Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - DIAMOND DISCOVERIES INTERNATIONAL CORP | exhibit_311.htm |

| EX-32.1 - CERTIFICATION - DIAMOND DISCOVERIES INTERNATIONAL CORP | exhibit_321.htm |

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

Washington, D.C. 20549

FORM 10-K /A

(Amendment No. 1)

(Mark One)

þANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission file number: 000-31585

DIAMOND DISCOVERIES INTERNATIONAL CORP.

(Name of Small Business Issuer)

| Delaware | 06-1579927 | |

|

(State or Other Jurisdiction of Incorporation)

|

(IRS Employer Identification No.) |

|

45 Rockefeller Plaza, Suite 2000 New York, NY

|

10111 | |

|

(Address of Principal Executive Offices)

|

(Zip Code) |

(212) 332-8016

(Issuer’s Telephone Number, Including Area Code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock

| Title of Each Class |

Name of Each Exchange on Which Registered

|

|

| Common Stock, par value $.001 | None |

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No þ

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B is not contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10- K or any amendment to this Form 10-K. o

Issuer’s revenues for its most recent fiscal year were: $0.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “small reporting company” in Rule 12-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | þ |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold as of May 10, 2011 is $6,454,717.

The number of shares outstanding of the Company’s common stock, as of May 12, 2011 is 403,414,907.

Transitional Small Business Disclosure Format (check one): Yes o No þ

TABLE OF CONTENTS

| DESCRIPTION OF BUSINESS | 3 | |||

| DESCRIPTION OF PROPERTY | 9 | |||

| LEGAL PROCEEDINGS | 14 | |||

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 15 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 17 | |||

| INDEX TO FINANCIAL STATEMENTS | 22 | |||

| FINANCIAL STATEMENTS | 23 | |||

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 36 | |||

| CONTROLS AND PROCEDURES | 36 | |||

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS; COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT | 38 | |||

| EXECUTIVE COMPENSATION | 39 | |||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 41 | |||

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 44 | |||

| PRINCIPAL ACCOUNTANT FEES AND SERVICES | 45 | |||

| EXHIBITS AND REPORTS ON FORM 8-K | 45 | |||

| SIGNATURES | 46 |

2

Explanatory Note

We are filing this Amendment No. 1 to Diamond Discoveries International, Inc.’s (the “Company”) Form 10-K for the fiscal year ended December 31, 2010, filed on May 10, 2011, in response to comments the Company received from the United States Securities and Exchange Commission on September 20, 2011.

PART I

This Amendment No. 1 to the Company’s Annual Report on Form 10-K and the information incorporated by reference includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. Various statements, estimates, predictions, and projections stated under “Risk Factors,” “Management’s Discussion and Analysis or Plan of Operations” and “Business,” and elsewhere in this Annual Report are “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These statements appear in a number of places in this Annual Report and include statements regarding the intent, belief or current expectations of Diamond Discoveries International or our officers with respect to, among other things, the ability to successfully implement our acquisition and exploration strategies, including trends affecting our business, financial condition and results of operations. While these forward-looking statements and the related assumptions are made in good faith and reflect our current judgment regarding the direction of the related business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions, or other future performance suggested herein. These statements are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control and reflect future business decisions which are subject to change. Some of these assumptions inevitably will not materialize, and unanticipated events will occur which will affect our results. Some important factors (but not necessarily all factors) that could affect our revenues, growth strategies, future profitability and operating results, or that otherwise could cause actual results to differ materially from those expressed in or implied by any forward-looking statement, include the following:

· our ability to successfully implement our acquisition and exploration strategies;

· the success or failure of our exploration activities and other opportunities that we may pursue;

· changes in the availability of debt or equity capital and increases in borrowing costs or interest rates;

· changes in regional and national business and economic conditions, including the rate of inflation;

· changes in the laws and government regulations applicable to us; and

· increased competition.

Stockholders and other users of this Annual Report on Form 10-K are urged to carefully consider these factors in connection with the forward-looking statements. We do not intend to publicly release any revisions to any forward-looking statements contained herein to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events.

ITEM 1. DESCRIPTION OF BUSINESS

Acquisition Agreements Caribou Property

On March 17, 2008, we entered into an acquisition agreement with Messrs. Bertrand Brassard and Michel Lavoie. Pursuant to such agreement, we acquired certain mineral rights in property located in the Thetford Mines area, part of the Appalachian Belt, Province of Quebec, Canada. The total consideration of $205,000, of which $75,000 represents the amount paid in cash and $130,000 represents the fair value of a total of 10,000,000 shares of the Company’s common stock issued to Messrs. Brassard and Lavoie.

In connection with the acquisition of these mineral rights, the Company agreed to pay the sellers a 2% royalty on the “net smelter returns” of the property. Net smelter returns are determined by the net amount received from the production of all metals and/or minerals from the property. The Company has the right to purchase, at any time prior to the beginning of any commercial production on the property, 1% royalty on the “net smelter returns” for a total cash payment of $1,000,000.

3

Torngat Property

On September 12, 2000, we entered into an acquisition agreement to acquire certain mineral exploration permits covering an area of approximately 469.05 square kilometers in the Torngat fields, which are located on the east coast of Ungava Bay, in the northwestern part of Quebec. The Company performed exploration activities in the Torngat fields from 2000 to 2007. In 2008, we abandoned exploration of the Torngat fields in favor of the Caribou Property.

Our Exploration Program Caribou Property

Prior to any decision to develop the properties, a mineral deposit must be assessed to determine the total tonnage of minerals bearing material and the estimated value of the minerals. Gathering this data usually takes, as noted above, at least two years. At that time, we will decide whether, and, if so, how, to proceed. We may seek either a joint venture partner or a senior partner that will undertake the exploration of the properties. It must be noted that there is a substantial risk that no commercially viable mineral deposit will be found, and if that is the case, we are likely to have difficulty finding any partners to undertake further exploration.

At the present time, we do not hold any interest in a mineral property that is in production. Our viability and potential success lie in our ability to successfully explore, exploit and generate revenue from our properties. There can be no assurance that such revenues will be obtained. The exploration of mineral deposits involves significant risks over a long period of time, which a combination of careful evaluations, experience and knowledge may not eliminate. It is impossible to ensure that the current or proposed exploration programs on the exploration permits will be profitable or successful. Our inability to locate a viable mineral deposit on our properties could result in a total loss of our business.

We intend to continue to explore the Caribou Property through the completion of the exploration phase. We contract with third parties to perform all exploration activities.

Our exploration operations are subject to all of the hazards and risks normally incident to exploration of this type, any of which could result to damage to life or property, environmental damage, and possible legal liability for any or all damages. Our activities may be subject to prolonged disruptions due to weather conditions surrounding the location of properties over which we have permits. Difficulties, such as an unusual or unexpected rock formation encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and data, and could delay our exploration program. While we may obtain insurance against certain risks in such amounts as we deem adequate, the nature of these risks are such that liabilities could exceed policy limits or be excluded from coverage. We do not currently carry insurance to protect against these risks and there is no assurance that we will obtain such insurance in the future. There are also risks against which we cannot, or may not elect to, insure. The potential costs which could be associated with any liabilities not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our final position, future earnings, and/or competitive position.

FY 2008 Activities

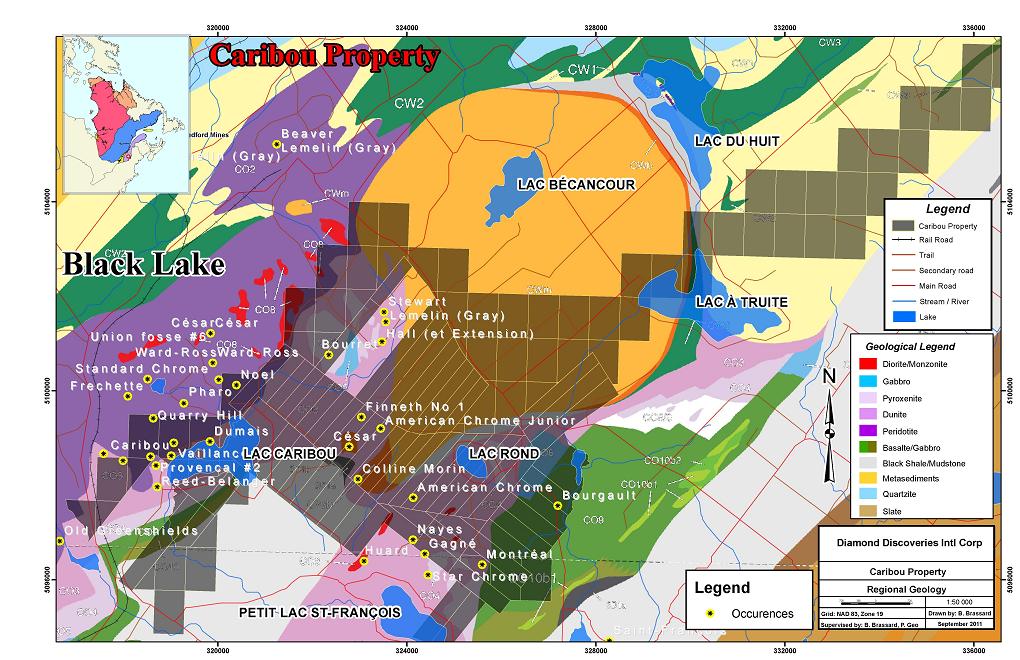

In June 2008, the Company’s wholly-owned subsidiary, Platinum Discoveries Corp., received from GEOLOGICA Groupe – Conseil Inc. (“Geologica”) a NI 43 -101 Technical Report on the Company’s 100% owned Caribou Property authored by Alain-Jean Beauregard, P.Geo., OGQ, FGAC and Daniel Gaudreault, P. Eng., OIQ, AEMQ, Thetford-Mines area in the province of Quebec Canada. Eleven (11) deposits and showings are present on the Caribou property (Montreal Mine, Caribou Mine, American Chrome Deposit, American Chrome Jr., Finneth, Cesar, Dumais, Vaillancourt, Gagne, Greenshields and Lambly-Nadeau/Victoria Mines). Compiling and analyzing all previous work led to sensing a very close relationship between the cumulate sequence of the Thetford Mines Ophiolitic Complex, chromiferous mineralization, and Platinum Group Elements (PGE) mineralization.

More than eleven (11) known chromite occurences on the Company’s property were recognized and defined. The report indicates that the results of the past work confirm the presence of platinum and palladium on the Caribou property, but also seem to show that PGE mineralization is preferentially associated with the contact between ultramafic and mafic units of the Thetford Mines Ophiolitic Complex. More than 10 Km of favorable contact is present on the Property. Large-scale mapping of this metalotect led to identifying new PGE showings.

4

In September 2008 the Company announced that Platinum Discoveries Corp. commenced evaluation of the Caribou project in the Thetford Mines area of Southern Quebec. Sampling of the eleven (11) showings that are present on the Caribou Property have begun and will be sent to ALS Laboratories for assay testing. These showings have shown potential for chromium, nickel and platinum mineralizations. A heliborne geophysical survey is also planned that in addition to the surface sampling will assist in prioritizing drill targets.

In November 2008, preliminary results from the exploration work done in 2008 field season confirmed the presence of chromium (Cr2O3) mineralization in pyroxenite unit over several meters.

FY 2009 Activities

The 2008 field season focused on known chromite showings to confirm the chromite and platinum group elements (PGE) potential. The 2009 field season followed a structural-geological study completed in the fall of 2008 on the Property based on satellite imagery. The study defined potential structural targets at a 1:10,000 scale. The report was titled “Structural/Geological Interpretation Using Satellite Imagery of the Brassard South Project, Quebec, Canada” dated December 2008 by A. Moreau, P. Geo., M.A. Sc., Geological Engineering, of Technologies Earth Metrix Inc.(Rouyn-Noranda, Quebec)

The channel sampling of 2009 of known showings (Finneth, American Chrome Junior and Cesar) confirmed chromium and PGE potential. All samples selected on outcrop were 1 meter wide. One sample obtained on American Chrome Junior graded 21.47 % of Cr2O3. All seven (7) samples contain chromium PGE. One sample from the Finneth Showing contains 6.36% Cr2O3. All 15 samples contain chromium values. The three (3) best Cr2O3 values graded .1 ppm PGE (Pt-Pd-RH). The two (2) best values obtained on Cesar graded 2% Cr2O3. It was recommended to do more trenching in the surrounding area of each showing.

FY 2010 Activities

In 2010, the Company acquired an additional 41 mineral claims totaling 2,460 hectares on the northeast corner of the existing property. These claims were acquired for their gold potential. This acquisition brought the total land package to 143 claims representing 6,236 hectares.

FY 2011 Planned Activities

Plans for 2011 include additional surface sampling and phase one drilling of 5-8 targets totaling 1-2000 meters for chromium values and 5-8 targets totaling 1-2000 meters for gold values. The total budget for these exploration activities is $500,000 to $1,000,000. The Company is actively pursuing strategic alliances and joint-venture opportunities in order to achieve these exploration goals.

We estimate that it will require approximately $500,000 to $1,000,000 to conduct an exploration program on the Caribou property through 2011. This amount will be used to pay for continued drilling of identified targets, prospecting and geological mapping, helicopter and airplane support, lodging and food for workers, pick-up truck rentals, assays, property taxes to the Quebec Department of Natural Resources and supervision. If we continue with the exploration of the Caribou property, we plan to raise a minimum of $500,000 to $1,000,000 through one or more private offerings pursuant to Rule 506 or Regulation D or through an offshore offering pursuant to Regulation S; however, nothing in this annual report shall constitute an offer of any securities for sale. Such shares when sold will not have been registered under the Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. If we are unable to raise this amount, we will most likely cease all activity related to our exploration program, or at the very least, proceed on a reduced scale. We have to date relied on a small number of investors to provide us with financing for the commencement of our exploration program, including TVP Capital Corp., a principal stockholder. Amounts owed to these individuals are payable upon demand.

Torngat Property

The Company performed exploration activities related to the Torngat Property from 2000 through the end of 2007 at which time it was determined not to pursue any further exploration of that property.

5

Government Regulation and Licensing

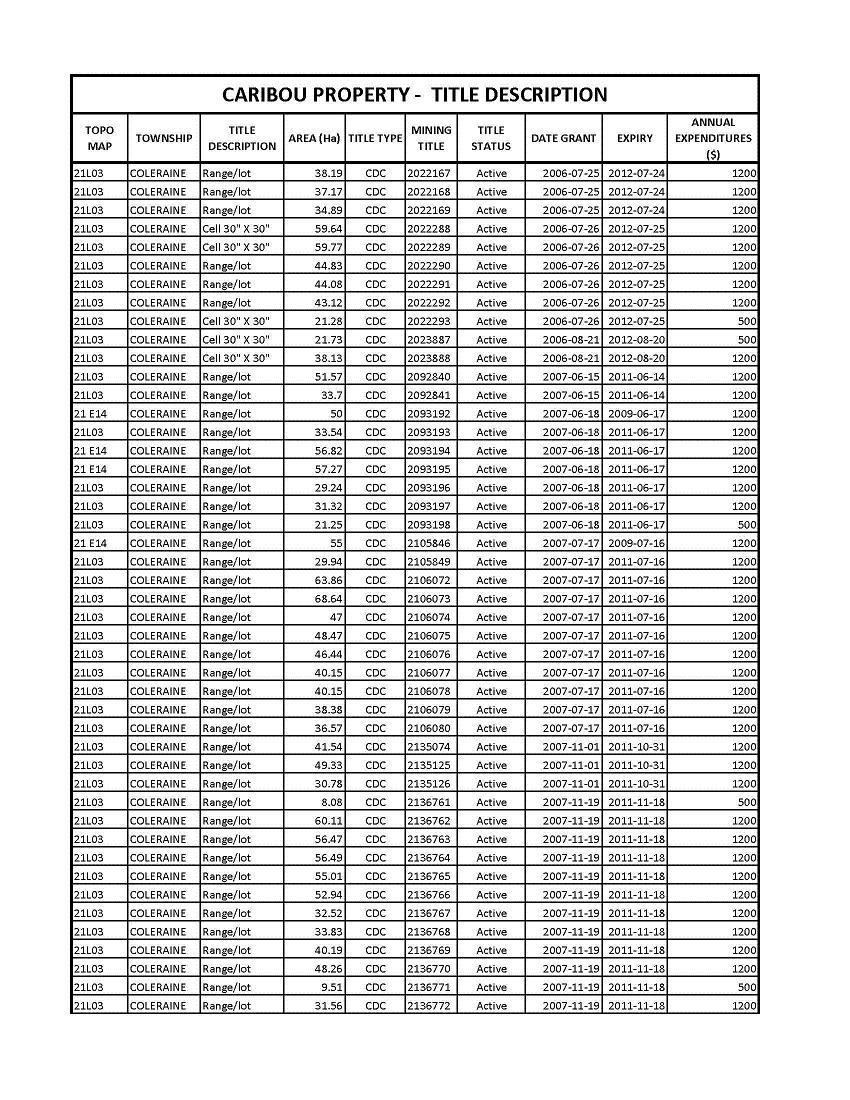

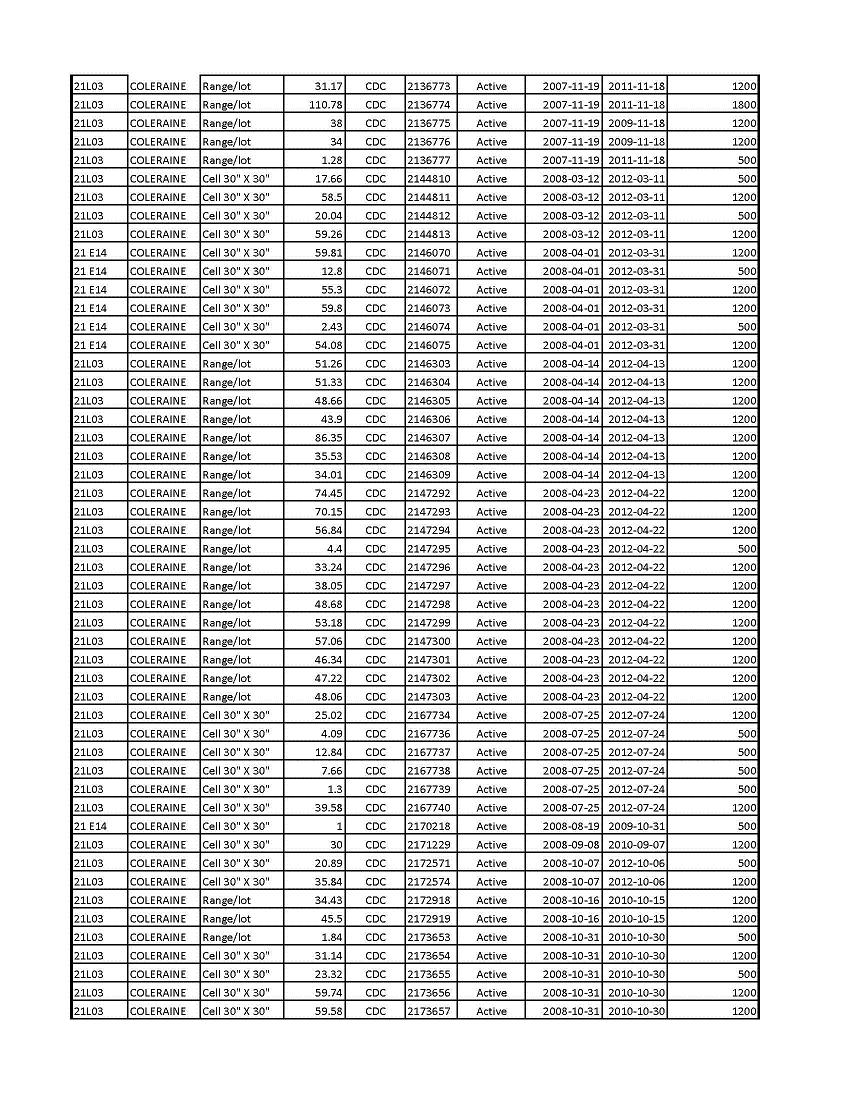

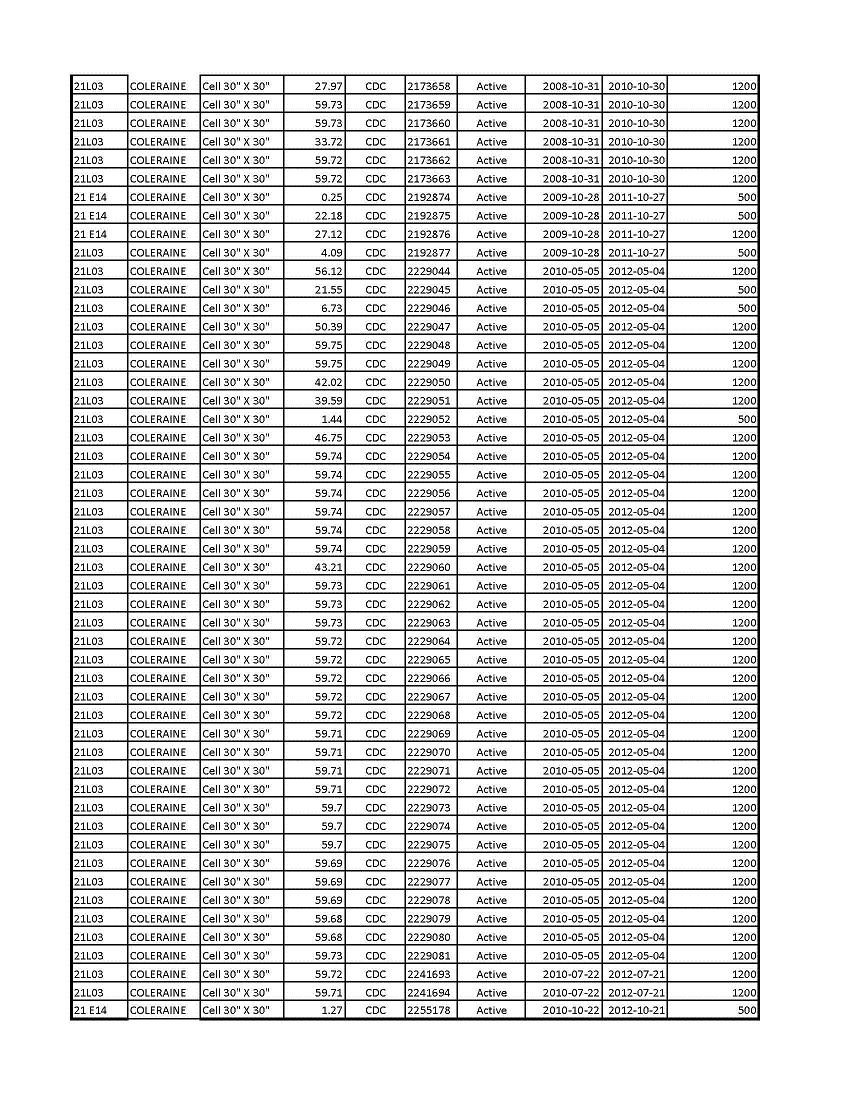

Our operations require licenses and permits from various governmental authorities. We believe that we presently hold all necessary licenses and permits required for our intended activities under applicable laws and regulations, and we believe that we are complying at the present time in all material respects with the terms of such licenses and permits. However, our licenses and permits are subject to changes in regulations and in various operating circumstances. We may not be able to obtain all necessary licenses and permits required to carry out exploration activities. We believe we have met all exploration work activities to keep our claims in good standing and have provided a table (Table 1) that summarizes our permits and exploration work requirements.

We are currently subject to the environmental regulations set forth under the Environmental Act (Quebec), the Mining Act (Quebec) and the Forest Act (Quebec). We believe that we are in compliance with all of these acts, and moreover, we believe that the environmental impact of our exploration activities will be minimal. To the extent that we remove large amounts of rock or soil from the properties, we will likely have to remediate any environmental disruption caused by our activities. It is impossible to assess with any certainty the cost of such replacement or remediation activities, or the potential liability that we would face if we were to be found to have violated one, or more, of these Acts.

6

7

8

Employees

We do not have any full time employees at the present time. We have one part time employee, Mr. Antonio Sciacca, who is an executive officer. We use third parties to oversee and conduct our exploration activities.

Competition

The mineral exploration business is competitive in all of its phases. We expect to compete with numerous other exploration companies and individuals, including competitors with greater financial, technical and other resources than us, for the resources required for exploration. The greater resources of other entities will likely position these competitors to conduct exploration within a shorter time frame than we can, giving them a market advantage.

Currency Fluctuation

We also have exposure to currency fluctuations, since our properties are located in Canada, and thus our transactions are largely in Canadian dollars. Such fluctuations can materially affect our financial position and other results of operations. References to the “dollar” or “$US” in this Form 10K are to United States Dollars, and “Canadian” or “$Cdn” refers to Canadian dollars. Unless otherwise stated, the translations of $US to $Cdn and vice versa have been made at the average rate for the year indicated. The following table sets forth the high and low exchange rate of the Canadian dollar per US dollar as of the latest practicable date and for each of the last six months:

|

Period

|

High

|

Low

|

||||||

|

April 2011

|

0.9722 | 0.9450 | ||||||

|

March 2011

|

0.9974 | 0.9671 | ||||||

|

February 2011

|

0.9984 | 0.9710 | ||||||

|

January 2011

|

1.0035 | 0.9848 | ||||||

|

December 2010

|

1.0216 | 0.9931 | ||||||

|

November 2010

|

1.0286 | 0.9980 | ||||||

ITEM 2. DESCRIPTION OF PROPERTY

We do not own real property, nor do we hold any other real property interest other than the exploration permits which we discuss above under the caption “Description of Business.” As noted above, we engaged Messr. Bertrand Brassard as our on-site project manager for our exploration activities of the Caribou Property.

In compliance with Guide 7 of Industry Guides under the Securities Act of 1933 and the Securities Exchange Act of 1934, the following information is provided, since we are engaged or are to be engaged in significant mining operations:

9

10

11

Description and Location

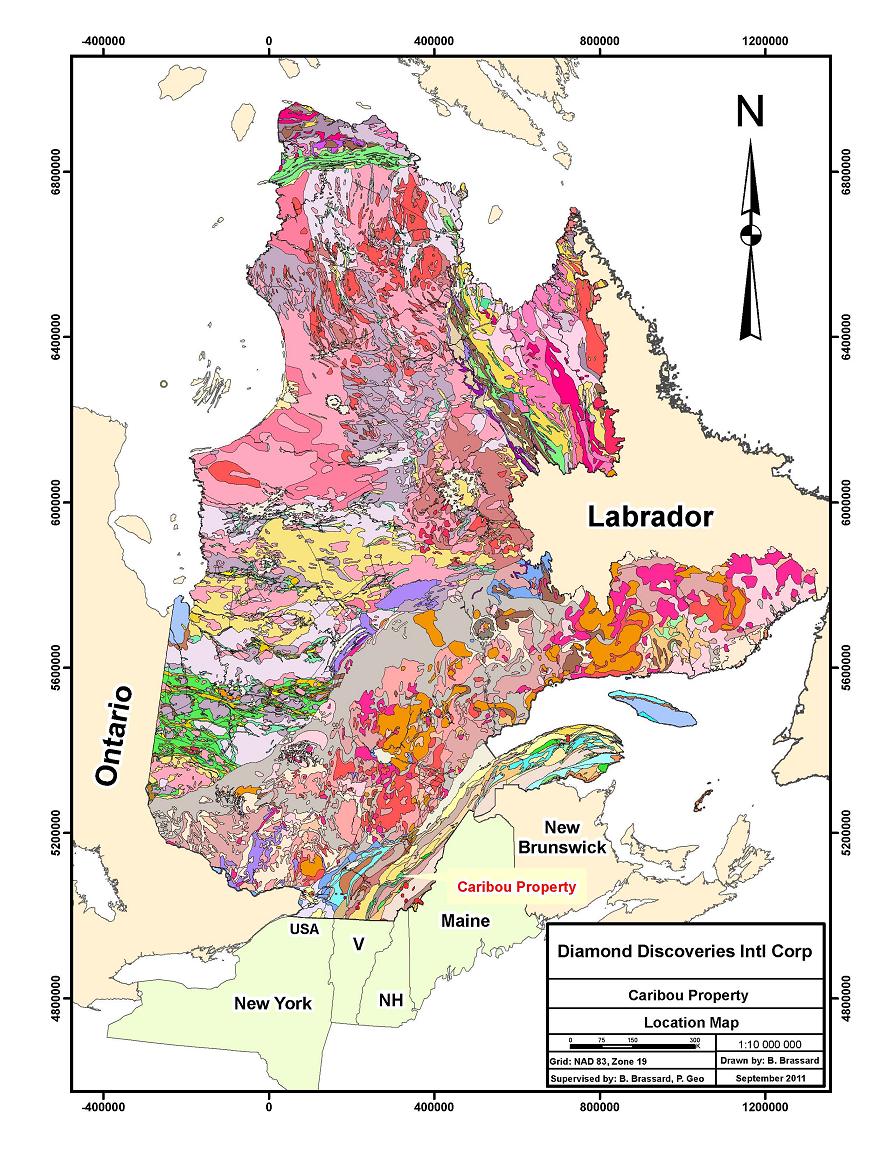

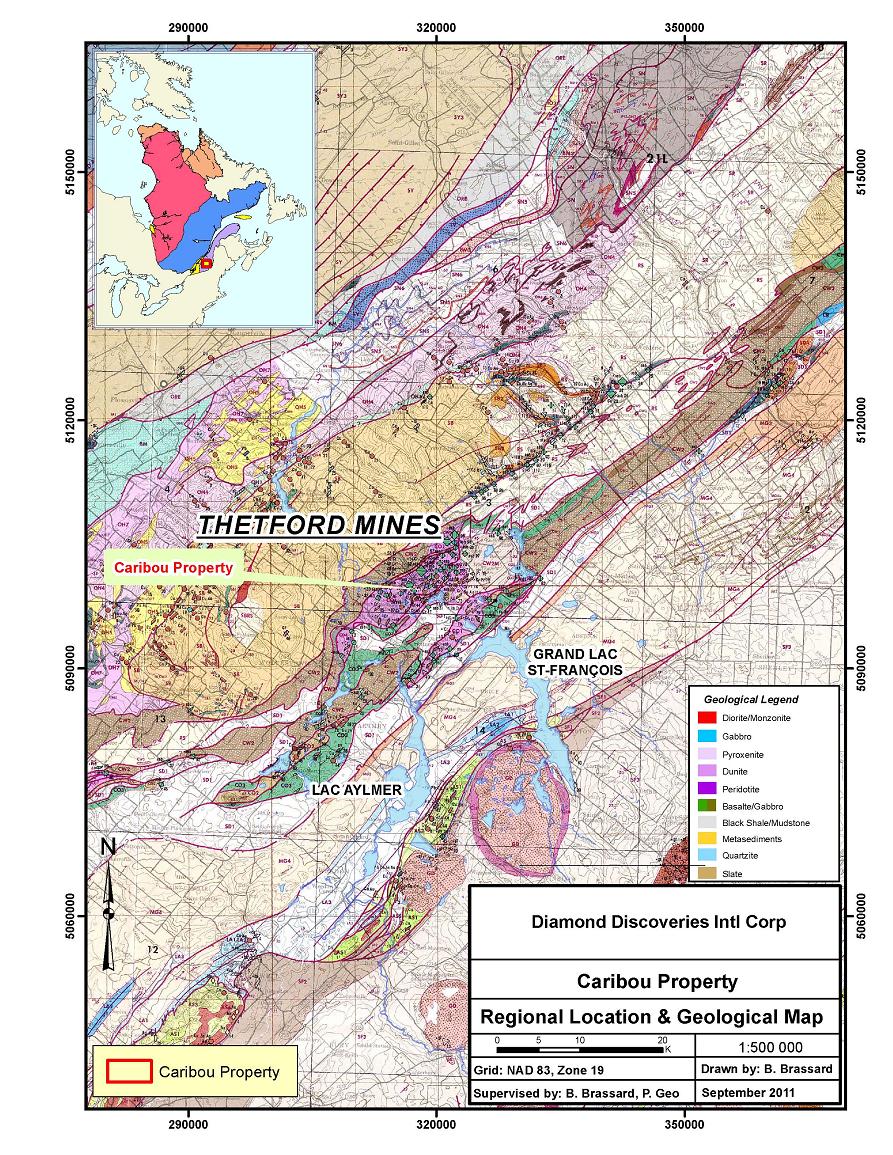

The Caribou property is located approximately 200 kilometers NE of the city of Montreal and 5 kilometers south of the town of Thetford Mines, Province of Quebec (Figures 1). The property lies within the NTS 21E/14 and 21L/03 map sheets and is centered on 324,000 mE and 5,099,000 mN (UTM Nad 83).

The property consists of 140 mining claims totalling 6,500 hectares (Table 1 and Figure 2).

The property is free and clear of any and all liens, charges, encumbrances, claims (actual, pending or threatened), royalties or interests of others of whatsoever nature and kind (“Encumbrances”).

12

Accessibility, local Resources, Infrastructures, Physiography and Climate

The property is easily accessible by road and secondary roads from Thetford Mines.

A large swamp covers the central part of the property, while spruce and mixed deciduous and coniferous forests cover the northern and southern extremities. The relief rarely exceeds 50 meters, except where hills, eskers and glacial deposits are found.

The local climate is that of the Eastern Townships at this latitude, that is to say typically continental, with hard winters extending from November to March with snow precipitations which can reach several meters and total precipitation of 80 centimeters per year. Summers are relatively hot and fairly wet.

Regional Geology

The area of the Caribou property is located within the Southern Québec Ophiolite Belt (J.H. Bédard and al, 2001), that comprises four major ophiolitic complexes (Figure 3): the Thetford Mines (TMOC), Asbestos (AOC), Lac Brompton (LBOC), and Mont Chauve/Mont Oxford (MOOC) complexes, and numerous smaller slivers (e.g. the Rivière des Plantes ophiolitic mélange).

These massive ophiolite units were previously considered to represent kilometre-scale, fault-bounded blocks within the St.-Daniel Mélange, which was interpreted as the mixture of a subduction complex (Cousineau and St-Julien, 1992, 1994). Recent detailed mapping and structural analysis in the Thetford Mines area has challenged this interpretation, suggesting rather that the St.-Daniel is a piggyback basin deposited on top of the ophiolite as it was being obducted, exhumed, eroded(Schroetter et al., 2003, 2005, 2006, cf. Dérosier, 1971; Hébert, 1983). The base of the St.-Daniel, the Coleraine Breccia (Hébert, 1981; Schroetter et al., 2003, 2006), contains fragments of ophiolitic (thichnesses of 10 of metres in site) and continental margin rocks, indicating that both were being exhumed and eroded at this time. The 441 to 460 Ma Ascot Complex (U-Pb zircon ages; David and Marquis, 1994), dominated by felsic to intermediate volcanic rocks, is interpreted as an arc, built partly on oceanic basement, partly on a detached continental sliver (Tremblay, 1989, Tremblay et al., 1989, 1994).

Local Geology

The Caribou property is located within the Thetford Mines Ophiolitic Complexe (TMOC). The TMOC consists of a complete ophiolitic sequence showing a polarity towards south-east. Theoretically, such a sequence is composed, from bottom to top, of a tectonic peridotite being able to contain dunite lenses, a zone of transition from dunitic composition, mafic cumulates, hypabyssal rocks containing layred dykes and a volcanic formation.

The Black Lake intrusive mass outcrops in the north-eastern part of the property while the Adstock Mount mass is located in the south-eastern part. In the Black Lake intrusion, the tectonic peridotite, of a thickness of less than 5 km, consists especially of a deformed harzburgite. This lithology is host to important asbestos deposits of the area. The cumulates of stratiform nature, rest in tectonic contact on the harzburgite in the Black Lake intrusive mass, while they represent the base of the ophiolitic sequence in the Adstock Mount intrusion. The cumulats are overlapped by hypabyssal rocks, which include homogeneous gabbros as well as dykes and diabase sills. Moreover, a lower volcanic formation is mainly constituted of basaltic pillow lavas with a thin cover of red mudstones. The ophiolitic sequence is capped by the formation of volcanogenic rocks including basaltic and andesitic lavas, pyroclastic rocks, breccias and pelagic sediments.

In the eastern part of the property, the Black Lake and Adstock Mount intrusions are in contact with the Caldwell Group. The rocks of this group are within the Bécancour dome, which is an anticlinal structure which limits are sheilded by normal faults and underlined by a tectonic breccia (St-Julien, 1987).

The geology separating the Black lake and the Mount Adstock intrusive masses (transition area) is not known precisely. Marcotte (1980) indicates that the St-Daniel Formation contains an enclave of rocks of the Caldwell Group, Hébert (1979) indicates that these last outcrop continuously, but that the south-eastern end is included within the St-Daniel Formation. Finally, St-Julien and Slivitsky (1987) indicate the presence of a band of ultramafic rocks at the contact between the Caldwell Group and the St-Daniel Formation.

The geological compilation completed by Ressources Minières Coleraine indicates that the sector of the Black Lake intrusion comprises an assembly of pyroxenite and werhlite. Contacts between these two lithologies are an irregular form. However, a pyroxenite-werhlite-dunite assembly shows an east-west trend which is very well developed. This assembly is clearly recut by the dunitic assembly which hosts the old Hall, Lemelin and Stewart mine sites.. One observes an important increase in the dunite proportion within the pyroxenite and werhlite assemblage. This new assemblage is defined as pyroxenite-werhlite-dunite(non bedded).

The sector of the Adstock Mount intrusive mass is dominated by an association between the dunitic and werhlitic dunite assemblages. These rock assemblages are in contact in the south-west with an assembly dominated by the pyroxenite, which can contain werhlite or a werhlitic dunite. Moreover, this sector contains an important granitoid intrusive mass.

13

The transition area presents lithological assemblages of the Black Lake intrusive mass in contact with the sedimentary rocks, which limit the TMOC. This sector is characterized by the abundance of breccias of sedimentary composition as well as ultramafic units.

(1) Pursuant to an agreement between us and Messrs. Bertrand Brassard and Michel Lavoie. Pursuant to such agreement, we acquired certain mineral rights in property located in the Thetford Mines area, part of the Appalachian Belt, Province of Quebec, Canada. The total consideration of $205,000, of which $75,000 represents the amount paid in cash and $130,000 represents the fair value of a total of 10,000,000 shares of the Company’s common stock issued to Messrs. Brassard and Lavoie.The terms of this agreement has been satisfied and in addition the company has spent approximately $130,000.00 on exploration to date.

In connection with the acquisition of these mineral rights, the Company agreed to pay the sellers a 2% royalty on the “net smelter returns” of the property. Net smelter returns are determined by the net amount received from the production of all metals and/or minerals from the property. The Company has the right to purchase, at any time prior to the beginning of any commercial production on the property, 1% royalty on the “net smelter returns” for a total cash payment of $1,000,000.

(3) To our knowledge, Messrs. Brassard and Lavoie bought the original 102 claims totaling 3,776 hectares of property in the Caribou Property located in Quebec, Canada, from Allican Resources, Inc. and there were no previous owners, operators, or operations on the property since the early 1950s.

(4) Although there can be no assurance of successful mineral development, initial progress reports of the property have indicated that there are potential chromium, nickel and platinum mineralizations on the property.

Phase 1

The following is a breakdown of the estimated budget for particular aspects of Phase 1 of our exploration activities:

The following is a breakdown of the estimated budget for particular aspects of Phase 1 of our exploration activities:

| Drill program (2,000 meters x approximately $200.00 per meter,10-16 drill targets 100-200 meters each) | 400,000 | |||

| Testing samples | 100,000 | |||

| Total | $ | 500,000 |

Phase 2

If the Phase 1 Drill Program is successful, then Phase 2 will begin. The following is a breakdown of the estimated budget for particular aspects of Phase 2 of our exploration activities:

| Drill program (2,000 meters x approximately $200.00 per meter ,5-8 drill targets 200-400 meters each) | 400,000 | |||

| Testing samples | 100,000 | |||

| Total | $ | 500,000 |

(5) To date, no proven reserves have been established and there can be no assurance that any such reserves will ever exist.

(6) Mr Bertrand Brassard will be overseeing and conducting exploration work,he is a P.Geo.,and is a Qualified Person within the meaning of National Instrument 43-101.He has been conducting exploration work in the Thetford Mines,Quebec area over the past 25 years.

(7) Quality Assurance/Quality Control (QA/QC) protocols have been used to date for sample collection.Surface sampling to date was logged by a representative of B. Brassard Geoconseil,a firm owned by Bertrand Brassard.During the logging process surface rocks are marked for surface sampling .Most of the sampled rocks are then broken and placed in a plastic bag with the sample tag and sealed and sent to the testing laboratory,while the remaining rockis placed in storage. on site.Sample analysis is performed by accredited analytical laboratory ALS Chemex Labs in Val D’or,Quebec.

ITEM 3. LEGAL PROCEEDINGS

There are no legal proceedings pending or threatened against us.

14

PART II.

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

As of July 18, 2002 prices for the Common Stock were quoted on the Over the Counter Bulletin Board operated by the National Association of Securities Dealers, Inc. under the symbol DMDD. The Company’s common stock was delisted on May 17, 2008 and has been reported on the pink sheets since that date. The following table sets forth the high and low closing bid prices of the Company’s Common Stock for the periods indicated as reported by the NASD. These quotations reflect inter-dealer prices without retail markup, markdown or commissions and may not necessarily represent actual transactions.

|

High

|

Low | |||||||

|

Fiscal Year 2009

|

||||||||

|

First Quarter

|

N/A | N/A | ||||||

|

Second Quarter

|

N/A | N/A | ||||||

|

Third Quarter

|

N/A | N/A | ||||||

|

Fourth Quarter

|

N/A | N/A | ||||||

|

Fiscal Year 2010

|

||||||||

|

First Quarter

|

N/A | N/A | ||||||

|

Second Quarter

|

N/A | N/A | ||||||

|

Third Quarter

|

N/A | N/A | ||||||

|

Fourth Quarter

|

N/A | N/A | ||||||

|

Fiscal Year 2011

|

||||||||

|

First Quarter

|

N/A | N/A | ||||||

Of the 403,414,907 shares of our common stock issued and outstanding as of May 12, 2011, 92,209,049 shares of our common stock are currently considered “restricted securities” and in the future, may be sold only in compliance with Rule 144 or in an exempt transaction under the Act unless registered under the Act.

As of May 12, 2011 the number of holders of record of our common stock was approximately 120.

We do not anticipate paying any cash dividends on our common stock in the foreseeable future because we intend to retain our earnings to finance the expansion of our business. Thereafter, the declaration of dividends will be determined by the Board of Directors in light of conditions then existing, including, without limitation, our financial condition, capital requirements and business condition. We are prohibited from paying cash dividends on the common stock until any issued and outstanding preferred stock is converted into common stock. However, there were no shares of preferred stock outstanding as of December 31, 2010.

Equity Compensation Plan Information:

|

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

|

Weighted-average exercise

price of outstanding options,

warrants and rights

|

Number of securities

available for future issuance

under equity compensation

plans (excluding securities

reflected in column

(a))

|

||||||

|

(a)

|

(b)

|

(c)

|

||||||

|

Equity compensation plans approved by security holders

|

0

|

|

$

|

0.00

|

|

1,500,000

|

||

|

Equity compensation plans not approved by security holders

|

0

|

|

$

|

0.00

|

|

2,200,000

|

||

|

Total

|

0

|

|

$

|

0.00

|

|

3,700,000

|

||

15

Stock Option Plans

2005 Plan

On November 14, 2005, the Company adopted the Diamond Discoveries International Corp. 2005 Stock Incentive Plan (the “2005 Plan”). Under the 2005 Plan, 35,000,000 shares of common stock are reserved for issuance. The purpose of the 2005 Plan is to provide incentives for officers, directors, consultants and key employees to promote the success of the Company, and to enhance the Company’s ability to attract and retain the services of such persons. Options granted under the 2005 Plan may be either: (i) options intended to qualify as “incentive stock options” under Section 422 of the Internal Revenue Code of 1986; or (ii) non-qualified stock options. Stock options may be granted under the 2005 Plan for all employees and consultants of the Company, or employees of any present or future subsidiary or parent of the Company. The 2005 Plan is administered by the Board of Directors. The Compensation Committee is empowered to interpret the 2005 Plan and to prescribe, amend and rescind the rules and regulations pertaining to the 2005 Plan. Options granted under the 2005 Plan generally vest over three years. No option is transferable by the optionee other than by will or the laws of descent and distribution and each option is exercisable, during the lifetime of the optionee, only by the optionee. The Compensation Committee may not receive options.

Any incentive stock option that is granted under the 2005 Plan may not be granted at a price less than the fair market value of the Company’s Common Stock on the date of grant (or less than 110% of the fair market value in the case of holders of 10% or more of the total combined voting power through all classes of stock of the Company or a subsidiary or parent of the Company.) Non-qualified stock options may be granted at the exercise price established by the Compensation Committee, which may be less than the fair market value of the Company’s Common Stock on the date of grant.

Each option granted under the 2005 Plan is exercisable for a period not to exceed ten years from the date of grant (or five years in the case of a holder of more than 10% of the total combined voting power of all classes of stock of the Company or a subsidiary or parent of the Company) and shall lapse upon expiration of such period, or earlier upon termination of the recipient’s employment with the Company, or as determined by the Compensation Committee.

2004 Plan

On September 30, 2004, the Company adopted the Diamond Discoveries International Corp. 2004 Stock Incentive Plan (the “2004 Plan”). Under the 2004 Plan, 35,000,000 shares of common stock are reserved for issuance. The purpose of the 2004 Plan is to provide incentives for officers, directors, consultants and key employees to promote the success of the Company, and to enhance the Company’s ability to attract and retain the services of such persons. Options granted under the 2004 Plan may be either: (i) options intended to qualify as “incentive stock options” under Section 422 of the Internal Revenue Code of 1986; or (ii) non-qualified stock options. Stock options may be granted under the 2004 Plan for all employees and consultants of the Company, or employees of any present or future subsidiary or parent of the Company. The 2004 Plan is administered by the Board of Directors. The Compensation Committee is empowered to interpret the 2004 Plan and to prescribe, amend and rescind the rules and regulations pertaining to the 2004 Plan. Options granted under the 2004 Plan generally vest over three years. No option is transferable by the optionee other than by will or the laws of descent and distribution and each option is exercisable, during the lifetime of the optionee, only by the optionee. The Compensation Committee may not receive options.

Any incentive stock option that is granted under the 2004 Plan may not be granted at a price less than the fair market value of the Company’s Common Stock on the date of grant (or less than 110% of the fair market value in the case of holders of 10% or more of the total combined voting power through all classes of stock of the Company or a subsidiary or parent of the Company.) Non-qualified stock options may be granted at the exercise price established by the Compensation Committee, which may be less than the fair market value of the Company’s Common Stock on the date of grant.

Each option granted under the 2004 Plan is exercisable for a period not to exceed ten years from the date of grant (or five years in the case of a holder of more than 10% of the total combined voting power of all classes of stock of the Company or a subsidiary or parent of the Company) and shall lapse upon expiration of such period, or earlier upon termination of the recipient’s employment with the Company, or as determined by the Compensation Committee.

2003 Plan

On May 30, 2003, the Company adopted the Diamond Discoveries International Corp. 2003 Stock Incentive Plan (the “Plan”). Under the Plan, 15,000,000 shares of common stock are reserved for issuance. The purpose of the Plan is to provide incentives for officers, directors, consultants and key employees to promote the success of the Company, and to enhance the Company’s ability to attract and retain the services of such persons. The Plan orivudes for the grant of incentive stock options and nonqualified stock options (“Options”) and restricted stock awards (“Restricted Stock Awards”) and Stock Appreciation Rights, Performance Shares, Dividend Equivalent Payments, and Other Stock Based Awards (“Options,”“Restricted Stock Awards,” and “Stock Appreciation Rights,” are collectively referred to herein as “Awards”). Options granted under the Plan may be either: (i) options intended to qualify as “incentive stock options” under Section 422 of the Internal Revenue Code of 1986; or (ii) non-qualified stock options. Stock options may be granted under the Plan for all employees and consultants of the Company, or employees of any present or future subsidiary or parent of the Company. The Plan is administered by the Board of Directors. The Compensation Committee is empowered to interpret the Plan and to prescribe, amend and rescind the rules and regulations pertaining to the Plan. Options granted under the Plan generally vest over three years. The Compensation Committee may not receive options.

16

Any incentive stock option that is granted under the Plan may not be granted at a price less than the fair market value of the Company’s Common Stock on the date of grant (or less than 110% of the fair market value in the case of holders of 10% or more of the total combined voting power through all classes of stock of the Company or a subsidiary or parent of the Company.) Non-qualified stock options may be granted at the exercise price established by the Compensation Committee, which may be less than the fair market value of the Company’s Common Stock on the date of grant, but in no event shall such exercise price be less than 55% of such fair market value.

Each option granted under the Plan is exercisable for a period not to exceed ten years from the date of grant (or five years in the case of an incentive stock option granted to a holder of more than 10% of the total combined voting power of all classes of stock of the Company or a subsidiary or parent of the Company) and shall lapse upon expiration of such period, or earlier upon termination of the recipient’s employment with the Company, or as determined by the Compensation Committee.

Awards are generally non-transferable other than by will or the laws of descent and distribution or pursuant to a qualified domestic relations order.

The Company’s Board of Directors may at any time, and from time to time, amend, terminate, or suspend one or more of the Plan in any manner it deems appropriate, provided that such amendment, termination or suspension cannot adversely affect rights or obligations with respect to shares or options previously granted, unless the Award recipient consents to such changes in writing. The Board of Directors may not, without shareholder approval: make any amendment which would materially modify the participation eligibility requirements for the 2005 Plan and 2004 Plan, to the extent they require approval in order to satisfy the Internal Revenue Code requirements; make other modifications requiring stockholder approval to satisfy the Internal Revenue Code requirements, increase the total number of shares of common stock which may be issued pursuant to the 2005 Plan and 2004 Plan, except in the case of a reclassification of the Company’s capital stock or a consolidation or merger of the Company.

Recent Sales of Unregistered Securities

In April 2009, in connection with a private placement of its common stock, the Company issued 17,500,000 shares of its common stock for $175,000.

In December 2010, in connection with a private placement of its common stock, the Company issued 13,453,077 shares of its common stock for $34,978.

In January 2011, in connection with a private placement of its common stock, the Company issued 11,530,000 shares of its common stock for $29,978.

The sale and issuance of the aforementioned shares were exempt transactions under Section 4(2) of the Securities Act of 1933 as a transaction by an issuer not involving a public offering. At the time of sale, the persons who acquired these securities were all full, informed and advised about matters concerning us, including our business, financial affairs and other matters. The shareholders acquired the securities for their own account or their designees.

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION OR PLAN OF OPERATION

The following discussion and analysis should be read in conjunction with the financial statements and notes thereto included elsewhere in this Annual Report on Form 10-K. The following discussion regarding us and our business and operations contains forward-looking statements. Such statements consist of any statement other than a recitation of historical fact, and can be identified by the use of such forward-looking terminology such as “may,” “expect,” “anticipate,” “estimate” or “continue” or the negative thereof or other variations thereon, or comparable terminology. The reader is cautioned that all forward-looking statements are necessarily speculative, and there are certain risks and uncertainties that could cause actual events or results to differ materially from those referred to in such forward-looking statements. The Company undertakes no obligation to update the information contained herein. Forward-looking statements are subject to inherent risks and uncertainties, some of which are summarized in “Risk Factors” section of this Form 10-K.

17

Operations to Date

We were incorporated in the State of Delaware in April of 2000. We have not engaged in commercial operations since inception, and therefore have not realized any revenues from operations since inception. We do not expect to commence operations in the foreseeable future and do not expect to generate revenue in calendar year 2011.

For the fiscal years ended December 31, 2010 and 2009 and the period from April 24, 2000 (date of inception) to December 31, 2010 we incurred $24,520, $26,281 and $2,455,092 in exploration costs (net of reimbursements), and $69,657, $88,060 and $16,428,796 in general and administrative expenses, respectively. General and administrative expenses consisted primarily of professional fees related to our corporate filings and consulting and other expenses incurred in operating our business. We incurred a net loss of $94,177 or $(.00) per share based on 399,886,289 weighted average shares outstanding for the fiscal year ended December 31, 2010 compared to a net loss of $114,341 or $(.00) per share based on 397,176,762 weighted average shares outstanding for the fiscal year ended December 31, 2009.

Going Concern

In connection with their audit report on our financial statements as of December 31, 2010, Rodefer & Moss, our independent registered public accounting firm, expressed substantial doubt about our ability to continue as a going concern because such continuance is dependent upon our ability to raise sufficient capital.

We have explored, and continue to explore, all avenues possible to raise the funds required. Continuation of our exploration efforts is dependent upon our ability to raise capital.

Ultimately, we must achieve profitable operations if we are to be a viable entity. Although we believe that there is a reasonable basis to believe that we will successfully raise the needed funds to continue exploration, we cannot assure you that we will be able to raise sufficient capital to continue exploration, or that if such funds are raised, that exploration will result in a finding of commercially exploitable reserves, or that if exploitable reserves exist on our properties, that extraction activities can be conducted at a profit.

Cash Flow and Capital Resources

Through December 31, 2010 we have relied on advances of approximately $1,779,000 from our principal stockholders, trade payables of approximately $257,000, notes payable of approximately 1,479,000 and proceeds of approximately $5,366,000 from the sale of common stock to support our limited operations. As of December 31, 2010, we had approximately $6,801 of cash.

We plan to seek additional equity or debt financing of up to $1,000,000 which we plan to use for the next phase of our exploration program to be conducted through December 31, 2011, as well as working capital purposes. We currently have limited sources of capital, including the public and private placement of equity securities and the possibility of issuance of debt securities to our stockholders. With virtually no assets, the availability of funds from traditional sources of debt will be limited, and will almost certainly involve pledges of assets or guarantees by officers, directors and stockholders. Stockholders have advanced funds to us in the past, but we cannot assure you that they will be a source of funds in the future. If we do not get sufficient financing, we may not be able to continue as a going concern and we may have to curtail or terminate our operations and liquidate our business (see Note 1 to financial statements).

Plan of Operation

Our business plan for the next year will consist of further exploration on the properties over which we hold the mineral exploration permits as well as preliminary marketing efforts.

We estimate that it will require approximately $500,000 to $1,000,000 to conduct an exploration program on the Caribou property through 2011. This amount will be used to pay for continued drilling of identified targets, prospecting and geological mapping, helicopter and airplane support, lodging and food for workers, pick-up truck rentals, assays, property taxes to the Quebec Department of Natural Resources and supervision. If we continue with the exploration of the Caribou property, we plan to raise a minimum of $500,000 through one or more private offerings pursuant to Rule 506 or Regulation D or through an offshore offering pursuant to Regulation S; however, nothing in this annual report shall constitute an offer of any securities for sale. Such shares when sold will not have been registered under the Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. If we are unable to raise this amount, we will most likely cease all activity related to our exploration program, or at the very least, proceed on a reduced scale. We have to date relied on a small number of investors to provide us with financing for the commencement of our exploration program, including TVP Capital Corp., a principal stockholder. Amounts owed to these individuals are payable upon demand.

18

We employ one individual on a part time basis, who is an executive officer. We do not expect any significant changes in the number of employees within the next twelve months.

Risk Factors

Operations—New Entity/Startup Entity

We have no history running our mineral exploration business.

We are engaged in the exploration stage of our business. We have not engaged in any substantive business operations to date. More particularly, we have not engaged in any mining operations. We have only engaged in exploratory activities, feasibility studies and the establishment of initial exploration plans. Thus, we have no way to evaluate the likelihood that we will be able to operate our business successfully. You should consider our business future based on the risks associated with our early stage, and lack of experience.

We expect to face many of the typical challenges of a startup business.

A startup business like ours faces a number of challenges. For example, engaging the services of qualified support personnel and related consultants and other experts is very important in the mineral exploration business, and there is keen competition for the services of these experts, consultants, and support personnel. Equally important in the mineral exploration business is establishing initial exploration plans for mining prospects and analyzing relevant information efficiently. Establishing and maintaining budgets and appropriate financial controls is also very important to a startup business. We expect to incur substantial operating losses for the foreseeable future, as well. The failure to address one or more of these activities, or curb operating losses, may impair our ability to carry out our business plan.

Operations—Mineral Exploration Activities

Mineral exploration has many inherent risks of operations which may prevent ultimate success.

Mineral exploration has significant risks. Mineral exploration companies (like us) are dependent on locating mineral reserves on the properties over which it has mineral permits, and are also dependent on the skillful management of minerals, when and if found or located on these properties. These minerals, when found in deposits and mineralizations, can vary substantially in a prospect, rendering what was initially believed to be a profitable deposit into one of little or no value. Unforeseen changes in regulations, the value of minerals, environmental regulations, mining technology, site conditions, and/or labor conditions can all have a negative impact on our operations, and each may impair our ability to carry out our business plan.

Our business future is dependent on finding mineral deposits with sufficient mineralization and grade.

Our business model depends on locating prospects with a sufficient amount of mineralization to justify surface and drilling sampling. No assurance can be given that our specific exploration target areas will be valuable in locating mineralizations. Even if initial mineralization reports are positive, subsequent activities may determine that deposits are not commercially viable. Thus, at any stage in the exploration process, we may determine that there is no business reason to continue and, at that time, our resources may not enable us to continue exploratory operations and will cause us to terminate our business.

We have no known mineral reserves, and if we cannot find any, we will have to cease operations.

We have no mineral reserves. If we do not find a mineral reserve containing diamonds, or if we cannot develop any diamond-bearing mineral reserve, either because we do not have the money to effect such a development, or because it will not be economically feasible to do it, we will have to cease operations, and you may lose your entire investment.

We are relying on geological reports to locate potential mineral deposits, which may be inaccurate.

We rely on geological reports to determine which of the properties, for which we have mineral permits, to explore. There is no sure method of verifying the care and manner used to prepare these reports without further verification on our part, or on our agents’ part. Verification of reports is expected to be costly, and may take a considerable period of time. Verification could result in our rejecting a potential mineral prospect; however, we will have borne the expense of this verification with no likelihood of recovering the amounts expended. Decisions made without adequately checking the mining prospects could result in significant unrecoverable expenses. Mineral deposits initially thought to be valuable may, in fact, turn out to be of little value. Therefore, it is possible that investment funds will have been used, with no value having been achieved from the operations based on the reports.

19

Regulatory compliance in the mineral exploration business is complex, and the failure to meet all of the various requirements could result in fines, or other limitations on the proposed business.

Our mineral exploration activities will be subject to regulation by numerous governmental authorities. We are subject to environmental regulations under the Environmental Act (Quebec), the Mining Act (Quebec), and the Forest Act (Quebec). The failure to comply fully with these or any other governmental regulations will adversely affect our ability to explore for economic mineralization, and our subsequent business stages. The failure to comply with any regulations or licenses may result in fines or other penalties. We expect compliance with these regulations to be substantial. Therefore, compliance with (or, conversely, the failure to so comply with) applicable regulations will affect our ability to succeed in our business plans and to generate revenues and profits.

Mineral exploration is a hazardous business, which entails risks for liability and/or damages.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure against, or against which we may not elect to insure. We do not currently carry any insurance to protect against the potential liability of such hazards. The payment of any liabilities attributed to us may have a material adverse effect on our financial position and may cause us to cease operations.

We face intense competition, and our competitors may have greater resources than we do and be better able to locate and explore mineral resources in a quicker and more cost efficient manner than we can.

It is our belief that there are a significant number of companies with greater resources than those available to us, to locate and explore mineral resources. These companies may be able to reach production stages sooner than we can, and obtain a share of the market for mineral products before we can.

Because some of our management has only limited experience in mineral exploration, we have a higher risk of failure.

Some of our management has only limited experience in mineral exploration. As a result of this limited experience, there is a higher risk of our being unable to complete our business plan in the exploration of our mineral property.We have added Bertrand Brassard as our President and Manager of our exploration program.Mr Brassard is a geologist with more than 25 years experience in the exploration sector from grass roots to advanced projects.Mr Brassard holds a B.Sc. degree in geology and a M.Sc. degree in Economic Geology from the University of Quebec at Montreal.

Capital Issues

We do not currently have sufficient capital to engage in exploration activities.

The cost of our planned exploration activities is approximately $500,000. As of the date of this filing, we do not have sufficient capital to engage in exploration activities, and no sources for financing. The extent to which we will be able to implement our exploration for minerals will be determined by our ability to engage in offerings of equity securities and/or debt securities. Without additional capital, we will have to either curtail our business plan, or abandon it altogether.

We do not have any identified sources of additional capital, the absence of which may prevent us from continuing our operations.

We do not, presently, have any arrangements with any investment banking firms or institutional lenders. Because we will need additional capital, we will have to expend significant effort to raise operating funds. These efforts may not be successful. If not, we will have to either curtail our business plan, or abandon it altogether.

Corporate Governance Risks

Our officers and directors will devote approximately one-third of their time to our operations.

Our officers and directors have other interests. Because of these other interests, each will be devoting only one-third of their time to our operations, which could have a negative impact on the efficiency of our operations.

Critical Accounting Policies and Estimates

Our financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates. We base our estimates on historical experience and on other assumptions that are believed to be reasonable under the circumstances. Accordingly, actual results could differ from these estimates under different assumptions or conditions. This section summarizes the critical accounting policies and the related judgments involved in their application.

20

Valuation of Deferred Tax Assets

We regularly evaluate our ability to recover the reported amount of our deferred income taxes considering several factors, including our estimate of the likelihood that we will generate sufficient taxable income in future years in which temporary differences reverse. Due to the uncertainties related to, among other things, the extent and time of future taxable income and the potential changes in the ownership of the Company, which could subject our net operating loss carryforwards to substantial annual limitations, we offset our net deferred tax assets by an equivalent valuation allowance as of December 31, 2010.

Valuation of Long-Lived Assets

We assess the recoverability of long-lived assets, such as mining claims, whenever we determine that events or changes in circumstances indicate that their carrying amount may not be recoverable. Our assessment is primarily based upon our estimate of future cash flows associated with these assets. If at some point in the future, we estimate that the undiscounted cash flows is less than the carrying value of the assets, this determination could result in non-cash charges to income that could materially affect our financial position or results of operations for that period.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not Applicable.

21

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTAL DATA

DIAMOND DISCOVERIES INTERNATIONAL CORP.

(An Exploration Stage Company)

INDEX TO FINANCIAL STATEMENTS

| Report of Independent Registered Public Accounting Firm | 23 | |||

| Balance Sheets December 31, 2010 and 2009 | 24 | |||

| Statements of Operations Years Ended December 31, 2010 and 2009 and Period from April 24, 2000 (Date of Inception) to December 31, 2010 | 25 | |||

| Statements of Changes in Stockholders’ Deficiency Years Ended December 31, 2010 and 2009 and Period from April 24, 2000 (Date of Inception) to December 31, 2010 | 26 | |||

| Statements of Cash Flows Years Ended December 31, 2010 and 2009 and Period from April 24, 2000 (Date of Inception) to December 31, 2010 | 27 | |||

| Notes to Consolidated Financial Statements | 28 |

22

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders Diamond Discoveries International Corp.:

We have audited the accompanying consolidated balance sheets of Diamond Discoveries International Corp. (an exploration stage company) (the “Company”) as of December 31, 2010 and 2009, and the related consolidated statements of operations, changes in stockholders’ deficiency and cash flows for each of the years in the two-year period ended December 31, 2010, and for the period April 24, 2000 (inception) through December 31, 2010. Diamond Discoveries International Corp.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion of the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Diamond Discoveries International Corp. (an exploration stage company), as of December 31, 2010 and 2009, and the results of its operations and cash flows for each of the years in the two-year period ended December 31, 2010, and for the period April 24, 2000 (inception) through December 31, 2010 in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has no present revenue. The success of the Company’s business plan is also dependent upon the amount of funds it is able to raise in the near future. The Company’s capital resources as of May 12, 2011 are not sufficient to sustain operations or complete its planned activities for the upcoming year unless it raises additional funds. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans concerning these matters are described in Note 1. The accompanying financial statements do not include any adjustments that might result from the outcome of these uncertainties.

/s/ Rodefer Moss & Co, PLLC

Knoxville, Tennessee May 12, 2011

23

DIAMOND DISCOVERIES INTERNATIONAL CORP.

(An Exploration Stage Company)

DECEMBER 31, 2010 AND 2009

|

2010

|

2009

|

|||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$

|

6,801

|

$

|

5,533

|

||||

|

6,801

|

5,533

|

|||||||

|

Mineral rights

|

243,614

|

237,517

|

||||||

|

Total

|

$

|

250,415

|

$

|

243,050

|

||||

|

LIABILITIES AND STOCKHOLDERS- DEFICIENCY

|

||||||||

|

Liabilities:

|

||||||||

|

Notes payable

|

$

|

1,561,313

|

$

|

1,463,869

|

||||

|

Accounts payable

|

257,177

|

215,441

|

||||||

|

Advances from stockholders

|

315,001

|

274,924

|

||||||

|

2,133,491

|

1,954,234

|

|||||||

|

Total liabilities

|

2,133,491

|

1,954,234

|

||||||

|

Commitments and contingencies

|

||||||||

|

Stockholders- deficiency:

|

||||||||

|

Preferred stock, par value $.001 per share; 20,000,000 shares authorized; none issued

|

-

|

-

|

||||||

|

Common stock, par value $.001 per share; 480,000,000 shares authorized; 391,884,907 and 401,491,830 shares issued and outstanding at December 31, 2010 and 2009, respectively

|

391,885

|

401,492

|

||||||

|

Additional paid-in capital

|

17,233,226

|

17,218,641

|

||||||

|

Deficit accumulated during the exploration stage

|

(18,585,001

|

)

|

(18,490,824

|

)

|

||||

|

Accumulated other comprehensive (loss)

|

(923,186

|

)

|

(840,493

|

)

|

||||

|

Unearned compensation

|

-

|

-

|

||||||

|

Total stockholders- deficiency

|

(1,883,076

|

)

|

(1,711,184

|

)

|

||||

|

Total

|

$

|

250,415

|

$

|

243,050

|

||||

See Notes to Consolidated Financial Statements.

24

DIAMOND DISCOVERIES INTERNATIONAL CORP.

(An Exploration Stage Company)

YEARS ENDED DECEMBER 31, 2010 AND 2009 AND PERIOD FROM

APRIL 24, 2000 (DATE OF INCEPTION) TO DECEMBER 31, 2010

|

2010

|

2009

|

April 24,

2000 to

December 31,

2010

|

||||||||||

|

Revenues

|

$ | - | $ | - | $ | - | ||||||

|

Operating expenses:

|

||||||||||||

|

Exploration costs

|

24,520 | 26,281 | 4,004,530 | |||||||||

|

Reimbursements of exploration costs

|

- | - | (1,549,438 | ) | ||||||||

|

Exploration costs, net of reimbursements

|

24,520 | 26,281 | 2,455,092 | |||||||||

|

General and administrative expenses

|

69,657 | 88,060 | 16,428,796 | |||||||||

|

Total operating expenses

|

94,177 | 114,341 | 18,883,888 | |||||||||

|

Operating loss

|

(94,177 | ) | (114,341 | ) | (18,883,888 | ) | ||||||

|

Other income (expenses)

|

||||||||||||

|

(Loss) gain on modification of debt

|

- | - | 1,193,910 | |||||||||

|

Interest expense

|

- | - | (895,023 | ) | ||||||||

|

Net loss

|

$ | (94,177 | ) | $ | (114,341 | ) | $ | (18,585,001 | ) | |||

|

Basic net loss per common share

|

$ | - | $ | - | ||||||||

|

Basic weighted average common shares outstanding

|

399,886,289 | 397,176,762 | ||||||||||

See Notes to Consolidated Financial Statements.

25

DIAMOND DISCOVERIES INTERNATIONAL CORP.

(An Exploration Stage Company)

YEARS ENDED DECEMBER 31, 2010 AND 2009 AND PERIOD FROM APRIL 24, 2000

(DATE OF INCEPTION) TO DECEMBER 31, 2010

|

Additional

|

Deficit

Accumulated

during the

|

Accumulated

other

comprehensive

|

Subscriptions

|

|||||||||||||||||||||||||||||||||||||

|

Preferred stock

|

Common stock

|

paid-in

|

exploration

|

income

|

receivable

|

Unearned

|

||||||||||||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

capital

|

stage

|

(loss)

|

Shares

|

Amount

|

compensation

|

Total

|

||||||||||||||||||||||||||||||

|

Issuance of shares to founders effective as of April 24, 2000

|

- | $ | - | 4,850,000 | $ | 4,850 | $ | - | $ | - | - | - | $ | - | $ | - | $ | 4,850 | ||||||||||||||||||||||

|

Issuance of shares as payment for legal services

|

- | - | 150,000 | 150 | 3,600 | - | - | - | - | - | 3,750 | |||||||||||||||||||||||||||||

|

Issuance of shares in connection with acquisition of mineral permits

|

- | - | 2,000,000 | 2,000 | 48,000 | - | - | - | - | - | 50,000 | |||||||||||||||||||||||||||||

|

Subscription for purchase of 10,000,000 shares

|

- | - | 10,000,000 | 10,000 | 240,000 | - | - | 10,000,000 | (250,000 | ) | - | - | ||||||||||||||||||||||||||||

|

Proceeds from issuance of common stock

|

- | - | - | - | - | - | - | (1,000,000 | ) | 25,000 | - | 25,000 | ||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (713,616 | ) | - | - | - | - | (713,616 | ) | |||||||||||||||||||||||||||

|

Balance, December 31, 2000

|

- | - | 17,000,000 | 17,000 | 291,600 | (713,616 | ) | 9,000,000 | (225,000 | ) | - | (630,016 | ) | |||||||||||||||||||||||||||

|

Proceeds from issuance of common stock

|

- | - | - | - | - | - | - | (9,000000 | ) | 225,000 | - | 225,000 | ||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (1,021,190 | ) | - | - | - | - | (1,021,190 | ) | |||||||||||||||||||||||||||

|

Balance, December 31, 2001

|

- | - | 17,000,000 | 17,000 | 291,600 | (1,734,806 | ) | - | - | - | (1,426,206 | ) | ||||||||||||||||||||||||||||

|

Proceeds from private placements of units of common stock and warrants

|

- | - | 1,685,000 | 1,685 | 756,565 | - | - | 51,758 | (23,291 | ) | - | 734,959 | ||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (877,738 | ) | - | - | - | - | (877,738 | ) | |||||||||||||||||||||||||||

|

Balance, December 31, 2002

|

- | - | 18,685,000 | 18,685 | 1,048,165 | (2,612,544 | ) | 51,758 | (23,291 | ) | - | (1,568,985 | ) | |||||||||||||||||||||||||||

|

Issuance of shares as payment for accounts payable

|

- | - | 3,000,000 | 3,000 | 295,423 | - | - | - | - | - | 298,423 | |||||||||||||||||||||||||||||

|

Issuance of shares as payment for services

|

- | - | 6,715,000 | 6,715 | 1,368,235 | - | - | - | - | - | 1,374,950 | |||||||||||||||||||||||||||||

|

Issuance of stock options

|

- | - | - | - | 1,437,000 | - | - | - | - | (1,437,000 | ) | - | ||||||||||||||||||||||||||||

|

Issuance of shares as payment for advances from stockholders

|

- | - | 7,500,000 | 7,500 | 767,500 | - | - | - | - | - | 775,000 | |||||||||||||||||||||||||||||

|

Issuance of shares as payment for notes payable

|

- | - | 1,810,123 | 1,810 | 124,898 | - | - | - | - | - | 126,708 | |||||||||||||||||||||||||||||

|

Proceeds from issuance of common stock

|

- | - | 6,000,000 | 6,000 | 444,000 | - | - | 4,000,000 | (281,250 | ) | - | 168,750 | ||||||||||||||||||||||||||||

|

Proceeds from issuance of common stock in connection with exercise of stock options

|

- | - | 10,050,000 | 10,050 | 292,450 | - | - | - | - | - | 302,500 | |||||||||||||||||||||||||||||

|

Amortization of unearned compensation

|

- | - | - | - | - | - | - | - | - | 169,744 | 169,744 | |||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (3,222,057 | ) | - | - | - | - | (3,222,057 | ) | |||||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | (360,900 | ) | - | - | - | (360,900 | ) | |||||||||||||||||||||||||||

|

Total comprehensive loss ($3,582,957)

|

- | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||

|

Balance, December 31, 2003

|

- | - | 53,760,123 | 53,760 | 5,777,671 | (5,834,601 | ) | (360,900 | ) | 4,051,758 | (304,541 | ) | (1,267,256 | ) | (1,935,867 | ) | ||||||||||||||||||||||||

|

Issuance of shares as payment for services

|

- | - | 16,842,000 | 16,842 | 1,614,858 | - | - | - | - | - | 1,631,700 | |||||||||||||||||||||||||||||

|

Proceeds from issuance of common stock

|

- | - | 4,000,000 | 4,000 | 384,832 | - | - | 524,207 | (56,754 | ) | - | 332,078 | ||||||||||||||||||||||||||||

|

Issuance of shares as payment for accounts payable

|

- | - | 1,400,000 | 1,400 | 138,600 | - | - | - | - | - | 140,000 | |||||||||||||||||||||||||||||

|

Issuance of stock options

|

- | - | - | - | 1,139,000 | - | - | - | - | (1,139,000 | ) | - | ||||||||||||||||||||||||||||

|

Proceeds from issuance of common stock in connection with exercise of stock options

|

- | - | 31,125,000 | 31,125 | 395,125 | - | - | - | - | - | 426,250 | |||||||||||||||||||||||||||||

|

Forgiveness of stock subscriptions

|

- | - | - | - | - | - | - | (4,575,965 | ) | 361,295 | - | 361,295 | ||||||||||||||||||||||||||||

|

Amortization of unearned compensation

|

- | - | - | - | - | - | - | - | - | 529,423 | 529,423 | |||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (3,724,106 | ) | - | - | - | - | (3,724,106 | ) | |||||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | (131,269 | ) | - | - | - | (131,269 | ) | |||||||||||||||||||||||||||

|

Total comprehensive loss ($3,855,375)

|

- | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||

|

Balance, December 31, 2004

|

- | - | 107,127,123 | 107,127 | 9,450,086 | (9,558,707 | ) | (492,169 | ) | - | - | (1,876,833 | ) | (2,370,496 | ) | |||||||||||||||||||||||||

|

Issuance of shares as payment for services

|

- | - | 6,000,000 | 6,000 | 204,000 | - | - | - | - | - | 210,000 | |||||||||||||||||||||||||||||

|

Proceeds from issuance of common stock

|

- | - | 69,883,657 | 69,884 | 2,376,044 | - | - | - | - | - | 2,445,928 | |||||||||||||||||||||||||||||

|

Issuance of shares as payment for accounts payable

|

- | - | 36,481,050 | 36,481 | 1,156,386 | - | - | - | - | - | 1,192,867 | |||||||||||||||||||||||||||||

|

Issuance of stock options

|

- | - | - | - | 1,218,500 | - | - | - | - | (1,218,500 | ) | - | ||||||||||||||||||||||||||||

|

Proceeds from issuance of common stock in connection with exercise of stock options

|

- | - | 28,125,000 | 28,125 | 253,125 | - | - | - | - | - | 281,250 | |||||||||||||||||||||||||||||

|

Amortization of unearned compensation

|

- | - | - | - | - | - | - | - | - | 889,960 | 889,960 | |||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (3,419,547 | ) | - | - | - | - | (3,419,547 | ) | |||||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | (151,691 | ) | - | - | - | (151,691 | ) | |||||||||||||||||||||||||||

|

Total comprehensive loss ($3,571,238)

|