Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONSUMERS ENERGY CO | d244949d8k.htm |

Wells

Fargo Advisors October 19, 2011

Exhibit 99.1 |

The

presentation also includes non-GAAP measures when describing CMS Energy’s results of

operations and financial performance. A reconciliation of each of these measures

to the most directly

comparable

GAAP

measure

is

included

in

the

appendix

and

posted

on

our

website

at

www.cmsenergy.com. 1

This presentation is made as of the date hereof and contains “forward-looking

statements” as defined in Rule 3b-6 of the Securities Exchange Act of

1934, as amended, Rule 175 of the Securities Act of 1933, as amended, and

relevant legal decisions. The forward-looking statements are subject

to risks and uncertainties. They should be read in conjunction with

“FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS”

sections of CMS Energy’s and Consumers Energy’s Form 10-K for the

year ended December 31 and as updated in subsequent 10-Qs. CMS

Energy’s and Consumers Energy’s “FORWARD- LOOKING STATEMENTS

AND INFORMATION” and “RISK FACTORS” sections are incorporated

herein by reference and discuss important factors that could cause CMS Energy’s

and Consumers Energy’s results to differ materially from those anticipated in such

statements. CMS Energy and Consumers Energy undertake no obligation to update

any of the information presented herein to reflect facts, events or

circumstances after the date hereof.

Reported earnings could vary because of several factors, such as legacy issues

associated with prior asset sales. Because of those uncertainties, the

company is not providing reported earnings guidance. |

2

CMS Energy

Corporation

Consumers Energy

(Michigan Utility)

Consumers Energy

(Michigan Utility)

YE 2010 financial data

CMS Energy ranks #360 on Fortune 500 list (2011).

CMS Enterprises

Revenue –

$0.2 billion

Gas

Revenue

–

$2.4

billion

Customer

Base

–

1.7

million

Electric

Revenue

–

$3.8

billion

Customer

Base

–

1.8

million |

•

•

Fourth largest

Fourth largest

combination Utility in the

combination Utility in the

United States

United States

•

•

1.8 million electric and 1.7

1.8 million electric and 1.7

million gas customers

million gas customers

•

•

Top renewable energy

Top renewable energy

provider in Michigan

provider in Michigan

•

•

One of largest investors

One of largest investors

and employers in

and employers in

Michigan

Michigan

•

•

Celebrating 125

Celebrating 125

th

anniversary

anniversary

Overview

Overview

Territory

Territory

3

D E Karn

D E Karn

J C Weadock

J C Weadock

Mio

Mio

Alcona

Alcona

Cooke

Cooke

Foote

Foote

Loud

Loud

5 Channels

5 Channels

Tippy

Tippy

Rogers

Rogers

Webber

Webber

Electric

Electric

Gas

Gas

Combination

Combination

Zeeland

Zeeland

J R Whiting

J R Whiting

Cross Winds

Energy Park

. . . . is significant contributor to Michigan economy.

Ludington

Ludington

Pumped

Pumped

Storage

Storage

B C Cobb

B C Cobb

J H Campbell

J H Campbell

Allegan

Allegan

Hodenpyl

Hodenpyl

Hardy

Hardy

Croton

Croton

Lake Winds

Energy Park |

•

•

Attractive dividend yield of 4.2%

Attractive dividend yield of 4.2%

a

a

•

•

58% payout ratio growing to peer average over time

58% payout ratio growing to peer average over time

•

•

5% to 7% estimated long-term EPS growth rate

5% to 7% estimated long-term EPS growth rate

•

•

Driven

Driven

by

by

$6.5

$6.5

billion

billion

investment

investment

in

in

regulated

regulated

Utility

Utility

over

over

next

next

five

five

years

years

•

•

No need for equity next five years

No need for equity next five years

•

•

Constructive regulatory environment supports Utility

Constructive regulatory environment supports Utility

investment in Michigan

investment in Michigan

•

•

Over 95% of business is regulated by the Michigan Public Service

Over 95% of business is regulated by the Michigan Public Service

Commission

Commission

4

_ _ _ _ _

a

Based on closing stock price of $19.79 on September 30, 2011

. . . . represents good total return opportunity. |

Financial

•

Use Net Operating

Losses to Eliminate

Need for Equity

•

Grow Operating

Cash Flow and

EPS 5% -

7%

Business

•

Invest in Utility

•

Create jobs

•

Enhance customer value

•

Constructive regulation

supports cost recovery

•

Customer Base Rate

Increases <2%

Consistent

Consistent

financial

financial

performance

performance

Utility

Utility

investment

investment

Fair and timely regulation

Fair and timely regulation

Customer

Customer

value

value

Safe, excellent operations

Safe, excellent operations

. . . . predictable and sustainable.

5 |

6

. . . . “needed”

(vs “wanted”) --

grows rate base 5% to 7%.

Distribution

New

Customers

Generation

Renewables

Smart Grid

Reliability

Environmental |

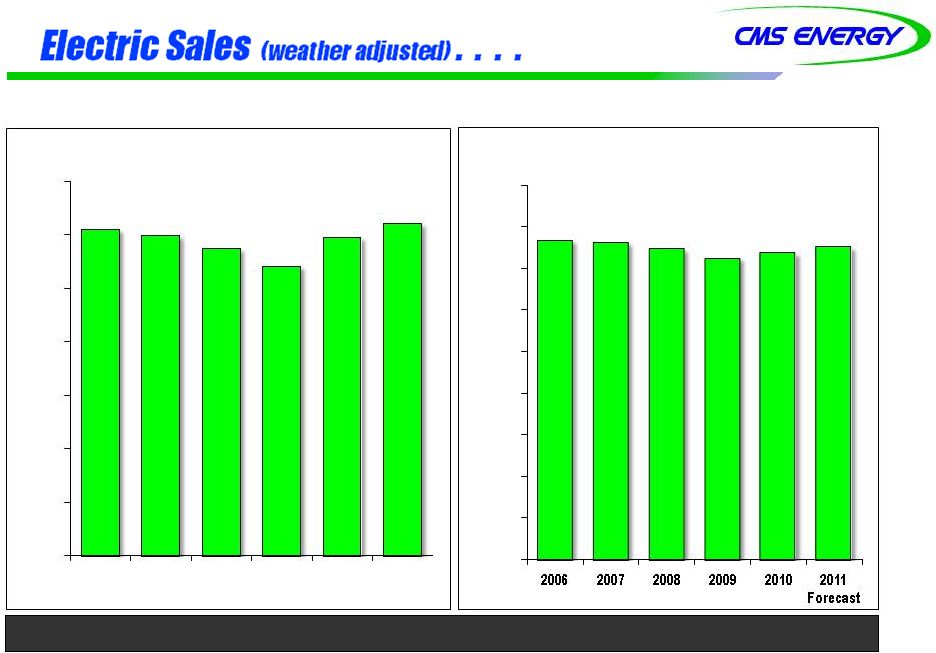

Total

Sales Total Sales

. . . . near pre-recession levels, conservative outlook.

Industrial Sales

Industrial Sales

7

38,379

38,107

37,339

36,229

36,839

37,558

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

GMhs

12,196

11,952

11,482

10,814

11,889

12,414

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

2006

2007

2008

2009

2010

2011

Forecast

GWhs |

Growth

Renewable energy

Energy optimization

Speed

File and implement

Forward test year

Risk mitigation

Customer choice cap (10%)

Decoupling

8

. . . . enables timely rate recovery and mitigates risks. |

9

Regulatory environment –

comparison by state

Tier 1

Tier 2

Tier 3

Tier 4

Tier 5

Delaware

Florida

Hawaii

Kansas

Louisiana

Massachusetts

Missouri

Arizona

Nevada

Arkansas

Alabama

New Jersey

District of Columbia

California

New York

Illinois

Georgia

Ohio

Maine

Idaho

Indiana

Oregon

Michigan (2008)

Connecticut

Colorado

Michigan (2009)

South Carolina

Mississippi

Maryland

Iowa

North Dakota

Texas

Pennsylvania

Montana

Kentucky

Oklahoma

Utah

South Dakota

New Hampshire

Minnesota

Tennessee

Washington

Vermont

New Mexico

Wyoming

Virginia

Wisconsin

West Virginia

Rhode Island

Source: Barclays Capital, 2-7-11

. . . . compares favorably. |

10

8% CAGR

Annual dividend/share

Payout

25%

30%

40%

84¢

$1.20

$1.25

$1.26

$1.35

5%-7% Growth

58%

68%

Dividend

Increase

$0.81

0.90

0.96

1.08

0.84

$1.36

$0.80

0.85

0.90

1.00

0.80

20¢

50¢

2003

2004

2005

2006

2007

2008

2009

2010

2011

Future

36¢

$1.21

b

Actual

a

Guidance

_ _ _ _ _

a

Adjusted EPS (non-GAAP) excluding MTM in 2004-2006

b

$1.25 excluding discontinued Exeter operations and accounting changes related to

Convertible debt and restricted stock . . . . results from “needed”

investments. |

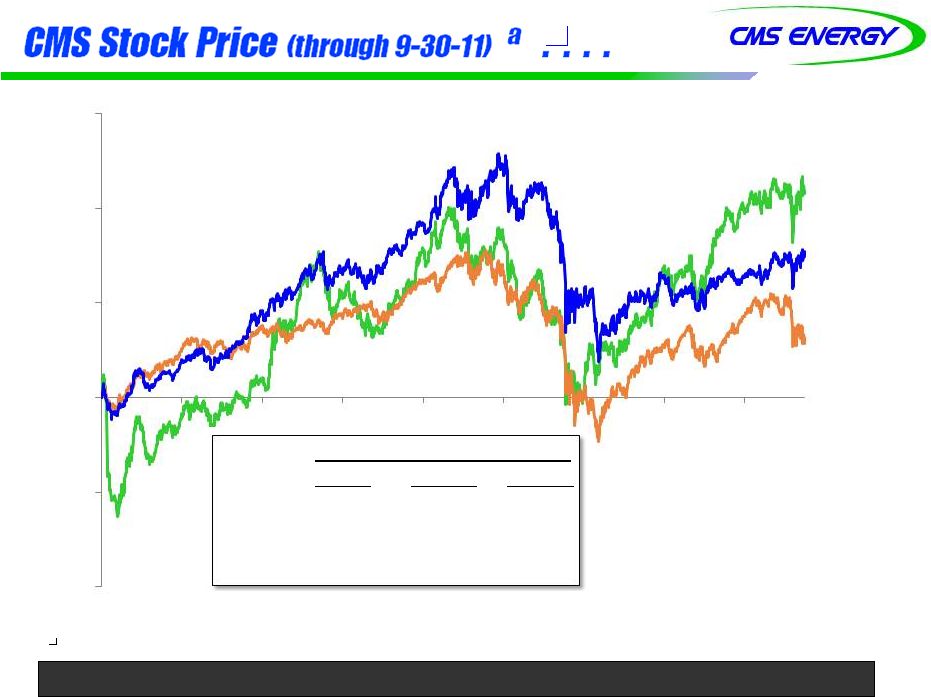

11

2003

2004

2005

2006

2007

2008

2009

2010

2011

CMS

110%

UTY

75%

S&P 500

29%

_ _ _ _ _

a

Historical performance is no prediction of future results

-100%

-50%

0%

50%

100%

150%

Annual Growth

1 Year

3 Years

5 Years

CMS

10%

17%

7%

S&P 500

(1)

(1)

(3)

UTY

7

1

0

. . . . has outperformed past eight years. |

•

Dividend yield (4%) and EPS growth (5% -

7%)

provide attractive total return

•

“Needed”

Utility investment provides transparent,

long-term earnings growth

•

Constructive regulatory environment and good

energy law support Utility investment in Michigan

12

. . . . predictable and repeatable. |

GAAP

Reconciliation GAAP Reconciliation |

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||||||||

| Reported earnings (loss) per share — GAAP |

$ | (0.30 | ) | $ | 0.64 | $ | (0.44 | ) | $ | (0.41 | ) | $ | (1.02 | ) | $ | 1.20 | $ | 0.91 | $ | 1.28 | ||||||||||||

| After-tax items: |

||||||||||||||||||||||||||||||||

| Electric and gas utility |

0.21 | (0.39 | ) | — | — | (0.07 | ) | 0.05 | 0.33 | 0.03 | ||||||||||||||||||||||

| Enterprises |

0.74 | 0.62 | 0.04 | (0.02 | ) | 1.25 | (0.02 | ) | 0.09 | (0.03 | ) | |||||||||||||||||||||

| Corporate interest and other |

0.16 | (0.03 | ) | 0.04 | 0.27 | (0.32 | ) | (0.02 | ) | 0.01 | * | |||||||||||||||||||||

| Discontinued operations (income) loss |

(0.16 | ) | 0.02 | (0.07 | ) | (0.03 | ) | 0.40 | (* | ) | (0.08 | ) | 0.08 | |||||||||||||||||||

| Asset impairment charges, net |

— | — | 1.82 | 0.76 | 0.60 | — | — | — | ||||||||||||||||||||||||

| Cumulative accounting changes |

0.16 | 0.01 | — | — | — | — | — | — | ||||||||||||||||||||||||

| Adjusted earnings per share, including MTM — non-GAAP |

$ | 0.81 | $ | 0.87 | $ | 1.39 | $ | 0.57 | $ | 0.84 | $ | 1.21 | (a) | $ | 1.26 | $ | 1.36 | |||||||||||||||

| Mark-to-market impacts |

0.03 | (0.43 | ) | 0.51 | ||||||||||||||||||||||||||||

| Adjusted earnings per share, excluding MTM — non-GAAP |

NA | $ | 0.90 | $ | 0.96 | $ | 1.08 | NA | NA | NA | NA | |||||||||||||||||||||

| * | Less than $500 thousand or $0.01 per share. |

| (a) | $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. |

2003-10 EPS