Attached files

| file | filename |

|---|---|

| EX-31.1 - SECTION 302 CEO CERTIFICATION - IMPERIAL PETROLEUM INC | d244922dex311.htm |

| EX-32.1 - SECTION 906 CEO CERTIFICATION - IMPERIAL PETROLEUM INC | d244922dex321.htm |

Table of Contents

SECURITIES EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 31, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-09923

IMPERIAL PETROLEUM, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 95-3386019 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer identification No.) |

101 NW First Street, Suite 213

Evansville, IN 47708

Registrant’s telephone number, including area code (812) 867-1433

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 13(g) of the Act:

Common Stock. $0.006 par value per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of the Regulation K is not contained herein, and will not be contained to the best of the Registrant’s knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-Accelerated filer x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ¨ No x

On July 31, 2011, there were 34,905,136 shares of the Registrant’s common stock issued and outstanding. The aggregate market value of the Registrant’s voting stock held by non-affiliates is $30,160,758. See Item 5. Market for Registrant’s Common Stock and Related Stockholder Matters.

Documents Incorporated by Reference: NONE

Table of Contents

IMPERIAL PETROLEUM, INC

FORM 10-K

FISCAL YEAR ENDED JULY 31, 2010

| Page | ||||||

| PART I | 1 | |||||

| ITEM 1. | 1 | |||||

| 1 | ||||||

| 3 | ||||||

| 4 | ||||||

| 4 | ||||||

| 6 | ||||||

| ITEM 1A. | 6 | |||||

| ITEM 2. | 16 | |||||

| 17 | ||||||

| 26 | ||||||

| Principal Exploration and Development Projects: Mining Ventures |

29 | |||||

| 29 | ||||||

| 31 | ||||||

| 32 | ||||||

| 32 | ||||||

| 32 | ||||||

| 33 | ||||||

| 33 | ||||||

| ITEM 3. | 33 | |||||

| ITEM 4. | 34 | |||||

| PART II | 35 | |||||

| ITEM 5. | Market For Registrant’s Common Stock; and Related Stockholder Matters |

35 | ||||

| ITEM 6. | 35 | |||||

| ITEM 7. | Management’s Discussion and Analysis of the Financial Condition and Results of Operations |

35 | ||||

| 35 | ||||||

| 38 | ||||||

| 39 | ||||||

| 40 | ||||||

| 40 | ||||||

| 40 | ||||||

| 40 | ||||||

Table of Contents

| ITEM 7A. |

40 | |||||

| 40 | ||||||

| 41 | ||||||

| ITEM 8. | 41 | |||||

| ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. |

41 | ||||

| ITEM 9A. | 41 | |||||

| 42 | ||||||

| ITEM 9B. | 42 | |||||

| PART III | 43 | |||||

| ITEM 10. | 43 | |||||

| 43 | ||||||

| 43 | ||||||

| 44 | ||||||

| ITEM 11. | 45 | |||||

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management |

46 | ||||

| ITEM 13. | 46 | |||||

| ITEM 14. | 47 | |||||

| PART IV | 48 | |||||

| ITEM 15. | Exhibits, Financial Statement Schedules and Reports on Form 8-K |

48 | ||||

| 50 | ||||||

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

In the interest of providing the Company’s stockholders and potential investors with certain information regarding the Company’s future plans and operations, certain statements set forth in this Form 10-K relate to management’s future plans and objectives. Such statements are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934, as amended. Although any forward looking statements contained in this Form 10-K or otherwise expressed on behalf of the Company are, to the knowledge and in the judgment of the officers and directors of the Company, expected to prove to come true and to come to pass, management is not able to predict the future with absolute certainty. Forward looking statements involve known and unknown risks and uncertainties which may cause the Company’s actual performance and financial results in future periods to differ materially from any projection, estimate or forecasted result. These risks and uncertainties include, among other things, volatility of commodity prices, changes in interest rates and capital market conditions, competition, risks inherent in the Company’s operations, the inexact nature of interpretation of seismic and other geological, geophysical, petro-physical and geo-chemical data, the imprecise nature of estimating reserves, events that deprive the Company of the services of its Chairman of the Board, Chief Executive Officer and largest shareholder, and such other risks and uncertainties as described from time to time in the Company’s periodic reports and filings with the Securities and Exchange Commission. Accordingly stockholders and potential investors are cautioned that certain events or circumstances could cause actual results to differ materially from those projected, estimated or predicted. The Company does not intend to update forward-looking statements. You should refer to and carefully review the information in future documents we file with the Securities and Exchange Commission.

Table of Contents

As used in this Form 10-K, the following terms shall have the following meanings.

Biodiesel and Biofuels:

“ASTM” refers to the American Society for Testing and Materials International, an organization that develops and delivers international voluntary consensus standards, including United States standards for fuel.

“ASTM D6751” refers to the ASTM specification for pure biodiesel, or B100, in the United States.

“ASTM D7467” refers to the ASTM specification for biodiesel blends in the United States from 6% to 20% biodiesel.

“ASTM D975” refers to the ASTM specification for diesel fuel in the United States, which includes up to 5% biodiesel.

“Biodiesel” means ASTM quality transportation fuel made from renewable vegetable, mineral, or animal fats and oils.

“B2, B5, B6, B10, B11, B99.9 and B100” refer to blends of biodiesel with petroleum-based diesel. The number represents the biodiesel percentage of the blend. For instance, a blend of 5% biodiesel and 95% petroleum-based diesel would be represented as B5.

“blender’s tax credit” refers to the federal excise tax credit of $1.00 per gallon of biodiesel that is available to the person who blends biodiesel with petroleum-based diesel.

“BQ-9000” refers to a cooperative and voluntary program for the accreditation of biodiesel producers and marketers. The program combines the ASTM standard for biodiesel, ASTM D6751, and a quality systems program that includes storage, sampling, testing, blending, shipping, distribution and fuel management practices.

“CBOT” refers to the Chicago Board of Trade.

“MMGY” refers to million gallons per year.

“nameplate production capacity” refers to the production capacity of a particular facility based on the expected annual throughput in gallons based upon producing at 100% of design capacity for approximately 330 days per year using a particular feedstock.

“Obligated Parties” refers to petroleum refiners and petroleum fuel importers in the 48 contiguous states and Hawaii that have annual renewable fuel volume obligations to use biofuels under RFS2.

“OPIS” refers to the Oil Price Information Service.

“RFS” refers to the renewable fuel standard created under the Energy Policy Act of 2005, which established the first renewable fuel volume requirement in the United States.

“RFS2” refers to the expanded renewable fuel standard that became effective July 1, 2010 requiring for the first time that a specific portion of the diesel fuel consumed in the United States annually be renewable.

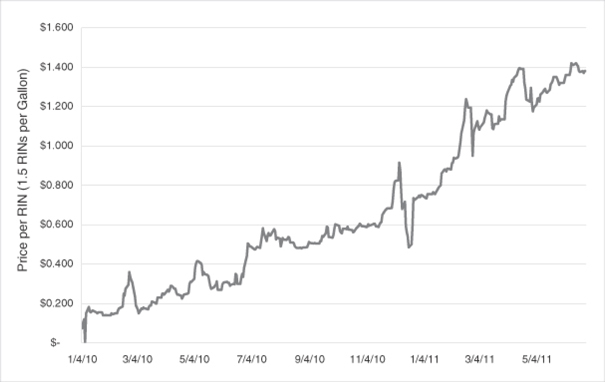

“RIN” refers to a renewable identification number, which is a unit of measurement generated in connection with the production or importation of renewable fuel that may be used to satisfy certain renewable fuel requirements of RFS2.

“RVO” refers to a renewable volume obligation, the annual renewable fuel volume requirement for an Obligated Party under RFS2.

1

Table of Contents

“ULSD” refers to ultra low sulfur diesel, which is diesel fuel containing 15 parts per million or less of sulfur, which is the current United States standard for on-road diesel fuel.

Oil & Natural Gas & Mining:

“Base Metals” refers to a family of metallic elements, including copper, lead and zinc.

“Bbl” means barrel.

“Bcf” means billion cubic feet.

“BOE” means equivalent barrels of oil.

“Company,” unless the context requires otherwise, means Imperial Petroleum, Inc., a Nevada corporation (“Imperial”) and its consolidated subsidiaries. Ridgepointe Mining Company, a Delaware corporation (“Ridgepointe”), , Phoenix Metals, Inc., dba The Rig Company a Texas corporation (“Phoenix”), Hoosier Biodiesel Company (formerly Global/Imperial Joint Venture Inc.) a Nevada corporation and e-Biofuels, LLC, an Indiana limited liability corporation.Phoenix was acquired effective April 30, 1997. Phoenix has conducted limited activities since 1997 as Imperial Environmental Company and subsequently as The Rig Company although it has not officially changed its name and now operates under the d/b/a of Imperial Chemical Company. Hoosier Biodiesel Company was incorporated in Nevada in 2000. The Company acquired 100% of the equity of e-Biofuels, LLC, effective on May 24, 2010, and as a result e-Biofuels, LLC became a wholly-owned subsidiary of the Company and its results of operations and financial statements are consolidated beginning on that date.

“Grade” refers to the metal or mineral content of rock, ore or drill or other samples. With respect to precious metals, grade is generally expressed as troy ounces per ton of rock.

“Gross” refers to the total leasehold acres or wells in which the Company has a working interest.

“MBbls” means thousand barrels.

“MBOE” means thousands equivalent barrels of oil.

“Mcf” means thousand cubic feet.

“Mcfe” means thousand cubic feet equivalent.

“Mineable” refers to that portion of a mineral deposit from which it is economically feasible to extract ore.

“MMBbls” means million barrels.

“MMcf” means million cubic feet.

“Mmcfe” means million cubic feet equivalent.

“Net” refers to gross leasehold acres or wells multiplied by the percentage working interest owned by the Company.

“Net production” means production that is owned by the Company less royalties and production due others.

“Net Smelter Royalty” is a royalty based on the actual sale price received for the subject metal less the cost of smelting and/or refining the material at an offsite refinery or smelter along with off-site transportation costs.

“Oil” includes crude oil, condensate and natural gas liquids.

“Patented Mining Claim” is a mining claim, usually comprising about 20 acres, to which the US Government has conveyed title to the owner.

“Proved developed reserves” are those reserves which are expected to be recovered through existing wells with existing equipment and operating methods.

“Proved reserves” are estimated quantities of crude oil, natural gas and natural gas liquids, which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions.

2

Table of Contents

“Proved undeveloped reserves” are those reserves which are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion.

“Unpatented Mining Claim” is a mining claim which has been staked or marked out in accordance with federal and state mining laws to acquire the exclusive rights to explore for and exploit the minerals which may occur on such lands. The title to the property has not been conveyed to the holder of an unpatented mining claim.

Unless otherwise indicated herein, natural gas volumes are stated at the legal pressure base of the state or area in which the reserves are located and at 60 degrees Fahrenheit. Natural gas equivalents are determined using the ratio of six Mcf of natural gas to one Bbl of crude oil

Imperial Petroleum, Inc., a Nevada corporation (“the Company”), has three primary areas of activity in energy production: (a.) we own and operate a biodiesel production facility with a nameplate capacity of approximately 30 MMGPY in Middletown, Indiana and produce ASTM quality transportation biodiesel; (b.) we own a license to revolutionary tar sand producing technology and the surfactant used therein and (c.) we own operating oil and natural gas wells in Louisiana. Our shares of common stock are quoted on the Over-the-Counter Market (“OTCQX”). The OTCQX is an electronic trading service offered by the National Association of Security Dealers (“NASD”) that shows real-time quotes, last sale prices and volume information for over-the-counter equity securities.

A summary of our activities by segment is included below:

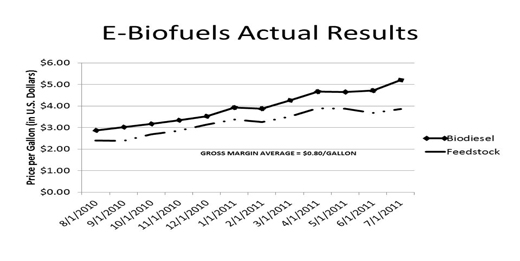

Biodiesel Production: We acquired e-Biofuels, LLC in May 2010. We produce and sell ASTM quality transportation biodiesel as our primary product and crude glycerine as our secondary product. We currently operate a 30 MMGPY nameplate capacity plant located in Middletown, Indiana. In fiscal 2010 and fiscal 2011, we sold approximately 1.9 million and 26.4 million gallons of biodiesel respectively, representing approximately 0.6% in 2010 and an estimated 2.9% of United States biodiesel production. We are currently operating at the capacity of our Middletown plant at approximately 2.5-3.0 million gallons per month and we are undertaking another capacity expansion of the facility to approximately 50 MMGPY at the present time. Our biodiesel business accounted for revenues of $5.5 million in fiscal 2010 and $109.6 million in revenues in fiscal 2011 and currently represents approximately 99.6% of our total revenues for fiscal 2011.

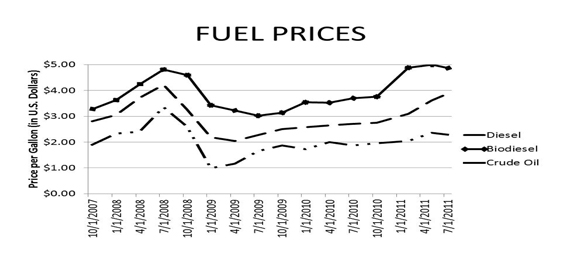

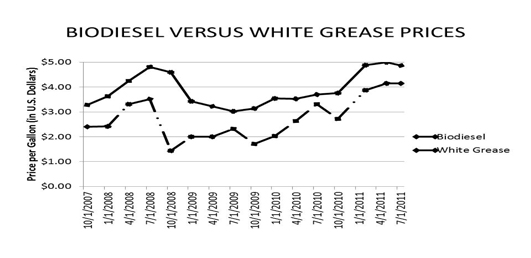

We are a low-cost biodiesel producer. We produce our biodiesel from a wide variety of feedstocks, including soy oil, inedible animal fat, used cooking oil and inedible corn oil. We also have the capability to re-process off-spec methyl esters into ASTM quality biodiesel. We believe our ability to process these feedstocks provides us with a cost advantage over many biodiesel producers, particularly those that rely exclusively on higher cost virgin vegetable oils, such as soybean oil and those facilities that are not feedstock flexible. We are a RIN certified generating facility, we are qualified as an advanced biofuels producer and we are BQ 9000 certified.

Biodiesel is a small but growing part of the distillate pool. According to the United States Energy Information Administration (EIA) the petroleum-based distillate market in the United States comprises some 53 billion gallons annually which includes diesel fuel, heating oil and fuel used for power generation. Biodiesel is compatible with the existing diesel and distillate fuel infrastructure and has been mandated as an additive to petroleum diesel and heating oil in ever-increasing amounts through 2022 under the Renewable Fuel Standard (RFS2) which became effective on July 1, 2010. RFS2 requires that Obligated Parties (primarily refiners and fuel jobbers) blend biomass-based additives to diesel through 2022. Under the current supervision of the United States Environmental Protection Agency (EPA), the mandates, (including advanced biofuels volumes for which biodiesel qualifies) are 1.375 billion gallons in 2011, 2.0 billion gallons in 2012 and 2.75 billion gallons in 2013. Biodiesel is currently the only commercially significant RFS2-compliant biomass-based diesel fuel additive produced in the United States. As a result, demand for biodiesel has increased significantly There are a number of other federal and state incentives for the production of biodiesel and other renewable fuels that are discussed under the section below: “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Heavy Oil Production: We formed Arrakis Oil Recovery, LLC in February 2010 to acquire a non-exclusive license for the development of a revolutionary new, eco-friendly process to recover oil (bitumen) from tar (oil) sands outside of Canada. The process is a non-thermal, mechanical and chemical process using a closed loop system to eliminate emissions. The process technology works equally well on oil-wet (US) tar sands or water-wet (Canadian) tar sands. We acquired an exclusive license to use the technology in Canada and completed an agreement with an international partner, wherein we retained an overriding royalty interest of 2.5% in the application of the process technology in Canada, Mexico, Venezuela,

3

Table of Contents

Russia and Argentina in exchange for relinquishing its technology rights outside the United States. We acquired the exclusive rights to manufacture, sell and distribute the chemical surfactant used in the tar sands process technology and set up a distribution facility in Houston, Texas. We have acquired 121 acres in Kentucky and are leasing additional acreage in the vicinity as we complete the permitting process. We intend to move the 2,500 ton per day commercial processing unit we constructed in Texas to a permanent site in Kentucky on our acreage and to begin mining and processing tar sands to recover the heavy oil for sale to refineries.

Oil and Natural Gas Production: At July 31, 2011, we operated 18 oil and gas wells in Louisiana. Net daily production from the Company’s oil and gas properties was approximately 12.5 Bopd and 18 Mmcfpd for the year ended July 31, 2011 although we have established more continuous production since May 2011 at about 70 Bopd. The Company’s estimated net proven oil and gas reserves as of July 31, 2011 were 311 MBO and 3,109 Mmcfg, respectively and has an estimated present value discounted at 10% of approximately $13.99 million.

Gold Mining: We are the operator and owner of certain claims in Utah comprising the Duke Gold Mine, although no significant operations occurred during the fiscal year.

The Company was incorporated on January 16, 1981 and is the surviving member of a merger between itself, Imperial Petroleum, Inc., a Utah corporation incorporated on June 4, 1979 (“Imperial-Utah”), and Calico Exploration Corp., a Utah corporation incorporated on September 27, 1979 (“Calico”). The Company was reorganized under a Reorganization Agreement and Plan and Article of Merger dated August 31, 1981 resulting in the Company being domiciled in Nevada. On August 11, 1982, Petro Minerals Technology, Inc. (“Petro”), a 94% -owned subsidiary of Commercial Technology Inc. (“Comtec”) acquired 58% of the Company’s common stock. Petro assigned to the Company its interests in two producing oil and gas properties in consideration for 5,000,000 shares of previously authorized but unissued shares of common stock of the Company and for a $500,000 line of credit to develop these properties. Petro has since undergone a corporate reorganization and is now known as Petro Imperial Corporation. On August 1, 1988 in an assumption of assets and liabilities agreement, the same 58% of the Company’s common stock was acquired from Petro by Glauber Management Co., a Texas corporation, (“Glauber Management”), a 100% owned subsidiary of Glauber Valve Co., Inc., a Nebraska corporation (“Glauber Valve”).

Pursuant to an Agreement to Exchange Stock and Plan of Reorganization dated August 27, 1993 (the “Stock Exchange Agreement”), as amended by that certain First Amendment to Agreement to Exchange Stock and Plan of Reorganization dated as of August 27, 1993, (the “First Amendment”), between the Company, Glauber Management, Glauber Valve, Jeffrey T. Wilson (“Wilson”), James G. Borem (“Borem”) and those persons listed on Exhibit A attached to the Stock Exchange Agreement and First Amendment (the “Ridgepointe Stockholders”). The Ridgepointe Stockholders agreed to exchange (the “Ridgepointe Exchange Transaction”) a total of 12,560,730 shares of the common stock of Ridgepointe, representing 100% of the issued and outstanding common stock of Ridgepointe, for a total of 12,560,730 newly issued shares of the Company’s common stock, representing 59.59% of the Company’s resulting issued and outstanding common stock. Under the terms of the Stock Exchange Agreement, (i) Wilson exchanged 5,200,000 shares of Ridgepointe common stock for 5,200,000 shares of the Company’s common stock representing 24.67% of the Company’s issued and outstanding common stock, (ii) Borem exchanged 1,500,000 shares of Ridgepointe common stock for 1,500,000 shares of the Company’s common stock representing 7.12% of the Company’s issued and outstanding common stock, and (iii) the remaining Ridgepointe Stockholders in the aggregate exchanged 5,860,730 shares of Ridgepointe common stock for 5,860,730 shares of the Company’s issued and outstanding common stock, representing, in the aggregate, 27.81% of the Company’s issued and outstanding common stock. The one-for-one ratio of the number of shares of the Company’s common stock exchanged for each share of Ridgepointe common stock was determined through arms length negotiations between the Company, Wilson and Borem.

The Ridgepointe Exchange Transaction was closed on August 27, 1993. As a result, Ridgepointe is now a wholly, owned subsidiary of the Company. At the time of acquisition, Ridgepointe was engaged in the development of a copper ore mining operation in Yavapai County, Arizona and, through its wholly owned subsidiary, I.B. Energy, in the exploration for and production of oil and gas in the Mid-continent and Gulf Coast regions of the United States.

In connection with the closing of the Ridgepointe Exchange Transaction, each member of the Board of Directors of the Company resigned and Wilson, Borem and Dewitt C. Shreve (“Shreve”) were elected Directors of the Company. In addition, each officer of the Company resigned and the Company’s new Board of Directors elected Wilson as Chairman of the Board, President and Chief Executive Officer, Borem as Vice President and Cynthia A. Helms as Secretary of the Company.

4

Table of Contents

Ms. Helms subsequently resigned and Kathryn H. Shepherd was elected Secretary. Mr. Borem, Mr. Shreve and Ms. Shepherd subsequently resigned and Mr. Malcolm W. Henley and Mrs. Stacey D. Smethers were elected to the Board. The Board of Directors further authorized the move of the Company’s principal executive offices from Dallas, Texas to its current offices in Evansville, Indiana.

As a condition to closing the Ridgepointe Exchange Transaction, the Company received and canceled 7,232,500 shares of the Company’s common stock from the Company’s former partner, Glauber Management, and 100,000 shares of the common stock of Tech-Electro Technologies, Inc from an affiliate of Glauber Management and Glauber Valve. In addition, pursuant to the terms of the First Amendment, Glauber Management or Glauber Valve, or their affiliates, were to transfer to the Company 75,000 shares of common stock of Wexford Technology, Inc. (formerly Chelsea Street Financial Holding Corp.) no later than October 31, 1993, which such transfer subsequently occurred.

Recent Transactions:

The Company formed Arrakis Oil Recovery, LLC in February 2010 to acquire a non-exclusive license for the development of a revolutionary new, eco-friendly process to recover oil (bitumen) from tar (oil) sands outside of Canada. The process is a non-thermal, mechanical and chemical process using a closed loop system to eliminate emissions. The process technology works equally well on oil-wet (US) tar sands or water-wet (Canadian) tar sands. The Company acquired an exclusive license to use the technology in Canada from Proven Technology in exchange for 1.0 million shares of its restricted common stock in July 2010. The Company signed a Term Sheet on September 1, 2010 to access capital for the construction of a commercial scale demonstration facility and construction of the commercial unit was completed in November 2010 and the Company completed an agreement with an international partner, Clean Sands International, Inc., which included rights to Clean Sands to develop the technology in Canada, Russia, Venezuela, Mexico and Argentina in exchange for a fee paid to the Company of $500,000, an ongoing royalty interest of 2.5% of gross proceeds in the facilities developed by Clean Sands, including a royalty of 1.65% for a facility to be located in the southeastern United States and constructed by Clean Sands. The Company limited its rights to use the technology to the United States as a result of the agreement and consolidated its interest in Arrakis by purchasing its partners. The Company now owns 100% of Arrakis. (See Form 8-K filed February 3, 2011 and incorporated herein by reference.)

The Company acquired e-biofuels, LLC on May 24, 2010, a biodiesel producer located in Middletown, Indiana with a nameplate capacity of 15 million gallons per year. The Company issued 2.0 million shares of its restricted common stock; $3.75 million in four-year term Promissory Notes with an interest rate of 10% and assumed approximately $15 million in debt as a result of the acquisition In May 2011 the principal noteholders converted their principal and accrued interest of approximately $4.0 million into 5,047,461 shares of the Company’s restricted common stock. (See Form 8-K filed May 16, 2011 and incorporated herein by reference.)

The Company signed consulting agreements with two parties in August 2010 and issued 1.4 million shares of its restricted common stock as compensation under the agreements. The consultants’ services are to assist the Company in the development of the Duke Gold Mine in Utah and to assist the Company in website development and maintenance and in the recovery of trade accounts receivable from oil and gas operations and the negotiation of accounts payable within our biofuels subsidiary.

Mr. Malcolm Henley resigned as a director of the Company effective August 16, 2010 due to personal reasons. There were no disputes between Mr. Henley and management of the Company or with its auditors. Mr. John Ryer was approved by the Board to replace Mr. Henley until the next regular shareholders meeting.

In December 2010 the Company agreed to acquire a 26% working interest in the Coquille Bay field and a 25% working interest in the Chrisjo Pipeline that services the Coquille Bay field for 250,000 shares of the Company’s restricted common stock. In addition, the Company agreed to acquire the balance of the pipeline partners’ interest for the issuance of up to 1.25 million additional shares of the Company’s restricted common stock. The purchase of the pipeline and additional interest in Coquille Bay is expected to save the Company approximately $3.00bbl and $1.00/mcf in transportation fees on its future production.

In June 2011, the Company acquired the exclusive rights to manufacture, sell and distribute SANDKLENE 950, the chemical surfactant used in the Arrakis tar sand recovery process in exchange for the payment of $150,000 in cash and 100,000 shares.

5

Table of Contents

In July 2011, Annalee Wilson resigned as a Director of the Company due to personal reasons. There were no disputes between Mrs. Wilson and management of the Company or with its auditors. Mr. Ben Campbell was approved by the Board to replace Mrs. Wilson until the next regular shareholders meeting.

Subsequent Events

On June 9, 2011, the Company entered into an engagement agreement (the “Engagement Agreement”) with Rodman & Renshaw, LLC to act as our exclusive placement agent (the “Placement Agent”) in connection with an offering of the Company’s securities (the “Offering”). On September 21, 2011 (the “Closing Date”), pursuant to a securities purchase agreement (the “Securities Purchase Agreement”), the Company completed the closing of the Offering for total subscription proceeds of $3,177,501.50 through the issuance of (i) 4,236,669 shares of our common stock at a price of $0.75 per share (the “Purchased Shares”) and (ii) five-year warrants (the “Warrants”) exercisable into 2,118,334 shares of common stock (the “Warrants Shares”) equal to 50% of the Purchased Shares at an exercise price of $1.00 per share to certain accredited investors (the “Investors”). The number of shares of common stock to be received upon the exercise of the Warrants and the exercise price of the Warrants are subject to adjustment for reverse and forward stock splits, stock dividends, stock combinations and other similar transactions of the common stock that occur after the Closing Date.

On August 24, 2011 we executed a Letter of Engagement to secure a 2 year feedstock supply agreement for our biodiesel operations in Middletown, Indiana and are working to execute a definitive agreement.

The Company’s management has focused its efforts on the expansion of our biodiesel operations and the development and deployment of new technologies to reduce costs in the production of biodiesel and biofuels, the commercialization and development of our oil sands recovery business and the acquisition and exploitation of energy assets. We believe that the development of multiple forms of energy provides the Company with additional financial flexibility and protection from cycles in the energy commodities.

| ITEM 1A. | Risk Factors. |

In addition to the other information set forth elsewhere in this Form 10-K, you should carefully consider the following factors when evaluating the Company. An investment in the Company is subject to risks inherent in our business. The trading price of the shares of the Company is affected by the performance of our business relative to, among other things, competition, market conditions and general economic and industry conditions. The value of an investment in the Company may decrease, resulting in a loss. The risk factors listed below are not all inclusive.

An investment in us involves a high degree of risk and may result in the loss of all or part of your investment. You should consider carefully all of the information set out in this document and the risks attaching to an investment in us, including, in particular, the risks described below. The information below does not purport to be an exhaustive list and should be considered in conjunction with the contents of the rest of this document.

We have a history of operating losses.

We have had a history of net operating losses. There is no assurance that our current fiscal year results can be sustained.

The federal excise tax credit for biodiesel is set to expire on December 31, 2011 and Congress has not enacted legislation to extend this credit. If the credit is not renewed, our cost of producing biodiesel may increase and our sales price for biodiesel could be reduced, which could have an adverse effect on our financial position.

In October 2004, Congress passed a biodiesel tax incentive, structured as a federal excise tax credit, as part of the American Jobs Creation Act of 2004. The credit amounted to one cent for each percentage point of vegetable oil or animal fat biodiesel that was blended with petrodiesel (and one-half cent for each percentage point of recycled oils and other non-agricultural biodiesel), subsequently amended and increased to one cent. For example, blenders that blended B20 made from soy, canola and other vegetable oils and animal fats received a 20¢ per gallon excise tax credit. The tax incentive generally was taken by petroleum distributors and was passed on to the consumer. It was designed to lower the cost of biodiesel to consumers in both taxable and tax-exempt markets. The tax credit was scheduled to expire at the end of 2006, but was extended in the Energy Policy Act of 2005 to December 31, 2008 and most recently it was extended to December 31, 2011.

Congress did not enact any legislation to extend this tax credit beyond December 31, 2009 and it expired at that time. In December 2009, the United States House of Representatives passed a bill extending this credit to December 31, 2010. On March 10, 2010, the United States Senate passed a similar bill as part of the American Workers, State and Business Relief Act, H.R. 4213. In addition to extending the credit to December 31, 2011, both bills retroactively apply the credit to the beginning of 2010. If the tax credit is not renewed, our biodiesel sales prices will likely decrease by $1.00 per gallon. If biodiesel feedstock costs do not decrease significantly relative to biodiesel prices, we will realize a negative gross margin on biodiesel. As a result, we would cease producing biodiesel, which could have an adverse effect on our financial condition.

The current volatility in global economic conditions and the financial markets may adversely affect our industry, business and results of operations.

The volatility and disruption to the capital and credit markets since mid-2008 have affected global economic conditions, resulting in significant recessionary pressures and declines in consumer confidence and economic growth. These conditions have led to economic contractions in the developed economies and reduced growth rates in the emerging markets. Despite fiscal and monetary intervention, it is possible that further declines in consumer spending and global growth rates may occur in the foreseeable future. Reduced consumer spending may cause changes in customer order patterns including order cancellations, and changes in the level of inventory held by our customers, which may adversely affect our

6

Table of Contents

industry, business and results of operations. The impact of the credit crisis and economic slowdown will vary by region and country. The diversity of our geographic customer and operating footprint limits our reliance and exposure to any single economy.

These conditions have also resulted in a substantial tightening of the credit markets, including lending by financial institutions and other sources of credit and liquidity. This tightening of the credit markets has increased the cost of capital and reduced the availability of credit. Based on our latest discussions, we believe that our sources of credit and liquidity are able to fulfill their commitments to us as of our filing date. We cannot predict, however, how long the current economic and capital and credit market conditions will continue, whether they will deteriorate and which aspects of our products or business could be adversely affected. However, if current levels of economic and capital and credit market disruption and volatility continue or worsen, there can be no assurance that we will not experience an adverse impact, which may be material, on our business, the cost of and access to capital and credit markets, and our results of operations. In addition, we monitor the financial condition of our customers on a regular basis based on public information or data provided directly to us. If the financial condition of one of our major customers was negatively impacted by market conditions or liquidity, we could be adversely impacted in terms of accounts receivable and/or inventory specifically attributable to them.

The industries in which we compete are highly competitive.

The biodiesel industry, as well as the oil and gas business, are highly competitive. There is competition within these industries and also with other industries in supplying the energy, fuel and chemical needs of industry and individual consumers. We will compete with other firms in the sale or purchase of various goods or services in many national and international markets. We will compete with large national and multi-national companies that have longer operating histories, greater financial, technical and other resources and greater name recognition than we do. In addition, we will compete with several smaller companies capable of competing effectively on a regional or local basis, and the number of these smaller companies is increasing. Our competitors may be able to respond more quickly to new or emerging technologies and services and changes in customer requirements. As a result of competition, we may lose market share or be unable to maintain or increase prices for our products and/or services or to acquire additional business opportunities, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. Although we will employ all methods of competition which are lawful and appropriate for such purposes, no assurances can be made that they will be successful. A key component of our competitive position, particularly given the expected commodity-based nature of many of our products, will be our ability to manage expenses successfully, which requires continuous management focus on reducing unit costs and improving efficiency. No assurances can be given that we will be able to successfully manage such expenses.

Our competitive position in the markets in which we participate is, in part, subject to external factors in addition to those that we can impact. Natural disasters, changes in laws or regulations, war or other outbreak of hostilities, or other political factors in any of the countries or regions in which we operate or do business, or in countries or regions that are key suppliers of strategic raw materials, could negatively impact our competitive position and our ability to maintain market share.

Increases in the construction of biodiesel production plants may cause excess biodiesel production capacity in the market. Excess capacity may adversely affect the price at which we are able to sell the biodiesel that we produce and may also adversely affect our anticipated results of operation and financial condition.

In 2008, 2009 and 2010, approximately 700 million gallons; 450-490 million gallons and 315 million gallons, respectively, of biodiesel were produced in the United States. There is a reported 2.49 billion gallons per year of biodiesel production capacity in the United States operated by 173 companies. With such biodiesel production capacity in the United States, compared to historical production levels, there is a risk that there will be a significant amount of excess biodiesel produced in the U.S., which may adversely affect the price at which we are able to sell the biodiesel that we produce and thereby adversely affect our anticipated results of operation and financial condition.

7

Table of Contents

Anti-subsidy and anti-dumping complaints have been filed with the European Commission concerning imports of biodiesel originating in the United States. The existence of such complaints, and an adverse decision by the European Commission, could reduce demand for biodiesel produced in the United States.

Anti-subsidy and anti-dumping complaints have been filed with the European Commission concerning imports of biodiesel originating in the United States. Although we are not a target of such complaints and do not import biodiesel into the European community, the existence of such complaints, and an adverse decision by the European Commission, could reduce demand for biodiesel produced in the United States. Such a reduction in demand could reduce the amount of biodiesel that we sell, which could have an adverse effect on our financial condition.

Fluctuations in commodity prices may cause a reduction in the demand or profitability of the products or services we produce.

Prices for alternative fuels tend to fluctuate widely based on a variety of political and economic factors. These price fluctuations heavily influence the oil and gas industry. Lower energy prices for existing products tend to limit the demand for alternative forms of energy services and related products and infrastructure. Historically, the markets for alternative fuels have been volatile, and they are likely to continue to be volatile. Wide fluctuations in alternative fuel prices may result from relatively minor changes in the supply of and demand for oil and natural gas, market uncertainty and other factors that are beyond our control, including:

| • | worldwide and domestic supplies of oil and gas; |

| • | the price and/or availability of biodiesel feedstocks; |

| • | weather conditions; |

| • | the level of consumer demand; |

| • | the price and availability of alternative fuels; |

| • | the availability of pipeline and refining capacity; |

| • | the price and level of foreign imports; |

| • | domestic and foreign governmental regulations and taxes; |

| • | the ability of the members of the Organization of Petroleum Exporting Countries to agree to and maintain oil price and production controls; |

| • | political instability or armed conflict in oil-producing regions; and |

| • | the overall global economic environment. |

These factors and the volatility of the commodity markets make it extremely difficult to predict future alternative fuel price movements with any certainty. There may be a decrease in the demand for our products or services and our profitability could be adversely affected.

We are reliant on certain strategic raw materials for our operations.

We are reliant on certain strategic raw materials (such as soybean oil, waste greases and fats and methanol) for our operations. We have implemented certain risk management tools, such as a long term supply agreement and hedging, as appropriate, to mitigate short-term market fluctuations in raw material supply and costs. There can be no assurance, however, that such measures will result in cost savings or that all market fluctuation exposure will be eliminated. In addition, natural disasters, changes in laws or regulations, war or other outbreak of hostilities, or other political factors in any of the countries or regions in which we operate or do business, or in countries or regions that are key suppliers of strategic raw materials, could affect availability and costs of raw materials.

While temporary shortages of raw materials may occasionally occur, these items have historically been sufficiently available to cover current requirements. However, their continuous availability and price are impacted by natural disasters, plant interruptions occurring during periods of high demand, domestic and world market and political conditions, changes in government regulation, and war or other outbreak of hostilities. In addition, as we increase our biodiesel capacity, we will require larger supplies of raw materials which have not yet been secured and may not be available for the foregoing reasons, or may be available only at prices higher than current levels. Our operations or products may, at times, be adversely affected by these factors.

8

Table of Contents

Our ability to market our biodiesel may be impaired by capacity constraints, modifications to third party facilities and by weather issues.

We generally sell our biodiesel to large retail outlets such as Element Renewable, Fusion Renewables, Flying J, Pilot and others and much of that product is transported by truck. As such adverse weather conditions or modifications to facilities owned by others could limit our ability to sell our products and result in increased inventories or plant shut-downs.

Changes in technology may render our products or services obsolete.

The alternative fuel industry may be substantially affected by rapid and significant changes in technology. Examples include competitive product technologies, such as green gasoline and renewable diesel produced from catalytic hydroforming of renewable feedstock oils and competitive process technologies such as advanced biodiesel continuous reactor and washing designs that increase throughput. These changes may render obsolete certain existing products, energy sources, services and technologies currently used by us. We cannot assure you that the technologies used by or relied upon by us will not be subject to such obsolescence. While we may attempt to adapt and apply the services provided by us to newer technologies, we cannot assure you that we will have sufficient resources to fund these changes or that these changes will ultimately prove successful.

Failure to comply with governmental regulations could result in the imposition of penalties, fines or restrictions on operations and remedial liabilities.

The biofuel industry subject to extensive federal, state, local and foreign laws and regulations related to the general population’s health and safety and those associated with compliance and permitting obligations (including those related to the use, storage, handling, discharge, emission and disposal of municipal solid waste and other waste, pollutants or hazardous substances or waste, or discharges and air and other emissions) as well as land use and development. Existing laws also impose obligations to clean up contaminated properties or to pay for the cost of such remediation, often upon parties that did not actually cause the contamination. Compliance with these laws, regulations and obligations could require substantial capital expenditures. Failure to comply could result in the imposition of penalties, fines or restrictions on operations and remedial liabilities. These costs and liabilities could adversely affect our operations.

Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent or costly waste handling, storage, transport, disposal or cleanup requirements could require us to make significant expenditures to attain and maintain compliance and may otherwise have a material adverse effect on our business segments in general and on our results of operations, competitive position or financial condition. We are unable to predict the effect of additional environmental laws and regulations which may be adopted in the future, including whether any such laws or regulations would materially adversely increase our cost of doing business or affect our operations in any area.

Under certain environmental laws and regulations, we could be held strictly liable for the removal or remediation of previously released materials or property contamination regardless of whether we were responsible for the release or contamination, or if current or prior operations were conducted consistent with accepted standards of practice. Such liabilities can be significant and, if imposed, could have a material adverse effect on our financial condition or results of operations.

Our biofuels operations may be harmed if the government were to change current laws and regulations.

Alternative fuels businesses benefit from tax credits and government subsidies. If any of the state or federal laws and regulations relating to the tax credits and government subsidies change, the ability to recover capital expenditures from our alternative fuels business could be harmed. Our biofuels platform is subject to federal, state, and local laws and regulations governing the application and use of alternative energy products, including those related specifically to biodiesel. For instance, biodiesel products benefit from being the only alternative fuel certified by the U.S. Environmental Protection Agency that fulfills the requirements of Section 211(B) of the Clean Air Act. If agency determinations, laws, and regulations relating to the application and use of alternative energy are changed, the marketability and sales of biodiesel production could be materially adversely affected.

9

Table of Contents

Market conditions or transportation impediments may hinder access to raw goods and distribution markets.

Market conditions, the unavailability of satisfactory transportation, or the location of our manufacturing complex from more lucrative markets may hinder our access to raw goods and/or distribution markets. The availability of a ready market for biodiesel depends on a number of factors, including the demand for and supply of biodiesel and the proximity of the plant to trucking and terminal facilities. The sale of large quantities of biodiesel necessitates that we transport our biodiesel to other markets since the Indiana regional market is not expected to absorb all of our contemplated production. Currently, common carrier pipelines are not transporting biodiesel. This leaves trucks, barges, and rail cars as the means of distribution of our product from the plant to these storage terminals for further distribution. However, the current availability of rail cars is limited and at times unavailable because of repairs or improvements, or as a result of priority transportation agreements with other shippers. If transportation is restricted or is unavailable, we may not be able to sell into more lucrative markets and consequently our cash flow from sales of biodiesel could be restricted.

The biodiesel industry also faces several challenges to wide biodiesel acceptance, including cold temperature limitations, storage stability, fuel quality standards, and exhaust emissions. If the industry does not satisfy consumers that these issues have been resolved or are being resolved, biodiesel may not gain widespread acceptance which may have an adverse impact on our cash flow from sales of biodiesel.

Our insurance may not protect us against our business and operating risks.

We maintain insurance for some, but not all, of the potential risks and liabilities associated with our business. For some risks, we may not obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented. As a result of market conditions, premiums and deductibles for certain insurance policies can increase substantially and, in some instances, certain insurance policies may become unavailable or available only for reduced amounts of coverage. As a result, we may not be able to renew our existing insurance policies or procure other desirable insurance on commercially reasonable terms, if at all. Although we will maintain insurance at levels we believe are appropriate for our business and consistent with industry practice, we will not be fully insured against all risks which cannot be sourced on economic terms. In addition, pollution and environmental risks generally are not fully insurable. Losses and liabilities from uninsured and underinsured events and delay in the payment of insurance proceeds could have a material adverse effect on our financial condition and results of operations.

If a significant accident or other event resulting in damage to our operations (including severe weather, terrorist acts, war, civil disturbances, pollution, or environmental damage) occurs and is not fully covered by insurance or a recoverable indemnity from a customer, it could adversely affect our financial condition and results of operations.

We depend on key personnel, the loss of any of whom could materially adversely affect our future operations.

Our success will depend to a significant extent upon the efforts and abilities of our executive officers. The loss of the services of one or more of these key employees could have a material adverse effect on us. Our business will also be dependent upon our ability to attract and retain qualified personnel. Acquiring or retaining these personnel could prove more difficult to hire or cost substantially more than estimated. This could cause us to incur greater costs, or prevent us from pursuing our expansion strategy as quickly as we would otherwise wish to do.

We depend heavily on the services of Jeffrey T. Wilson, our chairman, chief executive officer, and chief financial officer and on the services of key management in our biodiesel subsidiary, Craig Ducey, Chad Ducey and Tim Jones. We do not have an employment agreement with any of the parties, and we do not presently have a “key person” life insurance policy on the lives of any of these individuals to offset our losses in the event of their death.

If we are unable to effectively manage the commodity price risk of our raw materials or finished goods, we may have unexpected losses.

We hedge our raw materials and/or finished products for our biofuels segment to some degree to manage the commodity price risk of such items. This requires the purchase or sale of commodity futures contracts and/or options on those contracts or similar financial instruments. We may be forced to make cash deposits available to counterparties as they mark-to-market these financial hedges. This funding requirement may limit the level of commodity price risk management that we are prudently able to complete. If we do not or are not capable of managing the commodity price risk of our raw materials and/or finished products for our biofuels segment, we may incur losses as a result of price fluctuations with respect to these raw materials and/or finished products.

10

Table of Contents

If we are unable to acquire or renew permits and approvals required for our operations, we may be forced to suspend or cease operations altogether.

The operation of our manufacturing plant requires numerous permits and approvals from governmental agencies. We may not be able to obtain all necessary permits (or modifications thereto) and approvals and, as a result, our operations may be adversely affected. In addition, obtaining all necessary renewal permits (or modifications to existing permits) and approvals for future expansions may necessitate substantial expenditures and may create a significant risk of expensive delays or loss of value if a project is unable to function as planned due to changing requirements.

The lack of business diversification may adversely affect our results of operations.

Unlike other entities which may have the resources to complete several business combinations of entities operating in multiple industries or multiple areas of a single industry, it is possible that we will not have the resources to diversify effectively our operations or benefit from the possible spreading of risks or offsetting of losses.

Our indebtedness may limit our ability to borrow additional funds or capitalize on acquisition or other business opportunities.

Our biofuels subsidiary operates under an extension to its credit facility through January 31, 2012. There is no assurance that the bank will grant an additional extension of time if we are unable to secure alternative financing. The restrictions governing this indebtedness may reduce our ability to incur additional indebtedness, engage in certain transactions or capitalize on acquisition or other business opportunities. If we are unable to meet our future debt service obligations and other financial obligations, we could be forced to restructure or refinance such indebtedness and other financial transactions, seek additional equity or sell assets.

We expect to have capital expenditure requirements, and we may be unable to obtain needed financing on satisfactory terms.

We expect to make capital expenditures for the expansion of our biofuels production capacity and complementary infrastructure. We intend to finance these capital expenditures primarily through proceeds from the recent financing, cash flow from our operations and existing cash. However, if our capital requirements vary materially from those provided for in our current projections, we may require additional financing sooner than anticipated. A decrease in expected revenues or adverse change in market conditions could make obtaining this financing economically unattractive or impossible. As a result, we may lack the capital necessary to complete the projected expansions or capitalize on other business opportunities.

We may be unable to successfully integrate future acquisitions with our operations or realize all of the anticipated benefits of such acquisitions.

Failure to successfully integrate future acquisitions, if any, in a timely manner may have a material adverse effect on our business, financial condition, results of operations, and cash flows. The difficulties of combining acquired operations include, among other things:

| • | operating a significantly larger combined organization; |

| • | consolidating corporate technological and administrative functions; |

| • | integrating internal controls and other corporate governance matters; and |

| • | diverting management’s attention from other business concerns. |

In addition, we may not realize all of the anticipated benefits from future acquisitions, such as increased earnings, cost savings, and revenue enhancements, for various reasons, including difficulties integrating operations and personnel, higher and unexpected acquisition and operating costs, unknown liabilities, and fluctuations in markets. If benefits from future acquisitions do not meet the expectations of financial or industry analysts, the market price of our shares of common stock may decline.

11

Table of Contents

Natural gas, and oil prices fluctuate widely, and low prices would have a material adverse effect on our revenues, profitability and growth.

The market price of all energy products remains enormously volatile and recent high prices have been replaced with relatively low prices and all within a few months. Our revenues, profitability and future growth will depend significantly on natural gas and crude oil prices. Prices received also will affect the amount of future cash flow available for capital expenditures and repayment of indebtedness and will affect our ability to raise additional capital. Lower prices may also affect the amount of natural gas, oil and biodiesel that we can economically produce. Factors that can cause price fluctuations include:

| • | The domestic and foreign supply of natural gas and oil. |

| • | Overall economic conditions. |

| • | The level of consumer product demand. |

| • | Adverse weather conditions and natural disasters. |

| • | The price and availability of competitive fuels such as heating oil and coal. |

| • | Political conditions in the Middle East and other natural gas and oil producing regions. |

| • | The level of LNG imports. |

| • | Domestic and foreign governmental regulations. |

| • | Potential price controls and special taxes. |

Natural gas and oil reserves are depleting assets and the failure to replace our reserves would adversely affect our production and cash flows.

Our future natural gas and oil production depends on continuing to make our current properties productive and our success in finding or acquiring new reserves. If we fail to replace reserves, our level of production and cash flows would be adversely impacted. Production from natural gas and oil properties decline as reserves are depleted with the rate of decline depending on reservoir characteristics. Our total proved reserves will decline as reserves are produced unless we conduct other successful exploration and development activities or acquire properties containing proved reserves, or both. Further, the majority of our reserves are proved developed producing. Accordingly, we do not have significant opportunities to increase our production from our existing proved reserves. Our ability to make the necessary capital investment to maintain or expand our asset base of natural gas and oil reserves would be impaired to the extent cash flow from operations is reduced and external sources of capital become limited or unavailable. We may not be successful in exploring for, developing or acquiring additional reserves. If we are not successful, our future production and revenues will be adversely affected.

Reserve estimates depend on many assumptions that may turn out to be inaccurate. Any material inaccuracies in these reserve estimates or underlying assumptions could materially affect the quantities and present values of our reserves.

The process of estimating natural gas and oil reserves is complex and involves a degree of subjective interpretation of technical data and information. It requires analysis of available technical data and the application of various assumptions, including assumptions relating to economic factors. Any significant inaccuracies in these interpretations or assumptions could materially affect the estimated quantities and present value of reserves shown in this report.

In order to prepare these estimates, our independent third party petroleum engineer must project production rates and timing of development expenditures as well as analyze available geological, geophysical, production and engineering data, and the extent, quality and reliability of this data can vary. The process also requires economic assumptions relating to matters such as natural gas and oil prices, drilling and operating expenses, capital expenditures, taxes and availability of funds. Therefore, estimates of natural gas and oil reserves are inherently imprecise.

Actual future production, natural gas and oil prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable natural gas and oil reserves most likely will vary from our estimates. Any significant variance could materially affect the estimated quantities and pre-tax net present value of reserves shown in this report. In addition, estimates of our proved reserves may be adjusted to reflect production history, results of exploration and development, prevailing natural gas and oil prices and other factors, many of which are beyond our control. Some of the producing wells included in our reserve report have produced for a relatively short period of time. Because some of our reserve estimates are not based on a lengthy production history and are calculated using volumetric analysis, these estimates are less reliable than estimates based on a more lengthy production history.

You should not assume that the pre-tax net present value of our proved reserves prepared in accordance with SEC guidelines referred to in this report is the current market value of our estimated natural gas and oil reserves. We base the pre-tax net present value of future net cash flows from our proved reserves on prices and costs on the date of the estimate. Actual future prices, costs, taxes and the volume of produced reserves may differ materially from those used in the pre-tax net present value estimate.

12

Table of Contents

Exploration is a high risk activity, and our participation in drilling activities may not be successful.

Our future success will largely depend on the success of our exploration drilling program. Participation in exploration drilling activities involves numerous risks, including the risk that no commercially productive natural gas or oil reservoirs will be discovered. The cost of drilling, completing and operating wells is often uncertain, and drilling operations may be curtailed, delayed or canceled as a result of a variety of factors, including:

| • | Unexpected drilling conditions. |

| • | Blowouts, fires or explosions with resultant injury, death or environmental damage. |

| • | Pressure or irregularities in formations. |

| • | Equipment failures or accidents. |

| • | Tropical storms, hurricanes and other adverse weather conditions. |

| • | Compliance with governmental requirements and laws, present and future. |

| • | Shortages or delays in the availability of drilling rigs and the delivery of equipment. |

Even when properly used and interpreted, 3-D seismic data and visualization techniques are only tools used to assist geoscientists in identifying subsurface structures and hydrocarbon indicators. They do not allow the interpreter to know conclusively if hydrocarbons are present or economically producible. Poor results from our drilling activities would materially and adversely affect our future cash flows and results of operations.

In addition, as a “successful efforts” company, we choose to account for unsuccessful exploration efforts (the drilling of “dry holes”) and seismic costs as a current expense of operations, which immediately impacts our earnings. Significant expensed exploration charges in any period would materially adversely affect our earnings for that period and cause our earnings to be volatile from period to period.

The natural gas and oil business involves many operating risks that can cause substantial losses.

The natural gas and oil business involves a variety of operating risks, including:

| • | Blowouts, fires and explosions. |

| • | Surface cratering. |

| • | Uncontrollable flows of underground natural gas, oil or formation water. |

| • | Natural disasters. |

| • | Pipe and cement failures. |

| • | Casing collapses. |

| • | Stuck drilling and service tools. |

| • | Abnormal pressure formations. |

| • | Environmental hazards such as natural gas leaks, oil spills, pipeline ruptures or discharges of toxic gases and liquids. |

If any of these events occur, we could incur substantial losses as a result of:

| • | Injury or loss of life. |

| • | Severe damage to and destruction of property, natural resources or equipment. |

| • | Pollution and other environmental damage. |

| • | Clean-up responsibilities. |

| • | Regulatory investigations and penalties. |

| • | Suspension of our operations or repairs necessary to resume operations. |

Offshore operations are subject to a variety of operating risks peculiar to the marine environment, such as capsizing and collisions. In addition, offshore operations, and in some instances, operations along the Gulf Coast, are subject to damage or loss from hurricanes or other adverse weather conditions. These conditions can cause substantial damage to facilities and interrupt production. As a result, we could incur substantial liabilities that could reduce the funds available for exploration, development or leasehold acquisitions, or result in loss of properties.

13

Table of Contents

If we were to experience any of these problems, it could affect well bores, platforms, gathering systems and processing facilities, any one of which could adversely affect our ability to conduct operations. In accordance with customary industry practices, we maintain insurance against some, but not all, of these risks. Losses could occur for uninsurable or uninsured risks or in amounts in excess of existing insurance coverage. We may not be able to maintain adequate insurance in the future at rates we consider reasonable, and particular types of coverage may not be available. An event that is not fully covered by insurance could have a material adverse effect on our financial position and results of operations.

Not hedging our oil and gas production may result in losses.

Due to the significant volatility in natural gas and oil prices and the potential risk of significant hedging losses if NYMEX natural gas and oil prices spike on the date options settle, our oil and gas production is not currently hedged. By not hedging our production, we may be more adversely affected by declines in natural gas and oil prices than our competitors who engage in hedging arrangements. We do have short term hedges in place for our biodiesel production to cover the period of time from which we purchase the feedstock and produce the biodiesel product. Typically these hedges are in place for less than 30 days and do not provide any long-term protection from volatility.

Our ability to market our natural gas and oil may be impaired by capacity constraints on the gathering systems and pipelines that transport our natural gas and oil.

All of our natural gas and oil is transported through gathering systems and pipelines, which we do not own. Transportation capacity on gathering systems and pipelines is occasionally limited and at times unavailable due to repairs or improvements being made to these facilities or due to capacity being utilized by other natural gas or oil shippers that may have priority transportation agreements. If the gathering systems or our transportation capacity is materially restricted or is unavailable in the future, our ability to market our natural gas or oil could be impaired and cash flow from the affected properties could be reduced, which could have a material adverse effect on our financial condition and results of operations.

We have no conclusive assurance of title to our oil and gas leased interests.

Our practice in acquiring exploration leases or undivided interests in natural gas and oil leases is to not incur the expense of retaining title lawyers to examine the title to the mineral interest prior to executing the lease. Instead, we rely upon the judgment of third party landmen to perform the field work in examining records in the appropriate governmental, county or parish clerk’s office before leasing a specific mineral interest. This practice is widely followed in the industry. Prior to the drilling of an exploration well the operator of the well will typically obtain a preliminary title review of the drillsite lease and/or spacing unit within which the proposed well is to be drilled to identify any obvious deficiencies in title to the well and, if there are deficiencies, to identify measures necessary to cure those defects to the extent reasonably possible. We have no assurance, however, that any such deficiencies have been cured by the operator of any such wells. It does happen, from time to time, that the examination made by title lawyers reveals that the lease or leases are invalid, having been purchased in error from a person who is not the rightful owner of the mineral interest desired. In these circumstances, we may not be able to proceed with our exploration and development of the lease site or may incur costs to remedy a defect. It may also happen, from time to time, that the operator may elect to proceed with a well despite defects to the title identified in the preliminary title opinion.

Competition in the energy industry is intense, and we are smaller and have a more limited operating history than most of our competitors.

We compete with a broad range of energy companies in our activities. We also compete for the equipment and labor required to operate and to develop these properties. Most of our competitors have substantially greater financial resources than we do. These competitors may be able to pay more for exploratory prospects and productive natural gas and oil properties. Further, they may be able to evaluate, bid for and purchase a greater number of properties and prospects than we can. Our ability to explore for natural gas and oil and to acquire additional properties in the future will depend on our ability to evaluate and select suitable properties and to consummate transactions in this highly competitive environment. In addition, most of our competitors have been operating for a much longer time than we have and have substantially larger staffs. We may not be able to compete effectively with these companies or in such a highly competitive environment.

14

Table of Contents

We are subject to complex laws and regulations, including environmental regulations that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to numerous laws and regulations governing the operation and maintenance of our facilities and the discharge of materials into the environment. Failure to comply with such rules and regulations could result in substantial penalties and have an adverse effect on us. These laws and regulations may:

| • | Require that we obtain permits before commencing drilling. |

| • | Restrict the substances that can be released into the environment in connection with drilling and production activities. |

| • | Limit or prohibit drilling activities on protected areas, such as wetlands or wilderness areas. |

| • | Require remedial measures to mitigate pollution from former operations, such as plugging abandoned wells. |

Under these laws and regulations, we could be liable for personal injury and clean-up costs and other environmental and property damages, as well as administrative, civil and criminal penalties. We maintain only limited insurance coverage for sudden and accidental environmental damages. Accordingly, we may be subject to liability, or we may be required to cease production from properties in the event of environmental damages. These laws and regulations have been changed frequently in the past. In general, these changes have imposed more stringent requirements that increase operating costs or require capital expenditures in order to remain in compliance. It is also possible that unanticipated factual developments could cause us to make environmental expenditures that are significantly different from those we currently expect. Existing laws and regulations could be changed and any such changes could have an adverse effect on our business and results of operations.

We cannot control the activities on properties we do not operate.

Other companies currently operate properties in which we have an interest. As a result, we have a limited ability to exercise influence over operations for these properties or their associated costs. Our dependence on the operator and other working interest owners for these projects and our limited ability to influence operations and associated costs could materially adversely affect the realization of our targeted returns on capital in drilling or acquisition activities. The success and timing of our drilling and development activities on properties operated by others therefore depend upon a number of factors that are outside of our control, including:

| • | Timing and amount of capital expenditures. |

| • | The operator’s expertise and financial resources. |

| • | Approval of other participants in drilling wells. |

| • | Selection of technology. |

Acquisition prospects are difficult to assess and may pose additional risks to our operations.

We expect to evaluate and, where appropriate, pursue acquisition opportunities on terms our management considers favorable. Acquisition of biodiesel facilities will depend on facility cost versus replacement value, proximity to feedstocks and to retail markets, rail access, operating systems and costs and potential environmental liabilities. We expect to pursue acquisitions that have the potential to increase our biodiesel production and our domestic natural gas and oil reserves. The successful acquisition of natural gas and oil properties requires an assessment of various of the following:

| • | Recoverable reserves. |

| • | Exploration potential. |

| • | Future natural gas and oil prices. |

| • | Operating costs. |

| • | Potential environmental and other liabilities and other factors. |

| • | Permitting and other environmental authorizations required for our operations. |

In connection with such an assessment, we would expect to perform a review of the subject properties that we believe to be generally consistent with industry practices. Nonetheless, the resulting conclusions are necessarily inexact and their accuracy inherently uncertain, and such an assessment may not reveal all existing or potential problems, nor will it necessarily permit a buyer to become sufficiently familiar with the properties to fully assess their merits and deficiencies. Inspections may not always be performed on every platform or well, and structural and environmental problems are not necessarily observable even when an inspection is undertaken.

15

Table of Contents

Future acquisitions could pose additional risks to our operations and financial results, including:

| • | Problems integrating the purchased operations, personnel or technologies. |

| • | Unanticipated costs. |

| • | Diversion of resources and management attention from our exploration business. |

| • | Entry into regions or markets in which we have limited or no prior experience. |

| • | Potential loss of key employees, particularly those of the acquired organizations. |

We do not currently intend to pay dividends on our common stock.

We have never declared or paid a dividend on our common stock and do not expect to do so in the foreseeable future. Our current plan is to retain any future earnings for funding growth, and, therefore, holders of our common stock will not be able to receive a return on their investment unless they sell their shares.