain an orderly market for the products would cause an interruption to cash flow until the production is sold.

|

|

|

●

|

The regularity of cash flow is dependent upon a regular sales program which has not been finalized by us.

|

|

|

●

|

Smelting costs fluctuate over time.

|

|

|

●

|

Transportation of concentrates and final metals produced to the market is subject to weather interruption.

|

|

|

●

|

The start date of mining operations may be impacted by delays in the various permits required by government agencies.

|

|

We have a limited operating history on which to base an evaluation of our business and prospects.

Although we were incorporated in 1992 and continue to perform engineering services, acquired the Calico Silver Project in 2007 and gained control of the Prince and Pan American Mine s in 2010, we are still in the exploratory stage due to our change in business plans and have little operating history and have incurred losses during the exploratory period. We have never had any revenues from exploration or mining operations. In addition, our operating history has been restricted to the acquisition and exploration of our mineral properties and this does not provide a meaningful basis for an evaluation of our prospects if we ever determine that we have a mineral reserve and commence the construction and operation of a mine. We have no way to evaluate the likelihood of whether our mineral properties will be found to contain any mineral reserve or, if they do that we will be able to build or operate a mine successfully. We anticipate that we will continue to incur operating costs without realizing any revenues during the period when we are exploring our properties. We therefore expect to continue to incur significant losses into the foreseeable future, which will require us to raise funds to cover our ongoing costs. If we are unable to generate significant revenues from mining operations and any dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition. There is no history upon which to base any assumption as to the likelihood that we will prove successful in implementing our current business plan and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

9

We have no history of mining operations.

The company has no history of mining operations, and there is no assurance that it will successfully operate profitably or provide a return on investment in the future. The costs, timing and complexities of mine construction and development are increased by the remote locations of our properties. It is common in new mining operations to experience unexpected problems and delays during construction, development, and mine start-up. In addition, delays in the commencement of mineral production often occur. Accordingly, there are no assurances that our activities will result in profitable mining operations or that we will profitably produce metals at any of its properties. Other factors mentioned in this section entitled “Risk Factors” may also prevent us from successfully operating a mine.

Our management has conflicts of interest that may favor the interests of our management, but to the detriment of our minority shareholders’ interests.

Our officers and directors also serve as officers and/or directors of other mining exploration companies and are related by family relations to one another. As a result, their personal interests and those of the companies that they are affiliated with may come into conflict with our interests and those of our minority stockholders. We as well as the other companies that our officers and directors are affiliated with may present our officers and directors with business opportunities that are simultaneously desired. Additionally, we may compete with these other companies for investment capital, technical resources, key personnel and other things. You should carefully consider these potential conflicts of interest before deciding whether to invest in our shares of our common stock. We have not yet adopted a policy for resolving such conflicts of interests. Because the interests of our officers and the companies that they are affiliated with may disfavor our own interests and those of our minority stockholders, you should carefully consider these conflicts of interest before purchasing shares of our common stock.

The services of our President and Chief Executive Officer, Executive Vice President/Chief Financial Officer, Consulting Geologist, and our Vice President of Administration and Logistics, are essential to the success of our business; the loss of any of these personnel will adversely affect our business.

Our business depends upon the continued involvement of our officers, directors, and Consulting Geologist, each of whom have mining experience from 12 to 38 years. The loss, individually or cumulatively, of these personnel would adversely affect our business, prospects, and our ability to successfully conduct our exploration activities. Before you decide whether to invest in our common stock, you should carefully consider that the loss of their expertise, may negatively impact your investment in our common stock.

We may be denied the government licenses and permits or otherwise fail to comply with federal and state requirements for our exploration activities.

Our future exploration activities will require licenses, permits, or compliance with other state and federal requirements regarding prospecting, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Delays or failures to acquire required licenses or permits or successfully comply with the pertinent federal and state regulations will negatively impact our operations.

We carry only limited property and casualty insurance which may expose us to liabilities that will negatively affect our financial condition.

The search for valuable minerals exposes us to numerous hazards. As a result, we may become subject to liability for such hazards, including environmental pollution, cave-ins, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes or other hazards that we cannot insure against or which we may elect not to insure. At the present time we have no coverage to insure against these hazards. Should we incur liabilities involving these hazards that may have a material adverse effect on our financial condition.

10

Our management devotes less than full time to our business, which may negatively impact our operations and/or reduce our revenues.

Harold Roy Shipes, our Chief Executive Officer, John McKinney, our Executive Vice President/Chief Financial Officer, and Matthew Lang, our Vice President of Administration/Corporate Secretary, devote less than full time to our business. Each member of our management described above devotes approximately 50% of their time to us. Because our management may be unable to devote the time necessary to our business, we may be unsuccessful in the implementation of our business plan.

We may be unable to successfully manage our growth, and we currently have limited management systems and resources available to us to manage any such potential growth.

We are in the process of expanding our operations and anticipate that significant expansion of our operations will be required in order to address potential market opportunities. This potential growth will place a significant strain on our management, operational and financial resources. We expect to add additional key personnel in the near future. Increases in the number of employees will place significant demands on our management. In order to manage the expected growth of its operations, we will be required to expand existing operations, particularly with respect to mining personnel, to improve existing procedures and controls, including improvement of our financial and other internal management systems, on a timely basis.

Further, our management will be required to establish and maintain relationships with various third parties and to maintain control over our strategic direction in a rapidly changing environment. There can be no assurance that our current personnel, systems, procedures and controls will be adequate to support our future operations, that management will be able to identify, hire, train, retain, motivate and manage required personnel or that our management will be able to manage and exploit existing and potential market opportunities successfully. If we are unable to manage growth effectively, our business, results of operations and financial condition will be materially adversely affected.

We may be unable to obtain funds for our operations.

We may not have adequate funds to complete the acquisition and initiate and achieve operations of any or our present or proposed properties. Implementation of our plan to develop these properties is dependent upon receiving financing, for which there are no assurances. If we are unable to obtain financing, we may have to curtail, delay or cease operations, which will negatively affect the value of an investment in our securities. Unless we are able to generate revenue from our operations, we may be unable to obtain traditional bank financing on reasonable terms, if at all, and we may be limited to equity-based offerings, which is likely to dilute the interest of our stockholders. Further, there is no assurance that we will be successful in obtaining financing through debt or equity offerings, on commercially reasonable terms or at all. Any of these eventualities would have a material adverse effect on our business and operations.

There are uncertainties regarding development of the mining properties.

Any mining operations we undertake will involve substantial development. We may encounter various technical and control problems during our development of mining operations. No assurance can be given that any of our proposed mining operations will not involve a longer period of time or the expenditure of a greater amount of funds and other resources than is presently contemplated. Such technical or operational problems may negatively impact the economic performance of the project.

Our operations are subject to extensive governmental regulation.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

11

Although we believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to remain in compliance. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

Land reclamation requirements for exploration properties may be burdensome and may divert funds from our exploration programs

Although variable, depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies, as well as companies with mining operations, in order to minimize long term effects of land disturbance. Reclamation may include requirements to control dispersion of potentially deleterious effluents and to reasonably re-establish pre-disturbance land forms and vegetation. In order to carry out reclamation obligations imposed on us in connection with its mineral exploration, we must allocate financial resources that might otherwise be spent on further exploration programs.

Because of the inherent dangers involved in mineral exploration and exploitation, there is a risk that we may incur liability or damages as we conduct our business.

The search for and exploitation of valuable minerals involves numerous hazards. In the course of carrying out our operations, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. We currently have no such insurance nor do we expect to get such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all of our assets, resulting in the loss of your entire investment in us.

Foreign investments and operations are subject to numerous risks associated with operating in foreign jurisdictions.

We may seek to have mining, development or exploration activities in Mexico. Foreign mining investments are subject to the risks normally associated with the conduct of business in foreign countries. The occurrence of one or more of these risks could have a material and adverse effect on our profitability or the viability of its affected foreign operations, which could have a material and adverse effect on our future cash flows and earnings (if any), as well as results of operations and financial condition.

Risks may include, among others, labor disputes, invalidation of governmental orders and permits, corruption, uncertain political and economic environments, sovereign risk, war (including in neighboring states), civil disturbances and terrorist or drug-gang actions, arbitrary changes in laws or policies, the failure of foreign parties to honor contractual relations, corruption, foreign taxation, delays in obtaining or the inability to obtain necessary governmental permits, opposition to mining from environmental or other non-governmental organizations, limitations on foreign ownership, limitations on the repatriation of earnings, limitations on gold exports, instability due to economic under- development, inadequate infrastructure and increased financing costs. In addition, the enforcement by us of our legal rights to exploit its properties may not be recognized by the government of Mexico or by its court system. These risks may limit or disrupt our operations, restrict the movement of funds or result in the deprivation of contractual rights or the taking of property by nationalization or expropriation without fair compensation. The economy and political system of Mexico should be considered by investors to be less predictable than those in countries in which the majority of investors are likely to be resident. The possibility that the current, or a future, government may adopt substantially different policies, take arbitrary action which might halt production, extend to the re-nationalization of private assets or the cancellation of contracts, the cancellation of mining and exploration rights and/or changes in taxation treatment cannot be ruled out, the happening of any of which could result in a material and adverse effect on our results of operations and financial condition.

12

We face competition in many areas of our business.

We will compete with other companies engaged in the mining industry, most of which are larger than us. Therefore, we will face substantial competition in connection with the hiring and retaining of highly qualified mining, metallurgical, financial and administrative personnel, which creates a high degree of risk. Among our competitors are BHP/Billeton and Phelps Dodge, as well as numerous other foreign and domestic companies in the mining business. Many of these competitors are well established, have substantially greater financial and other resources than we have, and have an established reputation for success in mining that will be competitive with our operations.

In addition, the mineral exploration, development, and production industry is largely un-integrated. We compete with other exploration companies looking for mineral resource properties. While we compete with other exploration companies in the effort to locate and acquire mineral resource properties, we will not compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of mineral products. Therefore, we will likely be able to sell any mineral products that we identify and produce.

In identifying and acquiring mineral resource properties, we compete with many companies possessing greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future.

Accordingly, there can be no assurance that we will be able to compete successfully with other companies or that we will ever achieve profitability.

SPECIFIC RISKS RELATING TO THE COMPANY AND OUR COMMON STOCK

We have not paid dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if its stock price appreciates.

There is a limited market for our common stock which may make it more difficult to dispose of your stock.

Our common stock is currently quoted on the Over the Counter OTC QB market under the symbol "ISLV". There is a limited trading market for our common stock. Accordingly, there can be no assurance as to the liquidity of any markets that may develop for our common stock, the ability of holders of our common stock to sell our common stock, or the prices at which holders may be able to sell our common stock.

We may have difficulty in attracting and retaining management and outside independent members to our board of directors as a result of their concerns relating to their increased personal exposure to lawsuits and stockholder claims by virtue of holding these positions in a publicly held company.

The directors and management of publicly traded corporations are increasingly concerned with the extent of their personal exposure to lawsuits and stockholder claims, as well as governmental and creditor claims which may be made against them, particularly in view of recent changes in securities laws imposing additional duties, obligations and liabilities on management and directors. Due to these perceived risks, directors and management are also becoming increasingly concerned with the availability of directors and officers liability insurance to pay on a timely basis the costs incurred in defending such claims. We currently do not carry limited directors and officer’s liability insurance. Directors and officers liability insurance has recently become much more expensive and difficult to obtain. If we are unable to provide directors and officers liability insurance at affordable rates, it may become increasingly more difficult to attract and retain qualified outside directors to serve on our board of directors.

13

We are effectively controlled by our management.

Our senior management owns in the aggregate a majority of our outstanding common stock. Accordingly, they will be able to elect our entire board of directors, and to take action requiring stockholder approval without the vote of other stockholders, subject to governing laws, rules and regulations. Investors in the Company will thus have little ability to influence our business or operations.

Our directors have the right to authorize the issuance of shares of our preferred stock and additional shares of our common stock.

Our directors, within the limitations and restrictions contained in our articles of incorporation and without further action by our stockholders, have the authority to issue shares of preferred stock from time to time in one or more series and to fix the number of shares and the relative rights, conversion rights, voting rights, and terms of redemption, liquidation preferences and any other preferences, special rights and qualifications of any such series. Any issuance of additional shares of preferred stock could adversely affect the rights of holders of our common stock. Should we issue additional shares of our common stock at a later time, each investor's ownership interest in our stock would be proportionally reduced. No investor will have any preemptive right to acquire additional shares of our common stock, or any of our other securities. A sale of a substantial number of shares of our common stock may cause the price of its common stock to decline. If our stockholders sell substantial amounts of the Company’s common stock in the public market, the market price of its common stock could fall. These sales also may make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

Our issuance of shares of common stock to management at a price below market value may affect our financial statements.

During 2009, we issued 3,200,000 shares of common stock to our officers. In our financial statements we reflected the compensation at $0.01 per share, which reflected a discount from the quoted price of $0.40 per share. At the time of the grant, October 6, 2009, there had been no reported trading in our common stock approximately six months prior to the issuance of the shares. Although we believe that the valuation is reasonable in view of the absence of any trading in our common stock for the six months prior to issuance, in the event that the SEC disagrees with our conclusion, it may be necessary for us to restate our financial statements, which would have the effect of increasing our loss for 2009.

Because we restated our financial statements in 2009, investors may lack confidence in our ability to present financial information and it may be difficult for us to raise funds for our operations.

We restated our financial statements for the year ended December 31, 2009 and if the SEC disputes our valuation of shares issued to related parties, we may be forced to further restate our financial statements for 2009. Potentially, any need to restate our financial statements would reflect the inadequacy of our disclosure controls and our controls over financial reporting and may impair our ability to raise funds we require for our operations and may otherwise impair our operations and our relationships with our investors. Further, we cannot assure you that further restatements for other reasons will not be required. Efforts to comply with securities laws and regulations will increase our costs and require additional management resources, and we still may fail to comply.

The SEC requires us, as a reporting company, to include a report of management on our internal controls over financial reporting in our annual reports on Form 10-K. O ur chief executive officer and chief financial officer, neither of which is an accountant, have concluded that our financial controls are in effective, we cannot assure you that, if our controls were reviewed by our independent registered accounting firm, such firm would reach the same conclusion. We have not engaged any independent firm to evaluate our internal controls or to make recommendations with respect to internal controls. If our auditors are unable to conclude that we have effective internal controls over financial reporting, investors could lose confidence in the reliability of our financial statements, especially in view of our need to restate prior financial statements, which could result in a decrease in the value of our securities. We cannot assure you that we will be able to adequately address in a timely manner any internal controls issues in a timely manner. Further, although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts companies with a public float of less than $75 million from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal controls over financial reporting and will not affect the requirement to include the auditor’s attestation if our public float exceeds $75 million. Regardless of whether we are required to receive an attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, especially in view of our need to restate financial statements for the years ended December 31, 2009, potential investors may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer

14

Our common stock is thinly traded and the market price of our common stock is very volatile, leading to the possibility of its value being depressed at a time when you may want to sell your shares.

Our stock is quoted on the OTC QB, the middle tier of the OTC market. It had previously been quoted on the OTC Bulletin Board and the OTC Pink. The OTC QB is not a stock exchange. There is not an active market for our common stock. There may be many periods, some of significant duration, in which there is no or insignificant trading volume in our common stock. The absence of any significant activity can result in a very volatile stock. When there is little trading activity, the purchase or sale of a relatively small number of shares could result in a disproportionate change in the stock price. In addition, numerous other factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. In addition to market and industry factors, the price and trading volume for our common stock may be highly volatile for specific business reasons. Securities class action litigation is often instituted against companies following periods of volatility in their stock price. This type of litigation could result in substantial costs to us and divert our management’s attention and resources.

Our common stock is subject to the "Penny Stock" rules of the SEC and the trading market in our securities is limited, which makes transaction in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted Rule 3a51-1 which establishes the definition of a "penny stock," for the purposes relevant to us, is any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9 requires: that a broker or dealer approve a person's account for transactions in penny stocks; and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must: obtain financial information and investment experience objectives of the person; and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form: sets forth the basis on which the broker or dealer made the suitability determination; and that the broker or dealer received a signed, written agreement from the investor prior to the transaction. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Item 2. Properties

Our Corporate Offices

Tucson, Arizona

Our corporate offices, which are located at 5210 E. Williams Circle, Suite 700, Tucson, Arizona 85711, are leased from an affiliate, Atlas Precious Metals, Inc., who have a five-year lease with WC Partners, a Los Angeles, California-based company, whereby Atlas Precious Metals pays a base rent of $8,393 monthly, including utilities. We pay Atlas Precious Metals Inc. $500 per month for our space at this location. Our space is adequate for our purposes.

15

Exploration Properties and Claims

We may explore for various metals, including gold, silver, copper, lead, manganese, zinc, barite; however, our initial primary activities will focus on the exploration of silver. Our exploration rights were obtained through outright property acquisition, staking of federal mining claims on lands managed by the U.S. Bureau of Land Management ,purchase options of privately held surface and mineral rights, purchase of unpatented claims on Bureau of Land Management managed federal lands and through exploration leases. All are held by International Silver without underlying royalty interests . Our properties are located in San Bernardino County, California and the Pioche mining district of Lincoln County, Nevada. These properties and the land tenure are further discussed in later sections as:

|

●

|

The Prince Mine

|

|

| ● | The Pan American Mine | |

| ● | T he Castelton Concentrator | |

|

●

|

The Calico Silver Project.

|

|

With respect to our properties for exploration purposes, our properties may or may not progress to the development stage. We are subject to competitive conditions for exploration properties since our competitors may be in a better operational and financial position to compete against us for desirable properties. Additionally, there are material issues regarding whether we do or do not insure our properties.

The Pioche Mining District, Lincoln County, Nevada

Introduction:

Our principal area of interest is the Pioche District of Lincoln County, Nevada. We believe that this District represents a unique opportunity in North American mining, in that, we have secured control of a large portion of a very unique silver district and plan to continue to expand our holdings in this area. For the next few years, we will exclusively devote our attention to this district, to completing the acquisition of the Prince and Pan American Mines and the Caselton Concentrator, all of which we have under a lease with purchase option. Having a complete concentrator will enable us to a ffect a relatively quick start of production at a time when metal prices are at unprecedented highs. Much of the mineral ization in the district is completely oxidized, making it potentially amenable to low cost sulfuric acid leaching, solvent extraction and electro-winning to produce special high grade zinc, obviating the need for downstream smelting and dramatically increasing our recovery of zinc. The acid leaching will convert the lead to an insoluble lead sulfate which will act as a collector of precious metals and is amenable to re-flotation to produce a commercial lead/precious metals concentrate. Manganese will require reduction ahead of leaching, to produce a commercial electro-manganese dioxide through electro-winning. The district is of a size that may give many years of profitable commercial operations. Strong indications are that an open pit ore body may exist between the Prince Mine and the Caselton Concentrator and our initial exploration will be in this area and then in exploring the fully developed, but inactive, Pan American Mine.

History:

Silver was discovered on the eastern slope of the Pioche Mountains in 1869 and exploited for high grade, bonanza silver ore until the 1930's when the known fissures were fundamentally depleted. This ore occurred in brecciated fissure veins hosted in the Cambrian age Prospect Mountain Quartzite. This type of ore was found near the town of Pioche mostly in the Treasure Hill area. The veins ranged in thickness from one to four feet, with swells up to ten feet, but the three most productive extended for several thousand feet in strike and to a depth of 1200 feet. The silver ore was mostly oxidized and contained lead as cerussite, some galena, with silver chloride and argentite. Supergene processes apparently removed the zinc from the non-reactive siliceous rock which was likely present in the original sulfides.

16

Just to the west of the bonanza silver vein area and extending from it into exposures of stratigraphically higher limestones and shales, bedded replacement lead/zinc/silver ore was discovered. The lower part of the Combined Metals Member of the Pioche Shale has been the most productive sequence for non-oxidized sulfide replacements. This unit is the first of the beds enclosed in shales directly above the Cambrian age, Prospect Mountain Quartzite. An east-west structural zone termed the Caselton Channel was found to host replacement mineralization for a strike of over 10,000 feet. The ore zone ranged in thickness from 4 to 40 feet, averaged six feet and had a width of 100 to 1800 feet. The grade of the 3.2 million tons of sulfide ore mined between 1924 and 1959 averaged 4.8 ounces of silver, 0.044 ounces per ton gold, 4.5% lead and 12% zinc. The ore consisted primarily of sphalerite, galena and pyrite in a gangue of manganiferous siderite and minor quartz. Oxidized replacements exist above the sulfide zone but were only partially mined mostly due to smelting issues.

Geology:

The Pioche Mining District encompasses roughly the northern half of the Pioche Hills but extends into the Highland Range to the west . Th e Pioche Hills are a relatively minor mountain range that follows a northwest trend between Meadow and Lake Valleys. This trend is in marked contrast to the ranges both east and west which align themselves north-south. The Pioche Hills are largely composed of Cambrian sedimentary rocks but these are obscured on the southeast flank where overlain by Tertiary volcanic flow rocks. The mineralized area is entirely within Paleozoic sediments. The principal formations in ascending order are the Prospect Mountain Quartzite, Pioche Shale, Lyndon Limestone, Chisholm Shale and Highland Peak Limestone.

The structural setting of the Pioche Hills has been interpreted mostly in terms of regional thrust faulting. The exposed Paleozoic sedimentary rocks were apparently overridden by a regional thrust plate. This plate termed the Highland thrust consists of a stacked sequence of Upper Cambrian sediments similar to the lower plate but may include some Tertiary volcanic rocks as well. The Highland Peak Formation and a stratigraphic section down to the lower part of the Lyndon Limestone were displaced eastward along the thrust structures. Some flat thrust faults tend to follow shale beds and cut out thicknesses of rock units with little obvious physical expression.

The early Tertiary (and possibly similar pre-Mesozoic?) structures have in turn been displaced by subsequent events. The most traceable set of faults are related to Tertiary extensional basin and range faulting. There appears to be a strike slip component to these major features. They tend to strike north and dip away from the range. Further, the Cambrian rocks are offset by a series of closely spaced, northeast trending normal faults which drop the strata deeper toward the center of the range.

Both the Prince and Pan American Mines were underground mines which were developed on the very large sulfide replacement "channels" or structural zones containing silver, zinc, lead, gold and manganese with commercial ore grades, but with varying grade in each channel. The three principle and most significant channels are the Caselton Channel, the Prince Channel and the Pan American Channel. These channels are known to extend for several miles in length and range from 100 feet to as much as 1,800 feet wide with ore up to 90 feet thick. Typically, they historically grade d 2.3 ounces of silver and 0.02 ounces of gold per ton, 2.5% lead, 3.5% zinc and 12% manganese dioxide.

While the initial operations of both Prince and Pan American both focused on sulfide replacement ore bodies in limestone with much higher grades, massive oxidized mineralization is believed to remain which ha s only been minimally mined. As technology has advanced, significant opportunity remains in using the very low cost acid leaching of oxidized zinc, followed by solvent extraction and electro-winning to produce special high grade zinc cathode which can be sold at a premium. In the solvent extraction process, sulfuric acid is regenerated for re-use which minimizes costs of operation. These methods of processing oxide ores will be evaluated in conjunction with our exploration activities in the district.

17

Property Description, Geology and History

The Prince Mine

An exploration lease with an option to acquire the Prince Mine property was entered into by International Silver on November 6, 2010 as further discussed in Note D. The initial land position held under the lease/option consists of twelve patented lode mining claims held in fee simple title by Prince Mine LLC. These claims comprise 227 acres of surface and mineral rights. Shoud the purchase rights be exercised the property title will transfer to International Silver without a retained royalty. Subsequent to the exercise of the lease, International Silver acquired through Federal mining law by location, an additional 495 acres in 25 lode mining claims on BLM managed lands next to the patented leased land. The lease / option requires annual payments to the lessor. The Federal lode mining claims require annual maintenance fee payments to the U.S. BLM.

The geology of the Prince Mine is characterized by substantial faulting and displacement of the silver – lead – zinc - gold carbonate replacement type of mineralization . The Prince member of the Lyndon formation has been uplifted along a northwest trending mineralized structure bringing a large block of oxidized mineralization very near the surface, to within ten feet in some areas. International Silver sampling and analysis indicates that this mineralizing structure likely continues past all known workings in the mine and past any drilling, and most likely intersects the Caselton Channel to the North. Our exploration target is an open pit ore body hosting as much as 15 million tons of mineralized material in these carbonate replacement horizons.

The Prince Mine is a n historic underground silver producer w hich reportedly contains over 2 million tons of historically measured in-situ ore grade mineralization accessible through existing workings. Its main shaft is 850 feet deep and has several levels of drifts extending outward. It is located 1.5 miles from the Caselton Concentrator, a 1,500-ton per day minerals processing plant. Our immediate focus will be to explore the mineral ized zone through geochemical and geophysical surveys and surface drilling. Due to its proximity to the surface, the drill holes will be relatively shallow, 1000 feet or less . At the same time, access to underground workings will be cleaned and repaired to allow inspection and verification sampling. The program hopes to delineate mineralization amenable to mining but there are presently no known mineable reserves established for the mine property.

The Pan American Mine

An exploration lease with option to acquire the Pan American Mine and the Caselton Concentrator was entered into by International Silver on December 21, 2010 as further discussed in Note D. The land position at the Pan American Mine consists of 44 patented lode mining claims held in fee simple by Pan American Zinc Company, a Nevada corporation. These claims comprise approximately 900 acres of surface and mineral rights. In addition, 78 federal unpatented lode mining claims over some 1600 acres were also included under the lease. If acquired through exercise of the option to purchase, all right, title and interest to the property is to be transferred without a retained royalty. Mining or exploration on the unpatented federal claims will require acceptance of a new and updated Plan of Operation by the Bureau of Land Management. As lessee International Silver is responsible for payment of the annual BLM maintenance fees necessary to maintain the owner’s rights to the claims. Monthly payments to the owner are also necessary to maintain the lease/option.

The Pan American Mine last operated as a Joint Venture between the Anaconda Corporation and the Bunker Hill Company which mined at a rate of 1, 5 00 tons per day of sulfide replacement ore grading 2 ounces of silver and 0.0 05 ounces of gold per ton, 1.2 % lead, 2 .4% zinc and 9 % manganese as carbonate. The ore was trucked 1 6 miles to the Caselton Concentrator for processing. A clean zinc concentrate containing an average of 5 4 % zinc, and a lead/precious metals concentrate grading 60% lead with 58 ounces per ton silver were produced. The lead/precious metals concentrates as well as the zinc concentrates, were shipped by rail to the Bunker Hill Company's smelting and refining complex in Kellogg, Idaho. That refining complex is now closed.

18

Mine records of the Pan American Mine indicate that between 1.7 and 6.0 million tons of similar grade mineralization may exist in the mine but has been offset downward by faulting. The remaining offset has been identified through drilling but a measured reserve has not been established.

The mine operated as a room and pillar mine which allowed bulk mining using rubber tired haulage and mining equipment. The main entry adit is in very good condition as are haulage ways within the mine but much of the development is now under water. The remaining mineralization reported by Bunker Hill is sulfide in nature and amenable to processing at the existing facilities . In addition there may be substantial amounts of undefined oxidized mineralization in the Pan American Channel above and adjacent to the mine. However, there are currently no known mineable ore reserves established for the mine at this time.

The focus of International Silver as regards the Pan American will be to determine how much readily accessible mineralization remains in the mine that could support a rapid start of operations with the Caselton Concentrator and to quantify the cost thereof. At the same time, the oxide resources of the Pan American Channel will be defined to determine their potential. This program consists of engineering and exploration only, and is to be conducted in advance of any future determination of the feasibility of renewed mining operations.

The Caselton Concentrator

The Caselton Concentrator is a 1500 ton per day sulfide flotation mill located on 33 acres of fee land with surface rights only in sections 28 and 29 T1N R67E MDBM Lincoln County Nevada. A lease with option to acquire the property was included with the lease option of the Pan American Mine. Subsequently International Silver caused to be located some 22 unpatented federal lode mining claims comprising approximately 450 acres on BLM managed land adjacent to the Concentrator. These mining claims were located over the western extension of the mineralized ore zone previously mined at the Caselton #2 Mine. Although highly prospective, the claims host no known mineable reserves and are held for exploration. An annual maintenance fee of $140/claim must be paid each August in order to maintain the rights to explore and possibly mine the unpatented claims.

The Caselton Concentrator facility was first constructed to process ores from the Combined Metals Reduction Company Caselton #2 Mine in 1944. The concentrator was subsequently refurbished to process ore from the Pan American Mine in 1966 and again refurbished in 1976. It was last operated commercially in 1978 and has been held on a care and maintenance status since that time. Although basically sound, much of the equipment, particularly the electrical components, will require modernization prior to operation. Roof panels also need replacement in the primary crushing section.

The mill is arranged to produce lead – silver concentrates and zinc concentrates. It is equipped with a two stage crushing circuit which feeds eight 550 ton fine ore storage bins. The bins feed three grinding and classification units which in turn provide feed for three flotation circuits capable of producing lead, zinc and manganese products through roughing, cleaning and scavenging lines. Three concentrate thickeners dewater the products prior to a three disk vacuum filtration plant. A single 120’ diameter tailings thickener is present to assist water conservation and tailings disposal. There are no lined tailings disposal areas to service the facility at present and such facilities will need to be designed and permitted prior to operation of the concentrator facility. Power is supplied to the facility by the Lincoln County Power District through an adjoining 69 KV transmission line from the Hoover Dam. Water for processing is secured by rights to pump the Caselton #2 Mine which was historically adequate to supply the mill. Rail service for concentrate shipping was formerly provided by the U.P. directly to the Concentrator but has since been discontinued. The nearest rail siding is now at the town of Caliente Nevada, approximately 20 miles distant.

Property Location and Access

The International Silver Inc. Pioche Mining District properties are located near the town of Pioche, the county seat of Lincoln County Nevada U.S.A. State highway 93 serves Pioche. The Prince Mine is about two miles southwest of the town and the Caselton Concentrator is about one and one half miles north-northwest of the Prince Mine. Both are accessed by paved state road 320 which connects to highway 93. The Pan American Mine is twelve air miles west of Caselton and is accessible by sixteen miles of graded county road, the Pan American Road. The following maps further illustrate the access and relative positions of the Pioche District properties.

19

20

21

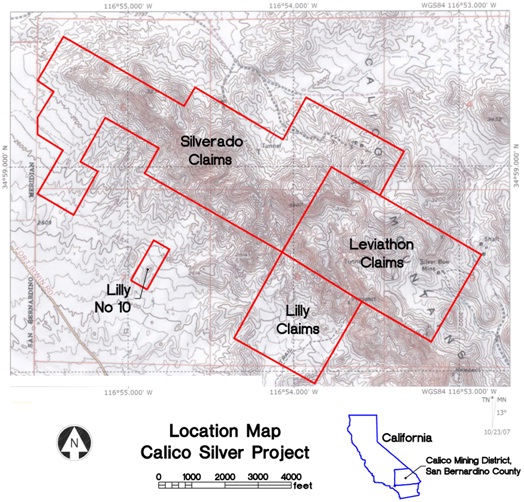

Calico Silver Project

The Calico Silver Project is an exploration project with a substantial land position in an area of known bulk mineable disseminated silver-barite mineralization. A wide and elongated zone of epithermal silver-barite veining which is exposed on the property will be the area initially investigated.

Geology and History

The project is in the Calico Mining District of Southern California. The district has been the site of historic underground mining of bonanza grade silver deposits since the 1880’s and more recently has attracted notice for the discovery of large tonnage disseminated silver deposits. The mineralization of the Calico Silver Project occurs in a series of parallel veins up to 50 feet wide in a zone several hundred feet wide and primarily visible at the surface. The veins strike NW/SE, dip steeply to almost vertical, and are traceable for 1.25 miles on the Leviathon claims . Country rock is tertiary volcanics in related pyroclastic and sedimentary formations. The Leviathon vein system is located northeast of the Calico Fault. The Lilly claims are southwest of the fault in argillically altered tuffaceous sediments of the Barstow formation. These claims lie directly between two known disseminated silver deposits, the Waterloo and Langtry but have not been adequately tested by exploration drilling.

Over 100,000 tons of barite ore wa s mined in the early 1950’s on the claims by open pit methods in a large cut known as the Leviathon Mine. Approximately 50,000 tons of drilling mud grade barite was shipped. Previous to this, all workings on the property were for underground silver mining in the Silverado Mine and the Silver Bow Mine and is believed to have occur red in the late 1890’s. Records are sketchy and no reliable information on these two mines has been located. The above information pertaining to mining only depicts historical information and has no significance whatsoever whether mineable mineral deposits presently exist on the mining claims. The claims are held for exploration only as no mineable mineral reserves have as yet been discovered or developed.

Property Description

The Calico Silver Property consists of 60 unpatented Federal lode mining claims, which were acquired through staking and filing Notices of Location with the Bureau of Land Management. The Claims are grouped as Leviathon, Silverado and Lilly groups that were located in September and October 2007, at which time the Bureau of Land Management approved the Company’s Notice of Location for Lode Mining Claims accepting that we have located and have the right to the unpatented mining claims. Each claim generally consists of 20. 66 acres for a total of 1,30 0 acres. Annual maintenance fees of $140 per claim are required to be paid to the BLM each August in order to maintain the rights to explore and possibly mine on the federal land.

Property Location and Access

The Calico Silver Project, is located approximately 15 miles northeast of the town of Barstow, California, 145 miles northeast of Los Angeles. The small communities of Dagget and Yermo, California lie about six miles east from Barstow on Interstate 15 and taking the Meridian Road exit, then east one mile on Frontage Road to the Yermo cutoff, then 3.2 miles north on Merdian Road to the paved portion of the Randberg-Barstow Road, then two miles north to a dirt road which leads eastward onto the claims. Access to the property is accessible year round. There are no weather related conditions preventing access to the property on a year round basis. We know of no overriding environmental or archeological issues related to this property although it is located within the Mohave Desert Conservation Area and will be held to the applicable environmental compliance standards associated with that area. The property is an exploration stage project without reserves and the sources for power and water, should exploration be successful, have yet to be determined.

22

23

Item 3. Legal Proceedings

There are no pending or threatened lawsuits against us.

Item 4. (Removed and Reserved)

PART II

Item 5. Market Price of and Dividends on our Common Equity and Related Stockholder Matters.

Market Information