Attached files

| file | filename |

|---|---|

| 10-K - VILLAGE SUPER MARKET FORM 10-K JULY 30, 2011 - VILLAGE SUPER MARKET INC | villagesupermarket10k.htm |

| EX-21 - SUBSIDIARIES OF REGISTRANT - VILLAGE SUPER MARKET INC | villagesupermarketexh21.htm |

| EX-14 - CODE OF ETHICS - VILLAGE SUPER MARKET INC | villagesupermarketexh14.htm |

| EX-23 - CONSENT OF KPMG LLP - VILLAGE SUPER MARKET INC | villagesupermarketexh23.htm |

| EX-32.1 - CERTIFICATION - VILLAGE SUPER MARKET INC | villagesupermarketexh321.htm |

| EX-32.2 - CERTIFICATION - VILLAGE SUPER MARKET INC | villagesupermarketexh322.htm |

| EX-31.2 - CERTIFICATION - VILLAGE SUPER MARKET INC | villagesupermarketexh312.htm |

| EX-31.1 - CERTIFICATION - VILLAGE SUPER MARKET INC | villagesupermarketexh311.htm |

Exhibit 13

|

VILLAGE SUPER MARKET, INC . AND SUBSIDIARIES

|

|

|

Contents

|

|

|

Letter to Shareholders

|

2

|

|

Selected Financial Data

|

3

|

|

Unaudited Quarterly Financial Data

|

3

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

4

|

|

Consolidated Balance Sheets

|

10

|

|

Consolidated Statements of Operations

|

11

|

|

Consolidated Statements of Shareholders’ Equity and Comprehensive Income

|

12

|

|

Consolidated Statements of Cash Flows

|

13

|

|

Notes to Consolidated Financial Statements

|

14

|

|

Management’s Report on Internal Control over Financial Reporting

|

27

|

|

Report of Independent Registered Public Accounting Firm

|

27

|

|

Stock Price and Dividend Information

|

28

|

|

Corporate Directory

|

Inside back cover

|

1

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Dear Fellow Shareholders

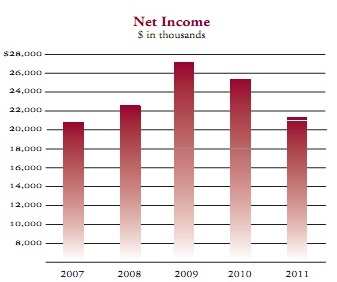

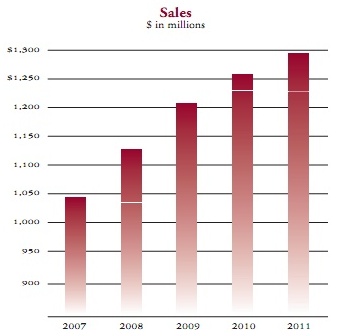

Our business was affected again this year by the weak economy and high unemployment. Customers continue to spend cautiously by trading down to lower priced items and concentrating their buying on sale items. Despite these challenges, Village’s sales increased 2.9% to $1.3 billion in fiscal 2011. Excluding a 53rd week in the prior year, fiscal 2011 sales increased 4.7%, and same store sales increased 4.0%, due to improved sales in the Marmora store, higher sales in five stores due to store closings by competitors during the fiscal year, and a substantial increase

in transaction counts. The Company expects same store sales in fiscal 2012 to increase from 3.0% to 5.0%, with larger increases in the first half of the year.

Net income was $21 million in fiscal 2011. Excluding the $1.2 million positive impact of the 53rd week last year and a $4.2 million charge for withdrawing from a multi-employer pension fund in fiscal 2011, net income increased 4%.

During fiscal 2011, Village paid dividends of $19.1 million, acquired two stores in Maryland for $6.6 million and spent $13.3 million on capital expenditures, while still increasing cash by $22.3 million. Our high cash position, virtually no debt except leases, and strong cash flow provides us the financial flexibility to take advantage of expansion opportunities such as the Maryland acquisition.

On July 7, 2011, as part of our long term growth strategy outside of our primary trade area, we acquired the store fixtures, leases and pharmacy lists of store locations in Silver Spring, Maryland and Timonium, Maryland for $6.6 million. After tireless effort by our associates, these stores were successfully opened as ShopRites® in a mere three weeks, on July 28, 2011. Although these two stores represent Village’s initial entry into Maryland, there are currently ten ShopRites in the state. The Silver Spring location is the first ShopRite® in the Washington, DC market. As we

begin operating in these new areas, where the ShopRite® name is less known than in New Jersey, marketing and other costs will likely be higher as we invest resources to build market share and brand awareness. In addition, sales are initially expected to be lower than our typical store. We are excited by the challenge to establish the ShopRite® brand in this new trading area.

Village paid dividends of $19.1 million in fiscal 2011, consisting of $1.70 per Class A common share and $ 1.105 per Class B common share. These amounts include $14 million of special dividends paid in December 2010, comprised of $1.25 per Class A common share and $.8125 per Class B common share. The Board of Directors declared these special dividends to provide a return to shareholders in 2010, instead of 2011, while tax rates on dividends remained low. This action was taken before the 15% tax rate was extended. The Board will reconsider dividend policy and other methods of providing returns to shareholders in 2012 and future years based on a variety of factors, including

tax rates on dividends and capital gains in effect at that time. Village has paid $59.5 million of dividends in the last four years.

We continually focus on improving our customers shopping experience and differentiating our stores. We recently added on-site registered dieticians in five stores, including both Maryland stores, to consult with customers on shopping for healthy meals and proper nutrition, as well as leading health related events both in-store and in the community as part of the Live Right with ShopRite® program.

While the economic environment has been difficult recently, Village continues to build on its strong foundation, recognizing our founder’s vision of “Helping Families Live Better”.

As always, we thank you for your support

James Sumas,

Chairman of the Board

October 2011

|

|

2

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Selected Financial Data

(Dollars in thousands except per share and square feet data)

|

July 30,

|

July 31,

|

July 25,

|

July 26,

|

July 28

|

||||||||||||||||

|

For year

|

2011

|

2010

|

2009

|

2008

|

2007

|

|||||||||||||||

|

Sales

|

$ | 1,298,928 | $ | 1,261,825 | $ | 1,208,097 | $ | 1,127,762 | $ | 1,046,435 | ||||||||||

|

Net income

|

20,982 | 25,381 | 27,255 | 22,543 | 20,503 | |||||||||||||||

|

Net income as a % of sales

|

1.62 | % | 2.01 | % | 2.26 | % | 2.00 | % | 1.96 | % | ||||||||||

|

Net income per share:

|

||||||||||||||||||||

|

Class A common stock:

|

||||||||||||||||||||

|

Basic

|

$ | 1.86 | $ | 2.28 | $ | 2.46 | $ | 2.04 | $ | 1.91 | ||||||||||

|

Diluted

|

1.54 | 1.88 | 2.02 | 1.67 | 1.56 | |||||||||||||||

|

Class B common stock:

|

||||||||||||||||||||

|

Basic

|

1.21 | 1.48 | 1.60 | 1.33 | 1.24 | |||||||||||||||

|

Diluted

|

1.21 | 1.47 | 1.59 | 1.33 | 1.22 | |||||||||||||||

|

Cash dividends per share

|

||||||||||||||||||||

|

Class A

|

1.700 | .970 | .765 | 1.91 | .345 | |||||||||||||||

|

Class B

|

1.105 | .631 | .498 | 1.24 | .224 | |||||||||||||||

|

At year-end

|

||||||||||||||||||||

|

Total assets

|

$ | 386,190 | $ | 357,129 | $ | 338,810 | $ | 305,380 | $ | 283,123 | ||||||||||

|

Long-term debt

|

43,147 | 41,831 | 32,581 | 27,498 | 21,767 | |||||||||||||||

|

Working capital

|

44,448 | 41,201 | 30,856 | 8,871 | 22,359 | |||||||||||||||

|

Shareholders’ equity

|

208,157 | 205,775 | 187,398 | 171,031 | 167,565 | |||||||||||||||

|

Book value per share

|

15.22 | 15.35 | 14.03 | 12.90 | 12.87 | |||||||||||||||

|

Other data

|

||||||||||||||||||||

|

Same store sales increase (decrease)

|

4.0 | % | (.7 | %) | 4.8 | % | 2.5 | % | 2.9 | % | ||||||||||

|

Total square feet

|

1,604,000 | 1,483,000 | 1,462,000 | 1,394,000 | 1,272,000 | |||||||||||||||

|

Average total sq. ft. per store

|

57,000 | 57,000 | 56,000 | 56,000 | 55,000 | |||||||||||||||

|

Selling square feet

|

1,264,000 | 1,171,000 | 1,155,000 | 1,103,000 | 1,009,000 | |||||||||||||||

|

Sales per average square foot of selling space(1)

|

$ | 1,109 | $ | 1,085 | $ | 1,070 | $ | 1,068 | $ | 1,037 | ||||||||||

|

Number of stores

|

28 | 26 | 26 | 25 | 23 | |||||||||||||||

|

Sales per average number of stores(1)

|

$ | 49,959 | $ | 48,532 | $ | 47,376 | $ | 46,990 | $ | 45,497 | ||||||||||

|

Capital expenditures and acquisitions

|

$ | 19,941 | $ | 20,204 | $ | 26,625 | $ | 28,398 | $ | 15,692 | ||||||||||

Unaudited Quarterly Financial Data

(Dollars in thousands except per share amounts)

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

Fiscal

Year

|

||||||||||||||||

|

2011

|

||||||||||||||||||||

|

Sales

|

$ | 307,397 | $ | 329,917 | $ | 316,594 | $ | 345,020 | $ | 1,298,928 | ||||||||||

|

Gross profit

|

80,927 | 88,641 | 86,418 | 94,173 | 350,159 | |||||||||||||||

|

Net income

|

3,934 | 6,616 | 1,668 | 8,764 | 20,982 | |||||||||||||||

|

Net income per share:

|

||||||||||||||||||||

|

Class A common stock:

|

||||||||||||||||||||

|

Basic

|

.35 | .59 | .15 | .77 | 1.86 | |||||||||||||||

|

Diluted

|

.29 | .49 | .12 | .64 | 1.54 | |||||||||||||||

|

Class B common stock:

|

||||||||||||||||||||

|

Basic

|

.23 | .38 | .10 | .50 | 1.21 | |||||||||||||||

|

Diluted

|

.23 | .38 | .09 | .49 | 1.21 | |||||||||||||||

|

2010

|

||||||||||||||||||||

|

Sales

|

$ | 302,784 | $ | 315,309 | $ | 300,991 | $ | 342,741 | $ | 1,261,825 | ||||||||||

|

Gross profit

|

80,568 | 86,156 | 82,413 | 93,788 | 342,925 | |||||||||||||||

|

Net income

|

4,542 | 6,737 | 5,205 | 8,897 | 25,381 | |||||||||||||||

|

Net income per share:

|

||||||||||||||||||||

|

Class A common stock:

|

||||||||||||||||||||

|

Basic

|

.41 | .61 | .47 | .80 | 2.28 | |||||||||||||||

|

Diluted

|

.34 | .50 | .39 | .66 | 1.88 | |||||||||||||||

|

Class B common stock:

|

||||||||||||||||||||

|

Basic

|

.27 | .39 | .30 | .52 | 1.48 | |||||||||||||||

|

Diluted

|

.26 | .39 | .30 | .51 | 1.47 | |||||||||||||||

Fiscal 2010 contains 53 weeks, with the additional week included in the fourth quarter. All other fiscal years contain 52 weeks.

(1) Amounts exclude results of the two stores acquired in Maryland in July 2011.

3

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(Dollars in thousands except per share and per square foot data)

OVERVIEW

Village Super Market, Inc. (the “Company” or “Village”) operates a chain of 28 ShopRite supermarkets in New Jersey, Maryland and northeastern Pennsylvania. On July 7, 2011, Village acquired the store fixtures, leases and pharmacy lists of locations in Silver Spring, Maryland (64,000 sq.ft.) and Timonium, Maryland (57,000 sq.ft.) for $6,595 from Super Fresh. In addition, Village purchased pharmacy inventories at cost. Village began operating pharmacies at these locations on July 7, 2011. These stores opened as ShopRites on July 28, 2011 after minor remodeling. Village opened a replacement store in Washington, NJ on February 21,

2010.

Village is the second largest member of Wakefern Food Corporation (“Wakefern”), the nation’s largest retailer-owned food cooperative and owner of the ShopRite name. This ownership interest in Wakefern provides Village many of the economies of scale in purchasing, distribution, advanced retail technology, marketing and advertising associated with larger chains.

The Company’s stores, five of which are owned, average 57,000 total square feet. Larger store sizes enable Village to offer the specialty departments that customers desire for one-stop shopping, including pharmacies, natural and organic departments, ethnic and international foods, and home meal replacement. During fiscal 2011, sales per store were $49,959 and sales per square foot of selling space were $1,109, excluding the Maryland stores. Management believes these figures are among the highest in the supermarket industry.

The supermarket industry is highly competitive. The Company competes directly with multiple retail formats, including national, regional and local supermarket chains as well as warehouse clubs, supercenters, drug stores, discount general merchandise stores, fast food chains, dollar stores and convenience stores. Village competes by using low pricing, superior customer service, and a broad range of consistently available quality products, including ShopRite private labeled products. The ShopRite Price Plus card and the co-branded ShopRite credit card also strengthen customer loyalty.

We consider a variety of indicators to evaluate our performance, such as same store sales, percentage of total sales by department (mix); shrink; departmental gross profit percentage; sales per labor hour; and hourly labor rates.

During fiscal 2011 and 2010, the supermarket industry was impacted by changing consumer behavior due to the weak economy and high unemployment. Consumers are increasingly cooking meals at home, but spending cautiously by trading down to lower priced items, including private label, and concentrating their buying on sale items. Also, the Company estimates that product prices overall experienced inflation in fiscal 2011, particularly the second half of the year, compared to deflation in fiscal 2010.

The Company utilizes a 52 - 53 week fiscal year, ending on the last Saturday in the month of July. Fiscal 2010 contains 53 weeks. The inclusion of the 53rd week in fiscal 2010 had an estimated positive impact on net income of $1,200. Fiscal 2011 and 2009 contain 52 weeks.

RESULTS OF OPERATIONS

The following table sets forth the components of the Consolidated Statements of Operations of the Company as a percentage of sales:

|

July 30,

2011

|

July 31,

2010

|

July 25,

2009

|

||||||||||

|

Sales

|

100.00 | % | 100.00 | % | 100.00 | % | ||||||

|

Cost of sales

|

73.04 | 72.82 | 72.64 | |||||||||

|

Gross profit

|

26.96 | 27.18 | 27.36 | |||||||||

|

Operating and administrative expense

|

22.57 | 22.25 | 22.15 | |||||||||

|

Depreciation and amortization

|

1.43 | 1.34 | 1.27 | |||||||||

|

Operating income

|

2.96 | 3.59 | 3.94 | |||||||||

|

Interest expense

|

(.33 | ) | (.29 | ) | (.25 | ) | ||||||

|

Interest income

|

.17 | .16 | .17 | |||||||||

|

Income before income taxes

|

2.80 | 3.46 | 3.86 | |||||||||

|

Income taxes

|

1.18 | 1.45 | 1.60 | |||||||||

|

Net income

|

1.62 | % | 2.01 | % | 2.26 | % | ||||||

4

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (Continued)

SALES

Sales were $1,298,928 in fiscal 2011, an increase of $37,103, or 2.9% from the prior year. The prior year included $21,000 of sales attributable to a 53rd week. Excluding the 53rd week from the prior year, fiscal 2011 sales increased $58,103, or 4.7%. Sales increased due to the opening of the Washington, NJ replacement store on February 21, 2010 and a same store sales increase, excluding the 53rd week in the prior year, of 4.0%. Same store sales increased due to improved sales in the Marmora store, which opened in 2009, higher sales in five stores due to store closings by competitors during fiscal 2011, and a substantial increase in transaction counts. Although Village

experienced inflation in the second half of fiscal 2011, there was minimal change in the average transaction size during the year. Sales continued to be impacted by changing consumer behavior, which has resulted in increased sale item penetration and trading down. Same store sales in the fourth quarter of fiscal 2011, excluding the impact of the 53rd week in the prior year, accelerated to an increase of 7.7% as this was the first complete quarter to include all the store closings by competitors. The Company expects same store sales in fiscal 2012 to increase from 3.0% to 5.0%, with larger increases in the first half of the year. The impacts of inflation and the competitive store closings that occurred in fiscal 2011 are expected to moderate in the second half of fiscal 2012. New stores and replacement stores are included in same store sales in the quarter after the store has

been in operation for four full quarters. Store renovations are included in same store sales immediately. The Washington, NJ replacement store was included in same store sales for the first time in the fourth quarter of fiscal 2011.

Sales were $1,261,825 in fiscal 2010, an increase of $53,728, or 4.4% from the prior year. Sales increased due to opening of the Marmora, NJ store on May 31, 2009 and the opening of the Washington, NJ replacement store on February 21, 2010. In addition, sales increased approximately $21,000, or 1.7%, due to fiscal 2010 containing 53 weeks. Same store sales, excluding the impact of the 53rd week, declined .7%. Same store sales declined due to cannibalization from the opening of the Marmora store and reduced sales in three stores due to competitive store openings. In addition, sales were impacted in fiscal 2010 by deflation and changing consumer behavior

due to economic weakness, which has resulted in increased coupon usage, sale item penetration and trading down. Same store sales in the fourth quarter of fiscal 2010, excluding the 53rd week, were flat.

GROSS PROFIT

Gross profit as a percentage of sales decreased .22% in fiscal 2011 compared to the prior year primarily due to decreased departmental gross margin percentages (.29%), higher promotional spending (.08%), and a LIFO charge in fiscal 2011 compared to a LIFO benefit in the prior year (.06%). These declines were partially offset by decreased warehouse assessment charges from Wakefern (.23%).

Gross profit as a percentage of sales decreased .18% in fiscal 2010 compared to the prior year primarily due to decreased departmental gross margin percentages (.22%), higher promotional spending (.14%) and increased warehouse assessment charges from Wakefern (.07%). These decreases were partially offset by higher patronage dividends (.12%), a LIFO benefit in fiscal 2010 compared to a charge in 2009 (.11%) and improved product mix (.04%).

OPERATING AND ADMINISTRATIVE EXPENSE

Operating and administrative expense increased .32% as a percentage of sales in fiscal 2011 compared to the prior year primarily due to a $7,028 charge for the withdrawal liability from a multi-employer defined benefit plan (.54%) and pre-opening costs for the Maryland stores (.06%). These increases were partially offset by lower payroll costs (.16%) and operating leverage from the 4.0% same store sales increase.

Operating and administrative expense increased .10% as a percentage of sales in fiscal 2010 compared to the prior year primarily due to increased fringe benefit (.18%) and snow removal (.04%) costs, and the loss of operating leverage from the .7% same store sales decline in the current year. These increases were partially offset by the prior year including a charge (.10%) for litigation related to the old Washington store and leverage provided by the additional sales week in fiscal 2010.

DEPRECIATION AND AMORTIZATION

Depreciation and amortization expense was $18,621, $16,900 and $15,319 in fiscal 2011, 2010 and 2009, respectively. Depreciation and amortization expense increased in fiscal 2011 and 2010 compared to the prior years due to depreciation related to fixed asset additions, including the new stores.

INTEREST EXPENSE

Interest expense was $4,280, $3,660 and $3,016 in fiscal 2011, 2010 and 2009, respectively. Interest expense increased in 2011 compared to the prior year due to an amendment of a store lease near the end of fiscal 2010 being treated as a capital lease. Interest expense increased in fiscal 2010 compared to fiscal 2009 due to interest on the Marmora store financing lease, partially offset by lower interest expense due to payments on loans.

INTEREST INCOME

Interest income was $2,207, $2,020 and $2,064 in fiscal 2011, 2010 and 2009, respectively. Interest income was similar in all three fiscal years as amounts invested and interest rates were comparable.

INCOME TAXES

The Company’s effective income tax rate was 42.1%, 41.8% and 41.5% in fiscal 2011, 2010 and 2009, respectively.

CRITICAL ACCOUNTING POLICIES

Critical accounting policies are those accounting policies that management believes are important to the portrayal of the Company’s financial condition and results of operations. These policies require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

5

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (Continued)

IMPAIRMENT

The Company reviews the carrying values of its long-lived assets, such as property, equipment and fixtures for possible impairment whenever events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. Such review analyzes the undiscounted estimated future cash flows from asset groups at the store level to determine if the carrying value of such assets are recoverable from their respective cash flows. If an impairment is indicated, it is measured by comparing the fair value of the long-lived asset groups held for use to their carrying value.

Goodwill is tested for impairment at the end of each fiscal year, or more frequently if circumstances dictate. Since the Company’s stock is not widely traded, management utilizes valuation techniques, such as earnings multiples, in addition to the Company’s market capitalization to assess goodwill for impairment. Calculating the fair value of a reporting unit requires the use of estimates. Management believes the fair value of Village’s one reporting unit exceeds its carrying value at July 30, 2011. Should the Company’s carrying value of its one reporting unit exceed its fair value, the amount of any resulting goodwill impairment may be material to

the Company’s financial position and results of operations.

PATRONAGE DIVIDENDS

As a stockholder of Wakefern, Village earns a share of Wakefern’s earnings, which are distributed as a “patronage dividend” (see Note 3). This dividend is based on a distribution of substantially all of Wakefern’s operating profits for its fiscal year (which ends September 30) in proportion to the dollar volume of purchases by each member from Wakefern during that fiscal year. Patronage dividends are recorded as a reduction of cost of sales as merchandise is sold. Village accrues estimated patronage dividends due from Wakefern quarterly based on an estimate of the annual Wakefern patronage dividend and an estimate of Village’s share of this

annual dividend based on Village’s estimated proportional share of the dollar volume of business transacted with Wakefern that year. The amount of patronage dividends receivable based on these estimates were $9,018 and $8,758 at July 30, 2011 and July 31, 2010, respectively.

PENSION PLANS

The determination of the Company’s obligation and expense for Company-sponsored pension plans is dependent, in part, on Village’s selection of assumptions used by actuaries in calculating those amounts. These assumptions are described in Note 8 and include, among others, the discount rate, the expected long-term rate of return on plan assets and the rate of increase in compensation costs. Actual results that differ from the Company’s assumptions are accumulated and amortized over future periods and, therefore, generally affect recognized expense in future periods. While management believes that its assumptions are appropriate, significant differences in

actual experience or significant changes in the Company’s assumptions may materially affect cash flows, pension obligations and future expense.

The objective of the discount rate assumption is to reflect the rate at which the Company’s pension obligations could be effectively settled based on the expected timing and amounts of benefits payable to participants under the plans. Our methodology for selecting the discount rate as of July 30, 2011 was to match the plans cash flows to that of a yield curve on high-quality fixed- income investments. Based on this method, we utilized a weighted-average discount rate of 4.99% at July 30, 2011 compared to 5.19% at July 31, 2010. The .20% basis point decrease in the discount rate, and a change in the mortality table utilized, increased the projected benefit obligation

at July 30, 2011 by approximately $887. Village evaluated the expected long-term rate of return on plan assets of 7.5% and the expected increase in compensation costs of 4 to 4.5% and concluded no changes in these assumptions were necessary in estimating pension plan obligations and expense.

Sensitivity to changes in the major assumptions used in the calculation of the Company’s pension plans is as follows:

|

Projected benefit

|

|||||

|

Percentage

|

obligation

|

Expense

|

|||

|

point change

|

decrease(increase)

|

decrease (increase)

|

|||

|

Discount rate

|

÷1- 1.0%

|

$ 4,500 $ (5,418)

|

$ 45 $ (99)

|

||

|

Expected return on assets

|

÷1- 1.0%

|

—

|

$ 276 $ (276)

|

Village contributed $3,115 and $3,045 in fiscal 2011 and 2010, respectively, to these Company-sponsored pension plans. Village expects to contribute $3,000 in fiscal 2012 to these plans. The 2011, 2010 and expected 2012 contributions are substantially all voluntary contributions.

On April 15, 2011, Village, along with all of the other individual employers trading as ShopRite, permanently withdrew from participating in the United Food and Commercial Workers Local 152 Retail Meat Pension Fund (“the Fund”), effective the end of April 2011. The Fund is a multi- employer defined benefit plan that includes other supermarket operators. Village, along with the other affiliated ShopRite operators, determined to withdraw from the Fund due to exposures to market risks associated with all defined benefit plans and the inability to partition ShopRite’s liabilities from those of the other participating supermarket operators. Village

will provide affected associates with a defined contribution plan for future service, which eliminates market risks and the exposure to shared liabilities of other operators, and is estimated to be less costly than the defined benefit plan in the future, while ensuring that our associates are provided a secure benefit.

The Company recorded a pre-tax charge of $7,028 in fiscal 2011 for this withdrawal liability, which represents our estimate of the liability based on calculations provided by the Fund actuary. The Company has not yet determined whether to satisfy this obligation through a lump sum or quarterly payments. Village remains liable for potential additional withdrawal liabilities to the Fund in the event a mass withdrawal, as defined by statute, occurs within two plan years after the plan year of Village’s withdrawal. Such liabilities could be material to the Company’s consolidated financial statements.

SHARE-BASED EMPLOYEE COMPENSATION

All share-based payments to employees are recognized in the financial statements as compensation expense based on the fair market value on the date of grant. Village determines the fair market value of stock option awards using the Black-Scholes option pricing model. This option pricing model incorporates certain assumptions, such as a risk-free interest rate, expected volatility, expected dividend yield and expected life of options, in order to arrive at a fair value estimate.

UNCERTAIN TAX POSITIONS

The Company is subject to periodic audits by various taxing authorities. These audits may challenge certain of the Company’s tax positions such as the timing and amount of deductions and the allocation of income to various tax jurisdictions. Accounting for these uncertain tax positions requires significant management judgment. Actual results could materially differ from these estimates and could significantly affect the effective tax rate and cash flows in future years.

6

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (Continued)

LIQUIDITY and CAPITAL RESOURCES

CASH FLOWS

Net cash provided by operating activities was $64,144 in fiscal 2011 compared to $35,313 in fiscal 2010. This increase is primarily attributable to an increase in payables in the current fiscal year compared to a decrease in payables in the prior fiscal year. The changes in payable balances outstanding were due to the $7,028 pension withdrawal liability and differences in the timing of payments.

During fiscal 2011, Village used cash to fund capital expenditures of $13,346, dividends of $19,086, the acquisition of the Maryland stores for $6,595 and treasury stock purchases of $2,171. Capital expenditures include the purchase of land for future development, several small remodels, and remodeling and equipment for the acquired Maryland stores.

Net cash provided by operating activities was $35,313 in fiscal 2010 compared to $47,863 in fiscal 2009. This decrease is primarily attributable to a decrease in payables in fiscal 2010 compared to an increase in payables in fiscal 2009. The changes in payables balances outstanding were due to differences in the timing of payments.

During fiscal 2010, Village used cash to fund capital expenditures of $20,204, dividends of $10,820 and debt payments of $5,448. Capital expenditures include the completion of construction and equipment for the replacement store in Washington, installation of a solar energy system at the Garwood store, and several small remodels. Debt payments include the final installment of $4,286 on Village’s unsecured Senior Notes.

LIQUIDITY and DEBT

Working capital was $44,448, $41,201 and $30,856 at July 30, 2011, July 31, 2010 and July 25, 2009, respectively. Working capital ratios at the same dates were 1.41, 1.49 and 1.33 to one, respectively. The Company’s working capital needs are reduced since inventory is generally sold before payments to Wakefern and other suppliers are due.

Village has budgeted approximately $20,000 for capital expenditures in fiscal 2012. Planned expenditures include the beginning of construction of two replacement stores, several small remodels and the installation of solar panels in one store. The Company’s primary sources of liquidity in fiscal 2012 are expected to be cash and cash equivalents on hand at July 30, 2011 and operating cash flow generated in fiscal 2012

At July 30, 2011, the Company had a $19,512 15-month note receivable due from Wakefern earning a fixed rate of 7%. This note is automatically extended for additional, recurring 90-day periods, unless, not later than one year prior to the due date, the Company notifies Wakefern requesting payment on the due date. This note currently is scheduled to mature on August 24, 2012. On December 8, 2009, a $15,822 note receivable from Wakefern matured and is currently invested in overnight deposits at Wakefern.

On December 19, 2008, Village amended its unsecured revolving credit agreement, which would have expired on September 16, 2009. The amended agreement increased the maximum amount available for borrowing to $25,000 from $20,000. This loan agreement expires on December 31, 2013. The revolving credit line can be used for general corporate purposes. Indebtedness under this agreement bears interest at the prime rate, or at the Eurodollar rate, at the Company’s option, plus applicable margins based on the Company’s fixed charge coverage ratio. There were no amounts outstanding at July 30, 2011 or July 31, 2010 under this facility.

The revolving loan agreement contains covenants that, among other conditions, require a maximum liabilities to tangible net worth ratio, a minimum fixed charge coverage ratio and a positive net income. At July 30, 2011, the Company was in compliance with all terms and covenants of the revolving loan agreement. Under the above covenants, Village had approximately $105,000 of net worth available at July 30, 2011 for the payment of dividends.

During fiscal 2011, Village paid cash dividends of $19,086. Dividends in fiscal 2011 consist of $1.70 per Class A common share and $ 1.105 per Class B common share. These amounts include $14,005 of special dividends paid in December 2010, comprised of $1.25 per Class A common share and $.8125 per Class B common share.

During fiscal 2010, Village paid cash dividends of $10,820. Dividends in fiscal 2010 consist of $.97 per Class A common share and $.631 per Class B common share.

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

The table below presents significant contractual obligations of the Company at July 30, 2011:

|

Payments due by fiscal period

|

||||||||||||||||||||||||||||

|

2012

|

2013

|

2014

|

2015

|

2016

|

Thereafter

|

Total

|

||||||||||||||||||||||

|

Capital and financing leases (2)

|

$ | 4,026 | $ | 4,026 | $ | 4,045 | $ | 4,284 | $ | 4,491 | $ | 88,454 | $ | 109,326 | ||||||||||||||

|

Operating leases (2)

|

10,604 | 9,645 | 9,109 | 8,812 | 7,616 | 54,119 | 99,905 | |||||||||||||||||||||

|

Notes payable to

Related party

|

487 | 407 | 550 | 500 | 365 | 755 | 3,064 | |||||||||||||||||||||

| $ | 15,117 | $ | 14,078 | $ | 13,704 | $ | 13,596 | $ | 12,472 | $ | 143,328 | $ | 212,295 | |||||||||||||||

|

(1)

|

In addition, the Company is obligated to purchase 85% of its primary merchandise requirements from Wakefern (see Note 3).

|

|

(2)

|

The above amounts for capital, financing and operating leases include interest, but do not include certain obligations under these leases for other charges. These charges consisted of the following in fiscal 2011: Real estate taxes - $4,047; common area maintenance - $1,846; insurance - $215; and contingent rentals - $881.

|

|

(3)

|

Pension plan funding requirements are excluded from the above table as estimated contribution amounts for future years are uncertain. Required future contributions will be determined by, among other factors, actual investment performance of plan assets, interest rates required to be used to calculate pension obligations, and changes in legislation. The Company expects to contribute $3,000 in fiscal 2012 to fund Company-sponsored defined benefit pension plans compared to actual contributions of $3,115 in fiscal 2011. The table also excludes contributions under various multi-employer pension plans, which totaled $6,159 in fiscal 2011. As more fully described previously herein,

during 2011 Village permanently withdrew from participating in one multi-employer defined benefit plan. The Company recorded a pre-tax charge of $7,028 in fiscal 2011 for this withdrawal liability. The Company has not yet determined whether to satisfy this obligation through a lump sum in fiscal 2012 or quarterly payments for seven years.

|

|

(4)

|

The amount of unrecognized tax benefits of $8,109 at July 30, 2011 has been excluded from this table because a reasonable estimate of the timing of future tax settlements cannot be determined.

|

7

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (Continued)

RECENTLY ADOPTED ACCOUNTING STANDARDS

Effective August 1, 2010, Village adopted a new accounting standard which changes how a company determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. The determination of whether a company is required to consolidate an entity is based on, among other things, an entity’s purpose and design and a company’s ability to direct the activities of the entity that most significantly impact the entity’s economic performance. The adoption had no impact on the Company’s consolidated

financial position or results of operations.

OUTLOOK

This annual report contains certain forward-looking statements about Village’s future performance. These statements are based on management’s assumptions and beliefs in light of information currently available. Such statements relate to, for example: economic conditions; expected pension plan contributions; projected capital expenditures; cash flow requirements; inflation expectations; and legal matters; and are indicated by words such as “will,” “expect,” “should,” “intend,” “anticipates”,

“believes” and similar words or phrases. The Company cautions the reader that there is no assurance that actual results or business conditions will not differ materially from the results expressed, suggested or implied by such forward-looking statements. The Company undertakes no obligation to update forward-looking statements to reflect developments or information obtained after the date hereof.

|

•

|

We expect same store sales to increase from 3.0% to 5.0% in fiscal 2012 with larger increases in the first half of the year. The impacts of inflation and the competitive store closings that occurred during fiscal 2011 are expected to moderate in the second half of fiscal 2012.

|

|

•

|

During fiscal 2011 and 2010, the supermarket industry was impacted by changing consumer behavior due to the weak economy and high unemployment. Consumers are increasingly cooking meals at home, but spending cautiously by trading down to lower priced items, including private label, and concentrating their buying on sale items. Management expects these trends to continue at least through the first half of fiscal 2012.

|

|

•

|

We expect retail price inflation in fiscal 2012, with larger increases in the first half of the year. The Company estimates that product prices overall experienced inflation in fiscal 2011, particularly the second half of the year, compared to deflation in fiscal 2010.

|

|

•

|

We have budgeted $20,000 for capital expenditures in fiscal 2012. This amount includes the beginning of construction of two replacement stores, several small remodels and solar panels for one store.

|

|

•

|

On December 28, 2010, the Company paid special dividends of $14,005. The Board of Directors declared these dividends to provide a return to shareholders in 2010, instead of 2011, while tax rates on dividends remained low. This action was taken before the 15% tax rate was extended. The Board will reconsider dividend policy and other methods of providing returns to shareholders in 2012 and future years based on a variety of factors, including tax rates on dividends and capital gains in effect at that time.

|

|

•

|

We believe cash flow from operations and other sources of liquidity will be adequate to meet anticipated requirements for working capital, capital expenditures and debt payments for the foreseeable future.

|

|

•

|

We expect our effective income tax rate in fiscal 2012 to be 41.5% - 42.5%.

|

|

•

|

We expect operating expenses will be affected by increased costs in certain areas, such as medical and pension costs, and credit card fees.

|

|

|

Various uncertainties and other factors could cause actual results to differ from the forward-looking statements contained in this report. These include:

|

|

•

|

The supermarket business is highly competitive and characterized by narrow profit margins. Results of operations may be materially adversely impacted by competitive pricing and promotional programs, industry consolidation and competitor store openings. Village competes with national and regional supermarkets, local supermarkets, warehouse club stores, supercenters, drug stores, convenience stores, dollar stores, discount merchandisers, restaurants and other local retailers. Some of these competitors have greater financial resources, lower merchandise acquisition cost and lower operating expenses than we do.

|

|

•

|

The Company’s stores are concentrated in New Jersey, with one store in northeastern Pennsylvania and two in Maryland. We are vulnerable to economic downturns in New Jersey in addition to those that may affect the country as a whole. Economic conditions such as inflation, deflation, interest rates, energy costs and unemployment rates may adversely affect our sales and profits.

|

|

•

|

Village acquired two stores in July 2011 in Maryland, a new market for Village where the ShopRite name is less known than in New Jersey. As the Company begins operating in this new market, marketing and other costs may be higher than in established markets as Village attempts to build market share and brand awareness. In addition, sales for these two stores are initially expected to be lower than the typical Company store. Potentially higher costs and sales results lower than the Company’s expectations could have a material adverse effect on Village’s results of operations.

|

|

•

|

Village purchases substantially all of its merchandise from Wakefern. In addition, Wakefern provides the Company with support services in numerous areas including supplies, advertising, liability and property insurance, technology support and other store services. Further, Village receives patronage dividends and other product incentives from Wakefern. Any material change in Wakefern’s method of operation or a termination or material modification of Village’s relationship with Wakefern could have an adverse impact on the conduct of the Company’s business and could involve additional expense for Village. The failure of any Wakefern member to fulfill its

obligations to Wakefern or a member’s insolvency or withdrawal from Wakefern could result in increased costs to the Company. Additionally, an adverse change in Wakefern’s results of operations could have an adverse effect on Village’s results of operations.

|

|

•

|

Approximately 92% of our employees are covered by collective bargaining agreements. Any work stoppages could have an adverse impact on our financial results. If we are unable to control health care and pension costs provided for in the collective bargaining agreements, we may experience increased operating costs.

|

|

•

|

Village could be adversely affected if consumers lose confidence in the safety and quality of the food supply chain. The real or perceived sale of contaminated food products by us could result in a loss of consumer confidence and product liability claims, which could have a material adverse effect on our sales and operations.

|

8

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (Continued)

|

•

|

On April 15, 2011, Village, along with all of the other individual employers trading as ShopRite, permanently withdrew from participating in the United Food and Commercial Workers Local 152 Retail Meat Pension Fund (“the Fund”), effective the end of April 2011. The Fund is a multi-employer defined benefit plan that includes other supermarket operators. Village, along with the other affiliated ShopRite operators, determined to withdraw from the Fund due to exposures to market risks associated with all defined benefit plans and the inability to partition ShopRite’s liabilities from those of the other participating supermarket operators. Village will

provide affected associates with a defined contribution plan for future service, which eliminates market risks and the exposure to shared liabilities of other operators, and is estimated to be less costly than the defined benefit plan in the future, while ensuring that our associates are provided a secure benefit. The Company recorded a pre-tax charge of $7,028 in fiscal 2011 for this withdrawal liability, which represents our estimate of the liability based on calculations provided by the Fund actuary. Village remains liable for potential additional withdrawal liabilities to the Fund in the event a mass withdrawal, as defined by statute, occurs within two plan years after the plan year of Village’s withdrawal. Such liabilities could be material to the Company’s consolidated financial statements.

|

|

We believe a number of the multi-employer plans to which we contribute are underfunded. As a result, we expect that contributions to these plans may increase. Additionally, the benefit levels and related items will be issues in the negotiation of our collective bargaining agreements. Under current law, an employer that withdraws or partially withdraws from a multi-employer pension plan may incur withdrawal liability to the plan, which represents the portion of the plan’s underfunding that is allocable to the withdrawing employer under very complex actuarial and allocation rules. The failure of a withdrawing employer to fund these obligations can impact remaining

employers. The amount of any increase or decrease in our required contributions to these multi-employer pension plans will depend upon the outcome of collective bargaining, actions taken by trustees who manage the plans, government regulations and the actual return on assets held in the plans, among other factors.

|

|

|

•

|

Our effective tax rate may be impacted by the results of tax examinations and changes in tax laws, including the disputes with the state of New Jersey described in note 5 of the accompanying notes to the consolidated financial statements.

|

RELATED PARTY TRANSACTIONS

The Company holds an investment in Wakefern, its principal supplier. Village purchases substantially all of its merchandise from Wakefern in accordance with the Wakefern Stockholder Agreement. As part of this agreement, Village is required to purchase certain amounts of Wakefern common stock. At July 30, 2011, the Company’s indebtedness to Wakefern for the outstanding amount of this stock subscription was $3,064. The maximum per store investment, which is currently $775, increased by $25 in both fiscal 2011 and 2010, resulting in additional investments of $648 and $590,

respectively. Wakefern distributes as a “patronage dividend” to each member a share of its earnings in proportion to the dollar volume of purchases by the member from Wakefern during the year. Wakefern provides the Company with support services in numerous areas including advertising, supplies, liability and property insurance, technology support and other store services. Additional information is provided in Note 3 to the consolidated financial statements.

At July 30, 2011, the Company had a $19,512 15-month note receivable due from Wakefern earning a fixed rate of 7%. This note is automatically extended for additional, recurring 90-day periods, unless, not later than one year prior to the due date, the Company notifies Wakefern requesting payment on the due date. This note currently is scheduled to mature on August 24, 2012. On December 8, 2009, a $15,822 note receivable from Wakefern matured and is currently invested in overnight deposits at Wakefern.

At July 30, 2011, Village had demand deposits invested at Wakefern in the amount of $74,231. These deposits earn overnight money market rates.

The Company subleases the Galloway and Vineland stores from Wakefern at combined current annual rents of $1,227. Both leases contain normal periodic rent increases and options to extend the lease.

Village leases a supermarket from a realty firm partly owned by certain officers of Village. The Company paid rent to this related party of $615, $595 and $595 in fiscal years 2011, 2010 and 2009, respectively. This lease expires in fiscal 2016 with options to extend at increasing annual rents.

The Company has ownership interests in three real estate partnerships. Village paid aggregate rents to two of these partnerships for leased stores of approximately $764, $781 and $750 in fiscal years 2011, 2010 and 2009, respectively.

IMPACT OF INFLATION AND CHANGING PRICES

Although the Company cannot accurately determine the precise effect of inflation or deflation on its operations, it estimates that product prices overall experienced inflation in fiscal 2011 compared to deflation in fiscal 2010 and inflation in fiscal 2009. The Company recorded a pre-tax LIFO charge of $412 in fiscal 2011 compared to a pre-tax LIFO benefit of $418 in fiscal 2010 and a pre-tax LIFO charge of $964 in fiscal 2009. The Company calculates LIFO based on CPI indices published by the Department of Labor, which indicated weighted-average CPI changes of 1.3%, (1.3%) and 3.3%

in fiscal 2011, 2010 and 2009, respectively.

MARKET RISK

At July 30, 2011, the Company had demand deposits of $74,231 at Wakefern earning interest at overnight money market rates, which are exposed to the impact of interest rate changes.

At July 30, 2011 the Company had a $19,512 15-month note receivable due from Wakefern earning a fixed rate of 7%. This note is automatically extended for additional, recurring 90-day periods, unless, not later than one year prior to the due date, the Company notifies Wakefern requesting payment on the due date. This note currently is scheduled to mature on August 24, 2012.

9

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(In thousands)

|

July 30,

|

July 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$ | 91,362 | $ | 69,043 | ||||

|

Merchandise inventories

|

38,547 | 36,256 | ||||||

|

Patronage dividend receivable

|

9,018 | 8,758 | ||||||

|

Other current assets

|

13,407 | 11,825 | ||||||

|

Total current assets

|

152,334 | 125,882 | ||||||

|

Note receivable from Wakefern

|

19,512 | 18,204 | ||||||

|

Property, equipment and fixtures, net

|

174,530 | 175,286 | ||||||

|

Investment in Wakefern

|

22,461 | 20,263 | ||||||

|

Goodwill

|

10,605 | 10,605 | ||||||

|

Other assets

|

6,748 | 6,889 | ||||||

| $ | 386,190 | $ | 357,129 | |||||

|

LIABILITIES and SHAREHOLDERS’ EQUITY

|

||||||||

|

Current Liabilities

|

||||||||

|

Capital and financing lease obligations

|

$ | — | $ | 13 | ||||

|

Notes payable to Wakefern

|

487 | 341 | ||||||

|

Accounts payable to Wakefern

|

55,409 | 47,088 | ||||||

|

Accounts payable and accrued expenses

|

15,017 | 12,609 | ||||||

|

Accrued wages and benefits

|

19,094 | 11,825 | ||||||

|

Income taxes payable

|

17,879 | 12,805 | ||||||

|

Total current liabilities

|

107,886 | 84,681 | ||||||

|

Long-term Debt

|

||||||||

|

Capital and financing lease obligations

|

40,570 | 40,351 | ||||||

|

Notes payable to Wakefern

|

2,577 | 1,480 | ||||||

|

Total long-term debt

|

43,147 | 41,831 | ||||||

|

Deferred income taxes

|

277 | 1,372 | ||||||

|

Pension liabilities

|

21,513 | 18,299 | ||||||

|

Other liabilities

|

5,210 | 5,171 | ||||||

|

Commitments and Contingencies (Notes 3, 4, 5, 6, 8 and 9)

|

||||||||

| Shareholders' Equity | ||||||||

|

Preferred stock, no par value: Authorized 10,000 shares, none issued

|

— | — | ||||||

|

Class A common stock, no par value: Authorized 20,000 shares; issued 7,833 shares at July 30, 2011 and 7,541 shares at July 31, 2010

|

35,385 | 32,434 | ||||||

|

Class B common stock, no par value: Authorized 20,000 shares; issued and outstanding 6,376 shares

|

1,035 | 1,035 | ||||||

|

Retained earnings

|

187,686 | 185,790 | ||||||

|

Accumulated other comprehensive loss

|

(11,142 | ) | (10,421 | ) | ||||

|

Less treasury stock, Class A, at cost (530 shares at July 30, 2011 and 513 shares at July 31, 2010)

|

(4,807 | ) | (3,063 | ) | ||||

|

Total shareholders’ equity

|

208,157 | 205,775 | ||||||

| $ | 386,190 | $ | 357,129 | |||||

See notes to consolidated financial

statements.

10

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Consolidated Statements of Operations

(In thousands, except per share amounts)

|

July 30,

2011

|

Years ended

July 31,

2010

|

July 25,

2009

|

||||||||||

|

Sales

|

$ | 1,298,928 | $ | 1,261,825 | $ | 1,208,097 | ||||||

|

Cost of sales

|

948,769 | 918,900 | 877,552 | |||||||||

|

Gross profit

|

350,159 | 342,925 | 330,545 | |||||||||

|

Operating and administrative expense

|

293,222 | 280,767 | 267,667 | |||||||||

|

Depreciation and amortization

|

18,621 | 16,900 | 15,319 | |||||||||

|

Operating income

|

38,316 | 45,258 | 47,559 | |||||||||

|

Interest expense

|

(4,280 | ) | (3,660 | ) | (3,016 | ) | ||||||

|

Interest income

|

2,207 | 2,020 | 2,064 | |||||||||

|

Income before income taxes

|

36,243 | 43,618 | 46,607 | |||||||||

|

Income taxes

|

15,261 | 18,237 | 19,352 | |||||||||

|

Net income

|

$ | 20,982 | $ | 25,381 | $ | 27,255 | ||||||

|

Net income per share:

|

||||||||||||

| Class A common stock: | ||||||||||||

|

Basic

|

$ | 1.86 | $ | 2.28 | $ | 2.46 | ||||||

|

Diluted

|

$ | 1.54 | $ | 1.88 | $ | 2.02 | ||||||

|

Class B common stock:

|

||||||||||||

|

Basic

|

$ | 1.21 | $ | 1.48 | $ | 1.60 | ||||||

|

Diluted

|

$ | 1.21 | $ | 1.47 | $ | 1.59 | ||||||

See notes to consolidated financial statements.

11

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity and Comprehensive Income

(in thousands)

Years ended July 30, 2011, July 31, 2010 and July 25, 2009

|

Class A

|

Class B

|

Accumulated other

|

Treasury stock

|

Total

|

||||||||||||||||||||||||||||||||

|

Common stock

|

Common stock

|

Retained

|

comprehensive

|

Class A

|

shareholders’

|

|||||||||||||||||||||||||||||||

|

Shares issued

|

Amount

|

Shares issued

|

Amount

|

earnings

|

income (loss)

|

Shares

|

Amount

|

equity

|

||||||||||||||||||||||||||||

|

Balance, July 26, 2008

|

7,522 | $ | 25,458 | 6,376 | $ | 1,035 | $ | 152,445 | $ | (4,071 | ) | 642 | $ | (3,836 | ) | $ | 171,031 | |||||||||||||||||||

|

Net income

|

— | — | — | — | 27,255 | — | — | — | 27,255 | |||||||||||||||||||||||||||

|

Recognition of pension actuarial loss, net of tax of $201

|

— | — | — | — | —— | 303 | — | — | 303 | |||||||||||||||||||||||||||

|

Increase in pension liability,net of tax of $4,511

|

— | — | — | — | — | 6,767 | ) | — | — | (6,767 | ) | |||||||||||||||||||||||||

|

Comprehensive income

|

20,791 | |||||||||||||||||||||||||||||||||||

|

Dividends

|

— | — | — | — | (8,471 | ) | — | — | — | (8,471 | ) | |||||||||||||||||||||||||

|

Exercise of stock options

|

— | 406 | — | — | — | — | (87 | ) | 523 | 929 | ||||||||||||||||||||||||||

|

Share-based compensation expense

|

16 | 2,573 | — | — | —— | — | — | — | 2,573 | |||||||||||||||||||||||||||

|

Excess tax benefits from exercise of stock options and restricted share vesting

|

— | 545 | — | — | — | — | — | — | 545 | |||||||||||||||||||||||||||

|

Balance, July 25, 2009

|

7,538 | 28,982 | 6,376 | 1,035 | 171,229 | (10,535 | ) | 555 | (3,313 | ) | 187,398 | |||||||||||||||||||||||||

|

Net income

|

— | — | — | — | 25,381 | — | — | — | 25,381 | |||||||||||||||||||||||||||

|

Recognition of pension actuarial loss, net of tax of $496

|

— | — | — | — | —— | 744 | — | — | 744 | |||||||||||||||||||||||||||

|

Increase in pension liability, net of tax of $420

|

— | — | — | — | —— | (630 | ) | — | — | (630 | ) | |||||||||||||||||||||||||

|

Comprehensive income

|

25,495 | |||||||||||||||||||||||||||||||||||

|

Dividends

|

— | — | — | — | (10,820 | ) | — | — | — | (10,820 | ) | |||||||||||||||||||||||||

|

Exercise of stock options

|

— | 236 | — | — | — | — | (42 | ) | 250 | 486 | ||||||||||||||||||||||||||

|

Share-based compensation expense

|

3 | 2,929 | — | — | —— | — | — | — | 2,929 | |||||||||||||||||||||||||||

|

Excess tax benefits from exercise of stock options and restricted share vesting

|

— | 287 | — | — | — | — | — | — | 287 | |||||||||||||||||||||||||||

|

Balance, July 31, 2010

|

7,541 | 32,434 | 6,376 | 1,035 | 185,790 | (10,421 | ) | 513 | (3,063 | ) | 205,775 | |||||||||||||||||||||||||

|

Net income

|

— | — | — | — | 20,982 | — | — | — | 20,982 | |||||||||||||||||||||||||||

|

Recognition of pension actuarial loss, net of tax of $660

|

— | — | — | — | —— | 991 | — | — | 991 | |||||||||||||||||||||||||||

|

Increase in pension liability, net of tax of $1,140

|

— | — | — | — | —— | (1,712 | ) | — | — | (1,712 | ) | |||||||||||||||||||||||||

|

Comprehensive income

|

20,261 | |||||||||||||||||||||||||||||||||||

|

Dividends

|

— | — | — | — | (19,086 | ) | — | — | — | (19,086 | ) | |||||||||||||||||||||||||

|

Exercise of stock options

|

— | 300 | — | — | — | — | (59 | ) | 427 | 727 | ||||||||||||||||||||||||||

|

Treasury stock purchases

|

— | — | — | — | — | — | 76 | (2,171 | ) | (2,171 | ) | |||||||||||||||||||||||||

|

Share-based compensation expense

|

292 | 3,007 | — | — | —— | — | — | — | 3,007 | |||||||||||||||||||||||||||

|

Net tax deficit from exercise of stock options and restricted share vesting

|

— | (356 | ) | — | — | — | — | — | — | (356 | ) | |||||||||||||||||||||||||

|

Balance, July 30, 2011

|

7,833 | $ | 35,385 | 6,376 | $ | 1,035 | $ | 187,686 | $ | (11,142 | ) | 530 | $ | (4,807 | ) | $ | 208,157 | |||||||||||||||||||

See notes to consolidated financial statements.

12

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(In thousands)

|

Years ended

|

||||||||||||

|

July 30, 2011

|

July 31, 2010

|

July 25, 2009

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||||||

|

Net income

|

$ | 20,982 | $ | 25,381 | $ | 27,255 | ||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

18,621 | 16,900 | 15,319 | |||||||||

|

Non-cash share-based compensation

|

3,007 | 2,929 | 2,573 | |||||||||

|

Deferred taxes

|

(1,543 | ) | (900 | ) | (16 | ) | ||||||

|

Provision to value inventories at LIFO

|

412 | (418 | ) | 964 | ||||||||

|

Changes in assets and liabilities:

|

||||||||||||

|

Merchandise inventories

|

(2,703 | ) | (1,565 | ) | (2,164 | ) | ||||||

|

Patronage dividend receivable

|

(260 | ) | (1,312 | ) | (568 | ) | ||||||

|

Accounts payable to Wakefern

|

8,321 | (6,399 | ) | 1,142 | ||||||||

|

Accounts payable and accrued expenses

|

2,408 | (1,949 | ) | 885 | ||||||||

|

Accrued wages and benefits

|

7,269 | 344 | 1,459 | |||||||||

|

Income taxes payable

|

2,268 | 3,453 | 311 | |||||||||

|

Other assets and liabilities

|

5,362 | (1,151 | ) | 703 | ||||||||

|

Net cash provided by operating activities

|

64,144 | 35,313 | 47,863 | |||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||||||

|

Capital expenditures

|

(13,346 | ) | (20,204 | ) | (26,625 | ) | ||||||

|

Maturity of (investment in) note receivable from Wakefern

|

(1,308 | ) | 14,463 | (1,546 | ) | |||||||

|

Acquisition of Maryland store assets

|

(6,595 | ) | — | — | ||||||||

|

Net cash used in investing activities

|

(21,249 | ) | (5,741 | ) | (28,171 | ) | ||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||||||

|

Proceeds from exercise of stock options

|

727 | 486 | 929 | |||||||||

|

Excess tax benefit related to share-based compensation

|

703 | 287 | 545 | |||||||||

|

Principal payments of long-term debt

|

(749 | ) | (5,448 | ) | (5,618 | ) | ||||||

|

Dividends

|

(19,086 | ) | (10,820 | ) | (8,471 | ) | ||||||

|

Treasury stock purchases

|

(2,171 | ) | — | — | ||||||||

|

Net cash used in financing activities

|

(20,576 | ) | (15,495 | ) | (12,615 | ) | ||||||

|

NET INCREASE IN CASH AND CASH EQUIVALENTS

|

22,319 | 14,077 | 7,077 | |||||||||

|

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR

|

69,043 | 54,966 | 47,889 | |||||||||

|

CASH AND CASH EQUIVALENTS, END OF YEAR

|

$ | 91,362 | $ | 69,043 | $ | 54,966 | ||||||

|

SUPPLEMENTAL DISCLOSURES OF CASH PAYMENTS MADE FOR:

|

||||||||||||

|

Interest

|

$ | 4,280 | $ | 3,771 | $ | 3,150 | ||||||

|

Income taxes

|

$ | 12,095 | $ | 15,171 | $ | 18,527 | ||||||

|

NONCASH SUPPLEMENTAL DISCLOSURES:

|

||||||||||||

|

Financing and capital lease obligations

|

$ | — | $ | 9,638 | $ | 9,144 | ||||||

|

Investment in Wakefern

|

$ | 2,198 | $ | 590 | $ | 1,382 | ||||||

See notes to consolidated financial statements.

13

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

NOTE 1 — SUMMARY of SIGNIFICANT ACCOUNTING POLICIES

(All amounts are in thousands, except per share data)

Nature of operations

Village Super Market, Inc. (the “Company” or “Village”) operates a chain of 28 ShopRite supermarkets in New Jersey, eastern Pennsylvania and Maryland. The Company is a member of Wakefern Food Corporation (“Wakefern”), the largest retailer-owned food cooperative in the United States.

Principles of consolidation

The consolidated financial statements include the accounts of Village Super Market, Inc. and its subsidiaries, which are wholly owned. Intercompany balances and transactions have been eliminated.

Fiscal year

The Company and its subsidiaries utilize a 52-53 week fiscal year ending on the last Saturday in the month of July. Fiscal 2010 contains 53 weeks. Fiscal 2011 and 2009 contain 52 weeks.

Industry segment

The Company consists of one operating segment, the retail sale of food and nonfood products.

Revenue recognition

Merchandise sales are recognized at the point of sale to the customer. Sales tax is excluded from revenue. Discounts provided to customers through ShopRite coupons and loyalty programs are recognized as a reduction of sales as the products are sold.

Cash and cash equivalents

The Company considers all highly liquid investments purchased with a maturity of three months or less and proceeds due from credit and debit card transactions with settlement terms of less than five days to be cash equivalents. Included in cash and cash equivalents at July 30, 2011 and July 31, 2010 are $74,231 and $51,174, respectively, of demand deposits invested at Wakefern at overnight money market rates.

Merchandise inventories

Approximately 65% of merchandise inventories are stated at the lower of LIFO (last-in, first-out) cost or market. If the FIFO (first-in, first-out) method had been used, inventories would have been $14,241 and $13,829 higher than reported in fiscal 2011 and 2010, respectively. All other inventories are stated at the lower of FIFO cost or market.

Vendor allowances and rebates

The Company receives vendor allowances and rebates, including the patronage dividend and amounts received as a pass through from Wakefern, related to the Company’s buying and merchandising activities. Vendor allowances and rebates are recognized as a reduction in cost of sales when the related merchandise is sold or when the required contractual terms are completed.

Property, equipment and fixtures

Property, equipment and fixtures are recorded at cost. Interest cost incurred to finance construction is capitalized as part of the cost of the asset. Maintenance and repairs are expensed as incurred.

Depreciation is provided on a straight-line basis over estimated useful lives of thirty years for buildings, ten years for store fixtures and equipment, and three years for vehicles. Leasehold improvements are amortized over the shorter of the related lease terms or the estimated useful lives of the related assets.

When assets are sold or retired, their cost and accumulated depreciation are removed from the accounts, and any gain or loss is reflected in the consolidated financial statements.

Investments

The Company’s investments in its principal supplier, Wakefern, and a Wakefern affiliate, Insure-Rite, Ltd., are stated at cost (see Note 3). Village evaluates its investments in Wakefern and Insure-Rite, Ltd. for impairment through consideration of previous, current and projected levels of profit of those entities.

The Company’s 20%-50% investments in certain real estate partnerships are accounted for under the equity method. One of these partnerships is a variable interest entity which does not require consolidation as Village is not the primary beneficiary (see Note 6).

Store opening and closing costs

All store opening costs are expensed as incurred. The Company records a liability for the future minimum lease payments and related costs for closed stores from the date of closure to the end of the remaining lease term, net of estimated cost recoveries that may be achieved through subletting, discounted using a risk-adjusted interest rate.

Leases

Leases that meet certain criteria are classified as capital leases, and assets and liabilities are recorded at amounts equal to the lesser of the present value of the minimum lease payments or the fair value of the leased properties at the inception of the respective leases. Such assets are amortized on a straight- line basis over the shorter of the related lease terms or the estimated useful lives of the related assets. Amounts representing interest expense relating to the lease obligations are recorded to effect constant rates of interest over the terms of the leases. Leases that

do not qualify as capital leases are classified as operating leases. The Company accounts for rent holidays, escalating rent provisions, and construction allowances on a straight-line basis over the term of the lease.

For leases in which the Company is involved with the construction of the store, if Village concludes that it has substantively all of the risks of ownership during construction of the leased property and therefore is deemed the owner of the project for accounting purposes, an asset and related financing obligation are recorded for the costs paid by the landlord. Once construction is complete, the Company considers the requirements for sale-leaseback treatment. If the arrangement does not qualify for sale- leaseback treatment, the Company amortizes the financing obligation and

depreciates the building over the lease term.

14

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Continued)

NOTE 1 — SUMMARY of SIGNIFICANT ACCOUNTING POLICIES (continued)

Advertising

Advertising costs are expensed as incurred. Advertising expense was $9,294, $8,972 and $8,449 in fiscal 2011, 2010 and 2009, respectively.

Income taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in operations in the period that includes the enactment

date.

The Company recognizes a tax benefit for uncertain tax positions if it is “more likely than not” that the position is sustainable, based on its technical merits. The tax benefit of a qualifying position is the largest amount of tax benefit that is greater than 50% likely of being realized upon effective settlement with a taxing authority having full knowledge of all relevant information.

Use of estimates

In conformity with U.S. generally accepted accounting principles, management of the Company has made a number of estimates and assumptions relating to the reporting of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of expenses during the reporting period. Some of the more significant estimates are patronage dividends, pension accounting assumptions, share-based compensation assumptions, accounting for uncertain tax positions, accounting for contingencies and the impairment of

long-lived assets and goodwill. Actual results could differ from those estimates.

Fair value

Fair value is defined as the exit price that would be received to sell an asset or paid to transfer a liability. Fair value is a market-based measurement that should be determined using assumptions that market participants would use in pricing an asset or liability. The fair value guidance establishes a three-level hierarchy to prioritize the inputs used in measuring fair value. The levels within the hierarchy range from Level 1 having the highest priority to Level 3 having the lowest.

Cash and cash equivalents, patronage dividends receivable, accounts payable and accrued expenses are reflected in the consolidated financial statements at carrying value, which approximates fair value because of the short-term maturity of these instruments. The carrying values of the Company’s notes receivable from Wakefern and short and long-term notes payable approximate their fair value based on the current rates available to the Company for similar instruments. As the Company’s investments in Wakefern can only be sold to Wakefern at amounts that approximate the

Company’s cost, it is not practicable to estimate the fair value of such investments.

Long-lived assets

The Company reviews long-lived assets, such as property, equipment and fixtures on an individual store basis for impairment when circumstances indicate the carrying amount of an asset group may not be recoverable. Such review analyzes the undiscounted estimated future cash flows from such assets to determine if the carrying value of such assets are recoverable from their respective cash flows. If an impairment is indicated, it is measured by comparing the fair value of the long-lived assets to their carrying value.

Goodwill

Goodwill is tested at the end of each fiscal year, or more frequently if circumstances dictate, for impairment. An impairment loss is recognized to the extent that the carrying amount of goodwill exceeds its implied fair value. Village operates as a single reporting unit for purposes of evaluating goodwill for impairment and primarily considers earnings multiples and other valuation techniques to measure fair value, in addition to the value of the Company’s stock, as its stock is not widely traded.

15

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Continued)

NOTE 1 — SUMMARY of SIGNIFICANT ACCOUNTING POLICIES (continued)

Net income per share

The Company has two classes of common stock. Class A common stock is entitled to cash dividends as declared 54% greater than those paid on Class B common stock. Shares of Class B common stock are convertible on a share-for-share basis for Class A common stock at any time.

The Company utilizes the two-class method of computing and presenting net income per share. The two-class method is an earnings allocation formula that calculates basic and diluted net income per share for each class of common stock separately based on dividends declared and participation rights in undistributed earnings. Under the two-class method, Class A common stock is assumed to receive a 54% greater participation in undistributed earnings than Class B common stock, in accordance with the classes respective dividend rights. Unvested share-based payment awards that contain

nonforfeitable rights to dividends are treated as participating securities and therefore included in computing net income per share using the two-class method.

Diluted net income per share for Class A common stock is calculated utilizing the if-converted method, which assumes the conversion of all shares of Class B common stock to Class A common stock on a share-for- share basis, as this method is more dilutive than the two-class method. Diluted net income per share for Class B common stock does not assume conversion of Class B common stock to shares of Class A common stock.

The tables below reconcile the numerators and denominators of basic and diluted net income per share for all periods presented.

|

2011

|

2010 | 2009 | ||||||||||||||||||||||

| Class A | Class B | Class A | Class B | Class A | Class B | |||||||||||||||||||

|

Numerator:

|

||||||||||||||||||||||||

|

Net income allocated, basic

|

$ | 12,752 | $ | 7,741 | $ | 15,351 | $ | 9,435 | $ | 16,422 | $ | 10,201 | ||||||||||||

|

Conversion of Class B to Class A shares

|

7,741 | — | 9,435 | — | 10,201 | — | ||||||||||||||||||

|

Effect of share-based compensation on allocated net income

|

8 | (6 | ) | 59 | (57 | ) | 78 | (93 | ) | |||||||||||||||

|

Net income allocated, diluted

|

$ | 20,501 | $ | 7,735 | $ | 24,845 | $ | 9,378 | $ | 26,701 | $ | 10,108 | ||||||||||||

|

Denominator:

|

||||||||||||||||||||||||

|