Attached files

| file | filename |

|---|---|

| 8-K - Petron Energy II, Inc. | restconcepts8k083111.htm |

| EX-3.2 - Petron Energy II, Inc. | ex3-2.htm |

| EX-10.3 - Petron Energy II, Inc. | ex10-3.htm |

| EX-10.9 - Petron Energy II, Inc. | ex10-9.htm |

| EX-10.4 - Petron Energy II, Inc. | ex10-4.htm |

| EX-10.7 - Petron Energy II, Inc. | ex10-7.htm |

| EX-10.8 - Petron Energy II, Inc. | ex10-8.htm |

| EX-10.6 - Petron Energy II, Inc. | ex10-6.htm |

| EX-10.5 - Petron Energy II, Inc. | ex10-5.htm |

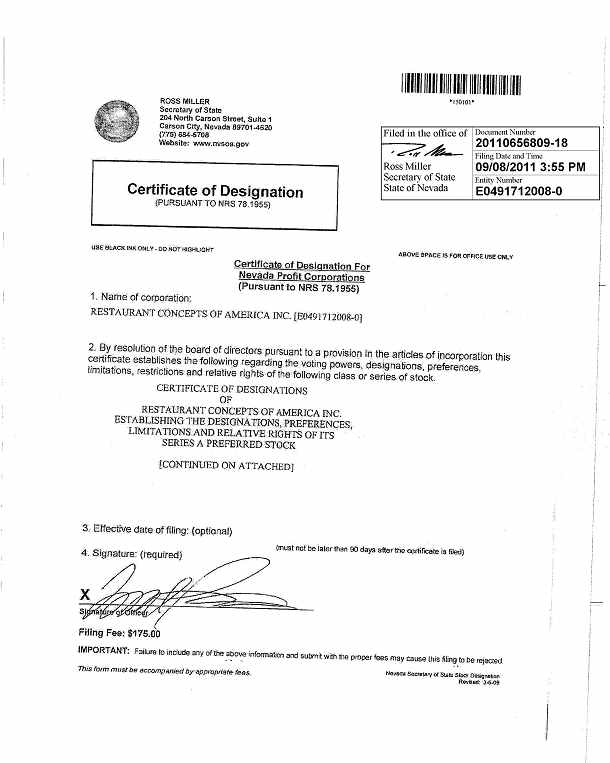

Exhibit 3.1

CERTIFICATE OF DESIGNATIONS

OF

RESTAURANT CONCEPTS OF AMERICA INC.

ESTABLISHING THE DESIGNATIONS, PREFERENCES,

LIMITATIONS AND RELATIVE RIGHTS OF ITS

SERIES A PREFERRED STOCK

Pursuant to Section 78.1955 of the Nevada Revised Statutes (the “NRS”), Restaurant Concepts of America Inc., a corporation organized and existing under the NRS (the "Company"),

DOES HEREBY CERTIFY that pursuant to the authority conferred upon the Board of Directors by the Articles of Incorporation, as amended, of the Company, and pursuant to Section 78.1955 of the NRS, the Board of Directors, by unanimous written consent of all members of the Board of Directors effective on September 7, 2011, duly adopted a resolution providing for the issuance of a series of Series A Preferred Stock, which resolution is and reads as follows:

RESOLVED, that pursuant to the authority expressly granted to and invested in the Board of Directors of the Company by the provisions of the Articles of Incorporation of the Company, as amended, a series of the preferred stock, par value $0.001 per share, of the Company be, and it hereby is, established; and it is further

RESOLVED, that the series of preferred stock of the Company be, and it hereby is, given the distinctive designation of "Series A Preferred Stock"; and it is further

RESOLVED, that the Series A Preferred Stock shall consist of One Thousand (1,000) shares; and it is further

RESOLVED, that the Series A Preferred Stock shall have the powers and preferences, and the relative, participating, optional and other rights, and the qualifications, limitations, and restrictions thereon set forth below (the “Designation” or “Certificate of Designations”), which rights shall amend, replace and supersede the Prior Preferred Stock:

SECTION 1. DESIGNATION OF SERIES; RANK. The shares of such series shall be designated as the "Series A Preferred Stock" (the "Preferred Stock") and the number of shares initially constituting such series shall be up to One Thousand (1,000) shares.

SECTION 2. DIVIDENDS. The holders of the Preferred Stock shall not be entitled to receive dividends paid on the Common Stock.

SECTION 3. LIQUIDATION PREFERENCE. The holders of the Preferred Stock shall not be entitled to any liquidation preference.

SECTION 4. VOTING.

4.1 Voting Rights. The holders of the Preferred Stock will have the voting rights as described in this Section 4 or as required by law. For so long as any shares of the Preferred Stock remain issued and outstanding, the holders thereof, voting separately as a class, shall have the right to vote on all shareholder matters equal to fifty-one percent (51%) of the total vote. For example, if there are 10,000 shares of the Company’s common stock issued and outstanding at the time of a shareholder vote, the holders of the Preferred Stock, voting separately as a class, will have the

right to vote an aggregate of 10,400 shares, out of a total number of 20,400 shares voting.

4.2 Amendments to Articles and Bylaws. So long as the Preferred Stock is outstanding, the Company shall not, without the affirmative vote of the holders of at least 66-2/3% of all outstanding shares of Preferred Stock, voting separately as a class (i) amend, alter or repeal any provision of the Articles of Incorporation or the Bylaws of the Company so as to adversely affect the designations, preferences, limitations and relative rights of the Preferred Stock or (ii) effect any reclassification of the Preferred Stock.

4.3 Amendment of Rights of Preferred Stock. The Company shall not, without the affirmative vote of the holders of at least:

(a) 66-2/3% of all outstanding shares of the Series A Preferred Stock; and

(b) a majority of the holders of any series of Preferred Stock designated by the Company after the date of this Designation (“Future Designated Preferred Stock”), which provides for such Future Designated Preferred Stock holders to have the right to approve any amendment, alteration, or repeal to the Series A Preferred Stock;

amend, alter or repeal any provision of this Statement of Designations, PROVIDED, HOWEVER, that the Company may, by any means authorized by law and without any vote of the holders of shares of the Preferred Stock, make technical, corrective, administrative or similar changes in this Statement of Designations that do not, individually or in the aggregate, adversely affect the rights or preferences of the holders of shares of the Preferred Stock.

SECTION 5. CONVERSION RIGHTS. The shares of the Preferred Stock shall have no conversion rights.

SECTION 6. REDEMPTION RIGHTS. The shares of the Preferred Stock shall have no redemption rights.

SECTION 7. AUTOMATIC RIGHTS TRANSFER UPON HOLDER DEFAULT.

7.1 Effect of Default. At any time prior to the Transfer Deadline and after the occurrence of a Default (as defined below, and regardless of whether such Default is subsequently cured), ASL Energy Corp., a Texas corporation (“ASL”) shall have the

right, but not the obligation, at any time after sixty-one (61) days prior written notice (a “Transfer Notice”) by ASL to the Company, of its intent to affect a transfer of the Rights of the Series A Preferred Stock from the Holders to ASL (a “Transfer”). Such Transfer shall automatically and without any required action by the Company or any Holder thereof affect (effective as of the date set forth in the Transfer Notice) the assignment and transfer of the Rights to ASL. Following a Transfer, the original Holder of such Series A Preferred Stock (or any permitted transferee thereof) shall have no further rights in connection with such Series A Preferred Stock (except as

provided below in the event of the occurrence of a Non-Physical Ownership Transfer). For the sake of clarity and in an abundance of caution, effective immediately upon a Transfer, which as provided above requires that ASL provide the Holders a Transfer Notice of at least sixty-one (61) days prior to the requested date of such Transfer, ASL shall exercise and hold all ownership of the Rights to the Series A Preferred Stock (the “Rights Transfer”). The occurrence of any Defaults as relating to ASL or any additional Defaults of the Company as provided above shall have no effect on the Rights Transfer.

7.2 Defaults. The occurrence of the following events shall be defined as a “Default” hereunder:

|

(a)

|

Mr. Smith dies or becomes Disabled.

|

7.3 Rights. As used in Section 7.1, above, the term “Rights” shall mean, if (a) requested by ASL in writing in the Transfer Notice or thereafter and allowed pursuant to Applicable Laws in the reasonable determination of the Company’s counsel, the transfer of the ownership, dispositive and

voting control, and physical ownership and rights associated therewith of the Series A Preferred Stock (a “Physical Ownership Transfer”); and (b) if requested by ASL in writing in the Transfer Notice or prior to the date of any Physical Ownership Transfer and/or if a Physical Ownership Transfer is not allowed under Applicable Laws, that the Holder shall (i) hold the Series A Preferred Stock on behalf of ASL, and (ii) cooperate with ASL for no additional consideration in any lawful arrangement (including entering into a voting agreement, proxy arrangement, or agreeing to vote, transfer or dispose such shares of Series A Preferred Stock as ASL may request from time to time) requested by ASL in order to provide ASL with all of the benefits of such Series A Preferred Stock subject to Applicable

Laws (a “Non-Physical Ownership Transfer”), provided that ASL shall have the ability to affect a Physical Ownership Transfer at any time following a Default, regardless of whether it initially chooses only to affect a Non-Physical Ownership Transfer, upon written notice to the Holder. In the event of a Non-Physical Ownership Transfer, each Holder shall comply with his, her or its obligations under this Designation and maintain its corporate or other existence until all obligations pursuant to this Section and otherwise herein are performed in full and/or until a Physical Ownership Transfer is requested by ASL and is actually affected. Notwithstanding the above, no Transfer shall be deemed to have occurred in the event such Transfer would violate Applicable

Laws.

7.4 Definitions. The terms below have the following meanings as used in this

Section 7:

(a) “Applicable Laws” means any and all state and federal securities laws, including, but not limited to Rule 144 of the Securities Act of 1933, as amended;

(b) “Disabled” means that any Person suffers a physical or mental disability which renders such Person, in the reasonable judgment of a third party mutually agreed to by ASL and the holder of the Series A Preferred Stock, unable to perform such Person’s duties and obligations as an executive of the Company for either thirty (30) consecutive days or ninety (90) days in any twelve (12) month period; and

(c) “Person” means an individual, partnership, corporation, business trust, limited liability company, limited liability partnership, joint stock company, trust, unincorporated association, joint venture or other entity,

7.5 Transfer Deadline. The “Transfer Deadline” shall be the date which falls eighteen (18) months from the date that the Preferred Stock is first issued to the holder. The Rights shall expire and be of no force and effect on the Transfer Deadline; provided that if a Transfer has occurred prior to the Transfer Deadline, such Transfer shall remain in full force and

effect following such Transfer Deadline.

SECTION 8. TRANSFER RIGHTS. The Preferred Stock shall not be able to be sold, assigned, disposed of, distributed, pledged or otherwise transferred (each a “Holder Transfer”) by the original Holder thereof (except as provided in and pursuant to Section 7 above), unless such Holder Transfer is approved in writing, prior to such Holder Transfer being effective, by ASL. ASL shall be able to assign its rights hereunder, without the required consent of the Company or any Holder, by

providing written notice of such assignment to the Company and Holders, subject to Applicable Laws (as defined in Section 7 above)(an “Assignment”). In the event of an Assignment, each reference herein to ASL or words of similar meaning shall be automatically replaced by a reference to such assignee of ASL. In the event of a Transfer, as provided in Section 7 above, ASL shall have the right and ability to affect a Holder Transfer (as relating to the Preferred Stock then held by ASL) in its sole discretion, subject only to such Holder Transfer (as relating to ASL) complying with Applicable Laws (as defined in Section 7, above).

SECTION 9.NOTICES. Any notice required hereby to be given to the Holders of shares of the Preferred Stock shall be deemed given if deposited in the United States mail, postage prepaid, and addressed to each Holder of record at his address appearing on the books of the Company.

SECTION 10. PROTECTIVE PROVISIONS.

Subject to the rights of series of Preferred Stock which may from time to time come into existence, so long as any shares of Series A Preferred Stock are outstanding, this Company shall not without first obtaining the approval (by written consent, as provided by law) of the Holders of at least 66-2/3% of the then outstanding shares of Series A Preferred Stock, voting together as a class, except as otherwise provided for in this Designation:

(a) Increase or decrease (other than by redemption or conversion) the total number of authorized shares of Series A Preferred Stock;

(b) Effect an exchange, reclassification, or cancellation of all or a part of the Series A Preferred Stock, excluding a reverse stock split or forward stock split;

(c) Effect an exchange, or create a right of exchange, of all or part of the shares of another class of shares into shares of Series A Preferred Stock; or

(d) Alter or change the rights, preferences or privileges of the shares of Series A Preferred Stock so as to affect adversely the shares of such series, including the rights set forth in this Designation.

PROVIDED, HOWEVER, that the Company may, by any means authorized by law and without any vote of the Holders of shares of the Series A Preferred Stock, make technical, corrective, administrative or similar changes in this Statement of Designations that do not, individually or in the aggregate, adversely affect the rights or preferences of the Holders of shares of the Series A Preferred Stock.

SECTION 11. MISCELLANEOUS.

(a) The headings of the various sections and subsections of this Certificate of Designation are for convenience of reference only and shall not affect the interpretation of any of the provisions of this Certificate of Designation.

(b) Whenever possible, each provision of this Certificate of Designation shall be interpreted in a manner as to be effective and valid under applicable law and public policy. If any provision set forth herein is held to be invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining provisions of this Certificate of Designation. No provision herein set forth shall be deemed dependent upon any other

provision unless so expressed herein. If a court of competent jurisdiction should determine that a provision of this Certificate of Designation would be valid or enforceable if a period of time were extended or shortened, then such court may make such change as shall be necessary to render the provision in question effective and valid under applicable law.

(c) Except as may otherwise be required by law, the shares of the Preferred Stock shall not have any powers, designations, preferences or other special rights, other than those specifically set forth in this Certificate of Designation.

[Remainder of page left intentionally blank. Signature page follows.]

IN WITNESS WHEREOF, the Company has caused this “Certificate of Designations of Restaurant Concepts of America Inc. Establishing The Designations, Preferences, Limitations And Relative Rights of its Series A Preferred Stock” to be duly executed by its Chief Executive Officer this 7th day of September 2011.

RESTAURANT CONCEPTS OF AMERICA INC.

/s/ Floyd L. Smith

Floyd L. Smith

Chief Executive Officer