Attached files

| file | filename |

|---|---|

| 8-K - HR 06 30 11 SHAREHOLDER PRESENTATION - HINES REAL ESTATE INVESTMENT TRUST INC | hreit063011shpresentation8k.htm |

Exhibit 99.1

Hines Real Estate Investments, Inc., Member FINRA/SIPC, is the Dealer Manager. 8/11

Hines Real Estate Investment Trust, Inc. (Hines REIT) is closed to new investors.

Hines REIT Update

As of June 30, 2011

Hines REIT Portfolio Summary

as of June 30, 2011

as of June 30, 2011

2

Total Assets:

§58 properties; $3.5 billion1

Total Square Feet:

§Over 28 million

Portfolio Occupancy:

§89%; 4% above the national average

Total Distributions Since Inception:

§$539.7 million

Current Loan-to-Value Ratio:

§55%

Current Annualized Distribution Rate:

§5.0%2 (30% of the distribution represents a return of invested

shareholder capital)

shareholder capital)

1 Owned directly or indirectly based on estimated aggregate value.

2 Based on $10.08 share price; assumes consistent distribution rate for 12-month period. Hines REIT declared distributions

through the month of October 2011. The distribution, in an amount equal to $0.00138082 per share, per day will be paid in

January 2012 in cash or reinvested in stock for those participating in Hines REIT's dividend reinvestment plan. Of the amount

described above, $0.00041425 of the per share, per day dividend will be designated by the Company as a special distribution

which will be a return of a portion of the shareholders’ invested capital and, as such, will reduce their remaining investment in

the Company. The special distribution represents a portion of the profits from sales of investment property. The above

designations of a portion of the distribution as a special distribution will not impact the tax treatment of the distributions to our

shareholders.

through the month of October 2011. The distribution, in an amount equal to $0.00138082 per share, per day will be paid in

January 2012 in cash or reinvested in stock for those participating in Hines REIT's dividend reinvestment plan. Of the amount

described above, $0.00041425 of the per share, per day dividend will be designated by the Company as a special distribution

which will be a return of a portion of the shareholders’ invested capital and, as such, will reduce their remaining investment in

the Company. The special distribution represents a portion of the profits from sales of investment property. The above

designations of a portion of the distribution as a special distribution will not impact the tax treatment of the distributions to our

shareholders.

Hines REIT Portfolio

as of June 30, 2011

as of June 30, 2011

3

Proactive Leasing Highlights

Houston, TX - Williams Tower

§Williams Companies, an integrated

natural gas company that produces,

gathers, processes and transports

natural gas

natural gas company that produces,

gathers, processes and transports

natural gas

– Executed 60,000 SF expansion

through 2018

through 2018

§Ryan and Co, a national tax audit

defense and recovery service firm

defense and recovery service firm

– Renewal of 32,000 SF through

2019

2019

§Rowan Co., an international provider

of contact drilling services

of contact drilling services

– Executed 10,000 SF expansion

through 2020

through 2020

Denver, CO - Industrial Portfolio

§Comcast (CMCAS, CMCSK),

provider of entertainment, information

and communications products and

services

provider of entertainment, information

and communications products and

services

– Executed 35,000 Square Feet

(SF) lease through 2021 at 345

Inverness

(SF) lease through 2021 at 345

Inverness

§GolfTech, focus on golf improvement

– Renewal of 13,000 SF through

2016 at Arapahoe II

2016 at Arapahoe II

Seattle, WA - 5th and Bell

§Notkin Engineering, a mechanical

engineering firm

engineering firm

– Renewal of 15,000 SF for

10 years

10 years

New York, NY -

499 Park Avenue

499 Park Avenue

§Quadrant Capital

Advisors, a national

investment advisory firm

Advisors, a national

investment advisory firm

– Renewal of 11,000

SF through 2022

SF through 2022

Hines REIT Portfolio

as of June 30, 2011

as of June 30, 2011

4

Houston, TX -

Two Shell Plaza

Two Shell Plaza

§Dune Energy, an

independent exploration and

development company

independent exploration and

development company

– Renewal of 15,000 SF

through 2016

through 2016

Charlotte, NC -

Charlotte Plaza

Charlotte Plaza

§Capgemini, provider of

consulting, technology

and outsourcing services

consulting, technology

and outsourcing services

– Executed 24,000 SF

lease through 2016

lease through 2016

Proactive Leasing Highlights

Hines REIT Strategic Dispositions

5

Atrium on Bay,

Toronto, ON, Canada

§Acquired: February 2007

for $215 million USD

for $215 million USD

§Sold: June 2011 for $353

million USD

million USD

§Hines REIT’s effective

ownership percentage at

date of sale: 100%

ownership percentage at

date of sale: 100%

Brazilian Industrial Parks

Araucaria, Elouveira and

Vinhedo

Vinhedo

§Acquired: December 2008

for $115 million

for $115 million

§Sold: January 2010 and

April 2010 for $141 million

April 2010 for $141 million

§Hines REIT’s effective

ownership percentage at

date of sale: 100%

ownership percentage at

date of sale: 100%

600 Lexington,

New York, NY

§Acquired: February

2004 for $92 million

2004 for $92 million

§Sold: May 2010 for

$193 million

$193 million

§Hines REIT’s effective

ownership percentage at

date of sale: 11.67%

ownership percentage at

date of sale: 11.67%

Houston, TX -

Land Parcel Adjacent to

Williams Tower

Land Parcel Adjacent to

Williams Tower

§Acquired: May 2008

§Sold: September 2010

generating net proceeds of

$12 million

generating net proceeds of

$12 million

§Hines REIT’s effective

ownership percentage at

date of sale: 100%

ownership percentage at

date of sale: 100%

Portfolio Diversification

Regional Mix1, 3

% of Total Portfolio

% of Total Portfolio

City Mix1, 3

% of Total Portfolio

% of Total Portfolio

Tenant Credit Quality1, 2

% of Total Portfolio

% of Total Portfolio

Asset Class Mix1, 3

% of Total Portfolio

% of Total Portfolio

1 Data as of June 30, 2011 and based on Hines REIT’s pro rata ownership.

2 Based on square footage

3 Based on estimated aggregate value

4 Represents all of the cities that comprise less than 1% of the total portfolio.

6

4

Tenant Diversification

1 Data is based on Hines REIT’s effective ownership in each property based on leased square feet.

2 Represents all of the tenant industry mix categories that comprise less than 1% of the portfolio.

Tenant Industry Diversification1

% of Total Leasable Square Feet Expiring in Portfolio1

7

2

Top 10 Tenants1

1.Shook, Hardy & Bacon LLP…………………………...2555 Grand

International Law Firm

International Law Firm

2.Raytheon Company …………………………………….Raytheon/DIRECTV Buildings

Defense Aerospace Systems Company

Defense Aerospace Systems Company

3.State of California ………………………………………1515 S. Street

State Government

State Government

4.Microsoft Corporation……………………………….Daytona-Laguna Portfolio

Public Multinational Software Corporation

Public Multinational Software Corporation

5.Williams Companies…………………………………….Williams Tower

Integrated Natural Gas Company

Integrated Natural Gas Company

6.Honeywell International………………………………...Daytona-Laguna Portfolio

Engineering Services Conglomerate 345 Inverness Drive

Engineering Services Conglomerate 345 Inverness Drive

7.Oracle……………………………………………………….2100 Powell

Multinational Computer Technology Company

Multinational Computer Technology Company

8.Kay Chemical……………………………………………..4050 & 4055 Corporate Drive

Private Specialty Cleaning Company

Private Specialty Cleaning Company

9.Norwegian Cruise Lines………………………………..Airport Corporate Center

Cruise Line

Cruise Line

10.American Bar Association……………………………..321 North Clark

Largest Voluntary Professional Association in the World

Largest Voluntary Professional Association in the World

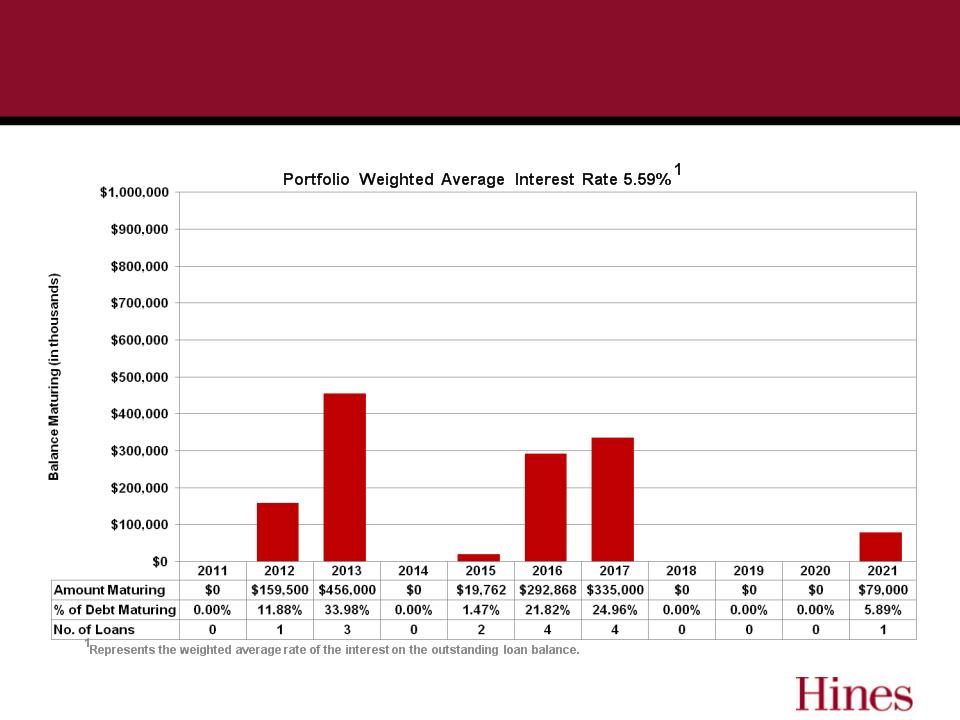

Hines REIT Debt Maturity Chart

(as of June 30, 2011)

(as of June 30, 2011)

8

2Amounts have been rounded to thousands for purposes of this presentation.

2

Distribution History

9

We funded our cash distributions with cash flows from operating activities, distributions received from our unconsolidated investments,

proceeds from the sales of our real estate investments and cash generated during prior periods.

proceeds from the sales of our real estate investments and cash generated during prior periods.

Hines REIT Exit Strategy

10

§ Overall goal is to maximize returns to investors

§ Exit strategy may include the targeted sale of individual

or groups of assets

or groups of assets

§ May also consider a sale, merger or listing on a

national exchange

national exchange

§ Will continue to identify opportunities for strategic asset sales

Current Priorities & Focus

11

§ Alignment of interests

• Hines has approximately $100 million invested in Hines REIT

• Hines waived 1/3 of its cash asset management fees from

July 2011 through December 2012 to enhance the

Company’s cash flows

July 2011 through December 2012 to enhance the

Company’s cash flows

§ Total fee waiver is projected to be over $7.5 million

§ Our near-term priorities consist of:

• Leasing of existing assets in our portfolio

• Strategic asset sales

• Managing liquidity and maximizing distributions

to shareholders

to shareholders

Current Priorities & Focus

12

§ Our long-term priorities consist of:

• Evaluating potential exit strategies

• Managing our debt maturities

§ These priorities are designed to assist us in maximizing

shareholder returns over the long term and returning

shareholder capital

shareholder returns over the long term and returning

shareholder capital

Hines Real Estate Investments, Inc., Member FINRA/SIPC, is the Dealer Manager. 8/11

Hines Real Estate Investment Trust, Inc. (Hines REIT) is closed to new investors.

Thank You

13