Attached files

| file | filename |

|---|---|

| EX-23.2 - CONSENT OF LBB & ASSOCIATES LTD., LLP, CERTIFIED PUBLIC ACCOUNTANT - Press Ventures, Inc. | presv_ex23-2.htm |

As filed with the Securities and Exchange Commission on October 11, 2011

Registration No. 333-171209

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM S-1/A

PRE-EFFECTIVE AMENDMENT NO. 4 TO S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PRESS VENTURES, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

1000

|

39-2077493

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

1733 First Avenue NW

Calgary, Alberta, Canada T2N 0B2

Telephone: 403-648-2720

Fax: 403-648-2755

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Caroline Johnston, President

Press Ventures, Inc.

1733 First Avenue NW

Calgary, Alberta, Canada T2N 0B2

Telephone: 403-648-2720

Fax: 403-648-2755

Empire Stock Transfer, Inc.

1859 Whitney Mesa Drive

Henderson, NV 89014

(US)

(Name, address, including zip code, and telephone number, including area code, of agents for service)

Copies of all communications to:

Kristen A. Baracy, Esq.

Carol S. McMahan, Esq.

Synergy Law Group, LLC

730 West Randolph Street, 6th Floor

Chicago, IL 60661

(312) 454-0015

Fax (312) 454-0261

Approximate Date of Commencement of Proposed Sale to Public: As soon as practicable after the effective date of this Registration Statement

If any of the securities being registered on this Form as to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

Amount to be

Registered

|

Proposed

Maximum

Offering Price

Per Unit(1)

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration

Fee(2)

|

||||||||||||

|

Common Stock

|

2,800,000

|

$

|

0.01

|

$

|

28,000

|

$

|

2.00

|

|||||||||

|

(1)

|

The price was arbitrarily determined by the Company.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 under the Securities Act.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, dated [Date], 2011

PRELIMINARY PROSPECTUS

PRESS VENTURES, INC.

2,800,000 SHARES OF COMMON STOCK

$0.01 PER SHARE

This prospectus relates to the offering (the “Offering”) of 2,800,000 shares of common stock (the “Shares”) of Press Ventures, Inc. (hereinafter referred to as “Press,” “we,” “our,” the “Company” or the “Registrant”), in a self-underwritten direct public offering, without any participation by underwriters or broker-dealers. The Shares will be sold through the efforts of our sole officer and director. Our officer and director will not receive any compensation for her role in selling such Shares. The offering price is $0.01 per share (the “Offering Price”). The offering period (“Offering Period”) will begin on the date the Company’s registration statement is declared effective (the “Effective Date”) by the Securities and Exchange Commission (the “SEC”) and will close 180 days thereafter or such earlier date as the Company has received subscriptions for 2,800,000 Shares. The Company will offer the Shares on an all-or-none basis. Subscriptions will be held in an escrow account during the Offering Period. If the Company has not received subscriptions for 2,800,000 shares upon the expiration of the Offering Period, all subscription funds will be promptly returned to investors without interest or deduction. Prior to this Offering, there has been no public market for the common stock of the Company.

This is our initial public offering. Prior to this Offering there has been no public market for our common stock and we have not applied for listing or quotation on any public market. After the Effective Date, we intend to seek a listing of our common stock on the OTC Bulletin Board (“OTCBB”), which is maintained by the Financial Industry Regulatory Authority, Inc. (“FINRA”). There is no guarantee that the securities of the Company will be accepted for listing on the OTCBB.

The Company has incurred a cumulative net loss from inception through July 31, 2011 of $31,572 . The estimated proceeds of this Offering are $28,000, and the Company expects to incur Offering expenses of approximately $18,000. AT THIS TIME, THE COMPANY’S LIABILITIES EXCEED ITS ASSETS. OUR AUDITORS HAVE ISSUED AN OPINION EXPRESSING SUBSTANTIAL DOUBT ABOUT THE COMPANY'S ABILITY TO CONTINUE AS A GOING CONCERN. SEE “RISK FACTORS” AND “LIQUIDITY AND CAPITAL RESOURCES.”

BEFORE PURCHASING ANY OF THE SHARES COVERED BY THIS PROSPECTUS, CAREFULLY READ AND CONSIDER THE RISK FACTORS INCLUDED IN THE SECTION ENTITLED “RISK FACTORS” BEGINNING ON PAGE 5. THESE SHARES INVOLVE A HIGH DEGREE OF RISK, AND PROSPECTIVE PURCHASERS SHOULD BE PREPARED TO SUSTAIN THE LOSS OF THEIR ENTIRE INVESTMENT. THERE IS CURRENTLY NO PUBLIC TRADING MARKET FOR THE SECURITIES.

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained in this Prospectus. We have not authorized any person to provide you with any information about this Offering, the Company, or the Shares offered hereby that is different from the information included in this Prospectus. If anyone provides you with different information, you should not rely on it.

This Offering will commence promptly after the date of this prospectus and close no later than 180 days from the date of this prospectus.

The date of this prospectus is ___________, 2011.

1

TABLE OF CONTENTS

2

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this Prospectus and may not contain all of the information you should consider before investing in the Shares. You are urged to read this Prospectus in its entirety, including the information under “Risk Factors“, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, before making an investment decision.

In this prospectus, ‘‘Press,’’ ‘‘the Company,’’ ‘‘we,’’ ‘‘us,’’ and ‘‘our,’’ refer to Press Ventures, Inc. unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending October 31, 2010. Unless otherwise indicated, the term ‘‘common stock’’ refers to shares of the Company’s common stock.

All dollar amounts are reported in U.S. dollars (USD).

Overview

This Prospectus relates to the offering of shares by the Company on a self-underwritten basis. The Company proposes to raise $28,000 (the “Offering Amount”) through the sale of 2,800,000 shares of the common stock of the Company (each a “Share” and collectively the “Shares”) at the price of $0.01 per Share (the “Offering”) as more fully described in the “Plan of Distribution.” The Company is offering the Shares on an all-or-none basis. If the Company has not received subscriptions for 2,800,000 shares upon the expiration of the Offering Period, all subscription funds will be promptly returned to investors without interest or deduction.

Investors should be aware that our independent auditors have issued an audit opinion which includes a statement expressing substantial doubt as to our ability to continue as a going concern. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next twelve months. Our auditor's opinion is based on our having incurred a loss since inception with further losses anticipated. Our only other sources for cash at this time are investments by others in our Company or a possible capital advance/loan by our sole officer and director. We need to raise approximately $28,000 to fund operating expenses and begin the first phase of exploration. Our sole officer and director has made an unenforceable and non-binding verbal commitment to advance capital to us up to a maximum of $15,000 if necessary as determined in her sole discretion. The costs for Phase Two exploration, if warranted, are estimated at $109,608. We would need to raise additional funds to proceed beyond phase one exploration. See “Risk Factors” beginning on page 5.

The Company

Press Ventures, Inc. was incorporated under the laws of the state of Nevada on October 5, 2010. The Company’s principal offices are located at 1733 First Avenue NW, Calgary, Alberta, Canada T2N 0B2. Our telephone number is 403-648-2720 and fax number is 403-648-2755.

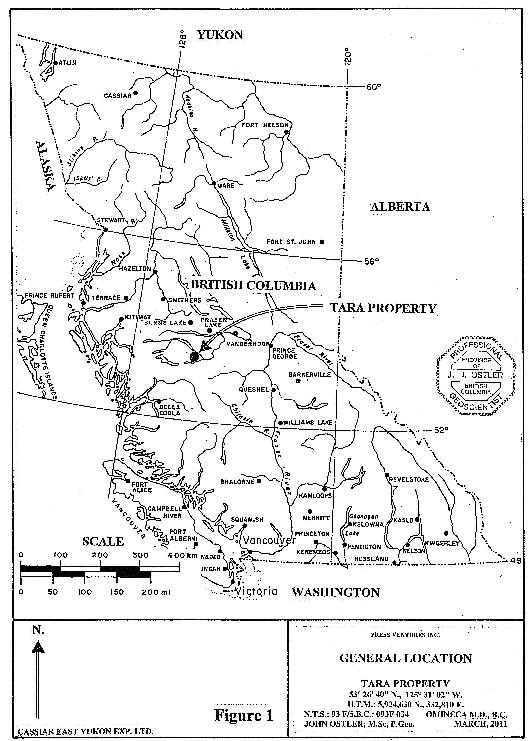

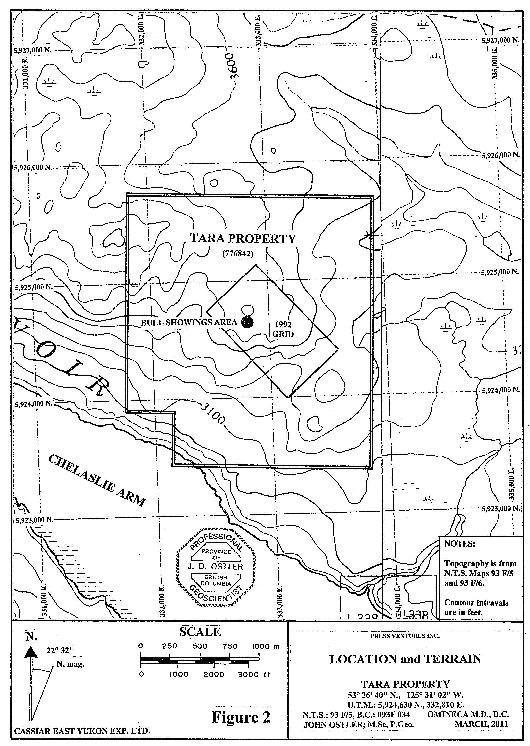

The Company is a mining exploration stage company and will be engaged in the acquisition and exploration of mineral properties. Presently, the Company beneficially owns one mining claim called the Tara Property covering 462.22 hectares located in the Omineca Mining Division of British Columbia, Canada. This property consists of one claim held by Mr. I.J. Boga (the “Trustee”) under Declaration of Trust dated October 7, 2010 in favor of the Company. The Tara Property consists of one mineral claim which has showing called the Bull showings. We refer to this claim as the “Property” or the “Claim” throughout this Prospectus. We acquired the Property for the cost of $5,000. We have not yet commenced any exploration activities on the Claim other than completing a technical report. We have not generated revenue from mining operations.

We received our initial funding of $22,000 through the private sale of common stock to our sole officer and director who purchased 5,500,000 shares of our common stock at $0.004 per share. Our financial statements from inception (October 5, 2010) through July 31, 2011 report a net loss of $31,572. Our independent auditor has issued an audit opinion which includes a statement expressing substantial doubt as to our ability to continue as a going concern.

The Property may not contain any mineral reserves and funds that we spend on exploration may be lost. Even if we complete an initial exploration program and are successful in identifying a mineral deposit, we will be required to raise additional and substantial funds to bring our Claim to production. We have no known potential sources of funds for exploration beyond the proceeds of this Offering and an advance, if any, from our sole officer and director. Should the Company determine to raise money by selling securities, the ownership of investors in this Offering would be diluted. Neither Ms. Johnston, our sole officer and director, nor our independent consulting geologist has personally visited the Property. Ms. Johnston is relying upon her discussions with our consulting geologist, and our consulting geologist’s recommendations are based upon his expertise and experience in mining operations in Western Canada.

3

The Terms of the Offering

|

Securities Being Offered

|

The Company is offering for sale 2,800,000 shares of common stock.

|

|

|

Offering Price

|

The Offering Price is $0.01 per Share. The Offering Price was determined arbitrarily by the Company.

|

|

|

Terms of the Offering

|

The Shares will be sold through the efforts of our sole officer and director beginning on the date this registration statement is declared effective (the “Effective Date”) by the SEC.

|

|

|

Offering Period

|

The Shares may be sold following the Effective Date of the Company’s Registration Statement. The Offering will commence promptly after the date of this prospectus and close no later than 180 days from the date of this prospectus. We may, in our sole and absolute discretion, terminate the Offering at any time for any reason whatsoever.

|

|

|

Minimum Number of Shares to be Sold in the Offering

|

The Company is offering 2,800,000 shares of common stock on an all-or-none basis. If the Company has not received subscriptions for 2,800,000 shares upon expiration of the Offering Period, subscription funds will be promptly returned to investors without interest or deduction.

|

|

|

Risk Factors

|

The securities offered hereby involve a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See ‘‘Risk Factors’’ beginning on page 5.

|

|

|

Common Stock Issued And Outstanding Before Offering

|

5,500,000 shares of our common stock are issued and outstanding as of the date of this Prospectus.

|

|

|

Common Stock Issued And Outstanding After Offering

|

Upon completion of the Offering, we will have 8,300,000 shares of common stock issued and outstanding if we sell the Shares offered in this Offering.

|

|

|

Net Proceeds to Our Company

|

Assuming 2,800,000 shares are sold in this Offering, the estimated proceeds will be $28,000. Unpaid offering expenses estimated at $8,000 will be paid from cash on hand, from working capital funded from the proceeds of this Offering and/or from a capital advance from the Company’s sole officer and director if such an advance is provided as determined in Ms. Johnston’s sole discretion.

|

|

|

Use of Proceeds

|

The Company will use the net proceeds from the Offering substantially for general working capital including payment of unpaid Offering expenses and to begin exploration of the Property for potential development.

|

|

|

Dividend Policy

|

We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future.

|

Summary Financial Information

|

Balance Sheet Data

|

July 31, 2011

|

|||

|

Cash and Cash Equivalents

|

$

|

1,793

|

||

|

Total Current Assets

|

$

|

1,793

|

||

|

Current Liabilities

|

$

|

11,365

|

||

|

Total Stockholder’s Equity

|

$

|

(9,572

|

) | |

|

Statement of Operations From Inception

on October 5, 2010 To July 31, 2011

|

||||

|

Revenue

|

$

|

-

|

||

|

Net Loss

|

$

|

(31,572

|

) |

4

RISK FACTORS

You should carefully consider the risks and uncertainties described below and the other information in this Prospectus before deciding whether to invest in the Shares we are offering. The risks described below are not the only ones we will face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our financial performance and business operations. If any of these risks actually occur, our business and financial condition or results of operation may be materially adversely affected, the trading price of our common stock could decline and you may lose all or part of your investment. We make various statements in this section which constitute “forward-looking” statements.

Risks Relating to Our Company

Our only mining property is one mining claim, the feasibility of which has not been established as we have not completed exploration or other work necessary to determine if it is commercially feasible to develop the Property.

We are currently an exploration stage mining company. Our only mining asset is one mining claim on the Property. The Property does not have any proven or probable reserves. A “reserve,” as defined by the U. S. Securities and Exchange Commission (the “SEC”), is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. A reserve requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically extracted and produced. We have not carried out any feasibility study with regard to the Property. As a result, we currently have no reserves and there are no assurances that we will be able to prove that there are reserves on the Property.

Because our auditors have issued a going concern opinion and because a loan from our sole officer and director, if any, will be in a limited amount, we will require additional funds to continue operations.

Our auditors have issued an audit opinion which expresses substantial doubt that we will be able to continue as a going concern. As of the date of this Prospectus, we have not commenced operations. Our sole officer and director has made an unenforceable verbal commitment to advance capital to us up to a maximum of $15,000. However, because she is not obligated to make such a loan to the Company and such a loan, if one is provided, will be limited to $15,000, we will require additional funds in order to continue operations.

Investors should not rely on the verbal commitment of our sole officer and director to make a loan to the Company, because the commitment is unenforceable and non-binding.

Caroline Johnston, our sole officer and director, has made an unenforceable and non-binding verbal commitment to loan up to $15,000 to fund Company expenses in its initial stage. There is no legal obligation for Ms. Johnston to make such a loan. Ms. Johnston, in her sole discretion, will determine whether she deems such a loan necessary and the amount of such a loan, if any. Investors should not rely on this commitment to make a loan, because such a verbal commitment is unenforceable and non-binding.

The Company’s has incurred a net loss and its liabilities exceed its assets at the present time and may be considered insolvent.

The Company has incurred a cumulative net loss from inception through July 31, 2011 of $31,572. The estimated proceeds of this Offering are $28,000, and the Company expects to incur Offering expenses of approximately $18,000. At this time, the Company’s liabilities exceed its assets.

Subscription Funds Held in Escrow are Subject to Third Party Claims

Subscriber funds for the purchase of the common stock pursuant to this Prospectus will be held in an escrow account for the benefit of the Company during the Offering Period. Pursuant to the terms of the Escrow Agreement between the Company and the escrow agent, the escrow agent is expressly authorized to obey and comply with all writs, orders or decrees entered or issued if any funds held under the Escrow Agreement are attached, garnished or levied upon by any court, or the delivery thereof is stayed or enjoined by court order or judgment is entered affecting the funds.

We need to raise approximately $28,000 in this Offering in order to commence phase one exploration of the Claim. If we are unable to sell all of the Shares included in this Offering, we may not be able to commence phase one exploration of the Claim, in which event we will promptly return subscription funds to investors without interest or deduction. In such case, we will be unable to implement our business plan.

We may never find commercially viable reserves.

Mineral exploration and development involve a high degree of risk and few properties that are explored are ultimately developed into producing mines. We cannot assure you that any future mineral exploration and development activities will result in any discoveries of proven or probable reserves as defined by the SEC since such discoveries are remote. Further, we cannot provide any assurance that, even if we discover commercial quantities of mineralization, a mineral property will be brought into commercial production. Development of our mineral property will follow only upon obtaining sufficient funding and satisfactory exploration results.

5

We will require significant additional capital to continue our exploration activities, and, if warranted, to develop mining operations.

Exploration activities and, if warranted, development of the Property will involve significant expenditures. We will be required to raise significantly additional capital in order to fully develop the Property for mining production assuming that economically viable reserves exist. Following this Offering, we will need additional funds if we determine to proceed with the next phase of our exploration program. There is no assurance that the exploration will disclose potential for mineral development and no assurance that any such development would be financially productive. Our ability to obtain additional necessary funding depends upon a number of factors, including, among others, the price of copper and other base metals and minerals which we are able to locate and mine, the status of the national and worldwide economy and the availability of funds in the capital markets. If we are unable to obtain the required financing for these or other purposes, our exploration and any production activities would be delayed or indefinitely postponed, and this would likely, eventually, lead to failure of our Company. Even if financing is available, it may be on terms that are not favorable to us, in which case, our ability to become profitable or to continue operating would be adversely affected. If we are unable to raise funds to continue our exploration and feasibility work on the Property, or if commercially viable reserves are not present, the market value of our securities will likely decline, and our investors may lose some or all of their investment.

We have incurred losses since our incorporation and may never be profitable which raises substantial doubt about our ability to continue as a going concern.

Since the Company was incorporated October 5, 2010, we have been involved in organizational activities, have no operations and have incurred operating losses. If we are able to commence exploration activities on the Property, we expect to incur additional losses in the foreseeable future, and such losses may be significant. To become profitable, we must be successful in raising capital to continue with our exploration activities, discover economically feasible mineralization deposits and establish reserves, successfully develop the Property and finally realize adequate prices on our minerals in the marketplace. It could be years before we receive any revenues from copper and mineral production, if ever. Thus, we may never be profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a long-term basis. These circumstances raise substantial doubt about our ability to continue as a going concern as described in note 1 of the notes to financial statements. If we are unable to continue as a going concern, investors will likely lose all of their investments in the Company.

Because we have not yet commenced business operations, evaluating our business is difficult.

We were incorporated on October 5, 2010, and to date have been involved primarily in organizational activities. We have not earned revenues as of the date of this Prospectus and have incurred total losses of $31,572 from inception on October 5, 2010 to July 31, 2011.

Accordingly, we have no operating history upon which you can evaluate our business or our future prospects. To date, our business development activities have consisted solely of organizational activities. Potential investors should be aware of the difficulties normally encountered by exploration stage companies and the high rate of failure of such enterprises. In addition, there is no guarantee that we will commence business operations. Even if we do commence operations, we cannot guarantee when such operations would commence.

Furthermore, prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development of the Claim and any production of minerals from the Claim, we will not be able to earn profits or continue operations.

Very few mineral properties are ultimately developed into producing mines.

The business of exploration for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into producing mines. At present, the Claim has no known body of commercial mineralization. Most exploration projects do not result in the discovery of commercially mineable deposits of mineralization.

Substantial expenditures are required for the Company to establish mineralization reserves through drilling, to develop metallurgical processes, to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining.

Although substantial benefits may be derived from the discovery of a major mineral deposit, we cannot assure you that the Company will discover minerals in sufficient quantities to justify commercial operations or that it can obtain the funds required for development on a timely basis. The economics of developing precious and base metal mineral properties is affected by many factors including the cost of operations, variations in the grade of ore mined, fluctuations in metal markets, costs of processing equipment and other factors such as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection.

Fluctuating metal and mineral prices could negatively impact our business plan.

The potential for profitability of metal and mineral mining operations which we commence, if any, and the value of the Property will be directly related to the market price of the metals and minerals that we mine, if any. Historically, metal and mineral prices have widely fluctuated and are influenced by a wide variety of factors, including inflation, currency fluctuations, regional and global demand and political and economic conditions. Fluctuations in the price of metal and minerals that we mine, if any, may have a significant influence on the market price of our common stock, and a prolonged decline in these prices will have a negative effect on our results of operations and financial condition.

6

Reclamation obligations on the Property and our mining operations, if any, could require significant additional expenditures.

We will be responsible for the reclamation obligations related to any exploratory and mining activities located on the Property. Since we have not yet begun exploration activities, we cannot estimate these costs at this time. We may be required to file for a reclamation bond for any mining operations which we conduct, and the cost of such a bond will be significant. We do not currently have an estimate of the total reclamation costs for mining operations on the Property. The satisfaction of current and future bonding requirements and reclamation obligations will require a significant amount of capital. There is a risk that we will be unable to fund these additional bonding requirements, and further, that increases to our bonding requirements or excessive actual reclamation costs will negatively affect our financial position and results of operation.

Title to mineral properties can be uncertain, and we are at risk of loss of ownership of the Claim.

Our ability to explore and mine the Property depends on the validity of title to the Claim. The Property consists of a mining claim. Unpatented mining claims are effectively only a lease from the government to extract minerals; thus an unpatented mining claim is subject to contest by third parties or the government. These uncertainties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, failure to meet statutory guidelines, assessment work and possible conflicts with other claims not determinable from descriptions of record. Since a substantial portion of all mineral exploration, development and mining now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry. There could be challenges to the title to the Claim which, if successful, could impair future development and/or operations.

Our operations, if any, will be subject to environmental risks, which could expose us to significant liability and delay, suspension or termination of our operations.

Mining exploration and exploitation activities are subject to national, provincial and local laws, regulations and policies, including laws regulating the removal of natural resources from the ground and the discharge of materials into the environment. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Exploration and exploitation activities are also subject to national, provincial and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of exploration methods and equipment.

National and provincial agencies may initiate enforcement activities against our Company. The agencies involved, generally, can levy significant fines per day of each violation, issue and enforce orders for clean-up and removal, and enjoin ongoing and future activities. Our inability to reach acceptable agreements with agencies in question would have a material adverse effect on us and our ability to continue as a going concern.

Environmental and other legal standards imposed by national, provincial or local authorities are constantly evolving, and typically in a manner which will require stricter standards and enforcement, and increased fines and penalties for non-compliance. Such changes may prevent us from conducting planned activities or increase our costs of doing so, which would have material adverse effects on our business. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages that we may not be able to or elect not to insure against due to prohibitive premium costs and other reasons. Unknown environmental hazards may exist on the Property or upon properties that we may acquire in the future caused by previous owners or operators, or that may have occurred naturally.

Weather interruptions in the area of the Property may delay or prevent exploration.

The terrain of the Property is of mainly steep to moderate relief in British Columbia, Canada. The area is subject to extreme winter conditions which may delay or prevent exploration of the Property during the months from early October to late June.

Our industry is highly competitive, attractive mineral lands are scarce and we may not be able to obtain quality properties or recruit and retain qualified employees.

We will compete with many companies in the mining industry, including large, established mining companies with capabilities, personnel and financial resources that far exceed our limited resources. In addition, there is a limited supply of desirable mineral lands available for claim-staking, lease or acquisition in British Columbia, and other areas where we may conduct exploration activities. We expect to be at a competitive disadvantage in acquiring mineral properties, since we will compete with these larger individuals and companies, many of which have greater financial resources and larger technical staffs. Likewise, our competition will extend to locating and employing competent personnel and contractors to prospect, develop and operate mining properties. Many of our competitors can offer attractive compensation packages that we may not be able to meet. Such competition may result in our Company being unable not only to acquire desired properties, but to recruit or retain qualified employees or to acquire the capital necessary to fund our operation and advance any properties acquired. Our inability to compete with other companies for these resources would have a material adverse effect on our results of operation and business.

7

Management has only limited experience in resource exploration.

The Company’s management, while experienced in evaluating lease sites for mining properties and reclamation review, has no technical training or experience in resource exploration or mining. The Company relies on the opinions of consulting geologists that it intends to retain from time to time for specific exploration projects or property reviews. As a result of management’s inexperience, there is a higher risk of the Company being unable to complete its business plan. To date, the only mining consultant retained by the Company is John Ostler who prepared an assessment report on the Property which is attached as Exhibit 99.1 to the Company’s registration statement.

Because our management does not have technical training or experience in exploring for, starting, and operating an exploration program, we will have to hire or retain qualified personnel or consultants. If we can’t locate qualified personnel or consultants, we may have to suspend or cease operations which will result in the loss of your investment.

Because our management is inexperienced with exploring for, starting, and operating an exploration program, we will have to hire or retain qualified persons to perform surveying, exploration, and excavation of the property. Our management has no direct training or experience in these areas and as a result may not be fully aware of many of the specific requirements related to working within the industry. Management’s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently our operations, earnings and ultimate financial success could suffer irreparable harm due to management’s lack of experience in this industry. As a result we may have to suspend or cease operations which will result in the loss of your investment.

Presently, our sole officer and director, Caroline Johnston, intends to devote approximately 15 hours per week of her business time providing her services to us. While Ms. Johnston presently possesses adequate time to attend to our interests, it is possible that the demands on her from her other obligations could increase with the result that she would no longer be able to devote sufficient time to the management of our business.

Our knowledge about the Property is limited by the fact that neither our sole officer and director nor our consulting geologist has visited the Property.

Neither our sole officer and director nor our independent consulting geologist has visited the Property. Investors should be aware that no one connected with the Company has personally visited the Property. Our knowledge of the Property is limited to the extent that there is information or knowledge which would be gained by an on-site visit to the Property by a representative of the Company. Decisions regarding the Property will be made on the basis of technical and geology reports of the exploration results conducted at the direction of our consulting geologist.

Mineral exploration and production activities are highly speculative activities and involve greater risk than many other businesses. Many exploration programs do not result in the discovery of economically feasible mineralization. Few properties that are explored are ultimately advanced to the stage of producing mines. We will be subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties. The primary risk related to exploration activities is that the exploration activity will reveal that there are no mineral deposits on the Property to warrant the commencement of production activities, in which case the expenses for the exploration activity will have been spent with no prospect of recovery. Risks which we expect to experience in the production phase of our operations, if operations are warranted based upon the results of our exploration phase, include but are not limited to:

|

•

|

economically insufficient mineralized material;

|

|

|

•

|

fluctuations in production costs that may make mining uneconomical;

|

|

|

•

|

labor disputes;

|

|

|

•

|

unanticipated variations in grade and other geologic problems;

|

|

|

•

|

environmental hazards;

|

|

|

•

|

water conditions;

|

|

|

•

|

difficult surface or underground conditions;

|

|

|

•

|

industrial accidents; personal injury, fire, flooding, cave-ins and landslides;

|

|

|

•

|

metallurgical and other processing problems;

|

|

|

•

|

mechanical and equipment performance problems; and

|

|

|

•

|

decreases in revenues and reserves due to lower gold and mineral prices.

|

8

Any of these risks can materially and adversely affect, among other things, the development of any properties acquired by the Company, production quantities and rates, costs and expenditures and production commencement dates with respect to properties in the production phase, if any. We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable.

Our operations will be subject to permitting requirements which could require us to delay, suspend or terminate our operations, if any, on our mining property.

Our operations, including our planned exploration activities on the Property, will require permits from the provincial and national governmental agencies. We may be unable to obtain these permits in a timely manner, on reasonable terms or at all. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration of the Property will be adversely affected.

Mineral exploration involves a high degree of risk against which the Company is not currently insured.

Unusual or unexpected rock formations, formation pressures, fires, power outages, labor disruptions, flooding, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are risks involved in the operation of mines and the conduct of exploration programs. The Company has relied on and will continue to rely upon consultants and others for exploration expertise.

It is not always possible to fully insure against such risks, and the Company may decide not to take out insurance against such risks as a result of high premiums or other reasons with respect to exploration or production activities conducted, if any. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of the Company’s shares. The Company does not currently maintain insurance relating to the Property.

Because we hold all of our cash reserves in United States dollars, we may experience weakened purchasing power in Canadian dollar terms and may not be able to afford to conduct our planned exploration program.

We hold all of our cash reserves in United States dollars. Due to foreign exchange rate fluctuations, the value of these United States dollar reserves can result in both translation gains and losses in Canadian dollar terms. If there is a significant decline in the US dollar versus the Canadian Dollar, our US dollar purchasing power in Canadian dollars would also significantly decline. If a there is a significant decline in the US dollar, we might not be able to afford to conduct our planned exploration program. We have not entered into derivative instruments to offset the impact of foreign exchange fluctuations.

It may be difficult to enforce judgments or bring actions outside the United States against us and certain of our officers and directors.

Our sole officer and director resides outside of the United States and the primary assets of the Company are located outside of the United States. As a result, it may be difficult or impossible for you to (i) enforce in courts outside the United States judgments obtained in the United States courts based upon the civil liability provisions of the United States federal securities laws against these persons and us; or (ii) bring in courts outside the United States an original action to enforce liabilities based upon United States federal securities laws against us and our officers and directors.

Mining accidents or other material adverse events at our mining location, if any, may reduce our anticipated production levels.

If we commence mining operations on the Property, production may fall below estimated levels as a result of mining accidents, such as a pit wall failure in an open pit mine, or cave-ins or flooding at underground mines. In addition, production may be unexpectedly reduced at a location if, during the course of mining, unfavorable ground conditions or seismic activity are encountered, ore grades are lower than expected, the physical or metallurgical characteristics of the ore are less amenable to mining or treatment than expected, or our equipment, processes or facilities fail to operate properly or as expected.

The costs to meet our reporting and other requirements as a public company subject to the Securities Exchange Act of 1934 will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

Upon becoming subject to the reporting requirements of the Securities Exchange Act of 1934, we will incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements, if applicable. We estimate that these costs will range up to $12,000 per year for the next few years and will be higher if our business volume and activity increases but lower during the first year of being public because our overall business volume will be lower. These obligations will reduce our ability and resources to fund other aspects of our business and may prevent us from meeting our normal business obligations.

9

Risks Associated with Our Common Stock

The Offering Price of the Shares is arbitrary.

The Offering Price of the Shares has been determined arbitrarily by the Company and bears no relationship to the Company’s assets, book value, potential earnings or any other recognized criteria of value.

The offering price of the Shares was determined arbitrarily and should not be used as an indicator of the future market price of the securities. Therefore, the offering price bears no relationship to the actual value of the Company and may make our shares difficult to sell.

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of $0.01 per share for the shares of common stock was determined arbitrarily. The offering price bears no relationship to the book value, assets or earnings of our company or any other recognized criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities.

The Company has a lack of dividend payments.

The Company has no plans to pay any dividends in the foreseeable future.

Certain Company actions and the interests of stockholders may differ.

The voting control of the Company could discourage others from initiating a potential merger, takeover or another change-of-control transaction that could be beneficial to stockholders. As a result, the value of stock could be harmed. Purchasers should be aware that after this offering, assuming all offered shares are sold, a single stockholder who is our sole officer and director will own 66.27% of the Company’s issued and outstanding common stock.

Currently, there is no public market for our securities, and we cannot assure you that any public market will ever develop and it is likely to be subject to significant price fluctuations.

Currently, there is no public market for our stock and our stock may never be traded on any exchange, or, if traded, a public market may not materialize. Even if we are successful in developing a public market, there may not be enough liquidity in such market to enable stockholders to sell their stock.

Our common stock is unlikely to be followed by any market analysts, and there may be few or no institutions acting as market makers for the common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until our common stock is fully distributed and an orderly market develops in our common stock, if ever, the price at which it trades is likely to fluctuate significantly. Prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of the Company, and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock.

Because our sole officer and director, who is also our sole promoter, will own more than 50% of the outstanding shares after this Offering, she will retain control of us and be able to elect directors which could decrease the price and marketability of the Shares.

If we sell 2,800,000 shares of common stock in this Offering, our sole officer and director, Caroline Johnston will still own 5,500,000 shares and will continue to control the Company. As a result, Ms. Johnston will have significant influence to:

|

|

·

|

elect or defeat the election of our directors;

|

|

|

·

|

amend or prevent amendment of our articles of incorporation or bylaws;

|

|

|

·

|

effect or prevent a merger, sale of assets or other corporate transaction; and

|

|

|

·

|

effect the outcome of any other matter submitted to the stockholders for vote.

|

Moreover, because of the significant ownership position held by Ms. Johnston, new investors may not be able to effect a change in the Company’s business or management, and therefore, stockholders would be subject to decisions made by management and the majority stockholder.

10

In addition, sales of significant amounts of shares held by Ms. Johnston, or the prospect of these sales, could adversely affect the market price of our common stock. Management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

You will incur immediate and substantial dilution of the price you pay for your Shares.

Our existing stockholder acquired her shares at a cost of $0.004 per share, a cost per share that is substantially less than the amount you will pay for the Shares you purchase in this Offering. Accordingly, any investment you make in these shares will result in the immediate and substantial dilution of the net tangible book value of those shares from the $0.01 you pay for them. Upon completion of the Offering, the net tangible book value of your Shares will be $0.0049.

We may, in the future, issue additional common shares, which would further reduce investors' percentage of ownership in the Company and may dilute our share value.

Our Certificate of Incorporation authorizes the issuance of 100,000,000 shares of common stock, $0.001 par value, of which 5,500,000 shares are issued and outstanding. The future issuance of common stock may result in further and substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors and might have an adverse effect on any trading market for our common stock.

Our Common Stock will be subject to “penny stock” rules which may be detrimental to investors.

The SEC has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) of less than $5.00 per share or an exercise price of less than $5.00 per share. Such securities are subject to rules that impose additional sales practice requirements on broker-dealers who sell them. For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchaser of such securities and have received the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the transaction, of a disclosure schedule prepared by the SEC relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, among other requirements, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. As the shares immediately following this Offering will likely be subject to such penny stock rules, purchasers in this Offering will in all likelihood find it more difficult to sell their Shares in the secondary market.

We have not voluntarily implemented various corporate governance measures, in the absence of which, stockholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

Recent U. S. legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or The NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges and NASDAQ are those that address board of directors’ independence, audit committee oversight and the adoption of a code of ethics. We have not yet adopted any of these corporate governance measures and, since our securities are not listed on a national securities exchange or NASDAQ, we are not required to do so. It is possible that if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. For example, in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages to our senior officers and recommendations for director nominees may be made by a majority of directors who have an interest in the outcome of the matters being decided. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

11

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for certain customers. FINRA requirements will likely make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder’s ability to resell shares of our common stock.

If quoted on the OTCBB, the price of our common stock may be volatile, which may substantially increase the risk that you may not be able to sell your shares at or above the price that you may pay for the shares.

Currently, there is no public market for our stock and our stock may never be traded on any exchange, or, if traded, a public market may not materialize. Even if our shares are quoted for trading on the OTCBB following this offering and a public market develops for our common stock, the market price of our common stock may be volatile. It may fluctuate significantly in response to the following factors:

|

|

·

|

variations in quarterly operating results;

|

|

|

·

|

our announcements of significant commissions and achievement of milestones;

|

|

|

·

|

our relationships with other companies or capital commitments;

|

|

|

·

|

additions or departures of key personnel;

|

|

|

·

|

sales of common stock or termination of stock transfer restrictions;

|

|

|

·

|

changes in financial estimates by securities analysts, if any; and

|

|

|

·

|

fluctuations in stock market price and volume.

|

Your inability to sell your shares during a decline in the price of our stock may increase losses that you may suffer as a result of your investment.

Because we do not intend to pay any dividends on our common stock, holders of our common stock must rely on stock appreciation for any return on their investment.

We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future. Accordingly, holders of our common stock will have to rely on capital appreciation, if any, to earn a return on their investment in our common stock.

The Company will deposit offering proceeds into its operating account upon receipt and use them to conduct its business and operations, and proceeds are non-refundable.

Subscription funds submitted by subscribers will be deposited into the Company’s operating account upon receipt and used to conduct the Company’s business and operations. All proceeds from the sale of the Shares are non-refundable.

FORWARD LOOKING STATEMENTS

This Prospectus contains projections and statements relating to the Company that constitute “forward-looking statements.” These forward-looking statements may be identified by the use of predictive, future-tense or forward-looking terminology, such as “intends,” “believes,” “anticipates,” “expects,” “estimates,” “may,” or similar terms. Such statements speak only as of the date of such statement, and the Company undertakes no ongoing obligation to update such statements. These statements appear in a number of places in this Prospectus and include statements regarding the intent, belief or current expectations of the Company, and its respective directors, officers or advisors with respect to, among other things: (1) trends affecting the Company’s financial condition, results of operations or future prospects, (2) the Company’s business and growth strategies and (3) the Company’s financing plans and forecasts. Potential investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that, should conditions change or should any one or more of the risks or uncertainties materialize or should any of the underlying assumptions of the Company prove incorrect, actual results may differ materially from those projected in the forward-looking statements as a result of various factors, some of which are unknown. The factors that could adversely affect the actual results and performance of the Company include, without limitation, the Company’s inability to raise additional funds to support operations and capital expenditures, the Company’s inability to effectively manage its growth, the Company’s inability to achieve greater and broader market acceptance in existing and new market segments, the Company’s inability to successfully compete against existing and future competitors and other factors described elsewhere in this Prospectus, or other reasons. Potential investors are urged to carefully consider such factors. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements and the “Risk Factors” described herein.

12

USE OF PROCEEDS

Assuming 2,800,000 Shares are subscribed for in this Offering, the gross proceeds from this Offering will be $28,000. We expect to disburse the proceeds from this offering in the priority set forth below, within the first 12 months after successful completion of this Offering:

|

Offering Proceeds

|

$ | 28,000 | ||

|

Phase 1 Exploration of the Claim

|

$ | 25,894 | ||

|

Unpaid Offering expenses

|

8,000 | |||

|

Working Capital Deficit

|

951 | |||

|

Total

|

$ | 34,845 | * |

*The deficit will be funded by an additional offering of securities, commercial financing arrangements, including bank loans, or a possible capital advance from the sole officer and director of the Company.

The Company estimates that the total Offering expenses will amount to approximately $18,000. To date the Company has paid Offering expenses in the amount of $10,002 which were paid from proceeds of the sale of stock to our sole shareholder, officer and director.

Working Capital

The Company plans to engage consultants with technical expertise to explore the Claim and mine the reserves if any are discovered. Working capital will support payment of unpaid Offering expenses, personnel or consulting costs as well as the general administration and management of the Company’s start-up phase.

Exploration of the Claim

As set forth in the table above, in addition to working capital, the Company intends to use the net proceeds from the Offering for exploration of the Claim, including assessment, mapping and sampling.

Receipt of Less than the Minimum Offering Proceeds

If we do not receive subscriptions for 2,800,000 shares of our common stock, we will promptly return subscription funds to investors without interest or deduction and abandon our business plan.

DETERMINATION OF OFFERING PRICE

There is no established market for our common stock. The Offering Price of the Shares has been determined arbitrarily by the Company and bears no direct relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of Shares to offer and the Offering Price, we took into consideration our capital structure and the amount of money we would need to implement our business plan. The Offering Price of the Shares should not be considered an indication of the actual or subsequent trading value of our common stock.

Penny Stock Rules

The Securities and Exchange Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

|

|

a.

|

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

|

b.

|

contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws;

|

|

|

c.

|

contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;

|

|

|

d.

|

contains a toll-free telephone number for inquiries on disciplinary actions;

|

|

|

e.

|

defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and

|

|

|

f.

|

contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation.

|

The broker or dealer also must provide, prior to effecting any transaction in a penny stock, the customer with:

a. bid and offer quotations for the penny stock;

b. the compensation of the broker-dealer and its salesperson in the transaction;

|

c.

|

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

|

d. a monthly account statement showing the market value of each penny stock held in the customer’s account.

13

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a suitably written statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock. Therefore, if our common stock becomes subject to the penny stock rules, stockholders may have difficulty selling those securities.

Holders

We have one holder of record of our common stock as of the date of this Prospectus.

Securities Authorized For Issuance under Equity Compensation Plans

We do not have any securities authorized for issuance under any equity compensation plans.

DIVIDEND POLICY

We have not paid any dividends since our incorporation and do not anticipate the payment of dividends in the foreseeable future. At present, our policy is to retain earnings, if any, to pursue our business plan. The payment of dividends in the future will depend upon, among other factors, our earnings, capital requirements, and operating financial conditions.

Dilution represents the difference between the Offering Price and the net tangible book value per share immediately after completion of this Offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the Offering Price of the Shares being offered. Dilution of the value of the Shares you purchase is also a result of the lower book value of the shares held by our existing stockholder.

In this Offering, the level of dilution is increased as a result of the relatively low book value of the Company’s presently issued and outstanding stock. This is due to the shares of common stock issued to the Company’s founder totaling 5,500,000 shares at $0.004 per share for $22,000 cash versus the current Offering Price of $0.01 per share.

The Company’s net book value on October 31, 2010 was $14,749 or approximately $0.0027 per share, based upon 5,500,000 shares outstanding. Upon completion of this Offering, but without taking into account any change in the net tangible book value after completion of this offering other than that resulting from the sale of the Shares and receipt of the total proceeds of $28,000, the net tangible book value of the 8,300,000 shares to be outstanding will be $42,749, or approximately $0.0049 per share. Accordingly, the net tangible book value of the shares held by our existing stockholder (5,500,000 shares) will be increased by $.0022 per share without any additional investment on her part. The purchasers of Shares in this Offering will experience immediate dilution (a reduction in the net tangible book value per share from the offering price of $0.01 per share) of $0.0051 per share.

After completion of the Offering, the existing stockholder will own 66.27% of the total number of shares then outstanding, for which she will have made a cash investment of $22,000, or $0.004 per share. Upon completion of the Offering, the purchasers of the Shares offered hereby will own 33.73% of the total number of shares then outstanding, for which they will have made a cash investment of $28,000, or $0.01 per share.

The following table illustrates the per share dilution to the new investors and does not give any effect to the results of any operations subsequent to October 31, 2010:

Dilution Table

|

100% of

|

||||

|

|

Shares Sold

|

|||

|

Offering Price Per Share

|

$

|

0.0100

|

||

|

Net Tangible Book Value Per Share Before the Offering

|

$

|

0.0027

|

||

|

Net Tangible Book Value Per Share After the Offering

|

$

|

0.0049

|

||

|

Net Increase to Original Stockholders

|

$

|

0.0022

|

||

|

Decrease in Investment to New Stockholders

|

$

|

0.0051

|

||

|

Dilution to New Stockholders

|

51

|

%

|

||

14

The following table summarizes the number and percentage of shares purchased the amount and percentage of consideration paid and the average price per share paid by our existing stockholder and by new investors in this offering:

|

Price per Share

|

Total Number of Shares Held

|

Percentage of Ownership

|

Consideration Paid

|

|||||||||||||

|

Existing Stockholder

|

$ | 0.004 | 5,500,000 | 66.27 | % | $ | 22,000 | |||||||||

|

Investors in This Offering

|

$ | 0.01 | 2,800,000 | 33.73 | % | $ | 28,000 | |||||||||

Tax Considerations

We are not providing any tax advice as to the acquisition, holding or disposition of the securities offered herein. In making an investment decision, investors are strongly encouraged to consult their own tax advisor to determine the federal, state and any applicable foreign tax consequences relating to their investment in the Shares.

PLAN OF DISTRIBUTION

There is no public market for our common stock. Therefore, the current and potential market for our common stock is limited and the liquidity of our Shares may be severely limited. To date, we have made no effort to obtain listing or quotation of our securities on a national stock exchange or association. We have not identified or approached any broker/dealers with regard to assisting us to apply for such listing or quotation. We are unable to estimate if or when we expect to undertake this endeavor. No market may ever develop for our common stock, or if developed, such market may not be sustained in the future. Accordingly, the Shares should be considered totally illiquid, which inhibits investors' ability to sell their Shares. The market price of the Shares of common stock is likely to be highly volatile and may be significantly affected by factors such as actual or anticipated fluctuations in the Company's operating results, announcements of technological innovations, new products and/or services or new contracts by the Company or its competitors, developments with respect to copyrights or proprietary rights, adoption of new accounting standards or regulatory requirements affecting the mining business, general market conditions and other factors. In addition, the stock market from time to time experiences significant price and volume fluctuations that may adversely affect the market price for the Company's common stock.

The Offering

The Company is offering to sell 2,800,000 Shares pursuant to the terms of this Prospectus in a self-underwritten direct public offering, without any participation by underwriters or broker-dealers. The Offering Price is $0.01 per Share. The Offering Period will commence on the date of this prospectus and close no later than 180 days from the date of this prospectus. The Company is offering the Shares on an all-or-none basis. If upon expiration of the Offering Period the Company has not received subscriptions for 2,800,000 shares of its common stock, it will promptly return subscription funds to investors without interest or deduction.

Shares will be sold through the efforts of the sole officer and director of the Company. There will be no participation by underwriters or broker-dealers. The Shares will be sold in accordance with the laws of the states in which the Shares are offered and/or sold.

This is a self-underwritten offering. There are no plans or arrangements to enter into any contracts or agreements to sell the Shares with a broker or dealer. Ms. Johnston, our officer and director, will sell the shares and intends to offer them to friends, family members and business acquaintances with no commission or other remuneration payable to her for any Shares she sells. In offering the securities on our behalf, she will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934 (the “Exchange Act”).

15

Ms. Johnston will not register as a broker-dealer pursuant to Section 15 of the Securities Exchange Act of 1934, in reliance upon Rule 3a4-1, which sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer's securities and not be deemed to be a broker-dealer. Our sole officer and director satisfies the requirements of Rule 3a4-1, because she is an officer and director of the Company and:

|

|

(a)

|

is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39)of the Exchange Act, at the time of her participation; and

|

|

|

(b)

|

will not be compensated in connection with her participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and

|

|

|

(c)

|

is not, nor will she be at the time of her participation in the offering, an associated person of a broker-dealer; and

|

|

|

(d)

|

meets the conditions of paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that she (A) primarily performs, or is intended primarily to perform at the end of the offering, substantial duties for or on behalf of our company, other than in connection with transactions in securities; and (B) is not a broker or dealer, or been associated person of a broker or dealer, within the preceding twelve months; and (C) has not participated in selling and offering securities for any issuer more than once every twelve months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii).

|

Only after our registration statement is declared effective by the SEC, do we intend to advertise, through tombstones, and hold investment meetings. We will not utilize the internet to advertise our offering. Ms. Johnston will also distribute the prospectus to potential investors at the meetings, to business associates and to her friends and relatives who are interested in us and a possible investment in the Offering. No Shares purchased in this Offering will be subject to any kind of lock-up agreement.

Our officer, director, control person and her affiliates do not intend to, but may, purchase any Shares in this Offering.

We intend to sell our Shares to purchasers both inside and outside the United States.

Section 15(g) of the Exchange Act

Section 15(g) of the Exchange Act, and Rules 15g-1 through 15g-6 and Rule 15g-9 promulgated thereunder, impose additional sales practice requirements on broker/dealers who sell our securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). While Section 15(g) and Rules 15g-1 through 15g-6 apply to brokers-dealers, they do not apply to us.

Rule 15g-1 exempts a number of specific transactions from the scope of the penny stock rules. Rule 15g-2 declares unlawful broker/dealer transactions in penny stocks unless the broker/dealer has first provided to the customer a standardized disclosure document.

Rule 15g-3 provides that it is unlawful for a broker/dealer to engage in a penny stock transaction unless the broker/dealer first discloses and subsequently confirms to the customer current quotation prices or similar market information concerning the penny stock in question.

Rule 15g-4 prohibits broker/dealers from completing penny stock transactions for a customer unless the broker/dealer first discloses to the customer the amount of compensation or other remuneration received as a result of the penny stock transaction.

Rule 15g-5 requires that a broker/dealer executing a penny stock transaction, other than one exempt under Rule 15g-1, disclose to its customer, at the time of or prior to the transaction, information about the sales persons compensation.

Rule 15g-6 requires broker/dealers selling penny stocks to provide their customers with monthly account statements.