Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IDEX CORP /DE/ | d246441d8k.htm |

| EX-99.2 - EX-99.2 - IDEX CORP /DE/ | d246441dex992.htm |

EXHIBIT 99.1

Third Quarter 2011 Earnings Release

October 20, 2011

Agenda

IDEX Market Assessment / Outlook Q3 2011 Summary Q3 2011 Segment Performance

Fluid & Metering

Health & Science Dispensing Equipment Fire & Safety

2011 Guidance Update Q&A

| 2 |

|

Replay Information

Dial toll–free: 855.859.2056 International: 404.537.3406 Conference ID: #66069195 Log on to: www.idexcorp. com

IDEX Proprietary & Confidential

| 3 |

|

Cautionary Statement Under the Private Securities Litigation Reform Act

This presentation and discussion will include forward ? looking statements. Our actual performance may differ materially from that indicated or suggested by any such statements. There are a number of factors that could cause those differences, including those presented in our most recent annual report and other company filings with the SEC.

IDEX Proprietary & Confidential

| 4 |

|

Long Term – Planning for Growth

Remain bullish on our business in 2012 & beyond

Expect organic growth in 2012

Positive order trends remain in our base businesses

Improve our growth profile

Increased exposure to high? growth regions

Increased focus on high? value end markets

Improve our margin profile

Deliver savings through operational excellence and integrated supply chain

Aftermarket penetration on our large install base

Innovation

New Products New Markets Acquisitions

Growth

Operational

Excellence

Commercial

Excellence

Conversion

IDEX Proprietary & Confidential

Strategy remains: Focus on growing global platforms and execute with a disciplined operating model

| 5 |

|

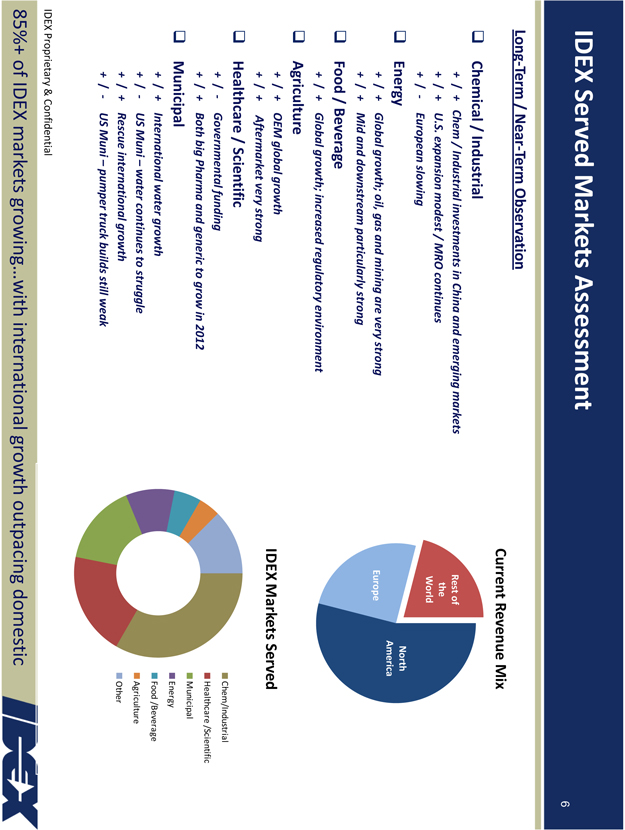

IDEX Served Markets Assessment

Long? Term / Near? Term Observation

Chemical / Industrial

+ / + Chem / Industrial investments in China and emerging markets

+ / + U.S. expansion modest / MRO continues

+ / ? European slowing

Energy

+ / + Global growth; oil, gas and mining are very strong

+ / + Mid and downstream particularly strong

Food / Beverage

+ / + Global growth; increased regulatory environment

Agriculture

+ / + OEM global growth

+ / + Aftermarket very strong

Healthcare / Scientific

+ / ? Governmental funding

+ / + Both big Pharma and generic to grow in 2012

Municipal

+ / + International water growth

+ / ? US Muni – water continues to struggle

+ / + Rescue international growth

+ / ? US Muni – pumper truck builds still weak

IDEX Proprietary & Confidential

85%+ of IDEX markets growing …with international growth outpacing domestic

Current Revenue Mix

Rest of the World

Europe

North America

IDEX Markets Served

Chem/Industrial

Healthcare /Scientific Municipal Energy Food /Beverage Agriculture Other

| 6 |

|

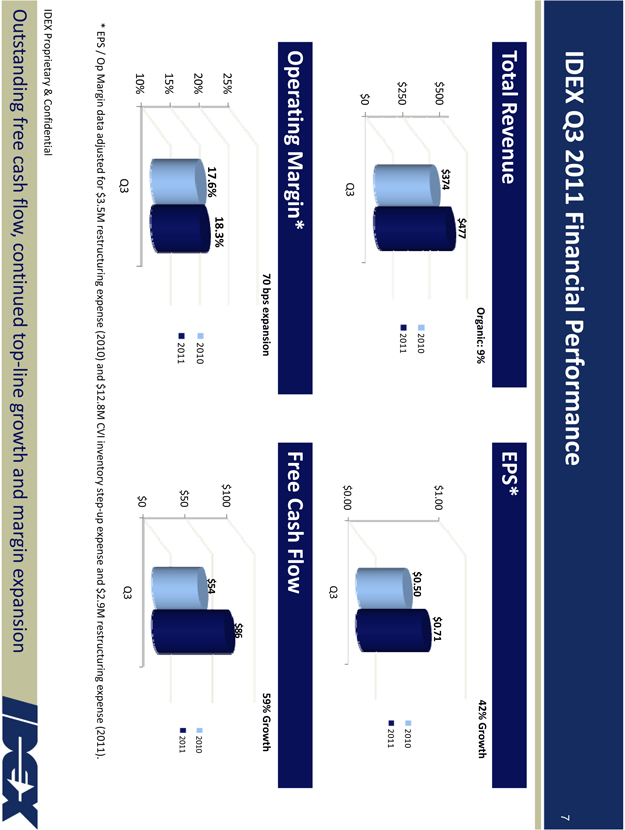

IDEX Q3 2011 Financial Performance

Total Revenue

$500 $250 $0

$477 $374

Organic: 9%

2010

2011

Q3

Operating Margin*

70 bps expansion

25% 20% 15% 10%

18.3% 17.6%

2010

2011

Q3

* EPS / Op Margin data adjusted for $3.5M restructuring expense (2010) and $12.8M CVI inventory step? up expense and $2.9M restructuring expense (2011).

EPS*

42% Growth

$1.00

$0.00

$0.71

$0.50

Free Cash Flow

59% Growth

$100 $50 $0

$86

$54

2010

2011

2010

2011

IDEX Proprietary & Confidential

Outstanding free cash flow, continued top? line growth and margin expansion

| 7 |

|

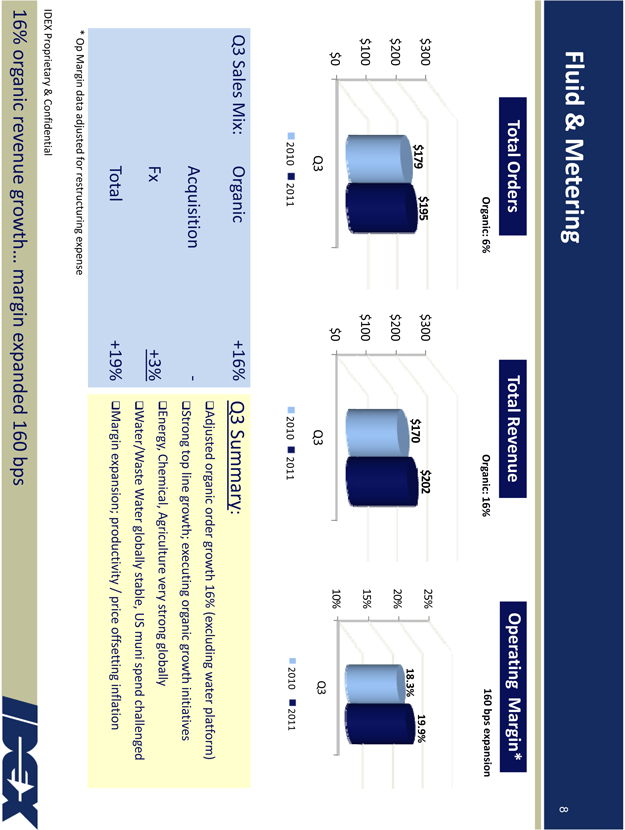

Fluid & Metering

Total Orders

Organic: 6%

Total Revenue

Organic: 16%

Operating Margin*

160 bps expansion

$300 $200 $100 $0

$195 $179

Q3

2010

2011

$300 $200 $100 $0

$170 $202

25% 20% 15% 10%

Q3

2010

2011

Q3

2010

2011

Q3 Sales Mix: Organic +16%

Acquisition ?Fx +3% Total +19%

Q3 Summary :

Adjusted organic order growth 16% (excluding water platform) Strong top line growth; executing organic growth initiatives Energy, Chemical, Agriculture very strong globally Water/Waste Water globally stable, US muni spend challenged Margin expansion; productivity / price offsetting inflation

| * |

|

Op Margin data adjusted for restructuring expense |

IDEX Proprietary & Confidential

16% organic revenue growth… margin expanded 160 bps

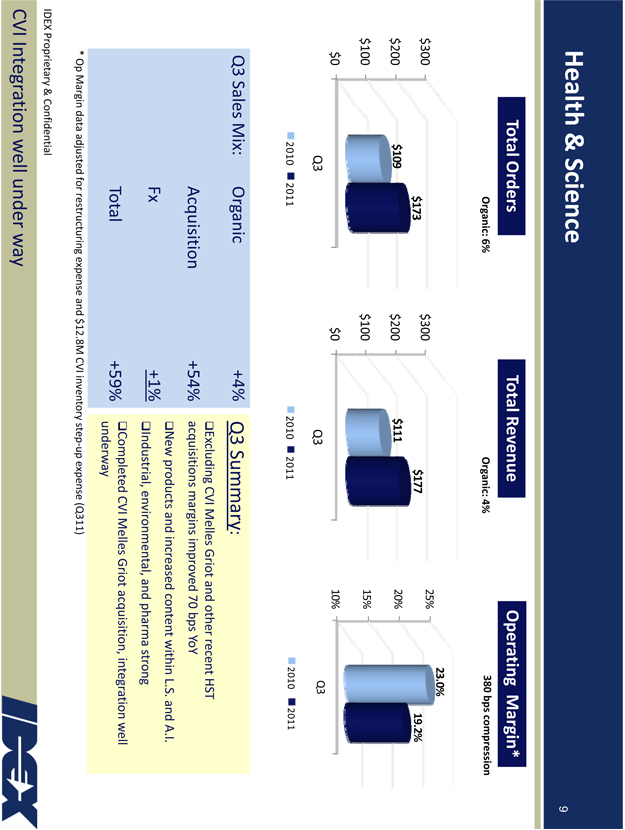

Health & Science

Total Orders

Organic: 6%

$300 $200 $100 $0

$173 $109

Q3

2010

2011

Total Revenue

Organic: 4%

$300 $200 $100 $0

$177 $111

25% 20% 15% 10%

Q3

2010

2011

Operating Margin*

380 bps compression

23.0%

19.2%

Q3

2010

[Graphic Appears Here]

Q3 Sales Mix: Organic +4%

Acquisition +54% Fx +1% Total +59%

Q3 Summary :

Excluding CVI Melles Griot and other recent HST acquisitions margins improved 70 bps YoY

New products and increased content within L.S. and A.I.

Industrial, environmental, and pharma strong

Completed CVI Melles Griot acquisition, integration well underway

| * |

|

Op Margin data adjusted for restructuring expense and $12.8M CVI inventory step? up expense (Q311) |

IDEX Proprietary & Confidential

CVI Integration well under way

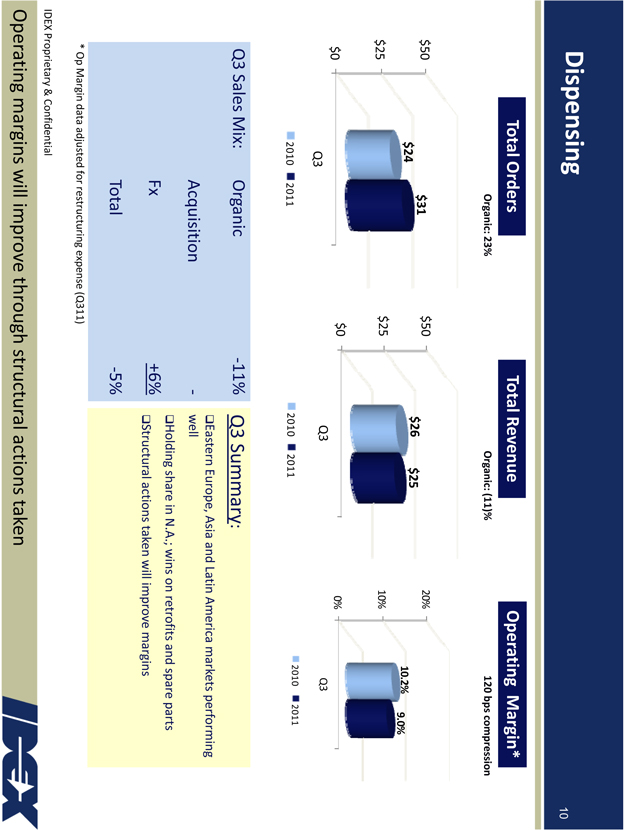

Dispensing

Total Orders

Organic: 23%

$50 $25 $0

$31 $24

Q3

2010

2011

Total Revenue

Organic: (11)%

$50 $25 $0

$26 $25

Q3

2010

2011

Operating Margin*

120 bps compression

20% 10% 0%

10.2% 9.0%

Q3

2010

2011

Q3 Sales Mix: Organic ? 11%

Acquisition ?Fx +6% Total 5%

| * |

|

Op Margin data adjusted for restructuring expense (Q311) |

IDEX Proprietary & Confidential

Operating margins will improve through structural actions taken

Q3 Summary :

Eastern Europe, Asia and Latin America markets performing well

Holding share in N.A.; wins on retrofits and spare parts

Structural actions taken will improve margins

10

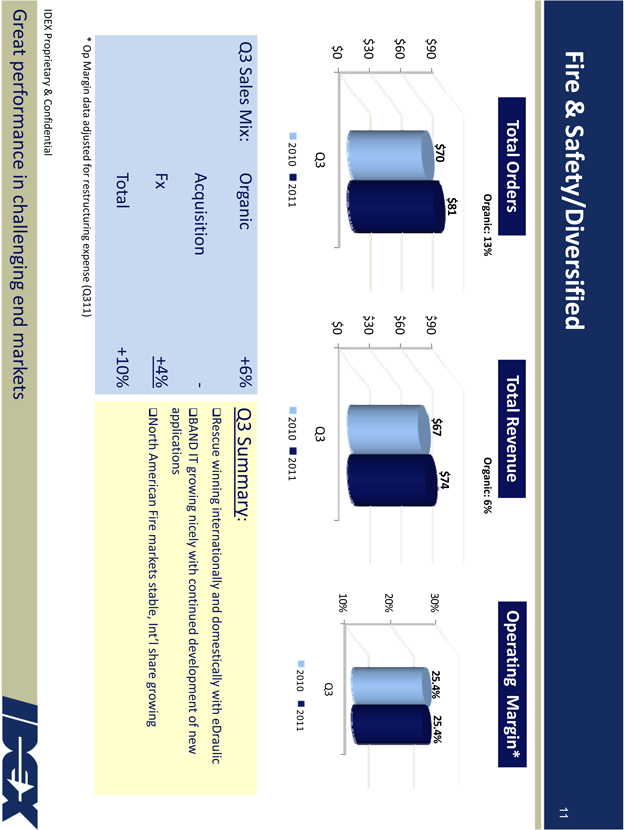

Fire & Safety/Diversified

Total Orders

Organic: 13%

$90

$60

$30

$0

$81 $70

Q3

2010

2011

Q3 Sales Mix: Organic +6%

Acquisition ?Fx +4% Total +10%

$90

$60

$30

$0

Total Revenue

Organic: 6%

$74 $67

Q3

2010 2011

Operating Margin*

30% 20% 10%

25.4% 25.4%

Q3

2010 2011

Q3 Summary :

Rescue winning internationally and domestically with eDraulic

BAND IT growing nicely with continued development of new applications

North American Fire markets stable, Int’l share growing

| * |

|

Op Margin data adjusted for restructur ing expense (Q311) |

IDEX Proprietary & Confidential

Great performance in challenging end markets

11

Outlook: 2011 Guidance Summary

Q4 2011

Adjusted EPS estimate range: $0.60 – $0.63

Organic revenue growth of 4% – 5%

Positive Fx impact of ~2% to sales (at September 30 rates) Positive impact of 10% from acquisitions

FY 2011

Adjusted EPS estimate range: $2.51 – $2.54

Organic revenue growth in the high single digits Operating margin of ~18%

Positive Fx impact of ~2% to sales (at September 30 rates) Positive impact of 9% from acquisitions

Other modeling items

Tax rate = 30% Cap Ex $36? 38M

Free Cash Flow will exceed net income

EPS estimate excludes future restructuring, acquisitions and acquisition –related costs

IDEX Proprietary & Confidential

12

Q&A

IDEX Proprietary & Confidential

13